Berenice Abbott Columbus Circle, Manhattan 1936

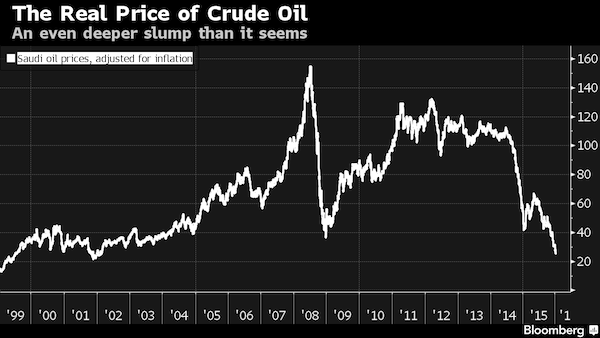

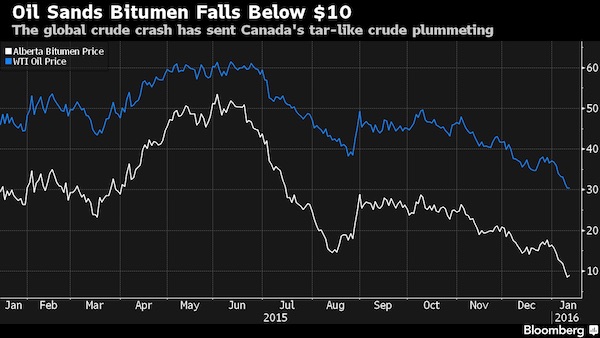

We’ve only really been in two weeks of trading in the new year, things are looking pretty bad to say the least, so predictably the press are asking -and often answering- questions about when the slump will be over. Rebound, recovery, the usual terminology. When will we get back to growth?

For me personally, but that’s just me, that last question sounds a bit more stupid every single time I hear and read it. Just a bit, but there’s been a lot of those bits, more than I care to remember. Luckily, the answer is easy. The slump will not be over for a very long time, there will be no rebound or recovery, and please stop talking about a return to growth unless you can explain what you want to grow into.

I’m sorry, I know that’s not what you want to hear, but life’s a bitch and so’s the economy. You’ve lived on pink fumes for a long time, most of you for their whole lives, but reality dictates that real ‘growth’ stopped decades ago, and you never figured that out because, and I quote here (see below), you and the world you’re part of became “addicted to borrowing money, spending it, and passing this off as ‘growth'”.

That you believed this was actual growth, however, is on you. You fell for a scam and you’re going to have to pay the price. If there’s one single thing people are good at, it’s lying. It’s as old as human history, and it happens every day, so you’re no exception to any rule. You’re perhaps just not particularly clever.

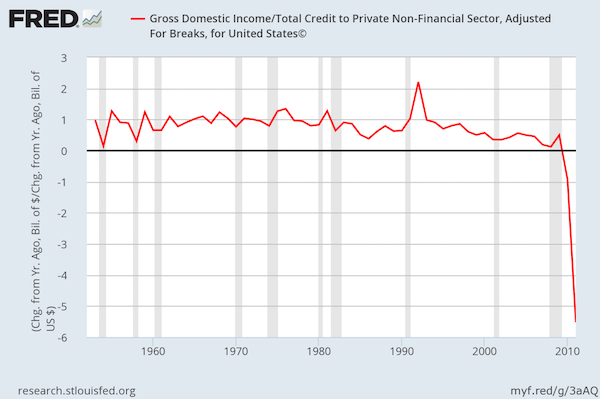

How do we know a ‘recovery’ is so far off it’s really no use to even talk about it? As I said, it’s easy. Let me lead this in with a graph I saw just today, which deals with a topic the Automatic Earth has covered a lot: marginal debt, or more precisely, the productivity/growth gained from each additional dollar of debt.

Please note, this particular graph deals with private non-financial debt only, we’ll get to other kinds of added debt, but that restriction is actually quite illuminating.

Now of course, you have to wonder about the parameters the St. Louis Fed uses for its data and graphs, and whether ‘growth’ was all that solid in the run up to 2008. There’s plenty of very valid arguments that would say growth in the 1960’s was a whole lot more solid than that in the naughties, after the Glass-Steagall repeal, and after the dot.com blubber.

However, that’s not what I want to take away from this, I use this to show what has happened since 2008, more than before, when it comes to “passing debt off as ‘growth'”.

But it’s another thing that has happened since 2008, or rather not happened, that points out to us why this slump will have legs. That is, in 2008 a behemoth bubble started bursting, and it was by no means just US housing market. That bubble should have been allowed to fully deflate, because that is the only way to allow an economy to do a viable restart.

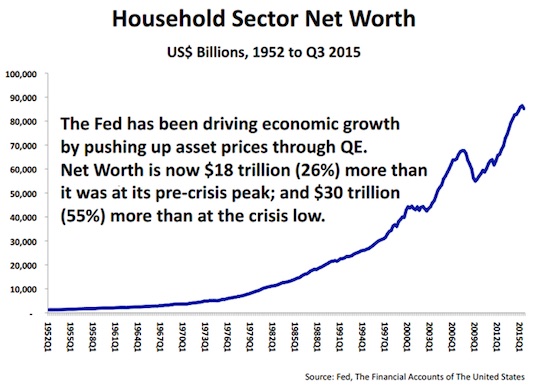

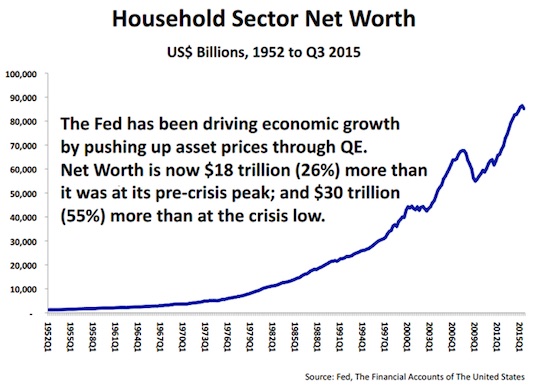

Instead, all that has been done since 2008, QE, ZIRP, the works, has been aimed at keeping a facade ‘alive’, and aimed at protecting the interests of the bankers and other rich parties. That facade, expressed most of all in rising stock markets, has allowed for societies to be gutted while people were busy watching the S&P rise to 2,100 and the Kardashians bare 2,100 body parts.

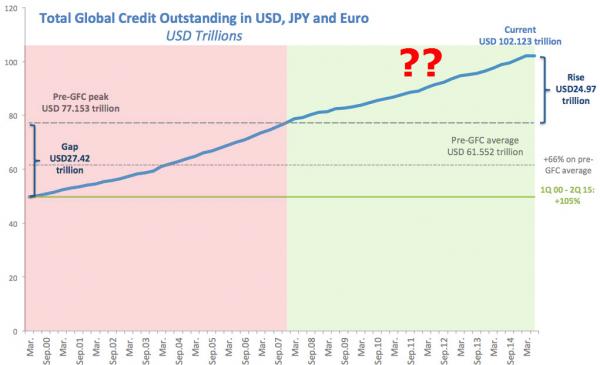

It was all paid for, apart from western QE, with $28 trillion and change of newfangled Chinese debt. The problem with this is that if you find yourself in a bubble and you don’t go through the inevitable deleveraging process that follows said bubble in a proper fashion, you’re not only going to kill economies, you’ll destroy entire societies.

And that is not just morally repugnant, it also works as much against the rich as it does against the poor. It’s just that that is a step too far for most people to understand. That even the rich need a functioning society, and that inequality as we see it today is a real threat to everyone.

Recognizing this simple fact, and the consequences that follow from it, is nothing new. It’s why in days of old, there were debt jubilees. It’s also why we still quote the following from Marriner Eccles, chairman of the Federal Reserve under FDR and Truman from 1934-1948, in his testimony to the Senate Committee on the Investigation of Economic Problems in 1933, which prompted FDR to make him chairman in the first place.

It is utterly impossible, as this country has demonstrated again and again, for the rich to save as much as they have been trying to save, and save anything that is worth saving. They can save idle factories and useless railroad coaches; they can save empty office buildings and closed banks; they can save paper evidences of foreign loans; but as a class they cannot save anything that is worth saving, above and beyond the amount that is made profitable by the increase of consumer buying.

It is for the interests of the well to do – to protect them from the results of their own folly – that we should take from them a sufficient amount of their surplus to enable consumers to consume and business to operate at a profit. This is not “soaking the rich”; it is saving the rich. Incidentally, it is the only way to assure them the serenity and security which they do not have at the present moment.

Everything would all be so much simpler if only more people understood this, that you need a – fleeting, ever-changing equilibrium- to prosper.

Instead, we’re falling into that same trap again. Or, more precisely, we already have. We have been fighting debt with more debt and built the facade put up by the Fed, the BoJ and the ECB, central banks that all face the same problems and all take the same approach: save the rich at the cost of the poor. Something Eccles said way back when could not possibly work.

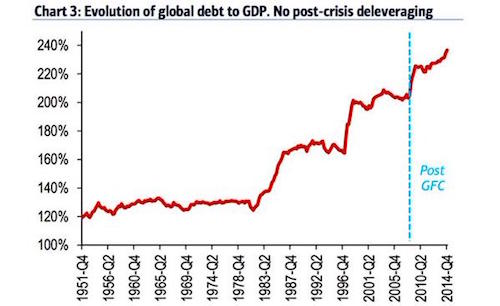

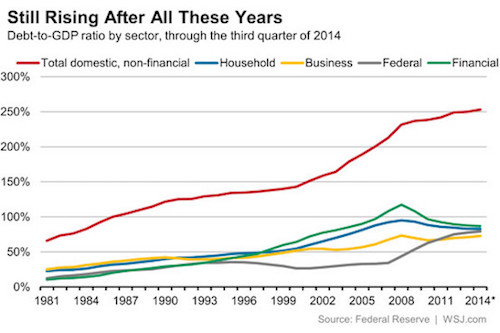

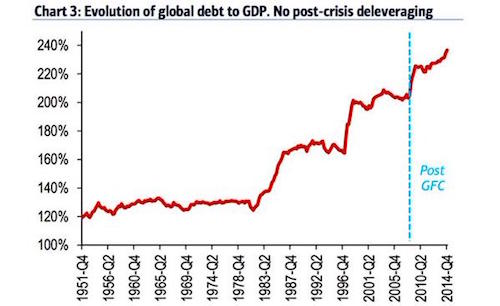

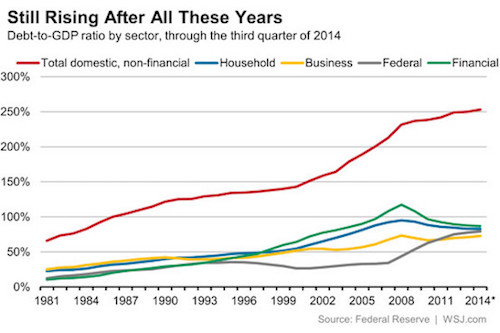

Anyway, so here are the graphs that prove to us why the slump has legs. There’s been no deleveraging, the no. 1 requirement after a bubble bursts. There’s only been more leveraging, more debt has been issued, and while households have perhaps deleveraged a little bit, though that is likely strongly influenced by losses on homes etc. plus the fact that people were simply maxed out.

First, global debt and the opposite of deleveraging:

And global debt from a longer, 65 year, more historical perspective:

It’s a global debt graph, but it’s perhaps striking to note that big ‘growth’ spurts happened in the days when Reagan, Clinton and Obama were the respective US presidents. Not so much in the Bush era.

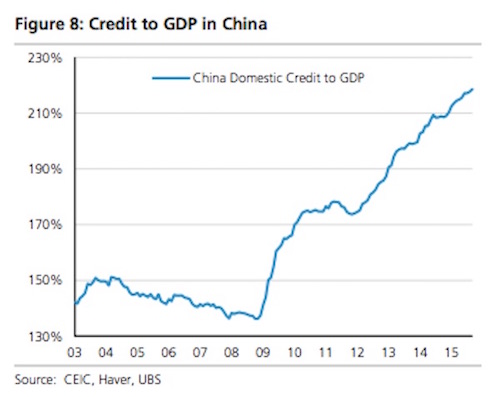

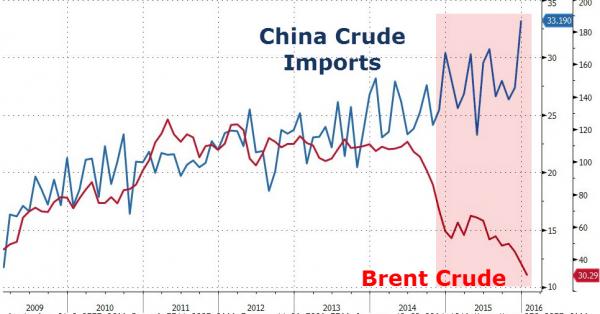

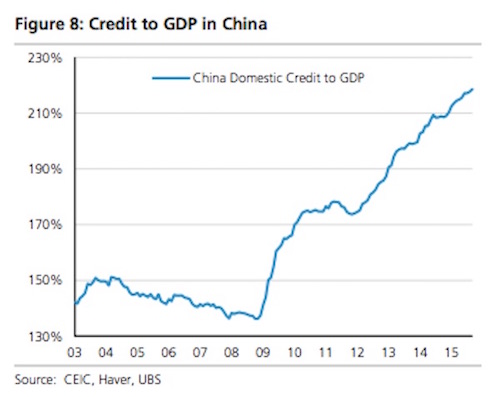

Next, China. What we’re looking at is what allowed the post 2008 global economic facade to have -fake- credibility, an insane rise in debt, largely spent on non-productive overinvestment, overcapacity highways to nowhere and many millions of empty apartments, in what could have been a cool story had not Beijing gone all-out on performance enhancing financial narcotics.

Today, the China Ponzi is on its last legs, and so is the global one, because China was the last ‘not-yet-conquered’ market large enough to provide the facade with -fleeting- credibility. Unless Elon Musk gets us to Mars very soon, there are no more such markets.

So US debt will have to come down too, belatedly, with China, and it will have to do that now. because there are no continents to conquer and hide the debt behind. We’re all going to regret engaging in the debt game, and not letting the bubble deflate in an orderly fashion when we still could, but all those thoughts are too late now.

What the facade has wrought is not just the idea that deleveraging was not needed (though it always is, after every single bubble), but that net US household worth rose by 55% in the 6-7 years since the bottom of the crisis, an artificial bottom fabricated with…more debt, with QE, and ZIRP.

Meanwhile, in today’s world, as stock markets go down at a rapid clip, China, having lost control of a market system it never had the control over that Politburos are ever willing to acknowledge they don’t have, plays a game of Ponzi whack-a-mole, with erratic ‘policies’ such as circuit breakers and CIA-style renditions of fund managers and the like.

And all the west can do is watch them fumble the ball, and another one, and another. And this whole thing is nowhere near the end.

China bad loans have now become a theme, but the theme doesn’t mean a thing without including the shadow banking system, which in China has been given the opportunity to grow like a tumor, on which Beijing’s grip is limited, and which has huge claims on local party officials forced by the Politburo to show overblown growth numbers. If you want to address bad loans, that’s where they are.

Chinese credit/debt graphs paint only a part of the picture if and when they don’t include shadow banks, but keeping their role hidden is one of Xi’s main goals, lest the people find out how bad things really are and start revolting. But they will anyway. That makes China a very unpredictable entity. And unpredictable means volatile, and that means even more money flowing out of, and being lost in, markets.

The ‘least worst’ place to be for what money will be left is US dollars, US treasuries and perhaps metals. But there’ll be a whole lot less left than just about anyone thinks. That’s the price of deleveraging.

The price of not deleveraging, on the other hand, is what we see in the markets today. And there is no cure. It must be done. The price for keeping up the facade rises sharply with each passing day, and the effort will in the end be futile. All bubbles have limited lifespans.

I’ll close this with a few recent words from Tim Morgan, who puts it so well I don’t feel the need to try and do it better.

The Ponzi Economy, Part 1

In order to set the Ponzi economy into some context, let’s put some figures on it. In the United States, total “real economy” debt (which excludes inter-bank borrowing) increased by $19.4 trillion – in real, inflation-adjusted terms – between 2000 and 2014, whilst real GDP expanded by only $3.7 trillion. Britain, meanwhile, added £1.9 trillion of new debt for less than £400bn on “growth” over the same period. I spent part of the holiday period unearthing quite how much debt countries added for each dollar of “growth” over a period starting at the end of 2000 and ending in mid-2015.

Unsurprisingly, the league is topped by Portugal ($5.65 for each $1 of growth), Ireland ($5.42) and Greece ($5.39). Britain’s ratio ($3.46) is somewhat flattering, in that the UK has used asset sales as well as borrowing to sustain its consumption. The average for the Eurozone ($3.54) covers ratios as diverse as Germany (just $1.87) and France ($4.22).

China’s $2.56 looks unexceptional until you note that the more recent (post-2007) number is much worse. Economies which seem to have been growing without too much borrowing (such as Brazil and Russia) are now experiencing dramatic worsening in their ratios, generally in the wake of tumbling commodity prices.

In the proverbial nutshell, then, the world has become addicted to borrowing money, spending it, and passing this off as “growth”. This is a copybook example of a pyramid scheme, which in turn means that the world’s most influential economic mentor is neither Keynes nor Hayek, but Charles Ponzi.

[..] How, in the absence of growth, can inflated capital values be sustained? The answer, of course, is that they can’t. Like all Ponzi schemes, this ends with a bang, not a whimper. This is why I find forecasts of a ‘big fall’ or ‘sharp correction’ in markets hard to swallow. Ponzi schemes don’t end gradually, any more than someone can fall off a cliff gradually, or be “slightly pregnant”.

The Ponzi economy simply continues for as long as irrationality prevails, and then implodes. Capital markets, though, are the symptom, not the cause. The fundamental problem is an inability to escape from an addictive practice of manufacturing supposed “growth” on the basis of borrowed money.

There may be shallow lulls in the asset markets, nothing ever only falls down in a straight line in the real world, but that debt I’ve described here will and must come down and be deleveraged.

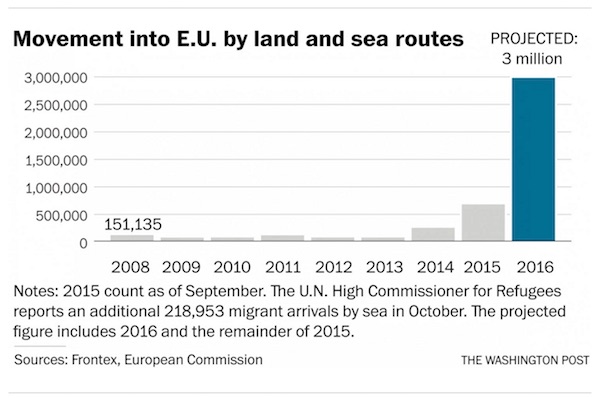

The process will in all likelihood lead to warfare, and to refugee movements the likes of which the world has never seen just because of the sheer numbers of people added in the past 50 years.

When your children reach your age, they will not live in a world that you ever thought was possible. But they will still have to live in it, and deal with it. They will no longer have the facade you’ve been staring at for so long now, to lull them into a complacent sleep. And the Kardashians will no longer be looking so attractive either.