Kennedy and Johnson Dallas, Morning of November 22 1963

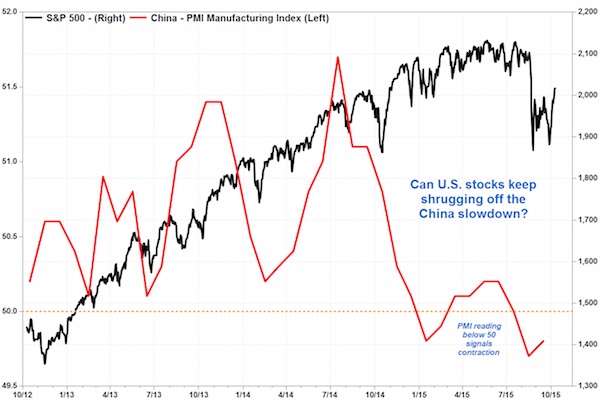

Can’t believe people would still seek to ignore this. It’s China grinding to a halt.

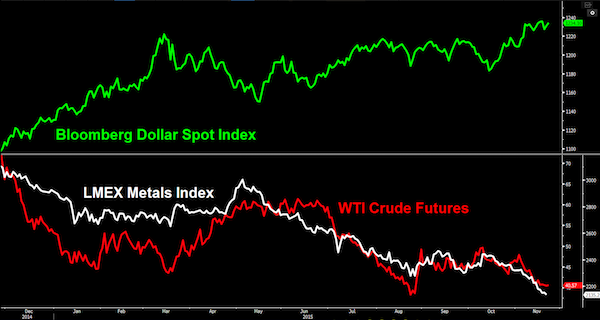

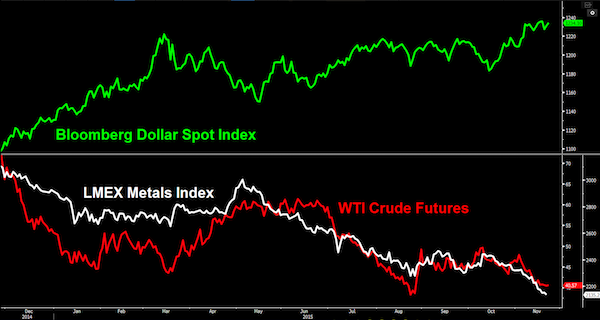

• Commodity Slump Deepens as Dollar Gains; European Stocks Slide (Bloomberg)

A slump in commodities deepened, with industrial metals and oil leading losses as the dollar extended gains. European equities retreated after the region’s equities posted their biggest weekly advance in four weeks. Crude extended its drop below $42 a barrel and copper fell to levels unseen since 2009 as comments from Federal Reserve officials about the prospect of a December rate increase bolstered the greenback. Nickel plunged 4.1% and gold declined, helping send the Bloomberg Commodity Index to a 16-year low. Russia’s ruble and the Australian dollar led commodity-producers’ currencies lower. The Stoxx Europe 600 Index slid, while the euro touched the weakest level in seven months against the dollar.

“This is not a really welcoming environment for risk taking,” said Tim Condon at ING in Singapore. “Liquidity is beginning to dry up as people are waiting for what happens in December with the Fed. Worries about China persist.” The greenback’s surge this year has weighed on material prices at the same time as demand slows in China, the world’s biggest commodity consumer. John Williams, president of the Fed Bank of San Francisco, said at the weekend that there was a “strong case” for a U.S. rate hike at the Fed’s last meeting of 2015. Agricultural commodities face a new headwind after Sunday’s election of Mauricio Macri as Argentina’s president, according to growers and analysts, who said the result heralds the end of punitive export taxes and may unleash an estimated $8 billion in shipments of stored crops.

Read more …

But wasn’t eurozone business activity supposed to be great?

• Europe Warned On ‘Permanent’ Downturn Amid PMIs (CNBC)

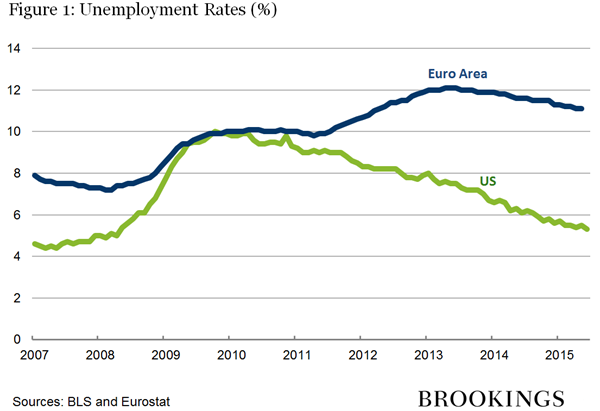

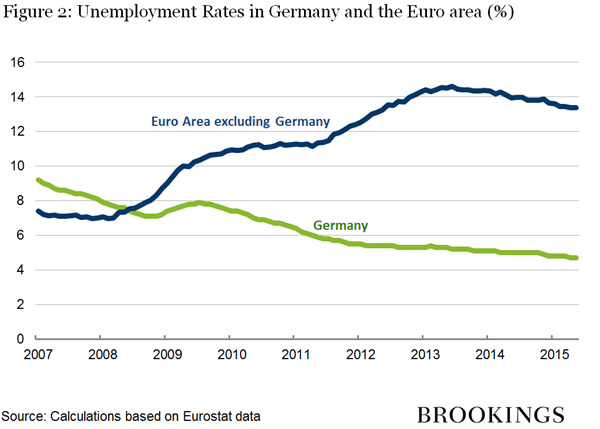

The economic downturn experienced by Europe and its after-effects, such as high unemployment and labor market weakness, could become a permanent fixture in the region, according to a leading think tank. “Europe continues to face the significant challenges of tackling unemployment, underemployment and inactivity,” the Institute for Public Policy Research (IPPR), a U.K.-based left-leaning think tank, said in its latest report on Monday. “The southern European economies in particular are still combating the effects of the sovereign debt crisis – high levels of joblessness and insecure or temporary work.” Across the rest of the continent, the IPPR said that workers could be left behind due to advances in automation and global competition which “act as more long-term headwinds blowing skill supply and demand out of alignment.”

Such headwinds, the IPPR added, “threaten to consolidate some of the medium-term effects of recession into more permanent features of the economy – a prospect that would be deeply alarming.” The 19-country euro zone bloc was plunged into a deep crisis and regional recession following the 2008 financial crisis. The most acute effect of the crisis was the widespread loss of jobs as a result of industry and business cutbacks and closures. The crisis hit southern euro zone countries more than their more prosperous northern counterparts with a number of countries, Greece, Portugal, Spain, Cyprus and Ireland, requiring bailouts of various magnitudes.

Despite a slow economic recovery in most of the euro zone over recent years, unemployment remains a problem and is stubbornly high in several countries. While Germany has the lowest rate of unemployment, at 4.5% in September, according to Eurostat, joblessness in Greece and Spain remains high, at 25%. in Greece (in July) and 21.6% in Spain. For young people aged 16-25, the statistics are even worse. The IPPR said that policymakers needed to respond “by minimizing the long-term erosion of skills as a result of recession, and investing to reshape and re-skill the labor force for the jobs of the future.”

Read more …

Wish he would go do just that. In the Arctic.

• Euro Drops To Seven-Month Low As Draghi Feeds Bears (Bloomberg)

The euro weakened to a seven-month low after futures traders added to bearish bets and ECB President Mario Draghi encouraged speculation his board will ease policy next week. Europe’s common currency dropped versus the majority of its 10 developed-market peers after Draghi said Friday the ECB will do what it must to raise inflation “as quickly as possible.” The Governing Council meets in Frankfurt on Dec. 3 for its next monetary-policy decision. Hedge funds ramped up wagers on dollar strength last week by the most since August 2014. The Australian dollar tumbled as copper and nickel prices plunged to multi-year lows. “It’s probably reasonable to think we can spend time down below $1.05 now,” for the euro, said Ray Attrill at National Australia Bank in Sydney. “It looks to me like we’re building up into a fairly classic sell the rumor, buy the fact.”

The euro slid 0.2% to $1.0623 at 6:46 a.m. in London Monday. It earlier touched $1.0601, the lowest since April 15. The shared currency traded at 130.83 yen after declining 0.9% to 130.77 at the end of last week. The dollar rose 0.3% to 123.17 yen. Japanese markets are shut for a holiday. The Aussie dollar dropped 0.8% to 71.79 U.S. cents, following a two-week, 2.8% advance. Copper fell through $4,500 for the first time since 2009, while nickel dropped to the lowest level since 2003 after Chinese smelters announced plans to cut production. “The commodity washout is weighing on Aussie sentiment,” Stephen Innes at foreign- exchange broker Oanda wrote.

New Zealand’s dollar weakened 0.7% to 65.17 U.S. cents. Swaps traders increased the odds the Reserve Bank will cut its benchmark interest rate next month to 55%, from 46% a week ago, according to data compiled by Bloomberg. “A mix of U.S. dollar strength and rising expectations of more RBNZ rate cuts” dragged the kiwi lower, said Elias Haddad, a currency strategist at Commonwealth Bank of Australia in Sydney. “The accumulation of unimpressive New Zealand economic data and declining dairy prices are weighing on short-term swap rates.” New Zealand’s currency will depreciate to 59 cents by the middle of next year, he said.

Read more …

Overcapacity bites.

• Zinc Producers Keep Cutting Back, Yet Prices Keep Falling (Bloomberg)

Zinc producers keep on cutting back and yet prices keep on falling. After Glencore cut a third of its supply last month to combat a rout, the price rallied 10% and the gains lasted a month. When producers in China did the same on Friday, the jump was smaller and got rolled back after a day. “The benefit of previous such announcements have been fleeting, and we are not expecting this occasion to be any different,” Australia & New Zealand Banking analyst Daniel Hynes said in a note on Monday. “The market is intently focused on slowing growth in manufacturing activity in China.”

The rapid rollback of zinc’s bounce, which followed the announcement by China suppliers of output cuts for 2016, signals supply curtailments by producers probably won’t be sufficient on their own to change the course of the rout in base metals. That tallies with the view from Goldman Sachs, which said in a note this month recent output cuts aren’t large enough to rescue prices, and that will require a substantial rise in Chinese demand. In addition to zinc, producers have also announced reductions in copper and aluminum. “If you look at the track record of these vaguely worded statements, unless there is a specificity to it, they are generally not fully carried through,” Ivan Szpakowski at Citibank in Hong Kong, said by phone on Monday. “The market is very suspicious.”

A group of 10 Chinese smelters – including Zhuzhou Smelter Group, the country’s top producer – said they planned to lower refined output 500,000 tons next year, according to a joint statement. That represents about 7% of China’s production and over 3.5% of world supply, according to ANZ. Still, prices fell on Monday as base metals sank. Zhuzhou Smelter hasn’t yet completed drafting its production plan for 2016, according to Liu Huichi, the company’s securities representative. The company is still working on meeting the production target for this year, Liu said by phone on Monday.

Read more …

Ambrose loves taking “the other side”, but ignores that a soaring money supply is meaningless if there’s no-one to spend it. And that means people, not companies buying their own stock.

• Barclays Bets On Stock Boom As World Money Growth Soars (AEP)

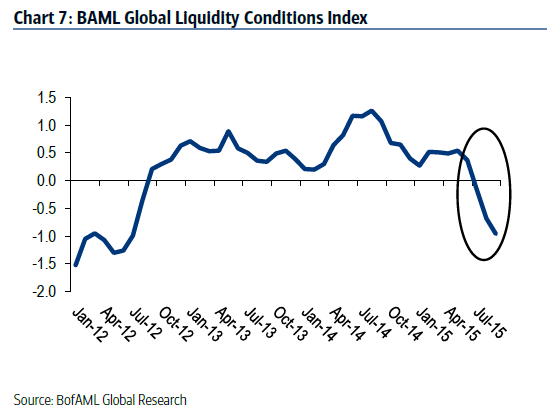

Barclays has advised clients to jump into world stock markets with both feet, citing the fastest growth in the global money supply in over thirty years and an accelerating recovery in China. Ian Scott, the bank’s global equity strategist, said the sheer force of liquidity will overwhelm the first interest rate rises by the US Federal Reserve, expected to kick off next month. Global equities rose by an average 15pc over the six months after the last three US tightening cycles began, on average, and Barclays argues that this time stocks are cheaper. The cyclically-adjusted price to earnings ratio (CAPE) for the world’s equity markets is currently 18, compared to 25.5 at the beginning of the last rate rise episode in 2004.

This is roughly 14pc below the CAPE average since 1980, though critics say earnings have been artificially inflated by companies borrowing a rock-bottom rates to buy back their own stock. Mr Scott said the growth of global M1 money – essentially cash and checking accounts – has surged to 11pc in real terms, led by China and the eurozone. This is higher than during the dotcom boom and the pre-Lehman BRICS boom. It is likely to ignite a powerful rally in equities nine months later if past patterns are repeated, although the lags can be erratic, and the M1 data gave false signals in the mid 1990s. Barclays said American stocks are trading at a 30pc premium to the rest of the world. This gap is likely to close as emerging markets – “the epicentre of negative sentiment” – come back from the dead.

The pattern of foreign fund flows into the reviled sector has triggered a contrarian buy-signal. Everything hinges on China where real M1 money has ignited after languishing for over a year. Floor space sold is growing at 20pc and house prices have stabilized. Simon Ward from Henderson Global Investors says real M1 is now surging in China at the fastest rate since the post-Lehman credit blitz, though money data is cooling in the US Chinese fiscal spending has jumped by 36pc from a year ago and bond issuance by local governments has taken off, drawing a line under the recession earlier this year. “A growth revival is under way and will gather strength into the first half of 2016,” he said.

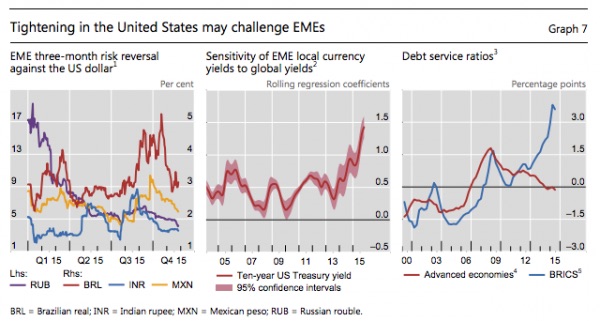

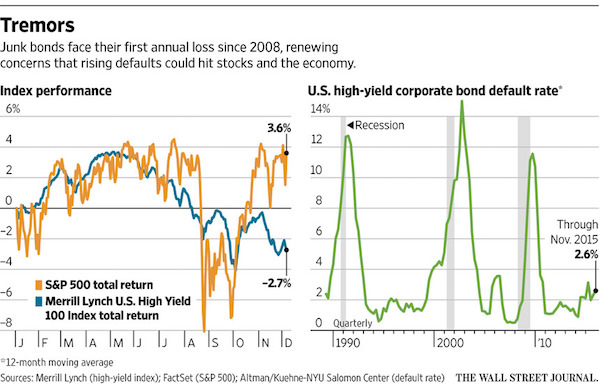

[..] Sceptics abound. Nobody knows for sure what will happen to the most indebted countries if the Fed embarks on a serious tightening cycle. Dollar debts in emerging markets have jumped to $3 trillion, and much higher under some estimates. Private credit in all currencies has risen from $4 trillion to $18 trillion in a decade in these countries. Research by the Bank for International Settlements suggests that rate rises by the Fed ineluctably lifts borrowing costs everywhere.

Read more …

“..Singer wrote that the world could face a more severe scenario like a “global central bank panic.”

• Masters of the Finance Universe Are Worried About China (Bloomberg)

David Tepper says a yuan devaluation may be coming in China. John Burbank warns that a hard landing there could spark a global recession. Tepper, the billionaire owner of Appaloosa Management, said last week at the Robin Hood Investor’s Conference that the Chinese yuan is massively overvalued and needs to fall further. His comments follow similar forecasts from some of the biggest hedge fund managers, including Crispin Odey, founder of the $12 billion Odey Asset Management, who predicts China will devalue the yuan by at least 30%. The money managers are losing faith in China’s ability to revive its economy, which suffers from rising nonperforming loans and falling exports, after the surprise 1.9% currency devaluation in August and global market rout that followed.

The investors made their dire forecasts after shares of U.S.-traded Chinese companies, which their funds sold in the third quarter, began to rebound in October. “The downside scenario for China seems more intimidating than ever before,” billionaire Dan Loeb wrote on Oct. 30 to investors at Third Point, which manages $18 billion. “The new question is not whether but how severe the slowdown of the world’s foremost growth machine will be.” Goldman Sachs on Thursday echoed the managers’ concerns, saying the biggest risk to a rebound in emerging-market assets next year is a “significant depreciation” of the yuan. Policy makers, facing a stronger dollar and slower growth, may let the currency decline, which would ripple through emerging markets, strategists led by Kamakshya Trivedi wrote. “In our view, the fallout from such a shift is the primary risk,” the analysts said.

[..] Elliott Management’s Paul Singer also warned about global contagion from China’s decline. Singer told investors in an October letter that emerging market countries are “choking” on U.S. dollar-denominated debt that was extended due to low interest rates and monetary stimulus. He said many emerging economies, which are in recession, are “scared to death” about even a 25 basis-point increase in U.S. interest rates. While “muddling along” is still an option, Singer wrote that the world could face a more severe scenario like a “global central bank panic.” He said that policy makers will probably “double down on monetary extremism” in response to deteriorating economies in emerging markets and China.

Read more …

It’s about discounting the future as much as you can. Faustian.

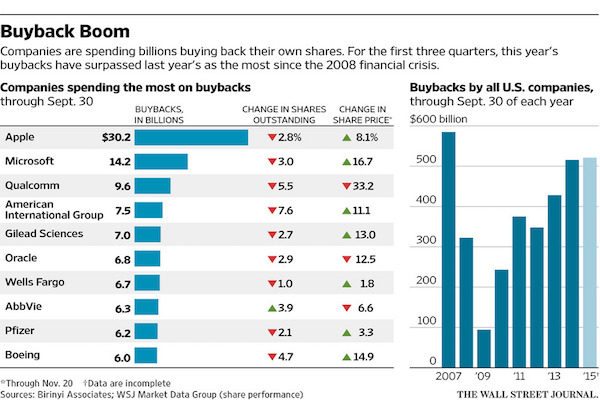

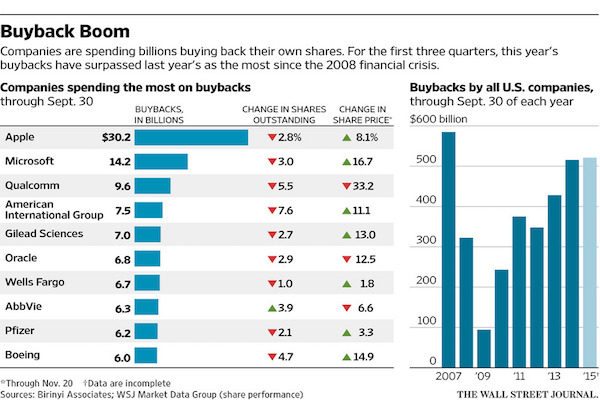

• Is the Surge in Stock Buybacks Good or Evil? (WSJ)

Corporate stock buybacks are climbing toward a post-financial-crisis high this year, furthering the debate about the use of hundreds of billions of dollars in company cash to enhance quarterly earnings reports. Stock repurchases boost earnings per share, even if total earnings don’t change, by reducing the number of shares. Analysts and investors typically track per-share earnings, not overall earnings. Buybacks have drawn criticism from some fund managers including Larry Fink, chief executive of BlackRock, which oversees $4.5 trillion in assets. He has said some companies invest too much in buybacks and too little in longer-term business growth. Repurchases also have become a political issue. Democratic presidential candidate Hillary Clinton has called for more-frequent and fuller disclosure of them by the companies involved, even as some activist investors push for more buybacks as a way of returning cash to investors.

In the year’s first nine months, U.S. companies spent $516.72 billion buying their own shares, with third-quarter reports still not complete, according to Birinyi Associates. That is the highest amount for the first three quarters since the record year of 2007, the year before the financial crisis. It leaves this year on track for a post-2007 high if fourth-quarter buybacks hold up. Buybacks can have a significant impact on earnings, as was illustrated this quarter by companies including Microsoft, Wells Fargo, Pfizer and Express Scripts. Microsoft turned a decline in total earnings into a per-share gain by repurchasing a little more than 3% of its shares in the past 12 months. Its total third-quarter earnings were down 1.3% from a year earlier, but per-share earnings rose 3.1%, according to FactSet.

For Wells Fargo, a 0.6% increase in total earnings became a 2.9% gain in earnings per share after buybacks. At Pfizer, a 2% overall earnings gain became a 5.3% per-share jump. Express Scripts, a large drug-benefits manager, turned a 2.8% overall gain into a 12.4% per-share increase. Apple Inc. is by far the biggest buyback spender this year, with $30.22 billion, followed by Microsoft, Qualcomm and AIG. This year isn’t on pace to surpass 2007 in total buybacks. But Birinyi’s data show that announcements of planned future buybacks are the highest for any year’s first 10 months, more even than in 2007. “If companies execute their plans, we are looking at a record amount being deployed over the next couple of years,” said Birinyi analyst Robert Leiphart.

Read more …

“No one’s ever suggested including the loonie in the SDR.”

• You’re Not the Yuan That I Want (Bloomberg)

In its ongoing quest for glory and global influence, China appears to have won a notable victory. The IMF is set to anoint the renminbi – the “people’s currency,” also known by the name of its biggest unit, the yuan – as one of the world’s reserve currencies along with the dollar, pound, euro and yen. For those who fear (or hope) that China will eventually transform the postwar economic order, this appears to be the first step toward dethroning the dollar. The IMF’s decision, however, is mere political theater. The yuan will now be included among the basket of currencies that make up its so-called Special Drawing Rights. As the IMF itself notes, “the SDR is neither a currency, nor a claim on the IMF.” Holders simply have the right to claim the equivalent value in one or more of the SDR’s component currencies. Central banks and investors won’t suddenly be required or even explicitly encouraged to use the yuan.

Indeed, all that’s changed is that it’s now clear that the IMF isn’t blocking the yuan from becoming a true global reserve currency: China is. To the contrary, the IMF appears to be doing everything it can to help China. SDR currencies are meant to be “freely usable,” which the IMF defines as “widely used to make payments for international transactions” and “widely traded in the principal exchange markets.” The yuan’s champions note that the currency has grown from being used in less than one% of international payments in September 2013 to 2.5% in October – among the top five globally. This simple metric, however, enormously overstates the yuan’s influence. Globally, it’s still barely used more than the Canadian and Australian dollars. No one’s ever suggested including the loonie in the SDR.

True, China is the world’s second-largest economy and its biggest trading nation. Yet at the same time, more than 70% of payments made in yuan still go through Hong Kong, primarily due to its strategic location as a shipping and trading hub for the mainland. All but 2% of yuan-denominated letters of credit are issued to Hong Kong, Macau, Singapore, and Taiwan to facilitate trade with China. Even in Asia, the yuan isn’t accepted as collateral for derivatives trading and similar financial transactions. Instead it’s used almost exclusively for trade in physical goods where China is one of the counterparties. Nor is the currency widely traded in financial markets. Hong Kong, the largest center of yuan deposits outside of China, holds less than 900 billion renminbi, or about $140 billion.

That’s $40 billion less than Coca-Cola’s market cap (and barely a fifth the value of Apple’s). The entirety of yuan deposits held outside of China still amounts to less than the market capitalization of the Thai stock market. This isn’t the result of prejudice against China, but deliberate policy. Take the oft-cited statistic that 2% of global reserves are already held in renminbi. Virtually all yuan reserves are held under swap agreements with the People’s Bank of China, rather than as physical currency. That means China’s central bank maintains control over the currency and its pricing and can refuse transactions if needed, as it did last week when it ordered banks to halt renminbi lending offshore. While other central banks have significant latitude to engage in onshore renminbi purchases, they face restrictions on using the currency outside China.

Read more …

As Greece and Britain show us, yes you CAN cut a society to death.

• UK Deficit Could Hit £40 Billion By 2020 On Ill-Advised Cuts (Guardian)

George Osborne could be forced to borrow billions of pounds more than forecast by 2020 if he sticks with spending cuts that will damage hit economic growth, according to a report by City University. With only days to go before the chancellor’s autumn statement, the report said the Treasury has underestimated the impact of welfare and departmental spending cuts on the broader economy and especially cuts to public sector investment. Without a boost to public infrastructure, private sector businesses will limit their own investment plans, leading to lower productivity and depressed GDP growth over the next four years. By 2020 the government will be forced to report a £40bn deficit instead of the planned £10bn surplus, the report concludes, undermining Osborne’s fiscal charter, which dictates that governments borrow only in times of distress.

The study by two academics from City University comes only days before the chancellor is expected to tell parliament that he plans to achieve a budget surplus by 2020 from a mixture cuts to departmental spending, welfare and from higher tax receipts, especially income tax and national insurance. But he is already off track in the current 2015/16 year after a run of poor figures for the public finances. Last week the Office for National Statistics reported that higher government spending and lower corporation tax receipts than expected in October had sent borrowing to highest for that month since 2009. Richard Murphy, an academic at City University who has advised the Labour leader Jeremy Corbyn, said the £50bn gap in borrowing is likely because the Treasury will repeat the same mistakes it made between 2010 and 2015, when the coalition government borrowed £160bn more than predicted.

He said the government planned to ignore a detailed study by the IMF that showed cuts to public expenditure during the recovery from a financial crash can result in lower growth, depressed tax receipts and the need for higher borrowing. The analysis of the multiplier effect from spending cuts shows that far from allowing private consumption and investment to accelerate, it remains modest at best, limiting growth and tax receipts. Murphy said: “The very low multiplier the Treasury uses assumes that cuts in government spending will stimulate growth. That’s an assumption, and not a fact. “It is one the IMF now disagree with. And the result of basing policy on that multiplier is we have more cuts than we need, lower growth in the UK economy as a result, lower earnings for most households and so lower tax revenues – which actually makes balancing the government’s books harder,” he added.

Read more …

The world view of a handful crazed rich sociopaths is ruining an entire formerly proud nation.

• Everything We Hold Dear Is Being Cut To The Bone. Weep For Our Country (Hutton)

Last Thursday, my wife was readmitted to hospital nearly two years after her first admission for treatment for acute lymphoblastic leukemia. She is very ill, but the nursing, always humane and in sufficient numbers two years ago, is reduced to a heroic but hard-pressed minimum. She has been left untended for hours at a stretch, reduced to tearful desperation at her neglect. The NHS, allegedly a “protected” public service, is beginning to show the signs of five years of real spending cumulatively not matching the growth of health need. Between 2010 and 2015, health spending grew at the slowest (0.7% a year) over a five-year period since the NHS’s foundation. As the Health Foundation observed last week, continuation of these trends is impossible: health spending must rise, funded if necessary by raising the standard rate of income tax.

There will be tens of thousands of patients suffering in the same way this weekend. Yet my protest on their behalf is purposeless. It will cut no ice with either the chancellor or his vicar on earth, Nick Macpherson, permanent secretary at the Treasury. Their twin drive to reduce public spending to just over 36% of GDP in the last year of this parliament is because, as Macpherson declares more fervently than any Tory politician, the budget must be in surplus and raising tax rates is impossible. Necessarily there will be collateral damage. It is obviously regrettable that there are too few nurses on a ward, too few police, too few teachers and too little of every public service. but this is necessary to serve the greater cause of debt reduction. To reduce the stock of the public debt to below 80% of GDP and not pay a penny more in income or property tax, let alone higher taxes on pollution, sugar, petrol or alcohol, is now our collective national purpose.

Everything – from the courts to local authority swimming pools – is subordinate to that aim. Not every judgment George Osborne makes is wrong. He is right to advocate the northern powerhouse, to spend on infrastructure, to stay in the EU, radically to devolve control of public spending to city regions in return for the creation of coherent city governance and to sustain spending on aid and development. It is hard to fault raising the minimum wage or to try to spare science spending from the worst of the cuts. But the big call he is making is entirely misconceived. There is no economic or social argument to justify these arbitrary targets for spending and debt, especially when the cost of debt service, given low interest rates and the average 14-year term of our government debt, has rarely been lower over the past 300 years.

Read more …

But £12 billion more for the military.

• Five Years Into Austerity, Britain Prepares For More Cuts (Reuters)

After laying off nearly half its staff over the last five years, scaling back street cleaning and relying on volunteers to work at some of its libraries, the London borough of Lewisham is getting ready for what could be much more painful spending cuts. Officials in Lewisham’s town hall, like those across the country, know they will have to shoulder much of finance minister George Osborne’s renewed push to fix Britain’s budget. Osborne is due to announce on Wednesday the details of a new spending squeeze which, according to International Monetary Fund data, ranks as the most aggressive austerity plan among the world’s rich economies between now and 2020. It is also a gamble by Osborne, a leading contender to be the next prime minister, that voters can stomach more cuts.

He rejects accusations that his insistence on a budget surplus by the end of the decade is a choice, saying Britain needs fiscal strength to fight off future shocks to the economy. As in the first five years of his austerity push – which Osborne originally hoped would wipe out the budget deficit – he plans to spare Britain’s health service, schools and foreign aid budget from his new cuts and will increase defense spending. That means that cuts for unprotected areas of government, such as local councils, will be all the deeper. Kevin Bonavia, a councilor who oversees Lewisham’s budget, said the borough had just agreed to merge computing teams with another one on the other side of London as it seeks to make more savings in its back-office operations and protect services.

But voters are likely to notice the cuts more in the years ahead than they have done so far. Rubbish bins may no longer be emptied weekly. Delivery of cooked meals could be replaced with help for people in need to do their own online shopping. Lewisham will also have to find savings in the way it provides social care for the elderly and children, which accounts for the lion’s share of its spending. “We are always trying to rationalize. But we have to do it at pace now, and when you do it at pace, you can make mistakes,” Bonavia, a member of the opposition Labour Party, said.

Read more …

You read that right: £12 billion more for the military

• Save The Library, Lose The Pool: Britain’s Austere New Reality (Guardian)

On a weekday morning in Blakelaw, two miles from the heart of Newcastle, the scene inside a community centre suggests a perfect example of what David Cameron used to call the “big society”. Local women have gathered for a “coffee and conversation” session, while people nearby are cutting flyers for a residents’ association’s Christmas fair. Meanwhile, an effervescent 36-year-old councillor called David Stockdale is discussing plans to bring a key amenity into community ownership. The prime minister would presumably balk at his terminology: Stockdale proudly talks about a “socialist post office”. Since March 2013, the Blakelaw neighbourhood centre has been run as a not-for-profit local partnership, raising money and rising to the challenges presented by austerity.

When the library that extends off the foyer was threatened with closure, the partnership took over its funding. About six months after Newcastle city council cut all money for youth services, the partnership appointed a full-time youth worker. For all Stockdale’s collectivist passions, if you believe wonders can result from the enforced retreat of the state, what happens here might hint at a positive case study – but scratch the surface and it is a lot more complicated. The coffee-and-conversation women say the weekly sessions are pretty much all the area’s pensioners have left: cuts in council grants stopped the exercise classes and local history group. Doreen Jardine, chair of the residents’ association, says that in the past she had enough money from the council to organise up to seven annual coach trips for local children. She’s now down to two.

And while Stockdale extols self-organisation, he also wonders how his area has reached this point. “This is one of the most deprived communities in Newcastle,” he says. “Can you imagine what we could be doing if we didn’t have to meet the costs of running our library? We run this thing on a shoestring, with the goodwill of a lot of people. And it’s difficult.” It is my fourth journalistic visit to Newcastle in three years. The last time I was here, in November 2014, I talked to people anxious about the city’s fate, and pieced together the story of local austerity with the city’s Labour leader, Nick Forbes.

The council was in the midst of a £100m programme of cuts to be spread from 2013 to 2016. Its projections pointed to additional cuts in 2016-17 of £30m then £20m the next year – and Forbes suggested by that point the financial position would be impossible. “By 2017-18,” he told me, “our estimate is that we will have less than £7m to spend on everything the city council does, above and beyond adult and children’s social care. So it’s completely untenable.” Now, in the buildup to George Osborne’s spending review, the position seems even tougher. The projected cuts for 2017-18 have gone up by £20m, and thanks chiefly to Osborne’s failure to pay down the deficit by his original deadline, another £30m is set to follow in 2018-19.

Read more …

That sinking feeling persists.

• Greek Disposable Income Shrinks Twice As Fast As GDP (Kath.)

Despite the major decline in disposable incomes, Greece remains among the most expensive countries in Europe in dozens of products and services. For instance, a kilogram of flour in Spain costs €1.03, while in Greece it costs €1.25. An iPhone 6s, with a capacity of 16 gb costs €789 in Greece against €739 in Germany, Portugal and Austria, €749 in France and €770 in Italy, all of them countries with a considerably higher per capita income than Greece.

While prices have started declining marginally in this country since 2013, disposable incomes started shrinking from 2008 by an average rate of 6.7% every year, according to figures collected by the Organization for Economic Cooperation and Development (OECD): This stands nowadays at €17,448 per household, far below the OECD member-state average of €24,339 per year. That means Greece ranks only 27th among the OECD’s 36 member-states in terms of people’s disposable income, way below fellow countries of the European south, such as Portugal, Spain and Italy. In practice the disposable income in Greece appears to have shrunk in the last seven years at a rate almost twice as big as the country’s economic contraction rate.

Read more …

Cutting production is not on the table. They simply can’t.

• Cut Oil Supply or Drop Riyal Peg? Saudis Face ‘Critical’ Choice (Bloomberg)

The longer oil languishes, the more pressure builds on Saudi Arabia to abandon its currency peg. Contracts used to speculate on the riyal’s exchange rate in the next 12 months climbed to a 13-year high on Thursday, before trimming the increase a day later, according to data compiled by Bloomberg. Six-month agreements rose to near the highest in seven years on Friday. Saudi Arabia is pumping oil at a record level this year, leading OPEC’s effort to defend market share even as oil trades near the lowest level in six years. That’s forced the kingdom to tap savings and sell debt to make up for a plunge in revenue and defend its 30-year-old peg to the dollar. For Bank of America Corp., the country may face a choice next year: cut production to help boost prices or adjust the riyal’s rate to stem a decline in foreign reserves.

“A depeg of the Saudi riyal is our number one black-swan event for the global oil market in 2016, a highly unlikely but highly impactful risk,” BofA strategists led by Francisco Blanch in New York wrote in a Nov. 19 report. “It is a lot easier politically to implement a modest supply cut at first than allow for a full-blown currency devaluation.” One-year forward points for the riyal jumped 167.5 points to 525 on Thursday, before falling to 455 a day later. That reflects expectations for the currency to weaken about 1.2% to 3.7962 per dollar in the next 12 months. Six-month agreements rose on Friday to 152.5, near the highest level since 2008. Weak global growth and inflation as well as a strong dollar will remain a “huge” headwind for dollar-based commodity prices, BofA said. Brent crude closed last week at $44.66 per barrel, down 44% from a year earlier.

Still, Saudi Arabia’s reserves are hardly depleted. While net foreign assets fell to a near three-year low in September as the government drew down financial reserves accumulated over the past decade, they’re among the highest in the region at $646.9 billion. The country’s peg survived low oil prices in the 1990s and revaluation pressure resulting from surging prices in the late 2000s, Shaun Osborne at Scotiabank wrote last week. Pressure may also build on the Chinese yuan amid declining reserves at central banks across the world and with expected U.S. interest-rate increases, BofA said. A meltdown of the yuan may ultimately force Saudi Arabia’s hand because of the “very high sensitivity” of commodities to the currency, the bank said.

Read more …

Betting against your own resources is the only way to make money.

• Oil Deal of the Year: Mexico Set for $6 Billion Hedging Windfall (Bloomberg)

Mexico is set to get a record payout of at least $6 billion from its oil hedges this year, according to data compiled by Bloomberg. The Latin American country locks in oil sales as a shield against price declines through a series of financial deals with banks including Goldman Sachs, JPMorgan and Citigroup. For 2015, Mexico guaranteed sales at almost $30 a barrel higher than average prices over the past year. The 2015 payment, due next month, is set to surpass the record from 2009, when the Mexican government said it received $5.1 billion after prices plunged with the global financial crisis. The country’s crude has fallen by almost half over the hedging period so far this year. Crude sales historically cover about a third of the government budget.

“The windfall is huge,” said Amrita Sen, chief oil analyst at Energy Aspects Ltd., a London-based consulting company. “This gives Mexico breathing space.” The hedge, which runs from Dec. 1 to Nov. 30, covered 228 million barrels at $76.40 each for the Mexican oil basket, according to government documents and statements. With less than two weeks to the end of the program, the basket has averaged $46.61 a barrel over the period. The difference would result in a payment of around $6.8 billion, not including fees. The final figure could vary from the Bloomberg estimate as some details of the hedge aren’t public and oil prices will change over the next two weeks. The Mexican oil basket fell on Nov. 18 to $33.28 a barrel – its lowest since December 2008.

Read more …

“People are sick of seeing these people in the paper who made a million after just mowing the lawn three times,” said Wetzell, the realtor in Devonport.”

• London House Prices Have Nothing on Auckland (Bloomberg)

Even with its mold-streaked bathroom and kitchen without a sink, the duplex in bayside Auckland attracted a frenzied bidding war. Now it’s one of the city’s newest million-dollar government-built houses. The two-bedroom, brick cottage on Kerr Street on the city’s inner north shore fetched NZ$1.04 million ($685,000) at an auction in September, netting the vendor, New Zealand’s government, double a valuation used for taxes. Long symbols of economic disadvantage, homes built by the state last century for low-income tenants are on a tear, thanks to their typically generous land sizes and proximity to the city.

The changing fortunes of these modest dwellings — loved and derided by New Zealanders for their functionality over style — reflect a fervor that’s spurred Auckland’s biggest property boom in two decades. The average house price in New Zealand’s largest city is now higher than London’s. “It’s like the supermarket before it closes on Christmas Day — everyone thinks they’d better get in or they’ll miss out,” said Carol Wetzell, a realtor at Barfoot & Thompson in Devonport, the agency that sold the 82-year-old Kerr Street home. State homes, particularly those built from local timber in a wave of government-led construction in the 1940s, are regarded as iconic — products of a time when the government was determined to ensure no one lived in squalor.

Prime Minister John Key was raised in a state house in Christchurch by his widowed immigrant mother, and the Auckland municipal government plans to create a NZ$1.5 million sculpture of one on the city’s waterfront. Now, with house prices up 24% in Auckland in the past year alone, the government can count more than 650 state homes, or “staties,” worth at least NZ$1 million in its Auckland property portfolio, according to data obtained by Bloomberg News via a freedom of information request. Among the most valuable listed by property researcher CoreLogic: a two-bedroom home in the leafy, inner-city suburb of Westmere with a rotting clapboard facade. With the prospect of sea views if renovated, plus space for a tennis court and swimming pool, it’s valued at NZ$2.2 million.

Read more …

Blowback for the west’s handling of the Middle East in the past 150 years.

• We Still Haven’t Grasped That This Is War Without Frontiers (Robert Fisk)

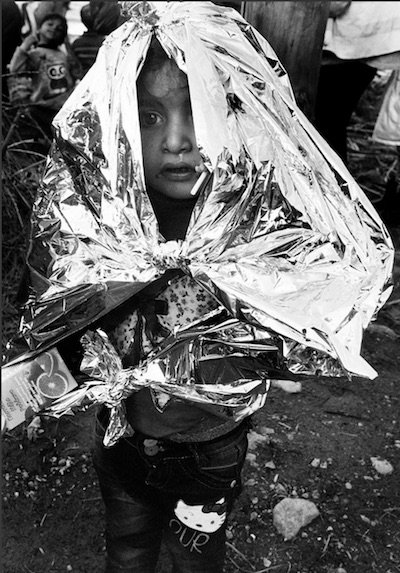

[..] Isil’s realisation that frontiers were essentially defenceless in the modern age coincided with the popular Arab disillusion with their own invented nations. Most of the millions of Syrian and Afghan refugees who have flooded into Lebanon, Turkey and Jordan and then north into Europe do not intend to return- ever – to states that have failed them as surely as they no longer – in the minds of the refugees – exist. These are not “failed states” so much as imaginary nations that no longer have any purpose. I only began to understand this when, back in July, covering the Greek economic crisis, I travelled to the Greek-Macedonian border with Médecins Sans Frontières. In the fields along the Macedonian border were thousands of Syrians and Afghans.

They were coming in their hundreds through the cornfields, an army of tramping paupers who might have been fleeing the Hundred Years War, women with their feet burned by exploded gas cookers, men with bruises over their bodies from the blows of frontier guards. Two of them I even knew, brothers from Aleppo whom I had met two years earlier in Syria. And when they spoke, I suddenly realised they were talking of Syria in the past tense. They talked about “back there” and “what was home”. They didn’t believe in Syria any more. They didn’t believe in frontiers. Far more important for the West, they clearly didn’t believe in our frontiers either.

They just walked across European frontiers with the same indifference as they crossed from Syria to Turkey or Lebanon. The creators of the Middle East’s borders found that their own historically created national borders also had no meaning to these people. They wanted to go to Germany or Sweden and intended to walk there, however many policemen were sent to beat them or smother them with tear gas in a vain attempt to guard the national sovereignty of the frontiers of the EU. The West’s own shock – indeed, our indignation – that our own precious borders were not respected by these largely Muslim armies of the poor was in sharp contrast to our own blithe non-observance of Arab frontiers.

Read more …

No, Europe is being broken apart by the EU.

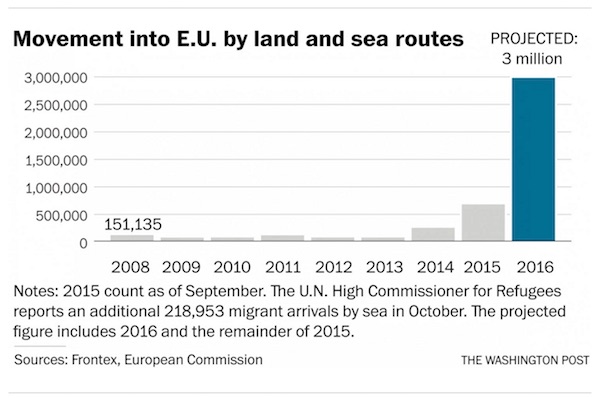

• Yanis Varoufakis: Europe Is Being Broken Apart By Refugee Crisis (Guardian)

Europe’s stumbling response to the refugee crisis is the result of the divisions caused by the six-year monetary crisis which has fragmented the continent and turned nations against each other, former Greek finance minister Yanis Varoufakis has told the Guardian. With thousands of migrants travelling to Europe from Africa, the Middle East and south Asia, Varoufakis said the future of the European Union was threatened by the worst such crisis since 1945. European leaders have agreed a plan to share 120,000 refugees through a quota system, but countries on the Balkan route have begun refusing people of certain nationalities as part of a backlash against migrants in the wake of the Paris attacks. The issue has become symbolic of Europe’s inability to act together.

Countries such as Britain were gripped by “moral panic” at the sight of refugees camped out at Calais, Varoufakis said, while countries such as Hungary had erected razor-wire fences to prevent migrants getting in. “Take a glance at events in Europe over the last 10-15 years ever since monetary union. The project has failed spectacularly,” said Varoufakis, who quit his job in July after failing to win the deal on debt relief that he believed was necessary for the Greek economy to turn the corner. “Europeans are a people divided by a common currency. The euro crisis has fragmented Europe, turning Greeks against Germans, Irish against Spanish etc. “It makes it hard for the EU to function as a political entity, as a unified entity. The centrifugal force of monetary union has made it harder to deal with the refugee crisis. In a sense, it is the straw that has broken the camel’s back.”

Varoufakis, speaking during a short speaking tour of Australia, admitted that he did not have the solution to the refugee crisis. “I don’t have the answer. The numbers of people are very large. But if someone knocks on my door at three in the morning, scared, hungry and having been shot at, as a human it is my moral duty to let them in and give them a drink and feed them. And then ask questions later. Anything else is an affront to European civilisation. “From a European perspective, we have a lot to answer for. Countries such as Iraq and Syria are creations of western imperialism and the cynicism of the west’s treatment of the region in the past has caused a backlash. “The invasion of Iraq was a great example of the inanity of the west. Syria and Iraq were very fragile states but by creating the rupture, it propelled a shockwave.”

Read more …

Back to the future.

• Life After Schengen: What a Europe With Borders Would Look Like (Bloomberg)

Continental Europeans have gone so long – two decades – without internal border controls that the younger generation doesn’t know what life is like with them. For a glimpse of the past, and the fortress mentality setting in after the Paris terrorist attacks, look no further than France’s frontier with Luxembourg. Five days after the Paris murder spree, the highway into Luxembourg resembled a truck parking lot, with a two-hour wait as the police stopped and, occasionally, searched. “What a pain in the neck,” said Alban Zammit, 43, a shaven-headed French truck driver who travels back and forth across the border with cargoes ranging from batteries to sacks of sugar. “Is it just to give people the impression of increased security?”

To grasp the economic toll in the time-is-money society, imagine commuters and truckers lining up for passport checks every morning to take the George Washington Bridge or Lincoln Tunnel from New Jersey into Manhattan. Rush hour is slow enough as it is. Luxembourg is central to the border-free story. The Grand Duchy is at the heart of Europe, and every day its population of 550,000 swells by 157,000 commuters taking the train or bus, or driving or carpooling in from bedroom communities in France, Germany and Belgium. Schengen, a Luxembourg town just across the Moselle river from where Germany meets France, was the site of the signing of the open-borders treaty in 1985. Border controls were fully abolished in 1995, initially between seven countries.

Now passport-free travel is the norm between 26 European countries, with the island nations of Britain and Ireland as the notable exceptions. Some 400 million people live in the zone that makes travel within Europe like travel between American states, with only signs like “Bienvenue en France” to denote a change of country. The European Commission guesstimates that there are 1.25 billion cross-border journeys annually, but the unsupervised nature of the system makes the true number unknowable. Incantations such as “Schengen is the greatest achievement of European integration” – intoned by the European Union’s home affairs commissioner, Dimitris Avramopoulos, on Wednesday – are now coupled with the fear that the system will be rolled back, and in the worst case abolished.

Before the Paris attacks, five countries had temporarily reimposed passport controls to cope with the unprecedented wave of refugees from the Middle East. France followed suit as the Europe-wide manhunt got under way for the Paris culprits. Brief suspensions are nothing new, and are foreseen during security scares and for countries staging big events like the Group of Seven summit in southern Germany in June or the European soccer championship in Poland in 2012. But never before has there been so much pressure for a wholesale tightening of the system.

Read more …

Wonder what Christmas they will have,

• Greek Concerns Mount Over Refugees As Balkan Countries Restrict Entry (Guardian)

Concerns are mounting in Greece that the country could have to deal with thousands of trapped migrants and refugees, after border crossings to Balkans countries to the north were abruptly closed. Macedonia’s decision to prohibit entry to anyone not perceived to be from wartorn countries such as Syria, Afghanistan and Iraq has ignited concern that the EU’s weakest member may be left picking up the pieces. “The nightmare scenario has started to develop where Greece is turned from a transit country to a holding country due to the domino effect of European nations closing their borders,” said Dimitris Christopoulos, vice-president of the International Federation for Human Rights. “There is no infrastructure in place to handle people being stuck here,” he told the Guardian.

An estimated 3,600 Europe-bound migrants were stranded on the Greek side of the frontier on Sunday. “More and more are arriving all the time,” said Luca Guanziroli, field officer with the United Nations refugee agency in the border village of Idomeni. “There is a lot of anxiety, a lot of tension.” Labouring under its worst crisis in modern times, debt-stricken Athens is ill-placed to deal with any emergency that might put more burden on a fragile state apparatus. As spontaneous protests erupted at the weekend, the government dispatched its junior interior minister for migration, Yiannis Mouzalas, to Idomeni to hold talks with local officials. One said: “We are very worried. We can hardly cope, and that’s just waving them [refugees] through.”

Those affected by the ban – mainly Iranians, north Africans, Pakistanis and Bangladeshis – demonstrated within spitting distance of Macedonian border guards on Saturday, shouting “we are not terrorists” and “we are not going back”. The UNHCR said it was wrong to profile people on the basis of nationality. “You cannot assume that they are all economic migrants,” said Guanziroli. “You cannot assume that a lot of them aren’t persecuted in their own countries.” Macedonia is not the only state to tighten border controls. In the wake of the Paris attacks, many nations along Europe’s refugee corridor – in the western Balkans and further north – have also restricted access to those not thought to be fleeing war. “This business of placing restrictions and erecting fences to keep terrorists out when terrorists are already in their countries makes no sense whatsoever,” said Ketty Kehayiou, a UNHCR spokeswoman in Athens. “Profiling by nationality defies every convention.”

Read more …

“..some of the attackers were French citizens, so they could have come to New York without needing a visa.”

• Why Syrian Refugees Are Not A Threat To America (Forbes)

The days following the Paris attacks have seen a backlash against Syrian refugees. The governors of 31 states have refused to accept Syrian refugees, citing security fears. But the numbers don’t back them up. Here are a few powerful statistics. Only 2% of Syrian refugees admitted to America are males of military age. 50% are children, and 25% are above the age of 65, according to the the U.S. Committee for Refugees and Immigrants. There are very few Syrian refugees in the United States. Since Oct. 1 2012, a total of 2,128 of the world’s four million Syrian refugees have been resettled across the United States, with 4,900 more in the pipeline. That’s hardly the unmanageable torrent some Republicans are fearfully describing. Six of the states that are refusing to accept refugees have not had a single refugee settle there since 2012.

For comparison, the U.S. State Department issues visas to tens of thousands of tourists and students each year. They go through some security checks, but they avoid the stringent refugee screening process. It takes at least four years for refugees to be approved to enter the U.S.. The United Nations High Commissioner For Refugees (UNHCR) puts refugees through its own two-year screening process before referring them to the U.S.. The American screening process takes about another two years as well. Lavinia Limon, the chief executive officer of USCRI points out that that’s a long time for undercover terrorists to wait. ”It seems to me that terror networks are better funded than to keep someone in a refugee camp for four years to hope that they’ll be the half of 1% that will get to come in,” she said.

“That’s not very efficient!” She pointed out that some of the attackers were French citizens, so they could have come to New York without needing a visa. Once they get that UNHCR referral, refugees are vetted by a high number of American agencies. Lee Williams of USCRI names a few. “We know they go through the CIA, the FBI, the national counter-terrorism database, and the Department of Defense,” he said. Then they’re vetted by “agencies with acronyms that none of us know about,” he added, describing the process as a “black box.” It works, for the most part.

Since 9/11 just three refugees out of the 784,000 admitted have been arrested on terrorism charges. Two weren’t planning an attack on American soil, and the plans of the third were “barely credible,” according to the Migration Policy Institute. None of the three were Syrian. Once the refugees get to America, they’re placed in one of 300 resettlement sites by one of nine resettlement agencies. The goal of these agencies is to get the refugees to self-sufficiency as quickly as possible, Simon said. 85 percent of family groups are self-sufficient four months after they arrive.

Read more …