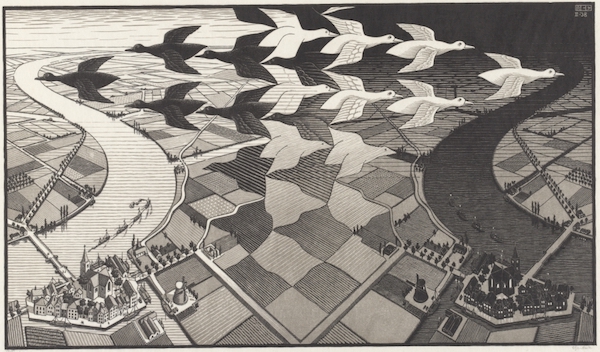

M. C. Escher� Day and Night �1938

This ain’t over.

• Collins, Manchin Vote “Yes”, Ensuring Kavanaugh Confirmation (ZH)

Court nominee Brett Kavanaugh now has the 50 votes required to be confirmed to the Supreme Court, after both GOP Sen. Susan Collins of Maine and Democrat Joe Manchin of West Virginia announced that they would be voting yes. GOP holdout Jeff Flake of Arizona also said that he would vote to confirm Kavanaugh “unless something big changed.” Earlier in the day, the Senate completed a cloture vote to advance Kavanaugh to final confirmation, which Manchin broke ranks and voted in favor of.

“Most senators sat at their desk as the dramatic roll call unfolded, with major suspense over where Murkowski, Manchin and Flake would land. Collins was the first swing vote to support Kavanaugh on the procedural roll call, quickly followed by Flake. Murkowski then inaudibly voted no, a jarring defection that left Republicans with no room for error. After it was clear that Kavanaugh had the 50 votes needed to advance, Manchin became Kavanaugh’s only Democratic supporter. Manchin, who left the chamber when the clerk called his name, came back into the chamber and voted in favor of Kavanaugh. His phone could be seen ringing and Manchin stared at it as the vote continued.” -Politico

“This is a difficult decision for everybody,” Flake said to reporters, who added that he thinks Kavanaugh will be confirmed on Saturday. Meanwhile, Sen. Steve Daines (R-MT) is set to fly to Montana to attend his daughter’s Saturday wedding. If the vote is too close without Daines, he will be forced to fly back to Washington D.C. to cast the deciding vote. “We’ll wait and see how this all unfolds,” Daines said. “We have transportation arranged and we’ll wait and see what happens.” He added that Rep. Greg Gianforte (R-MT) offered him the use of his private plane. President Trump has taken a largely hands-off approach to Kavanaugh’s confirmation – instead communicating in private with his political allies, such as Sen. Lindsey Graham (R-SC), according to Politico, which adds that the White House is “cautiously opimistic” that Kavanaugh will be confirmed.

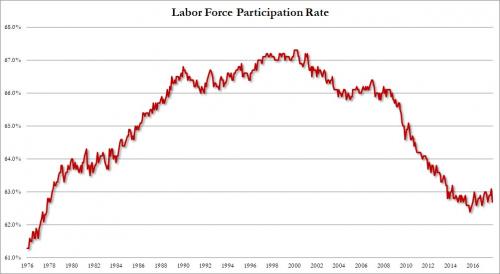

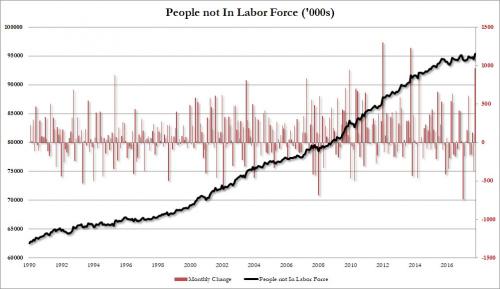

How many Americans have multiple jobs?

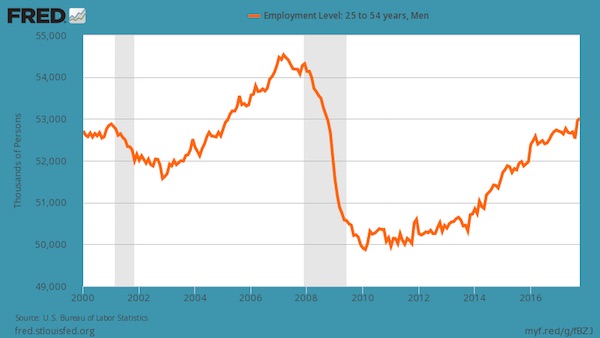

• US Unemployment Rate Falls To Lowest Level Since 1969 (G.)

US figures have shown the lowest jobless rate since the year of the first moon landings, keeping the world’s largest economy on course for further interest rate rises. Eagerly awaited figures for jobs and wages showed less inflationary pressure in the world’s biggest economy than had been feared, but still pointed to more hikes by the Federal Reserve. Financial markets had been braced for a sharp sell off had the latest monthly payroll numbers indicated faster employment growth and pay increases in September, which could have paved the way for faster-than-expected monetary tightening by the US central bank. As a result of the figures undershooting the most optimistic expectations, losses were smaller than feared in early trading in New York but all the major US markets ended down with the biggest losses on the tech heavy Nasdaq exchange.

Data from the Bureau for Labour Statistics (BLS) reported an increase in non-farm payrolls of 134,000 in September, well below the 180,000 predicted by Wall Street analysts. A 0.3% in pay left annual earnings 2.8% higher than a year earlier, a slightly weaker rate of increase than the 2.9% posted the previous month. Most economists said the jobs market remained strong, pointing to the drop in unemployment from 3.9% to 3.7% – its lowest since 1969 – and upward revisions to employment in July and August. Last month, the Fed raised short-term interest rates for the eighth time since 2015, to a range of 2%-2.25%, and indicated that there would be further increases “consistent with sustained expansion of economic activity”.

Don’t have a collusion to investigate?

• Mueller Moves For Forfeiture Order To Seize Manafort Assets (Hill)

Attorneys for special counsel Robert Mueller moved on Friday for an order to seize assets that former Trump campaign chairman Paul Manafort purchased with funds he hid from U.S. authorities in foreign bank accounts. Mueller’s attorneys submitted a court document as part of Manafort’s plea agreement asking Judge Amy Berman Jackson to grant a request to seize five properties in New York owned by Manafort as well as a life insurance policy and three bank accounts. Forfeiture of the assets identified as part of Manafort’s scheme to hide millions of dollars made lobbying for pro-Russia parties in Ukraine was agreed upon in a plea agreement Manafort signed with Mueller’s team last month.

Manafort signed the deal and agreed to cooperate with Mueller’s team to avoid a second trial in Washington, D.C., after a jury found him guilty on eight counts in a separate trial in northern Virginia in August. “[T]he defendant admitted to the forfeiture allegations in the Information and agreed that the following property constitutes or is derived from proceeds traceable to the offense alleged in Count One,” the court document states, while noting that two of the New York properties were substitutes for assets unable to be seized by the government.

“..the entire Russiagate investigation was a ginned up operation research/information warfare campaign..”

• Storm Clouds on Robert Mueller’s Horizon (LaRouche)

On October 3rd, the House Committees investigating the Department of Justice Russiagate insurrection against Donald Trump took testimony from behind closed doors from former FBI General Counsel James Baker, a close confidant of fired FBI Director James Comey. According to widespread leaks Thursday, October 4th, Baker’s testimony included the fact that he, Baker, met directly with Perkins, Coie, the lawyers for the DNC and Hillary Clinton, receiving directly materials which went into the FBI’s FISA warrant against Carter Page and characterized this process has “highly abnormal.” The Perkins, Coie, lawyer involved, Michael Sussman, is also the guy who orchestrated the fake information warfare story that the Russians hacked the DNC on behalf of Donald Trump.

Coming out of the testimony, one of the sources for the story spoke plainly: Baker’s testimony shows that the entire Russiagate investigation was a ginned up operation research/information warfare campaign, involving the FBI and Hillary’s Clinton’s campaign rather than any “conspiracy” involving the Trump Campaign and Russia. October 4th was the deadline for Andrew McCabe’s memos about meetings occurring in the wake of James Comey’s firing May, 2017, in which Deputy Attorney General Rod Rosenstein and others discussed wearing wires and recording the President and also invoking the 25th Amendment to remove the President.

In a discussion with Hill TV on Wednesday, Congressman Mark Meadows, who is leading this investigation, said that he has seen evidence that “confidential human sources” used by the FBI “actually taped members within the Trump campaign.” “There is strong suggestions in that some of the text messages, emails, and so forth who was involved, that extraordinary measures were used to surveil,” Meadows said. There is now a major national outcry for the President to declassify all of the relevant documents concerning Russiagate. Speculation on his failure, thus far, to do so, centers on both the Kavanaugh nomination fight and forcing his hand on Rosenstein before the Midterm elections.

Looking for Blairite traitors.

• May Secretly Woos Labour MP’s To Back Her Brexit Deal (G.)

Theresa May has drawn up plans for a secret charm offensive aimed at persuading dozens of Labour MPs to back her Brexit deal even if it costs Jeremy Corbyn the chance to be prime minister, the Guardian has learned. Senior Conservatives say they have already been in private contact with a number of Labour MPs over a period of several months, making the case that the national interest in avoiding a no-deal outcome is more important than forcing a general election by defeating the government on May’s Brexit deal. Now, with talks in Brussels entering their frantic final phase, the prime minister and her party whips are stepping up efforts to win backing for a compromise deal that one minister described as a “British blancmange”.

They are convinced they will need Labour votes to win, after a fractious Tory conference in Birmingham, at which determined opponents of the prime minister’s approach, including Jacob Rees-Mogg, won plaudits for saying they would vote against it. One Tory source compared the challenge of striking a deal with the EU27 that would satisfy both sides of his own party to “landing a jumbo jet on the penalty spot”. Labour MPs will thus be the focus of intense lobbying, in the period between May returning from Brussels with a Brexit deal and the meaningful vote, which is expected to come about a fortnight later.

If May gives enough, yes…

• Juncker: Brexit Deal Could Be Reached Within Weeks (Sky)

The president of the European Commission has said he is sure a Brexit agreement could be reached in November, if not sooner. Jean-Claude Juncker told three Austrian newspapers that Brexit without a deal “would not be good for the UK, as it is for the rest of the union”. He added: “I assume that we will reach agreement on the terms of the withdrawal agreement. “We also need to agree on a political statement that accompanies this withdrawal agreement – we are not that far yet.” He said: “I have reason to think that the rapprochement potential between both sides has increased in recent days, but it can not be foreseen whether we will finish in October. “If not, we’ll do it in November.”

Britain and the EU are trying to agree a divorce deal as well as one for a post-Brexit relationship in time for leaders’ summits scheduled for 17-18 October and 17-18 November. Mr Juncker insisted that the EU’s “will is unbroken to reach agreement” with Britain but spoke of his regret that the European Commission had not been involved in the 2016 referendum campaign. He said that the then-government of David Cameron had asked him “not to interfere”. “If the commission intervened, perhaps the right questions would have entered the debate,” he added. “Now you discover new problems almost daily, on both sides. “At that time it was already clear to us to what trials and tribulations this pitiful vote of the British would lead.”

They’re bloated.

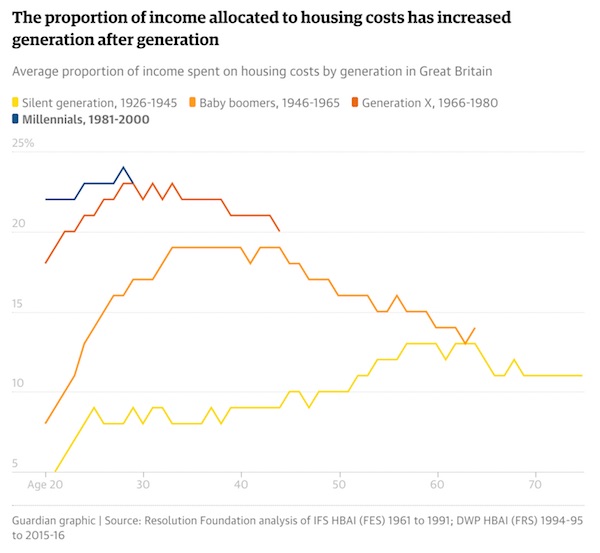

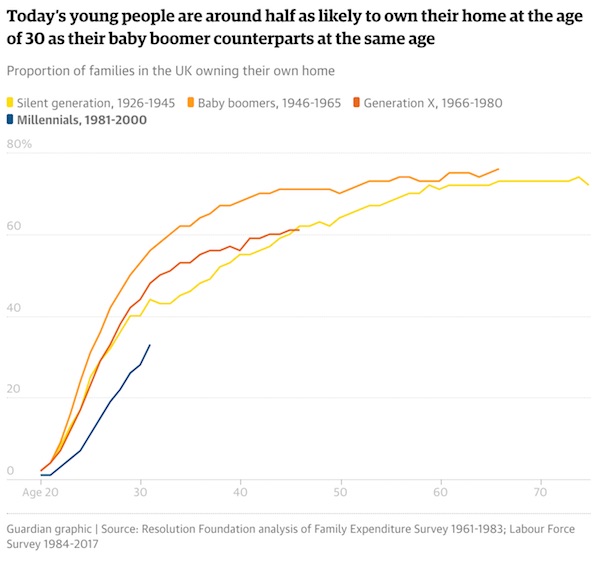

• UK House Prices Fall Sharply In September (G.)

UK house prices unexpectedly dropped at the fastest pace for almost six months in September, according to Halifax, as the number of homes for sale in 2018 fell to a decade low. Britain’s biggest mortgage lender said the average price of a home in Britain dropped to £225,995 last month, down 1.4% from the level recorded in August. The price of a home remained 2.5% higher than a year ago. City economists had forecast month-on-month growth of 0.2% in September. The latest snapshot of the housing market a little more than six months before Britain leaves the EU suggests sluggish levels of demand for home buying amid the political uncertainty of Brexit.

Economists said the national picture painted by Halifax obscured some regional differences. London house prices are falling for the first time since 2009, yet prices elsewhere are rising. They also cautioned that the Halifax house price index can be more changeable than other industry barometers of residential property because it is on a monthly basis. Earlier this week Theresa May announced the government would lift a cap on the amount councils can borrow to build housing, potentially helping to increase the number of homes built by local authorities.

“..I’ve never seen a political fiasco as demented as the Kavanaugh confirmation process..”

• Fishtailing into the Future (Jim Kunstler)

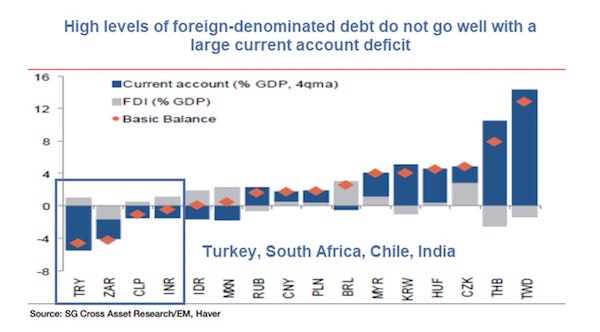

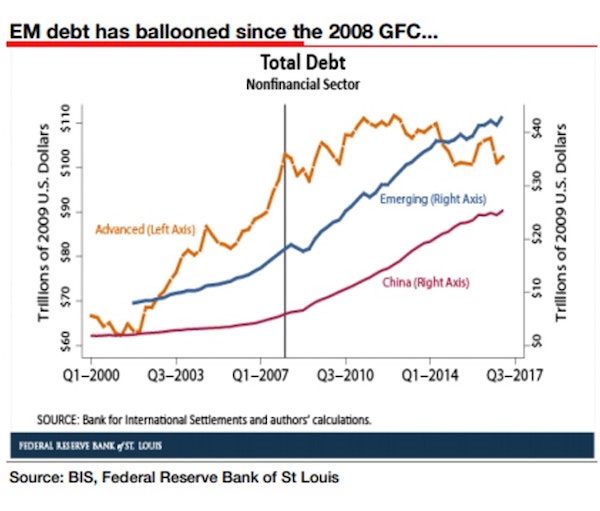

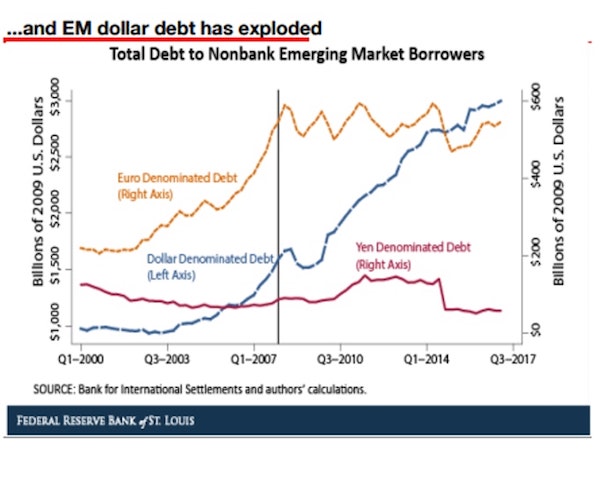

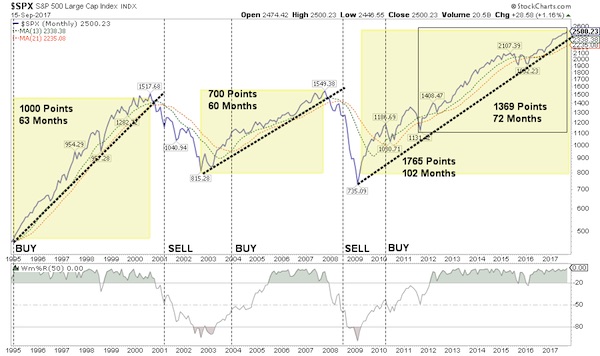

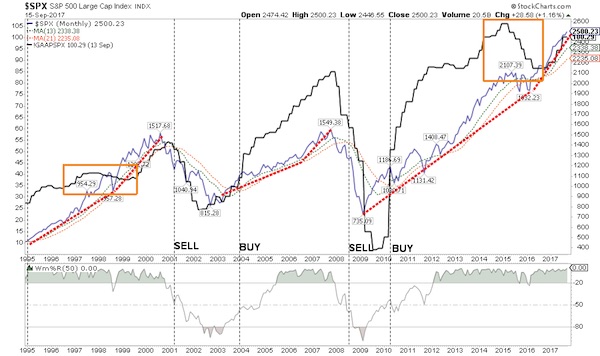

[..] at the macro level, this system and its subsystems are out-of-control and shaking themselves loose. Government has attempted to prop them up by schemes that amount to racketeering of one kind or another — the dishonest manipulation and representation of money — and now money itself is in revolt, as can be seen in the sudden rise of interest rates, especially the ten-year US Treasury Bond above 3.2 percent just before today’s market open

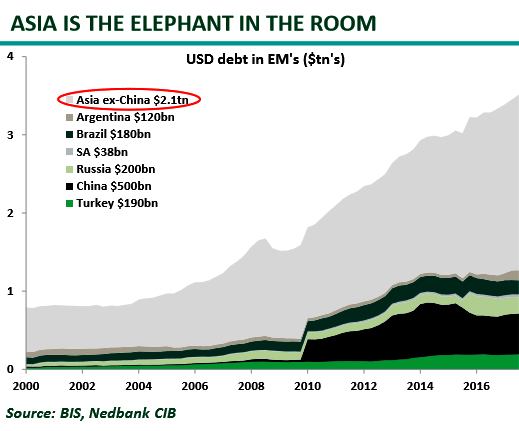

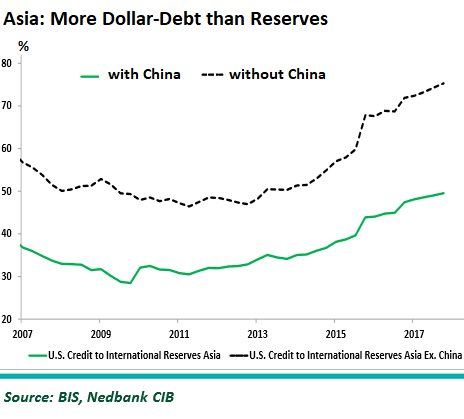

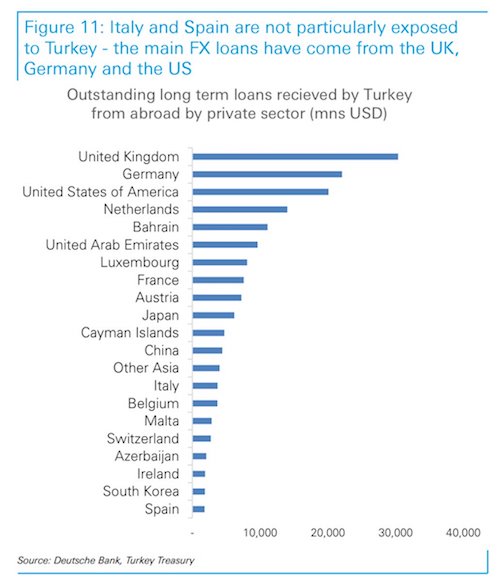

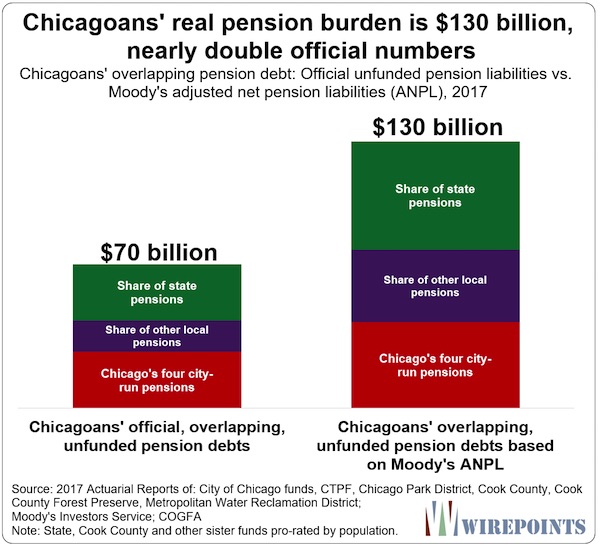

The US government can’t handle interest rates at this level, after decades of debt accumulation. Other nations can’t pay back their dollar-denominated loans either, and that has produced havoc at the so-called margins of the global economy — as currencies crash, and companies go under, and sovereign debt instruments melt down. You can be sure that this disorder will eventually spread from the margins to the center, which is the USA. It’s already up-and-running in our politics, which might be considered the early warning system of the larger picture. In my long life of three-score and ten, I’ve never seen a political fiasco as demented as the Kavanaugh confirmation process, with its harking back to Medieval social hysterias and stunning exercises in bad faith.

This riveting horror show has also distracted the nation — and a media fully invested in compounding the psychodrama — from the momentous tectonic movements in the world’s money system, now shaking apart. Among other things, it will blow up the fantasy that Mr. Trump has magically orchestrated a new miracle economy. But it will also bring to an abrupt close the pornographic machinations of his adversaries in Swamptown. And then we will get on in earnest with the true business of the long emergency — making new arrangements, however difficult — to escape the deadly clutter of our own constructed hyper-complex hyper-reality.

The US will fight back.

• Russia Announces Plan To Disentangle Its Economy From US Dollar (RT)

The Russian Finance Ministry has announced a plan to wean the country of dollar dependence. It is expected to be a long and painful process. RT has asked analysts to explain how this could be done. According to the plan published this week, Russia seeks to de-dollarize the economy by 2024. The program is long and complicated, but its key point is that Russian exporters who use rubles instead of dollars would get huge taxation benefits including quicker VAT returns and other stimulus to ditch the greenback. But there are also other ways to strengthen the role of the ruble in Russia.

“It is necessary to gradually switch to such a system of international payments, which implies payment in rubles for Russia’s best and most popular goods on the world market like oil, gas and arms exclusively,” Andrey Perekalsky, analyst at insurance brokerage FinIst, told RT. Russia should also unite with China and the European Union in creating a payment channel that can’t be controlled by the United States. The alternative to the SWIFT interbank settlement network that could bypass Iranian sanctions could be seen as a first step in that direction, the analyst notes. Petr Pushkarev, chief analyst at TeleTrade, says that Russia with its almost $500 billion in foreign reserves, could keep the ruble stable despite US sanctions pressure. The current period of high oil prices could also help.

However, Russia should diversify not only into rubles, but also use the Chinese yuan, Vietnamese dong, Indian rupee, and even the euro, the analyst says. “The euro shouldn’t be feared. The dollar is pretty much overvalued against the euro; the IMF forecasts a gradual devaluation of the dollar by 10-15 percent,” Pushkarev said. “American policy is disliked not only in Russia. EU officials have already openly announced that they are starting to create their own system of settlements with Iran, in which transactions will not be transparent to the US authorities and therefore will not be subject to sanctions,” he added.

Funny.

• Banksy Artwork Shreds Itself After £1m Sale At Sotheby’s (BBC)

A stencil spray painting by elusive artist Banksy shredded itself after it was sold for more than £1m. Girl With Balloon, one of Banksy’s most widely recognised works, was auctioned by Sotheby’s in London. The framed piece shows a girl reaching towards a heart-shaped balloon and was the final work sold at the auction. However, in a twist to be expected from street art’s most subversive character, the canvas suddenly passed through a shredder installed in the frame. Posting a picture of the moment on Instagram, Banksy wrote: “Going, going, gone…”

The 2006 piece was shown dangling in pieces from the bottom of the frame, after it sold for £1.042m on Friday night. “It appears we just got Banksy-ed,” said Alex Branczik, Sotheby’s senior director and head of contemporary art in Europe. Banksy is a Bristol-born artist whose true identity – despite rampant speculation – has never been officially revealed. He came to prominence through a series of graffiti pieces that appeared on buildings across the country, marked by deeply satirical undertones. Friday’s self-destruction was the latest in a long history of anti-establishment statements by the street artist.