Harris&Ewing The Post Office building in Washington DC 1911

A model valid for all larger organizations.

• A Cynical Theory of Power and Organizational Dynamics (Dave Pollard)

I‘ve previously mentioned that the most important thing I learned from 37 years in the business world is that in large organizations of every kind, almost all valuable work is done by workarounds, i.e. people on the front lines doing what they know is best for the organization, even when this ignores or (often) contravenes what they’ve been told to do (or not to do) by senior executives. Or which contravenes the executives’ surrogate, the policy and procedures manual, which is now substantially embedded in the software these poor front-line employees have to use, and which forces them to tell you “sorry I am not authorized to do that for you; is there something else I can help you with today?”.

This is a cynical view, but it actually makes sense when you understand the nature of complex systems. No one can know what to do or how to effectively intervene in large, complex systems — there are far too many variables, too many moving parts, and too many unknowns, and the further removed you are from the customers, citizens or clients of the organization, the less likely you are to know what they want or need, or the cost/benefit of giving it to them. The belief that ‘experienced’ executives, ‘experts’, consultants or other highly-paid (often obscenely so) people know anything more about what to do is sheer hubris. As Charles Handy has pointed out, modern capitalism (and the modern organizational model) are inherently anti-democratic.

He also noted that, as any student of history can tell you, nobody gives up power voluntarily. And as Joel Bakan’s The Corporation explained (and Hugh Macleod’s cartoon above satirizes), large profit-driven organizations are necessarily pathological. So how does this weird power dynamic in organizations arise? If hierarchy is so unhealthy, why is it the prevailing model in almost all human social systems and organizations? My theory is that it arose to exploit the fundamental human loathing for complexity and the fear-driven desire to believe that everything can be controlled. Shareholders don’t want to hear that “nobody knows anything”; they want to know that their investment is going to rise in value.

As organizations grow in size, they inevitably grow exponentially more dysfunctional. Paradoxically, this growth also conveys the power to outspend, out-market, and acquire smaller, more innovative, more agile, customer- and citizen-focused organizations. Acquisitions of small companies by larger ones almost always destroy value (any honest M&A practitioners will tell you that ‘economies of scale’ don’t actually exist — what exists is ‘power of scale’ — and oligopoly)

Poof! And that’s with record stock buybacks.

• Apple Plunges 7% On iPhone Sales Miss, China, Weak Guidance, Strong Dollar (ZH)

Apple is important. Perhaps the most important company not only for the Dow Jones, but because it also happens to be the largest company by market cap, in the world. As such nobody will be happy that moments ago AAPL reported results which were in a word, lousy. It wasn’t so much the earnings, because the EPS of $1.85 was a modest beat of expectations of $1.81, while revenues also beat consensus of $49.4 billion fractionally, printing at $49.6 billion; the margin also beat slightly coming at 39.7% above the exp. 39.5%. The problem was in the detail, with 47.5 million iPhone shipments missing expectations by 1.3 million units, even as both iPad (whose ASP came at $415 below the $426 expected), and Mac units coming in as expected.

But the biggest surprise was in China, where as we warned previously, the Apple euphoria appears to have ended with a bang, with greater China sales tumbling by 21% from $16.8 billion to $13.2 billion. And keep in mind this was in the quarter when the Composite was hitting multi year highs, and the July crash was not even on the horizon. As for the cherry on top it was the company’s guidance which now sees Q4 revenue at $49-$51 billion, or below the $51.1 bn consensus estimate, with the CFO adding that the strong USD is finally getting to the company, warning that Apple “faced a difficult foreign exchange environment.” And all this happened in a quarter in which AAPL bought back $10 billion of its own stock. [..] And here, from the WSJ, is a reminder why AAPL is so very crucial to not only the tech sector, but the entire market:

No company produces bigger profits than Apple Inc. Likewise, no company contributes more to the profit picture of the S&P 500 than Apple. Apple is a leviathan of a company that is a major contributor of profits in corporate America. Its fortunes, also, are inextricably intertwined with two of the biggest growth markets that exist, smartphones and China. That makes it a bellwether. Because of its success, Apple is also an out-sized member of the S&P 500. We noted yesterday that the stock comprises about one%age point of the S&P 500’s 3.5% gain for this year (before Tuesday’s selloff).

It is also, due to its massive profits and market-cap weighting within the index, the largest single contributor to S&P 500 profits. By a long shot. Now, there certainly isn’t anything to be worried about here. Apple is expected to earn about $1.80 a share, or about $10.4 billion, on nearly $50 billion in sales, and as usual with this company, the only real question is by how far will it exceed Street estimates. Apple is projected to single-handedly give the tech sector all of its earnings growth this quarter, just edging it up by 0.2%. Without Apple, the sector would see a contraction of 6%.

The periphery of the Anglo world are a bunch of one trick ponies. How about markets start going after New Zealand the way they did in Europe a few years ago? There’s no ”whatever it takes” there.

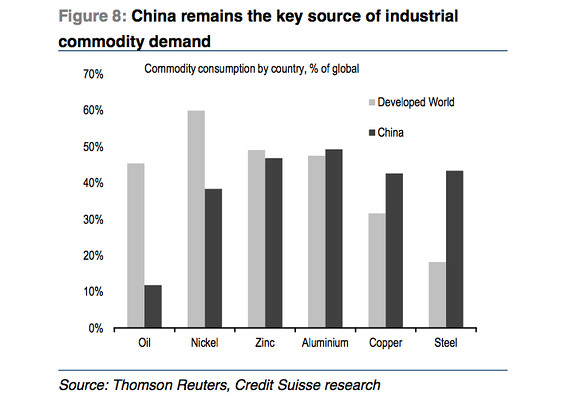

• Commodity Currencies: Who’s The Ugliest Of Them All? (CNBC)

The dollars of New Zealand, Australia and Canada are among the worst-performing major currencies this year and all face further losses, but the land of Hobbits may offer the best short. Known as the Kiwi, Aussie, and Loonie, respectively, all three have tumbled to six-year lows in recent sessions, with year-to-date losses of 10-15%. “Despite the fact that they have already fallen a long way, we expect them to weaken further,” said Capital Economists in a recent note. The three nations are large producers of commodities: energy is Canada’s top export, iron ore for Australia and dairy for New Zealand. Prices for all three commodities have declined significantly over the past year, worsening each country’s terms of trade and causing major currency adjustments.

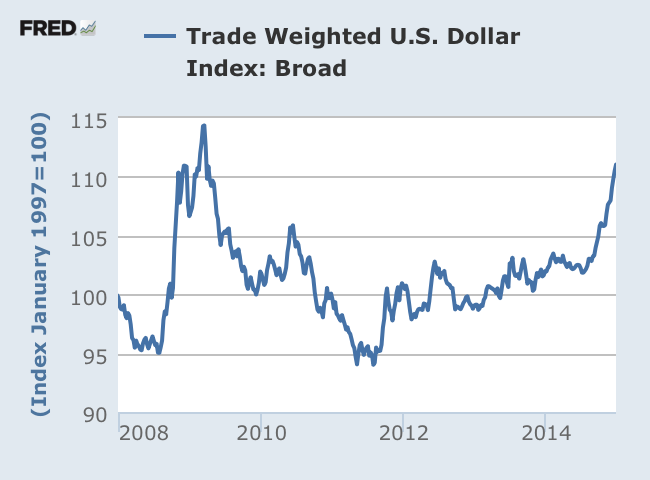

Worsening the outlook, the greenback is climbing again on the prospect of higher U.S. interest rates later this year. Federal Reserve Chair Janet Yellen confirmed last week that the central bank will tighten its purse strings if the economy continues to strengthen, helping the dollar index hit a three-month high on Monday, which in turn, hit dollar-denominated commodities. Out of the three, New Zealand’s central bank has the most room to ease policy further, a key catalyst for further currency depreciation. The Reserve Bank of New Zealand (RBNZ) could slash rates by 50 basis points on Thursday— its second consecutive rate cut— as souring milk prices and low inflation hit growth in a country dubbed 2014’s “rock star economy.”

“From a monetary policy view, we expect three further rate cuts from the RBNZ this year, including one this week. The recent fall in milk prices has been much larger and severe compared to the commodity exports of Australia or Canada,” said Khoon Goh, ANZ senior FX strategist. But analysts warn of a possible short-term spike in the Kiwi: “The IMM futures market is in a record net short position for the New Zealand dollar. In comparison, positioning in the Australian dollar and the Canadian dollar do not appear nearly as stretched,” remarked Greg Gibbs, head of Asia Pacific markets strategy at the Royal Bank of Scotland.

It’s commodities in general. Zombie money is disappearing real fast.

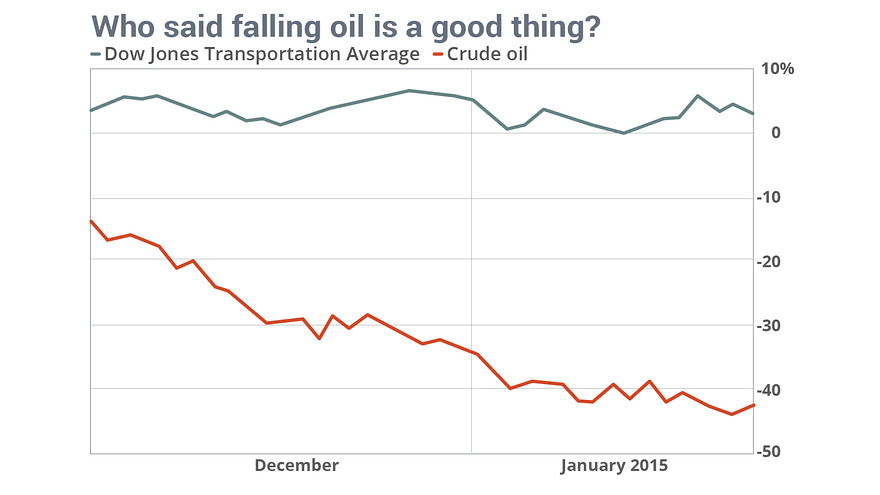

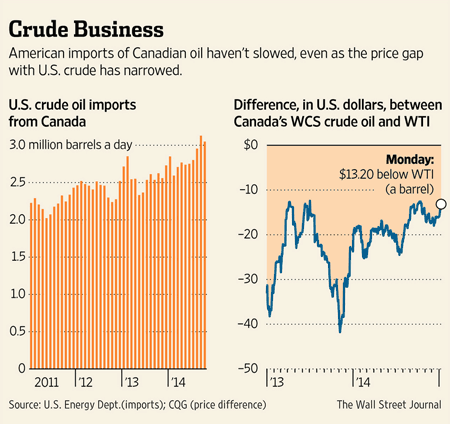

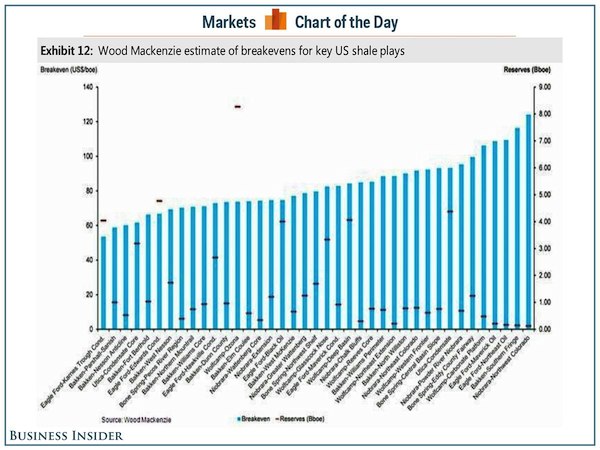

• Plunging Oil Prices and A Volatile New Force In The Global Economy (WaPo)

He’d spent years touting his vision that America would one day dominate one of the world’s most powerful markets. And when Harold Hamm, a pioneer in discovering vast reserves of shale oil under American soil, took the stage in front of several hundred oil luminaries, he never acknowledged that the narrative was in doubt. “For the next 50 years, we can expect to reap the benefits of the shale revolution,” Hamm said one day this spring. “It’s the biggest thing that ever happened to America.” But away from the stage, the US oil industry – and Hamm – was in crisis. In the previous six months, Hamm, founder of oil giant Continental Resources, had lost $6.5bn, more than one-third of his net worth.

The industry that Hamm had helped create was facing its greatest test in a frantic race to stay profitable as rival Saudi Arabia worked to drive down oil prices and, according to some analysts, undermine America’s oil industry at the most important moment in its history. Behind the low price of a gallon of gas at the pump this summer lies a competition worth trillions of dollars that is capable of swinging the geopolitical balance of power. On one side are Hamm, a famous wildcatter, and other American oilmen who rode the discovery of hydraulic fracturing to tens of billions of dollars of wealth and a promise of, in Hamm’s words, ending the “disastrous” days of Saudi Arabian control.

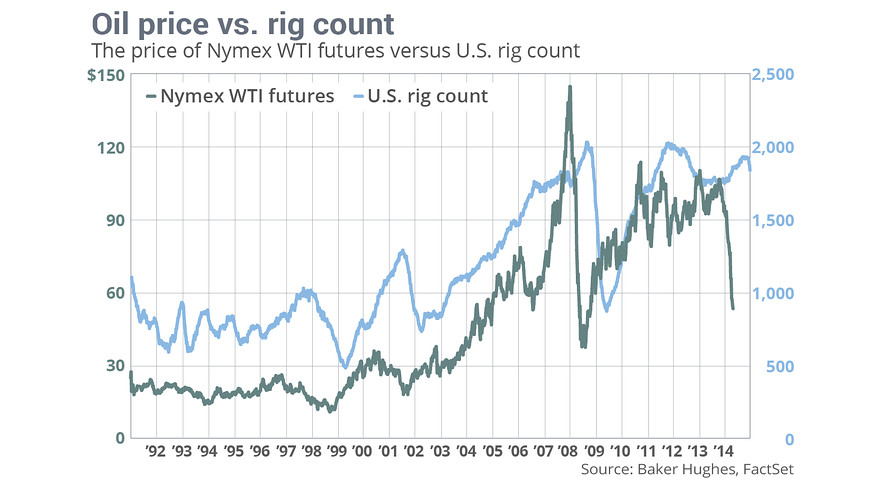

On the other are the Saudis and their allies in OPEC, which are trying to stem rising US oil power and maintain their 40 years of dominance. This month, the cost of West Texas Intermediate oil, a US benchmark, has been hovering at just over $50 a barrel – down from about $110 over the past year. Meanwhile, the number operating oil rigs in the country has fallen to just 645. That was lowest rig count in almost five years, down from more than 1,500 a year ago. Opec said last month that it would continue to pump 30m barrels a day, despite low prices, sending a strong signal to US competitors that it had no plans to let up the pressure on the Americans.

And now there is a new pressure on the scene. The decision to strike a nuclear agreement with Iran, which has more oil reserves than all but four Opec countries, will over the coming months unleash new Iranian oil into the markets. Analysts expect Iran to pump 1m or more barrels a day as a result, so the prospect of the deal has been driving prices down in recent weeks – by about 15% – interrupting a stabilising in the price of oil since the big plunge last year.

Why insist on using the word “market”?

• China’s Market Plunge: Where Only 3% of Firms Could Trade (WSJ)

China may have the world’s second-biggest stock market after the U.S., but at one point during a roller-coaster ride for investors this month only 93 of 2,879 listed companies were freely tradable—about the same number as trade in Oman. On July 9, a day after the market hit bottom, just 3.2% of Chinese-listed companies could be traded normally, according to an analysis by The Wall Street Journal using FactSet data. The rest of the shares on the Shenzhen and Shanghai stock exchanges either were suspended or hit their daily limit. China’s market rules prevent share prices from moving freely once they rise or fall by 10%. The findings are supported by an independent analysis by Gottex Fund Management, done at the behest of the Journal.

The daily-limit rule affected thousands of companies as the Shanghai market slid 32% in less than four weeks through the July 8 bottom, then rebounded 15% since then, while the smaller Shenzhen market slid 40% and then rebounded 20.2%—crossing the 20% threshold that defines a bull market on Tuesday. Most markets, including the New York Stock Exchange, employ “circuit breakers” to prevent wild swings in share prices over a short period, which can happen as a result of rapid-fire trading algorithms or human error. But in China, the limit rule was impeding trading of many companies at the same time investors were locked out of hundreds more that used an exchange rule allowing them to apply for trading halts ahead of major news that might cause a drastic price fluctuation.

At the height of suspensions, 51% had taken themselves off the market, according to the Journal’s analysis. An additional 46% were halted because of limit rules. As the selloff started to turn on July 9, trading volume declined sharply in Shenzhen, after trading in the majority of stocks had been halted. However, in the larger Shanghai market, shares still were trading at the same frenzied pace seen before the selling started. Investors were chasing an ever-dwindling pool of securities, which only got worse as more stocks hit limit up.

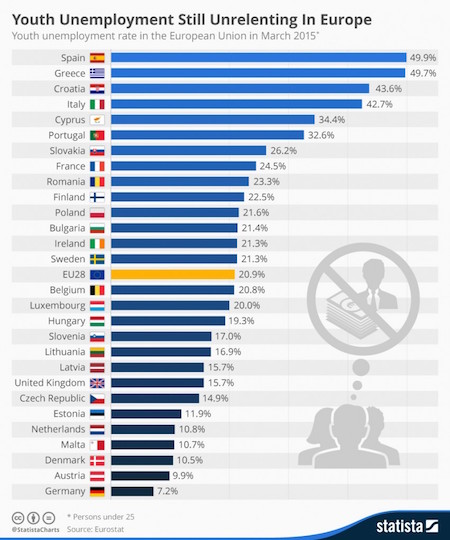

“This is not a moment in European history – it is at least two parallel moments..”

• Europe Divided By A Sense Of Crisis And A Sea Of Amnesia (Fintan O’Toole)

There is no euro zone crisis. It’s impossible to understand what’s going on now if you start out with the assumption that there is a single community of nations experiencing the same historic moment. There isn’t. If, for example, Germany seems detached from the sufferings of the more peripheral euro-zone countries, it’s not because Germans are hard-hearted. It’s because their own current experience is not of crisis but of bonanza. The euro may look like a disastrous project for Ireland or Greece but in Germany it’s an enormous success. The German branch of the consultants McKinsey calculated the economic benefits of the euro’s first decade when the currency had 17 members. Those benefits were divided 50/50: half went to Germany, the other half to the remaining 16 countries.

Those were the good years, but what of the euro’s bad times? For Germany, they don’t exist. The euro’s weakness has been a jackpot for Germany. It has made German exports, especially to China and the US, much cheaper than they would have been otherwise. In 2014, total German exports swelled to €1.1 trillion, with an 11% rise in sales to China and 6.5% to the US. Even the Greek crisis has been fabulous news for Germany’s finances. The longer the crisis goes on, the more investors sail to the “safe haven” of German government bonds and the more Germany saves on the costs of borrowing. This year alone, Berlin has saved an estimated €20 billion in borrowing costs because of the Greek crisis.

It would be cynical to suggest that Wolfgang Schäuble as finance minister has an interest in keeping the threat of Grexit alive (as he did again last week), but in terms of hard cash, he does. All of this has many implications but one of them is that, as Hamlet put it, the time is out of joint. There is a complete disjunction between what “now” means in Germany and in much of the rest of the European Union. Germany’s now is not Ireland’s now or Portugal’s now or Italy’s now. This is not a moment in European history – it is at least two parallel moments, one of loss and anxiety, one of economic and political triumph. And in this divergence something crucial is lost – a sense of history itself. When the present means such different things, the past loses its meaning too.

Take that, and then move on to the next artile, which says the EU Court of Justice OKs debt relief, contrary to what Schäuble says.

• Greece Needs A €130 Billion Debt Haircut: Citi (Zero Hedge)

Fast forward to today, when Citi’s Guillaume Menuet repeats what Citi (and many others) said back then: without a debt haircut, Greece was doomed, is doomed, and explains “Why Greece’s Third Bailout Will Probably Fail (Eventually.)” The punchline of the analysis, as before, is that Greece desperately needs one simple thing to survive: a massive debt “haircut” and lots of it. In fact, far more than even the IMF (which now is also wearing its own tinfoil hat with honor) recommends and which eliminates between €110 and €130 billion (or 60%-72% of GDP) in debt. Citi’s thoughts:

The Euro Summit proposal does not include a clear commitment to debt restructuring, and essentially blames previous policy failures for Greece’s ‘insurmountable’ debt problems. It notes that “there are serious concerns regarding the sustainability of Greek debt. This is due to the easing of policies during the last twelve months, which resulted in the recent deterioration in the domestic macroeconomic and financial environment.” The proposal offers an agreement to consider ‘soft’ debt restructuring after the first positive assessment of the programme implementation, noting that “the Eurogroup stands ready to consider, if necessary, possible additional measures (possible longer grace and payment periods) aiming at ensuring that gross financing needs remain at a sustainable level”, and highlighting that “nominal haircuts on the debt cannot be undertaken”.

This position contrasts noticeably with that of the Greek government and the IMF. According to Greek PM Tsipras, the institutions had agreed to start discussing a reprofiling of Greek public liabilities this coming autumn, by ‘transferring’ to the ESM €27bn in ECB debt and €20bn in IMF debt. This process would have been conditional on full compliance with the bailout targets in the next few months (both in terms of budget and structural reforms). In an update of IMF staff’s preliminary debt sustainability analysis, the IMF concluded that an upfront debt relief agreement is needed because Greece’s public debt “has become highly unsustainable”.

The IMF noted that Greek public debt is projected to peak close to 200% of GDP by 2017, and to remain elevated (170% of GDP) by 2022, while pointing to considerable downside risks to these projections. The IMF calls for debt relief on a scale that would need to go well beyond what has been considered to date, noting three main options: i) a “dramatic” extension with grace periods of, say, 30 years on the entire stock of European debt (including new assistance), ii) explicit annual transfers to the Greek budget, or iii) deep upfront haircuts.

“The legal questions are by no means settled, but a leading decision of the Court of Justice of the EU on a related matter, the compatibility of ESM assistance with Art. 125 TFEU, gives some guidance.”

• EU Court Suggests Debt Restructuring Compatible With Euro Membership (LSE)

German finance minister Wolfgang Schäuble continues to emphasise that a Greek exit from the Eurozone would be the better option after agreement was reached at the Eurozone summit of 12 July. Schäuble stated that Greece’s debt could then be restructured, while a ‘debt cut is incompatible with membership of the currency union’. Indeed, as has been reported in the financial press, Berlin has signalled that ‘Germany would generously support Athens, including with a debt cut’ in the case of a Grexit. The problem with this logic is that it is based on a false premise: that there is one evidently correct interpretation of Art. 125 TFEU, and this interpretation prohibits debt relief of a Eurozone Member State. The legal questions are by no means settled, but a leading decision of the Court of Justice of the EU on a related matter, the compatibility of ESM assistance with Art. 125 TFEU, gives some guidance.

In Pringle, the Court explains that Art. 125 TFEU ‘is not intended to prohibit either the Union or the Member States from granting any form of financial assistance whatever to another Member State’. The Court therefore distinguishes between the assumption of an existing commitment and the creation of a new one. The latter is in line with the Treaty, ‘provided that the conditions attached to [the] assistance are such as to prompt that Member State to implement a sound budgetary policy.’ Thus, neither financial support in the form of a credit line or loans, nor purchases of government bonds on the primary market amount to the assumption of a Member State’s existing debts. Similarly, the purchase of bonds on the secondary market is not in breach of the no-bailout clause because the price paid is determined by the ‘rules of supply and demand on the secondary market of bonds’, i.e. the risk of default is presumably already priced in.

It is controversial whether Art 125 TFEU should be interpreted as literally as the quotes above seem to indicate. The Court itself in Pringle may be interpreted as raising some doubts when it mentions that under the ESM Treaty, ‘any financial assistance… must be repaid to the ESM by the recipient Member State and… the amount to be repaid is to include an appropriate margin’. However, it is clear from the judgment that the permissibility of assistance measures should be assessed against the objective of Art. 125 TFEU. The provision is intended to address the problem of moral hazard that arises when debts are mutualised by incentivising Member States to maintain budgetary discipline.

To achieve this aim, it is essential that the Member State is subject to market discipline ex ante, i.e. the market does not price government bonds on the basis of the expectation that the Member State will receive financial assistance when it experiences a liquidity crisis. On the other hand, whether the ESM is repaid in full, and whether it charges an appropriate margin, does not influence the expectations of the market and, hence, the incentives of Member States to maintain budgetary discipline before a liquidity crisis occurs.

It’s just the press, domestic and foreign, that wants to see him go. Not the Greeks.

• Tsipras Is More Popular Than Ever In Greece Despite Bailout Hardship (AP)

Under Alexis Tsipras, Greece slid back into recession, sank deeper into debt and found itself pushed to the brink of bankruptcy. Then after rejecting one painful bailout deal, the radical left leader agreed to a new one with possibly just as harsh terms. It wouldn’t be surprising to find Greeks calling for his head by now. But the telegenic prime minister is more popular than ever – testament to how his defiance of Europe has struck a chord with a nation fed up with sacrifices imposed from outside. The 40-year-old has an approval rating of nearly 60%, more than 10 points clear of his closest rival – leading to speculation about a possible snap election in the fall. A weekend opinion poll suggested his hard-left SYRIZA party would win a landslide victory if elections were held today.

Many Greeks like Tsipras’s message of hope – even if his actions may be leading to a harder life. “People are under tremendous pressure,” said Aleka Tani, who sells robes to Greek Orthodox priests, “and they need to hear something positive.” Tsipras’s SYRIZA party was elected in January on a promise to end austerity, forming a coalition with the right-wing, anti-bailout Independent Greeks party – a move that broadened his political influence. As Greece’s economy tanked under his leadership, Tsipras’s own popularity only grew. And that appeal has not faded despite caving into demands for more austerity last week in exchange for a bailout that kept Greece within the eurozone. The U-turn at the eurozone summit in Brussels was in many ways baffling.

For it came after Tsipras pleaded with Greeks to reject European creditors’ original bailout proposal, in a referendum called by the prime minister himself. Days after a resounding “No” vote on more austerity, Tsipras agreed to a pact that will bring more brutal austerity for years to come. That might have been political suicide for any other leader. But Tsipras appears to have won Greek hearts with his tough talk against Europe – and a frank admission in parliament that he had accepted tough terms after making mistakes. Defending the deal, Tsipras also argued that he had not walked away from the eurozone summit empty-handed. His long-standing demand for some way to ease Greece’s whopping 320 billion euro ($347 billion) national debt is now being discussion by Europe’s policymakers.

Elias Nikolakopoulos, a leading Greek pollster, said that although it is still early to accurately gauge the depth of Tsipras’s popularity, his resilience may be partly due to Greeks seeing him fighting in their corner, doing what he can whether good or bad. “People say that at least he fought,” Nikolakopoulos said. He added that Tsipras’s portrayal of Greece rejecting the meddling of “foreigners” resonates among many Greeks.

Aces up his sleeve yet?

• Greek PM Tsipras Rallies Syriza Backing Before Bailout Vote (Reuters)

Greek Prime Minister Alexis Tsipras tried to rally his leftwing Syriza party on Tuesday ahead of a vote in parliament on the second package of measures demanded by international creditors as a condition for opening talks on a new bailout deal. Tsipras has faced a revolt in the ruling Syriza party over the mix of tax hikes and spending cuts demanded by lenders but is expected to get the package through parliament with the support of pro-European opposition parties. Talking to Syriza officials on the eve of the vote, he said he aimed to seal the bailout accord, which could offer Greece up to €86 billion in new loans to bolster its tottering finances and ward off the threat of a forced exit from the euro.

“Up until today I’ve seen reactions, I’ve read heroic statements but I haven’t heard any alternative proposal,” he said, warning that party hardliners could not ignore the clear desire of most Greeks to remain in the single currency. “Syriza as a party must reflect society, must welcome the worries and expectations of tens of thousands of ordinary people who have pinned their hopes on it,” he said, according to an official at the meeting. Earlier government spokeswoman Olga Gerovasili said the government expected to wrap up bailout talks with the lenders by Aug. 20 with negotiations expected to begin immediately after Wednesday’s vote in parliament.

Officials from the creditor institutions, the Troika, are due in Athens on Friday for meetings with the government, Deputy Finance Minister Dimitris Mardas said. Wednesday’s vote in parliament follows a first vote last week on the so-called “prior actions” demanded of Greece as a condition before the start of full bailout talks. The bill was passed but a revolt by 39 Syriza lawmakers who refused to back the measures raised questions over the stability of the government, which came to power in January on an explicit anti-austerity platform.

Interesting take. Which other EU bigwigs are getting paid by corporates? Man, what a mess this is.

• Why Anti-Greece Hawk Verhofstadt Wants Greek Energy Privatisations (The Slog)

Guy Verhofstadt, the senior MEP who lambasted Alexis Tsipras in Brussels last week, is on the Board of two companies due to gain from Greek energy privatisation…and is paid €190,000 a year by billionaire Nicolas Boël to lobby to that end. He has also been hawkishly anti-Putin over the Ukraine issue, where the Boël dynasty plotted régime change as a means of gaining valuable fracking contracts. Many of you will doubtless have seen this Youtube vitriol aimed at Tsipras by Belgian MEP Guy Verhofstadt:

He’s a pretty unpleasant and vindictively sarcastic bloke who wants régime change in Greece more than most. But Verhofstadt’s vomit-inducing mélange of acrimony and sanctimony left out one rather important element: a declaration by this corrupt bombast that he has a personal financial interest in hounding Syriza from office. You see, mijnheer Veryhighstink is on the Board of an energy company called Sofina. Sofina is quoted on the Brussels bourse – so, very handy for Guy – and yes indeed, here he is listed at Bloomberg:

If the Greek privatisation programme demanded by Verhofshit et al goes ahead, then shareholders in Sofina stand to make a lot of money as the shares sky rocket and earnings per share rise. Last February 24th, Go-getter Guy argued strongly for the Greek energy privatisation to be given priority. Tsipras and Varoufakis specifically blocked such a move. Now however, Sofina’s partner in crime GDFSuez is a front runner to win that privatisation contract. It’s a funny thing, but mijnheer Veryfat is very close to the Boël billionaire patriarch Nicolas, who owns 53.8% of Sofina. Let’s not beat about the bush here, Guy Verhofstadt is paid €130,000 a year to lobby for Nicolas Boël.

It gets worse, I’m afraid. Verhypocradt is also on the board of Belgian shipping company Exmar, which specialises in the exploitation and transportation of gas; it too stands to make a fortune from the fire-sale of Greece’s seabed gas finds. And blow me down with a Belgian windbag, Guy Verhofstadt is paid €60,000 a year to lobby for Exmar. I think we have to ask European Parliament Chair and fellow anti-Tsipras loudmouth Martin Schulz why his chum Verhofstadt didn’t declare these obvious interest conflicts before laying into Alexis Tsipras, the spotless Prime Minister of an EU sovereign State. Also what he is going to do about these revelations.

And while Martin Shutzstaffel is pondering the best wriggle-strategy out of that one, he might also care to look into some of the Belgian chocolate’s other hobby-horses…and the remarkable confluence they have with his business interests. For example, mijnheer Verhofstadt has been a passionate advocate of fast-tracking Ukraine into the EU. This is because the Boël family is determined to grab a slice of the big shale-fracking potential of the Ukraine: and again, they pay him to make things easier for them. The EU has been happy dealing with corrupt politicians and mobsters in Ukraine to this end, because Verhofstadt has argued that the needs justify the means.

“The Greek government proposes to bundle public assets into a central holding company to be separated from the government administration and to be managed as a private entity, under the aegis of the Greek Parliament, with the goal of maximizing the value of its underlying assets and creating a homegrown investment stream.”

• Europe’s Vindictive Privatization Plan for Greece (Yanis Varoufakis)

On July 12, the summit of eurozone leaders dictated its terms of surrender to Greek Prime Minister Alexis Tsipras, who, terrified by the alternatives, accepted all of them. One of those terms concerned the disposition of Greece’s remaining public assets. Eurozone leaders demanded that Greek public assets be transferred to a Treuhand-like fund – a fire-sale vehicle similar to the one used after the fall of the Berlin Wall to privatize quickly, at great financial loss, and with devastating effects on employment all of the vanishing East German state’s public property. This Greek Treuhand would be based in – wait for it – Luxembourg, and would be run by an outfit overseen by Germany’s finance minister, Wolfgang Schäuble, the author of the scheme. It would complete the fire sales within three years.

But, whereas the work of the original Treuhand was accompanied by massive West German investment in infrastructure and large-scale social transfers to the East German population, the people of Greece would receive no corresponding benefit of any sort. Euclid Tsakalotos, who succeeded me as Greece’s finance minister two weeks ago, did his best to ameliorate the worst aspects of the Greek Treuhand plan. He managed to have the fund domiciled in Athens, and he extracted from Greece’s creditors the important concession that the sales could extend to 30 years, rather than a mere three. This was crucial, for it will permit the Greek state to hold undervalued assets until their price recovers from the current recession-induced lows.

Alas, the Greek Treuhand remains an abomination, and it should be a stigma on Europe’s conscience. Worse, it is a wasted opportunity. The plan is politically toxic, because the fund, though domiciled in Greece, will effectively be managed by the troika. It is also financially noxious, because the proceeds will go toward servicing what even the IMF now admits is an unpayable debt. And it fails economically, because it wastes a wonderful opportunity to create homegrown investments to help counter the recessionary impact of the punitive fiscal consolidation that is also part of the July 12 summit’s “terms.” It did not have to be this way.

On June 19, I communicated to the German government and to the troika an alternative proposal, as part of a document entitled “Ending the Greek Crisis”: “The Greek government proposes to bundle public assets (excluding those pertinent to the country’s security, public amenities, and cultural heritage) into a central holding company to be separated from the government administration and to be managed as a private entity, under the aegis of the Greek Parliament, with the goal of maximizing the value of its underlying assets and creating a homegrown investment stream. The Greek state will be the sole shareholder, but will not guarantee its liabilities or debt.”

Yeah, well, they won’t. It’s their golden goose.

• Why It’s Time For Germany To Leave The Eurozone (Telegraph)

Germany’s finance minister, Wolfgang Schauble, has drawn opprobrium and praise in equal measure for his suggestion that Greece takes a “time-out” from the eurozone. In proposing that Greece could be better off outside the euro, the irascible 72-year-old crossed a political rubicon: he confirmed that the single currency was “reversible” after all. But having broken the euro’s biggest taboo, commentators have now suggested that it should be Mr Schaeuble’s Germany, rather than Greece, that should now take the plunge and ditch the euro. Figures as esteemed as the former Federal Reserve chief Ben Bernanke used last week’s decision to press ahead with a new, punishing bail-out for Greece as an opportunity to remind Germany of its responsibilities to the continent.

Mr Bernanke took to his blog to highlight that Berlin’s excessively tight fiscal policy has helped scupper the euro’s dreams of prosperity and “ever-closer” integration between 18 disparate economies. In its latest assessment of Germany’s economic strength, even the IMF (seen in many German circles as chief disciplinarian against the errant Greeks) urged Berlin to carry out “more ambitious action… and contribute to global rebalancing, particularly in the euro area”. Germany’s record trade surplus is held up as the main symptom of its dangerously preponderant position in the eurozone. A measure of the economy’s position in relation to the rest of the world, Germany’s current account hit a euro-area record of 7.9pc or €215bn in 2014. It is now expected to hit more than 8pc of GDP this year, according to the IMF.

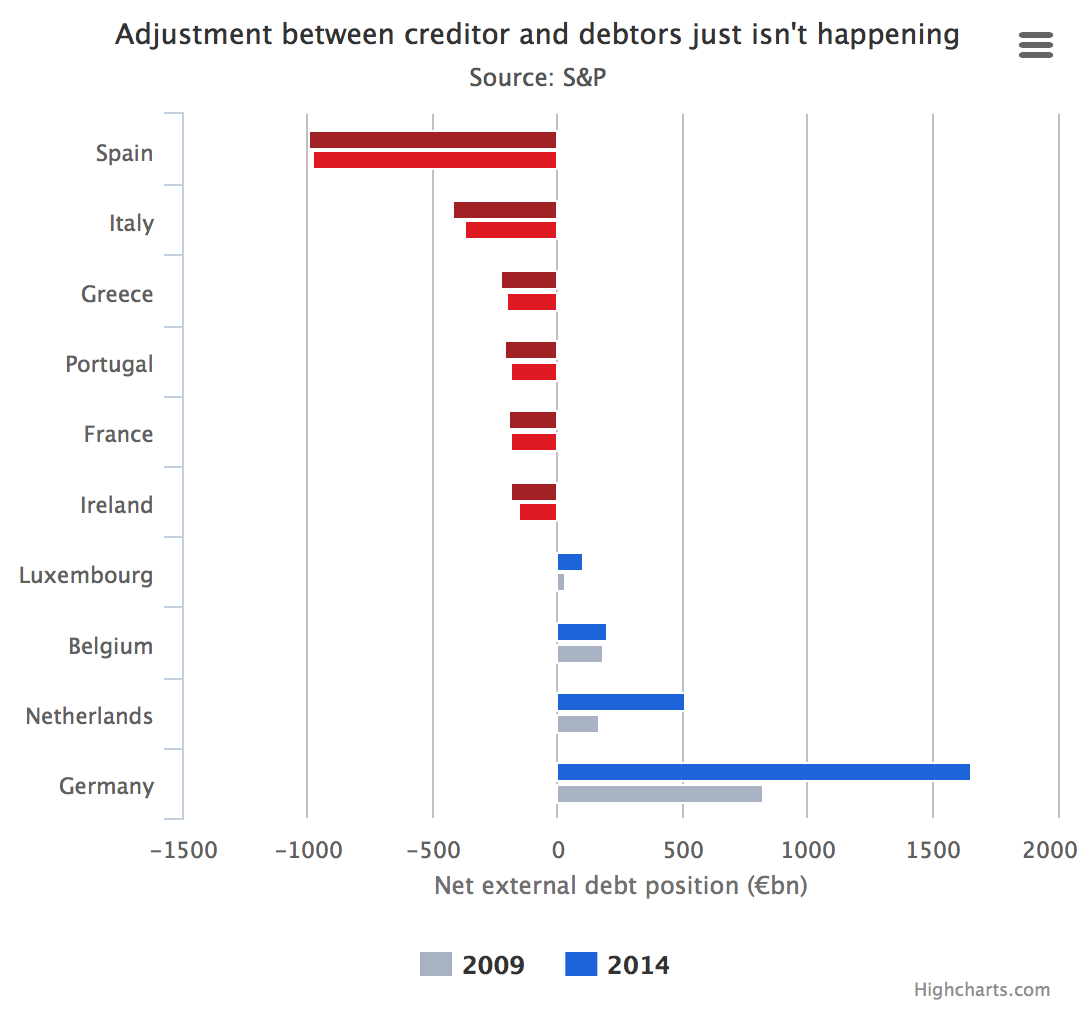

The persistently high surplus in part reflects the strength of Germany’s much-vaunted export industries. But other contributing factors are reasons for concern. The IMF has said such chronic imbalance also reflects a “reluctance by the corporate sector to invest more in Germany”. As Mr Bernanke also notes, the surplus puts “all the burden of adjustment on countries with trade deficits, who must undergo painful deflation of wages and other costs to become more competitive.” Southern economies such as Greece are chief victims of the cost of this adjustment. But as the chart below shows, with Germany in the bloc, the eurozone’s rebalancing act is going nowhere. The initial adjustment between debtor and creditor nations, which started in 2008, “has halted since 2012, and seems to be on the verge of reversing”, find Standard & Poor’s.

“Either someone has to give in, or Greece’s creditors must come up with a major fudge to square their impossible circle.”

• Greece’s Faulty Bailout Math (Briançon and Karnitschnig)

After promising up to €86 billion to finance a third bailout for Greece, the country’s creditors now just have to find the money. So far, the numbers don’t add up. The figures officially mentioned since Athens and other eurozone governments clinched a deal July 13 don’t square with the official statements of the signatories themselves. The reason is politics. The IMF, which contributed about a third of the funding of the two previous Greek bailouts in 2010 and 2012, has yet to say whether it will put fresh money into a third. The IMF won’t go in without debt relief. Eurozone governments won’t go in without the IMF, but want debt relief to be only “considered after the first positive completion of a review.”

Either someone has to give in, or Greece’s creditors must come up with a major fudge to square their impossible circle. The IMF can only lend to a country if it deems its debt sustainable. Asked on July 17 whether the deal agreed by Greece and its eurozone creditors a few days before would be viable without debt relief, IMF managing director Christine Lagarde said: “The answer is unequivocal: No.” Germany and a few other eurozone governments refuse to talk about debt relief for now. Chancellor Angela Merkel said in a lengthy interview Sunday on German public television that the only form of debt relief Berlin will consider is a re-profiling of Greece’s obligations by extending maturities and lowering interest rates.

Merkel pointed out that creditors have previously taken such measures to relieve Greece’s debt burden and are willing to do so again. But she stressed that such a step, as outlined in the deal reached last week with Greece, could only come if Athens passes its first bailout review, expected in November. “These steps are included in the mandate and we can discuss them, but only once Greece has successfully completed the initial review of its program, not now, only then,” Merkel said, reiterating her opposition to an upfront “haircut” on Greek debt. The chancellor was merely reiterating the European Council’s July 12 statement, but the fact that she took such a definitive stance on the issue in a primetime television interview suggests that she will not back down on this point.

At the same time, on the insistence of Germany and its closest eurozone allies, the same statement insists that the IMF contribution “is a pre-condition for the Eurogroup to agree on a new program.” The Fund was called in to take part in Greece’s financial rescue in 2010 on the insistence of Merkel, who thought the institution’s reputation would lend credibility to the conditionality attached to the bailout. So how do you find as much as €86 billion in this difficult context?

Like a primary dealer in the US refusing to buy bonds.

• Greek Bank NBG Turns Down Role In Bond Sale, Citing Capital Controls (Reuters)

National Bank of Greece declined to buy bonds from the euro zone’s bailout fund in a sale on Tuesday because of Greece’s capital controls, bankers said, a sign of the country’s financial isolation. NBG is one of 39 dealer banks the European Stability Mechanism routinely uses to help distribute its bonds. The banks, called the Market Group, underwrite the bonds and sell them on to investors in a process known as syndication. Banks earn a flat fee plus any margin they make in the process. Sources at two dealer banks said that NBG declined when it was asked in an online chat forum to take part in Tuesday’s bond sale, citing the capital controls.

The bankers said it was very rare for dealer banks to decline an offer to participate. NBG was not available for comment. The ESM declined to comment. Greece reopened its banks on Monday, three weeks after closing to prevent a collapse of the country’s banking system in a flood of withdrawals, but capital controls remain in place and the Athens stock market has yet to reopen. The ESM — which is expected to increase its issuance of bonds this year to fund a third bailout for Greece – sold €2 billion of bonds maturing in October 2019 on Tuesday.

Allegedly. Not sure about this one.

• Greek PM Tsipras Allegedly Asked Russia for $10 Billion to Print Drachmas (GR)

Greek Prime Minister Alexis Tsipras has asked Russian President Vladimir Putin for $10 billion in order to print drachmas, according to newspaper “To Vima.” The newspaper report cited Tsipras saying in his last major interview to Greek national broadcaster ERT that “in order for a country to print its own national currency, it needs reserves in a strong currency.” Moscow’s response was a vague mention of a 5-billion-dollar advance on the new South Stream natural gas pipeline construction that will pass through Greece. Tsipras also sent similar loan requests to China and Iran, but to no avail, the report said.

The idea of introduction of a new national currency was examined by technocrats and Greek Finance Ministry employees, who studied the model of Slovakia’s secession from Czechoslovakia in early 1993 and the introduction of the Slovak koruna, the report said. Tsipras was planning the return to the drachma since early 2015 and was counting on Russia’s help to achieve this goal. According to the report, Panos Kammenos, Yiannis Dragasakis, Yanis Varoufakis, Nikos Pappas, Panagiotis Lafazanis and other key coalition members were aware of his plan. In his first visit to Moscow, Tsipras condemned the EU policy in Ukraine and supported the referendum of east Ukraine seeking secession.

It was then that Germany realized Greece was prepared to shift alliances, something that would threaten the Eurozone cohesion. Tsipras was hoping that Germany would back down under that threat and offer Greece a generous debt haircut. At the time, Tsipras had the rookie ambition that he could change Europe, the report continued. It also spoke of a “geopolitical matchmaking” as Tsipras was introduced to Leonid Resetnikof, Director of the Russian Institute of Strategic Studies, before the European Parliament elections in May 2014. The introduction was made by Professor of Russian Studies Nikos Kotzias, who later cashed in on his services by getting the chair of Foreign Affairs Minister.

The July 5 referendum was a test for Tsipras to see what the Greek people were thinking about Europe and the Eurozone. However, on the night of the referendum, word came from Russia that Putin did not want to support Greece’s return to the drachma. That was confirmed the days that followed. After that, Tsipras had no choice left but to “surrender” to German Chancellor Angela Merkel and sign the third bailout package. The report created a stir and led 17 New Democracy MPs to send a letter to Tsipras, asking if any of the allegations are true.

Coming back to game theory all the time gets old. Yanis said ages ago that it was not relevent in the discussion.

• Greece And Germany’s Game Of Chicken (Böhnke)

“We are both heading for the cliff. Who jumps first is the chicken” were the famous last words of James Dean’s opponent in the classic movie “Rebel Without A Cause” The game of chicken is a standard model of conflict for two players in game theory. While game theorist and sometime finance minister Yanis Varoufakis has drawn all the attention for his ‘chicken’ negotiating approach, the real champion of this game of chicken has turned out to be Germany’s finance minister Wolfgang Schäuble. Many observers of the Greek crisis agree that it was Schäuble’s detailed Grexit proposal that forced Alexis Tsipras, who took over in this game from his co-pilot Varoufakis, to finally surrender and jump.

Although many observers expected that Angela Merkel and Wolfgang Schäuble would have been feted for their victory upon their return to Berlin, the exact opposite has been the case. The tersest reaction came from Thomas Strobl, vice chairman of the Christian Democrats (CDU) and Schäuble’s son-in-law. Prior to the CDU’s steering committee meeting after the euro summit last Monday he said: “The Greek has now annoyed long enough.” While Strobl has since been heavily criticised for this remark, this chauvinistic attitude does reflect strongly the sentiment of many people in Germany and in Strobl’s party in particular.

This ‘friend or foe’ thinking is back in vogue in Europe and it dominates the public debate in Germany. For weeks major German media outlets, including Bild-Zeitung and Die Welt have promoted this perception. This week Der Spiegel ran a story headlined “Our Greeks – Getting closer to a strange people” together with a political cartoon of a Greek man dancing with a glass of Ouzo and a bunch of Euros next to a betrayed looking German tourist. The polarisation of the debate since the last crisis summit on Sunday has divided the rhetorical battlefield in Germany into two major camps. In this bizarre zero-sum contest you can either be “for Greece and against Germany” or “for Germany and against Greece”.

The antagonistic attitude has been internalised by the government, the political parties, and public opinion, too. The most depressing aspect of this debate has been the combination on each side of a startlingly narrow-minded perspective on the political problems and a puzzling resistance to acknowledging the plains fact that Greece’s problems are inextricably part of the Eurozone’s own longstanding troubles.

“We knew from the beginning just how merciless the lenders would be.” I warned Varoufakis by email about this on January 25. And I’m not sure they really did.

• Why I Voted No (Yanis Varoufakis)

In an article which was published on Saturday in EfSyn (and translated by ThePressProject International), the former Finance Minister, Y.Varoufakis attempts to explain the reasons why he voted NO to the prior actions deal that the government brought to the parliament.

I decided to come into politics for one reason: to support Alexis Tsipras in his fight against debt serfdom. On his behalf, Alexis Tsipras honoured me in conscripting me for one reason: a particular understanding of the crisis based on the rejection of the Papakonstantinos dogma; namely, the view that given a choice between anarchic bankruptcy and toxic loans, the latter is always preferable. It is a dogma I rejected as being a standing threat, which helped enforce policies that guarantee permanent bankruptcy and, eventually, lead to debt serfdom. On Wednesday night, I was asked in the parliament to choose between (a) espousing the aforementioned dogma by voting in favour of the document that our “partners” imposed on Alexis Tsipras in the Euro Summit by putschist means and unimaginable aggression, or (b) say “no” to my Prime Minister.

The Prime Minister asked us “Is the blackmail real or make-belief?”, expressing the hideous dilemma that would burden all in everyone’s own consciousness – his too. Clearly, the blackmail was real. Its “reality” first hit me when on the 30th of January, J.Dissjenbloem visited me in my office to present me with the dilemma memorandum or closed banks . We knew from the beginning just how merciless the lenders would be. And yet we decided on what we kept repeating to each other during those long nights and days at the PM’s headquarters: “We are going to do all it takes to bring home a financially viable agreement. We will compromise but not be compromised. We will step back just as much as is needed to secure an agreement-solution within the Eurozone.

However, if we are defeated by the catastrophic policies of the memorandum we shall step down and pass on the power to those who believe in such means; let them enforce those measures while we return to the streets.” The Prime Minister asked on Wednesday Is there an alternative? I estimate that, yes, there was. But I shall not dwell on that now. It is not the appropriate time. What is important is that on the night of the referendum the Prime Minister was determined that there was no alternative course of action. And that is why I resigned, so that I would facilitate his going to Brussels and coming back with the best terms he could possibly deliver. But that does not mean that we would be automatically committed to enforcing those measures no matter what they were!

“The state received nearly 71% of its entire GDP in federal funding on average over the past four years..”

• If Greece Were A US State, It Would Be… North Dakota?! (CNBC)

Germans aren’t too keen on paying off Greek debts. It’s a good thing that U.S. taxpayers don’t have that hang-up. Most Americans aren’t aware that their states have made similar bargains—protection from economic fallout in exchange for helping the federal government prop up weaker states when they need it. Billions of dollars flow from wealthier to less well-off states. The oft-cited strategic problem with the euro zone is that while European countries bound themselves together in a monetary union, they didn’t do much to give the combined entity power over fiscal decisions. That prevents the easy flow of liquidity and means that although EU countries will effectively sink or swim together, each country is alone in making budget decisions and in dealing with fiscal emergencies when they arise.

At the same time, a country can’t make traditional economic maneuvers like devaluing their currency when they get in trouble. But just as in Europe, some U.S. states end up taking more and some states end up giving more. So which state is our Greece? It changes, but based on average figures from 2011 to 2014 for federal tax payments and funding outlays to the states, our North Dakota takes the prize. The state received nearly 71% of its entire GDP in federal funding on average over the past four years—and almost $50 billion more than the state contributed in taxes last year, according to the Internal Revenue Service. That probably feels like a bad deal for nearby Minnesota and Kansas, which together paid about that amount more in taxes than they received—around 13% of their GDPs.

And what about Germany and the fiscally sound countries of Northern Europe? California, Texas and New York together paid out almost $345 billion more than they received in 2014, but as a%age of GDP, Delaware is the most generous. The tiny state paid an average of $20.5 billion, or 20.8% of its GDP over the past four years, to the Feds to be redistributed among its needy neighbors, according to the IRS. Perhaps economic unity is a small price to pay for peace of mind—Delaware could be the new Greece the next time around.

“..the debt-laden nation has been slow to embrace generics is that the country has traditionally had low prices for branded drugs relative to the rest of Europe, and relatively high ones for generics..”

• To Fix Greece’s Debt Woes, Generics Are Just What Doctor Ordered (Bloomberg)

Here’s a simple way to prune Greece’s debt load: use fewer brand-name drugs. The land of Hippocrates taps fewer generic medicines (and reaps lower savings) than any other European nation at the moment. Not ideal for a country negotiating its third bailout. Greek pharmacies last year continued to dispense a majority of branded medicines from overseas, according to data from IMS Health, which tracks drug consumption. Novartis’s Diovan, which keeps blood vessels from narrowing, and Pfizer’s cholesterol-buster Lipitor still dominate, years after their expired patents opened the door for generics. That’s because Greece doesn’t require doctors to prescribe cheaper alternatives, according to Per Troein, IMS’s vice president of strategic partners.

The branded drug dominance is hobbling authorities’ efforts to comply with the terms of the last rescue. “If they’re going to save money, they need to have prescription guidelines,” Troein said by phone. “The first-line treatment in many cases should be an off-patent product.” Diovan, for instance, accounted for 82% of prescriptions in the fourth quarter, according to IMS. By contrast, the medicine makes up only 4% of pharmacy sales in Germany after it lost patent protection in Europe four years ago. The Lipitor original commands 29% of the market in Greece, compared with just 5% in Germany. Lipitor, which went off patent in 2012, costs about €11.51 for a pack of 14 tablets of 40 milligrams each in Greece, 27% more than the generic version, IMS data show.

Diovan costs about €7.22, or 48% more than the generic, for a pack of pills that are 320 milligrams each. Even so, branded drugs account for 51% of medicines dispensed in Greece, the most among 20 European countries studied by IMS in a report published last month. The daily treatment cost in Greece for seven key drug classes is the third-highest in Europe, behind Switzerland and Ireland, the IMS data show. Panagiotis Kouroumplis, who became health minister after the Syriza party came to power this year, blames drugmakers. He was among the cabinet ministers to retain his position after Greek Prime Minister Alexis Tsipras last week replaced officials who rejected austerity measures needed to appease creditors.

“Efforts to increase the penetration of generics in the Greek market did not yield fruit mainly because of the fact that the interests of the pharmaceutical companies which promote the brands are very powerful,” Kouroumplis said in an e-mailed response to questions earlier this month. Medicines are one of Greece’s biggest imports, alongside fuel, cars and electronics. Foreign-made drugs make up about 88 percent of Greece’s pharmaceutical market, according to IMS. Part of the reason the debt-laden nation has been slow to embrace generics is that the country has traditionally had low prices for branded drugs relative to the rest of Europe, and relatively high ones for generics, according to Troein.

This alone is reason enough to let the EU implode. There is no sense of humanity in it.

• EU Member States Miss Target To Relocate 40,000 Refugees (Guardian)

EU member states have fallen short of their own target to relocate 40,000 migrants from Greece and Italy in clear need of international protection. On Monday, the member states agreed to the relocation of 32,256 refugees, starting in October, which is 20% lower than the agreed goal. They also committed to the future resettlement of 22,504 refugees, although the target of 20,000 was met only thanks to “the readiness of [non-EU members] Iceland, Liechtenstein, Norway and Switzerland to participate in this effort through multilateral and national schemes”, according to the Council of the European Union meeting notes. The total falls short of the combined 60,000 target that was agreed at a summit at the end of June after hundreds of migrants died while attempting to cross the Mediterranean from Libya.

However, EU states at the time were unable to agree how to apportion the figure between countries as most disagreed with the European commission’s proposed distribution. Germany, France and the Netherlands, which are taking on the highest number of refugees, are in favour of the allocations the commission proposed earlier this year. However, most other states are not – and have refused to meet the figures suggested. For example, Spain has committed to 1,300 refugees, more than three times lower than the number the EU requested. The commitments of Baltic and several eastern European nations also fall well short. Latvia is proposing to take in only 200 asylum seekers, fewer than half of what the commission originally suggested.

While Slovakia is offering to take 100 refugees, which is fewer than Cyprus (173), a country with a population nearly five times smaller than that of the eastern European country. Lithuania has pledged to take 255 refugees, fewer than Luxembourg despite the Baltic country’s population being about six times larger. At the June summit, the Lithuanian president, Dalia Grybauskaité, had told Matteo Renzi, the prime minister of Italy, that she had no intention of contributing to any solution. Renzi accused government chiefs of wasting time and was said to reply: “If this is your idea of Europe, you can keep it.”

And they’re all still too busy humiliating Greek people. Let’s blow up the EU ASAP.

• Greek Islands Lesbos And Kos Host 1000s Of Migrants In Shocking Conditions (DM)

Thousands of desperate migrants are camping out on roundabouts amid squalid camps overflowing with rubbish on the Greek holiday islands of Lesbos and Kos. Around 5,000 people have arrived in Lesbos in the past few days and many are forced to sleep outside amid broken glass and piles of rubble without access to water, shelter, toilets or medical care. Shocking images taken at the official Moria camp near the main town of Mitlini show filthy and overflowing latrines strewn with discarded plastic bottles and tents perched next to piles of rubbish. Conditions at the unofficial Kara Tep camp, which has been heaving with up to 2,000 new arrivals in recent days, are similarly dire, with people camping out on roundabouts, puddles of unclean stagnant water and migrants forced to boil water on fires using discarded Coke cans.

The pictures have been released by Médecins Sans Frontières/Doctors Without Borders (MSF), which has emergency teams in Lesbos and Kos – the only two Greek islands with capacity to receive migrants, the majority fleeing war and persecution in Syria, Afghanistan and Iraq. MSF emergency coordinator in Lesbos, Elisabetta Faga, told MailOnline from the island: ‘There are people sleeping on bits of paper and using nets meant to collect olives to try and make a sort of shelter. ‘The camps are not clean. When they are busy, just like in a discotheque when you have 2,000 people who haven’t showered, the smell is not very good. ‘The municipality makes some effort to clean but it is very difficult to do the maintenance, cleaning the rubbish the latrines and the showers.

‘During June something like 15,000 people arrived on the island. It’s very difficult for Lesbos to receive these sorts of numbers. They come from many different countries and cultures. ‘Everybody is struggling and the authorities are trying to do something but we need to remember this is Greece so they are overworked already.’ Ms Faga has been on the island two weeks and the first day of her arrival she joined a small team checking up on migrants making the 70km (43 mile) walk in baking heat from arrival points on the north coast to the registration centre in Mitilini.

“He’s consistently lied about his pension funding intentions, and he’s yet to live up to the promises he’s already made.”

• NJ Union Chief Won’t Negotiate Pension Reforms With Chris Christie (Politico)

The head of New Jersey largest public employee union said Monday he will not negotiate any pension reforms with Governor Chris Christie, a Republican who rose to national prominence on claims he had “fixed” the state’s pension system. Four years later, Christie finds himself unable to make scheduled payments into the retirement system and saying, as a spokeswoman put it on Monday, that the system remains “broken and unaffordable.” But Wendell Steinhauer, president of the New Jersey Education Association, said he and his members “will not concede one inch to this governor.” “He’s dishonest, unreliable and hopelessly incapable of good-faith negotiations,” Steinhauer said in a fiery, six-paragraph statement.

“He’s consistently lied about his pension funding intentions, and he’s yet to live up to the promises he’s already made. The ball is in his court to fund the pensions according to the law he signed. We will not negotiate against ourselves.” After a lengthy and bitter battle with unions, Christie signed a reform package into law in 2011 that boosted contributions from public employees and slashed cost-of-living adjustments, but said the state would start making annual contributions to the fund. Christie hailed the deal for years, even talking about it in his 2012 keynote speech at the Republican National Convention. But the fiscal situation in New Jersey did not turn out as expected, and this year, Christie found himself unable to keep up with the payments.

As he prepared to launch his presidential campaign, the governor won a state Supreme Court case last month that allowed him to skip a $1.57 billion pension payment and balance the budget. Spokeswoman Nicole Sizemore said Monday the teacher’s union needs to recognize the reality the state is facing. “The simple fact is this: the average NJEA member contributes $186,000 to their pension and health benefit costs over 30 years and takes out $2.5 million in benefits,” Sizemore said. “The math does not work and all the name calling in the world by NJEA leadership won’t change that fact.”

Sorry, but I would like to hear something smarter than this.

• Sustainable Development Fails But There Are Alternatives To Capitalism (Gdn)

In the face of worsening ecological and economic crises and continuing social deprivation, the last two decades have seen two broad trends emerge among those seeking sustainability, equality and justice. First there are the green economy and sustainable development approaches that dominate the upcoming Paris climate summit and the post-2015 sustainable development goals (SDGs). To date, such measures have failed to deliver a harmonisation of economic growth, social welfare and environmental protection. Political ecology paradigms, on the other hand, call for more fundamental changes, challenging the predominance of growth-oriented development based on fossil fuels, neoliberal capitalism and related forms of so-called representative democracy.

If we look at international environmental policy of the last four decades, the initial radicalism of the 1970s has vanished. The outcome document of the 2012 Rio+20 Summit, The Future We Want, failed to identify the historical and structural roots of poverty, hunger, unsustainability and inequity. These include: centralisation of state power, capitalist monopolies, colonialism, racism and patriarchy. Without diagnosing who or what is responsible, it is inevitable that any proposed solutions will not be transformative enough. Furthermore, the report did not acknowledge that infinite growth is impossible in a finite world. It conceptualised natural capital as a “critical economic asset”, opening the doors for commodification (so-called green capitalism), and did not challenge unbridled consumerism.

A lot of emphasis was placed on market mechanisms, technology and better management, undermining the fundamental political, economic and social changes the world needs. In contrast, a diversity of movements for environmental justice and new worldviews that seek to achieve more fundamental transformations have emerged in various regions of the world. Unlike sustainable development, which is falsely believed to be universally applicable, these alternative approaches cannot be reduced to a single model. Even Pope Francis in the encyclical Laudato Si’, together with other religious leaders like the Dalai Lama, has been explicit on the need to redefine progress: “There is a need to change ‘models of global development’; […] Frequently, in fact, people’s quality of life actually diminishes […] in the midst of economic growth.

In this context, talk of sustainable growth usually becomes a way of distracting attention and offering excuses. It absorbs the language and values of ecology into the categories of finance and technocracy, and the social and environmental responsibility of businesses often gets reduced to a series of marketing and image-enhancing measures.” But critique is not enough: we need our own narratives. Deconstructing development opens up the door for a multiplicity of new and old notions and world views. This includes buen vivir (or sumak kawsay or suma qamaña), a culture of life with different names and varieties emerging from indigenous peoples in various regions of South America; ubuntu, with its emphasis on human mutuality (“I am because we are”) in South Africa; radical ecological democracy or ecological swaraj, with a focus on self-reliance and self-governance, in India; and degrowth, the hypothesis that we can live better with less and in common, in western countries.