Marc Chagall The watering trough 1925

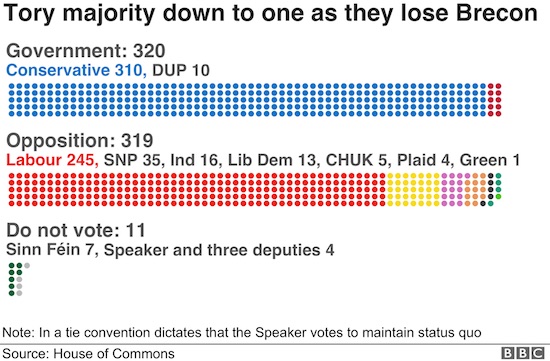

A Scotsman taking down the Queen.

• The Dogs in the Street Know (Craig Murray)

There are some very obvious facts in British politics which nobody seems to be saying. Joanna Cherry stated in her successful court case that “the dogs in the street know” that the real reason that Boris Johnson had prorogued parliament was to prevent parliament from having an effective say on the outcome of Brexit. The documents that the government was forced to produce to the Scottish Courts proved beyond any shadow of a doubt that was indeed Johnson’s motive. So why are we expected to believe that what you knew and I knew, what Joanna Cherry knew, what the very dogs in the street knew, was not known to the Queen?

Do we really believe that the Queen was “misled” and that she and her courtiers were the only people in the entire country who actually believed that Johnson just wanted the longest prorogation for 89 years to prepare a really good Queen’s speech? Are we really expected to believe that the Queen had not noticed that Brexit was at a crucial stage and the effect that prorogation would have on parliament’s say in the process? This is obviously complete and utter nonsense. The Queen has better sources of information than any of us and knew exactly what was happening. She was not “misled” by Boris Johnson, she was his ally in a common purpose. She absolutely understood both the context and the effect of the prorogation. All this utter nonsense about the Queen being “lied to” and “misled” is part of this strange myth of the ultimate goodness of authority which is a recurring theme in human societies.

Peasants died under the knout while building the Trans-Siberian railway thinking “if only the good Tsar knew.” The Queen is not a naive figure of Christ like innocence taken in by Boris Johnson, she is an ultra wealthy woman of very conservative views embedded in a social circle dominated by very rich and reactionary people. To repeat what I have repeatedly explained, it was unconstitutional for the Queen to appoint Boris Johnson in the first place when it was plain as a pikestaff that he could not command a parliamentary majority. That initial crime (and I use the word advisedly) was compounded by the decision to prorogue parliament to enable her no majority Prime Minister to govern. In a sane world we should be getting out the pitchforks. Instead people are tut-tutting about the poor Queen being misled.

Prior to his election to Speaker, Bercow was a longtime member of the Conservative Party.

• Speaker Bercow Warns Boris Johnson Against Disobeying Brexit Law (BBC)

John Bercow has vowed “creativity” in Parliament if Boris Johnson ignores the law designed to stop a no-deal Brexit. The Commons Speaker also said in a speech that the only possible Brexit was one backed by MPs. A new law, passed before the suspension of Parliament, forces the PM to seek a delay until 31 January 2020, unless a deal or no-deal exit is approved by MPs by 19 October. The PM has said he would rather be “dead in a ditch” than ask for a delay. Delivering a lecture in London, Mr Bercow said: “Not obeying the law must surely be a non-starter. Period.” He said it would be a “terrible example to set to the rest of society”.

“The only form of Brexit which we will have, whenever that might be, will be a Brexit that the House of Commons has explicitly endorsed,” he said. “Surely, in 2019, in modern Britain, in a parliamentary democracy, we – parliamentarians, legislators – cannot in all conscience be conducting a debate as to whether adherence to the law is or isn’t required.” He called it “astonishing” that “anyone has even entertained the notion”. If the government comes close to disobeying the Act, the MP said that Parliament “would want to cut off such a possibility and do so forcefully”. “If that demands additional procedural creativity in order to come to pass, it is a racing certainty that this will happen, and that neither the limitations of the existing rule book nor the ticking of the clock will stop it doing so,” he added.

Hmm. Should McCabe run free?

• Former FBI Deputy Director Andrew McCabe Must Face Criminal Charges (CNBC)

Former FBI deputy director Andrew McCabe has failed in his efforts to convince the Justice Department not to file potential criminal charges against him for allegedly lying to federal agents, NBC News reported Thursday. Lawyers for McCabe, who has not been charged in the case, reportedly met last month with a top Justice official the U.S. Attorney for the District of Columbia and in what were believed to be talks seeking to dissuade then from filing criminal charges. The Washington Post reported last week that federal prosecutors for months have been using a grand jury to investigate McCabe, a critic of President Donald Trump.

They have to ASK?

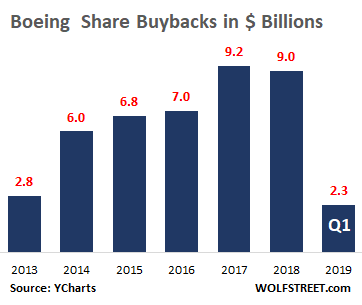

• US House Panel Wants Boeing To Allow Employee Interviews On 737 MAX (R.)

Congress on Thursday asked Boeing Co’s chief executive to make several employees available for interviews as part of a congressional probe into the design, development and certification of 737 MAX aircraft involved in two crashes that killed 346 people. House of Representatives Transportation Committee Chairman Peter DeFazio and Representative Rick Larsen, who chairs the aviation subcommittee, said in a statement that while Boeing has provided substantial documents and shared senior management’s perspective, “it’s important to the committee’s investigation to hear from relevant Boeing employees.”

The committee plans another Boeing hearing in the coming weeks and previously asked whistleblowers to come forward with any information about the plane’s development. Boeing has provided more than 300,000 pages of documents, a person briefed on the matter said, speaking on condition of anonymity. Boeing said in a statement it was “deeply disappointed the committee chose to release private correspondence given our extensive cooperation to date. We will continue to be transparent and responsive to the committee.”

[..] CEO Dennis Muilenburg said at an investor conference on Wednesday that the company is still targeting “early fourth quarter for getting the airplane back up in the air” but added that “ultimately return-to-service timing will be determined by the regulator.” The FAA has repeatedly said it will not certify the plane to fly again until it is safe to do so. The European Aviation and Space Agency said on Tuesday it “intends to conduct its own test flights separate from, but in full coordination with, the FAA. The test flights are not scheduled yet, the date will depend on the development schedule of Boeing.”

If they’re pressuring Israel, they much be pressuring others too.

• US Pressures Israel To Drop China ‘Belt And Road’ Investments (ZH)

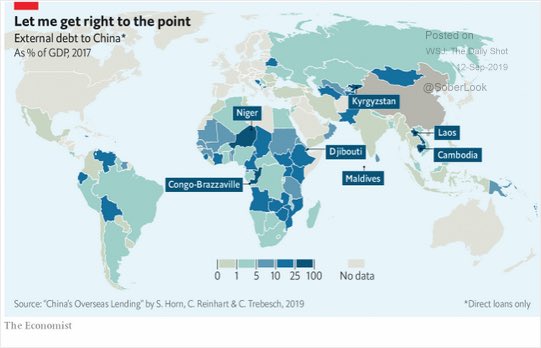

As China executes on its “Belt and Road” global trade scheme, more than 130 countries who have either committed to or expressed interest in the $600 billion initiative have been hard at work expanding their infrastructure to accommodate Beijing’s ambitious plan. And while President Trump has been pounding the table in an ongoing US-China trade war, progress made on Belt and Road threatens to reduce US leverage over Beijing – putting US allies such as Israel, which extended a 25-year offer for the operation of the Haifa terminal to state-controlled Shanghai International Port Group – in a tricky position, according to Bloomberg’s Ivan Levingston.

“With national elections approaching on Sept. 17, Prime Minister Benjamin Netanyahu can ill afford to alienate the Trump administration on its signature international issue. Trump has endeared himself to Netanyahu by transferring the U.S. Embassy from Tel Aviv to Jerusalem and recognizing Israeli sovereignty in the disputed Golan Heights. Netanyahu reciprocated by naming a new Golan settlement after Trump and praising the American leader for, among other things, quitting the Iranian nuclear accord. “Over the years, Israel has been blessed to have many friends who sat in the Oval Office, but Israel has never had a better friend than you,” Netanyahu told the president during a March trip to the White House. An October Pew study found that 69% of Israelis had confidence in Trump’s performance as president, and many of Netanyahu’s campaign ads prominently feature the U.S. leader.” -Bloomberg

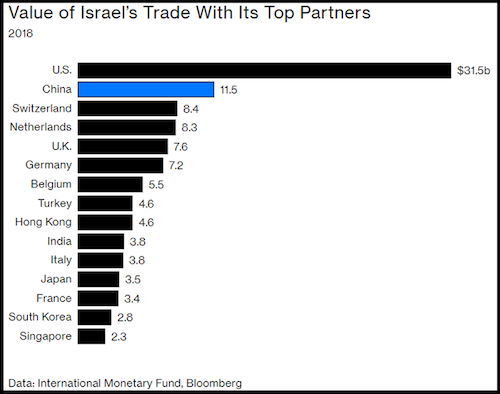

Of note, China is currently Israel’s second-largest trading partner with around $11.5 billion in annual transactions in 2018, according to the report. Meanwhile, the United States has pressed Israel to create a buffer with China in the interest of national security – which would look something like the Committee on Foreign Investment in the US (the same one that rubber-stamped Russia’s purchase of 20% of America’s Uranium). “Israel and Israeli companies are quickly coming to the realization that it’s going to be difficult to sustain business as usual in work with China while keeping the United States as the primary partner,” said Daniel Shapiro, Barack Obama’s US ambassador to Israel.

How is Huawei linked to Belt & Road?

• Huawei CEO Offers To License 5G Technology To American Companies (F.)

Zhengfei Ren, the CEO and founder of Huawei offered an olive branch to the Trump administration: License the Chinese telecommunications giant’s 5G technology to American companies, with the caveat that the U.S. government ““the U.S. side has to accept us at some level for that to happen.” Currently, the use of Huawei equipment is banned from U.S. networks over concerns that it could be used by the Chinese government as a method to spy or disrupt telecom systems. The offer [..] would essentially allow the U.S. to finally get in the race for 5G supremacy which is now dominated by Chinese firms Huawei and ZTE, Ericsson of Sweden and Nokia from Finland.

“Huawei is open to sharing our 5G technologies and techniques with U.S. companies, so that they can build up their own 5G industry. That would create a balanced situation between China, the U.S. and Europe,” told Ren to the newspaper. [..] Ren added that the U.S. companies would be allowed to modify as they see fit the software code used to run any of Huawei’s 5G equipment or even change it and use their own. [..] Ren added that the American licensees will be able to sell their 5G equipment based on Huawei’s intellectual property anywhere in the world, except in China.

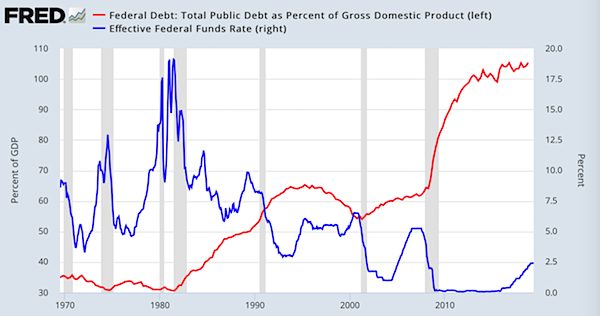

“We are going to start with 50 years, and if the answer is, 50-years is successful, we’ll consider 100-year bonds..”

• Mnuchin Says 100-Year Treasury Bond Possible (R.)

U.S. Treasury Secretary Steven Mnuchin on Thursday said the United States will issue 50-year bonds if there is “proper demand,” a moved aimed at “derisking” the government’s $22 trillion of debt and locking in low interest rates. “We are going to start with 50 years, and if the answer is, 50-years is successful, we’ll consider 100-year bonds,” Mnuchin said in an interview with New York Times’ DealBook and streamed online live, adding that he began looking into the possibility of ultra-long U.S. bonds two years ago. The longest-dated U.S. Treasury currently is 30 years.

U.S. President Donald Trump has proposed a different fix for the rising cost of the record U.S. debt, calling on Wednesday on the “boneheads” at the Federal Reserve to reduce interest rates to below zero so as to reduce interest-rate payments. The Fed is widely expected to cut interest rates by a modest quarter of a percentage point next week when U.S. rate-setters meet. Fed Chair Jerome Powell and other policymakers see U.S. economic conditions as still generally favorable despite a global slowdown and a still-unresolved U.S.-China trade war, and they have consistently pushed back against the notion of negative rates or of setting rates to cater to political pressure.

Is something moving?

• US Justice Department To Release Name Of Shadowy Figure In 9/11 Case (R.)

The U.S. Justice Department on Thursday said it would release the name of an individual sought by people who are suing the government of Saudi Arabia for alleged involvement in the Sept. 11, 2001, hijacking attacks. U.S. prosecutors in New York said in a court filing that Attorney General William Barr had decided not to invoke state secrets and will share the person’s name with attorneys involved in the case. The decision could help victims of the Sept. 11 attacks and their family members, who charge in a long-running lawsuit that the Saudi government supported the hijackers who crashed jet liners into the World Trade Center, the Pentagon and a Pennsylvania field, killing nearly 3,000 people.

The Saudi government has repeatedly denied involvement in the attacks. The Saudi embassy in Washington did not immediately respond to requests for comment on Thursday. The case, filed in 2003, received a boost in 2016 when Congress passed a law making it easier to sue foreign governments for alleged involvement in terrorism. The plaintiffs have been trying to obtain redacted material from a 2012 FBI report which indicated the agency was investigating two Saudi officials, Omar al-Bayoumi and Fahad al-Thumairy, and said there was evidence that a third, unnamed party had ordered them to help the hijackers. Attorneys will now get to learn the name of that person, though their identity will remain under seal.

Scary people.

• Trump’s Taliban Talks Led by Neocon Operation Cyclone Agent (MPN)

John Bolton wasn’t the only veteran of the conflict in Afghanistan now charged with resolving it. Nor was he the only PNAC veteran in the Trump administration. U.S. Special Representative for Afghanistan Reconciliation Zalmay Khalilzad, the top American official in the negotiations, was a PNAC charter member and has been quietly overseeing the destruction of Afghanistan for most of his political career — longer than the Taliban has existed as an organization. Khalilzad worked closely with late National Security Advisor Zbigniew Brzezinski, who took a leading role in Operation Cyclone under President Carter. The secret CIA program pumped the Afghan Mujahideen up with cash, weapons, training, and jihadist school books.

The Brooklyn-based Al-Kifah Afghan Refugee Center — a front for Maktab al-Khidamat, an organization co-founded by Osama bin Laden — would become key to this endeavor. Brzezinski’s aim, as he stated, was to give the Soviets their own Vietnam quagmire. Back then, his message to the Mujahideen fighters that would become al-Qaeda and the Taliban was: “Your cause is right and God is on your side.” Even after the devastating attacks of September 11, Brzezinski defended the decision to support the Mujahideen in the name of defeating the Soviet Union.

The United States’ support for the Mujahideen in Afghanistan, and later Bosnia, was intended to bleed the Soviet Union. It is no surprise that the same leeches — the Taliban and al-Qaeda — that were trained by the United States, would turn on their masters. In the case of the Taliban, clinging on to the U.S. for nearly two decades, slowly sucking away all the while. In the case of al-Qaeda, the attacks on the World Trade Center dealt massive blows. The end-game tactics mirror the CIA’s philosophy in training the Mujahideen against the USSR. U.S officials like Khalilzad would spend decades in luxurious buildings in and around Washington while the people of Afghanistan would continue to suffer nearly another two decades of conflict because of their policies.

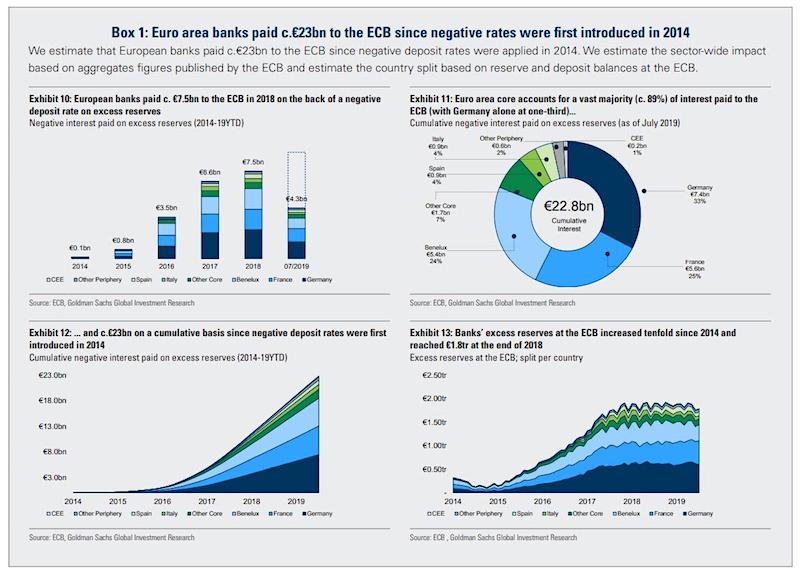

Wolf Richter sees the ECB falling to bits. Wonder what Lagarde is doing these days.

• Palace Revolt at the ECB, Legitimacy of Policy out the Window (WS)

ECB President Mario Draghi, who is on his way out, will, as we’re learning more and more, do anything to push his agenda and make it stick at the ECB long after he leaves, but whatever his agenda may be, it’s clearly unrelated to the European economy which has been buckling under the consequences of his agenda: the destructive weight of negative interest rates and QE. And in the process, he is destroying the legitimacy of the ECB’s policy. The latest incident was on Thursday. During the press conference following the ECB’s policy meeting, he lied to reporters, claiming that the “consensus was so broad there was no need to take a vote,” when in fact he had a revolt on his hand during the meeting by the presidents of the national central banks that represented half of the economy of the Eurozone, and by members of the Executive Board.

Among the key policy changes the ECB announced on Thursday was the restart of QE to the tune of €20 billion a month and a tiny 10-basis point cut in its deposit rate, from the old negative -0.4% to the new negative -0.5%. The announcement also included a provision to help banks – which have been getting re-crushed by these idiotic negative interest rates – to survive those negative interest rates: the ECB would exempt part of the banks’ deposits at the ECB from negative rates in a two-tier system. It was the QE portion of the decision that had triggered the unprecedented revolt during the meeting. “Officials with knowledge of the matter” told Bloomberg that during the contentious meeting, the members of the Governing Council and of the Executive Board who vigorously opposed the restart of QE included but was not limited to:

• Jens Weidmann, President of the Bundesbank • Francois Villeroy de Galhau, Governor of the Bank of France • Klaas Knot, President of the Dutch central bank • Ewald Nowotny, Governor of the Austrian central bank • Ardo Hansson, Governor of the Bank of Estonia • Sabine Lautenschlaeger, Member of the Executive Board • Benoit Coeure, Member of the Executive Board. The countries of the five heads of the national central banks, from Weidmann to Hansson, account for about half of the economy of the Eurozone. They opposed the restart of QE, but there was no vote – which is common in ECB proceedings when there is a consensus. But there was no consensus. And Draghi simply imposed his agenda.

Mistake perhaps. But hardly an honest one, if you read Wolf Richter’s piece above. The ECB IS the mistake.

• The New ECB QE Is A Mistake. Here Is What It Should Have Done (Lacalle)

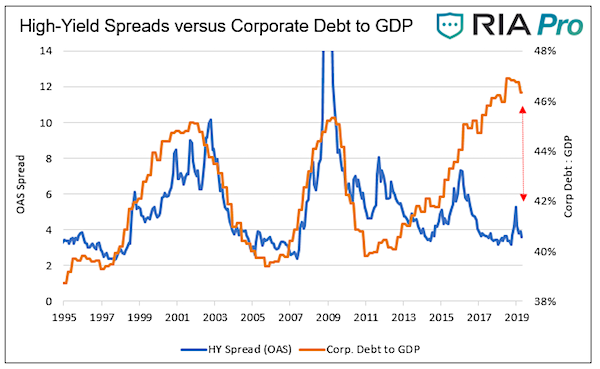

The ECB is creating a dangerous bubble and should not have cut rates by 10bps nor added a new purchase program of €20 billion per month. 1) Eurozone states are already financing themselves at negative rates. There is no need for lower rates and this disguises real risk. This has saved governments more than 1 trillion euro in interest expenses. 2) The ECB has not abandoned its stimulus. It repurchases all maturities, launched a liquidity injection (TLTRO) in March 2019 and balance sheet stands at almost 40% of eurozone GDP. 3) Excess liquidity is 1.7 trillion euro. More liquidity does not lead agents to spend/invest more. There is no higher solvent credit demand because monetary policy perpetuates overcapacity and zombifies the economy. Share of zombie companies has soared c30% since 2013 (BIS).

4) Interest rates are already negative. This has caused a 23 billion euro loss for banks (according to Scope Ratings) and a worrying rise in junk debt demand. 5) There is no evidence of a need for more credit growth. Rather the opposite. The ECB believes the eurozone problem is one of excess saving and lack of demand when it is of excess debt and oversupply. 6) Negative rates zombify the economy and are a massive transfer of wealth from savers and productive sectors to the indebted and inefficient. 7) The ECB already accumulates a disproportionate amount of sovereign debt as well as corporate bonds of issuers that never had a problem financing themselves at low rates. This disguises risk and creates an enormous bubble.

8) The problem of the eurozone is not one of lack of stimuli, but an excess of them. Governments burden the productive private sector with higher taxes and unnecessary regulations, so economic surprise falls despite massive stimulus. 9) When this fails or -even worse- explodes, central planners will likely blame “markets” or “lack of stimulus” to repeat. 10) Saying that negative rates are “demanded” by investors is a sad excuse. Financial repression leads economic agents to take more risk for lower yields and central banks go from lenders of last resort to enablers of financial bubbles.