DPC Royal Street, New Orleans 1900

Headline Of The Day/Week/Month. Hands down.

• China Adds a Chainsaw to Its Juggling Act (Pesek)

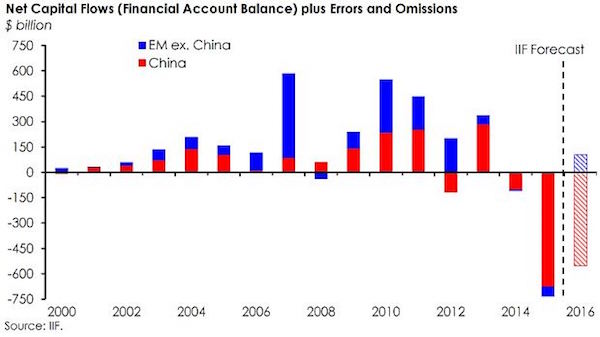

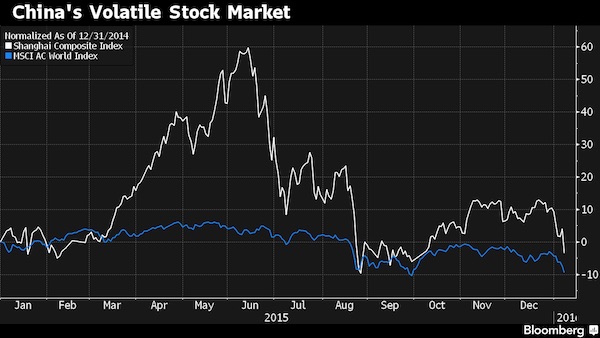

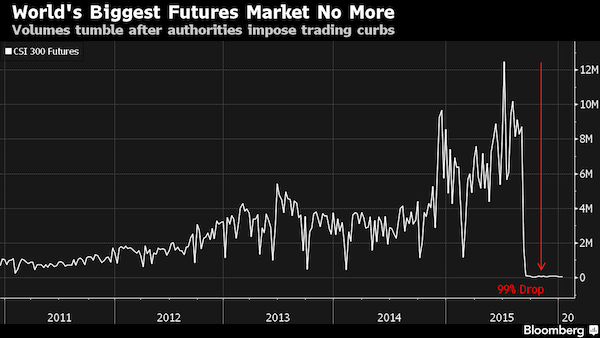

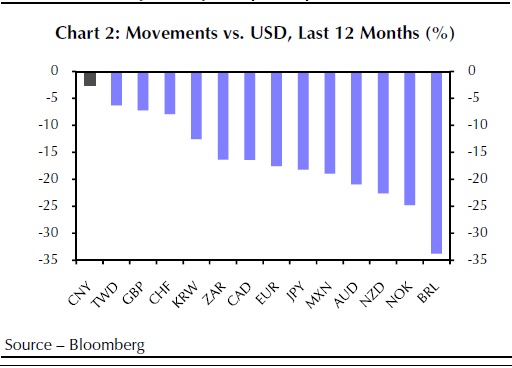

Chinese President Xi Jinping has just added a chainsaw to what had already been a pretty daunting juggling act. All year he’s been trying to keep aloft two giant economic bubbles – one in debt, one in stocks. This week he added a much more unwieldy prop, the value of the yuan, to the show. As I’ve argued, China is entirely justified in lowering its exchange rate, so far by 2.8%. It’s a risky move, but worth taking if it stabilizes the world’s second-biggest economy and nudges it toward a market-determined financial system – assuming Xi’s team truly knows what it’s doing. The problem for China’s president is this latest challenge threatens his ability to manage the other two. As China guides its currency lower, it heightens default risks on foreign-currency debt and increases the odds of capital flight, which would slam stock prices.

It’s not that China lacks latitude to devalue its currency. Before Tuesday’s 1.9% cut in the central bank’s reference rate, the yuan had risen about 15% on a trade-weighted basis in 12 months. But there are other considerations that should constrain Chinese policy. The Group of Seven nations would throw a fit if China lowered the yuan’s value any further; China could even become a target for candidates in the 2016 U.S. presidential election. That’s why Wednesday’s devaluation by an additional 0.9% raised more questions than it answers. The whole idea of devaluing is to do it all at once: make a huge, one-time step, ride out the turbulence and move on. China, it appears, favors a drip-by-drip approach.

That could dent the market’s confidence in the country’s policy makers. Will investors, analysts, risk managers, executives and journalists feel they can still rely on Chinese pronouncements, or will they have to sit on pins and needles every morning, waiting to see how much the People’s Bank of China lops off the yuan? As Ray Dalio of Bridgewater sees it, Beijing’s “promises to defend it here will need to be kept or it will lead to a loss of credibility – like the implied promise to support the stock market at around 3,500 needs to be defended or it will lead to the appearance that the marketplace is more powerful than the government.” Failure to hold the line, Dalio says, “will add currency volatility to stock market volatility and economic volatility on the government’s list of worries.”

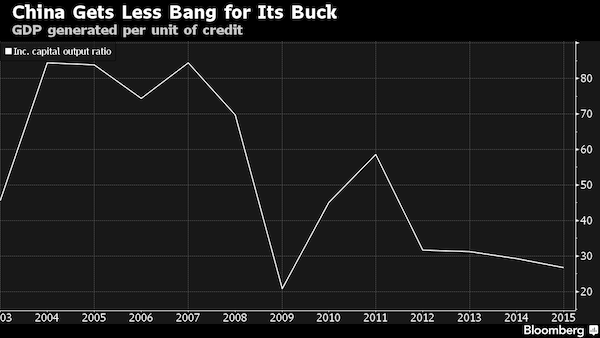

It’s not clear whether Xi’s team understands the trap it’s setting for itself. Beijing is already stuck on what hedge-fund manager Jim Chanos calls a “treadmill to hell” as local governments amass $4 trillion of debt and credit. The Chinese government has also ensnared itself in a dangerous cycle of stock-market interventions that imperil its global clout. Wednesday’s bloodbath in shares of major e-retailer Alibaba demonstrates the worsening state of economic fundamentals.

Read more …

One-off cubed.

• China Weakens Yuan For A Third Straight Day On Thursday (CNBC)

The People’s Bank of China (PBoC) weakened the yuan against the dollar for a third consecutive day on Thursday, following reports the central bank intervened to stem the currency’s sharp slide late on Wednesday. The PBoC set the yuan fixing at 6.4010, compared to the previous day’s close of 6.3870, sending the currency to 6.40 per dollar in morning trade. Thursday’s fix was 1.1% below Wednesday’s fix of 6.3306, a pause from the aggressive weaker fixings in recent days: On Tuesday the fix weakened 1.9% and then 1.6% on Wednesday. Traders said Thursday’s slower pace of devaluation made sense following reports by the Wall Street Journal that the central bank asked state-owned lenders to sell dollars on its behalf in the last 15 minutes of U.S trading on Wednesday, which caused the yuan to rally 1% against the greenback after falling to fresh four-year lows in intraday trade.

Earlier on Wednesday, the PBoC warned it was not pursuing steady depreciation in response to allegations that Beijing was manipulating the currency to boost exports. The central bank has yet to confirm the supportive action, but it is broadly being treated as fact by market insiders. Wednesday’s intervention signaled the central bank may have gotten cold feet about its commitment to loosen the reins on the exchange rate. Experts say the PBoC acted to prevent the renminbi from falling too rapidly, a consequence that was widely flagged when the PBoC first announced a more market-oriented yuan just 24 hours earlier.

Read more …

It will take a long time and huge effort for people to understand what this means.

• Deflation Ice Age Looms After Yuan Move, Albert Edwards Says (Bloomberg)

China’s currency devaluation took Albert Edwards a step closer to realizing his doomsday prediction: deflation spreading from Asia to the U.S. and Europe and sending economies crashing. Tumbling emerging-market currencies will now accelerate their declines, curbing import costs in developed nations and triggering a broad drop in prices that will undermine economic growth, according to Edwards, the top-ranked global strategist at Societe Generale. “Make no mistake, this is the start of something big, something ugly,” Edwards wrote in a report on Wednesday. Edwards has long maintained a view he refers to as the Ice Age, when deflation will eventually cover the earth. China’s surprise change to its currency regime this week takes investors one step closer to this outcome, Edwards said.

It will eventually result in an emergency of similar magnitude to the collapse of Lehman Brothers Holdings Inc. in 2008 and the ensuing global financial crisis, he said. “We expect the acceleration of emerging market devaluations to send waves of deflation to the west to overwhelm already struggling corporate profitability and take us back into outright recession,” he wrote. Renowned for his prescient warning in the late 1990s of an impending Asian crisis, he’s also been telling investors to reduce their holdings in equities for almost 20 years. At the end of 2012 he said the New Year would bring nothing but disappointment, just before U.S stocks proceeded to soar 30%. The world’s second-biggest economy shocked markets this week by depreciating its currency by the most in two decades, with the goal of aligning the yuan more closely to the market rate.

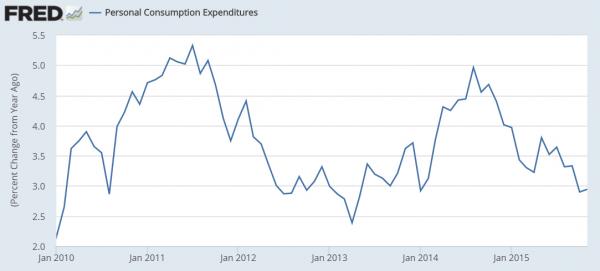

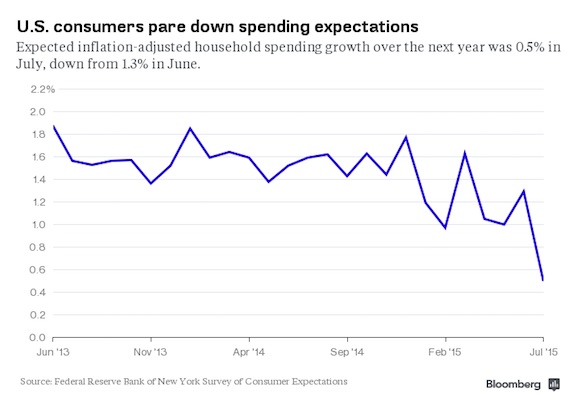

China’s decision to make its goods cheaper for the rest of the world to buy also makes it more difficult for wages and consumer prices to increase globally. The yuan fell on Thursday in a third day of losses since Tuesday’s devaluation as the central bank’s reference rate dropped 1.1%. Inflation expectations for the U.S. tumbled this week to the lowest since January. The gap between yields on U.S. five-year notes and similar-dated Treasury Inflation Protected Securities shrank to show traders expect annual consumer-price growth to average 1.27% through 2020. “The key thing here is that Tuesday’s devaluation is not just a one-off –- you will see persistent weakness” from here on, Edwards wrote. “This move will transform perceptions about the resilience of the U.S. economy.”

Read more …

I wrote ‘tidal wave’ 36 hours ago for an upcoming artile. Need to find a new metaphor now.

• China’s Currency Devaluation Could Spark ‘Tidal Wave Of Deflation’ (Guardian)

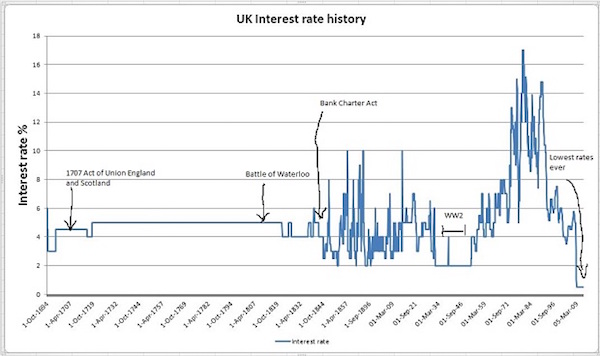

“Make no mistake, this is the start of something big, something ugly.” City economist Albert Edwards rarely minces his words, but his reaction to China’s devaluation, which sent shockwaves through global markets, underlined how powerfully Beijing’s move may be felt thousands of miles away. Edwards, of the bank Société Générale, argues that as well as creating a challenge for China’s Asian rivals, by making its exports more competitive, a cheaper yuan will send “a tidal wave of deflation” breaking over the world economy. Central banks in the US and the UK have primed investors for interest rate rises, with the Bank of England Mark Carney pointing to the turn of the year for a move, and Janet Yellen, at the Federal Reserve, signalling that a tightening could start as soon as September.

Edwards argues that instead of pushing up rates, central banks in the west should be preparing themselves to ward off a deflationary slump. In the period running up to the financial crisis of 2008, which became known as the “Great Moderation”, inflation in the west was kept under control by the influx of cheap commodities and consumer goods from China and other low-wage economies. Economies including the UK and the US were able to expand more rapidly than they otherwise might have done, without generating a surge in inflation. But today, with inflation already close to zero – indeed at zero in the UK – China’s decision to devalue could bring a fresh wave of price weakness to the west.

Cheap goods are great news when economic demand is relatively strong; but economists fret about falling prices because entrenched deflation can prompt businesses and consumers to postpone spending – hoping prices have farther to fall – and blunt policymakers’ standard tool of interest rate cuts. Erik Britton, of City consultancy Fathom, said: “We’re all going to feel it: we’ll feel it through commodities; we’ll feel it through manufactured goods exports, not just from China but from everywhere that has to compete with it; and we’ll feel it through wages.”

Read more …

Can’t really say China triggers it. It’s just one of many causes, a mere symptom really.

• China Could Trigger The Biggest Financial Rout Since 2008 (MarketWatch)

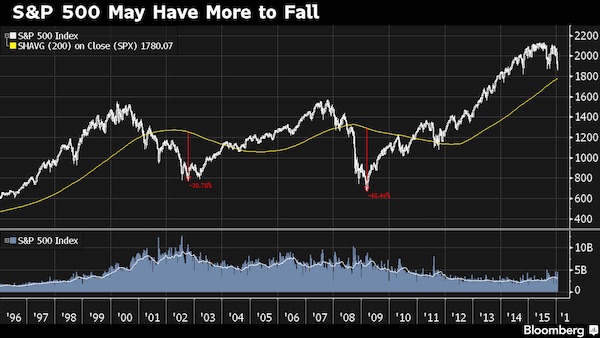

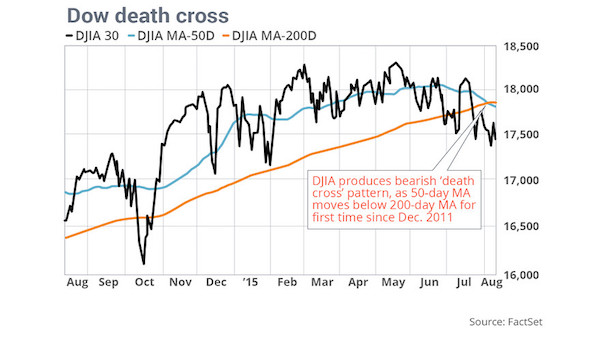

So much for that “one-time correction.” The People’s Bank of China let the yuan drop again overnight, fixing the currency 1.6% below Tuesday’s close, following the 1.9% devaluation heard around the world a day ago. It then had to intervene to keep things from getting out of hand. Cue continued freakout for global markets. Deutsche Bank, for one, is predicting the yuan is overvalued by around 10%, so if the yuan continues to weaken, things could yet get a lot darker for markets. And stocks aren’t dealing well with the new China reality they’ve seen so far. Jani Ziedins of the Cracked Market blog says the U.S. market’s reaction — the S&P 500 fell 1% Tuesday, and futures are pointing sharply lower on Wednesday — looks a bit overdone.

Still, he says, it’s understandable given the reasons behind it — fears of much bigger economic problems in China. Good news? “…if a crumbling Chinese economy cannot bring down this market, then nothing will and all we can do is hang on and enjoy the ride,” he says. Ziedins says watch the next two days to get some insight into the market’s psyche. Either selling is revving up to drop this market to levels not seen in years or this emotional purge will exhaust itself, and a rebound will follow, he predicts. Our chart of the day shows just how long it’s been since the S&P 500 has had a decent correction. But if death crosses and visions of rotting Apples are disturbing your sleep, you aren’t alone.

”The darkest horizon ever approaches, infused with Chinese black coal,” predicts the Fly, blogging for iBank Coin. It’s time to be cautious, he says. If you really want to shiver your timbers, then check out our call of the day. One of the biggest bears out there is riding the China devaluation to the hilt, talking boils and puss and predicting a financial crisis a la 2008. Brr…

Read more …

First devalue, then support it. Not terribly reassuring.

• China Intervenes To Support Tumbling Yuan (MarketWatch)

China intervened on Wednesday to prop up the yuan in the last minutes of trading, according to people familiar with the matter, in an apparent attempt to prevent an excessive fall in the currency as the authorities seek to give the market more say in setting the exchange rate. The yuan had dropped nearly 2% to its lowest level against the dollar during mainland trading, with one dollar buying about 6.45 yuan, as the People’s Bank of China followed through on its pledge to let market forces play a bigger role in determining the yuan’s value. To that end, the central bank set Wednesday’s reference rate for the yuan based on the currency’s closing level in the previous trading session.

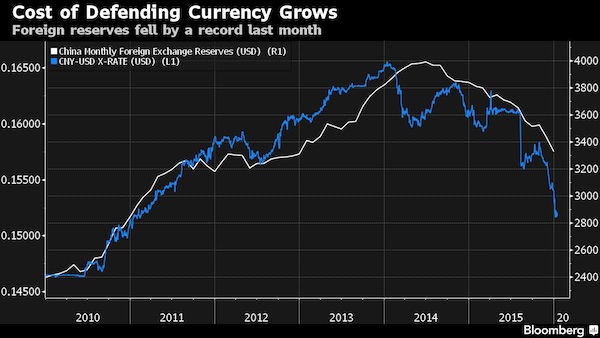

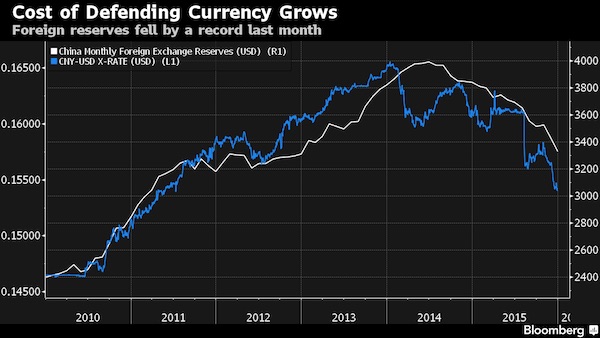

In the past, it had often ignored the daily market moves, at times setting the level–also known as the midpoint, or fixing–so that the yuan was stronger against the dollar even on days after the market indicated it should have been weaker. But the move led to more selling of the yuan, and a statement by the central bank earlier in the day trying to reassuring investors that there was “no economic basis” for continued yuan depreciation largely failed to stabilize the market. The PBOC then instructed state-owned Chinese banks to sell dollars on its behalf in the last 15 minutes of Wednesday’s trading, according to the people. The result: The yuan jumped about 1% in value against the dollar in the final moments of trading, bringing it to a level where one dollar would buy 6.3870 yuan. The Chinese currency is now down 2.8% since Monday’s closing.

Read more …

Big important point. China’s the end of the line.

• Yuan’s Plunge Marks End of Chinese Stability for Global Economy (Bloomberg)

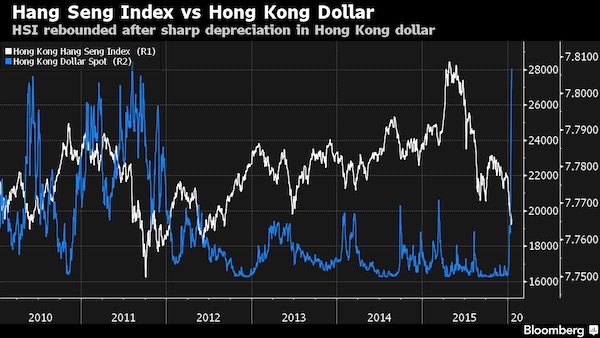

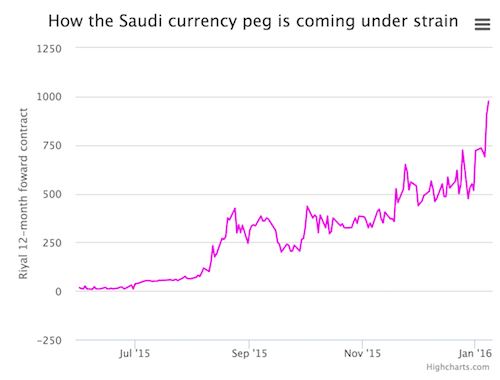

For about two decades China’s yuan was an anchor of stability for the global economy, helping it navigate Asian and global crises by holding steady even as other currencies slid. That era appears to be over. The yuan fell for a third day as the central bank’s reference rate dropped 1.1%. It recorded its steepest fall in 21 years after the People’s Bank of China said Tuesday it will allow markets a greater role setting its value. Commodities from oil to industrial metals plunged and policy makers around the region weighed responses, with Vietnam widening the trading band for its currency on Wednesday. An extended slide in the value of the yuan risks triggering a series of competitive devaluations and threatens a global deflation shock as prices of exports and commodities fall.

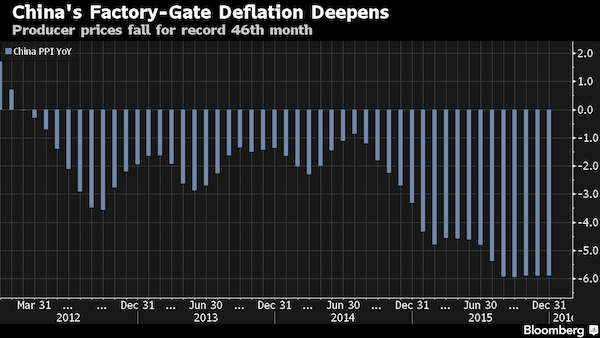

Morgan Stanley said Wednesday that China’s export of deflationary pressures “is not a marginal event” given its $10 trillion economy and a deepening slump in producer prices. “Until Tuesday the two biggest economies in the world – the U.S. and China – had shared the burden of stronger currencies,” said Stephen Jen at hedge fund SLJ Macro Partners. “But we have likely seen China breaking off, leaving the U.S. as the sole economy bearing the burden.” The currency realignment will lower profit margins and exports in the U.S., said Jen. It should also enable China and Asia to export some deflation to the rest of the world, he said. The yuan’s depreciation will lead to a profit and export volume transfer from China’s trading partners into China, wrote Morgan Stanley analysts.

China’s economy needs a competitive devaluation against other Asian producers and that points to weak global growth, lower commodity prices and lower inflation worldwide, according to Bill Gross. In the short term, China’s currency move will amplify challenges to global growth and add volatility to markets that have lost some of their fundamental anchoring, wrote Bloomberg View columnist Mohamed El-Erian. “The Chinese currency has been known for its predictability over the past two decades and now that has gone,” said Tao Dong at Credit Suisse in Hong Kong. “China is the second largest economy, the biggest buyer of commodities and machineries, the anchor for Asian economies.”

Read more …

Ambrose’s basic point is China is doing just fine, thank you. But… “China’s fixed investment reached $5 trillion last year, matching the whole of Europe and North America combined.” Thing is, AEP,it was all borrowed.

• China Cannot Risk The Global Chaos Of Currency Devaluation (AEP)

If China really is trying to drive down its currency in any meaningful way to gain trade advantage, the world faces an extremely dangerous moment. Such desperate behaviour would send a deflationary shock through a global economy already reeling from near recession earlier this year, and would risk a repeat of East Asia’s currency crisis in 1998 on a larger planetary scale. China’s fixed investment reached $5 trillion last year, matching the whole of Europe and North America combined. This is the root cause of chronic overcapacity worldwide, from shipping, to steel, chemicals and solar panels. A Chinese devaluation would export yet more of this excess supply to the rest of us. It is one thing to do this when global trade is expanding: it amounts to beggar-thy-neighbour currency warfare to do so in a zero-sum world with no growth at all in shipping volumes this year.

It is little wonder that the first whiff of this mercantilist threat has set off an August storm, ripping through global bourses. The Bloomberg commodity index has crashed to a 13-year low. Europe and America have failed to build up adequate safety buffers against a fresh wave of imported deflation. Core prices are rising at a rate of barely 1pc on both sides of the Atlantic, a full six years into a mature economic cycle. One dreads to think what would happen if we tip into a global downturn in these circumstances, with interest rates still at zero, quantitative easing played out, and aggregate debt levels 30 percentage points of GDP higher than in 2008. “The world economy is sailing across the ocean without any lifeboats to use in case of emergency,” said Stephen King from HSBC in a haunting report in May.

Whether or not Beijing sees matters in this light, it knows that the US Congress would react very badly to any sign of currency warfare by a country that racked up a record trade surplus of $137bn in second quarter, an annual pace above 5pc of GDP. Only deficit states can plausibly justify resorting to this game. Senators Schumer, Casey, Grassley, and Graham have all lined up to accuse Beijing of currency manipulation, a term that implies retaliatory sanctions under US trade law. Any political restraint that Congress might once have felt is being eroded fast by evidence of Chinese airstrips and artillery on disputed reefs in the South China Sea, just off the Philippines. It is too early to know for sure whether China has in fact made a conscious decision to devalue. Bo Zhuang from Trusted Sources said there is a “tug-of-war” within the Communist Party.

All the central bank (PBOC) has done so far is to switch from a dollar peg to a managed float. This is a step closer towards a free market exchange, and has been welcomed by the US Treasury and the IMF. The immediate effect was a 1.84pc fall in the yuan against the dollar on Tuesday, breathlessly described as the biggest one-day move since 1994. The PBOC said it was a merely “one-off” technical adjustment. If so, one might also assume that the PBOC would defend the new line at 6.32 to drive home the point. What is faintly alarming is that the central bank failed to do so, letting the currency slide a further 1.6pc on Wednesday before reacting. The PBOC put out a soothing statement, insisting that “currently there is no basis for persistent depreciation” of the yuan and that the economy is in any case picking up. So take your pick: conspiracy or cock-up.

Read more …

Hints?

• Devaluation Hints at China’s Rising Distress Over Economy (NY Times)

Whenever China’s economy swooned in recent downturns, its currency never buckled. It held steady, or strengthened, even as China’s neighbors or trading partners scrambled to cut the value of their own currencies to deal with the fallout. With the Chinese renminbi now taking its biggest plunge in decades, the worry is that the country’s already slowing economy is even worse off and the government is panicking. By the official measures, the economy is growing at 7%, right in line with government targets. It is a steady pace that the leadership has indicated can support decent job growth and put more money into consumers’ pockets. But a look below the surface shows a different, more worrisome picture. The data coming out of China, too, is somewhat suspect.

Economists now wonder whether, despite official figures showing growth, some provinces and regions could be dealing with outright recessions. “To be honest, no one has a clue where the economy is, and I don’t think that it’s properly measured,” said Viktor Szabo, a senior investment manager at Aberdeen Asset Management. “Definitely there is a slowdown. You can have an argument about what level it is, but it’s not 7%,” he added. The government’s aggressive action on the currency has brought the economy into sharp focus. China allowed the renminbi to weaken even further on Wednesday after a sharp devaluation the previous day. The currency’s official fixing against the dollar is down 3.5% over the last two days. On a typical day, the renminbi rises or falls just a small fraction of a percentage point.

While the government said the decision was intended to make the currency more market oriented, the devaluation was also largely a gift to exporters. In relative terms, it makes China’s shipments of clothing or electronics to consumers in the United States or Europe more affordable. “I don’t see this mini-devaluation as some kind of outrageous act,” said George Magnus, an economic adviser to the bank UBS and an associate at Oxford University’s China center. “But it is part of an array of other economic and financial stimulus measures designed to shore up the flagging growth rate.” The government has taken the usual steps by cutting interest rates and freeing up more money for banks to lend. But the leadership has also turned to more unconventional means in recent months to try to cushion the blow as the economy’s once-runaway expansion sinks back to earth.

Read more …

“The PBOC is telling people that if they want to take their money out, please do..”

• Yuan Bear in Wilderness in 2014 Now Warns of China Credit Crisis (Bloomberg)

In a March 2014 report, Daiwa Securities Co. senior economist Kevin Lai forecast a 10% drop in the yuan by the end of 2015 and warned China needed “very delicate” policy to avert a crisis. He’s still worried, and no longer so alone. The currency has devalued 3.7% since Tuesday morning, when the People’s Bank of China cut its daily reference rate by a record and said it would let the market play a greater role in the fixing. Lai, whose uber-bearish prediction is now halfway to fulfillment, estimates China has some $3 trillion of dollar-denominated debt outstanding which has suddenly become more expensive. “The PBOC is telling people that if they want to take their money out, please do,” Lai said in an interview Wednesday.

“As the selling pressure increases, this could spin into a currency and a credit crisis. They’re exporting the crisis.” The yuan’s tumble roiled Asian currencies and equities this week, even as the central bank said there’s no economic basis for a continuous fall. The cost to insure Chinese government debt against nonpayment rose to the highest in two years, advancing six basis points Tuesday to 107.5 basis points, according to data provider CMA. Chinese corporations have sold bonds and gotten bank loans offshore at a record pace in the past three years and now are the biggest component of major fixed-income indexes in the region.

These issuers will buy dollars as they seek to protect themselves from the currency move, Lai said, increasing the pressure on the yuan and making it even more difficult to pay back their foreign dues. In his March 2014 note and a subsequent report in October, Lai outlined how fake export invoicing, metals purchases and disguised foreign investment had driven $1 trillion of short-term speculative flows into China. He sees the yuan falling to 6.60 per dollar, or more, by the end of 2015, from 6.44 now.

Read more …

Core deflation?!

• China’s Slowdown Threatens Euro’s Core More Than Periphery (Reuters)

Few parts of the world will remain unscathed by the plunging stock markets and economic slowdown rocking China, but the companies of Europe’s soft underbelly may weather it best. Countries comprising the euro zone’s periphery, such as Spain, Italy and Portugal, have relatively small exposure to the world’s growth engine. Core countries like Germany, France and The Netherlands have much deeper links. Strong demand from China has fuelled the boom in Germany’s German auto industry, the success of France’s luxury and fashion empires and solid growth in the Dutch and Finnish chemicals and capital goods sectors. Investment by their companies has grown accordingly.

But that demand may be cooling. China’s factory activity shrank in July at the fastest rate in two years, the country’s stock markets have slumped 30% since mid-June and growth could soon fall below 7% for the first time since early 2009. “Germany has products China wants. But we’ve got slowing global trade, slowing global growth, and Germany has already benefited from its currency weakness advantage,” said Stewart Richardson, partner at RMG Wealth Management in London.” “Germany suffers if China suffers. So on European equities, the periphery outperforms Germany,” he said. European stocks have been the destination of choice for investors this year, with cash flowing in from emerging markets and the United States. A net $80 billion has gone into European equity funds this year, according to Bank of America Merrill Lynch.

Read more …

Now’s the time for Tsipras to be bold.

• Greece Is About To Be Dismantled And Fed To Profit-Hungry Corporations (Ind.)

Greece is heading towards its third “bailout”. This time €86 billion is on the table, which will be packaged up by international lenders with a bundle of austerity and sent off to Greece, only to return to those same lenders in the very near future. We all know the spiralling debt cannot and will not be repaid. We all know the austerity to which it is tied will make Greece’s depression worse. Yet it continues. If we look deeper, however, we find that Europe is not led by the terminally confused. By taking those leaders at their word, we’re missing what’s really going on in Europe. In a nutshell, Greece is up for sale, and its workers, farmers and small businesses will have to be cleared out of the way.

Under the eye-watering privatisation programme, Greece is expected to hand over its €50 billion of its “valuable state assets” to an independent body under the control of the European institutions, who will proceed to sell them off. Airports, seaports, energy systems, land and property – everything must go. Sell your assets, their contrived argument goes, and you’ll be able to repay your debt. But even in the narrow terms of the debate, selling off profitable or potentially profitable assets leaves a country less able to repay its debts. Unsurprisingly the most profitable assets are going under the hammer first. The country’s national lottery has already been bought up. Airports serving Greece’s holiday islands look likely to be sold on long-term lease to a German airport operator.

The port of Pireus looks likely to be sold to a Chinese shipping company. Meanwhile, 490,000 square meters of Corfu beachfront have been snapped up by a US private equity fund. It has a 99-year lease for the bargain price of €23million. According to reporters, the privatisation fund is examining another 40 uninhabited islands as well as a massive project on Rhodes which includes an obligatory golf course. Side-by-side with the privatisation is a very broad programme of deregulation which declares war on workers, farmers and small businesses. Greece’s many laws that protect small business such as pharmacies, bakeries, and bookshops from competition with supermarkets and big businesses are to be swept away. These reforms are so specific that the EU is writing laws on bread measurements and milk expiry dates. Incredibly, Greece is even being told to make its Sunday opening laws more liberal than Germany’s. Truly a free market experiment is being put into place.

Read more …

Let’s please never forget: Opposing views discussed out in the open are democracy’s lifeblood.

• Greek Government Criticizes Rebel Lawmakers Before Bailout Vote (Reuters)

The Greek government criticized rebels within its ranks intent on opposing a new bailout deal in Thursday night’s parliamentary vote, saying a government without a majority “cannot go far” and raising the possibility of early elections. With opposition support, parliament is preparing to approve the €85 billion bailout deal that Greece needs to avoid defaulting on a debt repayment next week. The agreement is expected to easily pass since opposition parties have promised to support Prime Minister Alexis Tsipras to ensure Greece does not return to financial chaos. But the vote will test the strength of a rebellion by anti-austerity lawmakers of Tsipras’s leftist Syriza party, which could raise pressure on him to call snap elections as early as September.

Government spokeswoman Olga Gerovasili said that after the parliamentary vote, the focus would shift to a meeting of euro zone finance ministers on Friday who must also back the bailout, Greece’s third in the past five years. However, she acknowledged there would be a parliamentary rebellion and signaled that the government would struggle in the coming months if Syriza remained disunited. “It is known that some Syriza lawmakers will not vote in favor of the accord,” she told Mega TV. “A government that does not have a governing majority cannot go far.” Far-left members of Syriza insist the government should stand by its promises on which it was elected in January to reverse waves of spending cuts and tax rises imposed since 2010, which have had a devastating effect on an already weak economy.

The rebels, who include some former ministers, have already voted against the government on the austerity deal, angered by Tsipras’s capitulation to the creditors’ demands as Greece edged close to an economic precipice last month. As Greece needs the deal to make a €3.2 billion debt repayment to the ECBon Aug. 20, Tsipras asked parliamentary speaker Zoe Konstantopoulou to expedite debate on the bill approving the bailout. Konstantopoulou, a Syriza hardliner who opposes the deal, responded by calling a series of parliamentary committee meetings to consider the bill on Thursday, delaying the start of the plenary debate that is likely to last well beyond midnight before the vote is held.

Gerovasili made clear the government’s displeasure. “Ms Konstantopoulou has her own ways,” she said. “There are two differing views which are creating disharmony.” Pressed on speculation that Syriza might formally split, leading to elections in the autumn, she said: “It is possible that in the future there could be procedures to seek a new mandate from the people… This will happen when there is an assessment that there must be fresh elections.”

Read more …

“The IMF… is throwing up its hands collectively despairing at a program that is simply founded on unsustainable debt…”

• Varoufakis: Greece Bailout Deal ‘Will Not Work’ (AFP)

Greece’s former finance minister Yanis Varoufakis on Wednesday warned that the latest bailout deal was doomed to fail despite Prime Minister Alexis Tsipras saying he was “confident” of ending economic uncertainty. In a implicit criticism of his former ally Tsipras, he told BBC radio: “Ask anyone who knows anything about Greece’s finances and they will tell you this deal is not going to work.” “The Greek finance minister… says more or less the same thing,” he added. The controversial politician resigned the day after Greeks voted against a proposed bailout in a July 5 referendum, accusing the country’s creditors of “terrorism.” Varoufakis told the BBC that Germany’s veteran Finance Minister Wolfgang Schaeuble had had to “go to the Bundestag and effectively confess this deal is not going to work”.

“The IMF… is throwing up its hands collectively despairing at a program that is simply founded on unsustainable debt… and yet this is a program that everybody is working towards implementing,” he said. Tsipras on Wednesday said he was confident that his debt-crippled nation would secure loan support from a third international bailout which is up for parliamentary approval this week. “I am and remain confident that we will succeed in reaching a deal and in loan support (from the European Stability Mechanism)… that will end economic uncertainty,” he said. Greece and its creditors are under pressure to finalize a deal by next Thursday when Athens must repay some €3.4 billion to the ECB. Germany on Wednesday said it needed more time to comb through the 400-page text setting out the fiscal and other policy measures Greece must take in exchange for the lifeline.

Read more …

“Much better than Varoufakis. More conciliatory, constructive – and modest.”

• Varoufakis Exit Marked ‘Sea Change’ In Greek Talks, EU Sources Say (Reuters)

Negotiations on a bailout deal between Greece and its creditors reached this week underwent a “sea change” after combative finance minister Yanis Varoufakis was removed from the talks, EU sources said on Wednesday. The deal, which will provide Greece with the new money needed to prevent financial meltdown and keep it from crashing out of the single currency, was reached after months of often bad-tempered talks with international lenders. The mood apparently changed after the appointment of Euclid Tsakolotos as finance minister in place of Varoufakis early last month. “There was a sea change in the negotiations with the Greek authorities in recent weeks,” one of the EU sources said.

“The new Greek finance minister has an absolutely different attitude in the talks than the previous one. Talks were very constructive,” the source said. Varoufakis, a charismatic motorbike-riding academic who described himself as an “erratic Marxist,” was feted as a political rock star when he took the finance portfolio after the left-wing Syriza party emerged victorious from an election in January. But as the debt talks dragged on the confrontational Varoufakis lost the confidence of his negotiating partners, irritating German Finance Minister Wolfgang Schaeuble in particular and accusing Europe of “terrorism” in its attempts to resolve the Greek crisis.

He further riled the Germans, the main contributors to a series of rescue packages for Greece, by saying an outline deal last month was like the Versailles treaty which forced crushing reparations on Germany after World War One and led to the rise of Adolf Hitler. In a development that prompted widespread shock and disbelief in Greece, Varoufakis confirmed that he had made secret preparations to hack into citizens’ tax codes to create a parallel payment system. Mild-mannered and professorial, Tsakalotos marked a clear change in style from his leather-jacketed predecessor. One official in Brussels described him last month as: “Much better than Varoufakis. More conciliatory, constructive – and modest.”

Read more …

The conquering force.

• Germany Criticises Greek Bailout Agreement (FT)

Germany criticised an outline deal between Athens and its bailout monitors as insufficient, upsetting eurozone attempts to smooth the way to a new €85bn rescue for Greece. Germany’s finance ministry outlined its objections in a paper circulated to its eurozone counterparts just hours before the Greek parliament was due to debate on Wednesday the painful austerity and reform package that had been reluctantly accepted by the radical left government of prime minister Alexis Tsipras. It also sets up a potentially difficult meeting of eurozone finance ministers on Friday who are due to decide whether to approve the deal — or grant Athens a bridging loan to give the negotiators time to rework the agreement.

Berlin did not make clear whether it would ask for such a delay on Friday. The finance ministry denied that it was rejecting the deal and said it was only raising “some open questions that need to be addressed in the euro group”. These include delays in planned reforms, debt sustainability and the role of the IMF, which has helped EU institutions finance the past two Greece packages. The German intervention revives memories of last month’s acrimonious summit, when Wolfgang Schäuble, Berlin’s hawkish finance minister, openly aired the possibility of a temporary Greek exit from the euro. It punctures the optimism that had been building in Brussels that a deal could be done in time for Athens to pay a €3.2bn debt to the ECB on August 20.

The German paper concedes that “large parts” of the reform programme laboriously agreed last month were indeed included in the outline deal, ranging from tax collection to competition in tourist property rentals. But it says some measures are delayed until October or November and some others “are not yet specified”. Berlin is particularly concerned about a proposed delay in establishing a planned €50bn privatisation fund, which is due to take control of Greek state assets. Amid arguments about how authority over this fund would be shared by the Greek government and EU institutions, the negotiators agreed on a task force to sort out the issue by December. The German report says drily: “Just to set up a task force is not sufficient.”

[..] Meanwhile, the memorandum of understanding, obtained by the FT, makes clear how challenging the plan is for Mr Tsipras’s government, not least in the face of splits in his ruling Syriza party. It highlights how extensive external control of the Greek economy will be, how quickly Athens must implement reforms in the coming weeks and months, and how demanding are the budget plans.

Read more …

Will the entire country be affected? Is a Troika loan in the offing?

• There’s A New Twist In The Austrian Bad Bank Saga (Coppola)

Austria’s province of Carinthia is in trouble again. Followers of the Hypo Alpe Adria (HAA) saga will know that under its erstwhile leader Joerg Haider (who conveniently died in a car crash in 2008) Carinthia’s government guaranteed HAA’s loans, bonds and subordinated debt to the value of about €11bn, which is more than 5 times its annual income. These are “deficiency guarantees”, which means they only kick in if the borrower actually defaults. When HAA failed in 2008, the Austrian federal government prevented the guarantees from kicking in by nationalizing it, buying it from the German Landesbank BayernLB for a nominal €1. From then until 2014 it remained frozen, rescued but not resolved.

Clearly things couldn’t stay that way for ever. Last year, the Austrian federal government passed a law called the Hyposanierunggesetz (Hypo Reorganisation Law), usually known as HaaSanG, which voided deficiency guarantees issued by Carinthia on €890m of HAA subordinated debt and on 800m euros of loans from BayernLB. HAASanG was intended to protect taxpayers by forcing losses on to subordinated debt holders and BayernLB. But the subordinated debt holders fought back. And in a landmark judgment, the Austrian Constitutional Court has found in their favor. Declaring HaaSanG “unconstitutional”, it has repealed it, reinstating not only the guarantees on subordinated debt but also the guarantees on BayernLB’s loans. Carinthia is now once again liable for losses under these guarantees.

Admittedly, this is only 1.69bn of Carinthia’s 11bn total notional liability. And the Austrian federal government is still insisting that the much larger bail-in of subordinated and unsecured creditors under Austria’s version of the European Bank Recovery & Resolution Directive (EBRRD), known as BaSAG, will proceed. The repeal of HAASanG is a setback, but not a showstopper. But there is more to come.

The Austrian newspaper Der Standard reports that the Vienna Commercial Court has petitioned for repeal of BaSAG’s special bail-in provisions for Heta at the Constitutional Court. If this is successful, then all guarantees on HAA assets currently in the HETA “bad bank” and against which bonds have been issued will be reinstated. We know Carinthia can’t possibly honor the guarantees, so if subordinated debt holders suddenly rank pari passu with senior unsecured debt holders because of their reinstated guarantees, losses will have to be shared by everyone equally – including the Austrian federal government.

Read more …

Cute, but..

• Lawrence Lessig Wants To Crowdfund His Way To The Presidency (Forbes)

Lawrence Lessig wants to make it to the Oval Office, pass just one bill and then resign. On Tuesday, the Harvard Law professor and reform activist, released a video announcing his exploratory bid for president. In the video, Lessig explained his plan to run as a “referendum president” on a platform of sweeping political reform—the core of which would be campaign finance reform—in an effort to fix America’s “rigged” political system. In keeping with his platform, Lessig launched a crowdfunding campaign to fund his potential run. If he manages to raise one million dollars by Labor Day, Lessig will officially declare his candidacy and make a run for office for 2016.

Lessig believes that money in politics has stripped America of a truly democratic political system and wants to change that. This is not the first time the professor has delved into politics. In 2014, Lessig co-founded Mayday PAC, a super PAC billed as “a crowdfunded Super PAC to end all Super PACs and the corruption of private money.” With 27 days to go, Lessig’s crowdfunding campaign raised more than $128,800 at the time of publication. Forbes spoke with Lessig about his plan to “unrig the system,” his motivations and the challenges he has yet to face. Can you explain your plan and this concept of a “referendum president”? How would your plan circumvent all these issues facing the other democratic candidates currently in the running?

It’s my view that if we had a referendum on this issue with the American public, it would overwhelmingly produce support for the reform. But we don’t have a referendum power, so this is a way to hack on into the system. So a candidate for president says, “I am going to do this one thing and when that thing is over, I will step aside.” In that process you have a candidate whose election would be a mandate for that one thing and could stand up to Congress and say, here is that one thing and if you don’t do it, you are going to have the wrath of the people who say that you have not respected their mandate. When they do it then we will have created a Congress that is actually free to lead rather than compelled to follow the money.

What motivated you to explore this option?

I had been watching the Democratic Party candidates talk about really incredibly bold and inspiring ideas about what they want to do in the next administration, but I come from Massachusetts—our senator is Elizabeth Warren—and as Warren likes to say, “the system is rigged.” What increasingly frustrated me was the failure to connect that fact to strategy for actually making it possible to achieve these bold ideas. The system is rigged, what that means is that you have to unrig the rigged system first. So what is the plan for unrigging that rigged system and where is the priority for that plan? What led me to do this was recognizing that I didn’t think that any of the candidates actually could do this. If you enter office office with a mandate that is divided among seven or eight issues, it’s hard to stand up to the most powerful interest in the United States and say to them that you are going to have to yield to this because so much else is hanging on what the administration does.

Read more …

Country in a coma.

• Canadians Piling Up ‘Good Debt,’ Report Says (Globe and Mail)

Canadians are borrowing more, but much of what they owe is “good debt,” a new report suggests. The average amount of debt Canadians now hold rose significantly to about $93,000 in June from $76,140 a year earlier, according to the report released Wednesday by Bank of Montreal. The report, which looks at major contributors to overall household debt in the country, found credit card debt and mortgage debt listed as the top two types. Of the Canadians surveyed, 80% said they are in debt. While the percentage stayed the same as last year, so-called “smart purchases” such as home purchases, home repairs/renovations and education expenses topped the list of debt sources for Canadians.

49% of Canadians said buying a home was a significant contributor to their current debt, with 34% saying it was the main factor. Home sales are up 6% in the first half of 2015 from the same period a year ago, according to BMO Economics, with hot housing markets adding fuel to debt levels. Last week, The Real Estate Board of Greater Vancouver reported sales of existing homes in the region soared 30% in July compared with a year earlier, causing benchmark prices to rise more than 11%. The Toronto Real Estate Board reported home sales rising 8% to hit a new July record, with prices jumping 9.4% for the year. “Home sales remain resilient across most of the country, led by soaring transactions in Toronto and Vancouver,” said BMO Nesbitt Burns Inc. economist Sal Guiatieri.

Read more …

“Conservative government used public money on outreach campaign to counter criticism..” I say sue ’em.

• Canadian Government Spent Millions On Secret Tar Sands Advocacy (Guardian)

Conservative government used public money on outreach campaign to counter criticism of controversial Alberta tar sands. Canada’s Conservative government spent several million dollars on a tar sands advocacy fund as its push to export the oil faltered, documents reveal. In its 2013 budget, the government invested $30 million over two years on public relations advertising and domestic and international “outreach activities” to promote Alberta’s tar sands. The outreach activities, which cost $4.5 million and were never publicly disclosed, included efforts to “advance energy literacy amongst BC First Nations communities.” The Harper government has been trying to ship tar sands to the British Columbia coast via two pipelines, Northern Gateway and Kinder Morgan, which scores of First Nations communities have pledged to block because of environmental and economic concerns.

With Canada’s federal election in full swing, Prime Minister Stephen Harper has been on the defensive over his backing of the tar sands, which have derailed the country’s emissions reduction targets and, since the crash of oil prices, destabilized its economy. According to the government documents, other outreach activities included research to support Canadian lobbying against a European environmental measure that would have hampered tar sands exports. Canada has succeeded in delaying the measure – the EU Fuel Quality Directive – several times. The government also partnered with the International Energy Agency to “advance knowledge” about unconventional fuels like fracked shale gas, which several Canadian provinces have passed moratoriums against.

Read more …

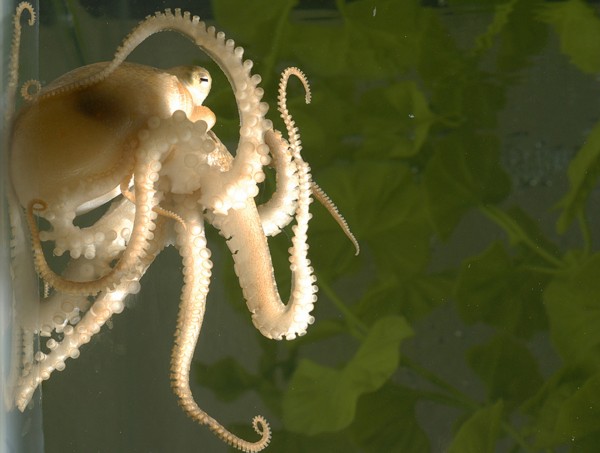

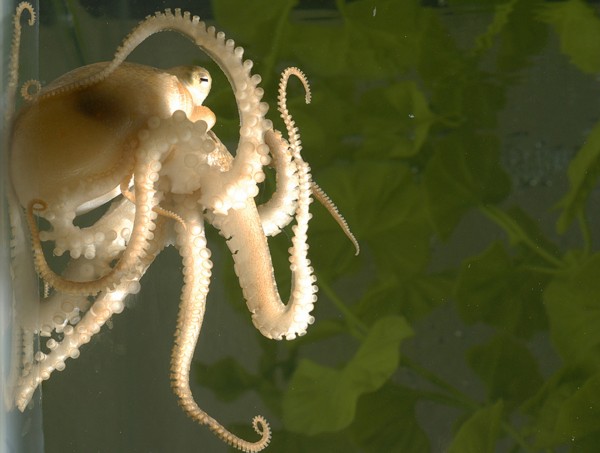

“.. as if the octopus genome had been “put into a blender and mixed“

• Don’t Freak Out, But Scientists Think Octopuses ‘Might Be Aliens’ (IE)

Not to send you into a meltdown or anything but octopuses are basically ‘aliens’ – according to scientists. Researchers have found a new map of the octopus genetic code that is so strange that it could be actually be an “alien”. The first whole cephalopod genome sequence shows a striking level of complexity with 33,000 protein-coding genes identified – more than in a human. Not only that, the octopus DNA is highly rearranged – like cards shuffled and reshuffled in a pack – containing numerous so-called “jumping genes” that can leap around the genome. “The octopus appears to be utterly different from all other animals, even other molluscs, with its eight prehensile arms, its large brain and its clever problem-solving abilities,” said US researcher Dr Clifton Ragsdale, from the University of Chicago.

“The late British zoologist Martin Wells said the octopus is an alien. In this sense, then, our paper describes the first sequenced genome from an alien.” The scientists sequenced the genome of the California two-spot octopus in a study published in the journal Nature. They discovered unique genetic traits that are likely to have played a key role in the evolution of characteristics such as the complex nervous system and adaptive camouflage. Analysis of 12 different tissues revealed hundreds of octopus-specific genes found in no other animal, many of them highly active in structures such as the brain, skin and suckers. The scientists estimate that the two-spot octopus genome contains 2.7 billion base pairs – the chemical units of DNA – with long stretches of repeated sequences.

And although the genome is slightly smaller than a human’s, it is packed with more genes. Reshuffling was a key characteristic of the creature’s genetic make-up. In most species, cohorts of certain genes tend to be close together on the double-helix DNA molecule. A gene is a region of DNA that contains the coded instructions for making a protein. In the octopus, however, there are no such groupings of genes with related functions. For instance, Hox genes – which control body plan development – cluster together in almost all animals but are scattered throughout the octopus genome. It was as if the octopus genome had been “put into a blender and mixed”, said co-author Caroline Albertin, also from the University of Chicago.

Read more …