‘Daly’ Somewhere in the South, possibly Miami 1941

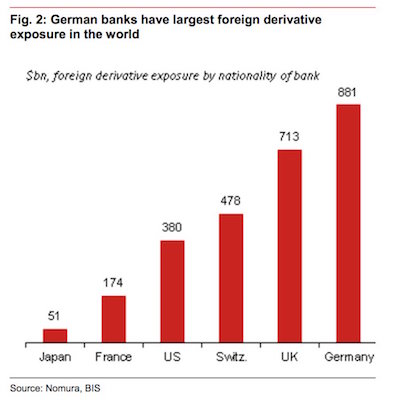

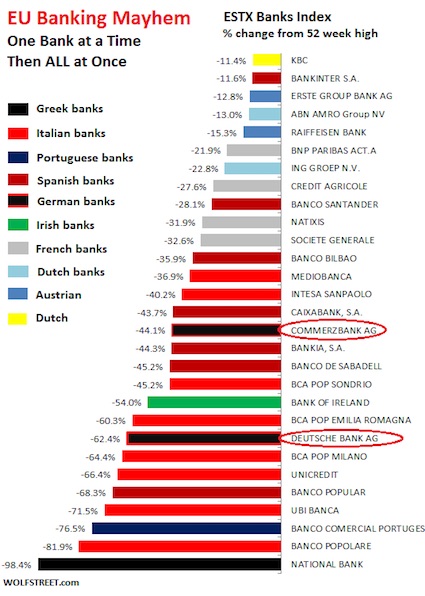

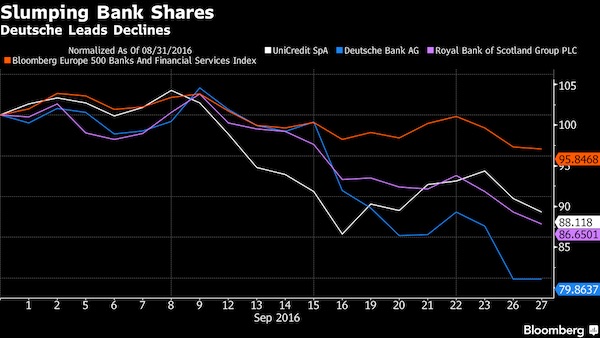

“A large part of the European banking sector would be on the brink of collapse and no stress test could anticipate the magnitude of that kind of credit risk..”

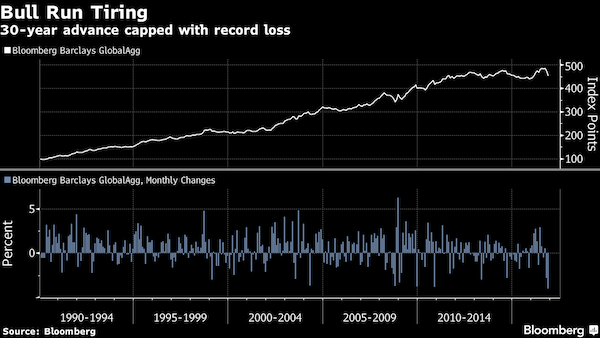

• The ECB Is Creating A World Of Zombie Banks And Zombie Companies (HandBl.)

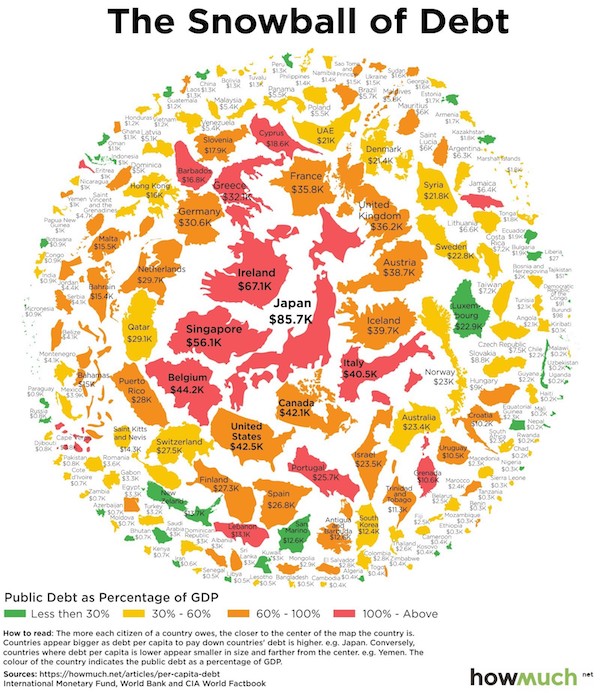

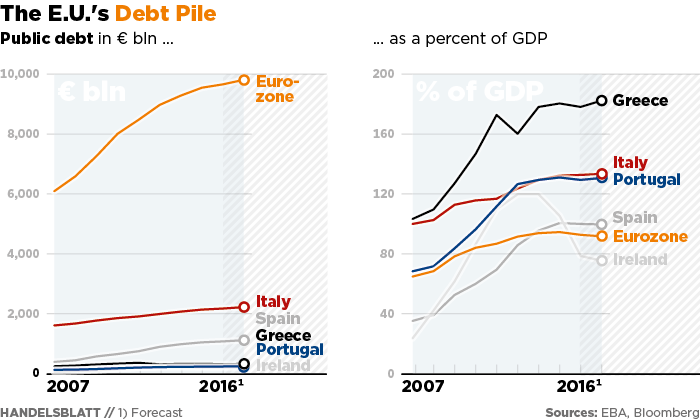

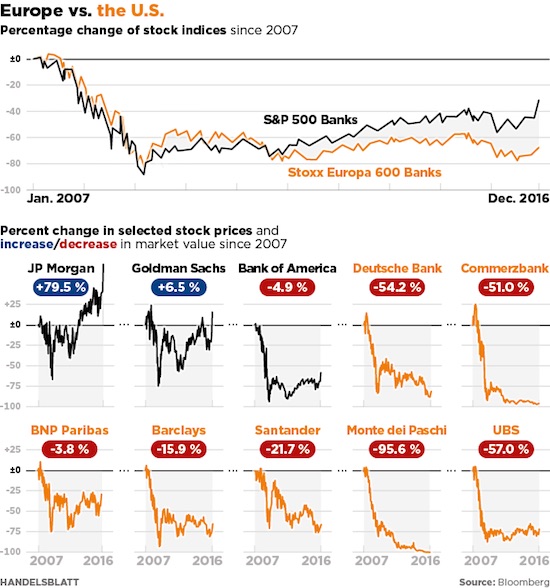

Next year could turn out to be a make-or-break year for Europe. But unlike in 2008, neither the governments nor the central banks have sufficient means to deal with another crisis. And it’s not entirely clear whether their intervention last time actually made things better or worse. Take Mr. Draghi, for instance. By lowering interest rates in the euro zone and buying up debt en masse, he has been trying to give the European economy a much needed shot in the arm. Yet despite all of his efforts, the specter of deflation still looms over the bloc, the future of the common currency is uncertain and lenders in southern Europe are still fighting for their existence. At the same time, the negative effects of Mr. Draghi’s policies are becoming more apparent. The STOXX Europe 600 index may have closed at its highest level in more than two months earlier this week, but it’s still 65% lower than where it was before the financial crisis.

The IMF has even said it feared a third of European banks wouldn’t be able to become profitable again even if the economy were to recover. The weird thing about the way the European economy has fared after the financial crisis is that even though businesses have been struggling, not a lot of them are going under. Insolvencies have been below the historical average. In Germany, for instance, the%age of companies declaring bankruptcy was the same right before the Lehman Brothers crash as it was in the 1990s – between 1.5 and 2%. Since the crisis began, that metric has fallen steadily. In 2015, the last full year for which data is available, it stood at 0.6%. Insolvency rates have even dropped in the euro zone’s weakest members along its southern periphery. Common sense would have one believe that the number of bankruptcies increases in times of crisis – especially during crises as protracted as financial ones.

“With its zero interest rate policy and the massive purchasing of bonds, the ECB is undermining the process of creative destruction, which is so important to a market economy,” said Markus Krall at Goetz Partners in Frankfurt. The ECB, for its part, was willing to do anything to prevent the economy from tanking. The central bank flooded the banks with money, and that deluge reduced companies’ capital costs to practically nothing. Even the most inefficient businesses can survive in that environment. Mr. Krall did the math on what it would mean for the balance sheets of European banks if insolvency rates had been at the historical average all along. He discovered that the €1 trillion in bad loans the ECB identified in its latest report would be closer to the tune of €2.5 trillion in that hypothetical scenario. “A large part of the European banking sector would be on the brink of collapse and no stress test could anticipate the magnitude of that kind of credit risk,” Mr. Krall said. “The ECB is creating a world of zombie banks and zombie companies,” he added.

1929, 1999, 2007.

• Stocks Have Only Been This Expensive During Times Of Crisis (BI)

Stocks are getting a bit pricey. All three major indexes break though their all-time highs on a seemingly daily basis, and this has pushed earnings multiples higher and higher. The current 12-month trailing price-to-earnings ratio of the S&P 500 sits at 25.95x, while the forward 12-month price-to-earnings is roughly 17.1x, according to FactSet data. Each of these is higher than its long-term average. In fact, based on one measure of valuation, the market hasn’t been this expensive anytime other than before a massive crash. The cyclical adjusted price-to-earnings ratio, better known as Shiller P/E, which adjusts the price-to-earnings ratio for cyclical factors such as inflation, stands at 27.86 as of Friday.

There have only been a few instances in history when stocks have been this expensive: just before the crash of 1929, the years leading up to the tech bubble and its bursting, and around the financial crisis of 2007-09. This does not necessarily mean that a crash is imminent — during the tech bubble, the Shiller P/E made it well into the 30s before coming back down. Additionally, there are some criticisms that Shiller P/E is generally more backward-looking since it adjusts for the cycle, so it may not be as accurate. Another caveat is that, during the three previous instances, investors have been incredibly bullish on stocks (there’s a reason Robert Shiller’s book is titled “Irrational Exuberance”) and most indicators of sentiment — from the American Association of Individual Investors to Bank of America Merrill Lynch’s sell-side sentiment indicator — are still depressed. Still, an elevated level for the Shiller P/E certainly isn’t going to make it any easier to sleep at night.

As the EU descends into chaos, some of these people are going to remember something about a gift horse’s mouth.

• UK Government Faces New Brexit Court Case (R.)

Opponents to Britain leaving the EU will launch a fresh legal action this week, which could further hamper Prime Minister Theresa May’s Brexit plans, The Sunday Times reported. The newspaper said campaigners will write to the UK government on Monday saying they are taking it to the High Court in an effort to keep Britain in the single market. It said the claimants will seek a judicial review in an attempt to give lawmakers a new power of veto over the terms on which Britain leaves the EU. They argue the government “has no mandate” to withdraw from the single market because it was not on the referendum ballot paper on June 23 and was not part of the ruling Conservative Party’s manifesto for the 2015 general election.

May has said she wants to invoke Article 50 of the EU’s Lisbon Treaty by the end of March, kicking off up to two years of exit negotiations. However the High Court ruled last month that Article 50 cannot be triggered without parliament’s assent. That ruling is being challenged by the government in Britain’s Supreme Court. The Sunday Times said the new court case hinges on whether the government would also have to trigger another legal measure — Article 127 of the European Economic Area agreement — in order to quit the single market. It said ministers argue Britain automatically exits the single market when it quits the EU. But, it said if the claimants win the new case, the government would have to gain the approval of lawmakers.

Sanity evaporates in the US. And it’s not Trump.

• Senate Quietly Passes “Countering Disinformation And Propaganda Act” (ZH)

While we wait to see if and when the Senate will pass (and president will sign) Bill “H.R. 6393, Intelligence Authorization Act for Fiscal Year 2017”, which was passed by the House at the end of November with an overwhelming majority and which seeks to crack down on websites suspected of conducting Russian propaganda and calling for the US government to “counter active measures by Russia to exert covert influence … carried out in coordination with, or at the behest of, political leaders or the security services of the Russian Federation and the role of the Russian Federation has been hidden or not acknowledged publicly,” another, perhaps even more dangerous and limiting to civil rights and freedom of speech bill passed on December 8.

Recall that as we reported in early June, “a bill to implement the U.S.’ very own de facto Ministry of Truth has been quietly introduced in Congress. As with any legislation attempting to dodge the public spotlight the Countering Foreign Propaganda and Disinformation Act of 2016 marks a further curtailment of press freedom and another avenue to stultify avenues of accurate information. Introduced by Congressmen Adam Kinzinger and Ted Lieu, H.R. 5181 seeks a “whole-government approach without the bureaucratic restrictions” to counter “foreign disinformation and manipulation,” which they believe threaten the world’s “security and stability.” Also called the Countering Information Warfare Act of 2016 (S. 2692), when introduced in March by Sen. Rob Portman, the legislation represents a dramatic return to Cold War-era government propaganda battles.

“These countries spend vast sums of money on advanced broadcast and digital media capabilities, targeted campaigns, funding of foreign political movements, and other efforts to influence key audiences and populations,” Portman explained, adding that while the U.S. spends a relatively small amount on its Voice of America, the Kremlin provides enormous funding for its news organization, RT.“Surprisingly,” Portman continued, “there is currently no single U.S. governmental agency or department charged with the national level development, integration and synchronization of whole-of-government strategies to counter foreign propaganda and disinformation.”

Long before the “fake news” meme became a daily topic of extensive conversation on wuch mainstream fake news portals as CNN and WaPo, H.R. 5181 would rask the Secretary of State with coordinating the Secretary of Defense, the Director of National Intelligence, and the Broadcasting Board of Governors to “establish a Center for Information Analysis and Response,” which will pinpoint sources of disinformation, analyze data, and — in true dystopic manner — ‘develop and disseminate’ “fact-based narratives” to counter effrontery propaganda.

I don’t really want to mention Krugman ever again, but maybe just this once…

• Does Krugman Really Support The Working Class? (Dean Baker)

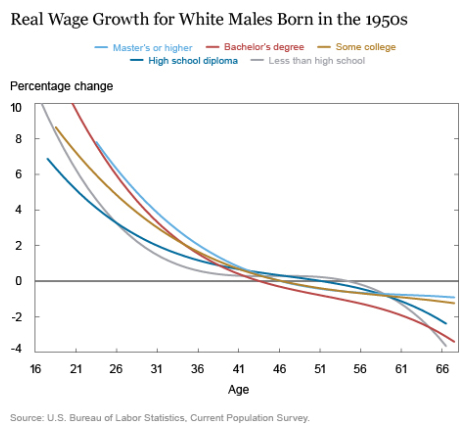

Paul Krugman told readers that intellectual types like him tend to vote for progressive taxes and other measures that benefit white working class people. This is only partly true. People with college and advanced degrees tend to be strong supporters of recent trade deals [I’m including China’s entry to the WTO] that have been a major factor in the loss of manufacturing jobs in the last quarter century, putting downward pressure on the pay of workers without college degrees. They also tend to support stronger and longer patent and copyright protections (partly in trade deals), which also redistribute income upward. (We will pay $430 billion for prescription drugs this year, which would cost 10-20% of this amount in a free market. The difference is equal to roughly five times annual spending on food stamps.)

Educated people also tended to support the deregulation of the financial sector, which has led to some of the largest fortunes in the country. They also overwhelmingly supported the 2008 bailout which threw a lifeline to the Wall Street banks at a time when the market was going to condemn them to the dustbin of history. (Sorry, the second Great Depression story as the alternative is nonsense — that would have required a decade of stupid policy, nothing about the financial collapse itself would have entailed a second Great Depression.)

His crew has also been at best lukewarm on defending unions. However they don’t seem to like free trade in professional services that would, for example, allow more foreign doctors to practice in the United States, bringing their pay in line with doctors in Europe and Canada. The lower pay for doctors alone could save us close to $100 billion a year in health care expenses.

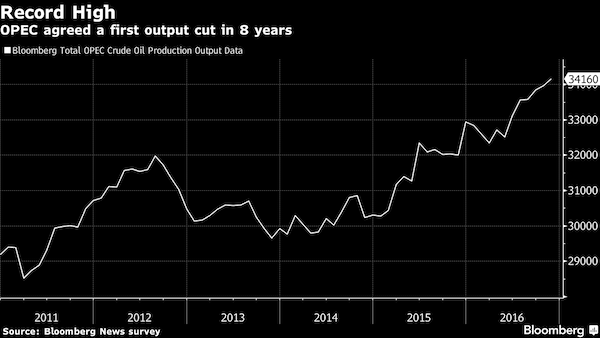

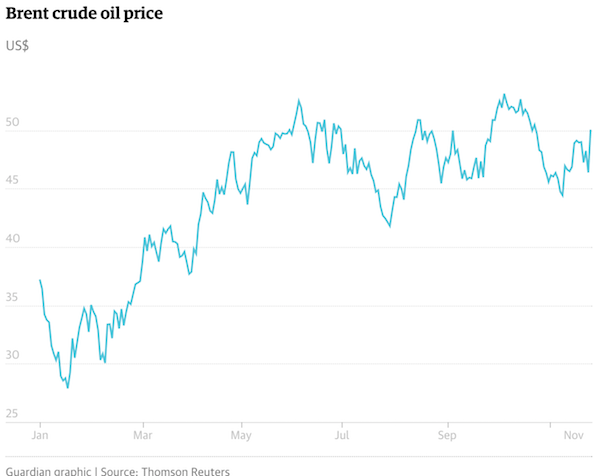

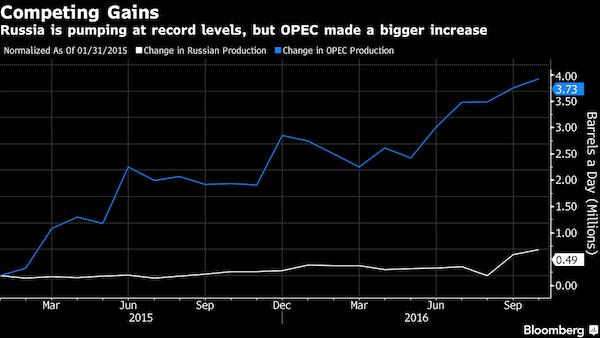

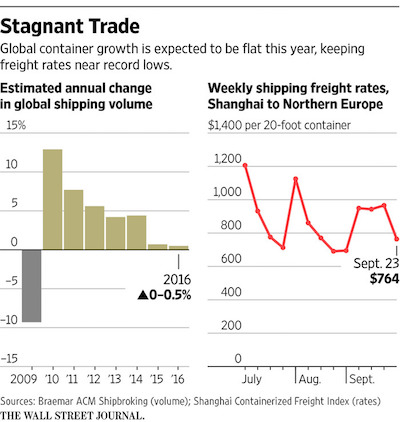

OPEC members cheat. What do you think non-members will do? Still, prices can remain ‘high-ish’ until we find out.

• Non-OPEC Oil States Agree To Cuts In ‘Historic’ Deal (AFP)

11 countries agreed on Saturday to cut their oil output, teaming up with the OPEC cartel in an exceptional bid to end the world’s glut of crude and reverse a dramatic fall in income. Russia and 10 other non-OPEC states will reduce their production by more than half a million barrels per day (bpd), OPEC announced. The deal will take effect from the start of 2017 and last for six months, though it may be extended depending on market conditions. “I am happy to announce that a historic agreement has been reached,” said Qatar’s Energy Minister Mohammed Bin Saleh Al-Sada, whose country holds the rotating presidency of the OPEC. The cut will contribute to OPEC’s own initiative to ease a saturated market and end a price slump that has brutally affected the economies of many oil producers.

On November 30 its members announced a slash in output by 1.2 million barrels per day (bpd) beginning in January, to 32.5 million bpd. Under that deal, OPEC called on non-member producer states to lower their output by 600,000 bpd. Saturday’s deal approves cuts totalling 558,000 bpd. Russia had already signalled it would provide half of that production cut in the first half of 2017. Among the other countries that will contribute cuts Kazakhstan agreed to reduce production by 20,000 bpd, Mexico 100,000 bpd, Oman 40,000 bpd and Azerbaijan 35,000 bpd, according to Bloomberg. The deal also includes Malaysia, Bahrain, Equatorial Guinea, Sudan, South Sudan and Brunei.

Québec is powered by hydro. All this is just for export to the US. Turn ‘La Belle Province’ into a moonscape. It’s up to the First Nations again to stop the mess. You still like Justin?

• Quebec Paves Way For More Oil And Gas Exploration (BBG)

Quebec’s legislature passed a bill that will pave the way for more oil and gas exploration, providing a boost to drillers such as Junex Inc. while drawing criticism from environmental, aboriginal and citizen groups. Bill 106 passed Quebec’s National Assembly in a 62-38 vote early Saturday after an overnight debate ahead of the holiday break. The legislation is meant to implement Quebec’s clean energy plan but also contains provisions allowing for energy exploration, potentially including fracking. “Quebec’s government just voted down an amendment to ban fracking in a triumph of science over ‘leave it in the ground’ lunacy,” Calgary-based Questerre Energy tweeted early Saturday morning. Shares of companies that hold exploration rights, including Questerre and Junex, based in Quebec City, surged last week as passage of the legislation looked likely.

Questerre holds about 1 million acres and has drilled test wells in the Utica shale formation along the St. Lawrence River, according to its website. Questerre’s shares rose the most in more than eight years on Thursday and inched up again on Friday. Junex’s stock increased 30%, the most in almost two years. Bill 106 creates a new agency to promote Quebec’s transition to cleaner energy yet also lays out a framework for oil and gas development in the Canadian province. Environmental, aboriginal and citizen groups argued that the bill’s mandate is contradictory, that debate was rushed and that it should have included a moratorium on fracking as well as greater protection for landowners. [..] Bill 106 strips power from landowners who will be powerless to stop exploration by companies with drilling claims, Carole Dupuis at Regroupement vigilance hydrocarbures Quebec, said by phone.

That, in turn, will hurt property values, especially if exploration leads to fracking. “If there was not the fracking issue, the landowner issue would not be a problem. It’s an access issue,” she said. “What’s the value of your land if someone has been drilling one kilometer from you and you don’t know if your drinking water is safe?” [..] Bill 106 goes against aboriginal rights to self-determination and to establish the best use of their lands, Mi’gmaq Chief Darcy Gray said in an e-mail Saturday. “The bill also opens up our lands to exploration that we feel could have long-lasting, detrimental and irreparable damage,” he wrote “especially with regards to hydraulic fracturing and or other types of well stimulation.” “Why this would even be considered, or how it could be construed as a favorable initiative, is beyond me,” he said.

When will Modi’s support crash?

• Goa Goes Cashless: ‘Who Buys Fish With A Credit Card?’ (G.)

It’s 11 o’clock, and Laxman Chauhan still hasn’t sold any fish. His stall in the central market in the west Indian city of Panjim has been open for three hours, but none of his usual clients have come today. He checks his watch, and then takes a walk to see if other vendors have had any customers. “Sold anything yet?” he asks Ramila Pujjar, who has set her stall up with a glistening display of the morning’s catch. She hasn’t either. “I’m losing 2,000-3,000 rupees (£23-£35) a day,” says Chauhan. “I’m throwing fish away every day.” The low footfall at Panjim’s fish market is unusual; fish is a staple in Goan cuisine but, for the past month, since the prime minister, Narendra Modi, abolished the 500 and 1,000 rupee notes, business has suffered. “I’m losing money because of the government,” says Pujjar.

“The government only takes care of the rich, the poor will always be poor.” Modi’s surprise announcement wiped out 86% of the nation’s currency overnight, leaving the vendors at Panjim’s fish market to suffer heavy losses. “Nobody has cash, so they’re not buying fish.” Panjim is no different to the rest of India. Long queues wind around banks and ATMs in every city as people scramble to exchange their high-value banknotes. The cash crisis has hit millions of traders, as people tighten purse strings and save up precious banknotes. But now, this sleepy tourist town is going to become the laboratory for a radical new experiment. From January, Goa’s government has announced that the city will go “cashless”, meaning every street vendor, rickshaw driver and shopkeeper must offer their customers the option to pay using a debit card or mobile phone. The cash-free drive will attempt to close down India’s thriving parallel economy of untaxed cash transactions.

A government circular at the beginning of the month instructed traders: “Goa is likely to become the state in India to go for cashless transactions from 31 December. Even though cash transactions are not being banned, it is in the interest of the government to encourage cashless transactions.” The policy, announced by India’s defence minister, Manohar Parrikar, is in line with Modi’s vision for a cash-free India. Last week, the finance minister, Arun Jaitley, announced a series of discounts on digital transactions for petrol, railway tickets and insurance policies. Modi has urged young people to support his “less cash” economy in a radio broadcast: “I need the help of young people in India … There are many people in your families or neighbourhoods who may not know how to use technologies such as e-wallets and payments through mobiles. I urge you to spend some time … to teach this technology to at least 10 families who may not know it,” he said.

Sure. Just get your most creative accountants out. A “landmark year”?

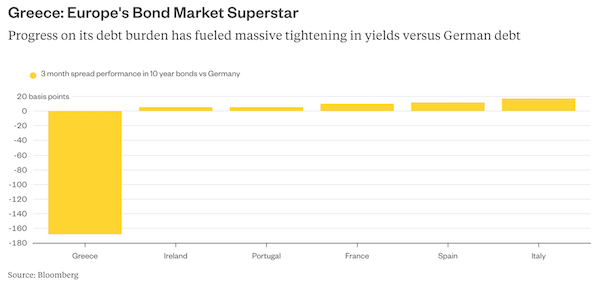

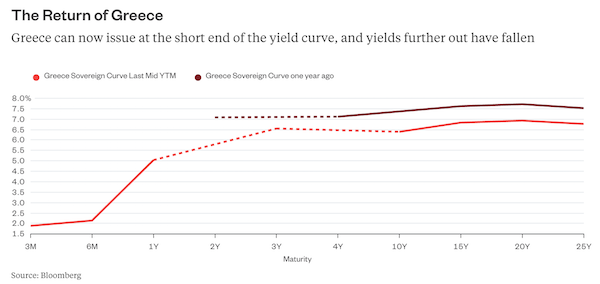

• Greece Passes Austerity 2017 Budget, Eyes 2.7% Growth (AP)

Greece’s Parliament has passed a budget of continued austerity as mandated by the country’s creditors, but which forecasts robust growth for 2017. Prime Minister Alexis Tsipras says it will mark Greece’s “final exit” from its nearly decade-long financial crisis. The budget adds more than €1 billion in new taxes, mostly indirect taxes on items from phone calls to alcohol. It also cuts spending by over €1 billion. The budget was backed by the left-dominated ruling coalition and opposed by all other parties. It passed by a vote of 152-146 on Saturday. Despite the continued austerity, Tsipras predicted that 2017 will be a “landmark year” with 2.7% economic growth. He said his government has achieved a higher-than-forecast 2016 primary surplus.

Interesting long interview.

• The Icelandic Minister Who Refused To Help The FBI Frame Assange (Katoikos)

You are “the minister” who refused to cooperate with the FBI because you suspected their agents on mission in Iceland were of trying to frame Julian Assange. Do you confirm this? Yes. What happened was that in June 2011, US authorities made some approaches to us indicating they had knowledge of hackers wanting to destroy software systems in Iceland. I was a minister at the time. They offered help. I was suspicious, well aware that a helping hand might easily become a manipulating hand! Later in the summer, in August, they sent a planeload of FBI agents to Iceland seeking our cooperation in what I understood as an operation set up to frame Julian Assange and WikiLeaks.

Since they had not been authorised by the Icelandic authorities to carry out police work in Iceland and since a crack-down on WikiLeaks was not on my agenda, to say the least, I ordered that all cooperation with them be promptly terminated and I also made it clear that they should cease all activities in Iceland immediately. It was also made clear to them that they were to leave the country. They were unable to get permission to operate in Iceland as police agents, but I believe they went to other countries, at least to Denmark. I also made it clear at the time that if I had to take sides with either WikiLeaks or the FBI or CIA, I would have no difficulty in choosing: I would be on the side of WikiLeaks.

Erdogan’s son-in-law, “groomed to be Mr Erdogan’s successor”. Parliament certain to vote to hand Erdogan much increased powers. Seen any false flags lately?

• WikiLeaks Emails ‘Link Turkey Oil Minister To Isis Oil Trade’ (Ind.)

WikiLeaks has released a cache of thousands of personal emails allegedly from the account of senior Turkish government minister Berat Albayrak, son-in-law of the country’s president, Recep Tayyip Erdogan, which it says shows the extent of links between Mr Albayrak and a company implicated in deals with Isis-controlled oil fields. The 60,000 strong searchable cache, released on Monday, spans the time period between April 2000 – September 23 2016, and shows Mr Albayrak had intimate knowledge of staffing and salary issues at Powertrans, a company which was controversially given a monopoly on the road and rail transportation of oil into the country from Iraqi Kurdistan.

Turkish media reported in 2014 and 2015 that Powertrans has been accused of mixing in oil produced by Isis in neighbouring Syria and adding it to local shipments which eventually reached Turkey, although the charges have not been substantiated by any solid evidence. The emails were apparently obtained by Redhack, a Turkish hactivist collective. WikiLeaks founder Julian Assange said that they were published in response to the Turkish government’s widening crackdown on dissent. Mr Albayrak, one of the most powerful individuals in Turkey, is widely seen as being groomed to be Mr Erdogan’s successor. The hardline president has been consolidating his grip on power by implementing emergency powers and arresting thousands of journalists, activists and academics in the wake of a failed military coup in July.

Reported without any added anti-Putin innuendo?!

• Russian Bombardment Forces ISIS Out Of Palmyra Hours After Re-Entry (AFP)

A Russian aerial onslaught forced Islamic State fighters to withdraw from Palmyra at dawn on Sunday, only hours after the jihadis had re-entered the ancient Syrian city, a monitor said.“Intense Russian raids since last night forced IS out of Palmyra, hours after the jihadists retook control of the city,” said Rami Abdel Rahman of the Syrian Observatory for Human Rights.The raids killed a large number of militants in the desert city in central Syria, Abdel Rahman told AFP. “The army brought reinforcements into Palmyra last night, and the raids are continuing on jihadist positions around the city.”Isis began an offensive last week near Palmyra, which is on Unesco’s world heritage list. In May last year, the Sunni Muslim extremist group seized several towns in Homs province including Palmyra, where they caused extensive damage to many of its ancient sites. They were ousted from Palmyra in March by Syrian regime forces backed by Russia.