Arthur Rothstein Family leaving South Dakota drought for Oregon Jul 1936

Plunge protection saved Shanghai from bigger losses overnight. Tomorrow’s China’s big parade day, got to look good for that. Will they let markets do their own thing after tomorrow?

• Global Stock Markets Begin September With More Losses (Guardian)

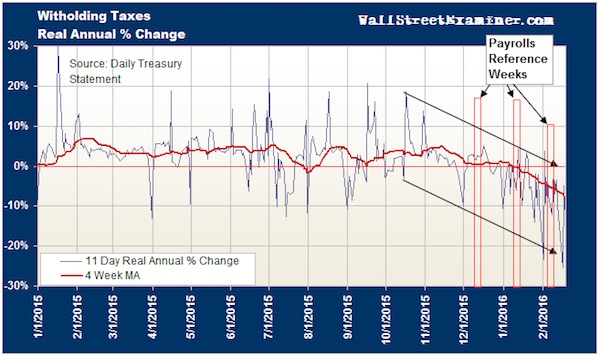

Global stock markets staged a dramatic start to September as rising worries about China’s economic slowdown sparked fresh sell-offs in Asia, Europe and on Wall Street. After suffering their worst month in three years in August, US shares tumbled after Tuesday’s opening bell. At close, the Dow Jones industrial average had dropped 469 points, or 2.8%, to 16,058 and the Standard & Poor’s 500 index fell 58 points, or 3%, to 1,913. News that US manufacturing activity slowed in August added to pressure on share prices. The sell-off on Wall Street mirrored losses in Asia overnight, and later on European bourses, in the wake of more weak data on China’s manufacturing sector, suggesting output slumped to a three-year low in August.

Worries about waning demand from the world’s second biggest economy left Japan’s Nikkei down a hefty 3.8%, taking it close to a six-month low last week. China’s Shanghai composite index suffered a smaller 1.3% loss. As the sell-off rippled out to Europe, the FTSE 100 closed down more than 3% at 6,058.54 on Tuesday afternoon, extending last month’s sharp losses. A 6.7% drop during August marked the worst month for UK’s leading share index since May 2012. The pan-European FTSEurofirst 300 shed 9% over the same period, the worst monthly performance for four years. On Tuesday it was down 3%. Investor confidence has been rattled by a combination of factors.

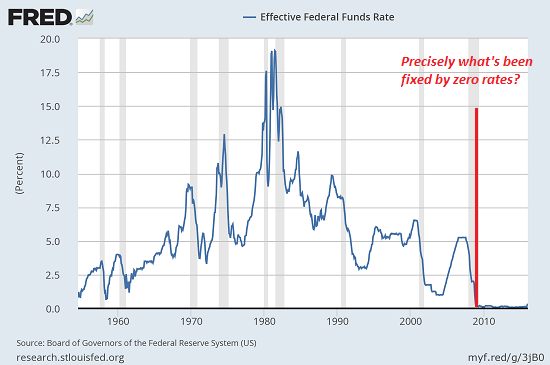

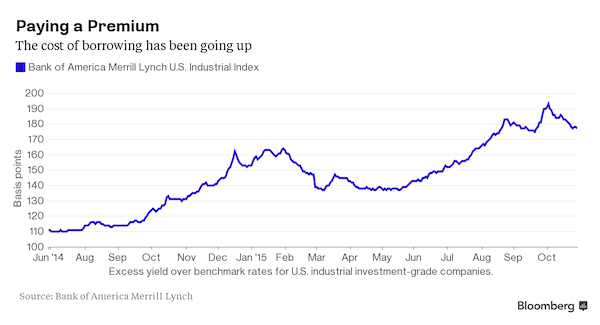

Alongside signs China’s economy is slowing, the country’s stock market has tumbled from multi-year highs in June and interventions by policymakers have done little to stem the rout. At the same time, markets are bracing for the prospect of the first US interest rate rise since before the global financial crisis. Despite the recent market turmoil, there is still some expectation that the US Federal Reserve could hike as soon as this month, especially after its vice-chair Stanley Fischer said over the weekend that it was too soon to decide on a September move. The likelihood of higher borrowing costs in the US is undermining already fragile confidence in emerging markets from Latin America to Asia.

Read more …

Could be much faster.

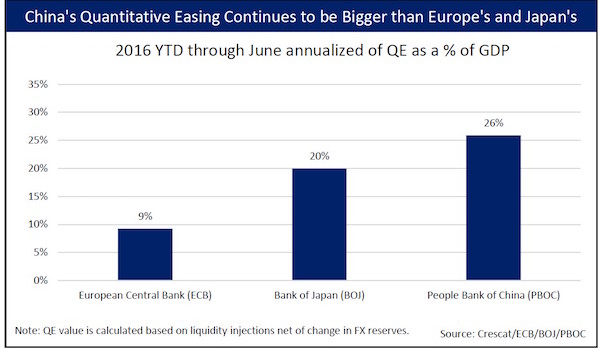

• Central Banks To Dump $1.5 Trillion FX Reserves By End 2016 -Deutsche (Reuters)

Central banks will sell $1.5 trillion foreign exchange reserves by the end of next year as they try to counter capital outflows stemming from slowing growth in China, low oil prices and an impending rise in U.S. interest rates, Deutsche Bank said on Tuesday. This would mark a major shift in global capital flows, ending two decades of reserve accumulation by emerging markets and potentially forcing the Federal Reserve into slowing down the unwinding of its “quantitative easing” crisis-fighting stimulus. George Saravelos, currency strategist at Deutsche and co-author of the report, said the $1.5 trillion estimate is based on the pace that emerging markets – especially China – have been drawing down their FX reserves recently to counter capital flight. “The risks are it’s actually faster than that,” Saravelos said.

Also on Tuesday, analysts at Dutch bank Rabobank published a report estimating that China sold up to $200 billion of reserves in the last few weeks of August alone. China is by far the biggest holder of FX reserves in the world with around $3.65 trillion, mostly thought to be in dollar-denominated assets like U.S. government bonds and bills. Last year, it had almost $4 trillion. China and emerging markets led the build up in global FX reserves following the 1997 Asian crisis to a peak of $12 trillion last year. This cash pile shielded them from the 2007-08 crisis, and looks like it is once again being deployed. The Deutsche estimate is the latest of many from analysts trying to determine just how much China’s slowdown and recent currency devaluation, low commodity prices, the prospect of higher U.S. rates and recent market volatility will deplete global reserves.

Bond and currency markets will feel the impact. “The peak in bond demand is probably behind us. QE in the U.S. has stopped, and the shift in global reserve accumulation has started too,” he said. The Fed could be forced to delay the unwinding of its QE programme because of the “significant amount of pressure” reserves selling could put on the Treasuries market. Saravelos said the upward pressure on U.S. yields from the selling of large quantities of bonds should also put upward pressure on the dollar, with every $100 billion reduction in reserves pushing the euro down three cents against the dollar.

Read more …

But deny it at the same time.

• Investors Wake Up To Emerging Market Currency Risk (FT)

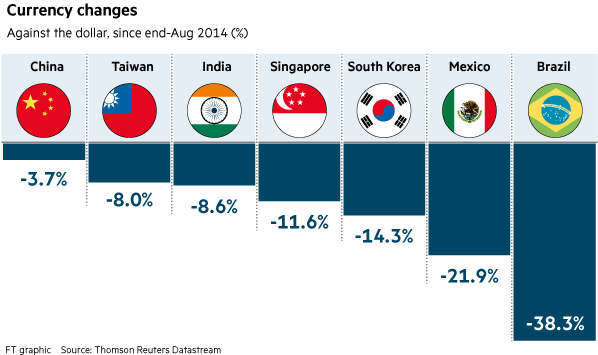

If there is a mood of anxiety across the US and Europe over the impact of China catching a cold, there is an air of déjà vu for investors who deal in emerging markets. The panicked market reaction to “Black Monday” in Chinese equities suggests much of the developed world has only just woken up to the risk that a slowing Chinese economy poses around the globe. But it is nothing new for EM countries. “The biggest surprise [about last week’s market panic] was not that China has slowed but that it’s come as such a surprise,” says Paul McNamara, EM portfolio manager at GAM Holding. China’s slowdown has been worrying EM countries throughout 2015.

It has been a year of falling commodity prices, brought lower, thanks in part, to drip-drip evidence that the Chinese investment drive — which fuelled growth in commodity countries and investor interest in their economies — was being checked. Black Monday, says Mr McNamara, was “a pretty intense dose of what we’ve been seeing all year”. It has been a year of consistent weakness, “a lot of which has been sourced in China”. Take Colombia, a big oil producer. Its peso currency had fallen 24% from the beginning of the year up until Black Monday, when it fell a further 4%. EM countries have been pummelled by double blows to the solar plexus all through the year. Punch one: the Chinese slowdown. Punch two: the continuous market focus on when the US would raise rates, which has driven dollar strength and so weakened EM currencies.

Read more …

The repetitive empty void of words like these will come back to hurt Lagarde. The IMF is nothing without credibility. The window of credibility is narrowing.

• IMF’s Lagarde Sees Weaker Than Expected Global Economic Growth (Reuters)

Global economic growth is likely to be weaker than earlier expected, the head of the IMF said on Tuesday, due to a slower recovery in advanced economies and a further slowdown in emerging nations. IMF Managing Director Christine Lagarde also warned emerging economies like Indonesia to “be vigilant for spillovers” from China’s slowdown, tighter global financial conditions, and the prospects of a U.S. interest rate hike. “Overall, we expect global growth to remain moderate and likely weaker than we anticipated last July,” Lagarde told university students at the start of a two-day visit to Indonesia’s capital. The IMF in July forecast global growth at 3.3% this year, slightly below last year’s 3.4%.

Lagarde said China’s economy was slowing, although not sharply or unexpectedly, as it adjusts to a new growth model. “The transition to a more market-based economy and the unwinding of risks built up in recent years is complex and could well be somewhat bumpy,” she said. “That said, the authorities have the policy tools and financial buffers to manage this transition.” Lagarde, who is visiting Indonesia for the first time in three years, said Southeast Asia’s largest economy had the “right tools to actually react” to the global volatility. “You have very sound public finances with overall government debt in the range of 20%-ish relative to GDP, you have a relatively small deficit,” she said before meeting with Indonesian President Joko Widodo.

Read more …

“..the government has already shelled out $1.3 trillion.”

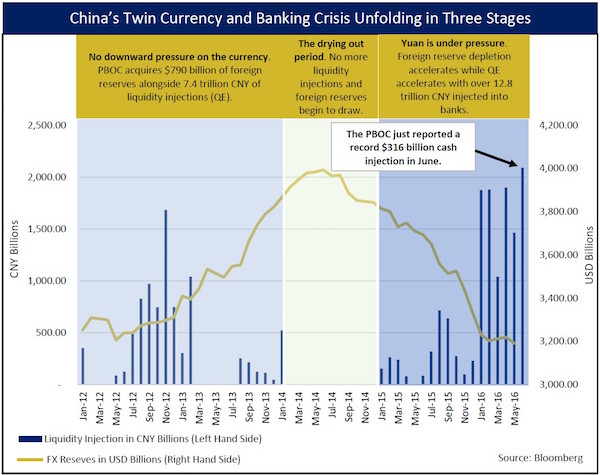

• 2015: The Year China Goes Broke? (Gordon G. Chang)

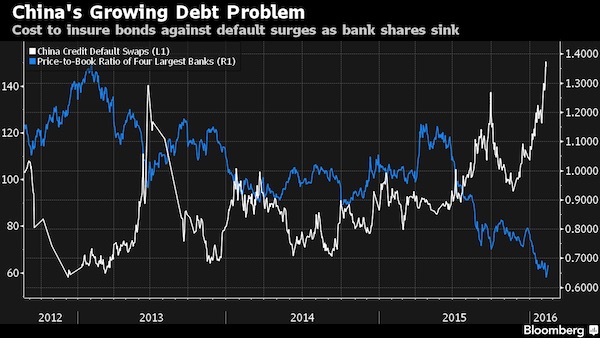

China, the Financial Times noted Friday, could exhaust its foreign exchange reserves within a year as it defends the value of its plunging currency, the renminbi. The paper’s arithmetic is correct of course, but the projection, which at first sounds alarming, is actually optimistic. Beijing might be broke in months—and maybe by the end of this year—despite now holding the world’s largest foreign exchange reserves. At the same time, the Chinese central government has been supporting stock valuations through various means, especially the direct purchases of shares. Beijing’s efforts to defend both stocks and the currency are severely straining its finances. China’s problems were a long time in the making, but they became evident this spring, when the main indexes measuring the Shanghai and Shenzhen stock markets peaked on June 12 and then fell precipitously.

In early July, Beijing, in a series of announcements, unveiled its rescue program, which included the government buying of shares. The ill-conceived effort was largely abandoned, it appears. As a result, shares fell hard last Monday, now known in China as “Black Monday,” and the following two days. The Shanghai Composite, the most widely followed index of Chinese stocks, ended trading on last Wednesday down 43.3% from its June 12 peak. Chinese leaders, however, took markets by surprise on Thursday, when shares snapped their five-day losing streak. The Shanghai Composite was down 0.7% entering the last hour of trading of the afternoon session. Massive government purchases of large-cap stocks sent prices soaring in the final minutes, and the index closed up 5.3%.

Sources told Bloomberg that Beijing’s buying was intended to prevent stocks from plunging during the run up to the September 3-4 holiday to mark the 70th anniversary of the end of World War II, what China has renamed the Chinese People’s War of Resistance against Japanese Aggression. Beijing repeated the trick Friday, engineering an impressive rally in the last 90 minutes of trading. The Shanghai index posted a 4.8% gain for the day. Late buying was also evident Monday, although it was not quite enough to completely erase the sharp drop in the morning session. Are happy times here again? About a year ago, Chinese technocrats created a stock market boom by doing nothing more than talking up the market.

Unsupported by fundamentals—either a robust economy or rising corporate earnings—the market is inevitably coming back down unless the Chinese central government purchases more shares. Beijing’s so-called “national team”—a collection of state entities—appears to be the only big buyer in the market. The government has a large “war chest,” believed to be between 2 and 5 trillion yuan (about $322 billion to $807 billion). Whatever its size, the fund has been rapidly depleted since officials started buying stock in large quantities. In the middle of this month, Goldman Sachs estimated the government had spent 800-900 billion yuan to acquire shares. Christopher Balding of Peking University’s HSBC Business School, taking a more expansive view of Beijing’s market-supporting initiatives, believes the government has already shelled out $1.3 trillion.

Read more …

More on China’s frantic ‘market support’.

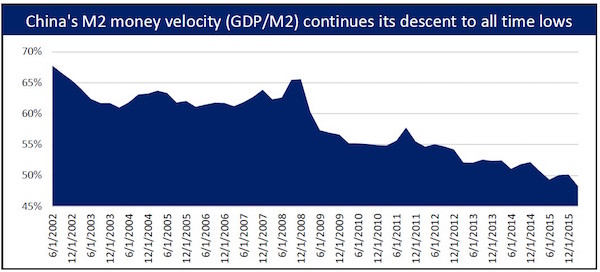

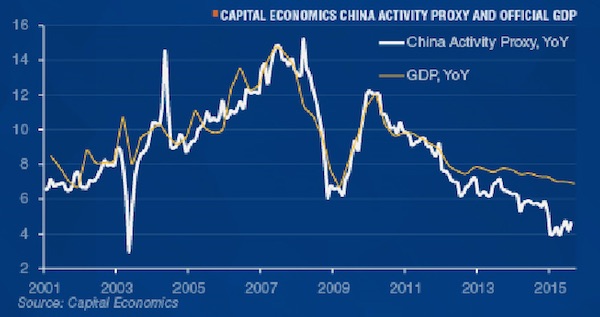

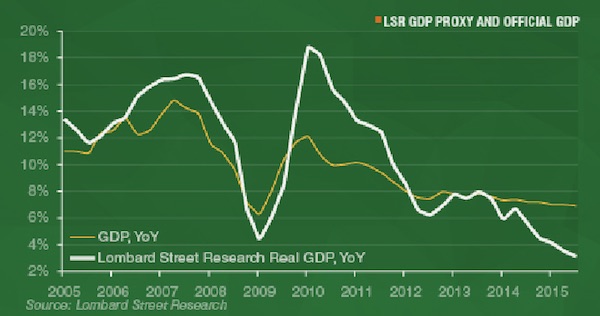

• China Risks An Economic Discontinuity (Martin Wolf)

David Daokui Lee, an influential Chinese economist, has argued that: “The stock market sell-off is not the problem… the problem — not a huge one, but a problem nonetheless — is the Chinese economy itself.” I agree with both points, with one exception. The problem may prove huge. Market turmoil is not irrelevant. It matters that Beijing has spent $200bn on a failed attempt to prop up the stock market and that foreign exchange reserves fell by $315bn in the year to July 2015. It matters, too, that a search for scapegoats is in train. These are indicators of capital flight and policymaker panic. They tell us about confidence — or the lack of it. Nevertheless, economic performance is ultimately decisive. The important economic fact about China is its past achievements.

Gross domestic product (at purchasing power parity) has risen from 3% of US levels to some 25% (see chart). GDP is an imperfect measure of the standard of living. But this transformation is no statistical artefact. It is visible on the ground. The only “large”(bigger than city state) economies, without valuable natural resources, to achieve something like this since the second world war are Japan, Taiwan, South Korea and Vietnam. Yet, relative to US levels, China’s GDP per head is where South Korea’s was in the mid-1980s. South Korea’s real GDP per head has since nearly quadrupled in real terms, to reach almost 70% of US levels. If China became as rich as Korea, its economy would be bigger than those of the US and Europe combined.

This is a case for long-run optimism. Against it is the caveat that “past performance is no guarantee of future performance”. Growth rates usually revert to the global mean. If China continued fast catch-up growth over the next generation it would be an extreme outlier .

In emerging economies growth tends to be marked by “discontinuities”. But what Chinese policymakers call the “new normal” is not itself such a discontinuity. They believe they have overseen a smooth slowdown from annual growth of 10% to still-fast growth of 7%. Is a far bigger slowdown possible? More important, would this be a temporary interruption, as in South Korea in the late 1990s crisis — or more permanent, as in Brazil in the 1980s or Japan in the 1990s?

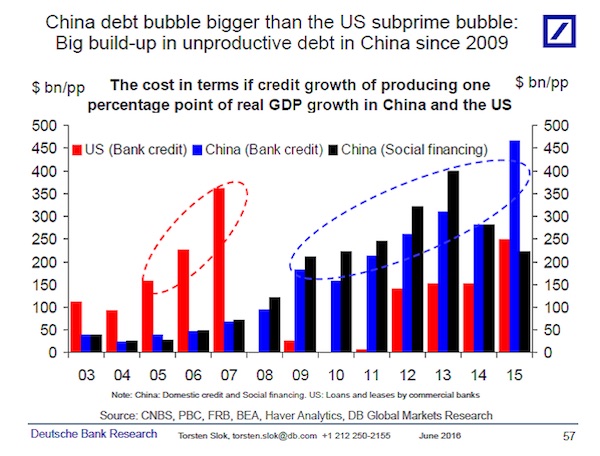

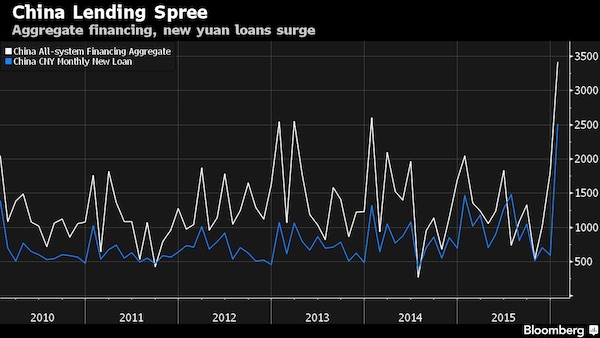

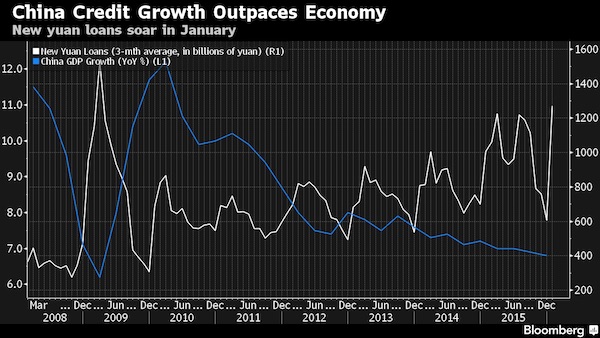

There are at least three reasons why China’s growth might suffer a discontinuity: the current pattern is unsustainable; the debt overhang is large; and dealing with these challenges creates the risks of a sharp collapse in demand. The most important fact about China’s current pattern of growth is its dependence on investment as a source of supply and demand (see charts). Since 2011 additional capital has been the sole source of extra output, with the contribution of growth of “total factor productivity” (measuring the change in output per unit of inputs) near zero. Moreover, the incremental capital output ratio, a measure of the contribution of investment to growth, has soared as returns on investment have tumbled.

Read more …

Looks like a smart view.

• Alibaba Is the Canary in China’s Coal Mine (Pesek)

It turns out investors were right about Alibaba: No company is more on the front lines of China’s economic shifts than Jack Ma’s juggernaut. And that’s just where the problems begin. Alibaba’s shares slide with each new report of middle-class Chinese who are dumping apartments to raise cash, delaying weddings, canceling vacations, terminating automobile orders and cutting up credit cards. A social media app called “Guide on Safe Passage Through the Economic Crisis” is all the rage as hundreds of millions of mainlanders encounter their first bear market. All that most Chinese younger than 50 know is annual growth of more than 10%. Crashing stocks and recession are Western maladies, not China’s. Ma has hitched the fortunes of his e-commerce behemoth to these people, and the value of his company is falling in sync with them.

After surging as much as 75% from their initial offering price of $68 each last September, the company’s American depositary receipts plunged 16% in August, to $66.12, the third consecutive monthly decline in New York. Anyone who doubts that China won’t experience a negative wealth effect as Shanghai cracks hasn’t looked at Alibaba’s numbers. Skeptical investors have shaved $65 billion from its market value since last year’s euphoric initial public offering. Things are about to get worse — both for the economy and Ma’s investors. Five interest-rate cuts since November aren’t boosting factory activity, which is the weakest in at least three years. The 49.7 reading on the August Purchasing Managers’ Index confirmed the worst fears of China bulls: Domestic and external demand is sliding with the Shanghai Composite Index.

Read more …

Li and Xi will do anything to keep the blame of their own shoulders.

• China Turns Up Heat On Market Participants (FT)

Beijing intensified its clampdown on stock market impropriety and rumour-mongering on Tuesday as the whereabouts of one of China’s leading hedge fund managers remained unclear. The husband of Li Yifei, Man Group China head, denied that she was in detention. An earlier Bloomberg report saying she had been taken into custody by police in connection with the stock market probe into market volatility was “not accurate”, Wang Chaoyong, Ms Li’s husband, told the Financial Times. “Li is in a meeting with [financial industry] authorities at the moment in the suburbs of Beijing,” he said, adding that the meeting was continuing from Monday and that “it sounds like there are a lot of people attending from foreign financial institutions”.

Mr Wang said he did not know the purpose of the meeting, adding “it’s confidential, they are not allowed to turn on their phones”. But he said such encounters between foreign businesses and the Chinese market authorities were normal and he did not appear distressed about his wife’s situation. “I talked to her yesterday morning and the day before,” he said. “I haven’t talked to her today.” Questions over Ms Li’s whereabouts come after Chinese authorities turned up the heat on other prominent figures, including four senior executives of Citic Securities, a respected financial journalist and an official of the China Securities Regulatory Commission, the market watchdog.

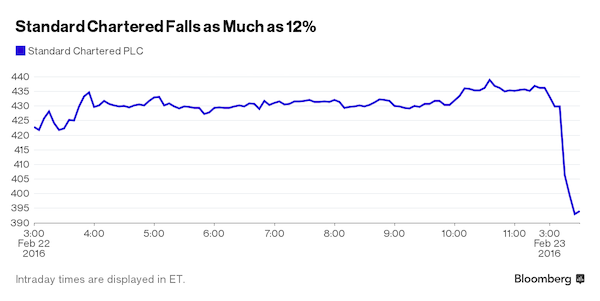

Authorities have blamed market manipulation and foreign forces as the market slumps lower. The Shanghai Composite index is down more than 40% from its June 12 peak, prompting a slew of detentions alongside technical measures designed to reverse the slide. Ms Li leads the China business of London-listed Man Group, the world’s largest publicly traded hedge fund. A kung fu expert who once worked as a stunt double in martial arts, she previously held senior roles in China for MTV and Viacom. But Man Group does not run a trading desk or make investments from its Chinese office, and fewer than five people are employed there. Ms Li’s role is to sell Man Group funds to Chinese institutional investors. The group first received permission to market in China from the government under the so-called QDLP programme, which was launched in 2013. The programme allowed approved foreign hedge funds to raise up to $50m in assets in mainland China.

Read more …

The rally explained.

• Huge Purchases By Chinese Oil Trader Raise Prices, Confusion (WSJ)

A Chinese oil-trading company bought record volumes of oil on a regional cash market for Middle Eastern crude last month, pushing up benchmark prices and causing confusion among crude buyers and sellers in Asia about the company’s motives. Chinaoil, the trading arm of state-run China National Petroleum, bought nearly 90% of the oil cargoes on the Dubai spot market in August, setting a record for the number of cargoes traded on the small marketplace in a single month. Chinaoil has engaged in heavy crude-buying in Dubai periodically over the past year, during which time global oil prices have fallen by roughly half. China’s oil imports have held up this year despite a slowdown in the country’s economic growth, with much of the crude believed to have gone toward building up the country’s strategic oil reserves.

China is expected to surpass the U.S. as the world’s largest oil importer this year on an annual basis, and its net oil imports were up 9.4% over the first seven months of this year. Still, traders involved in the Dubai market have questioned Chinaoil’s motives, saying its market dominance is distorting prices by making them higher than they would otherwise be. “The Dubai oil price is detached from actual supply and demand. There is a very clear disconnect from the market,” said one Singapore-based oil trader. Dubai crude prices are widely used by Asian oil producers and sellers when fixing contracts, as much of the region’s crude is sourced from the Middle East. The benchmark is assessed by price-reporting agency Platts, a unit of McGraw Hill, which bases its assessment on trades done during a 30-minute window each day.

Platts assessed the price of Dubai crude cargoes for loading in October at $48.41 a barrel on Monday, and at an average of $47.691 a barrel over August. Brent crude was trading at $52.16 a barrel on Monday. The Dubai market is now in a situation called backwardation, in which current prices are higher than future prices, because of Chinaoil’s large purchases. For global benchmarks such as Brent and West Texas Intermediate, by contrast, the price for oil to be delivered in a month is sharply lower than future prices, a situation called contango. “If you look at the physical market it is not tight. So [Chinaoil’s buying] is kind of distorting the market,” said Tushar Bansal at Facts Global Energy. Oil traders offered several theories for Chinaoil’s large purchases. Some said the company could be engaged in opportunistic stockpiling, while others said it could be profiting by taking an offsetting position in the oil futures market.

Read more …

This will cost a lot of people a lot of money. A huge headfake in oil prices.

• A Corner of the Oil Market Shows Why It’s So Tough to Read China (Bloomberg)

Glencore Plc’s Ivan Glasenberg has lamented the difficulty of reading China’s commodity demand. The nation’s oil traders aren’t helping. State-run China National United Oil Corp., a unit of the country’s biggest energy company, bought 36 million barrels of Middle East crude last month as part of a pricing process in Singapore used to determine commodity benchmarks around the world. While the purchases by the trader known as Chinaoil were unprecedented, what’s more unusual is that the seller of most of those cargoes was another government-owned trading company called Unipec. “It’s unsettling and confusing for other players, and defies market logic,” Victor Shum at IHS said by phone from Singapore.

China has surpassed the U.S. as the world’s biggest buyer of overseas oil, driven by an ambition to keep a strategic stockpile of supplies. As global markets convulse after the surprise devaluation of the yuan in August, one state company buying from another underscores the challenge of determining demand in the largest user of energy, metals and grains. Glasenberg, the chief executive officer of leading commodity trader Glencore, said last month that “none of us know what is going on” currently in the world’s second-largest economy.

The record buying in Singapore was part of the market-on-close price assessment process run by Platts, a unit of McGraw Hill Financial Inc., where bids, offers and deals are reported by traders through e-mails, instant messages and phone conversations in a fixed period each day. These are used to create end-of-day price assessments for various commodities and form benchmarks for transactions globally. “Chinaoil and Unipec each have their own trading book and strategy,” Ehsan Ul-Haq, a senior market consultant at KBC Advanced Technologies, said by phone from London. “The Chinese government will not hinder free trading.”

Read more …

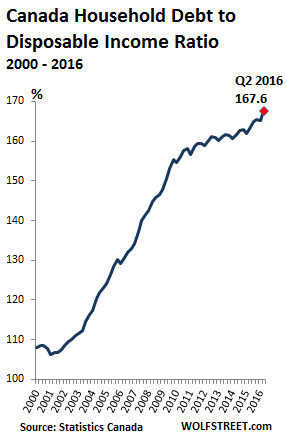

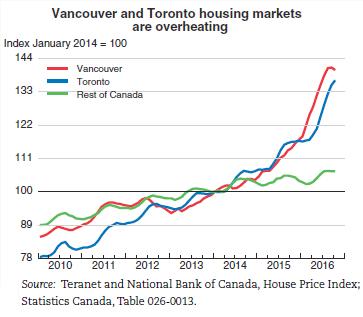

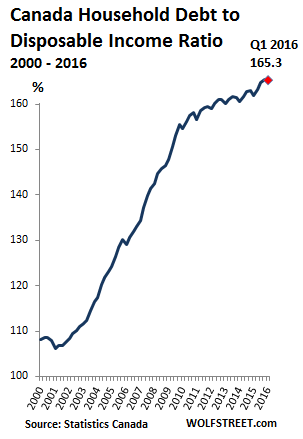

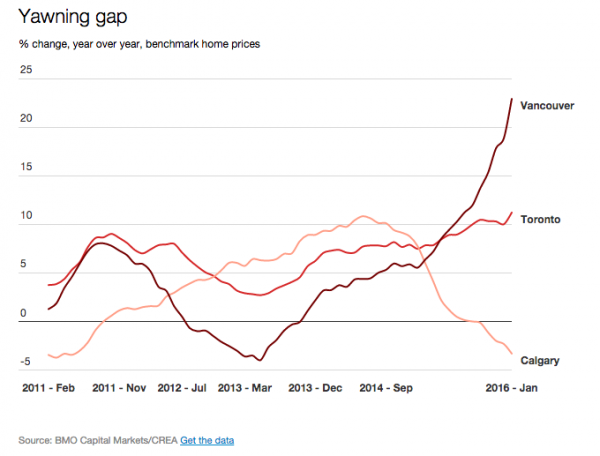

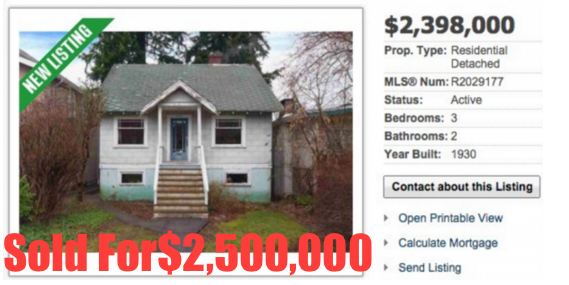

These boyos are talking about a technical recession. Wait till home prices start plummeting, then we’ll talk again.

• Hit By Cheap Oil, Canada’s Economy Falls Into Recession (Reuters)

The Canadian economy shrank again in the second quarter, putting the country in recession for the first time since the financial crisis, with a plunge in oil prices spurring companies to chop business investment. The confirmation on Tuesday of a modest recession will figure heavily into the election campaign as Canadians head to the polls Oct. 19 and poses a challenge to Conservative Prime Minister Stephen Harper, who is seeking a rare fourth consecutive term. Still, there was a silver lining as growth picked up for the first time in six months in June, underscoring expectations the recession will be short-lived. Harper was quick to downplay what some supporters and economists have dismissed as a “technical” recession, pointing to the upbeat June figures during a campaign stop. “The Canadian economy is back on track,” he said.

But politicians from the opposition New Democrats and Liberals said the numbers were evidence Harper’s economic policies were failing. Economists mostly agreed the 0.5% pickup in June put Canada on good footing for a better third quarter. “Despite the technical recession materializing, it does look like the Canadian economy is jumping back, is rebounding strongly in the third quarter,” said Derek Burleton at Toronto-Dominion Bank. The Canadian dollar initially rallied to a session high against the greenback following the data before giving up ground later in the day as oil prices fell. The last time Canada was in recession was in 2008-09, when the U.S. housing market meltdown triggered a global credit crisis.

This time around, Canada has been primarily hit by the slump in crude prices, with weakness concentrated in energy-related sectors. Oil-exporting provinces like Alberta and Saskatchewan have been particularly hard-hit. GDP contracted at an annualized 0.5% rate in the second quarter, Statistics Canada said. That was better than forecast, though revisions showed the first quarter’s contraction was steeper than first reported. Two consecutive quarters of contraction are typically considered the textbook definition of a recession. But some economists have argued that such a definition is too narrow. They note unemployment has remained relatively subdued at 6.8%, and housing markets outside of Alberta and retail sales have been reasonably strong.

Read more …

Hear that distant rumble over the prairies?

• Alberta Issues Bleak Economic Report (Globe and Mail)

Alberta’s economy is sliding into recession and its deficit for this year could top $6.5-billion, the province’s NDP government says in an economic update. It is a dramatic change from March, when the previous government forecast a deficit of nearly $5-billion and was expecting the economy to grow in 2015. Monday’s bleak new numbers came as neighbouring Saskatchewan announced it is forecasting a $292-million deficit this year due to low oil prices and the cost of fighting forest fires. The Prairie province had projected a surplus of $107-million in March. Alberta Finance Minister Joe Ceci avoided using the word “recession” on Monday, but confirmed the update’s findings that the economy of the province, Canada’s economic engine for much of the past decade, will contract by 0.6% this year and grow by only 1.3% in 2016.

“The last month has been volatile for the energy sector,” he said. “It is clear that revenues have dipped even further these past few weeks. If current conditions continue, the final deficit will be in the range of $6.5-billion.” Alberta’s new projected deficit is the second-largest in the country as a proportion of its economy, after that of Newfoundland and Labrador. “There is no doubt many Alberta families and businesses are feeling the effects of the dramatic drop in oil prices,” Mr. Ceci said. On Tuesday, Statistics Canada will report on whether the national economy shrank for a second consecutive quarter. The Federal Balanced Budget Act defines two consecutive quarters of negative growth as a recession. “Almost certainly, all the headlines on Tuesday will be ‘Canada in recession,’” said ATB Financial chief economist Todd Hirsch.

“But over the last five years, all of Canada’s growth has been coming from Alberta. We’ve been doing our share of the heavy lifting, but in 2015, we’re a drag on the national economy.” His forecast for this year fits with the government’s latest numbers. However, he is expecting zero growth next year. Alberta’s government finances are closely tied to the price of a barrel of oil, with royalties paying for as much as one-third of provincial spending during times of high energy prices. Recent fluctuations in oil prices have made forecasting difficult. Over the past week, oil prices have surged from $38.24 (U.S.) a barrel to $49.20 on Monday. “The situation over the month of August has changed so dramatically, I don’t want to say that the forecast is inaccurate, but we might see some revision,” Mr. Hirsch said. “Anything could happen in the next few months. We could be at $20 oil or $60-per-barrel oil.”

Read more …

“Put your head between your legs and kiss your ass goodbye.”

• Say Goodbye to Normal (Jim Kunstler)

The tremors rattling markets are not exactly what they seem to be. A meme prevails that these movements represent a kind of financial peristalsis — regular wavelike workings of eternal progress toward an epic more of everything, especially profits! You can forget the supposedly “normal” cycles of the techno-industrial arrangement, which means, in particular, the business cycle of the standard economics textbooks. Those cycles are dying. They’re dying because there really are Limits to Growth and we are now solidly in grips of those limits. Only we can’t recognize the way it is expressing itself, especially in political terms. What’s afoot is a not “recession” but a permanent contraction of what has been normal for a little over two hundred years.

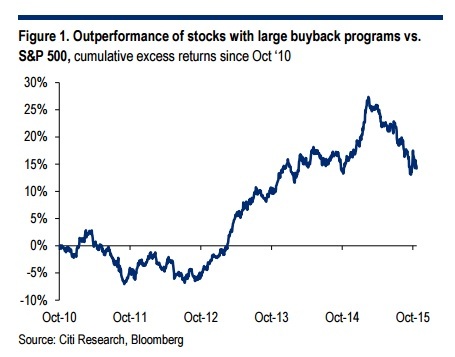

There is not going to be more of everything, especially profits, and the stock buyback orgy that has animated the corporate executive suites will be recognized shortly for what it is: an assest-stripping operation. What’s happening now is a permanent contraction. Well, of course, nothing lasts forever, and the contraction is one phase of a greater transition. The cornucopians and techno-narcissists would like to think that we are transitioning into an even more lavish era of techno-wonderama — life in a padded recliner tapping on a tablet for everything! I don’t think so. Rather, we’re going medieval, and we’re doing it the hard way because there’s just not enough to go around and the swollen populations of the world are going to be fighting over what’s left.

Actually, we’ll be lucky if we can go medieval, because there’s no guarantee that the contraction has to stop there, especially if we behave really badly about it — and based on the way we’re acting now, it’s hard to be optimistic about our behavior improving. Going medieval would imply living within the solar energy income of the planet, and by that I don’t mean photo-voltaic panels, but rather what the planet might provide in the way of plant and animal “income” for a substantially smaller population of humans. That plus a long-term resource salvage operation.

[..] I have to say it again: prepare to get smaller and more local. Things on the grand level are not going to work out. Get your shit together locally, and do it in place that has some prospect for keeping on: a small town somewhere food can be grown and especially places near the inland waterways where some kind of commercial exchange might continue in the absence of the trucking industry. Sound outlandish? Okay then. Keep buying Tesla stock and party on, dudes. Hail the viziers in their star-and-planet bedizened Brooks Brother raiment. Put your head between your legs and kiss your ass goodbye.

Read more …

You would almost hope Marine Le Pen takes over.

• France ‘Intimidated’ By Germany On Economic Policy: Stiglitz (AFP)

France has been intimidated by Germany into pursuing an economic policy that isn’t working, Nobel prize-winning economist Joseph Stiglitz told AFP in an interview on Monday. “There is a kind of intimidation,” Stiglitz, an outspoken opponent of austerity policy, said of the influence of Germany over the economic policy pursued by President Francois Hollande. Stiglitz also said he agreed with former Greek finance minister Yanis Varoufakis that Germany’s intransigence against Athens was aimed at striking fear in Paris and convincing the French government to continue austerity policies. “The centre-left government in France has not been able to stand up against Germany” on its budget policy, eurozone policy, or on the response to the Greek crisis, said the former World Bank chief economist and advisor to US president Bill Clinton.

Regarding the EU, he criticised Brussels for focusing on nominal deficits of member states rather than those adjusted for the economic cycle, as well as the policy response. “Cutting taxes and expenditures contracts the economy, just the opposite to what you need,” said Stiglitz. “I do not understand why Europe is now trying that after all the evidence, all the theory says it does not work,” he added. He said the “totally discredited” policy now only has support in Germany and a few people in France. Stiglitz, who is in France to promote the translation of his latest book, “The Great Divide”, said the “centre-left has lost confidence in its progressive agenda”. He noted that former British prime minister Tony Blair, ex-German chancellor Gerhard Schroeder and US President Barack Obama all supported the “banking system, have supported deregulation, trade agreements that are bad for ordinary workers”.

Read more …

Contradictio in terminus: “The euro is irreversible – but if it is irreversible for every country has become an open question..”

• Grexit May Be Better For Greece: Euro Architect (CNBC)

Leaving the euro might help struggling Greece, according to Otmar Issing, the former ECB board member and chief economist who is known as one of the euro currency’s architects. “The euro is irreversible – but if it is irreversible for every country has become an open question,” Issing told CNBC on Tuesday. Issing raised eyebrows earlier this summer when he said that the euro’s irreversibility was an “illusion,” contradicting current ECB members who have insisted that there is no going back from the single currency. However, economists and politicians away from the ECB have questioned whether highly indebted Greece can remain in the euro zone and whether it might in fact do better economically outside the currency union.

“For Greece, there are very good arguments that it would do well outside the euro area for some time to come, but it all depends on the Greek government’s reactions” Issing told CNBC. Greece has just begun a third much-needed bailout, after months of negotiations, which looked like they might result in a disorderly exit from the single currency region. Since then, China has replaced Greece as the economy causing most worry to the global financial system. Issing, who is currently president of the Center for Financial Studies at Goethe University, spoke of the “high degree of uncertainty” that remains and forecast an era of “moderate growth but not stagnation.”

“We are heading for a time of high uncertainty in which governments still have many measures in hand to sustain the situation,” he said. He cautioned the ECB, which meets later this week, against any further extension of its quantitative easing program, arguing that the “danger of creating bubbles in fixed income markets” outweighed any advantages.

Read more …

It’s no use trying to democratize the EU. Or rather: the only way to democratize the EU is to dismantle the union. Yanis should know that better than just about anyone.

• Democratizing the Eurozone (Yanis Varoufakis)

Like Macbeth, policymakers tend to commit new sins to cover up their old misdemeanors. And political systems prove their worth by how quickly they put an end to their officials’ serial, mutually reinforcing, policy mistakes. Judged by this standard, the eurozone, comprising 19 established democracies, lags behind the largest non-democratic economy in the world. Following the onset of the recession that followed the 2008 global financial crisis, China’s policymakers spent seven years replacing waning demand for their country’s net exports with a homegrown investment bubble, inflated by local governments’ aggressive land sales. And when the moment of reckoning came this summer, China’s leaders spent $200 billion of hard-earned foreign reserves to play King Canute trying to hold back the tide of a stock-market rout.

Compared to the European Union, however, the Chinese government’s effort to correct its errors – by eventually allowing interest rates and stock values to slide – seems like a paragon of speed and efficiency. Indeed, the failed Greek “fiscal consolidation and reform program,” and the way the EU’s leaders have clung to it despite five years of evidence that the program cannot possibly succeed, is symptomatic of a broader European governance failure, one with deep historical roots. In the early 1990s, the traumatic breakdown of the European Exchange Rate Mechanism only strengthened the resolve of EU leaders to prop it up. The more the scheme was exposed as unsustainable, the more doggedly officials clung to it – and the more optimistic their narratives. The Greek “program” is just another incarnation of Europe’s rose-tinted policy inertia.

The last five years of economic policymaking in the eurozone have been a remarkable comedy of errors. The list of policy mistakes is almost endless: interest-rate hikes by the European Central Bank in July 2008 and again in April 2011; imposing the harshest austerity on the economies facing the worst slump; authoritative treatises advocating beggar-thy-neighbor competitive internal devaluations; and a banking union that lacks an appropriate deposit-insurance scheme. How can European policymakers get away with it? After all, their political impunity stands in sharp contrast not only to the United States, where officials are at least accountable to Congress, but also to China, where one might be excused for thinking that officials are less accountable than their European counterparts. The answer lies in the fragmented and deliberately informal nature of Europe’s monetary union.

Read more …

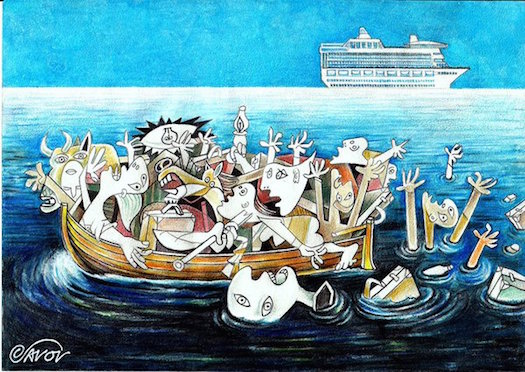

If finance doesn’t implode the union, we have other flavors.

• Inability To Unite On Major Challenges May Pull The EU Apart (EurActiv)

French Socialist Party leaders have warned that the multitude of crises currently buffeting the European Union could deal a death blow to the European project. EurActiv France reports. The economic crisis, the Greek crisis and the refugee crisis are subjects of grave concern for the French Socialists. “This is a time when the European construction could actually disappear,” the MEP Pervenche Bérès warned at the French Socialist Party’s summer university in La Rochelle last week. Between the economic crisis that has rumbled on since 2008, the threat of a “Grexit” earlier in the summer, security concerns and the rise of terrorism and now the humanitarian crisis unfolding on Europe’s borders with the arrival of so many refugees, there is no shortage of reasons to be worried.

The political unity of Europe is at stake. For Guillaume Bachelay, a French Socialist MP, “the risk is that generations to come will have to suffer the deconstruction of the European project”. The Greek crisis is an open wound. For many, the fact that high ranking politicians in countries like Germany had called for Greece’s eviction from the eurozone caused damage to the Union that is not easily repaired. Perhaps unsurprisingly, the socialist camp has nothing but praise for French President, François Hollande, whose unwavering support for Greece certainly helped them avoid this fate.

“If France succeeded in playing this role, it was not in the name of a currency or the interests of the Greeks, Europe, or France. It was in the name of a political idea. When Europe moves forward, there is no way back. We refused to let the EU crumble,” said Michel Sapin, the French finance minister and a close ally of François Hollande.

Read more …

Too late now for leaders to stand up.

• Bid For United EU Response Fraying Over Refugee Quota Demands (Guardian)

Europe’s fragmented attempts to get to grips with its worst ever migration crisis are disintegrating into a slanging match between national capitals ahead of what is shaping up to be a major clash between eastern and western Europe over a common response. Berlin has won plaudits for seizing the moral high ground and opening its doors unconditionally to Syrian refugees but Austria and Hungary attacked it on Tuesday for stoking chaos at their railway stations, on their roads and at their borders as thousands of people seek transit to Germany. The German chancellor, Angela Merkel, rejected the criticism and stepped up her campaign to pressure reluctant EU partners into relieving the load on Germany and taking part in a more equitable system of sharing refugees across the EU.

“We must push through uniform European asylum policies,” she said. With Germany expecting to process 800,000 asylum applications this year – more than four times the figure for 2014 and more than the rest of the EU combined – Merkel insisted that there had to be a fairer distribution. “The criteria must be discussed,” she said. Mariano Rajoy, the Spanish prime minister, stood alongside Merkel in Berlin as she spoke, but he rejected the German pressure for a new system of binding quotas for refugees spread across the EU. “Some countries don’t want refugees,” he said. “You can’t force anyone [to take them].” “It’s not the time to be pointing fingers at each other,” said Natasha Bertaud, the European commission’s spokeswoman on immigration.

Read more …

Hungary has no idea what to do, and receives as little aid as Greece does.

• Hungarian TV ‘Told Not To Broadcast Images Of Refugee Children’ (Guardian)

Employees of Hungarian state television have been instructed not to include children in footage of news pieces about migrants and refugees, a leaked screenshot of editorial advice to journalists at news channel M1 reveals. Hungary’s government-appointed Media Authority, MTVA, denied state media outlets have been told to limit public sympathy towards refugees, arguing that the memo was designed to protect children, while a pro-government journalist, who wished to remain anonymous, told the Guardian this had only been one-off instruction. “They do show children sometimes: actually the%age of children registered in Hungary this year is quite low, so in some opposition media they are somewhat overrepresented,” the source said.

Hungary has become a major transit country for migrants and refugees in recent months, but while M1 was quick to broadcast footage showing demonstrations outside the overcrowded transit zone at Budapest’s Keleti station over the weekend, protests against government policies on refugees have received scant coverage in state media. Refugee solidarity group MigSzol has held mass protests against the Hungarian government’s “national consultation” on immigration and the construction of a fence along the country’s border with Serbia. However, the pro-government journalist argued that these protests have been overlooked because “MigSzol tends to campaign against some Hungarian and even EU laws regarding migration.”

The civic aid initiatives that have sprung up in lieu of co-ordinated state help have also been largely ignored by state media. The journalist said: “The NGOs helping the migrants are very political: people known from the opposition scene take part and they mix pro-migration content with criticism of the government, so pro-government, more rightwing media won’t really give (a platform) for these people … even if their work to help migrants is okay.”

Read more …

Democracy in action.

• Greece’s Ionian Islands To Hold Plebiscite Over Airport Privatization (Kath.)

The Regional Authority of the Ionian Islands has said that it is planning to hold a referendum over government plans to privatize 14 airports around the country, including the popular holiday islands of Corfu and Cephalonia. “The decision… for the concession of 14 regional airports to the German consortium of Fraport is a particularly negative development for the Ionian islands,” Regional Governor Theodoros Galiatsatos told the state-run Athens-Macedonian News Agency on Tuesday, following a meeting of the regional council, which agreed to organize a plebiscite following the September 20 general elections. “The impact on the region’s economy is expected to be extremely negative as four of the 14 airports that are up for sale have a direct effect on the region’s socio-economic life,” Galiatsatos said, referring to the airports of Corfu, Aktaio, Cephalonia and Zakynthos.

Read more …

I think it’s more sinister than mere indifference.

• The Price of European Indifference (Bernard-Henri Lévy)

Europe’s migration debate has taken a disturbing turn. It began with the creation of the catch-all concept (a legal freak) of a “migrant,” which obscures the difference, central to the law, between economic and political migration, between people escaping poverty and those driven from their homes by war. Unlike economic migrants, those fleeing oppression, terror, and massacre have an inalienable right to asylum, which entails an unconditional obligation by the international community to provide shelter. Even when the distinction is acknowledged, it is often as part of another sleight of hand, an attempt to convince credulous minds that the men, women, and children who paid thousands of dollars to travel on one of the rickety boats washing up on the islands of Lampedusa or Kos are economic migrants.

The reality, however, is that 80% of these people are refugees, attempting to escape despotism, terror, and religious extremism in countries like Syria, Eritrea, and Afghanistan. That is why international law requires that the cases of asylum-seekers are examined not in bulk, but one by one. And even when that is accepted, when the sheer number of people clamoring to get to Europe’s shores makes it all but impossible to deny the barbarity driving them to flee, a third smokescreen goes up. Some, including Russian Foreign Minister Sergei Lavrov, claim that the conflicts generating these refugees rage only in Arab countries that are being bombed by the West. Here again, the figures do not lie.

The top source of refugees is Syria, where the international community has refused to conduct the kinds of military operations required by the “responsibility to protect” – even though international law demands intervention when a mad despot, having killed 240,000 of his people, undertakes to empty his country. The West also is not bombing Eritrea, another major source of refugees. Yet another damaging myth, perpetuated by shocking images of refugees swarming through border fences or attempting to climb onto trains in Calais, is that “Fortress Europe” is under assault by waves of barbarians. This is wrong on two levels. First, Europe is far from being the migrants’ primary destination. Nearly two million refugees from Syria alone have headed to Turkey, and one million have fled to Lebanon, whose population amounts to just 3.5 million.

Jordan, with a population of 6.5 million, has taken in nearly 700,000. Meanwhile, Europe, in a display of united selfishness, has scuttled a plan to relocate a mere 40,000 asylum-seekers from their cities of refuge in Italy and Greece. Second, the minority who do choose Germany, France, Scandinavia, the United Kingdom, or Hungary are not enemies who have come to destroy us or even to sponge off of European taxpayers. They are applicants for freedom, lovers of our promised land, our social model, and our values. They are people who cry out “Europe! Europe!” the way millions of Europeans, arriving a century ago on Ellis Island, learned to sing “America the Beautiful.”

Read more …

A portrait.

• This Is What Greece’s Refugee Crisis Really Looks Like (Nation)

In the baking midday August heat on the Greek island of Lesbos, Ziad Mouatash bounces out of an overcrowded inflatable raft and touches EU soil for the first time. The 22-year-old from Yarmouk—the Palestinian refugee camp on the edge of Damascus that has been besieged and bombed since 2012 by Bashar al-Assad’s forces and recently invaded by ISIS and the Al Qaeda–affiliated Nusra Front—hugs everyone around him, ecstatic to be alive. From the Greek shore, activists and locals had looked on helplessly as the boat’s motor broke down two miles away, water pouring into the barely floating rubber dinghy. Children and adults alike cried desperately for help, until they were towed to Greece by another boat of refugees coming from Turkey.

Mouatash paid human traffickers in Turkey over 1,000 euros for this near-death experience, but as far as he’s concerned, it was a far less risky choice than continuing to hide out in deteriorating Damascus, which he’d abandoned for Turkey two weeks before. As a Palestinian who grew up in Syria’s refugee camps, he is stateless, but he has a brother in Paris and hopes to start a new life in France. He paces up and down the shoreline, unsure of which direction to go, while local activists try to bring the new arrivals together to tell them that they need to start a 40-mile walk to a registration center on the other side of the island. “Thanks to God I have made it here. I am free, I am alive!” Mouatash exclaims, overcome with emotion.

Although he has escaped the horrors of Syria’s grinding civil war, Mouatash is just beginning the difficult journey through Europe. He will have to cross more borders illegally; rest in filthy, makeshift camps; pay traffickers to help him cross those borders; dodge border police; and sleep in parks and fields, before he can reunite with his brother. Still, Mouatash is one of the lucky ones. Four days after his arrival, a raft off the Greek island of Kos capsized and six Syrians—including a baby—drowned. According to Lt. Eleni Kelmani, a spokesperson for the Lesbos Coast Guard, up to 2,000 refugees are now arriving daily on the island. She notes that this sunny tourist haven has seen the arrival of 75,000 of the estimated 120,000 refugees who have landed in Greece this year. Outside her office, hundreds of them sleep next to parked cars or in tents on the edge of the port.

Read more …

Kathimerini, too, persists in using the term ‘migrants’. That’s called a political agenda.

• Greek Island Lesvos Registers 17,500 Refugees Just Over The Past Week (Kath.)

More than 4,200 refugees were due to arrive in Piraeus on two ships from Lesvos Tuesday, only temporarily easing the pressure on scant resources on the island but at the same time increasing concern in Athens about the fate of those who would disembark. Authorities on Lesvos have registered some 17,500 refugees and migrants over the past week but the transfer to Athens of many of those people would only provide brief respite as hundreds more are arriving each day. While many refugees head for Greece’s border with the Former Yugoslav Republic of Macedonia (FYROM), some end up stranded in Athens. Victoria Square in the city center has become a popular gathering point for refugees.

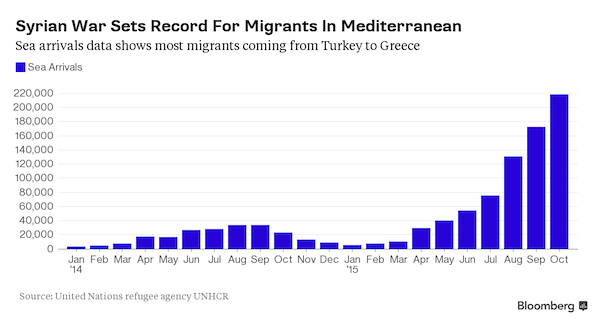

Athens Mayor Giorgis Kaminis is due to meet caretaker Immigration Minister Yiannis Mouzalas Thursday to discuss the issue. European Commissioner for Migration Dimitris Avramopoulos is also due in Greece Thursday. Greek President Prokopis Pavlopoulos called his French counterpart Francois Hollande to discuss the issue. Pavlopoulos took the opportunity to explain to Hollande the size of the problem Greece is facing. More than 350,000 migrants have crossed the Mediterranean this year and 2,600 have died while making the journey, the International Organization for Migration said Tuesday.

The latest figures from IOM show that 234,778 migrants had landed in Greece and another 114,276 in Italy, with most of the other arrivals split between Spain (2,166) and the island of Malta (94). The figure from 2015 already dwarfs that of 2014, when 219,000 made the crossing throughout the entire year.

Read more …

Orwell reigns supreme in Brussels. New Europe equals newspeak.

• EU Task Force To Take On Russian Propaganda (New Europe)

The European Commission is launching a small ‘start-up’ team, composed of ten experts, in efforts to respond to the misleading Russian information system. The step comes in reaction to the conclusions of the March European Council, which stressed “the need to challenge Russia’s ongoing disinformation campaigns”. The spokesperson for foreign and security policy of the European Commission, Catherine Ray, told journalists that, “We indeed put a team in place a team within the EEAS to work on it, and they will start working on it as of September. They are now in full shape.” As requested by the March Council, An Action Plan on Strategic Communication was prepared.

The focus of the Action Plan, the EU source described to New Europe, “is on proactive communication of EU policies and values towards the Eastern neighbourhood. The measures cover not only EU Strategic Communication, but also wider EU efforts aimed at strengthening the media environment and supporting independent media. Some of the actions are for the EU institutions to take forward; others are more relevant to the Member States.” It remains to be seen how the different efforts will be divided between Institutions and Member States, and indeed what the impact on the media landscape will be. The decision to create such a team has been considered a reaction to growing concern in eastern Europe and the Baltic states about the destabilizing influence of Russian propaganda.

The EU Official told New Europe that “This is not about engaging in counter-propaganda. However, where necessary the EU will respond to disinformation that directly targets the EU and will work with partners to raise awareness of these activities.“ The special team will be part of the European External Action Service (EEAS) and will be based in its headquarters in Brussels. According to the source, the tasks of the team include “media monitoring” and “the development of communication products and media campaign focused on explaining EU policies in the region.” The mission will also support independent media and work with partner governments. With the goal to effectively communicate the EU policies in the the Eastern neighborhood, the task force will monitor, analyze and respond to reports on EU activities. In regards to expanding the missions, the task force, the EU source said, is “only one element of a wide range of EU activities aimed at communicating on EU policies.”

Read more …

Not very useful exercise if manmade disasters are not part of the discussion.

• Is The World Running Out Of Space? (BBC)

Sometimes it’s difficult to fathom that the world could actually become even more crowded than it is today – especially when elbowing through a teeming Delhi market, hustling across a frenetic Tokyo street crossing or sharing breathing space with sweaty strangers crammed into a London Tube train. Yet our claustrophobia-inducing numbers are only set to grow. While it is impossible to precisely predict population levels for the coming decades, researchers are certain of one thing: the world is going to become an increasingly crowded place. New estimates issued by the United Nations in July predict that, by 2030, our current 7.3 billion will have increased to 8.4 billion. That figure will rise to 9.7 billion by 2050, and to a mind-boggling 11.2 billion by 2100.

Yet even today, it’s difficult enough to get away from one another. Drive a few hours outside of New York City or San Francisco, into the Catskill Mountains or Point Reyes National Seashore, and you’ll find crowds of city-dwellers clogging trails and beaches. Even more remote and supposedly idyllic spaces are feeling the crush, too. Backcountry permits for the Grand Tetons in Wyoming sell out months in advance, while Arches National park in Utah had to shut down for several hours last May due to a traffic gridlock. For those who can afford the luxury of occasionally escaping other members of our own species, doing so often requires getting on a plane and travelling to increasingly far-fetched locales.

Yet humanity’s footprint extends even to the most seemingly isolated of places: you’ll find nomadic herders in Mongolia’s Gobi desert, Berbers in the Sahara and camps of scientists in Antarctica. This begs the question: as the world becomes even more crowded, will it become practically impossible to find a patch of land free from human settlement or presence? Will we eventually overtake all remaining habitable space?

Read more …