Getty Marilyn Monroe in NY subway 1955

Why are Apple shares rising? We can’t know. This is not a market.

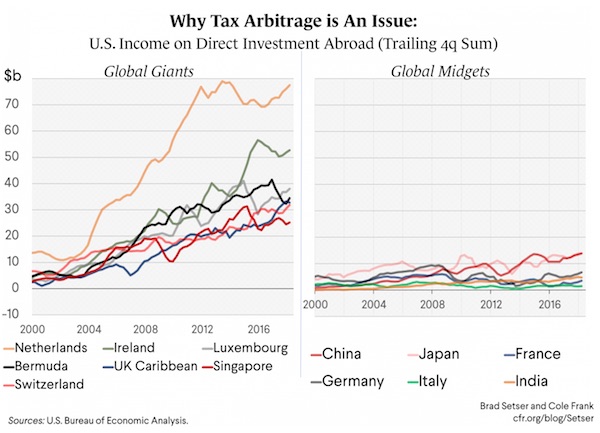

• Apple Buybacks Eclipse Value Of Most S&P 500 Companies (R.)

Apple Inc said on Tuesday it handed its shareholders $20 billion through share buybacks in the June quarter, bringing its tally this year to a record $43 billion and helping push its stock price to an all-time high. With a mountain of overseas cash freed up by last year’s sweeping U.S. corporate tax cuts, Apple’s share repurchases in the first half of calendar 2018 exceed the stock market value of almost three quarters of the companies in the S&P 500, including Ford, Delta Air Lines and Twitter Inc. Apple’s share repurchases in the June quarter were only eclipsed in the history of the S&P 500 by Apple repurchasing $22.8 billion of its shares in the prior quarter, according to S&P Dow Jones Indices analyst Howard Silverblatt.

The recent pace of Apple’s buybacks, disclosed in a quarterly report that beat Wall Street’s expectations, could help support the iPhone maker’s stock as investors worry that some high-flying technology companies have become too expensive. Confidence in top-shelf technology and consumer stocks has been shaken in recent days following poor results from Facebook and Netflix. Apple said in May it was adding $100 billion to its budget for buybacks. Its stock is up 16% in 2018, compared with the S&P 500’s 5% rise. “I see the buybacks as a major determinant of near-term price appreciation,” said D.A. Davidson & Co analyst Thomas Forte.

Effectively borrowing at an 18% interest rate?!

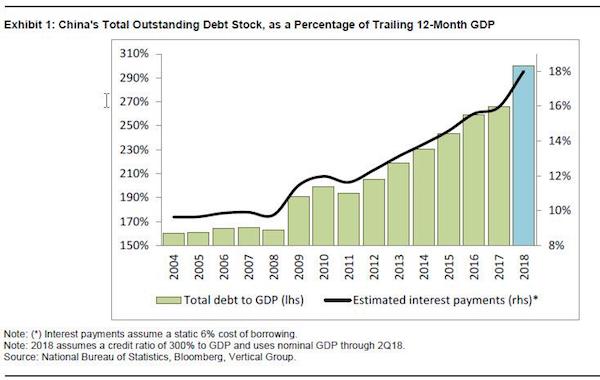

• A Record 18% Of China’s GDP Goes To Debt Service (ZH)

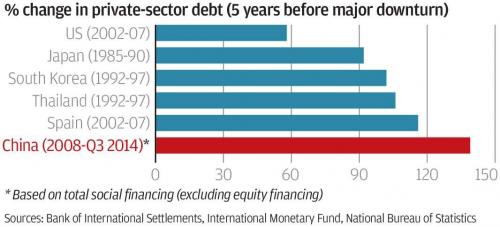

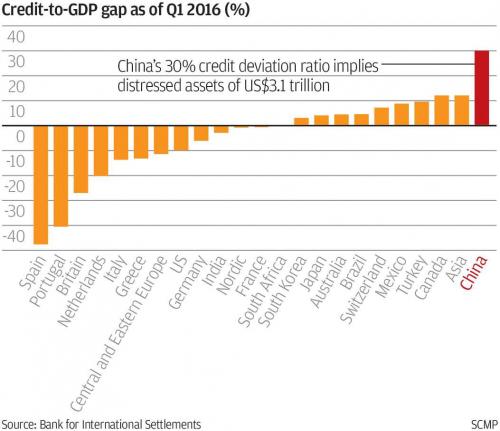

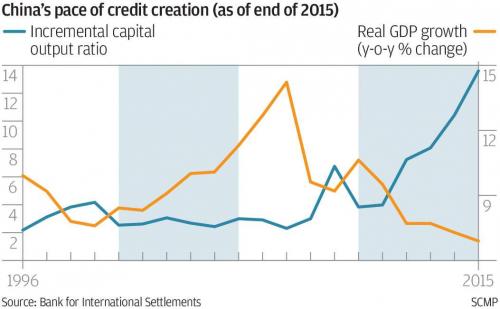

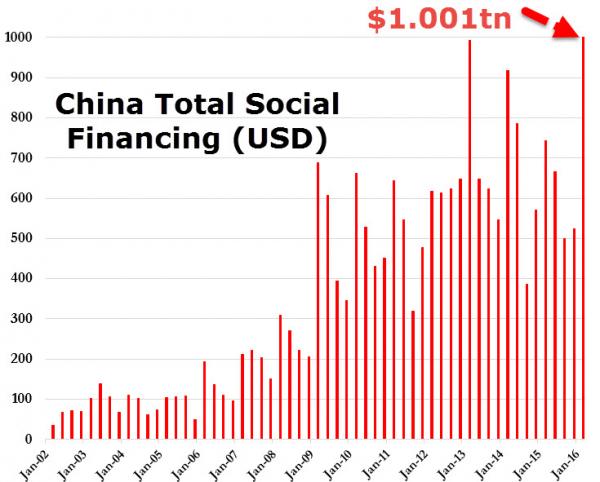

Think China’s new “proactive” fiscal policy shigt will be sufficient to kick start the local economy, and boost global GDP? Think again. In the latest analysis from Vertical Group’s Gordon Johnson, the strategist writes “that China’s proactive fiscal policy pledge could fall short as servicing its existing credit stock absorbs an increasing share of GDP.” As a reminder, last week, China’s State Council said it will adopt a proactive fiscal policy, outlining ways to fund ¥1.4tn in bonds to local government for infrastructure & provide ¥1.1tn in tax cuts, among other actions (e.g., R&D tax credits), all while urging no broad-based stimulus.

In Johnson’s view, this is a narrative that is rather reminiscent of ‘14, when the gov’t unleashed a wave of “micro-stimulus” measures after a string of weak data points (i.e., 5 mos. of contracting real estate investment). Yet, as he notes, the most recent PBoC mini-stimulus is much smaller than ‘14, while key restrictions remain in place for real estate/shadow loans (historically growth-driving conduits), compounded by the law of diminishing returns, suggesting a smaller boost from a much larger base this time around.

Moreover, China’s total credit stock is markedly higher now than in ’14, implying more of every yuan in stimulus is going to service outstanding debt. How much? That may well be the critical question to gauge the flow through from any new fiscal policy. Here is Vertical Group’s answer: While China exited ’17 with an est. 266% of total credit to GDP, some economists put that ratio at >300% today. On trailing 12-mo. nominal GDP of ¥86.5tn, as of 2Q, this equates to >¥259.5tn in credit, which, assuming an avg. borrowing cost of 6%, means China’s annual debt service is ~¥14.3tn, or 18.0% of GDP – sensitizing interest & credit-to-GDP, to a respective range of 4-7% & 285-320%, puts China’s debt service at 14-22% of GDP.

Insanity: “..Greece’s debt costs will “begin an uninterrupted rise” after 2038 — costing around 20% of the country’s GDP every year..”

• IMF Warns On Greek Debt Sustainability (ZH)

As Greeks attempt to recover from the devastating and deadly wildfires, The IMF has decided to pile on the pain with a new report that raises questions about Greece’s debt sustainability, warning that the nation’s cash buffer is set to drop by half by end of 2022. IMF Mission Chief for Greece Peter Dohlman told reporters on conference call this morning that Greece’s cash buffer will rise to EU24b as a result of debt relief measures agreed by euro-area finance ministers in June, but that amount is set to drop by half to EU12b by end of 2022. Translating The IMF’s newspeak, it is explaining that without more generous debt relief measures, Greece “could struggle to maintain market access over the long run”, the fund said in its last economic assessment of the country before the end of its bailout on August 20.

The fund’s calculations find Greece’s debt costs will “begin an uninterrupted rise” after 2038 — costing around 20% of the country’s GDP every year. It is at this point that “additional relief would be needed to secure debt sustainability”, said the report. [..] Additionally, the fund suggests that Greek banks raise capital: “Stress tests results published by the ECB in May point to the resilience of the Greek banks in the baseline scenario but significant capital depletions in the adverse scenario,” IMF says in Art. IV report on the state of the Greek economy. IMF “staff estimates that if the three banks with lower CET1 were asked to maintain capital ratios under adverse conditions in line with a capital requirement of 7.5–8.0%, the related capital shortfall could be in the range of €1.3–1.9 billion”.

Any recovery stories for Greece are bogus. Oh, and Zero Hedge is a ‘satirical blog’?

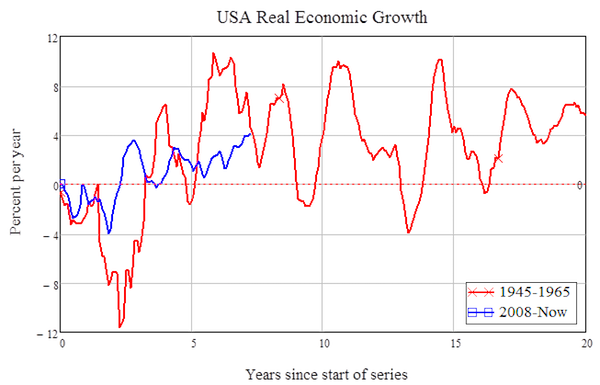

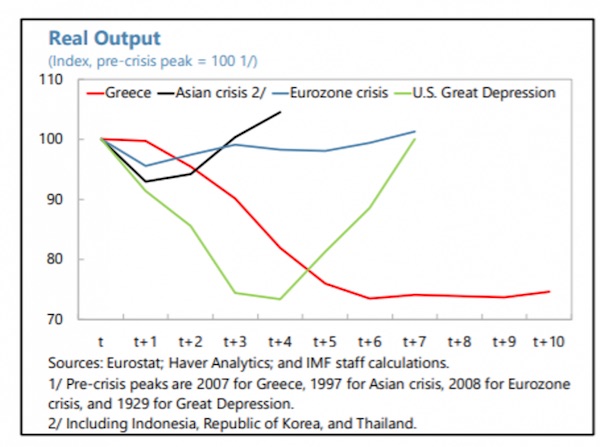

• The Greatest Depression (Coppola)

The IMF has just released its latest review of the Greek economy. “Following a deep and protracted contraction,” it says in its press release, “growth has finally returned to Greece.” The green light has been given for Greece’s exit from its bailout program in August 2018. For many, this is welcome news. Greece has turned a corner. The dark days are behind it, and the future will be bright. But is this really the end of Greece’s troubles – or will there be more pain to come? The magnitude of Greece’s collapse over the last decade is extraordinary. Right at the start of the IMF’s review is this chart, which compares the fall in Greek output over the last 10 years with other major historical contractions, including the U.S.’s Great Depression:

The Greek people have just lived through a Depression as deep as the Great Depression and considerably longer. It is now the greatest recorded peacetime Depression. Fortunately, the Greatest Depression may now have run its course. The Greek economy grew by 1.4% in 2017, and the IMF projects that GDP growth will rise to 2% in 2018 and 2.4% in 2019. Of course, IMF growth forecasts for Greece need to be treated with considerable caution. As the Greek economy sank ever deeper into depression, the IMF continued to predict that growth would rebound “any day now.” The satirical blog ZeroHedge lampooned the IMF’s dire forecasting record as “hockey stick comedy.” But Greece did emerge from its long-running depression in 2017, and indications so far are that growth will be maintained this year.

[..] The legacy of the Greatest Depression, even with the doubtful benefit of those structural reforms, is a terribly weak and deeply damaged economy. Adult unemployment, which peaked at over 25% at the height of the Greatest Depression, is still over 20%, while youth unemployment is twice as high. In a footnote to its review, the IMF comments that structural unemployment (the average excess of people over jobs across the business cycle) was 15% in 2016 and is expected to fall only gradually “over the next two decades.” Many of Greece’s young people will be middle-aged by the time there is any work for them. Some may never work at all. An entire generation thrown on the scrap heap.

Despite all the pain the Greeks have endured to fix their country’s finances, Greece’s fiscal situation remains extremely precarious. The IMF staff predictions show absolutely no room for fiscal expansion, even though it is desperately needed, not least to relieve extremely high poverty levels. One in four people in Greece is living below the poverty line.

The EU doesn’t think May will last much longer.

• EU’s Brexit Declaration Could Be Just ‘Four Or Five Pages’ Long (G.)

The EU’s declaration on the trade and security relationship with the UK after Brexit will be just five to 30 pages long, reflecting a lack of time to have an internal debate and scepticism that Theresa May will remain in Downing Street to deliver it, officials in Brussels have disclosed. While the UK is seeking a “precise and substantive” document, to match the recently published 100-page white paper, officials in Brussels say the EU’s political declaration on the “future framework” has diminishing importance for them. Brussels is aware that the prime minister needs the document, due in the autumn, to be a “sweetener” to the main withdrawal agreement, which will commit the UK to pay a £39bn divorce bill and spell out whatever difficult deal is sealed on the issue of the Irish border.

The declaration will not be legally binding on either party but is designed to offer major economic actors some reassurance through a vision of the future trading and security relationship, and it will form part of the package on which the UK parliament and MEPs will ultimately vote in the new year. Given doubts in Brussels that May will get a deal through parliament, or remain in Downing Street for long if she manages it with the help of Labour votes, there will not be the high level of detail that the British government has been seeking, sources said.

A senior EU official told The Guardian that the paper could even be as short as “four or five pages”, the same length as the European council guidelines setting out the bloc’s headline objectives. “It can either be four five pages, or it could be a bit more elaborate but I think we are in the league of five to 25 to 35 pages. We have not time to thrash out the details,” the official said. “The more details you want the more advanced you should be in these negotiations.” The official added: “The reality is that, imagine after March next year the UK gets rid of May, the hard Brexiters take over and Boris says: ‘Too bad. I am not interested in all this. I want a basic free trade agreement, I want all my freedom.’ We have to adjust.

And it will get a lot worse.

• UK Government Accused Of Trying To Hide Devastating Impact Of Brexit (Ind.)

Ministers have been accused of misleading the public after denying that plans to “turn most of Kent into a giant lorry park” are because of Brexit. Work is underway to convert four lanes of a 13-mile stretch of the M20 motorway to allow hundreds of articulated lorries to park up if they are delayed in reaching the Port of Dover. The Department for Transport (DfT) claimed the work was simply an improvement on the existing Operation Stack, a way of managing traffic used many times to cope with “serious disruption to cross-channel transport”. But it has now emerged that the project has been renamed Operation Brock – which Kent County Council says stands for “Brexit Operations Across Kent”.

Vast extra space for lorries will be needed if the Brexit talks fail and, as Theresa May has threatened, the UK crashes out of the EU without a deal next year. There will be massive disruption if any extra checks are required in future – with one study warning of immediate 20-mile tailbacks at Dover if the time taken to clear customs merely doubles from the current two minutes. Virendra Sharma, a Labour MP and supporter of the anti-Brexit Best for Britain group, said: “The government is trying to hide the devastating impact of their Brexit policy. “Food will rot on the motorway and jobs are at risk as manufacturing supply chains are muddled and slowed by Brexit. We cannot let ministers use secrecy to railroad the concerns of councils about Brexit.”

Nobody’s ready. If only because they don’t know what to be ready for.

• No UK Car Manufacturer Ready For Brexit (Ind.)

The British motor industry has warned that “no one would confess to being Brexit ready” in their trade. Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT), argues that his members are “increasingly concerned” about the prospects for the UK leaving the EU on World Trade Organisation (WTO) terms, in the light of developments since Theresa May published the government’s latest Brexit white paper, which he and the SMMT welcomed. Michel Barnier, the EU’s chief negotiator, has since expressed scepticism about the proposed Facilitated Customs Arrangement (FCA), which would have been of particular value to manufacturing and the automotive sector.

In the light of EU resistance, and growing UK political volatility, the chances of the UK going to a “no deal” exit are increasing, meaning that Britain would move to WTO terms, as opposed to staying in the Single Market, the customs union or the FCA. This would imply tariffs of up to 10% in UK-EU trade in cars and parts, and greater bureaucracy in both directions, which would only be partly mitigated by “stockpiling” in the short run, given the demands of “just in time” manufacturing techniques and integrated cross-border supply chains. There is a tail risk that factory production of models such as the Mini at BMW’s plant in Oxford could be disrupted if crucial car components become unavailable.

Mr Hawes added that the prospect of a “no deal” Brexit was something no-one wished to see and that industry leaders wished to see “all options open as long as possible”. Reflecting on the 1,100 trucks that enter the UK from Europe every day to feed its factories, he said that the eight months remaining until formal Brexit on 29 March 2019 were “a real challenge”. British car production for the home market almost halved in June, compared to the same month a year ago, due to what the industry calls “a perfect storm” of factors that resulted in a freakish result.

“The day after 9/11 we should have gone to Russia. We did the one thing that George Kennan warned us never to do – to expand NATO too far..”

• Seymour Hersh On Novichok, Russian Links To Donald Trump And 9/11 (Ind.)

Hersh is honest enough to admit that today he might not have made it. He worked during the heyday of American journalism – when he was paid handsomely for exposes and when media outlets had the financial muscle to fund serious writing. When he covered the Paris Peace Accords for The Times, he was put up at the world famous five-star deluxe Hotel de Crillon. It is not long before we discuss contemporaneous events including the alleged Russian hacking of the US presidential election. Hersh has vociferously strong opinions on the subject and smells a rat. He states that there is “a great deal of animosity towards Russia. All of that stuff about Russia hacking the election appears to be preposterous.” He has been researching the subject but is not ready to go public… yet.

Hersh quips that the last time he heard the US defence establishment have high confidence, it was regarding weapons of mass destruction in Iraq. He points out that the NSA only has moderate confidence in Russian hacking. It is a point that has been made before; there has been no national intelligence estimate in which all 17 US intelligence agencies would have to sign off. “When the intel community wants to say something they say it… High confidence effectively means that they don’t know.” Hersh is also on the record as stating that the official version of the Skripal poisoning does not stand up to scrutiny. He tells me: “The story of novichok poisoning has not held up very well. He [Skripal] was most likely talking to British intelligence services about Russian organised crime.”

The unfortunate turn of events with the contamination of other victims is suggestive, according to Hersh, of organised crime elements rather than state-sponsored actions – though this flies in the face of the UK government’s position. [..] He ends the Goldsmiths talk with an anecdote about having lunch with his sources in the wake of 9/11. He vents his anger at the agencies for not sharing information. One of his CIA sources fires back: “Sy you still don’t get it after all these years – the FBI catches bank robbers, the CIA robs banks.” It is a delicious, if cryptic aphorism.

The Pope is not a bad idea.

• Please Sign Letter To Pope Francis Seeking Help For Julian Assange (LACW)

Your Holiness,

In your first Papal visit outside of Rome only months after your election as Supreme Pontiff, you choose the Italian island of Lampedusa, a refuge for migrants and asylum seekers fleeing the prospect of death. You did so to express your closeness and love to suffering people, to promote their dignity, which was under threat at home and in jeopardy in the countries where they seek refuge. Your first act upon arrival was to lay a wreath in the sea in memory of all those who had lost their lives seeking refuge. We, the undersigned, write to you, Your Holiness, as a loving Father to those who lives are in imminent danger, begging and beseeching you to speak up for someone whose life is in imminent danger.

A life that can only be saved by your intervention. In order to lessen the possibility of us laying a wreath in the coming days, in memory of the stateless asylum seeker Julian Assange, we ask that you speak out on his behalf. Julian is possible moments or hours away but certainly days away from being abducted by a SAS squad from the Ecuadorian Embassy in London, where his asylum status is about to be revoked. Based on the precedent the risk of death is very high. Last time the SAS entered an Embassy in London they assassinated their targets after they had surrendered and were unarmed lying on the ground.

With all legal avenues exhausted and the British, American, Ecuadorian and Australian governments all arranging the imminent raid on Julian, we cry out to you, Holy Father and ask that you encourage nations to respect the life of Julian Assange and to cease his arbitrary detention (as cited by the United Nations) and grant him asylum status where he can continue his work as a journalist, telling the truth, that is the truth that respects the dignity of persons. Please, Holy Father speak up and defend this life which so many powerful nations want to end and whose life only you can plead for leniency in a manner which may be heeded by the powerful who seek to end him.

Australia should honor its own laws. And that means protecting its citizens.

• Julian Assange And Lawyer Want Malcolm Turnbull To ‘Stand Up To US’ (N.)

[..] new British Foreign Secretary Jeremy Hunt claimed Assange was facing “serious charges” from local police. But there is confusion about what they are, as he is only facing a minor charge for breaching bail. Jennifer Robinson, Assange’s lawyer in London, told news.com.au she was “obviously very concerned” about the speculation he could be forced from the embassy. “We are monitoring that really closely. From our point of view he requires ongoing protection (because) the risk of prosecution is as high as it has ever been.” The Times quoted a source familiar with the case who expected Assange would “lose his asylum status imminently. This means he will be expelled from the embassy. When this will happen is impossible to say.”

It was Ms Robinson’s view, and Assange’s, that Australia could help break the stalemate. “Julian is still an Australian citizen and they have an obligation — and I think a duty — to exercise rights of protection over an Australian citizen,” she said. “They could usefully engage in this to help solve the impasse.” Ms Robinson said Canberra had good relationships with both the UK and US, so it shouldn’t be a difficult matter. “For me as a fellow Australian citizen, it is disappointing the government has not done more — but that doesn’t preclude them from doing it now and I very much hope that they will.” She said it raised concerns about the Federal Government’s willingness to “stand up for Australians” when the US Government was involved.

[..] Ms Robinson was mystified as to what charges Mr Hunt was referring to. “Jeremy Hunt’s statement is curious in the sense that Mr Assange doesn’t face any charges whatsoever … A magistrate will have to decide whether to bring bail proceedings against him when he leaves the embassy.” [..] “So is Mr Hunt talking about an extradition request from the US where he would face serious charges?” asked Ms Robinson. “Has he misspoken and disclosed that?” She told news.com.au that would be a serious matter. Assange’s legal team had sought assurances from the UK there was no extradition request and had been met with a “standard, blanket will not confirm or deny”. “So if Mr Hunt is talking about serious charges … there are none on the public record, so of course, we are concerned about what that might be from the US.”

“..prosecuting a journalist for publishing authentic documents would arguably constitute a greater leap in the direction of Orwellian dystopia than the Patriot Act.”

• As Long As Assange Is Silenced, Claims Against Him Are Illegitimate (CJ)

As attempts to evict Julian Assange from the Ecuadorian embassy in London get more and more aggressive, we are seeing a proportionate increase in the establishment smear campaign against him and against WikiLeaks. This is not a coincidence. The planned campaign to remove Assange from political asylum and the greatly escalated smear campaign to destroy public support for Assange are both occurring at the same time that Assange has been cut off from the world without internet, phone calls or visitors, completely unable to defend himself from the smear campaign. This, also, is not a coincidence.

The ability to control the narrative about what is going on in the world is of unparalleled importance to the plutocrats who use governments as tools to advance their agendas. The agenda to make an example of a leak publisher with a massive platform who has repeatedly exposed the corruption of the establishment upon which western plutocrats have built their empires will require continuous narrative spin, since the precedent set by prosecuting a journalist for publishing authentic documents would arguably constitute a greater leap in the direction of Orwellian dystopia than the Patriot Act.

Among the latest components of this campaign has been a viral dump of Twitter DMs being promoted as a hot news item by outlets like Motherboard, The Hill, Forbes and Think Progress and across #Resistance Twitter. The fact that the juicy bits from those DMs had already been published months ago by The Intercept, and the fact that the smears and spin we’re seeing reruns of today were long ago ripped to shreds in journalist Suzie Dawson’s epic essay “Being Julian Assange” after the Intercept publication, has not dampened the orgiastic frenzy with which this non-story is being bandied about by establishment loyalists and defenders of power as evidence of Assange’s nefariousness.

Are we ever going to have that UN Emergency Meeting?

• Italian Ship Violates International Law, Returns Rescued People To Libya (G.)

A search and rescue charity has alleged that an Italian ship returned scores of people rescued from the Mediterranean to Libya, even though Libya is not regarded by Europe as a safe place under international law. In what would be an unprecedented case if confirmed, the Asso 28, an oil rig support vessel, allegedly saved 108 people from a dinghy and then took them to Tripoli. The allegation was made by Òscar Camps, the founder of Proactiva Open Arms, a Spanish sea search and rescue NGO. It is unclear whether the ship had received instructions from the Italian coastguard. “The Asso 28, with an Italian flag, rescued 108 people in international waters and is now deporting them to Libya, a country where human rights are not respected. No chance [for them] to get asylum or shelter,” Camps wrote on Twitter.

Camps’ allegation was supported by Nicola Fratoianni, an Italian politician with Free and Equal, a small leftwing party, who was on board the Proactiva rescue ship. “We don’t know yet if this operation was instructed by the Italian coastguard, but if so it would be a very serious precedent, a real collective rejection, which Italy and the captain of the ship would have to respond to in court,” Fratoianni said. Two weeks ago Italy assured Germany that it would continue to accept migrants rescued at sea until an EU-wide plan on redistributing people across the continent was established. The pledge came after high-profile moves by Matteo Salvini, the interior minister and leader of the far-right League, to block rescue ships from docking at Italian ports.

In a response to Camps’ allegation on Tuesday, Salvini made no mention of the alleged involvement of an Italian ship in the incident. He wrote on Twitter: “The Libyan coastguard has rescued and brought back 611 immigrants in recent hours. The NGOs protest and the traffickers lose business? Fine, we’ll continue in this direction!” In another post, on Facebook, he wrote: “The Italian Coast Guard has not coordinated and participated in any of these operations, as falsely declared by a foreign NGO and a poorly informed leftist MP.”