Edward Hopper Le Bistro or The Wine Shop 1909

Dore Maté Zelensky NATO

https://twitter.com/i/status/1513210890908225541

..about 40% of Ukraine’s armed forces – 102,000 fighters – were Paramilitary, aka the far-right, Nazis, and foreign mercenaries..

Time for the Guardian’s main propagandist on everything from Assange to Putin. Here’s Luke Harding.

• Austrian Chancellor To Meet Putin In Russia (G.)

Austria’s chancellor is set to meet Vladimir Putin on Monday, the Russian president’s first face-to-face meeting with an EU leader since ordering the invasion of Ukraine, amid warnings of a fresh offensive and shelling in the east. Karl Nehammer said the meeting would take place in Moscow and that Austria had a “clear position on the Russian war of aggression”, calling for humanitarian corridors, a ceasefire and full investigation of war crimes. On the ground, Russian forces pounded targets in eastern Ukraine with missiles and artillery on Sunday, and Ramzan Kadyrov, the powerful head of Russia’s republic of Chechnya, said there would be an offensive not only on the besieged southern port of Mariupol but also on Kyiv and other Ukrainian cities.

“Luhansk and Donetsk – we will fully liberate in the first place … and then take Kyiv and all other cities,” Kadyrov said in a video posted on his Telegram channel. The US has warned that the appointment of a new general in command of Russia’s military campaign is likely to usher in a fresh round of “crimes and brutality” against civilians. Alexander Dvornikov, 60, came to prominence at the head of Russian troops in Syria in 2015-16, when there was particularly brutal bombardment of rebel-held areas, including civilian populations, in Aleppo. Jake Sullivan, the national security adviser in Washington, said: “This particular general has a résumé that includes brutality against civilians in other theatres – in Syria – and we can expect more of the same” in Ukraine.

Nehammer met Ukrainian president Volodymyr Zelenskiy in Kyiv on Saturday – the same day as the British prime minister, Boris Johnson, who promised to give Ukraine 120 armoured vehicles and anti-ship missile systems. Washington has also pledged to give Ukraine “the weapons it needs” to defend itself against a new Russian offensive. Russia has failed to take any major cities, but Ukraine says it has been gathering its forces in the east for a major assault and has urged people to flee. Russian forces fired rockets into Ukraine’s Luhansk and Dnipropetrovsk regions on Sunday, officials said. Missiles completely destroyed the airport in the city of Dnipro, said Valentyn Reznichenko, governor of the central Dnipropetrovsk region. Russia’s defence ministry said high-precision missiles had destroyed the headquarters of Ukraine’s Dnipro battalion in the town of Zvonetsky.

The one country that has very little foreign debt: “Russia faces its first sovereign external default in more than a century..”

• Russia Threatens Legal Action If Forced Into Sovereign Debt Default (R.)

Russia will take legal action if the West tries to force it to default on its sovereign debt, Finance Minister Anton Siluanov told the pro-Kremlin Izvestia newspaper on Monday, sharpening Moscow’s tone in its financial wrestle with the West. “Of course we will sue, because we have taken all the necessary steps to ensure that investors receive their payments,” Siluanov told the newspaper in an interview. “We will present in court our bills confirming our efforts to pay both in foreign currency and in roubles. It will not be an easy process. We will have to very actively prove our case, despite all the difficulties.” Siluanov did not elaborate on Russia’s legal options.

Russia faces its first sovereign external default in more than a century after it made arrangements to make an international bond repayment in roubles earlier this week, even though the payment was due in U.S. dollars. Last week, Siluanov said Russia will do everything possible to make sure its creditors are paid. “Russia tried in good faith to pay off external creditors,” Siluanov said on Monday. “Nevertheless, the deliberate policy of Western countries is to artificially create a man-made default by all means.” Siluanov said Russia’s external liabilities amount to about 20% of the total public debt, which stood at about 21 trillion roubles ($261.7 billion). Of that, about 4.5-4.7 trillion roubles were external liabilities.

Russia has not defaulted on its external debt since the aftermath of its 1917 revolution, but its bonds have now emerged as a flashpoint in its economic tussle with Western countries. A default was unimaginable until recently, with Russia rated as investment grade in the run up to its Feb. 24 invasion of Ukraine, which Moscow calls a “special military operation” and which on Sunday intensified in eastern Ukraine. “If an economic and financial war is waged against our country, we are forced to react, while still fulfilling all our obligations,” Siluanov said. “If we are not allowed to do it in foreign currency, we do it in roubles.”

Finland, Sweden, Austria?!

• Finland Poised To Request NATO Membership As Early As May (Fox)

The Finnish government is poised to formally apply for NATO membership “before midsummer” and potentially as early as May. Finnish Prime Minister Sanna Marin stated Friday that the country would vote “before midsummer” on sending an application to join NATO. Former Prime Minister Alexander Stubb says the vote will likely happen as early as May, according to Agence France-Presse. “We will have very careful discussions but not taking any more time than we have to,” Marin said during a press conference. “I think we will end the discussion before midsummer.” Stubb, however, was more specific in his prediction, telling the AFP on Saturday the government would likely vote on the issue before the end of May, just in time for NATO’s June summit in Madrid.

“The Finns think that if Putin can slaughter his sisters, brothers and cousins in Ukraine, as he is doing now, then there is nothing stopping him from doing it in Finland. We simply don’t want to be left alone again,” Stubb told AFP. While the Finnish public has traditionally been opposed to joining NATO, polls showed a seismic shift on the issue following Russia’s invasion of Ukraine in late February. Finland shares an 830-mile border with Russia, and support for joining NATO jumped from 26% to 60% following the invasion. Finland has remained wary of its eastern neighbor since the Winter War of 1939, when Soviet forces attempted to invade at the start of World War II. Finish forces famously delivered a resounding defeat to the Soviets. Finland lost 26,000 soldiers compared at least 126,000 dead or missing for the USSR. NATO General Secretary Jens Stoltenberg has stated that Finland would certainly be approved should it apply to join the alliance.

Some Russian lawmakers are already offering hostile language regarding a potential NATO-allied Finland. Russian lawmaker Vladimir Dzhabarov stated that joining the alliance would be a “strategic mistake” for Finland, adding that the country would “become a target.” “I think it [would be] a terrible tragedy for the entire Finnish people,” Dzhabarov said, adding that with such an action, “the Finns themselves will sign a card for the destruction of their country.”

“North Asia-Pacific Treaty Organisation”?

• NATO to Engage in Asia-Pacific to Counter China (ET)

The North Atlantic Treaty Organisation (NATO) has announced that it will begin engaging in the Asia-Pacific region both practically and politically in light of Beijing’s growing influence and coercion and its unwillingness to condemn Russia’s invasion of Ukraine. Speaking following the meetings of NATO Ministers of Foreign Affairs on April 7, NATO Secretary-General Jens Stoltenberg said the global implications of the Ukrainian conflict had propelled the organisation to step up its engagement with Asia-Pacific partners for the first time. “We have seen that China is unwilling to condemn Russia’s aggression. And Beijing has joined Moscow in questioning the right of nations to choose their own path,” Stoltenberg said. “This is a serious challenge to us all. And it makes it even more important that we stand together to protect our values.”

NATO and its Asia-Pacific partners—Australia, Japan, New Zealand, and the Republic of Korea—met in Brussels to discuss international support for Ukraine. Stoltenberg said the gathered foreign ministers agreed that NATO’s next Strategic Concept briefing, expected to be finalised for the Madrid Summit in June, must deliver a response on how they relate to Russia in the future and how, for the first time, they take into account that their security is affected by China’s growing influence and coercive policies. “NATO and our Asia-Pacific partners have now agreed to step up our practical and political cooperation in several areas, including cyber, new technology, and countering disinformation,” he said. “We will also work more closely together in other areas such as maritime security, climate change, and resilience. Because global challenges demand global solutions.”

‘Nice country of 1.5 billion hungry people you got there Modi. With all this talk of global famine going around, it’d be a shame if you couldn’t feed them.’

• Biden Schedules Meeting With India Prime Minister (CTH)

Against the backdrop of increased Russia-India trade {link}, and the BRICS discussions about new trade payment mechanisms to avoid being shackled to the dollar {link}, it would appear the people behind the White House operation to create/maintain conflict with Russia are scheduling a stern conversation with India’s Prime Minister Narendra Modi. WHITE HOUSE – ” President Joseph R. Biden, Jr. will meet virtually with Prime Minister Narendra Modi of India on Monday, April 11 to further deepen ties between our governments, economies, and our people. President Biden and Prime Minister Modi will discuss cooperation on a range of issues.” … “President Biden will continue our close consultations on the consequences of Russia’s brutal war against Ukraine and mitigating its destabilizing impact on global food supply and commodity markets.”

The message from the White House will likely be akin to: ‘Nice country of 1.5 billion hungry people you got there Modi. With all this talk of global famine going around, it’d be a shame if you couldn’t feed them.’ Oh, and by the way, did you happen to catch what just rolled out in Pakistan? Imagine that – what with common borders and such… For those unfamiliar, it appears the DoS/CIA were up to their old tricks again, because Pakistan was favorable to the position of China and Russia in the Ukraine conflict and would not take sides with NATO and western allied leaders. Pakistani Prime Minister Imran Khan was ousted through a majority parliamentary no-confidence vote early Sunday, that smells identical to the way Obama/Biden DoS/CIA ousted Egyptian President Hosni Mubarak.

(VOA) – […] Khan is the first prime minister to be ousted by a no-confidence vote in Pakistan, but no democratically elected prime minister has served a full five-year term since the founding of the country in 1947. The repeatedly delayed no-confidence vote against Khan was held after the country’s Supreme Court ruled last week he had acted unconstitutionally when he previously blocked the no-confidence vote, and subsequently dissolved parliament. The embattled Pakistani leader had defended his blocking of the vote, alleging that the no-confidence motion was the result of the United States meddling in his country’s politics. Washington rejected the charges, saying there was “no truth” to them.

[..] (VIA ABC) – […] Khan has claimed the U.S. worked behind the scenes to bring him down, purportedly because of Washington’s displeasure over his independent foreign policy choices, which often favor China and Russia. He has occasionally defied America and stridently criticized America’s post 9/11 war on terror. Khan said America was deeply disturbed by his visit to Russia and his meeting with Russian President Vladimir Putin on Feb. 24, the start of the devastating war in Ukraine. The U.S. State Department has denied his allegations.

“The Pentagon does not do missionary work,” he says. “They kill people, and that’s why they are there.”

• Bioweapons Expert Speaks Out About US Biolabs in Ukraine (BIN)

According to bioweapons expert Francis Boyle, Russia’s accusation that Ukraine is conducting U.S.-funded bioweapons research appears to be accurate If true, everyone involved is subject to life in prison under the Biological Weapons Anti-Terrorism Act of 1989. According to Boyle, the U.S. government and Pentagon have had a “comprehensive policy” to “surround Russia with biological warfare laboratories” and “preposition biological weapons” there for use against them The problem with trying to make a distinction between “biodefense” and “biowarfare” is that, basically, there is none. No biodefense research is purely defensive, because to do biodefense work, you’re automatically engaged in the creation of biological weapons, and all dual use research can be used for military purposes. SARS-CoV-2 may be the result of such dual use research

Boyle believes we can hold the culprits behind the SARS-CoV-2 bioweapon accountable by asking local prosecutors to convene a grand jury to seek the indictment of those responsible for the pandemic for murder and conspiracy to commit murder In the video above, “InfoWars” host Owen Shroyer interviews Francis Boyle, Ph.D., a Harvard educated lawyer and bioweapons expert with a Ph.D. in political science, about the biolabs in Ukraine, which Russia claims are engaged in U.S.-funded bioweapons research. For decades, Boyle has advocated against the development and use of bioweapons. In fact, he was the one who called for biowarfare legislation at the Biological Weapons Convention of 1972. He then went on to draft the Biological Weapons Anti-Terrorism Act, which was passed unanimously by both houses of Congress and signed into law by then-president George Bush Sr. in May 1989.

While the U.S. has vehemently denied Russia’s accusations, Boyle says that based on what he’s discovered so far, the labs in Ukraine are all conducting biological warfare research — including ethnic-specific biological weapons — at the behest of the U.S. Pentagon, just as Russian authorities are claiming. “The Pentagon does not do missionary work,” he says. “They kill people, and that’s why they are there.” He also points out that everyone involved is subject to life in prison under the Biological Weapons Anti-Terrorism Act of 1989, which explains the mad scramble to project these labs as something other than what they are.

DR FRANCIS BOYLE start at 5 min.

2023 will be worse.

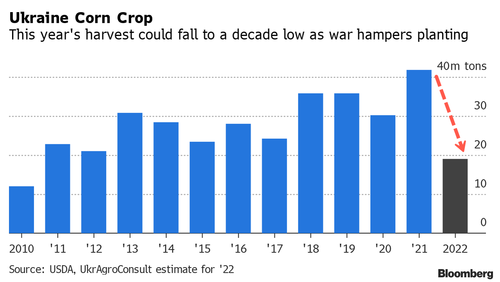

• Ukraine’s Crop Harvest Could Be Halved (ZH)

Ukraine is one of the world’s top exporters of corn, sunflower oil, and wheat. Disruptions stemming from Russia’s invasion of Ukraine have stoked fears the war-torn country could experience a 50% decline in crop output this year, according to Bloomberg. Forecast data from ag expert UkrAgroConsult show Ukraine’s corn output could be as low as 19 million tons, about half of last year’s 41 million tons. UkrAgroConsult’s pessimistic outlook follows huge production uncertainties as farmers experience shortages of diesel and fertilizer and bombed-out infrastructure.

The outlooks of two other ag firms aren’t as gloomy. Black Sea research firm SovEcon expects Ukraine’s 2022 corn harvest to be 27.7 million tons, and Barva Invest’s outlook is 29.5 million tons. Both a far below 2021 totals. Maxigrain analyst Elena Neroba warned if farmers don’t have diesel, they “can’t plant huge hectares.” “Some farmers still don’t have access to seeds and fertilizers. Even if they already paid for them, the delivery supply chain doesn’t work as well as it should,” Neroba said. Regardless of how much the conflict impacts output, global food prices have never risen so fast and have never been so high in anticipation of food shortages worldwide. In March, global food prices jumped a stunning 12.64% MoM – almost double the previous record monthly surge…

The CIA won’t mind another Arab Spring at all.

• Rising Food Costs Push Arab World’s Vulnerable to Breaking Point (BBG)

Seated around the dining table, the family of four stares blankly at pictures of food sketched on the tablecloth. “Tonight,” the father says, “we’re coloring for dinner.” The scene in a cartoon in a Moroccan newspaper speaks to the predicament facing the kingdom’s 37 million people and their peers across North Africa as the Muslim world marks Ramadan. Normally characterized by abstention broken by plentiful sunset feasts, the holy month for many this year is a confrontation with painful economic reality. Global foods costs are up more than 50% from mid 2020 to a record and households worldwide are trying to cope with the strains on their budgets. In North Africa, the challenge is more acute because of a legacy of economic mismanagement, drought and social unrest that’s forcing governments to walk a political tightrope at a precarious time.

The Middle East and North Africa region’s net food and energy importers are especially vulnerable to shocks to commodity markets and supply chains resulting from Russia’s war on Ukraine, according to the International Monetary Fund. That’s in countries where the rising cost of living helped trigger the Arab Spring uprisings a little over a decade ago. “Just how much more do we have to take?” asked Ahmed Moustafa, a 35-year-old driver and father of three in Cairo. He already had to sell some appliances to keep food on the table and cover other expenses, he said. “We keep being asked to cut and cut and cut, but there’s not much left to cut from.”

Home to large, mainly urban populations and lacking oil wealth, governments in Egypt, Morocco and Tunisia are struggling to maintain subsidies for food and fuel that have helped keep a lid on discontent. The World Food Programme has warned that people’s resilience is at “breaking point,” while the United Arab Emirates moved to help ally Egypt, the world’s largest buyer of wheat, to shore up its food security and ward off potential instability. Egypt is also seeking IMF help.

“.. they will have missed an entire season. There will be no harvest next year.”

• Dems Ignore Food Crisis, Fixate On ‘Tesla Charging Stations’ – Cammack (JTN)

Amid warnings of an upcoming food crisis, Democrats on the House Agriculture Committee are prioritizing the installation of “Tesla charging stations” in rural America, Rep. Kat Cammack (R-Fla.) lamented this week. The United Nations’ World Food Programme (WFP) released a report Monday titled “Unprecedented Needs Threaten a Hunger Catastrophe.” “The world cannot afford another conflict as is happening today in Ukraine,” the report warned. “The war is a catastrophe, compounding what is already a year of destructive hunger.” “Ukraine and Russia account for a third of the global wheat supply, and over half of WFP’s supply of the grain,” the report explains. “The crisis in the breadbasket of Europe is driving up the price of wheat as well as maize, sunflower oil and crude oil — with dramatic fallouts for food security worldwide.”

If the Russian invasion continues beyond April, “an additional 47 million people” will experience acute hunger, up “from a prewar baseline of 276 million people,” WFP noted in another report, released on Wednesday. “Altogether, this means that up to 323 million people could become acutely food insecure in 2022,” the report added. On Friday, the U.N. Food and Agriculture Organization said the invasion of Ukraine is causing a 17.1% increase in prices for grain, which includes wheat, oats, barley and corn. On the John Solomon Reports podcast on Wednesday, Cammack warned of the approaching food crisis as Russia’s invasion of Ukraine continues, preventing the latter country from planting crops.

“Ukraine should be planting right now,” she said. “They are not planting. So while this would be a typical growing season and a planting season, tractors are being used for the war effort, fuel is being used for the war effort — that is going to be a major, major issue as we move into the fall and the winter, because they will have missed an entire season. There will be no harvest next year.” There will be a “700% increase in fertilizer costs,” Cammack predicted. “And when you compound that with fuel prices — it was $5.19 a gallon for diesel in my district just this past weekend. You factor in the regulatory environment that is squeezing our producers to death. This administration has thrown more red tape on them and the threat of new taxes and regulations on producers, and then you basically put a bow on it with a pretty scarce labor market, it’s looking pretty grim.”

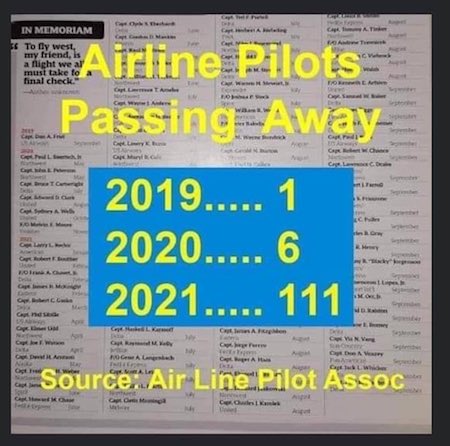

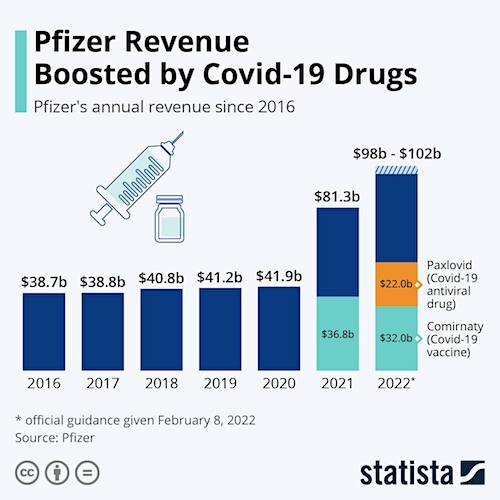

“..spike protein inhibits DNA damage repair by hindering DNA repair protein recruitment..”

• The Spike Protein Pathogenic Algorithm (Chesnut)

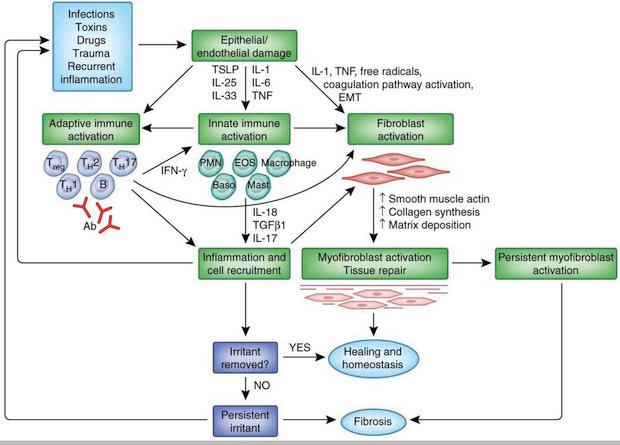

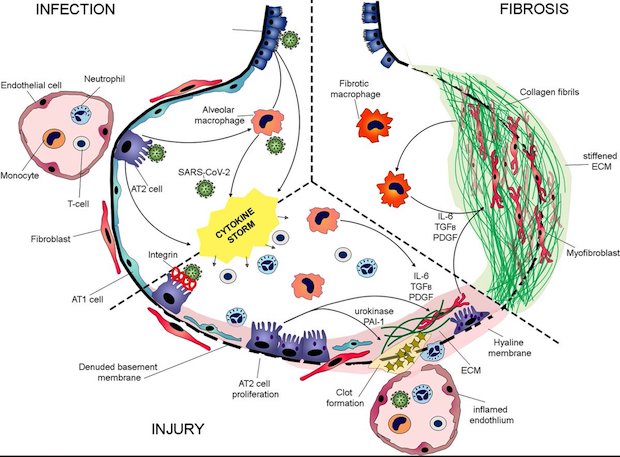

THE SPIKE PROTEIN PATHOGENIC ALGORITHM – DUAL PATHS TO TERMINAL SYSTEMIC FIBROSIS: IMMEDIATE FOR THOSE WITH SIGNIFICANT COMORBIDITIES, INDUCED FOR THOSE WITHOUT. The Spike Protein is inducing terminal systemic fibrosis of all organs, including the blood, via two principal mechanisms. The first is a direct, immediate path via binding to RGD-binding integrins, which includes several TGF-β-activating integrins. This activates Myofibroblasts which induces Fibrosis. Indeed, in autopsies of COVID-19 patients with advanced disease, 38% collagen deposition was found in their lungs. This is a rapid and certainly fatal circumstance. But, this is not limited to the lungs. In a series of cardiac autopsies conducted in Washington state, the most common changes observed were fibrosis in 14 (100%) patients and myocyte hypertrophy in 13 (93%) patients.

Let that sink in. In 100%. In EVERY SINGLE CARDIAC AUTOPSY, FIBROSIS WAS OBSERVED. The other mechanism is via DNA Double Strand Breaks and Impaired DNA Repair Mechanisms. This induces fatal systemic fibrosis in those who do not succumb to the initial assault. In mice that have their DNA Repair Mechanisms genetically deleted (this kind of mouse was developed to study Alzheimer’s) they experience The same level of DNA Damage as normal type mice. However, they accumlate DNA lesions faster due to their impaired DNA repair response. What is the effect of this? THEIR AGING IS ACCELERATED 6-FOLD OVER NORMAL TYPE MICE. What happens to these mice? They develop conditions common in elderly humans such as osteoporosis, pulmonary fibrosis, chronic kidney disease, cardiovascular disease, muscle wasting, peripheral neuropathy, hepatic fibrosis, urinary incontinence, intervertebral disc degeneration, cognitive decline, and loss of hearing and vision.

Sounds like Long COVID, doesn’t it? How does this happen? SARS–CoV–2 full–length spike protein inhibits DNA damage repair by hindering DNA repair protein recruitment. Why should this happen in some faster than others? Let us look at Diabetics. Diabetes-induced, persistent DNA damage is associated with organ fibrosis. Non-diabetics are accumulating DNA damage lesions, which will result in terminal fibrosis, but Diabetics are accumulating them FASTER as they already experience HIGHER LEVELS OF DNA DAMAGE, WHICH IS ALSO NOT. BEING. REPAIRED.

Let us look at Obesity. Altered DNA repair; an early pathogenic pathway in Alzheimer’s disease and obesity. In an inverted mechanism to Diabetes, the Obese already have an impaired DNA Repair Response, so, their DNA Repair Response becomes DYSREGULATED INCREASINGLY FASTER than those without this common comorbidity. What is the ultimate point of the Spike Protein’s inhibition of DNA repair Loss of the DNA repair potential results in persistent DNA damage signaling, senescence, SASP, fibrosis, and organ failure.

You’re on your own. But not really.

• Fauci Admits Covid Won’t Be Eliminated, Advises People To Calculate Risk (JTN)

White House Chief Medical Adviser Dr. Anthony Fauci admitted on Sunday that COVID-19 will not be eliminated and that people will have to calculate their own level of risk that they are willing to take with the virus. “This is not going to be eradicated and it’s not going to be eliminated,” Fauci told Jonathan Karl on ABC’s “This Week.” “What’s going to happen is that we’re going to see that each individual is going to have to make their calculation of the amount of risk that they want to take in going to indoor dinners and in going to functions, even within the realm of a green zone map of the country where you see everything looks green but it’s starting to tick up,” he said.

As of Sunday, the Centers for Disease Control and Prevention has placed most of the United States at green, or at a “low” level of community transmission, and the 7-day moving average for cases sits at less than 27,000. “We’re going to have to live with some degree of virus in the community,” Fauci said, adding, “The best way to mitigate that, Jon, is to get vaccinated.” Fauci urged Americans ages 50 and older as well as immunocompromised people to get the fourth COVID-19 vaccine. He also warned that Americans could be required to mask-up again if cases rise. “We may need to revert back to being more careful and having more utilizations of masks indoors. But right now we’re watching it very, very carefully. And there is concern that it’s going up,” he said. “But hopefully we’re not going to see increased severity.”

“Yet the homebound are the lucky ones.”

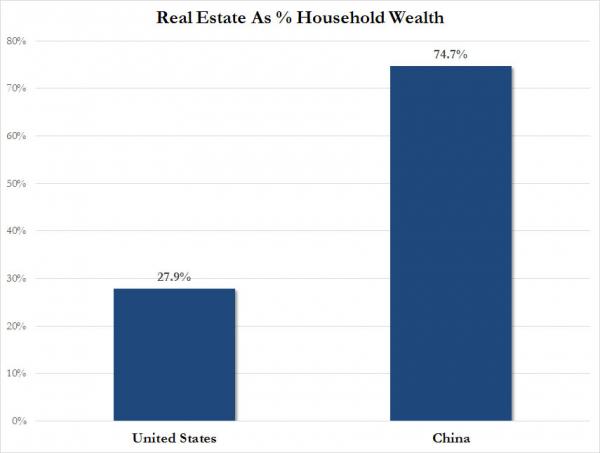

• China Brutalizes Citizens In Quest To Achieve ‘Covid Zero’ (Mosher)

For over two weeks the financial capital of China, Shanghai, has been locked down tight. Some 26 million people languish in their apartments, staring at their now-empty refrigerators, unable to set foot outside to forage for food for fear of arrest and incarceration. Foreigners are in the same predicament, as one complained on Twitter: “Day 16 of our COVID lockdown in Shanghai today and food is the key thing on people’s minds. We aren’t allowed to leave home so delivery is the only way I was up at 6 am yesterday trying to get any kind of delivery but nothing was available all day. So far, same results today..” Yet the homebound are the lucky ones.

The unlucky ones are those who test positive for COVID each day, like the 17,077 Shanghainese who did on Wednesday. Symptomatic or not — and nine out of 10 show no signs of illness — they are hauled off to hastily erected quarantine camps. The Shanghai lockdown, the largest since the first Wuhan lockdown two years ago, is China’s latest attempt to achieve COVID Zero. An army of health care workers, some 38,000 in all, have been sent to Shanghai, with instructions to completely stamp out the coronavirus within the city. They are frantically testing and retesting everyone. Unable to protest their lock-up any other way, people have taken to venting their anger by yelling out of their apartment windows. Most of their complaints have to do with food. “We have no food to eat,” they scream. “We haven’t eaten in a very long time. We are starving to death.”

One starving lockdowner found a quieter way to protest his growling stomach. He rolled his refrigerator onto his balcony and opened its doors. The inside is completely empty. Other protests have taken more tragic forms. As they did in Wuhan two years ago, people are once again jumping off the balconies of high-rise apartment buildings. One video circulating in China shows a couple falling to their deaths. The husband was said to be distraught because the lockdown had cost him his business. Those desperate enough to venture outside in their search for food are hunted down by “Big Whites” — members of the security forces who owe their nickname to the white hazmat suits they wear. Patrolling the streets day and night, the “Big Whites” arrest and jail anyone caught breaking quarantine, who often get beaten in the process.

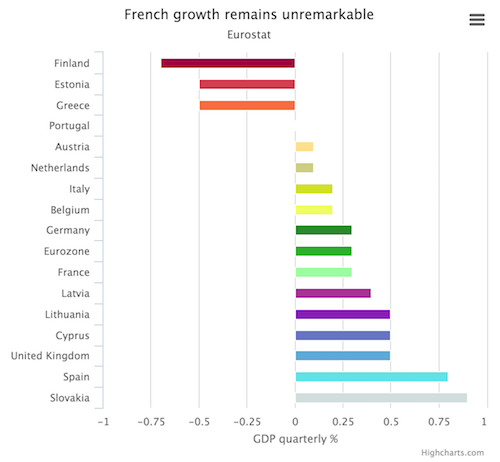

He won’t lose.

• Macron To Face Off Against Marine Le Pen Again (JTN)

French President Emmanuel Macron will face off against hard-right leader Marine Le Pen later this month in a runoff election. With 97% of the votes in, the incumbent Macron won 27.35% of the vote while Le Pen came in second at 23.97%, according to the French Interior Ministry. Paris mayor Anne Hidalgo, the Socialist candidate, received less than 2% of the vote. Macron, of The Republic On the Move Party, has served as president since 2017. “Make no mistake, nothing is decided,” he told supporters on Sunday evening, according to the BBC. Le Pen celebrated Sunday’s results on Twitter. “I call on all French people, of all sensitivities, to join this great national and popular gathering that I am carrying!” she wrote.

Le Pen has surged in popularity following Russia’s invasion of Ukraine as the cost of living increased, the Financial Times reported. She has been accused of being far-right for her anti-Islam views. Le Pen has said that she would limit immigration and forbid the Muslim veil in public. “That’s not us,” Macron said. “Make no mistake. This contest is not finished, and the debate we’ll have in the next two weeks will be decisive for our country and for Europe … I want a France rooted in a strong Europe.” Le Pen has also been skeptical of the European Union and NATO. If she wins, the founder of the National Rally Party promised to restore France’s “prosperity and grandeur.” Left-wing Jean-Luc Melenchon, who came in third at less than 22%, urged his followers Sunday evening, “You must not give a single vote to Marine Le Pen,” according to the BBC. He did not, however, endorse the current president.

George Webb Azov-Metabiota

Many questions on bioagents and NATO will be answered in the next few days at Azovstal. pic.twitter.com/9xKrcZSLhH

— George Webb – Investigative Journalist (@RealGeorgeWebb1) April 10, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.