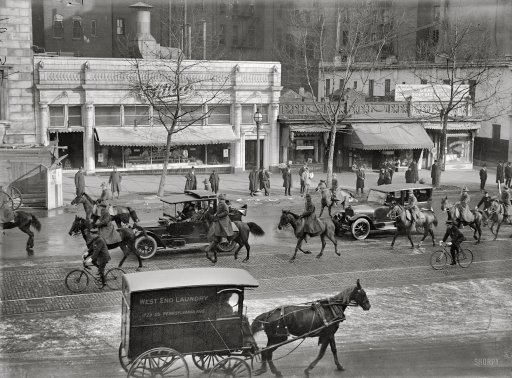

DPC “Broad Street and curb market, New York” 1906

This will attract some media attention. Better do it after the markets close.

• Trump Ultimatum: Pass Health Bill Now Or Live With Obamacare (MW)

President Donald Trump reportedly laid down an ultimatum to House Republicans on Thursday night: Pass the health-care bill, as is, on Friday, or live with Obamacare. The hard line came after more than a day of frantic negotiations to win the support of conservative Republicans who oppose the bill, and could block its passage. A vote on the bill had been scheduled for Thursday night, but was postponed earlier in the day after the GOP couldn’t win over holdout lawmakers. White House budget director Mitch Mulvaney dropped Trump’s demand in a meeting with rank-and-file House Republicans, and said the administration and House Speaker Paul Ryan were done with negotiations, according to a report in The Wall Street Journal. If Friday’s bill fails, Trump is resigned to live with Obamacare and move on, he said.

CNN similarly reported that the closed-door meeting ended with an ultimatum, and Rep. Chris Collins (R-N.Y.) told the network that the vote is expected to be held Friday afternoon. The move is a gamble by the Trump administration, which has placed much political capital in its promise to repeal and replace the Affordable Care Act, also known as Obamacare. “They’re going to bring it up, pass or fail,” Rep. Mike Simpson (R-Idaho) told the Washington Post. The GOP can’t afford more than 21 dissenting votes, but CNN counted 26 “no” votes and four more “likely” no votes. Every House Democrat is expected to oppose the bill.

And what’s worse, no way out.

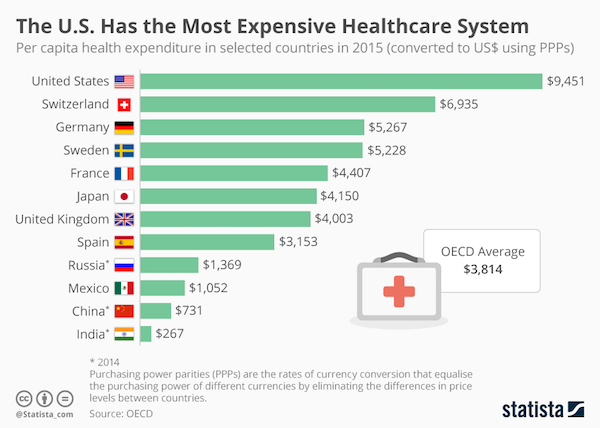

• The US Has the Most Expensive Healthcare System in the World (Statista)

If the American Healthcare Act, President Trump’s first major legislative effort, is going to a vote in the House of Representatives as scheduled on Thursday, it is by no means clear that it will receive the 215 votes it needs for passage. When the Republican healthcare plan was first presented to the public on March 6, it left people from both sides of the political spectrum dissatisfied. While Democrats fear that the suggested bill, which would repeal large portions of Obama’s Patient Protection and Affordable Care Act, would leave millions of Americans uninsured and hurt the poor and vulnerable, many Republicans think it doesn’t go far enough in erasing all traces of Obamacare.

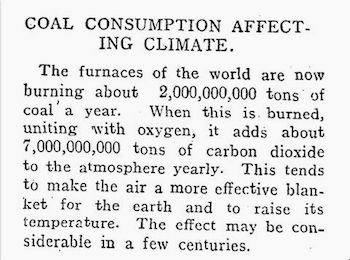

For many years now, the American healthcare system has been flawed. As our chart illustrates, U.S. health spending per capita (including public and private spending) is higher than it is anywhere else in the world, and yet, the country lags behind other nations in several aspects such as life expectancy and health insurance coverage. This chart shows health spending (public and private) per capita in selected countries.

Not my original observation, but true: it looks a lot like Russia in the 1990s.

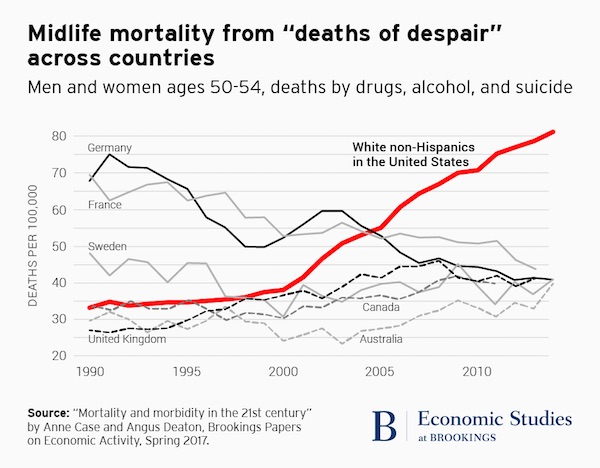

• ‘Deaths of Despair’ Surge in White US Middle Class (Vox)

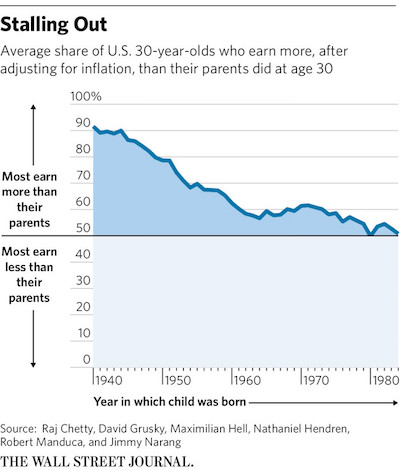

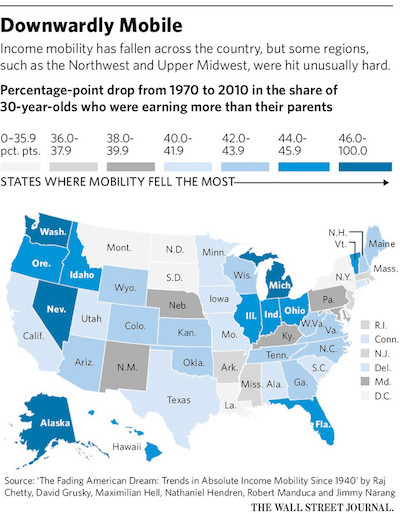

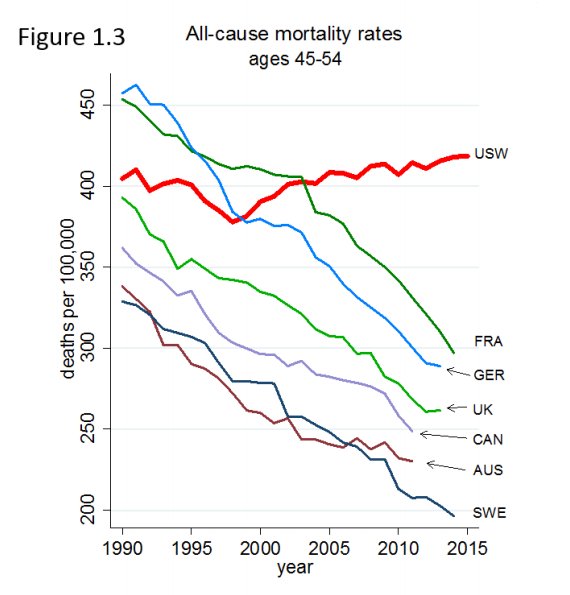

In 2015, a blockbuster study came to a surprising conclusion: Middle-aged white Americans are dying younger for the first time in decades, despite positive life expectancy trends in other wealthy countries and other segments of the US population. The research, by Princeton University’s Anne Case and Angus Deaton, highlighted the links between economic struggles, suicides, and alcohol and drug overdoses. Since then, Case and Deaton have been working to more fully explain their findings. They’ve now come to a compelling conclusion: It’s complicated. There’s no single reason for this disturbing increase in the mortality rate, but a toxic cocktail of factors. In a new 60-page paper, “Mortality and morbidity in the 21st Century,” out in draft form in the Brookings Papers on Economic Activity Thursday, the researchers weave a narrative of “cumulative disadvantage” over a lifetime for white people ages 45 through 54, particularly those with low levels of education.

[..] The US, particularly middle-aged white Americans, is an outlier in the developed world when it comes to this mid-life mortality uptick. “Mortality rates in comparable rich countries have continued their pre-millennial fall at the rates that used to characterize the US,” Case and Deaton write. “In contrast to the US, mortality rates in Europe are falling for those with low levels of educational attainment, and are doing so more rapidly than mortality rates for those with higher levels of education.” If American wants to turn the trend around, then it has to become a little more like other countries with more generous safety nets and more accessible health care, the researchers said.

Introducing a single-payer health system, for example, or value-added or goods and services taxes that support a stronger safety net would be top of their policy wish list. (America right now is, of course, moving in the opposite direction under Trump, and shredding the safety net.) They also admit, though, that it’s taken decades to reverse the mortality progress in America, and it won’t be turned around quickly or easily. But there is one “no-brainer” change that could help, Case added. “The easy thing would be close the tap on prescription opioids for chronic pain.” Unlike health care and increasing taxes, opioids are actually a public health issue with bipartisan support. Deaton, for his part, was hopeful. Paraphrasing Milton Friedman, he said, “All policy seems impossible until it suddenly becomes inevitable.”

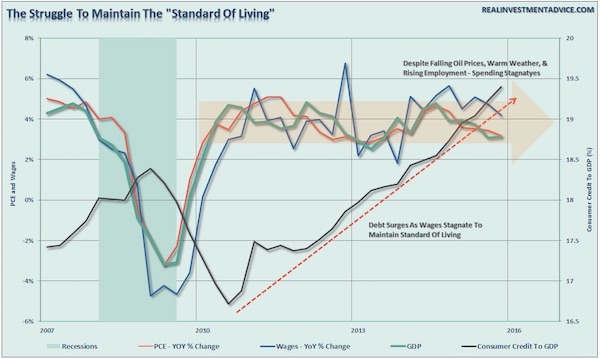

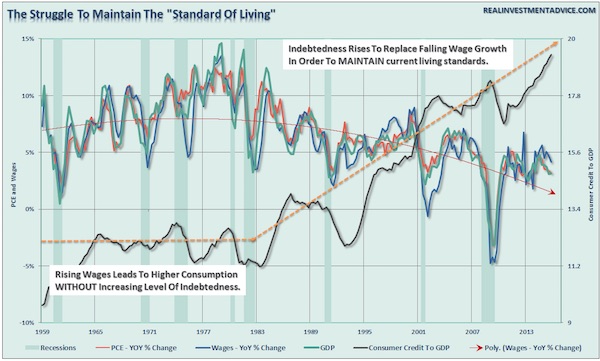

“Visits declined by 50% between 2010 and 2013..” “What’s going on is the customers don’t have the fucking money. That’s it. This isn’t rocket science.”

• The Retail Apocalypse Has Officially Descended On America (BI)

Thousands of mall-based stores are shutting down in what’s fast becoming one of the biggest waves of retail closures in decades. More than 3,500 stores are expected to close in the next couple of months. Department stores like JCPenney, Macy’s, Sears, and Kmart are among the companies shutting down stores, along with middle-of-the-mall chains like Crocs, BCBG, Abercrombie & Fitch, and Guess. Some retailers are exiting the brick-and-mortar business altogether and trying to shift to an all-online model. For example, Bebe is closing all its stores — about 170 — to focus on increasing its online sales, according to a Bloomberg report. The Limited also recently shut down all 250 of its stores, but it still sells merchandise online.

Others, such as Sears and JCPenney, are aggressively paring down their store counts to unload unprofitable locations and try to staunch losses. Sears is shutting down about 10% of its Sears and Kmart locations, or 150 stores, and JCPenney is shutting down about 14% of its locations, or 138 stores. According to many analysts, the retail apocalypse has been a long time coming in the US, where stores per capita far outnumber that of any other country. The US has 23.5 square feet of retail space per person, compared with 16.4 square feet in Canada and 11.1 square feet in Australia, the next two countries with the most retail space per capita, according to a Morningstar Credit Ratings report from October. Visits to shopping malls have been declining for years with the rise of e-commerce and titanic shifts in how shoppers spend their money. Visits declined by 50% between 2010 and 2013, according to the real-estate research firm Cushman & Wakefield.

[..] as longtime retail analyst Howard Davidowitz observed in 2014, “What’s going on is the customers don’t have the fucking money. That’s it. This isn’t rocket science.”

This could be a huge blow to Apple. Who wants to buy something the CIA has already tinkered with in the factory? Expect giant lawsuits too. Apple knew.

• WikiLeaks Releases Vault 7 “Dark Matter”: CIA Bugs “Factory Fresh” iPhones (WL)

Today, March 23rd 2017, WikiLeaks releases Vault 7 “Dark Matter”, which contains documentation for several CIA projects that infect Apple Mac Computer firmware (meaning the infection persists even if the operating system is re-installed) developed by the CIA’s Embedded Development Branch (EDB). These documents explain the techniques used by CIA to gain ‘persistence’ on Apple Mac devices, including Macs and iPhones and demonstrate their use of EFI/UEFI and firmware malware. Among others, these documents reveal the “Sonic Screwdriver” project which, as explained by the CIA, is a “mechanism for executing code on peripheral devices while a Mac laptop or desktop is booting” allowing an attacker to boot its attack software for example from a USB stick “even when a firmware password is enabled”. The CIA’s “Sonic Screwdriver” infector is stored on the modified firmware of an Apple Thunderbolt-to-Ethernet adapter.

“DarkSeaSkies” is “an implant that persists in the EFI firmware of an Apple MacBook Air computer” and consists of “DarkMatter”, “SeaPea” and “NightSkies”, respectively EFI, kernel-space and user-space implants. Documents on the “Triton” MacOSX malware, its infector “Dark Mallet” and its EFI-persistent version “DerStake” are also included in this release. While the DerStake1.4 manual released today dates to 2013, other Vault 7 documents show that as of 2016 the CIA continues to rely on and update these systems and is working on the production of DerStarke2.0.

Also included in this release is the manual for the CIA’s “NightSkies 1.2” a “beacon/loader/implant tool” for the Apple iPhone. Noteworthy is that NightSkies had reached 1.2 by 2008, and is expressly designed to be physically installed onto factory fresh iPhones. i.e the CIA has been infecting the iPhone supply chain of its targets since at least 2008. While CIA assets are sometimes used to physically infect systems in the custody of a target it is likely that many CIA physical access attacks have infected the targeted organization’s supply chain including by interdicting mail orders and other shipments (opening, infecting, and resending) leaving the United States or otherwise.

A lot of cities around the world share that risk.

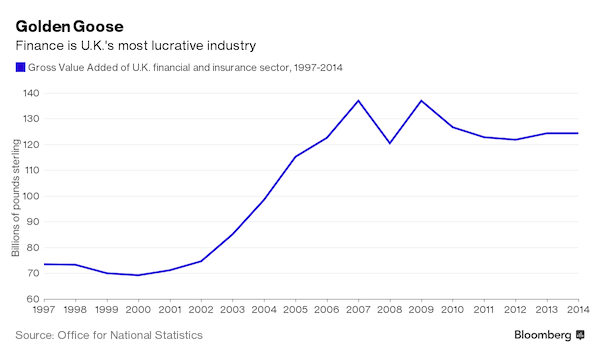

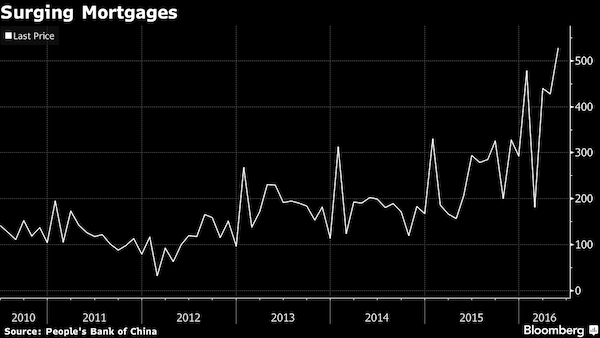

• China’s Property Bubble Risks Youth Revolt (CNBC)

China faces the risk of youth disenchantment as property prices rise beyond their reach, a renowned Chinese economist said Friday. “In a regular country, wealth should be concentrated in the financial markets, not fixed assets,” said Renmin University of China Vice President Wu Xiaoqiu at a media interview at the Boao Forum in the province of Hainan. He highlighted the risks from the current property bubble in China, such as negative asset values if prices tank. More importantly, the social risks that come from the property bubble in the form of youth disenchantment with not being to afford a home will be damaging, he said. “If young people lose hope, the economy will suffer, as housing is a necessity,” he said.

Wu said he was hopeful the authorities would find a solution to constrain the froth in Chinese real estate, but admitted that repeated measures to curb speculation have so far only met with short-term success. Wu’s comments follow a People’s Bank of China survey published on Tuesday, which found that 52.2% of urban households perceived housing prices to be “unacceptably high” in the first quarter of the year, Reuters reported. In February, gains in Chinese home prices picked up pace after they slowed in the previous four months despite government efforts to curb speculation, Reuters reported on Sunday. Prices in the big cities of Beijing, Shanghai and Shenzhen rose 22.1%, 21.1% and 13.5%, respectively, from a year ago.

Wow.

• China’s Largest Dairy Operator Crashes Over 90% In Minutes (ZH)

In December 2016, Muddy Waters’ Carson Block said China’s largest dairy farm operator, Hong-Kong listed China Huishan Dairy, is “worth close to zero” and questioned its profitability in a report. Today, with no catalyst, it suddenly almost is. The stock collapsed over 90% in minutes to a record low. The sudden crash wiped out about $4.2 billion in market value in the stock, which is a member of the MSCI China Index.

In December, Muddy Waters alleged that Huishan had been overstating its spending on its cow farms by as much as 1.6 billion yuan to “support the company’s income statement.” The report also alleged that the company made an unannounced transfer of a subsidiary that owned at least four cow farms to an undisclosed related party and Muddy Waters concluded that Chairman Yang Kai controls the subsidiary and farms. Those findings came from several months of research including visits to 35 farms and five production facilities, drone flyovers of Huishan sites and interviews with alfalfa suppliers, according to the report. Muddy Waters said it has shorted Huishan’s stock.

“It will be even harder for Huishan to get funded in the capital market after the report, amid a couple of earlier allegations that have raised some red flags to investors,” said Robin Yuen at RHB OSK Securities Hong Kong. Still, Huishan’s shares and operations are unlikely to “collapse” due to its high share concentration and sufficient cash flow generated by its dairy business, he said by telephone. About 73% of Huishan’s shares are held by Champ Harvest Ltd., a company that’s in turn 90% owned by Yang. A buying spree by Yang had supported the shares last year, making it a painful trade for short sellers. A one-year rally of about 80% through a peak in June had made the shares expensive.

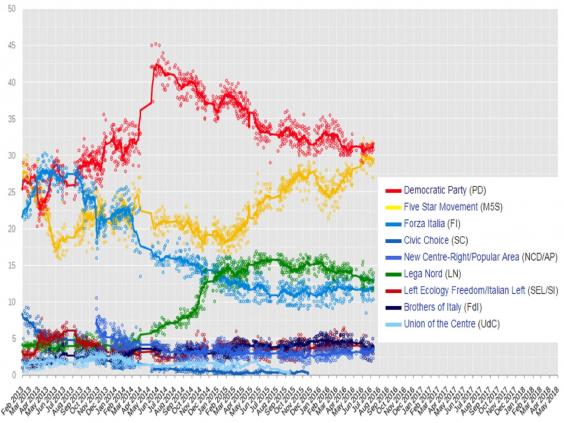

“If roughly half of all Italians are against the single currency today, imagine what it will be like when austerity begins really biting.”

• Eurozone Whistles Past its Biggest Threat: Italy’s Multi-Headed Hydra (ZH)

For the last three years, the political establishment in Italy and beyond have had a field day attacking, ridiculing, and vilifying Beppe Grillo’s 5-star movement. Europe’s media have tarred him with the brush of populism. In 2013 The Economist labelled him a clown on its front cover. Yet his party still leads the polls. And that lead is growing. A new Ipsos poll in Corriere della Sera newspaper has put Beppe Grillo’s 5-Star Movement on 32.3% – its highest ever reading. It placed 5.5 points ahead of the governing PD, on 26.8%, after the PD dropped more than three%age points in a month, as former prime minister Matteo Renzi battles to reassert his authority following a walkout by a left-wing faction. Internal political battles are nothing new in Italy. The country enjoys a hard-earned reputation for political instability and paralysis, having seen 63 governments come and go since 1945.

The problem this time around is that internal weakness and strife in Italy’s traditional center-left and center-right parties could end up gifting the next election to a party that refuses to play by the book. If it wins the next elections, which could be brought forward to as early as June this year, 5-Star Movement has pledged to hold a referendum of its own – albeit a non-binding one – on Italy’s membership of the euro. As polls have shown, there is much broader public apathy toward the single currency than in just about any other euro zone nation. Grillo’s plan could also receive the backing of former prime minister Silvio Berlusconi who is determined to pull off a political comeback and is talking of restoring the Italian Lira.

As Reuters reports, such a scenario could spook financial markets “wary of both the 5-Star’s euroskepticism and the threat of prolonged political instability in Italy,” which boasts a public debt burden of over €2 trillion (133% of GDP). In any normal situation that would be a problem. But Italy is not in a normal situation; it is on the cusp of a potentially very large financial crisis that, if mishandled, could bring down Europe’s entire financial system. Unlike many other Eurozone economies like Spain, Ireland Portugal, Italy did not experience a real estate or stock market bubble in the 2000s; nor were its banks heavily exposed to the financial derivatives that helped spread the fallout from the U.S. subprime crisis all around the world. As such, Italy has not had cause to bail out its financial system — until now.

[..] Italy’s current predicament is a multi-headed hydra: a banking crisis, an economic crisis, a debt crisis, and a political crisis all rolled into one, and all coming to a head at the same time. It’s the reason why economists including Deutsche Bank’s Marco Stringa are calling Italy, not France or Greece, the “main risk” to euro-area stability. From a Eurozone-stability point of view, and from a bondholder point of view, the best-case scenario would be the rescue of Italy’s banks, with taxpayers bearing most of the brunt. That should help steady investor nerves and put an end to the gathering exodus of funds out of Italian assets. But even then, the social, political and economic price to be paid in a country already with public debt of over €2 trillion, youth unemployment of almost 40%, and an economy that is 12% smaller than it was 10 years ago, will almost certainly be way too high. If roughly half of all Italians are against the single currency today, imagine what it will be like when austerity begins really biting.

He’s blowing up the EU without noticing a thing.

• Schäuble Annoyed By Foreign Minister Saying Germany Should Pay More To EU (R.)

German Finance Minister Wolfgang Schaeuble on Friday criticised Foreign Minister Sigmar Gabriel for saying Germany should provide more money for Greece and the European Union overall. Schaueble told Deutschlandfunk radio he was annoyed by Gabriel’s suggestion because it “goes in the wrong direction completely” and sent the wrong message. He added that Europe’s problem was not primarily money but that its money needed to be used in the right way. On whether Greece can stay in the euro zone, Schaeuble said: “Greece can only do that if it has a competitive economy.” He said the country needed to carry out reforms and that would take time, adding: “But if the time is not used to carry out reforms because that’s uncomfortable, then that’s the wrong path.”

Feels like a funeral party.

• Greek Objections Mar Preparations For EU’s 60th Birthday (R.)

Greece has stuck to its objections to a declaration to mark the European Union’s 60th anniversary, officials in Brussels and Athens said on Thursday, a potentially embarrassing setback for the bloc as it seeks to rebuild unity ahead of Brexit. The leaders of the EU’s 27 remaining states will mark the anniversary on Saturday at a gathering in Rome overshadowed by Britain’s unprecedented decision to leave. London is due to formally trigger the divorce negotiations next week. Athens has threatened not to sign the Rome declaration charting the future of the post-Brexit EU, making a link between agreeing to the text and separate talks on reforms that lenders are seeking from Greece in exchange for new loans. “The negotiations on the draft Rome Declaration have ended as the text was finalized by the EU27,” an EU source said. “Only Greece has a general reservation on the text.”

Greece has said it wants the Rome text to spell out more clearly the protection of labor rights. Greece’s separate debt talks with international lenders are now stuck over this specific issue. One diplomat in Brussels said the issue may now only be resolved at the highest level with Greek Prime Minister Alexis Tsipras. Another EU diplomat said any attempt by Athens to win leverage on the international debt talks by holding off in Rome should not succeed: “We won’t be blackmailed by one member state which is linking one EU issue with a totally different one.” As well as Greece, Poland indicated on Thursday it might also refuse to endorse the declaration, though diplomats played down the threat. Warsaw is particularly opposed to a ‘multi-speed Europe,’ an idea promoted by Germany, France and Brussels, among others, to help improve decision-making in the post-Brexit EU.

“Whether, in other words, the European acquis is valid for all member states without exception, or for all except Greece.”

• Greece Says To Support Rome Declaration, Calls For EU Backing On Reforms (R.)

Greece will support a declaration marking the EU’s 60th birthday but needs the bloc’s backing against IMF demands on labour reforms, Greek Prime Minister Alexis Tsipras said ahead of a Summit in Rome on Friday. In a letter addressed to EU Council President Donald Tusk and Commission President Jean Claude Juncker, Tsipras called for a clear statement on whether the declaration would apply to Greece, as talks over a key bailout review hit a snag again. “We intend to support the Rome Declaration, a document which moves in a positive direction,” Tsipras said. “Nevertheless, in order to be able to celebrate these achievements, it has to be made clear, on an official level, whether they apply also to Greece. Whether, in other words, the European acquis is valid for all member states without exception, or for all except Greece.”

Earlier this week, Greece threatened not to sign the Rome declaration, demanding a clearer commitment protecting workers’ rights – an issue on which it is at odds with its international lenders who demand more reforms in return for new loans. The disagreements among Athens, the EU and the IMF – which has yet to decide whether it will participate in the country’s current bailout – have delayed a crucial bailout review. As leaders prepared for the summit, Greek ministers were negotiating with lenders’ representatives in Brussels pension cuts and labour reforms, including freeing up mass layoffs and on collective bargaining. The latest round of talks ended inconclusively late on Thursday, according to Greek officials. [..] Greece has cut pensions 12 times since it signed up to its first bailout in 2010. It has also reduced wages and implemented labour reforms to make its market more flexible and competitive.

Just imagine that. And then talk about recovery. No, all you need to do is reform!

• 40% Of Greek Businesses Say Likely To Close Shop Within The Year (K.)

Four in 10 Greek businesses (40.3%) consider it likely that they will have to close shop within the year, according to a survey by the Hellenic Confederation of Professionals, Craftsmen and Merchants (GSEVEE), presented by the ANA-MPA news agency on Thursday. According to the survey, around 18,700 businesses will close in the first six months of the year, forcing thousands to join growing unemployment lines in the crisis-hit country. The majority of shutdowns, according to GSEVEE, will be in and around the capital and will concern the manufacturing sector, while some 34,000 jobs will be lost by the closure of companies that are currently considered high risk. 7 in 10 businesses have reported increasing liquidity problems and a shortage of capital from the market, with the number of firms indebted to the state and their suppliers growing by 10% compared to last year.

Over four in five small and medium-sized businesses (SMEs) admit to being exposed to credit risks, seeing a slump in economic activity and operating with the prospect of shrinking rather than expanding in the near future. In terms of employment, the forecasts for the first half of the year do not bode well, as for every two businesses (8.1% of the total) that plan to hire new staff, another three will be letting people go. GSEVEE estimates that 2,000 salaried jobs will be lost by June, without accounting for the impact on employment of the projected shutdowns. Moreover, 40% of those businesses that do plan to hire staff in the first half of 2017 said they won’t be offering payroll positions, but part-time or outsourced work.

Sentiment is also bleak, with 58.8% of respondents expecting conditions to deteriorate and just 11% seeing a possible improvement through June. As such, just 3.6% of businesses plan to make new investments and 6.4% have applied to investment funding programs for that period. “There needs to be a national plan for the country irrespective of who is in power, and politicians need to learn how to make decisions and give orders,” GSEVEE President Giorgos Kavvathas was quoted by the ANA-MPA news agency as saying. “Moreover, the uncertainty of the situation concerning the outcome of the negotiation [with foreign creditors] exacerbates fears and risks, which in turn make small businesses and the self-employed more vulnerable.”

Could be another scary spring and summer.

• EU Envoy: Three Million Migrants Waiting To Cross Into Greece (K.)

European Commissioner for Migration Dimitris Avramopoulos on Thursday underlined the need to safeguard a deal between Brussels and Ankara to curb human smuggling in the Aegean, noting that some 3 million refugees were in Turkey waiting to cross into Greece in a bid to reach Western and Northern Europe. In comments during a visit to Athens, Avramopoulos said the deal signed last year between Turkey and the EU had reduced an influx of migrants toward Europe and curbed deaths at sea. Reception centers on the islands of the eastern Aegean, the first point of arrival for most migrants arriving in Greece from Turkey, are already overcrowded. A woman and a child were injured in clashes between Afghan and Algerian migrants on Chios on Wednesday night.

We’re on track for multiple records.

• Over 250 Migrants Feared Drowned On ‘Black Day’ In Mediterranean (AFP)

More than 250 African migrants were feared drowned in the Mediterranean Thursday after a charity’s rescue boat found five corpses close to two sinking rubber dinghies off Libya. The UN’s refugee agency (UNHCR) said it was “deeply alarmed” after the Golfo Azzuro, a boat operated by Spanish NGO Proactiva Open Arms, reported the recovery of the bodies close to the drifting, partially-submerged dinghies, 15 miles off the Libyan coast. “We don’t think there can be any other explanation than that these dinghies would have been full of people,” Proactiva spokeswoman Laura Lanuza told AFP. “It seems clear that they sunk.” She added that the inflatables, of a kind usually used by people traffickers, would typically have been carrying 120-140 migrants each.

“In over a year we have never seen any of these dinghies that were anything other than packed.” Lanuza said the bodies recovered were African men with estimated ages of between 16 and 25. They had drowned in the 24 hours prior to them being discovered shortly after dawn on Thursday in waters directly north of the Libyan port of Sabrata, according to the rescue boat’s medical staff. Vincent Cochetel, director of the UN refugee agency (UNHCR)’s Europe bureau, said NGO boats patrolling the area had been called to the aid of a third stricken boat on Thursday afternoon, raising fears others may have perished on what Proactiva called “a black day in the Mediterranean.”

Despite rough winter seas, migrant departures from Libya on boats chartered by people traffickers have accelerated in recent months from already-record levels. Nearly 6,000 people have been picked up by Italian-coordinated rescue boats since the end of last week, bringing the number brought to Italy since the start of 2017 to nearly 22,000, a significant rise on the same period in previous years. Aid groups say the accelerating exodus is being driven by worsening living conditions for migrants in Libya and by fears the sea route to Europe could soon be closed to traffickers. Prior to the latest fatal incident, the UN had estimated that at least 440 migrants had died trying to make the crossing from Libya to Italy since the start of 2017. Its refugee agency estimates total deaths crossing the Mediterranean at nearly 600.