Matson Aircraft refueling at Semakh, British Mandate Palestine 1931

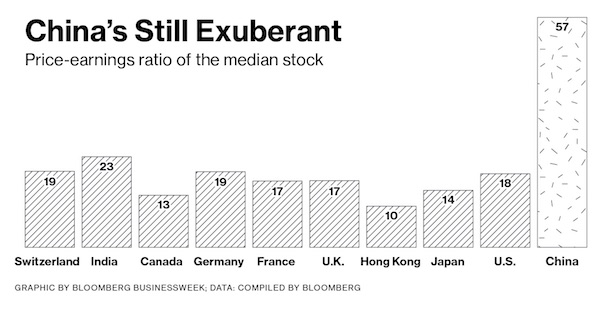

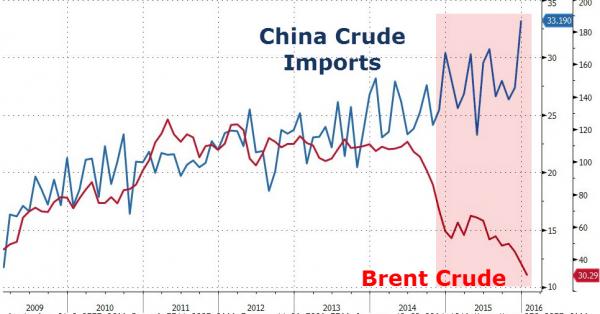

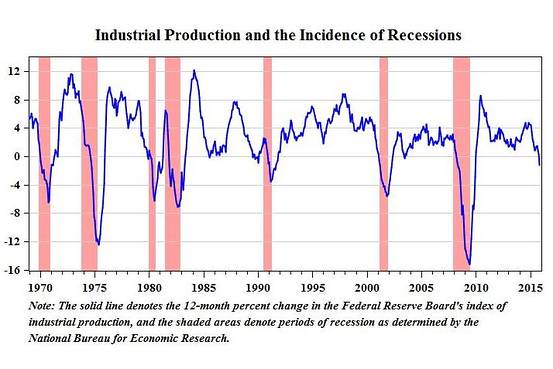

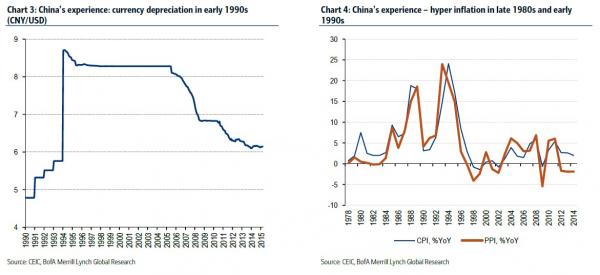

No kidding: “It is quite concerning that the significant monetary and fiscal stimulus in 2015 has only managed to slow the rate of decline in China’s industrial activity..”

• China Manufacturing Shrinks At Fastest Rate For Over 3 Years (Reuters)

Activity in China’s manufacturing sector contracted at its fastest pace in almost three-and-a-half years in January, missing market expectations, an official survey showed on Monday. The official purchasing managers’ index (PMI) stood at 49.4 in January, compared with the previous month’s reading of 49.7 and below the 50-point mark that separates growth from contraction on a monthly basis. It is the weakest index reading since August 2012. Analysts polled by Reuters predicted a reading of 49.6. The PMI marks the sixth consecutive month of factory activity contraction, underlining a weak start for the year for a manufacturing complex under severe pressure from falling prices and overcapacity in key sectors including steel and energy.

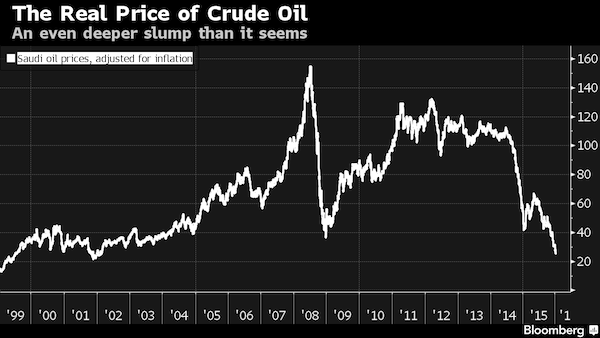

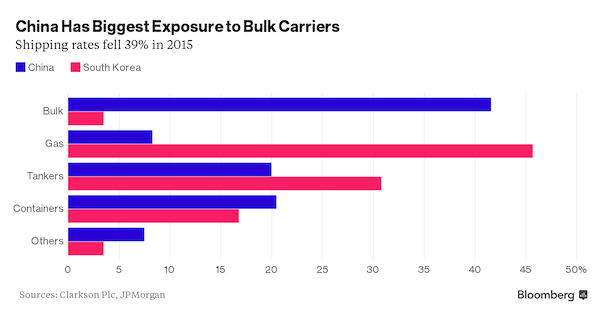

The price of oil fell on the disappointing data, which was compounded by weak export figures from South Korea. Brent crude was trading at $35.54 per barrel at 02.00 GMT, down 45 cents, or 1.25%, from the last close. China’s stock markets also fell in morning trading, although the Nikkei in Japan and the ASX/S&P 200 in Australia both swatted away the gloom to remain in positive territory. Zhou Hao, an economist at Commerzbank, said: “The electricity production remained sluggish and the crude steel output continued the weak trend in January, reflecting an ongoing deleveraging process in the industrial sectors.” “In the meantime, China has started an aggressive capacity reduction in many sectors, which could add downward pressure on the bulk commodity prices over time.”

Meanwhile, the official non-manufacturing PMI fell to 53.5 from December’s 54.4, according to the National Bureau of Statistics (NBS). The services index remained in expansionary territory highlighting continuing strength that has helped China weather the sharp slowdown in manufacturing. With manufacturing decelerating quickly, services have been a crucial source of growth and jobs for China over the past year, and analysts have been watching closely to see if the sector can maintain momentum in 2016. Angus Nicholson of IG in Melbourne said: “It is quite concerning that the significant monetary and fiscal stimulus in 2015 has only managed to slow the rate of decline in China’s industrial activity. “The first quarter of activity is always the weakest in China due to the seasonal disruption of Chinese new year, and there is the possibility of global markets reacting very negatively when the quarterly data starts filtering out in March and April.”

The China slowdown was underlined on Monday by figures showing that South Korea’s exports suffered their worst downturn in January since the depths of the global financial crisis in 2009. The trade ministry in Seoul said sluggish demand from China helped exports to fall to a worse-than-expected 18.5% from a year earlier, extending December’s slump of 14.1% and marking the 13th straight month of declines. Shipments to China, South Korea’s largest market, tumbled 21.5% on-year in January in their biggest drop since May 2009, and the trade ministry said export conditions were worsening.

There’s still not nearly enough scrutiny of the shadow banks. But that is where the real problems will be.

• Mid-Tier Chinese Banks Piling Up Trillions Of Dollars In Shadow Loans (Reuters)

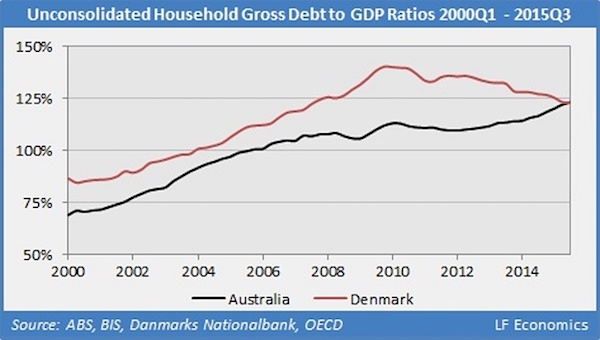

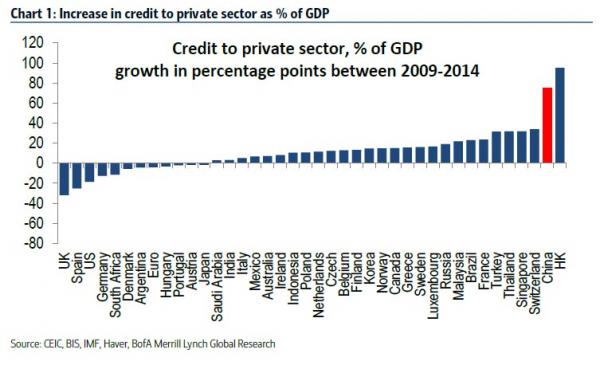

Mid-tier Chinese banks are increasingly using complex instruments to make new loans and restructure existing loans that are then shown as low-risk investments on their balance sheets, masking the scale and risks of their lending to China’s slowing economy. The size of this ‘shadow loan’ book rose by a third in the first half of 2015 to an estimated $1.8 trillion, equivalent to 16.5% of all commercial loans in China, a UBS analysis shows. For smaller banks, the rate is much faster. This growing practice, which involves financial structures known as Directional Asset Management Plans (DAMPs) or Trust Beneficiary Rights (TBRs), comes at a time when some mid-tier lenders, under pressure from China’s slowest economic growth in 25 years, are already delaying the recognition of bad loans.

“These are now the fastest growing assets on the balance sheets of most listed banks, excluding the Big Five, not just in percentage terms but absolute terms,” said UBS financial institutions analyst Jason Bedford, a former bank auditor in China who focuses on the issue. “The concern is that the lack of transparency and mis-categorization of credit assets potentially hide considerable non-performing loans.” To provide a buffer against tough times, banks are required to set aside capital against their credit assets – the riskier the asset, the more capital must be set aside, earning them nothing. Loans typically carry a 100% risk weighting, but these investment products often carry a quarter of that, so banks can keep less money in reserve and lend more.

Banks must also make provision of at least 2.5% for their loan books as a prudent estimate of potential defaults, while provisions for these products ranged between just 0.02 and 0.35% of the capital value at the main Chinese banks at the end of June, Moody’s Investors Service said in a note last month. At China’s mid-tier lender Industrial Bank Co, for example, the volume of investment receivables doubled over the first nine months of 2015 to 1.76 trillion yuan ($267 billion). This is equivalent to its entire loan book – and to the total assets in the Philippine banking system, filings showed. Investment receivables may include such benign assets as government bonds, but increasingly they include TBRs and DAMPs at mid-tier lenders.

At Evergrowing Bank, investment receivables reached 397 billion yuan in September, surpassing its loan book of 290 billion yuan. The bank said last year practically all of its investment receivables were DAMPs and TBRs. China Zheshang Bank, another smaller lender, also saw its investment receivables double over the same period, the bank’s prospectus to sell shares in Hong Kong shows. Zhang Changgong, the bank’s deputy governor, said banks were increasingly becoming return-seeking asset managers, not mere lenders. “In the past banks (made loans and) held assets. Now banks manage assets,” he said.

It’s game on. “When you talk about orders of magnitude, this is much larger than the subprime crisis..”

• US Hedge Funds Mount New Attacks on China’s Yuan (WSJ)

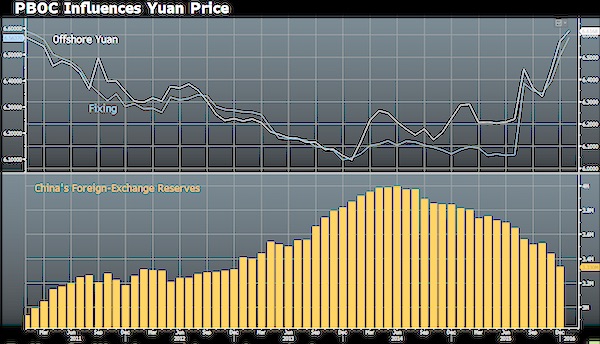

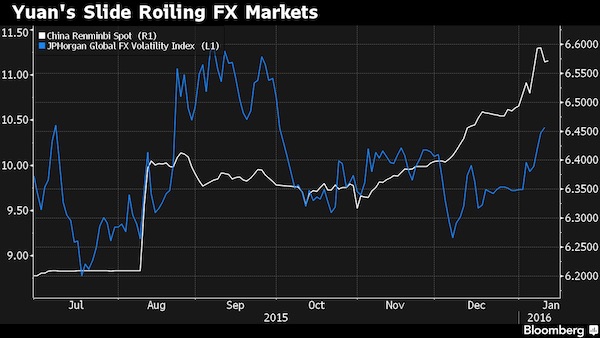

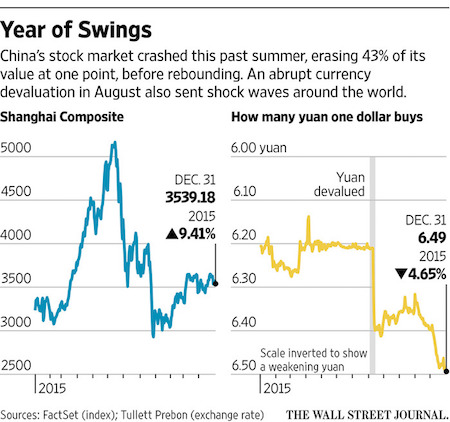

Some of the biggest names in the hedge-fund industry are piling up bets against China’s currency, setting up a showdown between Wall Street and the leaders of the world’s second-largest economy. Kyle Bass’s Hayman Capital Management has sold off the bulk of its investments in stocks, commodities and bonds so it can focus on shorting Asian currencies, including the yuan and the Hong Kong dollar. It is the biggest concentrated wager that the Dallas-based firm has made since its profitable bet years ago against the U.S. housing market. About 85% of Hayman Capital’s portfolio is now invested in trades that are expected to pay off if the yuan and Hong Kong dollar depreciate over the next three years—a bet with billions of dollars on the line, including borrowed money.

“When you talk about orders of magnitude, this is much larger than the subprime crisis,” said Mr. Bass, who believes the yuan could fall as much as 40% in that period. Billionaire trader Stanley Druckenmiller and hedge-fund manager David Tepper have staked out positions of their own against the currency, also known as the renminbi, according to people familiar with the matter. David Einhorn’s Greenlight Capital Inc. holds options on the yuan depreciating. The funds’ bets come at a time of enormous sensitivity for China’s leaders. The government is struggling on multiple fronts to manage a soft landing for the economy, deal with a heavily indebted banking system and navigate the transition to consumer-led growth.

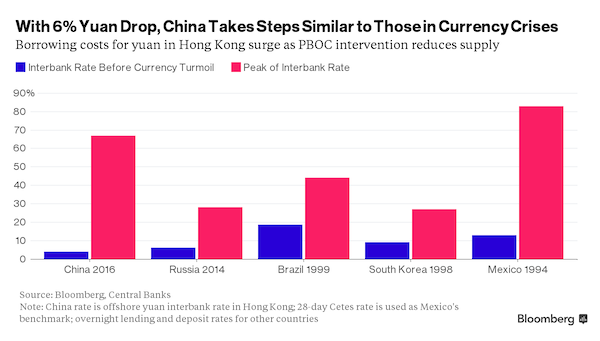

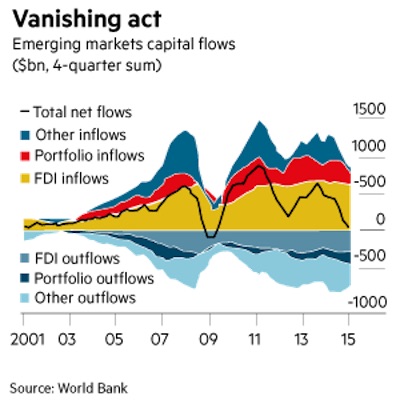

Expectations for a weaker yuan have led to an exodus of capital by Chinese residents and foreign investors. Though it still boasts the largest holding of foreign reserves at $3.3 trillion, China has experienced huge outflows in recent months. Hedge funds are gambling that China will let its currency weaken further in a bid to halt a flood of money leaving the country and jump-start economic growth. The effort is a lot riskier, though, than taking on a currency whose value is set by the market. China’s state-run economy gives the government a number of levers to pull and tremendous resources at its disposal. Earlier this year, state institutions bought up so much yuan in the Hong Kong market where foreigners place most of their bets that overnight borrowing costs shot up to 66%, making it difficult to finance short positions and sending the yuan up sharply.

Just the beginning. They don’t dare close too many mills and make large numbers of people unemployed. But they have, in my guess, at least 50% overcapacity.

• China’s Steel Sector Hit By Growing Losses (FT)

A sharp reversal in China’s steel industry has led to more than half of major producers reporting losses last year. Member companies of the China Iron and Steel Association suffered a combined loss of Rmb64.5bn ($9.8bn), compared with profits of Rmb22.6bn in 2014. The country’s steel industry, which accounts for more than half of global production, contracted for the first time last year, with raw steel production dropping 2.3% — the first fall since 1981. Steel demand is wilting as construction and heavy industry stutter, a slowdown highlighted on Monday when China’s official manufacturing purchasing managers’ index for January fell to 49.4, from 49.7 in December. PMI readings below 50 indicate a fall-off in activity.

Li-Gang Liu, China chief economist at ANZ, said the reading suggested “the contraction in the manufacturing sector became more entrenched”. Mr Liu noted that year-on-year steel output fell 12% in both December and early January. The National Bureau of Statistics attributed the steeper than expected fall on the government’s campaign to reduce industrial overcapacity, especially in the steel and coal sectors, as well as a spillover effect from the lunar new year holiday. The holiday begins on February 7 and firms often suspend activity weeks in advance. China’s economic slowdown hit domestic steel demand hard in 2015, with steel-intensive industries, including the once-resilient property sector, unwilling to launch new projects in the face of overhanging inventories.

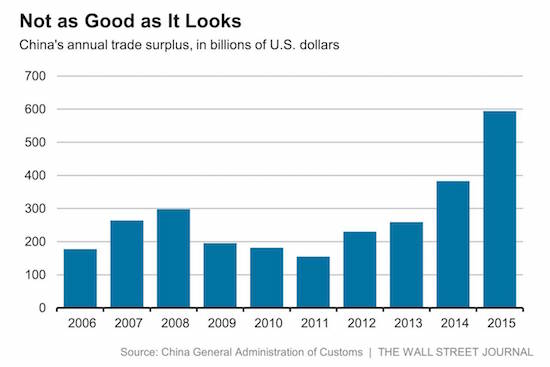

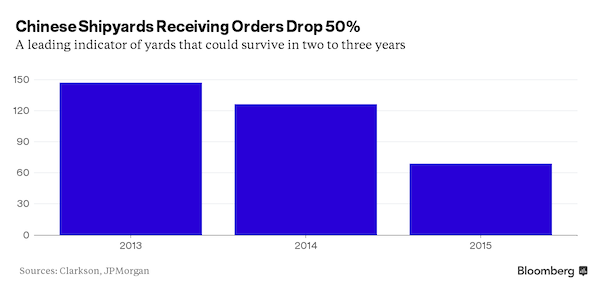

CISA, blaming industry losses on plummeting domestic prices, said its price index fell more than 30% over the course of 2015. Mill closures remain unlikely despite the losses, however, in part due to fears that the subsequent mass job losses could lead to social instability. The closure of so-called zombie companies alone could mean 400,000 lay-offs, according to a recent speech by Li Xinchuang, head of the China Metallurgical Industry Planning and Research Institute. Faced with these issues, ramping up export volume remains the industry’s chosen palliative for overcapacity. China’s steel exports grew more than 20 per cent in 2015 to 112m tonnes. The flood of Chinese steel is stoking trade protectionism as companies in other parts of the world struggle to compete with Chinese prices. In 2015, 37 cases were filed against Chinese steel producers, most on anti-dumping grounds.

Sure it’s not really Brussels where the deepest faultlines are?

• Athens And Rome Expose Europe’s Greatest Faultlines (Münchau)

How should we think about systemic risk in Europe today? The EU has been moderately successful at crisis management. But the ability to muddle through is reaching its limits when, as now, several crises intersect at once. You can see the problem most clearly in Greece — a country battling both an economic meltdown and a refugee crisis — with not much help from the rest of the EU. Last week when the European Commission issued a report criticising Athens over its failure to control its borders, Macedonia took the unilateral decision to close its southern crossing with Greece — leaving thousands of refugees in transit on the Greek side of the border. In Athens, meanwhile, parliament discussed pension reform, forced upon the country by their creditors as a quid pro quo for continued financial life support.

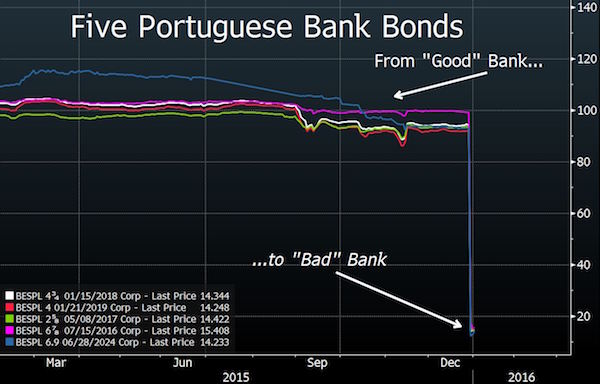

Greece may be the starkest example, but it is not the only country facing overlapping crises. It is not even the most important one facing this dilemma. That would be Italy. While Rome’s problems are different from those of Greece, the country’s long-term sustainability in the eurozone is just as uncertain, unless you believe that its economic performance will miraculously improve when there is no reason why it should. Italy was overwhelmed by the increase of refugees from north Africa last year. On top of that it faces unresolved economic problems — no productivity growth for 15 years; a large stock of public sector debt that leaves the government with virtually no fiscal room for manoeuvre; and a banking system with €200bn in non-performing loans, plus another €150bn of debt classified as troubled.

Then consider that its three main opposition parties have, at one time or another, all questioned the country’s membership of the eurozone. Even if none of them look like coming to power in the near future, it is clear that Italy only has a limited amount of time to fix its multiple problems. The struggle to repair the banking system is a good example of just how big the task is. Last week, the Italian government and the European Commission agreed a convoluted scheme to relieve the Italian banking system of some of these toxic assets. It uses all the dirty tricks of modern finance, including the infamous credit default swap, a financial product that mimics insurance against default on a bond, which was particularly popular during the pre-2007 credit bubble. These instruments allow investors to hedge against default risk. But more often than not, their true purpose is to conceal information, to fool investors, or to circumvent regulatory restrictions.

Which of course deepens the deflation. Ergo: more price cuts on the way. Rock and an impossible place.

• Euro-Area Factories Cut Prices as Deflation Risks Loom Large (BBG)

Factories in the euro area slashed prices of goods by the most in a year in January, highlighting the deflationary risks that’s keeping alarm bells ringing at the ECB. In its monthly manufacturing report, Markit Economics said price pressures “remained on the downside” and output charges fell for a fifth month. In addition, all countries in its survey reported declines, the first time that’s happened in 11 months. President Mario Draghi said the ECB’s stimulus policies will be reviewed in March as the region’s inflation rate may drop below zero again because of oil’s slump. Price growth has been slower than the central bank’s goal of just under 2% for almost three years. “The euro zone’s manufacturing economy missed a beat at the start of the year,” said Chris Williamson at Markit.

“If the slowdown in business activity wasn’t enough to worry policy makers, prices charged by producers fell at the fastest rate for a year to spur further concern about deflation becoming ingrained.” Inflation in the 19-country region accelerated to 0.4% in January, according to data last week, with the core rate rising to 1%. Still, that may only be a temporary reprieve. Markit’s headline Purchasing Managers’ Index fell to 52.3 from 53.2, matching an initial estimate published last month. Among the region’s largest countries, growth slowed in Germany and Italy, stagnated in France and accelerated in Spain. Markit said its survey signals annual manufacturing output growth of just 1.5% at the start of the year. “The data are likely to add to pressure on the ECB to expand the central bank’s stimulus programme as soon as March,” Williamson said.

Watch the dominoes go.

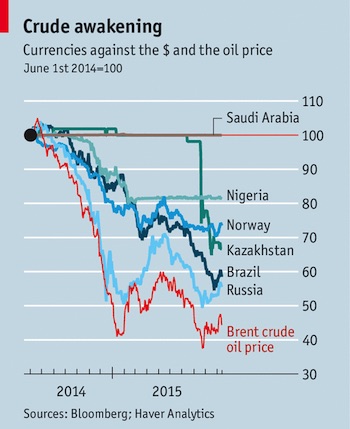

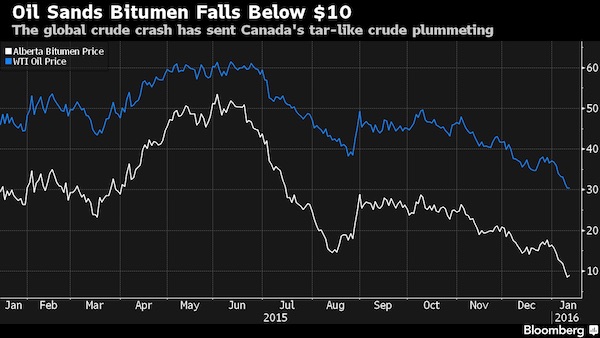

• Nigeria Asks For $3.5 Billion In Global Emergency Loans (FT)

Nigeria has asked the World Bank and African Development Bank for $3.5 billion in emergency loans to fill a growing gap in its budget in the latest sign of the economic damage being wrought on oil-rich nations by tumbling crude prices. The request from the eight-month-old government of President Muhammadu Buhari is intended to help fund a $15 billion deficit in a budget heavy on public spending as the west African country attempts to stimulate a slowing economy and offset the impact of slumping oil revenues. It comes as concerns grow over the impact of low oil prices on petroleum exporting economies in the developing world. Azerbaijan, which last month imposed capital controls to try and halt a slide in its currency, is in discussions with the World Bank and the IMF about emergency assistance.

Nigeria’s economy is Africa’s largest and has been hit hard by the fall in crude prices — oil revenues are expected to fall from 70% of income to just a third this year. Finance minister Kemi Adeosun told the Financial Times recently that she was planning Nigeria’s first return to bond markets since 2013. But Nigeria’s likely borrowing costs have been rising alongside its budget deficit. A projected deficit of $11bn, or 2.2% of gross domestic product, had already risen to $15bn, or 3%, as a result of the recent turmoil in oil markets. The $2.5bn loan from the World Bank and a parallel $1bn loan from the ADB, which would enjoy below-market rates, must still be approved by both banks’ boards.

Under World Bank rules its loan would be subject to an IMF endorsement of the government’s economic policies and bank officials say they would have to be confident the Nigerian government was undertaking significant structural reforms. But both loans would carry far fewer conditions than one from the IMF, which does not believe Nigeria needs a fully fledged international bailout at this point.

Can we call it a draw for now? Bit early to call, we’re just getting off the starting line.

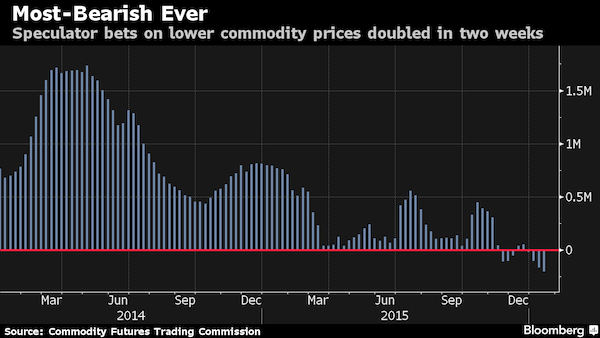

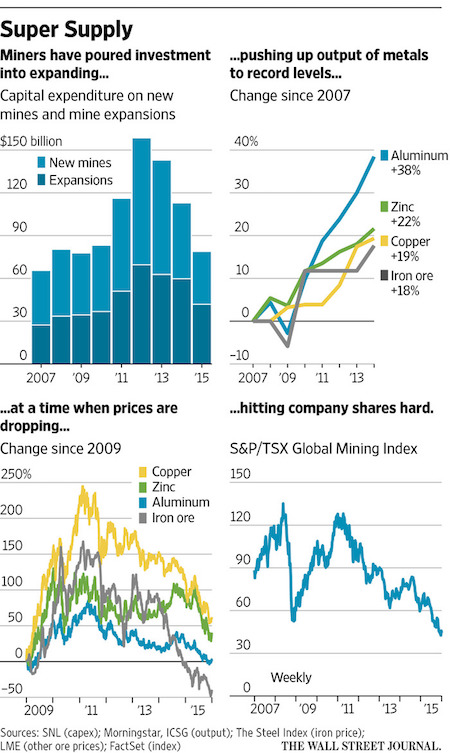

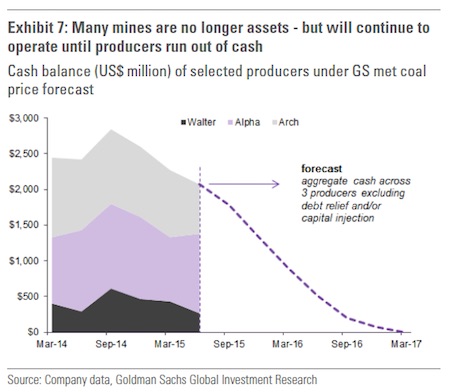

• Why Miners Have it Worse Than Oil Producers (BBG)

“Things’ll go your way, if you hold on for one more day,” vocal group Wilson Phillips once crooned. Mining companies seem to have taken those lyrics to heart, opting to maintain production as long as their cash reserves allow and in effect delay a long-awaited resolution in the supply and demand balance of dry commodities, according to a new note from Goldman Sachs. The nature of the metals and mining business—legal considerations combined with an ability to store excess supply for the long-haul—means the industry faces a longer shakeout than in the energy sector. “Many of the [mining] structures are no longer assets but rather liabilities due to environmental regulations,” write Goldman analysts led by Head of Commodities Research Jeffrey Currie.

“This suggests that, in order to delay the environmental costs of mine rehabilitation, the penalties associated with employee layoff and non-performance of commercial obligations, owners will operate the facilities until they run out of cash and are obliged to suspend operations.” The trend is particularly true of U.S. coal miners, according to the analysts, and underscored by recent failed auctions of mining assets. “[Last] week we saw Alpha Natural Resources cancel an auction of 35 coal mines at the last minute due to a lack of interest, illustrating the fact that some mining assets burdened with outstanding liabilities and negative margins are left without any residual value,” Goldman notes.

Fundamental differences between metals and energy businesses have resulted in lower volatility for prices of gold, aluminium and similar dry commodities compared to energy-related products such as natural gas, electricity, and crude, the Goldman analysts say. “Theoretically, once an energy market breaches storage capacity, prices need to collapse below cash costs to immediately re-balance supply with demand. In practice, however, operational stress in energy is a local, not global concept as breaching storage capacity happens most likely in landlocked locations, but it does whittle away at the global supply overhang,” the analysts write. “In contrast, metals can be ‘piled high’ in low-cost locations almost anywhere in the world with far greater density, i.e. dollar per square foot, than energy.”

To illustrate the point, Goldman calculates that $1 billion worth of gold would, at current spot prices, fit into a generously-sized bedroom closet, while $1 billion worth of oil would take up 17 very large crude carriers, each with a capacity of more than a quarter of a million deadweight metric tons. With an estimated 12 months of cash reserves left for some U.S. coal miners, financial stress needs to deepen before the supply-demand balance even begins to resolve itself.

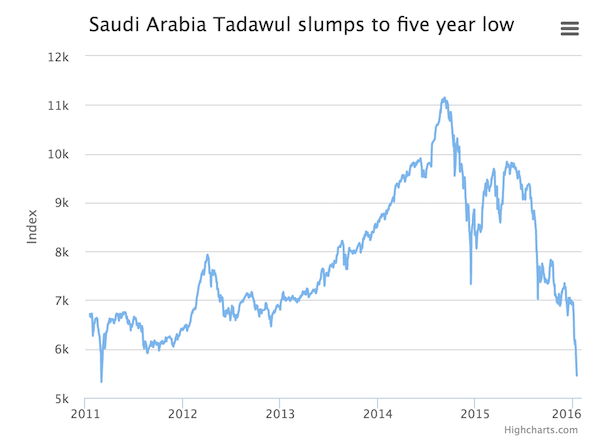

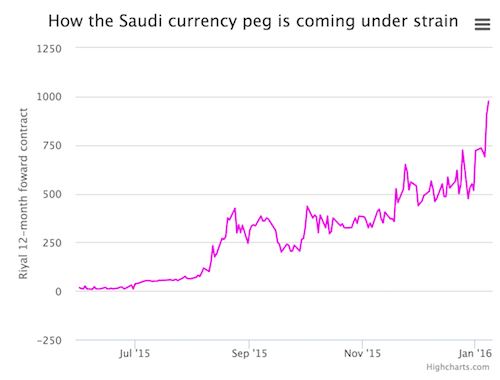

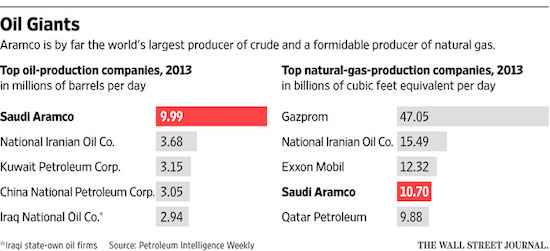

Saudi leaders have the same problem as the Chinese: they’re afraid of their people.

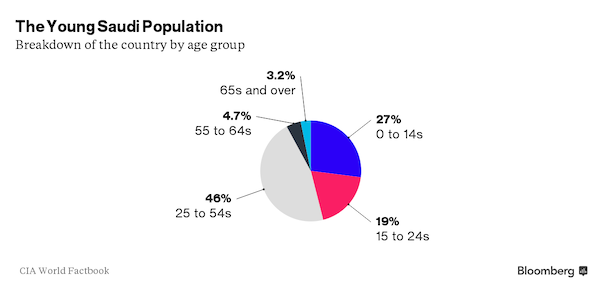

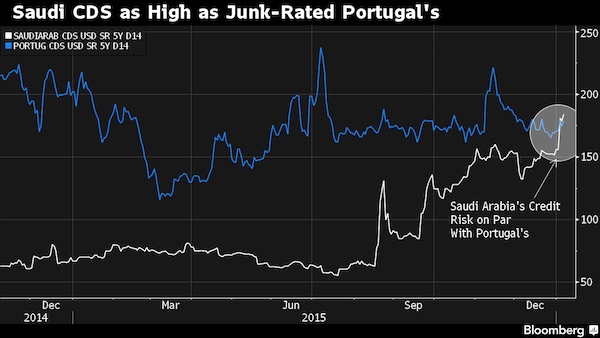

• Saudis Told To Embrace Austerity As Debt Defaults Loom (Tel.)

Saudi Arabia faces years of tough austerity as the worst oil price crash in the modern history forces the kingdom to make radical cuts to government largesse, the IMF has warned. The world’s largest producer of crude oil will need to “transform” its economy away from oil revenues, which make up more than 80pc of the government’s wealth, according to Masood Ahmed, head of the Middle East department at the IMF. The Saudi monarchy has already been forced to unveil the largest programme of government austerity in decades as oil prices have collapsed by more than 70pc in 18 months. “This will have to be part of a multi-year adjustment process,” Mr Ahmed told The Telegraph. He urged the kingdom to reform its generous system of oil subsidies and introduce a host of new taxes, including consumption levies such as VAT.

“There will have to be a major transformation of the Saudi economy. It is necessary and it is going to be difficult, but it is a challenge which I think the authorities have clearly laid out”, said Mr Ahmed. The warning comes as the world’s weakest oil producing nations could buckle under the pressure of the price rout. IMF officials have been in Azerbaijan this week amid fears Baku will need a $4bn international rescue package to stave off a debt default. During the world’s last major oil price crash in 1986, 17 out of 25 of the developing world’s major oil producers defaulted on their debts, according to research from Oxford Economics. Debt mountains in producer nations ballooned by 40pc of GDP on average.

“The 1980s precedents are alarming; producers that avoided sovereign defaults were the exception rather than the rule”, said Gabriel Sterne at Oxford Economics. Azerbaijan was forced to abandon its foreign exchange peg with the dollar in December, after speculators caused the currency to crash. The Saudis have been burning through their reserves at a record pace to protect the riyal’s fixed value against a soaring dollar, and should continue to preserve the peg at all costs, said the IMF. Mr Ahmed said it was “neither necessary nor appropriate” for Riyadh to move to a floating exchange rate, forcing it to undertake record levels of expenditure cuts instead.

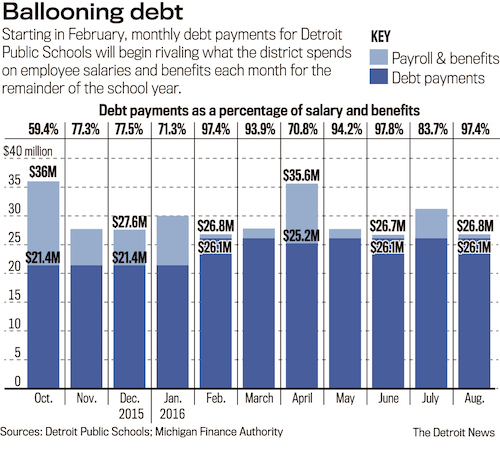

$7.6 billion in a year and a half. Eat your heart out, Bernie.

• 1 Million Investors Lose $7.6 Billion In China Online Ponzi Scheme (Reuters)

Chinese police have arrested 21 people involved in the operation of peer-to-peer lender Ezubao, the official Xinhua news agency said on Monday, over an online scam it said took in some 50 billion yuan ($7.6 bn) from about 900,000 investors. Ezubao was a Ponzi scheme, the Xinhua report said, and more than 95% of the projects on the online financing platform were fake. Among those arrested were Ding Ning, the chairman of Yucheng Group, which launched Ezubao in July 2014. It was not possible to reach Ezubao officials for comment and it was not clear if Ding had legal representation.

Ezubao’s website has been shut down and it appeared Yucheng Group’s Beijing office had been closed when Reuters reporters visited before Monday’s Xinhua report. Chinese police said they had sealed, frozen and seized the assets of Ezubao and its linked companies as part of investigations into China’s largest P2P online platform by lending figures. The Ezubao case has underscored the risks created by China’s fast-growing $2.6 trillion wealth management product industry. Many products are sold through loosely regulated channels, including online financial investment platforms and privately run exchanges.

“The combination of propaganda, financial power, stupidity and bribes means that there is no hope for European peoples.”

• The West Is Reduced To Looting Itself (Paul Craig Roberts)

I, Michael Hudson, John Perkins, and a few others have reported the multi-pronged looting of peoples by Western economic institutions, principally the big New York Banks with the aid of the International Monetary Fund (IMF). Third World countries were and are looted by being inticed into development plans for electrification or some such purpose. The gullible and trusting governments are told that they can make their countries rich by taking out foreign loans to implement a Western-presented development plan, with the result being sufficient tax revenues from economic development to service the foreign loan. Seldom, if ever, does this happen. What happens is that the plan results in the country becoming indebted to the limit and beyond of its foreign currency earnings.

When the country is unable to service the development loan, the creditors send the IMF to tell the indebted government that the IMF will protect the government’s credit rating by lending it the money to pay its bank creditors. However, the conditions are that the government take necessary austerity measures so that the government can repay the IMF. These measures are to curtail public services and the government sector, reduce public pensions, and sell national resources to foreigners. The money saved by reduced social benefits and raised by selling off the country’s assets to foreigners serves to repay the IMF. This is the way the West has historically looted Third World countries. If a country’s president is reluctant to enter into such a deal, he is simply paid bribes, as the Greek governments were, to go along with the looting of the country the president pretends to represent.

When this method of looting became exhausted, the West bought up agricultural lands and pushed a policy on Third World countries of abandoning food self-sufficiency and producing one or two crops for export earnings. This policy makes Third World populations dependent on food imports from the West. Typically the export earnings are drained off by corrupt governments or by foreign purchasers who pay little while the foreigners selling food charge much. Thus, self-sufficiency is transformed into indebtedness. With the entire Third World now exploited to the limits possible, the West has turned to looting its own. Ireland has been looted, and the looting of Greece and Portugal is so severe that it has forced large numbers of young women into prostitution. But this doesn’t bother the Western conscience.

Previously, when a sovereign country found itself with more debt than could be serviced, creditors had to write down the debt to an amount that the country could service. In the 21st century, as I relate in my book, The Failure of Laissez Faire Capitalism, this traditional rule was abandoned. The new rule is that the people of a country, even a country whose top offiials accepted bribes in order to indebt the country to foreigners, must have their pensions, employment, and social services slashed and valuable national resources such as municipal water systems, ports, the national lottery, and protected national lands, such as the protected Greek islands, sold to foreigners, who have the freedom to raise water prices, deny the Greek government the revenues from the national lottery, and sell the protected national heritage of Greece to real estate developers.

What has happened to Greece and Portugal is underway in Spain and Italy. The peoples are powerless because their governments do not represent them. Not only are their governments receiving bribes, the members of the governments are brainwashed that their countries must be in the European Union. Otherwise, they are bypassed by history. The oppressed and suffering peoples themselves are brainwashed in the same way. For example, in Greece the government elected to prevent the looting of Greece was powerless, because the Greek people are brainwashed that no matter the cost to them, they must be in the EU. The combination of propaganda, financial power, stupidity and bribes means that there is no hope for European peoples.

Humanity? Morals? Not us.

• US, UK-Backed Saudi War & Blockade Cause Mass Starvation In Yemen (Salon)

Mass starvation is ongoing in Yemen, the United Nations warns, calling it a “forgotten crisis.” The poorest country in the Middle East may be on the brink of famine, while it faces bombing and a blockade from a Saudi-led coalition, backed by the U.S. and the U.K. Approximately 14.4 million Yemenis — more than half of the population of the country — are food insecure, according to a new report by the Food and Agriculture Organization of the United Nations, also known as the FAO. The U.N. estimates there are 25 million people in Yemen. This means at least 58% of the population is food insecure. Hunger is growing. In the seven months since June 2015, the number of food insecure Yemenis has grown by 12%. Since late 2014, the number has grown by 36%. “The numbers are staggering,” remarked Etienne Peterschmitt, FAO deputy representative and emergency response team leader in Yemen.

Peterschmitt called the mass starvation “a forgotten crisis, with millions of people in urgent need across the country.” The FAO says “ongoing conflict and import restrictions have reduced the availability of essential foods and sent prices soaring.” What the FAO does not mention in its report, however, is that these import restrictions are a result of the Saudi blockade on Yemen. Since the war broke out in March, with the backing of the U.S. and U.K., Saudi Arabia has imposed a naval, land and air blockade on Yemen — which imports more than 90% of its staple foods. Because of the Saudi-led blockade and war, for more than six months, humanitarian organizations have warned that 80% of the Yemeni population, 21 million people, desperately need food, water, medical supplies and fuel.

The U.N. has insisted for over half a year that Yemenis are enduring a “humanitarian catastrophe.” Salon sent the FAO multiple requests for comment, inquiring as to why the agency did not directly acknowledge the Saudi blockade, yet did not receive a response. The U.S. media and government have devoted very little attention to the Saudi blockade, and the U.N. has not mentioned it much in its reports on Yemen. Journalist Sharif Abdel Kouddous has warned that “Yemen is now the world’s worst humanitarian crisis.” [..] The Obama administration has sold more than $100 billion in weapons to the Saudi absolute monarchy in the past five years. The Saudi military has dropped U.S.-made cluster munitions, which are banned in 118 countries, on civilian neighborhoods in Yemen, in what Human Rights Watch called “outrageous” and a “war crime.”

The unholy union on its last legs.

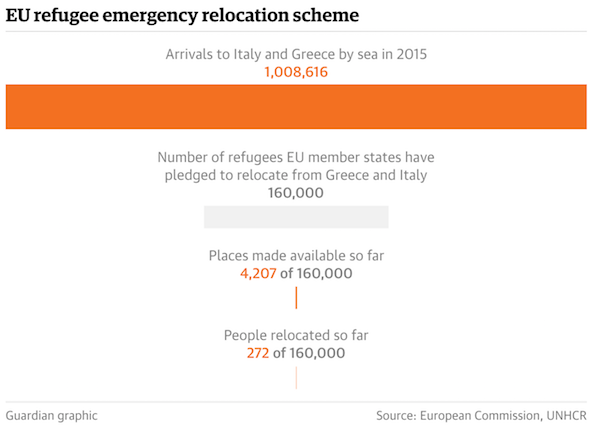

• Europe Chokes Flow of Refugees to Buy Time for a Solution (WSJ)

Europe is bottling up migrants at the foot of the Balkans as its other plans for stemming the migration crisis flounder. EU member states have sent border guards, police vehicles and fingerprinting machines to Macedonia, which isn’t a member of the bloc. The goal: to squeeze the river of people still streaming north from Greece toward Germany into a trickle, turning away all but those from war-torn countries such as Syria and Iraq. The mounting restrictions are buying German Chancellor Angela Merkel time as she asks voters for patience and lobbies fellow EU leaders to implement what she promises will be a comprehensive solution to the migration crisis.

Ms. Merkel wants Turkey to dismantle smuggling networks that bring migrants across the Aegean Sea to Greece, and she wants Greece to set up large registration camps that would allow recognized refugees to be settled across the EU. But with the chancellor’s approach making little headway, many European policy makers say they have only until March to reduce the numbers from the Middle East, South Asia and Africa who are arriving in the Continent’s core, mainly Germany. Soon, spring weather on the Aegean is expected to accelerate the arrivals, just as Ms. Merkel’s conservatives face state elections in which an anti-immigration party is poised for unprecedented gains. Within Ms. Merkel’s ruling coalition, demands to shut Germany’s own border are multiplying. Support for her open-door policy is waning abroad too. Even her ally Austria has announced an annual cap on asylum places.

Mounting political pressure around Europe to cut the numbers arriving, coupled with security fears about potential terrorists using the migrant trail, is leading to measures that could effectively redraw Europe’s border at the Balkans. In Macedonia, a small, impoverished ex-Yugoslav republic, officials warn that European governments are discussing a Plan B that would have the Macedonian-Greek border sealed off entirely, with the help of EU and Balkan countries further north. “We aren’t three months away, but weeks” from cutting off Greece, Macedonian Foreign Minister Nikola Poposki said in an interview. “Actually, this is the second-worst option, because the worst option isn’t doing anything, and then each of the [EU] member states would be sealing off its own borders,” he said.

“The last German politician under whom refugees were shot at was Erich Honecker..”

• German Police ‘Should Shoot At Migrants’, Populist Politician Says (BBC)

German police should “if necessary” shoot at migrants seeking to enter the country illegally, the leader of a right-wing populist party has said. Frauke Petry, head of the eurosceptic Alternativ fuer Deutschland (AfD) party, told a regional newspaper: “I don’t want this either. But the use of armed force is there as a last resort.” Her comments were condemned by leftwing parties and by the German police union. More than 1.1 million migrants arrived in Germany last year. Also on Saturday, German Chancellor Angela Merkel said most migrants from Syria and Iraq would go home once the wars in their countries had ended. She told a conference of her centre-right CDU party that tougher measures adopted last week should reduce the influx of migrants, but a European solution was still needed.

Police must stop migrants crossing illegally from Austria, Ms Petry told the Mannheimer Morgen newspaper (in German), and “if necessary” use firearms. “That is what the law says,” she added. A prominent member of the centre-left Social Democrats, Thomas Oppermann, said: “The last German politician under whom refugees were shot at was Erich Honecker” – the leader of Communist East Germany. Germany’s police union, the Gewerkschaft der Polizei, said (in German) officers would never shoot at migrants. It said Ms Petry’s comments revealed a radical and inhumane mentality. The number of attacks on refugee accommodation in Germany rose to 1,005 last year – five times more than in 2014.

Not PC. “They” are the enemy, not “We”.

• UK Labour MP Compares Cologne Attacks To Birmingham Night Out (Tel.)

The Labour MP Jess Phillips is facing calls to resign after comparing the organised sexual assaults committed by gangs of migrants in Cologne to the regular harassment of women on the streets of Birmingham. The city’s residents and business owners have hit back, saying her comments were “irresponsible, highly inaccurate and misleading”. Ms Phillips, the MP for Birmingham Yardley, suggested this week that the recent attacks in Germany are no different to the situation women find themselves in the centre of Birmingham. Her remarks have incensed locals who have called on her to resign from her post and “identify the error of her ways in what she said”. Mike Olley, manager of the West Side business improvement district, said that Birmingham’s Broad Street is “not like the Wild West”.

Speaking on BBC Radio 4’s Today programme, he said that sexual harassment is “not an institutionalised part of what goes on there” On New Year’s Eve in Cologne, Germany, dozens of women found themselves trapped in a crowd of around 1,000 men, who groped them, tore off their underwear, and shouted lewd insults. German authorities have since said that almost all of the New Year’s Eve sex attackers have a “migrant background”. Superintendent Andy Parsons, Police Commander for Central Birmingham, said that Ms Phillips’ comments “aren’t born out certainly in terms of crime statistics”. He added: “But I also appreciate it’s not just about statistics. I’ve got recent experience myself policing New Year on Broad Street, it was extremely busy and the atmosphere was one of celebration rather than one of sexual overtones.

“In a night time economy …there will be activity that is alcohol fuelled – but is it fair to compare it to incidents in Cologne on New Year? I don’t think it is.” However, some acknowledged that sexual harassment is a problem in the city. Michael Mclean, chairman of Broad Street Pub Watch said that sexual harassment is “something that we see and if I turned round and said that we didn’t, I’d be lying”. He went on: “Does it happen? Yes it does. Is it true what people are saying relating it to the cologne sex attacks? Absolutely not. The correlation between the two is a massive over exaggeration.”

Sutherland has consistently been that lonely civilized voice.

• The EU Must Reassert Humane Control Over Chaos Around The Mediterranean (UN)

by Peter Sutherland, UN’s special representative for migration

The European refugee debate reached a new nadir with a proposal to expel Greece from the Schengen zone and effectively transform it into an open-air holding pen for countless thousands of asylum seekers. The idea is not only inhumane and a gross violation of basic European principles; it also would prove vastly more costly than the alternative – a truly common EU policy that quells the chaos of the past year. Six countries have already reimposed border controls, and the European commission is preparing to allow them, and presumably others, to do the same for two years. The financial price of this alone is enormous – in the order of at least €40bn (including costs to fortify borders and those incurred by travellers and shippers). It would be much less expensive, financially and politically, to establish a common EU border and coastguard, and a functioning EU asylum agency.

This has proved to be, effectively, a zero-sum game. The rush by member states last year to seal their own perimeters left them unable to help shore up the EU’s external borders. They failed to send Greece the personnel and ships it had been promised. As such, the need for national border controls has become a self-fulfilling prophecy. A selfish, unilateral approach to borders constitutes a repeat of the tragedy of 2015, when EU member states individually spent about €40bn to address the crisis after it had reached European shores. In early 2015, the UN asked for a small fraction of that to feed, house and school the four million refugees in Turkey, Jordan, and Lebanon, but the international community and Europe failed to deliver (and many EU members still haven’t paid their share).

Unable to feed and educate their children, thousands of refugees ceded their savings to smugglers for a chance to reach Europe – precisely what you and I would have done had we been in their place. Europe cannot afford another such failure. The EU, working with the international community, must reassert humane control over the chaos around the Mediterranean. This entails immediate action on three fronts: first, raising the necessary tens of billions to allow refugees in frontline countries to live, work, and go to school there; states and the private sector must also help to create jobs both for refugees and natives through investments in the region and free-trade regimes.

Second, EU members must agree to accept several hundred thousand refugees directly from the region via safe, secure pathways and to match them to communities in Europe able to host them; failing to do this will alienate the frontline countries that bear most of the burden. Third, EU states must focus on creating a common-border regime, coastguard and asylum agency rather than return to the era of the Berlin Wall. The EU is hurtling towards disintegration, not due to some insurmountable challenge or outside force. It is instead succumbing to a self-induced panic that has paralysed its common sense. It is time to end the nightmare.