Harris&Ewing District National Bank, Washington, DC 1931

Smedley Butler knew it way back in 1933.

• Memorial Day: Our Soldiers Died For The Profits Of The Bankers (Smedley Butler)

Memorial Day commemorates soldiers killed in war. We are told that the war dead died for us and our freedom. US Marine General Smedley Butler challenged this view. He said that our soldiers died for the profits of the bankers, Wall Street, Standard Oil, and the United Fruit Company. Here is an excerpt from a speech that he gave in 1933:

“War is just a racket. A racket is best described, I believe, as something that is not what it seems to the majority of people. Only a small inside group knows what it is about. It is conducted for the benefit of the very few at the expense of the masses. I believe in adequate defense at the coastline and nothing else. If a nation comes over here to fight, then we’ll fight. The trouble with America is that when the dollar only earns 6% over here, then it gets restless and goes overseas to get 100%. Then the flag follows the dollar and the soldiers follow the flag. I wouldn’t go to war again as I have done to protect some lousy investment of the bankers. There are only two things we should fight for. One is the defense of our homes and the other is the Bill of Rights. War for any other reason is simply a racket.

There isn’t a trick in the racketeering bag that the military gang is blind to. It has its “finger men” to point out enemies, its “muscle men” to destroy enemies, its “brain men” to plan war preparations, and a “Big Boss” Super-Nationalistic-Capitalism. It may seem odd for me, a military man to adopt such a comparison. Truthfulness compels me to. I spent thirty-three years and four months in active military service as a member of this country’s most agile military force, the Marine Corps. I served in all commissioned ranks from Second Lieutenant to Major-General. And during that period, I spent most of my time being a high class muscle- man for Big Business, for Wall Street and for the Bankers. In short, I was a racketeer, a gangster for capitalism.”

“A rate that is too low, or a rate that many of us have never experienced, is so extraordinary that it doesn’t create any stability or faith in the future at all..”

• Europe’s Biggest Debt Collector: Central Banks’ Stimulus Has Failed (Bloomberg)

The head of Europe’s biggest debt collector says the historic wave of stimulus spilling out of central banks has failed to fuel investment growth. Lars Wollung, the chief executive officer of Intrum Justitia AB, warned that record-low interest rates “don’t seem to lead to investments that create jobs,” in an interview in Stockholm. “A rate that is too low, or a rate that many of us have never experienced, is so extraordinary that it doesn’t create any stability or faith in the future at all,” he said. “Rather the opposite: one feels insecure and waits with expansion plans and to hire more people.” The comments mark a blow to central banks who have resorted to everything from negative rates to bond purchases to aid growth.

A study by Intrum Justitia shows 73% of the almost 9,000 European firms surveyed between February and April said low interest rates brought about “no change in investments.” Some even reported a decline. In Sweden, where the central bank’s main rate is minus 0.25%, 82% of companies said it made no difference to their investments. What companies need if they’re “to believe in the future” is certainty that their bills will be paid, Wollung said. That means clearer payments legislation and more incentives for borrowers to repay their debts on time, he said. Intrum Justitia has devoted resources to lobbying officials in Brussels in an effort to bring across its point, Wollung said.

In Germany and Scandinavia, where companies and borrowers can refer to clear and robust legal systems, unemployment is low and economic growth strong, he said. A German firm waits 17 days on average to get paid by a client company. In Italy, it takes 80 days, Intrum figures show. The survey indicates that about 8 million European companies would hire more people if they got their payments faster. “Late payments are a significant problem for companies,” Wollung said. Having a stable cash flow is “probably more important than if interest rates are at 1% or 0.5%,” he said.

No holds barred.

• “It’s A Coup D’Etat”, “Central Banks Are Out Of Control” – David Stockman (ZH)

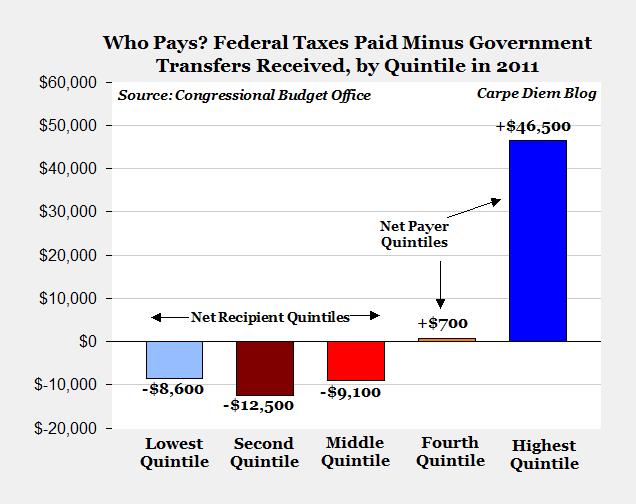

We’re all about to be taken to the woodshed, warns David Stockman in this excellent interview. The huge wealth disparity is “not because of some flaw in capitalism, or Reagan tax cuts, or even the greed of Wall Street; the problem is central banks that are out of control.” Simply put, they have “syphoned financial resources into pure gambling” and the people that own the stocks and bonds get the huge financial windfall. “The 10% at the top own 85% of the financial assets,” and thus, thanks to the unleashing of almost limitless money-printing, which has created a massive worldwide financial inflation, “the central banks have created and exaggerated the wealth gap.” Stockman concludes, rather ominously,

“it’s a coup d’etat, the central banks have taken over – unconstitutional domination of the entire economy.” “Everywhere, misleading distorted signals are being given to both public and private sector players about financial values… the prices have been falsified by The Fed. We can’t print our way to prosperity… The Fed is now petrified that Wall Street will have a hissy-fit when they tighten.”

Well, they caused it.

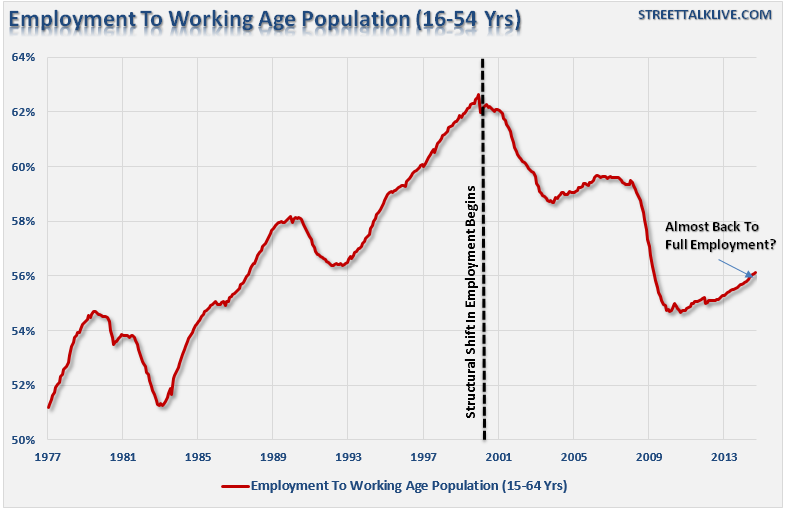

• Unemployment Is a Big Threat to Eurozone Economy, Central Bankers Warn (WSJ)

High and divergent unemployment rates in Europe pose a serious threat to the region’s long-term economic health, central bankers and economists warned during a weekend conference held by the European Central Bank. But they stopped short of offering specific advice on the best steps to take. The ECB’s seminar, the second of what it plans as an annual conference in the resort town of Sintra on Portugal’s western coast, brought together central bankers and economists from Europe, the U.S. and Asia to examine the root causes of high unemployment and persistently weak inflation in Europe. The attendees dwelled extensively on an economic concept known as “hysteresis,” a reduction in economic output brought on by weak growth that gives rise to long-term unemployment.

The remedies to such problems, however, lie partly with fiscal-policy officials and not central bankers, who don’t set labor and other economic policies. The conference largely lacked representatives from finance ministries and businesses. But ECB President Mario Draghi signaled that the stakes were too high for central bankers to keep silent, particularly in the 19-member eurozone, where diverse countries ranging from powerful Germany to recession-ravaged Greece set their own economic and fiscal policies but share a single currency and monetary policy. “In a monetary union you can’t afford having large and increasing structural divergences between countries,” Mr. Draghi said on Saturday. “They tend to become explosive; therefore they are going to threaten the existence of the monetary union.”

The eurozone is the world’s second-biggest economy after the U.S. But in recent years it has emerged as one of the global economy’s main trouble spots, having struggled through a pair of recessions since 2009 that pushed the bloc’s unemployment rate into double digits. The region has started to recover, but the damage has resulted in huge gaps in unemployment across the eurozone. “Unemployment in Europe, notably youth unemployment, is not only unbearably high. It is also unbearably different across nations belonging to an economic and monetary union,” Tito Boeri, professor at Bocconi University, and Juan Jimeno of the Bank of Spain wrote in a conference paper.

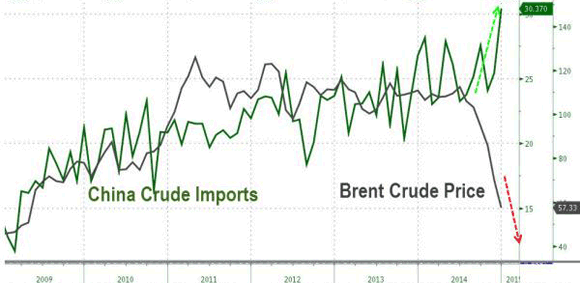

“JP Morgan estimates that the US economy contracted at a rate of 1.1pc in the first quarter..” “China accounted for 85pc of all global growth in 2012, 54pc in 2013, and 30pc in 2014. This is likely to fall to 24pc this year.”

• HSBC Fears World Recession With No Lifeboats Left (AEP)

The world economy is disturbingly close to stall speed. The United Nations has cut its global growth forecast for this year to 2.8pc, the latest of the multinational bodies to retreat. We are not yet in the danger zone but this pace is only slightly above the 2.5pc rate that used to be regarded as a recession for the international system as a whole. It leaves a thin safety buffer against any economic shock – most potently if China abandons its crawling dollar peg and resorts to ‘beggar-thy-neighbour’ policies, transmitting a further deflationary shock across the global economy. The longer this soggy patch drags on, the greater the risk that the six-year old global recovery will sputter out. While expansions do not die of old age, they do become more vulnerable to all kinds of pathologies.

A sweep of historic data by Warwick University found compelling evidence that economies are more likely to stall as they age, what is known as “positive duration dependence”. The business cycle becomes stretched. Inventories build up and companies defer spending, tipping over at a certain point into a self-feeding downturn. Stephen King from HSCB warns that the global authorities have alarmingly few tools to combat the next crunch, given that interest rates are already zero across most of the developed world, debts levels are at or near record highs, and there is little scope for fiscal stimulus. “The world economy is sailing across the ocean without any lifeboats to use in case of emergency,” he said.

In a grim report – “The World Economy’s Titanic Problem” – he says the US Federal Reserve has had to cut rates by over 500 basis points to right the ship in each of the recessions since the early 1970s. “That kind of traditional stimulus is now completely ruled out. Meanwhile, budget deficits are still uncomfortably large,” he said. The authorities are normally able to replenish their ammunition as recovery gathers steam. This time they are faced with a chronic low-growth malaise – partly due to a global ‘savings glut’, and increasingly to a slow ageing crisis across most of the Northern hemisphere. The Fed keeps having to defer its first rate rise as expectations fall short.

Each of the past four US recoveries has been weaker than the last one. The average growth rate has fallen from 4.5pc in the early 1980s to nearer 2pc this time. The US fiscal deficit has dropped to 2.8pc but is expected to climb again as pension and health care costs bite, even if the economy does well. The US cannot easily launch a fresh New Deal. Public debt was just 38pc on GDP when Franklin Roosevelt took power in 1933, and there were few contingent liabilities hanging over future US finances. “Fiscal stimulus – a novel idea at the time – may have been controversial, but the chances of it working to boost economic activity were quite high given the healthy starting position. Today, it is much more difficult to make the same argument,” he said.

” The reason for the fall in new loans is clear. There is a fundamental lack of demand in China.”

• Did China Just Launch World’s Biggest Spending Plan? (Gordon Chang)

Beijing has just initiated a round of accelerated government spending, and it will, in all probability, end up as the biggest such effort today. Wednesday, the Chinese central government announced both the allocation of 1.13 trillion yuan ($185.8 billion) for upgrading internet infrastructure and the creation of a 124.3 billion yuan fund for affordable housing. These expenditures follow Monday’s authorization of six new rail lines costing 250 billion yuan. This month, as Xinhua News Agency reports, Beijing has unveiled a “pro-growth measure” at the rate of one every two days. April was a banner month for Beijing’s spenders as well. The Ministry of Finance reported a 33.2% increase in fiscal spending compared with same month in 2014.

For the last several years, Beijing has been using fiscal stimulus in varying amounts to keep the economy humming. No one, however, thought Premier Li Keqiang, generally considered a reformer, would resort to the old-line, anti-reform tactic of massive government spending. There were two principal reasons for this belief. First, many thought Beijing had finally opted for fundamental restructuring to grow the economy. Analysts hailed the issuance of the Communist Party’s November 2013 Third Plenum decision, which promised substantial reforms, as proof of the political victory of those favoring progressive change.

Fiscal spending, on the other hand, has been considered the antithesis of reform because investment-led growth—the result of that spending—would only take China further away from the ultimate goal of reform, a consumption-based economy. Second, analysts believed just about everyone in Beijing had come to the inescapable conclusion that former Premier Wen Jiabao’s crash stimulus program, authorized in late 2008, was a huge mistake, largely because it had resulted in grossly inefficient usage of capital, large asset bubbles, and far too much debt. Yet the universally accepted view that there would be no large stimulus was premised on the assumption that the economy would respond to small-scale stimulus.

The economy, unfortunately, has not. Perhaps the most indicative statistic to come out of Beijing in recent days is that, despite all the monetary loosening since the end of last year, there were only 707.9 billion yuan of new loans in April, down from 1.18 trillion yuan in March. The reason for the fall in new loans is clear. There is a fundamental lack of demand in China.

“..a preliminary Reuters poll last week predicted adjusted Q1 U.S. GDP numbers due on Friday would be massively revised down and show a 0.7% contraction..”

• G7 Finance Ministers To Address Faltering Global Growth (Reuters)

Finance ministers from the world’s largest developed economies meet in Germany this week against a backdrop of faltering global growth, scant inflationary pressures and a bond market in turmoil. High on their agenda – even if unofficially – will be Greece and how it can stay in the troubled euro zone. Figures due on Friday from the United States that will almost certainly show the world’s biggest economy contracted last quarter are also likely to feature. “With the negotiations between Greece and the rest of the euro area at an impasse, an impatient German Chancellor Merkel has warned that an agreement must be reached before the end of the month,” said Thomas Costerg, senior economist at Standard Chartered.

Greece cannot make a payment to the IMF due on June 5 unless foreign lenders disburse more aid, a senior ruling party lawmaker said on Wednesday, the latest warning from Athens it is on the verge of default. Analysts largely agree the country’s cash squeeze is increasingly acute and fresh aid will be needed sooner or later to avoid bankruptcy. Merkel and French President Francois Hollande held talks on Thursday with Greek Prime Minister Alexis Tsipras on the sidelines of a European Union summit in Riga, hoping to speed the resolution of Athens’ debt crisis. With business growth slowing in the euro zone and factory activity contracting again in China, market watchers have been looking to the United States to drive a pick-up in growth.

But a preliminary Reuters poll last week predicted that adjusted first quarter U.S. GDP numbers due on Friday would be massively revised down and show a 0.7% contraction in the first three months of this year. “The poor Q1 2015 performance follows growth of just 2.2% in Q4 2014, so there has been very little growth over the last couple of quarters,” said Joseph LaVorgna, chief U.S. economist at Deutsche Bank. “As a result, market participants have started to wonder again whether the U.S. economy might be in an extended period of secular stagnation.”

And there should be.

• Schaeuble Expects Conflict at Dresden G-7 Over Austerity Policy (Bloomberg)

German Finance Minister Wolfgang Schaeuble expects a political tussle with his partners over austerity policy when G-7 finance ministers meet on May 27-May 29 in Dresden. Germany’s advocacy of budget cuts to heal euro-zone woes will come under attack at the meeting, Schaeuble said in a pamphlet distributed Saturday. The German government will face “demand-side” opponents of its policy in Dresden, he said without mentioning France or Italy or the U.S. “’Demand-side’ advocates will make clear in Dresden that cutting public spending leads to weaker demand for goods and services,” the minister said in a pamphlet distributed in the Dresden newspaper Saechsische Zeitung.

Germany’s position is that “solid public finance” boosts investment and growth, he said. Risks to Europe’s economic outlook stemming from the unresolved Greek crisis as well concern over the U.S. trade gap may fuse an alliance of France, Italy and the U.S. in Dresden. All three states fret that Germany’s rigorous advocacy of budget austerity may be holding back economic growth in Europe. U.S. Treasury Secretary Jacob J. Lew urged Germany to boost public investment to spur imports from Europe and spark a cycle of economic growth that would also benefit the U.S.

The U.S. trade gap widened in March to the biggest in more than six years while Germany in 2014 again reported a record surplus. The U.S. has also called for a quicker fix of Greece’s problems in a sign that it views Germany’s unmoving insistence that Greece fulfill bailout terms as a risk. Lew said Friday that failure to reach a deal quickly would create hardship for Greece, uncertainties for Europe and the global economy. Schaeuble remains adamant that Germany’s stance on sound budgeting is the right one, if unpopular. “Further convincing needs to be done” at Dresden, he said in his pamphlet.

Next weekend is a holiday weekend in Greece. Fears of capital controls.

• Greece Hasn’t Got The Money To Make June IMF Repayment (Reuters)

Greece cannot make debt repayments to the IMF next month unless it achieves a deal with creditors, its interior minister said on Sunday, the most explicit remarks yet from Athens about the likelihood of default if talks fail. Shut out of bond markets and with bailout aid locked, cash-strapped Athens has been scraping state coffers to meet debt obligations and to pay wages and pensions. With its future as a member of the 19-nation euro zone potentially at stake, a second government minister accused its international lenders of subjecting it to slow and calculated torture. After four months of talks with its euro zone partners and the IMF, the leftist-led government is still scrambling for a deal that could release up to 7.2 billion euros ($7.9 billion) in remaining aid to avert bankruptcy.

“The four installments for the IMF in June are €1.6 billion. This money will not be given and is not there to be given,” Interior Minister Nikos Voutsis told Greek Mega TV’s weekend show. Voutsis was asked about his concern over a ‘credit event’, a term covering scenarios like bankruptcy or default, if Athens misses a payment. “We are not seeking this, we don’t want it, it is not our strategy,” he said. “We are discussing, based on our contained optimism, that there will be a strong agreement (with lenders) so that the country will be able to breathe. This is the bet,” Voutsis said. Previously, the Athens government has said it is in danger of running out of money soon without a deal, but has insisted it still plans to make all upcoming payments.

The unbalance of global power.

• Greece’s Misery Shows We Need Chapter 11 Bankruptcy For Countries (Guardian)

Alexis Tsipras, Greece’s combative prime minister, is facing yet another week of fraught negotiations as he and his team struggle to agree a shopping list of economic reforms stringent enough to appease the country’s creditors, but different enough from the grinding austerity of the past five years to satisfy the Greek electorate. And all the while, bank deposits will leach out of the country, investment plans will remain on hold and consumers hammered by years of austerity will continue living hand to mouth. Change the actors – and the stakes – and it’s a tired plotline familiar to many governments across the world. According to Eurodad, the coalition of civil society groups that campaigns on debt, there have been 600 sovereign debt restructurings since the 1950s – with many governments, including Argentina for example, experiencing one wrenching write-off after another.

Many of these countries plunged deeper into recession as a result of the uncertainty and delay inherent in this bewildering process and the punishing austerity policies inflicted on them, with a resulting collapse in investor and consumer confidence. Argentina defaulted in 2001. Fourteen years later, it is still being pursued through the courts by so-called vulture funds, which buy distressed countries’ debts on the cheap and use every legal device they can to reclaim the money. Yet while the world’s policymakers have expended countless hours since the crisis of 2008 rewriting regulations on bonuses, mortgage lending, derivatives and too-big-to-fail banks, little attention has been paid to what should happen when a government is on the brink of financial meltdown.

Sacha Llorenti, the Bolivian ambassador to the UN, is currently touring the world’s capitals trying to change that. “We’re not just talking about a financial issue; it’s an issue related to growth, to development, to social and economic rights,” he says. The UN is not the obvious forum for discussing debt restructuring: unlike the IMF, it is not a lender of last resort with emergency cash to disburse, and doesn’t have a seat around the table when countries have to go to their creditors to ask for help. Yet also unlike the IMF, the UN general assembly is not dominated by the world’s major powers: each member country has one vote.

When Argentina tabled a motion calling for the UN to examine the issue of sovereign debt restructuring last autumn, 124 countries voted for it; 11, including the UK and the US, with their powerful financial lobbies, voted against; and there were 41 abstentions. Llorenti, who is chairing the UN “ad hoc committee” set up as a result of that vote, says the 11 countries that objected hold 45% of the voting power at the IMF. He believes they would prefer the matter to be tackled there, where they can shape the arguments: “It’s a matter of control, really.”

Support for Syriza is still very high. But people are afraid to.

• Greeks Back Government’s Red Lines, But Want To Keep Euro (AFP)

Cash-strapped Greeks remain supportive of the leftist government’s tough negotiating style, according to a new poll published Sunday, but hope for a deal with creditors that will keep the euro in their wallets. The poll conducted in May by Public Issue for the pro-government newspaper Avgi, shows 54% backing the SYRIZA-led government’s handling of the negotiations despite the tension with Greece’s international lenders. A total 59% believe Athens must not give in to demands by its creditors, with 89% against pension cuts and 81% against mass lay-offs. The SYRIZA-led government is locked in talks with the EU, ECB and the IMF to release a blocked final €7.2-billion tranche of its bailout.

In exchange for the aid, creditors are demanding Greece accept tough reforms and spending cuts that anti-austerity Syriza pledged to reject when it was elected in January. According to reports, creditors are demanding further budget cuts worth €5 billion including pension cuts and mass lay-offs. Prime Minister Alexis Tsipras made clear on Saturday however that his government “won’t budge to irrational demands” that involve crossing Syriza’s campaign “red lines”. Greece faces a series of debt repayments beginning next month seen as all but impossible to meet without the blocked bailout funds. Failure to honour those payments could result in default, raising the spectre of a possible exit from the euro. That is a scenario Greeks hope to avert, with 71% of those polled wanting to keep the euro while 68% said a return to the drachma could worsen the economic situation.

Yanies takes aim at the media.

• The Truth About Riga (Yanis Varoufakis)

It was the 24th of April. The Eurogroup meeting taking place that day in Latvia was of great importance to Greece. It was the last Eurogroup meeting prior to the deadline (30th April) that we had collectively decided upon (back in the 20th February Eurogroup meeting) for an agreement on the set of reforms that Greece would implement so as to unlock, in a timely fashion, the deadlock with our creditors. During that Eurogroup meeting, which ended in disagreement, the media began to report ‘leaks’ from the room presenting to the world a preposterously false view of what was being said within. Respected journalists and venerable news media reported lies and innuendos concerning both what my colleagues allegedly said to me and also my alleged responses and my presentation of the Greek position.

The days and weeks that followed were dominated by these false stories which almost everyone (despite my steady, low-key, denials) assumed to be accurate reports. The public, under that wall of disinformation, became convinced that, during the 24th April Riga Eurogroup meeting, my fellow ministers called me insulting names (“time waster”, “gambler”, “amateur” etc. were some of the reported insults), that I lost my temper, and that, as a result, my Prime Minister later “sidelined” me from the negotiations. (It was even reported that I would not be attending the following Eurogroup meeting, or that I would be ‘supervised’ by some other ministerial colleague.) Of course none of the above was even remotely true.

My fellow ministers never, ever addressed me in anything other than collegial, polite, respectful terms.

• I did not lose my temper during that meeting, or at any other point.

• I continue to negotiate with my fellow ministers of finance, leading the Greek side at the Eurogroup.

• Then came a New York Times Magazine story which raised the possibility of a recording of that Eurogroup meeting. All of a sudden, the journalists and news media that propagated the lies and the innuendos about the 24th April Eurogroup meeting changed tack. Without a whiff of an apology for the torrent of untruths they had peddled against me for weeks, they now began to depict me as a ‘spoof’ who had “betrayed” the confidentiality of the Eurogroup.This morning I went on the record on the Andrew Marr television show (BBC1) on this issue. I am taking this opportunity to commit the truth in writing also here – on my trusted blog. So here it goes:

Bruno is dead on.

• The Bloodied Idealogues vs. The Bloodthirsty Technocrats (StealthFlation)

On the grave Greek question, it appears that the moment of truth is finally upon us. After nearly four months of frenetic, fruitless and often feckless high level deliberations and negotiations, both sides remain essentially at an impasse, right where they started. The technocrats in Brussels want to see their austerity driven reform program carried forward and implemented unconditionally. As for the idealogues in Athens, they have pledged to put forth their own enlightened approach to rescue their sinking society. The Technocrats hold the purse strings, but the Ideologues hold the heart strings. For what it’s worth, that is typically a highly combustible combination, tick tock. With their recent cocksure bravado, are the Technocrats entirely misreading the desperate determination of the Idealogues?

Get ready for yet another Euro Summer swoon.. Everyone agrees that Greece, under a corrupt political oligarchy, grossly abused its privileges as a Eurozone member. In fact, with the help of a few sleazy sophisticated Goldman Sachs financiers, they actually cheated on their application forms in order to join the exclusive club to begin with. The illegitimate Ionian books were cooked from the get go, and it only got worse and worse over time. The self serving political elites and their self-seeking sponsors at multinational banks and corporations ran up a massive tab, while their ill-fated nation did not have the wherewithal to pay the astronomical bills. That is essentially what happened here. Oh, and the parties specifically involved all happened to personally get rather wealthy themselves along the way.

National elections at the end of the year could reinforce the changes.

• Spain’s Ruling Party Battered In Local And Regional Elections (EUObserver)

Spain took a turn towards the new left in Sunday’s regional and local elections, putting an end to the dominating two-party system. Despite having won the most votes in the elections across Spain on Sunday (24 May), Prime Minister Mariano Rajoy’s centre-right PP party has lost all of its absolute majorities and will now often depend on coalitions and pacts with other parties. Compromises and coalitions between parties is new in Spain where more than 30 years of alternating power between the socialists and the conservatives is being challenged by an ncreasingly fragmented political system including anti-austerity party Podemos and centrist Ciudadanos.

The biggest changes have been the move towards the new left parties in Barcelona and maybe also in Madrid – depending on a possible pact between a Podemos-supporting coalition called Ahora Madrid and the Social Democrats (PSOE). It would be the first time the Spanish capital would have a leftwing Mayor in the last 25 years. “It is clear that a majority for change has won,” said Manuela Carmena, the 71 year-old emeritus judge of the Spanish Supreme Court who wants to become Madrid’s new mayor. She is one seat short of Madrid’s former conservative Mayor Esperanza Aguirre. However, with the support of Social Democrats – who came third – the two left-wing parties could together hold the absolute majority in Madrid. Barcelona’s new Mayor Ada Colau calls for “more social justice” and leads a coalition of left-wing parties and citizens’ organisations called ‘Barcelona en Comú’, which includes members of Podemos.

“We are proud that this process hasn’t just been an exception in Barcelona, this is an unstoppable democratic revolution in Catalonia, in [Spain] and hopefully in southern Europe,” Colau said last night after it became clear that she had won a small majority in the Catalan capital. Colau, a former anti-eviction activist, was one of the founders of a platform for people affected by mortgages – Plataforma Afectados por la Hipoteca (PAH) – which won the European Parliament’s European Citizens’ Prize in 2013. The PAH was set up in response to the hike in evictions caused by abusive mortgage clauses during the collapse of the Spanish property market eight years ago. Colau herself entered politics last year calling for “more and better democracy” and a clean-up of corruption in politics.

Curious development?!

• Catalan Independence Bid Rocked by Podemos Victory in Barcelona (Bloomberg)

Catalan President Artur Mas’s bid to win independence from the rest of Spain was gasping for air on Sunday as voters in Barcelona ousted his party from city hall. Voters in the regional capital picked Podemos-backed activist Ada Colau as their next mayor, as the pro-independence parties Mas is aiming to lead to an overall majority in Catalonia won 45% of the vote. The regional leader has pledged to call an early regional election this year to prove to officials in Madrid the support for leaving Spain. “Mas is in deep trouble,” said Ken Dubin, a political scientist at the Instituto de Empresa business school in Madrid and Lord Ashcroft International Business School in Cambridge, England.

Colau, 41, gained national prominence during the financial crisis leading a campaign to stop banks evicting families from their homes after they defaulted on their mortgages. She joined forces with anti-austerity party Podemos, an ally of Greece’s governing party Syriza, for her assault on city hall. Her coalition, Barcelona en Comu, won 25% of the vote and 11 representatives in the 41-seat city assembly, the Spanish Interior Ministry said on its website. CiU won 10 seats compared with 14 in 2011. Barcelona accounts for about a third of the Catalan economy and hosts all the major regional institutions. “This result adds uncertainty to the planning process because it wasn’t considered a possibility,” said Jaume Lopez, a pro-independence political scientist at Pompeu Fabra University in Barcelona. “We will see whether that uncertainty becomes a problem.”

So screwed…

• Auckland Nears $1 Million Average House Price (Guardian)

Economists in New Zealand have expressed alarm at a housing market boom which could soon see average prices of property in the country’s largest city pass the $1m mark. In Auckland, the cost of an average domestic property has risen from $550,000 during the last property boom in 2007 to nearly $810,000 now. House prices increased at a rate of 14% last year, while the rest of the country’s index remained stable. Some houses are increasing in value by $1,000 every day while 36 suburbs in the city now have an average house value of $1m or more. And at current rates the whole city’s average will be $1m within a year-and-a-half.

The National government has in part recognised the boom and taken action for the first time to tackle what many believe is a housing crisis. It announced a multimillion dollar development plan to build affordable homes, a move added to a previously announced tax on property speculators. But some economists believe more needs to be done, and while growth is expected to slow, that will merely move the $1m mark back a month or two. Small, one–bedroom apartments are selling for $800,000 and delapidated wrecks in barely desirable suburbs are fetching more than $1m. Senior research analyst Nick Goodall of property analytics company CoreLogic said: “It is inevitable the average price in Auckland will be $1m.”

In the past 15 years housing has seen a phenomenal investment in Auckland, as huge demand and limited supply has increased prices at record levels. Expensive land, and restrictions on building new and denser housing, has seen limited new stock come on the market. And a strong economy, record net migration, especially to Auckland, and banks happy to lend money in a market with significant capital gains, has seen people paying over the top of each other. “The narrative goes because it has been good in the last 10 or 15 years, it must be good forever,” said Shamubeel Eaqub, principal economist at the Institute of Economic Research. But it is impossible for this to continue, he says. “Auckland is in a massive bubble.”

“.. it’s 8000% more expensive than normal cotton seed. But normal cotton seed is largely unavailable to Indian farmers because of Monsanto’s control of the seed market..”

• Monsanto’s GMO Cotton Problems Drive Indian Farmers To Suicide (RT)

Hundreds of thousands of farmers have died in India, after having been allegedly forced to grow GM cotton instead of traditional crops. The seeds are so expensive and demand so much more maintenance that farmers often go bankrupt and kill themselves. “Nationally, in the last 20 years 290,000 farmers have committed suicide – this as per national crimes bureau records,” agricultural scientist Dr. G. V. Ramanjaneyulu of the Center For Sustainable Agriculture told RTD, which traveled to India to learn about the issue. A number of the widows and family members of Indian farmers with whom the journalists have spoken have the same story to share: in order to cultivate the genetically modified cotton, known as Bt cotton, produced by American agricultural biotech giant Monsanto, farmers put themselves into huge debt.

However, when the crops did not pay off, they turned to pesticides to solve the problem – by drinking the poison to kill themselves. “My husband took poison. [On discovering him dead], I found papers in his pocket – he had huge debts. He had mortgaged our land, and he killed himself because of those debts,” one widow told RTD. “[He killed himself] with a bottle of pesticide… All because of the loans. He took them for the farm. He told our kids he was bankrupt,” another widow said. “He worked all day, but it was hard to make the field pay,” her daughter added. Farming GM crops in rural India requires irrigation for success. However, since rich farmers often distribute the seeds directly to the poorer ones, many smaller, less educated farmers are not aware of the special conditions Bt cotton requires to be farmed successfully.

“Bt cotton has been promoted as something that actually solves problems of Indian farmers who are cultivating cotton. But something that has been promoted as a crisis solution, creates even more problems,” agricultural scientist Kirankumar Vissa said. “There are many places where it is not suitable for cultivation. On the seed packages, Bt cotton seed companies say that it is suitable for both irrigated and non-irrigated conditions – this is basically deception of the farmers,” the scientist said, adding that Monsanto also spends huge amounts of money on advertising in India, with paid for publications not always clearly marked as such.

Saying that only Bt cotton is available in India, Alexis Baden-Mayer, political director of Organic Consumers Association, says this crop requires many inputs. “It is incredibly expensive; it’s 8,000% more expensive than normal cotton seed. But normal cotton seed is largely unavailable to Indian farmers because of Monsanto’s control of the seed market,” she told RTD, adding that India is now the fourth largest producer of genetically modified crops.

Genetic diversity is huge.

• ‘Incredibly Diverse’, Endangered Plankton Provide Half The World’s Oxygen (SR)

After a three-and-a-half year, sometimes harrowing, sea voyage covering some 87,000 miles of ocean, a team of researchers from the Tara Oceans Consortium is revealing details of “the most complete description yet of planktonic organisms to date,” co-author of a study published in the journal Science, Dr. Chris Bowler from the National Center for Scientific Research in Paris, told BBC News. Plankton is the term for a myriad of microscopic species that are at the ground floor of the oceans’ food chain. One type, zooplankton, gives sustenance to larger organisms, which are then consumed by larger animals, and so on. Without the tiny zooplankton, marine life could not sustain itself. Another type of plankton, called phytoplankton, produce their own food the same way plants do: through photosynthesis.

This process not only sucks up heat-trapping carbon dioxide in the atmosphere, it produces oxygen upon which life on planet Earth depends. The researchers report collecting 35,000 samples from 210 sites around the world’s oceans. Their analyses reveal not only an astounding genetic diversity among the plankton—about 40 million genes, which is about four times more than are found in the human gut—but that these organisms contribute about 50% of all the world’s oxygen, according to report by Tech Times. “Plankton are much more than just food for the whales,” said Dr. Bowler, in a report by Reuters. “Although tiny, these organisms are a vital part of the Earth’s life support system, providing half of the oxygen generated each year on Earth by photosynthesis and lying at the base of marine food chains on which all other ocean life depends.”

But what worries scientists is that climate change and warming oceans are causing some plankton to die off, according several studies, including by researchers at two universities in the UK who published their 2013 study in the journal Nature Climate Change. This is because as oceans warm, the natural cycles of nitrogen, phosphorous, and carbon dioxide are disturbed—a disruption that negatively affects the plankton. Dr. Bowler and his team also found that many marine microorganisms are sensitive to variations in temperature, “and with changing temperatures as a result of climate change we are likely to see changes in this community,” he told the BBC. Because of the massive amount of DNA data now made available to scientists everywhere by the newly released study—only 2% so far has been analyzed, Bowler says—future research is sure to shed more light on the way marine ecosystems function.