Unknown Army of the James, James River, Virginia. 1865

A voice of reason, but the troika is not about reason.

• The Troika Is Supposed To Build Greece Up, Not Blow It Apart (Guardian)

The phrase “trench warfare” comes to mind. On Friday evening the Greek prime minister, Alexis Tsipras, lobbed some choice words at his foes in Brussels, calling their proposed debt deal “absurd”. Days earlier, the IMF had joined its allies in Brussels to fire a volley of criticism at Athens. The Greeks already had “significant flexibility” to get out of their budget mess, IMF boss Christine Lagarde said, as she urged Athens to repay the €300m instalment of its bailout loan due on Friday. This could go on for several more weeks: Greece told the IMF it will have to wait until the end of the month to get its money, when it will “bundle” four payments together. And should the sides become more entrenched, this long-running war could still end in the disaster of Greek default.

In Washington, where the IMF is hunkered down, and in Europe’s finance ministries, the Greek stance is considered wilfully unreasonable. The Syriza government’s demand for the return of national pay bargaining, a relaxed timetable for pension reform and a lower budget surplus than that demanded by the EU, the IMF and the European Central Bank are all but ridiculed in Berlin, Helsinki and Riga. As Greece’s chief creditors, the EU and the IMF want Greece to adopt flexible labour markets, immediate restrictions on early retirement and a budget surplus big enough to accommodate some debt repayments.

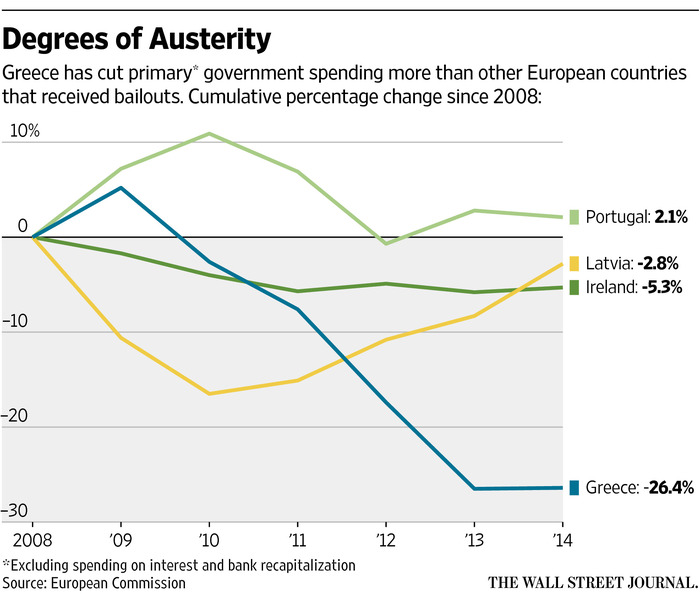

While much of what the radical leftists want seems unreasonable – especially the slow pace of pension reform, which in effect would allow tens of thousands of people in their late 50s to grab early retirement – it is the demands being made by Brussels and the IMF that are unconvincing and, worse, untenable. Running a larger budget surplus is only going to destroy Greece, not build it up. As US economist Joseph Stiglitz and many others, including former IMF staffers, have pointed out, the troika of creditors badly misjudged the economic effects of the programme they imposed in 2010 and 2012. “They believed that by cutting wages and accepting other austerity measures, Greek exports would increase and the economy would quickly return to growth,” Stiglitz said last week.

“They also believed that the first restructuring would lead to debt sustainability. The troika’s forecasts have been wrong.” The current proposals repeat the same mistake. Seven years after the crash, the Greek economy is still 25% smaller than it was at its previous peak, 10% of households have no electricity and youth unemployment is running at more than 50%. Tsipras and his finance minister, Yanis Varoufakis, may specialise in needling their creditors, but the troika also need to take into account the fact that Syriza has formed a legitimate, democratically elected government and cannot be told that its electoral programme is irrelevant.

826th edition.

• Greece Updating Proposals It Sent To Lenders (Kathimerini)

The Greek government is redrafting the 47-page proposal it sent to lenders last week with the aim of securing an agreement that would allow the disbursal of €7.2 billion in bailout funding. Kathimerini understands that Athens is focussing its attention on adjusting the fiscal measures it proposed with the aim of getting closer to the revenue target set by lenders. However, the coalition is reluctant to adjust its VAT proposal, which sees three brackets (6, 11 and 23%) rather than the two proposed by lenders (11 and 23). Greece also seems prepared to raise slightly its primary surplus proposals from 0.6% of GDP this year and 1.5% next year. The institutions proposed 1% for 2015 and 2% for 2016.

The updated suggestion from the Greek side is not expected to reach these targets. While Athens is prepared to change the law regarding early retirement, saving 100 million euros, it does not seem willing to go as far as lenders are demanding in terms of pension reform. There are also substantial differences between Greece and its creditors on the issue of labour market regulations. The updated proposals are expected to be discussed between Greek officials and representatives of the institutions over the next few days, ahead of a meeting between Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President Francois Hollande in the Belgian capital on Wednesday.

They want to make sure this sort of crisis will not happen again.

• Young Greek Radicals Don’t Just Want Power – They Want To Remake The World (PM)

At some point, as the Greek crisis lurches to its crescendo, Syriza – the radical left party – will call a meeting of something called a central committee. The term sounds quaint to 21st-century ears: the committee is so big that it has to meet in a cinema. You will not be surprised to learn that the predominant hair colour is grey. These are people who were underground activists in a military dictatorship; some served jail time, and in 1973 many were among the students who defied tanks and destroyed a junta. But they think, speak and act in a way shaped by the hierarchies and power concepts of 50 years ago.

The contrast with the left’s mass support base, and membership, is stark. In the average Greek riot, you are surrounded by concert pianists, interior designers, web developers, waitresses and actors in experimental theatre. It is usually 50:50 male and female, and drawn from a demographic as handy with a smartphone as the older generation are with Lenin’s selected works. Like young radicals across Europe and the US, they have been schooled in the ways of the modern middle classes: launching startup businesses, working two or three casual jobs; entrepreneurship, loose living and wild partying are the default way of life. Of course, every generation of radicals looks different from the last one, but the economic and behavioural contrasts that are obvious in Greece are also present in most other countries.

And this prompts the question: what do the radicals of this generation want when they win power? The success of Syriza, of Podemos in Spain and even the flood of radicalised young people into the SNP in Scotland makes this no longer an idle question. The most obvious change is that, for the rising generation, identity has replaced ideology. I don’t just mean as in “identity politics”. There is a deeper process going on, whereby a credible identity – a life lived according to a believed truth – has become a more significant badge in politics than a coherent set of ideas.

Just ask Abe and Kuroda.

• VAT Rate Hikes Always Reduce State Revenues (Thanos Tsiros)

Greece’s value-added tax rates have been raised three times since 2010, all within the space of one year: in March and July 2010 and then in January 2011. The hike that the government is negotiating with the country’s creditors will be the fourth in five years. Already the low and very low VAT rates have gone up by 44% since early 2010 – i.e. from 4.5 to 6.5% and from 9 to 13% respectively – while the main rate has grown 22%, from 19 to 23% nowadays. Those hikes, intended to increase the state’s income takings, in fact reduced revenues by 20%: In 2014 VAT revenues dropped below €14 billion, to €13.6 billion.

For this year, the budget had provided for VAT revenues of €14.4 billion, but in the first five months there has already been a shortfall of 350 million compared with the target for that point of the year. In comparison with 2008, the year that the recession started, VAT revenues shrank by €5 billion in 2014 in spite of the major hike in the rates. Modern Greek economic history has shown that any indirect tax rate increase leads to a reduction in consumption and an increase in tax evasion, meaning that revenues go down instead of up.

A rehearsed ploy.

• Juncker Vents Fury Over Greek Bailout Talks At G7 Summit (Guardian)

European Union officials delivered a blistering attack on the Greek government at the G7 summit in Bavaria, and world leaders including Barack Obama sought to avoid a transatlantic split over Ukraine by agreeing to maintain sanctions against Russia. In a day of secluded talks in the Alpine resort of Schloss Elmau, the biggest drama was provided by a verbal attack on the Greek prime minister, Alexis Tsipras, by the European commission president, Jean-Claude Juncker. The summit’s host, Angela Merkel, had hoped to solve the Greek bailout crisis before the summit, but instead Juncker felt forced to open proceedings by staging a press conference accusing Tsipras of undermining negotiations over new terms for a bailout and of effectively lying to the Greek parliament.

A visibly angry Juncker said he had told Tsipras during a meeting last Wednesday evening that there was room to negotiate but said the Greeks had been unwilling to take part in in-depth discussions at the meeting. Instead, he said, Tsipras had promised to send him his proposals the following day, but he was still waiting for them on Sunday. “Alexis Tsipras promised that by Thursday evening he would present a second proposal. Then he said he would present it on Friday. And then he said he would call on Saturday. But I have never received that proposal, so I hope I will receive it soon. I would like to have that Greek proposal,” he said. He told reporters he had said to Tsipras that he continued to exclude the idea of a Grexit – “because I don’t want to see it” – but that he could not “pull a rabbit out of a hat”.[..]

Juncker, perceived until now as an honest broker in the crisis – taking a softer approach than the Germans, who are viewed in Greece as the architects of austerity – has rarely been seen in such an irate state, sources close to the EU in Garmisch-Partenkirchen said. They warned that Greece might have lost its closest ally in its long fight to secure a rosier deal. Juncker said he had been disappointed by a speech Tsipras had given to the Athens parliament on Friday. “He was presenting the offer of the three institutions as a leave-or-take offer. That was not the case … He knows perfectly well that is not the case.” Juncker said Tsipras had failed to mention to parliament his (Juncker’s) willingness to negotiate over Greek pensions. [..]

In Athens Mega TV reported that relations between Berlin and Washington over Greece had become increasingly frosty – despite the exhortation from Barack Obama at the G7 for a quick solution to the European debt crisis. The Greek television channel, citing a senior German official, described the US treasury secretary, Jack Lew, imploring his German counterpart Wolfgang Schäuble to “support Greece” only to be told: “Give €50bn euro yourself to save Greece.” Mega’s Berlin-based correspondent told the stationthat the US official then said nothing “because, as is always the case according to German officials when it comes to the issue of money, the Americans never say anything”.

We have at least 3 weeks left. But after that, of course, Greece will have to plod on for many years.

• If You Think Greece’s Crisis Will End Any Time Soon, Think Again (Bloomberg)

Frustrated by Greece’s cat and mouse game with its creditors? Get used to it. Even if PM Alexis Tsipras clinches the €7.2 billion that creditors are withholding, he’s going to need another cash infusion shortly thereafter. What will ensue is a renewed battle after almost five months of trench warfare. The beleaguered country requires a third bailout of about €30 billion, according to Nomura analysts Lefteris Farmakis and Dimitris Drakopoulos. Tsipras says any aid must be on his terms rather than those of governments whose taxpayers have forked out billions in the past five years to keep Greece in the euro. “Any plausible deal at this stage is unlikely to do enough and it’s unlikely to be the end of the matter,” said Simon Tilford, deputy director of the Centre for European Reform in London.

“This could just play out again and again.” The latest episode in the five-year saga has focused on releasing the final tranche of Greece’s second bailout, which expires at the end of June. The amount at stake roughly equates to the bond repayments that Greece needs to make to the ECB in July and August. Here’s the problem for the policy makers struggling to avoid a default in Athens: Even if Greece muddles through until August, it faces a financing shortfall of at least €25 billion euros through the end of 2016. That’s likely to worsen as the economy slides deeper into recession and tax revenue shrivels. [..] “The dependence on our creditors will remain for two years in the best-case scenario,” said Aristides Hatzis, associate professor of law and economics at the University of Athens. “Greece is going to need cheap loans for the next two years.”

It was all there right from the start.

• 103 Years Later, Wall Street Turned Out Just As One Man Predicted (Zero Hedge)

In 1910, three years before the US Federal Reserve was founded, Senator Nelson Aldrich, Frank Vanderlip of National City (Citibank), Henry Davison of Morgan Bank, and Paul Warburg of the Kuhn, Loeb Investment House met secretly at Jekyll Island in Georgia to formulate a plan for a US central bank just years ahead of World War I. The result of their work was the so-called Aldrich Plan which called for a system of fifteen regional central banks, i.e., National Reserve Associations, whose actions would be coordinated by a national board of commercial bankers. The Reserve Association would make emergency loans to member banks, and would create money to provide an elastic currency that could be exchanged equally for demand deposits, and would act as a fiscal agent for the federal government.

In other words, the Aldrich Plan proposed a “central bank” that would be openly and directly controlled by Wall Street commercial banks on whose behalf it would solely operate, instead of doing so indirectly, behind closed doors and the need for criminal probe of Yellen’s Fed seeking to find who leaked what to whom. The Aldrich Plan was defeated in the House in 1912 but its outline became the model for the bill that eventually was adopted as the Federal Reserve Act of 1913 whose passage not only unleashed the Fed as we know it now, but the entire shape of modern finance.

In 1912, one person who warned against the passage of the Aldrich Plan, was Alfred Owen Crozier: a man who saw how it would all play out, and even wrote a book titled “U.S. Money vs Corporation Currency” (costing 25 cents) explaining and predicting everything that would ultimately happen, even adding some 30 illustrations for those readers who were visual learners. The book, which is attached at the end of this post, is a must read, but even those pressed for time are urged to skim the following illustrations all of which were created in 1912, and all of which predicted just what the current financial system would look like. Or, in the words of Overstock’s CEO Patrick Byrne, “that’s uncanny”

“..she also famously said “F—k the EU!” Obama is now seconding that statement of hers.”

• Obama Sidelines Kerry On Ukraine Policy (Eric Zuesse)

On May 21st, I headlined “Secretary of State John Kerry v. His Subordinate Victoria Nuland, Regarding Ukraine,” and quoted John Kerry’s May 12th warning to Ukrainian President Petro Poroshenko to cease his repeated threats to invade Crimea and re-invade Donbass, two former regions of Ukraine, which had refused to accept the legitimacy of the new regime that was imposed on Ukraine in violent clashes during February 2014. (These were regions that had voted overwhelmingly for the Ukrainian President who had just been overthrown. They didn’t like him being violently tossed out and replaced by his enemies.) Kerry said then that, regarding Poroshenko, “we would strongly urge him to think twice not to engage in that kind of activity, that that would put Minsk in serious jeopardy.

And we would be very, very concerned about what the consequences of that kind of action at this time may be.” Also quoted there was Kerry’s subordinate, Victoria Nuland, three days later, saying the exact opposite, that we “reiterate our deep commitment to a single Ukrainian nation, including Crimea, and all the other regions of Ukraine.” I noted, then that, “The only person with the power to fire Nuland is actually U.S. President Barack Obama.” However, Obama instead has sided with Nuland on this. Radio Free Europe, Radio Liberty, bannered, on June 5th, “Poroshenko: Ukraine Will ‘Do Everything’ To Retake Crimea’,” and reported that, “President Petro Poroshenko has vowed to seek Crimea’s return to Ukrainian rule. … Speaking at a news conference on June 5, … Poroshenko said that ‘every day and every moment, we will do everything to return Crimea to Ukraine.’”

Poroshenko was also quoted there as saying, “It is important not to give Russia a chance to break the world’s pro-Ukrainian coalition,” which indirectly insulted Kerry for his having criticized Poroshenko’s warnings that he intended to invade Crimea and Donbass. Right now, the Minsk II ceasefire has broken down and there are accusations on both sides that the other is to blame. What cannot be denied is that at least three times, on April 30th, then on May 11th, and then on June 5th, Poroshenko has repeatedly promised to invade Crimea, which wasn’t even mentioned in the Minsk II agreement; and that he was also promising to re-invade Donbass, something that is explicitly prohibited in this agreement. Furthermore, America’s President, Barack Obama, did not fire Kerry’s subordinate, Nuland, for her contradicting her boss on this important matter.

How will that be taken in European capitals? Kerry was reaffirming the position of Merkel and Hollande, the key shapers of the Minsk II agreement; and Nuland was nullifying them. Obama now has sided with Nuland on this; it’s a slap in the face to the EU: Poroshenko can continue ignoring Kerry and can blatantly ignore the Minsk II agreement; and Obama tacitly sides with Poroshenko and Nuland, against Kerry. The personalities here are important: On 4 February 2014, in the very same phone-conversation with Geoffrey Pyatt, America’s Ambassador in Ukraine, in which Nuland had instructed Pyatt to get “Yats” Yatsenyuk appointed to lead Ukraine after the coup (which then occured 18 days later), she also famously said “F—k the EU!” Obama is now seconding that statement of hers.

Absolutely in chracter.

• Masked Attackers Break Up Tent Camp On Kiev’s Maidan (RT)

Unidentified assailants wearing balaclavas assaulted and destroyed a tent camp set up on Sunday by protesters on Kiev’s landmark Maidan Square. Activists at the camp had been calling on the Ukrainian President to report on progress since taking office. The attack happened late Sunday evening, when a gang stormed the activist camp, forcefully removing tents and dispersing protesters. Police officers were reportedly stationed right next to the site and did nothing to stop the violent group. The organizer of the action, Rustam Tashbaev, was arrested, RIA Novosti reported. There were also blasts heard on Institutskaya Street near the Maidan. In Ruptly’s video, assailants are seen ripping through the camp, tearing everything apart, and dragging protesters out of the tents, while they can be heard screaming in the background.

“They took me and dragged me like I was in a sleigh. I screamed, thinking they would beat me up, but they quickly dispersed. It looked like a theater production because the police were nearby and did nothing,” one of the demonstrators told Ruptly video news agency. Earlier on Sunday, about 100 protesters set up several tents on Maidan, demanding President Petro Poroshenko and his cabinet report on what progress has been made in implementing the reforms which were promised last year. “We have launched this campaign, set up tents, and called this protest Maidan 3,” one of the organizers, Rustam Tashbaev, told Ruptly. “We demand these people perform the duties which they are obliged to perform.” Placards at the protest read “Out with [PM Arseny] Yatsenuk and his reforms” and “I’m on hunger strike against administrative dereliction.”

“..it costs the banks almost nothing to create new credit. That’s why we have so much of it.”

• Literally, Your ATM Won’t Work… (Bill Bonner)

While we were thinking about what was really going on with today’s strange new money system, a startling thought occurred to us. Our financial system could take a surprising and catastrophic twist that almost nobody imagines, let alone anticipates. Do you remember when a lethal tsunami hit the beaches of Southeast Asia, killing thousands of people and causing billions of dollars of damage? Well, just before the 80-foot wall of water slammed into the coast an odd thing happened: The water disappeared. The tide went out farther than anyone had ever seen before. Local fishermen headed for high ground immediately. They knew what it meant. But the tourists went out onto the beach looking for shells! The same thing could happen to the money supply…

Here’s how.. and why: It’s almost seems impossible. Hard to imagine. Difficult to understand. But if you look at M2 money supply – which measures coins and notes in circulation as well as bank deposits and money market accounts – America’s money stock amounted to $11.7 trillion as of last month. But there was just $1.3 trillion of physical currency in circulation – about only half of which is in the US. (Nobody knows for sure.) What we use as money today is mostly credit. It exists as zeros and ones in electronic bank accounts. We never see it. Touch it. Feel it. Count it out. Or lose it behind seat cushions. Banks profit – handsomely – by creating this credit. And as long as banks have sufficient capital, they are happy to create as much credit as we are willing to pay for.

After all, it costs the banks almost nothing to create new credit. That’s why we have so much of it. A monetary system like this has never before existed. And this one has existed only during a time when credit was undergoing an epic expansion. So our monetary system has never been thoroughly tested. How will it hold up in a deep or prolonged credit contraction? Can it survive an extended bear market in bonds or stocks? What would happen if consumer prices were out of control?

Jailing them would be better for shareholders value. And who in their right mind can claim it’s time to go easy on the banks?

• Banks’ Post-Crisis Legal Costs Hit $300 Billion (FT)

The total cost of litigation aimed at a group of the biggest global banks since 2010 has broken the £200bn ($306bn) barrier, according to a new study that challenges assumptions that banks are through the worst of post-crisis reparations. The annual study, carried out by the UK-based CCP Research Foundation, uses regulatory notices, annual reports and other public disclosures to tally the cost of fighting claims of misconduct over rolling five-year periods. In the latest report, which runs until the end of last year, the total for 16 banks stands at £205.6bn of fines, settlements and provisions — up almost a fifth from the previous year.

Despite that trend, many bank executives continue to act as if these are irregular charges from “legacy” issues, said Chris Steares, research director at the foundation. He noted that a recent flurry of settlements for currency manipulation cited abuses continuing until 2013. “If you ask the banks if their reputational risk is going to change, they’d have to say yes,” he said. “[But] with conduct costs continuing to be incurred, year after year, it does beg the question whether behaviours are being changed for the better.”

Some politicians in the US and UK have tried to draw a line under years of heavy lawmaking, taxes and fines, arguing that regulators should now go easier on the banks. Executives, too, have signalled that expenses have begun to fall, particularly after the resolution of cases linked to the mis-selling of residential mortgage-backed securities. Presenting earnings in April, for example, Bruce Thompson, Bank of America’s finance chief, noted two “much lighter” quarters of legal expenses which he hoped would allow the bank to hold less capital under international standards on operational risk.

Not unlikely.

• Will China’s Stock Market Explode On Wednesday? (MarketWatch)

Wednesday could be huge for Chinese stocks. On that day, about four hours before Shanghai opens for trade, MSCI will announce whether it will welcome China’s top yuan-denominated stocks into its extremely influential Emerging Markets Index, tracked by a mountain of roughly $1.7 trillion in assets worldwide. Such a move would be expected to ignite a significant rally in Shanghai blue chips, and a recent Wall Street Journal report cited major funds such as those of Vanguard Group Inc. planning to purchase Chinese equities ahead of the MSCI decision, which is due to be revealed Tuesday at about 5:30 p.m. EDT (Wednesday 5:30 a.m. in Shanghai) on the financial company’s website.

Hong Kong-listed shares of Chinese companies – known as “H-shares” – are already a sizeable presence in the MSCI EM Index. Rival FTSE Group (owned by the London Stock Exchange) recently added the mainland-listed stocks – known as “A-shares” – into transitional global indexes, and may add them to its benchmark EM index this September, according to HSBC. The possible MSCI move has been making big headlines in China’s news media, but that said, many analysts are not so sure the index compiler will take the plunge into Chinese equities this week, suggesting it will wait a little longer for the country’s financial reforms to solidify further.

Ironically, this means a huge increase in the trade surplus…

• China Imports Fall 17.6%, Exports Decline 2.5% (AFP)

Chinese imports fell for a seventh straight month in May while exports also sank, according to official data, as the world’s second-biggest economy shows protracted weakness even in the face of government measures to stimulate growth. The disappointing figures, out on Monday, also come as leaders try to transform the economy to one where growth is driven by consumer spending rather than government investment and exports. Imports slumped 17.6% year on year to $131.26bn, the Chinese customs department said in a statement. The decline was much sharper than the median forecast of a 10% fall in a Bloomberg News poll of economists, and followed April’s 16.2% drop.

“The May trade data … suggest both external and domestic demand remain weak,” said Julian Evans-Pritchard, an analyst with the research firm Capital Economics. Exports dropped for the third consecutive month, falling 2.5% to $190.75bn, customs said, although that was better than the median estimate of a 4% fall in the Bloomberg survey. The sharp decrease in imports meant the trade surplus expanded 65.6% year on year to $59.49bn, according to the data. In yuan terms, imports fell 18.1%, exports decreased 2.8% and the trade surplus expanded 65%. The figures provided further evidence that frailty in the Chinese economy, a key driver of world growth, has extended into the current quarter despite intensified government stimulus measures.

“Deutsche Bank is sitting on a powderkeg of derivatives dynamite..”

• Deutsche Bank CEO’s Forced to Resign Over Imminent Derivatives Melt-Down? (Doc)

The co-CEOs of Deutsche Bank unexpectedly stepped down. Recall that Deutsche Bank is now the largest holder of derivatives in the world. The ONLY reason these resignations would have been unexpectedly coerced like this is if Deutsche Bank was having a potentially uncontrollable problem in its OTC derivatives holdings. Because of accounting rules, we have no possible way of knowing what DB’s OTC derivatives book looks like. Although Jain oversaw the build-up of the book, it’s likely that not only does he not know where all the bodies are buried, he has lied to the board of directors and shareholders about the riskiness of the bank’s holdings. I know Jain from personal experience with him right after Deutsche Bank acquired Bankers Trust for BT’s derivatives capabilities.

It instantly put Deutsche Bank in the forefront of the fraud-based OTC derivatives business. Jain has lost money wherever he worked. He was brought over to DB from Merrill when Edson Mitchell assumed the reigns at Deutsche Bank’s US unit. I just remember thinking Jain was about as sleazy as they come. His sole charge was to build Deutsche’s derivatives book of business into the biggest in the world. From there he sleazed his way into the CEO position, a few years after Mitchell went down in plane accident. He then proceeded to climb to the top of Deutsche Bank by conspiring to “shoot” then-CEO Josef Ackerman in the back. Deutsche Bank is sitting on a powderkeg of derivatives dynamite. DB is also the entity that has leased out most of Germany’s sovereign gold.

From a good friend of mine who worked at DB and still keeps in touch with former colleagues: “Deutsche Bank is sitting on a lethal amount of derivatives and everyone at the bank knows it.” [..] “Like I said many times over the past 6 months…the derivatives in Europe have gone SIDEWAYS and there is blood in the back rooms of the world’s biggest derivative traders! News yesterday that $6B in derivatives were being “internally investigated” at the world’s largest derivative holder, Deutsche Bank, is followed today by the resignation of BOTH of it’s CEO’s!! Anshu Jain has thus overseen the world’s largest arsenal of deadly financial derivatives. When Deutsche Bank goes down in flames, the Jain’s bank account should be the first source of funding the losses. May whatever Higher Power there may be up above help us all when the derivatives financial nuclear daisy-chain starts to blow…

Moany spent locally is worth many times what is spent into box stores. Shopping at Wal-Mart impoverishes your economy, and ultimately you yourself.

• The Bristol Pound Is Giving Sterling A Run For Its Money (Guardian)

When his firm was going up against national companies for contracts to manage waste, Jon Free needed an edge to win the pitches. The answer he found was in the sense of community that existed among small businesses like his. By using his local currency, the Bristol pound, he saw companies were more willing to give their business to him and keep money flowing in the area. Launched almost three years ago, the community currency aims to keep money circulating among independent retailers and firms by encouraging people to use the local ‘cash’ instead of sterling, an idea that has inspired other towns and cities to take up similar schemes in the UK and abroad. “To be able to drop in and create a link to make [the money] a circular thing is a big part of it,” the managing director of Waste Source said.

“To say that we are registered with the Bristol pound shows that we are more community based.” In use since 2012, the system operates as both notes and in electronic form with each Bristol pound equal to one pound sterling. Some 800 businesses in the Bristol area now use the community currency, with coffees, meals, council tax and even pole-dancing lessons paid for with it. “The practical vision was to get something which would connect local communities with their businesses in a way which kept money building up in their local communities,” the currency’s co-founder, Ciaran Mundy, said. “What happens is that if you spend it at a large supermarket chain, 80% of that will exit the economy very quickly.”

While community currencies have a history going back to Victorian times, there has been a resurgence in recent years, with Bristol emerging as the standard-bearer in the UK. The system works by people exchanging their sterling for paper Bristol pounds – in single, five, 10 and 20 denominations – or by opening an account at the Bristol Credit Union. The currency can then be spent in participating businesses, or between businesses, in return for goods or services. So far, some £1m has been issued in the community currency, according to Mundy, of which about £700,000 is still in circulation. As it is a voluntary scheme, the currency can switch between sterling and Bristol pounds, he said.

The thinking behind the creation of the new currency, said Mundy, was to make a minor change to allow for more money to be spent in local areas. “I was looking for a technological and cultural innovation which allows people to conduct themselves in a way which is more sustainable. A big part of that is being aware of the impact of your economic activity,” he said.

Just did an interview with Max. Airs tomorrow on RT.

• Max Keiser’s Bitcoin Capital Continues to Attract Investors (NBTC)

Bitcoin Capital, a venture capital fund initiated by the celebrated finance journalist Max Keiser, is hinting to close on a very optimistic note. According to the details available at BnkToTheFuture.com, the VC fund has already generated a little over $1 million upon receiving support from 580 backers (at press time), especially when there are still three days left to the curtain call. The reports also claim that each investor has injected over $1,000 into the Bitcoin Capital, for which they are offered a 50% equity in the fund. A third part of the generated funds are promised to be invested in Bitcoin Capital’s Bitcoin mining rig in Iceland, a place which will also make sure that investors get to receive daily dividends in the form of newly-minted Bitcoins.

This step is planned to ensure speedy investment returns for the investors, something that puts Bitcoin Capital’s plan in an altogether different category, as it seems. But more than its promises, the VC fund is riding high on its backer’s reputation in the market. Max Keiser is known to be one of the most celebrated faces in the finance sector, for his previous professional collaborations with BBC News, Al Jazeera, Resonance FM and Huffington Post. He currently works for the last two, and also hosts a self-branded financial program on RT, titled Keiser Report. His activism for the cryptocurrency sector however was something that earned him a reputation inside the Bitcoin sector. He supported the idea of decentralization when every government and bank was rubbishing it right away.

“I have been critical of the traditional financial system for many years on my show” Keiser said. “I was the first global news outlet to cover bitcoin when it was trading at $3, recognizing its potential to change the world. Many startups in the bitcoin space credit Keiser Report for getting them started in the business. Bitcoin Capital allows the founders and investors to experiment with new crypto financial business models and currencies to transform global finance.”

Canada was once a nice country. Harper changed all that.

• Canada to Train Ukrainian Police as Russia Conflict Worsens (Bloomberg)

Canada will send officers and provide funding to bolster the Ukrainian police force, Prime Minister Stephen Harper said in his latest show of support for Ukraine on the eve of a Group of Seven nations summit. Canada will never accept the Russian occupation of Crimea or parts of eastern Ukraine, Harper said after meeting Ukraine President Petro Poroshenko on Saturday in Kiev. Work continues between the countries on trade talks and visa restrictions. “I’m proud to be here with you again to demonstrate our continued resolve in the face of the enormous challenge you and all Ukrainians are confronted with,” Harper said after earlier announcing the funding to help train Ukrainian police.

The conflict with Russia is “very high on Canada’s agenda” heading into the G7 summit in Germany, which begins Sunday, Harper said. He called on Russian President Vladimir Putin to withdraw all troops, equipment and support for separatists in Ukraine. “Canada will not, and the world must not, turn a blind eye to the near-daily attacks that are killing and wounding Ukrainians here on their own soil, soldiers and civilians alike,” Harper said. Poroshenko thanked Canada, and said he spoke Saturday with the leaders of the U.S., Japan and Germany. “The support by Canada in this very difficult and decisive time is very important for every Ukrainian,” Poroshenko said. “The relentless violation of international norms will not stand without punishment.”

Brussels lets others do its job and washes its hands.

• Greek Island Gateway To EU As Thousands Flee Homelands (Irish Times)

“Excuse me. Is this Greece?” asked a 24-year-old Pakistani man, whose suit was soaked to his waist. Behind him, a group of young Somali men struggled to lift the sole woman passenger from the boat to her wheelchair, the only possession she managed to bring from the other side. Later, Riyan (30), would explain that she had been shot in the back 15 years previously. She said she was making the journey on her own, and her aim was to reach Germany where she hoped she could have an operation. This migrant vessel was one of four to land last Tuesday morning near the beautiful town of Molyvos, with its medieval hilltop fortress that can be seen from miles around.

Tourism is the lifeblood of the place and the permanent population of about 1,500 relies almost exclusively on the money they make during the summer to keep them going during the difficult winter months after the tourists have gone. For weeks, Kempson, a British painter and sculptor who made his home in Molyvos 16 years ago, and his wife Philippa have been daily witnesses to the rapid increase in the numbers of refugees and migrants arriving from Turkey. “It’s been a nightmare for the last few weeks. We really need some help. Only a few of us have been trying to help. This story needs to get out there and Europe really needs to send some help,” he says.

About 70% of those arriving on the boats are Syrian refugees, including many families with young children. They are fleeing the four-year civil war that has devastated their country and, according to the United Nations, triggered the largest humanitarian crisis since the second World War. An estimated 7.6 million people are now displaced within Syria, while almost four million have fled to neighbouring countries, mostly to Turkey, Lebanon and Jordan, where the vast majority have remained, often in appalling conditions. Syrians in Molyvos say only Europe – by which they usually mean Germany or Sweden – can offer them and their families the safety and opportunities they desperately seek.