DPC Coaches at Holland House Hotel on Fifth Avenue, NY 1905

Not much recovery left.

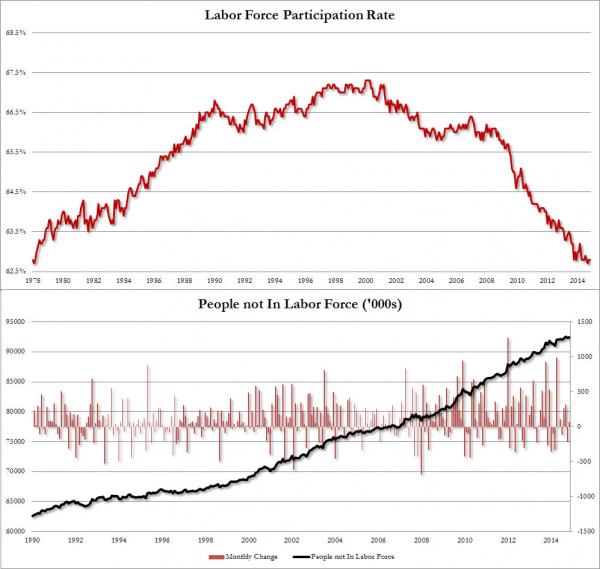

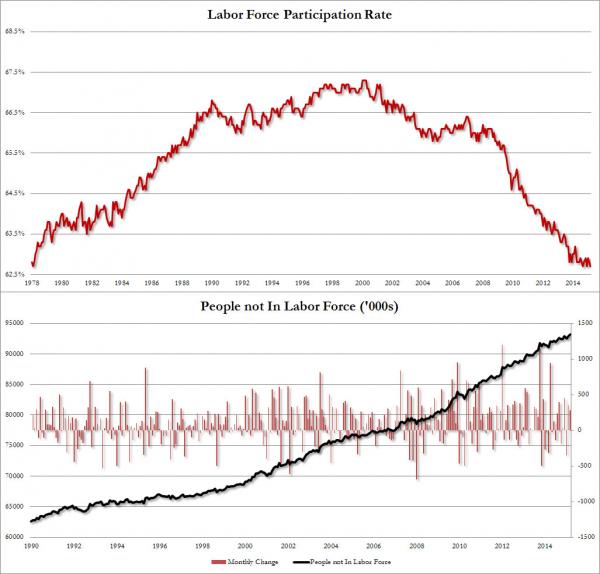

• Huge Miss: +126,000 Jobs, Labor Force -631,000 in Two Months (Mish)

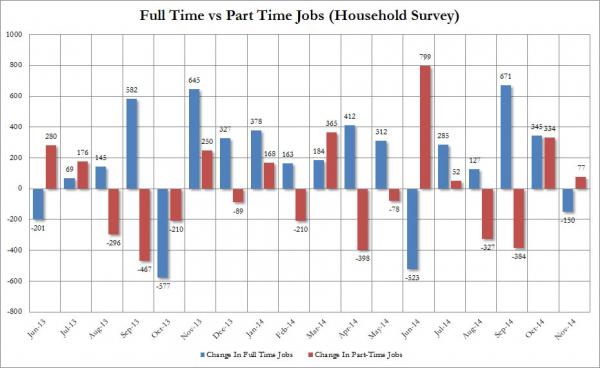

For a huge change we see the existing pattern of a strong establishment survey but a poor household survey has been replaced by weakness all around. Last month I stated “The household survey varies more widely, and the tendency is for one to catch up to the other, over time. The question, as always, is which way?” It is still difficult to say if this is the start of a new trend, but it could be. Last month the household survey showed a gain in employment of a meager 96,000 and much of that was teen employment. This month the household survey came in at an anemic 34,000.

The labor force declined in each of the last two months. Those “not in the labor force” rose by a whopping 631,000 in the last two months. The Bloomberg Consensus jobs estimate was for 247,000 jobs, missing by a mile. In fact, the number came in lower than any estimate. The estimate range was 200,000 to 271,000. Not only that, January and February were both revised lower. The net was 69,000 lower. Economists blame the weather. Bad weather in March? And not in January and February?

“Whichever way the economic data break in the months ahead, somebody is going to get caught badly offside.”

• US Jobs Data: Winter of Discontent, Summer of Discomfort (WSJ)

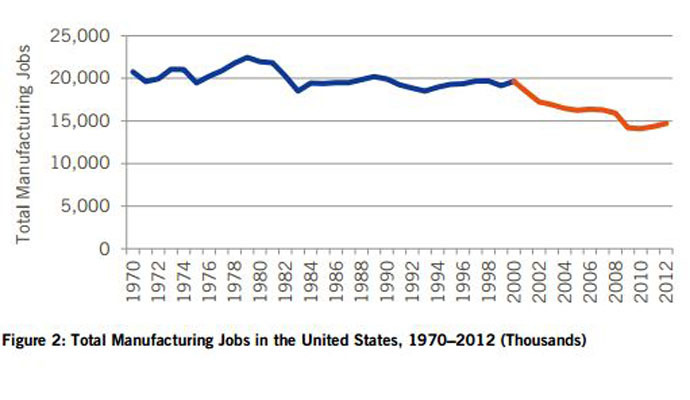

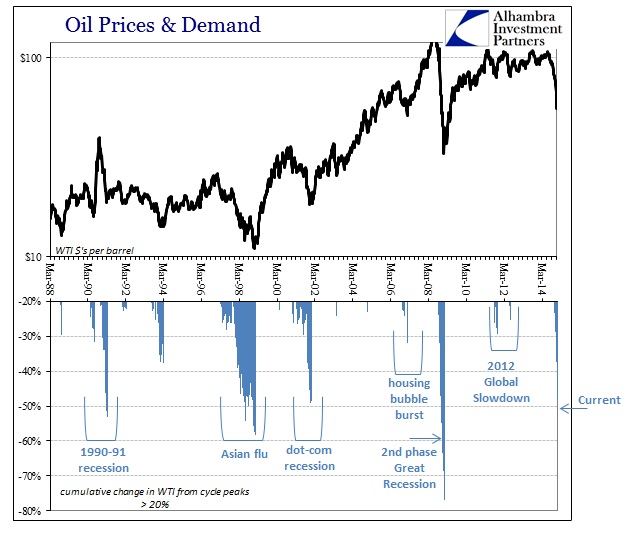

Friday’s jobs numbers made the Federal Reserve’s path over the next several months clearer. Just not in a good way. The Labor Department reported that the economy added just 126,000 jobs in March, far fewer than the 247,000 economists were looking for and the smallest gain in more than a year. Worse, downward revisions to January and February reduced America’s job count by 69,000. If there was any question that the Fed would pass up on raising rates at its June meeting, it has been resolved. Indeed, amid signs that global economic weakness has begun to weigh on the U.S. job market, even the September liftoff on rates that most economists have been forecasting is looking iffy. The labor market’s weakness last month was concentrated in what are known as the goods-producing sectors: manufacturing , construction and mining and logging.

These saw a loss of 13,000 jobs, marking the worst month since July 2013. Some of that may be attributable to the cold: The number of people who said they had jobs but didn’t work because of the weather was elevated, and the goods-producing sectors are prone to such effects. But the more worrisome exposure is to weakness abroad. Struggling economies overseas have helped send oil and other commodity prices lower and the dollar higher. These are things that hurt the mining sector (which includes oil extraction) and manufacturers (which compete globally) in particular. Chances are the labor market will be able to handle these challenges. Low oil prices help America more than they hurt it and over time should add more jobs than they take away.

In the absence of the factors that weighed on it over the winter—including not just the weather but also the West Coast port dispute and companies working down inventories—the economy should improve in the spring. And that should give more impetus to hiring. But the Fed will want to be sure. That is particularly the case when, partly as a result of those same overseas factors, inflation is running well below its 2% target. The big question now is whether the Fed will gain such confidence, and raise rates, by September. Fed funds futures contracts now put nearly even odds of it foregoing an increase at that meeting. Even if a June rate rise is off the table, the market’s chronic state of uncertainty ahead of the Fed’s next move lingers. Whichever way the economic data break in the months ahead, somebody is going to get caught badly offside.

WIth 93 million people not counted, it’s not hard to get low jobless numbers.

• Americans Not In The Labor Force Soar To Record 93.2 Million (Zero Hedge)

So much for yet another “above consensus” recovery, and what’s worse it is, well, about to get even worse, because while the Fed keeps baning some illusory drum that slack in the economy is almost non-existent, the reality is that in March the number of people who dropped out of the labor force rose by yet another 277K, up 2.1 million in the past year, and has reached a record 93.175 million. Indicatively, this means that the labor force participation rate dropped once more, from 62.8% to 62.7%, a level seen back in February 1978, even as the BLS reported that the entire labor force actually declined for the second consecutive month, down almost 100K in March to 156,906.

“People are so cynical about Wall Street they don’t believe any of it.”

• Michael Lewis: ‘I Knew Flash Boys Would Be A Bombshell’ (Guardian)

Katsuyama noticed that large stock orders were being “scalped”. Moments after an order was placed, high-speed traders (our titular Flash Boys) were snapping up shares before the order could be fulfilled, using powerful algorithms and super-charged computers to force buyers to pay a higher price. The difference in cost can be counted in fractions of a penny – but on massive orders the numbers add up and the losers are the pension funds of millions of Americans. Katsuyama set up IEX, the Investors Exchange, as a market free from scalpers. While he had alerted many big investors about his concerns, he had not spoken to the media about his findings. “They were afraid that if there was a huge controversy, it would hurt their business as opposed to just quietly informing investors how badly they were getting screwed,” Lewis said.

Instead they decided to work with the author of Moneyball and Liar’s Poker to tell their story. They didn’t escape controversy. Trading floors came to a standstill in New York when Lewis and Katsuyama were confronted on CNBC, the financial news channel, by William O’Brien, president of Bats Global Markets, the second-largest stock exchange operator in the US. “Shame on both of you for falsely accusing literally thousands of people and possibly scaring millions of investors in an effort to promote a business model,” O’Brien said, accusing the pair of dishonesty and Lewis of writing a 300-page commercial for IEX. Days later, O’Brien was being hauled over the coals by regulators for claims he made on the show. Months later, he was gone. Wall Street’s fightback, however, has not stopped.

The opposition has launched what Lewis describes as “essentially a political campaign” to minimise the impact of his book and the work of IEX. Last month, the former commodities trading regulator Bart Chilton called Lewis’s assertions that the market was rigged “a big lie”. Chilton, again on CNBC, asserted high-frequency trading had contributed to making markets cheaper, faster and safer than ever before. The former boss of the Commodities Futures Trading Commission now works with the high-frequency trade association Modern Markets Initiative. He said Lewis’s claims were irresponsible and had been debunked by academic research. Visibly irritated by what he sees as a campaign to halt reform and serious discussion, Lewis said Chilton was “essentially a flack”. “He’s deceiving the public in order to make the markets less fair,” he said. “People are so cynical about Wall Street they don’t believe any of it.”

Interesting power struggle.

• German Bank Files Lawsuit To Challenge ECB Supervision (WSJ)

A small German lender has filed a lawsuit against the ECB in a bid to avoid coming under its supervision, marking the first legal challenge to the ECB’s new monitoring role. In November the ECB took over direct supervision of Europe’s 120 largest banks, assuming that responsibility from national supervisors such as Germany’s financial watchdog BaFin and the German Central Bank, or Bundesbank. The move has raised objections from some politicians and smaller banks that are concerned about the additional regulatory costs, among other issues. Development bank Landeskreditbank Baden-Württemberg filed a lawsuit with the European Court of Justice—the European Union’s highest court—to “legally challenge that it was put under direct supervision of the ECB,” the bank told the WSJ.

L-Bank, as it is known, claims ECB oversight entails significantly higher bureaucratic expenses. An ECB spokeswoman confirmed the central bank had received notice of the court case but declined to comment further. The lawsuit, filed March 12, is the most radical step by a European bank against ECB supervision, a cornerstone of the eurozone’s integration project. It highlights the headwinds the ECB is facing from some politicians and smaller lenders in Germany, Europe’s biggest economy. L-Bank said that higher costs tied to ECB supervision would undermine its ability to support local families and businesses. Instead it wants to be supervised by BaFin and the Bundesbank, which L-Bank says would be more appropriate, given its local focus.

L-Bank argues that its business model is simple and clear, while the ECB has been tasked with regulating more complex banks through a structure known as the single supervisory mechanism. Being under ECB scrutiny “goes against the guidelines of the single supervisory mechanism,” L-Bank said. The ECB is supposed to take direct responsibility for all banks whose assets either exceed €30 billion and/or make up more than 20% of their home country’s gross domestic product. In countries where banks don’t hit that threshold at least three banks will come under ECB oversight unless their assets are below €5 billion, as will any bank that has received help from one of the eurozone’s bailout funds. In addition, the ECB can claim supervisory powers over any bank that has significant operations in at least two countries.

L-Bank is one of 21 German banks under the ECB’s direct watch. It had around €70 billion in assets at the end of 2013, the most recent figures available, and recorded slightly more than €100 million in profit. In 2013, it supplied €7.4 billion in low-cost credit to support local projects, businesses and families.

“Freddie Mac has auctioned about $2 billion in defaulted debt in three separate sales since last year.”

• Fannie Mae to Begin Auctioning Defaulted Home Loans to Investors (Bloomberg)

Fannie Mae will begin bulk auctions of mortgages, including some sales targeted for non-profit groups and small investors, as the company moves to cut the number of non-performing loans on its books. “These transactions are intended to reduce the number of seriously delinquent loans that Fannie Mae owns, to help stabilize neighborhoods and to offer borrowers access to additional foreclosure prevention options,” Fannie Mae Senior Vice President Joy Cianci said in a statement Thursday. “Our goal is to market these loans to a diverse range of buyers”. The Federal Housing Finance Agency, which has overseen U.S. conservatorship of Freddie Mac and Fannie Mae since 2008, is requiring the companies to reduce the number of severely delinquent loans on their books this year.

In March, the agency released a set of new rules for the sale of troubled mortgages. Freddie Mac has auctioned about $2 billion in defaulted debt in three separate sales since last year. Fannie Mae’s first sale will happen “in the near future,” the company said. FHFA will require prospective investors to prove they’ve retained a loan servicer with a track record of handling delinquent debt, the agency said in a March 2 statement. Servicers also will have to offer aid to avoid foreclosures as a condition of sale. Demand for soured mortgages has been increasing as Wall Street firms compete to buy loans at a discount after a real-estate market rebound. Investment firms including Lone Star Funds, Bayview Asset Management and Selene Finance have been some of the biggest buyers of delinquent home loans.

“Russia-EU relations will be discussed in light of the sanctions policy applied by the EU and the rather cold attitude toward this sanctions policy from Athens..”

• Russia Said to Plan No Aid to Greece, May Ease Curbs on Food (Bloomberg)

Russia isn’t considering any financial assistance for Greece as Prime Minister Alexis Tsipras plans to visit Moscow next week, according to three Russian government officials with knowledge of the discussions. Even so, Russia is ready to discuss easing restrictions on Greek food products, which were imposed as as part of the retaliation for EU sanctions levied over the conflict in Ukraine, said two of the three officials. Russia has been building ties with European countries that may help it scuttle the sanctions. The 28-member bloc will need unanimous approval to prolong curbs targeting Russia’s financial and energy industries that expire in July. President Vladimir Putin will discuss the measures against Russia at the talks with Tsipras, according to the Kremlin.

The EU’s most-indebted state is locked in negotiations with euro-area countries and the IMF over the terms of its €240 billion rescue. The standoff, which has left Greece dependent on ECB loans, risks leading to a default within weeks and the nation’s potential exit from the euro area. “Russia-EU relations will be discussed in light of the sanctions policy applied by the EU and the rather cold attitude toward this sanctions policy from Athens,” Putin’s spokesman, Dmitry Peskov, told reporters Friday on a conference call. Putin and Tsipras will also hold talks on the economic situation in the Balkan country, Peskov said. Greece hasn’t yet asked Russia for any financial aid, he said.

Russia would consider a request from Greece if it’s made, Finance Minister Anton Siluanov said in an interview in February. Greece this week failed to win support from creditors for proposals to cut spending and receive €7 billion in bailout funds in return. Greece needs the money as government coffers empty and bills come due, such as a debt payment to the International Monetary Fund on April 9, the day after Tsipras visits Putin in Moscow. Greece is asking for money and a discount on natural gas supplies from Russia, neither of which is possible right now, one official said.

More US induced mess.

• Saudi Arabia and Iran Vie for Regional Supremacy (Spiegel)

The Saudi military coalition began its intervention in Yemen in the name of security. But after just a week, it has become clear that the top priority of the alliance is not that of creating a balance of power between the two adversarial camps in the Yemen conflict – which pits Shiite Houthi rebels, who have joined together with former Yemeni President Ali Abdullah Saleh (who was ousted in a 2011 “Arab Spring” uprising), against Saudi-backed government troops. Indeed, the conflict is more of a complicated domestic struggle than a purely sectarian fight. Still, the Saudi monarchy’s intervention is primarily aimed at its ideological rival: Iran.

At the same time, the military operation is a chance for Saudi King Salman bin Abdulaziz Al Saud to demonstrate his independence from the US – as well as to perhaps prove his country’s military leadership in the region as a complement to its longstanding economic strength. What is clear, however, is that the brewing Sunni-Shiite struggle in the Middle East is extremely dangerous. And the most recent escalation has the potential for not just destroying Yemen, but also for turning into a disaster for Saudi Arabia. It was only last fall that Riyadh badly miscalculated in Yemen by cutting off financial aid to Hadi, who has since fled his country for the Saudi capital. The Saudi monarchy believed that Hadi, a Sunni, was being far too lenient with the Shiite Houthis, which make up a third of the population of Yemen.

But Hadi had only been striving for political survival between the various fronts – a task made all the more difficult by the return of his Shiite predecessor Saleh, who was trying to regain power at the forefront of his own militia. Without support from Riyadh, Hadi didn’t have a chance. Even if the Iranians are confessional brothers to the Houthis and have allegedly supplied them with weapons, it is ex-president Saleh who has been the primary reason for their triumphant march through the country. It is an ironic development, given that Saleh, while in power, waged a campaign of his own against Houthi insurgents. Now, however, he has placed his own elite troops – which he once equipped with the help of hundreds of millions of dollars from the US – at their disposal. The troops are akin to a private army, and Saleh has a fortune of billions he can use to finance them.

And they’re right.

• Russia Calls UN Security Council Session On Yemen Crisis (RT)

As fighting in Yemen intensifies Russia has called up an emergency UN Security Council session to put on pause Saudi-led coalition airstrikes for humanitarian purposes in an effort to quell the violence that is impacting civilians. Russia insists it is necessary for the international community to discuss the establishment of regular and mandatory “humanitarian pauses” in the ongoing coalition air strikes on Yemen, Russian UN mission’s spokesman Aleksey Zaytsev told Sputnik. An extraordinary meeting is scheduled for Saturday, at 3pm GMT at the UN headquarters in NYC. A coalition of Arab states, led by Saudi Arabia, has been engaging Houthi militias from the air for over a week now, after the Yemeni President Abd Rabbuh Mansur Hadi was forced to flee the country and asked for an international intervention to reinstate his rule.

Moscow is calling for a diplomatic solution to the conflict emphasizing that foreign military intervention would only lead to more civilian deaths. On Friday, Russia’s Deputy Foreign Minister Mikhail Bogdanov met with the newly appointed Saudi ambassador, conveying the “necessity of a ceasefire” to create favorable conditions for a peaceful national dialogue. Russia has already taken steps to evacuate all of its personnel from its Yemeni consulate, which was damaged in the conflict. It has also taken an active role evacuating Russian nationals and other civilians from the country.

On Thursday Russia proposed amendments to a UN Security Council draft resolution on Yemen. The world security body “should speak in a principled manner for ending any violence…in the Yemen crisis,” Russian Foreign Minister Sergey Lavrov said, adding that a draft resolution on the crisis has already been submitted to the UNSC. Echoing Lavrov’s words, Foreign Ministry spokesman Aleksandr Lukashevich also called on immediate cessation of hostilities, adding that Russia will continue active diplomatic efforts in dealing with all Yemeni factions and Middle Eastern partners in order to restart political process. Lukashevich also called on the UN special envoy to Yemen, Jamal Benomar, to play a bigger role in the settlement of the crisis.

“Kiev’s army, after the recent IMF loan, was allocated no less than $3.8 billion for weapons…”

• Donbass: ‘The War Has Not Started Yet’ (Pepe Escobar)

Two top Cossack commanders in the People’s Republic of Donetsk and a seasoned Serbian volunteer fighter are adamant: the real war in Donbass has not even started. It’s a spectacular sunset in the People’s Republic of Donetsk and I’m standing in the Cossack ‘holy land’ – an open field in a horse-breeding farm – talking to Nikolai Korsunov, captain of the Ivan Sirko Cossack Brigade, and Roman Ivlev, founder of the Donbass Berkut Veterans Union group. Why is this Cossack ‘holy land’? They take no time to remind me of the legendary 17th century Cossack military hero Ivan Sirko, a.k.a. “The Wizard”, credited with extra-sensory powers, who won 55 battles mostly against Poles and Tatars.

Only three kilometers from where we stand a key battle at a crossroads on the ancient Silk Road called Matsapulovska Krinitsa took place, involving 3,000 Cossacks and 15,000 Tatars. Now, at the dawn of the Chinese-driven 21st century New Silk Road – which will also traverse Russia – here we are discussing the proxy war in Ukraine between the US and Russia whose ultimate objective is to disrupt the New Silk Road. Commander Korsunov leads one of the 18 Cossack brigades in Makeevka; 240 of his soldiers are now involved in the Ukrainian civil war – some of them freshly returned from the cauldron in Debaltsevo. Some were formerly part of the Ukrainian Army, some worked in the security business. Korsunov and Ivlev insist all their fighters have jobs, even if unpaid – and have joined the Donetsk People’s Republic army as volunteers. “Somehow, they manage to survive.”

What’s so special about Cossack fighters? “It’s historical – we’ve always fought to defend our lands.”Commander Korsunov was a miner, now he’s on a pension – although for obvious reasons he’s receiving nothing from Poroshenko’s Kiev set up; only support from the Berkut group, the Ministry for Youth and Sports of the People’s Republic, and humanitarian food convoys from Russia. Korsunov and Ivlev are convinced Minsk 2 will not hold; fierce fighting should resume “in a matter of weeks.” According to their best military intelligence, Kiev’s army, after the recent IMF loan, was allocated no less than $3.8 billion for weapons.

“After Odessa”, they say – a reference to the massacre of civilians in May last year – Ukraine as we know it “is finished”. So what would be the best political solution for Donbass? Their priority is “to free all Ukraine from fascism.” And after victory, referenda should be held in all regions of the country.“People should vote for what they want; whether to remain in Ukraine, whether to align with Europe, or with Russia.” This implies advancing towards Western Ukraine across hostile territory; “We’re ready for five, seven years of war, it doesn’t matter.” So even if a political solution might be possible on a distant horizon, they are preparing for a long war. The EU is “mistaken” to treat them as separatists and even terrorists. As for those elusive Russian tanks and soldiers relentlessly denounced by NATO, where are they? Hiding in the bushes? They laugh heartily – and we’re off to a countryside Cossack banquet.

“.. loan terms that changed abruptly after they paid deposits or prepared land for their new homes; surprise fees tacked on to loans; and pressure to take on excessive payments based on false promises that they could later refinance.”

• Warren Buffett’s Mobile Home Empire Preys On The Poor (Public Integrity)

The families’ dealers and lenders went by different names – Luv Homes, Clayton Homes, Vanderbilt, 21st Mortgage. Yet the disastrous loans that threaten them with homelessness or the loss of family land stem from a single company: Clayton Homes, the nation’s biggest homebuilder, which is controlled by its second-richest man – Warren Buffett. Buffett’s mobile home empire promises low-income Americans the dream of homeownership. But Clayton relies on predatory sales practices, exorbitant fees, and interest rates that can exceed 15 percent, trapping many buyers in loans they can’t afford and in homes that are almost impossible to sell or refinance, an investigation by The Center for Public Integrity and The Seattle Times has found.

Berkshire Hathaway, the investment conglomerate Buffett leads, bought Clayton in 2003 and spent billions building it into the mobile home industry’s biggest manufacturer and lender. Today, Clayton is a many-headed hydra with companies operating under at least 18 names, constructing nearly half of the industry’s new homes and selling them through its own retailers. It finances more mobile home purchases than any other lender by a factor of six. It also sells property insurance on them and repossesses them when borrowers fail to pay. Berkshire extracts value at every stage of the process. Clayton even builds the homes with materials — such as paint and carpeting — supplied by other Berkshire subsidiaries.

And Clayton borrows from Berkshire to make mobile home loans, paying up to an extra percentage point on top of Berkshire’s borrowing costs, money that flows directly from borrowers’ pockets. More than a dozen Clayton customers described a consistent array of deceptive practices that locked them into ruinous deals: loan terms that changed abruptly after they paid deposits or prepared land for their new homes; surprise fees tacked on to loans; and pressure to take on excessive payments based on false promises that they could later refinance. Former dealers said the company encouraged them to steer buyers to finance with Clayton’s own high-interest lenders.

“The Mediterranean Sea represents less than 1% of the global ocean area, but is important in economic and ecological terms. It contains between 4% and 18% of all marine species..”

• Mediterranean Sea ‘Accumulating Zone Of Plastic Debris’ (BBC)

Large quantities of plastic debris are building up in the Mediterranean Sea, say scientists. A survey found around one thousand tonnes of plastic floating on the surface, mainly fragments of bottles, bags and wrappings. The Mediterranean Sea’s biological richness and economic importance means plastic pollution is particularly hazardous, say Spanish researchers. Plastic has been found in the stomachs of fish, birds, turtles and whales. Very tiny pieces of plastic have also been found in oysters and mussels grown on the coasts of northern Europe. “We identify the Mediterranean Sea as a great accumulation zone of plastic debris,” said Andres Cozar of the University of Cadiz in Puerto Real, Spain, and colleagues.

“Marine plastic pollution has spread to become a problem of planetary scale after only half a century of widespread use of plastic materials, calling for urgent management strategies to address this problem.” Plastic is accumulating in the Mediterranean Sea at a similar scale to that in oceanic gyres, the rotating ocean currents in the Indian Ocean, North Atlantic, North Pacific, South Atlantic and South Pacific, the study found. A high abundance of plastic has also been found in other seas, including the Bay of Bengal, South China Sea and Barents Sea in the Arctic Ocean. Commenting on the study, published in the journal PLOS ONE, Dr David Morritt of Royal Holloway, University of London, said scientists were particularly concerned about very small pieces of plastic (less than 5mm in length), known as microplastics.

The study found more than 80% of plastic items in the Mediterranean Sea fell into this category. “These very small plastic fragments lend themselves to being swallowed by marine species, potentially releasing chemicals into the gut from the plastics,” Dr Morritt, of the School of Biological Sciences, told BBC News. “Plastic doesn’t degrade in the environment – we need to think much more carefully about how we dispose of it, recycle it, and reduce our use of it.” The Mediterranean Sea represents less than 1% of the global ocean area, but is important in economic and ecological terms. It contains between 4% and 18% of all marine species, and provides tourism and fishing income for Mediterranean countries. “Given the biological wealth and concentration of economic activities in the Mediterranean Sea, the effects of plastic pollution on marine and human life could be particularly relevant in this plastic accumulation zone,” said Dr Cozar.

“Shutting down disposal wells and the industry they serve, he added, “will make ‘The Grapes of Wrath’ look like a cheery movie.”

• As Quakes Rattle Oklahoma, Fingers Point to Oil and Gas Industry (NY Times)

From 2010 to 2013, Oklahoma oil production jumped by two-thirds and gas production rose by more than one-sixth, federal figures show. The amount of wastewater buried annually rose one-fifth, to nearly 1.1 billion barrels. And Oklahoma went from three earthquakes of magnitude 3.0 or greater to 109 — and to 585 in 2014, and to 750-plus this year, should the current pace continue. In the United States, only Alaska is shaken more. The Corporation Commission lacks explicit authority to regulate earthquake risks. So it is trying to contain the risks posed by roughly 3,200 active wastewater disposal wells using laws written to control water pollution. Last spring, the commission began trying to weed out quake risks by scrutinizing wells near larger quakes for operational problems and permit violations.

A few dozen wells made modifications; four shut down. It is now difficult to win approval for new wells near stressed faults, active seismic areas or the epicenters of previous quakes above 4.0 magnitude. Regulators significantly expanded the areas under scrutiny last month. Yet the quakes continue. Privately, some companies are cooperating with regulators and scientists by offering proprietary information about underground faults. Publicly, the industry wants Oklahomans to beware of killing the golden goose. Many in the industry were reluctant to comment for this article. But Kim Hatfield, the regulatory chairman of the Oklahoma Independent Petroleum Association and president of Crawley Petroleum, warned: “A reaction of panic is not useful.” Shutting down disposal wells and the industry they serve, he added, “will make ‘The Grapes of Wrath’ look like a cheery movie.”

The mechanics of wastewater-induced earthquakes are straightforward: Soaked with enough fluid, a layer of rock expands and gets heavier. Earthquakes can occur when the pressure from the fluid reaches a fault, either through direct contact with the soaked rock or indirectly, from the expanding rock. Seismologists have documented such quakes in Colorado, New Mexico, Arkansas, Kansas and elsewhere since the 1960s. But nowhere have they approached the number and scope of Oklahoma’s quakes, which have rocked a fifth of the state. One reason, scientists suspect, is that Oklahoma’s main waste disposal site, a bed of porous limestone thousands of feet underground, lies close to the hard, highly stressed rock containing the faults that cause quakes.

“..while green lawns may be at risk, urban water use accounts for a minority of the state’s total water use, PPIC noted. About 80% of human water use is in agriculture.”

• Half Of Urban California’s Water Is Used To Water The Grass (MarketWatch)

As California searches for ways to dramatically cut its water use, the lawn may have to go, or at least shrink. About half of water usage in the state’s urban areas goes for landscaping, said Jeffrey Mount, a senior fellow at the Public Policy Institute of California and a water expert. “We have a lot of room in the urban sector to adjust,” and the most obvious place is in landscaping. Reducing the amount of water devoted to lawns won’t have a major negative impact on the economy or on lifestyle, he said. On Wednesday, California Gov. Jerry Brown ordered statewide water reductions of 25% for the first time ever, as California’s drought worsens. Previously he had sought voluntary cuts of 20%. The State Water Resources Control Board is expected to decide on new regulations over the next month.

Brown’s announcement said campuses, golf courses, cemeteries and other large landscapes will have to make significant cuts in water use. But it did not mention residential lawns. PPIC says outdoor residential use accounts for one-third of urban water use, twice that of commercial and institutional landscapes, including golf courses and cemeteries. While homeowners may face further curbs of their water use, the state has already made strides in conserving water. Per-capita water use dropped more than 23% from 1990 to 2010, based on data compiled by the U.S. Geological Survey that is collected every five years. Some of that has come through low-flow shower heads, low-flush toilets, new standards for washing machines and dishwashers, and other water-saving technologies.

The state’s population has increased in that time, leaving overall urban water use essentially unchanged. And while green lawns may be at risk, urban water use accounts for a minority of the state’s total water use, PPIC noted. About 80% of human water use is in agriculture.