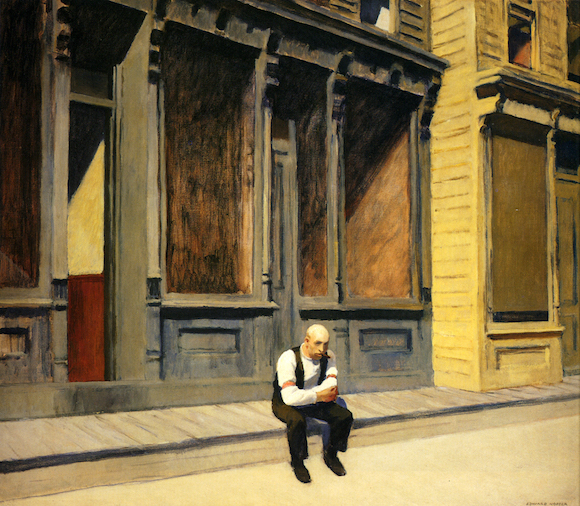

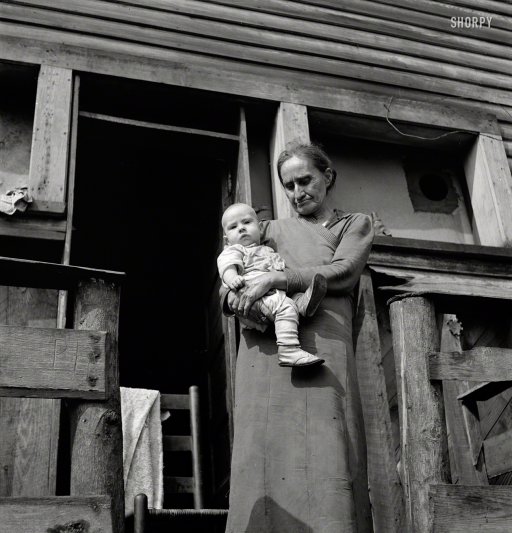

Paul Henry Altan Lough, Donegal 1933-34

Not that I need vindication, but it’s good to see that Larry King says the same I’ve been saying: CNN – like NYT, Wapo etc.- is in it for the money only, not for the news. Think of that as the recount stories start spreading.

• Larry King: CNN Stopped Doing News A Long Time Ago. They Do Trump (ZH)

HOST RICK SANCHEZ: You know it’s interesting. As I listen to you I’m thinking that both you and I are old enough to remember that there was a lot of antagonism during the 1960s. There was a lot of antagonism during Watergate. There was certainly antagonism during the Clinton years. But there is something, maybe it’s an undercurrent, that is different now. Can you put your finger on it? What is it?

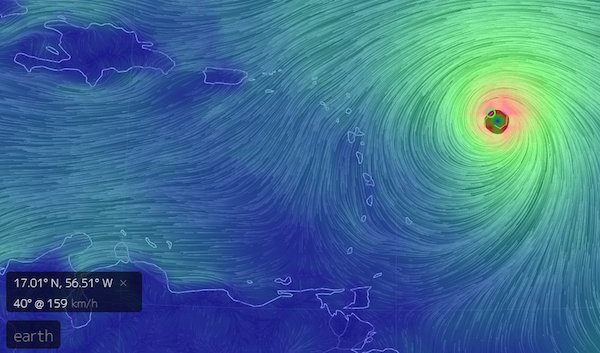

KING: Two things, Rick — the internet and cable news. Could you imagine cable news in Watergate? And they don’t do news anymore. In fact, RT is one of the few channels doing news. RT does news. CNN stopped doing news a long time ago. They do Trump. Fox is Trump TV and MSNBC is anti-Trump all the time. You don’t see a story — there was vicious winds and storms in the Northeast the other day – not covered on any of the three cable networks, not covered. Not covered! So when CNN started covering Trump — they were the first — they covered every speech he made and then they made Trump the story.

So, Trump is the story in America. I would bet that ninety-eight percent of all Americans mention his name at least once a day. And when it’s come to that, when you focus on one man, I know Donald 40 years — I know the good side of Donald and I know the bad side of Donald — I think he would like to be a dictator. I think he would love to be able to just run things. So, he causes a lot of this. Then his fight with the media and fake news. I’ve been in the media a long time, like you — longer than you, Rick. And at all my years at CNN, in my years at Mutual Radio, I have never seen a conversation where a producer said to a host “pitch the story this way. Angle it that way. Don’t tell the truth.” Never saw it. Never saw it.

SANCHEZ: You know it’s funny, just quick because you know these producers are telling me you guys have to start wrapping this up … you said something interesting about how CNN played along with Trump. I think they only played along or at least gave him that much airtime in many ways because they didn’t think he was going to win, correct?

KING: I guess it’s to their regret. But, they covered him as a character. They carried every speech he made. They carried him more than Fox News, at the beginning. And so they built the whole thing up and the Republicans had a lot of candidates and they all had weaknesses. When I saw Senator Cruz hug Donald Trump the other day I said, “this is what America has become.” He said that Cruz’s father helped kill Kennedy!

Healthcare good. Impeachment painfully dumb. These people should go looking for trustworthy news stories, not blindly parrot MSM.

• Democrats Want Healthcare Protected – And Trump Impeached (R.)

Democrats have a clear message for party leaders who will take control of the U.S. House of Representatives next year, according to a Reuters/Ipsos national opinion poll: Protect their healthcare and impeach President Donald Trump. The poll released on Thursday found that 43 percent of people who identified as Democrats want impeachment to be a top priority for Congress. That goal was second in priority only to healthcare, which played a major role in Democratic campaigns’ closing arguments before Tuesday’s elections.

They may be disappointed: Party leaders on Wednesday vowed to use their newly won majority to impose a new level of scrutiny on the Trump White House, but said impeachment would require evidence of action to subvert the Constitution that was so overwhelming that it would trouble even Trump’s supporters. Democratic Party leaders had practical reasons for caution. While they were poised to gain at least 30 House seats, more than the 23 they needed for a majority, Republicans strengthened their control of the U.S. Senate, which has the power to determine guilt or innocence in an impeachment proceeding. [..] The American public at large was far less supportive of impeachment proceedings, with just 24 percent of overall respondents listing it among their top three goals for the new Congress.

A raise next month is what’s next.

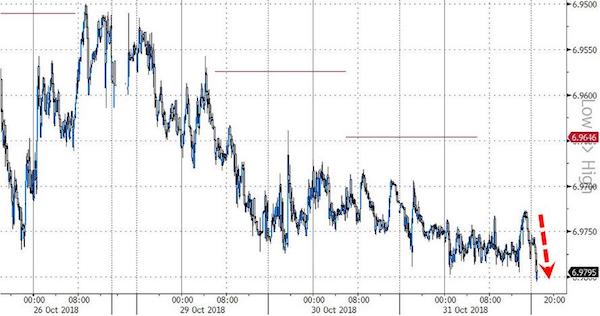

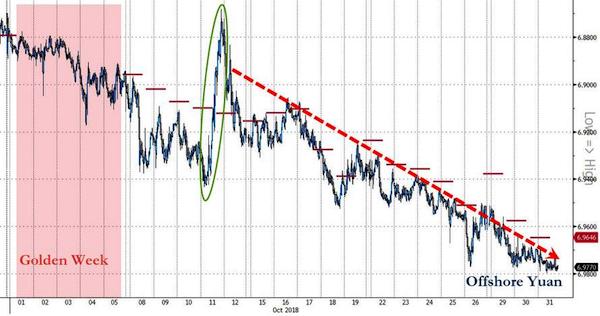

• The Fed Stands Pat on Thursday, What’s Next? (Street)

In an unsurprising move, Fed chair Jerome Powell kept rates flat on Thursday. “The committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions and inflation near the committee’s symmetric 2 percent objective over the medium term,” the Fed said following its regularly scheduled two-day meeting to discuss interest rates. “Risks to the economic outlook appear roughly balanced.” TheStreet Founder and Action Alerts portfolio manager Jim has been adamant that the pause was necessary given a “collapse in oil” and a “collapse in housing.” He noted that Powell’s pause, and potentially an extended pause, could change that.

[..] Powell has paused, but the market seems to be slow off the starting line so far as major indices finished Thursday down slightly. So what’s next? “People have to remember that this November meeting is the last lame duck meeting,” Quill Intelligence CEO and former Federal Reserve Bank of Dallas advisor Danielle DiMartino Booth told TheStreet. “imagine all of the drama with Trump castigating Powell.” She added that a raise is very likely in December and speculated that rates could possibly be raised again in January, which would surprise the markets. “I don’t think he has any qualms about having the market make monetary policy for him,” Dimartino Booth said. “He’s not afraid of the stock market.”

Why did that take 10 years? And what are the odds an actual person will be held accountable?

• US Sues UBS, Alleges Crisis-Era Mortgage Securities Fraud (R.)

The U.S. government on Thursday filed a civil fraud lawsuit accusing UBS, Switzerland’s largest bank, of defrauding investors in its sale of residential mortgage-backed securities leading up to the 2008-09 global financial crisis. UBS was accused of misleading investors about the quality of more than $41 billion of subprime and other risky mortgage loans backing 40 securities offerings in 2006 and 2007, the Department of Justice said in a complaint filed with the federal court in Brooklyn. The lawsuit came after UBS rejected a government proposal that it pay nearly $2 billion to settle, according to a person familiar with the talks who was not authorized to speak publicly about them.

While UBS was not a big originator of U.S. residential home loans, U.S. Attorney Richard Donoghue in Brooklyn said investors suffered “catastrophic losses” from the bank’s failure to fully disclose the risks of mortgage securities it helped sell. [..] U.S. officials faulted UBS for having a business culture that placed a higher priority on profits than full disclosure to investors, who were deprived of crucial information about the quality of the loans underlying the securities they bought. Thursday’s lawsuit quoted a UBS trader who in a 2006 instant message said “our crack due diligence effort is a joke,” and a UBS mortgage employee who the same year complained to his bosses about the bank’s ethics, including that “Lying is ok.”

His last warning?

• Frail Mikhail Gorbachev Warns Against Return To The Cold War (R.)

Mikhail Gorbachev, the last Soviet leader, warned on Thursday against rising tensions between Russia and the United States and said there should be no return to the Cold War. The frail 87-year-old was physically helped by aides to a cinema hall to watch the premiere in Russia of a new documentary about his life, his Soviet reforms in the 1980s and his arms control drive that helped end the Cold War. His legacy has come under a pall as ties between Moscow and Washington have fallen to post-Cold War lows, following Russia’s annexation of Crimea in 2014 and rows over sanctions, election meddling and the poisoning of a spy in England.

He spoke briefly to a cinema hall in Moscow after “Meeting Gorbachev”, a new documentary directed by filmmakers Werner Herzog and Andre Singer, and was asked if the world would hold back from a new Cold War. “We must hold back,” he said. “And not just from the Cold War. We have to continue the course we mapped. We have to ban war once and for all. Most important is to get rid of nuclear weapons.” Reviled by many Russians as the man whose reforms ultimately led to the Soviet breakup, Gorbachev is lauded in the West as the man who helped end the Cold War. Gorbachev, whose visibly ailing health was in stark contrast to the vigorous reformist figure he cut in the 1980s, said the world was moving dangerously closer to a new arms race.

This happened last year. Even university professors with 4 British kids are not safe.

• Corbyn Advisor Economist Mariana Mazzucato Has UK Residency Bid Rejected (G.)

The London-based international economist Mariana Mazzucato has said her application for permanent residency in the UK was turned down, prompting renewed anger about the government’s immigration policy. Mazzucato, the founding director of University College London’s Institute for Innovation and Public Purpose and the author of several influential books on the economy, was born in Italy but has lived in the UK for 20 years. She applied for permanent residency in 2017, a few months after the UK voted to leave the EU. On Thursday she tweeted that her application had been refused and her Italian passport kept by the Home Office for six months. Immigration officials blamed a credit card problem with her application fee, she said, adding that there was no problem with her card.

A spokesman for University College London said Prof Mazzucato did not want to elaborate on her Twitter update. Later, after her tweet prompted widespread outrage, it clarified that she was referring to an incident in 2017. Mazzucato joined Jeremy Corbyn’s Economic Advisory Committee in 2015 and 2016 alongside other big name economists, including Joseph Stiglitz and Thomas Piketty. She is a member of the Scottish government’s Council of Economic Advisers. Her attempt to secure permanent residency ran into problems over a mixup about single digit on her 85-page application. “My ‘big’ error was making 4 look like 9 in my credit card number,” she tweeted in May 2017. At the time she said her application had to be resubmitted.

No, we are not a smart species.

• As Renewables Drive Up Energy Prices US, Asia & Europe Opt For Nuclear (F.)

Voters in the U.S., Asia, and Europe are increasingly opting for nuclear power in response to rising electricity prices from the deployment of renewables like solar panels and wind turbines. By a more than two-to-one margin (70% to 30%), voters in Arizona on Tuesday rejected a ballot initiative (proposition 127) that would have resulted in the closure of that state’s nuclear power plant and in the massive deployment of solar and wind. In Taiwan, momentum is building for a repeal of that nation’s nuclear energy phase-out. Grassroots pro-nuclear advocacy inspired a former president to help activists gather over 300,000 signatures so voters could vote directly on the issue on November 24.

And after a coalition of grassroots groups rallied in Munich, Germany last month to protest the closure of nuclear plants, a wave of mostly positive media coverage spread across Europe, inspiring a majority of Netherlands voters, and the nation’s ruling political party, to declare support for building new nuclear reactors. Now, in the wake of rising public support for nuclear energy, a longstanding foe of nuclear power, the U.S.-based Union of Concerned Scientists, has reversed its blanket opposition to the technology and declared that existing U.S. nuclear plants must stay open to protect the climate.

The never ending battle continues. Just let interest rates bankrupt shale, and we’re good.

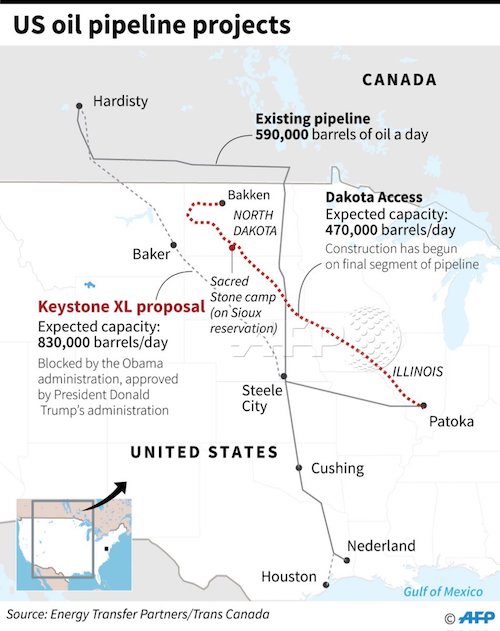

• US Court Halts Construction Of Keystone XL Oil Pipeline (AFP)

A federal judge on Thursday halted construction of the Keystone XL oil pipeline, arguing that President Donald Trump’s administration had failed to adequately explain why it had lifted a ban on the project. The ruling by Judge Brian Morris of the US District Court for the District of Montana dealt a stinging setback to Trump and the oil industry and served up a big win for conservationists and indigenous groups. Trump granted a permit for the $8 billion conduit meant to stretch from Canada to Texas just days after taking office last year. He said it would create jobs and spur development of infrastructure. In doing so the administration overturned a ruling by then president Barack Obama in 2015 that denied a permit for the pipeline, largely on environmental grounds, in particular the US contribution to climate change.

The analysis of a cross-border project like this is done by the State Department. The same environmental analysis that the department carried out before denying the permit in 2015 was ignored when the department turned around last year and approved it, the judge argued. “An agency cannot simply disregard contrary or inconvenient factual determinations that it made in the past, any more than it can ignore inconvenient facts when it writes on a blank slate,” Morris wrote. He added: “The department instead simply discarded prior factual findings related to climate change to support its course reversal.” The judge also argued that the State Department failed to properly account for factors such as low oil prices, the cumulative impacts of greenhouse gases from the pipeline and the risk of oil spills.

Who’ll know the difference?

• World’s First AI News Anchor Unveiled In China (G.)

China’s state news agency Xinhua this week introduced the newest members of its newsroom: AI anchors who will report “tirelessly” all day every day, from anywhere in the country. Chinese viewers were greeted with a digital version of a regular Xinhua news anchor named Qiu Hao. The anchor, wearing a red tie and pin-striped suit, nods his head in emphasis, blinking and raising his eyebrows slightly. “Not only can I accompany you 24 hours a day, 365 days a year. I can be endlessly copied and present at different scenes to bring you the news,” he says.

Xinhua also presented an English-speaking AI, based on another presenter, who adds: “The development of the media industry calls for continuous innovation and deep integration with the international advanced technologies … I look forward to bringing you brand new news experiences.” Developed by Xinhua and the Chinese search engine, Sogou, the anchors were developed through machine learning to simulate the voice, facial movements, and gestures of real-life broadcasters, to present a “a lifelike image instead of a cold robot,” according to Xinhua.

Britian’s reality.

• UN Envoy Meets UK Food Bank Users (G.)

At Britain’s busiest food bank in Newcastle’s west end people loaded carrier bags with desperately needed groceries as unemployed Michael Hunter, 20, took his chance to spell out to one of the world’s leading experts in extreme poverty and human rights just how tight money can get in the UK today. Previous destinations for Philip Alston, the United Nations rapporteur on the issue, have included Ghana, Saudi Arabia, China and Mauritania. But now his lens is trained on Britain, the fifth richest country in the world, and he listened as Hunter explained an absurdity of the government’s much-criticised universal credit welfare programme.

Users have to go online to keep their financial lifeline open, but computers need electricity – and with universal credit leaving a £465 monthly budget to stretch across the three people in Michael’s family (about £5 each a day), they can barely afford it with the meter ticking. “I have to be quick doing my universal credit because I am that scared of losing the electric,” he said. Alston mentally logged the situation, ahead of a report ruling on whether Britain is meeting its international obligations not to increase inequality. But it was not just the computer that was too expensive to power. “I am hungry sometimes,” Michael said. “I’m scared to eat sometimes in case we run out of food.”

Maybe mankind CAN solve some of its problems?!

• ‘Remarkable’ Decline In Global Fertility Rates (BBC)

There has been a remarkable global decline in the number of children women are having, say researchers. Their report found fertility rate falls meant nearly half of countries were now facing a “baby bust” – meaning there are insufficient children to maintain their population size. The researchers said the findings were a “huge surprise”. And there would be profound consequences for societies with “more grandparents than grandchildren”. The study, published in the Lancet, followed trends in every country from 1950 to 2017. In 1950, women were having an average of 4.7 children in their lifetime. The fertility rate all but halved to 2.4 children per woman by last year. But that masks huge variation between nations. The fertility rate in Niger, west Africa, is 7.1, but in the Mediterranean island of Cyprus women are having one child, on average.

Whenever a country’s average fertility rate drops below approximately 2.1 then populations will eventually start to shrink (this “baby bust” figure is significantly higher in countries which have high rate of deaths in childhood). At the start of the study, in 1950, there were zero nations in this position. Prof Christopher Murray, the director of the Institute for Health Metrics and Evaluation at the University of Washington, told the BBC: “We’ve reached this watershed where half of countries have fertility rates below the replacement level, so if nothing happens the populations will decline in those countries. “It’s a remarkable transition. “It’s a surprise even to people like myself, the idea that it’s half the countries in the world will be a huge surprise to people.”

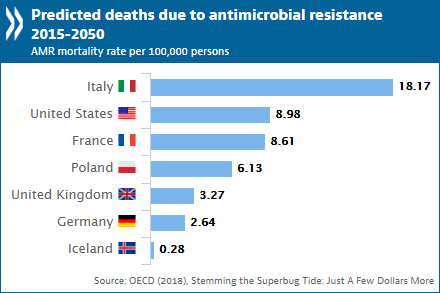

Apparently for the OECD, these are equal issues: ..handwashing and more prudent prescription of antibiotics. Though they know full well that simply putting a ban on antibiotics in agriculture would solve the issue in no time.

• Stopping Antimicrobial Resistance Would Cost Just $2 Per Person A Year (OECD)

Superbug infections could cost the lives of around 2.4 million people in Europe, North America and Australia over the next 30 years unless more is done to stem antibiotic resistance. Yet, three out of four deaths could be averted by spending just USD 2 per person a year on measures as simple as handwashing and more prudent prescription of antibiotics, according to a new OECD report. Stemming the Superbug Tide: Just A Few Dollars More says that dealing with antimicrobial resistance (AMR) complications could cost up to USD 3.5 billion a year on average across the 33 countries included in the analysis, unless countries step up their fight against superbugs.

Southern Europe risks being particularly affected. Italy, Greece and Portugal are forecast to top the list of OECD countries with the highest mortality rates from AMR while the United States, Italy and France would have the highest absolute death rates, with almost 30,000 AMR deaths a year forecast in the US alone by 2050. A short-term investment to stem the superbug tide would save lives and money in the long run, says the OECD. A five-pronged assault on antimicrobial resistance — by promoting better hygiene, ending the over-prescription of antibiotics, rapid testing for patients to determine whether they have viral or bacterial infections, delays in prescribing antibiotics and mass media campaigns — could counter one of the biggest threats to modern medicine.

Investment in a comprehensive public health package encompassing some of these measures in OECD countries could pay for themselves within just one year and end up by saving USD 4.8 billion per year, says the OECD. While resistance proportions for eight high-priority antibiotic-bacterium combinations increased from 14% in 2005 to 17% in 2015 across OECD countries, there were pronounced differences between countries. The average resistance proportions in Turkey, Korea and Greece (about 35%) were seven times higher than in Iceland, Netherlands and Norway, the countries with the lowest proportions (about 5%).