Jack Delano South Puerto Rico Sugar Company plant, Ensenada, Puerto Rico 1942

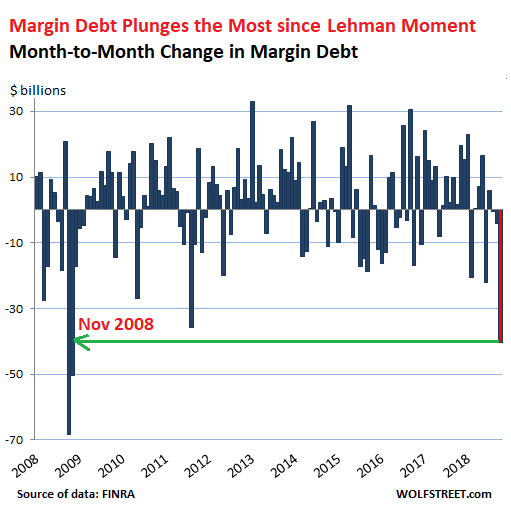

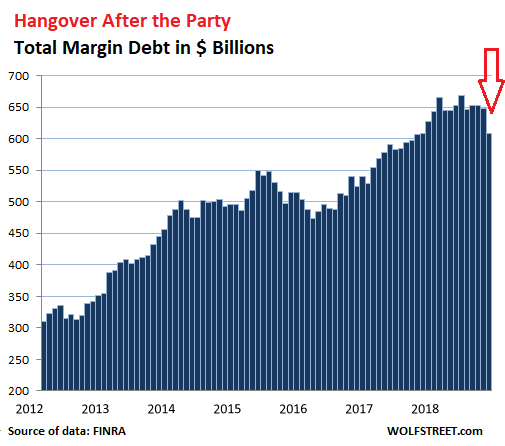

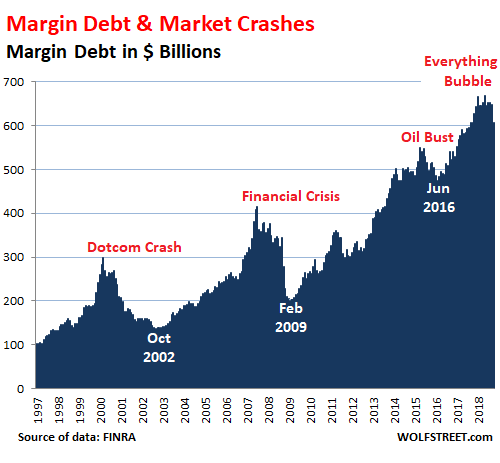

He gets very close to clamoring for a state-run economy. Let’s have a 5-year plan, shall we? It’s not that you couldn’t manipulate the ‘market’ 10,000 ponits higher right now, it’s what happens after that.

• Trump: The Stock Market Could Be As Much As 10,000 Points Higher (MW)

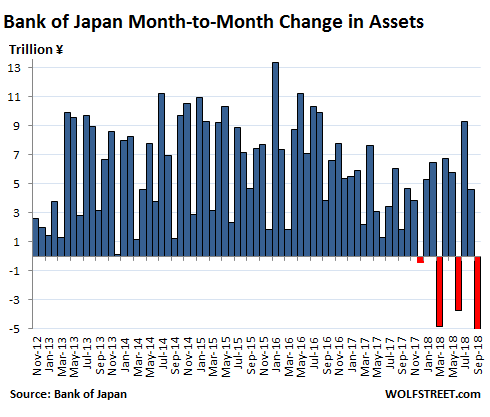

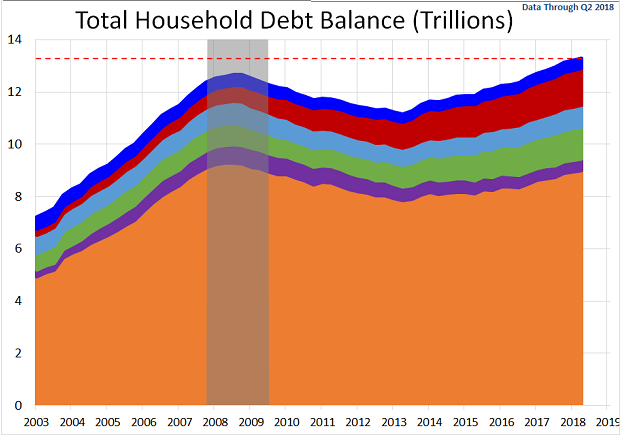

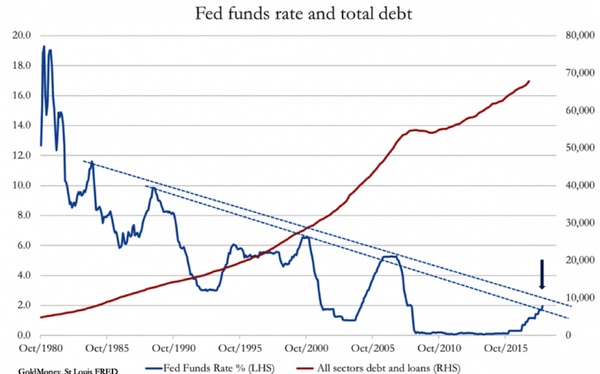

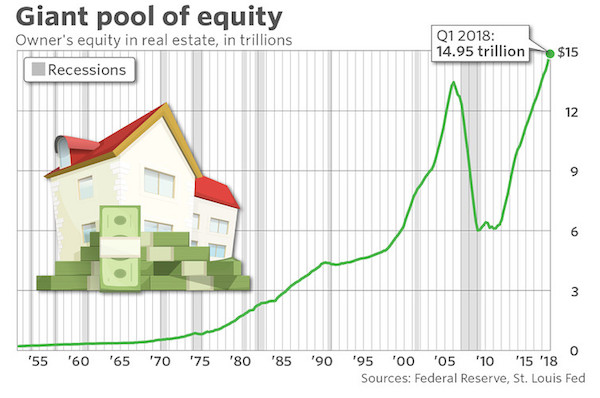

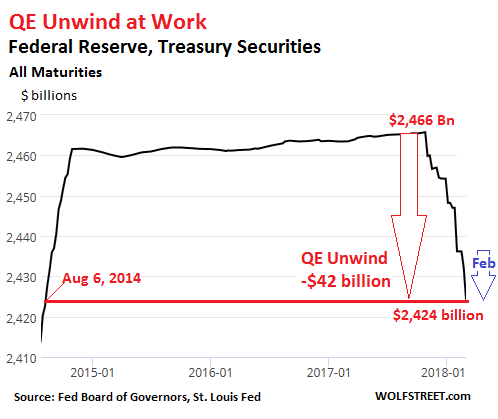

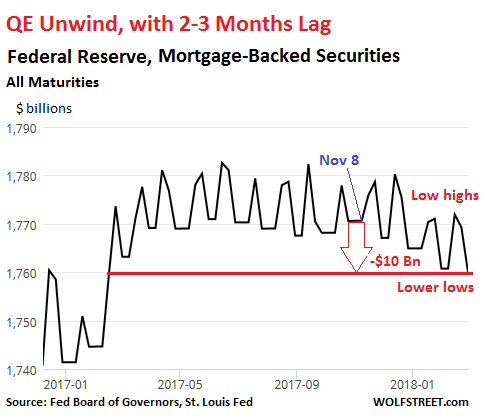

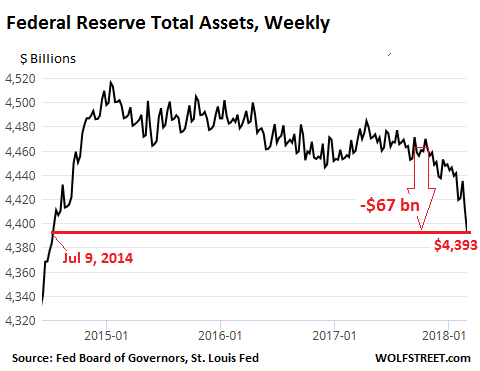

The value of the U.S. stock market has risen by $9.1 trillion, or 35.6%, since Election Day in 2016, according to Wilshire Associates. For President Donald Trump, that’s not nearly enough. Lately, he’s been blasting the Federal Reserve for raising rates, and he’s steadily urged the central banks to revert to the policies that supported the market during the last crisis, including the resumption of the Fed’s bond-buying program. “I would say in terms of quantitative tightening, it should actually now be quantitative easing,” he said last week. “You would see a rocket ship.”

On Sunday, he put numbers to that potential “rocket ship” rally: ‘If the Fed had done its job properly, which it has not, the Stock Market would have been up 5000 to 10,000 additional points, and GDP would have been well over 4% instead of 3%… with almost no inflation. Quantitative tightening was a killer, should have done the exact opposite!’ Trump’s tweet comes amid opposition from the Senate over his two picks, Herman Cain and Stephen Moore, for open seats on the Federal Reserve’s Board of Governors. Cain, according to a report from ABC News on Friday, plans to remove his name from consideration.

Pelosi is one scary woman, a talking mummy. She’s everything that’s wrong with Washington. But it’s sort of good that the young ones have to fight. Still, that should start with standing up for Assange, because that’s where the establishment’s ugliness shows most.

• Pelosi Rips AOC, Says Her Posse In Congress Is ‘Like Five People’ (NYPost)

House Speaker Nancy Pelosi just sent some more shade to Rep. Alexandria Ocasio-Cortez. In a “60 Minutes” interview, correspondent Lesley Stahl pointed out the different groups within the House Democratic caucus. “You have these wings — AOC and her group on one side,” Stahl said. “That’s like five people,” Pelosi interrupted. Stahl corrected the snarky remark, saying that the “progressive group is more than five.” “Well, I’m progressive — I’m a progressive, yeah,” Pelosi responded. The Congressional Progressive Caucus has 98 members and is the second largest group of Democrats in the Congress. Ocasio-Cortez is one of the group’s most recognizable freshmen members.

Seven Democratic House members, including Ocasio-Cortez, are supported by the progressive political action the Justice Democrats, which Pelosi could also have been referring to. On several occasions now, Pelosi has downplayed any splits within her ranks — and also tried to dim some of Ocasio-Cortez’s star power. In a recent interview with USA Today, the House Speaker pointed out that votes are more significant than Twitter followers — a remark that was also interpreted to be a dig at AOC. “While there are people who have a large number of Twitter followers, what’s important is that we have a large number of votes on the floor of the House,” Pelosi said.

On “60 Minutes” Pelosi said her Democrats weren’t fractured by those loud voices on the left. “By and large, whatever orientation they came to Congress with, they know that we have to hold the center. That we have to … go down the mainstream,” Pelosi said. When asked by Stahl if they really know that, Pelosi answered in the affirmative. “They do,” she said.

Can the Speaker of the House unify the Democratic party while getting pushback from the left and self-described democratic socialists like Alexandria Ocasio-Cortez? https://t.co/f4VUYTYIdw pic.twitter.com/a9wOobPj5g

— 60 Minutes (@60Minutes) April 14, 2019

The Guardian’s carefully constructed smear. No shame. Expect more, and expect it to get more intense. The paper has built strong ties with Ecuador ever since Moreno was elected with the explicit goal of smearing Assange.

• Assange Tried To Use Embassy As ‘Centre For Spying’ – Moreno (G.)

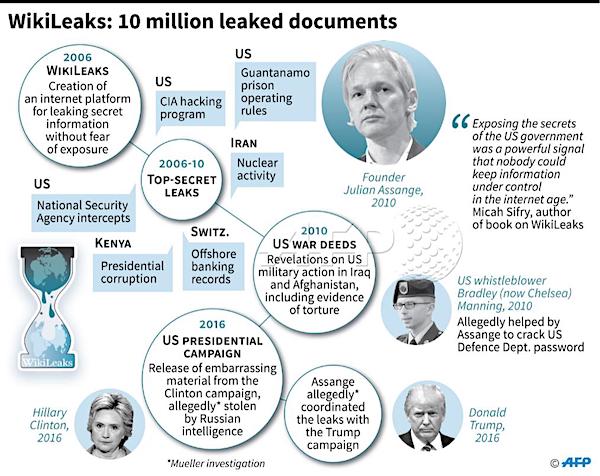

Julian Assange repeatedly violated his asylum conditions and tried to use the Ecuadorian embassy in London as a “centre for spying”, Ecuador’s president has said in an interview with the Guardian. Lenín Moreno also said he had been given written undertakings from Britain that Assange’s fundamental rights would be respected and that he would not be sent anywhere to face the death penalty. Assange, 47, was taken from the embassy by British police last Thursday after Ecuador revoked his political asylum, ending a stay there of nearly seven years. The WikiLeaks co-founder faces up to 12 months in prison after being found guilty of breaching his bail conditions when he entered the Ecuadorian embassy in 2012.

He made the move after losing a battle against extradition to Sweden where he faced allegations including of rape, which he denies. He is now expected to fight extradition to the US over an allegation that he conspired with the former army intelligence analyst Chelsea Manning to break into a classified government computer. Sweden is weighing up whether to reopen an investigation into the rape and sexual assault allegations. When there are competing extradition requests in the UK, the home secretary decides which country should take priority. Moreno’s move against Assange has proved controversial in Ecuador. The previous president, Rafael Correa, has accused his one-time political ally of “a crime humanity will never forget” and described Moreno as “the greatest traitor in Ecuadorian and Latin American history”.

In what may have been part of a campaign to weaken Moreno, WikiLeaks was linked to an anonymous website that claimed Moreno’s brother had created an offshore company, and it leaked material included private pictures of Moreno and his family. In his first interview with English-speaking media since Assange was ejected from the embassy, Moreno denied he had acted as a reprisal for the way in which documents about his family had been leaked, and said he regretted that Assange had allegedly used the embassy to interfere in other country’s democracies. “Any attempt to destabilise is a reprehensible act for Ecuador, because we are a sovereign nation and respectful of the politics of each country,” he said in the interview, which was conducted by email.

Many will follow.

• I’m Jumping Off the Trump Train: Assange Was the Last Straw (Jatras)

It’s plain and simple. The same entities (Deep State, permanent government, the oligarchy, the Borg, whatever term you like) that targeted Trump with the phony Russia collusion narrative want Assange’s scalp nailed to the wall. It’s one thing for favored outlets like the Washington Post and CNN to disseminate classified information that favors the Deep State, quite another to reveal information contrary to its interests. As the premier dispenser of embarrassing secrets that facilitates online dissidence from the established narrative (also under attack by governments and their tech giant accomplices) an example must be made of Assange pour encourager les autres.

He can count on being sentenced to rotting for decades in a nasty Office Space federal prison (the US will gladly waive the death penalty to spare the Brits’ prissy Euro-consciences) but may very well die soon enough of natural causes. An essential role in Assange’s betrayal by Moreno was played by Trump’s Veep Mike Pence and Secretary of State Mike Pompeo. Former President Rafael Correa says a direct condition of Moreno’s getting a $4.2 billion IMF loan was Assange’s head on a platter. That’s a lot more plausible than establishment media reports that Assange was ejected for transgressing the Ecuadorians’ fastidious hygiene standards, which (whether based in fact or not) are just cynical defamations to justify his upcoming lynching.

It’s irrelevant whether Trump – who theoretically is the boss of all US agency operatives working with their Brit colleagues to get their mitts on Assange – let the nab go forward because he was unwilling to order his minions to stand down or was powerless to do so. In that regard, it’s similar to pointlessly asking why he has the terrible, horrible, no good, very bad national security team he does. Is it because of “Javanka”? Is it because he’s beholden to a gaggle of oligarchs? (Supposedly his being a self-financed billionaire made him immune from such influences.) Is it a reflection of a personality disorder?

“Charles Schumer said he hoped Assange “will soon be held to account for his meddling in our elections on behalf of Putin and the Russian government”. Let the lies continue. Why not.

• Democrats And Liberals Cheering Assange’s Arrest Are Foolish (Robinson)

There has been plenty of over-the-top gloating about Assange’s arrest. In the Atlantic, Michael Weiss said Assange “got what he deserved”. Some Democratic politicians have been salivating at the possibility of prosecuting him. Hillary Clinton said that Assange needs to “answer for what he has done”. Charles Schumer said he hoped Assange “will soon be held to account for his meddling in our elections on behalf of Putin and the Russian government”. Dianne Feinstein has been calling for Assange to be brought here and prosecuted since 2010. West Virginia Democratic senator Joe Manchin went even further, with the truly disturbing comment that “now [Assange is] our property and we can get the facts and truth from him”.

Nor did Bernie Sanders speak up to defend Assange, opting for the same shameful silence he has taken on the imprisonment of whistleblower Chelsea Manning. The other 2020 candidates, with the exception of Mike Gravel and Tulsi Gabbard, have also stayed quiet. There’s a lot to be disturbed by here. First, it’s not clear that people like Schumer even care about the question of whether Assange broke any laws. Assange has been charged over allegedly helping Chelsea Manning to crack a Department of Defense password in 2010. The indictment has nothing to do with Putin or the 2016 election. Yet Democrats are thrilled enough to have a longtime villain in the clasps of the United States government that the actual charges, and their implications for free speech, are irrelevant.

“Moreno has long been rumored to be preparing an early exit and his right-wing allies appear poised to take over the helm..”

• Assange Is A Scapegoat, Distraction For Scandal-Ridden Ecuador Government (ZH)

Despite having been elected on a platform of continuing the leftist and nationalist policies of Rafael Correa’s Citizen’s Revolution, Moreno has actively attacked Correa’s legacy as well as the governments that ascribed to ‘21st century socialism.’ In recent months, Moreno’s government has restored a controversial fly-over program in the country with the US military, and also participated in the creation of the right-wing-led Prosur bloc as a measure to dismantle the Union of South American Nations created by Correa and allies such as the late Hugo Chavez. The Ecuadorian leader inked a $4.2 billion loan with the IMF, after spending months claiming Correa had driven the country into historic debt.

In light of these and other measures, Moreno’s move against Assange isn’t surprising, but the timing of it is about more than just appeasing his allies. “They want to use Julian Assange as a scapegoat to distract from the INA Papers scandal,” says Narvaez, referring to the allegations of corruption that have sullied Moreno, his family and other close associates. The Ecuadorian president is facing a political investigation over accusations of money laundering through offshore accounts and shell companies in Panama, including the INA Investment Corp, of which Moreno’s brother was the registered owner.

Documents obtained by an opposition lawmaker, as well as damning images and documents circulating on social media that were apparently hacked from Moreno’s telephone, have irreparably tarnished his image and his credibility as anti-corruption campaigner. Approval ratings for Moreno have since plummeted, and only 17 percent of Ecuadorians say they believe their president. Predictably, his party was punished at the polls in the country’s recent municipal elections, losing two-thirds of the territories they won previously. Risks of his impeachment are also growing.

[..] Impeachment or not, Moreno has long been rumored to be preparing an early exit and his right-wing allies appear poised to take over the helm in the Carondelet Palace. Nevertheless, his crusade against Correa’s Citizen’s Revolution has meant a dismantling of institutions and regulations, coupled with austerity measures that have included massive public layoffs. The country finds itself spiraling towards the political instability and disarray that characterized the Andean nation during the 1990s and early 2000s, and therefore laws and process may be insufficient to stop the extradition of Assange’s after his forced exit from Ecuador’s embassy. Assange is trapped in this Kafkaesque scenario, moved from one cage to another, waiting for his adversaries to determine his fate.

Let’s see what you can do.

• Hackers Warn UK Gov: ‘Free Assange or Chaos is Coming for You’ (Cassandra)

The Anonymous hackers who spent the weekend knocking Ecuadorian government websites offline have turned their attention to the United Kingdom, issuing a warning for the British government to “free Assange or chaos is coming for you. Speaking to the Gateway Pundit, a member of the hacker group who goes by the pseudonym ‘Nama’ declared they will be launching cyber attacks against the United States and Sweden after the UK. None of this was directed by WikiLeaks or Assange himself — the hackers say they are acting on their own as an act of protest. Over the weekend, the group took down or defaced over 30 Ecuadorian websites including the Central Bank of Ecuador, their Ministry of Interior, the Ecuadorian Assembly in the UK and the main website for the Government of Ecuador.

They also posted data dumps of 728 identification ID card numbers that appear to belong to people who work in the Ecuadorian government. After the websites had been offline for twelve hours, the hackers warned that if they were restored “we will fire again to burn their servers.” The official website of La Maná canton in Ecuador featured a picture of Assange for over twelve hours, along with a quote from him that read, “You have to start with the truth. The truth is the only way we can get anywhere. Because any decision-making based on lies or ignorance can not lead to a good conclusion.”

Can’t really see other airlines not following. For American alone, it’s over 100 cancelled flights a day.

• American Airlines Extends Boeing 737 MAX Grounding Until Mid-August (RT)

American Airlines has chosen to keep its fleet of Boeing 737 MAX grounded until at least August 19, even if it means canceling 115 flights a day in summer season, as probes into the troubled jet continue and new sales have frozen. The company, which owns 24 of the embattled jets that were involved in two recent deadly crashes, announced the decision in a letter to employees and customers. AA wants to ensure reliability “for the peak travel season and provide confidence to our customers and team members when it comes to their travel plans,” Chief Executive Doug Parker and President Robert Isom wrote.

Parker and Isom have at the same time expressed confidence in Boeing’s ability to fix the problem through software updates and changes to pilot training procedures. The US airline has 24 MAX planes in its fleet and is expected to get 16 more delivered this year. The grounding has already resulted in the cancelation of about 90 flights per day through early June, and the extension may put a strain on American’s ability to meet demand for seats during upcoming peak travel season. As many as 115 daily flights will have to be canceled in August, according to the letter.

They’re now just trolling Trump, aren’t they?

• Huawei Is ‘Open’ To Selling 5G Chips To Apple For iPhones (CNBC)

Huawei is “open” to selling high-speed 5G chips and other silicon to rival smartphone maker Apple, marking a significant shift in the Chinese tech giant’s thinking toward its own intellectual property. The world’s largest networking equipment maker has been in the consumer market for a relatively short amount of time with its own-brand smartphones, but it has quickly risen to become the third-largest vendor by market share. Huawei started by selling phones at low prices but in recent years has shifted focus to increase its market share in the high end of the market, battling Apple and Samsung. As part of that move, Huawei has developed its own chips, including a modem to give smartphones 5G connectivity, and a processor to power its devices.

5G is next-generation mobile internet, which delivers data at very high speeds. So far, those pieces of technology have been used only in Huawei’s devices. That could change. In an interview with CNBC that aired Monday, Huawei founder and CEO Ren Zhengfei said the company would consider selling its 5G chips to Apple. “We are open to Apple in this regard,” Ren said. The CEO spoke in Mandarin, which was translated into English by an official translator.

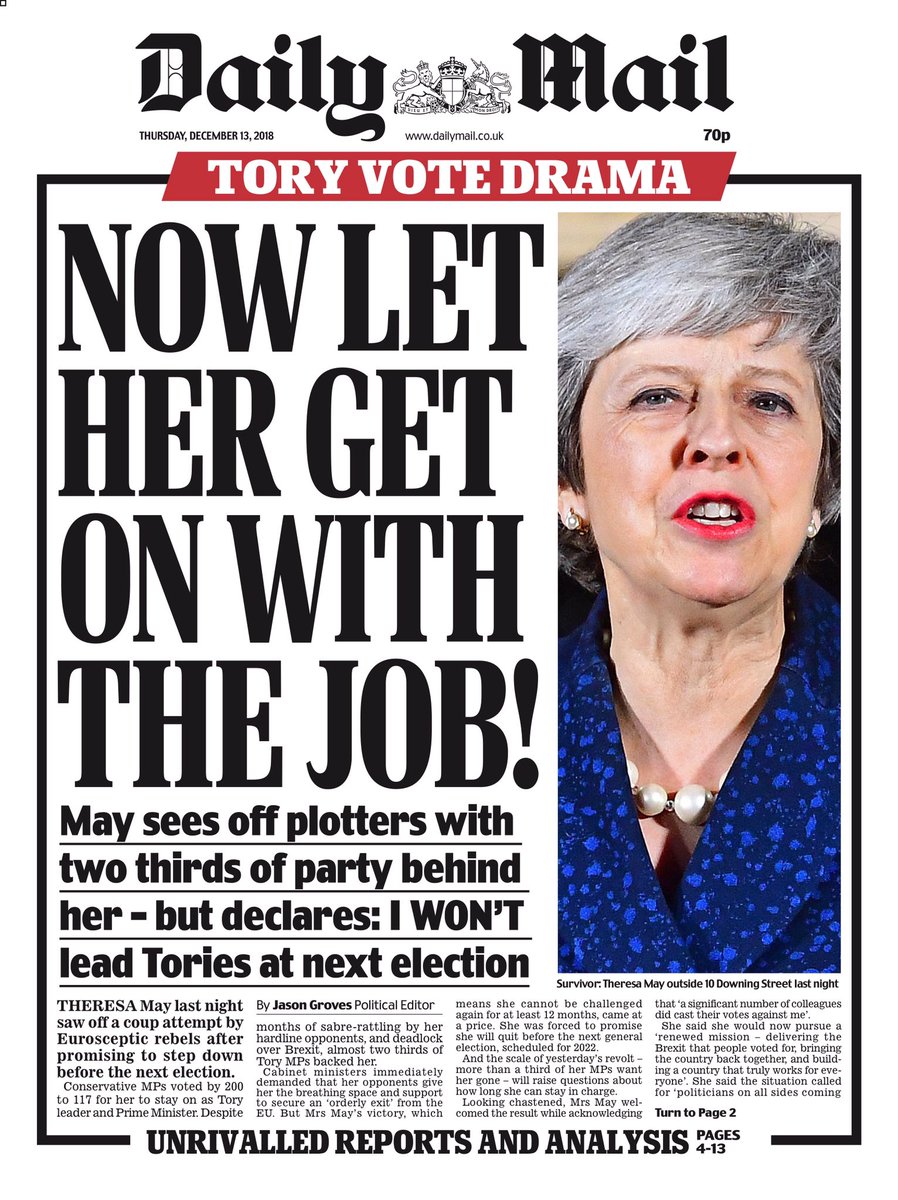

“We’re split in two mate, we’re absolutely shattered.”

• The Truth About Brexit In 135 Words (Eric Peters)

“They’re all liars mate,” said my London cabbie. “May was a Remainer. How were we going to get a good deal when our negotiators don’t want to leave?” he asked. I shrugged. “They’ll stall until they can say it’s not what people want no more – happened in every country that ever wanted a referendum or held one,” he said. “The EU paid to move a Land Rover factory from the Midlands to Slovakia where they earn 5 pound for every 25 we make – so our boys are out of work and the company makes more profit. How’s that right?,” he said. “For every two pound we put into the EU, we get one back.” So I asked if Brtiain held another referendum, which way it’d go? “We’re split in two mate, we’re absolutely shattered.”

This is from January, I wouldn’t normally include it in the news overview, but someone sent it to me on Twitter.

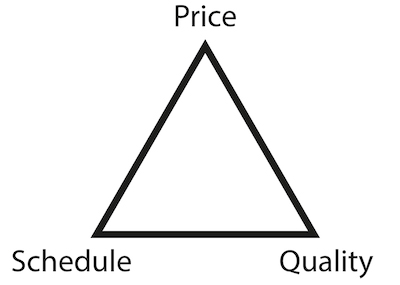

I’ve known this principle forever, just not under a hefty name like Iron Triangle. For us it was: If someone tells you they want a job done Good, Fast and Cheap, you say: Pick Two.

I’m also not so sure it applies to Brexit, I think there are other issues with it. But here it is.

• Brexit Cannot Break The Iron Triangle (HCG)

In all the chaos surrounding Brexit, I keep coming back to the same, simple fact: this is essentially a basic failure of project management. Experts are out of favour right now, but what I’m about to tell you is not expert knowledge: it’s something you instinctively do every day, but perhaps don’t have a name for. But in Project Management, something I did for 22 years, there is a name for the decisions we all make: The Iron Triangle.

I’ve managed projects to deliver everything from air-traffic control software to stock management and distribution for the world’s largest toy manufacturer. I’ve worked on software for Intel, Microsoft, international charities, hospitals, pension services, banking and warehousing. At the start of any project, I would draw this diagram. It’s called The Iron Triangle because it has three points, and describes an absolutely unbreakable rule: you can only have 2 things from the Iron Triangle. Never all three. All three is impossible.