Marjory Collins New York Times linotype operatots Sep 1942

You better move to a domestic industry.

• Surging Dollar May Be Triple Whammy For US Earnings (Reuters)

The suddenly unstoppable U.S. dollar is posing a triple threat to American companies’ profits: driving up the costs of doing business overseas, suppressing the value of non-U.S. sales and, perhaps most worryingly, signaling weak international demand. The dollar has been on a tear, with an index tracking it against six other major currencies notching roughly an 8% gain since the end of June. Few analysts see its breakout performance stalling out anytime soon since the U.S. economy stands on much firmer footing than most others around the world, Europe’s in particular. For companies in the benchmark S&P 500, that’s a big headwind because so many are multinationals, and as a group they derive almost half of their revenue from international markets. “You will get some companies that have failed to meet expectations based on the weakness we’re seeing overseas, so it is going to be a source of disappointment,” said Carmine Grigoli, chief investment strategist at Mizuho Securities in New York.

Moreover, that weakness, especially in Europe, “is going to be critical here,” he said. “It’s an important component of (U.S.) earnings going forward.” And while investors and analysts have begun to figure in the negative effects of a fast-strengthening dollar with regard to the approaching third-quarter reporting period, the risk to the fourth quarter and 2015 remains largely unaccounted for. For instance, third-quarter profit-growth expectations for S&P 500 companies have fallen back to 6.4% from about 11% two months ago, Thomson Reuters data showed. By contrast, the fourth-quarter growth forecast is down just slightly, to 11.1% from a July 1 forecast of 12.0%. And profit-growth estimates for 2015 have actually increased in that time from 11.5% to 12.4%. “If you try and extrapolate out to the fourth quarter and how much that currency effect is going to be, your guidance is probably going to come down for a good slug of the multinationals on the S&P,” said Art Hogan, chief market strategist at Wunderlich Securities in New York.

Read more …

No, but it will save the banks. Again.

• Can The US Dollar Save The World? (CNBC)

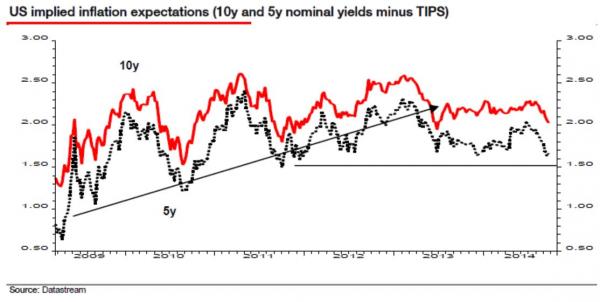

The U.S. dollar rally has much further to run, and could help out countries dealing with excessively low inflation, a report from HSBC argues. The dollar index, which measures the strength of the greenback against the major currencies, has risen near 7% this year, amid positive economic data out of the U.S. and increased expectations that as the U.S. Federal Reserve ends its massive bond-buying program, it will hike interest rates. But the rally has only just begun, analysts at HSBC said in a note published this week, who argue the greenback should rein supreme as the world’s strongest currency both this year and next. “The current U.S. dollar rally is unlike any we have seen before…[the rally] so far has only been roughly 5% yet history shows a 20% rise would not be implausible,” the analysts said.

And the dollar’s relative strength could be the perfect antidote for other global economies, such as the euro zone, struggling to fend off the threat of deflation, said HSBC. The single currency union this week saw its annual inflation rate fall further below the European Central Bank’s target of 2% in September to 0.3%. The idea is that if U.S. goods start to look too expensive due to the stronger dollar, buyers of those goods will start to look at alternatives nearer home, therefore increasing demand and consequently leading to a rise in prices. “While the scale of a U.S. dollar rally required to bring inflation all the way back to target in the likes of the euro zone would likely be unpalatable to U.S. policymakers, U.S. dollar strength will still help stave off the deflation threat,” added the HSBC analysts. “The U.S. dollar on its own may not be able to save the world but it will certainly buy these economies time,” they added.

Read more …

How much longer will Draghi be able to keep his post after his plans are shot down?

• Betting On Massive Central Bank Puts (CNBC)

Here is a bet based on the latest episode in a long-running policy dispute. Last Thursday (October 2), the meeting of the governing council of the European Central Bank (ECB) in the splendors of the Capodimonte (“top of the hill”) Palace in Naples, Italy, reaffirmed with overwhelming majority the zero (0.05%) interest rate policy and a program of security purchases that could expand the bank’s balance sheet by an estimated €1 trillion. Policy deliberations at this regal venue were greeted by some 2,000 protesters clashing with police and braving waves of teargas in a city (Naples) whose unemployment rate of 25% is exactly double Italy’s average, and whose per capita economic output is more than 30% below that of the country as a whole. True to form, Germany continued to strongly oppose this ECB policy. The German member of the ECB’s governing council maintains that the euro area banks don’t need virtually free loanable funds and security purchases that will, in his view, again lead to banks’ mischief requiring bailouts with taxpayers’ money.

His position was supported by his Austrian colleague (16:2, in case you want to keep the score). Who will win? Can Germany again bull its way through this one as it did with the widely condemned austerity policies? (Hint: if you look at the euro’s exchange rate, you will see that markets have already voted.) Staying within the policy mandate, the vast majority of the ECB’s governing council is inclined to look for additional measures that would restore the transmission mechanism (i.e., the financial intermediation system) between easy credit conditions and real economy. The ECB’s purchases of asset-backed securities are aiming to achieve that, because they are designed to provide incentives to the banking system to significantly expand lending to euro area businesses and households.

Read more …

Bond volatility is set to cause great damage. What does ‘fixed income’ mean anymore?

• The $100 Trillion Global Bond Market Is Much More Fragile Than You Think (AP)

A bottleneck is building in the global market for bonds. Main Street investors have poured a trillion dollars into bonds since the financial crisis, and helped send prices soaring. As fund managers and regulators fret about an inevitable sell-off, the bigger fear is that when people go to unload, there won’t be anyone to buy. Too many funds own the same bonds, making them difficult to sell in a sudden downturn. On top of that, the banks that used to bring bond buyers and sellers together have pulled back from the role. Investors looking to sell would be slow to find buyers, spreading fear through the $100 trillion global bond market and sending prices tumbling. It’s a situation known as “liquidity risk” and some bond pros are scrambling to prepare for it. Portfolio managers are hoarding cash. BlackRock, the world’s largest fund manager, is suggesting regulators consider new fees for investors pulling out of funds. Apollo Management, famous for profiting from a bond collapse 25 years ago, is launching a fund to bet against bonds.

Mohamed El-Erian, former CEO of bond fund giant Pimco, thinks ordinary investors are too blase about the flaws in the trading system. Investors today are like homeowners who only discover there’s a clog under the sink when it’s too late and they’re staring at a mess. “It’s only when you try to put a lot of things through the pipes that you realize” you’ve got a problem, says El-Erian, now chief economic adviser to global insurer Allianz. “You get an enormous backup.” What’s at risk is more than money in retirement accounts. Big investors often borrow when buying bonds and so losses can be magnified. Trillions of dollars of bets using derivatives ride on bonds, too. A small fall in prices could lead to losses that reverberate throughout the financial system. “The market is so tightly wound,” says JPMorgan’s William Eigen, head of its Strategic Income Opportunities fund, who has put 63% of his portfolio in cash. “There’s no place to hide.” In such a fragile situation, even news with no bearing on bond fundamentals can trigger losses.

[..] Since the financial crisis, the Federal Reserve’s efforts to hold down borrowing costs for businesses and consumers have pushed interest payments on many bonds to record lows. That’s set off a rush by investors into riskier ones offering higher payments. The buying has pushed up prices, and added to the risk. Since the start of 2009, funds invested in junk bonds have returned an average 14% each year and municipal bond funds 6%, according to the Investment Company Institute, double their averages in the prior six years. Even seemingly “safe” government debt looks dangerous now, according to a September report by Deutsche Bank. Many bonds sold by wealthy countries like France, Australia and Britain recently are so high-priced you’d have to go back centuries to find more expensive ones, the report notes. And since corporate bonds are priced off government ones, much of that market is also at risk for a fall.

Read more …

The energy casino.

• Tumbling Oil Prices Punish Hedge Funds Betting on Gains (Bloomberg)

Hedge funds increased bets on rising oil prices just before crude futures tumbled to a 17-month low on signs that global supply is outstripping demand. Prices capped the biggest weekly decline in two months after money managers boosted net-long positions in West Texas Intermediate by 4.1% in the seven days ended Sept. 30. Long positions climbed 2.7%, U.S. Commodity Futures Trading Commission data show. WTI sank below $90 on Oct. 2 after Saudi Arabia, the world’s largest oil exporter, cut its prices to Asia. U.S. production is the highest since 1986, while OPEC output expanded to the most in a year. The International Energy Agency last month reduced its projections for demand growth this year and in 2015, citing a weakening economic outlook.

“Oil isn’t looking like a good bet anymore,” Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts, said by phone Oct. 3. “Production continues to rise, flooding the market, while on a good day the demand picture looks anemic.” Crude declined 0.4% to $91.16 a barrel on the New York Mercantile Exchange in the period covered by the CFTC report. Futures were little changed in today’s electronic trading after sliding $1.27 to close at $89.74 on Oct. 3, the lowest settlement since April 2013. Saudi Arabia reduced the price for Arab Light to Asia by $1 a barrel to a discount of $1.05 to the average of Oman and Dubai crude, the lowest since December 2008. Official selling prices are regional adjustments Aramco makes to price formulas to compete against oil from other countries.

Production by the 12-member Organization of Petroleum Exporting Countries rose to 30.935 million barrels a day in September, the highest since August 2013, a Bloomberg survey of oil companies, producers and analysts showed. U.S. crude output reached 8.867 million barrels a day in the week ended Sept. 19, the most since March 1986. Production will climb to 9.53 million in 2015, a 45-year high, the Energy Information Administration said in its monthly Short-Term Energy Outlook on Sept. 9. “Earlier this week there was a debate over whether prices had reached a bottom,” John Kilduff, a partner at Again Capital, a New York-based hedge fund that focuses on energy, said by phone Oct. 3. “Investors took a chance and gathered length. Sometimes when you put your toe in the water it gets snapped off.”

Read more …

But who understands what’s happening?

• The Surprising Impact Of Plunging Oil Prices (CNBC)

Sliding crude oil prices are giving consumers relief at the pump, which is bound to provide a fillip for consumer spending. But whether that is good news for the stock market is another story. Crude oil futures have been demolished over the last four months, falling some 17% from their June highs, and settling at a 17-month low on Friday. And as oil prices have fallen, consumer gasoline prices have dropped to a nationwide average of $3.32 a gallon, the lowest since February, according to AAA. The motor club group also notes that in 26 states, gas can be found for cheaper than $3.00 per gallon. And AAA predicts that gas prices will continue to fall in October. Given the massive role gasoline plays in American life (in a February 2013 report, the U.S. Energy Information Administration estimated that Americans spend about 4% of their pre-tax income on gasoline) the drop in gas prices is naturally expected to have an impact on consumer spending.

“The per capita usage is about 400 gallons of gas used per year for each person in this country. That’s a lot of money going back into the economy when you have cheaper gas,” said Jim Iuorio of TJM Institutional Services. “Gasoline is down noticeably, and I know it’s noticeable, because I noticed it when I filled up my car,” remarked Jonathan Golub, chief U.S. market strategist at RBC Capital Markets. “That is a big deal, and it immediately hits consumption.” But that doesn’t necessarily mean it’s time to buy stocks. Golub notes that between oil stocks, the materials sector, and industrial and utilities names in commodity-related businesses, “17 or 18% of the S&P is a loser with falling oil prices.” rom a market perspective, then, the benefit to the consumer is “100% offset” by losses in oil-exposed names, making it a mere “rotation issue.” In other words, the market as a whole shouldn’t be expected to rise or sink on a big drop in energy prices, but those oily names should sink, and consumer-exposed names should get a boost.

Read more …

The perversion of ultra-low rates and central banks buying and pushing up stocks. There will be a huge price to pay.

• S&P 500 Companies Spend Almost All Profits on Buybacks, Payouts (Bloomberg)

Companies in the Standard & Poor’s 500 Index really love their shareholders. Maybe too much. They’re poised to spend $914 billion on share buybacks and dividends this year, or about 95% of earnings, data compiled by Bloomberg and S&P Dow Jones Indices show. Money returned to stock owners exceeded profits in the first quarter and may again in the third. The proportion of cash flow used for repurchases has almost doubled over the last decade while it’s slipped for capital investments, according to Jonathan Glionna, head of U.S. equity strategy research at Barclays. Buybacks have helped fuel one of the strongest rallies of the past 50 years as stocks with the most repurchases gained more than 300% since March 2009.

Now, with returns slowing, investors say executives risk snuffing out the bull market unless they start plowing money into their businesses. “You can only go so far with financial engineering before you actually have to have a business with real growth,” Chris Bouffard, chief investment officer who oversees $9 billion at Mutual Fund Store, said. “Companies have done about all that they can in terms of maximizing the ability to do those buybacks.” S&P 500 constituents will probably say earnings rose 4.9% in the third quarter when they begin reporting results this week, according to more than 10,000 analyst estimates compiled by Bloomberg. Alcoa, Yum! Brands. and Monsanto are among nine companies scheduled to announce financial details.

While the ratio to earnings shows how buybacks and dividends compare to past economic expansions, it doesn’t indicate companies are struggling to fund them. Five years of profit growth have left S&P 500 constituents with $3.59 trillion in cash and marketable securities and they’ve raised almost $1.28 trillion in 2014 through bond sales, headed for a record. “Buybacks are something corporations can take control of and at low borrowing costs, they’re a viable option,”Randy Bateman, chief investment officer of Huntington Asset Advisors, which manages about $2.8 billion, said by phone on Oct. 1. At the same time, he said, “If management can’t unearth future opportunities for growth, as a shareholder, I lose confidence.”

Read more …

It’s called ‘recession’.

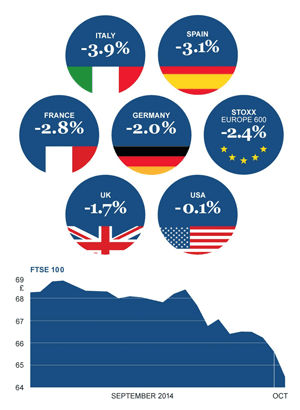

• German Orders Post Biggest Drop Since Start Of 2009 In August (Reuters)

German industrial orders posted their biggest drop in August since the height of the global financial crisis in 2009 due to the subdued euro zone economy and uncertainty caused by crises abroad, data from the Economy Ministry showed on Monday. Contracts plunged by 5.7% on the month, undershooting by far the Reuters consensus forecast for a 2.5% drop. Bookings from the euro zone slumped by 5.7% while domestic orders decreased by 2.0%. The data for July was revised up to a rise of 4.9% from a previously reported gain of 4.6%.

Read more …

Growth? We’re still talking growth in Europe?

• Faltering Demand Weighs On Eurozone Business Growth In September (Reuters)

Euro zone business grew at its slowest rate this year in September on tumbling demand, surveys showed on Friday, as the bloc struggles to add momentum to its fragile economic recovery. Germany’s private sector expanded at a robust pace last month, pointing to an economic rebound between July-September after Europe’s biggest economy unexpectedly shrank the quarter before. However, business growth in the euro zone’s number two and three economies – France and Italy – contracted, suggesting stagnation or worse there could continue. Despite firms cutting prices more deeply, the common thread across most of the surveys in the euro zone was that of weak demand, with businesses and consumers lacking the confidence to spend in economies plagued by high unemployment and years of austerity.

This mirrors order book conditions for factories in much of Asia as well. The data are likely to disappoint policymakers yet again, a day after the European Central Bank outlined its plans to buy securitised debt in a bid to revive lending and boost demand. “The PMIs reflect a familiar dangerous trend of low demand and weak producer pricing power which reinforces concerns on the effectiveness of the ECB’s stimulus,” said Lena Komileva, chief economist at G+ Economics in London. “The ECB does not have much room for error with the starting point of close to zero rate of inflation and growth.”

Read more …

“What people underestimate is that what’s at stake is the entire credibility of the rules …”

• EU Prepares to Reject France’s 2015 Budget, Set Up Clash Over Deficit (WSJ)

The European Union is preparing to reject France’s 2015 budget, according to European officials, setting up a clash that would be the biggest test yet of new powers for Brussels that were designed to prevent a repeat of the eurozone’s sovereign-debt crisis. French Finance Minister Michel Sapin said last month that his country would run a budget deficit of 4.3% of gross domestic product next year—far from the 3% deficit it had previously pledged. Stripping out the effects of the weak economy, the government’s planned cost cuts would amount to just 0.2% of GDP, falling short of cuts worth 0.8% that it had agreed upon with Brussels.

That could put France’s budget in “serious noncompliance” with tightened EU deficit rules, likely leading the commission to send it back to Paris for revisions, European officials said. So far, the French government has said it won’t take any extra belt-tightening measures beyond what it proposed in the spring, indicating it is ready to risk a public clash with Brussels. “People are ready to let the big boys in Brussels reject the budget,” a European official said. The conflict with France could be joined by a budget fight with Italy, which has also said that it will miss budget targets. Italy has more leeway because its past budgets have run lower deficits than France’s, but a senior EU official called a decision about whether to confront Italy “borderline.”

The credibility of Brussels’ new powers threatens to be seriously undermined if big countries such as France and Italy are able to flout the new rules—which give the European Commission the right to demand changes to proposed budgets before they are presented to national parliaments. It would signal the tough budget regime can only be imposed on the eurozone’s smaller economies, such as Greece and Portugal. Some European officials have drawn parallels with the way France and Germany ignored deficit limits a decade ago without consequences, a step that they believe fatally weakened budget discipline in the bloc. “What people underestimate is that what’s at stake is the entire credibility of the rules,” one of the officials said.

Read more …

Currencies around the world are going through a major reset, courtesy of the buck. Many will have a hard time with the transition, few are prepared.

• Have The Aussie Dollar Bears Won The Argument? (CNBC)

Despite a long downtrend in commodity prices, the Australian dollar has managed to keep a loyal set of diehard fans among currency traders and analysts — but now some of them are throwing in the towel. “We’ve been constructive on Australian dollar throughout 2014, consistently forecasting it to be the relative G-10 outperformer after the U.S. dollar,” Geoffrey Kendrick and Vandit Shah, analysts at Morgan Stanley, said in a note last week. But since the payrolls data release last month, the bank’s bullish assumptions have been called into question. Morgan Stanley cut its forecast for the Australian dollar to $0.84 by the end of 2014 and $0.76 by the end of 2015, a sharp drop from its previous expectation of $0.95 by the end of this year and $0.88 by the end of next. A number of analysts have long been calling for the Aussie to fall as low as 80 cents – a level it hasn’t seen since 2009 – as economic fundamentals come back into play, and the central bank continues to talk the currency lower.

Over the past year, Reserve Bank of Australia Governor Glenn Stevens repeatedly voiced his opinion that he would like to see the Aussie at 85 cents against the U.S. dollar. The Australian dollar is fetching $0.8655 in early Monday trade, down a bit more than 7% since the beginning of September, touching its lowest levels since January. Morgan Stanley’s bullish call had been premised on the assumption that non-resident buyers of Australian government debt and Japanese buyers of Australian-dollar assets would remain keen, as well as an expectation that the country’s terms of trade would stabilize. But with U.S. yields starting to rise again and increased volatility in markets, Australian government bonds became less attractive, Morgan Stanley said adding that it expected the Aussie dollar to depreciate further “especially with G-10 foreign exchange becoming increasingly sensitive to moves in the belly of the U.S. curve.”

Read more …

There we go again.

• Your Winter Heating Bills: It Won’t Be Pretty (CNBC)

The ongoing U.S. energy boom may be driving gasoline prices lower, but homeowners who heat with natural gas may be in for another winter of sticker shock. “It is now looking almost certain that stocks of natural gas in the U.S. will be significantly lower than the five-year average” when temperatures begin falling in November,” said Tom Pugh, commodities economist for Capital Economics. “Another cold winter, combined with lower stocks than last year, could lead to even higher price spikes than last year.” Thanks to big surges in seasonal demand, natural gas producers are busy this time of year building up supplies. But despite record production, natural gas storage levels are still below their five-year range heading into the winter heating season. The latest data from the Energy Department shows that producers are playing catch-up, with storage levels more than 10% lower than last year’s levels.

That means homeowners who heat with gas could see the same price spikes they saw last winter during cold snaps. Despite mild weather so far this fall, the gas storage shortfall already has helped nudge natural gas higher, well before households begin nudging up the thermostat despite mild temperatures. Last winter’s record demand for natural gas included a single day in January that sent demand to nearly double the average daily consumption, according to the American Gas Association. That pushed the average bill for gas customers up 10% over the year before—mostly due to gas furnaces working overtime, the AGA said. But the cold weather demand surge also produced a big jump in prices. The average weekly spot price peaked in February more than 80% higher than the end of November.

Read more …

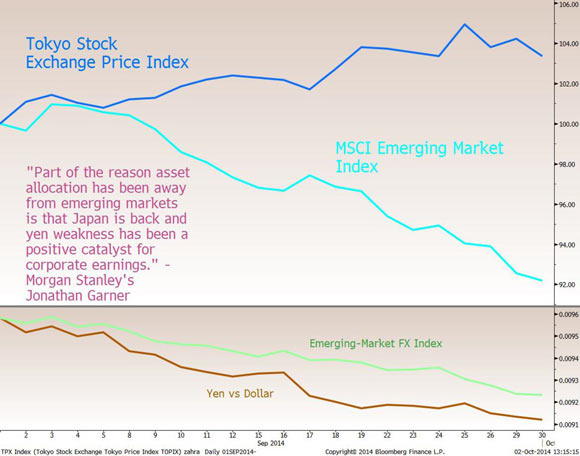

In reality, Abenomics died before it was conceived.

• RIP Abenomics: ‘This Week Japan Will State It Is In Recession’ (Zero Hedge)

We have been waiting for this particular bolded sentence ever since we predicted it would take place back in December 2012 when a bunch of Keynesians, a disgraced former/current prime minister with a diarrhea problem and, of course, the Goldman Sachs’ corner suite, first unleashed Abenomics. From Goldman’s Naohiko Baba, previewing this week’s key Japanese economic events

The Cabinet Office makes an assessment of the state of the economy based on the trend in the coincident CI, using a set of objective criteria. The August coincident CI is set to print negative mom. In this case, the Cabinet Office’s economic assessment will likely shift downward to “signaling a possible turning point” from the current level of “weakening”. According to the Cabinet Office, such a change in assessment provisionally indicates a likelihood that the economy has already fallen into recession. This is effectively akin to the government acknowledging that the economy is in recession.

And because every Keynesian lunacy has to end some time, RIP Abenomics: December 2012 – October 2014.

Read more …

For the sake of all of Europe, Rajoy must be careful not to incite violence.

• Catalan Standoff to Hit Spanish Economy, Whoever Wins (Bloomberg)

Spanish Prime Minister Mariano Rajoy is battling to keep his country together, facing down Catalan separatists. Even if he wins, the standoff risks weakening the economy that the two sides are fighting over. Catalan President Artur Mas, backed by about two-thirds of the region’s lawmakers, is defying orders from Spain’s highest court and pressing ahead with a vote on independence on Nov. 9. The wrangling last week pushed the gap between Spanish and German bond yields to the widest since Scotland voted to remain in the U.K. “Investors are pricing the risk of political instability in Catalonia,” said Francesco Marani, a fixed-income trader at Auriga Global Investors SA in Madrid, who trades government and regional debt. “The independence issue has already been hurting the Spanish economy, and it’s not over.” Spain’s economy is losing momentum amid a slowdown in its European trading partners.

Uncertainty over the future of Catalonia, whose contribution to the Spanish economy is twice that of Scotland’s to the U.K., risks undermining investment as well as pushing up borrowing costs and distracting politicians from tackling the 24% jobless rate. “Boosting growth requires an ambitious policy mix as political tensions over Catalonia may last for months, maybe till the next general elections, weighing on confidence and investment,” said Frederik Ducrozet, an economist at Credit Agricole CIB in Paris. Rajoy’s four-year mandate finishes at the end of next year. “Now is where the uncertainty begins,” Justin Knight, a London-based European rates strategist at UBS said in a telephone interview after the Constitutional Court declared the vote illegal last week. Despite that ruling, a poll commissioned by the Catalan regional government and published on Oct. 3 showed 71% of Catalans want the independence vote to be held next month.

Read more …

A big problem with most of the big charities: “On the one hand it protects the forest; on the other it helps corporations lay claim to land not previously in their grasp.”

• WWF International Accused Of ‘Selling Its Soul’ To Corporations (Observer)

WWF International, the world’s largest conservation group, has been accused of “selling its soul” by forging alliances with powerful businesses which destroy nature and use the WWF brand to “greenwash” their operations.The allegations are made in an explosive book previously barred from Britain. The Silence of the Pandas became a German bestseller in 2012 but, following a series of injunctions and court cases, it has not been published until now in English. Revised and renamed Pandaleaks, it will be out next week. Its author, Wilfried Huismann, says the Geneva-based WWF International has received millions of dollars from its links with governments and business.

Global corporations such as Coca-Cola, Shell, Monsanto, HSBC, Cargill, BP, Alcoa and Marine Harvest have all benefited from the group’s green image only to carry on their businesses as usual. Huismann argues that by setting up “round tables” of industrialists on strategic commodities such as palm oil, timber, sugar, soy, biofuels and cocoa, WWF International has become a political power that is too close to industry and in danger of becoming reliant on corporate money. “WWF is a willing service provider to the giants of the food and energy sectors, supplying industry with a green, progressive image … On the one hand it protects the forest; on the other it helps corporations lay claim to land not previously in their grasp.

WWF helps sell the idea of voluntary resettlement to indigenous peoples,” says Huismann. WWF’s conservation philosophy has changed considerably in 50 years, but until recently it was widely thought that people and wildlife could not live together, which led to the group being accused of complicity in evictions of indigenous peoples from Indian and African forests. The book also argues that WWF, which was set up by Prince Philip and Prince Bernhart of the Netherlands in 1961, runs an elite club of 1,001 of the richest people in the world, whose names are not revealed. Industrialists, philanthropists and ultra-conservative, upper-class naturalists, they are said to make up an “old boys’ network with influence in the corridors of global and corporate and policy-making power”.

Read more …

Rehash of 100 different Automatic Earth articles.

• Economists Are Blind to the Limits of Growth (Bloomberg)

For all their calculating nature, economists are surprisingly optimistic about humanity’s ability to have as much prosperity as it wants. Express concern about the negative impact of excessive growth on our planet’s ecosystems, and many will simply chuckle and say you don’t understand what growth means. Nobel laureate Paul Krugman, for example, chides natural scientists for thinking of growth as a “crude, physical thing, a matter simply of producing more stuff.” They fail to appreciate, he suggests, that growth is about innovation and deciding which technologies and resources to use. Allow me to explain why I am one of those scientists who are preoccupied with the physical. Economists are correct in saying that growth doesn’t necessarily require more pollution, more carbon pumped into the atmosphere or more deforestation, even though we’re getting all of the above today. Humans can learn, and we might figure out how to grow differently in the future, separating the benefits from the environmental costs. There’s just one crucial exception: energy.

Growth inevitably entails doing more stuff of one kind or another, whether it’s manufacturing things or transporting people or feeding electricity to Facebook server farms or providing legal services. All this activity requires energy. We are getting more efficient in using it: The available data suggest that the U.S. uses about half as much per dollar of economic output as it did 30 years ago. Still, the total amount of energy we consume increases every year. Data from more than 200 nations from 1980 to 2003 fit a consistent pattern: On average, energy use increases about 70% every time economic output doubles. This is consistent with other things we know from biology. Bigger organisms as a rule use energy more efficiently than small ones do, yet they use more energy overall. The same goes for cities. Efficiencies of scale are never powerful enough to make bigger things use less energy. I have yet to see an economist present a coherent argument as to how humans will somehow break free from such physical constraints.

Standard economics doesn’t even discuss how energy is tied into growth, which it sees as the outcome of interactions between capital and labor. Why does using ever more energy matter? For one, it feeds directly into all the bad things we’re trying to stop doing – polluting, destroying forests, wiping out habitats, covering the planet with an ever-denser network of roads. Our energy use – either by design or by accident – always ends up changing the environment in one way or another. Then there’s the issue of climate change. Even if by some miracle we act to fix carbon-dioxide levels soon, that won’t actually be a lasting solution. If energy consumption follows the historical trend, by 2150 or so the waste heat alone will warm the Earth as much as carbon dioxide is doing now. We’ll have yet another global warming problem. I’m not sure how economics broke free from the laws of physics and biology. Maybe we’ll eventually leave the planet and live among the stars, escaping the limits of our Earth. Those dreams aside, the physical limits to growth apply as much to us as they would to a colony of bacteria expanding into a jar of sugar water.

Read more …

The wrong people for the right cause. Watch out.

• The New Washington Consensus – Time To Fight Rising Inequality (Guardian)

The theme of this week’s annual meetings of the International Monetary Fund and the World Bank is shared prosperity. In years gone by, the Washington consensus was all about opening up markets and cutting public spending. The new Washington consensus is the need to tackle inequality. Everybody is getting in on the act. Justin Welby, the archbishop of Canterbury, will share a platform with Christine Lagarde, the head of the IMF, and Mark Carney, the governor of the Bank of England, next weekend to discuss how to make global capitalism more inclusive. The World Economic Forum – the body that organises the Davos shindig – thinks it can go one better. It is angling to get the pope along for its annual meeting in January. No question, 2014 has been the year when the need to tackle inequality has gone mainstream. Oxfam kicked it off with the report showing that 85 billionaires owned as much wealth as half the world’s population.

Thomas Piketty’s Capital in the 21st Century provided some intellectual underpinning, with its thesis that a rawer, 19th-century version of capitalism was reasserting itself. It’s not hard to see why both struck a chord: a tepid global economy, high unemployment, stagnant living standards and trickle up to those at the top have created an environment of sullen unease. No political speech these days is complete without a reference to the need to ensure that a rising tide lifts all boats. But talk is one thing, action another. How does Lagarde’s pledge to fight inequality square with the wage cuts and austerity the IMF has imposed on Greece and Portugal as part of its bailout packages? Is there not a disparity between the commitment of the World Bank president, Jim Kim, to raise the incomes of the bottom 40% of the world’s population with his organisation’s Doing Business report, an annual study that ranks countries by the progress they are making in cutting corporate taxes, keeping minimum wages at low levels and ensuring that paid holidays and sick pay are not excessive?

Read more …

“If wealthy, guilty people have to remain free to make money, and the living standards of working people have to decline, so be it. It’s just livelihoods on the line.”

• Carmen Segarra, The Whistleblower Of Wall Street (Guardian)

The key implications from this exposé are twofold. First, it shows who’s really running the country. The Fed is supposed to be working for the people, not the banks. Goldman is a private institution rescued by public money that has paid billions in settlements after selling dubious products that contributed to a major financial crisis. Segarra is told to show some humility; in reality that is an attribute Goldman would do well to acquire. Instead its chief executive still believes it is doing “God’s work”. So the state genuflects before capital, with those sole task it is to enforce the law deferring to those whose sole task is to make money.

Second, it indicates that America has apparently learned nothing from the financial crisis. As recently as 2012, a Goldman employee wrote on the day he left the company: “I don’t know of any illegal behaviour, but will people push the envelope and pitch lucrative and complicated products to clients even if they are not the simplest investments or the ones most directly aligned with the client’s goals? Absolutely. Every day, in fact.” When terrorists strike, we are told nothing will ever be the same. The full power of the state is marshalled to prevent a recurrence. If innocent people have to go to jail and basic human rights are violated, so be it. Lives are on the line. But when banks defraud the country into crisis, precious little changes. The bonuses keep coming. Profits keep rising. Regulation remains weak. If wealthy, guilty people have to remain free to make money, and the living standards of working people have to decline, so be it. It’s just livelihoods on the line.

Read more …

Very interesting interview.

• ‘In 1976 I Discovered Ebola, Now I Fear An Unimaginable Tragedy’ (Observer)

Professor Piot, as a young scientist in Antwerp, you were part of the team that discovered the Ebola virus in 1976. How did it happen?

I still remember exactly. One day in September, a pilot from Sabena Airlines brought us a shiny blue Thermos and a letter from a doctor in Kinshasa in what was then Zaire. In the Thermos, he wrote, there was a blood sample from a Belgian nun who had recently fallen ill from a mysterious sickness in Yambuku, a remote village in the northern part of the country. He asked us to test the sample for yellow fever.

These days, Ebola may only be researched in high-security laboratories. How did you protect yourself back then?

We had no idea how dangerous the virus was. And there were no high-security labs in Belgium. We just wore our white lab coats and protective gloves. When we opened the Thermos, the ice inside had largely melted and one of the vials had broken. Blood and glass shards were floating in the ice water. We fished the other, intact, test tube out of the slop and began examining the blood for pathogens, using the methods that were standard at the time.

But the yellow fever virus apparently had nothing to do with the nun’s illness.

No. And the tests for Lassa fever and typhoid were also negative. What, then, could it be? Our hopes were dependent on being able to isolate the virus from the sample. To do so, we injected it into mice and other lab animals. At first nothing happened for several days. We thought that perhaps the pathogen had been damaged from insufficient refrigeration in the Thermos. But then one animal after the next began to die. We began to realise that the sample contained something quite deadly.

Read more …

And that’s supposed to be a good thing.

• Ebola Is In America – And, Finally, Within Range Of Big Pharma (Observer)

As the Ebola epidemic continues to rage in west Africa, with more than 3,000 dead and infections doubling every few weeks, the first confirmed case in the US last week stepped up global fears over the rapid spread of the incurable virus. But behind the gruesome headlines, the scale of the outbreak has been raising hopes that it could focus minds at the world’s biggest pharmaceutical groups, boosting research on other devastating tropical diseases that have been neglected for years by the drugs makers. There are already an estimated 12 million Americans suffering from life-threatening or debilitating infections such as Chagas disease, dengue fever or West Nile virus.

“Ebola helps us realise we are a global planet: the health of one region affects the rest of us,” says Julie Jacobson, senior programme officer for infectious diseases at the Bill and Melinda Gates Foundation. Mike Turner, head of infection and immunobiology at the Wellcome Trust, says that “almost certainly, Ebola will increase the visibility” of tropical diseases. The worst Ebola outbreak in history has infected more than 6,500 people, mainly in Guinea, Liberia and Sierra Leone. The World Health Organisation (WHO) has declared the outbreak an international health emergency, warning that the deadly virus could infect up to 20,000 people by November. When last week a man was hospitalised with the disease in Dallas, Texas, it was the first case diagnosed outside Africa.

GlaxoSmithKline has started making 10,000 doses of its experimental Ebola vaccine – the most advanced product around – and could supply it to the WHO for an emergency vaccination programme early next year, assuming clinical trials go well. The vaccine has been rushed into tests on healthy human volunteers in the UK and US. Other Ebola vaccines in development, from Johnson & Johnson’s Crucell division and NewLink Genetics, are close to entering the laboratory. ZMapp, made by a San Diego-based company, is the most advanced of the experimental treatments and has cured some patients, including the British nurse Will Pooley, but stocks have now run out. ZMapp’s development was supported by the US military’s main biodefence research facility, amid fears that the virus could be turned into a biological weapon.

Read more …