Paul Klee Limits of the Mind 1927

Long time coming, we’ve been warning about this for as long as the Automatic Earth exists. It’s slow motion, but it’s certain.

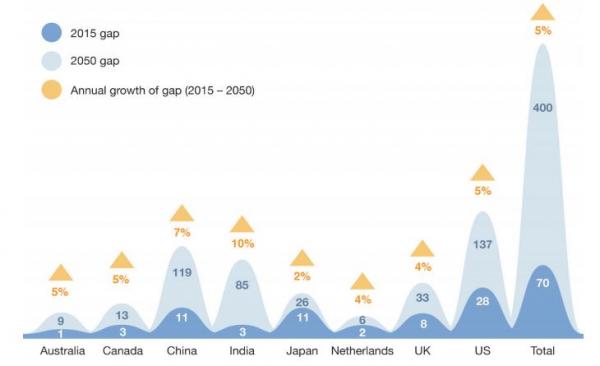

• Global Pension Underfunding To Grow To $400 Trillion Over Next 30 Years (ZH)

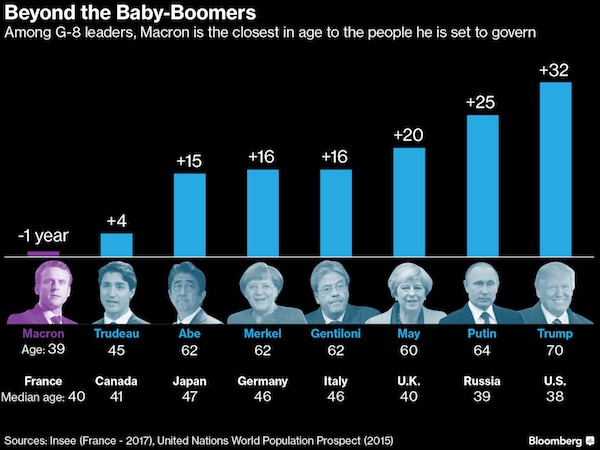

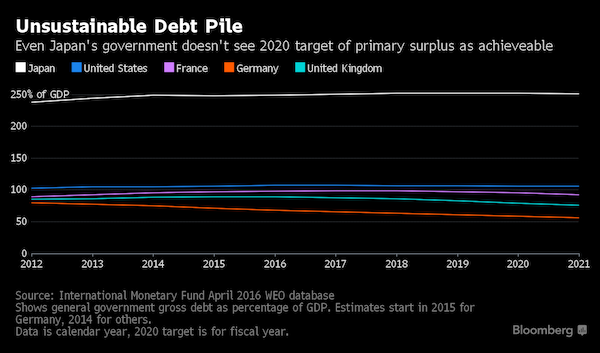

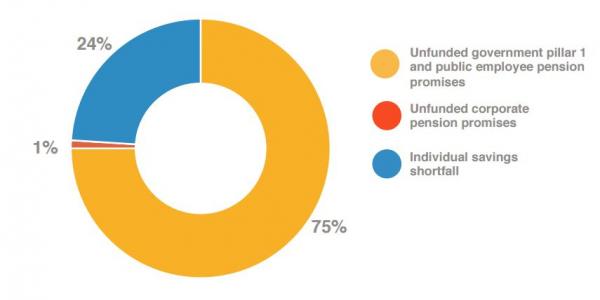

Of course, as we’ve argued before, the current pension underfunding levels are sure to only get worse over the coming decades as the world will have to contend with a wave of retiring Baby Boomers and a period of lackluster, volatile returns. So how bad could the global funding gap get? Unfortunately, the World Economic Forum (WEF) recently set out to solve that impossible math equation and it turns out the answer is about $400 trillion…give or take a couple trillion. Not surprisingly, the WEF attributed their terrifying conclusion to an ageing population, lack of savings, low expected growth rates and financially illiterate citizens.

• Long-term, low-growth environment: Over the past 10 years, long-term investment returns have been significantly lower than historic averages. Equities have performed 3%-5% below historic averages and bond returns have typically been 1%-3% lower. Low rates have grown future liabilities, and at the same time investment returns have been lower than expected and unable to make up the growing pension shortfall.

• Inadequate savings rates: To support a reasonable level of income in retirement, 10%-15% of an average annual salary needs to be saved. Today, individual savings rates in most countries are far lower. This is already presenting challenges where traditionally defined benefit structures would have provided a guaranteed pension benefit. Now, as workers look at their defined contribution retirement balances, with no guaranteed benefits, they are realizing that the retirement income their savings will provide will be much lower than expected.

• Low levels of financial literacy: Levels of financial literacy are very low worldwide. This represents a threat to pension systems which are more selfdirected and which rely more on private savings in addition to employer- or government-provided savings. Of course, ignoring that minor ~20 year increase in life expectancy over the past 60 years without raising retirement ages can take a toll on those present value calculations of future liabilities.

Oh, and turns out that politicians creating massive ponzi schemes to promise citizens that their government would take care of their financial needs in perpetuity, while never really bothering to explain the true costs of such programs, was probably a bad idea. But luckily these politicians are exempt from being prosecuted for their financial crimes…so taxpayers will just have to deal with picking up the $400 trillion tab.

And once you’re 80 everyhting’s gone, spent.

• UK Retirement Age Could Hit 80 As Pensions Deficit Sets Off Time Bomb (Ind.)

The UK has been told to prepare for a workforce of 80-year-olds as the world’s leading economies struggle to deal with a £54 trillion pensions time bomb. The amount could balloon to an astonishing £334 trillion by 2050 unless policymakers take urgent action, the World Economic Forum has warned. An ageing population, falling birth rates and poor access to pension products were the main sources of the widening gap between what people are saving and the amount they would have to put away to adequately fund their retirement, the WEF said. The projection is based on the OECD’s recommendation that people should have retirement income of around 70% of their salary.

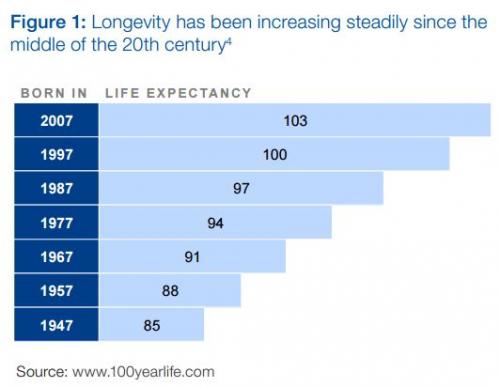

On this measure, the UK’s shortfall is higher than £6.2 trillion and set to increase by around 4% per year, reaching more than £25 trillion by 2050. To avoid the looming crisis, governments need to to improve financial literacy and increase access to pensions in order to boost the amount people save, the WEF said. “Policymakers do need to be thinking now about how to integrate 75- and even 80-year-olds in the workplace,” Michael Drexler, head of financial and infrastructure systems for the WEF told The Financial Times. The WEF said life expectancy has risen rapidly since the 1950s, increasing by two years every decade on average. Babies born now can expect to live longer than 100 years, according to the WEF report.

Nobody, Rep. or Dem., is interested in actually understanding the economy, they just want their favorite people to do well.

• President Trump’s Disastrous Budget Plan (John T. Harvey)

Several months ago, I graded President Trump’s economics. The standard I used was the extent to which various policies drained or refilled the swamp, with the assumption that the former represented acts that helped the middle class (or aspirants thereto). I marked him with two swamp drainers (+2) and five swamp refillers (-5) for a net of -3. His newly-announced budget plan, however — where I had given him the benefit of the doubt and a +1–just switched to a -1. It is absolutely disastrous. As much as I complained about Obama’s, this may be worse. You can do a quick Google search and find plenty of line-by-line analyses to see where the cuts will come. I won’t bother with that. Instead, I want you to take a step back and just look at the simple logic involved. What is the macro impact of Trump’s newfound conviction that we need to reduce the public deficit?

1. It lowers our savings. Ignoring for the moment the foreign sector, there are only two main actors in our economy: the public sector and the private sector. The inescapable accounting logic is that if the public sector spends more than it earns, then the private sector must earn more than it spends. Or put another way, the government’s deficit is your surplus. Period. No alternate interpretation is possible. Now add in the fact that we already spend more for foreign products than they spend for ours and you see that not only does the private sector need the government’s deficit if it is going to have any net savings, but that deficit needs to be even larger than our net outflow to China, et al!

2. It reduces profits. Actually, this is really part of the above, but it gets a little more concrete. When the government cuts spending, this isn’t just a number of a ledger somewhere. It’s someone’s income: a fireman, a librarian, a Marine, a park ranger, a university physics professor working with grant money, etc., etc. As it stands today, those people are buying bread, milk, gas, movie tickets, apartment rentals, cars, and so on. Who is going to buy those items if we lay off those government workers? No one. In fact, it would then logically lead to even more layoffs as those businesses lost profits. So much for helping the entrepreneur.

3. It burdens current generations (and does nothing to help future ones). Probably the most fundamental fact about the debt is also the least understood one: it is impossible — IMPOSSIBLE — for the U.S. to be forced to default on debt in dollars. I have written on this point extensively and will not go on about it here. The bottom line is that default is off the table, it can’t happen. Hence, the only impact of cutting the deficit is the reduction in savings and profits (and employment) mentioned above.

And so, without even considering the micro impacts of the various cuts he has in mind, it’s bad news all around and Trump’s grade has dropped from -3 (+2 – 5) to a -5 (+1 – 6). Of course, for the rest of us the impact is somewhat more significant than getting a bad report card.

Big changes were always going to happen. Losing Twitter, Spicer, Goldman alumni, Bannon, now maybe Kushner, no surprises there.

• Trump Prepares “War Room”, “Big White House Changes”, Loss Of Twitter (ZH)

In lieu of the Friday night “Trump bombshell” deliverable from the NYT-WaPo complex, today it was Reuters’ and the Wall Street Journal’s turn to lay out the suspenseful weekend reads, previewing major potential upcoming changes to the Trump administration. First, according to Reuters, Trump’s top advisors are preparing to establish a “war room” to combat negative reports and mounting questions about communication between Russia. Steve Bannon and Trump’s son-in-law Jared Kushner, both senior advisors to the president, will be involved in the new messaging effort, which also aims to push Trump’s policy agenda and schedule more rallies with supporters. This “most aggressive effort yet” to push back against allegations involving Russia and his presidential campaign, will launch once Trump returns from his overseas trip.

\

[..] Second, in a separate but similar report from the WSJ, the paper writes that Trump is “actively discussing major changes” in the White House, including a shakeup of his senior team, after spending much of his free time during his overseas trip weighing the Russia investigation and the political crisis it poses for him. A flurry of meetings devoted to White House operations are scheduled for next week, officials said, and sparks are expected to fly. While this isn’t the first time a major shake up around Trump was announced as imminent, recalls Axios reporting two weeks ago that an “angry” Trump was planning a huge reboot, and that Priebus, Bannon and Spicer could be fired …[..] The biggest change may be that Trump is about to lose his twitter privileges for good: One major change under consideration would vet the president’s social media posts through a team of lawyers, who would decide if any needed to be adjusted or curtailed. The idea, said one of Mr. Trump’s advisers, is to create a system so that tweets “don’t go from the president’s mind out to the universe.” Some of Mr. Trump’s tweets—from hinting that he may have taped conversations with Mr. Comey to suggesting without any evidence that former President Barack Obama wire-tapped Trump Tower—have opened him to criticism and at times confounded his communications team. Trump aides have long attempted to rein in his tweeting, and some saw any type of legal vetting as difficult to implement. “I would be shocked if he would agree to that,” said Barry Bennett, a former Trump campaign aide.

[..] most interesting is the alleged emerging tension between Trump and his Goldman advisors: “Some Trump advisers have also questioned the judgment of communications officials, citing as an example the rollout of a tax-plan outline in April that featured Goldman Sachs alumnae Steven Mnuchin, the Treasury secretary, and Gary Cohn, the National Economic Council director. “The left is automatically going to say the tax plan is tailored to the rich and to Wall Street. And we just gave them an image of the rich and of Wall Street,” one Trump former campaign official said. In an amusing tangent, the WSJ also points out that Trump’s return to Washington will mark the end of a period which, White House staffers said, “brought some relief from the hectic pace of the news surrounding the administration and the Russia investigation. Some noted that it gave them a rare time to eat dinner at home.”

Peeking out of the echo chamber.

• Trump’s Allies, Convicted of High Crimes Without a Trial (BBG)

Heard any good Mike Flynn jokes lately? How about this one from “Morning Joe,” this week? “When it comes to legal issues, he’s like Charmin. You just keep squeezing.” Maybe you’ve seen Stephen Colbert’s segment from February about Trump’s former national security adviser: “It’s funny ’cause it’s treason.” Don’t miss the exchange in the New Yorker last month with former acting attorney general Sally Yates. Reporter Ryan Lizza asked Yates about how she informed the White House counsel that Flynn had lied to his colleagues about his monitored conversations with the Russian ambassador. “You didn’t just text, ‘Heads-up, your N.S.A. might be a spy’?” Lizza asked. Yates quipped: “Is there an emoji for that?” Well it’s nice to see our elites are in such good humor about something so grave. If there truly was treason, it’s no joking matter.

If there was not, then this man’s name is being tarnished unfairly. Ha. Ha. After all, Flynn has yet to be charged with a crime. If there is evidence that he betrayed his country, it has yet to be presented. None of the many news stories about Flynn’s contacts with Russians and Turks has accused him of being disloyal to his country. And yet a decorated general has already been tried and convicted in the press. None of this would be happening without some very dirty business from the national security state. It’s a two-pronged campaign. First there are the whispers. Anonymous officials describe in detail elements of an ongoing investigation: intercepts of conversations between Russian officials about how they could influence Flynn during the transition; monitored phone calls about how Flynn had lied about his conversations with the Russian ambassador to his colleagues; how Flynn failed to disclose his payment from the Russian propaganda network on his official forms.

This prong of the campaign is at least factual, but the facts don’t speak for themselves. The second and more insidious element here is the innuendo. Yates never says Flynn was a spy for Russia. But her public remarks to Congress and the media appear designed to leave that impression. As she told Lizza, Flynn was “compromised by the Russians.” This sounds far more sinister than Flynn’s explanation when he left his post in February. Back then he said he had forgotten elements of his discussion with the Russian ambassador that covered a wide range of issues.

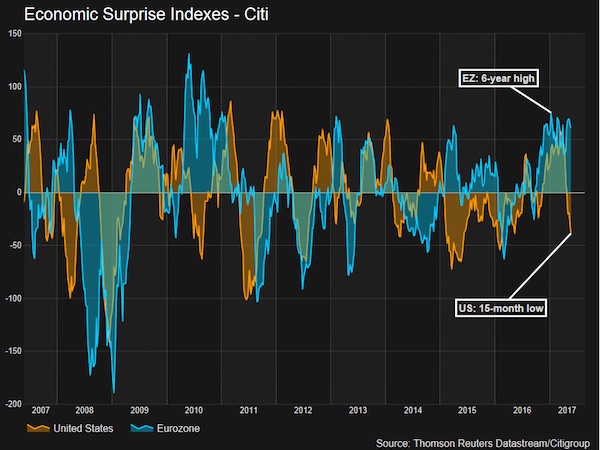

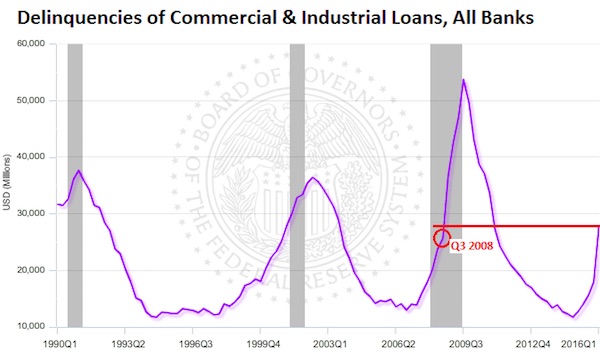

They aren’t because they can’t. This is what feeding bubbles leads to. This is the Fed for you.

• Millennials Want to Buy Homes but Aren’t Saving for Down Payments (WSJ)

Most millennials have saved virtually nothing for a down payment on a home, according to a new study, suggesting many will face steep obstacles to homeownership in the years ahead. Nearly 70% of young people ages 18 to 34 years old said they have saved less than $1,000 for a down payment, according to a survey by Apartment List, a rental listing company, expected to be released Friday. About 40% said they aren’t saving anything on a monthly basis. Even senior members of the group are falling short. Nearly 40% of older millennials, those age 25 to 34, who by historical measures should already own or be a few years away from homeownership, said they are saving nothing for a down payment each month.

The study helps illuminate a tension at the heart of the housing market. The vast majority—some 80%—of millennials said they eventually plan to buy a home. But 72% said the primary obstacle is that they can’t afford it. “It’s encouraging that millennials do want to buy homes. It suggests that they are delaying forming households but they’re not giving it up,” said Andrew Woo, director of data science and growth at Apartment List. “The biggest reason [they aren’t buying] is because of affordability.” Catie Peterson, a 22-year-old graphic designer in Fort Lauderdale, Fla., said she doesn’t expect to start saving for a down payment for another five years or so. “I barely have enough savings to cover my car if it were to break down,” she said.

Ms. Peterson said she pays $975 a month in rent for a small one-bedroom apartment, which is about one third of her paycheck, leaving little room to save. “Once I get settled in my career and settled in my family, I think buying a house would be reasonable,” she said. The reasons young people are falling behind include student loan debt, rising rents and the slow starts many got to their careers during the recession. Living in vibrant urban centers with ready access to restaurants, bars and entertainment might also make saving seem less urgent. Many are children of the affluent baby boomer generation and some expect their parents to give them a boost when the time comes. In all, about one-quarter of millennials ages 25 to 34 expect to receive help from friends or family, according to the survey. Still, three-quarters said they expect to receive less than $10,000, which might not be enough to close the gap.

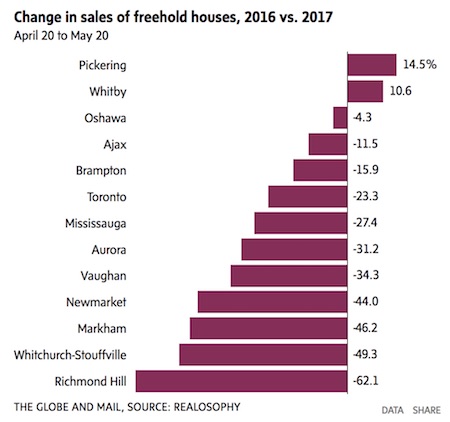

All the money that’s left is tied up in property.

• Australia Economy Hit By Spending Strike, Cyclone (AFR)

Australia’s economy looks to have experienced its weakest start to a year since 2011 – narrowly skirting a contraction – as a growing consumer spending strike and a cyclone-driven slowdown in exports weighs on activity just as the government bets its budget strategy on a rebound. While the country is not at risk just yet of a technical recession – or two quarters of consecutive declines in gross domestic product – the economy looks set to continue in 2017 its whip-saw pattern of the past year. Combined with weak spending and a fall in shipments of iron ore and coal, as well as lower commodity prices, the first quarter is likely to have been weighed down by a sudden collapse in construction work – a sign that a regulatory squeeze on apartment lending may be starting to bite.

Weak retail spending, which this week saw the seventh retailer go under in recent months, sharply rising car loan delinquencies and falling new car sales all point toward a population clamping down on discretionary spending. ANZ Bank economists said next month’s national accounts may show the economy grew just 0.1% from the December quarter – raising the spectre of the second negative quarter in nine months after GDP shrank by 0.5% in the September quarter before rebounding by 1.1% in late 2016. Annual growth may have shuddered to just 1.5% in the opening months of the year from 2.4% last year. While they are in the minority, some analysts are starting to warn that the economy may have gone backwards, not just in the March quarter, but may be doing so in the current period.

[..] Commonwealth Bank of Australia senior economist Michael Workman cautioned that it was “too early to tell” if GDP would go negative. “There’s always a lot of worriers out there, and they’re very good for the market,” he said. But he isn’t one of them. “It could be as low as 0.1, but it’s too early to tell with any certainty.” ANZ senior economist Felicity Emmett said there was a growing realisation among households that low wage growth was here to stay. “That’s quite difficult for the household sector when they have very high levels of debt. In terms of the atmospherics, the business surveys do suggest quite positive, but the decline in consumer spending quite worrying.”

Don’t be surprised if she loses.

• Theresa May Launches Strongest Attack Yet On Jeremy Corbyn (Tel.)

Theresa May has accused Jeremy Corbyn of providing an “excuse for terrorism” in her strongest attack on the Labour leader to date. The Prime Minister said Mr Corbyn had suggested the Manchester suicide bombing and other terrorist attacks “are our own fault” by linking terrorism to British foreign policy. She also rounded on Mr Corbyn for the timing of his remarks – made in a campaign speech on Friday – just days after 22 children and adults were killed. In an interview with the BBC’s Andrew Neil, Mr Corbyn repeated his claim that terrorism was partly caused by “the consequences of our interventions in Afghanistan, in Iraq, in Libya”. The Labour leader also would not withdraw his previous description of NATO as a “Frankenstein” organisation, and refused six times to guarantee a replacement of Trident.

It came as senior Tories expressed concern that Mrs May’s message of “strong and stable” leadership is not cutting through with voters after one poll found her lead over Labour had been reduced to just five points. Mrs May on Friday night claimed a victory in the war on terror as she convinced leaders of the G7 countries to sign up to plans she has drawn up for a crackdown on Facebook and other social media sites being used as recruiting tools by Isil. She also struck a deal to make countries pick up British jihadis before they get home, after it emerged that Manchester bomber Salman Abedi stopped in Germany on his way back from Libya just days before the attack. [..] Mr Corbyn was criticised by figures from across the political spectrum for linking the Manchester attack to British foreign policy in Libya and elsewhere.

Boris Johnson, the Foreign Secretary, said his comments were “absolutely obscene”, while Andy Burnham, the new Labour Mayor of Manchester, said Mr Corbyn was wrong when he pointed to “the connections between wars our government has supported or fought in other countries and terrorism here at home”. Mrs May looked angry as she addressed Mr Corbyn’s speech during a press conference at the G7 summit in Sicily. She said: “I’m going to be very clear about what has been said today. “What has happened is I have been here at the G7 working with other international leaders to fight terrorism. “At the same time, Jeremy Corbyn has said that terror attacks in Britain are our own fault – and he has chosen to do that just a few days after one of the worst terrorist atrocities we have experienced in the United Kingdom.

“Do you suppose that, in the hothouse of Washington, incoming foreign policy officers of Obama’s government had no conversations with foreign diplomats between the election of 2008 and Obama’s inauguration? The idea is laughable. ..”

A most curious feature in the current low state of American politics is the delusional thinking at both ends of the political spectrum. Both factions have gone off the rails mentally, and the parties they represent race toward oblivion like Thelma and Louise in their beater car. More ominously, there are no new factions with a grip on reality even beginning to form anywhere in the background — as in the 1850s when the Whigs foundered and the party of Lincoln segued into power. To see the Democrats go on about “Russian collusion” you would think we were watching a rerun of the John Birch Society in its heyday. Americans who have done business in Russia as private citizens are being persecuted as though they were trading with the enemy in wartime. Newsflash: we are not at war with Russia, which, by the way, is no longer the Soviet Union.

It is one of many European countries that Americans are entitled to do business in — even in the case of General Mike Flynn accepting a $20,000 speaking fee from the RT news company. Has anyone noticed that Ben Bernanke routinely takes $200,000-plus speaking fees in many foreign countries whose interests are not identical to ours and no one is persecuting him. Likewise, the insane idea that it is malfeasant for high public officials to speak to Russian officials, or for the president to share sensitive strategic information with them, especially about genuine mutual enemies such as the various Islamic jihad armies. Since when is that beyond the pale? Well, since January of this year when the Democrat Party ordained that members of the Trump transition team were forbidden to speak to Russian diplomats at the highest level.

Do you suppose that, in the hothouse of Washington, incoming foreign policy officers of Obama’s government had no conversations with foreign diplomats between the election of 2008 and Obama’s inauguration? The idea is laughable. [..] The party of the right, the Republicans, have made themselves hostages to the marginal personality of Donald Trump, who prevailed over a cast of Republican empty suits in the pathetic and appalling primary contests of last spring. The Republican party has not demonstrated that it has the dimmest idea what is going on “out there” in the very flyover districts its minions and flunkies pretend to represent, or that they believe in anything not cynically calculated to bamboozle the economically immiserated classes left behind by their deliberate asset-stripping approach to the public interest.

Libyan Coastguard gets EU funding.

• Libyan Coastguard Opened Fire At Refugee Boats: NGOs (AlJ)

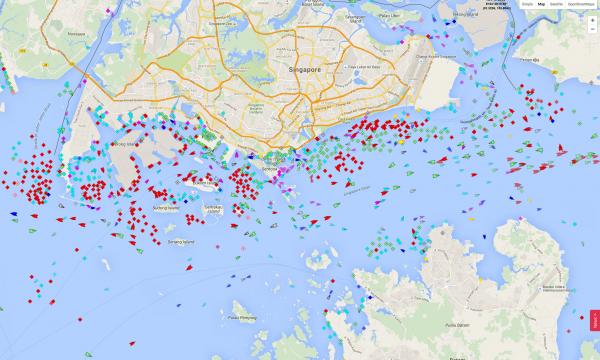

Libyan coastguard officers opened fire on two boats loaded with refugees while rescue attempts were under way in the Mediterranean Sea on Tuesday, according to nongovernmental organisations involved in the operations. The Libyan coastguard has rejected the accusations and demanded evidence. But those at the scene told Al Jazeera that at around noon, as rescue workers from four groups – French NGOs SOS Mediterranee and Doctors Without Borders (MSF), Italian NGO Save the Children and German NGO Jugend Rettet – were trying to save refugees, a speedboat equipped with four machine guns and bearing the emblem of the Libyan coastguard arrived at the scene.

The speedboat approached the rescue operation at high speed, creating large waves that made it difficult for the refugees to board rubber dinghies, the witnesses said. Shortly after, a series of gunshots could be heard coming from near the dinghies, Laura Garel, a communications officer on the SOS Mediterranee’s rescue vessel Aquarius, told Al Jazeera. Jugend Rettet. “For us the situation was critical,” said Jonas. “We are here to help, but were forced to stand idly by as to avoid getting hit by a bullet ourselves.” [..[ The Libyan coastguard denied Tuesday’s incident took place, calling the accusations “illogical”. Ayob Amr Ghasem, a Libyan navy spokesman, challenged the rescue groups to produce evidence of their claims. “Why would we have shot at boats if we are the ones that always save them?” Ghasem was quoted by the Italian ANSA news agency as saying.

The EU tries to blame its refugee failings on Trump. Same for its CON21 climate disaster.

• Hopes For Refugee Crisis Plan Fall Into Chasm Between G7 And Trump (G.)

Divisions between Donald Trump and other members of the G7 at the summit in Sicily have become so broad and deep that they may be forced to issue a brief leaders’ statement rather than a full communique, dashing Italian hopes of engineering a big step forward on migration and famine. With the US president apparently reluctant to compromise with European leaders over climate change, trade and migration, the European council president, Donald Tusk, was forced to admit on Friday that this would be the most challenging G7 summit in years and there was a risk of events spiralling out of control. A draft statement shown to the Guardian reveals Trump wants world leaders to make only a short reference to migration and to throw out a plan by the Italian hosts for a comprehensive five-page statement that acknowledges migrants’ rights, the factors driving refugees and their positive contribution.

The Italian plans – one on human movement and another on food security – were set to be the centrepiece of its summit diplomacy. Italy had chosen Taormina in Sicily as the venue to symbolise the world’s concern over the plight of refugees coming from the Middle East and Africa. It had hoped the summit would end on Saturday with a bold statement that the world, and not just individual nations, had a responsibility for the refugee crisis. Italy is expected to take in 200,000 refugees in 2017; more than 1,300 have drowned so far this year while trying to make the perilous crossing from north Africa. Trump’s negotiators brought a new brief text of the final communique to a pre-meeting of the G7 on 26 April and said they were vetoing the Italian “human mobility” plan, which had been the subject of careful negotiation for months.

The new text, offered by the US on a take-it-or-leave-it basis, acknowledges the human rights of migrants, but affirms “the sovereign rights of states to control their own borders and set clear limits on net migration levels as key elements of their national security”. It also asserts the need for refugees to be supported as close to their home countries as possible. Diplomatic sources said intense talks were under way to rescue some of the Italian agenda on migration. Italian officials, faced with little option, insisted the brief wording on migration in the draft represented a good compromise and said there was no problem with the Americans. The communique did reference the idea of “upstream” action on the issue – but also supporting legal pathways to return individuals to their country of origin. In a sign of the immediacy of the refugee crisis, the Libyan coastguard said as many as 20 boats had been spotted off the Libyan coast on Friday carrying thousands of migrants.