Jan van Eyck Saint Barbara 1437

“Consider 0% and near-zero interest rates to be the economic equivalent of a defibrillator: the most-extreme, last-resort attempt to “stimulate” the human body when it is near death. Our economies have had this economic defibrillator attached to them for more than eight years – without the slightest glimmer of life.”

• The Great Western Economic Depression (Nielson)

Western economies are “recovering”. How do we know this? We are told this, over and over and over again by our governments. Then this assertion is repeated thousands of times more by the dutiful parrots of the Corporate media. The problem is that in the real world there is not a shred of evidence to support this assertion. In the U.S.; ridiculous official lies were created claiming the creation of 15 million new jobs. In reality, there are three millionless Americans with jobs today than at the official end of the “recession”. These imaginary jobs are invented by assorted statistical frauds, with the primary deceit being so-called “seasonal adjustments”. To be legitimate, all seasonal adjustments must to net to zero at the end of each year. Instead, in the U.S.A., the biggest job creator in the nation every year is the calendar.

Beyond the grandiose but absurd claims of new jobs in the U.S., there have been few signs of economic health across the Corrupt West. Despite this, these traitorous regimes continue the pretense that their horrific mismanagement of our economies is making things better rather than worse. There are numerous subtle means of demonstrating that Western economies have never been in more calamitous ill health than they are today. Fortunately, there are also two very large and important indicators which provide absolute proof that all of the economies of the Corrupt West are in a Greater Depression: interest rates and energy demand. Regular readers have often seen the observation in these commentaries that interest rates across the West have never been this low for this long in the entire history of these nations – not even close. Why not? Two reasons:

1) Interest rates this low have always been perceived (by our governments and all legitimate economic commentators) as being so reckless that any short-term benefit from such rates would have been more than offset by long-term harm.

2) The reason why our governments have always deemed interest rates this low to be reckless is that in remotely healthy economies such rates would cause these economies to “over-heat” so rapidly and extremely that they would reach unsustainable levels of production and demand.

Are our economies over-heating? No. Nothing could be further from the truth. We see nothing but over-capacity all around us: one hundred million permanently unemployed people across the West, relentless business closures, declining real wages, and near-empty shopping malls (in “consumer economies”). Interest rates this low are supposed to cause such rapid business expansion that the economy suffers from a labour shortage. Why are there a hundred million people unemployed across the West instead of labour shortages? Regular readers have seen this question answered in the past in the form of a metaphor.

Consider 0% and near-zero interest rates to be the economic equivalent of a defibrillator: the most-extreme, last-resort attempt to “stimulate” the human body when it is near death. Our economies have had this economic defibrillator attached to them for more than eight years – without the slightest glimmer of life. What would happen to a human body if it was defibrillated continuously for more than eight years? Charred meat. This is what Western economies have become: charred meat.

Bit bland, because BBC. But useful to note that inequality collapses civilizations.

• How Western Civilisation Could Collapse (BBC)

While it’s impossible to predict the future with certainty, mathematics, science and history can provide hints about the prospects of Western societies for long-term continuation. Safa Motesharrei, a systems scientist at the University of Maryland, uses computer models to gain a deeper understanding of the mechanisms that can lead to local or global sustainability or collapse. According to findings that Motesharrei and his colleagues published in 2014, there are two factors that matter: ecological strain and economic stratification. The ecological category is the more widely understood and recognised path to potential doom, especially in terms of depletion of natural resources such as groundwater, soil, fisheries and forests – all of which could be worsened by climate change.

That economic stratification may lead to collapse on its own, on the other hand, came as more of a surprise to Motesharrei and his colleagues. Under this scenario, elites push society toward instability and eventual collapse by hoarding huge quantities of wealth and resources, and leaving little or none for commoners who vastly outnumber them yet support them with labour. Eventually, the working population crashes because the portion of wealth allocated to them is not enough, followed by collapse of the elites due to the absence of labour. The inequalities we see today both within and between countries already point to such disparities.

For example, the top 10% of global income earners are responsible for almost as much total greenhouse gas emissions as the bottom 90% combined. Similarly, about half the world’s population lives on less than $3 per day. For both scenarios, the models define a carrying capacity – a total population level that a given environment’s resources can sustain over the long term. If the carrying capacity is overshot by too much, collapse becomes inevitable. That fate is avoidable, however. “If we make rational choices to reduce factors such as inequality, explosive population growth, the rate at which we deplete natural resources and the rate of pollution – all perfectly doable things – then we can avoid collapse and stabilise onto a sustainable trajectory,” Motesharrei said. “But we cannot wait forever to make those decisions.”

Seeing the world through beer goggles.

• Why the Federal Reserve Is Bad for America (DDMB)

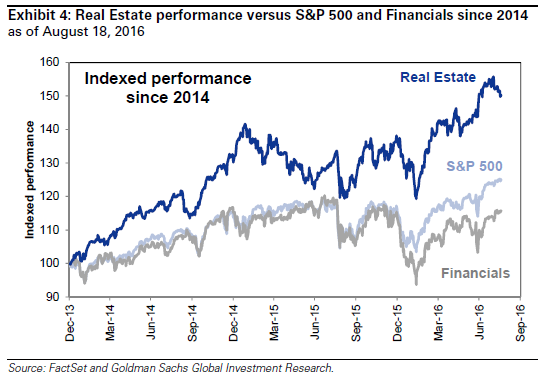

Commercial real estate and bonds are more overvalued than at any time in history and stocks are trading at their priciest level save one period, the late 1990s before the dotcom implosion. The beer goggles, it would seem, have blinded investors to the bubble wrap that’s enveloped their portfolios. There are a few brave souls at the Fed who have raised a red flag. On March 22nd, Boston Fed President Eric Rosengren warned, “…we must acknowledge that the commercial real estate sector has the potential to amplify whatever problems may emerge when we at some point face an economic downturn.”

Wiser words, especially given so few who recall that it was not the decline in oil prices that made the late 1980s such a painful period for the economy, but rather the crash in commercial real estate the energy crunch catalyzed. Underlying the multiple overheating markets is a persistent underappreciation of financial instability among Fed policymakers. The institution, overladen as it is with PhD economists, has yet to revisit the models that drive its setting of interest rate policy. Had the Fed’s inflation metrics taken into account runaway stock prices in the late 1990s and skyrocketing home prices in the early 2000s, it’s likely they would have intervened to tighten financial conditions much sooner than they did. Revisiting the wisdom of former Fed chair McChesney Martin is useful:

The danger with these econometricians is they don’t know their own limitations, and they have a far greater sense of confidence in their analyses than I have found to be warranted. Such people are not dangerous to me because I understand their limitations.

They are, however, dangerous to people like you and the politicians because you don’t know their limitations, and you are impressed and confused by the elaborate models and mathematics. The flaws in these analyses are almost always embedded in the assumptions on which they are based. And that is where broader wisdom is required, a wisdom that these mathematicians generally do not have.

You always want these technical experts on tap in positions like this, but never on top. The hope is that President Donald Trump heeds McChesney Martin’s 1970s-era wisdom, that he respects the wishes of those who originally envisioned the Fed as an appreciably more intellectually diverse entity. After all, the original 1913 Federal Reserve Act requires the president to appoint leaders across a diversity of industries.

How is it possible that these people completely miss out on the reason why? Which is: they have no money to spend. They’re not stingy, or skeptical, they’re simply poor.

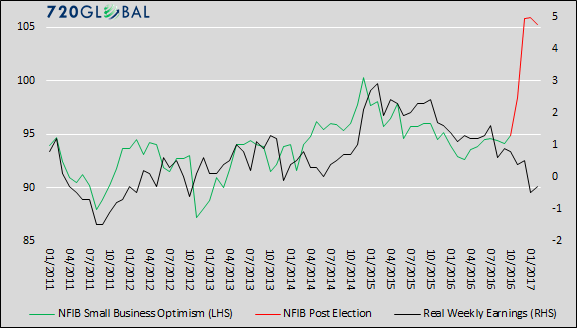

• Trump’s New Problem: Americans Aren’t Shopping (CNN)

President Trump keeps pushing “Buy American.” He’s planning to tout it again at a stop in Wisconsin on Tuesday. But the alarming reality is Americans aren’t spending much money on anything right now, regardless of where it’s made. Retail sales declined in February and March from the prior month, according the Commerce Department. Shoppers haven’t been this stingy since early 2015, and it’s likely to hurt the economy. The U.S. is on track for very sluggish 0.5% growth in the first three months this year, according to the latest estimates from Macroeconomic Advisers and the Atlanta Federal Reserve. That falls massively short of the 4% growth that Trump has promised. Trump loves to plug how Americans’ confidence in the economy has skyrocketed since he won the election. He’s right.

Consumers, businesses (big and small) and investors are all feeling a lot more optimistic, according to various surveys. But all that enthusiasm isn’t translating into more shopping, which drives the U.S. economy. About 70% of the American economy comes from people buying stuff. Kate Warne, a long-time investment strategist at Edward Jones, calls this the era of “skeptical optimism.” “People are more optimistic, but they’re skeptically optimistic,” Warne told CNNMoney. “I don’t think they are confident yet that things will change as much as they would like them too.” [..] Another twist is that Republicans are a lot more optimistic than Democrats. [..] Overall, the University of Michigan index of consumer confidence has jumped from 87 in October to 98 today. But that headline figure masks a wild division.

Democrats believe “a deep recession” is coming under Trump (their confidence index is a mere 55), while Republicans expected a “new era of robust economic growth” (their index level is a sky-high 122). Independents are in between, as you might expect. If half the country thinks recession is near, that might explain why retail sales are slowing, or even showing some signs of decline.

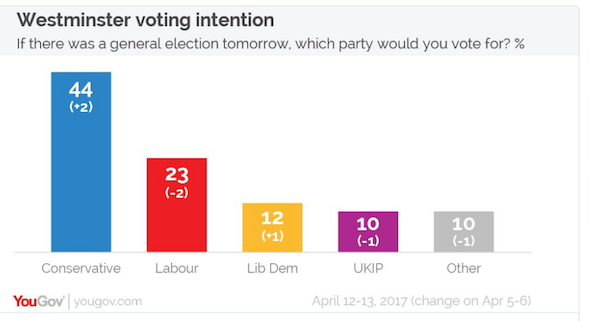

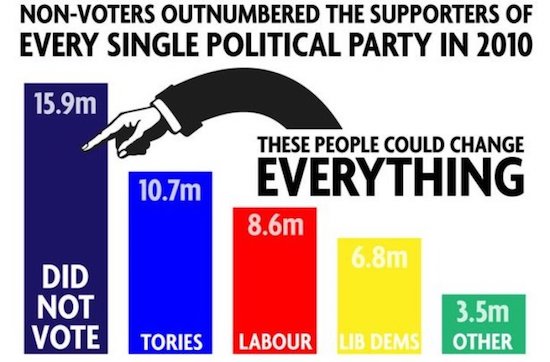

Good observation. But a good chance for May’s opponents.

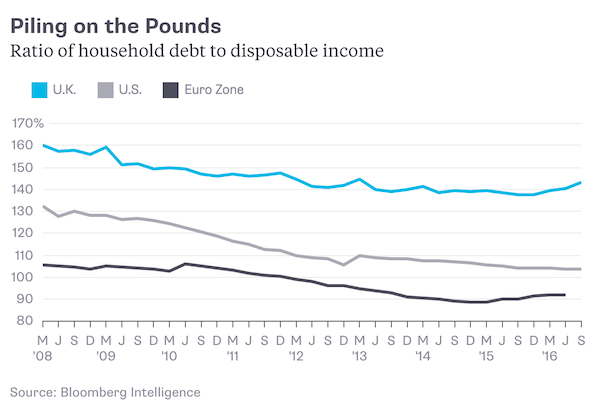

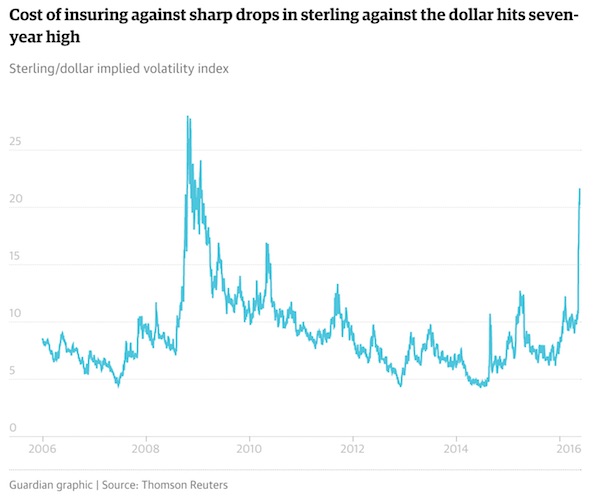

• British PM Wants Election Now, Before Cost of Brexit Becomes Clear (ICept)

Prime Minister Theresa May, who was actually against Brexit before she was for it, made another dramatic U-turn on Tuesday, declaring that Britain needs to elect a new Parliament in June, three years ahead of schedule, despite her clear promise not to call an election when she campaigned to succeed David Cameron last year. Her decision to subject Britons to a third national election campaign in just over two years — after the 2015 general election and the referendum on exiting the European Union ten months ago — was met with something less than enthusiasm by many voters. In her address to the nation, May claimed that a fresh election was necessary to keep opposition parties from obstructing her Conservative government during negotiations over Britain’s withdrawal from the European Union.

That argument rang hollow, however, given that the opposition Labour Party had just voted for the government’s bill to begin the process of leaving the E.U. and is not campaigning to overturn the results of last year’s referendum. To most political observers, it was clear that May’s decision was driven by something else: a desire to capitalize on the unprecedented weakness of the Labour Party, which is divided over Brexit, and its own leader, Jeremy Corbyn, and has trailed the Conservatives by up to 21 points in recent polls. As the writer Robert Harris and the broadcaster James O’Brien suggested, it might also be in May’s own self-interest, and that of her party, to ask the nation for a five-year term now, before the costs of Brexit become apparent. Although even many die-hard Labour supporters seemed resigned to defeat, some on the left welcomed the chance to vote against what they see as the potentially disastrous policy of a complete break with Europe.

What is this, Brazil?

• 20 UK Tory MPs Still Under Investigation For Election Fraud (Can.)

Theresa May has announced a snap election on 8 June 2017. But as the country prepares for another election campaign, it’s important to remember that MPs in her party are being investigated for election fraud for the 2015 general election. And given the mainstream media’s reluctance to report the issue, we need to ensure it is kept firmly on the agenda. 12 police forces have submitted files to the Crown Prosecution Service (CPS) over allegations that up to 20 MPs and/or their agents broke election spending limits in the 2015 election. The CPS is deciding whether charges should be brought. And a decision is expected soon – and is likely to come during the election campaign. The allegations centre around the ‘battle bus’ campaign, and associated expenses such as hotel rooms.

Many argue that the campaign promoted prospective local MPs in key seats. Under election law, any expenditure which promotes a local candidate should be covered locally. But the ‘battle bus’ and associated costs were declared nationally. Each constituency has a fixed amount of money it can spend locally. And including the ‘battle bus’ expenditure would have meant many candidates overspent. Additionally, the Election Commission has fined the Conservatives £70,000 for multiple breaches in connection to election spending during the 2015 campaign. But it isn’t just the ‘battle bus’ campaigns where the Conservatives have been accused of fraud. As The Canary previously reported, there are questions over how the party used social media and, particularly, Facebook, to target voters.

A report by the London School of Economics has also warned [pdf] that Facebook targeting opens the door to electoral fraud: “The ability to target specific people within a particular geographic area gives parties the opportunity to focus their attention on marginal voters within marginal constituencies. This means, in practice, that parties can direct significant effort – and therefore spending – at a small number of crucial seats. Yet, though the social media spending may be targeted directly at those constituencies, and at particular voters within those constituencies, the spending can currently be defined as national, for which limits are set far higher than for constituency spending.”

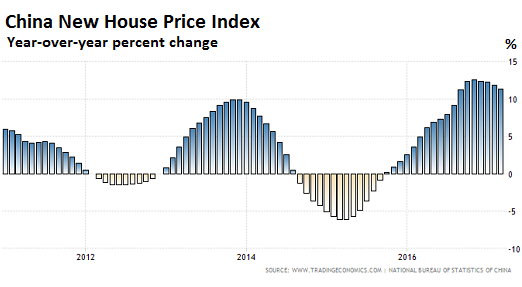

“..the property and construction industries, which contribute about 25 to 30% of China’s economic output..”

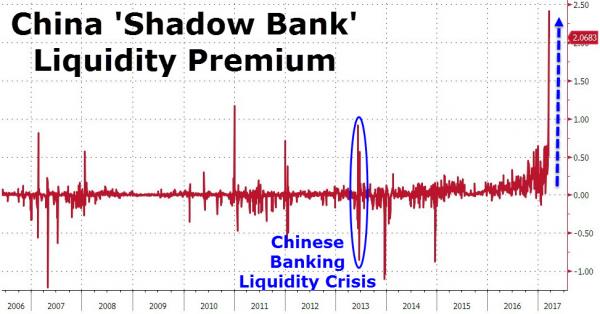

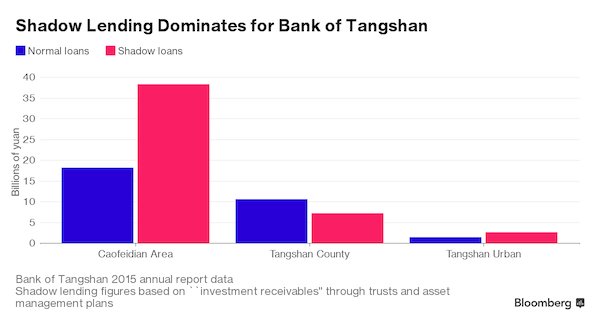

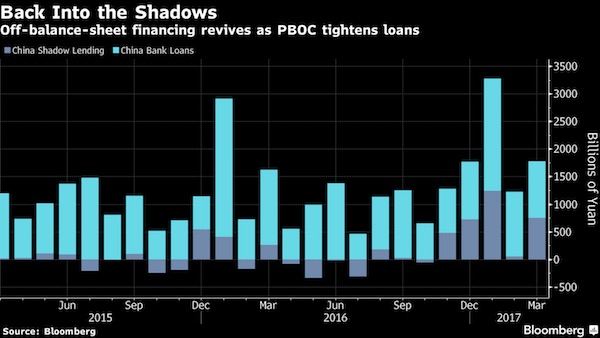

• China’s $8.5 Trillion Shadow Bank Industry Is Back in Full Swing (BBG)

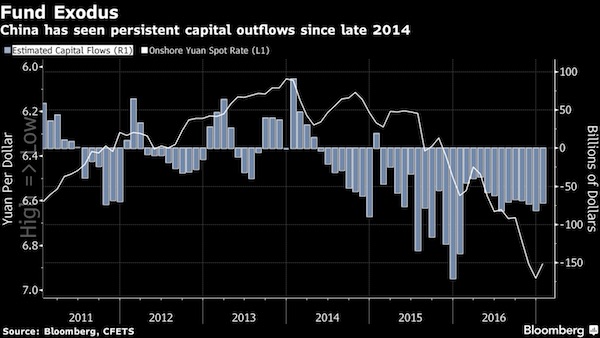

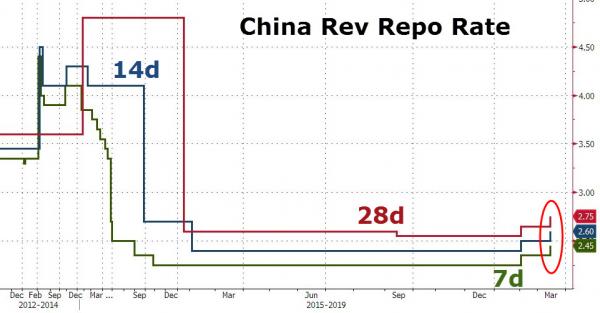

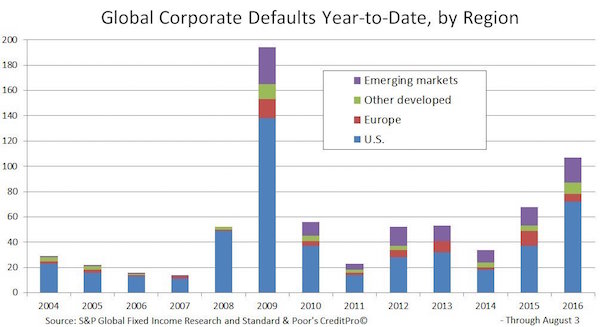

China’s shadow banking is back in full swing, an unintended side effect of the government’s campaign against financial leverage, which has curbed traditional lending and squeezed bond financing. Data from the central bank Friday showed that off-balance sheet lending surged 754 billion yuan ($109 billion) in March, taking the first quarter’s total increase to a record 2.05 trillion yuan. Efforts by the People’s Bank of China to curb fresh lending may have prompted borrowers, especially real estate developers, to resort to alternative forms of financing, said Xu Gao at Everbright Securities. Since late last year, the PBOC and regulators have taken steps to rein in risks to China’s financial system, including raising short-term interest rates, clamping down on leverage in the bond market, and curbing funding for property speculation.

The measures have sent debt-reliant borrowers scurrying to shadow financing, an industry Moody’s Investors Service estimates is worth about $8.5 trillion, and another area where regulators are trying to reduce risk. “You must tread a fine line,” said Everbright’s Xu. “Choking the bond market to death doesn’t mean the financing needs will be curbed as well. Instead, it will drive funding to areas that are more unreachable for the regulators. At the end of the day, risks may be declining in the bond market, but in the overall financial system, they would be rising.” The PBOC in January ordered the nation’s lenders to strictly control new loans in the first quarter of the year, putting a particular emphasis on mortgage lending to contain runaway home prices.

The move saw banks extending 4.22 trillion yuan of new loans in the first quarter, 8.5% less than the same period in 2016. It was the first year-on-year decline since 2011. The government is trying to contain the possibility of a shock emanating from the property and construction industries, which contribute about 25 to 30% of China’s economic output, Moody’s estimates. The increasing role of shadow banks as providers of finance is among characteristics that have raised the financial system’s vulnerability to a property-related shock, Moody’s said in a March report. In a move to curb shadow banking, financial regulators are working together to draft sweeping new rules for asset-management products, people familiar with the matter said in February.

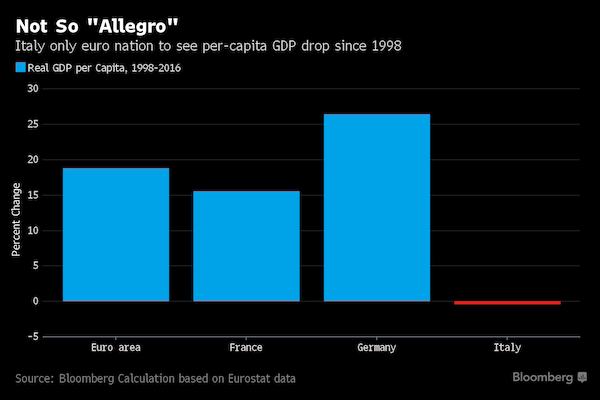

Cracking down on what is 25-30% of your economy?!

• So China’s Authorities Crack Down on Housing Speculation? (WS)

Dozens of cities have imposed ever tougher buying restrictions, more stringent down-payment requirements especially for second homes, stricter resale limits, etc. etc., and they’ve redoubled their efforts since mid-March when it became apparent that the prior redoubled efforts had not produced results, as people figured out how to get around them. But China depends heavily on property development and property speculation for its economic growth, and no one really wants to bring it down: The National Bureau of Statistics (NBS) reported on Monday that first-quarter growth in property investment – residential, commercial, and office spaces combined – soared 9.1%. This red-hot property sector, and the 40 other sectors that are directly affected by it, drove China’s official GDP growth in Q1 to 6.9%.

As always, analysts keep saying that it would take a few more months for the restrictions to take effect and start cooling the market. That line was once again repeated on Monday, officially: “Because the latest round of cooling measures came out after March 17, their impact on the entire economy including home prices may show in April or later,” Mao Shengyong, a spokesman for the NBS said at a briefing, according to Reuters. Houses are for habitation, not for speculative investment, he said. That would be a novel concept in these crazy times. But who really wants to cool the market, when state-owned developers and state-owned banks are firing it up? Yet, everyone sees the risks. Reuters: “Most analysts agree an overheating property market poses the single biggest risk to China’s economic growth, with increasingly tough government measures to cool soaring prices raising the risk of a nasty crash.”

But the cooling off is not happening yet. New construction measured in floor space soared 11.6% in the first quarter, year-over-year, the NBS reported, and sales jumped 19.5%, though that growth rate was down a notch from the year 2016, when sales at soared 22.5%, the highest in seven years, as the boom in first-tier cities was spilling into second- and third-tier cities. With state-owned developers, funded by state-owned banks, firing up much of the show, and with speculators, who assume the government has their back, running wild in a gushing celebration of ever-soaring prices and huge automatic profits, there’s little chance that this scheme that has already transcended irrational exuberance will simply “cool” to a level of “stability,” and plateau somewhere soon, as it is hoped. Phenomenal bubbles like this don’t go quietly.

“The Oxford Dictionary defines subsidiarity as “(in politics) the principle that a central authority should have a subsidiary function, performing only those tasks which cannot be performed at a more local level”

• Subsidiarity – A European Union Smokescreen To Justify Failure (Bilbo)

One of the various smokescreens that were erected by the European Commission and the bevy of economists that it either paid or were ideologically aligned to justify the design of the monetary union around the time of the Maastricht process was the concept of subsidiarity. In 1993, the Centre for Economic Policy Research (a European-based research confederation) published its Annual Report – Making Sense of Subsidiarity: How Much Centralization for Europe? – which attempted to justify (ex post) the decisions imported from the 1989 Delors Report into the Maastricht Treaty that eschewed the creation of a federal fiscal capacity.

It was one of many reports at the time by pro-Maastricht economists that influenced the political process and pushed the European nations on their inevitable journey to the edge of the ‘plank’ – teetering on the edge of destruction and being saved only because the European Central Bank has violated the spirit of the restrictions that a misapplication of the subsidiarity principle had created. It is interesting to reflect on these earlier reports. We find that the important issues they ignored remain the central issues today and predicate against the monetary union ever being a success. One of the authors of the 1993 Report, Jean-Pierre Danthine has recently reflected on the work some 25 years after its publication.

In his Op Ed (April 12, 2017) – Subsidiarity: The forgotten concept at the core of Europe’s existential crisis – he argues that “the disenchantment with Europe can arguably be traced to the failed application of the subsidiarity principle that was enshrined in the Maastricht Treaty.” He recognises that: “Europe’s deep-seated institutional design problem is tied to the inevitable trade-off between efficiency-enhancing centralisation and democracy-enhancing sovereignty.” Let’s go back to the Delors Report 1989, which I argue in my book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale – misapplied the concept of subsidiarity. It is clear from the historical record that the Delors Committee mainly relied on the concept of subsidiarity to justify the absence of a European-level fiscal function in the plan it outlined for monetary union.

The term, subsidiarity, a long-standing concept in political theory (as far back to Aristotle), entered the European dialogue in 1989 as part of a new ‘Eurolanguage’ as the political leaders were intent on pushing through the economic and monetary union. The Oxford Dictionary defines subsidiarity as “(in politics) the principle that a central authority should have a subsidiary function, performing only those tasks which cannot be performed at a more local level”. The concept was popularised by the Roman Catholic Church in the 1931 encyclical, Quadragesimo Anno, which pronounced that: “It is a fundamental principle of social philosophy, fixed and unchangeable, that one should not withdraw from individuals and commit to the community what they can accomplish by their own enterprise and/or industry.”

An ‘everybody gets rich’ scheme.

• Greece’s Migration Policy Ministry to Spread Migrants in Small Towns (GR)

The Migration Policy Ministry is developing a plan to spread about 20,000 migrants in small towns and rural communities across Greece, offering economic incentives to locals. According to a Proto Thema report, the project has been implemented in the town of Livadia with relative success. Now the ministry is looking for similar communities (with populations of 10,000-15,000) that have economic problems. According to the plan, such communities can accommodate 500-1,500 migrants in rented homes, while migrants can buy food and services using coupons provided by the State and the UNHCR. As authorities expect that some communities will be hostile to Muslim migrants, the ministry aims at counter-balancing religious differences and possible frictions by offering strong financial incentives to boost the ailing local economies.

The project will be extended in towns of Epirus, Western Macedonia and North-Western Greece that have high unemployment rates, provided that they are not located close to international borders. The Migration Policy Ministry also plans to offer high wages to people who wish to work in the migrant hospitality infrastructure. According to the Proto Thema report, a project coordinator working in Livadia right now earns an annual salary of 24,933 euros and a housing program director earns 22,666, wages that are double of that of an average public sector employee. Similar wages are offered to people who wish to work with migrants. The report says that such wages and overall economic incentives aim at mitigating any reactions by locals. Characteristically, the report says, apartments of 60-90 square meters in Livadia are rented for around 400 euros, again, a price above an average rental.

“Interest rates of 3.6% for a super senior risk free lender were almost three times as high as the more junior ESM loans..”

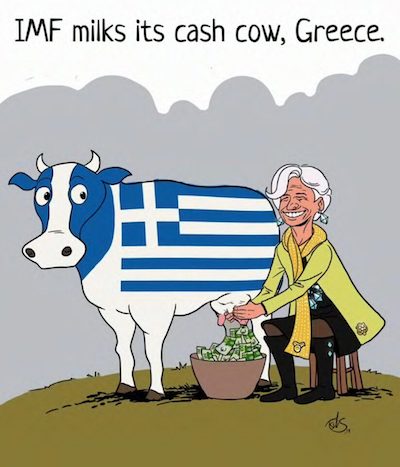

• How the Greek Crisis is Profitable for the International Monetary Fund (GR)

The relationship between Greece and the International Monetary Fund has been, from the start, very contentious to say the least. There is no question that Greece needs to build the trust and confidence of taxpayers and the global capital markets. But, the IMF advice more often than not seems to be more political or ideological than practical. However, the IMF should not be used as a scapegoat for successive Greek governments disappointing performance in building trust and confidence. The EC, especially Germany, enlisted the IMF to act as a foil for any failed policies, arguably smart political insurance. As the political foil, the IMF was provided with a cash cow to milk: Greece. And, milk Greece it has.

Greece has paid almost €4 billion in fees and interest to the IMF since the start of the programme. Interest rates of 3.6% for a super senior risk free lender were almost three times as high as the more junior ESM loans. Greece payments are so important to the IMF that they were 118% of IMF’s operating profit. Since 2010, IMF personnel expense have increased 48% compared to a decline of 8% in the prior seven years. And, not to go unnoticed, the IMF newly refurbished headquarters is 31% over budget at $562 million. With 97% of IMF’s cost now essentially fixed, losing Greece, Portugal, and Ireland, would cause massive financial trauma at the IMF and may well render it insolvent. So, the obvious question is: does the IMF have an incentive to keep Greece in crisis to protect its own financial survival and continue to milk the Greek cow?

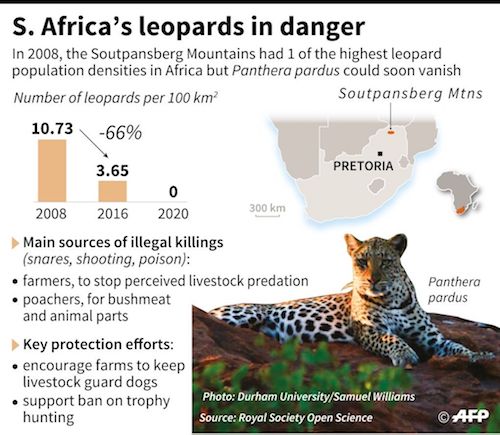

How many will just glance over a story like this? In only a few years, species are pushed over a cliff.

• Key South Africa Leopard Population Crashing (AFP)

The leopard population in a region of South Africa once thick with the big cats is crashing, and could be wiped out within a few years, scientists warned on Wednesday. Illegal killing of leopards in the Soutpansberg Mountains has reduced their numbers by two-thirds in the last decade, the researchers reported in the Royal Society Open Science journal. “If things don’t change, we predict leopards will essentially disappear from the area by about 2020,” lead author Samual Williams, a conservation biologist at Durham University in England, told AFP. “This is especially alarming given that, in 2008, this area had one of the highest leopard densities in Africa.” The number of leopards in the wild worldwide is not known, but is diminishing elsewhere as well. The “best estimate” for all of South Africa, said Williams, is about 4,500.

What is certain, however, is that the regions these predators roam has shrunk drastically over the last two centuries. The historic range of Panthera pardus, which includes more than half-a-dozen sub-species, covered large swathes of Africa and Asia, and extended well into the Arabian Peninsula. Leopards once roamed the forests of Sri Lanka and Java unchallenged. Today, they occupy barely a quarter of this territory, with some sub-species teetering on the brink of extinction, trapped in 1 or 2% of their original habitat. Leopards were classified last year as “vulnerable” to extinction on the International Union for the Conservation of Nature’s Red List of endangered species, which tracks the survival status of animals and plants.