Harris&Ewing Harding inauguration 1921

Actually not all that bad from the Guardian Ed. staff. Though they predictably conclude with plain silliness: In the long run, this failed globalisation needs to be turned into something more sustainable and more inclusive, built on higher wages, robust tax systems and strong public safety nets.

• The Global Economic Outlook: Dark Clouds Ahead (Guardian Ed.)

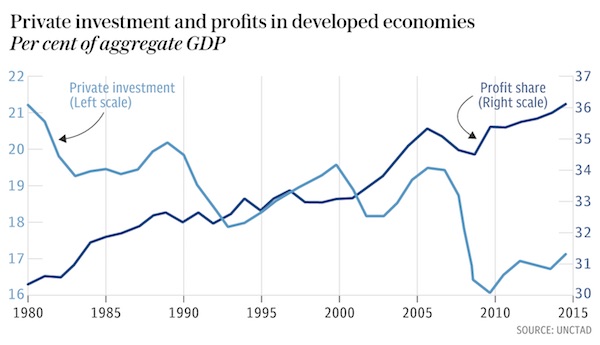

Eight years ago this month, a bank collapsed, Wall Street went into meltdown and the world economy plunged into crisis. Trillions were lost in output ($22tn in the US, within just five years), millions of workers were made redundant (8.8 million in America’s great recession, 1.2 million in the UK) and thousands of promises were made by politicians and policymakers – everyone from Barack Obama and Gordon Brown to David Cameron and Christine Lagarde – that things would change. Yet, nearly a decade later, what is most striking is how little has changed. In the US, the UK and the rest of the developed world, policymakers talk of the “new mediocre”, so tepid is economic performance. And in the developing world things look even worse.

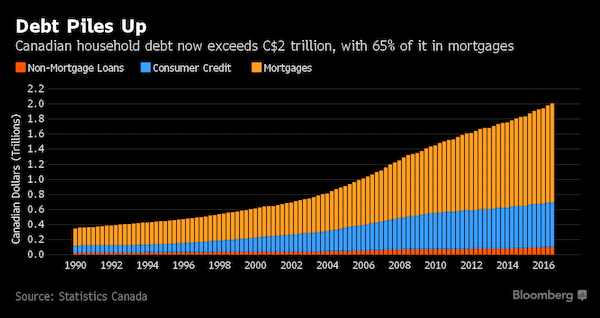

Such is the message from two of the world’s leading economic thinktanks, the OECD and the UN Conference on Trade and Development (Unctad). Both their reports on Wednesday were thick with cloud and short on silver lining. Yes, the OECD believes that Brexit Britain will have a slightly easier time this year – but that will be followed by a far choppier 2017. And the Unctad report is even more troubling. The biggest single warning it makes is that the world is on the verge of “entering a third phase of the financial crisis”. What began in the US subprime housing market before roiling Europe’s governments is likely to rear its head again – this time in Latin America, Africa and other poor countries. What will do for them, believe the Unctad researchers, is what also did for America and Europe: debt.

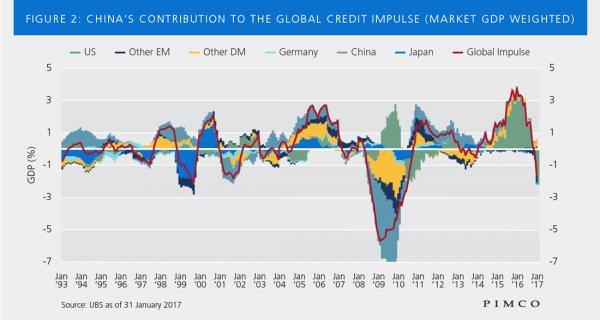

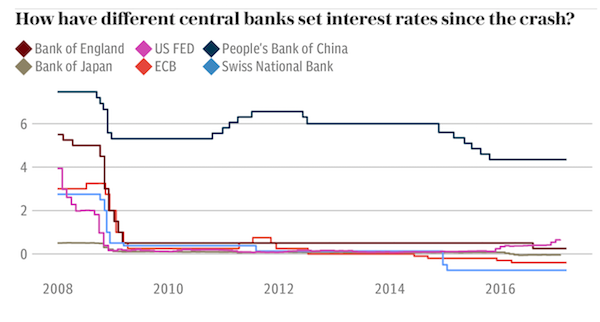

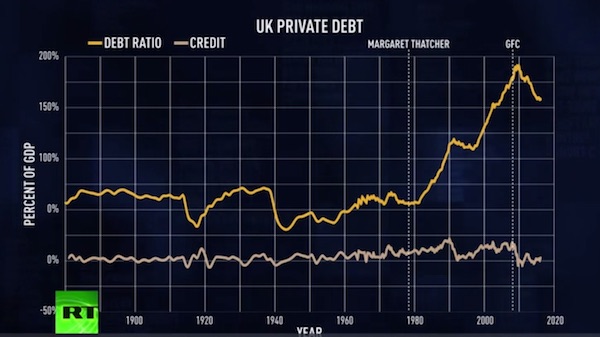

Much of the cheap money created by the Fed, the BOE and the ECB has been pushed by financial speculators into the higher-yielding markets of South Africa, Brazil and India, among others. Economists at the Bank for International Settlements, the central banks’ central bank, reckon that $9.8tn was pumped out in foreign bank loans and bonds in the first half-decade after the Lehman Brothers collapse. Unctad calculates that around $7tn of that was pushed through to emerging markets. By any standards, that is a flood of credit – one that was encouraged by panicky policymakers.

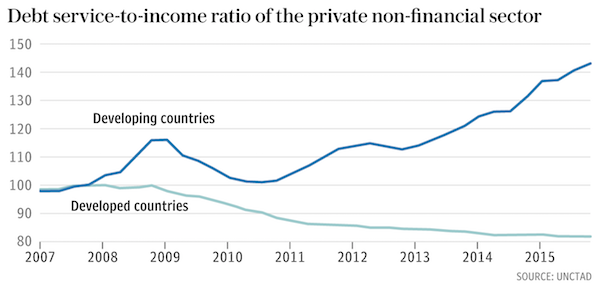

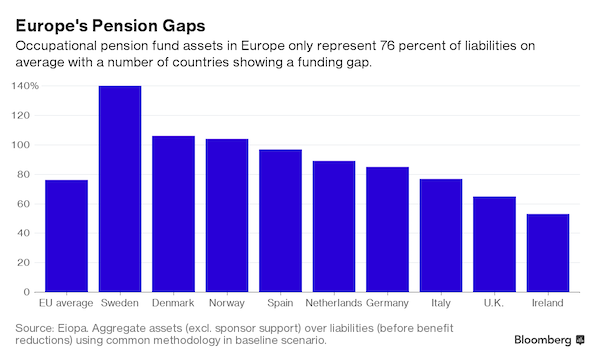

Wasn’t it the turn of China and the rest to pick up the slack in the global economy? Except now developing countries are lumbered with a gigantic private debt mountain to pay down. The private, non-financial sector across the developing world has debt service obligations worth nearly 150% of its income. The comparable figure for the developed world, by contrast, is just above 80%. And now developing countries are hobbling along rather than sprinting ahead, while commodity prices have tanked. To make matters worse, companies will typically have borrowed in US dollars and invested in their local currencies – but the strength of the dollar will make those loans all the harder to repay.

Read more …

“What is clear is that world will soon need a massive and coordinated spending push by governments to create demand and bring the broken global system back into equilibrium. UNCTAD is entirely right about that. If this does not happen, it is sauve qui peut.”

• UN Fears Third Leg Of Global Financial Crisis – With Epic Debt Defaults (AEP)

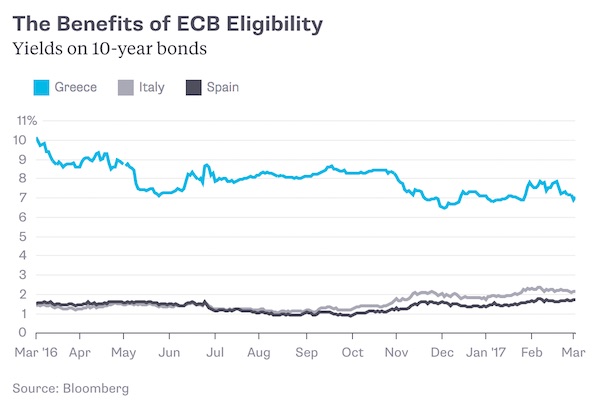

The third leg of the world’s intractable depression is yet to come. If trade economists at the United Nations are right, the next traumatic episode may entail the greatest debt jubilee in history. It may also prove to be the definitive crisis of globalized capitalism, the demise of the liberal free-market orthodoxies promoted for almost forty years by the Bretton Woods institutions, the OECD, and the Davos fraternity. “Alarm bells have been ringing over the explosion of corporate debt levels in emerging economies, which now exceed $25 trillion. Damaging deflationary spirals cannot be ruled out,” said the annual report of the UN Conference on Trade and Development (UNCTAD). We know already that the poisonous side-effect of zero rates and quantitative easing in the US, Europe, and Japan was to flood developing nations with cheap credit, upsetting their internal chemistry and drawing them into a snare.

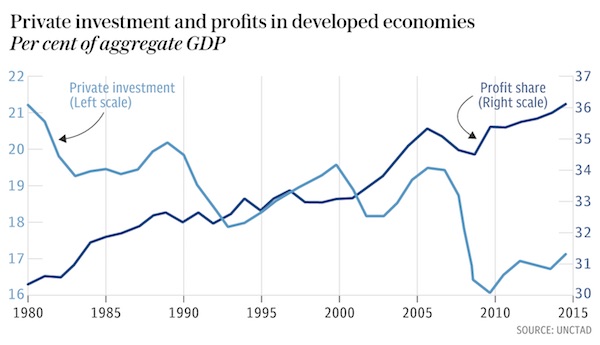

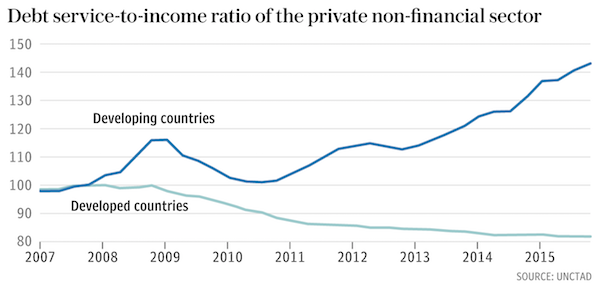

What is less understood is just how destructive this has been. Much of the money was wasted, skewed towards “highly cyclical and rent-based sectors of limited strategic importance for catching up,” it said. Worse yet, these countries have imported the deformities of western finance before they are ready to cope with the consequences. This has undermined what UNCTAD calls the “profit-investment nexus” that ultimately drives growth and prosperity. The extraordinary result is that some countries are slipping backwards, victims of “premature deindustrialisation”. Many of them have fallen further behind the rich world than they were in 1980 despite opening up their economies and following the global policy script diligently.

The middle income trap closed in on Latin America and the non-oil states of the Middle East a long time ago, but now it is beginning to close in such countries as Malaysia and Thailand, and in some respects China. “The benefits of a rushed integration into international financial markets post-2008 are fast evaporating,” it said. Yet the suffocating liabilities built up over the QE years remain. UNCTAD says corporate debt in emerging markets has risen from 57pc to 104pc of GDP since the end of 2008, and much of this may have to written off unless there is a world policy revolution. “If the global economy were to slow down more sharply, a significant share of developing-country debt incurred since 2008 could become unpayable and exert considerable pressure on the financial system,” it said.

“There remains a risk of deflationary spirals in which capital flight, currency devaluations and collapsing asset prices would stymie growth and shrink government revenues. As capital begins to flow out, there is now a real danger of entering a third phase of the financial crisis which began in the US housing market in late 2007 before spreading to the European bond market,” it said. These are deeply-disturbing assertions. The combined US subprime and ‘Alt-A’ property exposure before the Lehman crisis was just $2 trillion, and Greece’s debts were trivial. What UNCTAD is talking about is an order of magnitude larger.

Read more …

Haven’t featured Celente in ages…

• Major Trend Forecast For The Rest Of 2016 (Celente)

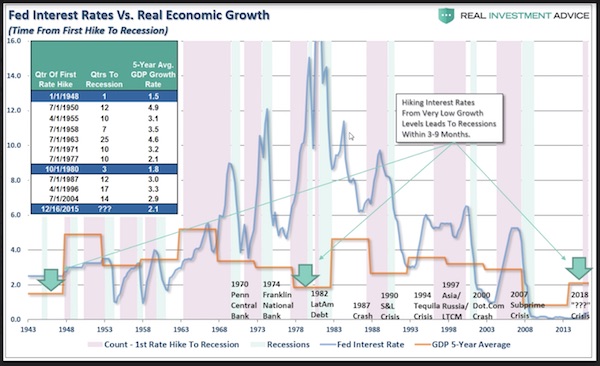

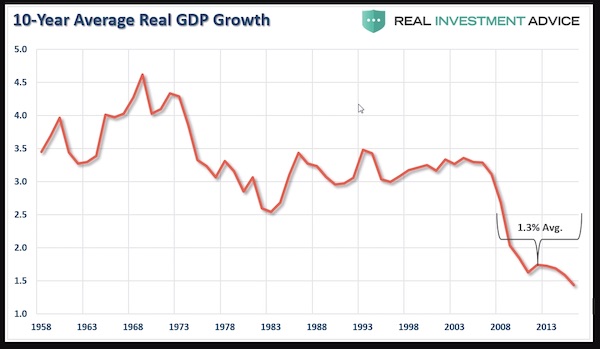

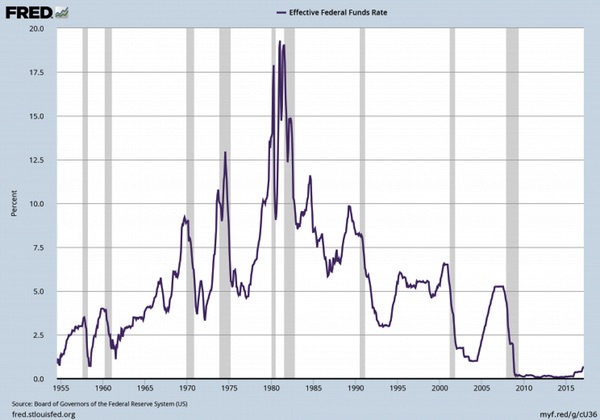

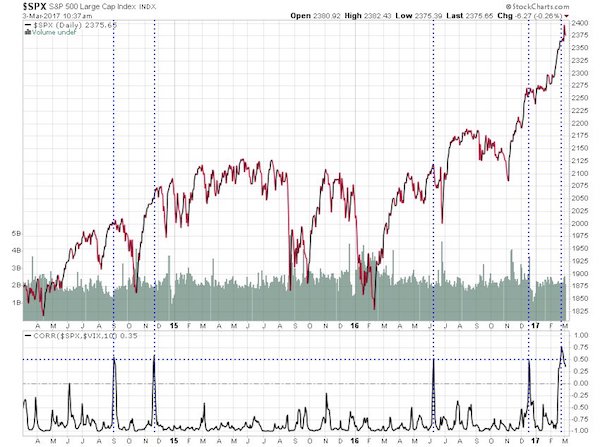

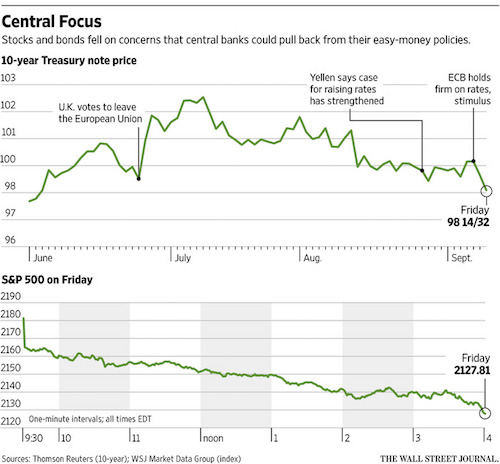

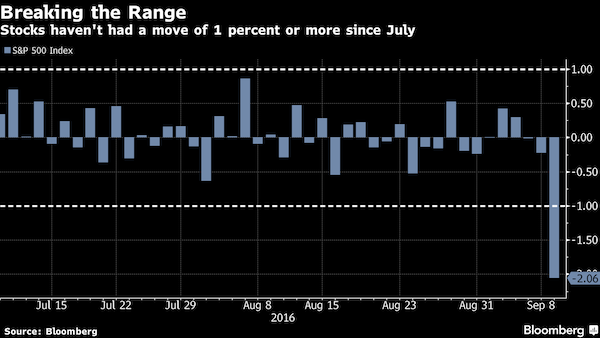

Central bank policies rule the financial world. Their never-in-the-history-of-the-world negative and historically low interest rate policies, plus massive government and corporate bond buying schemes have enriched equity markets but not the general economy… “In fact, what we have been forecasting and reporting since 2010, the Bank for International Settlements confirmed this week with its warning that central bank behavior, not economic fundamentals, hold sway over markets. Claudio Borio, head of the monetary and economic department of the BIS questioned whether “market prices fully reflect the risk ahead,” and “doubts about valuations seem to have taken hold in recent days.” Indeed true price discovery is dead.

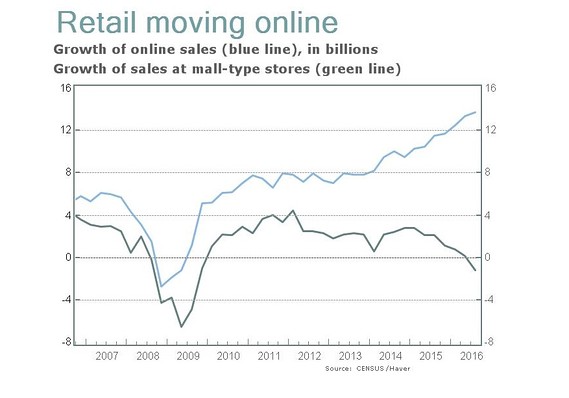

Despite massive Federal Reserve intervention in the US that has driven the Dow and NASDAQ to new highs, S&P 500 companies reported five straight quarters of year-over-year declines. Also on the market fundamental front, with retail sales down 0.3% in August, there was no back-to-school-splurge. The service sector, the main economic driver of the United States economy, fell to its lowest level since 2010. Despite “experts” forecasting US GDP to rise 3% in 2016, it’s slogged along at an annualized 1% for the first two quarters. Just yesterday it was reported that housing starts in the US came in at an annualized rate of 1.14 million in August, well below the expected 1.19 million while construction permits fell 0.4% to a 1.14 million-unit rate last month.

And while President Obama chastised “Anyone claiming that America’s economy is in decline is peddling fiction,” US economic growth since the recession ended is tracking at its weakest pace of any expansion since 1949. As the BIS report concludes, “A more balanced policy mix is essential to bring the global economy into a more robust, balanced and sustainable expansion.” Yet, today, all equity eyes are concentrated more on central bank maneuvers than market fundamentals. In Japan, with new data showing exports falling 9.6% and imports down 17.3% in August, the focus is on what new schemes the Bank of Japan will invent to boost the economy despite its long proven track record of failure.

Similarly, later today in the US, the markets await news of if, and when, the Fed will raise interest rates. Yet, as the data proves since the Panic of ’08, central banks’ “policy mix” has failed …and we forecast despite pending measures, they will continue to fail to generate true economic growth. Thus we forecast continued equity market volatility with increasing prospects for a market meltdown.

Read more …

There should have been much more of this. People would have understood the world they live in so much better. The lack of this sort of analysis gives birth to Brexit and the Donald.

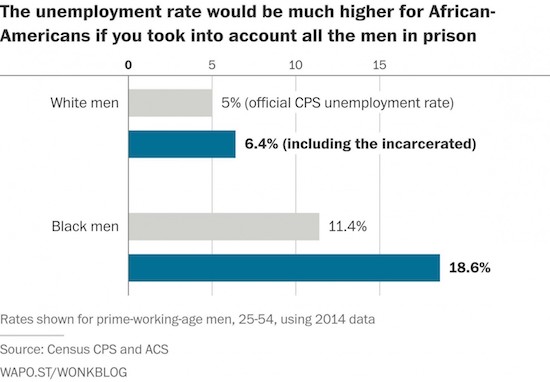

• Report Highlights Rising US Poverty (D&C)

Among the troubling statistics in a new report released Tuesday was the rising concentration of poverty in city neighborhoods, and expanding number of census tracts where the poverty rate stood at 40% or higher. The count of high-poverty census tracts has nearly doubled in the city, from 19 to 37 since 2000. Fully one-third of Rochester residents live in poverty, and nearly another third require some outside assistance to get by, according to estimates in the ACT Rochester and Rochester Area Community Foundation update to its 2013 report on the state of poverty and self-sufficiency across the Greater Rochester region. The numbers are a near mirror-image of the suburbs, where more than two-thirds of residents are self-sufficient. And while the poverty rate in the nine-county Greater Rochester region continues to creep upward, it remains below state and national averages, the report shows.

“We don’t really have a poverty problem,” said Edward Doherty, a Strategic Community Intervention associate who served as project manager and editor of the report, and is active in local efforts to combat poverty. “We have a concentration of poverty problem.” Rochester has the third-highest concentration of poverty in the nation. And a significant segment of that population is female-headed families with children younger than 18. Though accounting for 17% of the population, the report found, the city has 36% of such households, and that population has a staggering poverty rate of 59.9%. Doing the math, the report estimates these families account for nearly half of all people living in poverty in the city, and these children account for more than 80% of all poor children in the city.

Read more …

This is changing the world, all over the world. Poverty and loss hidden from us by media and political propaganda.

• In Places With Fraying Social Fabric, a Political Backlash Rises (WSJ)

Reading, Pa.— The buckling of social institutions fundamental to American civic life is deepening a sense of pessimism and disorientation, while adding fuel to this year’s rise of political populists like Donald Trump and Bernie Sanders. Here and across the U.S., key measures of civic engagement ranging from church attendance to civic-group membership to bowling-league participation to union activity are slipping. Unlocked doors have given way to anxiety about strangers. In Reading, tension between longtime white residents and Hispanic newcomers has added to the unease. For Mr. Martin, social and economic setbacks led him to support Mr. Sanders, who he figured would stick it to the big businesses Mr. Martin feels have sold out working people.

Other people here find resonance in Mr. Trump’s message that the U.S. has skidded so far off course that it needs to lock out immigrants and block imports to recover an era of greatness. “When you lose the family unit and you lose the church community, you are losing a whole lot,” says Bonnie Stock, a retired teacher in Reading and Trump supporter, who says the church where she was baptized is dying from lack of young members. “People are looking at Trump because most of us see this [country] isn’t working,” she says. Ms. Stock figures Mr. Trump’s business experience would help him better attack societal problems like drug addiction.

Across the U.S., the Republican presidential nominee has his firmest support among the white working class. In the Republican primaries, he carried all but nine of the country’s 156 counties where at least 85% of the adult population was whites without four-year college degrees. Mr. Trump won 64% of the vote in Berks and Schuylkill counties, where noncollege whites were 66% of the adult population as of 2014. In Berks County, once famous for the Reading Railroad stop on the Monopoly board game, social ills have been exacerbated by a 30% decline in manufacturing jobs and 6% fall in inflation-adjusted median income since 1995.

Read more …

In case you’re wondering why the Automatic Earth tries so hard to help the poorest Greeks. These are the very people your generous donations assist. The problem is their numbers are rising fast.

But we’re not going to give up. I’m breaking my head over the next steps in the process. We need to do something big for Christmas. Meanwhile, please keep donating through our Paypal widget, top left corner of the site, in amounts that end in $0.99 or $0.37.

• Greek Bakers Unite To Give Away Bread To Those Too Poor To Afford It (KTG)

Did you know that there are people in Greece who cannot afford to buy even a loaf of bread at a cost of €0.60 – €0.70? Almost a year after Greece surrendered into the arms of the international lenders and the IMF and the austerity cuts started to affect people’s lives, a bakery in our neighborhood was offering a bread at a special price for pensioners and unemployed. The special price was just half a euro. At one point, I remember that more and more people were going to this bakery and asking for bread from the previous day for a couple of cents or even free of charge. Two days ago, the grim Greek reality hit me again. I was at the bakery sometime at noon. All different kinds of bread loafs were waiting for customers, nicely set in order, one by one, next to each other.

Yet, somewhere, in a corner at one of the lower shelves there was a group of breads: several loaves, long and round, white and wholewheat, a couple of baguettes. “What are these?” I asked the baker and he answered “This is bread from yesterday, for the poor. We give it free of charge.” He told me further, that he had 6-7 returning customers who come every second day for the bread from yesterday. Mostly elderly, pensioners. And “maybe 2-3 people per day,” people he does not know who just step in and ask for “old bread for free.” The problem of poverty is not widespread only in Athens, where the cost of living is much higher than in the countryside. Today, I read about the action of the Bakers’ Association in Kozani, in Northern Greece. Customers can buy extra bread for those in need, while the bakers will keep records of the “Bread on the waiting” – as they call their action – and give it to those who cannot afford it.

Read more …

As I’ve written before: and still everyone says they love their kids.

• Young Britons Live In ‘Suspended Adulthood’ (G.)

Despair, worries about the future and financial pressures are taking a toll on millions of young Britons, according to a poll which found young women in particular were suffering. Low pay and lack of work in today’s Britain are resulting in “suspended adulthood”, with many living or moving back in with their parents and putting off having children, according to the poll of thousands of 18 to 30-year-olds. Large numbers describe themselves as worn down (42%), lacking self-confidence (47%) and feeling worried about the future (51%).

The Young Women’s Trust, the charity that commissioned the polling by Populus Data Solutions, warned that Britain was facing a “generation of young people in crisis” as it called on the government to take steps including creating a minister with responsibility for overall youth policy. Young women are being particularly affected. The percentage of women reporting that they lacked self-confidence was 54%, compared with 39% of young men. While four in 10 young people said they felt worn down, the percentage for young women was 46% compared with 38% of men. One in three said they were worried about their mental health, including 38% of young women and 29% of young men.

Read more …

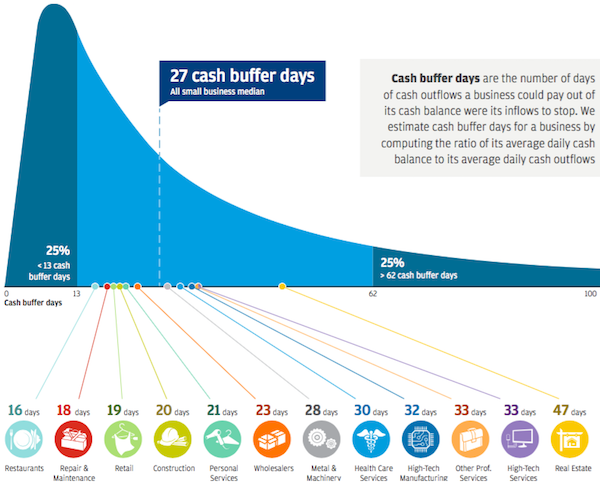

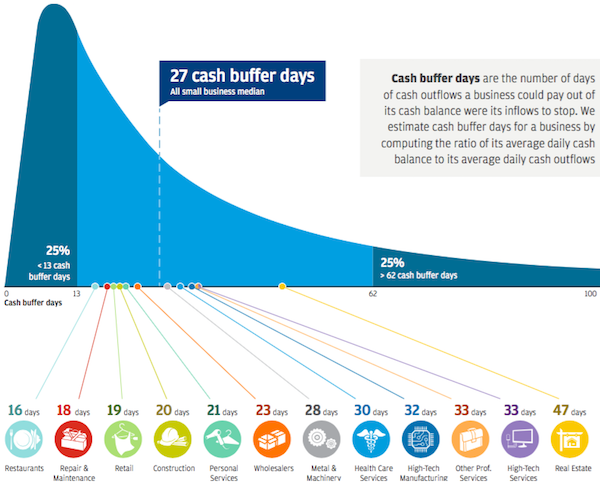

US small business dances on the edge. They account for 50% of GDP and more than 50% of new job creation.

• It’s Not Just Consumers That Are Living Paycheck To Paycheck (BBG)

As Federal Reserve officials gather to issue their monthly assessment of the world’s largest economy, a new study lays bare the extent to which many small firms are pressed for cash. “Most small businesses are operating on very small margins,” Diana Farrell, CEO of the JPMorgan Chase Institute, an in-house think tank that uses data from the bank to analyze the economy. “The small business sector is less full of future Googles and Ubers and tons and tons of very small operators living month to month,” she said in a phone interview. The companies in question may be small, but they represent an outsized share of the U.S. economy.

According to the Small Business and Entrepreneurship Council, they account for roughly 50% of GDP and more than 50% of new job creation — a metric that’s closely watched by the Fed in determining whether the economy can withstand a constriction in financing conditions. Yet even though they’re contributing a great deal to the economy there remains ignorance about their financial health, Farrell added. On average, the companies surveyed have just 27 days worth of cash reserves — or money to cover expenses if inflows suddenly stopped — according to the JPMorgan study, which analyzed 470 million transactions by 570,000 small business last year. Restaurants typically hold the smallest cash buffers, with just 16 days of reserves, while the real-estate sector boasts the biggest, at 47 days.

Read more …

These people get far too much attention. That makes them feel much too important. We should ignore them. After taking their undemocratic powers away.

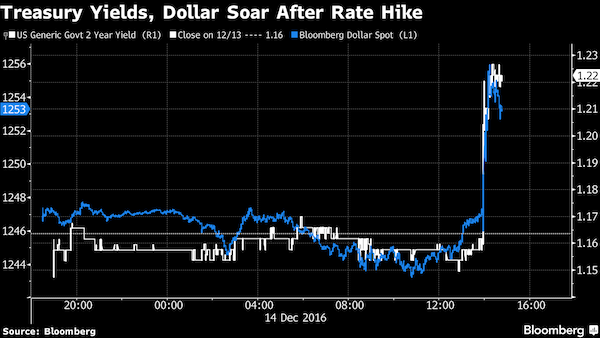

• Divided Fed Holds Fire, Signals 2016 Rate Increase Still Likely (BBG)

A divided Federal Reserve left its policy interest rate unchanged to await more evidence of progress toward its goals, while projecting that an increase is still likely by year-end. “Near-term risks to the economic outlook appear roughly balanced,” the Federal Open Market Committee said in its statement Wednesday after a two-day meeting in Washington. “The Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives.” The sixth straight hold extends U.S. central bankers’ run of getting cold feet amid risks from abroad and inconsistent signs of economic strength.

Now the focus will shift to December as the Fed’s likely last chance to raise interest rates in 2016 – a move that depends on how the economy, inflation and markets fare in the months surrounding a contentious presidential election. “The statement is much more hawkish than I thought it would be,” said Stephen Stanley at Amherst Pierpont Securities in New York, who said he expects a rate increase in December. “That just tells you they are revving up the engines.” Three officials, the most since December 2014, dissented in favor of a quarter-point hike. Esther George, president of the Kansas City Fed, voted against the decision for a second straight meeting. She was joined by Cleveland Fed President Loretta Mester – in her first dissent – and Eric Rosengren, head of the Boston Fed, whose previous dissents called for easier policy.

Read more …

Uh, no: The need for yet another overhaul of the BOJ’s policy framework [..] speaks to the deep-seated challenges facing policy makers. Actually, it speaks to the utter failure of all ‘policies’ up till now.

• Bank of Japan’s Inflation Overshoot Deepens Policy Innovation (BBG)

The first major central bank to adopt quantitative easing in the modern era has innovated again. BOJ Governor Haruhiko Kuroda and his colleagues adopted a pledge of “overshooting” their 2% inflation target, an idea floated by central bankers including Federal Reserve Bank of Chicago President Charles Evans, but not formally adopted up to now. They also unveiled a strategy of targeting short- and longer-term rates to provide the economy with cheap borrowing costs. Since taking the helm in 2013, Kuroda had previously pursued a QE-on-steroids policy to shock Japan out of deflation. Yet after three and a half years, he was running into increasing concerns about the sustainability of the purchases of government bonds, which have run at about 15% of gross domestic product annually.

The adoption of a negative interest rate on some bank reserves resulted in an outcry from banks, and – for a time – an alarming plunge in yields even on longer-dated securities. The Federal Reserve had a cap on long-term yields back in the 1940s, as part of the U.S. government’s efforts to keep down wartime and postwar debt financing. But a strategy of targeting the yield curve as a reflation initiative is new to the major central banks of today. “The BOJ had to do something revolutionary out of necessity – they are concerned about sustainability,” said Yuji Shimanaka at Mitsubishi UFJ Morgan Stanley Securities. The need for yet another overhaul of the BOJ’s policy framework – this is the third iteration under Kuroda alone – speaks to the deep-seated challenges facing policy makers. Japan’s consumer prices slumped 0.5% in July from a year before, far from the 2% gains targeted “at the earliest possible time.”

Read more …

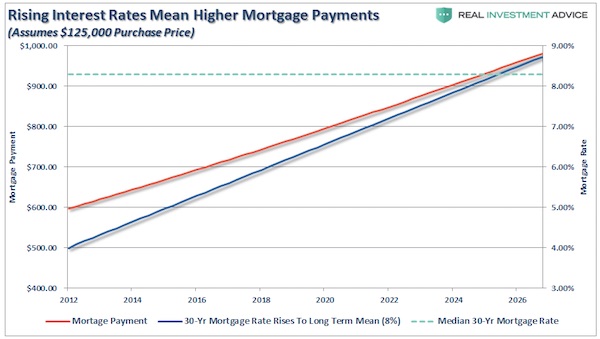

There are still scores of greater fools out there… This time lured by low rates.

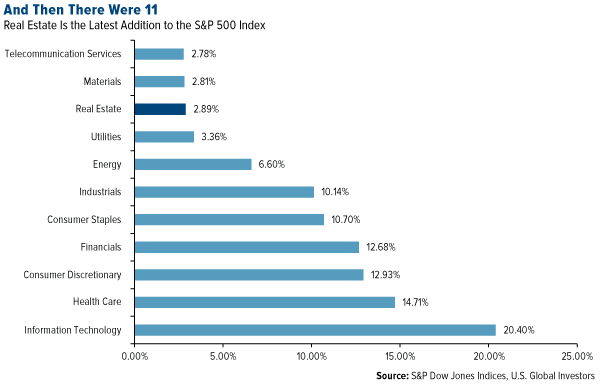

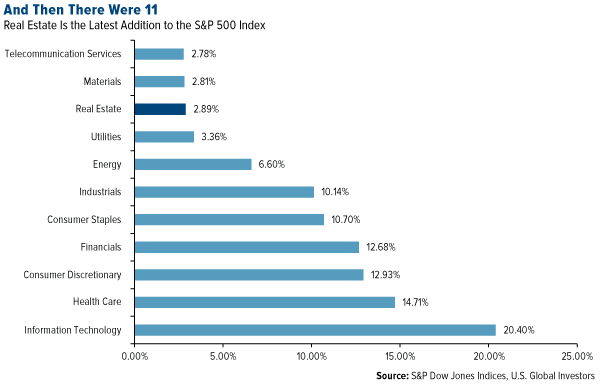

• Real Estate Gets Its Seat At The S&P 500 Table (Forbes)

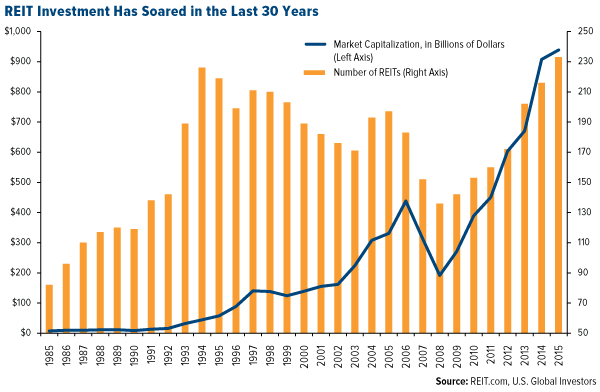

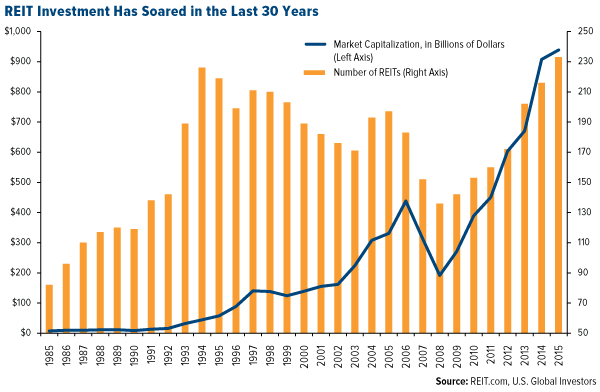

In case you haven’t noticed, the S&P 500 Index is looking a little different these days. Once a sub-industry of the financial sector, real estate now has its own zip code in the universe of blue chip stocks. It’s the first time since 1999 that such a change has been made to the S&P’s composition. The new sector has a weighting of nearly 3%, all of it taken out of financials. Real estate’s promotion should attract more institutional and individual investors to the space. It tells them this is no longer a niche market but one with a distinct and significant presence, with its own unique business drivers.

This has been a long time coming, to be perfectly honest. Ever since the housing and financial crisis, real estate investment trusts (REITs) have been pulling in some serious cash as more become available for trading on the New York Stock Exchange and elsewhere. Altogether, REITs currently have a market cap of over $1 trillion, according to REIT.com. With investors on the hunt for yield, it’s not hard to see why. As of August 31, the FTSE NAREIT All Equity REITs Index yielded an average of 3.61%, compared to the S&P 500’s 2.11%. During 2015, stock exchange-listed REITs paid out a whopping $46.5 billion in dividends.

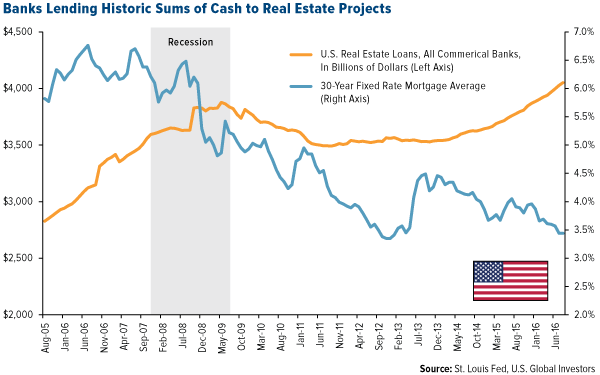

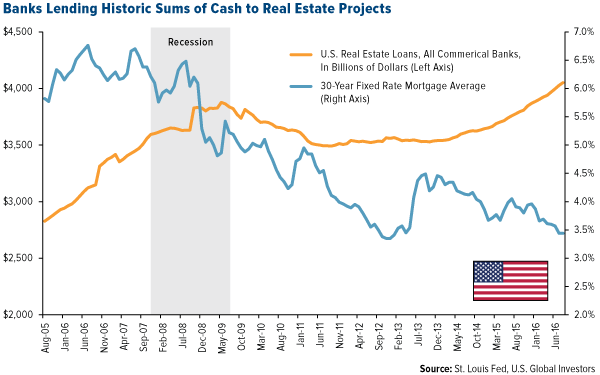

Looking just at the residential housing market, business is definitely booming. With 30-year mortgage rates at below 3.5%, the market is scorching hot in many parts of the U.S.—so much so, some builders are reporting a shortage in construction workers to meet demand. New construction starts rose to 1.2 million in July, beating analysts’ forecasts and suggesting the U.S. housing market appears to have finally made a full recovery eight years following the recession, with Bloomberg calling this the “strongest home sales since the start of the economic expansion.”

Trouble could be brewing, however. As I shared with you last month, millennials just aren’t buying homes at the same rate we’ve historically seen from 18- to 34-year-olds. There are many theories as to why this is, from millennials delaying starting families to focus on careers, to a loss of trust in homeownership as a reliable investment or even as an institution, to a preference to rent. This trend has contributed to the lowest U.S. homeownership rate in five decades. How can this be? How could there be both massive housing demand and yet declining home ownership?

Read more …

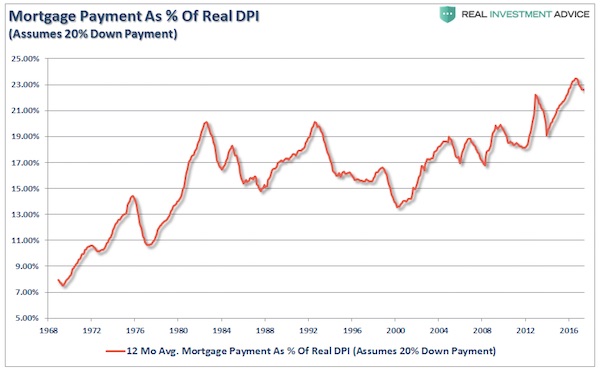

“On average, homeowners paid 28% more in mortgage payments than renters did in monthly rent.”

• With Mortgage Rates So Low, Why Are So Many People Still Renting? (Time)

With interest rates lower than they have been for years, many people still find that renting is more budget-friendly than a monthly mortgage payment. This is not true in all parts of the U.S., but a study by Robert W. Baird & Co. shows that living in one of the biggest housing markets in the country is often more expensive. The study looked at 28 different cities, and found that U.S. homeowners in 24 of the cities paid more than those who rent. On average, homeowners paid 28% more in mortgage payments than renters did in monthly rent. The study looked at properties with ratings of four or five stars to keep variables to a minimum.

The study also made some assumptions, such as that all mortgages were 30-year fixed loans, that all homeowners made a down payment of 15%, and that all mortgages included private mortgage insurance, homeowners’ insurance, and taxes. Of the 28 different markets examined, it was more affordable to own than to rent in Baltimore, Maryland, Tampa, Florida, Jacksonville, Florida, and Norfolk/Richmond, Virginia. Of the remaining 24 cities, 15 showed a 20% or higher difference in the cost of renting versus the cost of owning. These differences were due to factors such as the increase in housing prices and the fact that there are few houses on the market in many of these areas.

Read more …

More fallout from the war on interest rates.

• House-Flippers Are Back, With Anonymous Funding (BBG)

Alex Sifakis never raised this much money this fast. The house flipper from Jacksonville, Florida, crowdfunded nine deals totaling more than $9 million through RealtyShares over the last two and a half years. A July deal for $1 million took him just 12 hours. “Generally, raising money takes so much time,’’ said Sifakis, 33. “This offers so much flexibility and time savings. It’s so much better than going to family offices, banks or Wall Street firms.’’ House flippers and property developers are increasingly crowdfunding — tapping the virtual wallets of anonymous internet backers on platforms such as RealtyShares, LendingHome, PeerStreet and Patch of Land. For riskier ventures, such as building new homes and buying, renovating and selling existing ones, they’re finding quick financing can be easier to get online than from banks.

That’s contributed to an increase in home flipping. In the second quarter, 39,775 investors bought and sold at least one house, the most since 2007, according to ATTOM Data Solutions. The crowdfunding sites are part of the multibillion-dollar ecosystem of marketplace lenders, like LendingClub Corp. and Prosper Marketplace Inc., that match users who need money with people who want to provide it for anything from debt consolidation to elective medical procedures. That business hasn’t always run smoothly. LendingClub is going through a rough stretch after years of rapid growth. In May, its founder and chief executive officer resigned amid an internal probe into a botched loan sale, sending LendingClub’s shares tumbling. So far, there have been few defaults in real estate crowdfunding deals. When they happen, the platforms say they’ll pay investors the proceeds from property sales.

The business has other potential pitfalls. When it comes to real estate, faster isn’t always better. Wall Street’s home-mortgage machine of the mid-2000s valued speed over accuracy, with disastrous results, though most crowdfunding sites cater to investors and not homebuyers. Also, clicking for capital can be exploited by fraudsters who may not be who they say they are, according to Sara Hanks, co-founder and CEO of CrowdCheck, which provides due-diligence services for online investors. “We’ve seen some things where the entity that’s supposed to own the property doesn’t actually own it,’’ she said.

Read more …

“..40% of China’s expressways were built between 2010 and 2015..”

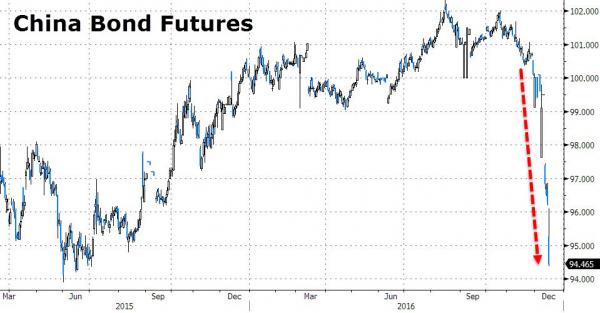

• China Chalks Up $667-Billion Debt Pile Over Toll Roads (R.)

China’s toll roads have stacked up a debt pile of 4.45 trillion yuan ($666.96 billion), with almost 80% of their annual income last year going to repay loans, the transport ministry said, as the country accelerates road building. Beijing has cranked up state spending on infrastructure to support economic growth as private sector investment falters, and efforts to lure investors into private-public partnerships to build projects such as toll roads have had few successes. The ministry published the 2015 figures late on Tuesday in a report that comes as global investors express growing concern over China’s overall credit, much of which has gone to build infrastructure. The toll road network’s debt grew an annual 15.7% last year, far outpacing income growth of 4.6%, the ministry said in the report.

“Although China’s toll road debt is relatively large, this is just a phase,” state newspaper the People’s Daily quoted Sun Yonghong, an official of the ministry’s highway division, as saying. “In the long run, the risks are controllable.” About three-quarters of 2015 revenue of 409.78 billion yuan went to paying down debt and interest, as banks sought payment of the principal one year after project completions, Sun said. Toll roads make up less than 4% of China’s road network, which stretches 4.5 million km (2.8 million miles). Sun said much of the debt was incurred to build expressways, and accumulation would slow as the road network matured. Almost 40% of China’s expressways were built between 2010 and 2015, at a cost of 3.32 trillion yuan, about 2.23 trillion yuan of which was paid through loans, he said.

Read more …

Sickening.

• Wells Fargo Too Arrogant To Own Up To Its Fraudulent Ways (WaPo)

The 2008 financial collapse was eight years ago this month — and the big banks are back to their old shenanigans. Venerable Wells Fargo has engaged in behavior that would have made a robber baron blush: It pressured low-wage workers with unrealistic sales targets, so these workers created 2 million bogus accounts over five years, causing customers to be hit with fees and damage to their credit ratings. About 5,300 workers have been fired and $185 million in penalties assessed to the bank, but not a single high-level executive has been sacked or even forced to give back the tens of millions of dollars in pay earned based on the fraud. When Wells Fargo chairman and CEO John Stumpf sat before the Senate Banking Committee this week, he represented a bank too big to fail, too sprawling to manage and too arrogant to own up to its failures.

Can’t Wells Fargo take back some of the executive payouts? “I’m not an expert in compensation,” Stumpf said. Would he commit to investigate whether the fraud began in earlier years? “I can’t tell you that today.” Did he learn about the fraud before reading about it in the Los Angeles Times? “I don’t remember the exact time frame.” Stumpf informed the senators that what Wells Fargo did “was not a scam,” disputed that “this is a massive fraud” and said he had no idea “why people did this.” Sen. Jerry Moran, R-Kan., encouraged Stumpf to “make certain that the employees are not the scapegoat for behavior at higher levels.” Stumpf repeated that “the 5,300, for whatever reason, they were dishonest, and I’m not scapegoating.” If high-level bankers didn’t go to prison for the subprime high jinks that caused the 2008 crash, it’s a safe bet that none will in the Wells Fargo scandal either.

But if arrogance were a criminal offense, Stumpf would be looking at a life sentence. The bank’s fraud, and the executive’s insolence, may have one salutary result: It takes off the agenda any plan to dismantle the Consumer Financial Protection Bureau, one of the post-2008 regulatory creations and a top target of Donald Trump and congressional Republicans. The Los Angeles city attorney and the Los Angeles Times may deserve more credit for exposing the wrongdoing, but the audacity at Wells Fargo shows that the industry isn’t about to police itself. Stumpf also managed to create rare bipartisan unity on the Banking Committee – in condemnation of his actions. Sherrod Brown, D-Ohio, was “stunned.” Dean Heller, R-Nev., compared him to Sgt. Schultz of “Hogan’s Heroes.” Robert Menendez, D-N.J., called the actions “despicable.” Patrick J. Toomey, R-Pa., told Stumpf: “This isn’t cross-selling, this is fraud.”

Read more …

“Let’s ask ourselves whether we are comfortable with the United States getting slowly, predictably, and all too quietly dragged into yet another war in the Middle East.”

• 27 US Senators Rebel Against Arming Saudi Arabia (I’Cept)

A Senate resolution opposing a $1.15 billion arms transfer to Saudi Arabia garnered support from 27 senators on Wednesday, a sign of growing unease about the increasing number of civilians being killed with U.S. weapons in Yemen. A procedural vote to table the resolution passed 71-27. The Obama administration announced the transfer last month, the same day the Saudi Arabian coalition bombed a potato chip factory in the besieged Yemeni capital. In the following week, the Saudi-led forces would go on to bomb a children’s school, the home of the school’s principal, a Doctors Without Borders hospital, and the bridge used to carry humanitarian aid into the capital. Saudi Arabia began bombing Yemen in March 2015, four months after Houthi rebels from Northern Yemen overran the capitol, Sanaa, and deposed the Saudi-backed ruler, Abdu Rabbu Mansour Hadi.

In addition to providing Saudi Arabia with intelligence and flying refueling missions for its air force, the United States has enabled the bombing campaign by supplying $20 billion in weapons over the past 18 months. In total, President Obama has sold more than $115 billion in weapons to the Saudi kingdom – more than any other president. After the White House failed to respond to a letter from 60 members of Congress requesting that the transfer be delayed, Sens. Chris Murphy, D-Conn., and Rand Paul, R-Ky., introduced a resolution condemning the arms sale. Paul and Murphy said they had planned to pursue binding legislation if their resolution was successful. “It’s time for the United States to press ‘pause’ on our arms sales to Saudi Arabia,” Murphy said. “Let’s ask ourselves whether we are comfortable with the United States getting slowly, predictably, and all too quietly dragged into yet another war in the Middle East.”

Read more …

Carter’s a real man. No Clinton, Bush or Obama is fit to shine his shoes.

• A First Step for Syria? Stop the Killing (Jimmy Carter)

The announcement this month of a new cease-fire agreement in Syria is good news. But a lack of trust among the Syrian belligerents and their foreign supporters means this agreement, like the one that came before it, is vulnerable to collapse. It is already showing severe signs of strain. Over the weekend, the United States accidentally bombed Syrian government troops. On Monday, the Syrian military declared it would no longer respect the deal, resumed airstrikes on Aleppo, and even a humanitarian aid convoy was bombed. Still, there is reason for hope. If Russia and the United States were willing to come far enough in their negotiations to reach this deal, these setbacks can be overcome. The targeting of the humanitarian convoy, a war crime, should serve as an added impetus for the United States and Russia to recommit to the cease-fire.

The two parties were well aware of the difficulties as they spent a month negotiating the cease-fire’s terms. The agreement can be salvaged if all sides unite, for now, around a simple and undeniably important goal: Stop the killing. It may be more likely than it sounds. Reliable sources estimate the number of Syrians killed to date at almost half a million, with some two million more people wounded. Well over half of the country’s 22 million prewar population has been displaced. These shocking numbers alone should convince all concerned that war itself is the greatest violation of human rights and the ultimate enemy of Syria. If this cease-fire is to last, the United States and Russia must find ways to work beyond the lack of trust that undermined the previous cease-fire, in February.

The countrywide cessation of hostilities that began then started to crumble within two months, with battles in much of the countryside around Damascus, central and northern Syria, and Aleppo. The resumption of the conflict led in April to the suspension of UN-sponsored peace talks in Geneva. However, a strong effort was made earlier in the year when the United States and Russia pressed their respective allies to pause the fighting and give the negotiations a chance. But the American and Russian expectation that they reach an agreement on issues of transitional governance by Aug. 1 was unrealistic. After five years of killing, and before any semblance of trust could be established, pushing the Syrian parties and their supporters to agree on power-sharing was seen as too threatening by some and too inadequate by others. Unsurprisingly, they reverted to violence.

Read more …

A lovely letter.

• Apologizing to My Daughter for the Last 15 Years of War (Van Buren)

I recently sent my last kid off for her senior year of college. There are rituals to such moments, and because dad-confessions are not among them, I just carried boxes and kept quiet. But what I really wanted to say to her — rather than see you later, call this weekend, do you need money? – was: I’m sorry. Like all parents in these situations, I was thinking about her future. And like all of America, in that future she won’t be able to escape what is now encompassed by the word “terrorism.” Terrorism is a nearly nonexistent danger for Americans. You have a greater chance of being hit by lightning, but fear doesn’t work that way. There’s no 24/7 coverage of global lightning strikes or “if you see something, say something” signs that encourage you to report thunderstorms.

So I felt no need to apologize for lightning. But terrorism? I really wanted to tell my daughter just how sorry I was that she would have to live in what 9/11 transformed into the most frightened country on Earth. Want the numbers? Some 40% of Americans believe the country is more vulnerable to terrorism than it was just after September 11, 2001 – the highest%age ever. Want the apocalyptic jab in the gut? Army Chief of Staff General Mark Milley said earlier this month that the threat remains just as grave: “Those people, those enemies, those members of that terrorist group, still intend – as they did on 9/11 – to destroy your freedoms, to kill you, kill your families, they still intend to destroy the United States of America.” All that fear turned us into an engine of chaos abroad, while consuming our freedoms at home.

And it saddens me that there was a different world, pre-9/11, which my daughter’s generation and all those who follow her will never know. [..] After the last cardboard boxes had been lugged up the stairs, I held back my tears until the very end. Hugging my daughter at that moment, I felt as if I wasn’t where I was standing but in a hundred other places. I wasn’t consoling a smart, proud, twenty-something woman, apprehensive about senior year, but an elementary school student going to bed on the night that would forever be known only as 9/11. Back home, the house is empty and quiet. Outside, the leaves have just a hint of yellow. At lunch, I had some late-season strawberries nearly sweet enough to confirm the existence of a higher power. I’m gonna really miss this summer.

Read more …