Jack Delano Jewish stores in Colchester, Connecticut 1940

The Great Disconnect.

• Bond Yields Are Surging Despite Deflation, And That Is Dangerous (AEP)

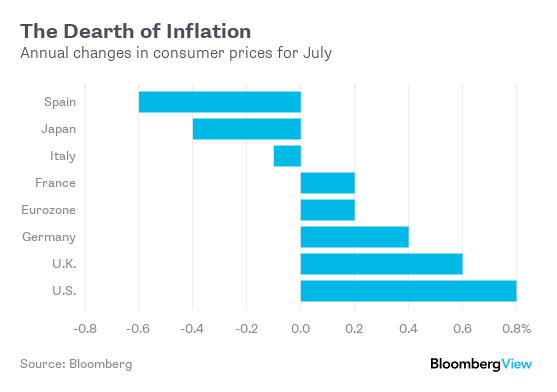

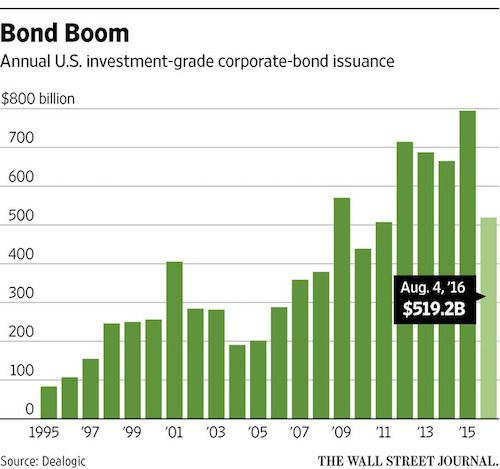

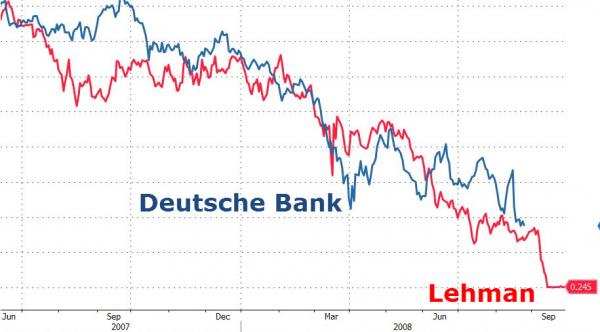

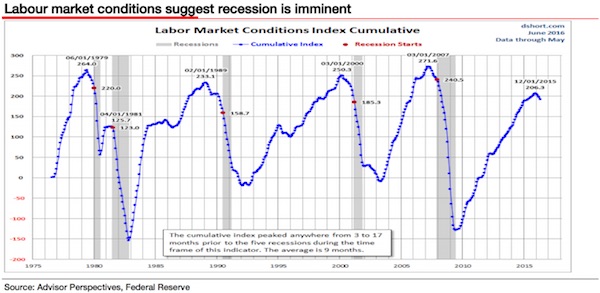

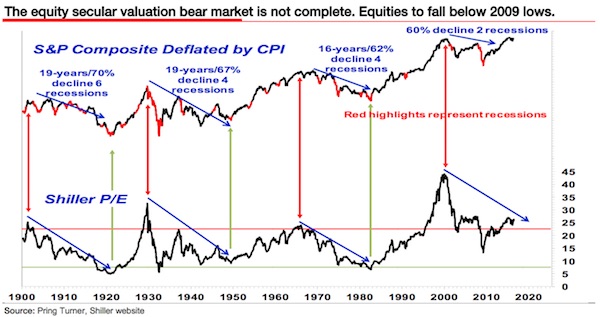

The growth rate of nominal GDP in the US has fallen to 2.4pc, the lowest level outside recession since the Second World War. It has been sliding relentlessly for almost two years, a warning signal that underlying deflationary forces may be tightening their grip on the US economy. Given this extraordinary backdrop, the violent spike in US and global bonds yields over the last four trading days is extremely odd. It is rare for AAA-rated safe-haven debt to fall out of favour at the same time as stock markets, and few explanations on offer make sense. We can all agree that oxygen is thinning as we enter the final phase of the economic cycle after 86 months of expansion. The MSCI world index of global equities has risen to a forward price-to-earnings ratio of 17, significantly higher than on the cusp of the Lehman crisis.

“We think that too much complacency has crept in,” says Mislav Matejka, equity strategist for JP Morgan. “After seven years of having a structural overweight stance on global equities, we believe the regime has fundamentally changed. We think that one should not be buying the dips any more, but use any rallies as selling opportunities,” he said. The correlation between bonds and equities has reached unprecedented levels, and that has the coiled the spring. The slightest rise in yields now has a potent magnifying effect across the spectrum of assets. Hence the angst over what is happening to US Treasuries. Yields on 10-year Treasuries – the benchmark borrowing cost for international finance – have jumped 19 basis points to 1.72pc since the middle of last week.

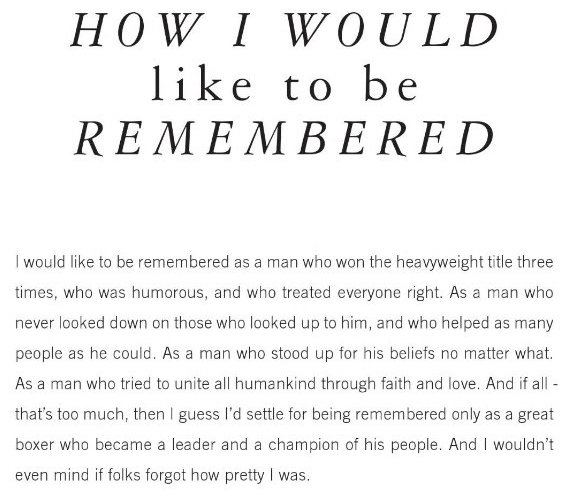

The amount of global government debt trading at rates below zero has suddenly fallen from $10 trillion to $8.3 trillion, with parallel effects for corporate bonds. You would have thought that inflation was picking up in the US and that the Fed was about to slam on the brakes, but that is not the case. The markets are pricing in a mere 15pc chance of a rate rise next week, and the figure has been falling. If anything, the US inflation scare has subsided. There were grounds for worrying earlier this year that Fed would have to act. In February, core CPI inflation was steaming ahead at a rate of 2.9pc on a three-month annualized basis. This has since dropped back to 1.8pc. Other core measures are lower.

Probably not going to calm down before next year.

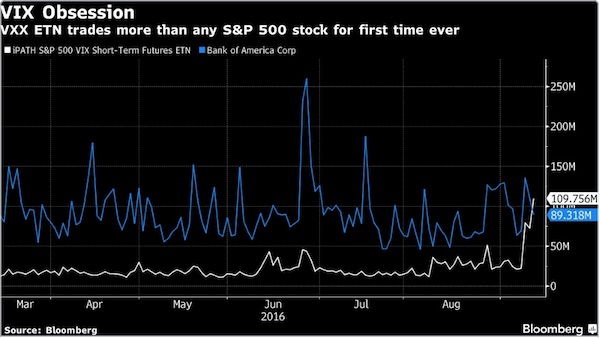

• Wall Street VIX ‘Fear Gauge’ Suggests Stock Market Is About To Get Wild (MW)

So much for the those calm markets. Wall Street’s “fear gauge” is rearing higher as U.S. equities logged a second sharp selloff in the past three sessions, as hand-wringing over central-bank monetary policy contributes to a renaissance of volatility. The CBOE Volatility Index often used as a measure of fear in the market, rose 18% on Tuesday at 17.85—its highest level since June 28 and implying that investors are starting to dial up bets that stocks could suffer further near-term swings turbulent. The VIX has hovered around 12 since mid-July. That level usually signals quiescence, while a reading of 20 or above indicates that investors are bracing for moves sharply south

The rise in the VIX comes as the Dow Jones Industrial Average and the S&P 500 index and the Nasdaq Composite relinquished all of the sharp gains racked up 24 hours ago. Monday’s rally followed another tumble on Friday that saw the VIX jump 40%—the largest daily move since Brexit on June 23. On Tuesday, volume in an exchange-traded fund that tracks the VIX, Barclays Bank PLC iPath S&P 500 VIX Short-Term Futures exceeded that of stocks on the S&P 500 for the first time ever, as Bloomberg highlights:

On Wednesday, the VIX ticked higher as the Dow and S&P 500 lost momentum to trade lower late in the session. Three straight days of swings of at least 1% for stocks, marks the first time since 1963 that the S&P 500 followed an extended period of calm—43 days—with a trio of such choppy trading days, according to Dow Jones data. That was the two-day period before and immediately following the assassination of President John F. Kennedy in November 1963, Dow Jones data show. “The pickup in volatility is notable, and typically characterizes pullbacks,” said Katie Stockton, chief market technician at BTIG.

“We are to various degrees close to pushing on a string..”

• ‘There’s Only So Much You Can Squeeze Out Of A Debt Cycle’: Ray Dalio (CNBC)

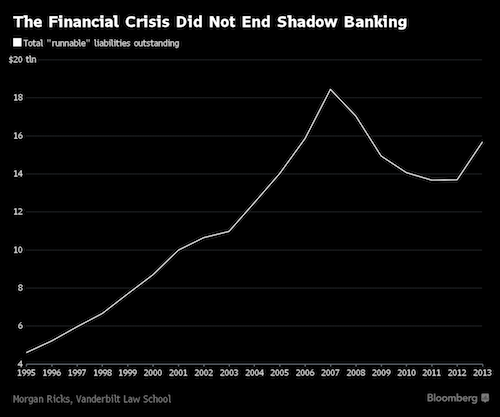

The debt market is in a “dangerous situation” as central banks around the world lose their ability to stimulate growth, hedge fund giant Ray Dalio said Tuesday. As the world faces more than $11 trillion in negative-yielding debt, Dalio said central banks like the Fed, the ECB and the BOJ are facing a dilemma. “There’s only so much you can squeeze out of the debt cycle, and we’re there globally,” the head of Bridgewater Associates said at the Delivering Alpha conference presented by CNBC and Institutional Investor. “You can’t lower interest rates more.” Dalio spoke as Fed officials contemplate a rate hike at some point this year. Market-implied probability indicates that the Fed won’t hike until at least December. Its September meeting is next week. While monetary policy has been used as a fuel for growth and asset price appreciation, Dalio said its effectiveness is waning. “We are to various degrees close to pushing on a string,” he said.

“..there is essentially only one practical way to reduce the stock of outstanding debts: defaults.”

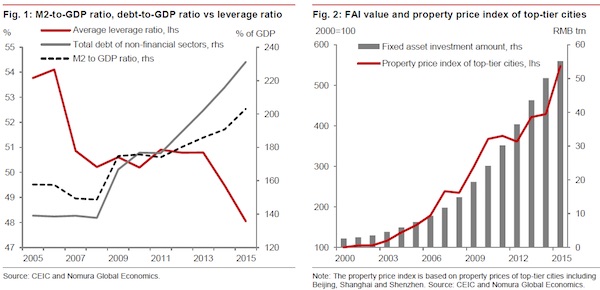

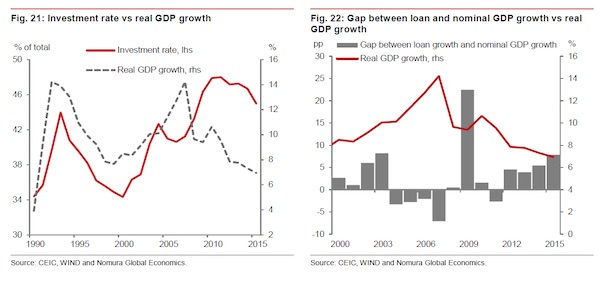

• China Debt Default Looms As Growth Options Run Out: Nomura (VW)

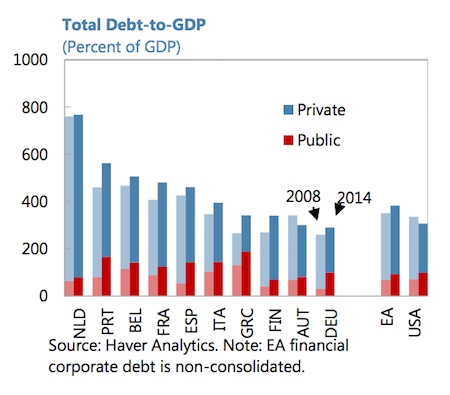

To alleviate its debt problem, China should adopt appropriate macro-economic policies encompassing currency depreciation and cutting interest rates to an ultra-low-level within two to three years, believe Nomura analysts. Yang Zhao and team said in their September 14 research piece titled “China: Solving the debt problem” that they believe RMB depreciation will continue and forecast USD/CNH at 7.1 at the end of 2017. Zhao and team highlight that debt-to-GDP ratio can be lowered either through reducing the numerator or increasing the denominator.

They believe that to contain or even reduce the debt-to-GDP ratio, the gap between debt growth and nominal GDP growth must shrink or turn negative. They believe lowering the ratio has to be premised on the acceptance of a slower rate of GDP growth: The Nomura analysts argue that default is the only practical way to trim the stock of outstanding debts. Instead of an outright default, per se, they suggest other approaches such as renegotiating terms, lowering interest rates, and tenure extension.

“Since increasing the denominator is unfeasible, policymakers must therefore look to lower the numerator. The only practical measures that can be taken to reduce the debt ratio are those aimed at reducing the growth of debt to below that of nominal GDP growth. “The outstanding stock of debt can only be reduced through either repayment or indeed default. One argument is that China’s corporate sector and/or local governments can, or should, simply repay their debts by selling the huge amount of assets that they have accumulated, but again, this is not a feasible solution.

The key reason behind the low level of corporate leverage despite the huge amount of debt is that asset prices have not collapsed. If the corporate sector or local governments repaid their debts by selling their assets – which are predominantly in real estate – their leverage will almost certainly spike higher due to the subsequent decline in the value of their remaining asset base. Hence, there is essentially only one practical way to reduce the stock of outstanding debts: defaults.”

Selling USD to prepare for SDR basket?!

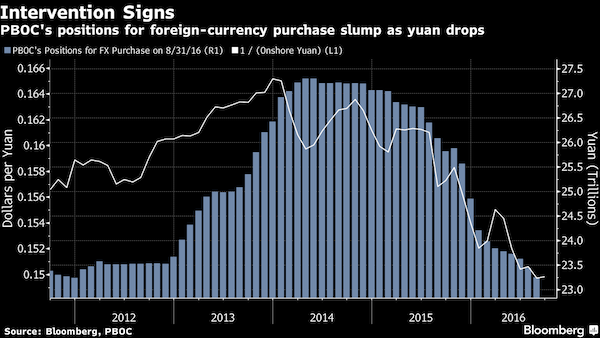

• PBOC Yuan Positions Drop to Lowest Since 2011 (BBG)

The Chinese central bank’s yuan positions – which reflect the amount of foreign currency held on its balance sheet – fell to the lowest since 2011 in August, a sign that it sold dollars to support the yuan. The People’s Bank of China has been seen intervening in the market to stem the currency’s slide, with Bank of East Asia and Natixis saying that policy makers will prevent the exchange rate from slipping past 6.7 per dollar before its admission into the IMF’s basket of reserves on Oct. 1.

The only thing left of globalization is a vague idea.

• The Closing of the World Economy (Satyajit Das)

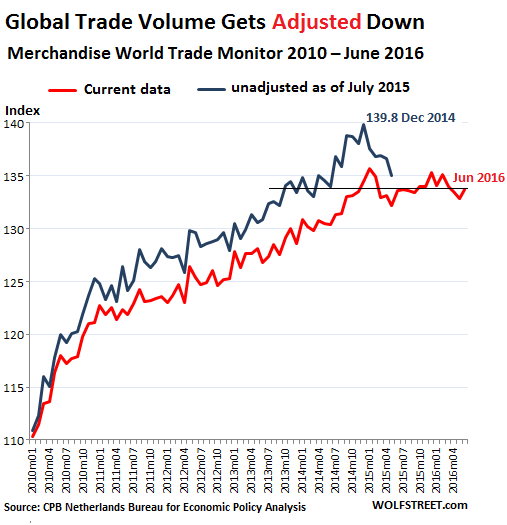

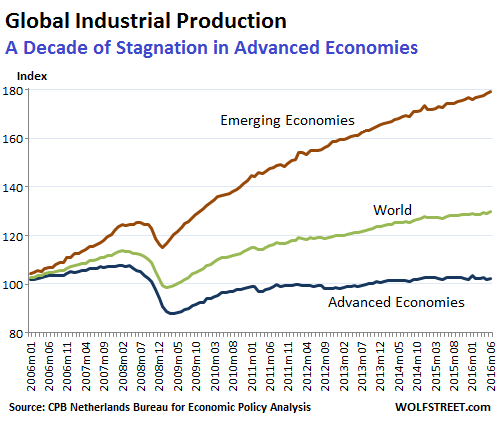

Pundits and policymakers everywhere are bemoaning the rise of a new, inward-looking populism. Led by the likes of Donald Trump and Nigel Farage, those who’ve felt only globalization’s ill effects, not its benefits, have mounted a fierce counterattack. Border-hopping elites fret that the whole process of opening up and knitting together the world through trade, capital flows and immigration may soon go into reverse. They’re missing the point. Support for freer trade and greater openness had in fact begun to falter well before economic nationalists like Trump and Farage took center stage. The same governments that count themselves among globalization’s greatest champions have been rolling it back steadily since the global financial crisis.

Their excuses are innocent-sounding and several: to protect national industries and iconic businesses; to secure export markets and competitive advantage; and above all, to prop up employment and incomes. Despite oft-repeated warnings about avoiding the beggar-thy-neighbor policies of the 1930s, these governments allowed global trade talks – the so-called Doha Round – to stall as early as 2008. Nations including the U.S. have instead pursued narrower bilateral and regional deals where they don’t have to satisfy so many different negotiating partners and can continue to protect key sectors. If these pacts are better than nothing, they more or less foreclose the possibility of a more ambitious multilateralism.

Meanwhile, between 2009 and 2015, three times as many discriminatory trade measures were introduced as liberalizing ones. In the first 10 months of 2015 alone, the latest Global Trade Alert database recorded 539 such initiatives adopted by governments worldwide that harmed foreign traders, investors, workers or owners of intellectual property – a record. Efforts to control trade flows have grown increasingly sophisticated. Most governments no longer impose tariffs or other crude roadblocks that would violate WTO rules. Instead countries from the U.S. – with the auto bailouts – to the U.K., China, Brazil, Canada and several EU members have funneled aid to domestic industries. State procurement rules – which in China, say, forbid buying strategic and defense technology from abroad – favor domestic suppliers, as do “buy local” campaigns like the ones launched since 2009 in the U.S., U.K. and Australia.

Innovation!?

• Wall Street’s Newest Money-Making Scheme Targets Your Home (MW)

Do you want Wall Street to get a piece of your house? On Tuesday, the noted venture capitalist Marc Andreesen announced that he’d invested in a startup called Point. Point casts itself as a solution to an intrinsic problem with home ownership: Most Americans have most of their wealth tied up in their home. There are mechanisms for “taking out” some of the equity built up as a mortgage is paid down, such as home-equity lines of credit or home-equity loans. But they require paying interest – not to mention having good credit. They also don’t help homeowners diversify their investments. Diversification was the driver behind an earlier version of what Point offers. Allan Weiss, who helped create the S&P/Case-Shiller price indexes, created a platform he calls “indexed fractional ownership.”

His idea came in part from a conversation with a neighbor who said he was looking forward to “cashing out” of an expensive home he’d owned for a long time – just before the housing market crashed. If you own a home and offer some of the equity to an investor like Point, the idea goes, you could take that money and invest it in a different asset class, like stocks. And what does Point get? If the house appreciates before it is sold, Point benefits. If the house depreciates, according to Andreessen Horowitz’s website, “Point gets paid back after the bank, but before the homeowner, in the event of a sale.” A blog post on Point’s site notes that, in addition to an initial appraisal, Point may require a “risk adjustment” that “offsets the chance that the home will depreciate before the end of the term.”

Yet Weiss and Andreessen Horowitz both envision their products gaining the critical mass to move beyond one-off agreements between investors and individual homeowners into what the latter calls a “broad basket” of homes. “It’s rethinking the fundamentals of residential real estate ownership – making single-family residential real estate a liquid, tradeable asset class,” the venture capitalists wrote.

By now, this is crazy.

• Ford Shifting All US Small-Car Production To Mexico (DFP)

F�o�r�d� �i�s� �s�h�i�f�t�i�n�g� �a�l�l� �N�o�r�t�h� �A�m�e�r�i�c�a�n� �s�m�a�l�l�-�c�a�r� �p�r�o�d�u�c�t�i�o�n� �f�r�o�m� �t�h�e� �U�.�S�.� �t�o� �M�e�x�i�c�o�,� �C�E�O� �M�a�r�k� �F�i�e�l�d�s� �t�o�l�d� �i�n�v�e�s�t�o�r�s� �t�o�d�a�y� �i�n� �D�e�a�r�b�o�r�n�.� “�O�v�e�r� �t�h�e� �n�e�x�t� �t�w�o� �t�o� �t�h�r�e�e� �y�e�a�r�s�,� �w�e� �w�i�l�l� �h�a�v�e� �m�i�g�r�a�t�e�d� �a�l�l� �o�f� �o�u�r� �s�m�a�l�l�-�c�a�r� �p�r�o�d�u�c�t�i�o�n� �t�o� �M�e�x�i�c�o� �a�n�d� �o�u�t� �o�f� �t�h�e� �U�n�i�t�e�d� �S�t�a�t�e�s�,�”� �F�i�e�l�d�s� �s�a�i�d�.� �T�h�e� �i�n�d�u�s�t�r�y� �h�a�s� �k�n�o�w�n� �f�o�r� �d�e�c�a�d�e�s� �t�h�a�t� �d�o�m�e�s�t�i�c� �m�a�n�u�f�a�c�t�u�r�e�r�s� �s�t�r�u�g�g�l�e� �t�o� �m�a�k�e� �a� �p�r�o�f�i�t� �o�n� �s�m�a�l�l� �c�a�r�s�.� �S�h�i�f�t�i�n�g� �t�h�e�i�r� �a�s�s�e�m�b�l�y� �t�o� �M�e�x�i�c�o� �c�a�n� �r�e�d�u�c�e� �c�o�s�t�s� �t�o� �a� �p�o�i�n�t�.� �B�u�t� �s�o�m�e� �o�f� �t�h�e�s�e� �c�a�r�s� �a�r�e� �o�v�e�r�-�e�n�g�i�n�e�e�r�e�d�.� �F�o�r� �e�x�a�m�p�l�e�,� �F�i�e�l�d� �s�a�i�d� �t�h�e� �c�u�r�r�e�n�t� �F�o�r�d� �F�o�c�u�s� �c�a�n� �b�e� �o�r�d�e�r�e�d� �i�n� �3�0�0� �d�i�f�f�e�r�e�n�t� �c�o�n�f�i�g�u�r�a�t�i�o�n�s� �o�f� �o�p�t�i�o�n�s� �a�n�d� �c�o�l�o�r�s�.� �F�o�r�d� �w�a�n�t�s� �t�o� �r�e�d�u�c�e� �t�h�a�t� �t�o� �3�0�,� �w�h�i�c�h� �w�i�l�l� �m�a�k�e� �t�h�e� �p�r�o�d�u�c�t�i�o�n� �p�r�o�c�e�s�s� �s�i�m�p�l�e�r� �a�n�d� �l�e�s�s� �e�x�p�e�n�s�i�v�e�.� �

B�u�t� �A�m�e�r�i�c�a�n�s� �p�r�e�f�e�r� �l�a�r�g�e�r� �v�e�h�i�c�l�e�s�,� �e�s�p�e�c�i�a�l�l�y� �p�i�c�k�u�p�s� �a�n�d� �h�i�g�h�e�r�-�r�i�d�i�n�g� �S�U�V�s� �a�n�d� �c�r�o�s�s�o�v�e�r� �v�e�h�i�c�l�e�s� �f�o�r� �t�h�e�i�r� �p�e�r�s�o�n�a�l� �u�s�e�.� �T�h�e� �f�u�t�u�r�e� �o�f� �s�m�a�l�l�e�r� �c�a�r�s� �i�n� �t�h�e� �U�.�S�.� �m�a�y� �d�e�p�e�n�d� �o�n� �t�h�e� �a�b�i�l�i�t�y� �t�o� �e�l�e�c�t�r�i�f�y� �t�h�e�i�r� �p�o�w�e�r�t�r�a�i�n�s� �a�n�d� �i�n�t�r�o�d�u�c�e� �t�h�e�m� �t�o� �r�i�d�e�-�s�h�a�r�i�n�g� �f�l�e�e�t�s� �w�h�e�r�e� �t�h�e�y� �c�a�n� �g�e�n�e�r�a�t�e� �r�e�v�e�n�u�e� �f�r�o�m� �f�a�r�e�s� �p�a�i�d� �b�y� �m�u�l�t�i�p�l�e� �r�i�d�e�r�s�.� �A�l�o�n�g� �t�h�o�s�e� �l�i�n�e�s�,� �F�i�e�l�d�s� �a�n�d� �o�t�h�e�r� �F�o�r�d� �e�x�e�c�u�t�i�v�e�s� �W�e�d�n�e�s�d�a�y� �o�u�t�l�i�n�e�d� �a�n� �a�g�g�r�e�s�s�i�v�e� �p�l�a�n� �t�o� �i�n�v�e�s�t� �$�4�.�5� �b�i�l�l�i�o�n� �o�v�e�r� �t�h�e� �n�e�x�t� �f�o�u�r� �y�e�a�r�s�.� �T�h�e�s�e� �w�i�l�l� �i�n�c�l�u�d�e� �n�e�w� �m�o�d�e�l�s� �i�n� �s�e�g�m�e�n�t�s� �s�u�c�h� �a�s� �c�o�m�m�e�r�c�i�a�l� �v�e�h�i�c�l�e�s�,� �t�r�u�c�k�s�,� �S�U�V�s� �a�n�d� �p�e�r�f�o�r�m�a�n�c�e� �v�e�h�i�c�l�e�s�.� �F�o�r�d� �a�l�s�o� �r�e�i�t�e�r�a�t�e�d� �i�t�s� �c�o�m�m�i�t�m�e�n�t� �t�o� �d�e�v�e�l�o�p�i�n�g� �a�n� �a�u�t�o�n�o�m�o�u�s� �v�e�h�i�c�l�e� �b�y� �2�0�2�1�.� �T�h�e� �c�o�m�p�a�n�y� �b�e�l�i�e�v�e�s� �t�h�a�t� �a�u�t�o�n�o�m�o�u�s� �v�e�h�i�c�l�e�s� �c�o�u�l�d� �a�c�c�o�u�n�t� �f�o�r� �u�p� �t�o� �2�0�%� �o�f� �v�e�h�i�c�l�e� �s�a�l�e�s� �b�y� �2�0�3�0�.�

Smart. But it may make prices fall even faster.

• Vancouver Tax on Empty Homes to Target Near-Zero Rental Supply (BBG)

Vancouver, suffering from a near-zero supply of homes available for rent, plans to slap investors sitting on vacant properties with a new tax in an effort to make housing more accessible in Canada’s most-expensive property market. The levy, which would start in January, may be as high as 2% of the property’s assessed value, Kathleen Llewellyn-Thomas, the city’s general manager of community services, told reporters Wednesday. That would mean a minimum C$20,000 ($15,000) annual payment for the typical C$1 million-plus detached home in Vancouver based on July 2015 assessment data, the most recent available. “Vancouver is in a rental housing crisis,” said Mayor Gregor Robertson, whose announcement follows a separate measure by the province in July to impose a 15% tax on foreign buyers.

“Dangerously low vacancy rates across the city are near zero.” While the city, ranked the world’s third-most-livable, has drawn attention for its sky-high purchase prices fomented by global money flows, the rental market has been just as contentious locally. Vacancies can get scooped up within hours, while bidding wars drive up the cost of leases. Public scrutiny has focused on absentee landlords, particularly from overseas, who are accused of sitting on investment properties where windows remain dark throughout the year. Robertson estimated that more than 10,000 homes are empty and an additional 10,000 are “under-utilized.” The tax aims to get those properties into the rental supply so that the vacancy rate rises to about 3 to 5% from near zero today, he said. The city expects to raise about C$2 million from the tax in the first year.

People do recognize propaganda to an extent.

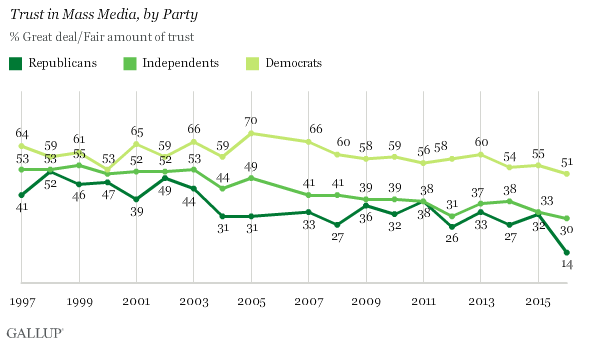

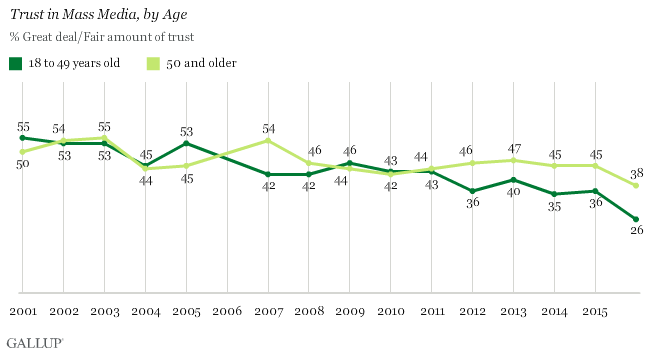

• US Confidence In Media Hits Fresh Low (AFP)

Americans’ trust in the media has sunk to a new low, and a bitter presidential race may be to blame, a Gallup survey showed Wednesday. The poll asking whether the media report the news “fully, accurately and fairly” found just 32% of Americans have a great deal or fair amount of trust, the lowest level in Gallup polling history and 8 percentage points below last year. Gallup began asking the question in 1972, and has polled Americans on a yearly basis since 1997. Trust and confidence in the media hit its highest point in 1976, at 72% following the investigative journalism coverage of the Vietnam and the Watergate scandal, according to the research group. But confidence has been below 50% since 2007.

“While it is clear Americans’ trust in the media has been eroding over time, the election campaign may be the reason that it has fallen so sharply this year,” Gallup said in its report. “With many Republican leaders and conservative pundits saying (Democratic presidential nominee) Hillary Clinton has received overly positive media attention, while (Republican nominee) Donald Trump has been receiving unfair or negative attention, this may be the prime reason their relatively low trust in the media has evaporated even more.” Gallup said Trump’s sharp criticism of the press may also have had an impact on public opinion.

Just 14% of Republicans said they trust the media, down sharply from 32% a year ago and the lowest level of confidence among Republicans in 20 years, according to Gallup. Among Democrats, 51% expressed confidence in the media, down from 55% a year ago, while the number of independents trusting news organizations fell to 30% from 33%. Trust was also low among younger adults: just 26% of those between the ages of 18 and 49 said they felt confidence in the media compared with 38% of those 50 and older.

Bubble.

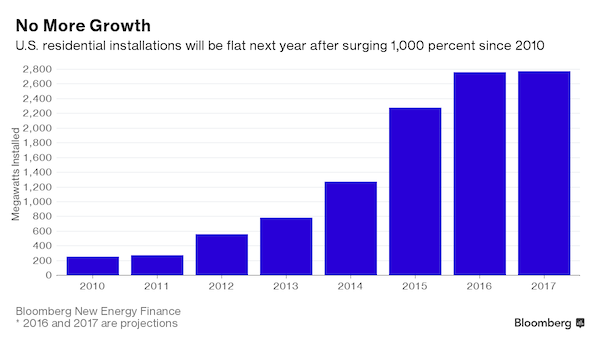

• US Rooftop Solar Boom Is Grinding To A Halt (BBG)

Rooftop solar, which has surged more than 1,000% since 2010, will barely grow at all next year. Residential installations are expected to increase by 21% this year, but in 2017 the figure will inch upward by about 0.3%. The change comes as utilities push back against mandates to buy the electricity and shifting tax policies curb demand. Throw in sliding electricity rates and it’s clear the economic benefits of rooftop panels are no longer so obvious to consumers. That’s forcing rooftop developers including Vivint Solar, Sunrun and Elon Musk-backed SolarCity to focus on profitability instead of growth.

“Much like PC manufacturers in the 1990s, solar installers need to realize substantial new customer sales each year just to tread water in terms of annual revenue,” Hugh Bromley at Bloomberg New Energy Finance said. Residential installations are already slowing from the 79% expansion in 2015. Developers are expected to add 2.76 gigawatts this year and that will inch upward to 2.77 gigawatts in 2017 as investment slips 6.4% to $6.8 billion, according to estimates from Bloomberg New Energy Finance. “After growing as much as it has, sustaining high double-digit growth rate forever is not realistic,” said Pavel Molchanov at Raymond James Financial.

US can’t afford to go to war anymore.

• Latest Estimate Pegs US Cost of Wars at Nearly $5 Trillion (I’Cept)

The total US budgetary cost of war since 2001 is $4.79 trillion, according to a report released this week from Brown University’s Watson Institute. That’s the highest estimate yet. Neta Crawford of Boston University, the author of the report, included interest on borrowing, future veterans needs, and the cost of homeland security in her calculations. The amount of $4.79 trillion, “so large as to be almost incomprehensible,” she writes, adds up like this:

• The wars in Iraq, Afghanistan, Pakistan, Syria, and other overseas operations already cost $1.7 trillion between 2001 and August 2016 with $103 billion more requested for 2017 • Homeland Security terrorism prevention costs from 2001 to 2016 were $548 billion. • The estimated DOD base budget was $733 billion and veterans spending was $213 billion. • Interest incurred on borrowing for wars was $453 billion. • Estimated future costs for veterans’ medical needs until the year 2053 is $1 trillion.

Crawford carried out a similar study in June 2014 that estimated the cost of war at $4.4 trillion. Her methodology mirrors that of the 2008 book The Three Trillion Dollar War: The True Costs of the Iraq Conflict by Linda Bilmes and Joseph Stiglitz. There are even more costs of war that Crawford does not include, she writes. For instance, “I have not included here state and local government expenses related to medical care of veterans and homeland security. Nor do I calculate the macro economic costs of war for the U.S. economy.” She also notes that she does not add the cost of war for other countries, nor try to put a dollar figures on the cost in human lives.

How did he land that job again?

• Juncker Denies Alcohol Problem In Interview, Drinks 4 Glasses Of Champagne

The controversial head of the European Commission has denied that he has a problem with alcohol during an interview in which he drank four glasses of champagne. Allegations have circulated around Brussels in recent years about Jean-Claude Juncker’s drinking and one senior diplomatic source has said he “has cognac for breakfast”. In an interview with a French newspaper he defended his record as he consumed numerous classes of champagne. In 2014 it emerged that Mr Juncker’s drinking habits had been discussed at the highest levels by European leaders who privately have concerns over his lifestyle. A week before the UK referendum vote a video emerged of an apparently-drunk Mr Juncker taken at a May 2015 EU summit welcoming Viktor Orban, the hardline Hungarian PM, as “the dictator” before giving him a playful slap on the cheek.

“The dictator is coming,” Mr Juncker is heard to say, before locking a shocked Mr Orban in a clumsy embrace while Donald Tusk, the president of the European Council looked on, visibly embarrassed. Defending himself in an interview with the Liberation, he said: “Orban, I always call dictator, I am like this. As soon as someone breaks the mould they are obviously crazy or an alcoholic. “You think I’d still be in office if I was having cognac for breakfast? It really makes me sad and it has even led my wife to question if I lie to her, as I do not drink when I’m home.” He also went on to blame his unsteady walking on problems with his leg after a serious car accident.

Basic. Better. Cheaper.

• Helping Homeless People Starts With Giving Them Homes (G.)

Finland is the only European country where homelessness has decreased in recent years. At the end of 2015 the number of single homeless people was for the first time under 7,000 and this number includes people living temporarily with friends and relatives, who constitute 80% of all homeless people. This development is mainly due to a national programme to reduce long-term homelessness. The main explanation for this success is quite simple: when the national programme started housing first was adopted as a mainstream national homelessness policy. This common framework made it possible to establish a wide partnership of state authorities, local communities and non-governmental organisations. Cooperation and targeted measures in the implementation of the programme led to the aforementioned results, which were backed up by independent international evaluations.

Implementing housing first is not reasonable without proper housing options. It should go without saying that you can’t offer homeless people homes if the homes do not exist. It is this scarcity of homes that engenders the system in Britain, with demand outstripping supply, and people in crisis forced to jump through hoops to avoid sleeping on the street. In Finland, housing options included the use of social housing, buying flats from the private market to be used as rental apartments for homeless people, and building new housing blocks for supported housing. An important part of the programme was the extensive conversion of shelters and dormitory-type hostels into supported housing, to address the huge need for accommodation that offered help to tenants.

The last big hostel for homeless people in Helsinki with 250 bed places was run by the Salvation Army. A couple of years ago this hostel was renovated and now consists of 80 independent apartments with on-site staff. The disappearance of temporary solutions like hostels has completely changed the landscape of Finnish homelessness policy in a very positive way, for vulnerable individuals and in combatting antisocial behaviour. All this costs money, but there is ample evidence from many countries that shows it is always more cost-effective to aim to end homelessness instead of simply trying to manage it. Investment in ending homelessness always pays back, to say nothing of the human and ethical reasons.