Acropolis and Temple of Jupiter Olympus Athens 1862

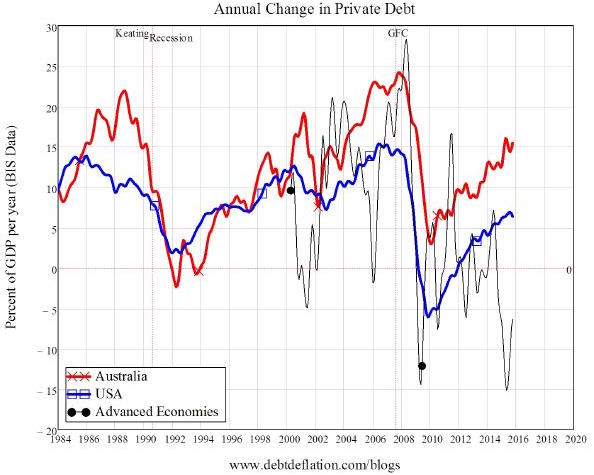

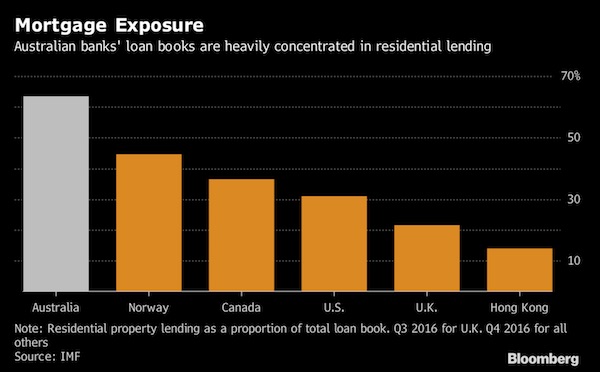

It’s just words. The illusion of well-managed control. When property goes down, and it must at some point, it will take the entire Australia economy down with it.

• Australia Slams the Brakes on Property Investment (BBG)

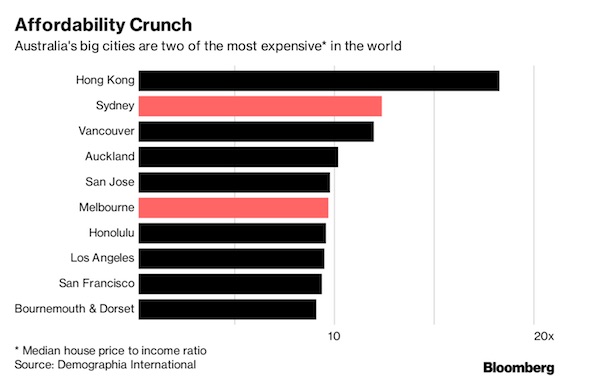

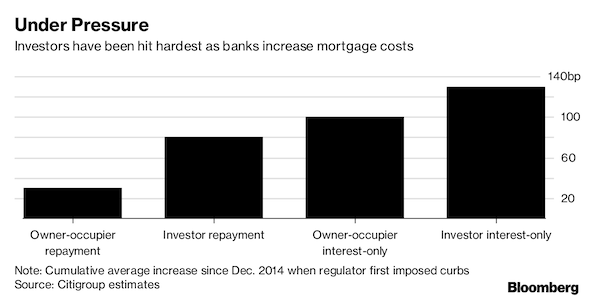

One of the key engines of Australia’s five-year housing boom is losing steam. Property investors, who have helped stoke soaring home prices in Australia, are being squeezed as regulators impose restrictions to rein in lending. The nation’s biggest banks have this year raised minimum deposits, tightened eligibility requirements and increased rates on interest-only mortgages – a form of financing favored by people buying homes to rent out or hold as an investment. Australia’s generous tax breaks for landlords, combined with record-low borrowing costs, have made the nation home to more than 2 million property investors. Demand from those buyers has contributed to a bull run that has catapulted Sydney and Melbourne into the ranks of the world’s priciest property markets. Now, signs are emerging that the curbs are starting to deter speculators – and home prices are finally starting to cool. [..]

The biggest banks have hiked rates on interest-only mortgages by an average of 55 basis points this year, according to Citigroup [..] ..property auction clearance rates in Sydney have held below 70% in seven of the past eight weeks, compared to as high as 81% in March before the curbs were imposed. And investor loans accounted for 37% of new mortgages in May, down from this year’s peak of 41% in January. That’s helping take the heat out of property prices, particularly in Sydney, the world’s second-most expensive housing market. Price growth in the city slowed to 2.2% in the three months through July, down from a peak of 5% earlier this year, CoreLogic said Tuesday. In Melbourne, rolling quarterly price growth has eased to 4.2%. “There have been some signs that conditions in the Sydney and Melbourne markets have eased a little of late,” the Reserve Bank of Australia said on Friday.

Now, with costs increasing, and price growth slowing, property may lose some of its luster as an investment asset. [That] changes “reduce investors’ ability to pay, and means they have to pay owner-occupier values rather than investor values,” said Angie Zigomanis, senior manager, residential property, at BIS Oxford Economics in Melbourne. The restrictions will take “some of the bubble and froth” out of the market, he said, forecasting median Sydney house prices will decline 5% by the end of mid-2019 as investors retreat.

[..] banks may need to get even tougher on lending standards in order to meet the regulator’s order to restrict interest-only loans to 30% of new residential loans by September. Interest-only loans are seen as more risky because borrowers aren’t paying down any principal and may look to sell en-masse if property prices decline.

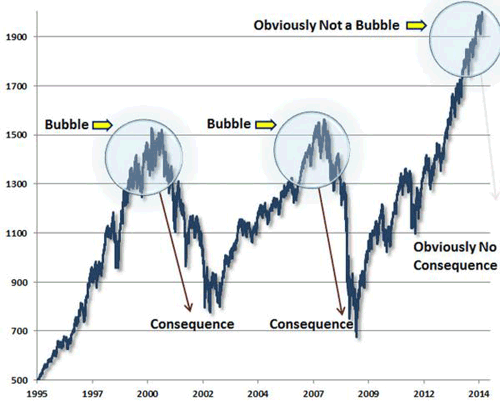

Bubble? Nah…

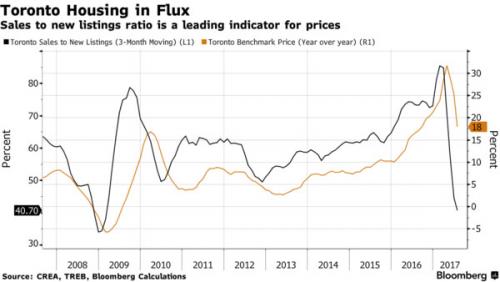

• Toronto Home Prices Suffer Worst Monthly Decline in 17 Years (BBG)

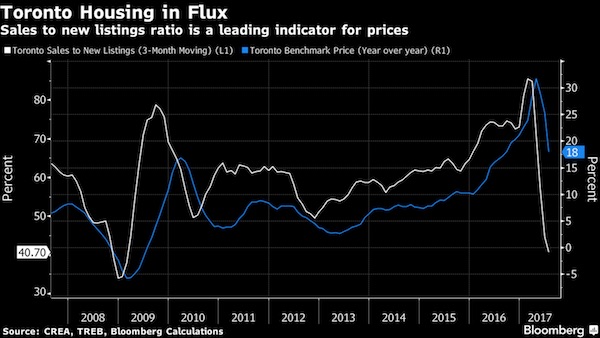

The benchmark Toronto property price, which tracks a typical home over time, dropped 4.6% to C$773,000 ($613,000) from June. That’s the biggest monthly drop since records for the price index began in 2000, according to Bloomberg calculations, and brings prices down to roughly March levels. Prices are still up 18% from the same month a year ago, according to the Toronto Real Estate Board. Transactions tumbled 40% to 5,921, the biggest year-over-year decline since 2009, led by detached homes. The average price, which includes all property types, rose 5% to C$746,218 from July 2016. That compares with a 17% increase at this time last year.

“..transactions tumbled 40.4%..”

• Toronto Housing Market Implodes: Prices Plunge Most On Record (ZH)

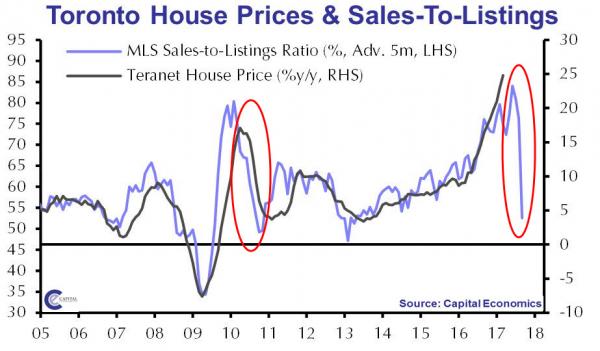

Until mid 2017, it appeared that nothing could stop the Toronto home price juggernaut:

And yet, In early May we wrote that “The Toronto Housing Market Is About To Collapse”, when we showed the flood of new home listings that had hit the market the market, coupled with an extreme lack of affordability, which as we said “means homes will be unattainable to all but the oligarchs seeking safe-haven for their ‘hard’-hidden gains, prices will have to adjust rather rapidly.”

Exactly three months later we were proven right, because less than a year after Vancouver’s housing market disintegrated – if only briefly after the province of British Columbia instituted a 15% foreign buyer tax spooking the hordes of Chinese bidders who promptly returned after a several month hiatus sending prices to new all time highs – just a few months later it’s now Toronto’s turn. On Thursday, the Toronto Real Estate Board reported that July home prices in Canada’s largest city suffered their biggest monthly drop on record amid government efforts to cool the market and the near-collapse of Home Capital Group spooked speculators. The benchmark Toronto property price, while higher 18% Y/Y, plunged 4.6% to C$773,000 ($613,000) from June. That was biggest monthly drop since records for the price index began in 2000, and brought prices down in the metro area to March levels.

More troubling than the price drop, however, was the sudden paralysis in the market as buyers and sellers violently disagreed about fair clearing prices and transactions tumbled 40.4% to 5,921, the biggest year-over-year decline since 2009, led by the detached market segment.

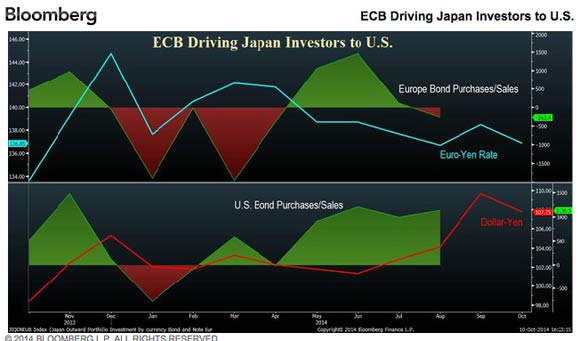

Wolf Richter with a good example of just how detructive Draghi’s -and other central bankers’- QE really is. The bonds may go nuts, but Draghi IS nuts. Or rather, Europeans are nuts not to stop him.

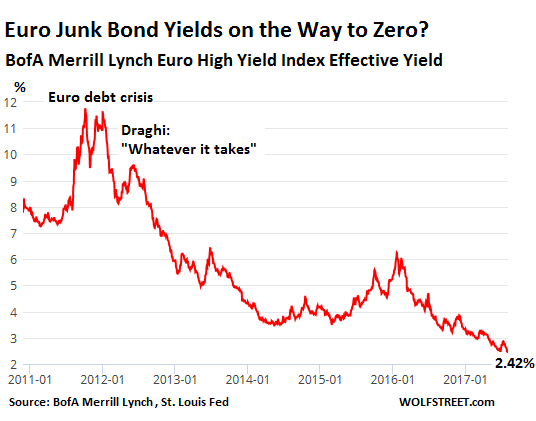

• Euro Junk Bonds and “Reverse Yankees” Go Nuts (WS)

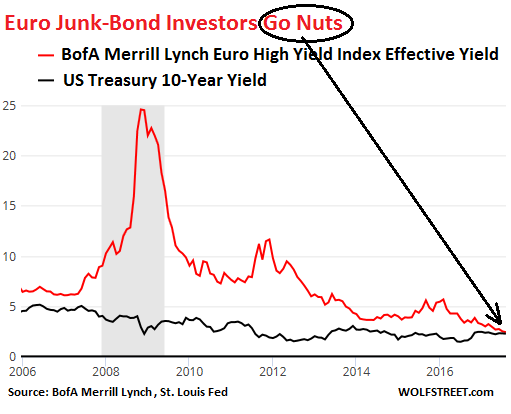

The ECB’s efforts to buy corporate bonds as part of its stupendous asset buying binge has not only pushed a number of government bond yields below zero, where investors are guaranteed a loss if they hold the bond to maturity, but it has also done a number – perhaps even a bigger one – on the euro junk-bond market. It has totally gone nuts. Or rather the humans and algorithms that make the buying decisions have gone nuts. The average junk bond yield has dropped to an all-time record low of 2.42%. Let that sink in for a moment. This average is based on a basket of below investment-grade corporate bonds denominated in euros. Often enough, the issuers are junk-rated American companies with European subsidiaries – in which case these bonds are called “reverse Yankees.”

These bonds include the riskiest bonds out there. Plenty of them will default, and losses will be painful, and investors – these humans and algos – know this too. This is not a secret. That’s why these bonds are rated below investment grade. But these buyers don’t mind. They’re institutional investors managing other people’s money, and they don’t need to mind. [..] The average yield of these junk bonds never dropped below 5% until October 2013. In the summer of 2012, during the dog days of the debt crisis when Draghi pronounced the magic words that he’d do “whatever it takes,” these bonds yielded about 9%, which might have been about right. Since then, yields have plunged (data by BofA Merrill Lynch Euro High Yield Index Effective Yield via St. Louis Fed). The “on the Way to Zero” in the chart’s title is only partially tongue-in-cheek:

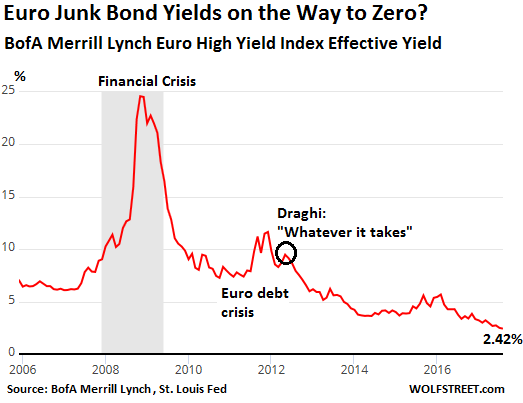

The chart below gives a little more perspective on this miracle of central-bank market manipulation, going back to 2006. It shows the spike in yield to 25% during the US-engineered Financial Crisis and the comparatively mild uptick in yield during the Eurozone-engineered debt crisis:

How does this fit into the overall scheme of things? For example, compared to the US Treasury yield? US Treasury securities are considered the most liquid and the most conservative investments. They’re considered as close to a risk-free financial instrument as you’re going to get on this earth. Turns out, from November 2016 until now, the 10-year US Treasury yield has ranged from 2.14% to 2.62%, comfortably straddling the current average euro junk bond yield of 2.42%.

If you want to earn a yield of about 2.4%, which instrument would you rather have in your portfolio, given that both produce about the same yield, and given that one has a significant chance of defaulting and getting you stuck with a big loss, while the other is considered the safest most boring financial investment out there? The answer would normally be totally obvious, but not in the Draghi’s nutty bailiwick. That this sort of relentless and blind chase for yield – however fun it may be today – will lead to hair-raising losses later is a given. And we already know who will take those losses: The clients of these institutional investors, the beneficiaries of pension funds and life insurance retirement programs, the hapless owners of bond funds, and the like.

In terms of the broader economy: When no one can price risk anymore, when there’s in fact no apparent difference anymore between euro junk bonds and US Treasuries, then all kinds of bad economic decisions are going to be made and capital is going to get misallocated, and it’s going to be Draghi’s royal mess.

Hint for central bankers: look at money velocity. People don’t spend, they borrow. Keyword: debt.

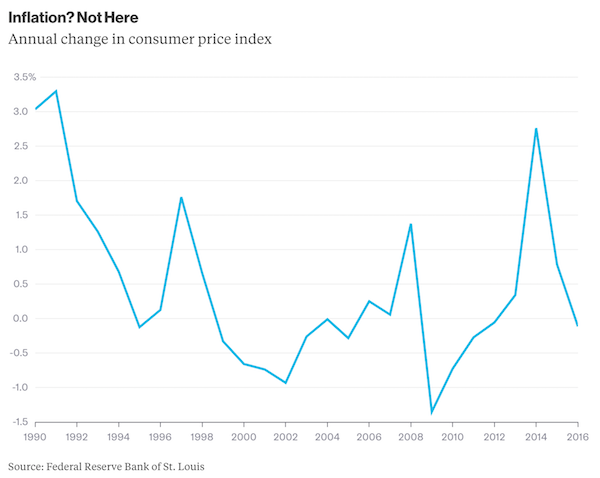

• Global Inflation Hits Lowest Level Since 2009 (WSJ)

Inflation in the Group of 20 largest economies fell to its lowest level in almost eight years in June, deepening a puzzle confronting central banks as they contemplate removing post-crisis stimulus measures. The OECD said Thursday that consumer prices across the G-20—the countries that accounts for most of the world’s economic activity—were 2% higher than a year earlier. The last time inflation was lower was in October 2009, when it stood at 1.7%, as the world started to emerge from the sharp economic downturn that followed the global financial crisis. The contrast between then and now highlights the mystery facing central bankers in developed economies as they attempt to raise inflation to their targets, which they have persistently undershot in recent years.

According to central bankers, inflation is generated by the gap between the demand for goods and services and the economy’s ability to supply them. As the economy grows and demand strengthens, that output gap should narrow and prices should rise. Right now, the reverse appears to be happening. Across the G-20, economic growth firmed in the final three months of 2016 and stayed at that faster pace in the first three months of 2017. Growth figures for the second quarter are incomplete, but those available for the U.S., the eurozone and China don’t point to a slowdown. Indeed, Capital Economics estimates that on an annualized basis, global economic growth picked up to 3.7% in the three months to June from 3.2% in the first quarter.

At what point are mainstream economists going to admit they have no clue as to what’s going on? It all sounds like if reality doesn’t fit their models, something must be wrong with reality.

• Japan Buries Our Most-Cherished Economic Ideas (BBG)

Japan is the graveyard of economic theories. The country has had ultralow interest rates and run huge government deficits for decades, with no sign of the inflation that many economists assume would be the natural result. Now, after years of trying almost every trick in the book to reflate the economy, the Bank of Japan is finally bowing to the inevitable. The BOJ’s “dot plot” shows that almost none of the central bank’s nine board members believe that the country will reach its 2% inflation target. Accordingly, the bank has pushed back the date at which it expects to hit its 2% target. That’s a little comical, since by now it should be fairly obvious that the date will only get pushed back again and again. If some outside force intervenes to raise inflation to 2%, the BOJ will declare that it hit the target, but it’s pretty clear it has absolutely no idea how to engineer a deliberate rise in inflation.

The bank will probably keep interest rates at zero indefinitely, but if decades of that policy haven’t produced any inflation, what reason is there to think that decades more will do the trick? Some economists think more fiscal deficits could help raise inflation. That’s consistent with a theory called the “fiscal theory of the price level,” or FTPL. But a quick look at Japan’s recent history should make us skeptical of that theory – even as government debt has steadily climbed, inflation has stumbled along at close to 0%. Japan’s situation should also give pause to economists who want to resurrect the idea of the Phillips Curve, which purports to show a stable relationship between unemployment and inflation. Japan’s persistently low inflation comes even though essentially everyone in Japan who wants a job has one.

Yeah sure, and then double again the next 25 years.

• Britain’s Finance Sector Will Double In Size In 25 Years – Mark Carney (G.)

The governor of the Bank of England has predicted that the financial sector could double in size to be 20 times as big as GDP within the next 25 years, but warned that the government must hold its nerve and resist pressure to water down regulation after Brexit. Speaking to the Guardian to mark the 10th anniversary of the start of the global financial crisis in August 2007,[..] eant repeating the risky speculation of a decade ago. Carney dismissed suggestions that London could become a financial centre with only light-touch regulation – often dubbed Singapore-on-Thames – in order to attract business after the UK left the EU. He said the size of the financial sector would increase relative to the size of the economy if things went according to plan after Brexit and that meant there could be no going back to the lax regime that existed before 2007.

The Bank, he said, was aware that “we have a financial system that is ten times the size of this economy … It brings many strengths, it brings a million jobs, it pays 11% of tax revenue, it is the biggest export industry by some token … All good things. But it’s risky”. He went on: “We have a view… that post-Brexit the level of regulation will be at least as high as it currently is and that’s a level that in many cases substantially exceeds international norms. “There’s a reason for that, because we’re not going to to go the lowest common denominator in a system that is 10 times size of GDP. If the UK financial system thrives in a post-Brexit world, which is the plan, it will not be 10 times GDP, it will be 15 to 20 times GDP in another quarter of century because we will keep our market share of cross-border capital flows. Well then you really have to hold your nerve and keep the focus.”

I told you: feudal. UK needs full reset.

• London’s “Land Banking” Ventures Expose Startling Wealth Inequality (O.)

No place is feeling the bite of the UK housing crisis quite as savagely as London. While homelessness, social housing heartbreak and painfully high housing costs reveal the harsh reality of living in Britain’s capital, empty property numbers in London stand at their highest level in 20 years. Who are the culprits? Many would argue it’s the billionaires, whose “land banking” ventures are becoming ever more profitable. At a time when wealthy people purchase property and leave it empty, only to make a huge profit when they sell their investment, ordinary citizens are living in the throes of a 21st century housing crisis that is crippling the capital. Recent government figures show around 1.4 million homes have been lying vacant in the UK for at least six months – the highest level of “spare” homes in two decades.

At the same time, London has witnessed a staggering 456% increase in “land banking” over the last 20 years. Kensington and Chelsea – London’s richest borough, where the Grenfell Tower tragedy took place – has the highest number of empty homes. Land banking in London has long been exploited by the super-rich. In 2014, one-third of the mansions stood empty on Bishops Avenue, a single street in north London that has been dubbed “Billionaires Row,” which ranked as the UK’s second most expensive street with an estimated £350 million worth of empty properties. The famous row of mansions – believed to be owned by members of the Saudi royal family – has stood virtually unused since being bought by investors between 1989 and 1993.

Putin says he likes globalization, but his country increasingly takes care of itself. The sanctions work to strengthen Russia, the opposite of what America hopes to achieve. Hopefully Russia doesn’t turn tomatoes into some large industrial thing.

• Russian Ban On Turkish Tomatoes Bears Domestic Fruit (R.)

A ban on Turkish tomato imports that was motivated by geopolitics has inspired Russia to become self-sufficient in tomato production, a windfall for companies who invested in the technology that would increase year-round production. Russia has been ramping up production of meats, cheese and vegetables since it banned most Western food imports in 2014 as a retaliatory measure for sanctions meant to punish Russia’s support of rebels in eastern Ukraine and annexation of Crimea. After Turkey shot down a Russian jet near the Syrian border in November 2015, Moscow expanded the ban to include Turkish tomatoes, for which Russia was the biggest export market. Ties between Ankara and Moscow have since largely normalized but the ban remains in place and may not be lifted for another three to five years, officials have said.

That may be too late for Turkish exporters if Russian efforts to ramp up domestic production bear fruit. Greenhouse projects being built with state support are key to Russia’s plans to become self-sufficient for its 144 million population by 2020, industry players, analysts and officials say. Although Russia only imports about 500,000 tonnes of the 3.4 million tonnes of tomatoes consumed annually, the country’s notoriously harsh winters have limited its ability to ramp up to full capacity, IKAR agriculture consultancy said. Currently only 620,000 tonnes of production comes from “protected ground”, or greenhouses, IKAR said. The remainder comes from “open ground” productive only from June to September, and most of that comes from private plots maintained and used by individual families or sold at local farmers’ markets.

This is what I wrote the other day I fear will happen if Americans don’t stop the demonization of Trump. Really, you should all think again, or you’ll find yourself in a war that nobody can oversee.

• Trump Will Now Become the War President (Paul Craig Roberts)

President Trump has been defeated by the military/security complex and forced into continuing the orchestrated and dangerous tensions with Russia. Trump’s defeat has taught the Russians the lesson I have been trying to teach them for years, and that is that Russia is much more valuable to Washington as an enemy than as a friend. Do we now conclude with Russia’s Prime Minister Dmitry Medvedev that Trump is washed up and “utterly powerless?” I think not. Trump is by nature a leader. He wants to be out front, and that is where his personality will compel him to be. Having been prevented by the military/security complex, both US political parties, the presstitute media, the liberal-progressive-left, and Washington’s European vassals from being out front as a leader for peace, Trump will now be the leader for war. This is the only permissible role that the CIA and armaments industry will permit him to have.

Losing the chance for peace might cost all of us our lives. Now that Russia and China see that Washington is unwilling to share the world stage with them, Russia and China will have to become more confrontational with Washington in order to prevent Washington from marginalizing them. Preparations for war will become central in order to protect the interests of the two countries. The situation is far more dangerous than at any time of the Cold War. The foolish American liberal-progressive-left, wrapped up as they are in Identity Politics and hatred of “the Trump deplorables,” joined the military/security complex’s attack on Trump. So did the whores, who pretend to be a Western media, and Washington’s European vassals, not one of whom had enough intelligence to see that the outcome of the attack on Trump would be an escalation of conflict with Russia, conflict that is not in Europe’s business and security interests.

Washington is already raising the violence threshold. The same lies that Washington told about Saddam Hussein, Gadaffi, Assad, Iran, Serbia and Russia are now being told about Venezuela. The American presstitutes duly report the lies handed to them by the CIA just as Udo Ulfkotte and Seymour Hersh report. These lies comprise the propaganda that conditions Western peoples to accept the coming US coup against the democratic government in Venezuela and its replacement with a Washington-compliant government that will permit the renewal of US corporate exploitation of Venezuela.

As the productive elements of American capitalism fall away, the exploitative elements become its essence. After Venezuela, there will be more South American victims. As reduced tensions with Russia are no longer in prospect, there is no reason for the US to abandon its and Israel’s determination to overthrow the Syrian government and then the Iranian government. The easy wars against Iraq, Libya, and Somalia are to be followed by far more perilous conflict with Iran, Russia, and China This is the outcome of John Brennan’s defeat of President Trump.

Two pieces on the IMF’s own internal report.

• IMF Admits Disastrous Love Affair With Euro and Immolation Of Greece (Tel)

The IMF’s top staff misled their own board, made a series of calamitous misjudgments in Greece, became euphoric cheerleaders for the euro project, ignored warning signs of impending crisis, and collectively failed to grasp an elemental concept of currency theory. This is the lacerating verdict of the IMF’s top watchdog on the fund’s tangled political role in the eurozone debt crisis, the most damaging episode in the history of the Bretton Woods institutions. “Many documents were prepared outside the regular established channels; written documentation on some sensitive matters could not be located” It describes a “culture of complacency”, prone to “superficial and mechanistic” analysis, and traces a shocking breakdown in the governance of the IMF, leaving it unclear who is ultimately in charge of this extremely powerful organisation.

The report by the IMF’s Independent Evaluation Office (IEO) goes above the head of the managing director, Christine Lagarde. It answers solely to the board of executive directors, and those from Asia and Latin America are clearly incensed at the way European Union insiders used the fund to rescue their own rich currency union and banking system. The three main bailouts for Greece, Portugal and Ireland were unprecedented in scale and character. The trio were each allowed to borrow over 2,000pc of their allocated quota – more than three times the normal limit – and accounted for 80pc of all lending by the fund between 2011 and 2014. In an astonishing admission, the report said its own investigators were unable to obtain key records or penetrate the activities of secretive “ad-hoc task forces”. Mrs Lagarde herself is not accused of obstruction.

“Many documents were prepared outside the regular established channels; written documentation on some sensitive matters could not be located. The IEO in some instances has not been able to determine who made certain decisions or what information was available, nor has it been able to assess the relative roles of management and staff,” it said. “The IMF remained upbeat about the soundness of the European banking system… this lapse was largely due to the IMF’s readiness to take the reassurances of national and euro area authorities at face value..” [..] “Before the launch of the euro, the IMF’s public statements tended to emphasise the advantages of the common currency,” it said. Some staff members warned that the design of the euro was fundamentally flawed but they were overruled.

[..] In Greece, the IMF violated its own cardinal rule by signing off on a bailout in 2010 even though it could offer no assurance that the package would bring the country’s debts under control or clear the way for recovery, and many suspected from the start that it was doomed. The organisation got around this by slipping through a radical change in IMF rescue policy, allowing an exemption (since abolished) if there was a risk of systemic contagion. “The board was not consulted or informed,” it said. The directors discovered the bombshell “tucked into the text” of the Greek package, but by then it was a fait accompli.

Bill Mitchell read the whole thing.

• Why Have No IMF Officials Been Prosecuted For Malpractice In Greece? (Bilbo)

I have just finished reading the 474-page Background Papers that the IEO released in 2016 and which formed the basis of its June 2016 Evaluation Report – The IMF and the Crises in Greece, Ireland, and Portugal. It is not a pretty story. It seems that the incompetence driven by the blind adherence to Groupthink that the earlier Reports had highlighted went a step further into what I would consider to be criminality plain and simple. The IEO found that IMF officials and economists violated the rules of their own organisation, hid documents, presumably to hide their chicanery and generally displayed a high level of incompetence including failing to under the implications of a common currency – pretty basic errors, in other words. The IEO Report sought to evaluate: “… the IMF’s engagement with the euro area during these crises in order to draw lessons and to enhance transparency..”

The period under review was 2010 to 2013, which covered the “2010 Stand-By Arrangement with Greece, the 2010 Extended Arrangement with Ireland, and the 2011 Extended Arrangement with Portugal.” The IEO noted that the IMF involvement with the Troika was quite different to its normal operations. 1. “the euro area programs were the first instances of direct IMF involvement in adjustment programs for advanced, financially developed, and financially open countries within a currency union”. 2. “they involved intense collaboration with regional partners who also were providing conditional financial assistance, and the modality of collaboration evolved in real time.” 3. “the amounts committed by the IMF … were exceptionally large … exceeded the normal limits of 200% of quota for any 12-month period or 600% cumulatively over the life of the program. In all three countries, access exceeded 2,000% of quota.”

So one would think that the IMF would have exercised especial care and been committed to transparency, given that for the “financial years 2011-14, these countries accounted for nearly 80% of the total lending provided by the IMF”. It didn’t turn out that way. Interestingly, the IEO for all its independence was set upon by “several Executive Directors and other senior IMF officials” at the outset of the evaluation process (when establishing the Terms of Reference), who claimed that the 2012 Bailout was just a “continuation of the 2010 SBA” and so it was not possible to evaluate them separately. In other words, the IMF was trying to close down assessment of its activities.