John Vachon Window in home of unemployed steelworker, Ambridge, PA 1941

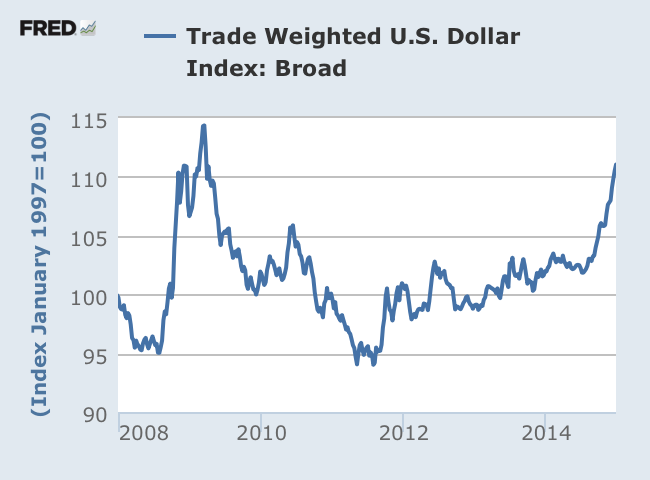

“..a Fed hike will act as a margin call on the global economy.”

• Steen Jakobsen Sees “Zero Growth, Zero Inflation, & Zero Hope” (Zero Hedge)

Entrepreneurs around the world are “drowning in this nothingness reality,” and Saxobank CIO Steen Jakobsen sees a crisis correction as the only outcome of a zero environment in his opinion. “We have zero growth, zero inflation and zero hope,” he explains based on his recent global travels meeting business leaders and key investors whose shared negative outlook was striking. The following brief clip concludes ominously, with Jakobsen noting that he “believes a Fed hike will act as a margin call on the global economy.”

Because if we just buy everything in sight with Monopoly money, what could possibly go wrong?

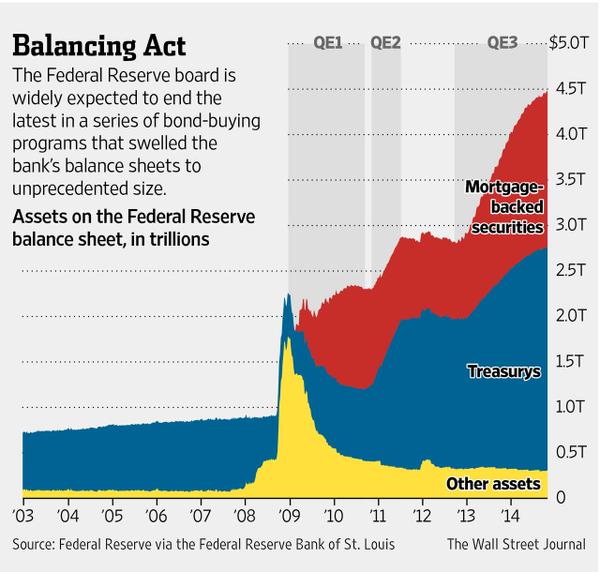

• Fed Should Make Bond Buys a Regular Policy Tool, Boston Fed Paper Finds (WSJ)

The Federal Reserve should consider keeping bond buys as a regular tool of monetary policy rather than return to a more conventional policy relying just on setting short-term rates, a newly-released paper from the Federal Reserve Bank of Boston says. In particular, the central bank’s new de-facto third mandate, overseeing financial stability, might benefit from a broader array of available policy measures, argues Michelle Barnes, a senior economist adviser at the Boston Fed. “Largely missing from discussions about the Fed’s ‘exit strategy’ is a consideration that perhaps it should retain, not discard, the balance sheet tools,” Ms. Barnes writes.

“Since the Dodd-Frank Act has added maintaining financial stability to the Fed’s existing dual mandate to achieve maximum sustainable employment in the context of price stability, it might be beneficial to have several tools to achieve multiple policy objectives.” In response to the financial crisis and its aftermath, the Fed has held short-term interest rates near zero since December 2008. It also has purchased trillions of dollars-worth of Treasury and mortgage-backed securities to hold down long-term rates in hopes of spurring stronger economic growth. It’s portfolio of assets is now about $4.5 trillion, up from less than $1 trillion before the crisis. The Fed has stopped buying assets but is maintaining the size of its balance sheet by reinvesting the payments of principal on the bonds it holds.

Fed Chairwoman Janet Yellen told the Senate Banking Committee in February the central bank had no plans to reduce the portfolio through asset sales. The Fed intends at some point to let the balance sheet shrink gradually by ceasing the reinvestment process, she said. The Fed’s long-run intention is to hold “no more securities than necessary for the efficient and effective implementation of monetary policy,” she added. But Ms. Barnes says the Fed should be open to buying more bonds in the future if necessary to influence interest rates and to maintaining a large balance sheet. “Having more than just one primary policy tool confers greater flexibility and may allow the Fed to better fulfill what are now its three policy goals,” the author writes.

What’s worse than stupid?

• Why Wall Street Is Scoffing At ‘Flash Crash’ Bust (CNBC)

In arresting Navinder Sarao this week and charging him with manipulating markets, regulators indicated they’d gotten to the bottom of 2010’s “flash crash.” Many on Wall Street, though, believe the work is only starting. That’s probably a gentle way of stating the Street’s reaction to Sarao’s arrest Tuesday. Many pros openly scoffed at the notion that Sarao was the sole culprit of the spectacular plunge on May 6, 2010. On that day, the Dow industrials rapidly lost about 600 points, taking the average down nearly 1,000 points on the session, only to rebound within a matter of minutes. According to separate indictments, Sarao masterminded a scheme in which he was able to send orders to the market that he had no intention of executing, a practice called “spoofing” that caused a market plunge on which Sarao capitalized.

The practice happened within minutes of the crash and was a direct cause of it, according to regulators. Authorities allege he acted mostly alone rather than as part of a large, sophisticated operation. However, many experts believe the explanation is at least an oversimplification and at most an intent to deflect attention away from more fundamental weaknesses in the financial markets. “The real issue here is that markets have dramatically changed over the past two decades but regulators have not kept up,” Joe Saluzzi and Sal Arnuk, who run Themis Trading and have been ardent supporters of changes to market structure, said in a blog post Thursday. “While technology has increased efficiency and brought down trading costs, it has also changed the way traders access the markets.”

” Shockingly, the SEC appeared in front of Congress claiming it has everything under control, when it now admits it never even looked at spoofing.”

• The Flash Crash Patsy and The ‘Mass Manipulation Of High Frequency Nerds’ (ZH)

There are several notable items in Bloomberg’s comprehensive overnight summary of the epic humiliation America’s market regulators are about to undergo, complete with yet another round of theatrical Congressional kangaroo courts, which will lead to a lot of red faces, a wrist slap or two and maybe even the termination of one or two lowly employees and… nothing else. Because what difference does it make? At this point only a bottom-up overhaul can “fix” the fragmented, broken market which by definition can only come after the next market crash, one which will promptly be blamed on HFTs (which leaving the central bankers unscathed). Back to the Bloomberg piece in which we first discover that it wasn’t even the CFTC that, 5 years later, “figured out” the flash crash was one person’s fault:

When Washington regulators did a five-month autopsy in 2010 of the plunge that briefly erased almost $1 trillion from U.S. stock prices, they didn’t even consider whether it was caused by individuals manipulating the market with fake orders. Their analysis was upended Tuesday with the arrest of Navinder Singh Sarao — a U.K.-based trader accused by U.S. authorities of abusive algorithmic trading dating back to 2009. Even that action was spurred not by regulators’ own analysis but by that of a whistle-blower who studied the crash, according to Shayne Stevenson, a Seattle lawyer representing the person who reported the conduct.

Your tax money not at work. But fear not: after today’s Deutsche Bank $2.5 billion “get out of jail” card, the CFTC will be $800 million richer and can finally even afford to hire a former trader who has some understanding of how the market works. [..] Second, the reason why the SEC wrote a 104-page report with “findings explaining the Flash Crash” which it will have no choice but to retract in light of the latest news and developments, is the following:

Spoofing wasn’t even part of the CFTC’s analysis of the crash, said James Moser, a finance professor at American University who was the agency’s acting chief economist in May 2010. The flash-crash review marked the first time that the agency worked through the CME’s massive order book. CFTC officials often needed to call the exchange for help interpreting the data, he said in an interview. “We didn’t look for any sort of spoofing activity,” said Moser, who added that he doubts that Sarao’s activity was the main cause of the crash. “At that point in 2010, that wasn’t high on the radar, at least in our minds.”

So the CME, which is the exchange that trades the E-mini, “concluded within four days of the 2010 flash crash that algorithmic trading on futures exchanges didn’t exacerbate losses in the market,” and a few months later, so did the SEC, which instead pinned the entire crash on Waddell & Reed. And the way it did it was by completely ignoring about 99% of all posted quotes: the layered and rapidly canceled trades or what we dubbed “quote stuffing” one whole month after the Flash Crash, in June. In fact we even explained it to anyone who cared to listen: “How HFT Quote Stuffing Caused The Market Crash Of May 6, And Threatens To Destroy The Entire Market At Any Moment.” Shockingly, the SEC appeared in front of Congress claiming it has everything under control, when it now admits it never even looked at spoofing.

“..there’s no way they didn’t know about this; You cannot miss it; it really is that easy.”

• Financial Experts Cast Doubt On Case Against ‘Flash Crash Trader’ (Guardian)

Financial experts have raised questions about how a 36-year-old Londoner could have almost single-handedly caused the 2010 “flash crash” that wiped billions off the value of US stocks in seconds. Navinder Singh Sarao, 36, from Hounslow, west London, appeared in court in the UK on Wednesday charged with crimes the Department of Justice believes helped cause the Dow Jones industrial average to plunge 600 points in five minutes, wreaking havoc on Wall Street. The DoJ and Commodity Futures Trading Commission (CFTC) have accused Sarao of multiple charges of wire fraud, commodities fraud and market manipulation, and are seeking his extradition to the US.

US authorities have offered several explanations for the flash crash, which rattled stock markets worldwide. Sarao’s arrest comes five years after the SEC and CFTC’s official report said the crash was caused in part by an automated sale algorithm at a mutual fund, widely identified as Waddell Reed. There was no mention in the report of Sarao, or an unidentified individual trader that could have been Sarao. Eric Hunsader, chief executive of financial data company Nanex which monitors all market trades, said it was very unlikely that a single trader could have caused the crash – and questioned why it had taken so long for the authorities to discover Sarao’s suspect trades.

“I think he’s a small fish, it’s really disappointing to see the Justice Department laying the blame on a small guy, [it is as if] they are afraid of the big players,” he told the Guardian. “I don’t think they thought this through. If one guy can do this what [could] a well capitalised country or terrorists do? The only thing preventing him from causing total destruction was fear of getting caught. A terrorist wouldn’t have that fear.” Hunsader said trade data also showed that Sarao’s trading algorithm was switched off two minutes before the crash which started at 14:42:44 on 6 May 2010. “The CTFC had audit trail data [at the time of the report], there’s no way they didn’t know about this,” Hunsader said. “You cannot miss it; it really is that easy.”

“..working backward to the present. The result of this method, in our government’s opinion, is an “austerity trap.”

• A New Deal for Greece (Yanis Varoufakis)

Three months of negotiations between the Greek government and our European and international partners have brought about much convergence on the steps needed to overcome years of economic crisis and to bring about sustained recovery in Greece. But they have not yet produced a deal. Why? What steps are needed to produce a viable, mutually agreed reform agenda? We and our partners already agree on much. Greece’s tax system needs to be revamped, and the revenue authorities must be freed from political and corporate influence. The pension system is ailing. The economy’s credit circuits are broken. The labor market has been devastated by the crisis and is deeply segmented, with productivity growth stalled.

Public administration is in urgent need of modernization, and public resources must be used more efficiently. Overwhelming obstacles block the formation of new companies. Competition in product markets is far too circumscribed. And inequality has reached outrageous levels, preventing society from uniting behind essential reforms. This consensus aside, agreement on a new development model for Greece requires overcoming two hurdles. First, we must concur on how to approach Greece’s fiscal consolidation. Second, we need a comprehensive, commonly agreed reform agenda that will underpin that consolidation path and inspire the confidence of Greek society. Beginning with fiscal consolidation, the issue at hand concerns the method.

The “troika” institutions have, over the years, relied on a process of backward induction: They set a date (say, the year 2020) and a target for the ratio of nominal debt to national income (say, 120%) that must be achieved before money markets are deemed ready to lend to Greece at reasonable rates. Then, under arbitrary assumptions regarding growth rates, inflation, privatization receipts, and so forth, they compute what primary surpluses are necessary in every year, working backward to the present. The result of this method, in our government’s opinion, is an “austerity trap.” When fiscal consolidation turns on a predetermined debt ratio to be achieved at a predetermined point in the future, the primary surpluses needed to hit those targets are such that the effect on the private sector undermines the assumed growth rates and thus derails the planned fiscal path.

Indeed, this is precisely why previous fiscal-consolidation plans for Greece missed their targets so spectacularly. Our government’s position is that backward induction should be ditched. Instead, we should map out a forward-looking plan based on reasonable assumptions about the primary surpluses consistent with the rates of output growth, net investment, and export expansion that can stabilize Greece’s economy and debt ratio. If this means that the debt-to-GDP ratio will be higher than 120% in 2020, we devise smart ways to rationalize, re-profile, or restructure the debt – keeping in mind the aim of maximizing the effective present value that will be returned to Greece’s creditors.

Greece already has. The ‘partners’ just haven’t accepted it.

• Greece Can Still Put Together Deal Before Money Runs Out: Eurozone (Guardian)

There is still time for Greece to stitch together a deal with Brussels before it runs out of money, according to eurozone finance ministers speaking privately at last week’s International Monetary Fund spring conference. And the betting must be that crisis-plagued Athens will eventually find a way to retain its membership of the eurozone with a messy compromise. But the odds are getting slimmer with every passing week. On Friday, finance minister Yanis Varoufakis meets his counterparts in the Latvian capital Riga in what many analysts believe is the penultimate gathering to work out a deal before Athens’s coffers run dry.

With only an outline sketch of an agreement on the table, many of Europe’s most senior policymakers are of the opinion that a crisis point will be reached and Athens’s radical left Syriza government will be forced to either capitulate to Brussels or quit the euro. Tsipras said on Thursday that a deal was close, contradicting an IMF statement that it had only just started to discuss a methodology for talks with the aim of slimming down the number of reforms required from double figures to nearer five. Until this week Varoufakis has worked to a longer timetable than the one set out by the eurogroup of finance ministers. While they want a deal tied down in May, Varoufakis has insisted he has until June.

That’s not just a ruse to buy more time. It is a more fundamental difference over what to discuss and what kind of agreement will stabilise Greek finances and provide the best long term solution for the currency union. As Varoufakis said last week: “Greece wants time … to persuade our partners, especially in northern Europe, that this government does not want to go back to the profligacy of recent years. And they need to persuade us that they do not want to impose a programme … that has failed.”

And it’s not, you can count on that.

• Varoufakis Tells Magazine: Grexit No Bluff If More Austerity Imposed (Reuters)

The risk that Greece would have to leave the euro if it has to accept more austerity is no bluff, Greek Finance Minister Yanis Varoufakis told a French magazine, saying that no one could predict what the consequences of such an exit would be. In a conversation with philosopher Jon Elster conducted at the end of March and published in France’s Philosophie Magazine, Varoufakis, a specialist in game theory, said this was not the time to bluff over Greece’s debt talks. “We cannot bluff anymore. When I say that we’ll end up leaving the euro, if we have to accept more unsustainable austerity, this is no bluff,” Varoufakis is quoted as saying.

Greek PM Alexis Tsipras called for a speeding up of work to conclude a reform-for-cash deal with euro zone creditors to keep his country afloat after talks with German Chancellor Angela Merkel on Thursday. The leftist Greek premier met the conservative German leader a day before euro zone finance ministers meet in Riga to review progress – or the lack of it – in slow-moving negotiations between Athens and its international lenders. The Greek government has insisted it will remain a euro zone member, and its currency bloc partners have said they want it to stay.

However, in contrast to the height of the debt crisis in 2012, when Grexit fears spurred panic selling of other weak euro zone sovereigns, investors now seem relaxed about the fate of Greece, which accounts for just 2% of the region’s economy. Asked what would happen if Greece was to leave the euro, Varoufakis mentioned comments made by European policymakers who say any contagion effect could be avoided and added that, on the contrary, he believed the consequences would be unpredictable. “Anyone who pretends they know what would happen the day we’ll be pushed over the cliff is talking nonsense and is working against Europe,” he said.

This is what Syriza is all about.

• Greek Bank Offers Up To €20,000 Relief To Poverty-Stricken Borrowers (Reuters)

Piraeus Bank will write off credit cards and retail loans up to €20,000 for Greeks who qualify for help under a law the leftist government passed to provide relief to poverty-stricken borrowers, it said on Thursday. Greece has received two EU/IMF bailouts totalling €240 billion since it was hit by a debt crisis. The austerity programme imposed as a condition of the rescue has left one in four people out of work, and thousands struggling to pay debts. The Syriza party was elected in January on a promise to end the belt-tightening. Its first legislative act was to pass a bill offering free food and electricity to thousands of struggling Greeks. Piraeus said it would also write off interest on mortgages for qualifying borrowers, but did not provide details on how many people might benefit.

He knows the answer in advance, but the motions need to be gotten through..

• Alexis Tsipras Seeks Interim Deal For Greece In Talks With Merkel (Guardian)

Greece’s increasingly desperate financial state was highlighted on Thursday when the country’s prime minister Alexis Tsipras urged the German chancellor Angela Merkel to use her influence to speed up deadlocked negotiations over a new aid package. Amid signs that the long-running talks between Athens and its creditors are having a dampening effect on the eurozone economy, Tsipras used a meeting with Merkel in Brussels to seek an interim deal by the end of the month that would provide money in return for a Greek commitment to reform. The conversation between Tsipras and Merkel came on the fifth anniversary of Greece’s first call for a financial bail out, and raised hopes in the financial markets that a deal could be done before the stricken eurozone country ran out of money to pay pensions, salaries and debts to the IMF.

Shares in Athens rose by 2.4% after falling to a three-year low on Wednesday while interest rates (the yield) on two-year Greek bonds fell from 27.6% to 25.5%. A Greek official said the meeting between Tsipras and Merkel took place in a “positive and constructive atmosphere” and expressed confidence that a deal was close. The official gave no details of the discussion but said: “During the meeting, the significant progress made since the Berlin meeting until today was noted. The prime minister asked that the procedures be speeded up so that the 20 Feb decision, which foresees a first interim agreement by the end of April, be implemented.”

An interim deal would give Greece some of the money it needs to meet its €2bn wages and pensions bill on 30 April, and to make two payments to the IMF totalling €970m in early May. But the mood among European Commission officials was less upbeat, with Brussels sources saying that the refusal of Athens to provide information meant little real progress had been made. It had been hoped that a meeting of finance ministers from the 18-strong eurozone would sign off a new package of help for Greece when it meets in Riga on Friday. That, though, has proved impossible, prompting speculation that Greece is moving closer to a debt default that could eventually lead to its departure from the eurozone.

It doesn’t get emptier than this: “Europe is declaring war on smugglers..”

• EU Leaders Show Plan To Thwart Mediterranean Migration Wave (CNBC)

European Union leaders Thursday pledged to step up efforts to try to stem a wave of deadly migration across treacherous Mediterranean waters that has claimed hundreds of lives in just the past week. But the plan to thwart the lucrative smuggling trade faces huge political and economic obstacles, as millions of refugees in war-torn and impoverished nations seek better lives in Europe. “There is such a mass of people who are disposed at any cost to leave and come with the prospect of jobs or liberty and a better future,” said Marianna Vintiadis, who heads the Italian office of Kroll Associates, a risk management consultancy. “They’re spending 15 to 20 times the price of a plane ticket to make the most atrocious journey of their lives.”

A draft of the plan obtained by The Associated Press includes a pledge by the 28-nation bloc to double its spending on search and rescue operations to save lives, as well as to seize and destroy vessels used for human smuggling before they leave shore. British Prime Minister David Cameron committed his country’s navy flagship, HMS Bulwark, along with three helicopters and two border patrol ships to the EU effort. Germany reportedly pledged to send a troop supply ship and two frigates to assist in the effort. Belgium and Ireland also offered to deploy navy ships. The stepped-up efforts to halt a lethal wave of northward migration come as search and rescue operations have brought hundreds of bodies ashore in a series of deadly shipwrecks carrying migrants seeking passage to Europe.

The immigrant wave is being driven by strong demand for passage from people fleeing civil unrest, persecution or chronic unemployment in their home countries. “Europe is declaring war on smugglers,” AP quoted the EU’s top migration official, Dimitris Avramopoulos, who was in Malta to attend the funeral of 24 migrants who perished at sea.Italy’s proximity to Africa has made it another favored smuggling route. Italian ships recently rescued some 10,000 migrants in a single week, according to the IOM, bringing the total number of migrants reaching Italian shores to more than 21,000 so far this year. In 2013, more than 26,000 migrants arrived through April 30, the IOM said, citing the Italian Ministry of Interior figures.

Though northern African ports are popular transit points, millions of refugees are making their way from trouble spots across the continent, according to data collected by the United Nations High Commissioner for Refugees. Many more are displaced in their home country, unable to flee or seek asylum abroad.

If you’re big, you get a BIG stagnation. And then you die.

• France Declared “Lost In Stagnation” (Telegraph)

The French economy remained a blot on the eurozone’s economic landscape in April, as leading surveys of the private sector showed the country lagging the pack. Closely-followed indicators for France revealed that the country’s private sector growth slowed this month. The all-sector purchasing managers’ index (PMI) slipped from March’s 51.5 to 50.2, according to preliminary estimates compiled by Markit. Any number above 50 would imply that the private side of the economy was growing, a threshold the French index narrowly managed to remain above. While the currency bloc’s other large economies enjoyed stronger scores, analysts at French banks declared that the country was still limp. Frederik Ducrozet, an economist at Crédit Agricole, said that France was “still lost in stagnation”. Ken Wattret, of BNP Paribas, said that the reading “looks very disappointing”.

Both the manufacturing and services components of the French PMI fell in April, to 48.4 and 50.8 respectively, as the country’s industrial sector continues to shrink. Jack Kennedy, an economist at Markit, said: “Output growth stuttered almost to a halt in April, signalling a continuation of the moribund economic environment.” The data came as Benoit Coeure, a European Central Bank (ECB) board member, said that: “The eurozone recovery is clearly there.” The PMI for the entire eurozone came in at 53.5 in April, 0.5 points weaker than March’s reading. The euro stumbled against the dollar, dropping by 0.4pc as the euro’s nascent revival appeared slightly weaker. Mr Coeure said that “growth is coming back” but that at present the recovery has been “insufficient and somewhat unequally spread from country to country”.

Jessica Hinds, an economist at Capital Economics, said that the fall “suggests that fears over Greece might already be starting to dampen growth in the region”. She added: “The PMI for the region as a whole suggests that the region’s economic recovery failed to gain momentum at the start of the second quarter.” Chris Williamson, Markit’s chief economist, said: “The weaker rate of expansion is a big disappointment, given widespread expectations that the European Central Bank’s QE will have boosted the fledgling recovery seen at the start of the year.” However, he cautioned that it was too early to say that euro area growth was faltering again. “The slowdown in April was in fact therefore a symptom of weaker expansions in both Germany and France,” he said.

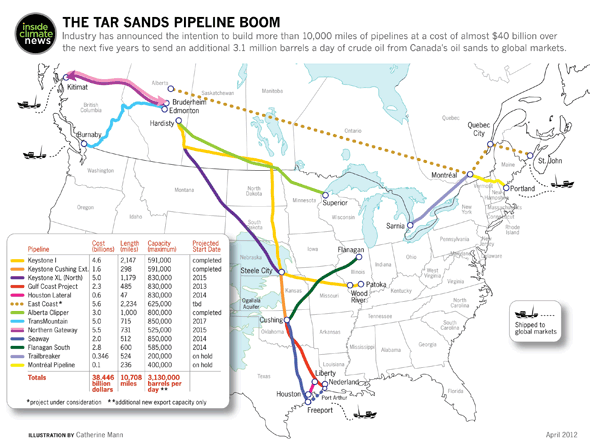

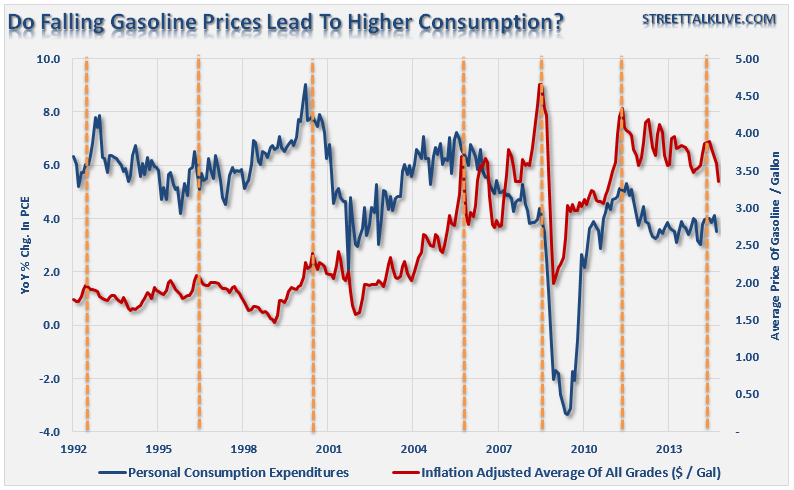

“The freight train of North American tight oil has just kept on coming. This is a classic price discovery exercise..”

• Oil Slump May Deepen As US Shale Fights OPEC To A Standstill (AEP)

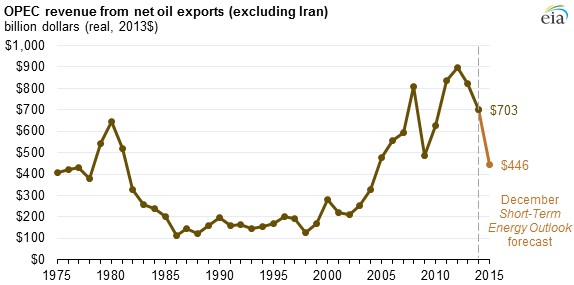

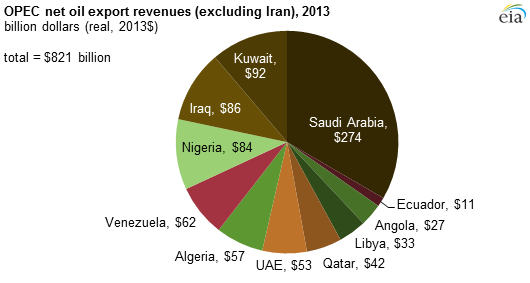

The US shale industry has failed to crack as expected. North Sea oil drillers and high-cost producers off the coast of Africa are in dire straits, but America’s “flexi-frackers” remain largely unruffled. One starts to glimpse the extraordinary possibility that the US oil industry could be the last one standing in a long and bitter price war for global market share, or may at least emerge as an energy superpower with greater political staying-power than OPEC. It is 10 months since the global crude market buckled, turning into a full-blown rout in November when Saudi Arabia abandoned its role as the oil world’s “Federal Reserve” and opted instead to drive out competitors. If the purpose was to choke the US “tight oil” industry before it becomes an existential threat – and to choke solar power in the process – it risks going badly awry, though perhaps they had no choice.

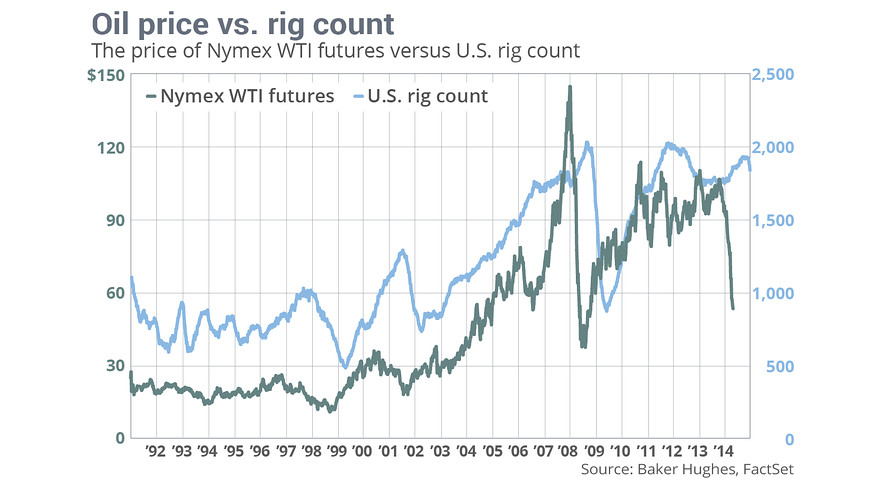

“There was a strong expectation that the US system would crash. It hasn’t,” said Atul Arya, from IHS. “The freight train of North American tight oil has just kept on coming. This is a classic price discovery exercise,” said Rex Tillerson, head of Exxon Mobil, the big brother of the Western oil industry. Mr Tillerson said shale producers are more agile than critics expected, which means that the price war will go on. “This is going to last for a while,” he said, warning that any rallies are likely to prove false dawns. The US “rig count” – suddenly the most-watched indicator in global energy – has fallen from 1,608 in October to 747 last week. Yet output has to continued to rise, stabilizing only over the past five weeks.

Mr Tillerson said this is more or less what happened in the sister market for US shale gas. In 2009, some 1,200 rigs produced 5.5bn cubic feet (bcf) of gas per day at a market price near $8. Today the price is just $2.50. Nobody would have believed back then that the industry would continue boosting supply to 7.3 bcf, and be able to do so with just 280 rigs. “Will we see the same phenomenon in five years in tight oil? I don’t know, but this is a very resilient industry. I think people will be surprised,” Mr Tillerson said, speaking at the IHS CERAWeek forum in Houston. “We’ve really only begun to scratch the surface. Shale can keep growing by 500,000 to 700,000 b/d easily,” said Harold Hamm, founder of Continental Resources. His company has cut costs by 20pc to 25pc over the past four months.

Man will kill itself while looking for better man.

• Chinese Scientists Edit Genes of Human Embryos (NY Times)

The experiment with human embryos was dreaded, yet widely anticipated. Scientists somewhere, researchers said, were trying to edit genes with a technique that would permanently alter the DNA of every cell so that any changes would be passed on from generation to generation. Those concerns drove leading researchers to issue urgent calls in major scientific journals last month to halt such work on human embryos, at least until it could be proved safe and until society decided if it was ethical. Now, scientists in China report that they tried it. The experiment failed, in precisely the ways that had been feared.

The Chinese researchers did not plan to produce a baby — they used defective human embryos — but did hope to end up with an embryo with a precisely altered gene in every cell but no other inadvertent DNA damage. None of the 85 human embryos they injected fulfilled those criteria. In almost every case, either the embryo died or the gene was not altered. Even the four embryos in which the targeted gene was edited had problems. Some of the embryo cells overrode the editing, resulting in embryos that were genetic mosaics. And speckled over their DNA was a sort of collateral damage – DNA mutations caused by the editing attempt.

“Their study should give pause to any practitioner who thinks the technology is ready for testing to eradicate disease genes during I.V.F.,” said Dr. George Q. Daley, a stem cell researcher at Harvard, referring to in vitro fertilization. “This is an unsafe procedure and should not be practiced at this time, and perhaps never.” David Baltimore, a Nobel laureate molecular biologist and former president of the California Institute of Technology, said, “It shows how immature the science is,” adding, “We have learned a lot from their attempts, mainly about what can go wrong.”

Which individual manager paid what though? If they didn’t pay a dime, how are they not going to do the same thing all over again?!

• Deutsche Bank Hit By Record $2.5 Billion Libor-Rigging Fine (Guardian)

Germany’s Deutsche Bank has been fined a record $2.5bn for rigging Libor, ordered to fire seven employees and accused of being obstructive towards regulators in their investigations into the global manipulation of the benchmark rate. The penalties on Germany’s largest bank also involve a guilty plea to the Department of Justice (DoJ) in the US and a deferred prosecution agreement. The regulators released a cache of emails, electronic messages and phone calls showing the attempts to move the rate used to price £3.5tn of financial contracts. “I’m begging u pleassssseeeee I’m on my knees” is among the examples provided by regulators in hundreds of pages of detail accompanying the fine – the eighth related to rigging interest rates.

Another trader, on learning a rate was unchanged, sent a message saying: “Oh bullshit…..strap on a pair and jack up the 3M (month). Hahahahaha.” . Georgina Philippou, the acting director of enforcement and market oversight at the Financial Conduct Authority, said the UK’s portion of the fine – £227m – was a record for Libor because the bank had been misleading the regulator. The manipulation took place to generate profits and was pervasive, the FCA said. “This case stands out for the seriousness and duration of the breaches by Deutsche Bank – something reflected in the size of today’s fine. One division at Deutsche Bank had a culture of generating profits without proper regard to the integrity of the market. This wasn’t limited to a few individuals but, on certain desks, it appeared deeply ingrained,” she said.

“Deutsche Bank’s failings were compounded by them repeatedly misleading us. The bank took far too long to produce vital documents and it moved far too slowly to fix relevant systems and controls,” said Philippou. The German bank had said on Wednesday that it would still remain profitable in the first quarter when it reports results next week before a major restructuring that could involve the bank pulling back from the high street. For the first time in a Libor-rigging settlement, New York state’s Department of Financial Services (NYDFS) was involved and it ordered the bank to sack seven employees – one managing director, four directors and one vice-president, all based in London, together with one Frankfurt-based vice-president. The bank immediately took action to comply with this demand.

It somehow seems fitting: “100,000 years of life lost due to premature death”. “First, the government closed the services,” wrote Tammy Solonec of Amnesty International, “It closed the shop, so people could not buy food and essentials. It closed the clinic, so the sick and the elderly had to move, and the school, so families with children had to leave, or face having their children taken away from them. The police station was the last service to close, then eventually the electricity and water were turned off. ”

• The Secret Country Again Wages War On Its Own People (John Pilger)

Australia has again declared war on Indigenous people, reminiscent of the brutality that brought global condemnation on apartheid South Africa. Aboriginal people are to be driven from homelands where their communities have lived for thousands of years. In Western Australia, where mining companies make billion dollar profits exploiting Aboriginal land, the state government says it can no longer afford to “support” the homelands. Vulnerable populations, already denied the basic services most Australians take for granted, are on notice of dispossession without consultation, and eviction at gunpoint. Yet again, Aboriginal leaders have warned of “a new generation of displaced people” and “cultural genocide”.

Genocide is a word Australians hate to hear. Genocide happens in other countries, not the “lucky” society that per capita is the second richest on earth. When “act of genocide” was used in the 1997 landmark report Bringing Them Home, which revealed that thousands of Indigenous children had been stolen from their communities by white institutions and systematically abused, a campaign of denial was launched by a far-right clique around the then prime minister John Howard. It included those who called themselves the Galatians Group, then Quadrant, then the Bennelong Society; the Murdoch press was their voice. The Stolen Generation was exaggerated, they said, if it had happened at all. Colonial Australia was a benign place; there were no massacres.

The First Australians were victims of their own cultural inferiority, or they were noble savages. Suitable euphemisms were deployed. The government of the current prime minister, Tony Abbott, a conservative zealot, has revived this assault on a people who represent Australia’s singular uniqueness. Soon after coming to office, Abbott’s government cut $534 million in indigenous social programmes, including $160 million from the indigenous health budget and $13.4 million from indigenous legal aid. In the 2014 report Overcoming Indigenous Disadvantage Key Indicators, the devastation is clear. The number of Aboriginal people hospitalised for self-harm has leapt, as have suicides among those as young as eleven.

The indicators show a people impoverished, traumatised and abandoned. Read the classic expose of apartheid South Africa, The Discarded People by Cosmas Desmond, who told me he could write a similar account of Australia. Having insulted indigenous Australians by declaring (at a G20 breakfast for David Cameron) that there was “nothing but bush” before the white man, Abbott announced that his government would no longer honour the longstanding commitment to Aboriginal homelands. He sneered, “It’s not the job of the taxpayers to subsidise lifestyle choices.”

“One just needs to look at the nations involved in pushing against Gazprom’s supposedly monopolistic practices: Lithuania, Estonia, Bulgaria, Czech Republic, Hungary, Latvia, Slovakia and Poland.”

• The EU-Gazprom War (Pepe Escobar)

The European Commission is slapping anti-trust charges against Russia’s Gazprom under the pretext the energy giant is blocking competition in Central and Eastern Europe. This is yet another graphic example of the extreme politicization involving what should have been Europe’s energy policy. There is no such policy – even after virtually a decade of “discussions” inside that glassy Kafkaesque Brussels nightmare, the Berlaymont. The EC investigation started in September 2012. Why did it take the Berlaymont bureaucrats so long to reach an initial verdict? Simple; it’s always been about politics – not energy. One just needs to look at the nations involved in pushing against Gazprom’s supposedly monopolistic practices: Lithuania, Estonia, Bulgaria, Czech Republic, Hungary, Latvia, Slovakia and Poland.

With the exception of Hungary, all these are, or have been forced to act, anti-Russian. The argument that Gazprom is “dominant” and prevents competition is bogus; there’s no competition because there are no other viable energy sources for the European market. The Europeans should blame the US instead, for keeping a nasty package of sanctions on Iran for so long. But of course EU Competition Commissioner Margrethe Vestager would never do that. If Gazprom is finally ruled guilty, fines may be as steep as 10% of overall sales to Europe – which were the ruble equivalent of €93 billion ($100 billion) in 2013, according to the latest data. Vestager has been busy lately. She already formally charged Google with abusing its also “dominant” position. Yet another case of no European company able to compete with Google.

It will be fascinating to watch the reaction in US business circles. Bets can be made on plenty of outrage in the Google case contrasting with plenty of rejoicing in the Gazprom case. Gazprom supplies roughly a third of the EU’s gas; half of the gas transits Ukraine. As even a low-level IMF clerk knows, Kiev is not exactly keen on paying its gas bills. So Gazprom had to go to great lengths to try to get the fees due – even suspending the gas flow on occasion as Kiev would be rerouting gas meant for the EU for its own internal needs. Anyway failed state Ukraine, for Gazprom, is finished as a transit route. Gazprom CEO Aleksey Miller has already announced that will end by 2019. By then, all the action will be around Turkish Stream.

“..the Americans’ secretiveness also comes in handy for Berlin. Not knowing anything officially prevents the government from having to take any action.”

• A War Waged From German Soil: US Ramstein Base Key in Drone Attacks (Spiegel)

Knowledge is power. Ignorance often means impotence. But sometimes ignorance can be comfortable, if it protects from entanglements, conflicts and trouble. This even applies to the German chancellor. In the heart of Germany’s Palatinate region — just a few kilometers from the city of Kaiserslautern — the United States maintains its largest military base on foreign soil. The base is best known as a hub for American troops making their way to the Middle East But another strategic task of the headquarters of the United States Air Force in Europe (USAFE) remained a national secret for years. Even the German government claimed to know nothing when, two years ago, the base became the subject of suspicion.

It was alleged that Ramstein is also an important center in President Barack Obama’s drone war against Islamist terror. A former pilot claimed that the data for all drone deployments is routed through the military base. The report caused quite a stir. Were the deadly precision weapons – which can eliminate al-Qaida terrorists, Taliban fighters or members of the Shabaab militia on the Horn of Africa with apparent clinical precision – guided toward their targets via German soil? No, the German government said at the time, that’s not quite correct. But even today, the government says it still has “no reliable information” about what exactly is going on. The United States has refused to provide it.

But the Americans’ secretiveness also comes in handy for Berlin. Not knowing anything officially prevents the government from having to take any action. Berlin’s comfortable position, though, could soon be a thing of the past. Classified documents that have been viewed by SPIEGEL and The Intercept provide the most detailed blueprint seen to date of the architecture of Obama’s “war on terror.” The documents, which originate from US intelligence sources and are classified as “top secret,” date from July 2012. A diagram shows how the US government structures the deployment of drones. Other documents provide significant insight into how operations in places like Somalia, Afghanistan, Pakistan or Yemen are carried out. And they show that a central – and controversial – element of this warfare is played out in Germany.

Blow baby blow! What other way are they ever going to wake up?!

• Giant New Magma Reservoir Found Beneath Yellowstone (Smithsonian)

Enough hot rock sits beneath Yellowstone National Park to fill the Grand Canyon nearly 14 times over, according to our best view yet of the supervolcano that lies below the famous landscape. The first three-dimensional image of the inner workings of the Yellowstone supervolcano has revealed an 11,200-cubic-mile magma reservoir about 28 miles below the surface. A previously known 2,500-cubic-mile magma chamber sits above that, at about 12 miles deep. Both serve as conduits between a hotspot plume that may originate in the Earth’s core and the Yellowstone caldera at the planet’s surface.

“Every additional thing we learn about the Yellowstone volcanic system is one more piece in the puzzle, and that gets us closer to really understanding how the volcanic system works,” says study co-author Fan-Chi Lin of the University of Utah. “If we could better understand the transport properties of magmatic fluids, we could get a better understanding of the timing and, therefore, where we are in the volcanic cycle.” The Yellowstone hotspot plume has been producing eruptions for the last 17 million years.

Due to plate tectonics, Earth’s surface has moved over the hotspot, creating a track of ancient eruptions that stretches from the Oregon-Idaho-Nevada border—the site of the first eruption—to the Yellowstone caldera. Since the hotspot reached Yellowstone some 2 million years ago, the supervolcano has erupted three times, most recently about 640,000 years ago. The hotspot currently feeds the geysers, hot springs and steam vents that are part of the draw of Yellowstone National Park. The chance that the supervolcano will erupt anytime soon is low—only about 1 in 700,000 annually. But should there be another eruption, the supervolcano could spew some 640 cubic miles of debris, covering large swathes of North America in ash and darkening skies for days.