John Collier Street Corner, Monday after Pearl Harbor, San Francisco 1941

Oh, really?! “..downside risks to the world economy appear more pronounced than they did just a few months ago.”

• Storm Clouds Gather Over Global Economy As World Struggles To Shake Crisis (T.)

Britain is among a handful of shining lights in the global economy this year as the world sees the slowest period of growth since the depths of the financial crisis, according to the IMF. The IMF edged up its forecast for UK growth in 2015 amid downgrades “across the board” for advanced and emerging economies. It said China’s slowdown, falling commodity prices and an expected increase in US interest rates would all weigh on output. The world economy is now expected to expand by 3.1pc in 2015, from a forecast of 3.3pc in July. This represents the slowest expansion since 2009, when global growth ground to a halt. Growth in 2016 is expected to pick up to 3.6pc. However, this is below the 3.8pc expansion that was previously forecast.

“Six years after the world economy emerged from its broadest and deepest post-war recession, the holy grail of robust and synchronised global expansion remains elusive,” said Maurice Obstfeld, the IMF’s chief economist. “Despite considerable differences in country-specific outlooks, the new forecasts mark down expected near-term growth marginally but nearly across the board. Moreover, downside risks to the world economy appear more pronounced than they did just a few months ago.” The Fund warned that the risk of recession in the US, eurozone and Japan over the next year had increased over the past six months, as emerging markets face a fifth year of slowing growth. Years of weak demand and anaemic productivity growth meant the likelihood of damage to growth over the medium term was “increasingly a concern”, the IMF warned.

A further decline in global demand could lead to “near stagnation” in advanced economies if emerging markets continued to falter, it added. The UK economy is projected to grow by 2.5pc this year, up slightly on the IMF’s July forecast of 2.4pc. Its projection for 2016 growth was unchanged, at 2.2pc. “In the United Kingdom, continued steady growth is expected, supported by lower oil prices and continued recovery in wage growth,” the IMF said in its latest World Economic Outlook. The outlook also showed US growth for 2015 was also higher than it expected three months ago, while Italy saw upgrades for both 2015 and 2016. The world’s biggest economy is expected to lead growth in the G7 this year. However, both the UK and US economies have recently shown signs of slowing down.

Remind me why we pay attention to anything the IMF says.

• IMF Warns On Worst Global Growth Since Financial Crisis (FT)

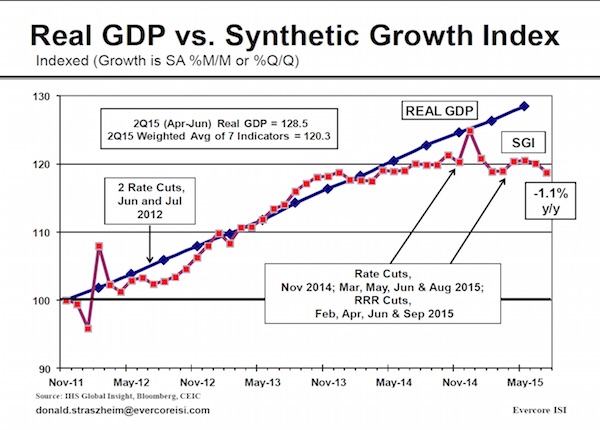

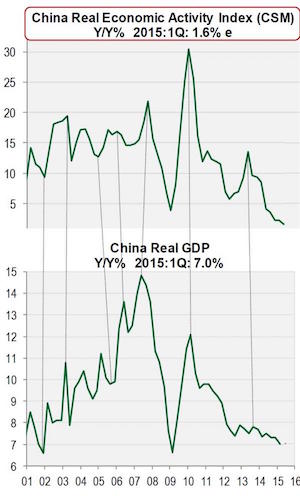

The world economy will this year grow at its slowest pace since the global financial crisis, the IMF said on Tuesday, with a deep slowdown in China and other emerging economies masking a strengthening recovery in rich countries. 2015 will mark the fifth consecutive year that average growth in emerging economies has declined, the fund predicts in its twice-yearly world economic outlook. This drag on global growth is sufficient to pull it down to 3.1% this year even though advanced economies will post their best performance since 2010. With downgrades to its growth forecasts, the fund called for countries to redouble efforts to boost domestic spending and reform their economies to improve the potential for expansion.

There was not one specific cause of the global economic weakness, the IMF said, although the slowdown in China and its realignment towards consumption and services compounded pain for countries which export oil and metals. Instead, the fund said the weakness reflected common longer-term forces slowing the potential for growth in many countries, including lower productivity growth, high public and private debt levels, ageing populations and a hangover from post-crisis investment booms in many emerging economies. Maurice Obstfeld, the IMF’s new chief economist, said: “Of course, countries with multiple diagnoses are faring worst, in some cases also facing high inflation.”

The fund has cut the global growth forecast for 2015 from 3.5% in April to 3.1% with a gradual recovery in the years ahead as it expects the faster growing emerging economies to recover and continue to account for the lion’s share of global expansion. In a move that will surprise many analysts, the IMF has not downgraded its forecast for China, despite the stock market crash, its August devaluation and policy U-turns which suggested the country’s economy was more troubled than official figures suggest.

One minor event away from the vortex.

• Most Americans Have Less Than $1,000 In Savings (MarketWatch)

Americans are living right on the edge — at least when it comes to financial planning. Approximately 62% of Americans have less than $1,000 in their savings accounts and 21% don’t even have a savings account, according to a new survey of more than 5,000 adults conducted this month by Google Consumer Survey for personal finance website GOBankingRates.com. “It’s worrisome that such a large percentage of Americans have so little set aside in a savings account,” says Cameron Huddleston, a personal finance analyst for the site. “They likely don’t have cash reserves to cover an emergency and will have to rely on credit, friends and family, or even their retirement accounts to cover unexpected expenses.”

This is supported by a similar survey of 1,000 adults carried out earlier this year by personal finance site Bankrate.com, which also found that 62% of Americans have no emergency savings for things such as a $1,000 emergency room visit or a $500 car repair. Faced with an emergency, they say they would raise the money by reducing spending elsewhere (26%), borrowing from family and/or friends (16%) or using credit cards (12%). And among those who had savings prior to 2008, 57% said they’d used some or all of their savings in the Great Recession, according to a U.S. Federal Reserve survey of over 4,000 adults released last year. Of course, paltry savings-account rates don’t encourage people to save either.

In the latest survey, 29% said they have savings above $1,000 and, of those who do have money in their savings account, the most common balance is $10,000 or more (14%), followed by 5% of adults surveyed who have saved between $5,000 and just shy of $10,000; 10% say they have saved $1,000 to just shy of $5,000. Just 9% of people say they keep only enough money in their savings accounts to meet the minimum balance requirements and avoid fees. But minimum balance requirements can vary widely and be hard to meet for some consumers. They can vary anywhere between $300 a month and $1,500 a month at some major banks.

So much for socialism.

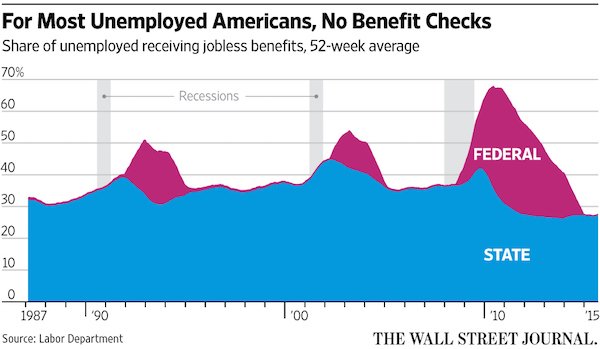

• Less Than a Third of Unemployed Americans Get Benefit Checks (WSJ)

The number of unemployed Americans dipped below eight million last month for the first time since 2008–but that figure doesn’t entirely reflect job growth. Unemployment dropped to a new low the same month that 350,000 Americans exited the labor force, the Labor Department said Friday. The civilian labor force has shrunk three of the past four months since touching a record high in May. One explanation for the trend is that Americans out of work for an extended period of time are giving up looking for jobs. The long-term jobless drop out of the labor force at a faster pace than those with shorter spells of unemployment, said Claire McKenna, policy analyst at the National Employment Law Project, an organization that advocates on behalf of the unemployed.

“The headline numbers are masking other vulnerabilities in the job market,” she said. Why are workers leaving the labor force? It could be because relatively few unemployed are receiving jobless benefits. The number of Americans receiving ongoing unemployment benefits touched a 15-year low last month. Those receiving government payments last month represented less than 28% of all unemployed Americans, according to an analysis of Labor Department data. That figure is down from 31% a year earlier. And it’s well below the 67% who received the assistance in September 2010, when emergency federal programs extended benefits beyond the 26 weeks granted in most states, to as long as 99 weeks.

Divvying up the looot.

• Making Bank: Wall Streeters Are Earning More Than Ever Before (Forbes)

If you work on Wall Street, you’re pulling in bigger bucks than ever before. Wall Street pay set a new record last year, according to a report out Tuesday from the New York State Comptroller’s office, with the average salary (including bonuses) rising 14% to $404,800. This is the first time since 2007 that the average pay on Wall Street has exceeded $400,000 and is the third-highest annual pay on the books when you adjust for inflation. The rise in pay has been propelled by larger bonuses, which rose 2% to $172,900 last year. The only times that workers collected bigger bonuses were in the two years leading up to the financial crisis. As New York City dwellers are well-aware, someone with a job on Wall Street is making a lot more money than their neighbors.

Here’s just how much: Average salaries on Wall Street were almost six times higher than the average salary of $72,300 at other NYC private-sector companies last year. The pace of wage growth on Wall Street has far outstripped other industries in the last 30 years, too. In 1981, Wall Street workers were making just twice as much as the average employee in the city’s private sector. There’s a disproportionate number of high-earners in finance, which helps bolster the numbers. Some 23% of Wall Street workers pulled in more than a quarter million dollars in 2013, the latest year in which there is data available, while less than 3% of the city’s other workers can say the same.

While Wall Street is still 9% smaller than before the recession and the industry has undergone years of downsizing, the number of people being hired is finally growing. In fact, Wall Street added 2,300 jobs in 2014, which was the first year of gains since 2011. Still, recent financial turmoil could potentially derail that. “After a very strong first half of the year, the securities industry faces volatile financial markets and an unsteady global economy,” said New York State Comptroller Thomas P. DiNapoli in a statement. “After years of downsizing, the industry has been adding jobs in New York City, but it may curtail hiring to bolster profits.” The city depends on Wall Street not only to pad its tax coffers, but to generate jobs and support the local economy.

“The American Society of Civil Engineers reckons that more than $3 trillion of work should be done.”

• 61,064 Failing US Bridges Must Wait as Cities Borrow at Decade Low (Bloomberg)

States and cities rely on the $3.7 trillion U.S. municipal-bond market to pay for roads, commuter trains and water works. Yet even with a growing backlog of projects, 61,064 deficient bridges and interest rates near a half-century low, such borrowing has dropped to the slowest pace in at least a decade. About $14.8 billion of municipal debt has been sold this year for highway, airport and mass-transit projects, on pace for the smallest amount since at least 2005, data compiled by Bloomberg show. The population has grown by 7.5% since then, placing an increasing demand on America’s infrastructure: The Federal Highway Administration estimates that when it comes to bridges alone, one in 10 is structurally deficient. The American Society of Civil Engineers reckons that more than $3 trillion of work should be done.

“It’s a pretty deteriorated backbone,” Marc Lipschultz, head of energy and infrastructure at KKR, said in an interview at Bloomberg Markets Most Influential Summit 2015 in New York on Tuesday. “There’s not enough capital in the public domain,” he said. “It’s trillions of dollars of capital that has to be invested.” One reason for the lack of borrowing: officials at local governments that were stung by budget shortfalls after the recession have been leery of taking on new debt. Instead, they’ve been seizing on low interest rates to refinance higher-cost bonds. About two-thirds of the $312.5 billion issued through Sept. 30 has been for that purpose, Bank of America Merrill Lynch data show. Federal subsidies briefly spurred work on infrastructure, though the program has since lapsed. Borrowing for new highway, airport and mass transit projects reached a record $65 billion in 2010, the last year of the federal Build America Bonds program, Bloomberg data show.

As predicted: “..the main reason for the decline would be a lack of bank financing for new shale developments.”

• ‘US Oil Output On Brink Of ‘Dramatic’ Decline’ (Reuters)

Oil executives warned on Tuesday of a “dramatic” decline in U.S. production that could pave the way for a future spike in prices if fuel demand increases. Delegates at the Oil and Money conference in London, an annual gathering of senior industry officials, said world oil prices were now too low to support U.S. shale oil output, the biggest addition to world production over the last decade. “We are about to see a pretty dramatic decline in U.S. production growth,” the former head of oil firm EOG Resources Mark Papa, told the conference. Papa, now a partner at U.S. energy investment firm Riverstone, said U.S. oil production would stall this month and begin to decline from early next year. He said the main reason for the decline would be a lack of bank financing for new shale developments.

Official data show that nationwide U.S. output has already begun to decline after reaching a peak of 9.6 million barrels per day in April, although production in some big shale patches, including North Dakota, has held steady thus far. The Energy Information Administration forecast on Tuesday that output would reach a low of around 8.6 million bpd next year. Until this year, U.S. oil output was growing at the fastest rate on record, adding around 1 million bpd of new supply each year thanks to the introduction of new drilling techniques that have released oil and gas from shale formations. But oil prices have almost halved in the last year on oversupply in a drop that deepened after OPEC in 2014 changed strategy to protect market share against higher-cost producers, rather than cut output to prop up prices as it had done in the past.

“Volkswagen’s R&D spending was higher than at Ford and GM combined.” “Where’s the innovation? Obviously not in diesel engines,” Ellinghorst said. “There’s a culture of spending and a lack of focus on efficiency in favor of striving to be bigger.”

• VW to Delay, Cancel Non-Essential Investments Due to Scandal (Bloomberg)

Volkswagen CEO Matthias Mueller said the company will delay or cancel non-essential projects as pressure mounts to slash spending in the wake of the diesel-emissions scandal. “We will review all planned investments, and what isn’t absolutely vital will be canceled or delayed,” Mueller told some 20,000 employees at the German company’s headquarters Tuesday, according to an e-mailed statement of his remarks. “And that’s why we will re-adjust our efficiency program. I will be completely clear: this won’t be painless.” Fixing about 11 million rigged diesel vehicles is a costly prospect. The €6.5 billion Volkswagen already set aside for repairs won’t be enough to cover fines and potential legal damages as well, Mueller said.

The company is exploring options from a simple software upgrade to outright replacing some cars. Fines may reach $7.4 billion in the U.S. alone, according to analysts from Sanford C. Bernstein. Volkswagen could put a push to gain market share in the North America on hold as long as there’s no clarity on the extent of the costs of fixing the cars and potential fines, said Jose Asumendi, a London-based analyst at JPMorgan Chase. The carmaker outlined plans in March for an investment of about $1 billion to expand its vehicle assembly plant in Mexico’s Puebla state. That work could face a delay, Asumendi said. “It’s going to to be tough to find projects they could chop that will actually move the needle,” Asumendi said. “What they really need to do is get costs under control.”

Labor leaders have been pushing VW to reel in research and development spending to protect jobs, while management wants personnel expenses reduced as well, people familiar with the situation said before the carmaker published Mueller’s statement. Other options include lowering purchasing expenses and reducing sponsorship activities, with the extent of the measures dependent on the cost of the cleanup, said the people, who asked not to be named because the talks are private. “We’ll pay extra attention to bonus payments to members of the management board,” Bernd Osterloh, a supervisory board member and head of the works council, told employees. All projects and investments will need to be examined, and “we’ll have to question everything that’s not economical,” he said.

The German company may be forced to tighten an “incredibly inefficient” organization and lop funding out of a $17.4 billion research and development budget that was the world’s biggest last year, about equal to the combined figure at Apple and the former Google, said Arndt Ellinghorst with Evercore ISI. Volkswagen’s R&D spending was higher than at Ford and GM combined. “Where’s the innovation? Obviously not in diesel engines,” Ellinghorst said. “There’s a culture of spending and a lack of focus on efficiency in favor of striving to be bigger.”

“The only thing that seemed to work was cash. Of course that’s the one thing they [the hedge funds] don’t have..”

• Hedge Funds Suffer Worst Month Since October 2008 (FT)

Hedge funds have suffered their biggest monthly monetary loss since the 2008 financial crisis in the wake of market turbulence that battered the portfolios of some of the industry’s best known investors. The sector as a whole lost $78 billion due to its performance in August, the worst monthly absolute fall in assets since October 2008 – the month following the collapse of Lehman Brothers – according to research by Citi. “The only thing that seemed to work was cash. Of course that’s the one thing they [the hedge funds] don’t have,” said Paul Brain, head of fixed income for Newton Investment Management and a former credit hedge fund manager.

Some of the worst hit were funds that specialised in stock picking, with David Einhorn’s $11 billion Greenlight Capital having lost 17% up to the end of September, Daniel Loeb’s $17 bilion Third Point down about 4% and Bill Ackman’s Pershing Square vehicle down double digits over the summer. Total hedge fund industry assets at the end of August stood at $3.05 trillion, according to Citi, down 0.2% year on year. Total hedge fund assets have doubled since 2008, according to HFR.

Q: what happens to house prices when the Chinese stop buying?

• Chinese Money Flows Into US Housing (CNBC)

From sunny suburban developments in Irvine, California, to shiny new condominium towers overlooking Manhattan’s skyline, Chinese buyers are sinking cash into U.S. residential real estate. Chinese are now the top foreign buyers of domestic properties, according to the National Association of Realtors, and nearly half of them are paying cash, according to RealtyTrac, a real estate sales and analytics company. 46% of Chinese buyers paid cash for their U.S. homes so far in 2015, up 229% from a decade ago. Compare that to a 33% cash share for buyers overall, up 65% from a decade ago.

“Cash buyers across the board are playing a much bigger role in the housing market now than they were 10 years ago, and that is particularly true for Chinese Mandarin-speaking cash buyers, who are more likely to be foreign nationals,” said Daren Blomquist at RealtyTrac. “Foreign cash buyers have helped to accelerate U.S. home price appreciation over the past few years given that these buyers are often not as constrained by income as local, traditionally financed buyers.” Recent instability in China’s economy and stock market has driven even more buyers to the U.S. — so much so that Long & Foster, a Virginia-based real estate agency, recently began working with Juwai, a China-based real estate listing site.

“We’re seeing demand from Chinese buyers with children of all ages – some as young as 1 year old – and they’re relying on our team for insight into the local areas and their educational offerings, from elementary to university level,” said Pandra Richie, president of Long & Foster’s corporate real estate services. “Access to quality education is one of the top priorities for Chinese buyers, and from Philadelphia to Richmond, our market areas offer some of the best school districts and universities.” Asian buyers accounted for 35% of all international purchases of U.S. real estate for the 12-month period ended in March 2015, spending more than $28 billion. They have been very active in high-end markets, especially in California and New York City.

Funny that iPhones count as imports.

• Mighty Dollar Sends US Exports To 3-Year Low, Trade Deficit Surges (MarketWatch)

U.S. exports have fallen 6% compared to one year ago, hurt by a rising value of the dollar that’s made American goods and services more expensive overseas. “The strongest dollar in more than a decade, coupled with waning demand overseas as a result of tepid economic growth, is undermining demand for U.S.-made goods, said Lindsey Piegza, chief economist at Stifel Fixed Income. Large U.S. manufacturers, energy producers and other internationally oriented firms have borne the brunt of a strong dollar. Barely any manufacturing jobs have been created in 2015, and energy producers have cut 120,000 jobs since December. In August, the U.S. exported less oil, plastic and other industrial supplies. A drop in oil prices at the end of the summer also reduced the value of American petroleum exports.

Overall, U.S. exports fell to $186.1 billion in August, marking the smallest amount since October 2012. At the same time, though, the strong dollar and decline in oil prices cut U.S. demand for foreign petroleum to the lowest level since 2004. That frees up more money for American consumers to save or buy other goods and services. Still, total U.S. imports rose 1.2% in August to $233.4 billion, driven by a surge in shipments of the latest iPhones that are hitting store shelves in time for the holiday season. The value of this category, ”cellphones and other household goods,” shot up 30% to $9.01 billion, the government said. The U.S. trade deficit with China, where most cell phones are made, increased 14.4% to $32.9 billion in August. The gap with the European Union rose 17% to $14.5 billion. Country data is not seasonally adjusted, and only includes goods and not services.

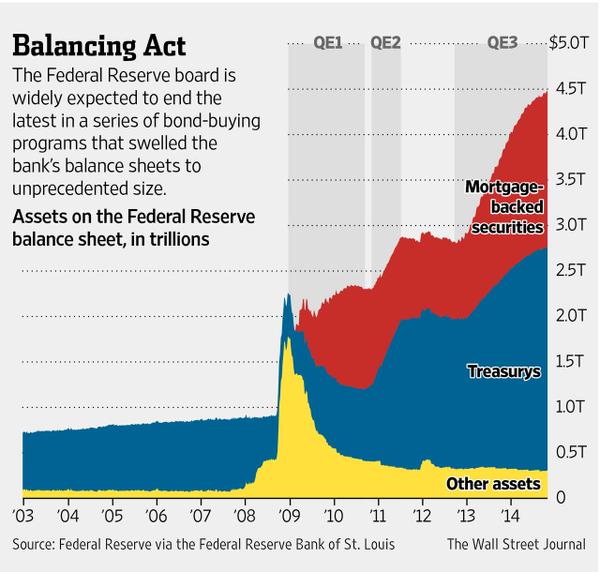

One more time: “..the Federal Reserve lends to healthy firms on a collateralized basis…”

• Bernanke Tries to Rewrite the Financial Crisis in New Book (Pam Martens)

Will the American people ever get an honest writing of the 2008-2009 Wall Street collapse? If you think it is to be found in the new book released on Monday by former Fed Chairman Ben Bernanke (which we seriously doubt you are thinking) you will be disappointed. What you will find in Bernanke’s book are photos of his grandparents, a photo of the Time Magazine cover with himself named “Man of the Year,” a photo of Bernanke with the masterminds of the repeal of the investor protection act known as Glass-Steagall (Robert Rubin, Alan Greenspan, Larry Summers), a photo of the grand double staircase in the Federal Reserve building, and so forth. What you will not find is an honest accounting of how the Fed allowed Citigroup to grow into a financial Frankenstein and then quietly and secretly shoveled trillions of dollars into the firm to keep it afloat.

You won’t find any of that because on March 3, 2009, former Fed Chairman Ben Bernanke testified under questioning from Senator Bernie Sanders that “the Federal Reserve lends to healthy firms on a collateralized basis…” In reality, Citigroup was a financial basket-case at that point. Its stock closed that day at $1.22. It would take a court battle launched by Bloomberg News and legislation pushed by Senator Bernie Sanders to unearth from the Fed the fact that it had funneled over $16 trillion in cumulative loans to save the financial system. Citigroup was the largest recipient of those loans, with a take of over $2.5 trillion cumulatively, on top of $45 billion in TARP funds and over $306 billion in asset guarantees.

Bernanke’s account in his new book, The Courage to Act: A Memoir of a Crisis and Its Aftermath, attempts to resuscitate the bogus scenario that it was the collapse of Lehman and AIG that set the crisis in motion, not mega banks weakened by lax regulation by the Fed and the repeal of the Glass-Steagall Act, a decision supported by the Fed. (Lehman Brothers, an investment bank, and AIG, an insurance company, were not overseen by the Federal Reserve at that time.)

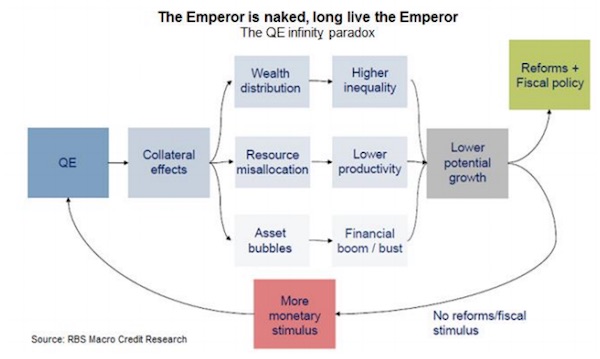

” In nature, the parasite makes the host think that the free rider, the parasite, is its baby, part of its body, to convince the host actually to protect the parasite over itself. That’s how the financial sector has taken over the economy.”

• Parasites In The Body Economic: The Disasters Of Neoliberalism (Michael Hudson)

Economists for the last 50 years have used the term “host economy” for a country that lets in foreign investment. This term appears in most mainstream textbooks. A host implies a parasite. The term parasitism has been applied to finance by Martin Luther and others, but usually in the sense that you just talked about: simply taking something from the host. But that’s not how biological parasites work in nature. Biological parasitism is more complex, and precisely for that reason it’s a better and more sophisticated metaphor for economics. The key is how a parasite takes over a host. It has enzymes that numb the host’s nervous system and brain. So if it stings or gets its claws into it, there’s a soporific anesthetic to block the host from realizing that it’s being taken over. Then the parasite sends enzymes into the brain.

A parasite cannot take anything from the host unless it takes over the brain. The brain in modern economies is the government, the educational system, and the way that governments and societies make their economic policy models of how to behave. In nature, the parasite makes the host think that the free rider, the parasite, is its baby, part of its body, to convince the host actually to protect the parasite over itself. That’s how the financial sector has taken over the economy. Its lobbyists and academic advocates have persuaded governments and voters that they need to protect banks, and even need to bail them out when they become overly predatory and face collapse.

Governments and politicians are persuaded to save banks instead of saving the economy, as if the economy can’t function without banks being left in private hands to do whatever they want, free of serious regulation and even from prosecution when they commit fraud. This means saving creditors – the 1%– not the indebted 99%. It was not always this way. A century ago, two centuries ago, three centuries ago and all the way back to the Bronze Age, almost every society has realized that the great destabilizing force is finance – that is, debt. Debt grows exponentially, enabling creditors ultimately to foreclose on the assets of debtors. Creditors end up reducing societies to debt bondage, as when the Roman Empire ended in serfdom.

Frontloading funds from 2007?!

• EU Parliament Backs Urgent Frontloading Of €35 Billion For Greece (Kath.)

The European Parliament on Tuesday backed a set of one-off measures aimed at boosting the effective spending of €35 billion earmarked for Greece in the EU 2014-2020 budget. This includes €20 billion from structural and investment funds and €15 billion from agricultural funds. MEPs followed the recommendation of Parliament’s regional development committee and adopted the Commission’s proposal by a vote of 586 to 87, with 21 abstentions, the European Commission said in a press release. This fast-track procedure paves the way for the swift adoption of the measures by the Council and their immediate implementation.

The measures are aimed at helping Greece ensure that all the money available from the 2007-2013 programming period is used before its expiry at the end of 2017 and to meet the requirements for accessing all the EU funds available to it in the current programing period of 2014-2020. The funding covers programing periods up to 2020. The amendment to the current regulation proposed by the Commission and agreed by Parliament allows some €500 million to be released as soon as the legislation is adopted and a further 800 million euros released in advance of the formal closure of the programs in 2017. Two specific measures will allow Greece to finish projects started under the 2007-2013 period by removing the need for national co-financing because the EU contribution rate is raised to 100% and making available the total amount, including pre-financing and interim payments, immediately (otherwise the last 5% of EU payments would have had to be held back until 2017).

Europe had better prepare. And no, trying to stop them is not an option.

• Turkey Warns 3 Million More Refugees May Be Headed To EU From Syria (AP)

Turkey has warned the European Union that 3 million more refugees could flee fighting in Syria as the EU struggles to manage its biggest migration emergency in decades. Around 2 million refugees from Syria are currently in Turkey, and tens of thousands of others have entered the EU via Greece this year, overwhelming coast guards and reception facilities. EU Council President Donald Tusk told lawmakers Tuesday that “according to Turkish estimates, another 3 million potential refugees may come from Aleppo and its neighborhood.” Tusk said that “today millions of potential refugees and migrants are dreaming about Europe.” He warned that “the world around us does not intend to help Europe” and that some of the EU’s neighbors “look with satisfaction at our troubles.”

Meanwhile, Austrian Chancellor Werner Faymann was heading to the eastern Aegean island of Lesvos with Greece’s prime minister to view first-hand the impact of the refugee crisis and tour the facilities set up to handle the new arrivals, which number in the hundreds and sometimes thousands every day. Faymann and Greece’s Alexis Tsipras were due on Lesvos around midday Tuesday and are to tour the reception center set up to register and process the arriving refugees and migrants. About 400,000 people have arrived in Greece so far this year, most in small overcrowded boats from the nearby Turkish coast. The vast majority don’t want to stay in the financially troubled country and head north through the Balkans to more prosperous European Union countries such as Austria, Germany and Sweden.

I said: not an option. This is going to cost human lives, for no reason at all.

• EU Launches Operation Targeting Libyan Refugee Smugglers (Guardian)

The EU hopes to begin intercepting people-smugglers in the southern Mediterranean on Wednesday, nearly six months after first pledging to target the Libyan smuggling industry. According to the EU’s foreign policy chief, Federica Mogherini, a combined EU naval mission known as EU Navfor Med will nominally now be able “to board, search and seize vessels in international waters, [after which] suspected smugglers and traffickers will be transferred to the Italian judicial authorities”. The move comes as the smuggling season begins to ebb, four months after the primary migration route to Europe switched from Libya to Turkey, and five-and-a-half months after EU heads of state, including David Cameron, promised to target Libyan smugglers.

EU officials have been vague about how their plan will be put into action, with a spokesman for the operation repeatedly avoiding direct questions on the subject. With no mandate from either the UN or the Libyan government, EU Navfor Med can only operate within international waters, raising questions about how it will be able to target smugglers who largely operate within Libya’s maritime borders. Smugglers currently cram migrants into rubber boats in Libyan waters, before sending the majority into international waters on their own. Only a minority of boats, usually wooden fishing vessels, are accompanied with a couple of expendable members of the smuggling network.

But both kinds of smuggling missions are already intercepted by rescue teams including EU Navfor Med, leading to confusion about whether Wednesday’s developments will constitute any significant change. The operation’s spokesman, Capt Antonello de Renzis Sonnino, acknowledged in an interview with the Guardian that boats laden with migrants will be handled just as they have been all year – with the passengers disembarked in Italy, and their smugglers presented to Italian policemen on arrival. The substantive change to the operation could conceivably come after the passengers are disembarked, when separate teams of smugglers dart into international waters to retrieve the abandoned fishing vessels and tow them back to Libya, ready to be reused in subsequent smuggling missions.

Even within the limits of its current mandate, the EU Navfor Med boats could pursue and seize smugglers who attempt to do this. Asked three times to confirm whether this was their plan, de Renzis Sonnino sidestepped each question, simply saying: “We are open 360 degrees to whatever is happening over there in international waters. So we are flexible. We can manage any situation – migrants alone, smugglers and migrants, or smugglers in their own boat.”

“There is more hatred in 2015 Bosnia than there was in 1995” .. “I have a message for the IMF: ‘Stop giving us money. Let us collapse.’ That’s the only way to clean house and get rid of all of these people. Let us starve for the next six months, and people will rise up and throw the leaders out.”

• Bosnia: A European Tinderbox Just Waiting For A Spark (Fortune)

For two decades, Srebrenica has memorialized the massacre, and this year a staggering 50,000 people came, including former U.S. President Bill Clinton, who resisted military engagement during post-Yugoslavia’s inter-ethnic battles (newly declassified White House minutes convey the vexing issues for the President and his advisors), and ultimately became the driver of the Dayton Peace Accords that ended the conflict. Bosnians have grown resentful of the U.S.-brokered agreement that pushed combatants into an uneasy peace, but offered little more than the template for separateness: Serb governance in the north and northeast (called Republika Srpska) with a Bosnian and Croat federation covering the rest of the landscape. And in the years since, festering animosity has had a crippling effect.

[..] The nation’s economy is at a standstill, and dangerously so. Industrial production is down, exports have slumped, consumer spending is anemic, and unemployment among youth is much higher than the official 60% jobless rate for 16 to 30 year-olds. Most employed Bosnians have secured government jobs through party patronage and ethnic ties. The IMF standby arrangement – an infusion of funds to avoid the country’s collapse – enables the government to meet payroll and to run public works, but critics say the help only delays coming up with a way forward. On one thing, at least, Bosnia’s fractured groups are in rare agreement: their state is a failure, emasculated by Serb, Muslim, and Croat entity presidents who operate on a mutually suspicious basis.

The Dayton accord effectively sanctioned leaders to push their own nationalist and religious agendas to the exclusion of one another. Savvy players profit by wielding ethno-centric power in public works, schools, arts, and especially memory. The National Art Gallery, along with a half dozen other major state institutions, have long been shuttered, as budgets shrink and Bosnian citizens reject anything that might suggest that they are part of a single nation. In mid-September, the government re-opened the National Museum after years of neglect. [..] Srebrenica survivor Muhamed Durakovic claims his pessimism about the nation’s economic future is well-placed and widely held. He echoes others’ indictment of Bosniak, Serb, and Croat leaders for financing and favoring loyalists regardless of an investment’s integrity, all at the expense of “actual development.”

Durakovic is wistful about his home in Srebrenica, where “hope for the future is really lost…there are very few sustainable projects.” In a bitter twist, the only consistent growth industry in Bosnia relates to the search for those lost to the war. Durakovic uses his forensics expertise with conflict-torn Libya as the Tripoli director of the International Commission on Missing Persons. Bosnia’s own search for skeletal parts and other clues is made more difficult by its ethnic rivalries. “There is more hatred in 2015 Bosnia than there was in 1995” as politicians prey on ethnic divides to preserve their own power, Durakovic asserts. “I have a message for the IMF: ‘Stop giving us money. Let us collapse.’ That’s the only way to clean house and get rid of all of these people. Let us starve for the next six months, and people will rise up and throw the leaders out.”

One Nobel Peace Prize recipient bombing another.

• Doctors Without Borders Airstrike: US Alters Story 4th Time In 4 Days (Guardian)

US special operations forces – not their Afghan allies – called in the deadly airstrike on the Doctors Without Borders hospital in Kunduz, the US commander has conceded. Shortly before General John Campbell, the commander of the US and Nato war in Afghanistan, testified to a Senate panel, the president of Doctors Without Borders said the US and Afghanistan and had made an “admission of a war crime”. Shifting the US account of the Saturday morning airstrike for the fourth time in as many days, Campbell reiterated that Afghan forces had requested US air cover after being engaged in a “tenacious fight” to retake the northern city of Kunduz from the Taliban. But, modifying the account he gave at a press conference on Monday, Campbell said those Afghan forces had not directly communicated with the US pilots of an AC-130 gunship overhead.

“Even though the Afghans request that support, it still has to go through a rigorous US procedure to enable fires to go on the ground. We had a special operations unit that was in close vicinity that was talking to the aircraft that delivered those fires,” Campbell told the Senate armed services committee on Tuesday morning. The airstrike on the hospital is among the worst and most visible cases of civilian deaths caused by US forces during the 14-year Afghanistan war that Barack Obama has declared all but over. It killed 12 Doctors Without Borders staff and 10 patients, who had sought medical treatment after the Taliban overran Kunduz last weekend. Three children died in the airstrike that came in multiple waves and burned patients alive in their beds.

On Tuesday, Doctors Without Borders denounced Campbell’s press conference as an attempt to shift blame to the Afghans. “The US military remains responsible for the targets it hits, even though it is part of a coalition,” said its director general, Christopher Stokes. Campbell did not explain whether the procedures to launch the airstrike took into account the GPS coordinates of the Doctors Without Borders field hospital, which its president, Joanne Liu, said were “regularly shared” with US, coalition and Afghan military officers and civilian officials, “as recently as Tuesday 29 September”.

We bring mayhem wherever we go. Maybe we should leave.

• No Foreign Aid Agencies Left In Afghanistan’s Kunduz (AFP)

All international aid organisations have left the embattled Afghan city of Kunduz following a US air strike on a hospital run by medical charity MSF and amid heavy fighting, the UN said Tuesday. The humanitarian situation in the strategic northern city, briefly captured by the Taliban last month, is thought to be difficult but the extent of what is needed remains unclear because of problems getting access, the UN humanitarian agency said. “There are presently no humanitarian agencies left inside Kunduz city,” said OCHA spokesman Jens Laerke. “Two UN entities, four national NGOs and 10 international NGOs have been temporarily relocated due to the ongoing conflict and unstable and fluid security situation in Kunduz,” he told AFP.

A US air strike hit MSF’s Kunduz hospital on Saturday, killing 22 people and sparking international outrage, with the charity branding the incident a war crime. The top US commander in Afghanistan on Tuesday said the hospital had been “mistakenly struck”. The strike came days after the Taliban briefly overran Kunduz in their most spectacular victory in 14 years. MSF has closed its trauma centre seen as a lifeline in the war-battered region after the incident, while UN Secretary General Ban Ki-moon has called for a “thorough and impartial investigation”. Laerke pointed out that the MSF hospital had been “the only facility of its kind in the entire northeastern region of the country, serving some 300,000 people in Kunduz alone.”

Now, he said, “the international aid agencies have been forced out of the city for the time being, so there is essentially no proper healthcare, no proper trauma care for those left inside the city.” In addition, he said water and electricity reportedly remained cut off across much of the city, and most food markets remained closed. “Thousands of people have fled Kunduz, and an estimated 8,500 families have been displaced in the northeast as a result of the fighting,” he said, adding that aid agencies were scrambling to gain access to the area so they could assess and address the needs. “Preliminary needs are expected to include food, emergency shelter, water and emergency health services, … and family tracing and reunification after the increased displacement,” Laerke said.

One word: oil.

• Amnesty Urges UK, US To Stop Providing Weapons To Saudi Arabia (Guardian)

Britain is being urged to halt the supply of weapons to its ally Saudi Arabia in the light of evidence that civilians are being killed in Saudi-led attacks on rebel forces in Yemen. Amnesty International has warned that “damning evidence of war crimes” highlights the urgent need for an independent investigation of violations and for the suspension of transfer of arms used in the attacks. Amnesty said it found a pattern of “appalling disregard” for civilian lives by the Saudi-led coalition in an investigation of 13 air strikes in north-eastern Saada governorate during May, June and July: these killed some 100 civilians – including 59 children and 22 women and injured a further 56, including 18 children. “In at least four of the airstrikes investigated … homes attacked were struck more than once, suggesting that they had been the intended targets despite no evidence they were being used for military purposes,” it said.

The complexities of the war in Yemen – overshadowed by the larger and more familiar conflict in Syria – were underlined again on Tuesday when a new affiliate of Islamic State claimed responsibility for four suicide bombings in the port city of Aden that killed at least 15 people including Saudi, Emirati and Yemeni troops. The UAE and other Gulf states are also taking part in the campaign against Yemeni Houthi rebels of the Zaydi sect who are widely seen as being supported by Iran, Saudi Arabia’s strategic rival. The declared aim is to restore the internationally recognised government of president Abed Rabbu Mansour Hadi, who is currently in Aden, having fled the capital, Sana’a, when the Houthis took over. Since last March coalition air strikes have hit homes, schools, markets and other civilian infrastructure, as well as miltiary objectives.

[..] “The conflict and restrictions imposed by the Saudi Arabia-led coalition on the import of essential goods have exacerbated an already acute humanitarian situation resulting from years of poverty, poor governance and instability,” Amnesty says. Currently 80% of Yemenis need some form of humanitarian assistance. The call to the UK is made because it is a major supplier of weapons to Saudi Arabia, including a recent consignment of 500lb Paveway IV bombs, used by Tornado and Typhoon fighter jets, which are manufactured and supplied by the UK arms company BAE Systems. Both aircraft have been used in Yemen.

“The UK government has previously claimed its arms are being properly used in Yemen, but what on earth is it basing this on?” said Amnesty International UK’s arms control programme director Oliver Sprague. “It seems to be no more than claims from the Saudi Arabian authorities themselves. With mounting evidence of the reckless nature of the Saudi-led coalition’s bombing campaign in Yemen, the government must urgently investigate whether UK-supplied weaponry has killed civilians in places like Saada.” The US is also a major arms supplier to Saudi Arabia. Amnesty also said coalition forces have repeatedly launched strikes using internationally banned cluster bombs.