René Magritte The human condition 1935

US “as the focus of global retaliation”..

• IMF Warns Trump Trade War Could Cost Global Economy $430 Billion (G.)

Rising trade tensions between the United States and the rest of the world could cost the global economy $430bn, with America “especially vulnerable” to an escalating tariff war, the International Monetary Fund has warned. Delivering a sharp rebuke for Donald Trump, the Washington-based organisation said the current threats made by the US and its trading partners risked lowering global growth by as much as 0.5% by 2020, or about $430bn in lost GDP worldwide. Although all economies would suffer from further escalation, the US would find itself “as the focus of global retaliation” with a relatively higher share of its exports taxed in global markets. “It is therefore especially vulnerable,” the fund said.

Trump raised the stakes in his mounting trade dispute with China last week by proposing 10% tariffs on $200bn of Chinese goods entering the country, on top of $34bn of tariffs that were officially imposed on Beijing at the beginning of the month. The Chinese government, which hit back at the first wave of US tariffs with similar measures, was quick to warn of further retaliation on Monday.[..] Issuing its latest World Economic Outlook report on Monday amid the rising tensions, the IMF said there were greater risks emerging for the global economy since its last assessment in the spring. Although world growth remains strong, the expansion is “becoming less even, and risks to the outlook are mounting”, it said.

So much vitriol these days. Craig Murray is one of many to tone it down.

• Detente Bad, Cold War Good (Murray)

The entire “liberal” media and political establishment of the Western world reveals its militarist, authoritarian soul today with the screaming and hysterical attacks on the very prospect of detente with Russia. Peace apparently is a terrible thing; a renewed arms race, with quite literally trillions of dollars pumped into the military industrial complex and hundreds of thousands dying in proxy wars, is apparently the “liberal” stance. Political memories are short, but just 15 years after Iraq was destroyed and the chain reaction sent most of the Arab world back to the dark ages, it is now “treason” to question the word of the Western intelligence agencies, which deliberately and knowingly produced a fabric of lies on Iraqi WMD to justify that destruction.

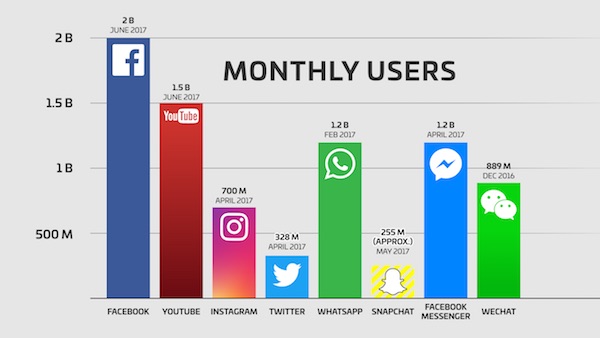

It would be more rational for it to be treason for leaders to blindly accept the word of the intelligence services. This is especially true on “Russia hacking the election” when, after three years of crazed accusations and millions of man hours by lawyers and CIA and FBI investigators, they are yet to produce any substantive evidence of accusations which are plainly nuts in the first place. This ridiculous circus has found a few facebook ads and indicted one Russian for every 100,000 man hours worked, for unspecified or minor actions which had no possible bearing on the election result.

There are in fact genuine acts of election rigging to investigate. In particular, the multiple actions of the DNC and Democratic Party establishment to rig the Primary against Bernie Sanders do have some very real documentary evidence to substantiate them, and that evidence is even public. Yet those real acts of election rigging are ignored and instead the huge investigation is focused on catching those who revealed Hillary’s election rigging. This gets even more absurd – the investigation then quite deliberately does not focus on catching whoever leaked Hillary’s election rigging, but instead seeks to prove that the Russians hacked Hillary’s election-rigging, which I can assure you they did not. Meanwhile, those of us who might help them with the truth if they were actually interested, are not questioned at all.

Excellent point by point take-down of the entire indictment.

• Mueller’s Latest Indictment Contradicts Evidence In The Public Domain (Carter)

Mueller’s indictment leaves us with the premise that a supposed GRU officer working in league with other GRU officers, acquiring Podesta’s attachments and, just three days after Julian Assange announces leaks are coming in relation to Hillary Clinton, releases deliberately tainted files that serve to pin the blame on Russians, that only really hurt Trump, that ultimately undermined leaks and that provided fabricated evidence. Evidence that, for whatever reason, supported several claims made by CrowdStrike executives published in a legacy media article the previous day.

Guccifer 2.0 repeatedly tried to associate his efforts with WikiLeaks (from the day he appeared) – an organization for whistleblowers to be able to leak files anonymously. Something a hacker willing to publish leaks on his own blog would have had no need for, especially not if he was connected to a site that published leaks already (that is, DCLeaks.com). What we know about Guccifer 2.0 and his multi-layered efforts to be seen as Russian destroy the notion that he was anyone operating on the side of the Russian state.

Ultimately, the indictment produces a lot of new claims, many in keeping with what we know or have heard, however, it presents no evidence to support what it has introduced and an indictment by itself is not evidence, points that have already been noted by Consortium News, Moon of Alabama, Mark McCarty and others. They have also picked up on the timing of the indictment, which seems to have become a theme for Mueller’s indictments in particular. This latest example comes immediately following Rosenstein and Strzok being grilled and receiving negative press as well as immediately before Trump’s summit with Putin. Exactly how much of the indictment is bogus, I can’t know for sure, but definitely, some of it is, especially those parts that relate to the Guccifer 2.0 persona “being on Russia’s side” in all of this.

The whole WMD presentation lost Mueller his right to be believed at face value.

• Has Mueller Caught the Hackers? (RN/NC)

AARON MATE: Right. So, then let me ask you, Michael, this question, this belief that Putin personally ordered this interference campaign against the U.S. The strongest evidence to bolster it that I’ve seen was this Washington Post report in June 2017, I believe, that said that the U.S. had a mole inside Putin’s inner circle who reported that he personally instructed this operation to happen. Doesn’t that strike you as odd, that, well A, that the U.S. could penetrate Putin’s inner circle at that high level, and B, if they did, that they’d be willing to disclose that in a media report, thereby potentially compromising this incredibly sensitive source of information?

MICHAEL ISIKOFF: Now, you read Russian Roulette and you read about the secret source they had inside the Kremlin in 2014, who was warning the U.S. government that this is exactly what Putin’s government was up to. And this is what they were planning. And I know exactly. I know, we know a lot more about that secret source than we put in the book. This was something that was vetted very carefully. But it is not at all unusual that American spy agencies would seek to cultivate and develop sources who can provide insight into what Putin’s up to, and in these cases they clearly did.

AARON MATE: Someone claims they did. I just find it shocking that they would publicly reveal that, something that high level.

MICHAEL ISIKOFF: Well, so what’s your suggestion? That they invented the source, or what’s your-?

AARON MATE: My suggestion is it’s quite possible that, given the legacy of U.S. intelligence officials inventing intelligence to fix, to comport with political imperatives whatever they are, whether it’s the Iraq War, whether it’s allegations against any number of official U.S. enemies, that that may have happened here. And I’m just urging skepticism in the absence of evidence that we obviously disagree on whether it has been presented yet.

Doesn’t look like we will ever see proof.

• Putin Rejects UK’s ‘Ungrounded Accusations’ Over Novichok Poisoning (AFP)

Vladimir Putin has accused Britain of making baseless allegations against Russia over the former Soviet spy and three other people poisoned, one fatally, with the novichok nerve agent in Salisbury. Asked in a Fox News interview about the British government’s assertion that Moscow was behind the novichok attack on the former spy Sergei Skripal, Putin said London had not provided any evidence to back up the claim. “We would like to get documentary evidence but nobody gives it to us,” Putin, speaking through a translator, told the US network after a summit with Donald Trump in Finland.

“It’s the same thing with the accusations of meddling in the election process in America,” he added in reference to claims that Russia interfered in the 2016 US presidential election which was won by Trump. Putin suggested the case could be driven by domestic issues in Britain, saying: “Nobody wants to look into these.” “We just see the ungrounded accusations – why is it done this way? Why should our relationship be made worse by this?” The former Russian double agent Skripal and his daughter Yulia collapsed in Salisbury on 4 March after being exposed to novichok. Both have since recovered. On 30 June Charlie Rowley and his partner Dawn Sturgess fell ill not far from the Skripal attack after being exposed to the same nerve agent. Sturgess died on 8 July.

Referred to the police. What are they going to do with this? At what point does the whole vote get nullified?

• Vote Leave Fined For Breaking Electoral Law (BBC)

Brexit campaign group Vote Leave has been fined £61,000 and referred to the police after an Electoral Commission probe said it broke electoral law. The investigation found “significant evidence of joint working” between the group and another organisation – BeLeave – leading to it exceeding its spending limit by almost £500,000. Vote Leave also returned an “incomplete and inaccurate spending report”, with almost £234,501 reported incorrectly, and invoices missing for £12,849.99 of spending, the watchdog said. BeLeave founder Darren Grimes has also been fined and referred to the police for breaking the group’s spending limit by more than £665,000 and wrongly reporting the spending as his own.

Veterans for Britain were also found to have inaccurately reported a donation it received from Vote Leave and has been fined £250. Bob Posner, from the Electoral Commission, said: “The Electoral Commission has followed the evidence and conducted a thorough investigation into spending and campaigning carried out by Vote Leave and BeLeave. “We found substantial evidence that the two groups worked to a common plan, did not declare their joint working and did not adhere to the legal spending limits. These are serious breaches of the laws put in place by Parliament to ensure fairness and transparency at elections and referendums.”

He added: “Vote Leave has resisted our investigation from the start, including contesting our right as the statutory regulator to open the investigation. It has refused to cooperate, refused our requests to put forward a representative for interview, and forced us to use our legal powers to compel it to provide evidence. “Nevertheless, the evidence we have found is clear and substantial, and can now be seen in our report.”

Like a full-time contortionist.

• May Narrowly Heads Off Defeat After Caving In To Brexit Hardliners (G.)

Theresa May has narrowly seen off a Commons rebellion from Conservative remainers unhappy that she had caved in to hardline Brexiters by accepting their amendments to the customs bill. The government majority was reduced to just three votes on the two most controversial amendments after leading Tory remainer Anna Soubry complained that the prime minister had lost control of events by making concessions to the rightwing European Research Group of MPs. The most important of the four amendments from the ERG, chaired by Jacob Rees-Mogg, had been designed to frustrate May’s compromise proposals over customs arrangements and had initially been opposed by the government, until Downing Street made a sudden U-turn in the afternoon.

No 10 then concluded that all four amendments were “consistent with the Brexit white paper”, a decision that so incensed Tory remainers they vowed to vote against the amendments in Monday night’s Commons debate. One junior minister, Guto Bebb, resigned rather than support the ERG customs union amendment, which narrowly passed by 305 to 302. A total of 14 Tory remainers voted against the government, while three Labour MPs and former Labour MP Kelvin Hopkins voted the other way. A second ERG amendment, preventing the UK joining in with the EU’s VAT regime post-Brexit, passed 303 to 300.

A frustrated Soubry had told the Commons: “The only reason that the government has accepted these amendments is because it is frightened of somewhere in the region of 40 members of parliament – the hard, no-deal Brexiteers, who should have been seen off a long time ago and should be seen off.”

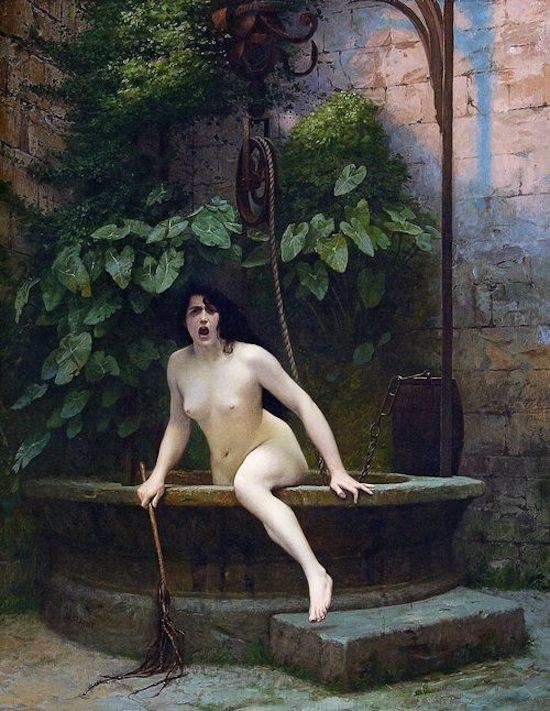

Nice metaphor.

• Brexit Is Like The Python That Swallowed An Alligator (Ind.)

About a year ago, I described the passage of Brexit through parliament as being like that regularly reappearing photograph of a Burmese python that tried to swallow a six-foot alligator whole and accidentally exploded. The alligator suffocated, the python’s head got blown off. That much is not contested. But apart from that, no one knows quite what happened in the hours before an amateur photographer chanced upon it. We must presume the alligator struggled til the last, and that is the stage of Brexit at which we have now arrived. Parliament embraced Brexit of its own free will, but now it cannot handle the monster coming down its oesophagus. And the monster itself does not want to die.

More than a year on from triggering Article 50, the point at which the teeth of the two beast’s teeth first touched, Theresa May had hoped she had found a way of easing its passage that might keep both alive. The so-called “Chequers deal”, which is not a deal at all but an agreed position among the cabinet, detonated the cabinet within moments of it being agreed to. None of which engages with the fact that the European Union was highly likely to reject the agreement anyway. David Davis has quit. Boris Johnson has quit. Justine Greening, the former education secretary who quit in January, has said the only way forward is a second referendum with three choices on the ballot paper (hard Brexit, no Brexit, or the least damaging Brexit the government can manage to get).

No there there.

• Theresa May Told Her Chequers Deal Is ‘Dead In The Water’ (Ind.)

Theresa May has faced taunts that her Chequers deal is “dead in the water” after caving in to a series of changes to customs rules demanded by pro-hard Brexit Tories. Plans for the UK to collect duties for the EU – which lie at the heart of the prime minister’s hopes for a deal with Brussels – will only go forward if the EU in turn agrees to collect them for the UK. There appears to be no prospect of the EU bowing to such a request, apparently throwing the hard-fought Chequers proposals up in the air after just 10 days. In the Commons, Ms May was accused of “dancing to the tune of the European Research Group” – the 60-80 strong organisation of Brexiteer MPs led by Jacob Rees-Mogg.

“By capitulating to their proposals on the Customs and [the] Trade Bill she is accepting that the Chequers deal is now dead in the water,” said Labour MP Stephen Kinnock. Ms May insisted he was “absolutely wrong”, telling MPs: “I would not have gone through all the work that I did to ensure that we reached that agreement only to see it changed in some way through these bills. They do not change that Chequers agreement.” Nevertheless, the Brexit white paper – published only four days ago – appeared to rule out a requirement for the EU to agree reciprocal arrangements. It said the two sides would have to “agree a mechanism for the remittance of relevant tariff revenue”, but added: “The UK is not proposing that the EU applies the UK’s tariffs and trade policy at its border for goods intended for the UK.”

Disturbing.

• IRS To Revoke 362,000 Passports From US Citizens (Black)

About two and a half years ago, I told you about a particularly nasty piece of legislation that President Obama quietly signed into law towards the end of his administration. They called it the “FAST Act”, which stood for Fixing America’s Surface Transportation. Yet despite $300 billion earmarked for infrastructure repairs, they didn’t manage to fix very much of America’s surface transportation. The legislation did, however, have two major effects: 1) The FAST Act authorized the US government to plunder excess capital from the Federal Reserve… which is about as stupid as thing as anyone could possibly do. The Federal Reserve is America’s central bank; they control the value and fate of the US dollar… which is still the most dominant currency in the world.

You’d think that having some excess cash on the Federal Reserve’s balance sheet would be viewed as wise and conservative. But not Congress. These guys are so broke, they’ll grab every penny they can get. Even from their own central bank. So they buried a provision into the FAST Act demanding that the Federal Reserve hand over any excess capital to the Treasury Department at the end of every calendar year. They started doing that almost immediately, in December 2015. And in 2016. And in 2017. This is one of the reasons why, to this day, the Federal Reserve is borderline insolvent… which hardly inspires confidence. Now, I could go on for quite some time about what an idiotic idea this was. But believe it or not, there was an even worse section of the FAST Act– one they only started implementing recently:

2) Section 32101 of the FAST Act required the US State Department to revoke or deny the passport of any taxpayer that the IRS deems to have “seriously delinquent tax debt.” They define seriously delinquent tax debt as owing $50,000 or more. Well, it took them a couple of years, but the IRS has finally started enforcing this law. Earlier this month the IRS acknowledged that they had sent at least 362,000 names to the State Department to start revoking or denying passports. And that’s just the beginning. The IRS is sending these names out ‘in batches’, so there will be many more to follow. They hope to be finished by the end of the year.

Washington DC, capital of cash.

• Going Cashless Is Discriminatory (G.)

Mobile payments. Credit cards. Digital currencies. Going cashless seems to be a worldwide trend. In Belgium, it is illegal to buy real estate with cash. Some banks in Australia have eliminated cash from their branches. Sweden has seen its use of cash drop to less than 2% of all transactions, and the number could be heading even lower in the next few years. However, one city in the US is resisting that trend: Washington DC. In the nation’s capital cash is still king, and a new bill introduced this week wants to keep it that way. The Cashless Retailers Prohibition Act of 2018 would make it illegal for restaurants and retailers not to accept cash or charge a different price to customers depending on the type of payment they use.

City councilmember David Grasso, and five other councilmembers who co-introduced the bill, are responding to the recent tide of retailers in their city and around the country – like the salad chain Sweetgreen – who are no longer accepting cash. These retailers, which mostly serve upscale customers, say that going cashless speeds up transactions, improves customer service and makes for more accurate accounting. They also argue that having less cash lying around also minimizes the risk of crime and contributes to a safer environment for both their customers and employees.

But to some, not accepting cash is discriminatory. A report last year by the Washington City Paper found that 27% of people in the US would have trouble using only a credit card to purchase products, and that the percentage in Washington DC is even higher. “I’m concerned with more and more restaurants, businesses and shops going cashless because you’re systematically excluding a group of people who are already disadvantaged and disenfranchised,” Linnea Lassiter, an analyst at the DC Fiscal Policy Institute, told the paper. “And now they can’t have access to this restaurant?”

When growth slows…

• Netflix Stock Slammed As Subscriber Growth And Revenue Fall Short (MW)

Netflix posted weaker-than-expected second-quarter revenue and subscriber numbers Monday afternoon, sending its stock into a sharp dive during after-hours trading. Netflix shares fell about 14% in the extended session after the Los Gatos, Calif-based company announced it added 5.2 million streaming users in the second quarter, a substantial drop from the 6.2 million estimate the company provided in April. The company added 4.47 million international subscribers and 670,000 domestic subscribers, missing its April estimates of 5.9 million and 1.2 million.

The company reported a profit of $384 million, or 85 cents a share, topping the FactSet consensus of 79 cents a share and up from $66 million, or 15 cents a share, in the same quarter a year ago. Revenue rose to $3.91 billion from $2.79 billion the year before, just below the FactSet consensus of $3.94 billion. In a letter to shareholders, Netflix said the company had a “strong but not stellar” quarter, acknowledging the company had “over-forecasted” both domestic and global net subscriber additions and “acquisition growth was lower than we projected.”

Doesn’t feel like the EU actually identifies the danger to society.

• Airbnb Warned It Breaches EU Rules Over Pricing Policy (G.)

Airbnb has been found in breach of EU law and given until the end of the summer to ditch a range of practices, including that of belatedly applying additional fees to the prices it promotes online. The accommodation service has been accused by the European commission and national regulators of failing its customers and making the mistake of many global digital firms of “forgetting its responsibilities”. Vera Jourova, the commissioner for justice and consumers, told reporters in Brussels that the company had until the end of August to show it was reforming its ways or it could expect national regulators across Europe to launch coordinated action.

The commissioner said the prices displayed to those using the Airbnb website fail to reflect the fees and charges later passed on to the consumer, including cleaning costs. The site did not clearly identify if the offer of accommodation was being made by amateur hosts or professionals. The issue is important because the level of consumer rights differ according to the status of the owner, as do the health and safety requirements. The commissioner said Airbnb’s terms and conditions were unclear. She also said the company should put an end to its policy of seeking to tackle legal complaints made by its clients in courts outside the country where the complainant resides.

Maybe the government can make a deal with Airbnb.

• High Housing Costs Prompt Thousands of Greeks To Disclaim Inheritance (K.)

Thousands of properties are coming into the state’s possession not because they’re bogged down in debt, but simply because the people who inherit them are opting to give up the titles. According to real estate experts, more than 135,000 inheritances were disclaimed in 2017, because the beneficiaries were unable to pay the inheritance tax or they found the future financial demands of the property unbearable. The slump in the real estate market, in combination with the fact that many properties are suffering from neglect, meanwhile, are making it even harder for those who may be hoping to find a buyer before accepting their inheritance.

“Property has become a burden,” says Babis Haralambopoulos, a certified valuer, scientific consultant to Solum Property Solutions and former president of the Hellenic Valuation Institute. “Since the start of the crisis, residential properties have shed an average of 45 percent of their value, while there’s a trend toward stabilization right now.” Meanwhile, recent data from Eurostat showed that Greece had the highest housing costs as a percentage of disposable income among the European Union’s member-states. In 2016, the proportion of Greek households that spent more than 40 percent of their disposable income on housing costs came to 40.5 percent, which is almost four times the EU average of 11.1 percent.