Jules Adler Panorama de Paris vu du Sacré Coeur 1935

A topic I’ve addressed a lot. It’s just that I would say “The New York Times and CNN’ Bashing of Trump”, not the other way around., After all, who started? Read the whole thing, it shows how smart Trump is when it comes to media.

“Concluding his December 2017 interview with The New York Times, Trump said: “Another reason that I’m going to win another four years is because newspapers, television, all forms of media will tank if I’m not there because without me, their ratings are going down the tubes […] So they basically have to let me win.“

• How Trump’s Bashing Of The New York Times and CNN Has Benefited All (F24)

Although Donald Trump has an antagonistic relationship with The New York Times and CNN, the ‘Trump bump’ has been a business boon to these outlets, while the US president has been keen to use them to pursue publicity and legitimacy. While Trump often rails against the US media generally – most notably as “enemies of the people” – the country’s foremost newspaper of record, The New York Times, and its oldest 24-hour news network, CNN, are frequently singled out for opprobrium as “The Failing New York Times” and “Fake News CNN”. The acrimony between Trump and CNN reached its zenith on November 8 when the White House revoked the press access of its reporter Jim Acosta after a rancorous post-midterm news conference – only for his press pass to be restored thanks to judicial review three days later.

Meanwhile the vitriolic rhetoric from the White House has provoked considerable alarm amongst the press. New York Times’ publisher A.G. Sulzberger warned on July 30 that Trump’s increasingly splenetic attacks on the news media “will lead to violence”, before its sister paper The Boston Globe led the way in launching the #EnemyofNone campaign against the president’s relentless attacks on the American press. Despite these tensions, The New York Times – like CNN – is far from failing. On the contrary, both outlets are enjoying booming subscription and viewer figures thanks to Trump’s presidency. From Trump’s election on November 8, 2016 until the end of that month, The New York Times saw an increase of 132,000 in paid subscriptions – 10 times the growth rate in November 2015.

This trajectory has continued. “NYT has well surpassed initial expectations for subscriber growth […] following the ‘Trump bump’,” JP Morgan analyst Alexia Quadrani wrote to clients in April 2018. The New York Times Company’s share price outperformed those of Apple, Amazon and Facebook between Trump’s election in 2016 and the end of June 2018, soaring by 141 percent. “When I talked to the [executive] editor of The New York Times [Dean Baquet], he told me with a smile on his face that Donald Trump has done at least one good thing – and that is that he has boosted the circulation of The New York Times,” Marvin Kalb, a senior fellow at The Brookings Institution in Washington D.C. and author of “Enemy of the People”, a book on Trump’s hostile regard towards the US media, told FRANCE 24.

“People who subscribe to and read [The New York] Times are for the most part people who oppose Trump, who do not think it is fake news,” explained Robert Shapiro, a professor of political science at Columbia University, whose area of expertise includes the relationship between mass media and US politics, in an interview with FRANCE 24. The paper has “used the facts of the Trump presidency to draw attention to the bad things that he is doing, and that’s attracted readers who want to get information to use against Trump”, Shapiro continued.

Anything to buy and sell some more.

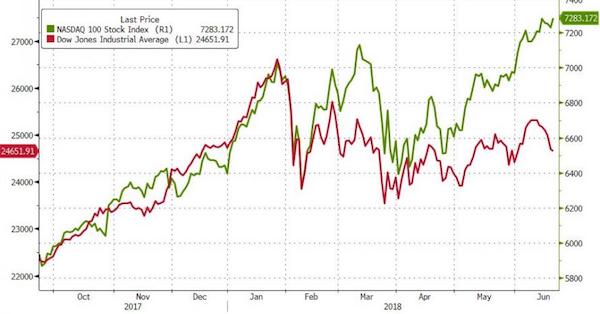

• Dow Futures Surge After Trump And Xi Agree To Pause Trade War (CNBC)

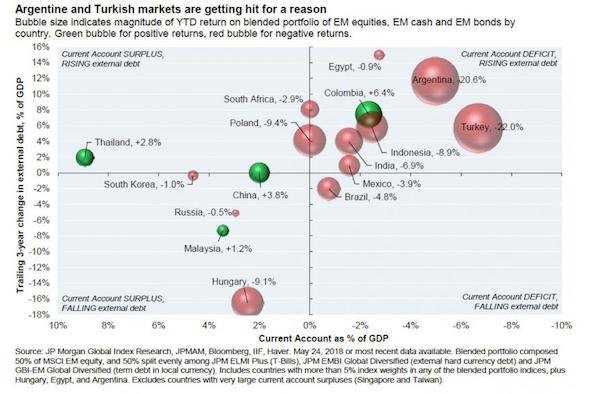

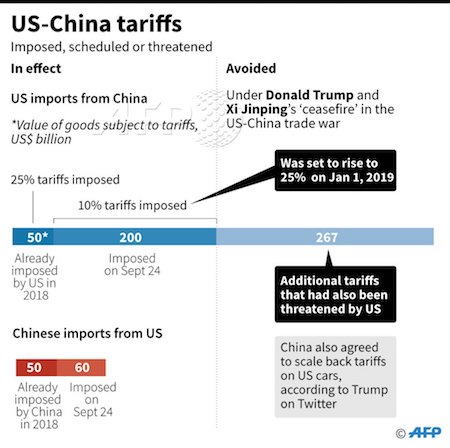

U.S. stock market futures surged after U.S. President Donald Trump and Chinese President Xi Jinping agreed to a 90-day ceasefire in the trade war that has weighed heavily on global stock markets for most of 2018. Futures on the Dow Jones Industrial Average jumped 488 points as of 11:31 p.m. ET Sunday. The advance implied a 471.54 point gain for the Dow at Monday’s open. Meanwhile, S&P 500 futures added around 1.71 percent, while futures on the Nasdaq-100, home of many technology companies which sell to China, jumped about 2.75 percent. Futures on oil and copper jumped on hopes a possible new China-U.S. trade agreement would boost global economic growth.

The two leaders, who met for dinner on Saturday at the G-20 summit in Argentina, agreed to hold off on additional tariffs on each other’s goods at the start of the new year to allow for talks to continue. The U.S. agreed to leave tariffs on more than $200 billion worth of Chinese products at 10 percent. If after 90 days the two countries are unable to reach an agreement, that rate will be raised to 25 percent, according to the White House. Trade negotiations will address forced technology transfer and intellectual property. “The explicit delay in tariffs is on the positive end of expectations,” said Helen Qiao, China and Asia economist with Bank of America Lynch, in a note to clients. “In contrast to the fear — especially in Asia —that the hawks in US administration would make impossible demands, evidence of President Trump working towards a trade deal with China has emerged.”

Something tells me they’ll want something in return.

• China Agrees To ‘Reduce And Remove’ Tariffs On US Cars: Trump (AFP)

China has agreed to scale back tariffs on imported US cars, President Donald Trump said Sunday, one day after agreeing with Xi Jinping to a ceasefire in the trade war between the world’s top two economies. Asia stocks had rallied on the news that Washington and Beijing would not impose any new tariffs during a three-month grace period, during which the two sides are meant to finalize a more detailed agreement. “China has agreed to reduce and remove tariffs on cars coming into China from the U.S. Currently the tariff is 40 percent,” Trump said on Twitter. On Saturday, Trump and Xi agreed to put a stop to their tit-for-tat tariffs row, which had roiled world markets for months.

The Republican president called their agreement – which Washington hopes will help close a yawning trade gap with the Asian giant and help protect US intellectual property – an “incredible” deal. Trump agreed to hold off on his threat to slap 25 percent tariffs on $200 billion worth of Chinese goods from January 1, leaving them at the current 10% rate. In return, China is to purchase “very substantial” amounts of agricultural, energy, industrial and other products from the US. In July, China reduced auto import duties from 25 percent to 15 percent, a boon for international carmakers keen to grow sales in the world’s largest auto market. But as trade tensions ratcheted up with the US this summer, Beijing retaliated by slapping vehicles imported from the US with an extra 25 percent tariff, bringing the total tariff rate to 40%.

May’s worst crisis to date. Parliament first votes on December 11.

• UK Faces Constitutional Crisis Over Brexit Legal Advice – Labour (BBC)

The UK faces a “constitutional crisis” if Theresa May does not publish the full legal advice on her Brexit deal on Monday, Labour has warned. The PM says the advice is confidential. but some MPs think ministers do not want to admit it says the UK could be indefinitely tied to EU customs rules. Ex-foreign secretary Boris Johnson has joined calls for its publication, which critics say could sink the PM’s deal. Attorney General Geoffrey Cox will make a statement about it on Monday. He is set to publish a reduced version of the legal advice – despite calls from MPs from all parties to publish a full version.

His statement to the House of Commons will be followed by five days of debate on the deal. MPs say the statement from the attorney general does not respect a binding Commons vote last month, which required the government to lay before Parliament “any legal advice in full”. Labour is planning to join forces with other parties, including the DUP, who keep Mrs May in power, to initiate contempt of Parliament proceedings unless the government backs down. Shadow Brexit secretary Sir Keir Starmer told Sky News: “If they don’t produce [the advice] tomorrow (Monday) then we will start contempt proceedings. This will be a collision course between the government and Parliament.”

Reuters manages to do an entire article on this without mentioning the Saudi-led Qatar boycott even once. Well done!

• Qatar To Withdraw From OPEC, Focus On LNG Exports (R.)

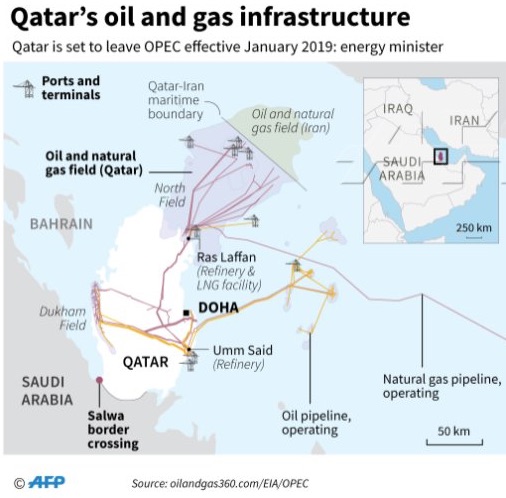

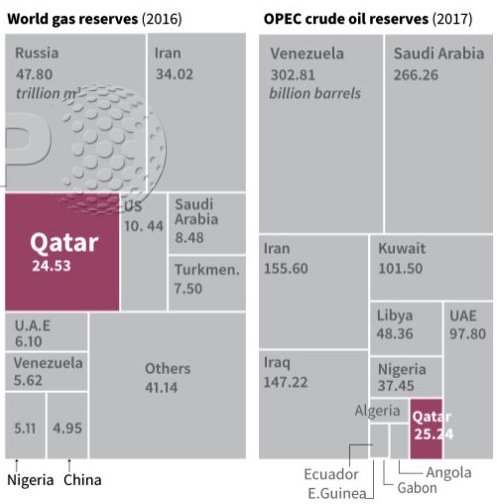

Qatar said on Monday it was quitting OPEC from January 2019 but would attend the oil exporter group’s meeting this week, saying the decision meant Doha could focus on cementing its position as the world’s top liquefied natural gas (LNG) exporter. Doha, one of the smallest oil producers in OPEC, is locked in a diplomatic dispute with the group’s de facto leader Saudi Arabia but said the move to leave OPEC was not driven by politics. Minister of State for Energy Affairs Saad al-Kaabi told a news conference that Qatar, which he said been a member of OPEC for 57 years, would still attend the group’s meeting on Thursday and Friday this week, and would abide by its commitments.

“Qatar has decided to withdraw its membership from OPEC effective January 2019 and this decision was communicated to OPEC this morning,” the minister said. “For me to put efforts and resources and time in an organization that we are a very small player in and I don’t have a say in what happens … practically it does not work, so for us it’s better to focus on our big growth potential,” he said. [..] Qatar has oil output of only 600,000 barrels per day (bpd), compared with the 11 million bpd produced by Saudi Arabia, the group’s biggest oil producer and world’s biggest exporter. But Doha is an influential player in the global LNG market with annual production of 77 million tonnes per year, based on its huge reserves of the fuel in the Gulf.

Perhaps the best indicator of where Macron finds himself are the policemen taking off their helmets to show solidarity with the gilets jaunes.

• Macron Tells PM To Hold Talks, Mulls State Of Emergency (R.)

Riot police on Saturday were overwhelmed as protesters ran amok in Paris’s wealthiest neighborhoods, torching dozens of cars, looting boutiques and smashing up luxury private homes and cafes in the worst disturbances the capital has seen since 1968. The unrest began as a backlash against fuel tax hikes but has spread. It poses the most formidable challenge yet to Macron’s presidency, with the escalating violence and depth of public anger against his economic reforms catching the 40-year-old leader off-guard and battling to regain control.

After a meeting with members of his government on Sunday, the French presidency said in a statement that the president had asked his interior minister to prepare security forces for future protests and his prime minister to hold talks with political party leaders and representatives of the protesters. A French presidential source said Macron would not speak to the nation on Sunday despite calls for him to offer immediate concessions to demonstrators, and said the idea of imposing a state of emergency had not been discussed. Arriving back from the G20 summit in Argentina, Macron had earlier rushed to the Arc de Triomphe, a revered monument and epicenter of Saturday’s clashes, where protesters had scrawled “Macron resign” and “The yellow vests will triumph”.

The “yellow vest” rebellion erupted out of nowhere on Nov. 17, with protesters blocking roads across France and impeding access to some shopping malls, fuel depots and airports. Violent groups from the far right and far left as well as youths from the suburbs infiltrated Saturday’s protests, the authorities said. Government spokesman Benjamin Griveaux had indicated the Macron administration was considering imposing a state of emergency. The president was open to dialogue, he said, but would not reverse policy reforms.

A president with a low enough approval rating and etractors that are sufficiently organized will always have a hard time.

• France’s Meltdown, Macron’s Disdain (Milliere)

On November 11th, French President Emmanuel Macron commemorated the 100th anniversary of the end of World War I by inviting seventy heads of state to organize a costly, useless, grandiloquent “Forum of Peace” that did not lead to anything. He also invited US President Donald Trump, and then chose to insult him. In a pompous speech, Macron – knowing that a few days earlier, Donald Trump had defined himself as a nationalist committed to defending America – invoked “patriotism”; then defined it, strangely, as “the exact opposite of nationalism”; then called it “treason”. In addition, shortly before the meeting, Macron had not only spoken of the “urgency” of building a European army; he also placed the United States among the “enemies” of Europe.

This was not the first time Macron placed Europe above the interests of his own country. It was, however, the first time he had placed the United States on the list of enemies of Europe. President Trump apparently understood immediately that Macron’s attitude was a way to maintain his delusions of grandeur,as well as to try to derive a domestic political advantage. Trump also apparently understood that he could not just sit there and accept insults. In a series of tweets, Trump reminded the world that France had needed the help of the USA to regain freedom during World Wars, that NATO was still protecting a virtually defenseless Europe and that many European countries were still not paying the amount promised for their own defense.

Trump added that Macron had an extremely low approval rating (26%), was facing an extremely high level of unemployment, and was probably trying to divert attention from that. Trump was right. For months, the popularity of Macron has been in free fall: he is now the most unpopular French President in modern history at this stage of his mandate. The French population has turned away from him in droves. Unemployment in France is not only at an alarmingly high level (9.1%); it has been been alarmingly high for years. The number of people in poverty is also high (8.8 million people, 14.2% of the population). Economic growth is effectively non-existent (0.4% in the third quarter of 2018, up from 0.2% the previous three months). The median income (20,520 euros, or $23,000, a year,) is unsustainably low. It indicates that half the French live on less than 1710 euros ($1946) a month. Five million people are surviving on less than 855 euros ($973) a month.

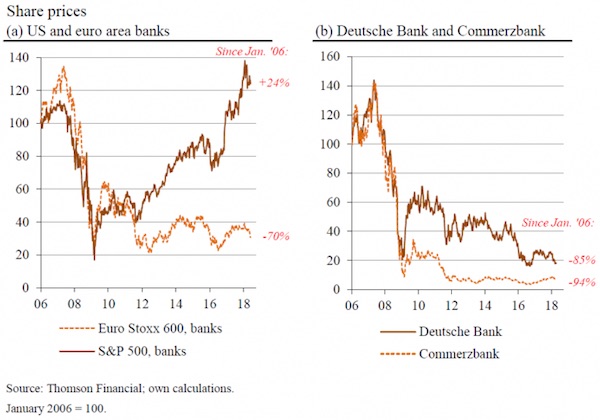

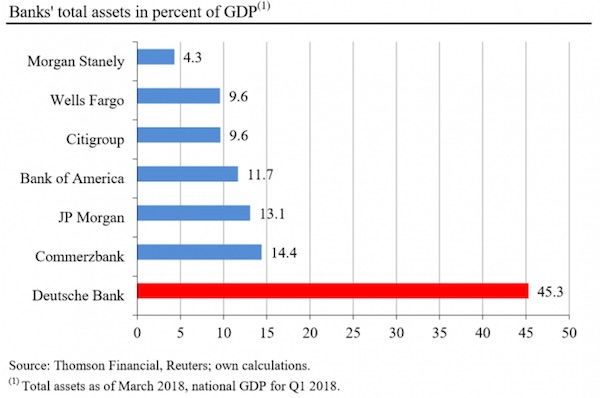

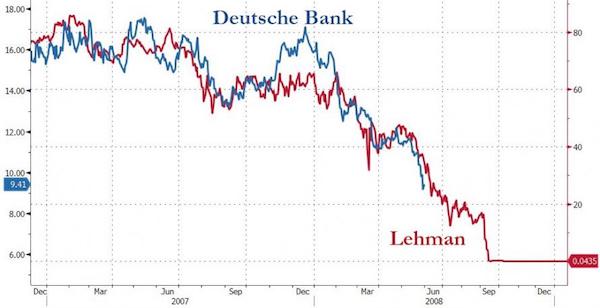

Deutsche is the archetypical too big to fail hot potato. The Fed must help, and so does Merkel. But to what end?

• Deutsche Bank Takeover Speculation Intensifies (ZH)

Since taking over troubled German lender Deutsche Bank back in April, Christian Sewing has watched the recidivist lender’s troubles go from bad to worse. On Friday, the bank’s shares reached an all-time low; they’re now down 50% YTD, making Deutsche the worst performer in a poorly performing index of the world’s largest global banks. The latest selloff was inspired by the Frankfurt prosecutor’s office deciding to raid six Deutsche buildings, including the bank’s headquarters The raid, which continued for two days, doubled as the first public revelation about the latest criminal scandal involving Europe’s biggest bank by assets, which has already paid $18 billion in legal penalties since the financial crisis.

Prosecutors revealed that they were investigating at least two employees in the bank’s wealth management unit (part of the division overseen by Sewing before he took the CEO job) for allegedly helping customers set up accounts in offshore tax shelters and helping criminals launder their ill-gotten gains – allegations that prosecutors said were inspired by the infamous ‘Panama Papers’ leak. During their raid, prosecutors searched the offices of five senior Deutsche executives, including the bank’s chief compliance officer, who was rumored to be leaving the bank in a report published just days before nearly 200 police officers, tax inspectors and prosecutors showed up outside Deutsche’s international headquarters and demanded that everybody step away from their computers.

Given the abysmal week the bank just had, it’s hardly surprising that the financial media has published a barrage of negative stories featuring anonymously sourced quotes from Deutsche “investors” effectively demanding that, if Sewing can’t get his shit together in the next quarter or two, he will need to abandon the “strategic alternatives” (cost-cutting, shifting the bank’s investment strategy to emphasize growth in wealth management) that he championed as a road toward salvation (alongside cost-cutting, of course) and seriously consider a sale.

Nordstream2 would bankrupt Ukraine. Hence the anti-Russia desperation.

• Merkel Protege Suggests Reducing Gas Flow Through Nord Stream 2 Pipeline (R.)

Germany must answer urgent, growing political concerns about the planned Nord Stream 2 gas pipeline project given Russia’s seizure of three Ukrainian ships and their crew off the coast of Crimea, a senior German conservative said on Sunday. Annegret Kramp-Karrenbauer, a top candidate to replace Chancellor Angela Merkel as leader of the Christian Democrats, told public broadcaster ARD it would be “too radical” to withdraw political support for the project, but Berlin could reduce the amount of gas to flow through the pipeline. Russia is resisting international calls to release three Ukrainian ships seized last weekend in the Kerch Strait near the Crimea region that Moscow illegally annexed from Ukraine in 2014.

Moscow has accused the 24 sailors of illegally crossing the Russian border, which Ukraine denies. After meeting with Russian President Vladimir Putin, Merkel on Saturday called on Russia to release the sailors and allow free shipping access to the Sea of Azov, but stopped short of endorsing any additional sanctions against Moscow. Kramp-Karrenbauer is a close Merkel ally but has taken a firmer stance on Russia’s actions in recent days. On Friday, she told Reuters the EU and the US should consider banning from their ports Russian ships originating from the Sea of Azov in response to the incident. She told ARD on Sunday that it was time to draw a firmer line against Russian actions, including its annexation of Crimea and its support for separatists in eastern Ukraine.

[..] Her suggestion of banning Russian ships from European ports triggered criticism from some Social Democrats, including former foreign minister Sigmar Gabriel, who urged calm and accused Ukraine of trying to drag Germany into a war with Russia.

They’re still dead set on more Europe.

• EU Delays Euro Zone Budget, Deposit Insurance Plans (R.)

EU finance ministers will agree on Monday to give the euro zone bailout fund new responsibilities, but they will delay decisions on the euro zone budget and a deposit guarantee scheme after failing to reach agreement, a draft document showed. The ministers will discuss deeper economic integration of the 19 countries sharing the euro, to prepare the single currency bloc for the next potential crisis. However, after a year of negotiations, fraught with political difficulties, little of the original ambition, championed by French President Emmanuel Macron, remains.

The two flagship ideas – a separate budget for euro zone countries to help stabilize their economies and a deposit guarantee scheme to make all euro zone bank deposits safe – are too controversial and will be worked on further until June 2019, according to the draft document, seen by Reuters. In the case of the deposit guarantee scheme, mistrust among euro zone countries is so great that they could not even agree on a roadmap for beginning political negotiations on EDIS (European Deposit Insurance Scheme), as mandated by EU leaders. “Further technical work is still needed to agree on a roadmap. We will establish a High-level working group with a mandate to work on next steps. The High-level group should report back by June 2019,” said the draft report by EU finance ministers.

Advice: don’t support anything the World Bank is involved in. They are not your friends.

• World Bank Promises $200 Billion In 2021-25 Climate Cash (AFP)

The World Bank on Monday unveiled $200 billion in climate action investment for 2021-25, adding this amounts to a doubling of its current five-year funding. The World Bank said the move, coinciding with a UN climate summit meeting of some 200 nations in Poland, represented a “significantly ramped up ambition” to tackle climate change, “sending an important signal to the wider global community to do the same.” Developed countries are committed to lifting combined annual public and private spending to $100 billion in developing countries by 2020 to fight the impact of climate change — up from 48.5 billion in 2016 and 56.7 billion last year, according to latest OECD data.

Southern hemisphere countries fighting the impact of warming temperatures are nonetheless pushing northern counterparts for firmer commitments. In a statement, the World Bank said the breakdown of the $200 billion would comprise “approximately $100 billion in direct finance from the World Bank.” Around one third of the remaining funding will come from two World Bank Group agencies with the rest private capital “mobilised by the World Bank Group.” “If we don’t reduce emissions and build adaptation now, we’ll have 100 million more people living in poverty by 2030,” John Roome, World Bank senior director for climate change, warned. “And we also know that the less we address this issue proactively just in three regions – Africa, South Asia and Latin America – we’ll have 133 million climate migrants,” Roome told AFP.