Jackson Pollock Greyed Rainbow 1953

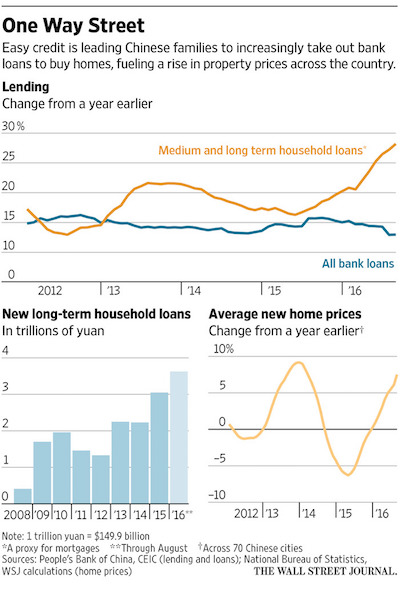

The article is somewhat confusing to me, bear of little brain and unpopular in China. But it’s good to make the point that bubbles spark poverty.

• The Rise And Fall Of The Property-Owning Democracy (FCFT)

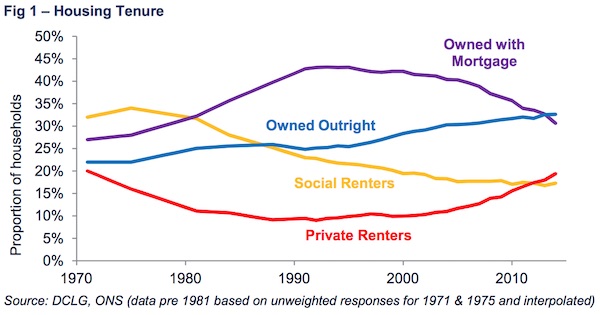

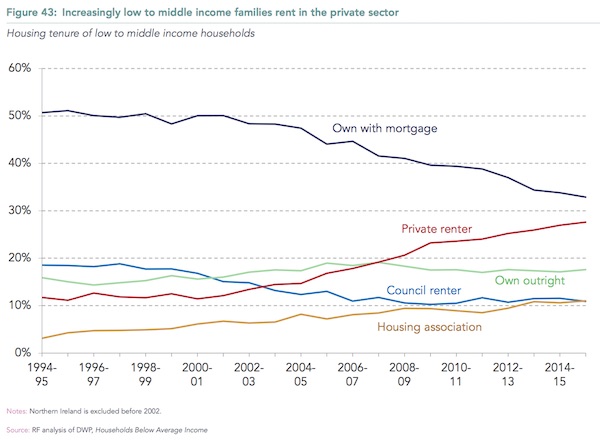

Sometime in the late 1980s, a friend who was on the libertarian right of the Conservative Party explained the idea of the property-owning democracy to me. The point, he said, was to detach the respectable working class from their poorer neighbours, encourage them to identify with the middle-class and thereby turn them into Tories. It worked for a while. Middle earners had been doing relatively well since the 1970s and home ownership was within the reach of many once mortgages became more readily available. Helped along by cheap council house sales, home ownership rose. In recent years, though, things have started shifting back the other way. The property-owning democracy is now looking like a one-off event rather than the ongoing process it was meant to be. Property analyst Neal Hudson pointed out that, as a proportion of all tenure, home ownership peaked in 2003 but mortgage ownership peaked in 1996. As older property owners paid off their housing debts, they were not being replaced at the same rate by new mortgagors.

[..] As the Resolution Foundation comments: The typical mortgagor AHC income is now twice that of the typical social renter, and over the past decade this income has grown by 17% compared to just 4% growth for the typical private renter. Even more than was the case before the financial crisis, the living standards split between those who own their own home and those who do not has become a key divide. While the proportion of households owning their own homes has fallen generally, that decline has been sharper among those on low to middle incomes. (Defined by the Resolution Foundation as working-age households with someone in work but with less than the median household income.) In the mid 1990s, over half of those on low to middle incomes were mortgagors. Now that has fallen to a third. Over the same period, private renting among this group rose.

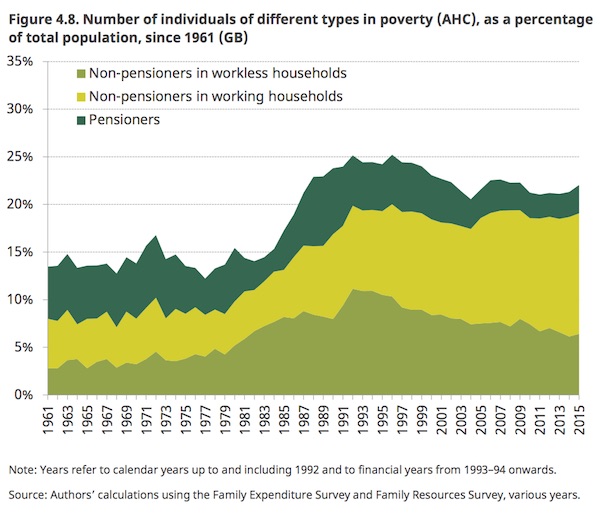

Last week’s report on poverty and inequality by the Institute for Fiscal Studies notes that most of those in poverty (defined as income less than 60% of the median) are now from households where someone is in work. “[R]elative poverty among children and working-age adults has increased and, over the past 20 years or so, has increasingly become an in-work phenomenon due to declines in worklessness, low earnings growth and widening earnings inequality.”

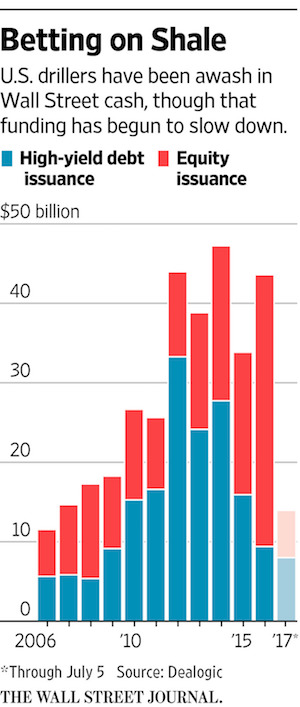

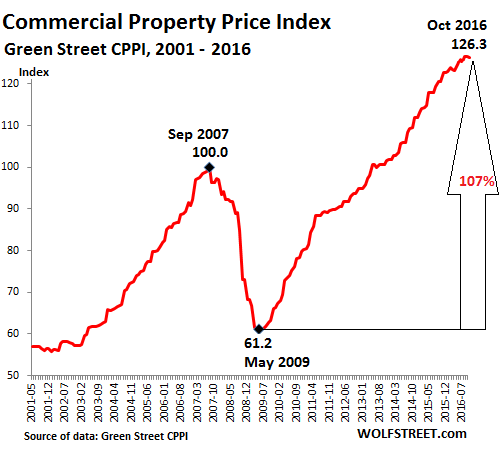

What bubble?

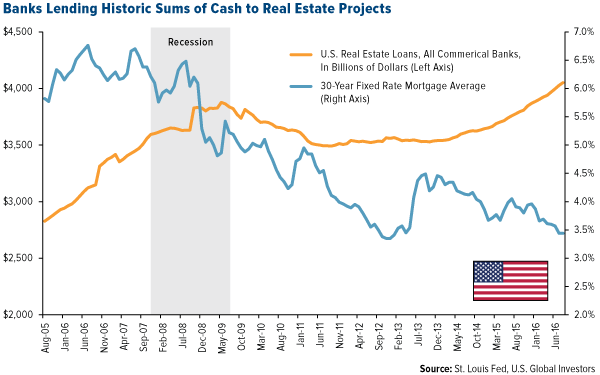

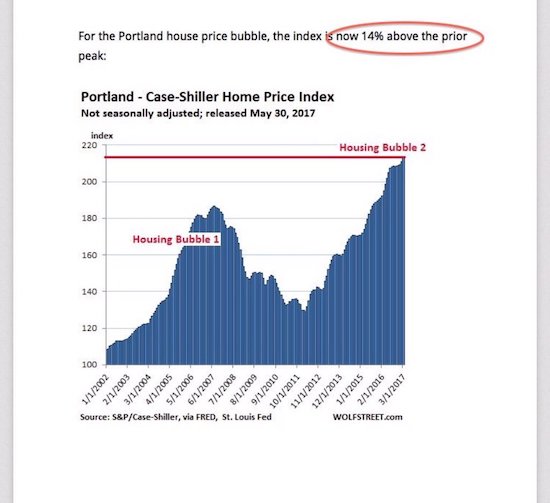

• Case-Shiller Home Prices Disappoint But Hit New Record High (ZH)

Great news ‘Murica – your house has never been worth more than it was in May (according to Case-Shiller’s national home price index). On the slightly less silver-lining side of the equation, April’s 0.28% gain in price was revised to 0.18% MoM drop and May’s proint disappointed at just 0.1% rise MoM. The 20-city property values index increased 5.7% y/y (est. 5.8%). All cities in the index showed year-over-year gains, led by a 13.3% advance in Seattle, an 8.9% increase in Portland and a 7.9% gain in Denver.

After seasonal adjustment, Seattle had the biggest month-over-month increase, at 0.9%, while New York posted a 0.6% decline. “Home prices continue to climb and outpace both inflation and wages,” David Blitzer, chairman of the S&P index committee, said in a statement. “The small supply of homes for sale, at only about four months’ worth, is one cause of rising prices. New home construction, higher than during the recession but still low, is another factor in rising prices.”

Just keep paying the piper.

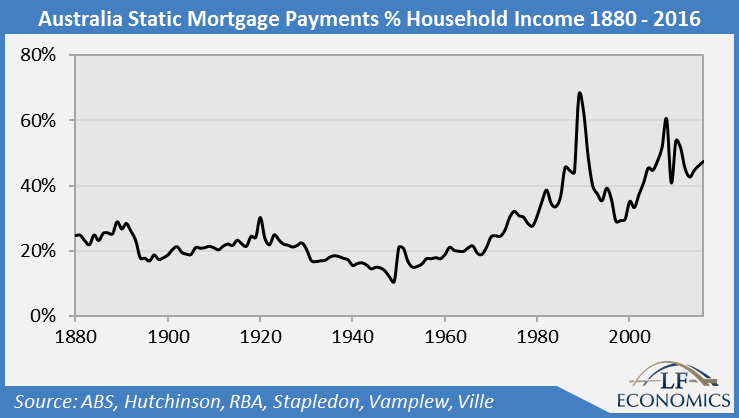

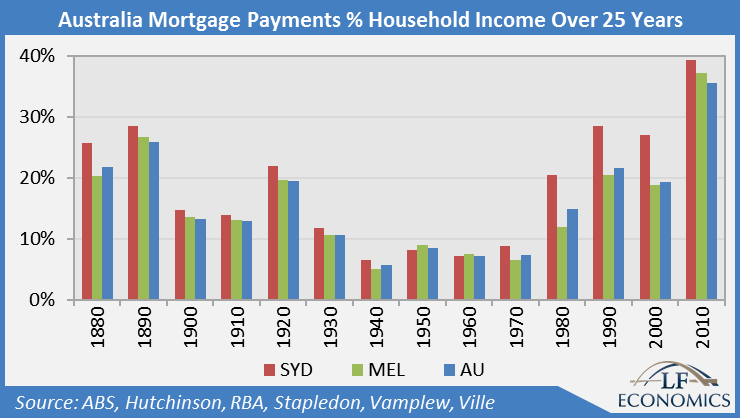

• Australian Housing Affordability the Worst in 130 Years (Soos/David)

The astronomical bubble in Australian housing prices has generated plenty of commentary regarding the current lack of affordability. This state of affairs clearly concerns aspiring home buyers everywhere, and Sydney and Melbourne in particular. First home buyers (FHBs) face almost insurmountable odds: the highest price to income and deposit to income ratios, the lowest savings rates, runaway dwelling prices, weak wage growth, including a political and economic establishment hell-bent on ensuring land prices keep on inflating no matter the wider cost to the economy. The legion of vested interests – basically 99% of commentators – choose to contend housing is actually more affordable today than back in the days of high mortgage interest rates, especially when rates peaked at 17% in 1989.

This is demonstrated by the standard mortgage payment to household income formula shown above, assuming 80% loan to value ratio (LVR). Their contention is bogus, however, because the metric is a static one, displaying mortgage payments to income at a particular point in time. The peak in 1989, for instance, is very high if, and only if, prices, interest rates and incomes remain constant over the life of the mortgage. Yet, these variables change by the next period. So, a more dynamic approach is required to assess housing affordability. The correct method was advocated by Glenn Stevens in 1997, Guy Debelle in 2004 and other economists like Dean Baker, who identified the US housing bubble and predicted the Global Financial Crisis in 2002. The important factor to consider is the effect wage inflation has upon mortgage payments.

While high mortgage interest rates result in large mortgage payments relative to income, this only occurs in the early years of the mortgage as high wage growth inflates away the burden. In contrast, borrowers facing high housing prices with low interest rates and poor wage growth face a greater burden across the life of the mortgage due to greater payments to income. This housing affordability analysis is applied to long-term annual data between 1880 and 2016, anchored to the median house price at an LVR of 80% at the start of each decade thereon. While data on mortgage interest rates and wage growth for the years after 2016 cannot be known, they are assumed to hold still at the present rates: 5.4% for the mortgage interest rate and 1.4% for wages. The following chart illustrates the outcome of applying this method, demonstrating the proportion of aggregate mortgage payments to household income over the 25 years of the mortgage. The results are overpowering.

Well, that’s what Draghi’s QE guarantees.

• There Are More ‘Zombie’ Companies In Europe Now Than Pre-Lehman (CNBC)

The ECB needs to beware of raising interest rates too quickly as there are a significant number of “zombie firms” in Europe that have become too dependent on cheap credit, according to analysis by the Bank of America Merrill Lynch. Barnaby Martin, head of European Credit Strategy at BofA Merrill Lynch, said businesses in Europe which have benefited from the ECB’s corporate bond purchase program would struggle once the bank raises interest rates, expected sometime in 2018. “The worst kept secret in the market is Mario Draghi is going to be tapering monetary policy next year and yet last week he was super, super dovish so I think that we’ve forgotten that monetary policy in Europe is on its way out,” he told CNBC on Tuesday, adding “there’s clearly political pressure for him to move away from this extraordinary era.”

“So the question becomes ‘can we handle a rapid rise in interest rates?’,” he said. ECB stimulus measures as part of its quantitative easing program designed to boost the European economy currently amount to €60 billion ($69.9 billion) a month. Some of this money goes into purchasing corporate bonds. While these purchases have enabled companies to continue to operate and invest, aiding a recovery in the European economy, the bank’s purchases have been credited for keeping ailing companies alive, hence the name “zombies.” The ECB started purchasing corporate bonds in June 2016 as part of its “corporate sector purchase program” (CSPP) and, as of June 7, 2017, its CSPP holdings stood at €92 billion, the bank said.

In a note examining “The rise of the Zombies” BofA Merrill Lynch’s credit strategists Martin, Ionnis Angelakis and Souhair Asba noted that 9% of non-financial companies in Europe (by market cap of Stoxx 600) are zombies, with “very weak interest coverage metrics.” “Note that this is still quite a high number: It was around 6% pre-Lehman, and fell to 5% in late 2013 after the peripheral crisis had faded,” they said. “The plethora of monetary support in Europe over the last 5 years has allowed companies with weak profitability to continue to refinance their debt and stave off defaults.” The analyst team also noted that bond issuance had been concentrated in “the hands of a few.” “Year-to-date, the top 20 bonds issuers have accounted for 40% of supply. In 2015 and 2016, the number was closer to 25%. The result has been that “superfirms” have been quietly building across the credit market,” they noted.

“The Netherlands says they won’t let the UK be an offshore tax haven. That’s because they don’t want them taking their business.”

• Netherlands and UK Are Biggest Channels For Corporate Tax Avoidance (G.)

Almost 40% of corporate investments channelled away from authorities and into tax havens travel through the UK or the Netherlands, according to a study of the ownership structures of 98m firms. The two EU states are way ahead of the rest of the world in terms of being a preferred option for corporations who want to exploit tax havens to protect their investments. The Netherlands was a conduit for 23% of corporate investments that ended in a tax haven, a team of researchers at the University of Amsterdam concluded. The UK accounted for 14%, ahead of Switzerland (6%), Singapore (2%) and Ireland (1%). Every year multinationals avoid paying £38bn-£158bn in taxes in the EU using tax havens. In the US, tax evasion by multinational corporations via offshore jurisdictions is estimated to be at least $130bn (£99bn) a year.

The researchers reported that there were 24 so-called “sink” offshore financial centres where foreign capital was ultimately stored, safe from the tax authorities. Of those, 18 are said to have a current or past dependence to the UK, such as the Cayman Islands, Bermuda, the British Virgin Islands and Jersey. The tax havens used correlated heavily to which conduit country was chosen by the multinational’s accountants. The UK is a major conduit for investments going to European countries and former members of the British Empire, such as Hong Kong, Jersey, Guernsey or Bermuda, reflecting the historical links and tax treaties enjoyed by firms setting up in Britain. The Netherlands is a principal conduit for investment ending in Cyprus and Bermuda, among others. Switzerland is used as a conduit to Jersey. Ireland is the route for Japanese and American companies to Luxembourg.

[..] Dr Eelke Heemskerk, who led the research, said that the work showed the importance of developed countries cleaning up their financial sectors. He said: “In the context of Brexit, where you have the UK threatening, unless they get a deal, to change their model to be attractive to companies who want to protect themselves from taxes, well, they are already doing it. “The Netherlands says they won’t let the UK be an offshore tax haven. That’s because they don’t want them taking their business.”

Russia’s getting an invaluable lesson in self-suffciency. There’s nothing like it.

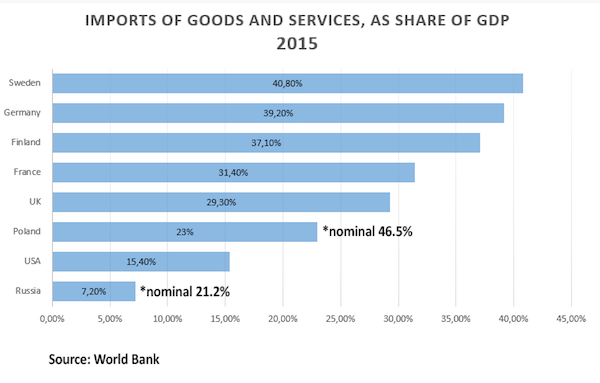

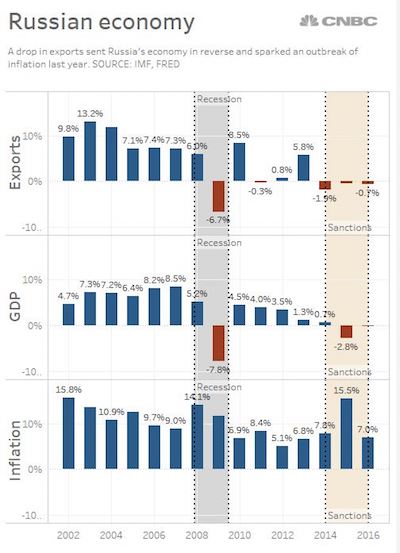

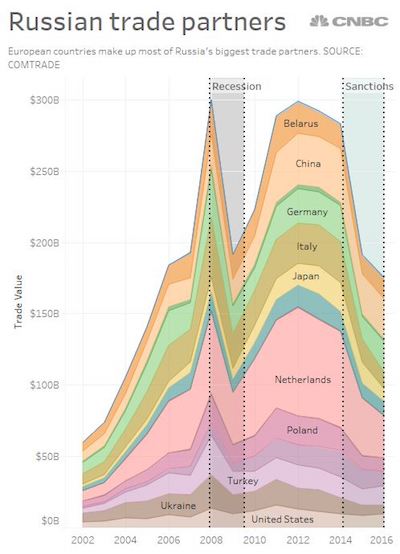

• US Sanctions Have Taken A Big Bite Out Of Russia’s Economy (CNBC)

Congress moved Tuesday to step up sanctions on a shrinking Russian economy that is already struggling under the weight of low oil prices, high inflation and a battered currency that has sent capital fleeing. In response to Moscow’s interference in the 2016 U.S. presidential election, the House voted overwhelmingly to tighten existing economic sanctions imposed in 2014 following the Russian invasion of Crimea. Among other things, the measures freeze assets and prohibit transactions with specific Russian companies and individuals, restrict financial transactions with Russian firms, and ban certain exports that are used in oil and gas exploration or have possible military uses.

Those 2014 U.S. sanctions were paired with related measures imposed by the European Union, which placed restrictions on business with Russia’s financial, defense and energy sectors. Today, Russia’s economy is still feeling the harsh impact of those measures, which coincided with a crash in global oil prices that cut deeply into revenues from the country’s main export. The loss of oil revenues – a drop of as much as 60%, according to a 2017 Congressional Research Service report — helped spark a collapse in Russia’s currency, the ruble, sending the prices of Russian consumer goods soaring. The Russian economy has also been hurt by a wave of capital flight out of the country, as individual Russians sought to move money offshore and convert their shrinking rubles to dollars and euros to protect their wealth. That money flow slowed in 2014 as U.S. and European sanctions took hold.

Though U.S. sanctions have put pressure on the Russian economy, the impact on American business has been limited because Russia makes up less than 1% of U.S. exports. Only six U.S states count Russia as a significant market for goods and services. Washington, the most reliant, sells roughly 1% of its total exports to Russia, consisting mostly of machinery and farm products. That’s half the level before the 2014 sanctions took effect. European nations, which export greater volumes to Russia than the U.S., imposed their own set of sanctions response to the Crimean annexation.

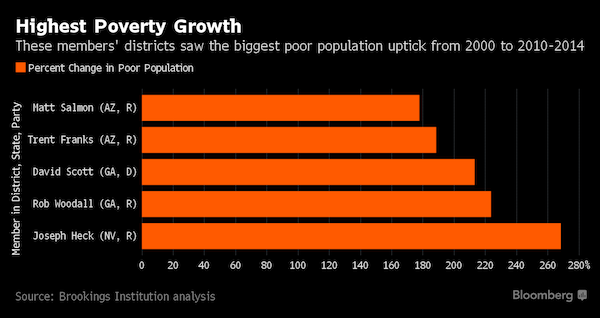

“The floundering non-elite masses have not learned the harsh lesson of our time that the virtual is not an adequate substitute for the authentic..”

• The Value of Everything (Jim Kunstler)

We are looking more and more like France on the eve of its revolution in 1789. Our classes are distributed differently, but the inequity is just as sharp. America’s “aristocracy,” once based strictly on bank accounts, acts increasingly hereditary as the vapid offspring and relations of “stars” (in politics, showbiz, business, and the arts) assert their prerogatives to fame, power, and riches — think the voters didn’t grok the sinister import of Hillary’s “it’s my turn” message? What’s especially striking in similarity to the court of the Bourbons is the utter cluelessness of America’s entitled power elite to the agony of the moiling masses below them and mainly away from the coastal cities. Just about everything meaningful has been taken away from them, even though many of the material trappings of existence remain: a roof, stuff that resembles food, cars, and screens of various sizes.

But the places they are supposed to call home are either wrecked — the original small towns and cities of America — or replaced by new “developments” so devoid of artistry, history, thought, care, and charm that they don’t add up to communities, and are so obviously unworthy of affection, that the very idea of “home” becomes a cruel joke. These places were bad enough in the 1960s and 70s, when the people who lived in them at least were able to report to paying jobs assembling products and managing their distribution. Now those people don’t have that to give a little meaning to their existence, or cover the costs of it. Public space was never designed into the automobile suburbs, and the sad remnants of it were replaced by ersatz substitutes, like the now-dying malls. Everything else of a public and human associational nature has been shoved into some kind of computerized box with a screen on it.

The floundering non-elite masses have not learned the harsh lesson of our time that the virtual is not an adequate substitute for the authentic, while the elites who create all this vicious crap spend millions to consort face-to-face in the Hamptons and Martha’s Vineyard telling each other how wonderful they are for providing all the artificial social programming and glitzy hardware for their paying customers. The effect of this dynamic relationship so far has been powerfully soporific. You can deprive people of a true home for a while, and give them virtual friends on TV to project their emotions onto, and arrange to give them cars via some financing scam or other to keep them moving mindlessly around an utterly desecrated landscape under the false impression that they’re going somewhere — but we’re now at the point where ordinary people can’t even carry the costs of keeping themselves hostage to these degrading conditions.

The kind of independence that tends to be bad for a man’s health.

• Bolivia’s President Declares ‘Total Independence’ from World Bank and IMF (AHT)

Bolivia’s President Evo Morales has been highlighting his government’s independence from international money lending organizations and their detrimental impact the nation, the Telesur TV reported. “A day like today in 1944 ended Bretton Woods Economic Conference (USA), in which the IMF and WB were established,” Morales tweeted. “These organizations dictated the economic fate of Bolivia and the world. Today we can say that we have total independence of them.” Morales has said Bolivia’s past dependence on the agencies was so great that the IMF had an office in government headquarters and even participated in their meetings. Bolivia is now in the process of becoming a member of the Southern Common Market, Mercosur and Morales attended the group’s summit in Argentina last week.

Bolivia’s popular uprising known as the The Cochabamba Water War in 2000 against United States-based Bechtel Corporation over water privatization and the associated World Bank policies shed light on some of the debt issues facing the region. Some of Bolivia’s largest resistance struggles in the last 60 years have targeted the economic policies carried out by the IMF and the World Bank. Most of the protests focused on opposing privatization policies and austerity measures, including cuts to public services, privatization decrees, wage reductions, as well the weakening of labor rights. Since 2006, a year after Morales came to power, social spending on health, education, and poverty programs has increased by over 45%.

A tour de force by Bill Mitchell. Germany’s profiting so much off of Greece’s despair that it can hide its own economic pitholes with it.

• Germany Fails To Honour Its Part Of The Greek Bailout Deal (Bilbo)

Effectively the “German Federal Government – through KfW” is providing funds to Greece as part of the bailout. On May 20, 2014, the KfW issued a further press statement – Institution for Growth in Greece (IfG) – which further details the way in which German government bailout support is channeled through the KfW. For example, in relation to the “three planned IfG sub-funds … The Hellenic Republic and KfW — on behalf of the German Federal Government — will each contribute EUR 100 million in funding debt to this sub-fund.” Clear enough. The Süddeutsche Zeitung article says that since 2010, these loans granted to Greece through the KfW have generated 393 million euros of interest income net of refinancing costs [..] A handy sum. And what is more – the profits generated have not been transferred to the Greek government.

Further gains were made on the Greek bailouts via the ECB’s Securities Market Program (SMP), which has generated German gains of around $€952 million, through ECB distributions of the profits to the Member State central banks. A similar story appeared in the English-version of the Handelsbatt next day (July 12, 2017) – Germany Profits From Greek Debt Crisis. It essentially sourced the Süddeutsche Zeitung and made the story more accessible (repeating it in English). It says that: “The German government has long been accused by critics of profiting from Greece’s debt crisis. Now there are some new numbers to back it up: Loans and bonds purchased in support of Greece over nearly a decade have resulted in profits of €1.34 billion for Germany’s finance ministry.”

The issue became public because the Greens parliamentary representatives have challenged the morality of the German government’s decision not to redistribute the profits and the role played by the KfW. The Greens representative was reported as saying that: “The profits from collecting interest must be paid out to Greece … Wolfgang Schäuble cannot use the Greek profits to clean up Germany’s federal budget …” It has long been claimed that “Greece’s crisis has helped” Schäuble keep the German fiscal balance in surplus. The KfW have been part of that. We knew back in 2015 that the KfW was helping the Finance Ministry generate fiscal surpluses.

On March 5, 2015, the German daily newspaper Rheinische Post published a report – So geht es den Griechen wirklich – presented a summary of a 40-page document that the German Finance Ministry had provided in response to a demand for information from the Linksfraktion (German Left Party Die Linke). The Finance Ministry document conceded that: “Between 2010 to 2014, the KfW has paid out around 360 million euro in revenues to the German government and in the coming years the federal government is expecting around 20 million euro per year on interest revenues.”

The Greek economy is worse than ever, but now people trust it?

• Insolvent Greece Goes To Market 2.0 (Varoufakis)

Why do I refuse to be impressed by the news of Greece’s return to the markets? “It is because the Greek state and the Greek banks remain deeply insolvent. And, their return to the money markets is a harbinger of the next terrible phase of Greece’s crisis, rather than a cause for celebration”. The above was my answer in a BBC interview on 9th April… 2014! It is also the only answer that fits today’s announcement of Greece’s new bond issue. Indeed, why script a new article, when that old post offers a most helpful response to the question: “What should the world think of Greece’s new bond issue?”

The only thing I need to add to these circa 2014 posts is this: The Tsipras government today is simply rolling over precisely the same bond that the Samaras-Venizelos-Stournaras government issued in 2014 – the subject matter of my criticism above. This is a remarkable U-turn by Mr Tsipras and his ministers. In 2014 they had sided entirely with my criticism of the then government’s argument that Greece’s return to the markets, with the issue of that one bond, was a sign the country was achieving escape velocity from the gravitational pull of its debt-deflationary crisis. Now, they are not only parroting the same arguments as Samaras-Venizelos-Stournaras but they are, lo and behold, rolling over the same bond! I rest my case.

It’s not that hard.

• Nine Out Of 10 People Call For ‘Plastic-Free Aisle’ In Supermarkets (Ind.)

Nine out of 10 people want supermarkets to introduce a “plastic-free aisle”, according to a new poll amid rising concern about pollution. The survey – of 2,000 British adults by Populus – was commissioned by campaign group A Plastic Planet, which said it was clear that the public wanted an alternative to “goods laden with plastic packaging”. Evidence of the synthetic substance’s harmful effects on the natural world is growing. Since 1950, humans have produced 8.3 billion tons of the stuff, with 6.3 billion tons being sent to landfill sites or simply being dumped in what scientists described as an “uncontrolled experiment” on the planet. Plastic, which acts like a magnet for toxic chemicals in the environment, breaks down into tiny pieces that are capable of passing through animals’ gut walls and into their body tissue.

The UN warned in a report last year that “the presence of microplastic in foodstuffs could potentially increase direct exposure of plastic-associated chemicals to humans and may present an attributable risk to human health”. A third of seabirds in the North Sea were also found to be suffering “widespread breeding failure”, largely because of plastic waste. The new poll found 91% of people supported aisles free from plastic packaging and 81% said they were concerned “about the amount of plastic packaging that is thrown away in the UK”. Sian Sutherland, a co-founder of A Plastic Planet, said: “It’s becoming increasingly clear that the Great British public wants a fresh alternative to goods laden with plastic packaging. Too much of our plastic waste ends up in oceans and landfill.

Am I a bad person for thinking that maybe this isn’t such a bad thing? Who wants more of us?

I like the term “semen parameters”. Name for a band. Double billing with Pussy Riot.

• Sperm Counts In The West Plunge By 60% In 40 Years (Ind.)

Sperm counts have plunged by nearly 60% in just 40 years among men living in the West, according to a major review of scientific studies that suggests the modern world is causing serious damage to men’s health. Pesticides, hormone-disrupting chemicals, diet, stress, smoking and obesity have all been “plausibly associated” with the problem, which is associated with a range of other illnesses such as testicular cancer and a generally increased mortality rate. The researchers who carried out the review said the rate of decline had showed no sign of “levelling off” in recent years. The same trend was not seen in other parts of the world such as South America, Africa and Asia, although the scientists said fewer studies had been carried out there.

One expert commenting on the study said it was the “most comprehensive to date”, and described the figures as “shocking” and a “wake-up call” for urgent research into the reasons driving the fall. Writing in the journal Human Reproduction Update, the researchers – from Israel, the US, Denmark, Brazil and Spain – said total sperm count had fallen by 59.3% between 1971 and 2011 in Europe, North America, Australia and New Zealand. Sperm concentration fell by 52.4%. “Sperm count and other semen parameters have been plausibly associated with multiple environmental influences, including endocrine disrupting chemicals, pesticides, heat and lifestyle factors, including diet, stress, smoking and body-mass index,” the paper said. “Therefore, sperm count may sensitively reflect the impacts of the modern environment on male health throughout the life course.”