Russell Lee Secondhand store in Council Bluffs, Iowa Dec 1936

Tall building syndrome?!

• Age of Plenty Seen Over for Gulf Arabs as Oil Tumbles (Bloomberg)

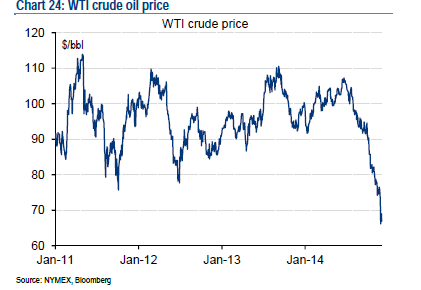

The boom that adorned Gulf Arab monarchies with glittering towers, swelled their sovereign funds and kept unrest largely at bay may be over after oil prices dropped by almost 50% in the last six months. The sheikhdoms have used the oil wealth to remake their region. Landmarks include man-made islands on reclaimed land, as well as financial centers, airports and ports that turned the Arabian desert into a banking and travel hub. The money was also deployed to ward off social unrest that spread through the Middle East during the Arab Spring. “The region has had 10 years of abundance,” said Simon Williams, HSBC chief economist for central and eastern Europe, the Middle East and North Africa. “But that decade of plenty is done. The drop in oil prices will hurt performance in the near term, even if the Gulf’s buffers are powerful enough to ensure there’s no crisis.”

Brent crude, which has averaged $102 a barrel since the end of 2009, plunged to about $60 by the end of last week. The slump accelerated after the Organization of Petroleum Exporting Countries, whose top producer is Saudi Arabia, decided in November to keep output unchanged. At $65 a barrel, the six nations of the Gulf Cooperation Council, which hold about a third of the world’s crude reserves, would run a combined budget deficit of about 6% of gross domestic product, according to Arqaam Capital, a Dubai-based investment bank. Cheaper oil “will force a reassessment of the ambitious infrastructure investment program” in the region, Qatar National Bank said in a report. One exception is likely to be Qatar, which is spending on infrastructure to host the 2022 soccer World Cup final, QNB said. The oil-price drop has already prompted economists to cut next year’s growth estimates for Saudi Arabia, the United Arab Emirates and Kuwait, according to data compiled by Bloomberg.

Complex political games.

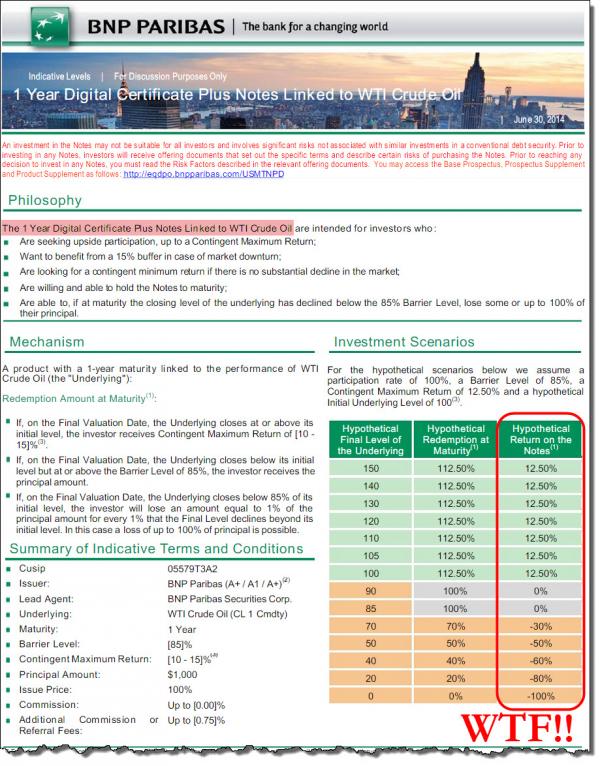

• Ready for $20 Oil? (A. Gary Shilling)

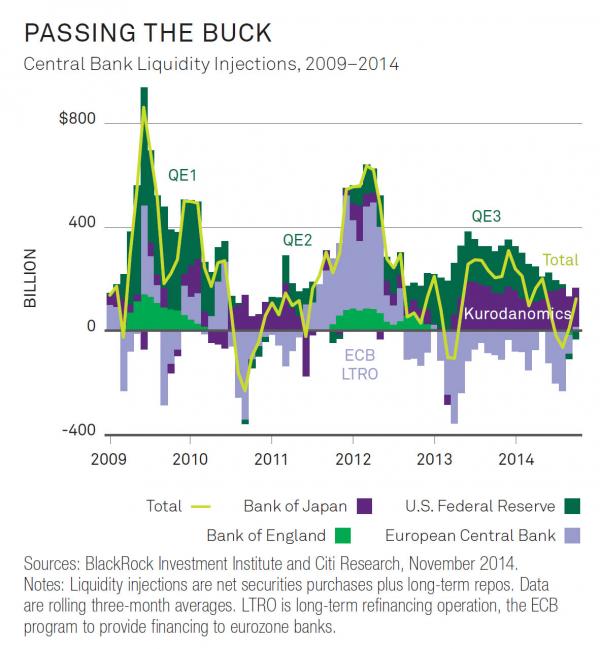

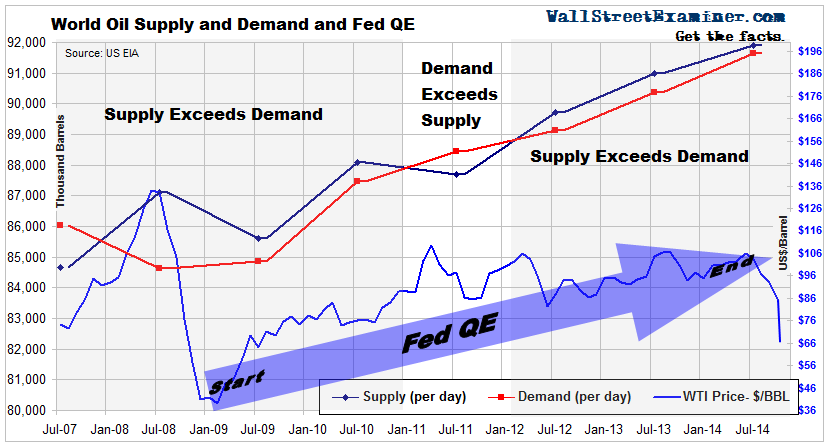

When the U.S. Federal Reserve ended its quantitative-easing program in October, it also ended the primary driver of U.S. stocks during the past six years. So long as the central bank kept flooding the markets with money, investors had little reason to worry about a broader economy limping along at 2% real growth. Now investors face more volatile markets and securities that no longer move in lock-step. At the same time, investors must cope with slower growth in China, minuscule growth in the euro area and negative growth in Japan. Such widespread sluggish demand – along with ample supplies of oil and most everything else – is the reason commodity prices are falling. They have been since early 2011, but many people failed to notice until recently, when crude oil prices nosedived.

Normally, less demand and a supply glut would lead OPEC, beginning with Saudi Arabia, to cut production. As the de facto cartel leader, the Saudis would often reduce output to prevent supply increases from driving down prices. Of course, this also cost the Saudis market share and encouraged cheating by OPEC members. Saudi leaders must grind their teeth over the last decade’s unchanged demand for OPEC oil, while all the global growth has been among non-OPEC suppliers, principally in North America. That may explain why, while Americans were enjoying their Thanksgiving turkeys, OPEC surprised the world. Pressed by the Saudis and other rich Persian Gulf producers, it refused to cut output despite a 38% drop in the price of Brent crude, the global benchmark, since June.

OPEC, in effect, is challenging other producers to a game of chicken. Sure, the wealthier producers need almost $100 a barrel to finance bloated budgets. But they also have huge cash reserves, which they figure will outlast the cheaters and the U.S. shale-oil producers when prices are low. The Saudis also seized the opportunity to damage their opponents, especially Iran and what they see as Iran-dominated Iraq, in the Syria conflict. They also want to help allies Egypt and Pakistan reduce expensive energy subsidies as prices fall.

“.. the four states where oil is more important to the local economy than Texas have a combined GSP that is only 16% of the Texas GSP.”

• Houston Suddenly Has A Very Big Problem (Feroli via ZH)

The well-known energy renaissance in the US has occurred in both the oil and natural gas sectors. Some states that are huge natural gas producers have limited oil production: Pennsylvania is the second largest gas producing state but 19th largest oil producer. The converse is also true: North Dakota is the second largest crude producer but 14th largest gas producer. However, most of the economic data as it relates to the energy sector, employment, GDP, etc, often lump together the oil and gas extraction industries. Yet oil prices have collapsed while natural gas prices have held fairly steady. To understand who is vulnerable to the decline in oil prices specifically we turn to the EIA’s state-level crude oil production data.

The first point, mentioned at the outset, is that Texas, already a giant, has become a behemoth crude producer in the past few years, and now accounts for over 40% of US production. However, there are a few states for which oil is a relatively larger sector (as measured by crude production relative to Gross State Product): North Dakota, Alaska, Wyoming, and New Mexico. For two other states, Oklahoma and Montana, crude production is important, though somewhat less so than for Texas. Note, however, that these are all pretty small states: the four states where oil is more important to the local economy than Texas have a combined GSP that is only 16% of the Texas GSP. Finally, there is one large oil producer, California, which is dwarfed by such a huge economy that its oil intensity is actually below the national average, and we would expect it, like the country as a whole, to benefit from lower oil prices.

As discussed above, Texas is unique in the country as a huge economy and a huge oil producer. When thinking about the challenges facing the Texas economy in 2015 it may be useful, as a starting point, to begin with the oil price collapse of 1986. Then, like now, crude oil prices collapsed around 50% in the space of a few short months. As noted in the introduction, the labor market response was severe and swift, with the Texas unemployment rate rising 2.0%-points in the first three months of 1986 alone. Following the hit to the labor market, the real estate market suffered a longer, slower, burn, and by the end of 1988 Texas house prices were down over 14% from their peak in early 1986 (over the same period national house prices were up just over 14%). The last act of this tragedy was a banking crisis, as several hundred Texas banks failed, with peak failures occurring in 1988 and 1989.

Chances they’ll do anything shrink by the day.

• Saudis Insist Oil Supply Cuts Are Not Needed (Independent)

Gulf states yesterday insisted that oil prices will recover without intervention from the OPEC cartel, arguing that current prices will boost global economic growth. Crude oil prices have plummeted as global demand has eased and new supplies such as US shale oil have come on to the market. The cost of benchmark Brent crude has nearly halved from $115 a barrel in June to below $60 last week. But although oil producers and explorers from Aberdeen to Alberta are struggling to operate at a profit, OPEC has refused to cut supply in order to lift prices. Ali al-Naimi, the Saudi oil minister, yesterday said he was “100% not pleased” with current prices, but insisted: “I am confident the oil market will improve.” He added: “Current prices do not encourage investment, but they stimulate global economic growth, leading ultimately to an increase in global demand and a slowdown in the growth of supplies.”

Saudi Arabia, OPEC (and the world’s) largest oil exporter, has been the “swing supplier” in the past, cutting or increasing production in order to stabilise global oil prices at around $100 a barrel. The Gulf state blames the current price slump on speculators and a lack of co-operation from producers outside OPEC, and Mr Naimi said the kingdom would not act this time. “If they [non-OPEC oil producers] want to cut production they are welcome,” he told reporters on the sidelines of the 10th Arab Energy Conference in the United Arab Emirates. “Certainly Saudi Arabia is not going to cut.” Attempts to get non-OPEC producers such as Russia to sign up to output reductions before last month’s meeting of the oil cartel failed. “I don’t think we [OPEC] need to cut,” Kuwait’s oil minister told Reuters yesterday. “We gave a chance to others, they were not willing to do so.”

“It’s been a really volatile period, and frankly that’s how Saudi Arabia wants it,” [..] “This is a battle of endurance.”

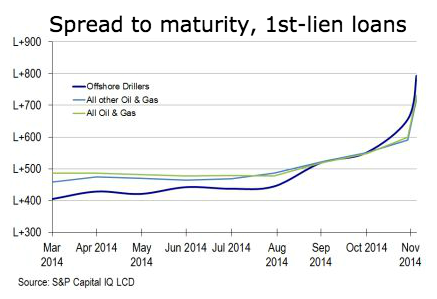

• Oil Crash Wipes $11.7 Billion From Buyout Firms’ Holdings (Bloomberg)

Oil’s plunge makes energy a great investment for the coming years, according to Blackstone’s Stephen Schwarzman and Carlyle’s David Rubenstein. For private equity firms, it’s also been painful. More than a dozen firms – including Apollo Global , Carlyle, Warburg Pincus and Blackstone – have lost a combined $11.7 billion in 27 publicly traded oil producers since June, when crude prices reached this year’s peak before beginning their six-month slide, according to data compiled by Bloomberg. Stocks of buyout firms with exposure to energy have slumped, and bond prices suggest some closely held oil producers may struggle to pay for their debt. “It’s been a really volatile period, and frankly that’s how Saudi Arabia wants it,” said Francisco Blanch, head of global commodity research at Bank of America. “This is a battle of endurance.”

Brent crude oil slumped 47% to about $61 late last week from its high this year of $115 a barrel, dragging down energy stocks, as the Organization of Petroleum Exporting Countries sought to defend market share amid a U.S. shale expansion that’s adding to a global glut. The group, responsible for 40% of the world’s supply, will refrain from curbing output, U.A.E. Energy Minister Suhail al-Mazrouei said on Dec. 14. Kosmos Energy, Antero Resources, EP Energy, Laredo Petroleum and SandRidge Energy, each of which is backed by a buyout firm as its largest shareholder, fell by an average of 50% in U.S. trading from oil’s peak through Dec. 19 in New York. Warburg Pincus is the top stakeholder in Kosmos, Antero and Laredo; Apollo is the largest investor in EP Energy; and Carlyle, with a partner, owns the biggest piece of SandRidge, according to data compiled by Bloomberg.

Apollo has $5 billion invested in energy debt and equity, including companies that are closely held. Carlyle has directed 10% of its $203 billion in assets into the industry. Blackstone, the second-biggest shareholder in Kosmos, has backed drilling projects off Ghana’s coast and in the Gulf of Mexico. The deals highlight private equity’s role in the debt-fueled shale push, as hydraulic fracturing in search of oil and gas leads to higher production. After investing billions of dollars, the firms are preparing to step in with more cash to fund development when prices stabilize.

More consequences.

• North Sea Oil Summit Announced By Aberdeen City Council (BBC)

A plan for a summit to look at the challenges facing the North Sea oil industry has been announced by Aberdeen City Council. Council leader Jenny Laing said the UK and Scottish governments, trade unions and industry bodies needed “to get round the table as soon as possible”. The Labour councillor said a “strategic plan” was required to save jobs as the price of oil continued to fall. Labour called on Nicola Sturgeon and David Cameron to attend the summit. It comes after a warning that the UK’s oil industry is in “crisis”. On Thursday, Robin Allan, chairman of the independent explorers’ association Brindex, told the BBC that the industry was “close to collapse”. He claimed almost no new projects in the North Sea were profitable with oil below $60 a barrel. However, Sir Ian Wood, another leading industry figure, said Mr Allan’s warning was “well over-the-top and far too dramatic”. Sir Ian predicted conditions would begin to recover next year.

Ms Laing said Aberdeen was the oil capital of Europe and as such it was her job, as leader of the city council, to work with the governments in Edinburgh and Westminster and the oil industry to ensure jobs in the city were protected and companies remained based there. She said: “I have today instructed Angela Scott, our chief executive, to arrange a summit between senior politicians, government officials, industry representatives, trade unions, and local politicians. “The aim will be to ensure an agreement to develop a strategic plan to ensure job losses are either avoided or kept to a minimum. “It must concern us all that the price of oil has dropped so heavily in such a short space of time and we need to agree a strategy to deal with fluctuations that undermine confidence in the North Sea.” Ms Laing said the council chief executive would write to various politicians within both the UK and Scottish governments, as well as UK Oil and Gas, other industry leaders and trade unions to encourage them to take part in the summit.

Dangerous development.

• Southwest’s Oil Swap Trade Waiver Raises CFTC Questions (Reuters)

Last month’s move by the U.S. commodities regulator to let Southwest Airlines Co keep its multibillion-dollar oil trades secret for 15 days offered the world’s biggest low-cost carrier a break it has been seeking for three years. However, the decision to grant the airline an exemption from rules calling for greater derivatives transparency raised concerns about its market impact and sparked a debate among regulators, according to people familiar with the approval process. All other swap trades except Southwest’s must be reported “as soon as technologically practicable.” The Dallas-based airline has argued that its deals are so specific that immediate disclosure could cause the market to move against it, adding tens of millions of dollars to its costs. For years, that argument was not enough to sway the Commodity Futures Trading Commission and its former chairman, Gary Gensler. One concern was that granting an exemption to just one company is unusual and could hurt others in a similar position.

Also, the waiver could set a precedent that would encourage others to seek similar special treatment, restoring a veil over bigger parts of derivative markets. The agency is already looking into problems the Mexican government is facing in its vast oil hedging program after news organizations, including Reuters, reported on the country’s trades using publicly available swaps trading data, said one person familiar with the agency’s procedures. A CFTC spokesman said Tim Massad, Gensler’s successor, had issued the waiver to Southwest after his staff had done proper analysis to confirm the company’s claims, and the relief was a lot narrower than what the company had originally requested. But the person familiar with the approval process said the decision caused “a big stink” within the agency.

Still happy?

• US Gas Prices Fall To Lowest Since May 2009 (Reuters)

The average price of a gallon of gasoline in the United States fell 25 cents in the past two weeks, tumbling to its lowest level in more than five-and-a-half years, according to the Lundberg survey released Sunday. Prices for regular-grade gasoline fell to $2.47 a gallon in the survey dated Dec. 19, down 25 cents since the previous survey on Dec. 5. The recent drop has taken prices down more than $1.25 a gallon since a recent peak in May of this year.

“This is mostly driven by crude oil prices, and absent a sudden spike we very well may see a drop of a few pennies more,” said the survey’s publisher, Trilby Lundberg. “That said, demand is up at these low prices.” U.S. crude futures have been sharply weaker of late, dropping for four straight weeks, as well as in 11 of the past 12 weeks. Crude prices fell 14.2% over the past two weeks, though they rose 5.1% on Friday, settling at $57.13 per barrel. The highest price within the survey area in 48 U.S. states was recorded in Long Island at $2.82 per gallon, with the lowest in Tulsa, at $2.06 per gallon.

Wonder if Russia stress tests its companies.

• Rosneft Repays $7 Billion and Says Has No Need to Buy Dollars (Bloomberg)

Rosneft repaid $7 billion in debt and said it is generating enough dollars to meet the obligations taken on to buy TNK-BP last year and become the world’s largest traded oil producer. The state-led company, hit by sanctions from the U.S. and EU limiting access to capital markets, said it has settled $24 billion this year in line with credit agreements. Rosneft has sufficient foreign currency to cover debt, Chief Executive Officer Igor Sechin said in a statement. “To service debt the company does not need to enter the currency market, because it generates enough foreign currency earnings,” Sechin said. The latest repayment doesn’t mean the end of financial pressure on Rosneft however.

The oil producer has to grapple with the slump in oil prices, sanctions that bar it from international capital markets and a Russian economy at risk of sliding into recession. Rosneft is scheduled to repay another bridge loan of $7.1 billion on Feb. 13, the first part of $19 billion in debt repayments scheduled for next year, according to data compiled by Bloomberg. Sechin, who denied speculation last week the company had been selling rubles to buy dollars, said today that the company may get state support from Russia’s state Wellbeing Fund. The money would be used to develop oil projects at home, he said.

“For the sake of national interests, China should deepen cooperation with Russia when such cooperation is in need.”

• China Offers Russia Help With Currency Swap Suggestion (Bloomberg)

Two Chinese ministers offered support for Russia as President Vladimir Putin seeks to shore up support for the ruble without depleting foreign-exchange reserves. China will provide help if needed and is confident Russia can overcome its economic difficulties, Foreign Minister Wang Yi was cited as saying in Bangkok in a Dec. 20 report by Hong Kong-based Phoenix TV. Commerce Minister Gao Hucheng said expanding a currency swap between the two nations and making increased use of yuan for bilateral trade would have the greatest impact in aiding Russia, according to the broadcaster. The ruble strengthened 4.1% against the dollar today amid the signs of willingness by China, the world’s second-largest economy, to prop up its neighbor.

Russia, the biggest energy exporter, saw its currency tumble as much as 59% this year as crude oil prices slumped and U.S. and European sanctions hurt the economy. President Xi Jinping last month called for China to adopt “big-country diplomacy” as he laid out goals for elevating his nation’s status. “Many Chinese people still view Russia as the big brother, and the two countries are strategically important to each other,” said Jin Canrong, Associate Dean of the School of International Studies at Renmin University in Beijing, referring to the Soviet Union’s backing of Communist China in its first years. “For the sake of national interests, China should deepen cooperation with Russia when such cooperation is in need.”

Still corrupt to the bone.

• China Investigates Possible Stock-Price Manipulation (WSJ)

China is investigating possible stock-price manipulation amid the recent run-up in the country’s equity market, according to officials with direct knowledge of the matter, a move that serves as a stark reminder of the problems that have long haunted Chinese stocks. The probe launched by the China Securities Regulatory Commission comes as stocks traded in mainland China rallied to their highest level in three years on Monday despite the country’s weakening economic growth. Much of the surge, analysts and officials say, has been triggered by short-term speculators betting on looser monetary conditions as opposed to investors with long-term belief in China’s economy. The securities commission is focusing its investigation on a practice that involves groups of investors pumping up prices of certain targeted stocks. Such practices were common during the early and mid-2000s when China’s stock market boomed along with the country’s breathtaking economic growth.

The market peaked in 2007 and started to plummet a year later as the global financial crisis weighed on China’s growth. The practice, which was common in China’s previous market boom, “is making a comeback,” one of the officials said. The securities agency said on Friday that it had launched investigations into 18 stocks, but didn’t explain the reasons for the probe at the time. Most of the stocks targeted are those of small-cap companies, such as a maker of automobile tires in eastern China’s Shandong province and a government-controlled hydroelectric power company in central China’s Hunan province. Shares in larger companies are harder to manipulate because the volumes are bigger. The probes mainly focus on the “individuals and institutions” who recently bought into the stocks, and the companies themselves aren’t the target, the officials said.

“.. early trade volumes in the program launched in mid-November were completely dominated by hedge funds and banks’ proprietary trading desks ..”

• China Stock Connect Scheme Scorecard Throws Up Surprises (Reuters)

A month after China opened up its equity markets in a landmark trading link with Hong Kong, demand has been subdued and the bulk of activity has come from short-term speculative investors. The authorities had hoped mutual and pension funds and private banks would form the bedrock of the Shanghai-Hong Kong stock connect. But early trade volumes in the program launched in mid-November were completely dominated by hedge funds and banks’ proprietary trading desks, according to five traders at some of the biggest brokerages participating in the scheme. Regulatory hurdles have kept out a large swathe of the investment community – and the steady business the financial industry and regulators had hoped they would bring – despite a sizzling stock market rally on the mainland.

Market players say it could take months for long-term investors to eventually trickle into the program, as they devise ways to cope with its peculiarities. “We are not participating in the scheme yet because of the operational issues that have yet to be resolved and we prefer to access the mainland markets via exchange traded funds,” Robert Cormie, Asia CEO of BMO Private Bank, told Reuters. Edmund Yun, executive director of investment at the same wealth management firm, agreed, citing a number of prohibitive issues. These include beneficial ownership, tax and trading settlement. Hedge funds use banks’ prime brokerages, which help them more deftly manage those regulatory constraints.

Stock portfolios of hedge funds are often held by the prime brokers themselves to facilitate quick trading decisions so they are unaffected by ownership constraints. For example, under the scheme, funds wanting to sell holdings of Shanghai-listed shares have to deliver the shares to brokers a day before they are to be sold, a peculiarity that exists in no other major stock market. While regulators have looked for ways to encourage long-term funds, including fast-tracking applications for products benchmarked under the stock connect scheme, industry officials say that persuading pension funds to participate could take months.

“.. there are no such things as “aggregate demand,” or “aggregate supply,” or output and employment “as a whole.” These are statistical creations constructed by economists and statisticians ..”

• The Fallacy of Keynesian Macro-Aggregates (Ebeling)

A specter is haunting the world, the specter of two% inflationism. Whether pronounced by the U.S. Federal Reserve or the European Central Bank, or from the Bank of Japan, many monetary central planners have declared their determination to impose a certain minimum of rising prices on their societies and economies. One of the oldest of economic fallacies continues to dominate and guide the thinking of monetary policy makers: that printing money is the magic elixir for the creating of sustainable prosperity. In the eyes of those with their hands on the handle of the monetary printing press the economic system is like a balloon that, if not “fully inflated” at a desired level of output and employment, should be simply “pumped up” with the hot air of monetary “stimulus.”

The fallacy is the continuing legacy of the British economist, John Maynard Keynes, and his conception of “aggregate demand failures.” Keynes argued that the economy should be looked at in terms of series of macroeconomic aggregates: total demand for all output as a whole, total supply of all resources and goods as a whole, and the average general levels of all prices and wages for goods and services and resources potentially bought and sold on the overall market. If at the prevailing general level of wages, there is not enough “aggregate demand” for output as a whole to profitably employ all those interested and willing to work, then it is the task of the government and its central bank to assure that sufficient money spending is injected into the economy. The idea being that at rising prices for final goods and services relative to the general wage level, it again becomes profitable for businesses employ the unemployed until “full employment” is restored.

Over the decades since Keynes first formulated this idea in his 1936 book, The General Theory of Employment, Interest, and Money, both his supporters and apparent critics have revised and reformulated parts of his argument and assumptions. But the general macro-aggregate framework and worldview used by economists in the context of which problems of less than full employment continue to be analyzed, nonetheless, still tends to focus on and formulate government policy in terms of the levels of and changes in output and employment for the economy as a whole. In fact, however, there are no such things as “aggregate demand,” or “aggregate supply,” or output and employment “as a whole.” These are statistical creations constructed by economists and statisticians, out of what really exists: the demands and supplies of multitudes of individual and distinct goods and services produced, and bought and sold on the various distinct markets that comprise the economic system of society.

“.. the EC wants Russia to bail out Ukraine while accusing Russia of invading Ukraine. Icing on the wonderland-cake is the Russian Ruble has plunged nearly 50% this year, but Ukraine needs money from Russia to fight Russia. Is this complete lunacy or what?”

• Europe in Wonderland Wants Russia to Bail Out Ukraine (Mish)

Ukraine’s president, speaking a day after the nation’s junk credit rating was cut further, said next year’s budget mustn’t cut corners on military spending and should account for the possibility of an invasion. “The war made us stronger, but has crushed the economy,” Poroshenko said. “There’s one article of spending that we won’t save on and that’s security. Ukraine is finalizing next year’s fiscal plan amid a new cease-fire in the conflict that’s ravaged its industrial heartland near Russia’s border. As its economy shrinks and reserves languish at a more than 10-year low, it’s also racing to secure more international aid to top up a $17 billion rescue.

Standard & Poor’s said Dec. 19 that a default may become inevitable, downgrading Ukraine’s credit score one step to CCC-. With official forecasts putting this year’s contraction at 7%, the government needs $15 billion on top of its bailout to stay afloat, according to the European Union. The European Union and the U.S. are discussing $12 billion to $15 billion in aid to Ukraine and “there needs to be a Russian contribution to the package,” Pierre Moscovici, the 28-nation bloc’s economy commissioner, said at a Bloomberg Government event this week in Washington. A decision is needed in January, he said.

Ukraine president says “War has made us stronger“. That lie is so stupid my dead grandmother knows it from the grave. The evidence is a CCC- debt rating, a step or so above above default, with default imminent. The story gets even stranger. To avoid default, Ukraine needs a “Russian contribution to the package” according to Pierre Moscovici, the economic policy commissioner for the European Commission. Europe and the US have crippling sanctions on Russia for the conflict in Ukraine, yet the EC wants Russia to bail out Ukraine while accusing Russia of invading Ukraine. Icing on the wonderland-cake is the Russian Ruble has plunged nearly 50% this year, but Ukraine needs money from Russia to fight Russia. Is this complete lunacy or what?

“Once we are shielded economically and politically, we can find the appropriate schedule for national elections, even by the end of 2015 ..”

• Greek Premier Makes Offer In Bid To Avoid Snap Elections (WSJ)

Greek Prime Minister Antonis Samaras reached out to lawmakers Sunday, offering a set of compromises to resolve an impasse over the selection of Greece’s future head of state and to avoid snap elections early next year. Speaking in an unscheduled televised address, the Greek premier called for consensus over the government’s presidential candidate. In return, he offered to hold general elections by the end of 2015 – before the term of the current government expires – but only after Greece concluded negotiations with its international creditors and passed political and constitutional reforms. “Once we are shielded economically and politically, we can find the appropriate schedule for national elections, even by the end of 2015,” Samaras said.

“We cannot enter into a period of uncertainty as soon as we finish another one. The problems of the country cannot stagnate in a permanent election campaign.” Samaras also offered to reshuffle his cabinet to include ministers who would be appointed by other political parties, a move aimed at winning over undecided lawmakers from smaller parties in parliament. Elected to a four-year term in mid-2012, the country’s current coalition government — composed of the conservative New Democracy and the socialist Pasok parties — isn’t due to face elections again until June 2016. But it faces an uphill struggle convincing a supermajority of lawmakers to back its candidate for head of state, a largely ceremonial role.

The opposition Syriza party is blocking the election of the government’s candidate in the hopes of forcing early elections. Under Greece’s constitution, parliament has three tries to elect a president — a first vote took place last week, a second is due on Tuesday and the last tentatively scheduled for Dec. 29. If it fails, parliament would be dissolved and fresh elections called within a month. In the first two rounds, the president must be elected by a two-thirds majority of the 300 lawmakers in parliament, but that threshold falls to 180 votes in the third and final round.

” .. It has conjured up the example of a European debt conference to wipe away a portion of the debt, as happened with Germany in 1953.”

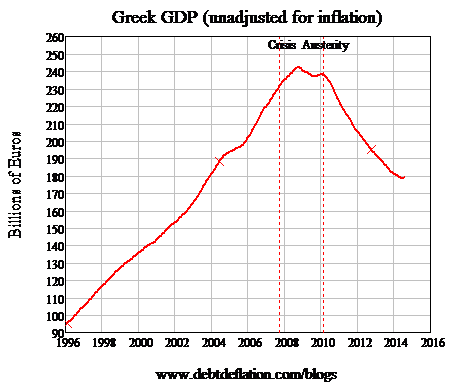

• Greece’s Radical Left Could Kill Off Austerity In The EU (Guardian)

What misery has been inflicted on Greece. One in four of its people are out of work; poverty has surged from 23% before the crash to 40.5%; and research has demonstrated how key services such as health have been hammered by cuts, even as demand has risen. No wonder the country has experienced a political polarisation that has prompted comparisons with Weimar Germany. The neo-Nazi Golden Dawn – which makes other European rightist movements look like fluffy liberals – at one point attracted up to 15% in the polls; though still a menace, its support has thankfully subsided to half that.

But unlike many other European societies – with the notable exceptions of Spain and Ireland – fury and despair with austerity has been channelled into the ranks of the populist left. After years on the fringes of Greek politics, Syriza only became a fully fledged party in 2012, and yet it won Greece’s elections to the European parliament earlier this year. The latest opinion polls give Syriza a substantial lead over the governing centre-right New Democracy party. A radical leftwing government could well assume power for the first time in the EU’s history. After years of social ruin, Syriza is offering Greeks that precious thing: hope. Although it has shifted from demanding an immediate cancellation of debt, it is demanding a negotiated solution.

It has conjured up the example of a European debt conference to wipe away a portion of the debt, as happened with Germany in 1953. Syriza’s manifesto proposes that repayment of debt could come through economic growth, rather than from budget cuts. It wants a European new deal backed up by an investment bank; an all-out war against the tax avoidance endemic in Greek society; an emergency employment programme; a raised minimum wage; and the restoration of collective bargaining. In alliance with anti-austerity forces such as Spain’s surging Podemos party, Syriza wants the EU to abandon crippling austerity policies in favour of quantitative easing and a growth-led recovery.

Getting worse.

• Rising Price Of Olive Oil Is A Pressing Matter (FT)

Never mind the shale revolution, or OPEC’s deliberations. Some oil producers are enjoying the highest prices in six years. A severe drought in Spain and a fruitfly infestation in Italy have caused a surge in the price of olive oil. The two countries normally account for just under 70% of output, and the Madrid-based International Olive Oil Council forecasts that production will drop next year by 27%. “Production in Spain is very, very short,” Rafael Pico Lapuente, director-general of Asoliva, the Spanish Olive Oil Exporters Association, said. The shortage has been pushing up wholesale prices for months. Premium-quality extra virgin olive oil rose to $4,282 a tonne last month, the highest since 2008, according to the International Monetary Fund. The civil war in Syria has also hit production there. Most Syrian output is consumed domestically, but some argue that this is providing further psychological support for prices.

Vito Martielli, analyst at Rabobank, said higher costs might further hit consumption in southern Europe, traditionally the largest market. The economic crisis in 2008 hit olive oil demand in Spain, Italy and Greece, and appetite has been waning as shoppers have turned to cheaper substitutes. Favorable weather in most parts of the world this year has meant that harvests of oilseed crops have been plentiful and prices have been falling. The price of soya oil has fallen 20% so far this year; palm oil has declined 17%, and rapeseed oil is down 5%. “We are in a situation where there are cheaper alternatives in Europe,” Mr Martielli said. The IOC expects olive oil consumption in 2015 to fall 7% to 2.8 million tonnes. Italy, the largest consumer of olive oil, is forecast to see a fall of 16% to 520,000 tonnes, Spain is expected to see a 3% decline to 515,000 tonnes, while Greece’s consumption is expected to fall 6% to 160,000 tonnes.

That’s what friends are for.

• Leaked CIA Docs Teach Operatives How To Infiltrate EU (RT)

Wikileaks has released two classified documents instructing CIA operatives how best to circumvent global security systems in international airports, including those of the EU, while on undercover missions. The first of the documents, dated September 2011, advises undercover operatives how to act during a secondary airport screening. Secondary screenings pose a risk to an agent s cover by focusing significant scrutiny on an operative via thorough searches and detailed questioning. The manual stresses the importance of having a “consistent, well-rehearsed, and plausible cover,” in addition to cultivating a fake online presence to throw interrogators off track. Meanwhile, the second document, dated January 2012, presents a detailed overview of EU Schengen Border Control procedures. The overview outlines the various electronic security measures, including the Schengen Information System (SIS) and the European fingerprint database EURODAC, used by border control and the dangers these measures may pose to agents on clandestine missions.

WikiLeaks’ chief editor Julian Assange explains that these documents show that under the Obama administration the CIA is still intent on infiltrating European Union borders and conducting clandestine operations in EU member states.” The document also demonstrates the CIA s increasing concern over the risks to operatives’ assumed identities posed by biometric databases the very same systems the US pushed for after 9/11. On Friday, WikiLeaks released a CIA report suggesting that though targeted killing programs, including drone strikes, may be effective in some cases, there is also a risk that the programs may backfire. For example, targeted strikes may prompt local populations to sympathize with insurgents or further radicalize remaining militants.