Pablo Picasso Self portrait 1972

They’ve been doing this forever: “..the fight is the “longest-running battle since the Trojan War.”

• Trump Slaps 20% Duty on Canada Lumber, Intensifying Trade Fight (BBG)

U.S. President Donald Trump intensified a trade dispute with Canada, slapping tariffs of up to 24% on imported softwood lumber in a move that drew swift criticism from the Canadian government, which vowed to sue if needed. Trump announced the new tariff at a White House gathering of conservative journalists, shortly before the Commerce Department said it would impose countervailing duties ranging from 3% to 24.1% on Canadian lumber producers including West Fraser Timber. “We’re going to be putting a 20% tax on softwood lumber coming in – tariff on softwood coming into the United States from Canada,” Trump said Monday, according to a tweet by Charlie Spiering at Breitbart News. A White House official confirmed the comment.

The step escalates an economic battle among neighboring countries that normally have one of the friendliest international relationships in the world. U.S. Commerce Secretary Wilbur Ross amplified Trump’s remarks in a statement afterward that also referenced a fight over a new Canadian milk policy that U.S. producers say violates Nafta. “It has been a bad week for U.S.-Canada trade relations,” Ross said, adding “it became apparent that Canada intends to effectively cut off the last dairy products being exported from the United States.” He said the Commerce Department “determined a need” because of unfair Canadian subsidies to the lumber industry to impose “countervailing duties of roughly one billion dollars.” In a dig at NAFTA, which Trump has said he wants to renegotiate, Ross added, “This is not our idea of a properly functioning Free Trade Agreement.”

[..] The so-called countervailing duties, which counter what the U.S. considers Canadian subsidies, came in below some analyst expectations. CIBC analyst Hamir Patel forecast the initial combined countervailing and anti-dumping duties could reach 45 to 55%, he said in an April 23 note. The U.S. may also apply anti-dumping duties if it determines Canadian firms are selling for below costs. That decision is expected in June. “It definitely could’ve been a heck of a lot worse,” Kevin Mason at ERA Forest Products Research said by phone. “I think a lot of people were bracing for a higher duty.”

[..] Most of the softwood in Canada is owned by provincial governments, which set prices to cut trees on their land, while in the U.S. it’s generally harvested from private property. The fees charged by Canadian governments are below market rates, creating an unfair advantage, U.S. producers say. Canada disputes that. Robert Lighthizer, Trump’s nominee to be the next U.S. Trade Representative, said at his confirmation hearing last month that he views the lumber dispute as the top trade issue between the U.S. and Canada. Oregon Democratic Senator Ron Wyden told Lighthizer the fight is the “longest-running battle since the Trojan War.”

Huffin’-and-a-puffin’.

• Trump Summons Entire Senate To White House Briefing On North Korea (G.)

The entire US Senate will go to the White House on Wednesday to be briefed by senior administration officials about the brewing confrontation with North Korea. The unusual briefing underlines the urgency with which the Trump administration is treating the threat posed by Pyongyang’s continuing development of nuclear weapons and missile technology. It follows a lunch meeting Trump held with ambassadors from UN member states on the security council on Monday where he emphasised US resolve to stop North Korea’s progress. “The status quo in North Korea is unacceptable and the council must be prepared to impose additional and stronger sanctions on North Korean nuclear and ballistic missile programs,” Trump said at the meeting. “North Korea is a big world problem, and it’s a problem we have to finally solve.”

On Friday the US secretary of state, Rex Tillerson, is due to chair a security council foreign ministers’ meeting on the issue in New York, at which the state department said he would call once more for the full implementation of existing UN sanctions or new measures in the event of further nuclear or missile tests. “This meeting will give the security council the opportunity to discuss ways to maximise the impact of existing security council measures and to show their resolve to response further provocations with appropriate new measures,” said Mark Toner, state department spokesman. Senators are to be briefed by the defence secretary, James Mattis, and Tillerson on Wednesday. Such briefings for the entire senate are not unprecedented but it is very rare for them to take place in the White House, which does not have large secure facilities for such classified sessions as Congress.

Not going to be easy. Trump’s too desperate to get a deal done.

• Trump Advisers To Lay Out Tax Plan For Top Republicans Tuesday (BBG)

President Donald Trump will call for cutting taxes for individuals and lowering the corporate rate to 15% to fulfill a promise he made during his campaign, according to a White House official. The president on Wednesday plans to make public the broad outlines of what he wants to change in the tax code, though the details likely will be left until later negotiations among congressional leaders and officials from Treasury. Trump’s top economic adviser Gary Cohn and Treasury Secretary Steven Mnuchin will brief House Speaker Paul Ryan, Senate Majority Leader Mitch McConnell and the leaders of congressional tax-writing committees – House Ways and Means Committee Chairman Kevin Brady and Senate Finance Committee Chairman Orrin Hatch.

While Trump and Ryan broadly agree on sharply cutting individual income and corporate taxes, there are areas of disagreement between the two. On the campaign, Trump called for a corporate tax rate of 15%; Ryan wants 20%, and he has warned that cutting it an additional 5 percentage points could prevent the ultimate tax plan from being revenue neutral. Without Democratic support, a plan would have to be revenue neutral to meet the criteria set by lawmakers to make tax changes permanent. “I’m not sure he’s going to be able to get away with that,” Hatch told reporters Monday. “You can’t very well balance the budget that way.”

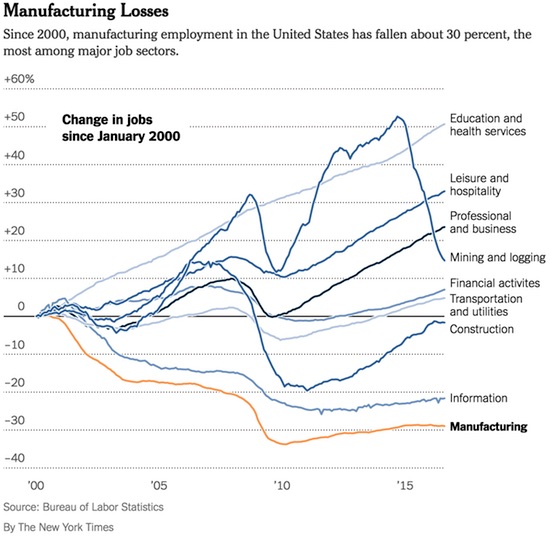

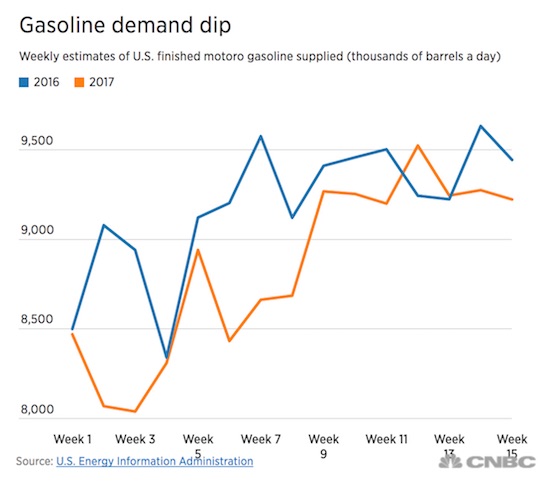

Demand goes down because people have less money to spend. All the rest is humbug.

• The Oil Market Has One Big Problem: People Aren’t Buying Enough Gas (CNBC)

Lackluster gasoline demand is once again raising concerns that the oil market won’t be able to escape the doldrums. Demand for U.S. gasoline has recovered since January, but remained below 2016 levels throughout much of this year. Now, analysts are worried weak consumption will cause gasoline stockpiles to keep building and eventually result in weaker crude oil demand and pricing. U.S. gasoline futures were down more than 1% on Monday, reflecting demand concerns as refiners emerge from the winter maintenance season and prepare to turn out more fuel. Meanwhile, U.S. crude settled 39 cents lower at $49.23, extending last week’s deep losses. “As gas prices drop, that creates an undertow for the entire crude oil market,” said Tom Kloza, global head of energy analysis at Oil Price Information Service.

Part of the problem is a tough comparison with extraordinarily low gasoline prices last year. The national average gasoline price on Monday was nearly 28 cents above last year’s level, according to GasBuddy.com. “I’m in the camp that says last year was a little bit of the anomaly,” Kloza said. “Gas was so cheap that we drove a little bit more almost capriciously. This year, I just don’t think it’s going to happen.” In a troubling sign, the nation’s gasoline station operators have reported at industry conferences that their sales are down 1.5 to 2% this year, according to Andy Lipow, president of Lipow Oil Associates. “When you hear retailers telling you that their demand is down you’ve got to be a believer,” he told CNBC. Lipow said he fears that trend will carry through for the balance of 2017. Demand is certain to rise as the summer driving season ramps up, but Lipow sees stockpiles remaining relatively high.

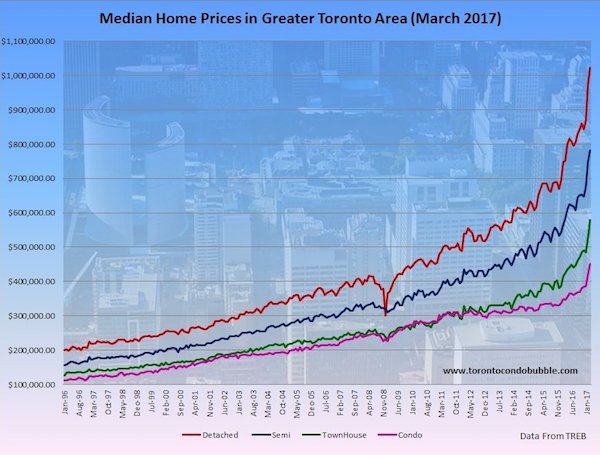

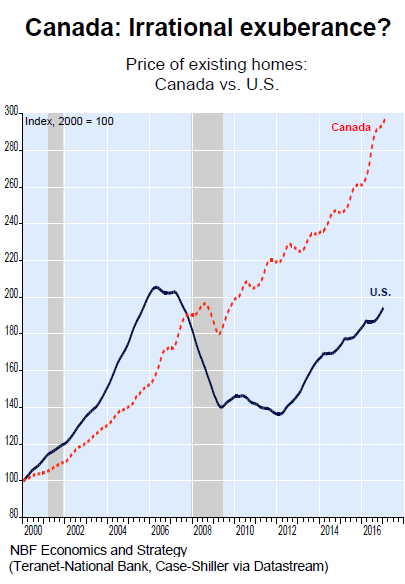

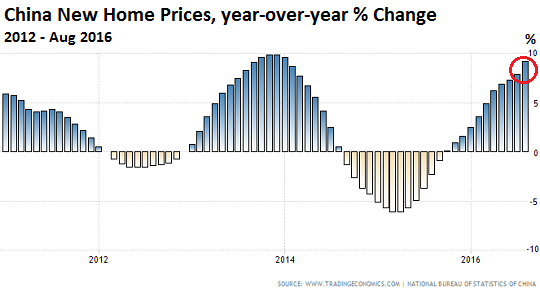

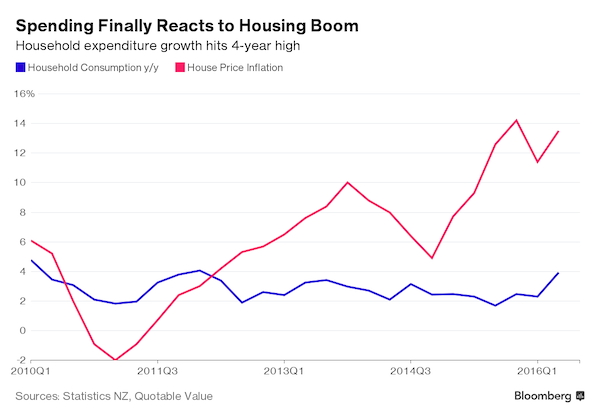

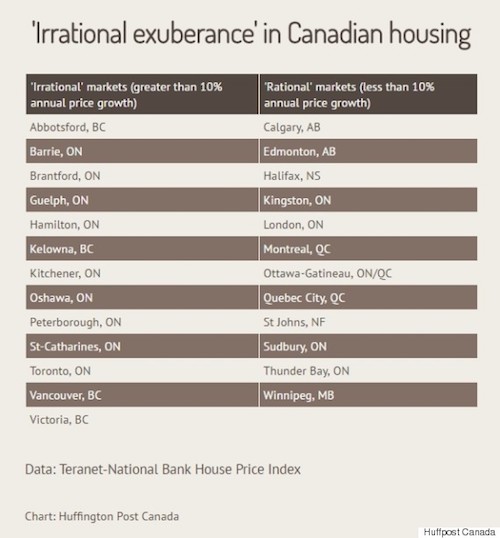

Stark raving madness. A housing market that is rising at ‘only’ 9.5% per year is labeled ‘rational’.

• Canadians’ Confidence In Housing Hits Record High (HPoC)

The experts are getting louder in their warnings that a housing bubble has formed in some parts of Canada, but Canadians don’t seem worried. In fact, confidence in the housing market hit a record high in the latest weekly Bloomberg-Nanos index — even as respondents turned negative on their own personal finances. The survey found 48.5% of Canadians expect house prices to rise in the next six months, the highest level recorded in the survey since 2008. Fewer than 11% expect to see house prices decrease. “Bullish sentiment on real estate in Canada continues to drive consumer confidence,” pollster Nik Nanos said in a statement. “Household expectations have improved by roughly 10% since the start of the year as the effects of the oil price shock have stabilized and the focus has moved toward rising property values,” Bloomberg economist Robert Lawrie said.

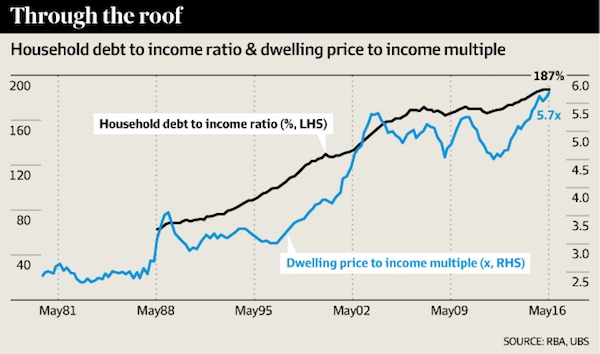

“In recent weeks, however, consumer sentiment regarding personal finances began drifting lower, with extended household balance sheets perhaps the next focus of concern for policymakers.” High debt levels are precisely why many market observers are growing concerned about Canada’s priciest housing markets, namely the Toronto and Vancouver regions. House prices in Toronto jumped 33% in March from a year earlier, to an average of $916,567. While Vancouver’s house prices have moderated over the past six months, they remain elevated, with the benchmark price at $919,300 in March.

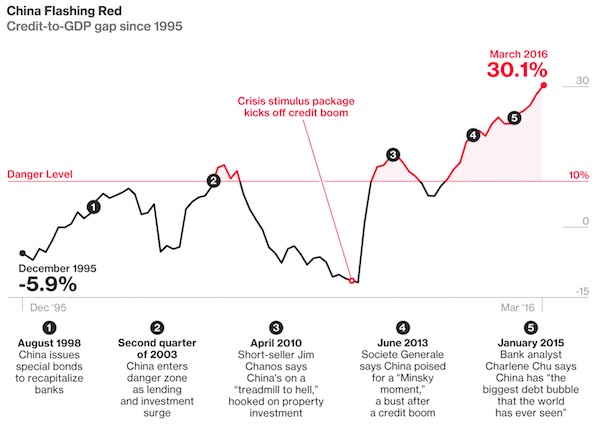

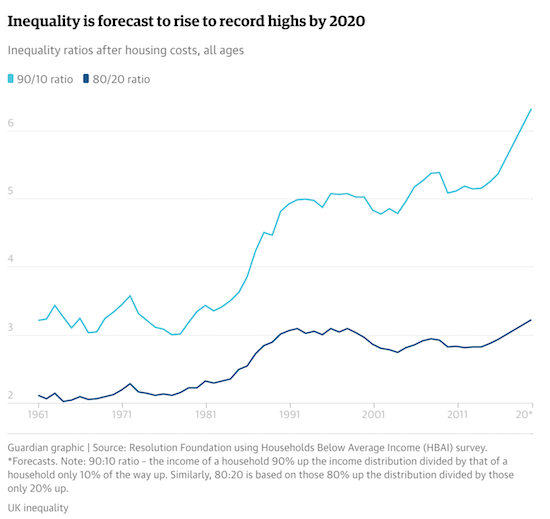

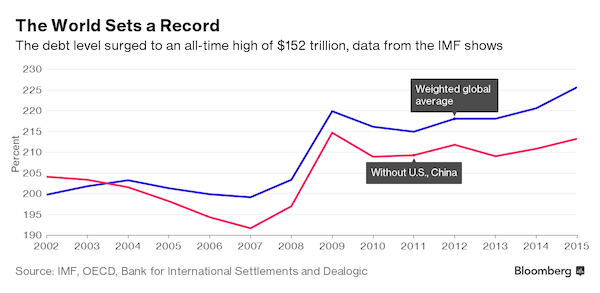

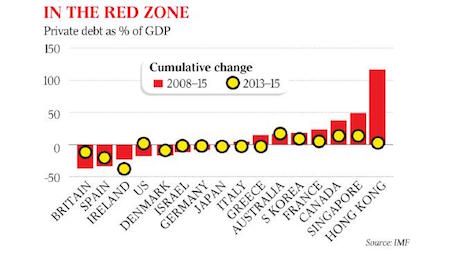

National Bank of Canada, which co-publishes the Teranet house price index, warned recently that “irrational exuberance” may be setting into some Canadian housing markets, noting that more than half of Canada’s regional markets are seeing price growth above 10% annually. With mortgages ballooning, Canadian household debt has repeatedly hit record highs in recent years, and now stands at $1.67 of debt for every dollar of disposable income. Those elevated debt levels are the main reason one why the Bank for International Settlements (BIS), a Geneva-based “central bank of central banks,” warned recently that Canada has the second-highest risk of a financial crisis, behind only China.

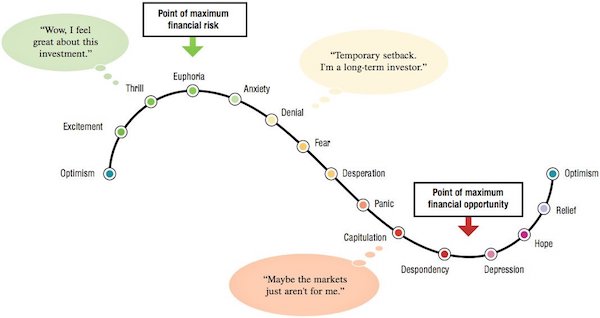

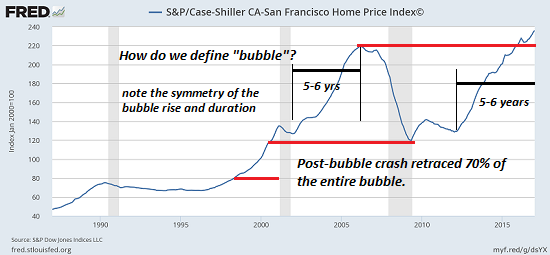

Essential and repeated here a 1000 times: “Bubbles have a habit of overshooting on the downside when they finally burst.”

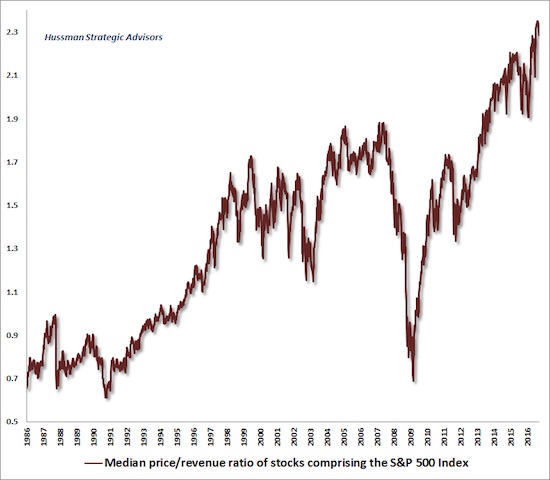

• Housing’s Echo Bubble Now Exceeds the 2006-07 Bubble Peak (CHSmith)

A funny thing often occurs after a mania-fueled asset bubble pops: an echo-bubble inflates a few years later, as monetary authorities and all the institutions that depend on rising asset valuations go all-in to reflate the crushed asset class. Take a quick look at the Case-Shiller Home Price Index charts for San Francisco, Seattle and Portland, OR. Each now exceeds its previous Housing Bubble #1 peak:

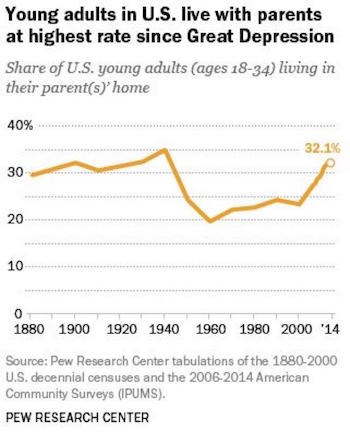

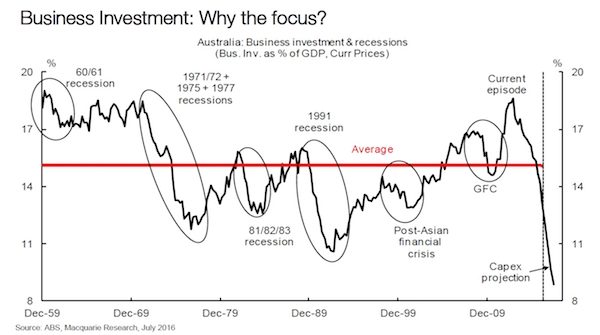

It seems housing bubbles take about 5 to 6 years to reach their bubble peaks, and about half that time to retrace much or all of the gains. Bubbles have a habit of overshooting on the downside when they finally burst. The Federal Reserve acted quickly in 2009-10 to re-inflate the housing bubble by lowering interest rates to near-zero and buying over $1 trillion of mortgage-backed securities. When bubbles are followed by echo-bubbles, the bursting of the second bubble tends to signal the end of the speculative cycle in that asset class. There is no fundamental reason why housing could not round-trip to levels below the 2011 post-bubble #1 trough.

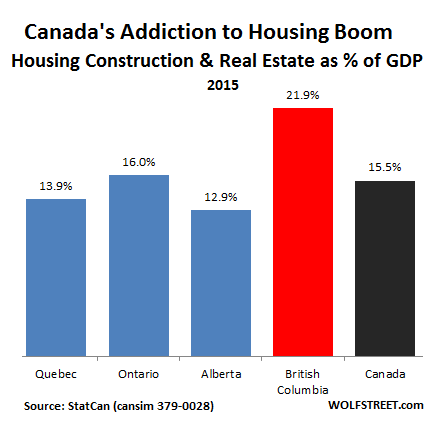

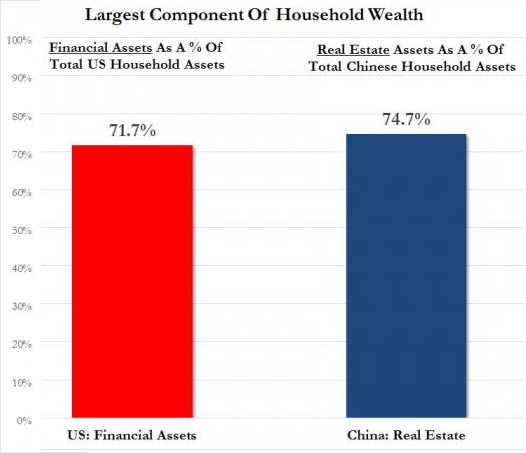

Consider the fundamentals of China’s remarkable housing bubble. The consensus view is: sure, China’s housing prices could fall modestly, but since Chinese households buy homes with cash or large down payments, this decline won’t trigger a banking crisis like America’s housing bubble did in 2008. The problem isn’t a banking crisis; it’s a loss of household wealth, the reversal of the wealth effect and the decimation of local government budgets and the construction sector. China is uniquely dependent on housing and real estate development. This makes it uniquely vulnerable to any slowdown in construction and sales of new housing. About 15% of China’s GDP is housing-related. This is extraordinarily high. In the 2003-08 housing bubble, housing’s share of U.S. GDP barely cracked 5%. Of even greater concern, local governments in China depend on land development sales for roughly 2/3 of their revenues.

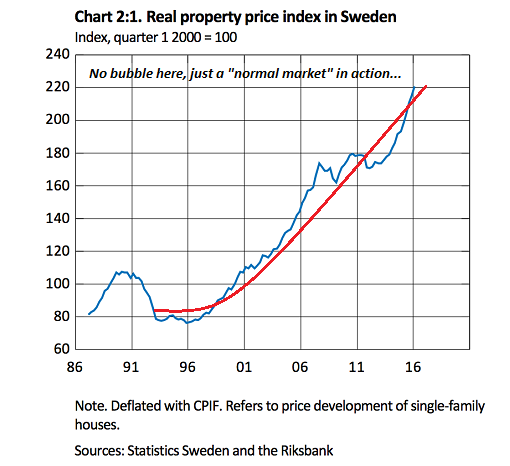

If you need some evidence that the echo-bubble in housing is global, take a look at this chart of Sweden’s housing bubble. Oops, did I say bubble? I meant “normal market in action.”

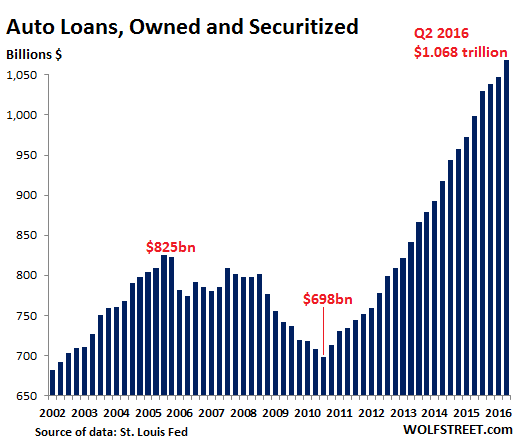

“..we may be in the latter stages of a bubble. As prices rise further and further out of reach, lenders need to find more and more ingenious tricks to keep rich people pumping their cash into an overheated market. The punch bowl has to keep going round, or the party stops.”

• Bubble, Bubble, Toil And Trouble: Ultra-Low Mortgage Rates Are Dangerous (G.)

Between autumn 1977 and Christmas 1979, interest rates rose from 5% to 17%. If you were a young boomer whose biggest cost was a variable rate mortgage, that would have hurt. In 2009, by contrast, interest rates were cut to a record low of 0.5%, and stayed there for the better part of a decade. When eventually they did move again, it was down. You don’t know you’re born. Except, of course, you do – because, if you’re reading this and you’re under 40, there’s a pretty good chance you’re still stuck paying rent. Yes, interest rates are low; no, this is not particularly helpful. Even if you do have a mortgage, it’s probably a fixed rate one because, let’s be honest, those rates are going up again one day. But not, it seems, today. The Yorkshire Building Society has just launched a new mortgage that charges an interest rate of just 0.89%. “We are very pleased to offer borrowers the lowest mortgage rate ever available,” said a spokesman.

“The cost of funding has fallen in recent weeks and, as a financially strong building society with no external shareholders to satisfy, we have the ability to pass this on to borrowers.” (“We used to dream of mortgages at under 1%,” say the boomers.) So does that means that owning a home is now cheaper than it’s ever been? Well, no, of course not. For one thing, this isn’t a fixed rate deal. It’s actually a (bear with me on this) two-year-long discount of 3.85% to the standard variable rate (SVR) of 4.74%. That means it’s very, very unfixed indeed: a normal tracker mortgage moves in response to Bank of England rates; an SVR one moves in response to the lender’s whims. Accepting this mortgage means placing a bet that the Yorkshire Building Society will be nice to you. It also comes with an unusually high arrangement fee of £1,495, but this shouldn’t bother you, because you probably can’t get that rate anyway. To even be considered, you need a deposit worth 35% of the value of your home.

[..] But there’s another, more sinister, reading of the recent rash of ultra-low mortgage rates: it suggests we may be in the latter stages of a bubble. As prices rise further and further out of reach, lenders need to find more and more ingenious tricks to keep rich people pumping their cash into an overheated market. The punch bowl has to keep going round, or the party stops. But bubbles tend to burst. Prices can’t rise forever: one day, interest rates must surely rise. When the inevitable happens, there is a danger that those who took advantage of this deal may find their equity wiped out – and the rate they’re paying will shoot through the roof.

That would obviously be very sad for those who are affected; for those shut out of home ownership, though, it may be no bad thing. That’s because nine years of record-low interest rates have probably contributed to the fact that house prices have soared out of reach; and higher prices have meant increasingly unattainable deposits. A rise in interest rates could, paradoxically, make housing more affordable.

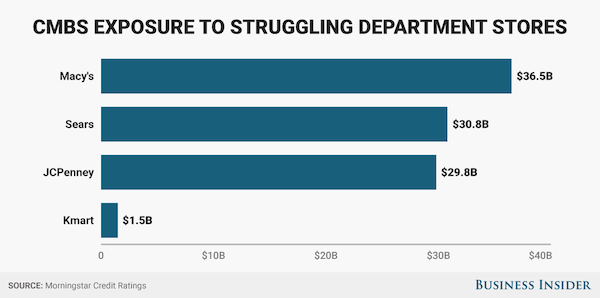

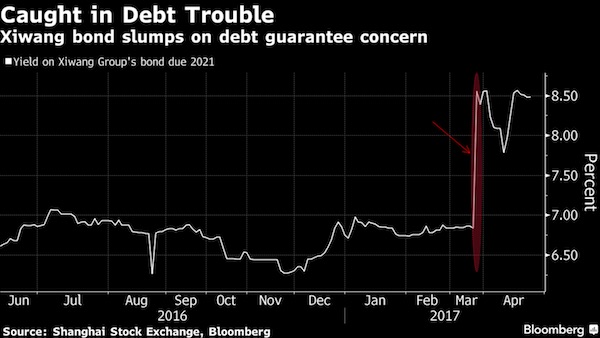

Companies guaranteeing each other’s crappy debt. What could go wrong? Problem is, Beijing had let them do it for years.

• Rising Defaults In China Reveal Hidden Debt (BBG)

Rising defaults in China are unearthing hidden debt at companies across the country. Small firms that can’t get loans by themselves have been winning banks over by getting other companies to guarantee their borrowings. The companies making those pledges exclude them from their balance sheets, leaving creditors in the dark. Borrowers often extend the guarantees for each other, raising the risk that failures could ricochet, at a time when increasing borrowing costs have already added to strains. China’s banking regulator has ordered checks of such cross-guaranteed loans, Caixin reported Friday. Scrutiny is mounting after a corn oil producer in the eastern province of Shandong said last month it had guaranteed debt of a neighboring aluminum product manufacturer which is now stuck in a cash crunch.

Just days before that, a local government financing vehicle in China’s southwest had to repay an auto parts maker’s loans it had guaranteed after the latter defaulted. “Disclosure of such guarantees isn’t timely,” said Qiu Xinhong at Shenzhen-based First State Cinda. “Sometimes, it’s like a buried mine and you don’t know when the risks will explode.” This debt minefield could be big. The amount of loan guarantees at privately held firms in China is equivalent to 11% of their equity, and at LGFVs is 18%, according to Citic Securities. The load is even heavier at weaker borrowers. About 44% of issuers rated lower than AA- have a ratio of more than 30%, according to Everbright Securities. The phenomenon is less common in the U.S. because banks don’t require such guarantees to offer loans, according to Fitch Ratings.

“If companies in the same region offer a huge amount of guarantees for each other’s debt, it would form a guarantee web and deepen interconnections among the companies,” said Gang Meng, director of rating at Golden Credit Rating International Co. in Beijing. “If one company has to repay debt for its guaranteed company, risks would quickly ripple to other companies in the web, which will result in a butterfly effect.” [..] Guarantors don’t mark the pledges on their balance sheets and often disclose them only on an annual basis. Such shadow debts pose rising risks after central bank tightening pushed up onshore corporate bond yields to two-year highs and defaults on local notes surged to a record.

The distinction between state banks and shadows has become very murky.

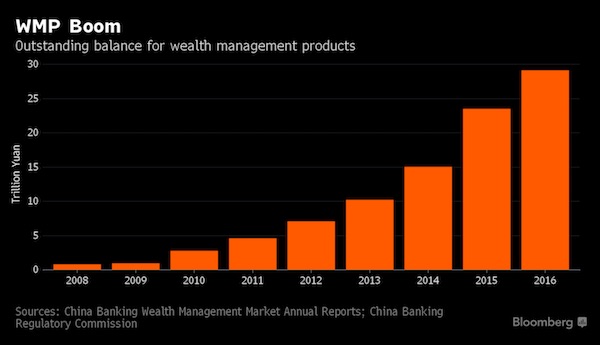

• China Markets Reel as $1.7 Trillion in Shadow Funds Unwinds (BBG)

A $1.7 trillion source of inflows into Chinese markets has suddenly switched into reverse, roiling the nation’s money management industry and sending local bonds and stocks to their biggest losses of the year. The turbulence has centered on so-called entrusted investments – funds that Chinese banks farm out to external asset managers. After years of funneling money into such investments, banks are now pulling back in response to a series of regulatory guidelines over the past three weeks that put a spotlight on the risks. Critics have blamed entrusted managers for adding leverage to China’s financial system and reducing transparency.

The banks’ withdrawals helped erase $315 billion of stock market value over the past six days and sent bond yields to the highest level in nearly two years, highlighting the challenge for Chinese authorities as they try to rein in shadow banking activity without destabilizing financial markets. While the government has plenty of firepower to prop up asset prices if it wants to, forecasters at Australia & New Zealand Banking predict the selloff will deepen this year. “We are seeing an exodus of funds,” said He Qian at HFT Investment Management, which oversaw about 189 billion yuan ($27.5 billion) as of last year. He was one of about half-a-dozen asset managers and analysts who said banks have started scaling back their entrusted investments.

The arrangements have become an important part of China’s shadow finance system. When banks sell wealth-management products – the ubiquitous savings vehicles that offer higher yields than deposits – the firms sometimes farm out client money to entrusted managers such as hedge funds and mutual funds. The managers invest the cash in bonds, stocks and other securities, hoping to generate enough income to cover the banks’ promised returns to WMP clients – plus some extra for themselves.

You better look good than feel good.

• Naked Selfies Used As Collateral For Chinese Loans (AFP)

Hundreds of photos and videos of naked women used as collateral for loans on a Chinese online lending service have leaked onto the web, highlighting regulatory problems in the fast-growing peer-to-peer marketplace. A 10-gigabyte file posted on the internet exposed the personal details of more than 160 young women who were asked to provide the explicit material to secure money through online lending platform Jiedaibao. Launched by JD Capital in 2015, Jiedaibao allows lenders to operate anonymously but requires borrowers to reveal their real names when making transactions. Loan amounts and interest rates can be customised to meet the needs of users – often people who have a hard time accessing loans through more traditional financial institutions, like banks.

Interest on the “nude loans” reached an astonishing 30% a week, according to the Global Times newspaper. Lenders told female borrowers that if they failed to repay the loans, their nude photos would be sent to their families and friends, whose information was also required for some transactions, the article said. Material in the file put on the web last Wednesday showed some borrowers also promised to repay loans with sexual favours, according to screen captures posted on social media websites. In a statement on its official Twitter-like Weibo account, Jiedaibao said it had tracked down the accounts of several borrowers through photos and ID information circulated online and had frozen the suspected lenders’ accounts. “The ‘nude loans’ deals were mainly initiated and completed offline, and Jiedaibao only played the role of a money transfer platform in the deals,” the statement said.

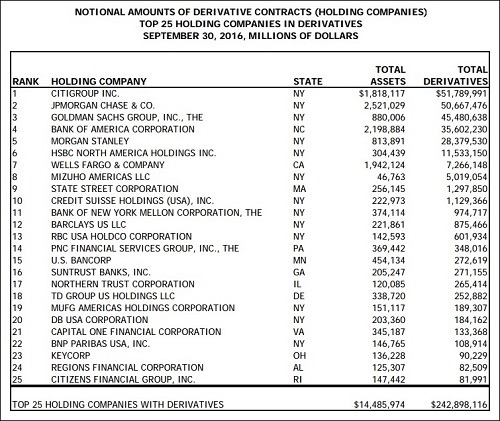

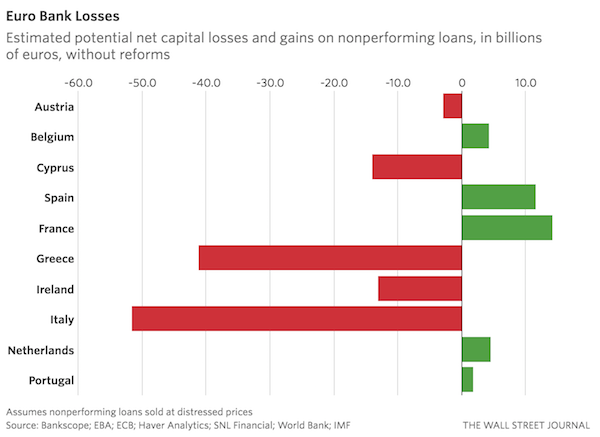

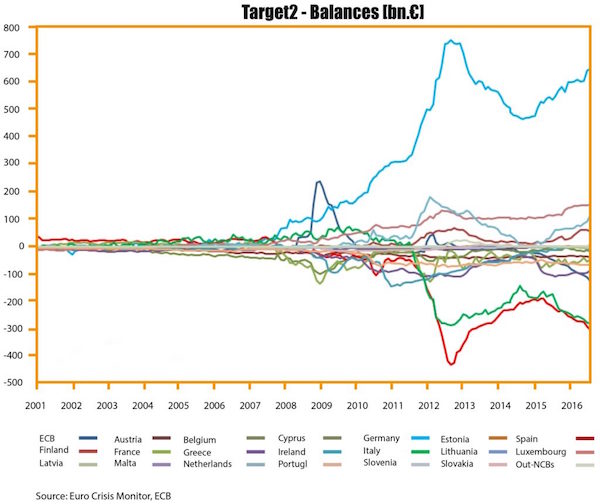

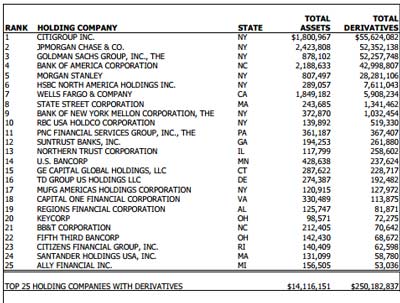

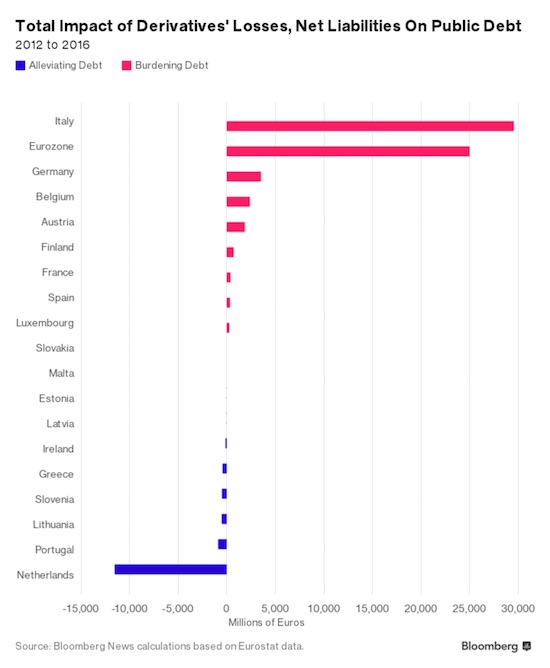

Derivatives used this way are instruments of massive wealth destruction. Why use different rates for each side of the deal? “..the Italian Treasury “usually pays a flow anchored to a fixed rate, while receiving one indexed to the 6-month Euribor rate..”

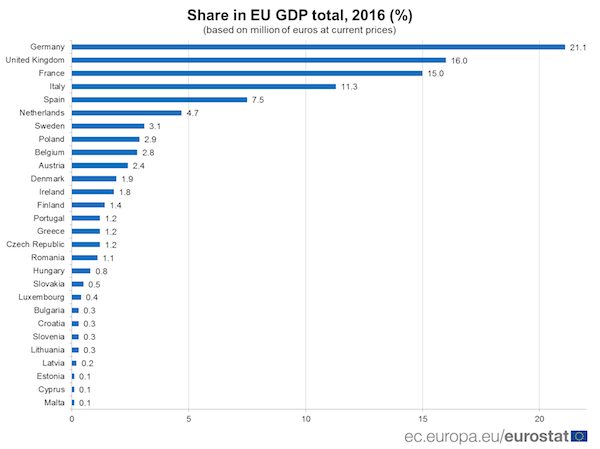

• Italy Is the Euro-Area’s Swaps Loser Facing $9 Billion Bill (BBG)

Derivatives burdened Italy’s public debt again last year for a record amount of €8.3 billion ($9 billion), making the country the biggest swaps loser in the euro region. Losses related to swaps held by the nation added €4.25 billion to the country’s debt while net liabilities’ burden totaled €4.07 billion, based on data released Monday by EU statistics office Eurostat. In the 2012-2016 period, the burden totaled €29.6 billion, also a euro-area record. Italy’s derivative-related losses and net liabilities were higher than those for the whole euro region combined both in 2016 and in the five-year period as some countries actually saw the swaps helping to alleviate their debts. Governments across the euro region have used derivatives to manage their debt-financing costs and to hedge against sudden changes in rates and excessive exchange-rate volatility.

Those deals have sometimes backfired with the effect of pushing nations’ debts even higher. In the existing interest-rate swaps the Italian Treasury “usually pays a flow anchored to a fixed rate, while receiving one indexed to the 6-month Euribor rate,” the government said earlier this month in an annex to its annual Economic and Financial Document. Since starting from November 2015, the Euribor stayed negative and the impact on the flow indexed to that rate was that the Treasury had to pay money to its counterparts, instead of being paid by them, the document also said. Italy’s public debt rose last year to €2.2 trillion, or 132.6% of the country’s GDP, Eurostat said in a separate report on Monday.

it’s important to get it right.

• Ontario To Pay Guaranteed Incomes To The Poor (AFP)

Ontario has launched a pilot program to provide a guaranteed basic income to a few thousand people to test its effects on recipients and public finances, the Canadian province announced on Monday. Provincial premier Kathleen Wynne said the program would provide a “basic income” for three years to 4,000 people living under the poverty line. “We want to find out whether a basic income makes a positive impact in people’s lives,” Ms Wynne said, adding that “everyone should benefit from Ontario’s economic growth.” Income support payments will be as high as Can$16,989 (£9,800) a year for an individual, or Can$24,027 for a couple, plus an additional Can$6,000 for the disabled.

The figures will be reduced for those holding part-time jobs – they will receive 50 cents less for each dollar earned. As a concrete example, a single person with a yearly salary of Can$10,000 will receive an additional payment of Can$11,989. The 4,000 participants, aged 18 to 65, have been chosen at random in three cities: Hamilton and Lindsay in the Toronto suburbs and Thunder Bay in the province’s west. The province estimates the cost of the program at Can$50 million a year. Ontario is the most heavily populated Canadian province, with 38% of the country’s 36.5 million inhabitants. 13% of Ontario residents live below the poverty line, according to Statistics Canada.

What the FBI did has already been declared illegal in New Zealand courts.

• Kim Dotcom Wants FBI Director Comey Questioned By New Zealand Police (IBT)

FBI Director James Comey is currently in New Zealand and if Kim Dotcom has his way, Comey could find himself being questioned by the New Zealand police. The internet entrepreneur, who is wanted by the United States on multiple charges including fraud and copyright infringement, filed a complaint with the police Tuesday against the FBI director for what Dotcom called theft of his data by the agency. The alleged theft happened when the police raided Dotcom’s home Jan. 20, 2012, as part of investigations instigated by the U.S. The charges against him are based on the now-defunct website Megaupload that he operated, where users could share content with each other.

Some of that content was illegal to share, but according to New Zealand laws, internet service providers are not held responsible for the actions of their users. In his complaint Tuesday, Dotcom’s lawyer urged the police to urgently question Comey, who is in New Zealand for a conference. The grounds for the complaint are that the FBI received copies of data that was taken from Dotcom’s home during the 2012 raid, an act which courts in the country have held to be illegal, according to the complaint.

The value you put on someone else’s life inevitably becomes the value of your own life.

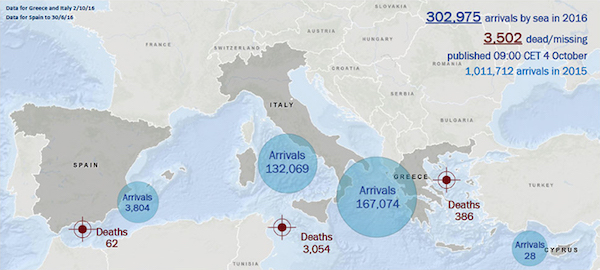

• At Least 16 Refugees Drown as Boat Sinks off Greece’s Lesbos (R.)

At least 16 people, including two children, drowned after an inflatable boat carrying refugees and migrants sank off Greece’s Lesbos island, authorities said on Monday. They are believed to be the first confirmed deaths in Greek waters this year of migrants or refugees making the short but dangerous crossing from Turkey on overcrowded rubber dinghies. Nine bodies were recovered in Greek territory and another seven in Turkish waters, Greek and Turkish coastguard officials said. Two survivors have been rescued. The two women, one of whom is pregnant, told the United Nations refugee agency UNHCR that 20 to 25 people were on board when the dinghy capsized around 1900 GMT on Sunday. The women are from Cameroon and the Democratic Republic of Congo.

Though fewer than 10 nautical miles separate Lesbos from Turkish shores, hundreds of people have drowned trying to make the crossing since Europe’s refugee crisis began in 2015. In that year, Lesbos was the main gateway into the European Union for nearly a million Syrians, Iraqis and Afghans. But a deal in March 2016 between the EU and Ankara has largely closed that route. Just over 4,800 people have crossed to Greece from Turkey this year, according to UNHCR data. An average of 20 arrive on Greek islands each day. “The number of people crossing the Aegean to Greece has dropped drastically over the past year, but this tragic incident shows that the dangers and the risk of losing one’s life remains very real,” said Philippe Leclerc, UNHCR Greece representative.