DPC “Unloading fish at ‘T’ wharf, Boston, Mass.” 1903

Renzi should have made these statements years ago. Now they look like cynical ways to get votes.

• Austerity Only Benefits Germany But Destroys Europe, Renzi Says (BBG)

Italian Prime Minister Matteo Renzi had some fighting words for German leader Angela Merkel: Your obsession with austerity is strangling Europe and your country is the only one profiting. That view, held by others in the EU, rarely gets aired publicly quite so forcefully. Especially by Renzi, who until recently had deployed priceless ancient Roman art and Ferraris in some of Merkel’s recent visits to Italy. But Brexit, which exposed cracks in the European project, has made the EU more vulnerable to jabs. In New York for the United Nations General Assembly, while Merkel hung back at home to face an angry electorate, Renzi lashed out. “Stressing austerity means destroying Europe,” Renzi told an audience of policy experts at the Council on Foreign Relations.

”Which is the only country which receives an advantage from this strategy? The one which exports the most: Germany.” The 41-year-old premier has staked his political future on a referendum on constitutional reform that polls show he could narrowly lose. Confronted with an economy in trouble, he’s stepped up criticism of the EU’s rigid budget deficit limits and of the nations seen as wielding the most power in the 28-nation bloc: Germany and France. His appeal for more flexibility has grown more strident as pressure mounts for him to pick a date for when Italians will vote on cutting back the Senate with the aim of making governments more stable and simplifying the passage of legislation. The referendum is expected to take place by the end of the year, and Renzi has said he would quit if he loses.

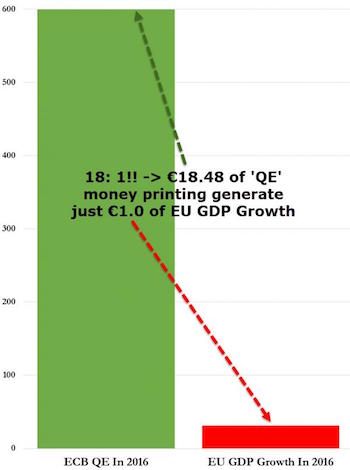

“..€80 billion have been wasted almost every month!..”

• €18 In ECB QE Generated Just €1 In GDP Growth (ZH)

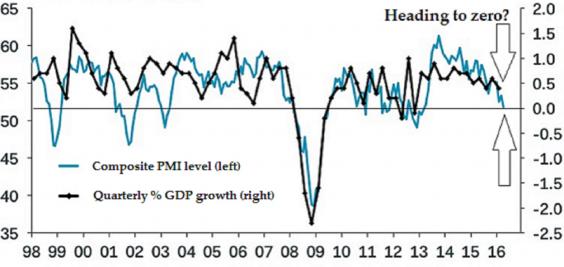

After almost two years of the quantitative easing program in the Euro Area, economic figures have remained very weak. As GEFIRA details, inflation is still fluctuating near zero, while GDP growth in the region has started to slow down instead of accelerating. According to the ECB data, to generate €1.0 of GDP growth, €18.5 had to be printed in the QE, which means that €80 billion have thus been wasted almost every month! This year, the ECB printed nearly €600 billion within the frame of asset purchase programme (QE). At the same time, GDP has increased by… €31 billion; even if up to the end of 2015 the ECB issued €650 billion during its QE program. Needless to say that the Greek debt is “only” €360 billion and there has been no chance of a relief, so far.

The question is where this money from the QE goes and who benefits from it. Clearly it is not the real sector, the so called Main Street of French, Italian or Portuguese cities (Greece is not under the QE program). European stocks are still weak, too, while stock exchanges in the USA are hitting their records. So, is the ECB serving Europeans?

More pension cuts is an immoral demand.

• IMF Calls For More Greek Pension Cuts, Greater Debt Relief (Kath.)

The International Monetary Fund called for Greece to cut pensions and taxes and for its lenders to provide significant debt relief in order for the country to make a convincing exit from the crisis. In its annual report on the Greek economy, following so-called Article Four consultations in Athens, the Fund described the country’s pension system as “unaffordable” despite recent reforms. It argued that the pension system’s deficit remains too high at 11%, compared to a 2.5% average in the eurozone, and that too much of a burden has been placed on Greeks currently in work, while existing pensioners have largely been protected. The Fund also said that Greece’s tax credit system was too generous, exempting around half of salary earners compared to a euro area average of 8%.

The IMF proposes a reduction in taxes and social security contributions, arguing that recent increases created incentives for undeclared work. “Greece needs less austerity, not more,” said IMF mission chief Delia Velculescu as she presented the report in a teleconference with journalists. The Fund, whose role in Greece’s third bailout program has yet to be clarified, also stressed the need for European lenders to deliver on their debt relief pledge as “growth prospects remain weak and subject to high downside risks.” “Even with full implementation of this demanding policy agenda, Greece requires substantial debt relief calibrated on credible fiscal and growth targets,” the report said.

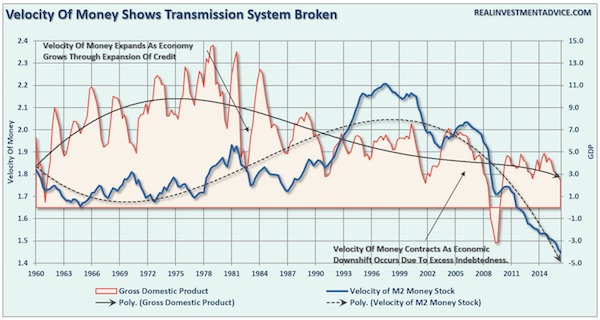

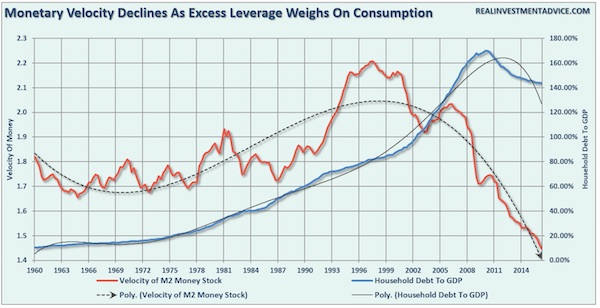

Plunging velocity is the most important deflation indicator.

• Plunging Velocity of Money Closes Fed Window (Roberts)

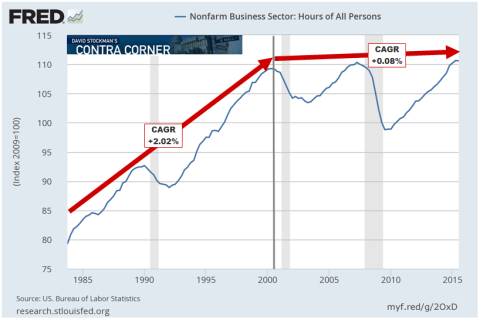

The problem for the Federal Reserve remains the simple fact there is NO evidence that “Quantitative Easing” actually works as intended. The artificial suppression of interest rates was supposed to spur economic activity by encouraging lending activities through the banks. Such an outcome should have been witnessed by an increase in monetary velocity. As the velocity of money accelerates, demand rises and inflationary pressures increase. However, as you can clearly see, the demand for money has been on the decline since the turn of the century.

The surge in M2V during the 90’s was largely driven by the surge in household leverage as consumers turned to debt to fill the gap between falling wage growth and rising standards of living. The issue for the Fed is the decline in the “unemployment rate,” caused solely by the shrinking labor force, is obfuscating the difference between a “real” and “statistical” full employment level. While it is expected that millions of individuals will retire in the coming years ahead; the reality is that many of those “potential” retirees will continue to work throughout their retirement years. In turn, this will have an adverse effect by keeping the labor pool inflated and further suppressing future wage growth.

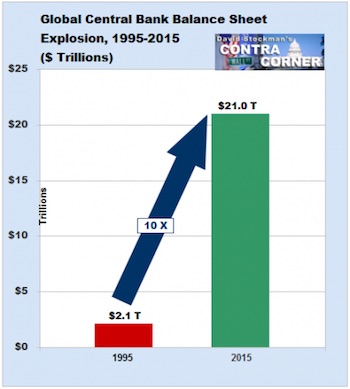

[..] It is quiet evident the financial markets, and by extension, the economy, have become tied to Central Bank interventions. As shown in the chart below, the correlations between Federal Reserve interventions and the markets is quite high. Of course, this was ALWAYS the intention of these monetary interventions. As Ben Bernanke suggested in 2010 as he launched the second round of Quantitative Easing, the goal of the program was to lift asset prices to spur consumer confidence thereby lifting economic growth. The problem was the lifting of asset prices acted as a massive wealth transfer from the middle class to the top-10% providing little catalyst for a broad-based economic recovery. Unwittingly, the Fed has now become co-dependent on the markets. If they move to tighten monetary policy, the market sells off impacting consumer confidence and pushes economic growth rates lower. With economic growth already running below 2%, there is very little leeway for the Fed to make a policy error at this juncture.

The smartest kid on the block.

• Russia’s Central Bank Criticizes The Easy Money Policies Of Its Peers (CNBC)

Russia’s economy is facing a different range of issues than those facing the U.S., Japan and the euro zone and so the central bank has to take a different approach, Russia’s central bank governor told CNBC, questioning whether other central banks still had the means to influence their economies. “Whether (other) central banks still have in their possession the types of tools to influence this situation (is the subject of a very broad discussion),” Russia Central Bank Governor Elvira Nabiullina told CNBC in Moscow. “Whether they are already finding themselves on the brink of negative interest rates and some are already in negative interest rate territory. These are most certainly not trivial problems. But as far as the Russian economy is concerned, we find ourselves in a totally different situation,” she said.

Nabiullina was critical of the environment of easy monetary policy that other central banks have created in recent years with their quantitative easing (QE) programs. These were aimed at boosting liquidity, investment and economic growth but they have not necessarily translated into investment in the real economy. Rather, there has been increased liquidity in financial markets, prompting concerns of an equity and bond bubble that will burst when QE programs are eventually wound down and monetary policy “normalized.” Nabiullina warned that “because of the continued easing of monetary policy in many countries there is also the possibility that a higher level of financial market volatility will persist.”

Tragedy waiting in the wings.

• BIS, OECD Warn On Canadian Housing Bubble Debt, See No Exit (WS)

Everyone is fretting about the Canadian house price bubble and the mountain of debt it generates – from the IMF on down to the regular Canadian. Now even the Bank for International Settlement (BIS) and the OECD warn about the risks. Every city has its own housing market, and some aren’t so hot. But in Vancouver and Toronto, all heck has broken loose in recent years. In Vancouver, for example, even as sales volume plunged 45% in August from a year ago – under the impact of the new 15% transfer tax aimed at Chinese non-resident investors – the “benchmark” price of a detached house soared by 35.8%, of an apartment by 26.9%, and of an attached house by 31.1%. Ludicrous price increases!

In Toronto, a similar scenario has been playing out, but not quite as wildly. In both cities, the median detached house now sells for well over C$1 million. Even the Bank of Canada has warned about them, though it has lowered rates last year to inflate the housing market further – instead of raising rate sharply, which would wring some speculative heat out of the system. But no one wants to deflate a housing bubble. During the Financial Crisis, when real estate prices in the US collapsed and returned, if only briefly, to something reflecting the old normal, Canadian home prices barely dipped before re-soaring. And this has been going on for years and years and years.

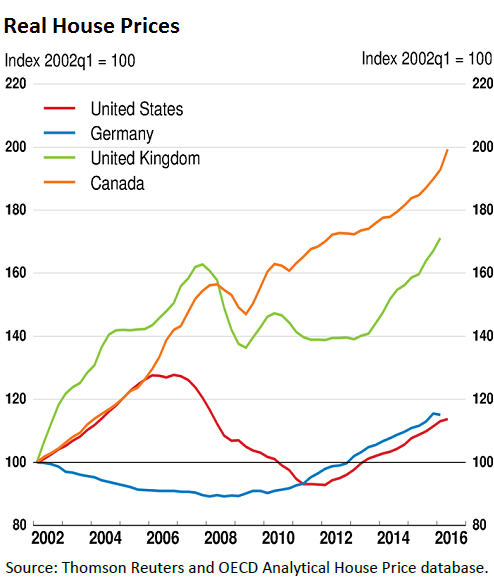

The OECD in its Interim Economic Outlook warned: “Over recent years, real house prices have been growing at a similar or higher pace than prior to the crisis in a number of countries, including Canada, the United Kingdom, and the United States. The rise in real estate prices has pushed up price-to-rent ratios to record highs in several advanced economies.” Canada stands out. Even on an inflation-adjusted basis, Canadian home prices have long ago shot through the roof. The OECD supplied this bone-chilling chart. The top line (orange) represents Canadian house price changes, adjusted for inflation.

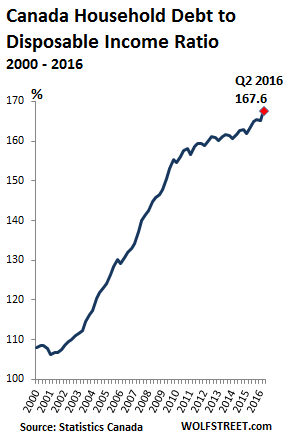

[..] Real estate is highly leveraged. It’s funded with debt. Many folks cite down-payment requirements in rationalizing why the Canadian market cannot implode, and why, if it does implode, it won’t pose a problem for the banks. However, an entire industry has sprung up to help homebuyers get around the down-payment requirements. So household debt has been piling up for years, driven by mortgage debt. Statistics Canada reported two weeks ago that the ratio of household debt to disposable income has jumped to another record in the second quarter, to a breath-taking 167.6%:

Even if there were a deal, global output would barely fall.

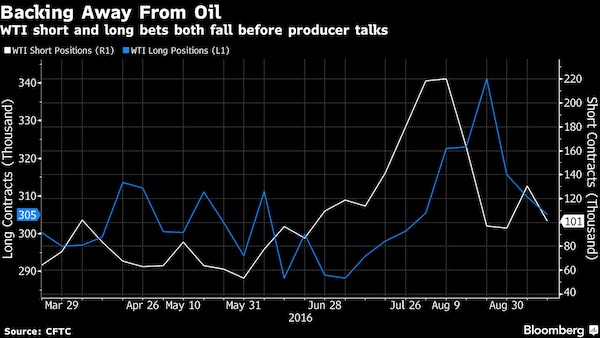

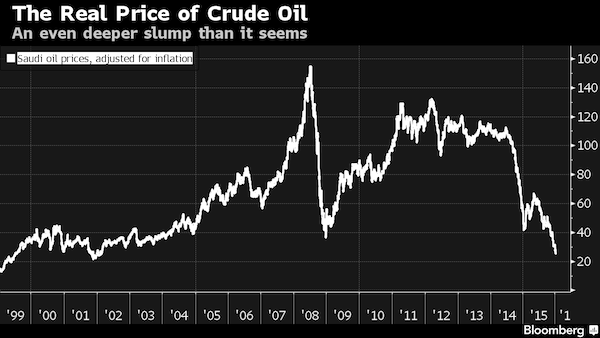

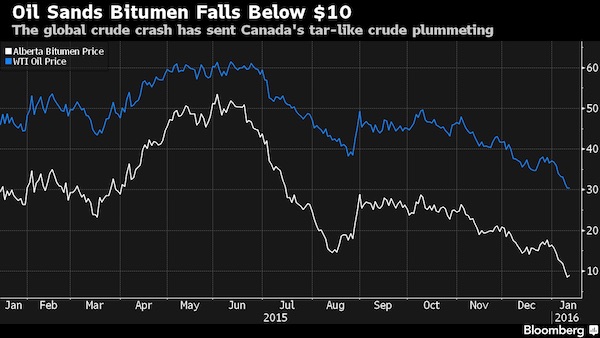

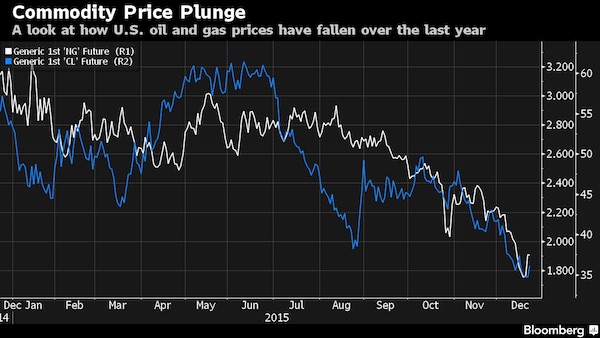

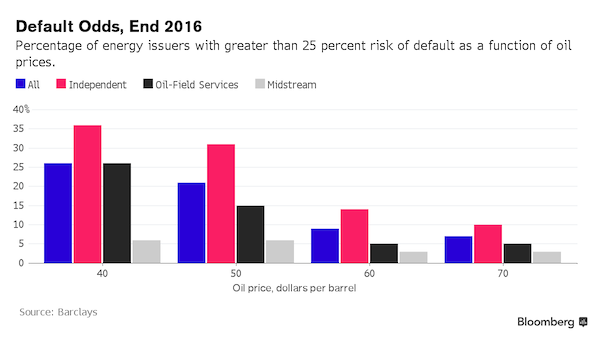

• Oil Slumps 4% As No Output Deal Expected For OPEC (R.)

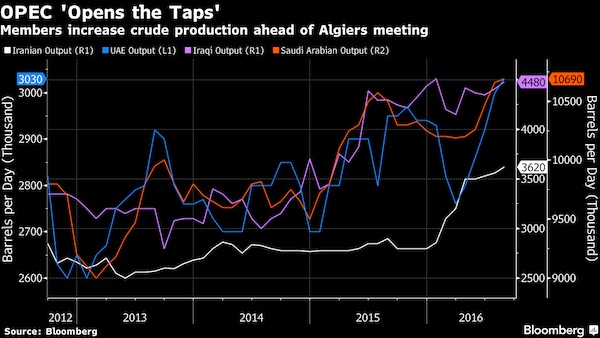

Oil prices tumbled 4% on Friday on signs Saudi Arabia and arch rival Iran were making little progress in achieving preliminary agreement ahead of talks by major crude exporters next week aimed at freezing production. Also weighing on sentiment was data showing the United States was on track to add the most number of oil rigs in a quarter since the crude price crash began two years ago. Lower equity prices on Wall Street and other world stock markets was another bearish factor. Brent crude futures settled down $1.76, or 3.7%, at $45.89 a barrel. For the week, it rose 0.3%, accounting for gains in the past two sessions. U.S. West Texas Intermediate (WTI) crude futures fell $1.84, or 4%, to settle at $44.48. On the week, WTI gained 3%.

Crude futures slumped after sources said Saudi Arabia did not expect a decision in Algeria where the OPEC and other big oil producers were to convene for Sept 26-28 talks. “The Algeria meeting is not a decision making meeting. It is for consultations,” a source familiar with Saudi oil officials’ thinking told Reuters. Earlier in the day, the market rallied when Reuters reported that Saudi Arabia had offered to reduce production if Iran caps its own output this year. Oil prices are typically volatile before OPEC talks and Friday’s session was tempered with caution despite market sentiment on a high this week after the U.S. government reported on Wednesday a third straight weekly drop in crude stockpiles. “A ‘No Deal’ result in our definition will be one where OPEC not only failed to get an explicit deal out of the meetings, but also failed to develop a forward plan,” Macquarie Capital said, referring to the Algeria talks. “This would be another epic fail by OPEC.”

People keep on suggesting that SA has a choice, without acknowledging that any output cut would promptly be filled by some other producer. Cutting output equals losing market share.

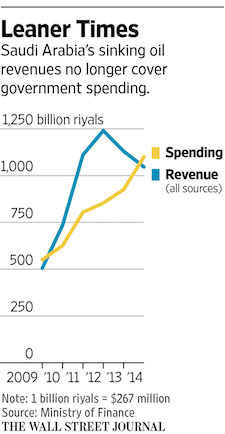

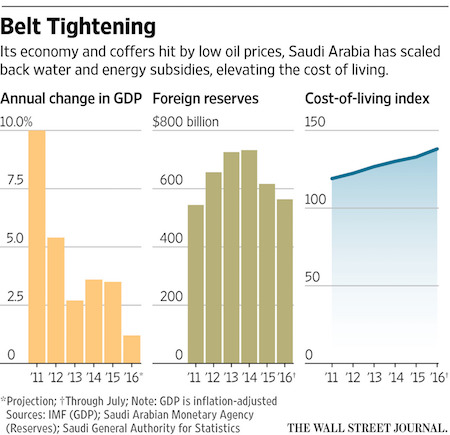

• Kingdom Comedown: Falling Oil Prices Shock Saudi Middle Class (WSJ)

[..] a sharp drop in the price of oil, Saudi Arabia’s main revenue source, has forced the government to withdraw some benefits this year—raising the cost of living in the kingdom and hurting its middle class, a part of society long insulated from such problems. Saudi Arabia heads into next week’s meeting of major oil producers in a tight spot. With a slowing economy and shrinking foreign reserves, the kingdom is coming under pressure to take steps that support the price of oil, as it did this month with an accord it struck with Russia. The sharp price drop is mainly because of a glut in the market, in part caused by Saudi Arabia itself. The world’s top oil producer continues to pump crude at record levels to defend its market share.

One option to lift prices that could work, some analysts say, is to freeze output at a certain level and exempt Iran from such a deal, given that its push to increase production to pre-sanction levels appears to have stalled in recent months. Saudi Arabia has previously refused to sign any deal that exempts arch-rival Iran. As its people start feeling the pain, that could change. The kingdom is grappling with major job losses among its construction workers—many from poorer countries—as some previously state-backed construction companies suffer from drying up government funding. Those spending cuts are now hitting the Saudi working middle class.

Funny. What I wonder about is, the criticism of mainstream economics is going mainstream, but the ‘solutions’ are not the same.

• Health Warning! “Realism” Virus Afflicting Mainstream Economists (Steve Keen)

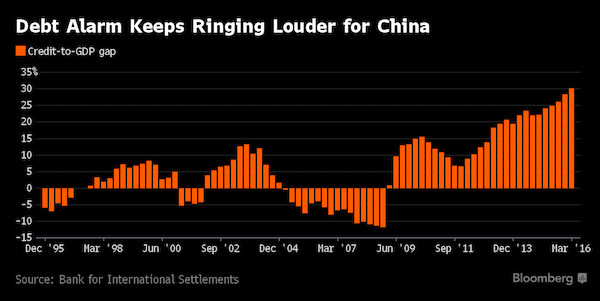

Some papers that are remarkably critical of mainstream economics have been published recently, not by the usual suspects like myself, but by prominent mainstream economists: ex-Minneapolis Fed Chairman Narayana Kocherlokata, ex-IMF Chief Economist Olivier Blanchard, and current World Bank Chief Economist Paul Romer. I discuss these papers in a tongue-in-cheek introduction to another key problems of unrealism in economics–the absence of any role for energy in both Post Keynesian and Neoclassical production functions. I also address Olivier Blanchard’s desire for a “widely accepted analytical macroeconomic core”, explain the role of credit in aggregate demand and income, and identify the countries most likely to face a credit crunch in the near future. I gave this talk to staff and students of the EPOG program at the University of Paris 13 on Friday September 23rd.

He’s stuck. Allowing it would open up one Pandora’s Box, not allowing it opens yet another.

• Obama Vetoes 9/11 Saudi Bill, Sets Up Showdown With Congress (R.)

President Barack Obama on Friday vetoed legislation allowing families of victims of the Sept. 11 attacks to sue Saudi Arabia, which could prompt Congress to overturn his decision with a rare veto override, the first of his presidency. Obama said the Justice Against Sponsors of Terrorism Act would hurt U.S. national security and harm important alliances, while shifting crucial terrorism-related issues from policy officials into the hands of the courts. The bill passed the Senate and House of Representatives in reaction to long-running suspicions, denied by Saudi Arabia, that hijackers of the four U.S. jetliners that attacked the United States in 2001 were backed by the Saudi government. Fifteen of the 19 hijackers were Saudi nationals.

Obama said other countries could use the law, known as JASTA, as an excuse to sue U.S. diplomats, members of the military or companies – even for actions of foreign organizations that had received U.S. aid, equipment or training. “Removing sovereign immunity in U.S. courts from foreign governments that are not designated as state sponsors of terrorism, based solely on allegations that such foreign governments’ actions abroad had a connection to terrorism-related injuries on U.S. soil, threatens to undermine these longstanding principles that protect the United States, our forces, and our personnel,” Obama said in a statement. Senator Chuck Schumer, who co-wrote the legislation and has championed it, immediately made clear how difficult it will be for Obama to sustain the veto. Schumer issued a statement within moments of receiving the veto, promising that it would be “swiftly and soundly overturned.”

Sure, why don’t you, against the will of your own people. Should work just fine.

• EU Refuses To Revise Canada CETA Trade Deal (BBC)

The European Commission has ruled that a controversial EU-Canada free trade deal – CETA – cannot be renegotiated, despite much opposition in Europe. “CETA is done and we will not reopen it,” said EU Trade Commissioner Cecilia Malmstrom. Ms Malmstrom was speaking as EU trade ministers met in Slovakia to discuss CETA and a similar deal with the US, TTIP, which has also faced criticism. A draft CETA deal has been agreed, but parliaments could still delay it. Thousands of activists protested against CETA and TTIP in Germany on Saturday and thousands more in Brussels – outside the EU’s headquarters – on Tuesday. Activists fear that the deals could water down European standards in the key areas of workers’ rights, public health and the environment.

There is also great anxiety about proposed special courts where investors will be able to sue governments if they feel that legislation hurts their business unfairly. Critics say the mere existence of such courts – an alternative to national courts – will have a “chilling” effect on policymakers, leading to slacker regulation on the environment and welfare. Ms Malmstrom said CETA would dominate Friday’s meeting in Bratislava. The Commission hopes the deal can be signed with Canada at the end of October, so that it can then go to the European Parliament for ratification. But it will also need to be ratified by national parliaments across the EU. “What we are discussing with the Canadians is if we should make some clarifications, a declaration so that we can cover some of those concerns,” Ms Malmstrom said. She acknowledged fears in some countries that politicians might see their “the right to regulate” diluted. “Maybe that [right] needs to be even clearer in a declaration,” she said, admitting that the CETA negotiations were still “difficult”.

Surprisingly lucid overview. Not everyone’s turned into a Putin basher yet.

• NATO’s Expansion Parade Makes America Less Secure (Forbes)

The transatlantic alliance was created in 1949 to protect war-ravaged Western Europe from the Soviet Union, an opportunistic predator after its victory over Nazi Germany. The threat to America reflected both Moscow’s control over Eastern and Central Europe and the USSR’s role as an ideologically hostile peer competitor. The end of the Cold War changed everything. The Soviet subject nations were freed, a humanitarian bonanza. More important, the successor state of Russia went from hostile superpower to indifferent regional power. NATO lost its essential purpose, since the U.S. no longer needed to shield Western Europe from Moscow. Yet the alliance proved to be as resilient as other government bureaucracies. NATO officials desperately sought new reasons to exist.

Explained Vice President Al Gore: “Everyone realizes that a military alliance, when faced with a fundamental change in the threat for which it was founded, either must define a convincing new rationale or become decrepit.” The latter was viewed as inconceivable, not even worth considering. So the alliance expanded both its mission (to “out-of-area” activities) and membership (inducting former Warsaw Pact members). Washington’s military obligations multiplied even as the most important threat against it dissipated. Objections to this course were summarily rejected. Not a single Senator voted against admitting the three Baltic states. Then no one imagined that the U.S. might be expected to fight on their behalf. The alliance was seen as the international equivalent of a gentleman’s club, to which everyone who is someone belongs.

Those who pointed to possible conflicts with Moscow were dismissed as scaremongers. Expansion was expected to be all gain, no pain. Alas, Russia did not perceive moving the traditional anti-Moscow alliance up to its borders as a friendly act. Despite coming from the KGB, Vladimir Putin originally didn’t seem to bear the U.S. or West much animus. However, NATO compounded expansion with an unprovoked war against Serbia, a traditional Slavic ally of Moscow, and proposals to include Georgia and Ukraine, the latter which long had especially close historical, cultural, economic, and military ties with Russia. Over time Putin, as well as many of his countrymen, came to view the transatlantic alliance as a threat.