Todd Webb Rue des Plantes, Paris 1950

We need a war on plastic, not cash.

• Americans Are Becoming Obsessed With Putting Everything On Credit (MW)

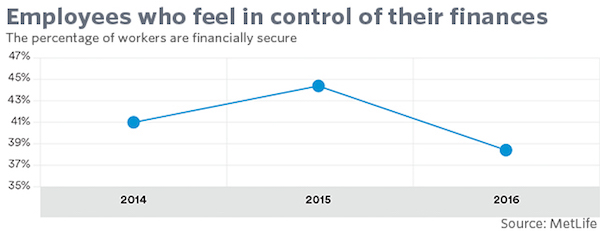

It’s more likely that the last time you bought a pack of gum or a can or soda, you used a credit card. People like their credit cards so much they’re using them even for the tiniest purchases, according to a new survey released Monday from the credit cards site CreditCards.com. Among people with credit cards, 17% said they use them to buy items in brick-and-mortar stores that cost less than $5, up from 11% last year. CreditCards.com surveyed about 1,000 U.S. adults in March 2017. After a lull in the wake of the Great Recession, credit cards are once again being used with increased frequency. The Federal Reserve reported last week that collective credit card debt in the U.S. had reached $1 trillion.

Credit-card debt and auto loan debt balances for people ages 60 and older have also risen since 2008, that Fed data showed, whereas credit-card debt for those 59 and younger has fallen. The Fed, when describing that phenomenon, said lending standards have tightened since the recession, and those who are older may also be more creditworthy. But when consumers can pay their balances each month, turning to credit cards for small purchases isn’t a bad thing, said Matt Schulz, a senior industry analyst for CreditCards.com. Putting more charges on a credit card may indicate consumers feel more optimistic about their financial picture for the future, he said. “People who are chasing rewards realize that those little purchases can add up to a lot of rewards over the course of a year,” he added.

Indeed, several high-profile credit cards offer cash back and perks for spending. For example, Amazon introduced a credit card this year for Prime members that gives 5% cash back on Amazon purchases (Prime itself costs $99 per year.) Some retailers, however, prohibit credit-card purchases below a certain amount to avoid paying transaction fees to the credit-card issuers for such purchases. That said, cash and debit cards still are the go-to options for making small purchases, despite the speed with which credit cards are gaining on them. Of those surveyed, 24% said they use debit cards for small purchases, and 55% said they use cash. It appears younger consumers are behind at least some of the growth in credit card use: Some 70% of baby boomers and their older cohorts, the Silent Generation, still choose cash for small purchases versus 43% of those under 53.

A little incoherent article, but point taken. Countries that try to go cashless should be careful.

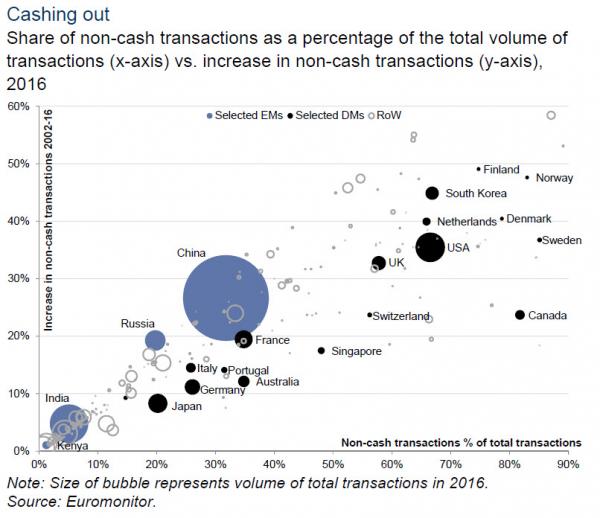

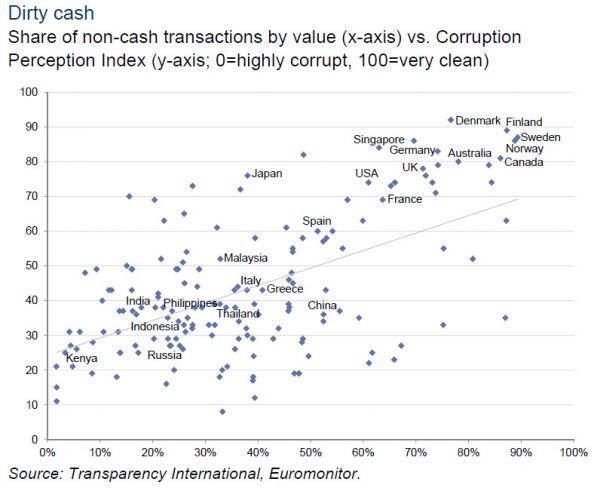

• Cash Is Dead. Long Live Cash. (WSJ)

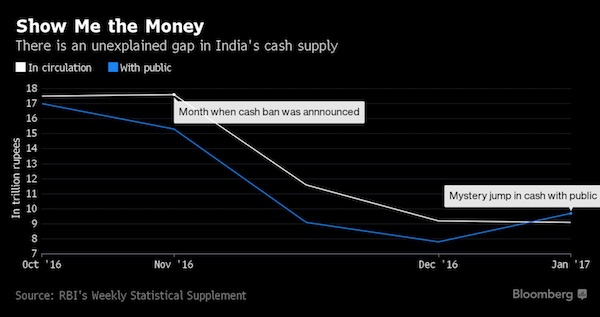

[..] the push to get rid of cash is hitting speed bumps all over. India, for example, is already partly reintroducing its 500- and 1000-rupee bills after the government’s abrupt demonetization program drew sharp criticism for hurting its cash-dependent rural population. The U.S. shows no inclination to pare back its notes. “I’m very conscious of the $100 bill being the world’s reserve currency, and every central bank around the world has stacks of $100 bills where they used to have gold,” Treasury Secretary Jacob Lew said in an interview with The Wall Street Journal shortly before he left office in January. One reason it’s a non-starter in the U.S.: About 8% of people don’t have a checking or savings account, making it all-but-impossible for them to participate in a cashless economy.

Banning cash “would bring the economy and many people to their knees if enforced,” said Hoover Institution economist John Cochrane. In the aboveground economy, card-based and digital payment systems offering ever-greater speed, safety and convenience have been steadily encroaching on paper money, even for small consumer transactions. Euromonitor International, a market-research firm, said the volume of global cash payments in 2016 for the first time fell below payments on credit and debit cards. Some of the growth in cash can be attributed to the financial crisis and the aftermath, when people lost faith in banks, and when ultralow interest rates and anemic investment returns reduced the opportunity costs of holding savings in cash. The number of $100 bills in circulation, worth $1.15 trillion in December, has surged 76% since 2009, according to Federal Reserve data.

“Brexit was a joke. Trump was a joke..”

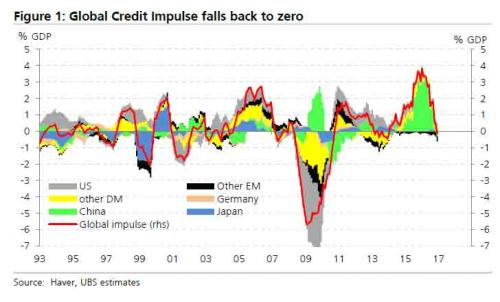

• A Change In The Change Of Change (Peters)

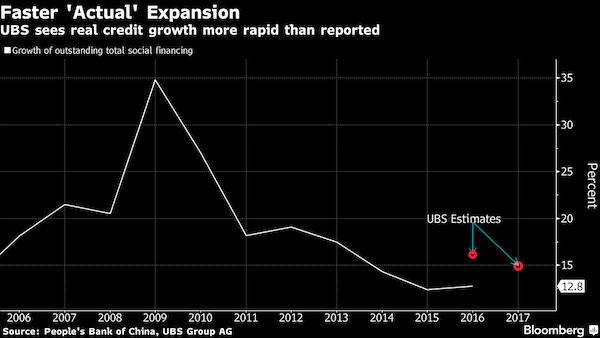

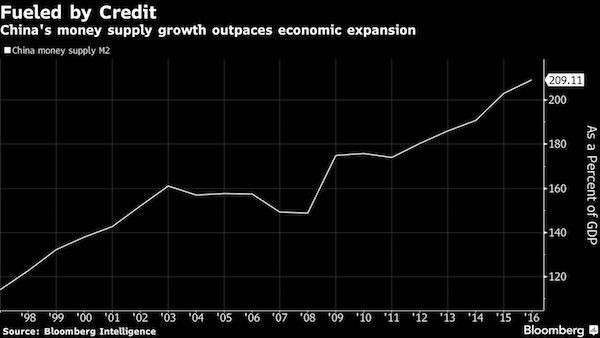

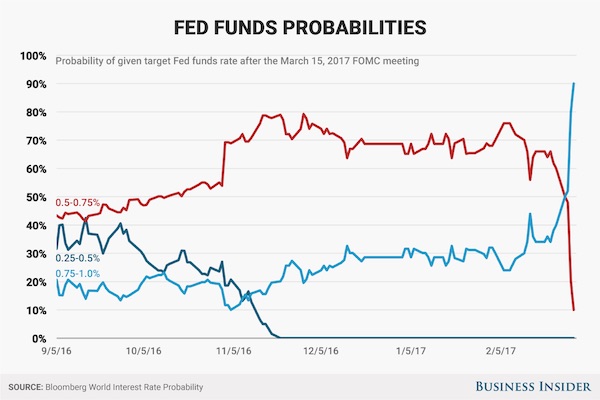

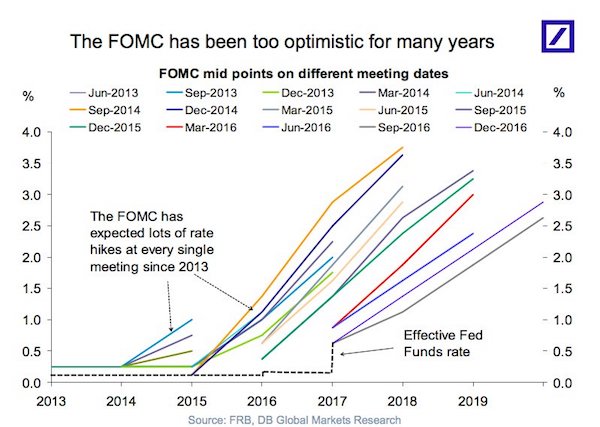

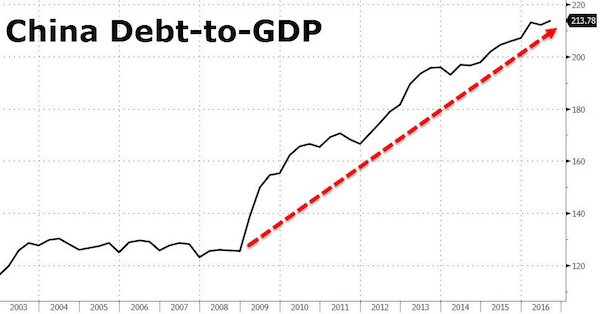

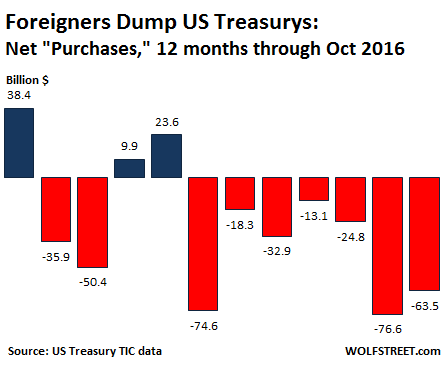

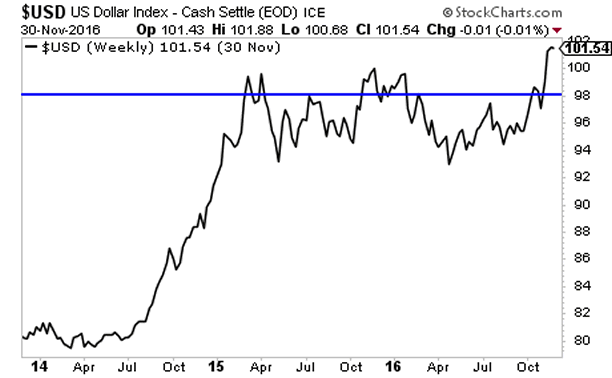

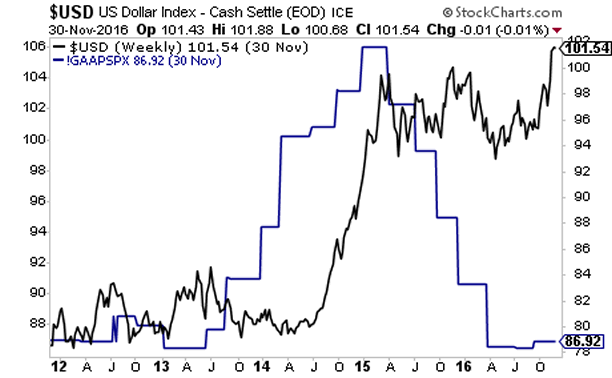

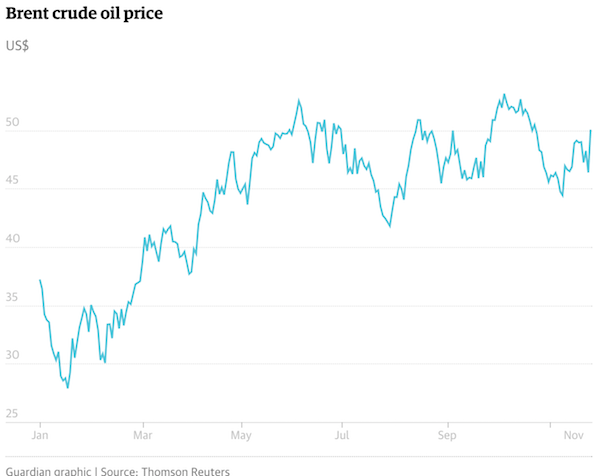

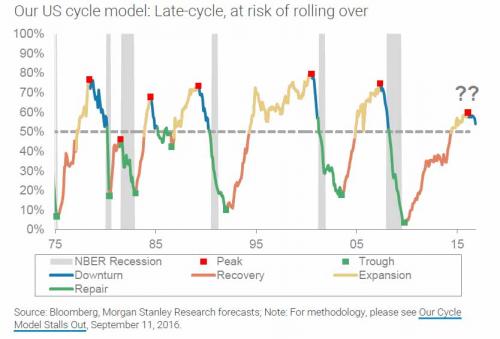

“The change of change is now negative,” said the CIO. “Global growth is still rising, but the rate of improvement is slowing,” he explained. “Same holds true for global inflation, oil prices, copper, iron ore. Credit growth is slowing in the US, Europe, Japan, China.” If these things were all contracting, we’d plunge into recession, but we’re not there. We’re simply at the point in the cycle where the rate of acceleration is slowing – which is both evidence of a pause, and a precondition for every major turn. “The last time we had a major shift in the change of change was a year ago.” In Jan/Feb 2016, China was imploding. Commodity prices were tanking with equity markets, the dollar soared alongside volatility. Then China unleashed explosive credit stimulus, while the Fed blinked, guiding forward interest rates dramatically lower. Within a short time, the change of change turned positive.

Which is not to say things immediately accelerated, it’s just that they started contracting more slowly. And that marked the time to buy. “Pretty much everything that happened in 2016 can be explained by two things; China and oil prices,” he said. “Literally, that’s it.” China’s stimulus-induced rebound and the oil price recovery is all that mattered. “Brexit was a joke. Trump was a joke. In fact, the only real significance of those events was that they provided investors with opportunities to jump on board the reflation trade at back near Q1 prices.” The reflation trade quietly began in the Q1 collapse, and accelerated off the extreme post-Brexit summer lows in global interest rates. That’s what made last year remarkable. Even investors who missed the first opportunity, had two chances to make a lot of money.” You see, that reward is usually reserved for those who act on the first signs of a change in the change of change.

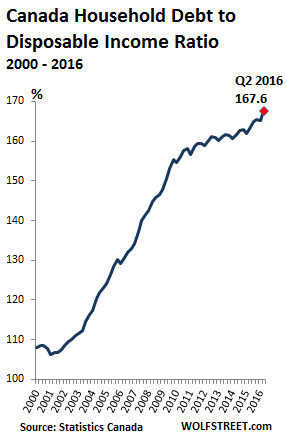

Credit shrinks, the Zombies fall.

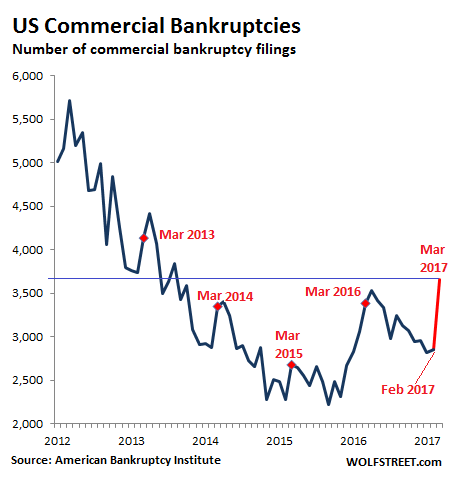

• Great Debt Unwind: Bankruptcies Surge (WS)

Commercial bankruptcy filings, from corporations to sole proprietorships, spiked 28% in March from February, the largest month-to-month move in the data series of the American Bankruptcy Institute going back to 2012. They’re up 8% year-over-year. Over the past 24 months, they soared 37%! At 3,658, they’re at the highest level for any March since 2013. Commercial bankruptcy filings skyrocketed during the Financial Crisis and peaked in March 2010 at 9,004. Then they fell sharply until they reached their low point in October 2015. November 2015 was the turning point, when for the first time since March 2010, commercial bankruptcy filings rose year-over-year.

Bankruptcy filings are highly seasonal, reaching their annual lows in December and January. Then they rise into tax season, peak in March or April, and zigzag lower for the remainder of the year. The data is not seasonally or otherwise adjusted – one of the raw and unvarnished measures of how businesses are faring in the economy. Note that there is no “plateauing” in this chart: since the low-point in September 2015, commercial bankruptcies have soared 65%! That red spike is the mega-increase in March:

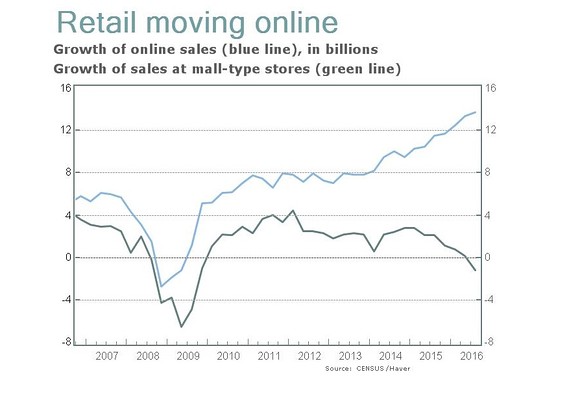

At first, they blamed the oil bust. The price of oil began to collapse in mid-2014. By 2015, worried bankers put their hands on the money spigot, and a number of companies in that sector, along with their suppliers and contractors, threw in the towel and started filing for bankruptcy protection. But now the price of oil has somewhat recovered, banks have reopened the spigot, Wall Street has once again the hots for the sector, new money is gushing into it, and oil & gas bankruptcy filings have abated. So now they blame brick-and-mortar retail which is in terminal decline, given the shift to online sales. I have reported extensively on the distress of the larger chain stores, but brick-and-mortar retailers include countless smaller operations and stores that no ratings agency follows because they’re too small and can’t issue bonds, and many of them are even more distressed.

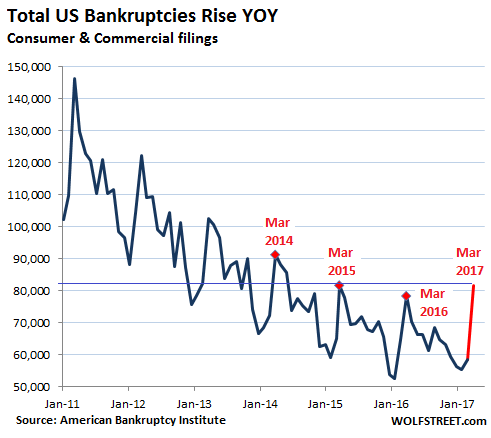

[..] Now come the consumers – not all consumers, but those with mounting piles of debt and stagnating or declining real incomes, of which there are many. They’d been hanging on by their teeth, with bankruptcy filings consistently declining since 2010. But that ended in November 2016. In December, bankruptcy filings rose 4.5% from a year earlier. In January they rose 5.4%. It was the first time consumer bankruptcies rose back-to-back since 2010. I called it “a red flag that’ll be highlighted only afterwards as a turning point.” In March, consumer bankruptcy filings rose 4% year-over-year, to 77,900, the highest since March 2015, when 79,000 filings occurred, according to the American Bankruptcy Institute data. The turning point has now been confirmed. Total US bankruptcy filings by consumers and businesses in March spiked 40% from February and rose 4% year-over-year to 81,590, the highest since March 2015:

Trust at risk.

• Trump’s Rollback of Bank Regulations Risks a Bondholder Backlash (Street)

President Donald Trump’s pledge to roll back regulations on U.S. banks could face resistance from an influential constituency: bondholders. While stockholders of firms like JPMorgan Chase and Goldman Sachs have cheered Trump’s plans to repeal or soften rules imposed in the wake of the 2008 financial crisis, bond-rater Standard & Poor’s is warning that such a move could undermine the industry’s creditworthiness. Measures like “stress testing,” in which regulators evaluate banks annually to determine if they’re sufficiently prepared to withstand a deep economic or market downturn, have made the firms safer, according to S&P. And so-called resolution planning – the practice of planning in advance how big banks would be wound down following a Lehman Brothers-style collapse – also has contributed to the industry’s resilience, the ratings firm wrote in a March 20 report.

The timetable for any such changes isn’t yet clear, however. Trump in February signed an executive order directing U.S. Treasury Secretary Steven Mnuchin to identify any laws that might impede economic growth or vibrant markets. Those could include the 2010 Dodd-Frank Act, signed by former President Barack Obama to curb risky activities like using excessive borrowings to fuel earnings growth and allowing in-house traders to speculate on markets with proprietary capital. “An overhaul of Dodd-Frank could be detrimental for bank creditors,” S&P wrote in the report. “If changes to Dodd-Frank watered down these features, and if banks reacted to such changes by weakening their financial management, we could lower ratings.” The fresh concerns could contribute to a shift in investor sentiment that’s been mostly positive toward banks since Trump’s surprise election on Nov. 8.

Xi responds after he’s left Mar-a-Lago.

• Syria Strike Designed To Intimidate North Korea: China State Newspaper (G.)

Donald Trump’s decision to attack Syria had also been designed to intimidate North Korean leader Kim Jong-un, a Chinese newspaper has claimed, as G7 foreign ministers meet to discuss the fallout from last week’s missile incursion. The state-run Global Times said a US strike against North Korea would unleash carnage on the Korean peninsula. The US navy has deployed a strike group towards the western Pacific Ocean, to provide a presence near the Korean peninsula. South Korean officials suspect Kim may be planning to hold his country’s sixth nuclear test later this week to mark the 105th anniversary of the birth of founder Kim Il-sung on 15 April, an event a number of foreign journalists have been invited to cover.

In an editorial entitled: ‘After Syria strikes, will North Korea be next?’, the Global Times suggested the US might now be preparing to launch “similar actions” against Pyongyang and warned of catastrophic consequences if it did. “A symbolic strike against North Korea by the US would bring a disaster to the people in Seoul,” the newspaper said, claiming a “decapitation attack” on North Korea was now “highly possible”. Such a strike would “very likely evolve into large-scale bloody war on the peninsula”. The Global Times noted the decision to deploy a strike force to the Western Pacific over the weekend and cautioned Pyongyang against doing anything that might further inflame the situation.

“New nuclear tests will meet with unprecedented reactions from the international community, even to a turning point.” The warnings came after the US secretary of state, Rex Tillerson, claimed that the situation in North Korea had “reached a certain level of threat that action has to be taken”. Asked if the attack on Syria could be seen as a message to Pyongyang, Tillerson told ABC: “The message that any nation can take is: ‘If you violate international norms, if you violate international agreements, if you fail to live up to commitments, if you become a threat to others, at some point a response is likely to be undertaken.”

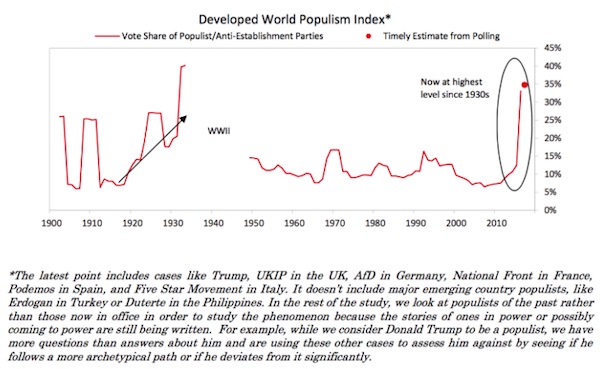

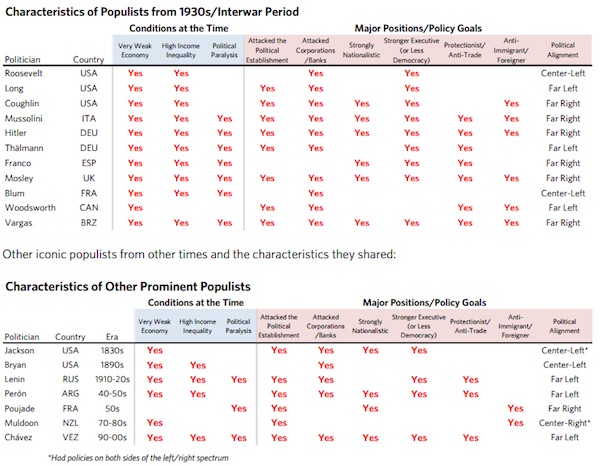

“Hayek: state regulation leads to totalitarianism. But instead self-regulating markets led to today’s authoritarians.”

• Is Globalisation Dead? (Pettifor)

In the BBC’s brief and pressured half-hour I wanted to get across that globalisation had not delivered on its promise – to make ‘the market’ the main driver of a more effective, more productive economy; to transform societies into nations of ‘shareholders’; to ensure a revolution in homeownership, and to avoid what Hayek called the threat of a totalitarian state. Instead financial globalisation has been an era largely fuelled by carbon (oil and coal) – as had been the case for over a century. However, unlike the Bretton Woods era, post 1970s de-regulated financial globalisation was built on mountains of private and public debt. The first – private debt – led to recurring financial crises, and the second – public debt – rose as private sector activity weakened, and tax revenues fell.

The consequences of these recurring financial crises in ‘advanced’ economies included ‘austerity’, the removal of employment protection, rising housing and education costs, the return of deflationary pressures, high unemployment, falling real wages, low productivity and rising inequality. These crises have led to increased insecurity and over-rapid social and economic change- as well as the greatest financial and economic crisis since 1929 (itself a product of excessive laissez-faire ideology). More widely, the insecurities and dislocations generated by financial globalisation have led whole populations to seek the ‘protection’ of a strong man (e.g. Presidents Trump, Duterte in the Philippines, Modi in India, Erdogan in Turkey, Putin in Russia).

Not that this worries the extreme adherents of laissez-faire – recall how Hayek supported the murderous dictator Pinochet in Chile for his brutal imposition of deregulatory ‘reform’. And so, contrary to Hayek’s expectations, financial globalisation has proved that it is market fundamentalism, and not the regulatory state that is leading the world into an era of authoritarianism and totalitarianism – in the US, Eastern Europe, India and China.

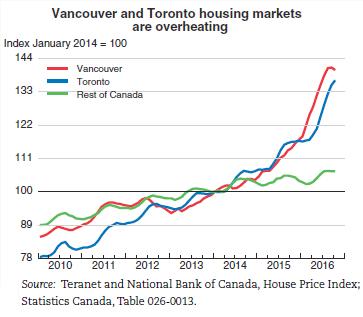

But politicians will keep saying that it’s all because not enough is being built. Why don’t you raise rates first and see what happens?

• Housing Costs Are Pushing People Further Out of Sydney (BBG)

New South Wales has taken over as Australia’s economic engine as the mining investment boom tails off, with central Sydney contributing almost a quarter of the nation’s growth last fiscal year. That success has come with a price. As workers flock to Sydney, an under-supply of housing, coupled with record-low interest rates, has made the city the world’s second-most expensive property market. Home prices jumped 19 percent in the past 12 months, stoking concern home ownership is increasingly beyond the reach of younger people. That’s a big political problem for the state’s new Premier Gladys Berejiklian, who made housing affordability one of her priorities when she took the job in late January. Housing affordability is “a barbecue stopper,” Berejiklian, 46, said in an interview in her Sydney office on Thursday.

“We are convinced if we put downwards pressure on prices through supply, that’s the best way we can solve it as a state government.” Sydney’s housing completions reached a 15-year high in 2016, though Berejiklian says the state is only now playing catch-up after “a decade of under-investment.” “There are about 100,000 dwellings we are behind on in terms of really digging into the demand,” she said. [..] There are several barriers to boosting housing supply in Sydney. The city is bordered by mountains to the west, the ocean to the east and rivers and national parks to the north and south, restricting the supply of new land, while moves to increase housing density in established suburbs have run into opposition from residents. That’s meant in the past three years, almost 70 percent of new detached houses have been built more than 30 kilometers from Sydney’s central business district…

“..the Canadian government has been trying to find ways to “crystallize” the value in some of its property assets…”

• Toronto Mayor Says He’s Open to Sale of City Real Estate Assets

Toronto’s mayor won’t rule out selling some of the city’s prime downtown real estate as he looks to make better use of assets amid an unprecedented property boom. “Would I take that off the table? No, I wouldn’t,” Mayor John Tory said in an interview last week at Bloomberg’s Toronto office. Selling buildings in the city’s costly downtown market probably wouldn’t be “quite as politically charged” as divesting other types of assets, such as the parking authority or power utility Toronto Hydro, he said. The need for North America’s fourth-largest city to fund critical transit upgrades and housing improvements coincides with skyrocketing property prices in the region. Toronto’s real estate portfolio includes 6,976 buildings with 106.3 million square feet (9.9 million square meters), almost half of which is multifamily, according to a Dec. 6 report on the city’s assets.

With all of the demands on the city to raise money for building transit lines and repairing existing housing, then “might you be looking at the business case for handling real estate in a different way? Because this is the most expensive downtown real estate you could possibly have,” said the mayor, elected in 2014. The report, commissioned by the city and conducted by Deloitte, estimates the value of municipal real estate including community housing, parks and forestry is C$27 billion ($20 billion), while the annual operating costs in “core” real estate and facilities management is C$1.1 billion. Tory said he watched with passing interest the federal government’s sale earlier this year of the Dominion Public Building. The historic downtown property beside Toronto’s Union Station sold for about C$275 million ($205 million), according to newspaper reports.

The property was “super underutilized,” BMO analyst Heather Kirk said in an interview, adding the Canadian government has been trying to find ways to “crystallize” the value in some of its property assets. “What a building is worth to the government in current form is totally different than the value to a developer,” Kirk said. “They are buying density.” When asked how any properties might be sold, Tory stressed he didn’t currently have any specific recommendations to make to the city council, although “I just know those are things that sit out there still as options that are in front of the city government to raise money to do the things we have to do,” he said.

Ehh.. how do you lock up the Bank of England?

• Secret Recording Implicates Bank of England In Libor Manipulation (BBC)

A secret recording that implicates the Bank of England in Libor rigging has been uncovered by BBC Panorama. The 2008 recording adds to evidence the central bank repeatedly pressured commercial banks during the financial crisis to push their Libor rates down. Libor is the rate that banks lend to each other and it sets a benchmark for mortgages and loans for ordinary customers. The Bank of England said Libor was not regulated in the UK at the time. The recording calls into question evidence given in 2012 to the Treasury select committee by former Barclays boss Bob Diamond and Paul Tucker, the man who went on to become the deputy governor of the Bank of England. Libor, the London Interbank Offered Rate, tracks how much it costs banks to borrow money from each other.

As such it is a big influence on the cost of mortgages and other loans. Banks setting artificially low Libor rates is called lowballing. In the recording, a senior Barclays manager, Mark Dearlove, instructs Libor submitter Peter Johnson, to lower his Libor rates. He tells him: “The bottom line is you’re going to absolutely hate this… but we’ve had some very serious pressure from the UK government and the Bank of England about pushing our Libors lower.” Mr Johnson objects, saying that this would mean breaking the rules for setting Libor, which required him to put in rates based only on the cost of borrowing cash. Mr Johnson says: “So I’ll push them below a realistic level of where I think I can get money?” His boss Mr Dearlove replies: “The fact of the matter is we’ve got the Bank of England, all sorts of people involved in the whole thing… I am as reluctant as you are… these guys have just turned around and said just do it.”

The warnings have always been there. Totally ignored.

• The Fire In The Hold Of The Doomed Euro (Ward)

The more basic stuff goes back at least twenty years, to the period where trouble was stored up for the future by fanatical federalists cutting every corner and pulling out all the stops to get EMU (the prototype single currency) up and running. Several eminent economists on continents ranging from Australia and the US to the UK and Europe itself made very sound predictions at the time about coming disaster, and they did so saying two related things: 1) It would offer Germany a cheap, fixed currency leading inevitably to its economic dominance, 2) It would point up the economic consequences of imposing one rigid means of exchange on 18 varietal cultures, leading generally to Southern/South Eastern Europe falling behind.

Just to add more weedkiller to the poisonous formulation, the key European leaders not only ignored the advice; they also first, ignored all the data showing that several member States were nowhere near ready to join the eurozone based on agreed criteria; and then second, were implicated in several corrupt deals on commodities – as varied as German butter, Italian wines and Greek olive oil – to cloud the existence of stark differentials in both export and industrial development. For once, the economic naysayers proved to be soothsayers. Messrs Hollande and Muscovici shrink from the limelight about their own book on the subject of cultural difference (fancy that) but it proved to be spot on….as did the musings of Lawson and Thatcher et al in relation to Germany’s dominance.

The Mark from around 1963 until the creation of EMU was the most reliable, performance-related currency on the planet. But only massive debt forgiveness by the victors after the Second World War enabled that outcome. Both the realities in that last paragraph explain why lectures from Hollande and Merkel today – when joined by hypocrisy from Draghi at the ECB – evoke so much hatred of the EU’s prime movers among the so-called ClubMed nations….and those of us Brits in the Brexit camp. I make these points not to be nihilistic, but rather to level the playing field of media coverage that has been so bombed, excavated, deliberately over-watered and then tilted for good luck by Brussels, Wall Street and Berlin obfuscation and mendacity since 2010. A very real outcome of nihilism is being encouraged (and indeed made inevitable) by the EC’s refusal to recognise that – even as the SS Eunatic set sail – there was a raging fire in the hold.

Big words.

• Tsipras: Debt Relief Prerequisite to Legislate New Measures (GR)

The mid-term debt relief measures so that Greece can enter the quantitative easing program is the prerequisite to vote for the new measures, Greek Prime Minister Alexis Tsipras said on Sunday. Addressing the SYRIZA Central Committee, the party leader spoke about the new austerity measures his administration has agreed to with creditors. He spoke of a compromise that had to be made so that measures had to be counter-balanced by social relief measures of equal fiscal value and aid that the Greek negotiating team. “There are measures that are neither necessary, nor are they the ones we would ever choose, but the compromise achieved would have counter-measures that would counterbalance the fiscal impact and generate zero fiscal balance, and both will be legislated and implemented simultaneously,” Tsipras said.

Speaking on the initial agreement reached at the Malta Eurogroup on Friday, the prime minister said that, “After Malta the way for the identification of the medium-term measures for the debt is open. This will send a clear message to the markets that the uncertainty is over.” “Now we will be the ones to decide the fiscal path the country will follow after the end of the program,” Tsipras said, explaining the strategy for the next round of negotiations. He stressed that without medium-term measures for debt relief that would allow Greece to enter the QE program, he would not implement the new measures.

The prime minister also unleashed an indirect attack against main opposition New Democracy claiming that, “Some were scheming so that the evaluation would not close, because they didn’t want us to be the ones who will pull Greece out of the crisis.” He also attacked ND leader Kyriakos Mitsotakis accusing him of “rushing to meet with the German finance minister to get his blessing and undermine the negotiations.” He also said that the conservative party espouses extreme neoliberalism.

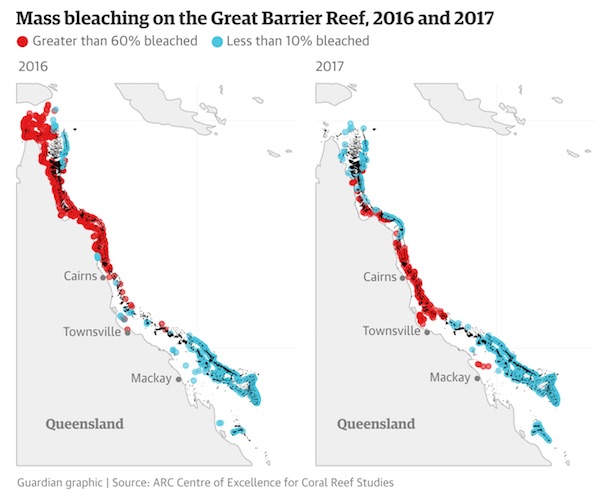

It was a big mistake to put the Great Barrier Reef near Australia.

• Great Barrier Reef at ‘Terminal Stage’ (G.)

Back-to-back severe bleaching events have affected two-thirds of Australia’s Great Barrier Reef, new aerial surveys have found. The findings have caused alarm among scientists, who say the proximity of the 2016 and 2017 bleaching events is unprecedented for the reef, and will give damaged coral little chance to recover. Scientists with the Australian Research Council’s Centre of Excellence for Coral Reef Studies last week completed aerial surveys of the world’s largest living structure, scoring bleaching at 800 individual coral reefs across 8,000km. The results show the two consecutive mass bleaching events have affected a 1,500km stretch, leaving only the reef’s southern third unscathed. Where last year’s bleaching was concentrated in the reef’s northern third, the 2017 event spread further south, and was most intense in the middle section of the Great Barrier Reef.

This year’s mass bleaching, second in severity only to 2016, has occurred even in the absence of an El Niño event. Mass bleaching – a phenomenon caused by global warming-induced rises to sea surface temperatures – has occurred on the reef four times in recorded history. Prof Terry Hughes, who led the surveys, said the length of time coral needed to recover – about 10 years for fast-growing types – raised serious concerns about the increasing frequency of mass bleaching events. “The significance of bleaching this year is that it’s back to back, so there’s been zero time for recovery,” Hughes told the Guardian. “It’s too early yet to tell what the full death toll will be from this year’s bleaching, but clearly it will extend 500km south of last year’s bleaching.”

A really funny man died over the weekend.

We featured quite a few Clarke and Dawe videos through the years. Here’s a few favorites:

How does the financial system work?

European Debt Crisis

The Greek Economy