NPC US Geological Survey fire, F Street NW, Washington DC 1913

“In 2014 nearly half of American households said they could not cover an unexpected $400 expense without borrowing or selling something..”

• In America, It’s Expensive To Be Poor (Economist)

When Ken Martin, a hat-seller, pays his monthly child-support bill, he uses a money order rather than writing a cheque. Money orders, he says, carry no risk of going overdrawn, which would incur a $40 bank fee. They cost $7 at the bank. At the post office they are only $1.25 but getting there is inconvenient. Despite this, while he was recently homeless, Mr Martin preferred to sleep on the streets with hundreds of dollars in cash—the result of missing closing time at the post office—rather than risk incurring the overdraft fee. The hefty charge, he says, “would kill me”. Life is expensive for America’s poor, with financial services the primary culprit, something that also afflicts migrants sending money home (see article). Mr Martin at least has a bank account.

Some 8% of American households—and nearly one in three whose income is less than $15,000 a year—do not (see chart). More than half of this group say banking is too expensive for them. Many cannot maintain the minimum balance necessary to avoid monthly fees; for others, the risk of being walloped with unexpected fees looms too large. Doing without banks makes life costlier, but in a routine way. Cashing a pay cheque at a credit union or similar outlet typically costs 2-5% of the cheque’s value. The unbanked often end up paying two sets of fees—one to turn their pay cheque into cash, another to turn their cash into a money order—says Joe Valenti of the Centre for American Progress, a left-leaning think-tank.

In 2008 the Brookings Institution, another think-tank, estimated that such fees can accumulate to $40,000 over the career of a full-time worker. Pre-paid debit cards are growing in popularity as an alternative to bank accounts. The Mercator Advisory Group, a consultancy, estimates that deposits on such cards rose by 5% to $570 billion in 2014. Though receiving wages or benefits on pre-paid cards is cheaper than cashing cheques, such cards typically charge plenty of other fees. Many states issue their own pre-paid cards to dispense welfare payments. As a result, those who do not live near the right bank lose out, either from ATM withdrawal charges or from a long trek to make a withdrawal. Other terms can rankle; in Indiana, welfare cards allow only one free ATM withdrawal a month. If claimants check their balance at a machine it costs 40 cents. (Kansas recently abandoned, at the last minute, a plan to limit cash withdrawals to $25 a day, which would have required many costly trips to the cashpoint.)

To access credit, the poor typically rely on high-cost payday lenders. In 2013 the median such loan was $350, lasted two weeks and carried a charge of $15 per $100 borrowed—an interest rate of 322% (a typical credit card charges 15%). Nearly half those who borrowed using payday loans did so more than ten times in 2013, with the median borrower paying $458 in fees. In 2014 nearly half of American households said they could not cover an unexpected $400 expense without borrowing or selling something; 2% said this would cause them to resort to payday lending.

Fixed Income, Currency and Commodity.

• Morgan Stanley Predicts Up To A 25% Collapse in Q3 FICC Revenue (Zero Hedge)

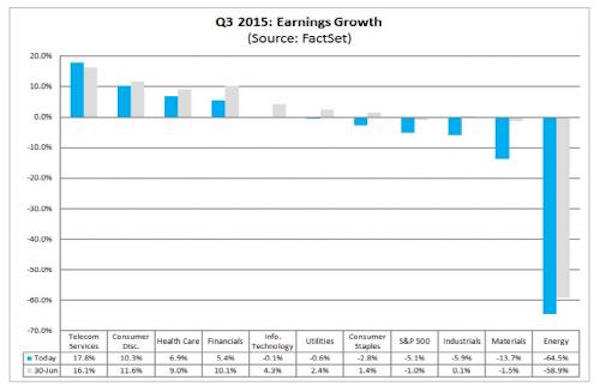

With the third quarter earnings season on deck, in which S&P500 EPS are now expected to post a 5.1% decline (versus a forecast -1.0% decline as of three months ago), it is common knowledge that the biggest culprit will be Energy companies, currently expected to suffer a 65% Y/Y collapse in EPS. What is less known is that the earnings weakness is far more widespread than just the Energy sector, touching on more than half of all sectors with Materials, Industrials, Staples, Utilities and even Info Tech all expected to see EPS declines: this despite what will likely be a record high in stock buyback activity. However, of all sectors the one which may pose the biggest surprise to investors is financials: it is here that Q3 (and Q4) earnings estimates have hardly budged, and as of September 30 are expected to rise by 10% compared to Q3 2014.

This may prove to be a stretch according to Morgan Stanley whose Huw van Steenis is seeing nothing short of a bloodbath in banking revenues, with the traditionally strongest performer, Fixed Income, Currency and Commodity set for a tumble as much as 25%, to wit: “we think FICC may be down 10- 25% YoY (FX up, Rates sluggish, Credit soft), Equities marginally up but IBD also down 10-20%. The reason for this: the double whammy of the ongoing commodity crunch as well as the collapse in fixed income trading, coupled with the lack of major moves across the FX space where the biggest beneficiary, now that bank manipulation cartels have been put out of business, are Virtu’s algos.

To be sure, if Jefferies – which as we previously reported suffered one of its worst FICC quarters in history, and actually posted negative revenues after massive writedown on energy holdings in its prop book – is any indication, Morgan Stanley’s Q3 forecast may be overly optimistic. For the full 2015, the picture hardly gets any better: “In 2015, we see industry revenues going sideways – slowing after a strong Q1. Overall we see FICC down ~3% on 2014, Equities up ~8% and IBD down ~6%. Overall we expect top line revenues to be flattish in 2015. In constant currency, it would be a little better for Europeans. But below this, there is a huge competitive battle afoot as all firms vie for share to drive profits on the cost base.”

Why stop at 10%?

• Bill Gross Sees Stocks Plunge Another 10%, Urges Flight to Cash (Bloomberg)

Bill Gross, who in January predicted that many asset classes would end the year lower, said U.S. equities have another 10% to fall and investors should sit out the current volatility in cash. The whipsaw market reaction to the lackluster U.S. jobs report last week shows that markets, especially stocks, high-yield bonds and some emerging market debt, are trading like a casino, Gross said in an interview on Friday. He was speaking from a cruise ship which had taken shelter near New York City amid stormy weather over the Atlantic. Gross, who earlier made prescient calls on German bunds and Chinese equities, said U.S. stocks will drop another 10% because economic conditions don’t support a rally like in 2013, when corporate profits were going up.

Today they are flat-lining and low commodity prices are hurting energy companies, said the manager of the $1.4 billion Janus Global Unconstrained Bond Fund. “More negative numbers lie ahead and if you define a bear market by a 20% correction, at some point – that’s 6 to 12 months – we’ll have a classic definition of a bear market, meaning another 10% downside,” he said. Just as New York City was the safe harbor for Hurricane Joaquin, Gross said, cash is the best bet until investors get a better view at what the Federal Reserve and the economy are going to do. “Cash doesn’t yield anything but it doesn’t lose anything,’’ so sitting it out and making 25 to 50 basis points in commercial paper compared to 4% to 5% in risk assets is not that much of a penalty, he said. “Investors need cold water splashed on their face and sit out the dance.”

Bottom. Race.

• Treasury Auction Sees US Join 0% Club First Time Ever (FT)

For the first time ever, investors on Monday parked cash for three months at the US Treasury in return for a yield of 0%. The $21bn sale of zero-yielding three-month Treasury bills brings the US closer into line with its rich-world peers. Finland, Germany, France, Switzerland and Japan have all auctioned five-year debt offering investors negative yields. As Alberto Gallo at RBS said in February, “negative yielding bonds are the fastest growing asset class in Europe”. Demand for the US issue was the highest since June, reflecting belief — stoked by Friday’s weak jobs report — that the Federal Reserve will keep interest rates at basement levels throughout 2015. David Bianco, strategist at Deutsche Bank, said the window for a “2015 lift-off” has been slammed shut. “We see a better chance of landing men on Mars before a full normalisation of nominal and real interest rates,” he wrote.

US Treasury debt is a haven asset, attracting hordes of investors whenever there is a flight to safety. Monday’s auction, however, occurred alongside the S&P 500 rallying 1.8%, a fifth straight gain. Also on Monday, the US auctioned six-month bills yielding 0.065%, the lowest in 11 months. The zero-yielding bond was anticipated in the secondary market, where investors trade outstanding bonds. The yield on bonds maturing on January 8 turned negative on September 21 and now yield -0.008%. In the swaps market, the chances that the Fed will lift rates at its October 28 meeting are just 10%. Just before the last meeting, the odds of a lift were placed at one-in-three. Before the financial crisis, three-month Treasury paper routinely paid investors more than 4%. But yields at the weekly auctions have been less than 0.2% at every auction since April 2009, reflecting the Fed’s suppression of interest rates. Until Monday the record low was 0.005%.

All legal. “..would collectively owe an estimated $620 billion in U.S. taxes if they repatriated the funds..”

• Big US Firms Hold $2.1 Trillion Overseas To Avoid Taxes (Reuters)

The 500 largest American companies hold more than $2.1 trillion in accumulated profits offshore to avoid U.S. taxes and would collectively owe an estimated $620 billion in U.S. taxes if they repatriated the funds, according to a study released on Tuesday. The study, by two left-leaning non-profit groups, found that nearly three-quarters of the firms on the Fortune 500 list of biggest American companies by gross revenue operate tax haven subsidiaries in countries like Bermuda, Ireland, Luxembourg and the Netherlands. The Center for Tax Justice and the U.S. Public Interest Research Group Education Fund used the companies’ own financial filings with the Securities and Exchange Commission to reach their conclusions.

Technology firm Apple was holding $181.1 billion offshore, more than any other U.S. company, and would owe an estimated $59.2 billion in U.S. taxes if it tried to bring the money back to the United States from its three overseas tax havens, the study said. The conglomerate General Electric has booked $119 billion offshore in 18 tax havens, software firm Microsoft is holding $108.3 billion in five tax haven subsidiaries and drug company Pfizer is holding $74 billion in 151 subsidiaries, the study said. “At least 358 companies, nearly 72% of the Fortune 500, operate subsidiaries in tax haven jurisdictions as of the end of 2014,” the study said. “All told these 358 companies maintain at least 7,622 tax haven subsidiaries.”

Fortune 500 companies hold more than $2.1 trillion in accumulated profits offshore to avoid taxes, with just 30 of the firms accounting for $1.4 trillion of that amount, or 65%, the study found. Fifty-seven of the companies disclosed that they would expect to pay a combined $184.4 billion in additional U.S. taxes if their profits were not held offshore. Their filings indicated they were paying about 6% in taxes overseas, compared to a 35% U.S. corporate tax rate, it said.

You don’t say…

• Lower Interest Rates Hurt Consumers: Deutsche Bank (Bloomberg)

Central banks the world over have reduced interest rates more than 500 times since the collapse of Lehman Brothers in 2008. But a crucial part of their thesis on how lower rates are supposed to help spur economic activity may be off the mark, according to strategists at Deutsche Bank. Cutting interest rates in response to a deteriorating outlook is thought to work through a variety of channels to help support the economy. Lower rates are supposed to encourage households to borrow and businesses to invest, while ceteris paribus, the softening in the domestic currency that accompanies a reduction in rates also makes the country’s goods and services more competitive on the global stage.

Most questions raised about the broken transmission mechanism from central bank accommodation to the real economy have centered on the efficacy of quantitative easing. But Deutsche’s team, led by chief global strategist Bankim “Binky” Chadha, contends that the commonly accepted link between traditional stimulus and household spending doesn’t have the net effect monetary policymakers think it does. This assertion comes about as a byproduct of the strategists’ investigation into what drives the U.S. household savings rate, which has largely been on the decline for a number of decades.

First, the strategists make the inference that the purpose of household savings is to accumulate wealth. If this holds, then it logically follows that in the event of a faster-than-expected increase in wealth, households will feel less of a need to save because they’ve made progress in collecting a sufficient amount of assets that allows them to enjoy their retirement, pass it down to their children, and so on. Chadha & Co. argue that wealth is therefore the driver of the U.S. savings rate. As this rises, the savings rate tends to fall: “The savings rate has been very strongly negatively correlated (-86%) with the value of gross assets scaled by the size of the economy, i.e., the ratio of household assets to nominal GDP which we use as our proxy for wealth, over the last 65 years,” wrote Chadha.

So it’s on life-support.

• Bernanke Says ‘Not Obvious’ Economy Can Handle Interest Rates At 1% (MarketWatch)

Former Fed Chairman Ben Bernanke said Monday that he was not sure the economy could handle four quarter-point rate hikes. Some economists and Fed officials argue that the U.S. central bank should hike rates now to anticipate inflation. That argument assumes the Fed can raise rates 100 basis points and it wouldn’t hurt anything, Bernanke said. ”That is not obvious, I don’t think everybody would agree to that,” he added in an interview with CNBC. Higher rates could “kill U.S. exports with a very strong dollar,” he said. Bernanke said the “mediocre” September employment report is a “negative” for the U.S. central bank’s plan to begin hiking rates in 2015, as a strengthening labor market was the key conditions for the Fed to be confident inflation was moving higher.

Bernanke said he would not second-guess Fed Chairwoman Janet Yellen, saying only that his successor faced “tough” calls. He said the two do not speak on the phone. Bernanke said interest rates at zero was not “radically easy” policy stance as some have suggested. He said he did not take seriously arguments that zero rates was creating an uncertain environment was holding down business investment Bernanke defended his policies, noting the steady decline in the unemployment rate in recent years. He said that the slower overall pace of GDP since the Great Recession was due to a downturn in productivity and other issues outside the purview of monetary policy. “I am not saying things are great, I don’t mean to say that at all,” he said.,.

No kidding.

• UK Finance Chiefs Signal Sharp Fall In Risk Appetite (FT)

The optimism and risk appetite of those in charge of the UK’s corporate finances has deteriorated sharply over the past three months. “Softening demand in emerging economies, greater financial market volatility and higher levels of risk aversion make for a more challenging backdrop for the UK’s largest businesses,” said David Sproul, chief executive of Deloitte. A Deloitte survey – of 122 chief financial officers of FTSE 350 and other large private UK companies – showed that perceptions of uncertainty were at a two-and-a-half year high, and had risen at the sharpest rate since the question was first put five years ago. Three-quarters of CFOs said the level of financial economic uncertainty was either “very high”, “high” or “above normal”, marking a return to the level last seen in the second quarter of 2013.

Ian Stewart, chief economist at Deloitte, said sentiment at large companies was heavily influenced by the global environment, especially by news flow and the performance of equity markets. “In both areas good news has been in short supply of late: UK equities down 16% from their April peaks; US institutional investor optimism at 2009 levels; financial market volatility up sharply and more downgrades to emerging market growth forecasts,” he said. But he added that CFOs were positive about the state of the UK economy. Instead, their biggest concerns were of imminent interest rate rises and of weakness in emerging market economies, particularly China. A year ago, corporate risk appetite was at a seven-year high. Now a minority of CFOs — 47% — felt that it was a good time to take risk on to their balance sheet, down from 59% in the second quarter of 2015.

A lot more.

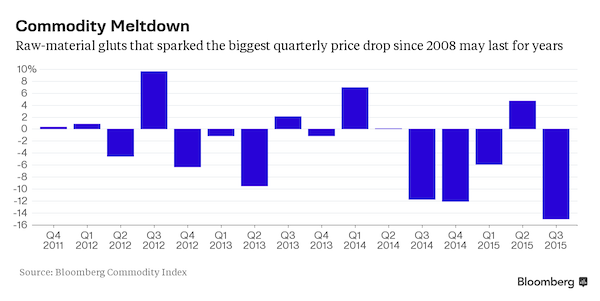

• Commodity Collapse Has More to Go as Goldman to Citi See Losses (Bloomberg)

Even with commodities mired in the worst slump in a generation, Goldman Sachs, Morgan Stanley and Citigroup are warning bulls that prices may stay lower for years. Crude oil and copper are unlikely to rebound because of excess supplies, Goldman predicts, and Morgan Stanley forecasts that weaker currencies in producing countries will encourage robust output of raw materials sold for dollars, even during bear markets. Citigroup says the sluggish world economy makes it “hard to argue” that most prices have already bottomed. The Bloomberg Commodity Index on Sept. 30 capped its worst quarterly loss since the depths of the recession in 2008. The economy in China, the biggest consumer of grains, energy and metals, is expanding at the slowest pace in two decades just as producers struggle to ease surpluses.

Alcoa, once a symbol of American industrial might, plans to split itself in two, while Chesapeake Energy cut its workforce by 15%. Caterpillar may shed 10,000 jobs as demand slows for mining and energy equipment. “It would take a brave soul to wade in with both feet into commodities,” Brian Barish at Denver-based Cambiar Investors. “There is far more capacity coming on than there is demand physically. And the only way that you fix the problem is to basically shut capacity in, and you do that by starving commodity producers for capital.” Investors are already bailing. Open interest in raw materials, which measures holdings of futures and options, fell for a fourth month in September, the longest streak since 2008, government data show.

U.S. exchange-traded products tracking metals, energy and agriculture saw net withdrawals of $467.8 million for the month, according to data compiled by Bloomberg. The Bloomberg Commodity Index, a measure of returns for 22 components, is poised for a fifth straight annual loss, the longest slide since the data begins in 1991. It’s a reversal from the previous decade, when booming growth across Asia fueled a synchronized surge in prices, dubbed the commodity super cycle. Farmers, miners and oil drillers expanded supplies, encouraged by prices that were at record highs in 2008. Now, that output is coming to the market just as global growth is slowing.

The dollar comes home.

• Emerging Market ETF Outflows Double as Losses Hit $12.4 Billion (Bloomberg)

Outflows from U.S. exchange-traded funds that invest in emerging markets more than doubled last week, with redemptions exceeding $12 billion in the third quarter. Taiwan led the losses in the five days ended Oct. 2. Withdrawals from emerging-market ETFs that invest across developing nations as well as those that target specific countries totaled $566.1 million compared with outflows of $262.1 million in the previous week, according to data compiled by Bloomberg. Stock funds lost $483.5 million and bond funds declined by $82.5 million. The MSCI Emerging Markets Index advanced 1.9% in the week. The losses marked the 13th time in 14 weeks that investors withdrew money from emerging market ETFs and left the funds down $12.4 billion for the quarter, the most since the first quarter of 2014, when outflows reached $12.7 billion.

For September, emerging market ETFs suffered $1.9 billion of withdrawals. The biggest change last week was in Taiwan, where funds shrank by $93.3 million, compared with $19.9 million of redemptions the previous week. All the withdrawals came from stock funds, while bond funds remained unchanged. The Taiex advanced 2.1%. The Taiwan dollar strengthened 0.2% against the dollar and implied three-month volatility is 8.5%. Brazil had the next-biggest change, with ETF investors redeeming $68.7 million, compared with $12.8 million of inflows the previous week. Stock funds fell by $64.1 million and bond ETFs declined by $4.6 million. The Ibovespa Index gained 4.9%. The real appreciated 1.1% against the dollar and implied three-month volatility is 24%.

They’ve all been overinvesting by a wide margin.

• China’s Slowing Demand Burns Gas Giants (WSJ)

The energy industry overestimated just how much natural gas China needs, and global oil-and-gas companies risk paying a heavy price. When China’s economy hummed along a few years ago, energy companies from Australia to Canada bet its demand for natural gas would grow fast. They spent billions of dollars on promising fields, with plans to freeze the gas into liquid, called LNG, and load it on tankers to sell to energy-starved Asian buyers at a premium. China was “always seen as the kind of wonder market that was going to grow and need so much LNG,” said Howard Rogers of the Oxford Institute for Energy Studies and a former gas executive at BP. “People got somewhat carried away.”

Recent data paints a grimmer picture. Chinese LNG imports are down 3.5% this year, compared with a 10% rise in 2014. Total gas consumption grew about 2% in the first half, a turnabout from double-digit growth in recent years. Natural gas is an extreme example of how China’s slowing economy has contributed to a global commodities crash. Producers of raw materials from aluminum to iron ore made heady bets on Chinese demand. So far, many are being proven wrong. The downturn is sparking an industrywide recalibration. Energy consultancy Wood Mackenzie slashed its China gas-demand forecast by about 15% to 360 billion cubic meters by 2020.

Globally, the market faces 25 million tons of LNG oversupply by 2018, says Citi Research—more than China imported all of last year. If all the projects being constructed, planned and proposed today came to fruition, the market would face around one-third more capacity than it needs by 2025, Citi estimates. “We’re already seeing China cannot absorb all the gas that is thrown at it—that it’s choking on gas somewhat at the moment,” said Gavin Thompson, an analyst at Wood Mackenzie. Northeast Asia spot LNG prices have fallen to less than $8 per million metric British thermal units from over $14 last fall, according to pricing agency Platts. U.S. Henry Hub prices are under $3 per mmBtu versus around $4 a year ago.

Just civil claims.

• BP’s Record Oil Spill Settlement Rises to More Than $20 Billion (Bloomberg)

The value of BP’s settlement with the U.S. government and five Gulf states over the Deepwater Horizon oil spill rose to $20.8 billion in the latest tally of costs from the U.S. Department of Justice. The settlement is the largest in the department’s history and resolves the government’s civil claims under the Clean Water Act and Oil Pollution Act, as well as economic damage claims from regional authorities, according to a U.S. Justice Department statement Monday. The pact is designed “to not only compensate for the damages and provide for a way forward for the health and safety of the Gulf, but let other companies know they are going to be responsible for the harm that occurs should accidents like this happen in the future,” U.S. Attorney General Loretta Lynch told reporters at a briefing in Washington.

BP’s total settlement cost of $18.7 billion announced in July didn’t include some reimbursements, interest payments and committed expenditures for early restoration of damages to natural resources. The London-based company has set aside a total of $53.7 billion to pay for the disaster in 2010, when an explosion on the Deepwater Horizon drilling rig in the Gulf of Mexico resulted in the largest offshore oil spill in U.S. history. The announcement Monday includes $700 million for injuries and losses related to the spill that aren’t yet known, $232 million of which was announced earlier. It also adds $350 million for the reimbursement of assessment costs and $250 million related to the cost of responding to the spill, lost royalties and to resolve a False Claims Act investigation, according to a consent decree filed by the Justice Department at the U.S. District Court in New Orleans.

“..prices did not reflect supply and demand because of “distortions” in the market.” True, but not in the way he means.

• Glencore Urges Rivals To Shut Lossmaking Mines (FT)

Glencore chief executive Ivan Glasenberg stepped up his defence of the under-fire miner and trading house on Monday, calling on rivals to shut unprofitable mines and blaming hedge funds for pushing down commodity prices. Shares in the London-listed company, which have been the worst performer in the FTSE 100 this year falling by almost two-thirds, rallied as much as 21% in the wake of his comments and as analysts said that a recent sell-off and comparisons to Lehman Brothers were “overblown”. Glencore shares are now back above 100p and have recouped all of the losses sustained last week during a one-day sell-off that wiped out almost a third of the company’s equity.

However, the stock remains highly volatile – it has risen 68% in five trading sessions – and is significantly below its 2011 flotation price of 530p. The Switzerland-based company was forced to put out a statement early on Monday after its Hong Kong shares surged more than 70% following a speculative report that said it was open to takeover offers. Glencore’s statement said there was no reason for the share price surge. Insiders at the company said any publicly listed company was for sale at the right price, but dismissed talk of an approach or management buyout.

Speaking on the sidelines of the Financial Times Africa Summit in London, Mr Glasenberg refused to comment on the recent wild swings in Glencore’s share price, but said the company was focused on completing its $10 billion debt reduction plan, which could knock a third off its net debt pile by the end of next year. Mr Glasenberg focused on copper – Glencore’s most important mined commodity – arguing that prices did not reflect supply and demand because of “distortions” in the market. Glencore has been scrambling to reassure investors and creditors and silence its critics who claim that the company will struggle to manage its $30 billion of net debt if commodity prices do not recover quickly.

Dutch disease.

• Norway Seen Tapping Its Wealth Fund to Ward Off Oil Slump Risks (Bloomberg)

For Norway, the future may already be here. The nation could as soon as next year start making withdrawals from its massive $830 billion sovereign wealth fund, which it has built over the past two decades as a nest egg for “future generations.” The minority government will reveal its budget plans on Wednesday and has flagged new spending measures and tax cuts. Prime Minister Erna Solberg is trying to avoid a recession as a slump in the nation’s key commodity takes its toll on the $500 billion oil-reliant economy. Norway has already spent recent years using a growing chunk of its oil revenue to plug deficits while at the same time building the wealth fund. Now, with tax revenue from petroleum extraction down 42% on last year, budget spending in 2016 will probably outstrip income.

“We have reached a point where we will from now on see that the oil-corrected balance will be above the cash flow – that’s based on oil prices increasing slowly in the future,” said Kyrre Aamdal, senior economist at DNB ASA in Oslo. Tapping the fund’s returns marks a turning point that wasn’t expected to come for “several more years,” he said. The government said in May its non-oil budget deficit, or spending in real terms, would be a record 180.9 billion kroner ($21.6 billion). With its crude output waning and prices falling, the government saw petroleum income dropping to 251.6 billion kroner this year, almost 30% lower than its October projections. Those estimates assumed oil at about $69 a barrel. Brent crude has averaged $56 so far this year.

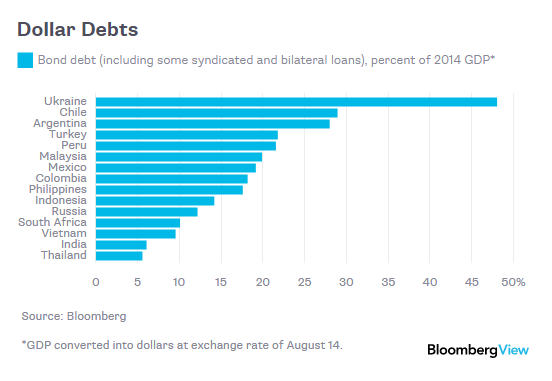

Dollar-denominated debt.

• South East Asia Economic Woes Test Built-Up Reserves, Defenses (Reuters)

Southeast Asia has spent the best past of two decades shoring defenses against a repeat of the Asian financial crisis, including building up record foreign exchange reserves, yet is now feeling vulnerable to speculative attacks again. Officials are growing increasingly concerned as souring sentiment has made currencies slide and investors reassess risk profiles in an environment where China is slowing and U.S. interest rates will rise at some point. And while economists have long dismissed comparisons with the 1997/98 currency crisis, pointing to freer exchange rates, current-account surpluses, lower external debt and stricter oversight by regulators, lately there has been a change.

Malaysia and Indonesia, which export oil and other commodities to fuel China’s factories, are looking vulnerable as the world’s second-largest economy heads for its slowest growth in 25 years and the prices of their commodity exports plunge. “We are worried about the contagion effect,” Indonesian Finance Minister Bambang Brodjonegoro said last week, using a word widely used in 1997/98. In 1997, “the thing happened first in Thailand through the baht, not the rupiah. But the contagion effect became widespread,” he added. Taimur Baig, Deutsche Bank’s chief Asia economist, said that unlike 1997, when pegged currencies were attacked as over-valued, today’s floating ones are “weakening willingly” in response to outflows. But there can still be contagion, as markets lump together economies reliant on China or on commodities.

“If you see a sell-off in Brazil, that can easily spread to Indonesia, which can spread to Malaysia, and so on,” he said. Foreign funds have sold a net $9.7 billion of stocks in Malaysia, Thailand and Indonesia this year, with the bourses in those three countries seeing Asia’s largest net outflows, Nomura said on Oct. 2. Baig said that as in 1997/98, falling currencies will naturally pose balance-sheet problems for companies with dollar debts and local-currency earnings. This year, Malaysia’s ringgit MYR= has fallen nearly 20% against the dollar and its reserves dropped by about the same%age, to below $100 billion. “It’s almost like a perfect storm for Malaysia,” the country’s economic planning minister, Abdul Wahid Omar, said.

Because their new phones don’t sell.

• Samsung Seen Tapping $55 Billion Cash Pile for Share Buyback (Bloomberg)

Investors in Samsung Electronics are watching their holdings plunge as new Galaxy smartphones get a lukewarm public response. With $55 billion in cash, the company may be poised to offer consolation. Analysts expect the world’s biggest smartphone maker to buy back shares as early as this month in an effort to return some value to stockholders. Removing more than $1 billion of stock from the market could prompt shares to rally by as much as 20%, according to the top-ranked analyst covering Samsung, potentially erasing their declines this year. Samsung has lost about $22 billion in market value – roughly equivalent to a Nintendo – this year as sales of the S6 and Note 5 devices sputter against new models from Apple and Chinese makers.

A buyback would be just the second in eight years and may take the sting out of sliding market share and sales projected to hit their lowest since 2011. “A share buyback should happen anytime now because the earnings haven’t been performing well,” said Dongbu Securities Co.’s Yoo Eui Hyung, who tops Bloomberg Absolute Return rankings for his calls on Samsung Electronics. Suwon-based Samsung is scheduled to release third-quarter operating profit and sales estimates Wednesday. That three-month period was marked by price cuts for the S6 and curved-screen S6 Edge phones just months after their debuts. Analysts expect profit of 6.7 trillion won in the period ended September.

While that is up from 4.1 trillion won a year earlier, it’s 34% below a record 10.2 trillion won two years ago. Net income and details of division earnings will be released later this month. Shares of Samsung rose 3.2% to 1,151,000 won in Seoul, paring this year’s decline to 13%. A stock repurchase also would help the founding Lees tighten their grip on the crown jewel of South Korea’s biggest conglomerate since the family typically doesn’t sell stock in a buyback, Yoo said. Vice Chairman Lee Jae Yong, the heir apparent, and his relatives control Samsung Group through a web of cross shareholdings with less than 10% of total shares.

Before VW.

• German Factory Orders Unexpectedly Fall in Sign of Economic Risk (Bloomberg)

German factory orders unexpectedly fell in August in a sign that Europe’s largest economy is vulnerable to weaker growth in China and other emerging markets. Orders, adjusted for seasonal swings and inflation, dropped 1.8% after decreasing a revised 2.2% in July, data from the Economy Ministry in Berlin showed on Tuesday. The typically volatile number compares with a median estimate of a 0.5% increase in a Bloomberg survey. Orders rose 1.9% from a year earlier. A China-led slowdown in emerging markets that threatens Germany’s export-oriented economy is exacerbated by an emissions scandal at Volkswagen AG that could affect as many as 11 million cars globally. Still, business confidence unexpectedly increased in September as the economy benefited from strengthening domestic demand on the back of record employment, rising wages and low inflation.

Excluding big-ticket items, orders dropped 2.1% in August, the Economy Ministry said in a statement. Domestic factory orders declined 2.6% as demand for investment goods slumped. The drop in orders was exaggerated by school holidays, it said. A bright spot was the rest of the euro area, where demand for capital goods jumped. Waning Chinese industrial demand has prompted Henkel AG to announce the removal of 1,200 jobs at its adhesives unit as it adapts capacity. While the brunt of the layoffs will be borne in Asia, 250 jobs will be cut in Europe and 100 in Germany. August factory orders don’t yet reflect the impact of VW’s cheating on U.S. emissions tests revealed last month. Chairman-designate Hans Dieter Poetsch warned that the scandal could pose “an existence-threatening crisis” for Europe’s largest carmaker.

“..EU laws that prohibit data-sharing with countries deemed to have lower privacy standards, of which the United States is one…”

• Top EU Court Says US-EU Data Transfer Deal Is Invalid (Reuters)

A system enabling data transfers from the European Union to the United States by thousands of companies is invalid, the highest European Union court said on Tuesday in a landmark ruling that will leave firms scrambling to find alternative measures. “The Court of Justice declares that the Commission’s U.S. Safe Harbor Decision is invalid,” it said in a statement. The decision could sound the death knell for the Safe Harbor framework set up fifteen years ago to help companies on both sides of the Atlantic conduct everyday business but which has come under heavy fire following 2013 revelations of mass U.S. snooping. Without Safe Harbor, personal data transfers are forbidden, or only allowed via costlier and more time-consuming means, under EU laws that prohibit data-sharing with countries deemed to have lower privacy standards, of which the United States is one.

The Court of Justice of the European Union (ECJ) said that U.S. companies are “bound to disregard, without limitation,” the privacy safeguards provided in Safe Harbor where they come into conflict with the national security, public interest and law enforcement requirements of the United States. Revelations by former National Security Agency contractor Edward Snowden of the so-called Prism program allowing U.S. authorities to harvest private information directly from big tech companies such as Apple, Facebook (FB.O) and Google prompted Austrian law student Max Schrems to try to halt data transfers to the United States. Schrems challenged Facebook’s transfers of European users’ data to its U.S. servers because of the risk of U.S. snooping.

As Facebook has its European headquarters in Ireland, he filed his complaint to the Irish Data Protection Commissioner. The case eventually wound its way up to the Luxembourg-based ECJ, which was asked to rule on whether national data privacy watchdogs could unilaterally suspend the Safe Harbor framework if they had concerns about U.S. privacy safeguards. In declaring the data transfer deal invalid, the Court said the Irish data protection authority had to the power to investigate Schrems’ complaint and subsequently decide whether to suspend Facebook’s data transfers to the United States. “This is extremely bad news for EU-U.S. trade,” said Richard Cumbley, Global Head of technology, media and telecommunications at law firm Linklaters. “Without Safe Harbor, (businesses) will be scrambling to put replacement measures in place.”

Democracy it ain’t.

• US, Japan And 10 Countries Strike Pacific Trade Deal (FT)

The US, Japan and 10 other Pacific Rim nations have struck the largest trade pact in two decades, in a huge strategic and political victory for US President Barack Obama and Japanese Prime Minister Shinzo Abe. The Trans-Pacific Partnership covers 40% of the global economy and will create a Pacific economic bloc with reduced trade barriers to the flow of everything from beef and dairy products to textiles and data, and with new standards and rules for investment, the environment and labour. The deal represents the economic backbone of the Obama administration’s “pivot” to Asia, which is designed to counter the rise of China in the Pacific and beyond. It is also a key component of the “third arrow” of economic reforms that Mr Abe has been trying to push in Japan since taking office in 2012.

But the TPP must still be signed formally by the leaders of each country and ratified by their legislatures, where support for the deal is not universal. In the US, Mr Obama will face a tough fight to push it through Congress next year, especially as presidential candidates such as the Republican frontrunner Donald Trump have argued against it. It is also likely to face parliamentary opposition in countries such as Australia and Canada, where the TPP has been one of the main points of economic debate ahead of an election on October 19. Critics around the world see it as a deal negotiated in secret and biased towards corporations. Those criticisms will be amplified when national legislatures seek to ratify the TPP.

“When Australian and New Zealand trade representatives asked to view the texts, they were asked to sign an agreement promising to keep it secret for at least four years “to facilitate candid and productive negotiations..”

• TPP Trade Deal Text Won’t Be Made Public For Four Years (Ind.)

The text of the Trans-Pacific Partnership that was agreed by trade ministers from US, Japan and ten other countries will not be made public for four years – whether or not it goes on to be passed by Congress and other member nations. If ratified by US Congress and other member nations, TPP will bulldoze through trade barriers and standardise international rules on labour and the environment for the 12 nations, which make up 40% of the world’s economic output. But the details of how it will do this are enshrined in secrecy. Politicians and ordinary people have been largely excluded from TPP negotiations, leaving it in the hands of multinational corporations.

Julian Assange, the founder of Wikileaks, said that the contents of the deal have been kept secret to avoid potential opposition. Wikileaks has leaked three of the 29 chapters of the TPP agreement. One section on intellectual property rights was published in November 2013, another on the environment was published in January 2014 and one on investment was published in March 2015. John Hilary, the executive director the political organisation War On Want, said the result is that nobody knows what’s being negotiated. “You have these far reaching deals that are going to change the face of our economies and societies know nothing about it,” Hilary said in an interview posted on the Wikileaks channel in August.

The US trade representative’s office keeps trade documents secret because they are considered matters of national security, according to Margot E. Kaminski, an assistant professor of law at the Ohio State University and an affiliated fellow of the Yale Information Society. The representatives claim that negotiating documents are “foreign government information” even though some may have been drafted by US officials. When Australian and New Zealand trade representatives asked to view the texts, they were asked to sign an agreement promising to keep it secret for at least four years “to facilitate candid and productive negotiations”, according to a document leaked by the Guardian.

” It’s the nature of the social dialogue in our country.”

• Air France Workers Rip Shirts From Executives After 2,900 Jobs Cut (Guardian)

Striking staff at Air France have taken demonstrating their anger with direct action to a shocking new level. Approximately 100 workers forced their way into a meeting of the airline’s senior management and ripped the shirts from the backs of the executives. The airline filed a criminal complaint after the employees stormed its headquarters, near Charles de Gaulle airport in Paris, in what was condemned as a “scandalous” outbreak of violence. Photographs showed one ashen-faced director being led through a baying crowd, his clothes torn to shreds. In another picture, the deputy head of human resources, bare-chested after workers ripped off his shirt and jacket, is seen being pushed to safety over a fence.

Tensions between management and workers at France’s loss-making flagship carrier had been building over the weekend in the runup to a meeting to finalise a controversial “restructuring plan” involving 2,900 redundancies between now and 2017. The proposed job losses involve 1,700 ground staff, 900 cabin crew and 300 pilots. After the violence erupted at about 9.30am on Monday morning, there was widespread condemnation from French union leaders who sought to blame each other’s members for the assaults. Laurent Berger, secretary general of the CFDT, said the attacks were “undignified and unacceptable”, while Claude Mailly, of Force Ouvrière (Workers Force) said he understood Air France workers’ exasperation, but added: “One can fight management without being violent.”

Manuel Valls, France’s prime minister, said he was “scandalised” by the behaviour of the workers and offered the airline chiefs his “full support”. Air France said it had lodged an official police complaint for “aggravated violence”. [..] Olivier Labarre, director of BTI, a human resources consultancy, told Libération newspaper in 2009: “This happens elsewhere, but to my knowledge, taking the boss hostage is typically French. It’s the nature of the social dialogue in our country.”

It’s not just rhino’s. We kill across the board.

• Nearly A Third Of World’s Cacti Face Extinction (Guardian)

Nearly a third of the world’s cacti are facing the threat of extinction, according to a shocking global assessment of the effects that illegal trade and other human activities are having on the species. Cacti are a critical provider of food and water to desert wildlife ranging from coyotes and deer to lizards, tortoises, bats and hummingbirds, and these fauna spread the plants’ seeds in return. But the International Union for the Conservation of Nature (IUCN)‘s first worldwide health check of the plants, published today in the journal Nature Plants, says that they are coming under unprecedented pressure from human activities such as land use conversions, commercial and residential developments and shrimp farming.

But the paper said the main driver of cacti species extinction was the: “unscrupulous collection of live plants and seeds for horticultural trade and private ornamental collections, smallholder livestock ranching and smallholder annual agriculture.” The findings were described as “disturbing” by Inger Andersen, the IUCN’s director-general. “They confirm that the scale of the illegal wildlife trade – including the trade in plants – is much greater than we had previously thought, and that wildlife trafficking concerns many more species than the charismatic rhinos and elephants which tend to receive global attention.”