Albert Freeman Effect of gasoline shortage in Washington, DC 1942

While I tend to largely agree with this, I also think what makes these discussions obsolete is that I haven’t seen a single person talk about the possibility that EU will not survive as is, or the single market, and what that would in turn mean for Brexit. Not a single one. Meanwhile, Britain has declared mudslinging its new national sport, and that will continue to make predicting anything at all very hard.

• Why Theresa May Is Right To Take A Huge Gamble On Hard Brexit (MW)

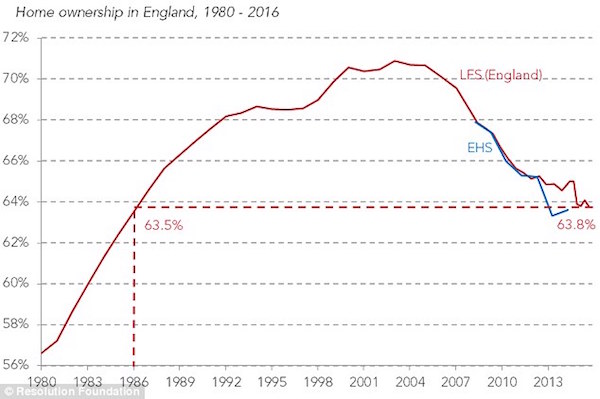

First, there is very little evidence that membership of the Single Market is worth the costs. Every country in the world has access to the single market, under WTO Rules, although occasionally subject to some very minor tariffs. What you lose by leaving is any voice in how the rules of that market are set, and the hassle and paperwork involved in exporting. How much that is really worth, it is hard to judge. What we do know is that ever since the single market was launched in 1992, the EU has been one of the slowest-growing regions in the world, and that trade between its member states has started to decline. If it is so important to an economy, that is, to put it mildly, a bit odd. The only honest position is to say we have absolutely no idea what difference it will make. No country has left the single market before. But given the obligations that come with it — especially open borders and budget contributions — it may well not be worth much.

Second, it strengthens the U.K.’s negotiating position. If Britain goes into the haggling over the terms of departure saying it has decided to leave the single market, and that there is nothing it really wants from Brussels, then suddenly the conversation changes. After all, there are two things the EU wants from the U.K.: the net budget contribution, which accounts for 7% of its total spending, and access to our market, given that the U.K. runs a massive trade deficit with Europe. The EU doesn’t have to have either — it will get by OK without them. But they are helpful. If the U.K. can offer both, while asking for virtually nothing in return, it is more likely to get what it genuinely wants — which is mainly free access to Europe for its financial sector.

Finally, the politics look right. The Conservative Party has remarkably and quickly reassembled itself as the Brexit Party. That might be the right or the wrong decision, but it is where the majority of the country is right now. After all, Leave won the referendum despite fierce warnings of catastrophe from the rest of the world. Of its opponents, the Liberal Democrats want to go back in, and Labour is hopelessly undecided. If Brexit is a reasonable success — and that simply means it regains control of its borders, and the economy keeps expanding even if it is at a lower rate than before — then the Tories will be rewarded with power for a generation. That makes it a prize worth fighting for.

True, the risks are great. The potential disruption to the economy may be a lot worse than anyone yet realizes. The pound could collapse, inflation could soar, and joblessness start to rise. If any of that happens, May will go down as a catastrophic prime minister. But it is more likely she has called this right — and a hard Brexit will turn out to be best the best option available.

Question is, how much can teh US do as long as the USD is the reserve currency and so much global debt is denominated in it?

• Trump Is Waving Adios To The Longstanding ‘Strong Dollar Policy’ (MW)

The strong dollar policy—a mantra of Democratic and Republican administrations for more than two decades—may be headed for the scrap heap once Donald Trump is sworn in as president on Friday. Indeed, Trump sent the dollar skittering lower Tuesday after he told The Wall Street Journal that the U.S. currency was “too strong,” in part due to Chinese efforts to hold down the yuan. But while much is made of Trump’s questioning of the need for NATO or the lasting power of the EU, an administration-level push for a weaker currency would hardly be without precedent. It would, however, be an adjustment a generation of investors and traders who came of age in an era when the executive branch at least paid lip service to the notion that a strong dollar was a desirable aim.

The tide last shifted during the Clinton administration after Robert Rubin, the former Goldman Sachs chief, took over as Treasury secretary from Lloyd Bentsen in early 1995. Before that, Bentsen and U.S. Trade Representative Mickey Kantor had often used language that inadvertently—or not—tended to weaken the dollar. Bentsen got the ball rolling early in Clinton’s first term, calling for a stronger yen in a February 1993 appearance and shocking currency traders who duly bid up the Japanese currency. As recounted in a 2001 paper by economists Brad DeLong and Barry Eichengreen, Bentsen saw the stronger yen as potentially helpful in alleviating the U.S. trade deficit, while Kantor saw a weaker dollar providing leverage in trade talks. That may sound a bit familiar. Trump made the U.S. trade deficit a centerpiece of his campaign, using it to argue that it was proof the nation is getting its lunch eaten by competitors in a zero-sum world.

[..] Douglas Borthwick, managing director of Chapdelaine Foreign Exchange, argued in a note earlier this month that an incoming Trump administration, by throwing out the strong dollar policy, could use the currency as a linchpin in implementing its economic agenda: “With a removal of the Strong USD Policy, the US Dollar will weaken against its global counterparts. This will give the FED the ability to normalize US interest rates, as they can use the weaker USD and the resulting inflation as an excuse for raising rates. The FED will then be used by the Administration as a brake on US Dollar weakness. The weaker USD will also force other countries struggling to get their economies moving to rewrite trade agreements in a way that is more advantageous to the US. In other words, we will see a normalization of US Interest rates, and better negotiated trade deals. Both a win for the new Administration.”

Pilger’s not a fan of Obama. Good read.

• The Issue Is Not Trump, It’s Us (John Pilger)

One of the persistent strands in U.S. political life is a cultish extremism that approaches fascism. This was given expression and reinforced during the two terms of Barack Obama. “I believe in American exceptionalism with every fiber of my being,” said Obama, who expanded the United States’ favorite military pastime: bombing and death squads (“special operations”) as no other president has done since the Cold War. According to a Council on Foreign Relations survey, in 2016 alone Obama dropped 26,171 bombs. That is 72 bombs every day. He bombed the poorest people on earth, in Afghanistan, Libya, Yemen, Somalia, Syria, Iraq, Pakistan. Every Tuesday — reported the New York Times — he personally selected those who would be murdered by mostly hellfire missiles fired from drones.

Weddings, funerals, shepherds were attacked, along with those attempting to collect the body parts festooning the “terrorist target.” A leading Republican senator, Lindsey Graham, estimated, approvingly, that Obama’s drones killed 4,700 people. “Sometimes you hit innocent people and I hate that,” he said, “but we’ve taken out some very senior members of Al Qaeda.” Like the fascism of the 1930s, big lies are delivered with the precision of a metronome, thanks to an omnipresent media whose description now fits that of the Nuremberg prosecutor: “Before each major aggression, with some few exceptions based on expediency, they initiated a press campaign calculated to weaken their victims and to prepare the German people psychologically … In the propaganda system … it was the daily press and the radio that were the most important weapons.”

Assange doesn’t lie. But he may demand the US clarify its positions.

• Focus Turns To Julian Assange After US Decision To Free Chelsea Manning (G.)

The decision by the US president, Barack Obama, to commute the sentence of Chelsea Manning has brought fresh attention to the fate of Julian Assange. On Twitter last week, Assange’s anti-secrecy site WikiLeaks posted: “If Obama grants Manning clemency Assange will agree to US extradition despite clear unconstitutionality of DoJ [Department of Justice] case.” Obama’s move will test the promise. The president commuted Manning’s 35-year sentence, freeing her in May, nearly three decades early. In a statement on Tuesday, Assange said Manning should never have been convicted and described her as “a hero, whose bravery should have been applauded not condemned”. Assange went on to demand that the US government “immediately end its war on whistleblowers and publishers, such as WikiLeaks and myself”, but made no mention of the Twitter pledge.

His lawyer said he has been pressing the Justice Department for updates on an investigation concerning WikiLeaks. The transgender former intelligence analyst, born Bradley Manning, was convicted in August 2013 of espionage and other offences after admitting to leaking 700,000 sensitive military and diplomatic classified documents to WikiLeaks in 2010. Assange has been holed up for more than four years at the Ecuadorian embassy in London. He has refused to meet prosecutors in Sweden, where he remains wanted on an allegation of rape, fearing he would be extradited to the US to face espionage charges if he leaves the embassy. In a statement on Tuesday, a lawyer for Assange did not address whether Assange intended to come to the US.

“For many months, I have asked the DoJ to clarify Mr Assange’s status. I hope it will soon,” Assange’s lawyer, Barry Pollack, said in the statement. “The Department of Justice should not pursue any charges against Mr Assange based on his publication of truthful information and should close its criminal investigation of him immediately.” Another Assange lawyer, Melinda Taylor, said: “Julian’s US lawyers have repeatedly asked the Department of Justice to clarify Julian Assange’s status and would like them to do so now by announcing it is closing the investigation and pursuing no charges.”

Only right thing to do.

• Russia Extends Snowden’s Residency Permit ‘By A Couple Of Years’ (R.)

Former U.S. intelligence contractor Edward Snowden has been given leave to remain in Russia for another couple of years, a spokeswoman for the Russian foreign ministry said. “Snowden’s residency in Russia has just been extended by another couple of years,” the spokeswoman, Maria Zakharova, said in a post on Facebook.

He must be having so much fun with this. And he’s right: “This shows a significant level of degradation of the political elite in the West.”

• Putin Mocks Claims That Trump Was Spied On (AFP)

President Vladimir Putin cracked raunchy jokes on Tuesday as he poked fun at claims that Russian secret services filmed US President-elect Donald Trump with prostitutes. Showing he is familiar with the claims in the explosive dossier, Putin launched into a series of ribald jokes about prostitutes, riffing on Trump’s former role as owner of the Miss Universe beauty contest. The unsubstantiated dossier published by American media last week alleged that Russia had gathered compromising information on Trump, namely videos involving prostitutes at a luxury Moscow hotel, supposedly as a potential means for blackmail. In his first public comments on the claims, Putin rubbished the idea that Russian secret services would have spied on Trump during his 2013 visit to Moscow for the Miss Universe final, as alleged in the dossier.

“Trump when he came to Moscow… wasn’t any kind of political figure, we didn’t even know of his political ambitions,” Putin said, responding to a journalist’s question at a news conference. “Does anyone think that our special services chase every American billionaire? Of course not, it’s just completely ridiculous.” Putin also questioned why Trump would feel the need to hire prostitutes, given his opportunities to meet beautiful women at the Miss Universe contest. “He’s a grown-up for a start and secondly a man who spent his whole life organising beauty contests and meeting the most beautiful women in the world,” Putin said. “I can hardly imagine that he ran off to a hotel to meet our girls of ‘lowered social responsibility’,” said Putin, adding jokingly “although they are of course the best in the world. “I doubt Trump fell for that.”

Putin went on to compare those behind the dossier unfavourably with prostitutes. “The people who order falsifications of the kind that are now circulating against the US president-elect – they are worse than prostitutes, they don’t have any moral limits at all. “The fact that such methods are being used against the US president-elect is a unique case: nothing like this has happened before. “This shows a significant level of degradation of the political elite in the West.”

Xi ordered no market selloffs while he’s in Davos. Joke.

• PBOC Cash Injections Surge To Record $60 Billion Before Holidays (BBG)

China’s benchmark money-market rate surged the most in 19 months, with record central bank cash injections being overwhelmed by demand before the Lunar New Year holidays. The People’s Bank of China put in a net 410 billion yuan ($60 billion) through open-market operations on Wednesday, the biggest daily addition since Bloomberg began compiling the data in 2004. That brings the total injections so far this week to 845 billion yuan. The interbank seven-day repurchase rate jumped 17 basis points, the most since June 2015, to 2.58% as of 1:18 p.m. in Shanghai, according to weighted average prices. Demand for cash tends to increase before the Lunar New Year holidays, when households withdraw money to pay for gifts and get-togethers.

Month-end corporate tax payments are adding to the pressure this time, with the break running from Jan. 27 through Feb. 2. The PBOC offered 200 billion yuan of seven-day reverse repos and 260 billion yuan of 28-day contracts, compared with 50 billion yuan of loans maturing on Wednesday. “The PBOC aims to ensure that the liquidity situation remains adequate, while the 28-day reverse repo is apparently targeted at covering the holidays,” said Frances Cheung at Societe Generale. “There could also be preparation for any indirect tightening impact from potential outflows.” China’s central bank has been offering more 28-day reverse repos than one-week loans in the past two weeks, while curbing the injection of cheaper, short-term funds amid efforts to lower leverage in the financial system. It drained a net 595 billion yuan in the first week of January, before switching to a net injection of 100 billion yuan last week as the seasonal funding demand started to emerge.

The result of cash injections.

• China New Home Prices Rise 12.4% Y/Y In December (R.)

Average new home prices in China’s 70 major cities rose 12.4% in December from a year earlier, slowing slightly from a 12.6% increase in November, an official survey showed on Wednesday. Compared with a month earlier, home prices rose 0.3% nationwide, slowing from November’s 0.6%, according to Reuters calculations from data issued by the National Bureau of Statistics (NBS). Shenzhen, Shanghai and Beijing prices rose 23.5%, 26.5% and 25.9%, respectively, from a year earlier. Monthly growth in Shanghai and Shenzhen slowed but was unchanged in Beijing as local governments’ tightening measures took effect.

China relied heavily on a surging real estate market and government stimulus to help drive economic growth in 2016, but policymakers have grown concerned that the property frenzy will fuel price bubbles and risk a market crash, with serious consequences for the broader economy. Soaring home prices have prompted more than 20 Chinese cities to tighten lending requirements on house purchases, while regulators have told banks to strengthen their risk management on property loans.

Scapegoating. You pick one to make the rest look good in comparison. But this is endemic, in a variety of forms.

• Rustbelt China Province Admits It Faked Fiscal Data For Years (BBG)

The rust-belt province of Liaoning fabricated fiscal numbers from 2011 to 2014, local officials have said, raising fresh doubts about the accuracy of China’s economic data just days ahead of the release of the nation’s full-year growth report. City and county governments in the northwestern region committed fiscal data fraud in the period, Governor Chen Qiufa said at a meeting with provincial lawmakers Tuesday, according to state-run People’s Daily. Fiscal revenues were inflated by at least 20 percent, and some other economic data were also false, the paper said, without specifying categories. Chen said the data were made up because officials wanted to advance their careers. The fraud misled the central government’s judgment of Liaoning’s economic status, he said, citing a report from the National Audit Office in 2016.

With growth now moderating, officials have sought to improve the credibility of economic data as diffusing financial risks becomes a key policy consideration, along with keeping growth ticking along at a rapid clip. Ning Jizhe, head of the National Bureau of Statistics, has said China should prevent fake economic data and increase the quality of its statistics. Liaoning has seen an unprecedented purge of more than 500 deputies from its legislature. The deputies were implicated in vote buying and bribery in the first provincial-level case of its kind in the Communist Party’s almost seven-decade rule, according to the official Xinhua News Agency. Former provincial party chief Wang Min, who led Liaoning from 2009 until 2015, was earlier expelled following corruption allegations by China’s top anti-graft watchdog.

Wonderful pair of articles. Take your pick. Ambrose has one view, while…

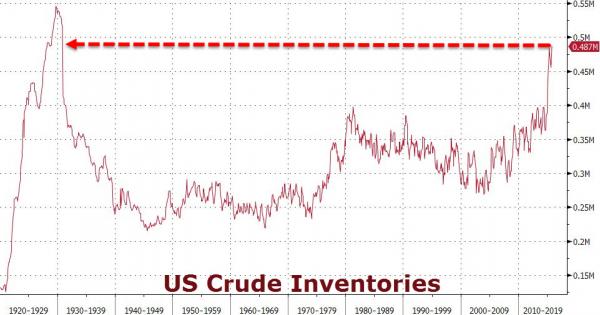

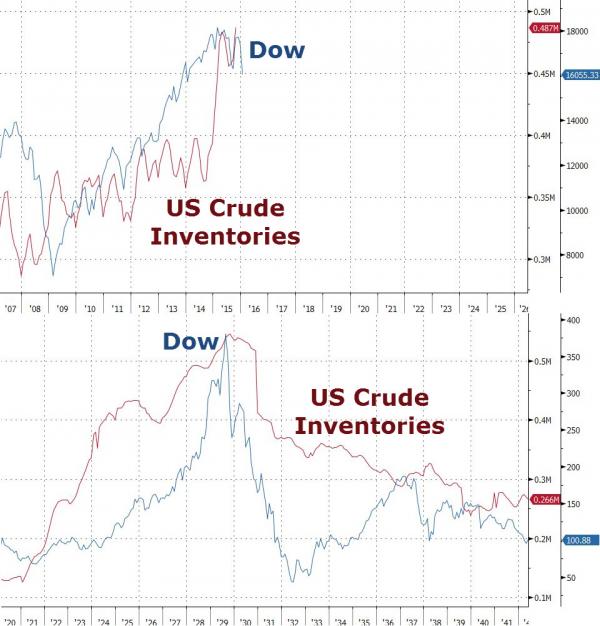

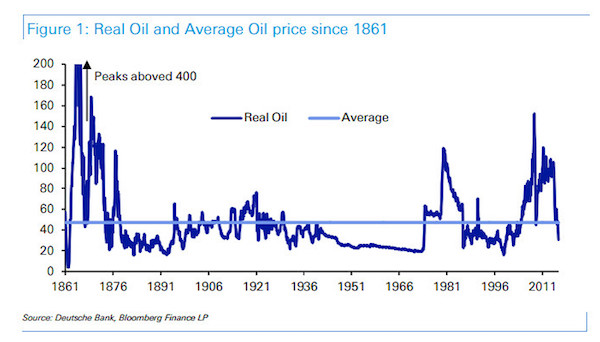

• Saudis Claim Victory Over US Shale Industry (AEP)

Saudi Arabia’s oil sheikhs insisted defiantly in Davos that they have defeated the challenge of the American shale industry and restored the balance to the global oil markets after two years of trauma and glut. The country’s energy minister Khalid Al-Falih said US oil frackers had survived only by tapping the most prolific wells and would face surging costs once again as recovery builds, while cannibalisation of their plant will prevent a rapid rebound in US output. “Their supply infrastructure has been decimated,” he said, speaking at the World Economic Forum. Mr Al-Falih admitted for the first time that Saudi Arabia’s decision to flood the world crude markets in 2014 and force a collapse in prices was essentially aimed at US shale frackers, a claim always denied in the past.

“If we had cut production and kept prices at three-digit levels, they would have kept adding one million barrels a day each year, for year after year. Saudi production would have been three million barrels day less in 2017 under that scenario. It was not sustainable,” he said. US drillers bridle at the suggestion that the Saudis won, insisting that they held Opec and Russia to a standstill, forcing them to capitulate last November with an agreement by 22 states to trim output by 1.2m barrels a day, and even that may not prove enough. “Opec engaged in a price war against US producers and they lost,” said Kenneth Hersh from Energy Capital. “This has brought the cost structure down for the whole world. There is no longer a cartel any more.”

Amin Nasser, head of Saudi Aramco, insisted that the job of knocking back shale is largely accomplished and that the market would rebalance by the first half of this year. The cycle is now switching to the opposite extreme. He warned that the world needs $1 trillion of fresh investment in oil projects each year just to keep up with growing demand, and the risk of “price spikes” later this decade is rising fast. The warning was echoed by Fatih Birol, head of the International Energy Agency, who fears a looming oil shortage after an unprecedented collapse in spending on exploration and development over the last two years. “Alarm bells will be ringing if there is no major new investment this year,” he said.

….MarketWatch has the exact opposite.

• Rising U.S. Shale-Oil Output Threatens OPEC’s Production Pact (MW)

The oil market got a stark reminder Tuesday that rising oil production in the U.S. could upend efforts by major producers to bring global supply and demand for crude back in to balance. Just ahead of the settlement for oil futures prices on the New York Mercantile Exchange on Tuesday, the Energy Information Administration released a report on drilling productivity—forecasting a monthly rise of 41,000 barrels a day in February oil production to 4.748 million barrels a day. “That is bearish for oil and a concern for OPEC,” said James Williams, energy economist at WTRG Economics, pointing out that the volume of new oil per rig has climbed because of gains in efficiency.

“If maintained, the expected February production gain means production from the shale plays will be up at least a half million barrels per day by the end of the year,” said Williams. Prices for February West Texas Intermediate crude lost the bulk of the day’s gain on Tuesday to settle with a modest 11-cent climb at $52.48 a barrel. “Since rigs are higher now than in December and should continue to increase, that means a half million [barrel-per-day] gain in production by year-end is a conservative estimate,” Williams said. “Most OPEC members expected this, but U.S. shale production will be the closest monitored data after OPEC’s own compliance with quotas,” he said.

Backroom dealmaking. Why the EU is on its way out.

• Italian Conservative Tajani Wins Race To Head European Parliament (R.)

Centre-right politician Antonio Tajani was elected the new president of the European Parliament on Tuesday after defeating his socialist rival, a fellow Italian, in a daylong series of votes. The new speaker, 63, a former EU commissioner and an ally of former premier Silvio Berlusconi, succeeds German Social Democrat Martin Schulz at a time of crisis for the European Union. Britain wants a divorce deal that needs the legislature’s blessing while old adversary Russia and old ally the United States both pose new threats to EU survivors holding together. Schulz’s tenure saw close cooperation with the centre-right head of the EU executive, Jean-Claude Juncker, but ended with recriminations over the end of a left-right grand coalition. That could spell trouble for the smooth passage of EU laws on a range of issues.

And the win for Tajani, who beat centre-left leader and fellow Italian Gianni Pittella by 351 votes to 282 in a fourth-round runoff, gives the right a lock on three pivotal EU political institutions. That has stirred some calls for change from either Juncker at the European Commission or Donald Tusk, who chairs the European Council of national leaders. However, there is no clear consensus for such changes. Tajani, mindful of the scars left by an unusually bruising battle over a post which can be a powerful influence on which EU rules are made, promised to be “a president for all of you”. His eventual victory came with backing from pro-EU liberals as well as from the ruling conservative parties of Britain and Poland, both of them sharply critical of the EU’s failings. They bristle at the EU impinging on national sovereignty and see it as bureaucratic and wasteful.

Not THE world, but THEIR world.

• The Bankers Who Fixed The World’s Most Important Number (G.)

By the time the market opened in London, Lehman’s demise was official. Hayes instant-messaged one of his trusted brokers in the City to tell him what direction he wanted Libor to move. Typically, he skipped any pleasantries. “Cash mate, really need it lower,” Hayes typed. “What’s the score?” The broker sent his assurances and, over the next few hours, followed a well-worn routine. Whenever one of the Libor-setting banks called and asked his opinion on what the benchmark would do, the broker said – incredibly, given the calamitous news – that the rate was likely to fall. Libor may have featured in hundreds of trillions of dollars of loans and derivatives, but this was how it was set: conversations among men who were, depending on the day, indifferent, optimistic or frightened.

When Hayes checked the official figures later that night, he saw to his relief that yen Libor had fallen. Hayes was not out of danger yet. Over the next three days, he barely left the office, surviving on three hours of sleep a night. As the market convulsed, his profit and loss jumped around from minus $20 million to plus $8 million in just hours, but Hayes had another ace up his sleeve. ICAP, the world’s biggest inter-dealer broker, sent out a “Libor prediction” email each day at around 7am to the individuals at the banks responsible for submitting Libor. Hayes messaged an insider at ICAP and instructed him to skew the predictions lower. Amid the chaos, Libor was the one thing Hayes believed he had some control over. He cranked his network to the max, offering his brokers extra payments for their cooperation and calling in favours at banks around the world.

By Thursday, 18 September, Hayes was exhausted. This was the moment he had been working towards all week. If Libor jumped today, all his puppeteering would have been for nothing. Libor moves in increments called basis points, equal to one one-hundredth of a percentage point, and every tick was worth roughly $750,000 to his bottom line. For the umpteenth time since Lehman faltered, Hayes reached out to his brokers in London. “I need you to keep it as low as possible, all right?” he told one of them in a message. “I’ll pay you, you know, $50,000, $100,000, whatever. Whatever you want, all right?” “All right,” the broker repeated. “I’m a man of my word,” Hayes said. “I know you are. No, that’s done, right, leave it to me,” the broker said.

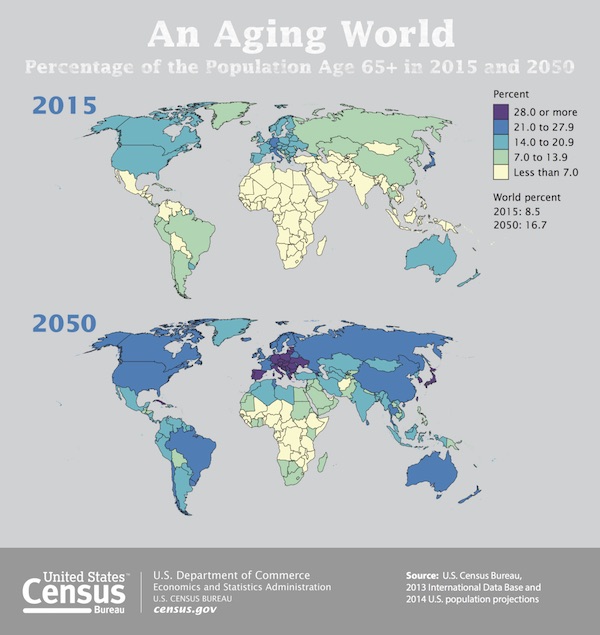

Yes, you should be scared. For your children.

• Percentage of World Population Age 65+ in 2015 and 2050 (BR)