Gottscho-Schleisner L Motors at 175th Street and Broadway, NYC 1948

center>

Not beginning, continuing.

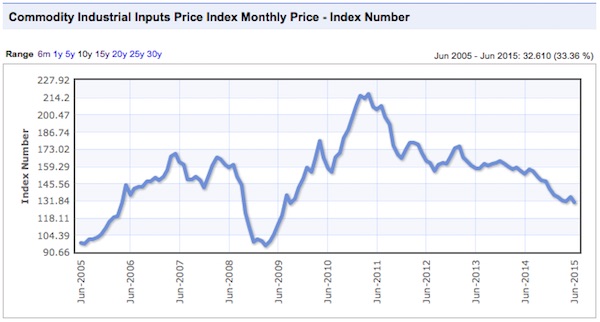

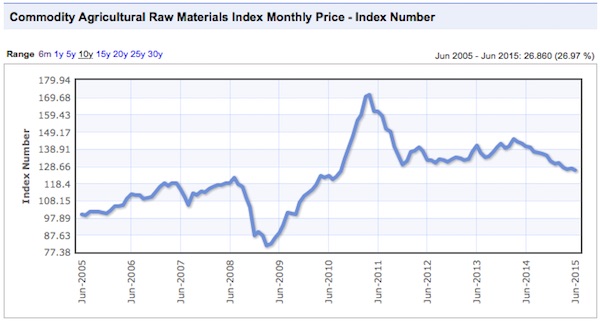

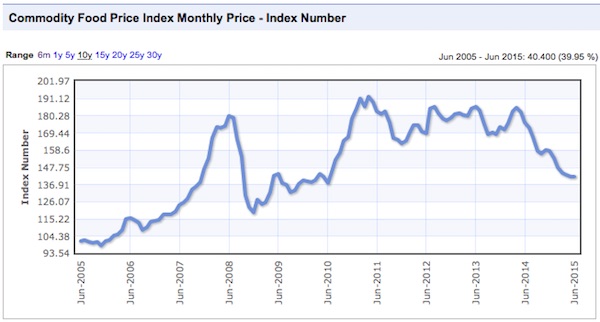

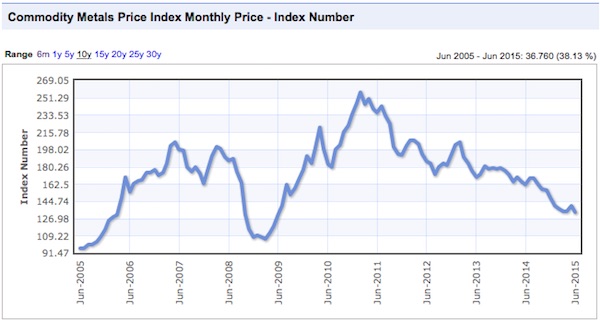

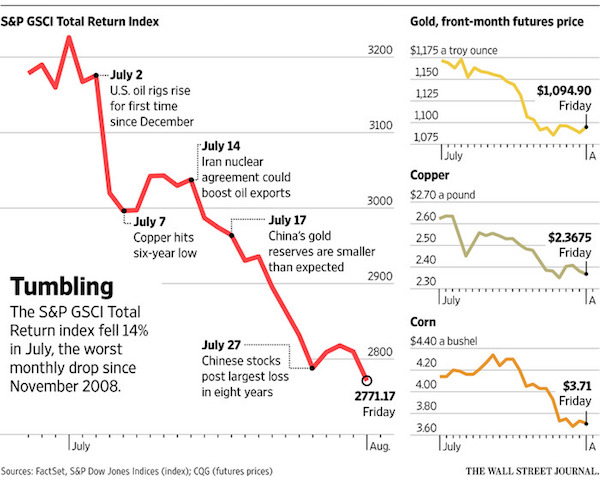

• Commodity Rout Beginning to Look Like a Full-Blown Crisis (Bloomberg)

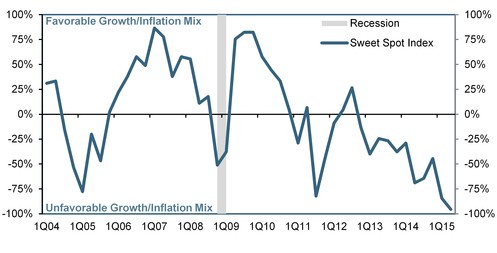

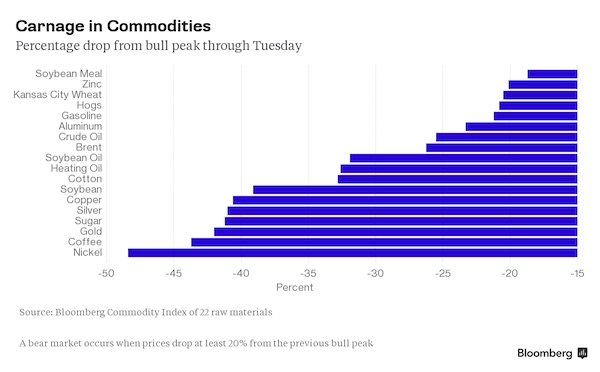

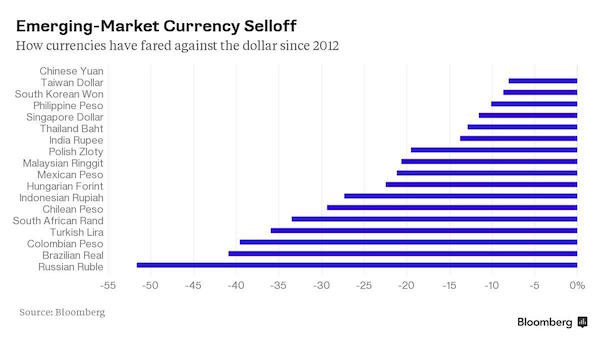

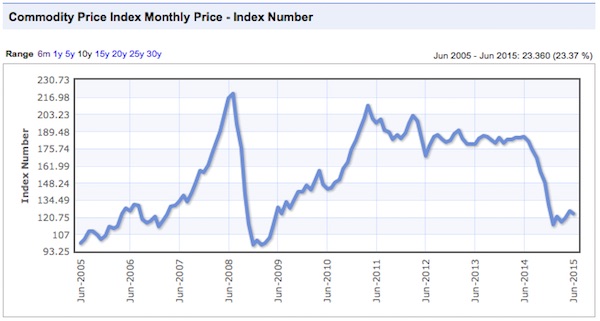

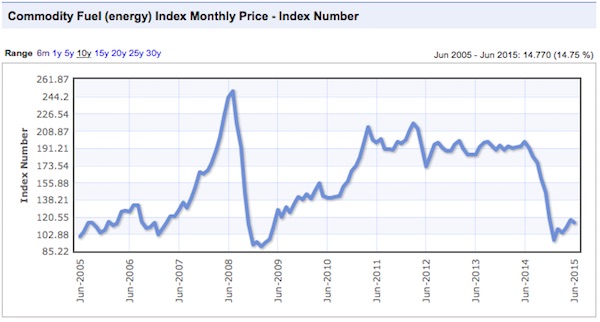

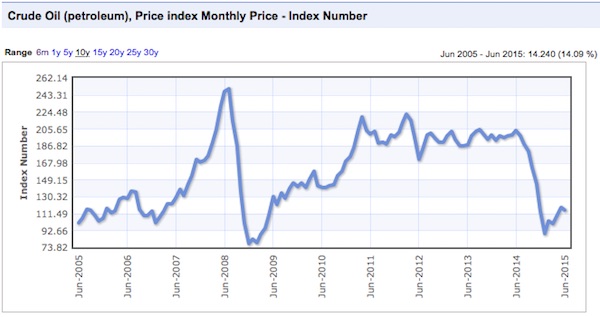

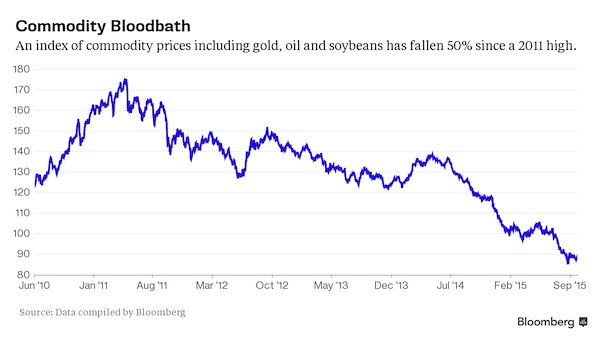

The 15-month commodities free-fall is starting to resemble a full-blown crisis. Investors are reacting to diminished demand from China and an end to the cheap-money era provided by the Federal Reserve. A Bloomberg index of commodity futures has fallen 50% since a 2011 high, and eight of the 10 worst performers in the Standard & Poor’s 500 Index this year are commodities-related businesses. Now it all seems to be coming apart at once. Alcoa, the biggest U.S. aluminum producer, said it would break itself into two companies amid a glut stemming from booming production. Shell announced it would abandon its drilling campaign in U.S. Arctic waters after spending $7 billion.

And the carnage culminated Monday with Glencore, the commodities powerhouse that came to symbolize the era with its initial public offering in 2011 and bold acquisition of a rival in 2013, falling by as much as 31% in London trading. “With China slowing down and a lot of uncertainty, fears in the market have intensified, and the reduction in the pace of demand growth for all commodities has seemed to send everybody off the cliff,” said Ed Hirs, managing director of a small oil producer who teaches energy economics at the University of Houston. Peak prices in gold and silver are four years old, oil’s plummet since June 2014 has been pushed along by OPEC’s November decision to keep pumping despite excess supply and U.S. natural gas prices have fallen to less than a fourth of their 2008 value.

It’s about to get worse, according to analysts John LaForge and Warren Pies of Venice, Florida-based Ned Davis Research Group. Commodities may be in the fourth year of a 20-year “bear super-cycle,” according to an Aug. 14 research note. The analysts looked at commodity busts dating to the 18th century and found them driven by factors such as market momentum rather than fundamentals, LaForge said Monday in an interview.

“More than 85% has been wiped off the stock so far this year..”

• Glencore Shares Obliterated After Analysts Warn They Could Be Worthless (Tel.)

Glencore shares plunged 30pc in afternoon trading to a new record low after analysts warned the stock could be worthless if commodity prices remain at current levels. The shares went into freefall after analysts at Investec issued a note warning that heavily indebted companies such as the Swiss-based mining and trading giant could see almost all their equity value eliminated under current commodity prices, leaving nothing for shareholders. Almost £2bn was wiped off the value of Glencore as investors panicked and dumped the stock. It puts further pressure on Glencore, which has already been hit hard by the slump in commodity prices. Earlier this month the miner was forced to raise $2.5bn through a share placement, selling 1.3 billion new shares at 125p apiece.

It has also has announced plans in recent weeks to suspend its dividend and sell off assets as part of debt reduction measures to bolster its balance sheet. Hunter Hillcoat, an analyst at Investec, said: “Mining companies gorged themselves on cheap debt in a race to grow production following the Chinese stimulus that occurred in the wake of the great financial crisis. “The consequences are only now coming home to roost, as mines take a long time to build. We expect commodity markets to remain subdued for several years to come given that excess supply has coincided with a slowdown in demand.”

Even a move by chief executive Ivan Glasenberg to instil confidence in investors by buying 110 million shares has had little effect on sentiment. More than 85pc has been wiped off the stock so far this year and it is trading far below its listing price in May 2011 of 530p. The analysis from Investec looked at the entire debt pile of Glencore, while the company itself has always argued its stockpiles of metals can quickly be sold to rapidly reduce the debt levels. However, the broker warned that: “If major commodity prices remain at current levels, our analysis implies that, in the absence of substantial restructuring, nearly all the equity value of both Glencore and Anglo American could evaporate.”

How about nothing?

• Is Glencore Worth $26 Billion Or $98 Billion? Analysts Can’t Decide (Bloomberg)

Glencore, the commodity trader that lost about a third of its value Monday, is worth either $98 billion or $26 billion, depending on which analyst you ask. At Sanford C. Bernstein, price targets published by Paul Gait suggest the Baar, Switzerland-based resource company can rally sevenfold to 450 pence, the top end of predictions tracked by Bloomberg. At the bottom, Nomura Holdings’s 120-pence forecast implies a market value that is $72 billion lower. The dispersion shows the difficulty in valuing a company caught between China’s slowing economy and mounting concerns about its debt load.

In addition to diverging views on copper prices, questions about how to evaluate Glencore’s trading business, unique among big mining companies, are muddling the equation, according to Clarksons Platou Securities’ Jeremy Sussman. “Glencore does have a unique trading business that is different from their competitors, and it’s a much more difficult business to model than a straight ‘you mine it, you sell it, and take whatever margin’ one,” said Sussman, an analyst for Clarksons Platou in New York. He recommends holding the stock, which he estimates will rise to 190 pence. Analysts “with targets in the higher end are probably in the camp that think trading will return to levels where it had been in the past couple of years.”

There goes your recovery. Not going to happen.

• Global Stocks Set to Fall As $800 Billion Wipeout Boosts Yen, Bonds (Bloomberg)

Global equities looked set to extend Monday’s $800 billion rout as U.S. and European index futures followed Asian stocks south amid a selloff in commodity-trading firms that’s sent investors toward the safety of the yen and sovereign bonds, while sending the cost of insuring debt skyward. Glencore dropped by a record in Hong Kong, tracking losses in London and dragging shares of Noble Group, Mitsui and BHP Billiton lower. The MSCI Asia Pacific Index is heading for its biggest quarterly loss since the global financial crisis, with every major benchmark in the region retreating on Tuesday. The yen was stronger against all 16 major peers, while the cost of insuring Asian debt jumped to the highest since October 2013. Australian and German bonds tracked Treasury gains.

A 15-month rout in raw materials and energy prices is colliding with surging corporate borrowing costs to challenge the business models of previously high-flying commodity firms such as Glencore, whose London shares have dropped 73% since June. The yield on U.S. non-investment grade corporate notes has risen for 11 straight days amid slowing Chinese growth and doubts about whether the U.S. economy is strong enough to handle higher Federal Reserve interest rates. “Glencore’s problems have heightened already deep concerns about the financial health of commodity companies,” said Win Udomrachtavanich at One Asset Management. “The outlook of commodity prices will continue to be very weak because of the prolonged global economic slowdown. Investors just face an even tougher environment with this as sentiment was already weakened by the U.S. interest-rate outlook.”

Demographics. Cute, but very one-sided.

• Three Major Trends that Shaped Global Economy for Decades Set to Change (BBG)

Demographics can explain two-thirds of everything, University of Toronto professor David K. Foot famously quipped. And according to Charles Goodhart, professor at the London School of Economics and senior economic consultant to Morgan Stanley, demographics explain the vast majority of three major trends that have shaped the socioeconomic and political environments across advanced economies over the past few decades. Those three would be declining real interest rates, shrinking real wages, and increasing inequality. Goodhart & Co.’s contentions aren’t necessarily novel, with versions of these conclusions having been articulated by Toby Nangle, head of multi-asset management at Columbia Threadneedle Investments, and given a U.S. focus by Matt Busigin and Guillermo Roditi Dominguez, portfolio managers at New River Investments.

But Goodhart’s work is a particularly thorough and forceful manifesto. The conditions that fostered these three intertwined major developments are nearly obsolete, writes the former member of the Bank of England’s Monetary Policy Committee and other analysts from Morgan Stanley, and this has profound implications for the framework of the global economy in the decades to come. Goodhart argues that since roughly 1970, the world has been in a demographic sweet spot characterized by a falling dependency ratio, or in plainer terms, a high share of working age people relative to the total population. At the same time, globalization provided multinational companies the ability to tap into this new pool of labor. This positive supply shock was a negative for established workers, forcing down the price of labor as capital flowed to these areas.

“More worrying, from Shell’s point of view, is the prospect of a declining reserves base. In common with several of the other oil majors, it is pumping oil faster than it can book new reserves of bankable assets.”

• Big Oil Faces Shrinking Prospects (FT)

One hundred and fifty miles from the Alaskan coast lies what must be the most expensive oil well ever drilled. Shell’s decision to abandon the Burger J prospect, along with its entire Arctic exploration campaign, marks an outcome that many at the oil major must have dreaded since it bought the leases in 2008. That is not because of the cost — enormous though it is — of setting up remote platforms and drilling into rock that lies beneath 140ft of water. Shell is reckoned to have spent about $7bn on the exploration effort; some estimates put the figure even higher. But its balance sheet is strong enough to absorb the loss. Nor will the public ill-will generated by years of exploration in pristine Arctic waters last for ever.

Indeed, for some senior executives at Shell, the prospect of success in the Arctic was more worrying than the possibility of failure. Building the permanent facilities needed for actual production would have been far more contentious than the limited (if sometimes hapless) exploration work. Among the people on record as opposing Arctic drilling is Hillary Clinton, the frontrunner for the Democratic nomination for president. That is a battle that Shell will no longer have to fight. More worrying, from Shell’s point of view, is the prospect of a declining reserves base. In common with several of the other oil majors, it is pumping oil faster than it can book new reserves of bankable assets. This was the reason for pushing on in the Arctic against public criticism and deteriorating economic prospects for so long.

If, as some of the company’s executives believed, the Chukchi Sea blocks held about 35bn barrels of oil, Shell’s reserve base would have been secured and much effort would have been devoted to winning hearts and minds and pushing down costs. As it stands, the reserve base will continue to decline. Shell’s $70bn purchase of BG Group, if completed, will bring access to some identified resources — for instance off the coast of Brazil — but the cost of development is high and success is very uncertain. In the long run, this is little short of an existential challenge. Can the existing reserves base be replaced with resources that can be developed commercially? Or is a period of corporate decline inevitable? For the past three years Shell has failed to find sufficient resources to replace production despite heavy exploration expenditure. In 2014 it replaced only 26% of its oil and gas production. Over the past three years the figure is just 67%.

How to spell desperation.

• Why Shell Quit Drilling In Arctic After Spending $7 Billion On Single Well (BBG)

Royal Dutch Shell’s abrupt announcement today that it would cease all offshore drilling in the Arctic is surprising for several reasons. One is the unusual degree of confidence the company expressed as recently as mid-August that it had identified 15 billion barrels of oil beneath the well known as Burger J it’s now abandoning. What on earth happened? After spending $7 billion over several years to explore a single well this summer, Shell said in a statement that it “found indications of oil and gas … but these are not sufficient to warrant further exploration.” This contrasts sharply with Shell officials’ statements as recently as July and August that based on 3D and 4D seismic analysis of core samples, its petroleum geologists were “very confident” drillers would find plentiful oil.

The geologists’ expectations were the main reason Shell spent all that money on a project that entailed much-higher-than-average operational risks and international environmental condemnation. Giving up has got to hurt at a company that prides itself on scientific and technical prowess. Shell said it would take an unspecified financial charge related to the folding of its Arctic operation, which carries a value of $3 billion on the company’s balance sheet. In late July, when Ann Pickard, Shell’s top executive for the Arctic, explained the economics of drilling in the Chukchi Sea, she readily acknowledged that if oil prices remained below $50 a barrel, the off-shore adventure would be for naught. At $70, Chukchi oil would be “competitive,” she told Bloomberg Businessweek, and at $110—a reasonable projection, according to the company’s economists—it would be a huge winner.

She was talking about prospective prices 15 years from now. Well, in recent weeks, Shell appears to have lost some of its bravado about where prices will be in 2030—according to a person familiar with the company’s thinking. Otherwise, it wouldn’t have given up altogether on the Chukchi, where it continues to hold 275 Outer Continental lease blocks. Indeed, Marvin Odum, director of Shell Upstream Americas, said in the written statement that the company “continues to see important exploration potential in the basin, and the area is likely to ultimately be of strategic importance to Alaska and the U.S.”

Indeed: “None of this should come as much surprise..”

• Saudi Arabia Withdraws Billions From Markets to Plug Budget Deficit (BBG)

Saudi Arabia has withdrawn as much as $70 billion from global asset managers as OPEC’s largest oil producer seeks to plug its budget deficit, according to financial services market intelligence company Insight Discovery. “Fund managers we’ve spoken to estimate SAMA has pulled out between $50 billion to $70 billion from global asset managers over the past six months,” Nigel Sillitoe, chief executive officer of the Dubai-based firm, said by telephone Monday. “Saudi Arabia is withdrawing funds because it’s trying to cut its widening deficit and it’s financing the war in Yemen,” he said, declining to name the fund managers. Saudi Arabia is seeking to halt the erosion of its finances after oil prices halved in the past year.

The Saudi Arabian Monetary Authority’s reserves held in foreign securities have fallen about 10% from a peak of $737 billion in August 2014, to $661 billion in July, according to central bank data. The government is accelerating bond sales to help sustain spending.

“Foreign-exchange reserve depletion, rather than accumulation, is the new reality for Saudi Arabia,” Jason Tuvey, Middle East economist at Capital Economics, said in an e-mailed note Monday. “None of this should come as much surprise,” given the current-account deficit and risk of capital flight, he said. Saudi Arabia’s attempts to bolster its fiscal position contrast with smaller and less-populated nations in the Arabian peninsular such as Qatar.The world’s richest nation on a per capita basis plans to channel about $35 billion of investment into the U.S. over the next five years as it seeks to move away from European deals. That’s on top of plans to set up a $10 billion investment venture with China’s Citic Group. With income from oil accounting for about 80% of revenue, Saudi Arabia’s budget deficit may widen to 20% of gross domestic product this year, according to the IMF. SAMA plans to raise between 90 billion riyals ($24 billion) and 100 billion riyals in bonds before the end of the year as it seeks to diversify its $752 billion economy, people familiar with the matter said in August.

Theer are rumblings inside the House of Saud as we speak.

• The Collapse Of Saudi Arabia Is Inevitable (Nafeez Ahmed)

On Tuesday 22 September, Middle East Eye broke the story of a senior member of the Saudi royal family calling for a “change” in leadership to fend off the kingdom’s collapse. In a letter circulated among Saudi princes, its author, a grandson of the late King Abdulaziz Ibn Saud, blamed incumbent King Salman for creating unprecedented problems that endangered the monarchy’s continued survival. “We will not be able to stop the draining of money, the political adolescence, and the military risks unless we change the methods of decision making, even if that implied changing the king himself,” warned the letter. Whether or not an internal royal coup is round the corner – and informed observers think such a prospect “fanciful” – the letter’s analysis of Saudi Arabia’s dire predicament is startlingly accurate.

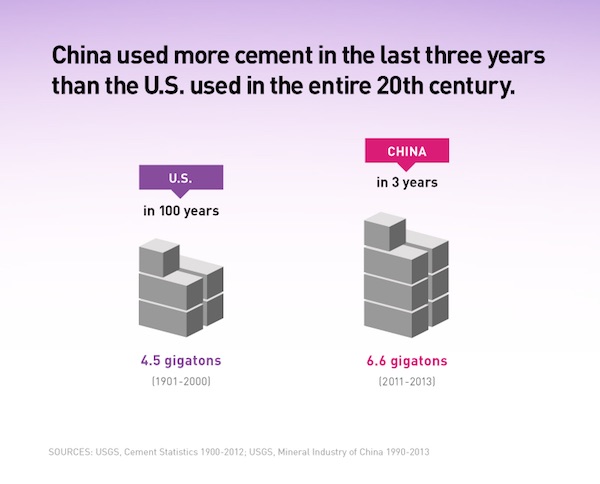

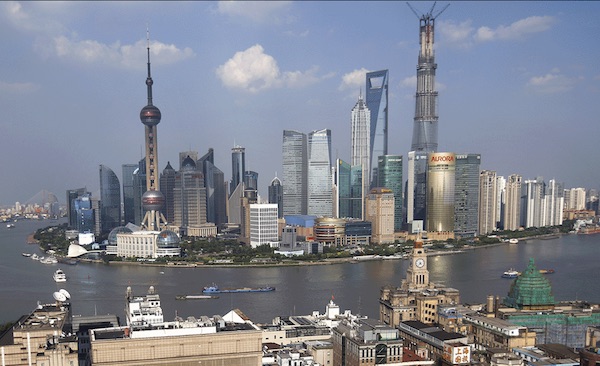

Like many countries in the region before it, Saudi Arabia is on the brink of a perfect storm of interconnected challenges that, if history is anything to judge by, will be the monarchy’s undoing well within the next decade. The biggest elephant in the room is oil. Saudi Arabia’s primary source of revenues, of course, is oil exports. For the last few years, the kingdom has pumped at record levels to sustain production, keeping oil prices low, undermining competing oil producers around the world who cannot afford to stay in business at such tiny profit margins, and paving the way for Saudi petro-dominance. But Saudi Arabia’s spare capacity to pump like crazy can only last so long. A new peer-reviewed study in the Journal of Petroleum Science and Engineering anticipates that Saudi Arabia will experience a peak in its oil production, followed by inexorable decline, in 2028 – that’s just 13 years away.

This could well underestimate the extent of the problem. According to the Export Land Model (ELM) created by Texas petroleum geologist Jeffrey J Brown and Dr Sam Foucher, the key issue is not oil production alone, but the capacity to translate production into exports against rising rates of domestic consumption. Brown and Foucher showed that the inflection point to watch out for is when an oil producer can no longer increase the quantity of oil sales abroad because of the need to meet rising domestic energy demand. In 2008, they found that Saudi net oil exports had already begun declining as of 2006. They forecast that this trend would continue. They were right. From 2005 to 2015, Saudi net exports have experienced an annual decline rate of 1.4%, within the range predicted by Brown and Foucher.

A report by Citigroup recently predicted that net exports would plummet to zero in the next 15 years. This means that Saudi state revenues, 80% of which come from oil sales, are heading downwards, terminally. Saudi Arabia is the region’s biggest energy consumer, domestic demand having increased by 7.5% over the last five years – driven largely by population growth. The total Saudi population is estimated to grow from 29 million people today to 37 million by 2030. As demographic expansion absorbs Saudi Arabia’s energy production, the next decade is therefore likely to see the country’s oil exporting capacity ever more constrained.

Add Deutsche to Merkel’s bailout list. VW, refugees etc etc

• Deutsche Bank Predicted To Cut 10,000 Jobs (Telegraph)

Deutsche Bank’s new chief executive has to focus on rapid cost cuts if he wants to turn the struggling German giant around and win over investors, according to a top banking analyst’s assessment of the lender. JP Morgan’s Kian Abouhossein expects Deutsche’s John Cryan to announce plans to cut expenses at the bank by at least €2.5bn (£1.8bn) by 2018, chop 10,000 staff and cut back on 10,000 of the external consultants paid for by the group. Mr Cryan was given the top job in June following the departure of former co-chief executives Anshu Jain and Jurgen Fitschen, who quit after a three-year reign at the bank that was marred by the biggest ever Libor fine and a failure to impress shareholders. The bank’s stock shot up 8pc on the day it was announced that the co-chiefs were leaving, although the shares have since slide to 23.7 cents, which is 14pc below the price when Mr Cryan took over.

Mr Abouhossein believes the new boss has a difficult task ahead to prove his worth to shareholders, as the investor base has been let down repeatedly in the past by executives who have failed to turn the bank around. “In our view, DB [Deutsche Bank] management should focus on creating shareholder value by growing retained earnings and the key is to cut costs – a task which DB has failed to achieve in the past, and hence, on which we believe has little ‘goodwill’ with investors,” said the analyst in a research note to investors. He argued that “Deutsche Bank’s cost management has been poor historically”, resulting in a workforce of 84,000 full time staff plus an army of 30,000 external consultants, after excluding the group’s retail arm, Postbank.

Globalization frees up everyone!

• UK Steel Industry Buckles Under The Weight Of Cheap Chinese Product (Guardian)

Britain’s steel industry has been in meltdown for years: slowing demand and a flood of cheap Chinese steel into the market has hammered high-cost western producers. About half of the 1.6bn tonnes of steel made globally each year now comes from China. But an already perilous situation for British steelmakers has exacerbated in the past year as the Chinese economy slowed sharply, forcing Beijing to aggressively chase foreign cash for its wares. Tom Blenkinsop, chairman of the all-party parliamentary group on steel and MP for Middlesbrough South and East Cleveland, summed up the dilemma: “China is pouring steel into the European and world market for any currency it can get.” Flooding the market with cheap Chinese product has forced the price of slab steel down by 45% in just 12 months, from $500 (£330) a tonne to about $280.

As a result, China’s steel exports have grown 53% in the last year. In Britain, imports of Chinese steel have ballooned from 2% of UK demand in 2011 to 8% this year. This influx of cheap steel is a threat to all but the fittest western players – bad news for SSI UK, which is one of the weakest. Britain’s second biggest steelmaker has confirmed plans to axe 1,700 jobs and mothball its Redcar plant. It threatens to bring the curtain down on 160 years of steelmaking in the Teesside region of north-east England. It is the latest grisly chapter for Britain’s once mighty steel industry. Steel produced on Teesside was used to build well-known UK structures including Birmingham’s Bullring and Canary Wharf in east London. However, the industry now employs about 20,000 workers, a 10th of the number employed in the sector during the 1970s.

As if anyone cares apart from those who seek to turn green into green.

• VW Stock to Be Removed From Dow Jones Sustainability Indexes (Bloomberg)

Volkswagen AG’s stock will be removed from the Dow Jones Sustainability indexes after the automaker cheated on emissions tests. The Sept. 18 admission by VW that it systematically manipulated U.S. emissions tests prompted a review of its status, S&P Dow Jones Indices LLC and RobecoSAM said in a statement Tuesday. The stock will be pulled after the close of trading Oct. 5 from the DJSI World, DJSI Europe and all other related indexes, according to the statement. S&P Dow Jones Indices and RobecoSAM manage the Dow Jones sustainability indexes, which track the performance of companies that rank the best in their industries in terms of economic, environmental and social criteria.

The Dow Jones Sustainability World Index, introduced in 1999, was the first global such benchmark, according to the companies. Volkswagen’s stock has plunged 39% since Sept. 18, cutting the company’s market value by €27 billion, and prosecutors in Germany said Monday that they’ve started a criminal probe of the company that includes an investigation of former Chief Executive Officer Martin Winterkorn.

Jim’s dead on on Putin.

• Tick Tick Tick (Jim Kunstler)

Did Charlie Rose look like a fucking idiot last night on 60-Minutes, or what, asking Vladimir Putin how he could know for sure that the US was behind the 2014 Ukraine coup against President Viktor Yanukovych? Maybe the idiots are the 60-Minutes producers and fluffers who are supposed to prep Charlie’s questions. Putin seemed startled and amused by this one on Ukraine: how could he know for sure? Well, gosh, because Ukraine was virtually a province of Russia in one form or another for hundreds of years, and Russia has a potent intelligence service (formerly called the KGB) that had assets and connections threaded through Ukrainian society like the rhizomorphs of the fungus Armillaria solidipes through a conifer forest. Gosh, Charlie, it’s like asking Obama whether the NSA might know what’s going on in Texas.

And so there is Vladimir Putin, a former KGB officer, having to spell it out for the American clodhopper super-journalist. “We have thousands of contacts with them. We know who and where, and when they met with someone, and who worked with those who ousted Yanukovych, how they were supported, how much they were paid, how they were trained, where, in which country, and who those instructors were. We know everything.” The only thing Vlad left out of course was the now-world-famous panicked yelp by Assistant Secretary of State Victoria Nuland crying, “Fuck the EU,” when events in Kiev started getting out of hand for US stage-managers. But he probably heard about that, too. Charlie then voice-overed the following statement: “For the record, the US has denied any involvement in the removal of the Ukrainian leader.”

Right. And your call is important to us. And your check is in the mail. And they hate us for our freedom. This bit on Ukraine was only a little more appalling than Charlie’s earlier segment on Syria. Was Putin trying to rescue the Assad government? Charlie asked, in the context of President Obama’s statement years ago that “Assad has to go.” Putin answered as if he were explaining something that should have been self-evident to a not-very-bright high school freshman: “To remove the legitimate government would create a situation which you can witness in other countries of the region, for instance Libya, where all the state institutions have disintegrated. We see a similar situation in Iraq. There’s no other solution to the Syrian crisis than strengthening the government structure.”

And Putin’s dead on when it comes to distorted western power games.

• Putin: West’s Rampant ‘Egotism’ To Blame For Syria, Ukraine, Isis (Guardian)

“Egotism” was a word Vladimir Putin used more than once as he gave a thinly veiled dressing down to the United States on Monday. His speech covered little new ground but sharpened his critique of the current world order and called on the world to come together to fight terrorism in the Middle East. Putin bemoaned “a world in which egotism reigns supreme” and railed against the arrogant hubris of the west. Putin has been giving much the same speech since he first laid out his grievances in February 2007: the “unipolar” world in which Washington dominates, he says, has led to a more dangerous world than that of the cold war, when an imperfect but useful balance stopped any one country from dominating.

This speech, his first to the United Nations general assembly since 2005, comes as Putin visits the US for the first time since the Ukraine crisis prompted acrimony, mistrust and sanctions. It was notable for its intonation. Putin adopted the tone of a wise elder, alternately angered by the bellicosity and saddened by the naivety of the west. “You want to ask the people who created this situation: ‘Do you at least understand what you’ve done?’ But I fear that the question would just hang in the air, because after all, they have not turned their back on policies based on self-certainty, a sense of superiority and impunity.” The chaos in the Middle East and the rise of the Islamic State? That was the fault of the west, who armed those it naively thought to be secular freedom fighters.

The military conflict in Ukraine (or, as Putin put it, the “armed coup organised from abroad followed by civil war”)? Also down to the meddling of the west. Washington, said Putin, was repeating the mistakes of the Soviet Union by trying to export its own model of development to other countries. It has forced post-Soviet countries to make a “false choice between east and west”, sowing chaos and prompting unrest, he said. It was a description of events that would not have gone down well with the Ukrainian delegation – though they were not there to hear it, having walked out before Putin took to the podium.

Obama’s speech at the UN yesterday was an exercise in severe embarrassment to himself and the US.

• Obama Deifies American Hegemony (Paul Craig Roberts)

On this 70th anniversary of the UN, I have spent much of the day listening to the various speeches. The most truthful ones were delivered by the presidents of Russia and Iran. The presidents of Russia and Iran refused to accept the Washington-serving reality or Matrix that Obama sought to impose on the world with his speech. Both presidents forcefully challenged the false reality that the propagandistic Western media and its government masters seek to create in order to continue to exercise their hegemony over everyone else. What about China? China’s president left the fireworks to Putin, but set the stage for Putin by rejecting US claims of hegemony: “The future of the world must be shaped by all countries.” China’s president spoke in veiled terms against Western neoliberal economics and declared that “China’s vote in the UN will always belong to the developing countries.”

In the masterly way of Chinese diplomacy, the President of China spoke in a non-threatening, non-provocative way. His criticisms of the West were indirect. He gave a short speech and was much applauded. Obama followed second to the President of Brazil, who used her opportunity for PR for Brazil, at least for the most part. Obama gave us the traditional Washington spiel: “The US has worked to prevent a third world war, to promote democracy by overthrowing governments with violence, to respect the dignity and equal worth of all peoples except for the Russians in Ukraine and Muslims in Somalia, Libya, Iraq, Afghanistan, Syria, Yemen, and Pakistan.” Obama declared Washington’s purpose to “prevent bigger countries from imposing their will on smaller ones.”

Imposing its will is what Washington has been doing throughout its history and especially under Obama’s regime. All those refugees overrunning Europe? Washington has nothing to do with it. The refugees are the fault of Assad who drops bombs on people. When Assad drops bombs it oppresses people, but when Washington drops bombs it liberates them. Obama justified Washington’s violence as liberation from “dictators,” such as Assad in Syria, who garnered 80% of the vote in the last election, a vote of confidence that Obama never received and never will. Obama said that it wasn’t Washington that violated Ukraine’s sovereignty with a coup that overthrew a democratically elected government. It was Russia, whose president invaded Ukraine and annexed Crimera and is trying to annex the other breakaway republics, Russian populations who object to the Russophobia of Washington’s puppet government in Ukraine.

[..] Did the UN General Assembly buy it? Probably the only one present sufficiently stupid to buy it was the UK’s Cameron. The rest of Washington’s vassals went through the motion of supporting Obama’s propaganda, but there was no conviction in their voices. Vladimir Putin would have none of it. He said that the UN works, if it works, by compromise and not by the imposition of one country’s will, but after the end of the Cold War “a single center of domination arose in the world”—the “exceptional” country. This country, Putin said, seeks its own course which is not one of compromise or attention to the interests of others. In response to Obama’s speech that Russia and its ally Syria wear the black hats, Putin said in reference to Obama’s speech that “one should not manipulate words.” Putin said that Washington repeats its mistakes by relying on violence which results in poverty and social destruction. He asked Obama: “Do you realize what you have done?”

UBS to get lenient treatment, squeal on all others in a LIBOR repeat.

• Barclays, HSBC Named In Swiss Precious Metals Price Fixing Investigation (TiM)

UK banks Barclays and HSBC are among seven financial institutions being investigated by Swiss officials amid allegations of price fixing in the precious metals market. According to the Bern-based Weko commission, the probe will look at possible collusion of bid/ask spreads in the metals market for gold, silver, platinum and palladium. Also under investigation are two Swiss banks, UBS and Julius Baer, as well as three foreign banks – Deutsche Bank, Morgan Stanley and Mitsui. Weko said in a statement: ‘We have indications that possible prohibited competitive agreements in the trading of precious metals were agreed among the banks mentioned.’ Weko said it was looking at what effects any possible collusion would have had on the Swiss market.

Findings are expected to be published by 2017 and banks found to have flouted Switzerland’s competition laws could be fined as much as 10% of revenue. Weko’s inquiry follows similar investigations by the European Commission and the US Department of Justice and is the latest in a long line of probes into manipulation of the precious metals and foreign exchange markets. Last year, Switzerland’s financial regulator FINMA said it had found a ‘clear attempt’ to manipulate precious metals price benchmarks during a cross-market investigation into trading at UBS. HSBC said this year that the US Department of Justice requested documents from the bank in November in relation to a criminal antitrust investigation in to precious metals.

In January, the US Commodity Futures Trading Commission also issued a subpoena to the bank, seeking documents relating to its precious metals trading operations. And in April, the European Commission issued a request for information related to HSBC’s precious metals operations and the bank is currently co-operating with authorities. The UK’s FCA has already taken action and last year fined Barclays £26million after an options trader was found to have manipulated the London gold fix.

“I write “debated”, but this is too generous to some of those who have passed judgment on the work.”

• It’s Time To Unpick Corporate Welfare (Kevin Farnsworth)

I am the person behind the second most-debated figure of the Labour leadership race – the £93bn corporate welfare bill. I write “debated”, but this is too generous to some of those who have passed judgment on the work. Once Jeremy Corbyn had begun campaigning on the basis that some of the £93bn could be saved, proper analysis and discussion gave way to myth making and conjecture, and I didn’t recognise many of the arguments that were attributed to me. Despite being mentioned at some point by just about all of the media outlets, the only journalist who contacted me before writing about my research was Aditya Chakrabortty, who wrote the original front-page splash for the Guardian based on my report.

I’m hardly surprised then, if disappointed, that publications as venerable as the Economist have got basic things confused in their rush to write off Corbyn and my research. The report was published in July by the Sheffield Political Economy Research Institute and builds on years of researching and writing about public and social policies. Each category of corporate welfare I identify – made up of the various forms of state provision that service the needs of businesses – builds on the work of British and international academics, journalists, governmental organisations, politicians, policymakers and think tanks. Businesses could not do business without huge amounts of government support.

They require legal protections, a state-backed currency, the right frameworks to hire and fire and essential infrastructure. They depend on financial backing to exploit innovations and invest. And public policies operate to socialise various corporate risks. Employers need educated and healthy workers. Unemployment benefits and pensions increase labour market flexibility, making it easier to hire, fire and retire employees. The annual Global Competitiveness Report clearly illustrates the importance of comprehensive state provision to economic growth, productivity, profitability and national competitiveness. And it is published by the World Economic Forum – the organisation that runs the Davos gathering, so hardly a mouthpiece of the left.

The £93bn estimate, in fact, excludes most of the above. It is made up only of more direct benefits and services. It doesn’t include the indirect benefits that accrue to businesses from the social welfare system and the legacy costs linked to the bank bailouts. It doesn’t even include the cost of in-work tax credits, which have been labelled corporate welfare by others, including Conservative MPs. The more direct categories of corporate welfare identified in my report include official estimates of the cost of subsidies and grants to companies, worth about £15bn a year. Beyond this, the report identifies tax benefits as a major component of corporate welfare, at £44bn. Not surprisingly, this has proved to be the most controversial category of all.

“You are a grandson of the Jamaican soil who has been privileged and enriched by your forebears’ sins of the enslavement of our ancestors … You are, Sir, a prized product of this land and the bonanza benefits reaped by your family and inherited by you continue to bind us together like birds of a feather..”

• Jamaica Seeks Billions Of Pounds In British Reparations For Slavery (Guardian)

David Cameron is facing calls for Britain to pay billions of pounds in reparations for slavery ahead of his first official visit to Jamaica on Tuesday. Downing Street said the prime minister does not believe reparations or apologies for slavery are the right approach, but the issue is set to overshadow his trade trip to the island, where he will address the Jamaican parliament. Ahead of his trip, Sir Hilary Beckles, chair of the Caricom Reparations Commission, has led calls for Cameron to start talks on making amends for slavery and referenced the prime minister’s ancestral links to the trade in the 1700s through his cousin six times removed, General Sir James Duff.

In an open letter in the Jamaica Observer, the academic wrote: “You are a grandson of the Jamaican soil who has been privileged and enriched by your forebears’ sins of the enslavement of our ancestors … You are, Sir, a prized product of this land and the bonanza benefits reaped by your family and inherited by you continue to bind us together like birds of a feather. “We ask not for handouts or any such acts of indecent submission. We merely ask that you acknowledge responsibility for your share of this situation and move to contribute in a joint programme of rehabilitation and renewal. The continuing suffering of our people, Sir, is as much your nation’s duty to alleviate as it is ours to resolve in steadfast acts of self-responsibility.”

Professor Verene Shepherd, chair of the National Commission on Reparation, told the Jamaica Gleaner that nothing short of an unambiguous apology from Cameron would do, while a Jamaican MP, Mike Henry, called on fellow parliamentarians to turn their back on Cameron if reparations are not on the agenda, noting that the Jamaican parliament has approved a motion for the country to seek reparation from Britain. “If it is not on the agenda, I will not attend any functions involving the visiting prime minister, and I will cry shame on those who do, considering that there was not a dissenting voice in the debate in parliament,” he told the newspaper.

Sweet.

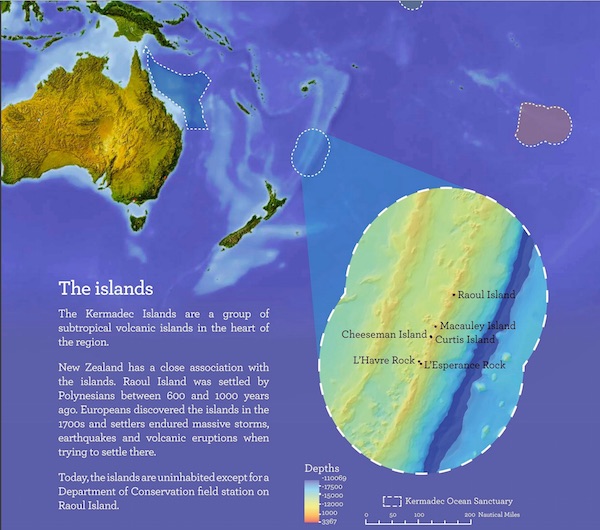

• New Zealand’s New Ocean Sanctuary One Of World’s Largest Protected Areas (Gua.)

New Zealand will create one of the largest marine protected areas in the world, spanning an area of 620,000 sq km. The Kermadec ocean sanctuary will be one of the world’s most significant fully protected ecosystems, the prime minister of New Zealand, John Key, told the UN general assembly in New York. The sanctuary is in the South Pacific Ocean, about 1000km north-east of New Zealand, and expands a marine reserve that surrounds a clutch of small islands. The area is considered crucial in terms of biodiversity, featuring nearly 35 species of whales and dolphins, 150 types of fish and three of the world’s seven sea turtle species. It is also geologically significant, encompassing the world’s longest chain of submerged volcanoes and the second deepest ocean trench, plunging to 10km underwater – deeper than Mount Everest is tall.

The scale of the sanctuary will dwarf any previous New Zealand protected area, spanning twice the size of the country’s landmass. It will cover 15% of New Zealand’s exclusive economic zone. Commercial and recreational fishing will be completely banned, as will oil, gas and mineral prospecting, exploration and mining. Key’s government aims to pass legislation establishing the sanctuary next year. “The Kermadecs is a world-class, unspoiled marine environment and New Zealand is proud to protect it for future generations,” Key said.

Every single day our shame grows bigger.

• More Than 1,100 Migrants Rescued Off Libyan Coast On Monday (DW)

The Italian coast guard coordinated the rescue of 1,151 migrants in nearly a dozen separate operations on Monday off the coast of Libya, it said. In one instance, a coast guard ship picked up more than 440 people from four inflatable boats. Separately, the charity Doctors Without Borders (MSF) said one of its boats had rescued 373 people, tweeting a picture of a distressed 6-year-old child. Libya is one of the major crossing points for African migrants trying to get to Europe. The European Union is trying to combat people smuggling and will go after suspected traffickers in the international waters of the Mediterranean Sea as of next week. Beginning October 7, the next phase of what’s known as Operation Sophia will allow naval forces belonging to EU member states to board, search and seize suspicious vessels. The operation has so far centered on saving those drifting on the high seas, but will now include directly targeting trafficking operations.