Paul Gauguin The Seine in Paris 1875

This Reuters journalist unexpectedly gets it just right: “The Pentagon’s late Friday announcement appeared to close the door to any imminent decision to wage retaliatory strikes against Iran following the attack..”

• United States Sending Troops To Bolster Saudi Defenses After Attack (R.)

U.S. President Donald Trump on Friday approved sending American troops to bolster Saudi Arabia’s air and missile defenses after the largest-ever attack on the kingdom’s oil facilities, which Washington has squarely blamed on Iran. The Pentagon said the deployment would involve a moderate number of troops – not numbering thousands – and would be primarily defensive in nature. It also detailed plans to expedite delivery of military equipment to both Saudi Arabia and the United Arab Emirates. Reuters has previously reported that the Pentagon was considering sending anti-missile batteries, drones and more fighter jets. The United States is also considering keeping an aircraft carrier in the region indefinitely.

“In response to the kingdom’s request, the president has approved the deployment of U.S. forces, which will be defensive in nature and primarily focused on air and missile defense,” U.S. Defense Secretary Mark Esper said at a news briefing. “We will also work to accelerate the delivery of military equipment to the kingdom of Saudi Arabia and the UAE to enhance their ability to defend themselves.” The Pentagon’s late Friday announcement appeared to close the door to any imminent decision to wage retaliatory strikes against Iran following the attack, which rattled global markets and exposed major gaps in Saudi Arabia’s air defenses.

Trump said earlier on Friday that he believed his military restraint so far showed “strength,” as he instead imposed another round of economic sanctions on Tehran. “Because the easiest thing I could do, ‘Okay, go ahead. Knock out 15 different major things in Iran.’ … But I’m not looking to do that if I can,” Trump told reporters at the White House.

Jim Rickards’s comment on Twitter: “Trump just sanctioned the central bank of Iran (Bank Markazi). If you’re not a banking expert and want to understand the impact, it’s like turning off the oxygen of a patient in intensive care. The result is predictable.”

• Trump Says He’s Sanctioning Iran’s National Bank (Hill)

President Trump announced Friday that he had sanctioned Iran’s national bank, calling them the “highest sanctions ever imposed on a country.” Trump made the comments to reporters during an Oval Office meeting with Australian Prime Minister Scott Morrison. The announcement comes two days after Trump said he had instructed the Treasury Department to increase sanctions on Iran following attacks on two oil facilities in Saudi Arabia. The Trump administration has blamed Iran in the attacks, which took out roughly 5 percent of the global oil supply on Saturday. “These are the highest sanctions ever imposed on a country, we’ve never done it to this level. It’s too bad what’s happening with Iran, it’s going to hell,” Trump told reporters, saying Tehran is “practically broke.”

The Treasury Department said in a statement that it was sanctioning Iran’s central bank, Iran’s national development fund and Etemad Tejarate Pars Co., an Iran-based firm that U.S. officials said is used to conceal financial transfers for purchases by Iran’s defense ministry. Treasury Secretary Steven Mnuchin joined Trump briefly in the Oval Office to announce the new sanctions on Friday. “We are continuing the maximum pressure campaign,” Mnuchin said. “This will mean no more funds going to the [Islamic Revolutionary Guards Corps] or to fund terror, and this is on top of our oil sanctions and our financial institution sanctions.” “The easiest thing I can do, OK go ahead, knock down 15 major things in Iran,” Trump told reporters in the Oval Office. “I could do that and it’s all set to go. But I’m not looking at doing that if I can.”

“So keep playing it out because you’re gonna look really bad when it falls, and I guess I’m about 22 and 0 and I’ll keep it that way… ”

• Trump Derides MSM Over Biden-Ukraine Story: You’re Gonna Look Really Bad (ZH)

A very smug President Trump brushed aside questions over a whistleblower complaint which reportedly involves promises made to Ukraine in exchange for an investigation into former Vice President Joe Biden. Calling the story “ridiculous” and describing the whistleblower as partisan, Trump said that it “doesn’t matter what I discussed,” adding “but I’ll tell you this, somebody ought to look into Joe Biden’s statement where He talked about billions of dollars that he’s not giving to a certain country unless a certain prosecutor is taken off the case. So, somebody ought to look into that and you wouldn’t because he’s a Democrat. And the fake news doesn’t look into things like that, it’s a disgrace.”

Trump was of course referring to a 2018 incident where Biden openly bragged about strongarming Ukraine into firing their top prosecutor, who was leading a wide-ranging corruption investigation into a natural gas firm whose board Hunter Biden sat on. Continuing on, Trump told reporters: “It was a totally appropriate conversation – it was actually a beautiful conversation.” Trump then warned the press they’re barking up the wrong tree after a “very bad week” in which the New York Times was forced to issue a major correction to an article about alleged sexual misconduct by Supreme Court Justice Brett Kavanaugh, after the two journalists who wrote it failed to include evidence from their own anti-Kavanaugh book which significantly undercut their argument.

“You know the press has had a very bad week with Justice Kavanaugh and all those ridiculous charges, and all of the mistakes made at the New York Times and other places,” said Trum, adding: “You’ve had a very bad week, and this will be better than all of ’em, this is another one. So keep playing it out because you’re gonna look really bad when it falls, and I guess I’m about 22 and 0 and I’ll keep it that way. “…keep asking questions and building it up as big as possible so you can have a bigger downfall.”

A top Ukrainne offical makes really silly statements: “Clearly, Trump is now looking for kompromat to discredit his opponent Biden, to take revenge for his friend Paul Manafort”..

• In Call, Trump Urged Ukraine President 8x To Investigate Biden’s Son (CNBC)

President Donald Trump repeatedly urged Ukraine’s president during a telephone call in July to investigate former Vice President Joe Biden’s son Hunter and his involvement with a Ukraine natural gas company, a new report says. The Wall Street Journal reported that Trump encouraged Ukraine President Volodymyr Zelensky “about eight times to work with Rudy Giuliani, his personal lawyer, on a probe, according to people familiar with the matter.” Biden is the current front-runner in the race to win the Democratic presidential nomination and face the Republican nominee, expected to be Trump, in the 2020 election.

Biden on Friday, when asked about Trump’s claims about him and his son, said, “Not one single credible outlet has given any credibility to his assertions. Not one single one. So I have no comment except the president should start to … be president.” [..] The Journal’s new report came as a top Ukraine official reportedly said that Trump “is looking” for Ukraine officials to investigate business dealings of Biden’s son in that country in an effort “to discredit” Biden as he seeks the Democratic presidential nomination.

The official, Anton Geraschenko, told The Daily Beast that Ukraine is ready to investigate Hunter Biden’s relationship with the Ukraine gas company “as soon as there is an official request.” But, he added, “Currently there is no open investigation.” Geraschenko is a senior advisor to Ukraine’s interior minister, who would be in charge of any investigation of Hunter Biden. “Clearly, Trump is now looking for kompromat to discredit his opponent Biden, to take revenge for his friend Paul Manafort, who is serving seven years in prison,” Geraschenko told The Daily Beast.

Does this settle the ‘dispute’?

• WaPo Reports No “Quid Pro Quo” Offered During Phone Call (ZH)

The latest ‘smoking gun’ Democrats have been clinging to in search of that ever-elusive Trump impeachment may have just imploded – after the Washington Post quietly reported on Friday evening that a July 25 phone call between President Trump and Ukrainian President Volodymyr Zelensky did not contain an explicit quid pro quo if Ukraine launched an investigation into former Vice President Joe Biden’s son as initially reported. While President Trump did reportedly “pressure the recently elected leader to more aggressively pursue” the investigation, “Trump did not raise the issue of American military and intelligence aid that had been pledged to Ukraine, indicating there was not an explicit quid pro quo in that call.”

Of course, it has been reported that there were multiple calls – however one might think that the Washington Post’s super high-level anonymous government source would have access to the others as well, and ostensibly would have leaked the most damaging information available. [..] “The revelation that Trump pushed Zelensky to pursue the Biden probe, which was first reported by the Wall Street Journal, represents the most detailed account so far of the president’s conduct that prompted a U.S. intelligence official to file a whistleblower action against the president.” -Washington Post

So – the current US president asked Ukraine to conduct a legal investigation into the former US Vice President, who openly bragged about withholding $1 billion in US loan guarantees unless they fired the guy investigating his son and his son’s company – and there was no quid pro quo offered in exchange for that investigation – at least not on that phone call.

Giuliani didn’t go looking, the Ukraine did.

• Missing Piece to the Ukraine Puzzle (Solomon)

The coverage suggests Giuliani reached out to new Ukrainian President Volodymyr Zelensky’s team this summer solely because he wanted to get dirt on possible Trump 2020 challenger Joe Biden and his son Hunter’s business dealings in that country. Politics or law could have been part of Giuliani’s motive, and neither would be illegal. But there is a missing part of the story that the American public needs in order to assess what really happened: Giuliani’s contact with Zelensky adviser and attorney Andrei Yermak this summer was encouraged and facilitated by the U.S. State Department. Giuliani didn’t initiate it. A senior U.S. diplomat contacted him in July and asked for permission to connect Yermak with him.

[..] Why would Ukraine want to talk to Giuliani, and why would the State Department be involved in facilitating it? According to interviews with more than a dozen Ukrainian and U.S. officials, Ukraine’s government under recently departed President Petro Poroshenko and, now, Zelensky has been trying since summer 2018 to hand over evidence about the conduct of Americans they believe might be involved in violations of U.S. law during the Obama years . The Ukrainians say their efforts to get their allegations to U.S. authorities were thwarted first by the U.S. embassy in Kiev, which failed to issue timely visas allowing them to visit America. Then the Ukrainians hired a former U.S. attorney — not Giuliani — to hand-deliver the evidence of wrongdoing to the U.S. Attorney’s Office in New York, but the federal prosecutors never responded.

The U.S. attorney, a respected American, confirmed the Ukrainians’ story to me. The allegations that Ukrainian officials wanted to pass on involved both efforts by the Democratic National Committee to pressure Ukraine to meddle in the 2016 U.S. election as well as Joe Biden’s son’s effort to make money in Ukraine while the former vice president managed U.S.-Ukraine relations, the retired U.S. attorney told me. Eventually, Giuliani in November 2018 got wind of the Ukrainian allegations and started to investigate. [..] Ukrainian officials also are discussing privately the possibility of creating a parliamentary committee to assemble the evidence and formally send it to the U.S. Congress, after failed attempts to get the Department of Justice’s attention, my sources say.

Now, THIS is a take-down. Read the whole thing.

• Is WeWork a Fraud? (Hawksberry)

WeWork will never ever, in its short history, generate a profit, let alone the tens of billions in revenues necessary to generate anywhere near the $3 billion in earnings required to (even then generously) value the company at £47 billion. A lot of people could have done what Adam Nuemann & Miguel McKelvey did, they don’t because they’re not prepared to engage in a fraud. They can play dumb all they like but when you fiddle with your financials, invent accounting principles, secretly acquire IP and double deal it for millions of dollars back to your own company, market yourselves misleadingly as a ‘technology’ play, cash out close to $1 billion and use that to acquire buildings to lease back to WeWork, employ half your family etc, etc, etc…please for heavens sake don’t try and convince me that they are unaware of what they are doing.

They know exactly what they’re doing. Adam and Miguel purposefully choose to hide those costs under ‘Community-Adjusted EBITA’s’. Why are they still parading WeWork as a technology company, does anybody believe as cunningly intelligent as they are, that they genuinely think WeWork is a ‘technology’ company? Why have they cashed out, and not just a few million dollars as a deposit on a big mortgage but hundreds of millions to buy buildings that they used to further bleed their own ponzi scheme with?. They have cashed out $1 billion whilst posting losses of $1.9 billion. Since their S1 release, Adam & Miguel have slashed their proposed post-IPO valuation by 86% in 4 re-valuations. The price started at $67 billion, then they quickly dropped it to $30/$40bn before again looking down at their calculator and punching buttons quicker than you can blink and coming back with $15/20bn.

As you’re about to click, it plunges 40% to $10bn. From $67 billion to $10 billion in 7 days. It’s pathetic seeing this kind of desperation. I don’t want to be in the room when he realises it’s not even close to being worth anywhere near $1 billion. Within the last 10 days or so, his wife Rebekah has also removed from her extraordinarily unnecessary position, they’ve hastily elected their first female to their Board, halved Adam’s voting power, lost a Chief Communications Officer, their bonds are crashing, two landlords have begun legal proceedings, their principle investor Masayoshi has publicly called for Adam to delay the IPO, even Alexandria Ocasio-Cortez weighed in and warned vulnerable investors Goldman Sachs & JP Morgan are now targeting… ‘you’re getting fleeced!’.

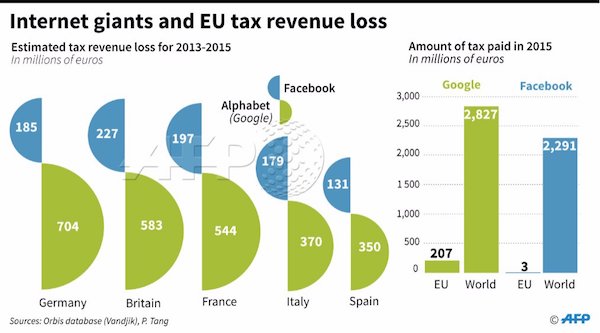

“Estimated losses include €31.8bn in Germany, at least €17bn for France, €4.5bn in Italy, €1.7bn in Denmark and €201m for Belgium.”

• ‘The Men Who Plundered Europe’: Bankers On Trial For Siphoning €60bn (G.)

They have been called “the men who plundered Europe”: a group of cowboy traders, seasoned tax lawyers and mathematical whizz kids who are alleged to have conspired in the heart of the City of London to siphon at least €60bn in taxpayers’ money from the state coffers of several EU countries. In Britain, the so-called “cum-ex” scandal, named after the complex derivatives juggling act employed, gained little attention amid the frenzied debate around the UK’s departure from the European Union when the fraud scheme was discovered in 2017. But in continental Europe what Le Monde has described as the “robbery of the century” has done almost as much to shape the view of Britain as Brexit itself.

Dutch media has called it “organised crime in pinstripe suits” and one of the original German whistleblowers saying he now welcomes Britain’s exit from the EU in the hope it could weaken the influence of London investment banking on European financial institutions. This week, a British former investment banker involved in developing the scheme for the first time gave the public an insight into how the scheme worked and what spurred on its architects. Speaking at a regional court in Bonn, Martin Shields, one of two former bankers on trial for 34 instances of serious tax fraud between 2006 and 2011, painted a picture of a London banking scene which lured in the brightest scientists from the country’s top universities and used them to boost their profit margins – without teaching them about the moral and legal consequences of their actions in return.

“This was the environment at that time: a financial industry that – at least as far as I could see – was geared towards maximum profit optimisation,” the 41-year-old told a packed courtroom on Wednesday. “One tool to achieve this goal was tax optimisation: avoiding taxation as far as possible – and taking advantage of any opportunities that could be found or created. This was not the clandestine approach of a few. Rather, I saw it as the clear and openly communicated expectation of most major banks and their customers.” [..] Estimated losses include €31.8bn in Germany, at least €17bn for France, €4.5bn in Italy, €1.7bn in Denmark and €201m for Belgium.

Is it too late to stop them?

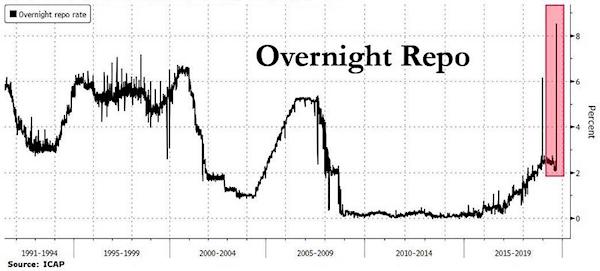

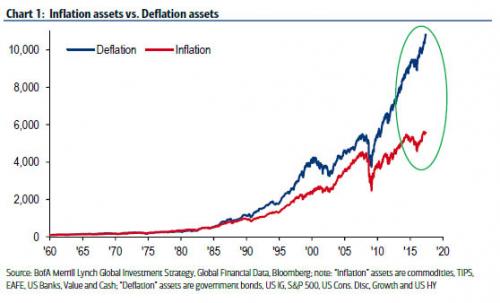

• Desperate Central Bankers Grab for More Power (Brown)

Central bankers are acknowledging that they are out of ammunition. Mark Carney, the soon-to-be-retiring head of the Bank of England, said in a speech at the annual meeting of central bankers in August in Jackson Hole, Wyoming, “In the longer-term, we need to change the game.” The same point was made by Philipp Hildebrand, former head of the Swiss National Bank, in an August 2019 interview with Bloomberg. “Really there is little if any ammunition left,” he said. “More of the same in terms of monetary policy is unlikely to be an appropriate response if we get into a recession or sharp downturn.” “More of the same” meant further lowering interest rates, the central bankers’ stock tool for maintaining their targeted inflation rate in a downturn.

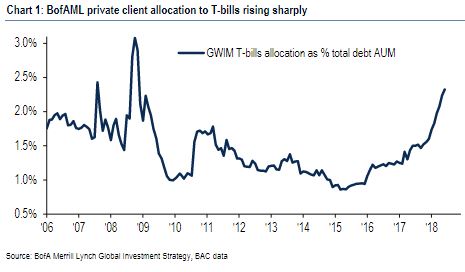

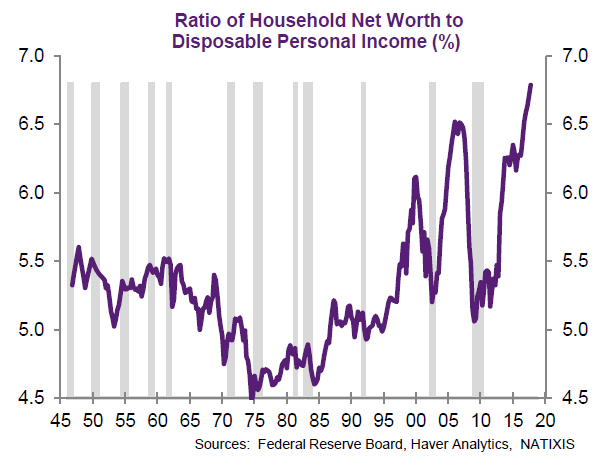

Bargain-basement interest rates are supposed to stimulate the economy by encouraging borrowers to borrow (since rates are so low) and savers to spend (since they aren’t making any interest on their deposits and may have to pay to store them). But over $15 trillion in bonds are now trading globally at negative interest rates, yet this radical maneuver has not been shown to measurably improve economic performance. In fact new research shows that negative interest rates from central banks, rather than increasing spending, stopping deflation, and stimulating the economy as they were expected to do, may be having the opposite effects. They are being blamed for squeezing banks, punishing savers, keeping dying companies on life support, and fueling a potentially unsustainable surge in asset prices.

So what is a central banker to do? Hildebrand’s proposed solution was presented in a paper he wrote with three of his colleagues at BlackRock, the world’s largest asset manager, where he is now vice chairman. Released in August to coincide with the annual Jackson Hole meeting of central bankers, the paper was co-authored by Stanley Fischer, former governor of the Bank of Israel and former vice chairman of the U.S. Federal Reserve; Jean Boivin, former deputy governor of the Bank of Canada; and BlackRock economist Elga Bartsch. Their proposal calls for “more explicit coordination between central banks and governments when economies are in a recession so that monetary and fiscal policy can better work in synergy.” The goal, according to Hildebrand, is to go “direct with money to consumers and companies in order to enliven consumption,” putting spending money directly into consumers’ pockets.

“The United States had removed tariffs overnight from over 400 Chinese products in response to requests from U.S. companies.”

• Hopes For Trade Breakthrough Fade As China Cancels US Farm Visits (R.)

A U.S.-China trade deal appeared elusive on Friday after Chinese officials unexpectedly canceled a visit to farms in Montana and Nebraska as deputy trade negotiators wrapped up two days of negotiations in Washington. Chinese officials were expected to visit U.S. farmers next week as a goodwill gesture, but canceled to return to China sooner than originally scheduled, agriculture organizations from Montana and Nebraska said. The United States had removed tariffs overnight from over 400 Chinese products in response to requests from U.S. companies. The Chinese Embassy and the U.S. Department of Agriculture did not immediately respond to requests for comment.

The U.S. Trade Representative’s office issued a brief statement characterizing the two days as “productive” and that a principal-level trade meeting in Washington would take place in October as previously planned. China’s Commerce Ministry, in a brief statement, described the talks as “constructive”, and said they had also had a good discussion on “detailed arrangements” for the high-level talks in October. [..] Trade experts, executives and government officials in both countries say that even if the September and October talks produced an interim deal, the U.S.-China trade war has hardened into a political and ideological battle that runs far deeper than tariffs and could take years to resolve.

“(Claiming to be a Cherokee was a forgivable way of sharing — sharing useful identities for career advancement.)”

• President of the Selfies (Kunstler)

Unlike the 2016 Democratic presidential candidate, Elizabeth Warren doesn’t radiate contempt, loathing, and horror at the task of mingling with the hoi polloi. Rather, she has become famous for staging lengthy sessions after campaign speeches to pose for selfies with her fans. The selfie-seekers, you will notice, are all women. It’s heartwarming as all get out. This is at the center of Senator Warren’s strategy for winning the next election: to cadge all of the women’s vote and become the President of all the women of the United States. It’s a shrewd strategy, to turn the election into a gender-bonding contest, but elections have turned on equally fatuous premises, probably more often than not.

Paradoxically, the lumbering President Trump, with his bay window belly, mystifying bouffant, fourth-grade vocabulary, and grab-them-by-the-pussy approach to romance, scored 53 percent of women’s votes last time around. Perhaps that was more a reflection of his opponent’s titanic loathsomeness than of Mr. Trump’s charms. But it only underscores Ms. Warren’s gambit: all she has to do is swing a generous majority of American women over to her side.

She is, in many ways, an exemplar of her sex. She’s made the best of her corn-fed Oklahoma looks. At 69, she capers energetically around the hustings in spanx and Nina McLemore jewel-toned, popped-collar jackets as though she were America’s yoga instructor, an appealing addition to her previous career as a distinguished Harvard law professor. She scores well on the feelings and sharing index, qualities that most men can only caricature. (Claiming to be a Cherokee was a forgivable way of sharing — sharing useful identities for career advancement.) And she has a palpable edge of anger about all the swindles and injustices in American life today, especially those spawned on Wall Street by the financial patriarchy — hey, who can argue with that one? If she has a husband (she has, Harvard law prof Bruce H. Mann) he might as well be hiding under a rock.

Cowards. What, they’re French?

• France Rejects Edward Snowden’s Asylum Request, Fears Major Fallout With US (ZH)

France’s foreign minister has indicated the country has dismissed former US National Security Agency contractor and leaker Edward Snowden’s asylum request because “it is not the time”. Snowden called on French President and former Rothschild banker Emmanuel Macron to grant him political asylum from the United States, after he’s been living in Russia since the 2013 bombshell leaks were released, having first fled from Hong Kong. “He asked for asylum in France, but also elsewhere, in 2013. At that time, France thought that it was not appropriate, I do not see anything that has changed Thursday, either from a political or a legal point of view,” French Foreign Minister Jean-Yves Le Drian told French TV station CNews on Thursday.

Paris is skittish over the whole issue due to US pressure and what such a move would do to its close relationship with Washington. “An adviser to French President Emmanuel Macron hinted earlier this week that welcoming Snowden to France would lead to a major diplomatic fallout with the U.S.,” Politico Europe reported. The whistleblower, who this week published his memoir, has escaped US prosecution as a guest of Putin’s Russia. He previously said he would “love to see” Macron allow him to live in France. Snowden made a first asylum appeal to France in 2013, which was rejected, and another last week. “I am not asking for a parade. I’m not asking for a pardon,” he said in a recent interview. “What I’m asking for is a fair trial.”

Speaking with France’s Inter radio on Monday as part of a press junket to promote his new memoir, the former NSA contractor said “Protecting whistleblowers is not a hostile act,” adding “Welcoming someone like me is not an attack on the United States.” “I would like to return to the United States. That is the ultimate goal. But if I’m gonna spend the rest of my life in prison, the one bottom line demand that we have to agree to is that at least I get a fair trial. And that is the one thing the government has refused to guarantee because they won’t provide access to what’s called a public interest defense,” Snowden told CBS This Morning.

Melzer says here: ““Trying to win any aspect of this case in the judicial arena has been a losing game for almost a decade..”

But that goes both ways. Governments haven’t been able to any more than those who are on Julian’s side. Obama was advised he had no chance in court. It took a highly partial and corrupt UK court to get the job done.

• Julian Assange: Justice Denied (Sagir)

Technically, Julian Assange is supposed to be released from his prison cell at HMP Belmarsh on Sunday. Yet a British court ruled last week that he has to remain in prison after the custody period of his current jail term ends due to his “history of absconding.” Assange is no longer a serving prisoner but someone facing extradition. Why is Assange actually being held prisoner? Well, the UN Special Rapporteur on Torture Nils Melzer tells me that Assange’s case is not about law, but rather politics. He says: “Trying to win any aspect of this case in the judicial arena has been a losing game for almost a decade because, from the outset, this case has been decided politically. His right to a fair trial has been systematically violated by all involved states.

“If this were about applying the law, he would have never been convicted of bail violation simply for seeking — and receiving — diplomatic asylum in the Ecuadorian embassy. “If this were about applying the law, he would not be in extradition detention under a US indictment of espionage simply for doing investigative journalism.” It seems that the only thing Assange is on trial for is the publication of the Chelsea Manning leaks. Melzer says: “The only other charge against him is for allegedly trying to help Manning to decode a password, albeit unsuccessfully and without causing any harm whatsoever. “Clearly, that is not a serious crime by any standards, and certainly not an offence any prosecutor would spend substantial resources on.”

[..] after 100 days and counting, the UK has not even responded to my official letter yet and Assange’s state of health is reportedly deteriorating as we speak,” Melzer says. Melzer says he is “appalled” at how Britain is “simply ignoring” his report. He was mandated by the UN human rights council, which includes Britain, to report to states on their compliance with the prohibition of torture and ill-treatment. Once Melzer investigates a case and makes an official finding that an act of torture has been committed, then they have to at least conduct an impartial and transparent investigation into the case, even if they come to different conclusions.

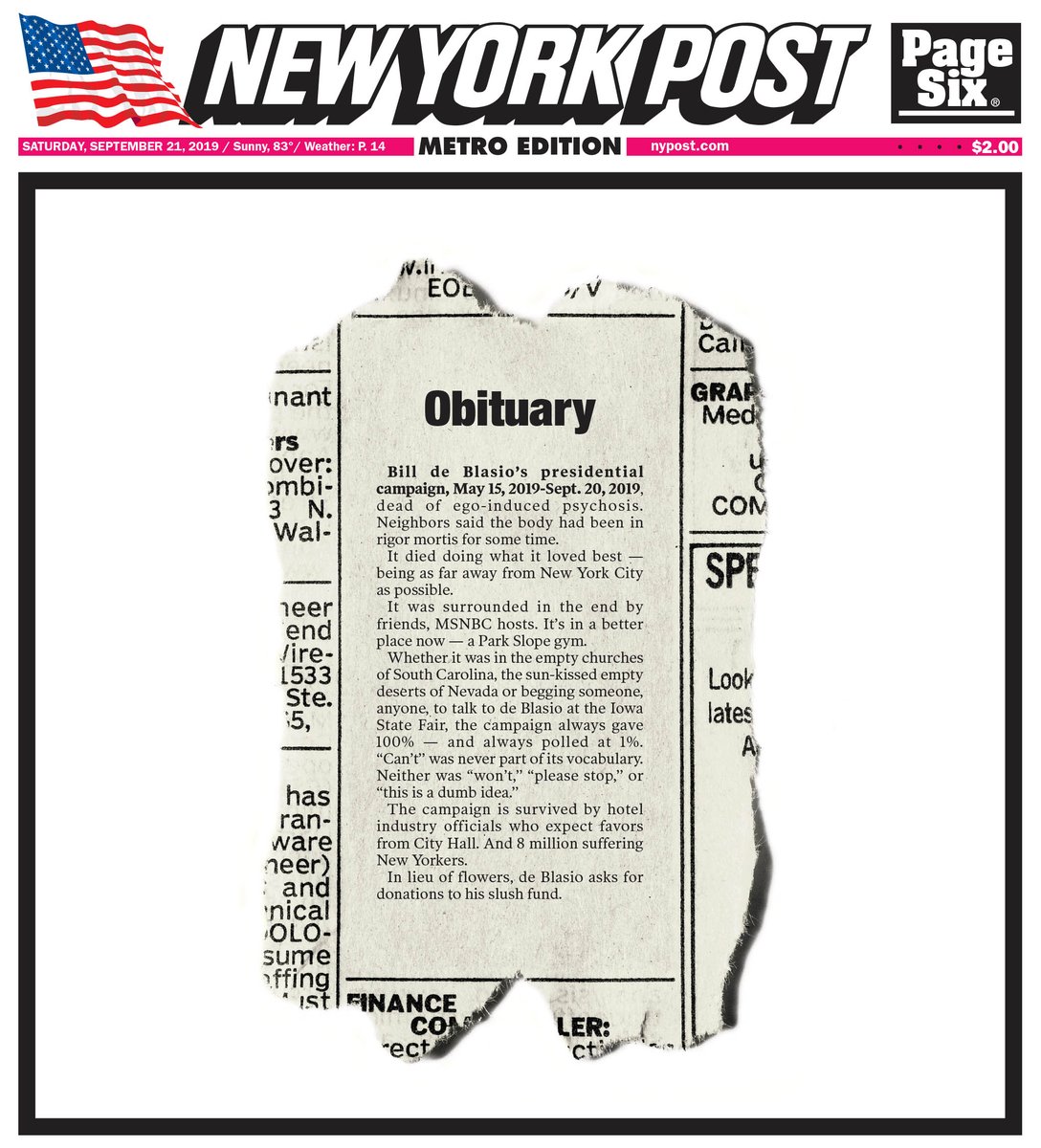

Front page NY Post today. Brilliant.