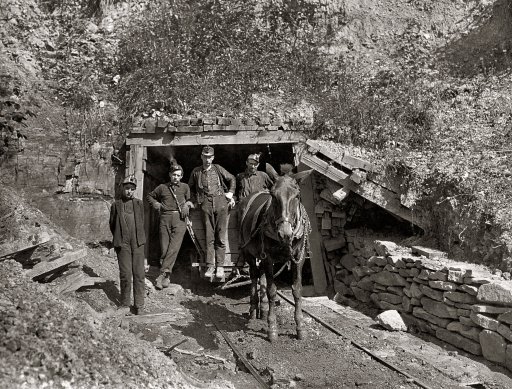

Konstantinos Polychronopoulos, Athens Christmas Day 2016

“..a “head-on collision” between perception and reality…”

• Recession, Market Crash Next Year, Expect Rate Cuts: Rickards (CNBC)

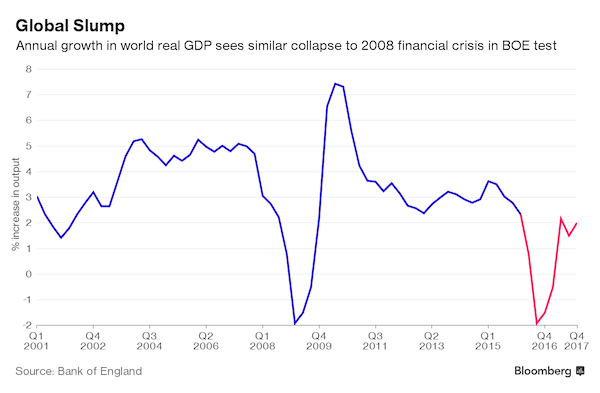

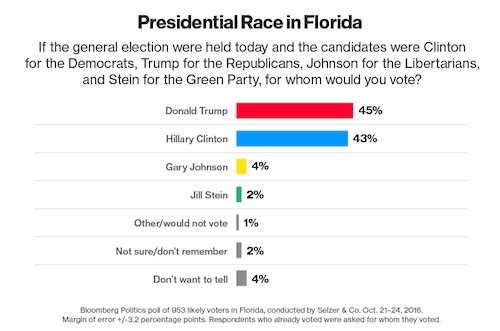

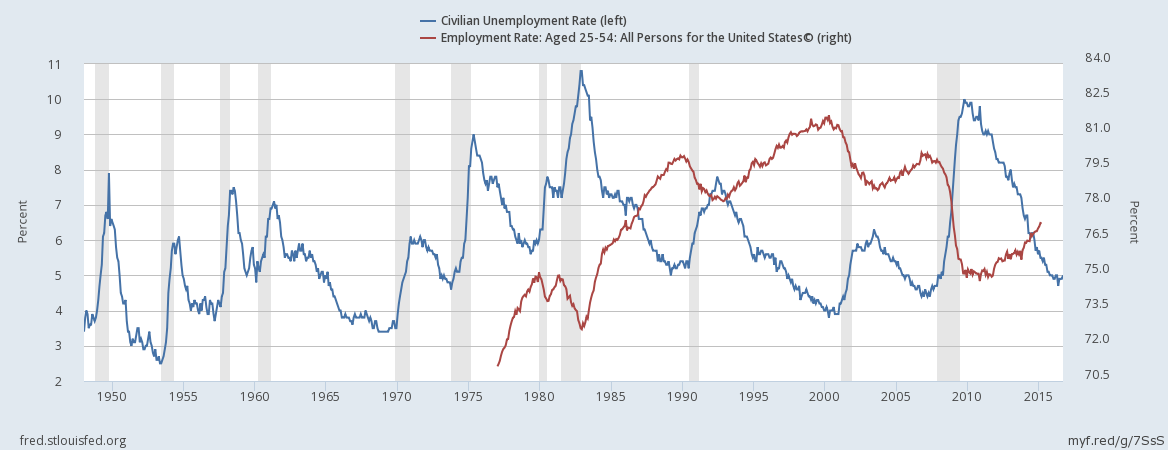

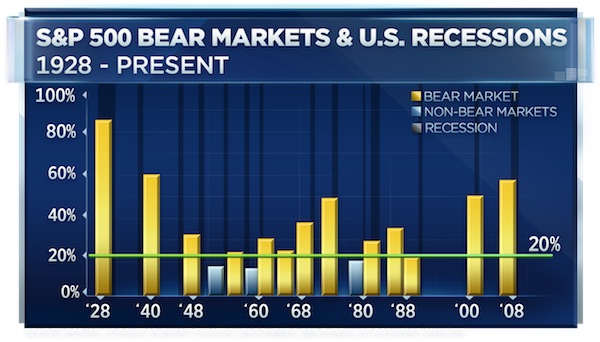

The Federal Reserve hiked interest rates just two weeks ago for the second time in a decade, but it will soon be cutting them again, said Jim Rickards on Tuesday. Speaking to CNBC’s Squawk Box, the director of The James Rickards Project said a stock market correction is coming as President-elect Donald Trump’s economic stimulus plans will not pan out, causing a “head-on collision” between perception and reality. “When the reality of no stimulus catches up with the perception of stimulus plus the Fed tightening: that’s the train wreck. Either we’re going to have a recession or a stock market correction,” he said. The markets have been rallying on the back of Trump’s win as investors bet on tax cuts and fiscal spending under the new administration.

However, “the stimulus is not going to come” as Trump’s proposed tax cuts will hit government revenue while the Congress is likely to block his stimulus plans as the U.S. is already $20 trillion in debt, Rickards added. This will lead to a recession or a “very severe correction” in the stock market, prompting rate cuts later next year, he said, prompting the Fed to cut rates. “They will raise (rates) in March and then something will hit the wall, either the economy or the stock market or both. Then the Fed will backpedal from there, starting with a forward guidance then perhaps a rate cut later in the year,” said Rickards, who recommends holding gold and U.S. 10-year Treasurys.

Ominous.

• Did Donald Trump Just Jump The ‘Dow 20,000’ Shark? (ZH)

It appears the sugar-high from holiday celebrations is still running through president-elect Trump's veins as his tweets took an even more narcisistic tone on this oh-so-aptly-named 'Boxing Day' in America. First Trump decided to take credit for the unprecedented short-squeeze in US stock markets – and the Christmas spending numbers…

The world was gloomy before I won – there was no hope. Now the market is up nearly 10% and Christmas spending is over a trillion dollars!

— Donald J. Trump (@realDonaldTrump) December 26, 2016

We just wonder what he will sat if/when Goldman Sachs stops rising and stocks tumble ("never gonna happen", probably The Fed's fault after all), but perhaps even more importantly, how does he feel about the $1.2 trillion of value he has erased from global capital markets since his election?

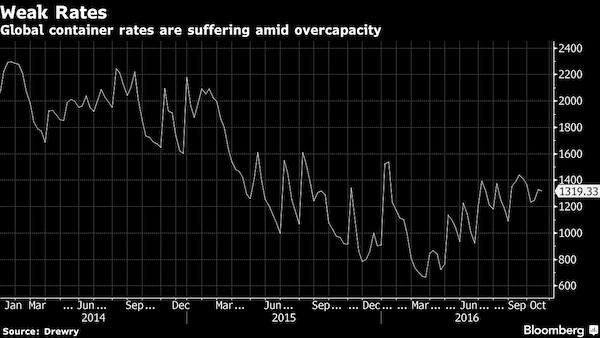

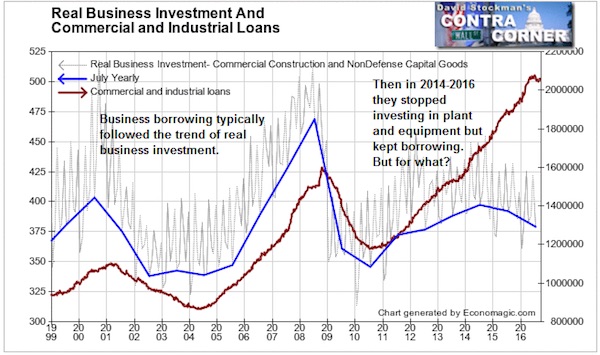

The drop in global debt and equity values in Q4 2016 is very reminiscent of the drop into 2015's Fed rate hike… which did not end well…

But, the last time that global stocks and global bonds decoupled so aggressively was following the end of QE3… here's what happened next…

But it's probably different this time, right? China is fine (oh wait, failed auctions and liquidity crisis), Europe is fine (oh wait, Italian banks are collapsing), and the US economy is great (oh wait, automakers are shuttering plants due to credit-created excess inventory).

* * *

But Trump was not done there, he took on the arrogance of Obama, as we detailed earlier…

President Obama said that he thinks he would have won against me. He should say that but I say NO WAY! – jobs leaving, ISIS, OCare, etc.

— Donald J. Trump (@realDonaldTrump) December 26, 2016

Invincible politician and stock market savior…Let's just hope nothing goes wrong to break that narrative in the next 4 years (or 4 weeks).

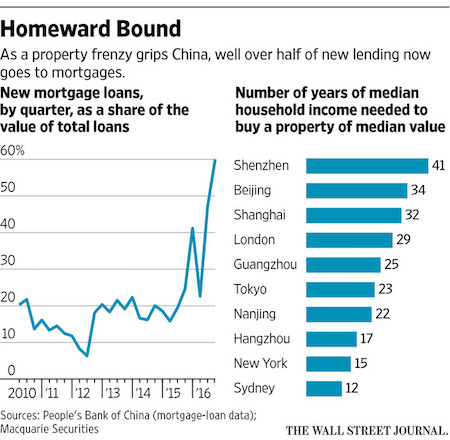

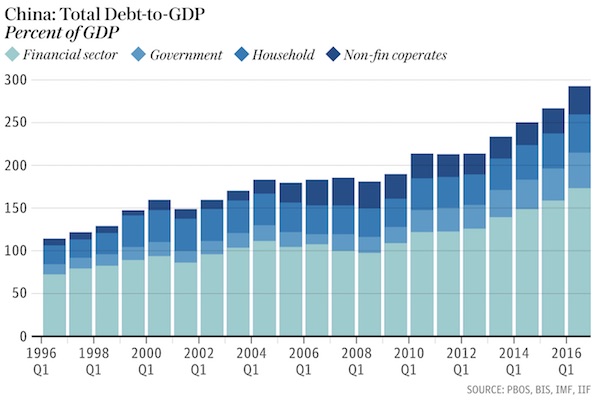

Beijing will be forced to take very unpopular decisions. Xi signaled tolerance for a lower growth target, and whoops goes the money. They’re stuck in their own bubbles.

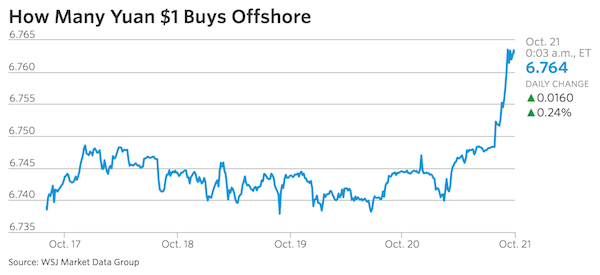

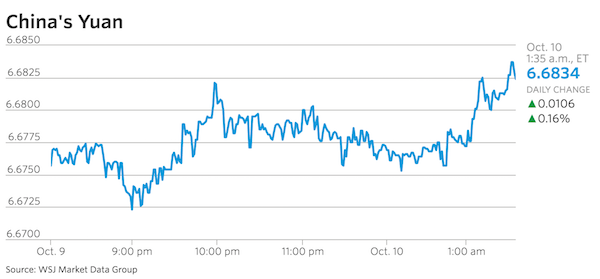

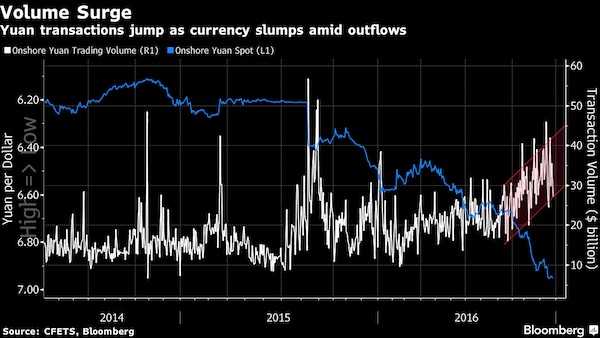

• Yuan Trading Volume Has Been Surging In December (BBG)

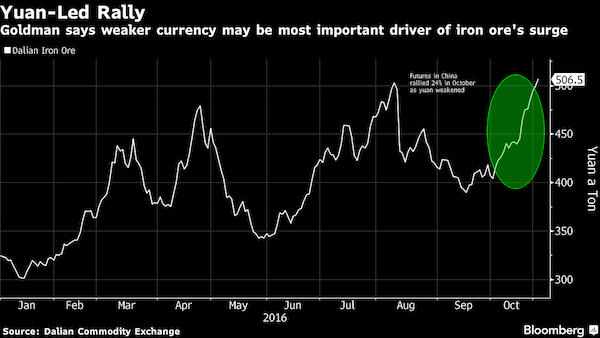

The onshore yuan’s surging trading volume is another piece of evidence that capital is fleeing China at a faster pace. The daily average value of transactions in Shanghai climbed to $34 billion in December as of Monday, the highest since at least April 2014, according to data from China Foreign Exchange Trade System. That’s up 51% from the first 11 months of the year. The increase suggests quickening outflows, given that data in recent months showed banks were net sellers of the yuan, according to Harrison Hu at RBS This month’s jump in trading volume signals sentiment has kept deteriorating since November, when the nation’s foreign-exchange reserves shrank by the most since January.

The Chinese currency is headed for its steepest annual slump in more than two decades and when the year turns, authorities will be faced with a triple whammy of the renewal of citizens’ $50,000 conversion quota, prospects of further Federal Reserve interest-rate increases, and concern that U.S. President-elect Donald Trump may slap punitive tariffs on China’s exports to the world’s largest economy. “Capital outflow pressures will stay, and in near term, we should monitor the impact upon the reset of the annual quota,” said Frances Cheung at Societe Generale. The pressures will likely ease toward the end of the first quarter as foreign flows into China’s bond market quicken, she said.

If it quacks like a typical bank run… Don’t you think they could perhaps have done this deal in silence?

• ECB: Monte dei Paschi Must Now Raise €8.8 Billion After Recent Withdrawals (R.)

The ECB has told Monte dei Paschi it needs to plug a capital shortfall of €8.8 billion, higher than a previous €5 billion gap estimated by the bank, the lender said on Monday, confirming what sources told Reuters. Last Friday the Italian government approved a decree to bail out Monte dei Paschi after Italy’s No. 3 lender failed to win investor backing for a desperately needed €5 billion capital increase. The bank said on Monday it had officially asked the ECB last Friday for go ahead for a “precautionary recapitalization”. A precautionary recapitalization is a type of state intervention in a struggling bank that is still solvent. It means only a modest bail-in of investors though the government can buy shares or bonds only on market terms endorsed by EU state aid officials in Brussels.

In its reply, the ECB said it had calculated the capital it believed the bank needed on the basis of a shortfall emerging from European stress test of large lenders earlier this year. In those tests Monte dei Paschi was the only Italian bank to come short under an adverse scenario. The ECB said the lender was solvent but signaled the bank’s liquidity position had rapidly deteriorated between the end of November and December 21, Monte dei Paschi said. [..] The European Commission said on Friday it would work with Rome to establish conditions were met for a bailout of Monte dei Paschi. But on Monday ECB policymaker Jens Weidmann said plans for a state bailout of Monte dei Paschi should be weighed carefully as many questions remain to be answered.

“..He was awarded the Nobel Peace Prize, but ended up invading 7 countries. He also became the very first U.S. President to be at continuous war during his entire 8 years in office…”

• War & The Rejection of Peace (Rossini)

Try to think of a time in your life when the U.S. government was not militarily involved somewhere in the world. It’s a sad fact that a vast majority of us can’t recall such a time. [..] When war is all that a population knows to exist, the idea of peace becomes an anomaly. We all know that people are habitual. We cling to our habits (good and bad) and resist the unknown where change can occur. Well, in America the unknown has become peace! How sad to think that the idea of peace actually terrifies so many people both in and out of government. One can at least understand why governments would want to avoid peace. As Randolph Bourne famously pointed: “War is the health of the state.” During times of war, government capitalizes on the fear that it generates and concomitantly seizes unbelievable powers for itself.

We can at least see the benefit to government and those with a lust for power and the ability to dominate others. But what’s in it for the people? Here we can quote Samuel B. Pettengill who said: “War – after all, what is it that the people get? Why – widows, taxes, wooden legs and debt.” Sounds like a raw deal for the people. And yet, Americans have sat idly by, and have turned a blind eye to an incredible list of military interventions over the years. More war, less liberty …. More war, less liberty …. If it happens over an administration or two, it can be spun as government losing its way to a few bad apples. But 100+ years of more war, less liberty? That’s a system!

[..] There is a tremendous amount of upside to war for those who are in power. It provides them with an opportunity to swipe away liberties at an exponential pace. The populace will give up virtually everything. Is it any wonder that those in power run away from even the prospect of peace? We’re soon about to have a new president, and he’s coming into office with a lot of expectations. The outgoing president had high expectations as well. He was awarded the Nobel Peace Prize, but ended up invading 7 countries. He also became the very first U.S. President to be at continuous war during his entire 8 years in office. Will this new president keep the boots of war firmly pressed against American throats? Will he continue the asphyxiation of the American Dream?

So far, when it comes to the insane idea of confronting a nuclear Russia, he has shown admirable qualities of restraint and cordial behavior. Will that continue through his presidential term? Or will he keep the century old American tradition of military adventurism overseas? The world is much bigger than Russia. There are plenty of other places that America can mire itself. There are other nuclear powers (like China) where trouble can be fomented. The president-elect has already shown that he has a bone to pick with the Chinese. Are we merely exchanging trouble with one nuclear power for another? Let’s hope that Donald Trump doesn’t repeat the mistakes of history. Let’s hope that he doesn’t become just another bad example for future generations to study.

Wouldn’t it be nice for Americans to someday be born into a life of liberty and peace? That was the original idea in the ‘land of the free’. A return to a foreign policy of non-interventionism and peace is desperately needed.

Quite the allegation.

• Israel Claims ‘Evidence’ That Obama Orchestrated UN Resolution (G.)

Israel has escalated its already furious war with the outgoing US administration, claiming that it has “rather hard” evidence that Barack Obama was behind a critical UN security council resolution criticising Israeli settlement building, and threatening to hand over the material to Donald Trump. The latest comments come a day after the US ambassador to Israel, Dan Shapiro, was summoned by Netanyahu to explain why the US did not veto the vote and instead abstained. The claims have emerged in interviews given by close Netanyahu allies to US media outlets on Monday after the Obama administration denied in categorical terms the claims originally made by Netanyahu himself.

However, speaking to Fox News on Sunday, David Keyes – a Netanyahu spokesman – said Arab sources, among others, had informed Jerusalem of Obama’s alleged involvement in advancing the resolution. “We have rather iron-clad information from sources in both the Arab world and internationally that this was a deliberate push by the United States and in fact they helped create the resolution in the first place,” Keyes said. Doubling down on the claim a few hours later the controversial Israeli ambassador to Washington, Ron Dermer, went even further suggesting it had gathered evidence that it would present to the incoming Trump administration. “We will present this evidence to the new administration through the appropriate channels. If they want to share it with the American people, they are welcome to do it,” Dermer told CNN.

Curious things for Obama to say. It’s not obvious enough yet that his own party has fallen apart?

• Corbyn Hits Back After Obama Suggests Labour Is ‘Disintegrating’ (G.)

A spokesman for Jeremy Corbyn has hit back after Barack Obama appeared to suggest that the Labour party has moved away from “fact and reality” and is disintegrating. The spokesman said the Labour leader “stands for what most people want” and suggested that the outgoing president’s Democratic party needed to “challenge power if they are going to speak for working people”. Obama had earlier said he was not worried when asked if the US Democrats could undergo “Corbynisation” and “disintegrate” like Labour in the wake of Hillary Clinton’s election defeat by Donald Trump. The departing US president was giving an in-depth interview, in which he also said he would have won the 8 November contest if he ran for a third term, to David Axelrod, formerly an adviser to Corbyn’s predecessor as Labour leader, Ed Miliband.

The 55-year-old compared the way the Labour party and the US Republicans had chosen to swing away from the middle ground and claimed even left-wing senator Bernie Sanders was a centrist compared to Corbyn. Asked about a potential “Corbynisation” of his party, he said: “I don’t worry about that partly because I think that the Democratic party has stayed pretty grounded in fact and reality.” He added: “[The Republican party] started filling up with all kinds of conspiracy-theorising that became kind of common wisdom or conventional wisdom within the Republican party base. That hasn’t happened in the Democratic party. I think people like the passion that Bernie brought, but Bernie Sanders is a pretty centrist politician relative to … Corbyn or relative to some of the Republicans.” In response Corbyn’s spokesman said: “Both Labour and US Democrats will have to challenge power if they are going to speak for working people and change a broken system that isn’t delivering for the majority.

They’re going to continue to fight over this for much longer.

• Hard Brexit ‘Could Boost UK Economy By £24 Billion’: Pro-Leave Group (Ind.)

The UK economy could benefit by £24bn a year – more than £450m a week – by leaving the European single market and customs union, a pro-Brexit pressure group has claimed. The Change Britain group said that the option – which it describes as “clean Brexit” – is likely to deliver annual savings of almost £10.4bn from contributions to the EU budget and £1.2bn from scrapping “burdensome” regulations, while allowing the UK to forge new trade deals worth £12.3bn. The group said its estimate was “very conservative” and that the benefits of withdrawal from the single market and customs union could be as much as £38.6bn a year. Even the lowest forecast within its range of likely outcomes was a boost of £20bn.

But the figure does not factor in the possibility of large-scale loss of exports to the remaining 27 EU nations, which advocates of a “soft Brexit” argue could happen if the UK faces tariff and non-tariff barriers to trade as a result of leaving the single market. Britain exported around £220bn of goods and services to the EU in 2015, while imports from the EU totalled around £290bn. Change Britain said that the biggest prize on offer was in potential trade agreements outside the EU which Britain could strike if it left the customs union, which requires it to take part only in deals negotiated by the European Commission. Depending on how many deals the UK secures, GDP could be boosted by between £8.5bn and £19.8bn, said Change Britain.

Might as well. It’s just that King has been ‘unlucky’ in his predictions for years.

• Mervyn King: Britain Should Be More Upbeat About Brexit (G.)

Britain may be better off going for a hard Brexit that would mean leaving the single market and customs union, Mervyn King, the former governor of the Bank of England, has suggested. Lord King, who has been more optimistic about leaving the EU than many economic commentators, acknowledged that Brexit would bring great political difficulties and would not be a “bed of roses”. Speaking to BBC Radio 4’s Today programme, he also said there would be many opportunities economically for the UK striking out on its own. The crossbench peer, who led the bank for a decade until 2013, said the UK should leave the European single market and warned there were “real question marks” over whether it should seek to remain in the customs union, which would limit its ability to forge trade deals on its own.

Theresa May’s cabinet is split on the issue of the single market and customs union, with the most pro-Brexit ministers seeking a clean break and others warning of the economic dangers of being cut adrift from the UK’s closest trading partners. King said before the referendum that warnings of economic doom about leaving the EU were overstated. Since then, he has welcomed the fall in the pound and said he believes Britain can be better off out than in the EU. He told the BBC on Boxing Day: “I think the challenges we face mean it’s not a bed of roses – no one should pretend that – but equally it is not the end of the world and there are some real opportunities that arise from the fact of Brexit we might take. “There are many opportunities and I think we should look at it in a much more self-confident way than either side is approaching it at present. Being out of what is a pretty unsuccessful European Union – particularly in the economic sense – gives us opportunities as well as obviously great political difficulties.”

At least he’s right on this.

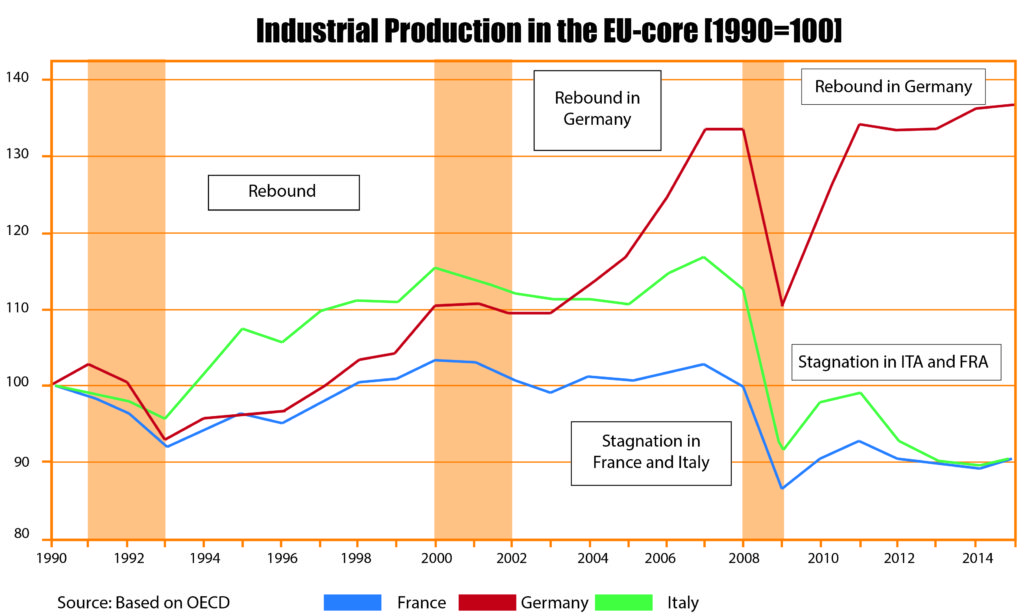

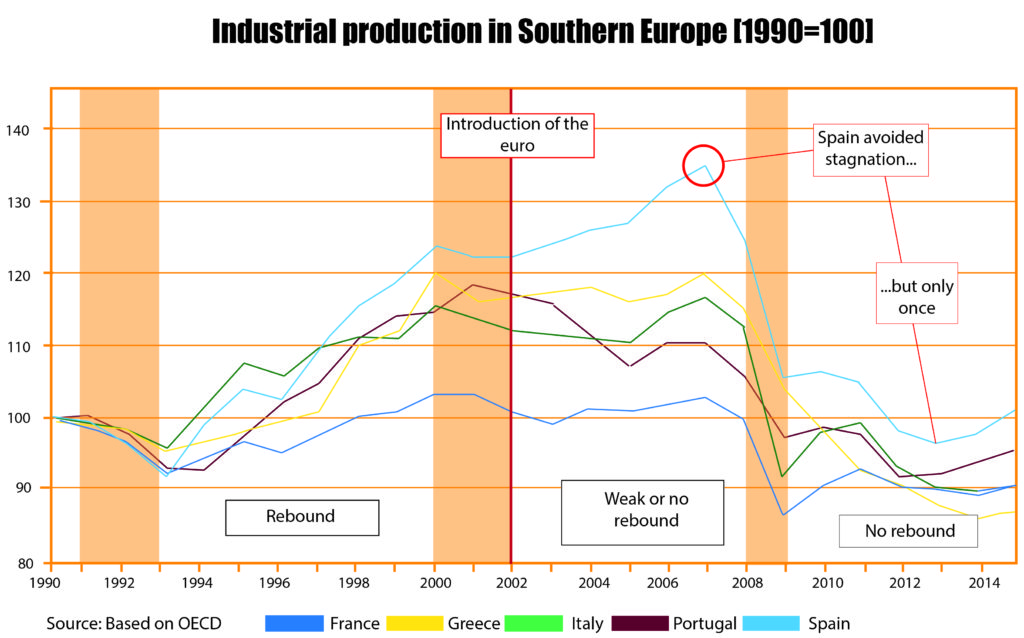

• EU Faces Two Major Problems – And Has Answers To Neither: King (Ind.)

The European Union is facing “existential problems” over migration and the single currency for which it does not yet have the answers, former Bank of England governor Lord King has warned. Lord King said the scale of the crises was such that Brexit amounted to little more than “minor irritant” by comparison. And he suggested that the factor which could bring the problems to a head was German voters asking whether they want to remain part of a project which involves them propping up less competitive eurozone economies like Italy, Portugal and France. Lord King said that the single currency project was flawed from the start, and that it would probably have been better to create two monetary unions for “premier league” and “second division” economies. But he said it was too late to move to this model now.

Speaking to BBC Radio 4’s Today programme, the former governor said: “I think the EU is facing two existential problems and it has answers to neither of them. “The first is the fate of the monetary union, which even the ECB is saying is in a critical position and needs major reform. “Secondly, migration from outside the EU into the EU and the knock-on consequences of that for the free movement of people. “I don’t think they have answers for either of those issues and it is a real crisis for the EU. “British membership is irrelevant to these two questions and from that perspective I think they regard our decision to leave the EU as a minor irritant.” Lord King said it was impossible to put any timescale on when the problems of the eurozone might come to a head. But he said: “They simply haven’t put in place the framework to make it a success, desperately trying to struggle from one month to the next.

“For a long period they were relying on the confidence that financial markets had in the words of (ECB) president Mario Draghi that they would do ‘whatever it takes’. But I think words in the end run out and you need to back them up by actions. “The problem now is that people in Germany and other countries in the northern part of the EU are deeply reluctant – understandably – to pay for countries in the south. That wasn’t the prospectus they were offered when they joined the monetary union. “In the long run, it would make some sense to recognise that it was a mistake to go to monetary union as early as 1999. I think they might have been able to divide it into two divisions – a premier league and a second division – but I think it may be too late to do. If you look at economies like Italy, Portugal and even France, they are really struggling.

Excellent from Jim, and that’s before his predictions for 2017.

• Exit, Hope and Change (Jim Kunstler)

From the get-go, he made himself hostage to some of the most sinister puppeteers of the Deep State: Robert Rubin, Larry Summers, and Tim Geithner on the money side, and the Beltway Neocon war party infestation on the foreign affairs side. I’m convinced that the top dogs of both these gangs worked Obama over woodshed-style sometime after the 2008 election and told him to stick with the program, or else. What was the program? On the money side, it was to float the banks and the whole groaning daisy chain of their dependents in shadow finance, real estate, and insurance, at all costs. Hence, the extension of Bush Two’s bailout policy with the trillion-dollar “shovel-ready” stimulus, the rescue of the car-makers, and a much greater and surreptitious multi-trillion dollar hand-off from the Federal Reserve to backstop the European banks with counter-party obligations to US banks.

In April of 2009, Obama’s new SEC appointees, strong-armed by bank lobbyists, pushed the Financial Accounting Standards Board (FASB) into suspending their crucial Rule 157, which had required publically-held companies to report their asset holdings based on standard market-based valuation procedures — called “mark-to-market.” After that, companies like Too-Big-Too-Fail banks could just make shit up. This opened the door to the pervasive accounting fraud that allowed the financial sector to pretend it was healthy for the eight years that followed. The net effect of their criminal fakery was to only make the financial sector artificially larger, more dangerously fragile, and more prone to cataclysmic collapse.

[..]in foreign affairs, there is Obama’s mystifying campaign against the Russian Federation. The US had an agreement with Russia after the fall of the Soviet Union that we would not expand NATO if they gave us a quantity of nuclear material that was in danger of falling into questionable hands in the disorder that followed the collapse. Russia complied. What did we do? We expanded NATO to include most of the former eastern European countries (except the remnants of Yugoslavia), and then under Obama, NATO began holding war games on Russia’s border. For what reason? The fictitious notion that Russia wanted to “take back” these nations — as if they needed to adopt a host of dependents that had only recently bankrupted the Soviet state. Any reasonable analysis would call these war games naked aggression by the West.

Then there was the 2014 US State Department-sponsored coup against Ukraine’s elected government and the ousting of President Viktor Yanukovych. Why? Because his government wanted to join the Russian-led Eurasian Customs Union instead of an association with European Union. We didn’t like that and we decided to oppose it by subverting the Ukrainian government. In the violence and disorder that ensued, Russia took back the Crimea — which had been gifted to the former Ukraine Soviet Socialist Republic (a province of Soviet Russia) one drunken night by the Ukraine-born Soviet leader Nikita Khrushchev. What did we expect after turning Ukraine into another failed state? The Crimean peninsula had been part of Russia for longer than the US had been a country. Its only warm water naval ports were located there.

One by one they leave us.

• Cheetahs Heading Towards Extinction As Population Crashes (BBC)

The sleek, speedy cheetah is rapidly heading towards extinction according to a new study into declining numbers. The report estimates that there are just 7,100 of the world’s fastest mammals now left in the wild. Cheetahs are in trouble because they range far beyond protected areas and are coming increasingly into conflict with humans. The authors are calling for an urgent re-categorisation of the species from vulnerable to endangered. According to the study, more than half the world’s surviving cheetahs live in one population that ranges across six countries in southern Africa. Cheetahs in Asia have been essentially wiped out. A group estimated to number fewer than 50 individuals clings on in Iran.

ZSL

Because the cheetah is one of the widest-ranging carnivores, it roams across lands far outside protected areas. Some 77% of their habitat falls outside these parks and reserves. As a result, the animal struggles because these lands are increasingly being developed by farmers and the cheetah’s prey is declining because of bushmeat hunting. In Zimbabwe, the cheetah population has fallen from around 1,200 to just 170 animals in 16 years, with the main cause being major changes in land tenure. [..] “The take-away from this pinnacle study is that securing protected areas alone is not enough,” said Dr Kim Young-Overton from Panthera, another author on the report. “We must think bigger, conserving across the mosaic of protected and unprotected landscapes that these far-reaching cats inhabit, if we are to avert the otherwise certain loss of the cheetah forever.”

We had a great Christmas Day live cooking event in Monastiraki square in Athens (see photos). I’ll get back to you on that. Donations through Paypal -top left hand corner of this page- of course remain welcome.

• The Automatic Earth in Greece: Big Dreams for 2017 (Automatic Earth)

Both Konstantinos and myself -and all the other volunteers at O Allos Anthropos- want to thank you so much for all the help you’ve given over the past year -and in 2015-. If I may make a last suggestion, please forward this ‘dream’ to anyone you know -and even those you don’t-, by mail, Twitter, Facebook, Instagram, word of mouth, any which way you can think of. Go to your local mayor or town council, suggest they can help and get -loudly- recognized for it. There may be a dream involved for 2017, but that was our notion a year ago as well, and look what we’ve achieved a year later: it is very real indeed. And anyone, everyone can become part of that reality for just a few bucks. If the institutions won’t do it, perhaps the people themselves should. That doesn’t even sound all that crazy or farfetched. There’s a lot of us.

Konstantinos Polychronopoulos, Athens Christmas Day 2016