DPC Elks Temple (Eureka Club), Rochester, NY 1908

Ambrose has come totally on board. Not bad for the right wing.

• Greek Debt Crisis Is The Iraq War Of Finance (AEP)

Rarely in modern times have we witnessed such a display of petulance and bad judgment by those supposed to be in charge of global financial stability, and by those who set the tone for the Western world. The spectacle is astonishing. The ECB, the EMU bail-out fund, and the IMF, among others, are lashing out in fury against an elected government that refuses to do what it is told. They entirely duck their own responsibility for five years of policy blunders that have led to this impasse. They want to see these rebel Klephts hanged from the columns of the Parthenon – or impaled as Ottoman forces preferred, deeming them bandits – even if they degrade their own institutions in the process. If we want to date the moment when the Atlantic liberal order lost its authority – and when the European Project ceased to be a motivating historic force – this may well be it.

In a sense, the Greek crisis is the financial equivalent of the Iraq War, totemic for the Left, and for Souverainistes on the Right, and replete with its own “sexed up” dossiers. Does anybody dispute that the ECB – via the Bank of Greece – is actively inciting a bank run in a country where it is also the banking regulator by issuing this report on Wednesday? It warned of an “uncontrollable crisis” if there is no creditor deal, followed by soaring inflation, “an exponential rise in unemployment”, and a “collapse of all that the Greek economy has achieved over the years of its EU, and especially its euro area, membership”. The guardian of financial stability is consciously and deliberately accelerating a financial crisis in an EMU member state – with possible risks of pan-EMU and broader global contagion – as a negotiating tactic to force Greece to the table.

I leave it to lawyers to decide whether this is a prima facie violation of the ECB’s primary duty under the EU treaties. It is certainly unusual. The ECB has just had to increase emergency liquidity to the Greek banks by €1.8bn (enough to last to Monday night) to offset the damage. It did so days after premier Alexis Tsipras accused the creditors of “laying traps” in the negotiations and acting with a political motive. He more or less accused them of trying to destroy an elected government and bring about regime change by financial coercion. In its report, the Bank of Greece claimed that failure to meet creditor demands would “most likely” lead to the country’s ejection from the European Union. Let us be clear about the meaning of this. It is not the expression of an opinion. It is tantamount to a threat by the ECB to throw the Greeks out of the EU if they resist.

Read more …

Stunning: “as our German counterpart was later to confirm, any written submission to a finance minister by either Greece or the institutions was “unacceptable”, as he would then need to table it at the Bundestag, thus negating its utility as a negotiating bid.”

• A Pressing Question For Ireland Before Monday’s Meeting On Greece (Varoufakis)

Last Thursday’s eurogroup meeting went down in history as a lost opportunity to produce an already belated agreement between Greece and its creditors. Perhaps the most telling remark by any finance minister in that meeting came from Michael Noonan. He protested that ministers had not been made privy to the institutions’ proposal to my government before being asked to participate in the discussion. To his protest, I wish to add my own: I was not allowed to share with Mr Noonan, or indeed with any other finance minister, our written proposals. In fact, as our German counterpart was later to confirm, any written submission to a finance minister by either Greece or the institutions was “unacceptable”, as he would then need to table it at the Bundestag, thus negating its utility as a negotiating bid.

The eurozone moves in a mysterious way. Momentous decisions are rubber- stamped by finance ministers who remain in the dark on the details, while unelected officials of mighty institutions are locked into one-sided negotiations with a solitary government-in-distress.

It is as if Europe has determined that elected finance ministers are not up to the task of mastering the technical details; a task best left to “experts” representing not voters but the institutions. One can only wonder to what extent such an arrangement is efficient, let alone remotely democratic. Irish readers need no reminder of the indignity that befalls a people forced to forfeit their sovereignty in the midst of an economic depression.

They may, however, be justified to look at the never-ending Greek crisis and allow themselves a feeling of mild superiority, on the basis that the Irish suffered quietly, swallowed the bitter pill of austerity and are now getting out of the woods. The Greeks, in contrast, protested loudly for years, resisted the troika fiercely, elected my radical left-wing party last January and remain in the doldrums of recession. While such a feeling is understandable, permit me, dear reader, to argue that it is unhelpful in at least three ways. First, it does not promote understanding of the current Greek drama. Second, it fails to inform properly the debate on how the eurozone, and the EU more generally, should evolve. Third, it sows unnecessary discord between peoples that have in common more than they appreciate.

Greece’s drama is often misunderstood in northern climes because past profligacy has overshadowed the exceptional adjustment of the past five years. Since 2009 the Greek state’s deficit has been reduced, in cyclically adjusted terms, by a whopping 20%, turning a large deficit into a large structural primary surplus. Wages contracted by 37%, pensions by up to 48%, state employment by 30%, consumer spending by 33% and even the current account deficit by 16%. Alas, the adjustment was so drastic that economic activity was choked, total income fell by 27%, unemployment skyrocketed to 27%, undeclared labour scaled 34%, public debt rose to 180% of the nation’s rapidly dwindling GDP, investment and credit evaporated and young Greeks, just as their Irish counterparts, left for distant shores, taking with them huge quantities of human capital that the Greek state had invested in them.

Read more …

And now we know why.

• Varoufakis Says Greek Proposal Not Discussed At Eurogroup (Reuters)

Greek Finance Minister Yanis Varoufakis said on Friday that there had been no discussion of a Greek proposal for a cash-for-reforms deal to the euro zone group of finance ministers, and said Europe’s leaders had a duty to come up with a deal. Greeks pulled more than €1 billion out of their banks in a single day on Thursday, banking sources said, as the country edged closer to the brink of default despite upbeat remarks from Prime Minister Alexis Tsipras. “In yesterday’s Eurogroup the Greek authorities presented a wide-ranging, comprehensive and credible proposal that can be the foundation of an agreement that not only concludes the current program but also, importantly, addresses decisively, and permanently, Greece’s future funding needs,” Varoufakis said in a statement. “Regrettably, no discussion of our proposal took place within the Eurogroup.”

Read more …

Think leverage. An ocean of it.

• The Truth About Greece Is In The Collateral Backstopping Derivatives (Phoenix)

The situation in Greece has very little to do with politics or economics. Instead it is entirely focused on just one thing. That issue is collateral. What is collateral? Collateral is an underlying asset that is pledged when a party enters into a financial arrangement. It is essentially a promise that should things go awry, you have some “thing” that is of value, which the other party can get access to in order to compensate them for their losses. For large European banks, EU nation sovereign debt (such as Greece) is the collateral backstopping hundreds of trillions of Euros worth of derivative trades. This story has been completely ignored in the media. But if you read between the lines, you will begin to understand what really happened during the Greek bailouts.

Remember:

1) Before the second Greek bailout, the ECB swapped out all of its Greek sovereign bonds for new bonds that would not take a haircut.

2) Some 80% of the bailout money went to EU banks that were Greek bondholders, not the Greek economy.

Regarding #1, going into the second Greek bailout, the ECB had been allowing European nations and banks to dump sovereign bonds onto its balance sheet in exchange for cash. This occurred via two schemes called LTRO 1 and LTRO 2 which happened in December 2011 and February 2012 respectively. Collectively, these moves resulted in EU financial entities and nations dumping over €1 trillion in sovereign bonds onto the ECB’s balance sheet. Quite a bit of this was Greek debt as everyone in Europe knew that Greece was totally bankrupt. So, when the ECB swapped out its Greek bonds for new bonds that would not take a haircut during the second Greek bailout, the ECB was making sure that the Greek bonds on its balance sheet remained untouchable and as a result could still stand as high grade collateral for the banks that had lent them to the ECB.

So the ECB effectively allowed those banks that had dumped Greek sovereign bonds onto its balance sheet to avoid taking a loss… and not have to put up new collateral on their trade portfolios. Which brings us to the other issue surrounding the second Greek bailout: the fact that 80% of the money went to EU banks that were Greek bondholders instead of the Greek economy. Here again, the issue was about giving money to the banks that were using Greek bonds as collateral, to insure that they had enough capital on hand. Piecing this together, it’s clear that the Greek situation actually had nothing to do with helping Greece. Forget about Greece’s debt issues, or protests, or even the political decisions… the real story was that the bailouts were all about insuring that the EU banks that were using Greek bonds as collateral were kept whole by any means possible.

Read more …

Flabouraris calls it a domino effect. We call it derivatives.

• Greece Says ECB Won’t Let Its Banks Collapse (Reuters)

The European Central Bank will not allow Greek lenders to collapse as this would create a domino effect and topple banks in other parts of Europe, a Greek state minister said on Saturday. As Greece moves perilously close to default and a possible exit from the euro zone, the ECB expanded emergency funding to keep Greek banks afloat, as nervous savers withdrew billions of euros from local lenders in recent days. “The ECB cannot let banks collapse,” State Minister Alekos Flabouraris told Greek Mega television. “They know that if Greece’s banking system collapses, there will be a domino effect.”

Read more …

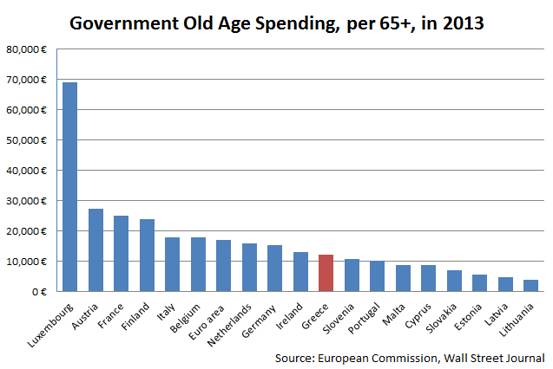

Good point: “the 25% collapse in Greek GDP over the last five years has made Greece’s pension burden look exceptionally big.”

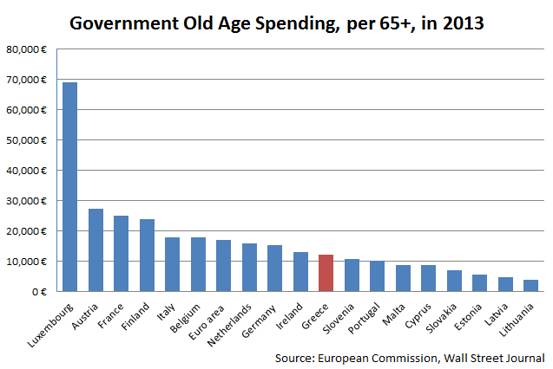

• Greek Pensions Have Been Cut Sharply, But Creditors Want More (WSJ)

Greece’s pension system has become the main obstacle to a deal with its creditors. The leftist government in Athens is flatly refusing to cut pensions more. The eurozone and the International Monetary Fund say pensions for poorer Greeks should be protected, but they argue Greece can’t afford its overall system. Without a compromise on pensions, there’s no deal, no money for Greece, default, capital controls, and return of the drachma. Real Time Brussels has already looked at some basic facts about Greece’s pension system, but only with data from 2012. Eurostat has a different dataset on government finances, with a category for spending on “old age.” That’s mainly pensions (the rest is Metamucil (jk)). This dataset goes up to 2013.

First thing to note is Greece’s pension spending fell a cumulative 13% in 2012 and 2013 because of cuts pushed by the troik – uh – Greece’s creditor. As the eurozone and the IMF are fond of noting, the Greek government’s pensions spending is the highest in the eurozone as a percentage of GDP. But that’s largely the result of two factors. First, the 25% collapse in Greek GDP over the last five years has made Greece’s pension burden look exceptionally big. And Greece has a relatively old population: Here’s the 2013 figures, adjusted for the number of people over age 65 in each country:

Side note: wow, it’s great to be old in Luxembourg. How much time do you have to spend in the Grand Duchy to qualify for a pension? So what exactly do Greece’s creditors want changed about the pension system? They haven’t gone into specifics in public. Olivier Blanchard, chief economist of the IMF, said in a blog post on Sunday that Greece needs to cut pension spending by 1% of GDP. Is that it? Would Greece’s creditors be satisfied if Athens hit that target by raising the denominator (GDP) rather than cutting the numerator?

Read more …

It’s good to deal with this in court, where people are under oath.

• SYRIZA MP Files Complaint Against Bank Of Greece Governor (KTG)

SYRIZA MP Rachil Makri took legal action against Bank of Greece Governor Yannis Stournaras, accusing the banking chief of “possible malice” as regards his monetary policy report on Wednesday. In the Monetary Policy report 2014-2015, the Bank of Greece warned of a likely Greek exit from the eurozone and even from the European Union in the event that the government fails to reach a deal with the country’s creditors. Makri, who lodged her legal suit with Supreme Court prosecutor Efterpi Koutzamani on Thursday, blamed the spike in withdrawals from Greek banks on Stournaras’s statements and suggested that he should resign.

She noted that previous central bank governors had expressed concerns to political party leaders in the past but in private, noting that Stournaras’s public warning came at a “critical point in the negotiations” between Greece and its lenders, while the BoG reports are been traditionally published either in October or in February. Speaking to reporters, Rachil Makri complained that the Bank of Greece report triggered insecurity among the citizens and stressed that “many horrified citizens call me and ask me what they should do with their money.” Before being appointed to the Bank of Greece, Yannis Stournaras had served as Finance Minister (July 2012 – June 2014) under New Democracy-PASOK government. He is considered a pro-austerity hardliner and he has been under frequent attack by the Greek left-wing – nationalist coalition government.

Read more …

“Keen quips that “the only people who should have joined the euro are the Germans.”

• Greece Faces A Eurozone Design Problem (City AM)

Greece’s economy is a shadow of its former self. It once had thriving investment banks which attracted cash from all over the world and invested it predominantly in the Balkans, helping countries there to thrive after the collapse of the Soviet Union. These operations are no longer. Its economy produces 30% less than it did it 2009 and is failing to grow. Every second person between the ages of 16 and 24 is out of a job, and the prospects for adults are not much better, with unemployment at 25%. Its government is close to bankruptcy, but to get more money its bailout monitors are pushing for further cuts to its minimum wage and pension reforms – anathema to the communist Syriza party’s values.

The Greeks also argue they have cut enough already. In 2012 they slashed monthly minimum wage from €877 to €684, a measly €8,200 a year. Many workers who work in the so-called black economy, where business is kept off the books, earn even less than that. Yet they acknowledge more work needs to be done. Reforms to inefficient public administration, oligopolistic product markets and the justice system areas are essential for success in other areas and should therefore be considered the top priority, according to researchers at London Business School. The Greek government has said it is prepared to do just that. But its biggest problem is its government debt. Nearly every economist agrees that Greece will be unable to repay, with interest, the huge debts that amount to 177% of GDP, more than double the UK’s.

Its finance minister, Yanis Varoufakis, has suggested linking the interest rates on its debt to growth, to ease the burden on Greece and ensure creditors get paid. His suggestion is relatively moderate. Debt restructuring is opposed by several Eurozone finance ministers. Steve Keen, a professor at London’s Kingston University and an old friend of Varoufakis, accuses the other ministers of ignoring economic reason and focusing on morality. He has a case. Greece has been accused of spending years covering up its level of debt, and would probably not have been allowed to join the Eurozone otherwise. But some argue that the price Greece has paid has been disproportionate compared with its crimes, due to the poor design of the currency bloc itself.

The Eurozone was not designed to handle banking crises, says Tim Congdon from the Institute for International Monetary Research. The complex system of a European Central Bank with national central banks lacked clarity on important roles such as who would be lender-of-last-resort. The lack of a robust crisis plan left European banks in a fragile state come 2012. For this reason, the Eurozone was only able to undertake a half-hearted attempt at restructuring Greece’s debt. Any restructure that would have truly benefited Greece would have been too costly to the fragile European banks that held its debt. Unable to properly restructure its debt, Greece had to face austerity, or look for transfers of cash from the rest of the Eurozone.

Read more …

He’s not given a choice.

• Tsipras Reaches Out To Putin For Help In Financial Crisis (Guardian)

Alexis Tsipras, the Greek prime minister, has made a broad overture to Russia as he seeks a way out of his country’s debt and currency impasse, telling Vladimir Putin that Greece wants new partners to help it out of the crisis. In a speech delivered in front of Putin in Russia, Tsipras said Moscow was one of Greece’s most important partners, and dismissed critics who wondered why he was in St Petersburg and not in Brussels trying to secure an urgent deal with European creditors. “As all of you are fully aware, we are at the moment at the centre of a storm, of a whirlpool, but we live near the sea so we’re not scared of storms. We are ready to go to new seas to reach new safe ports,” he added, in a subtle nod to his hosts.

Tsipras said the world’s economic centre of gravity had shifted and that there are “new emerging forces” such as the Bric countries and Putin’s new Eurasian union that are playing a more important economic role. “Russia is one of the most important partners for us,” said the Greek prime minister, ahead of formal talks with Putin. [..] “The EU should go back to its initial principles of solidarity, justice and social justice. Ensuring strict economic measures will lead us nowhere,” Tsipras said. “The so-called problem of Greece is the problem of the whole European Union.” “The question is whether the EU can once again be a social solidarity hub or it will continue to pursue the path that will lead to a dead-end,” he added.

Read more …

“The key point is that the European authorities and the IMF were wrong.” The key question then is: was that on purpose?

• The Eurozone’s Cover-Up over Greece (Simon Wren-Lewis)

It is pretty clear why the European authorities were so generous to Greece’s creditors. They were worried about contagion. The IMF agreed to this programme with only partial default, even though their staff were unable to vouch that the remaining Greek public debt was sustainable with high probability (IMF 2013, para 14). The key point is that the European authorities and the IMF were wrong. Contagion happened anyway, and was only brought to an end when the ECB agreed to implement OMT (i.e. to become a sovereign lender of last resort).This was a major error by policymakers – they ‘wasted’ huge amounts of money trying to stop something that happened anyway. If Eurozone governments had needlessly spent money on that scale elsewhere, their electorates would have questioned their competence.

This has not happened, because it has been so easy to cover-up this mistake. Politicians and the media repeat endlessly that the money has gone to bail out Greece, not Greece’s creditors. If the money is not coming back, it becomes the fault of Greek governments, or the Greek people. That various Greek governments, at least until recently, agreed to participate in this deception is lamentable, although they might respond that they were given little choice in the matter. (Some of a more cynical disposition might have wondered how many of the creditors were rich Greeks.)

The deception has now developed its own momentum. What should in essence be a cooperative venture to get Greece back on its feet as soon as possible has become a confrontation saga. If the story is that all this money has gone to Greece and they still need more, harsh conditions including further austerity must be imposed to justify further ‘generosity’. Among the Troika, hard liners can play to the gallery by appearing tough, perhaps believing that in the end they will be overruled by more sensible voices. The problem with this saga is similar to the problem with imposing further austerity – you harm the economy you are supposed to be helping. (Some see a more sinister explanation for what is currently going on, which is an attempt at regime change in Greece.)

That this is happening is perhaps not too surprising: politicians act like politicians often act. The really sad thing is that playing to the gallery seems to work: politicians using the nationalist card can deflect criticism that should be directed at them for their earlier mistakes. It happens all the time of course: see Putin and the Ukraine, or Scotland and the 2015 UK election. I wonder whether there will ever come a time when this cover-up strategy fails. Futile though it might be, I just ask those who might see this as an ungrateful nation always demanding more to realise they are being played.

Read more …

Nope. geez, have to agree with Krugman. What’s the world coming to?

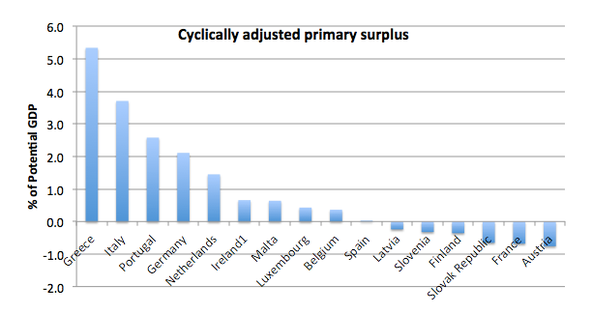

• Does Greece Need More Austerity? (Paul Krugman)

As many of us have noted, it’s hugely unfair when people claim that Greece has done nothing to adjust. On the contrary, it has imposed incredibly harsh austerity and substantial reforms on other fronts. Yet you might be tempted to argue that the results show that Greece hasn’t done enough — after all, last year it was running only a tiny primary budget surplus (that is, not counting interest), and this year it has slipped back into primary deficit. So more adjustment is needed, right? Well, step back for a minute and imagine that we weren’t talking about Greece but about the U.S. or the UK.

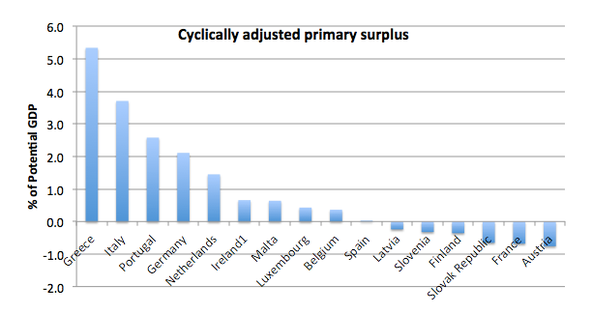

When we look at our budgets, we normally focus not on the headline budget balance but on the cyclically adjusted balance — an estimate of what it would be at more or less full employment. This helps avoid pressure to pursue procyclical policies that make the economy unstable, and also gives a better idea of the long-run sustainability of the position. And while cyclical adjustment can be controversial, there are standard estimates from third parties like the IMF and the OECD. So here’s a picture you probably haven’t seen: the IMF’s estimates of the cyclically adjusted primary balances of eurozone countries in 2014:

Greece is, by this measure, the most fiscally responsible, indeed crazily austere, nation in Europe. So why is it in fiscal crisis? Because the economy is deeply depressed. Suppose that there were a way to end this depression. Then Greece’s fiscal problems would melt away, with no need for further cuts. But is there any way to do that? The answer is, not as long as Greece remains in the euro. It can pursue reforms that might make it more competitive, but anyone promising dramatic, quick results has no idea what he is talking about.

On the other hand, Grexit would produce a rapid improvement in competitiveness, at the cost of possible financial chaos.This is not a route anyone has been willing to go down, but one does have to say that as the crisis worsens it becomes a more plausible outcome. The thing to understand, in any case, is that if Grexit does come, fiscal issues will immediately cease to be central to the story. Instead, it will all be about handling bank panic, managing the transition to a new currency, and possibly removing structural obstacles to increased exports (which would very much include tourism). In truth, this has never been a fiscal crisis at its root; it has always been a balance of payments crisis that manifests itself in part in budget problems, which have then been pushed onto the center of the stage by ideology.

Read more …

A bunch of nonsense from the man best known for saying ‘when things get serious, you have to lie’. At least he lives up to his word.

• ‘I Don’t Understand Tsipras,’ Juncker Tells German Weekly (AFP)

European Commission chief Jean-Claude Juncker voiced frustration with Greek Prime Minister Alexis Tsipras in a media report Friday amid the deepening debt crisis. “I don’t understand Tsipras,” Juncker told German news weekly Der Spiegel after he and Tsipras recently fell out a number of times. “The trust I placed in him has not always been reciprocated in kind.” Juncker said that instead of complaining about the Commission, Tsipras should tell the Greek voters that the EU executive body had offered the country an investment programme worth 35 billion euros ($39 billion) for the years 2015-20. “If I were the Greek prime minister I would claim that as a success,” Juncker told Spiegel according to an excerpt of an article to be published Saturday. “But I’m hearing nothing about it.”

Given the hardening positions, Juncker reportedly said he could no longer rule out a ‘Grexit’ – Greece leaving the eurozone. He said Athens had obviously misunderstood his role in seeking a compromise as “someone who can pull a rabbit out of the hat”, Juncker said. “But that is not the case. I repeatedly warned Mr Tsipras that he cannot rely on me to prevent a collapse of talks.” Greeces radical left Syriza government has rejected reforms demanded in exchange for the final tranche of its international bailout, which expires on June 30, the same day that a huge payment is due to the IMF. Former Luxembourg premier Juncker has been acting as a bridge to leftist leader Tsipras during the five-month crisis, but the pair have fallen out spectacularly on a number of occasions recently.

Read more …

A right wing UK MP who wonders what’s going on.

• In EU vs Greece, It Seems Democracy Itself is on Trial (John Redwood MP)

I am not a natural Syriza voter, but the words and deeds of the EU towards Greece are enough to provoke me to sympathise with the Greek people and their government over austerity. Greece has lost a quarter of its national income and output since 2007. That means, on average, a Greek citizen who was earning €10,000 in 2007 is today, after wage cuts, on €7,500. This is a crude average, so in practice many have suffered larger cuts as they have lost their jobs, or were on higher public sector pay, which has been cut more. The joint approach of the EU and the IMF is to cut public spending, reduce public sector wages and pensions, and cut the public sector workforce.

These IMF programmes to slim overgrown public sectors in problem countries are usually balanced by a devaluation of the currency to make private sector exporters more competitive and capable of winning extra work, and with a programme of suitable money relaxation to foster a general private sector-led recovery. Trapped in the euro, Greece can neither devalue nor increase the money in circulation. As the public sector sheds jobs and cuts pay, there is no offsetting increase in private sector jobs for people to move to. Greece has ended up with a quarter of its workforce out of work, and with more than half its young people unable to find a job. No wonder the Greek people elected a new party to government and swept away the traditional parties of centre-left and centre-right that had engineered this economic disaster with the EU.

I feel passionately that if an economic policy creates mass unemployment and crushes living standards it should be changed. I tried to get big changes to the UK’s banking policy prior to and during the crash of 2007-08 for that reason. I ask myself where are the voices from the left condemning Greek austerity, when this severe austerity offends my sense of justice and hope for the future? Why are so many on the left mesmerised by the EU that they think austerity in its name is fine? Worse still, where are the voices on the left who share my outrage that Greek democracy is overridden or ignored by the EU authorities? What part of the Greek condemnation of austerity policies did the EU not understand?

(John Redwood is the Conservative MP for Wokingham)

Read more …

PCR doesn’t pull any punches or mince any words. His view will not win any popularity contests. This is his address to the Conference on the European/Russian Crisis, held in Delphi, Greece, June 20-21, 2015

• Greece Is Another Victim Of Washington’s Empire (Paul Craig Roberts)

Is the left-wing more effective in Europe? Not that I can see. Look at Greece for example. The Greek people are driven into the ground by the EU, the IMF, the German and Dutch banks and the New York hedge funds. Yet, when presented with candidates who promise to resist the looting of Greece, the Greek voters give the candidates a mere 36% of the vote, enough to form a government, but not enough to have any clout with creditors. Having hamstrung their government with such low electoral support, the Greek people further impose impotence on their government by demanding to remain in the EU. If leaving the EU is not a realistic threat, the Greek government has no negotiating power.

Obviously, the Greek population is so throughly brainwashed about the necessity of being part of the EU that the population is willing to be economically dispossessed rather than to leave the EU. Thus Greeks have forfeited their sovereignty and independence. A country without its own money is not, and cannot be, an independent country. Once European intellectuals signed off on the EU, they committed nations to vassalage, both to the EU bureaucrats and to Washington. Consequently, European nations are not independent and cannot exercise an independent foreign policy. Their impotence means that Washington can drive them to war.

To fully understand the impotence of Europe look at France. The only leader in Europe worthy of the name is Marine Le Pen. Having said this, I am immediately denounced by the European left as a fascist, a racist, and so forth. This only shows the knee-jerk response of the European left. It is not I who shares Le Pen’s views on immigration. It is the French people. Le Pen’s party won the recent EU elections. What Le Pen stands for is French independence from the EU. The majority of French see themselves as French and want to remain French with their own laws and customs. Only Le Pen among European politicians has stated the obvious: “The Americans are taking us to war!”

Despite the French desire for independence, the French will elect Le Pen’s party to the EU but will not give it the vote to be the government of France. The French deny themselves their independence, because they are heavily conditioned by brainwashing, much coming from the left, and are ashamed to be racists, fascists, and whatever epithets have been assigned to Le Pen’s political party, a party that stands for the independence of France.

Read more …

IMF, EU, NATO: the dark side of the earth.

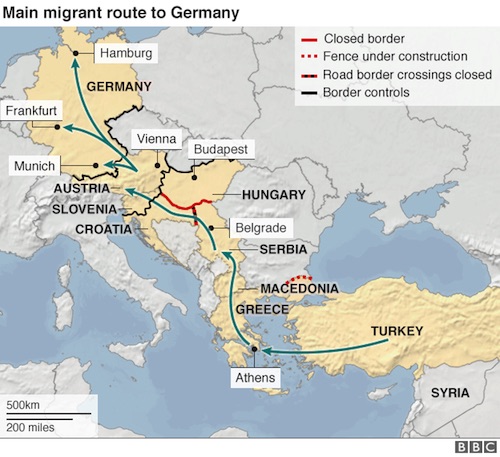

• NATO Sees Greek Exit From Euro As Security Risk (Bloomberg)

NATO is worried that a Greek exit from the euro area could pose a security risk to the alliance, deputy Secretary General Alexander Vershbow said. Russia, which is locked in a dispute with the North Atlantic Treaty Organization over the conflict in Ukraine, has made overtures to Greece as it wrangles over its future in the common currency with its international creditors. Russia boosted ties with Greece on Friday with a preliminary deal to build natural-gas pipelines through the Mediterranean state. “It does indeed have repercussions for” NATO, Vershbow told a security conference in Bratislava, the Slovak capital. “So we are worried about it.”

Russian President Vladimir Putin is wooing Greece and its neighbor Turkey with pledges to make them energy centers for southern Europe if it builds the proposed Black Sea gas link. Other countries Russia has approached include European Union candidate Serbia and aspirant Former Yugoslav Republic of Macedonia (FYROM), where Russian Foreign Minister Sergei Lavrov said “outside forces” are trying to stoke ethnic tension to derail the project. NATO and EU leaders have accused Russia of undoing years of stability by redrawing Europe’s borders with its annexation of Crimea from Ukraine last year. They also accuse it of funneling troops, cash and weapons to support the separatist war in that country’s eastern regions, where more than 6,400 people have died. Russia denies involvement.

The Greek crisis could ignite greater instability in the Balkans, less than two decades after the wars that ravaged the region following the disintegration of Yugoslavia in the 1990s, according to Wolfgang Ischinger, a former German ambassador to the U.S. who now heads the annual security conference that takes place in Munich. “If Greece leaves, I’ll bet you that in Moscow, this will be seen as confirmation of the Russian theory that the European Union is in decline and about to fall apart,” he said. “The Balkans are still not a stable and peaceful place. We need the stabilizing capacity of the European Union from all sides. If Greece falls out of that it’d be terrible.”

Read more …

“..”the fallacy of economic planning”..”

• Ron Paul: Stock Market ‘Day Of Reckoning’ Is Near (CNBC)

Despite record highs in the market, former Rep. Ron Paul says the Fed’s easy money policies have left stocks and bonds are on the verge of a massive collapse. “I am utterly amazed at how the Federal Reserve can play havoc with the market,” Paul said on CNBC’s “Futures Now” referring to Thursday’s surge in stocks. The S&P 500 closed less than 1% off its all-time high. “I look at it as being very unstable.” In Paul’s eyes, “the fallacy of economic planning” has created such a “horrendous bubble” in the bond market that it’s only a matter of time before the bottom falls out. And when it does, it will lead to “stock market chaos.”

As far as when the bubble will burst, the former Republican presidential candidate said, “I don’t think there’s any way to know what the [timeline] is, but after 35 years of a gigantic bull market in bonds, [the Fed] cannot reverse history and they cannot print money forever.” Of course, Paul has been known to make similar calls in the past, but even as stocks continue to make new highs, he remains just as convicted as ever that there “will be a day of reckoning” that will lead to a collapse in both the fixed income and equity markets. “I think [the crash] is going to be much greater [than 10%] and it will probably go a lot lower than people say it should,” said Paul. “I don’t think it’s going to be just a correction.” Paul added, eventually investors will “lose confidence” in the Fed, and when they do, the market could witness a “very big crash.”

Read more …

If you want to be effective on climate, better take this hurdle first.

• The Latest Critic of Too-Big-To-Fail: Pope Francis (Moneybeat)

Move over, Sen. Elizabeth Warren—there’s a new high-profile critic of the world’s largest banks, and he has over a billion followers. Pope Francis dedicated a few lines of his 183-page encyclical on the environment on Thursday to the topic of the failures of banks and markets. In the Holy Father’s view, “[t]he lessons of the global financial crisis have not been assimilated” and the governments’ response to the crisis have only set up the financial system for a future panic:

Saving banks at any cost, making the public pay the price, foregoing a firm commitment to reviewing and reforming the entire system, only reaffirms the absolute power of a financial system, a power which has no future and will only give rise to new crises after a slow, costly and only apparent recovery. The financial crisis of 2007-08 provided an opportunity to develop a new economy, more attentive to ethical principles, and new ways of regulating speculative financial practices and virtual wealth. But the response to the crisis did not include rethinking the outdated criteria which continue to rule the world.

While praising business as a “noble vocation, directed to producing wealth and improving our world,” His Holiness called out the financial sector for having outsized influence over the political process and endorsed limiting its reach:

[E]conomic powers continue to justify the current global system where priority tends to be given to speculation and the pursuit of financial gain, which fail to take the context into account, let alone the effects on human dignity and the natural environment… To ensure economic freedom from which all can effectively benefit, restraints occasionally have to be imposed on those possessing greater resources and financial power.

The pope’s views may be backed by some recent research: On Wednesday the Organization for Economic Cooperation and Development said that curbing certain kinds of bank lending could ameliorate income inequality around the world and increase economic growth.

Read more …

Even with $60 billion a month QE, there’s no funding?!

• Europe’s Banks Head to Asia Amid $1 Trillion Capital Shortfall (Bloomberg)

European banks are heading to Asia for capital as new rules at home demand they sell more than $1 trillion of equity and subordinated debt to increase loss buffers. French and German lenders have sold the equivalent of $1.8 billion in notes that act as a cushion in case of insolvency this year, in denominations from the Chinese yuan to the Japanese yen. Before this year, they’d issued none. Dutch and Italian banks that began issuing in the region in 2012 have also stepped up activity. Financial institutions are turning to Asia, where there’s ample cash to buy large amounts of securities and pricing is attractive, after money managers in Europe gorged on about $266 billion of subordinated debt in either dollars or euros since 2008. The move East is poised to accelerate as banks still need to issue about four times that amount.

“In anticipation of higher capital issuance requirements it makes sense to diversify funding sources,” Alexandra MacMahon at Citigroup in London said. There’s much more of a focus on expanding the investor base, “something we hadn’t seen so strongly in a number of years,” she said. European banks have $447.2 billion of subordinated notes that will stop counting toward their capital buffers in coming years, according to Bloomberg-compiled data. Those securities may have to be replaced by new ones that comply with Basel III rules, which, in addition to other requirements under discussion, could bring the total amount to be issued to $1 trillion..

Read more …

“..she should just retire to the glue factory now and stop harassing people with her psychotic derivatives.”

• Max Keiser: JP Morgan’s Blythe Masters Is The Devil Incarnate (IBTimes)

Max Keiser, founder of VC fund Bitcoin Capital, seeding currency startcoin, and the presenter of the Keiser Report, does not mince his words. Bitcoin completely challenged the banking world leaving banks and card issuers to play catch up, and this has led to a divide in the community: some think that banks are going to basically end up controlling the space and others believe that they will not. Keiser told IBTimes UK in no uncertain terms that the most prominent force attempting to wrestle back a proprietary fiefdom for banks is the former global head of commodities at JP Morgan, Blythe Masters. Masters joined blockchain-focussed company Digital Asset Holdings in March of this year. She is by far the biggest fish from Wall Street to enter the space – something which mainstream media sources generally reported as a huge vote of confidence for cryptocurrencies.

Keiser sees it differently: “Yes, I can tell you the evil cult leader is Blythe Masters. Jamie Dimon has moved her running the credit default swap desk in London – something she invented, the credit default swap.” Masters designed an elegant way of providing credit protection bundled into packages and offered to the market. It was a derivative born out of necessity following the Exxon Valdez oil spill (JPM offered Exxon a generous line in credit). Unfortunately, the modern credit default swap which she devised, rotted the financial system from within and caused its total collapse. Interestingly, her former husband Daniel Masters also moved into bitcoin trading, launching “the first fully regulated bitcoin hedgefund” in the off-shore haven of Jersey, called Global Advisors Bitcoin Investment Fund—or GABI for short.

Since 2008, Blythe Masters has spoken of her personal commitment to making markets safer. Working in the bitcoin space could be seen as a chance to achieve this goal and alter her legacy. But Keiser doesn’t see it this way: “They are there to try and figure out bitcoin – as Jamie Dimon said, ‘it could eat our lunch’ – so he put his top lieutenant Blythe Masters in charge of finding out what this is all about, now they are frantically trying to figure out what to do with this challenger. “Jamie Dimon made a billion dollars because of Blythe Masters skimming the global economy a penny at a time for 20 years. Now she has moved over to the crypto space. “The woman is the devil incarnate,” said Keiser.

Read more …

On our daily menu.

• Putin Straight Talk vs Obama Double Talk (Stephen Lendman)

“Russia does not claim some sort of hegemony. Russia does not claim some kind of ephemeral superpower status. We want relations based on equality with all members of the international community.”

Russia will go all-out to defend its interests, Putin explained. It’s not about to roll over and obey US diktats – nor should it or any other nation. After the Soviet Union’s dissolution, Washington began aggressively expanding east using enlarged NATO as a dagger targeting Russia’s heartland. “I’m completely convinced that after the so-called bipolar system ceased to exist, after the Soviet Union disappeared off the political map, several of our partners in the West, including the United States first and foremost, fell into euphoria and instead of setting up good neighborly and partner relations, they began grabbing geopolitical space as they saw fit,” said Putin. Confrontation substituted for normalized relations. Nothing in prospect suggests change.

“We are not the root cause of crisis in Ukraine,” Putin explained. Europe “shouldn’t have supported Washington’s anti-state and anti-constitutional coup, the armed seizure of power that eventually ignited a tough confrontation and de facto civil war in that country.” Multi-world polarity is the new way of things Putin stresses often. Instead of accepting it and building good relations, US-dominated NATO expanded east in violation of what Washington pledged not to do. “Quite possibly, some of our partners might have gotten an illusion that a global center like the Soviet Union had existed in the postwar world order and now that it was gone, vacuum appeared and it was to be filled urgently,” Putin said. “I actually think that’s an erroneous approach to the solution of the problem.”

Read more …

Old news.

• The Shale Industry Could Be Swallowed Whole By Its Own Debt (Bloomberg)

The debt that fueled the U.S. shale boom now threatens to be its undoing. Drillers are devoting more revenue than ever to interest payments. In one example, Continental Resources Inc., the company credited with making North Dakota’s Bakken Shale one of the biggest oil-producing regions in the world, spent almost as much as Exxon Mobil, a company 20 times its size. The burden is becoming heavier after oil prices fell 43% in the past year. Interest payments are eating up more than 10% of revenue for 27 of the 62 drillers in the Bloomberg Intelligence North America Independent Exploration and Production Index, up from a dozen a year ago. Drillers’ debt ballooned to $235 billion at the end of the first quarter, a 16% increase in the past year, even as revenue shrank.

“The question is, how long do they have that they can get away with this,” said Thomas Watters, an oil and gas credit analyst at Standard & Poor’s in New York. The companies with the lowest credit ratings “are in survival mode,” he said. The problem for shale drillers is that they’ve consistently spent money faster than they’ve made it, even when oil was $100 a barrel. The companies in the Bloomberg index spent $4.15 for every dollar earned selling oil and gas in the first quarter, up from $2.25 a year earlier, while pushing U.S. oil production to the highest in more than 30 years. “There’s a liquidity issue, and you start looking at the cash burn,” Watters said.

Continental borrows at cheaper rates than many of its smaller peers because its debt is investment grade. S&P assigns speculative, or junk, ratings to 45 out of the 62 companies in the Bloomberg index. “Our cash flow easily covers interest costs, and we expect to continue maintaining our investment-grade credit rating as commodity prices recover,” said Warren Henry, a spokesman for Oklahoma City-based Continental. Almost $20 billion in bonds issued by the 62 companies are trading at distressed levels, with yields more than 10%age points above U.S. Treasuries, as investors demand much higher rates to compensate for the risk that obligations won’t be repaid, data compiled by Bloomberg show. “Credit markets have played a big role in keeping the entire sector alive,” said Amrita Sen at Energy Aspects in London.

Read more …