Rene Magritte Memory 1948

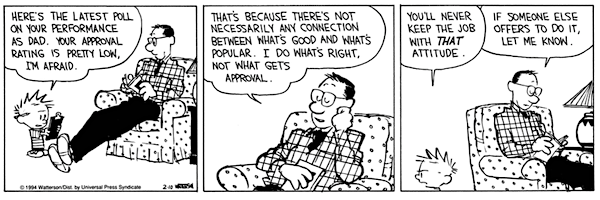

We’re digging ever deeper into politics. 25 days to go. And here comes the 25th Amendment commission.

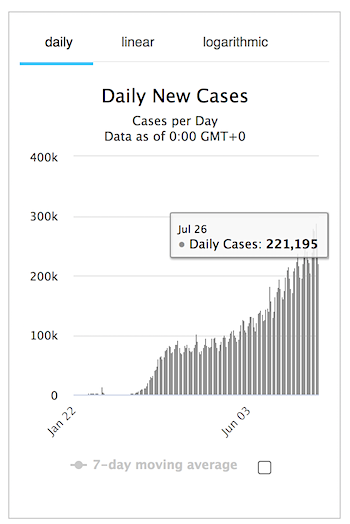

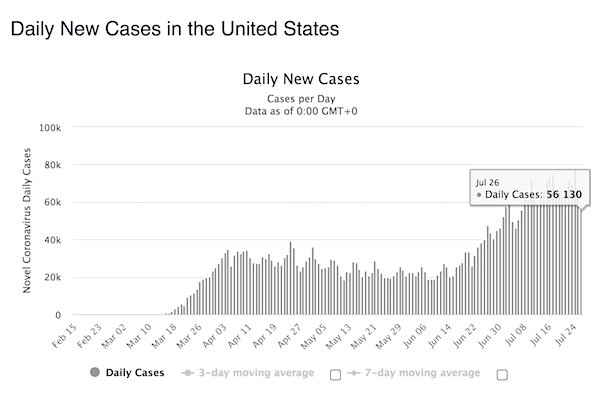

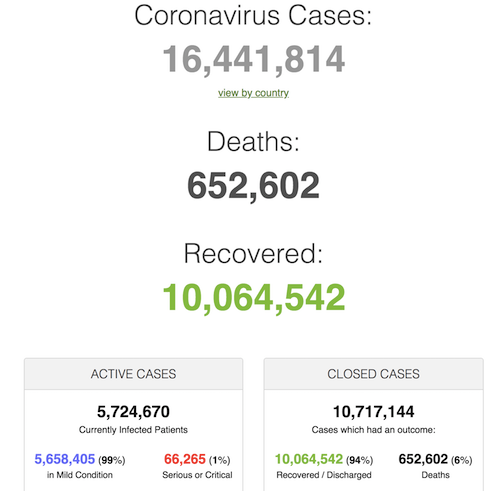

Trump VS Covid – Who Won?! | Russell Brand

“She accused him just this week of being in an “altered state.”

• Pelosi’s 25th Amendment Commission Is To Replace Biden With Kamala – Trump (RT)

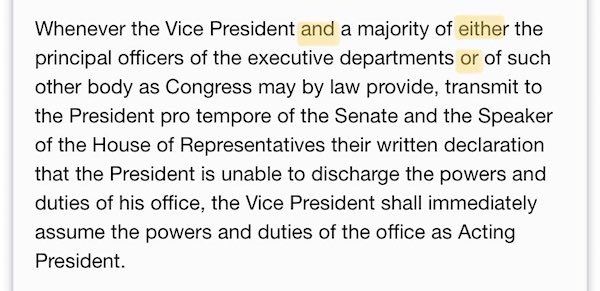

Soon after Rep. Nancy Pelosi introduced a commission that would allow Congress to remove a mentally unfit president, Donald Trump tweeted a claim its ulterior motive is to replace Democratic candidate Joe Biden with Kamala Harris.“This is not about President Trump,” Speaker of the House Pelosi said when announcing the legislation on Friday. “He will face the judgment of the voters. But he shows the need for us to create a process for future presidents.” Instead, the commission is needed to give “some comfort to people” about government stability, Pelosi (D-California) insisted. Some, however, were not convinced the commission is meant as just an additional safety mechanism in the time of the Covid-19 pandemic.

Pelosi’s assurance the legislation wasn’t about Trump has quickly sparked a theory that such a commission could be used to replace 77-year-old Joe Biden – whose own mental stability has been steadily questioned – should he win the election next month. President Trump himself floated that theory on Twitter shortly after Pelosi’s announcement. “Crazy Nancy Pelosi is looking at the 25th Amendment in order to replace Joe Biden with Kamala Harris. The Dems want that to happen fast because Sleepy Joe is out of it!!!” Trump wrote. Others, including former Speaker of the House Newt Gingrich, have similarly lobbed the accusation at Pelosi.

“Pelosi is talking about 25th amendment replacing incapacitated President as trial run for replacing Biden with Harris next Spring if they win,” Gingrich tweeted. “Target is Biden not Trump,” he added. Under the 25th Amendment, a president can be stripped of their authority if they are deemed unfit for some reason to carry out their duties. This requires a two-thirds vote from both houses. Pelosi’s bill, however, would make this potential commission the determining body about a president’s fitness. Pelosi has questioned the health of the president since he was diagnosed with Covid-19 and left Walter Reed Medical Center. She accused him just this week of being in an “altered state.”

“That Harris could become president without winning a single delegate in the primaries – having dropped out before they even started – seems an irony completely lost on the media and the party..”

• 25th Amendment Body: Unelected Bureaucrats Vs The Will Of American People (RT)

In addition to paving the way for a Harris administration, the proposed commission to govern the usurpation of presidential powers would create a ‘Deep State’-like cabal, including former officials, to gate-keep the White House. The pompously named Commission on Presidential Capacity to Discharge the Powers and Duties of Office, unveiled on Friday by House Speaker Nancy Pelosi (D-California) and Rep. Jamie Raskin (D-Maryland) is technically based on the provision in the 25th Amendment of the US Constitution, allowing for “such other body as Congress may by law provide” to govern the process of succession should a president become “incapacitated.”

With just weeks left till the November 3 election, and zero chance of the Republican-majority Senate or President Donald Trump endorsing the proposal, it’s unclear at first why the Democrats would unveil it now. Pelosi swears this isn’t about Trump. “He will face the judgment of the voters,” she told reporters on Friday. “But he shows the need for us to create a process for future presidents.” It didn’t take long for a number of people – from former House Speaker Newt Gingrich to Trump himself – to bring up the obvious: the first target of such a “process” may well be Joe Biden. In one of his more lucid moments, the 77-year-old actually said he wanted his running mate ready to take over “on day one.” Then he picked Senator Kamala Harris for the job.

That Harris could become president without winning a single delegate in the primaries – having dropped out before they even started – seems an irony completely lost on the media and the party normally harping on about “our democracy,” norms and traditions. No less intriguing than the “what” of the commission is the “how.” Raskin’s proposal envisions a 17-member panel, with 16 members appointed by congressional leaders of both parties electing the last one. Half the appointees would be physicians and psychiatrists, while the other eight would be chosen from the pool of former government officials: presidents, vice-presidents, surgeons-general, and heads of the departments of State, Treasury, Defense and Justice.

“Speaker Pelosi is not involved in her husband’s investments and was not aware of the investment until the required filing was made.”

• Pelosis Take a Big Stake in CrowdStrike (Maté)

The cybersecurity firm CrowdStrike rose to global prominence in mid-June 2016 when it publicly accused Russia of hacking the Democratic National Committee and stealing its data. The previously unknown company’s explosive allegation set off a seismic chain of events that engulfs U.S. national politics to this day. The Hillary Clinton campaign seized on CrowdStrike’s claim by accusing Russia of meddling in the election to help Donald Trump. U.S. intelligence officials would soon also endorse CrowdStrike’s allegation and pursue what amounted to a multi-year, all-consuming investigation of Russian interference and Trump’s potential complicity.

With the next presidential election now in its final weeks, the Democrats’ national leader, House Speaker Nancy Pelosi, and her husband, Paul Pelosi, are endorsing the publicly traded firm in a different way. Recent financial disclosure filings show the couple have invested up to $1 million in CrowdStrike Holdings. The Pelosis purchased the stock at a share price of $129.25 on Sept. 3. At the time of this article’s publication, the price has risen to $142.97. Drew Hammill, spokesman for Pelosi, said: “Speaker Pelosi is not involved in her husband’s investments and was not aware of the investment until the required filing was made. Mr. Pelosi is a private investor and has investments in a number of publicly traded companies. The Speaker fully complies with House Rules and the relevant statutory requirements.” The Pelosis’ sizeable investment in CrowdStrike could revive scrutiny of the company’s involvement in the Trump-Russia saga since the Democrats’ 2016 election loss.

After generating the hacking allegation against Russia in 2016, CrowdStrike played a critical role in the FBI’s ensuing investigation of the DNC data theft. CrowdStrike executives shared intelligence with the FBI on a consistent basis, making dozens of contacts in the investigation’s early months. According to Esquire, when U.S. intelligence officials first accused Russia of conducting malicious cyber activity in October 2016, a senior U.S. government official personally alerted CrowdStrike co-founder Dmitri Alperovitch and thanked him “for pushing the government along.” The final reports of both Special Counsel Robert Mueller and the Senate Intelligence Committee cite CrowdStrike’s forensics. The firm’s centrality to Russiagate has drawn the ire of President Trump. During the fateful July 2019 phone call that would later trigger impeachment proceedings, Trump asked Ukraine’s Volodymyr Zelensky to scrutinize CrowdStrike’s role in the DNC server breach, suggesting that the company may have been involved in hiding the real perpetrators.

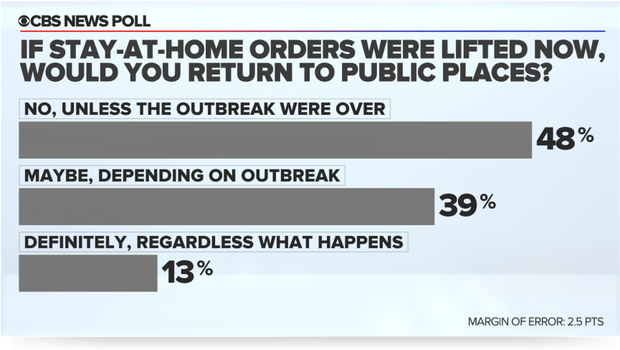

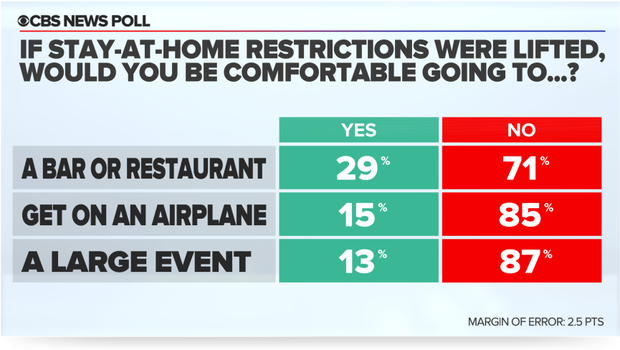

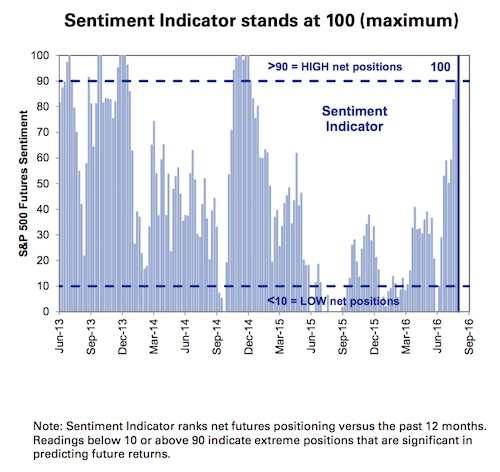

Looks very different from all the polls the media cites all the time. How come?

• Poll That Called 2016 Election Sees Another Shocking Outcome In November (ZH)

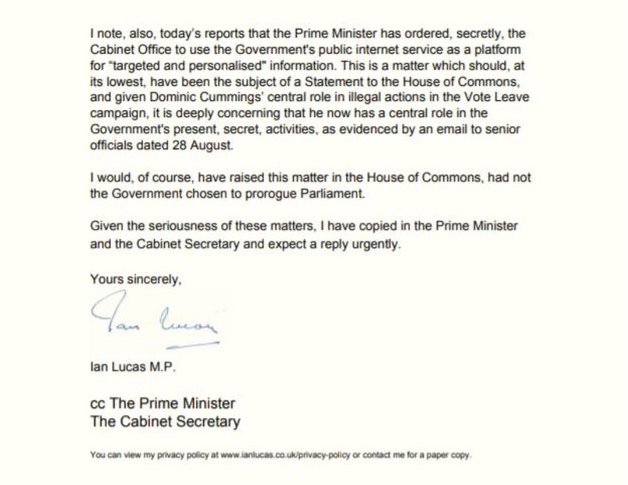

With Election Day less than a month away, we look at which party will likely control the White House, Senate and House in 2020… and what to watch for on Election Night. Currently, the major polls give former Vice President Biden more than a 9-point lead nationally against President Trump – according to RealClearPolitics National Average. And the Predictit markets imply a 67% probability of Biden winning on November 3rd. Additionally, those markets suggest that Democrats will win both the Senate and House (66% and 88% probabilities, respectively). Quite simply, it appears that a Blue Wave is fast approaching, something which the market has not only priced in, but has successfully digested as a favorable narrative for risk assets.

It would be easy to simply close the books and call the November contest over. But, of course, the major polls were all wrong in 2016; notably about the presidential race. In the following Election Review from Camelot Portfolios, we look at what some of the polling firms that called 2016 correctly are seeing today. “Shocking”, their polling suggests that President Trump will be re-elected, either narrowly or by a large margin. Therefore, as Camelot notes, “capital allocators today cannot easily assume next month’s results.” It’s very possible that Trump will win Florida, North Carolina and Arizona. If so, a win in Pennsylvania or Michigan will likely put him over the top in the electoral college. And speaking of “shocking”, Camelot notes that as far as the Senate and House are concerned, it also appears that Republicans will keep control of the Senate, especially if Trump has a strong night. On the other hand, the House is highly likely to remain in Democratic control.

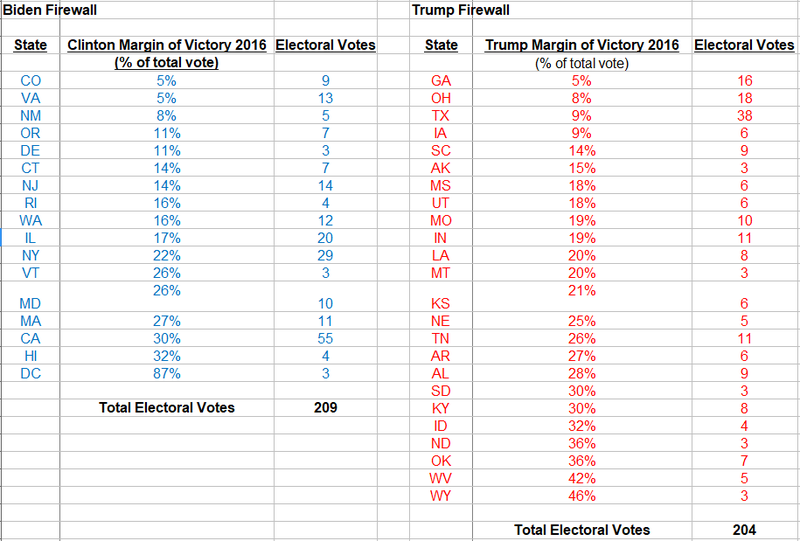

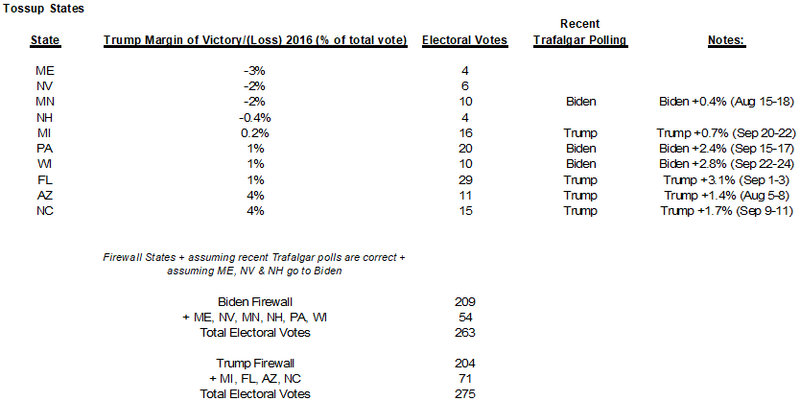

[..] Trafalgar Group was named best polling firm of 2016 presidential race. It was one of few pollsters to predict Trump would win PA and MI (sources: Trafalgar Group and RealClearPolitics) and also Trump’s victory. [..] The secret to Trafalgar’s success is that it best adjusted its polling to include ‘shy Trump voters’ and the votes missed in other polls. Democracy Institute also correctly predicted Trump’s victory in 2016, as well as Brexit. Which brings us to today, and what Camelot Portfolios sees as the likely firewall states for Trump and Biden:

Which brings us to the punchline, and what Trafalgar sees as the outcome on Nov 3. In a nutshell, based on Trafalgar swing state polls, Trumps wins with 275 electoral votes:

What about the “winner” in the 2016 polling fiasco, the Democracy Institute, and its Latest Poll for September:

• Only asks likely voters, and asks about so-called ‘shy votes’.

• Trump leads Biden 46%-45%, nationally.

• Trump leads in swing states (FL, IA, MI, MN, PA, WI) 47% to 43%.

• Trump’s swing state leads would give him 320 electoral votes, and Biden 218.

• 77% of Trump voters would not admit to friends and family.

• Amy Coney Barrett nomination has little impact on approximately 8 in 10 voters.

• Law and order is top issue (32%). Economy is second (30%).

• Voters trust Trump more on economy than Biden: 60% to 40%, respectively

“The attempt to remove President Trump from office encompassed all three branches of the U.S. government.”

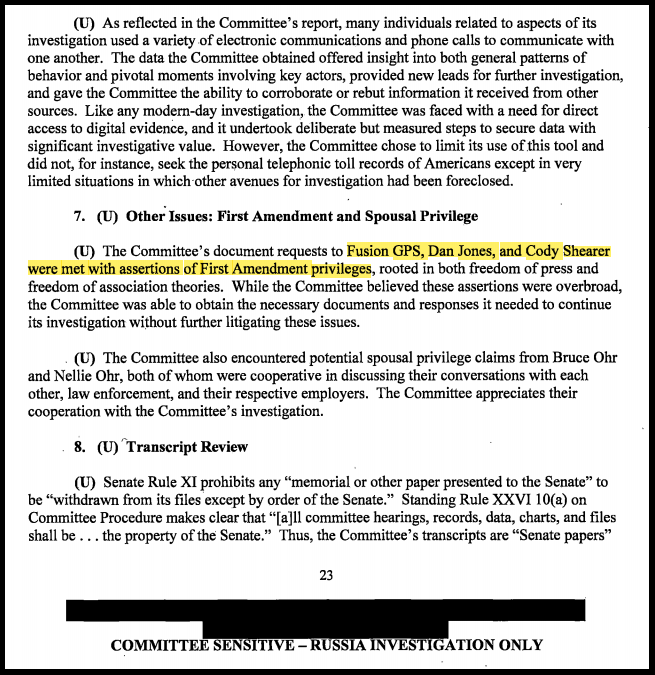

• SSCI Allowed Dan Jones, Fusion-GPS, Shearer to Avoid Questioning (sundance)

A fantastic catch by Twitter user “15poundstogo” highlights a key phrase within the Senate Select Intelligence Committee (SSCI) Russia Report Volume-5, showing how the SSCI allowed those who created the Trump-Russia narrative to avoid questioning. This is a very important detail to underpin the report we shared yesterday about former Dianne Feinstein top staffer Dan Jones attempting to avoid a subpoena from U.S. Attorney John Durham. This key highlight from the SSCI is evidence of how the attempted coup against President Trump was coordinated by people outside government and inside government.

Dan Jones left the SSCI prior to the 2016 election and went to work pushing the Trump-Russia narrative through his media contacts. Jones took over funding Fusion-GPS and Chris Steele in 2017 at the same time Senator Mark Warner took over as SSCI vice-chairman. Dan Jones and Mark Warner coordinated the efforts outside and inside government on the same objective. The Senate Intel Committee was part of the effort. As a result of their alignment and common purpose the SSCI didn’t investigate the origin of the Trump-Russia narrative; and instead positioned themselves as a shield to block any investigative inquiry into what took place. THIS IS A BIG DEAL !

The attempt to remove President Trump from office encompassed all three branches of the U.S. government.

• Executive Branch – FBI, DOJ, CIA, State Dept., and Special Counsel Office.

• Legislative Branch – SSCI in 2017 and 2018 with an assist from House Intelligence Committee and House Judiciary in 2019 and 2020.

• Judicial Branch – FISA Court 2015, 2016, 2017; Federal Judges (Sullivan, Walton, Howell, Berman-Jackson) in alignment with DC intents in 2018, 2019 and 2020.How does the office of the United States president; and more importantly a constitutional republic itself; survive a coordinated coup effort that involves all three branches of government; while simultaneously those in charge of exposing the corruption fear the scale of the effort is too damaging for the U.S. government to reveal?

A second part of the same article cited above.

On June 7, 2018, an indictment against Senate Intelligence Committee Security Director James Wolfe was unsealed. Approximately six weeks later, July 21, 2018, the DOJ mysteriously declassified and publicly released the Carter Page FISA application. That’s when I noticed the first two documents were related. The FISA application was the “top secret classified document” described in the Wolfe indictment. Immediately I recognized it wasn’t just any copy of the FISA application that was released by the DOJ; but rather a very specific copy of the FISA application. What the DOJ released was the exact copy used in the 2017 leak investigation of James Wolfe. The ramifications of this specific copy being publicly released were immediately noted, although almost everyone seemed to gloss over the issue in favor of discussing the content.

Over the course of the next several months the ramifications became more clear. Despite overwhelming evidence James Wolfe was never charged with leaking the FISA application on March 17, 2017. Quite the contrary, even to this day the official position of the FBI, DOJ and U.S. government is that Wolfe *did not* leak the FISA application. There’s a very big reason for that. First, it must be remembered the goal of the DOJ under former AG Jeff Sessions, despite his recusal on all things Trump, was the removal of political influence in the DOJ. That same objective has been repeated ad infinitum by current AG Bill Barr. This approach is why everyone in/around any issue that skirts on the investigative tissue keeps saying: “a very delicate balance is being navigated”, and “very sensitive approaches” are needed.

None of the former -and some remaining embed- officials in the FBI, DOJ, or Special Counsel actors, had any aversion to the use of weaponized politics in their corrupt investigations of President Trump. However, in the current investigation of the former weaponized political investigations the primary avoidance filter is politics. As expressed by almost everyone in and around the issue, any evidence that comes from inside the political silo is considered unusable. This sets up a rather challenging approach… hence the overused “delicate balances” etc. This overlay, the aggressive need not to use political information, is also frustrating.

Some are beginning to question whether it is actually a shield to justify a lack of accountability or institutional preservation. Keep up the pressure, the concerns are valid. The public doesn’t draw distinctions from the origin of evidence. Regardless of whether information comes from HPSCI ranking member Devin Nunes; and/or Senators Grassley, Johnson or Graham (political silo); or from the DOJ itself via John Bash, Jeff Jensen or John Durham; the public is absorbing all it. However, the current AG Barr instructions imply the non use of evidence emanating from the political silo in very direct terms.

FBI Washington Field Office Special Agent Brian Dugan was given a task in early 2017 to see if he could track down and identify people who were leaking information related to national security. Dugan used a Top-Secret Classified Information request by SSCI Vice-Chairman Mark Warner to begin a very specific leak investigation. On March 17, 2017, Brian Dugan picked-up a copy of the Carter Page FISA application from the FISA Court. He personally delivered that “read and return” copy to the Senate Select Committee on Intelligence Security Director James Wolfe. Shortly after 4:02 pm that same day, Vice-Chairman Mark Warner reviewed the FISA in the senate “scif”.

It is not known if any other SSCI committee member viewed that FISA (there is a great deal of circumstantial evidence to indicate only Wolfe and Warner saw it); however, what is factually certain – is that on the same day as Wolfe and Warner reviewed the FISA, Security Director James Wolfe leaked its content to journalist Ali Watkins. Both the New York Times and Washington Post began reporting on the FISA application. As soon as Ms. Watkins wrote an article for Buzzfeed, April 3, 2017, outlining Carter Page as “person one” in the application, Agent Dugan knew the FISA had been leaked.

” There are reportedly as many as 33,000 e-mails from Clinton’s private server that haven’t been released publicly..”

• Pompeo: Clinton Private Server Emails Could Be Released Before Election (JTN)

Secretary of State Mike Pompeo announced Friday that emails from former Secretary of State Hillary Clinton’s private email server might be released before the Nov. 3 election. Pompeo was asked if he is concerned that revealing the emails would have national security implications given that some of them likely contain classified information. “I’ve been at this a long time with President Trump, for four years now, almost. I’ve never seen him do anything that would put any kind of asset, any one of our officers in harms way. He wouldn’t do that,” Pompeo said on Fox News. “We’ll get the information out that needs to get out.”

Addressing the timing of the potential release of the emails, Pompeo said, “We’re doing it as fast as we can. I certainly think there will be more to see before the election.” President Trump said this week that he had declassified documents from the investigation into Clinton’s use of the private server for e-mail during her tenure as secretary of state, America’s top diplomat. There are reportedly as many as 33,000 e-mails from Clinton’s private server that haven’t been released publicly.

Joh Rubino is a very longtime friend of the Automatic Earth.

“The strategy of breaking the stimulus bill up into pieces puts the Dems in a tough spot, having to oppose saving big, crucial industries and giving money directly to voters in order to protect bail-outs for Dem-run states.”

• Well Played, Mr. President. Sorry To Have Doubted You (John Rubino)

The political and financial worlds were baffled by President Trump’s decision, just hours after being released from the hospital, to suspend coronavirus stimulus bill negotiations “until after the election.” Leaving aside the stupidity of massive new borrowing and spending on top of the past year’s multi-trillions, walking away from those talks seemed like a really bad political move. But then, in almost the same breath, Trump turns around and demands a huge bailout for the airlines and a new round of $1,200 stimulus checks for individuals. Had he joined Biden in the drift toward senility? Or was there some method to the apparent madness? With a little hindsight, it’s clear that this was one of his “Art of the Deal” tactics, albeit in compressed form.

You walk away from stalled talks, get in your car and drive off, leaving the other side stunned and, hopefully, softened up for compromise. Then you restart negotiations with each side a little more flexible, and — in this case the crucial second part of the strategy — the deal broken up into bite-sized, and thus more easily doable, parts. Huh. It appears to be working. Mnuchin and Pelosi are making hopeful sounds and the stock market – addicted as it is to ever-easier money – is now happily anticipating an extended high. Gold, meanwhile, has concluded that the now-imminent debt binge will indeed crush the dollar, sending capital pouring into safe havens. But the politics of this strategy are even more interesting than the finance.

The big conflict here is the Democrats’ burning desire to bail out their party’s governors and mayors colliding with Trump’s aversion to rewarding those officials’ horrendous mismanagement (and refusal to vote Republican). Remember, California, Illinois, New Jersey, and their peers were looking at pension crises (i.e., functional bankruptcy) before the pandemic hit. The strategy of breaking the stimulus bill up into pieces puts the Dems in a tough spot, having to oppose saving big, crucial industries and giving money directly to voters in order to protect bail-outs for Dem-run states. This is not a good place to be going into the election, but it’s where Trump has put them. So, well-played, Mr. President. Whatever else you’ve done, you have indeed taught the rest of us some lessons in hard-ball negotiating. We’ll be better for it no matter where you end up next year.

” If rejecting the $2.1 trillion “Heroes Act” stuffed with Democratic wish-list items such as imposing federal rules banning voter IDs is the result of downing steroids or Remdesivir, every member of Congress should be force-fed those meds.”

• Trump’s Brilliant Stimulus Ploy Rattles Democrats (Peek)

President Trump confounded the pundits once again when be turned the tables on House Speaker Nancy Pelosi (D-Calif.) and called off further negotiations on stimulus relief. For a president running on his ability to build (and rebuild) a strong economy, pulling the plug on a relief bill poised to prop up consumer spending seemed like an act of madness. Indeed, that was what Pelosi hinted, in one of her more reckless and shameful accusations to date, telling “The View” audience recently that taking coronavirus medications may have impacted the president’s “thinking” and that perhaps he needs an “intervention.” If rejecting the $2.1 trillion “Heroes Act” stuffed with Democratic wish-list items such as imposing federal rules banning voter IDs is the result of downing steroids or Remdesivir, every member of congress should be force-fed those meds.

The story, of course, does not end there. Trump pivoted soon thereafter, challenging Pelosi to accept a stream-lined and targeted relief effort. He tweeted, “If I am sent a Stand Alone Bill for Stimulus Checks ($1,200), they will go out to our great people IMMEDIATELY. I am ready to sign right now. Are you listening Nancy?” It was a brilliant move, and should the two sides come together to help the American people – which is the point, right? – Trump will emerge the consummate dealmaker. Americans are disgusted with Congress and its inability to get anything done. In the latest Gallup survey, only 17 percent of the country approved of Congress, while 80 percent disapproved, making Trump’s approval ratings look golden.

That’s down from 30 percent earlier this year, and surely reflects the ongoing warfare between Democrats and Republicans over, among other things, another relief package. As much as voters dislike congressional dysfunction, they must surely also hate the giant, pork-packed bills that govern our country. The “Heroes Act” weighs in at 2,100 pages. Why should doling out money to needy people and businesses require so much ink? Because that’s how Pelosi and, to be fair, her Republican counterparts, bury handouts to their favored constituents and allies. It is deplorable. Trump’s demand that Pelosi simply send out checks to struggling Americans will strike most people as reasonable. But not Madame Speaker. She loves those overstuffed pieces of legislation. After all, she’s the one who agreed to ObamaCare, saying of that 2,700-page monstrosity, “But we have to pass the bill so that you can find out what’s in it.”

The prevailing media-endorsed opinion (aka the Democratic talking point) is that Trump risks being blamed for the cut-off of aid to the unemployed and to small businesses if another bill does not pass. That certainty seems to have prompted Pelosi’s intransigence. She and the Democrats balked at spending anything less than $2 trillion, even knowing the GOP senate would never sign such a bill. But Pelosi has a lot on the line as well. The Blue Dog Democrats wrote a letter to the House speaker recently, in which they urged her “to continue the discussions over the weekend until a deal is achieved.” They further exhorted “Congress [to] stay here in Washington to keep negotiating.” Congress, in fact, has just left town for a six-week break. That’s how much they care about the American people.

” I took him literally but not seriously, in contrast to his supporters who took him seriously but not literally (credit to Peter Thiel for identifying this significant distinction)”

• I Didn’t Vote For Trump In 2016, But I’d Crawl Over Broken Glass Now (Sound)

Even though I had voted for every Republican presidential candidate since 1980, I didn’t vote for Donald Trump in 2016. Many Republican nominees had been huge disappointments to me, and I wasn’t going to vote for yet another GOP candidate I thought would betray my trust. I couldn’t imagine Trump as a genuine conservative who would champion limited government, respect individual freedom and liberty, and protect the unborn — but was I ever wrong. Although I didn’t vote for Trump in 2016, I would crawl over broken glass to vote for him in 2020. In 2016, I was convinced Trump was just another New York liberal. On election night, however, I smiled. I was happy that at least Hillary Clinton wouldn’t be president, and I suspected that the next four years with Trump would at least be entertaining.

The primary reason I didn’t vote for Trump in 2016 was that I didn’t believe him. I didn’t trust that he would be pro-life, a non-negotiable issue for me. His bluster and bravado didn’t appeal to me. I took him literally but not seriously, in contrast to his supporters who took him seriously but not literally (credit to Peter Thiel for identifying this significant distinction). By the time Trump took office, I was willing to give him a chance. He was the president, after all, and deserved the opportunity to prove himself. During the first year of his presidency, I was impressed by his commitment to keeping his campaign promises, unlike most politicians. By the end of 2017, I classified myself as a Trump supporter because of what he had already done as president.

In case you were still wondering exactly how absurd it was that Mueller based his investigation on a report paid for by the Democrats.

• State Dept Officials Cast Doubt On Christopher Steele’s Early Reports (DC)

State Department officials cast doubt on the credibility of several intelligence memos that former British spy Christopher Steele provided the agency in the years before he began investigating Donald Trump, according to emails the Daily Caller News Foundation obtained through a lawsuit. One State Department official, an ambassador to Ukraine, described Steele’s reporting as “flaky.” Another official said that a Steele report sounded “extreme,” and that others “do not ring true.” Despite the potential red flags regarding Steele’s work, the ex-MI6 officer was granted a meeting at Foggy Bottom in the weeks before the 2016 presidential election. During the meeting, Steele shared details later found in a dossier that accused the Trump campaign of conspiring with the Kremlin to influence the election.

Many of Steele’s allegations have been disputed or outright debunked in the years since the dossier was published. The State Department handed over the latest documents as part of a lawsuit that Judicial Watch filed on behalf of The Daily Caller News Foundation on April 25, 2018. The lawsuit sought several categories of records, including all of the reports that Steele provided to State Department officials prior to his investigation of Trump. Steele, who is based in London, had reportedly shared more than 100 intelligence reports about Russia and Ukraine from 2014 to 2016 with Jonathan Winer, who then served as the State Department’s special envoy to Libya.

Winer, a longtime aide to then-Sec. of State John Kerry, passed Steele’s memos to a small group of State Department officials, including Victor Nuland, Paul Jones and Geoffrey Pyatt. The State Department had released heavily redacted versions of Steele’s report through the lawsuit. The officials’ commentary was also largely redacted. The agency disclosed some of the officials’ assessments of Steele’s reports in response to an appeal from Judicial Watch. The email traffic shows initial enthusiasm for Steele’s reports. Nuland, who served as assistant secretary of state for European and Eurasian affairs, and the other officials said that the reports contained valuable insights into Russia and Ukraine.

Big Tech = Secret Service censorship.

• After The QAnon Ban, Who’s Next? (Taibbi)

Facebook announced Tuesday that it’s stepping up efforts to clean its platform of QAnon content: “Starting today, we will remove any Facebook Pages, Groups and Instagram accounts representing QAnon, even if they contain no violent content…” Facebook had already taken several rounds of action against QAnon, including the removal this summer of “over 1,500 Pages and Groups.” Restricting bans to groups featuring “discussions of potential violence” apparently didn’t do the trick, however, so the platform expended bans to include content “tied to real world harm”: “Other QAnon content [is] tied to different forms of real world harm, including recent claims that the west coast wildfires were started by certain groups, which diverted attention of local officials from fighting the fires and protecting the public.”

Describing what QAnon is, in a way that satisfies what its followers would might say represents their belief system and separates out the censorship issue, is not easy. The theory is constantly evolving and not terribly rational. It’s also almost always described by mainstream outlets in terms that implicitly make the case for its banning, referencing concepts like “offline harm” or the above-mentioned “real-world harm” in descriptions. As you’re learning what QAnon is, you’re usually also learning that it is not tolerable or safe. “QAnon was once a fringe phenomenon, the kind most people could safely ignore,” the New York Times wrote recently. “But in recent months, it’s gone mainstream.”

In rough terms, QAnon is a gospel spun by “Q,” ostensibly a current or former government official, who keeps the public appraised of an epic secret battle between good and evil, undertaken in political shadows. The villains are a globalist pedophile ring involving the mega-rich, Hollywood actors, and the Clintons (among many others), while Donald Trump leads the army of the righteous.

“The Jacobins Reign of Terror comes to its sudden and ignominious end with Robespierre bawling under the national razor.”

• Tomorrow, Come Here Tomorrow…. (Kunstler)

Is it possible that some Democratic Party voters begin to suspect that the party officials running this game have lost their minds? A good signifier, of course, is the ghostly figure carrying their battle-flag, Mr. Biden, the Flying Dutchman candidate whose mind slips in and out of fog-banks as he navigates the shoals of defeat. Why did the Party ship out with him on the poop-deck? My guess would be: to deflect indictments of himself and many other former officials as the steady flow of documentary evidence gets released by new DNI John Ratcliffe, including a batch this past week showing pretty incontrovertibly that everybody and his uncle in the Obama executive branch was keenly aware that RussiaGate was a Hillary campaign ploy and allowed themselves to be weaponized into the scheme — under the assumption that she couldn’t lose and they’d never be found out.

She lost. They’re found out. Grand juries have been convened by Mr. Durham. Something wicked is coming their way. Their ship is going down and the rats are all squeaking desperately in the scuppers at the rising water. Won’t this all be a shock to that crew of media fabulists who stupidly maintain that the Mueller Report actually proved something — the David Frenches, Max Boots, and Rachel Maddows of this world and their True Believer followers? History is rhyming again. It’s like 1794 in Paris. The Jacobins Reign of Terror comes to its sudden and ignominious end with Robespierre bawling under the national razor. So does today’s Reign of Perfidious Sedition close, with Jim Comey bawling, “I can’t recall,” into his laptop.

Incidental to this is the breaking news — sure to not be reported in The New York Times or by CNN — that one Devon Archer, business partner of Hunter Biden (and John Kerry stepson, Christopher Heinz) has just had his previously overturned conviction for security fraud reinstated by a federal appeals court. Sound abstruse? Yeah, kind of, but, believe me this boy is in some serious hot water, the rap being a federal one, and Mr. Archer now poised to sing like a canary to John Durham’s posse about his various financial exploits in Ukraine and other foreign lands with Joe Biden’s son (and Mr. Kerry’s stepson) in exchange for lighter jail time. You just watch.

Keep your ears pricked also for developments involving Senate Select Committee on Intelligence ranking member Mark Warner (D-VA) and his role in 2016-17 as an active disseminator of Steele Dossier RussiaGate dis-info in coordination with the George Soros funded Democracy Integrity Project, run by former Dianne Feinstein chief-of-staff Dan Jones and assisted by swamp lawyer Adam Waldman, a Steele / Warner go-between who happened to be a $40,000-a-month lobbyist for one Oleg Deripaska, a Russian billionaire and Clinton Foundation doner (at least $1-million) who also employed Christopher Steele as a dis-info errand boy. Unpacking that one will be like unpacking the surgical batting in a sucking chest wound. Scrub for it.

Can someone explain why this is not mandatory everywhere?

Dave Collum: “I am so impressed. Free testing. Wow. Somebody tell @GoldmanSachs that @Cornell tests 5,000 people per DAY.”

• Goldman Offers Workers Free On-Site COVID-19 Testing (ZH)

In September, Goldman Sachs employees in New York became the latest to suffer a trading floor outbreak as Wall Street banks called their investment banking workers back into the office before pretty much every other white-collar industry. But now that Microsoft is claiming that it plans to allow some employees to work from home permanently (well, at least some of the time), Goldman is touting its plans to offer all US-based employees antibody tests and saliva-based PCR tests and other on-sight screening for staff at 200 West Street, according to Financial News. The report cited a memo sent to staff dated Oct. 8, which was Thursday. Goldman is considering rolling the program out to other officers around the world, but it hasn’t made any final plans yet.

In New York, the tests will be available to workers first returning to the office, while those remaining at home can be reimbursed for any costs they incur related to their private health care programs and COVID-19 testing. CEO David Solomon is also introducing internal daily screenings and a “tracking and tracing” program to help prevent any future outbreaks. “As high-quality testing has become more available, we have engaged vendor partners to offer off-site COVID-19 tests to eligible people in the US at no cost,” reads the memo sent out to staff on Thursday. “Testing is one part of a comprehensive prevention strategy that includes wearing masks, following general hygiene and handwashing best practices, and practicing social distancing.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

John Solomon

Fighting for the Truth: @jsolomonreports says @realDonaldTrump shouldn’t tolerate his cabinet slow walking the release of vital Obamagate documents that the American people have the right to see before the election. #AmericaFirst #MAGA #Dobbs pic.twitter.com/045qE4vh4C

— Lou Dobbs (@LouDobbs) October 9, 2020

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars for Paypal and Patreon.