Fred Lyon Post&Powell Union Square San Francisco 1947

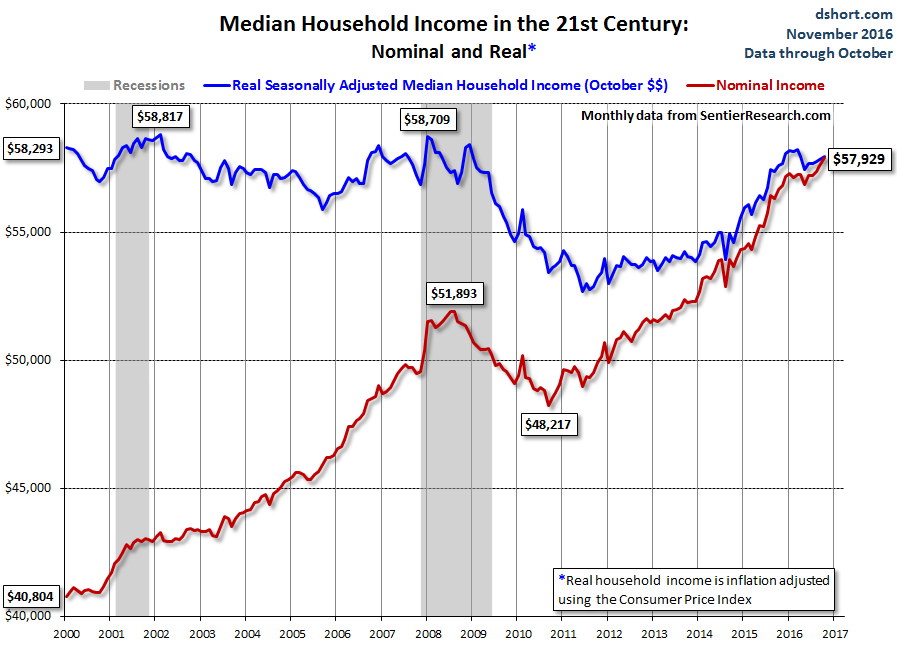

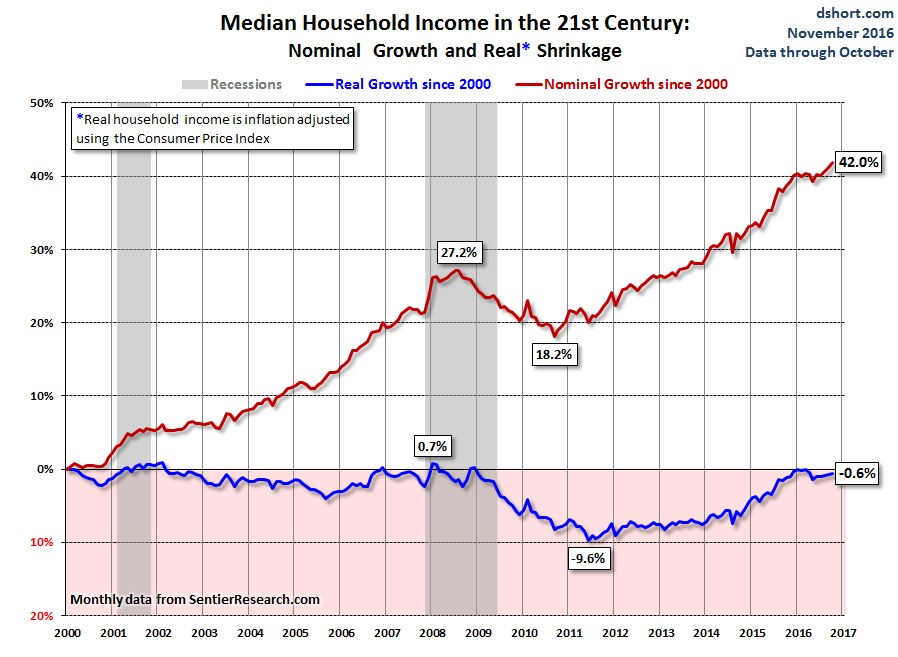

The numbers say it.

• 100% Chance of Recession Within 7 Months? (DR)

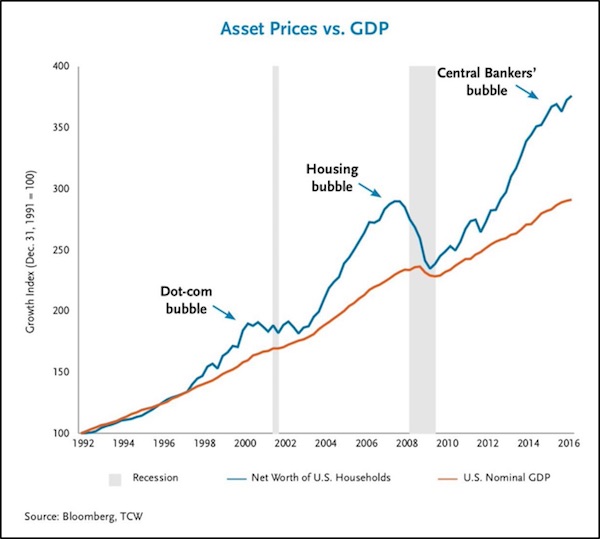

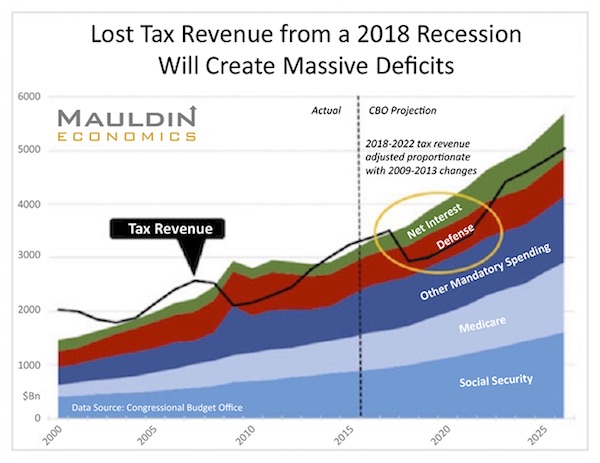

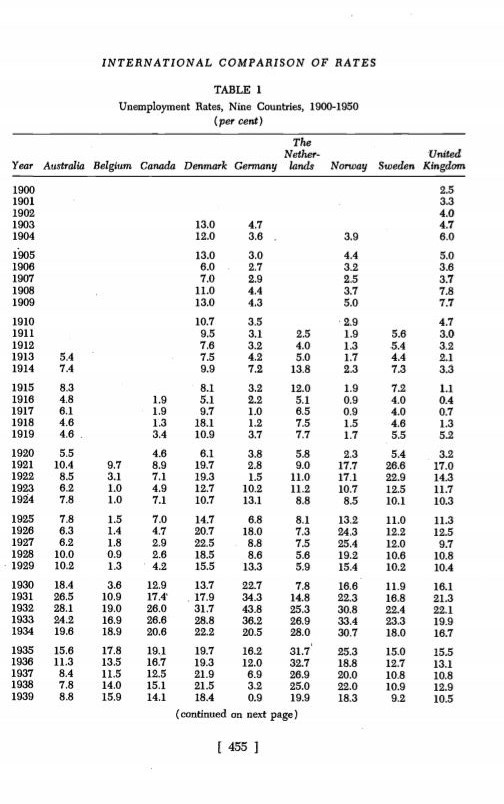

We asked this question one week after Trump was elected: “What does history predict for the Trump presidency?” The answer we furnished — based on over a century of data — was this: “A 100% chance of recession within his first year.” Not a 90% chance, that is. Not even a 99% chance. But a 100% chance of recession. That answer came by way of a certain Raoul Pal. He used to captain one of the largest hedge funds in the world. And to prove his case he called the unimpeachable witness of history to the stand… Crunching 107 years worth of data, he showed the U.S. economy enters or is in a recession every time a two-term president vacates the throne: “Since 1910, the U.S. economy is either in recession or enters a recession within 12 months in every single instance at the end of a two-term presidency… effecting a 100% chance of recession for the new president.”

Obama was a two-term president – if memory serves. Only two incoming presidents were not treated to a recession within the first year of office. And both followed one-term reigns: “Not every single election sees a recession, only every two-term incumbent change… Only two presidents in history did not see a recession, and they were inaugurated after single-term presidents.” Mr. Pal couldn’t fully explain the phenomenon. Maybe it takes two terms for presidential mischief to work its way into the economic machinery. One-term presidents just can’t heave enough sand in the gears. Regardless of the reason, this fellow’s research pointed him to one conclusion: “It is not a coincidence.” Trump’s now five months into his first 12. Where does the prediction stand? By grace of God or Janet Yellen or neither or both, no recession yet.

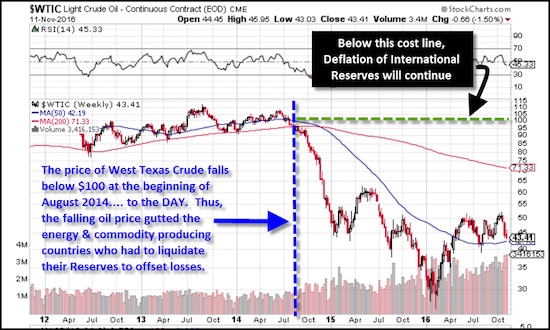

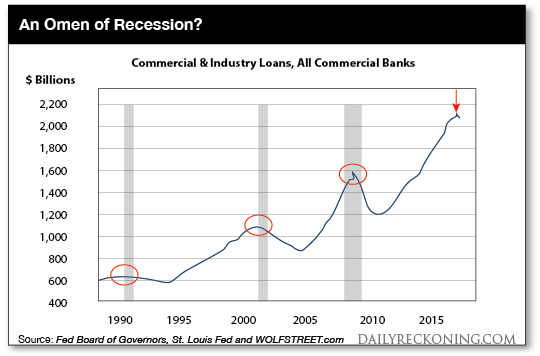

But our pessimistic side reminds us that seven months remain. And anxiety riles the deeps of our being… For we’ve spotted ill omens… disturbing portents of recession among the recent economic data… Old Daily Reckoning hand Wolf Richter: Over the past five decades, each time commercial and industrial loan balances at U.S. banks shrank or stalled… a recession was either already in progress or would start soon. There has been no exception since the 1960s. Last time this happened was during the financial crisis. “Now,” Wolf says, “it’s happening again.” Last month commercial and industrial loans (C&I) outstanding fell to $2.095 trillion, according to the St. Louis Fed. That’s down 4.5% from their November 2016 peak, says Wolf. And it marked the 30th consecutive week of no growth in C&I loans. Wolf argues C&I loans matter because they directly reflect the real economy – unlike today’s stock market, which is crooked as a Brit’s teeth.

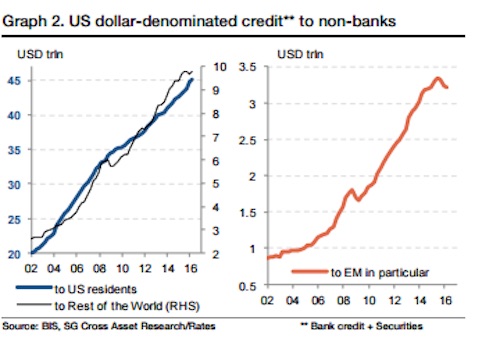

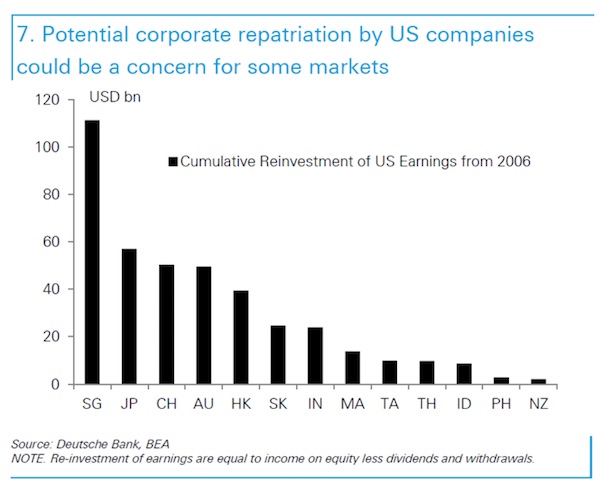

Tons of graphs from Steve. I find his use of ‘debt and ‘credit’ as seemingly separate terms a bit confusing.

• The Secret Source of Eternal Australian Growth (Steve Keen)

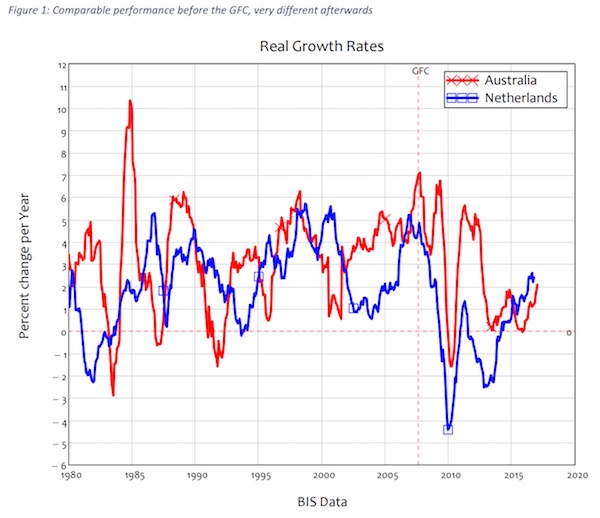

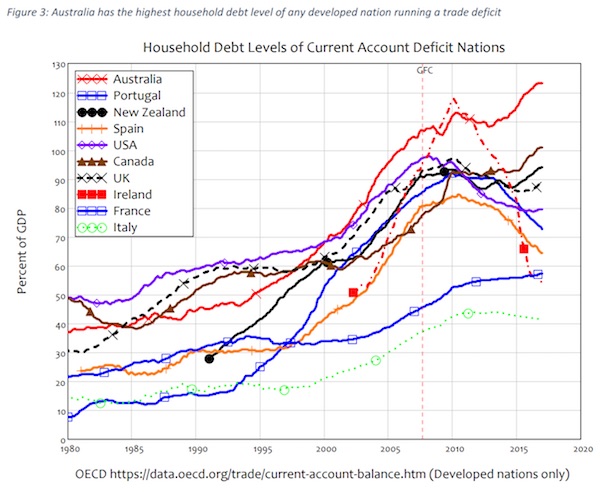

Much was made of the fact that Australia recently replaced The Netherlands as the world record holder for the longest period without a recession (using the colloquial definition of two consecutive quarters of negative growth). The Netherlands went just under 26 years (103 quarters between 1982 and 2008) without a recession, and Australia surpassed this when it recorded 0.3% growth in the March 2017 quarter (for an annual growth rate of 1.7%).

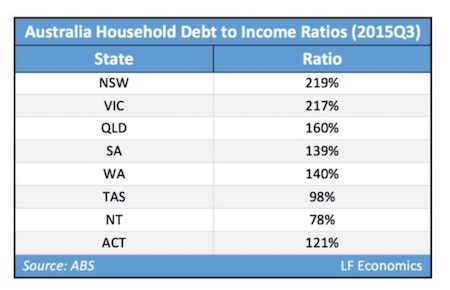

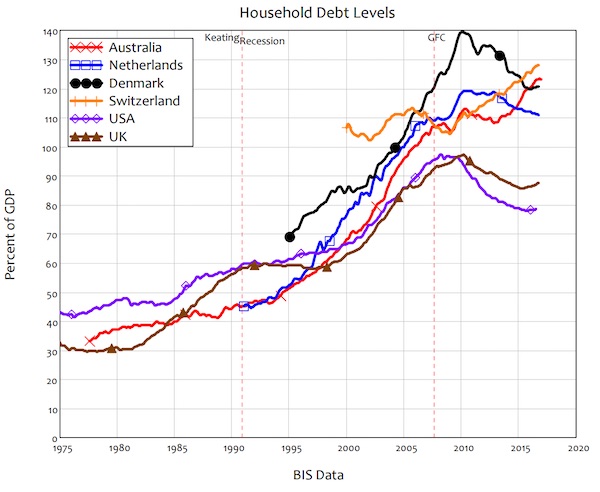

Rather less attention was given to another Australian record: household debt. Before its recession-free record was set, Australia had already overtaken The Netherlands for the record of the highest level of household debt ever recorded for a large country (one with more than 10 million people).

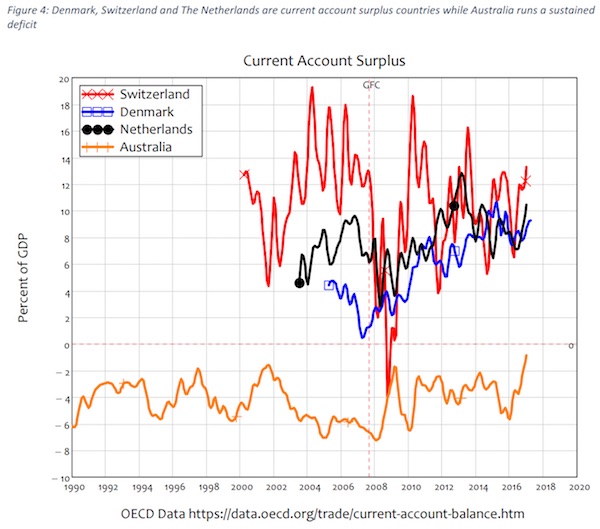

Australia’s household debt level of 123% of GDP has been exceeded only by Switzerland (population 8.3 million, household debt of 128% of GDP in 2016 Q3) and Denmark (population 5.6 million, 139% of GDP in 2009).2 Australia also stands apart from its household leverage competitors in another important respect: Denmark, Switzerland and The Netherlands also run significant current account surpluses—Switzerland’s average surplus since 2000 has been the highest on the planet at over 10% of GDP; Denmark’s has averaged 5.75% since 2005; The Netherlands’ average current account surplus is around 8% of GDP.

Australia, in contrast, has averaged a current account deficit of 3.2% of GDP since 1960, and 4.3% since 2000. Australia therefore holds the record of the highest level of household debt for a country running a trade deficit, and has done so since 2010, when it overtook the previous record-holder: Ireland. Ireland’s household debt level has also plunged since then, from a peak of 118% of GDP in 2010 to 54%. Australia’s closest competitor now is Canada, which has a household debt level 22% lower than Australia’s, and an average trade deficit of 1.4% of GDP, versus Australia’s long-run average of 3.2%.

Why does this matter? Because Australia’s two records are related: Australia avoided a recession in 2008 only by adding additional leverage to its already over-indebted household sector, and the only ways that Australia can keep its winning streak on GDP growth going (given that its government is obsessed with trying to run a surplus) is to either to achieve a huge trade surplus, or for the household sector to continue piling on debt faster than GDP itself grows. A trade surplus is one of three ways to increase both aggregate demand and the amount of money in an economy:3 goods you sell to foreigners are paid for in US dollars, which the exporter then effectively sells to its country’s Central Bank in return for domestic currency (on that front, The Netherlands is, like Germany, a huge beneficiary of the Euro).

A valiant effort, and economics should be redefined for sure, but Ann shirks far too close to assuming Brexit was about economics only and purely. Tempting when you’re an economist, but…

• We Need A Public Inquiry Into The Economics Profession (Pettifor)

If the British economy crashes as a result of Brexit, it will not vindicate economists. It will simply illustrate once again, their failure. I and my colleagues at Policy Research in Macroeconomics (PRIME) believe there is urgent need for an independent, public inquiry into the economics profession, and its role in precipitating both the financial crisis of 2007-9, the subsequent very slow ‘recovery’; and in the British European referendum campaign. Financial disarray is not unlikely under Brexit, but whether this turns into anything material depends in the first instance on economic policy. How can we trust economists at the Treasury not to impose more disastrous policies? Economists have once again proved themselves not only irrelevant, but a dangerous irrelevance. For too long they have resisted call after call for reform. If they will not do it themselves then it is time for others to take control.

The profession should be brought to account through a public inquiry into the this failure. In voting to leave the EU, England overwhelmingly has rejected economics – and in particular the dominant economic narrative. Unfortunately, the economics profession as a whole cannot resign, though perhaps the President of the RES, Andrew Chesher, should consider his position. Because this hardship is indirectly a consequence of the economics profession. Economists led the way to financial liberalisation of the past 40 years, which led to soaring levels of debt, crises and financial ruin. Economists dictated the terms for austerity that has so harmed the economy and society over the past years. As the policies have failed, the vast majority of economists have refused to concede wrongdoing, nor have societies been offered alternative economics policies.

While it is risky to second guess public opinion, it may just be that the prospect of hardship to come might not have been very compelling for those already suffering the hardship of low wages, insecure low-skilled jobs, bad housing, high rents, an under-resourced and increasingly privatised NHS, and other forms of public sector ‘austerity’. With this historic vote, the British people have not just rejected the EU. They have done something that should worry the British establishment, and their friends in the City of London, and internationally, far more. Perhaps most symbolically, even the Queen suggested they did not know what they were doing. It is hardly surprising, therefore, that the British public did not find the opinion of Remain ‘experts compelling’.

If you allow for homes to be speculative ‘assets’, you will end up with homeless people.

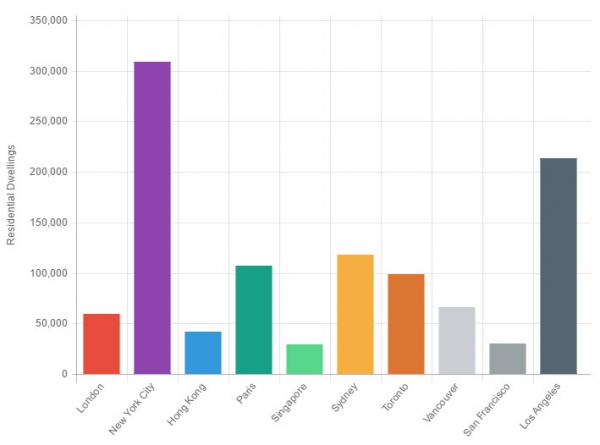

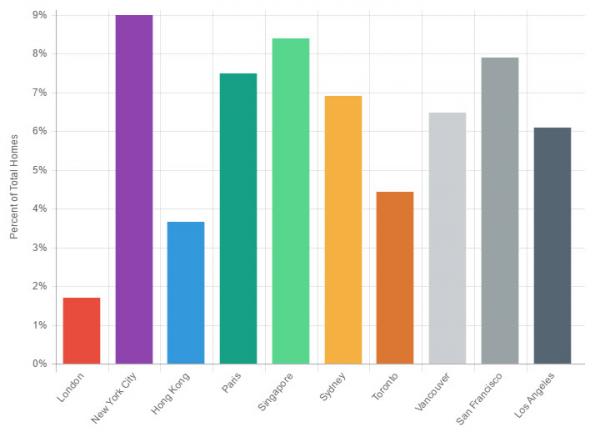

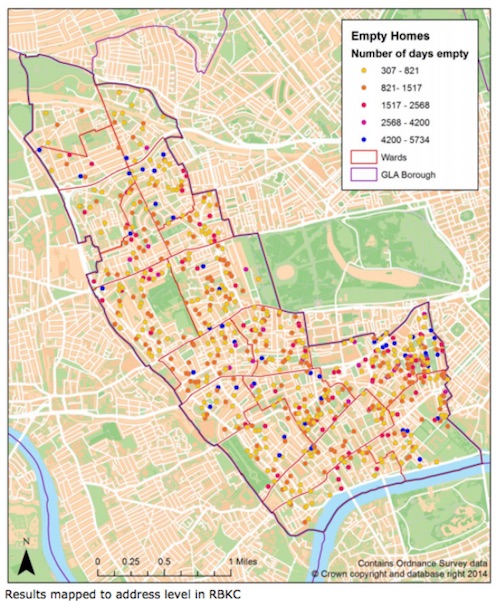

• Where Are The Empty Homes In Kensington? (Whoownsengland)

As the nightmare of the Grenfell Tower disaster continues to unfold, one of the many painful questions being asked by survivors is: ‘Where are we going to live now?’ Kensington & Chelsea Council have still been unable to give firm assurances that residents will be rehoused in the area, issuing a statement on Friday afternoon (later contradicted) that “Given the number of households involved, it is possible the council will have to explore housing options that may become available in other parts of the capital”. On Friday, the Times reported that Jeremy Corbyn had an alternative solution. “Corbyn: seize properties of the rich for Grenfell homeless” ran its above-the-fold headline (£). This was not, of course, what Corbyn had actually proposed, as the article itself revealed.

In a parliamentary debate, the Labour leader had suggested that “Properties must be found, requisitioned if necessary, to make sure those residents do get rehoused locally… It cannot be acceptable that in London you have luxury buildings and flats kept as land banking for the future while the homeless and the poor look for somewhere to live.” Not quite the State appropriation of private property conveyed by the sub-editor’s fevered headline, then – but a proposal for making better use of empty housing which happens to be supported by 59% of the British public, according to YouGov. So how many empty homes are there in Kensington? A lot, it turns out. The Department for Communities and Local Government regularly publishes statistics on vacant dwellings, broken down by local authority area.

The latest figures for Kensington & Chelsea reveal there are 1,399 vacant dwellings in the borough, as of April 2017 – and the number hasn’t dropped below a thousand for over a decade. 600 people lived in Grenfell Tower – so there are more than enough empty homes in the borough to house them all, if the properties could be accessed. But where are these empty homes? And who owns them? It turns out that Kensington Council themselves know precisely where they are. In a report published in July 2015, the council’s Housing and Property Scrutiny Committee examined in detail the problem of ‘buy to leave’ in the borough. ‘Buy to leave’ is the phenomenon of purchasing a property where the buyer has no intention to live in it; where the home is regarded purely as an investment – one that, in London’s super-heated property market, will rapidly accrue in value.

The council’s report used a variety of methods to locate empty housing, from council tax registers and payment data, to energy use and Land Registry records. Their findings broadly corroborate central government stats – that there are around a thousand long-term empty homes in Kensington & Chelsea. And on page 13 of the report, they display an extraordinary map of the 941 homes classified as unoccupied dwellings for the purposes of council tax:

Science and technology will not enforce human rights. Moral values will.

• Security…or Surveillance? Ron Paul Edward Snowden Interview (TAM)

Saying that you don’t care about privacy because you have nothing to hide is no different than saying you don’t care about freedom of speech because you have nothing to say.” That comment was made by famed whistleblower Edward Snowden during a recent interview on the Ron Paul Liberty Report. In his conversation with Dr. Paul and Daniel McAdams, published Tuesday, an articulate Snowden discusses the true meaning of freedom, the nature of the deep state, and even his upbringing as a child of a government family. “I’d like to know a little bit, what do you do all day long?” a genuinely curious Dr. Paul asks as his opening question. After talking about the insanity that erupted — both in the political spectrum and his personal life — following the revelations he made back in 2013, Snowden says he’s now become a hot commodity for groups championing causes.

“They want me to sort of front for these issues of privacy and civil liberties and protection of people’s rights,” Snowden replies. “And I want to do what I can, but I’m not a politician. I’m an engineer.” The whistleblower goes on to talk about how he’s now, at long last, finally able to devote time to more practical applications. For him, this means focusing on the area that holds the key to finding a balance between rights and laws in the digital age — technology. “How technically is this even happening?” Snowden poses, digging straight to the heart of the issue of mass surveillance. “How is it that so many governments are spying on so many people? Because even if we pass the best legal reforms in the world in the United States, that doesn’t do anything against China, or Russia, or Germany, or France or Brazil or any other country in the world.”

Continuing, Snowden says that future generations’ rights and protections will be dependent on the current generation’s ability to adapt to a constantly shifting environment: “We need to find new means, new mechanisms, for enforcing these rights in the new times. And I think that’s going to be primarily through science and technology.”

Wherever you live in the world, if you think things are a mess where you are, spare a thought for Brazil.

• Brazil Police Claim To Have Evidence President Temer Received Bribes (G.)

Brazil’s federal police has said that investigators have found evidence the president, Michel Temer, received bribes to help businesses, raising a new threat that the embattled leader could be suspended from office pending a corruption trial. Temer has been under investigation due to plea bargain testimony by the wealthy businessman Joesley Batista of the giant meatpacking company JBS that linked the president and an aide to bribes and the president to an alleged endorsement of hush money for jailed ex-House Speaker Eduardo Cunha. Temer has denied any wrongdoing and insists he will not resign. If Brazil’s top prosecutor agrees with the federal police recommendation, Congress will decide whether Temer should be investigated by the supreme court, which is the only body that can formally investigate the president.

If two-thirds of Congress voted to allow the investigation, Temer would be suspended from office pending trial. In a report published on Tuesday by Brazil’s top court, federal police investigators said they had enough evidence of bribes being paid to warrant a formal investigation of Temer for “passive corruption” – Brazil’s charge for the act of taking bribes. It said former Temer aide Rodrigo Rocha Loures directly received bribes from JBS on the president’s behalf. A previously released video made by investigators shows Loures carrying a suitcase filled with about $150,000 in cash allegedly being sent from JBS to the president. Loures later gave the bag and most of the money to Brazil’s federal police, authorities have said.

They’ll pass at some point.

• House Republicans Block Russia Sanctions Bill (ZH)

After recruiting Trump, the KGB and Moscow have clearly also managed to make all House Republicans their puppets, because the Senate bill that passed last week and slapped new sanctions on Russia (but really was meant to block the production on the Nord Stream 2 gas pipeline from Russia and which Germany, Austria and France all said is a provocation by the US and would prompt retaliation) just hit a major stumbling block in the House. At least that’s our interpretation of tomorrow’s CNN “hot take.” Shortly after House Ways and Means Chairman Kevin Brady of Texas said that House leaders concluded that the legislation, S. 722, violated the origination clause of the Constitution, which requires legislation that raises revenue to originate in the House, and would require amendments, Democrats immediately accused the GOP of delaying tactics and “covering” for the Russian agent in the White House.

“House Republicans are considering using a procedural excuse to hide what they’re really doing: covering for a president who has been far too soft on Russia,” Senate Minority Leader Chuck Schumer of New York said in a statement. “The Senate passed this bill on a strong bipartisan vote of 98-2, sending a powerful message to President Trump that he should not lift sanctions on Russia.” And, if the House does pass it, a huge diplomatic scandal would erupt only not between the US and Russia, but Washington and its European allies who have slammed this latest intervention by the US in European affairs… a scandal which the Democrats would also promptly blame on Trump. That said, the bill may still pass: Brady pushed back against Democrat suggestions that House GOP leadership is trying to delay the bill, stressing that he thought the Senate legislation was sound policy.

“I strongly support sanctions against Iran and Russia to hold them accountable. We were willing to work with the Senate throughout the process, but the final bill and final language violated the origination clause in the Constitution,” Brady told reporters on Tuesday. “I am confident working with the Senate and Chairman [Ed] Royce that we can move this legislation forward. So at the end of the day, this isn’t a policy issue, it’s not a partisan issue, it is a Constitutional issue that we will address.”

We’re still not clued in to how dangerous ‘our own’ are.

• We Are Inches From A New World War (Medium)

This is your fault, Clinton Democrats. You created this, and if our species is plunged into a new world war or extinction via nuclear holocaust, it will be your fault. You knuckle-dragging, vagina hat-wearing McCarthyite morons made this happen. American military provocations against the pro-Assad coalition in Syria are fast becoming a daily occurrence. In response to the US air force’s gunning down of a Syrian military plane on Sunday, Russia has cut off its hotline with which it was coordinating operations with America to avoid aerial collisions, and has warned that all US aircraft west of the Euphrates river will now be tracked and treated as potential targets. Today, 25 miles northwest of the Russian enclave of Kaliningrad, a US reconnaissance plane was intercepted by an armed Russian aircraft which came within five feet of the plane’s wingtip.

This on the same day that the US shot down yet another Iranian military drone in Syria. Clintonists have been working tirelessly since the election to manufacture these new Cold War tensions. Stephen Cohen, easily America’s foremost authority on US-Russia relations, has warned again and again that the political pressures being placed on the Trump administration to maintain escalations with Russia without conceding an inch has placed our species in a situation that is in some ways even more dangerous than those we faced at the height of the Cuban Missile Crisis. If Kennedy had had to negotiate that crisis while being pressured by his entire country to keep escalating tensions with the USSR without yielding an inch, there is no way any terrestrial life would have existed beyond 1962. The Clintonists (along with their neocon buddies on the other side of the aisle) are responsible for creating those pressures.

“You know it’s easy to joke about this, except that we’re at maybe the most dangerous moment in US-Russian relations in my lifetime, and maybe ever. And the reason is that we’re in a new cold war, by whatever name.

We have three cold war fronts that are fraught with the possibility of hot war, in the Baltic region where NATO is carrying out an unprecedented military buildup on Russia’s border, in Ukraine where there is a civil and proxy war between Russia and the west, and of course in Syria, where Russian aircraft and American warplanes are flying in the same territory. Anything could happen.”

~ Stephen CohenIt wasn’t enough for these Democratic neocons to try and elect a woman who had been pushing for dangerous escalations with Russia since long before any hacking allegations and who campaigned on a promise to invade Syria and seize control of an airspace wherein Russian military planes were conducting operations. No, once their initial bid to start World War 3 failed, these deranged death cultists began attacking Trump for any movement away from escalations with Russia or regime change in Syria and showering him with praise when he launched a missile strike against a Syrian airbase. The current administration is culpable for its own actions and should be unequivocally condemned for bowing to these pressures instead of honoring Trump’s campaign promises of pursuing detente with Russia and avoiding regime change in Syria, but if Clintonists had been pushing for peace instead of war this entire time the situation would doubtless look very, very different.

The opposite of what America needs.

• Iran Slams Tillerson Call For Regime Change (RT)

Iran has accused the United States of interfering in its domestic affairs after calls by the US Secretary of State to support “elements” that would ensure a “peaceful transition” in the Islamic Republic. Tehran also officially delivered a note of protest to the UN. Speaking last Wednesday before the House Foreign Affairs Committee, Rex Tillerson said Washington will support efforts of a regime change in Iran. “Our policy towards Iran is to push back on this hegemony, contain their ability to develop obviously nuclear weapons, and to work toward support of those elements inside of Iran that would lead to a peaceful transition of that government. Those elements are there, certainly as we know,” Tillerson said on June 14. In addition to voicing Washington’s apparent support of a regime change, Tillerson also said the US could pursue sanctions on Iran’s entire Islamic Revolutionary Guard Corps.

Tillerson’s remarks sparked an avalanche of criticism and condemnation from Iran. In the latest development, the Iranian Foreign Ministry summoned the Swiss charge d’affaires to Tehran to protest Washington’s policy. The Embassy of Switzerland represents American interests in the Islamic Republic after the US cut diplomatic relations with Iran in April 1980 in the wake of the 400-day US Embassy hostage crisis of 1979-1981. “Following the interfering and meddling statements made by the US Secretary of State Rex Tillerson… the charge d’affaires of the European country was summoned to express Iran’s complaint about Tillerson’s anti-Iran remarks in the country’s House of Representatives,” Iran’s Foreign Ministry spokesperson said in a statement, Mehr News reported.

[..] Tillerson’s remarks “is a brazen interventionist plan that runs counter to every norm and principle of international law, as well as the letter and spirit of UN Charter, and constitutes an unacceptable behavior in international relations,” Iran’s UN Ambassador Gholamali Khoshroo said in the letter. Tehran further accused the US of violating the 1981 Algiers Accords, a set of agreements signed by Washington and Tehran to end the Iran hostage crisis. “The United States pledges that it is and from now on will be the policy of the United States not to intervene, directly or indirectly, politically or militarily, in Iran’s internal affairs,” Point I of the Accord reads.

No surprise here.

• The US Seems Keener To Strike At Assad Than To Destroy Isis (Robert Fisk)

On the ground, the Syrian army is now undertaking one of its most ambitious operations since the start of the war, advancing around Sueda in the south, in the countryside of Damascus and east of Palmyra. They are heading parallel with the Euphrates in what is clearly an attempt by the government to “liberate” the surrounded government city of Deir ez-Zour, whose 10,000 Syrian soldiers have been besieged there for more than four years. If they can lift the siege, the Syrians will have another 10,000 soldiers free to join in the recapture of more territory. More importantly, however, the Syrian military suspects that Isis – on the verge of losing Raqqa to US-supported Kurds and Mosul to US-backed Iraqis – may try to break into the garrison of Deir ez-Zour and declare an alternative “capital” for itself in Syria.

In this context, the American strike on Monday was more a warning to the Syrians to stay away from the so-called Syrian Democratic Forces – the facade-name for large numbers of Kurds and a few Arab fighters – since they are now very close to each other in the desert. The Kurds will take Raqqa – there may well have been an agreement between Moscow and Washington on this – since the Syrian military is far more interested in relieving Deir ez-Zour. The map is quite literally changing by the day. But the Syrian military are still winning against Isis and its fellow militias – with Russian and Hezbollah help, of course – although comparatively few Iranians are involved. The US has been grossly exaggerating the size of the Iranian forces in Syria, perhaps because this fits in with Saudi and American nightmares of Iranian expansion. But the success of the Assad regime is certainly troubling the Americans – and the Kurds.

So who is fighting Isis? And who is not fighting Isis? Russia claims it has killed the terrible and self-appointed “caliph of the Islamic State”, al-Baghdadi. Russia says it is firing Cruise missiles at Isis. The Syrian army, supported by the Russians, is fighting Isis. I have witnessed this with my own eyes. But what is America doing attacking first Assad’s air base near Homs, then the regime’s allies near Al-Tanf and now one of Assad’s fighter jets? It seems that Washington is now keener to strike at Assad – and his Iranian supporters inside Syria – than it is to destroy Isis. That would be following Saudi Arabia’s policy, and maybe that’s what the Trump regime wants to do. Certainly, the Israelis have bombed both the Syrian regime forces and Hezbollah and the Iranians – but never Isis.

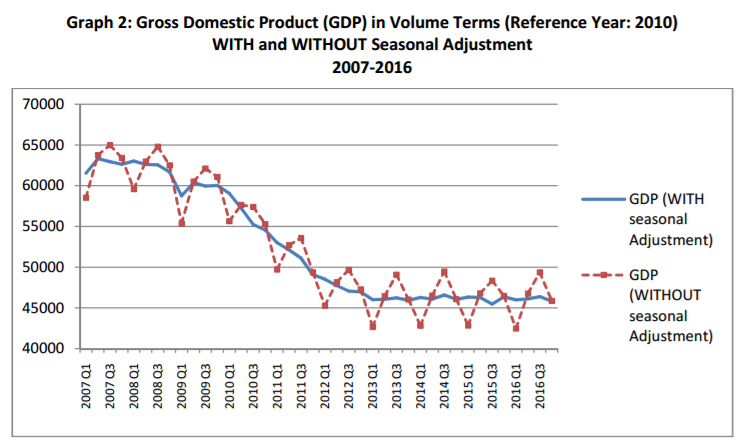

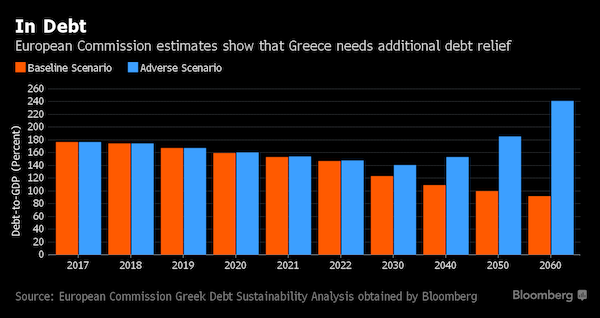

Complete nonsense: “..The baseline scenario is based on nominal GDP growth rates between 3 and 4% until 2060”

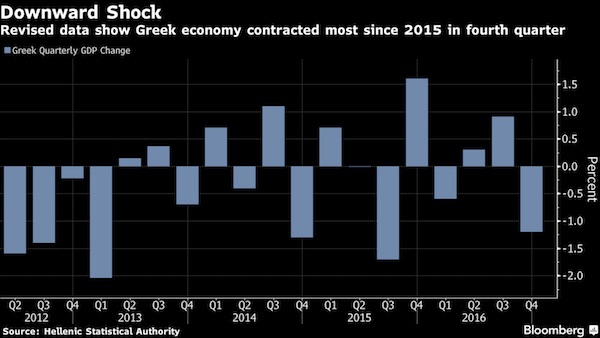

• EU Says Greece Needs More Debt Relief Despite €10 Billion Buffer (BBG)

Greece will need additional debt relief to regain the trust of investors, even though it’s likely to exit its bailout with a €9 billion ($10 billion) cash buffer, the European Commission said in a draft report obtained by Bloomberg. The country’s €86 billion third bailout program from the European Stability Mechanism, agreed by Prime Minister Alexis Tsipras and European creditors in 2015, will expire in August 2018 with €27.4 billion left unused, the commission estimates in the so-called “compliance report” dated June 16. Disbursements up to then should also “cater for the build-up of seizable cash buffer” of around €9 billion, according to the document. The report contains an analysis of the country’s public debt that points to potential wrangling with the IMF following an agreement last week to disburse bailout funds, in which the fund only agreed to a new program “in principle.”

Even as the commission’s analysis points “to serious concerns regarding the sustainability of Greek public debt,” its assumptions about the country’s future growth prospects are still more optimistic than those of the IMF. The IMF hasn’t disbursed funds to Greece in almost three years on fears that the country’s debt is unsustainable. Last week’s compromise deal averts a Greek financing crisis this summer by allowing release of €8.5 billion of ESM funds, while the IMF holds out for more Greek debt relief from European creditors at a later stage before it gives out new loans. The June 15 deal by euro-area finance ministers commits to capping gross financing needs at 15% of GDP for the medium term, and 20% thereafter. The country’s gross financing needs will drop to 9.3% of GDP in 2020 from 17.5% this year, before rising again and surpassing 20% after 2045, according to the baseline scenario of the commission’s debt sustainability report.

[..] The baseline scenario is based on nominal GDP growth rates between 3 and 4% until 2060, considerably higher than past IMF baseline estimates. The fund’s own assessment will be released before its executive board meets to approve the in-principle stand-by arrangement next month. The debt dynamics “become explosive” from the mid-2030s in the the most adverse scenario. In this scenario, which is still more optimistic than IMF assumptions, Greece’s gross financing needs exceed 20% in 2033, reaching 56% by 2060, while debt skyrockets to 241.4% of Greek GDP by 2060.

Bloomberg, too, will first have to understand that Greece does not have €326 billion in debt, and why it is people state that regardless.

• Europe’s Unserious Plan for Greece (BBG)

The deal struck last week between Greece and its euro-zone creditors is business as usual – and that’s not a good thing. This protracted game of “extend and pretend” serves nobody’s long-term interests: not those of the Greek government, the IMF or, most of all, the people of Greece. Euro-zone finance ministers have unlocked a payment of €8.5 billion ($9.5 billion), the newest installment of a rescue plan worth €86 billion. This will let Athens make debt repayments of €7 billion that fall due next month. But there’s still no agreement on how to get Greece’s debt burden under control. The IMF had previously insisted that this question should be settled now. It was right, and it should have stuck to that position. The new agreement fails to recognize what everybody knows: that Greece’s debt is unsustainable on the current terms.

In an effort to pretend otherwise, Athens has promised primary budget surpluses (meaning net of interest payments) of 3.5% of GDP until 2022, and then of “above but close to 2%” until 2060. True, the Greek economy achieved a better-than-expected primary surplus last year. As the European recovery gathers pace, there could be more good fiscal news. But the idea that Greece can maintain this degree of fiscal control for the next 40 years is ridiculous. For instance, at some point during the next four decades, there might be another recession. Stranger things have happened. The blow to the credibility of the IMF could prove to be lasting damage. The fund points to its refusal to disburse money at this point as proof it’s serious about debt relief. Yet it remains a partner in a project that, by its own analysis, is bound to fail.

It should have said, enough. Europe doesn’t need the fund’s money or expertise. Governments only sought the fund’s seal of approval – and should have been denied it. Granted, the euro zone has done a lot to support Greece since its fiscal crisis began. Athens has been granted no fewer three rescue packages, worth €326 billion€ in total. The euro zone has allowed generous grace periods for official loans, extended their maturities and lowered the interest rate. As a result, Greece’s debt repayments are actually quite manageable for now.

While taxes have risen. An endless hole.

• Greek Property Market Has Lost 65% Of Its Value Since 2009 (K.)

The value of the local property market has plummeted some €2 trillion since the outbreak of the financial crisis eight years ago, according to the calculations of a Greek real estate consultancy. CBRE-Atria calculated that the Greek market has lost 65% of its value in the years from 2009 to 2017, dropping from about €3 trillion to €1 trillion today. The head of the consultancy, Yiannis Perrotis, says the problem is that the majority of properties are not quality assets, which means that the economic crisis has affected them more by increasing their value loss. “Properties such as old apartments in less popular areas, fields in non-touristic areas, stores or offices of low standards in secondary spots,” Perrotis explains, have been hardest hit.

The drop in values has been aggravated by the imposition of high taxation. It’s easy to find examples of properties whose value has dropped 60-65% in the last few years: Data from estate agents show that a new fifth-floor apartment of 60 square meters in Kypseli, central Athens, which sold for €150,000 in 2008, was resold at end-2016 for just €60,000, a decline of 60%; a newly built apartment in Ambelokipi, also in Athens, was sold for €270,000 before the crisis, and today is for sale for just €120,000, down 55%.

So fitting. Though, World Refugee Day is the most cynical expression possible of the disaster we’ve created.

• At Least 120 Migrants Drown In Mediterranean On World Refugee Day (Ind.)

More than 120 refugees are feared to have drowned in the Mediterranean after a boat sank off the Libyan cost on Friday, the International Organization for Migration (IOM) has said. Four survivors who were rescued by Libyan fishermen said the boat sank after its motor was stolen by human traffickers, according to IOM spokesman Flavio Di Giacomo. After drifting for a while, the boat, believed to have been carrying 130 refugees — most of them of Sudanese and Nigerian nationality — capsized. News of the deaths comes on World Refugee Day, during which NGOs encourage the world to commemorate and show support for those forced to flee persecution. But there is little sign of the plight of refugees in the Mediterranean abating.

The death toll passed 1,000 in April — marking a record high with that figure not reached until the end of May last year — and the latest count by the IOM shows at least 1,850 have lost their lives on the dangerous crossing. Up to 146 people drowned when a refugee boat sunk in March, and up to 250 refugees, including a baby, were reported to have drowned in May after two refugee boats sunk in the Mediterranean Sea. It comes after a report earlier this month accused the EU of disregarding human rights and international law in its desperation to slow refugee boat crossings across the Mediterranean Sea. The bloc has pledged tens of millions of euros in funding for authorities in Libya, despite the country’s ongoing civil war and allegations of torture, rape and killings earning it the moniker “hell on Earth” among migrants, according to the report, published by the US-based Refugees International (RI) group.