NPC Ezra Meeker’s Wild West show rolls into town, Washington DC 1925

I’ve asked the question before: how much longer for Abe? He demanded the GPIF moved its pension money into stocks.

• Japanese Stock Market Plunges 5% As Global Rout Gathers Pace (Guardian)

The global stock market rout has continued in Asia Pacific with Japanese stocks plunging nearly 5% as investors continued to dump risky assets amid uncertainty about the stability of the financial system. Tokyo was heading for its biggest weekly fall for more than seven years, after fears over a slowdown in the global economy and an overnight selloff in banking shares sent the Nikkei share average down by 4.84%. After 24 hours’ respite offered by a public holiday on Thursday, the Nikkei share index sank below 15,000 points for the first time in 16 months. The Nikkei has fallen 12% over the week, putting it on course for its biggest weekly drop since October 2008.

Markets across the region were caught up in the selling despite the promise of a better day when oil prices jumped 5% on comments by an Opec energy minister sparked hopes of a coordinated production cut. South Korea’s main Kospi index ended the day 1.4% while the Kosdaq index of smaller stocks was suspended after plummeting more than 8%. The Hang Seng index was off 1% in Hong Kong. In Australia, where shares entered bear territory earlier in the week, stocks closed down more than 1% led lower by the country’s huge banking sector. The sell-off came despite comments from the Reserve Bank governor Glenn Stevens that fears of global slump were “overdone” and that investors were panicking.

The sell-off on Friday prompted the value of the yen, gold and government bonds to soar as investors rushed to traditional safe-haven assets. The yen was 110.985 to the US dollar on Thursday – its lowest level since October 2014 – punishing Japanese exporters, whose overseas earnings will suffer further if the yen continues on its current trajectory. “The markets are clearly starting to price in a sharp slowdown in the world economy and even a recession in the United States,” said Tsuyoshi Shimizu, chief strategist at Mizuho Asset Management.

Hmmm. We haven’t talked about Japanese banks much yet, have we?

• Asian Shares Slip As Bank Fears Add To Global Gloom (Reuters)

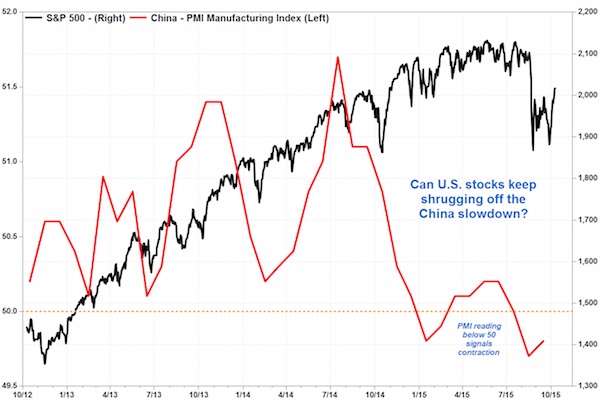

Asian shares slipped on Friday as mounting concerns about the health of European banks further threatened a global economic outlook already under strain from falling oil prices and slowdown in China and other emerging markets. The prices of yen, gold and liquid government bonds of favoured countries soared as investors rushed to traditional safe-haven assets. “The markets are clearly starting to price in a sharp slowdown in the world economy and even a recession in the United States,” said Tsuyoshi Shimizu, chief strategist at Mizuho Asset Management. “I do not expect a collapse or major financial crisis like the Lehman crisis but it will take some before market sentiment will improve,” he added.

MSCI’s index of Asia-Pacific shares outside Japan fell 0.5%. Japan’s Nikkei fell 5.3% to a 15-month low as sudden spike in the yen took most investors by surprise. “It is hard to find a bottom for stocks when the yen is strengthening this much. It is hard to become bullish on the market in the near future,” said Masaki Uchida, executive director of equity investment at JPMorgan Asset Management. “But the valuation of some (Japanese) bank shares is extremely cheap. So for long-term investors, it could be a good level to buy,” he added. Financial shares led losses in Australia and Hong Kong though their declines are still modest compared to peers in Europe and the US.

The strengthening yen touched 110.985 to the dollar on Thursday, rising almost 10% from its six-week low touched on Jan 29, when the Bank of Japan introduced negative interest rates. The currency last stood at 112.22 yen, hardly showing any reaction after Japanese Finance Minister Taro Aso stepped up his verbal intervention on Friday, saying he would take appropriate action as needed. MSCI’s broadest gauge of stock markets fell 0.6% in Asia on Friday, flirting with its lowest level since June 2013. It has fallen fell more than 20% below its record high last May, confirming global stocks are in a bear market.

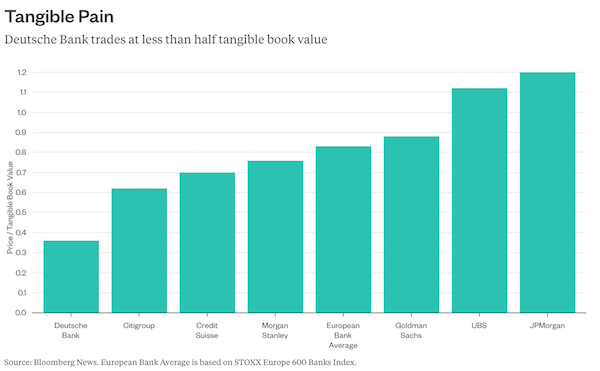

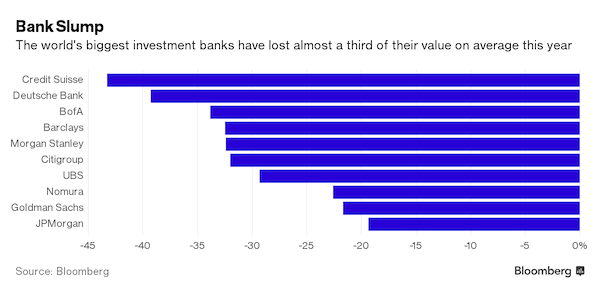

Banks are bubbles.

• Global Assault on Banks Intensifies as Investors Punish Weakness (BBG)

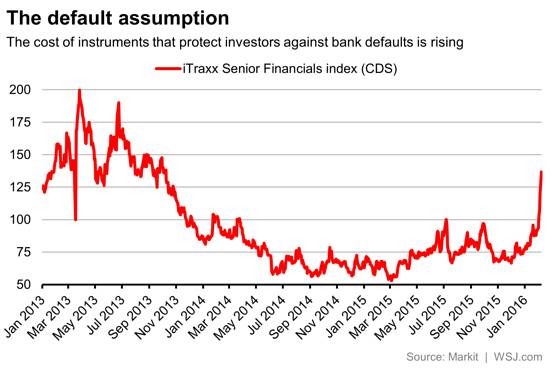

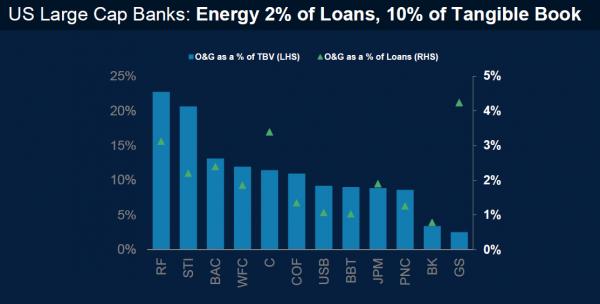

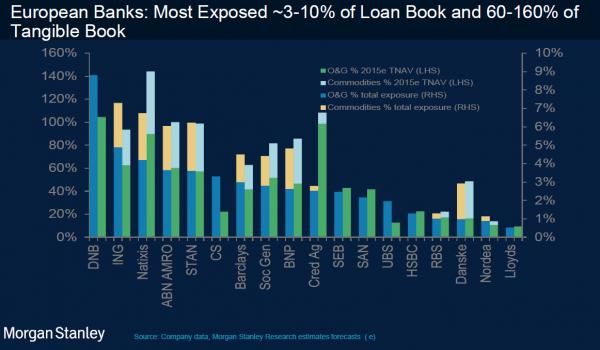

Credit Suisse Group AG shares plunged to the lowest in a generation and a one-year contract to insure Deutsche Bank debt against default surged to a record as a global rout in financial companies intensified. Theories abound as to what lies behind the selloff, with some traders fretting over falling oil prices, China’s slowing economy and negative interest rates. A pullback by some sovereign-wealth funds has also been blamed for lower asset prices. Whatever the cause, the hammering has been the worst in Europe, where concerns persist about the health of some of the biggest banks eight years after the financial crisis. “The market is aggressively penalizing banks,” said Nikhil Srinivasan at Assicurazioni Generali in Milan. “It’s going to be a challenging 2016, and I don’t see a short tunnel – this could go on for a while.”

Investors are fleeing lenders that show signs of weakness, as Societe Generale did yesterday when the Paris-based bank said it might miss its profitability goal this year. The stock plunged 13%, the most since 2011. Both Credit Suisse and Deutsche Bank published dismal fourth-quarter results in recent weeks that have sent shareholders and bondholders to the exits. U.S. lenders haven’t been spared. JPMorgan dropped to the lowest in more than two years after Federal Reserve Chair Janet Yellen said Thursday that the central bank was taking another look at negative interest rates as a potential policy tool if the U.S. economy faltered, a scenario some investors view as a possibility amid a darkening outlook for world growth.

South Korea even halted its small cap trading for a while.

• Emerging Stocks Rout Deepens on Risk Aversion as Currencies Drop (BBG)

Emerging-market equities headed for the worst weekly drop in a month and currencies retreated as anxiety over the worsening outlook for global growth sapped demand for riskier assets. South Korea’s Kospi led declines on Friday, poised for its worst week since August, as benchmark indexes in the Philippines and Indonesia fell. Chinese shares traded in Hong Kong slumped while markets in mainland China, Taiwan and Vietnam remain closed for Lunar New Year holidays. Malaysia’s ringgit and South Africa’s rand weakened the most and a gauge of 20 developing-nation currencies was set for its first five-day drop since mid-January.

World equities descended into a bear market on Thursday amid growing skepticism that central banks can arrest the slide in the world economy, and as crude oil in new York closed at the lowest level in more than 12 years. Signals from central banks in Europe and Japan that additional stimulus is likely did little to ease concerns about growth. Investors ignored a second day of testimony from Federal Reserve Chair Janet Yellen, whose indication that the U.S. won’t rush to raise interest rates failed to stem a global selloff.

Beijing is going to have a real exciting weekend.

• Yuan Declines Most in Two Weeks as Global Selloff Saps Sentiment (BBG)

The offshore yuan fell the most in two weeks, tracking Asian currencies and stocks lower as a global selloff eroded the appeal of riskier assets. Equity markets sank into bear territory amid skepticism central banks can arrest a slide in the world economy. The Bloomberg-JPMorgan Asia Dollar Index fell for a second day while stocks in Hong Kong headed for their lowest close in more than three years. Federal Reserve Chair Janet Yellen said this year’s global tumult was in response to a drop in the yuan and in oil prices, and not the U.S. central bank’s rate increase in December. A gauge of the dollar’s strength rose 0.1% on Monday, paring its decline from Feb. 5 to 0.8%.

The yuan traded in Hong Kong fell 0.16% to 6.5399 a dollar as of 11:50 a.m. local time, ending three days of gains, according to China Foreign Exchange Trade System prices. The currency is headed for a 0.4% advance for the week. China’s onshore financial markets will reopen on Monday, after a week-long holiday, with investors watching out for what the People’s Bank of China will do with the yuan’s reference rate. “There’s a tug of war right now as people are debating whether the dollar’s weakness and its effect on emerging-market currencies will be sustainable,” said Sim Moh Siong, a foreign-exchange strategist at Bank of Singapore Ltd. China’s central bank is likely to keep the yuan’s fixing stable on Monday, he added.

The hilarious reaction to Kuroda’s, and Abenomics’, failure.

• Asia’s Rich Advised to Buy Yen as BOJ’s Negative Rates Backfire (BBG)

Money managers for Asia’s wealthy families are favoring the yen as it benefits from the turmoil in global financial markets. Credit Suisse is advising its private-banking clients to buy the yen against the euro or South Korean won because the Japanese currency remains undervaluedversus the dollar. Stamford Management Pte, which oversees $250 million for Asia’s rich, told clients the yen is set to strengthen to 110 against the dollar as soon as the end of this month. Singapore-based Stephen Diggle, who runs Vulpes Investment Management, plans to add to assets in Japan where the family office already owns hotels and part of a nightclub in a ski resort. The yen has outperformed all 31 other major currencies this year as Japan’s current-account surplus makes it attractive for investors seeking a haven.

Bank of Japan Governor Haruhiko Kuroda’s Jan. 29 decision to adopt negative interest rates has failed to rein in the currency’s advance. “All existing drivers still point to more yen strength,” said Koon How Heng, senior foreign-exchange strategist at Credit Suisse’s private banking and wealth management unit in Singapore. “The BOJ will need to do more to convince the markets about the effectiveness of its negative interest-rate policy.” The yen has appreciated 7% against the dollar this year to 112.32 as of 12:10 p.m. in Tokyo Friday. It touched 110.99 Thursday, the strongest level since Oct. 31, 2014, the day the BOJ unexpectedly increased monetary stimulus for the second time during Kuroda’s tenure.

That’s a drawback for the central bank governor. He needs a weaker yen to help meet his target of boosting Japan’s inflation rate to 2% and keep exports competitive. Stamford Management has briefed some of the families whose wealth it helps to manage about the firm’s “bullish stance” on the yen, said its chief executive officer, Jason Wang. “The adoption of negative interest rates reeks of desperation to me,” Wang said. “It’s akin to an admission by the BOJ that conventional monetary policy is ineffective in hitting their 2% inflation target.”

Abe.

• Who Stole The Yen Carry Trade? (CNBC)

Japan’s descent into a negative interest rate policy should have weakened the yen, but instead it’s spurring a rally as appetite for using the currency to fund other bets wanes. The yen strengthened on Thursday to highs not seen since October of 2014, with the dollar fetching as few as 110.98 yen. That’s despite the Bank of Japan (BOJ) blindsiding global financial markets on January 29 by adopting negative interest rates for the first time ever – a move that should spur outflows of the local currency, not inflows. Instead, a confluence of factors – worries about banks’ profits, a commodities price slump and uncertainty over the Federal Reserve’s hiking path – is causing an old favorite, the yen carry trade, to fall out of fashion, which means the currency is moving in the opposite direction to that expected in the wake of the BOJ’s surprise rates move.

“The advent of negative rates is compounding concerns about underlying strains in the financial sector and bank profitability,” Ray Attrill, co-head of foreign-exchange strategy at National Australia Bank, told CNBC’s “Street Signs” on Wednesday. Japanese investors are repatriating funds in part because the BOJ’s move sparked concerns that other central banks could wage a campaign of competitive rate cuts in response. This in turn caused worries about global banks’ earnings because negative interest rates in Japan – as well as low interest rates globally – dents the banks’ net interest margins. That’s a driver of why bank shares have sold off particularly viciously in recent weeks amid a wider global market rout.

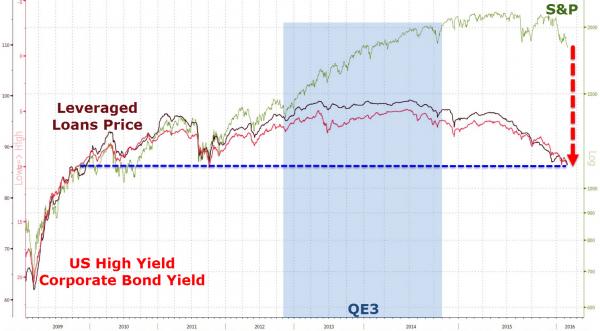

“…and credit is always right in the end!”

• If Credit Is Right, The S&P Is Facing A 40% Crash (ZH)

…and credit is always right in the end! 1,100 is the target…

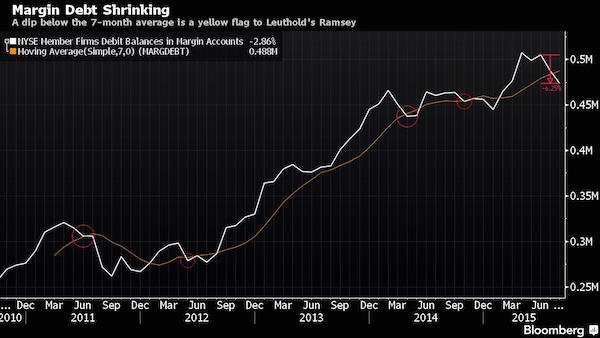

High Yield bond yields and Leveraged Loan prices are at their worst since 2009 as it seems the hosepipe of QE3 liquidity (its the flow not the stock, stupid) is slowly unwound from a buybacks-are-over equity market.

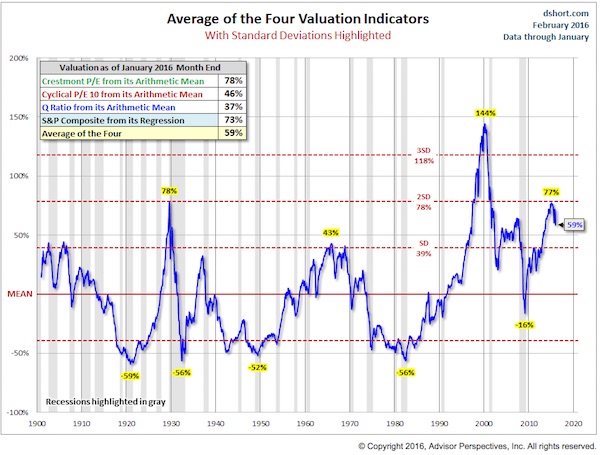

The Doug Short graph comes with a ton of caveats, but stock valuations sure look high.

• How Much Further Could Stocks Fall? (BI)

A few months ago, I noted that stocks were so frighteningly expensive that they could fall more than 50%. I also noted that that would not be the worst-case scenario. Well, since then, stocks have fallen sharply, and they’re now down about 15% off their highs. So how much further could they fall? On a valuation basis, I’m sorry to say, they could fall much further. It would take at least another 30% drop from here – call it 1,200 on the S&P 500 – before stock prices reached even historically average levels. And that would by no means be the worst-case scenario. Why do I say this? Because, by many historically predictive valuation measures, even after the recent 15% haircut, stocks are still overvalued to the tune of ~60%. That’s better than the ~80% over-valuation of a few months ago.

But it’s still expensive. In the past, when stocks have been this overvalued, they have often corrected by crashing — in 1929, 1987, 2000, and 2007, for example . They have also sometimes corrected by moving sideways and down for a long, long time — in 1901-1920 and 1966-1982, for example. After long eras of over-valuation, like the period we have been in since the late 1990s (with the notable exceptions of the lows after the 2000 and 2007 crashes), stocks have also often transitioned into an era of undervaluation, often one that lasts for a decade or more. In short, stocks are still so expensive on historically predictive measures that they are priced to deliver annual returns of only about 2%-3% per year for the next decade. So a stock-market crash of ~50% from the peak would not be a surprise. It would also not be the “worst-case scenario.” The “worst-case scenario,” which has actually been a common scenario over history, is that stocks would drop by, say 75% peak to trough.

Coco no more.

• S&P Cuts Deutsche Bank’s Tier 1 Securities Rating To B+ from BB- (Reuters)

Rating agency Standard and Poors on Thursday said it cut Deutsche Bank AG’s Tier 1 securities rating to B+ from BB- and also lowered Deutsche Bank Capital Finance Trust I perpetual Tier 2 instrument rating to BB- from BB. S&P said the bank’s €4.3 billion pro forma payment capacity for 2017 should be sufficient to enable continued Tier 1 interest payments, but its German GAAP earnings prospects are difficult to foresee amidst restructuring and volatile market conditions. The rating change with a stable outlook reflects the expectation that the Frankfurt-based bank will make steady progress during the next two years towards its financial and operational targets for 2020, S&P added.

Shares of Deutsche Bank have fallen about 40% since the start of this year as shareholders expressed doubts over the management’s execution of its two-year turnaround plan, announced last October. The bank, seeking to reassure investors, said on Monday it had “sufficient” reserves to make payments due this year on AT1 securities. Deutsche Bank is also looking at buying back several billion euros worth of its debt in an effort to reverse the falling value of its securities, the Financial Times said on Tuesday. However, S&P expects the German bank’s profitability to remain relatively poor in 2016-2017, due to restructuring charges and likely further litigation provisions.

Close, yes.

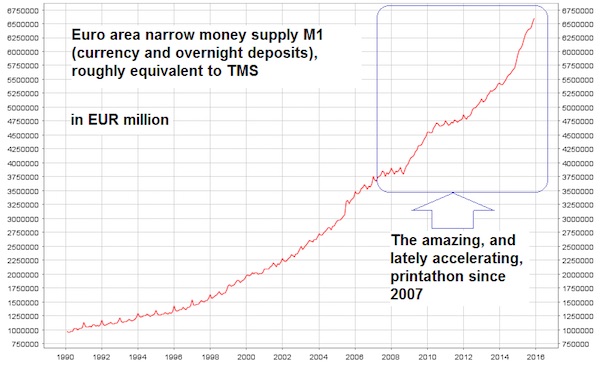

• The Week When Central Bank Planning Died? (MW)

Has the “Yellen put” finally expired? Financial markets are in the grips of a global rush to safety. Central banks, whose flood of liquidity have been given much of the credit for the sharp postcrisis rise in stocks and other asset prices, seem unable to stem the tide. “This week may go down in financial history as the week when central bank planning died—the 2016 version of the fall of the Berlin Wall. It sounds worse than it is, as this was always coming,” said Steen Jakobsen, chief economist at Saxo Bank, in a Thursday note. Markets took little comfort in two days of testimony by Federal Reserve Chairwoman Janet Yellen. The S&P 500 and Dow Jones Industrial Average posted their fifth straight decline Thursday. The yen, meanwhile, has soared despite the Bank of Japan’s easing efforts.

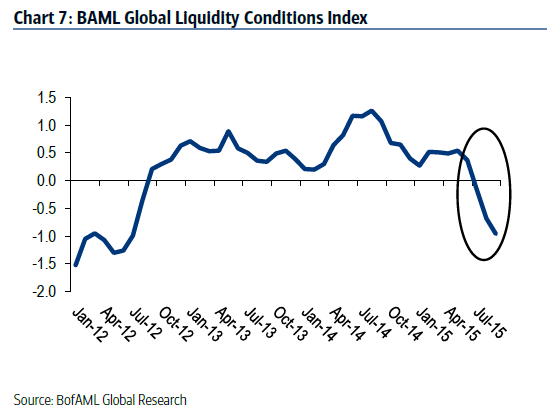

It was the Bank of Japan’s surprise decision in late January to impose a negative rate on some deposits that appeared to rock investor faith. As MarketWatch noted at the time, the move was viewed by many economists as desperate. Moreover, with central banks continually undershooting inflation targets despite extraordinarily loose policy, there are growing fears that the ability of monetary policy to affect the real economy has been impaired. The ability of central banks to steer the market—or vice versa—was first dubbed the “Greenspan put,” then renamed the “Bernanke put,” and, finally, the “Yellen put.” A put option gives an investor the right to sell the underlying security at a preset strike price. In other words, bullish stock investors could count on central bankers to keep a floor under the market. That’s what some think is finally coming to an end.

“We have relied on central bankers to fix the world’s economic woes, when all they could really do was to get the global financial system back on an even keel,” said Kit Juckes, global macro strategist at Société Générale, in a note. “Keeping policy too easy, for too long and boosting asset markets in the vain hope that this would deliver a sustainable pickup in demand has meant that even a timid attempt at normalizing Fed policy has caused two months of mayhem.” Now, amid a growing realization that central banks’ powers are on the wane, investors are rushing for havens, he said. The Bank of Japan wasn’t the first major central bank to go negative. It joined the European Central Bank and the Swiss National Bank, as well as the Swedish and Danish central banks. But there are fears that negative rates will prove counterproductive.

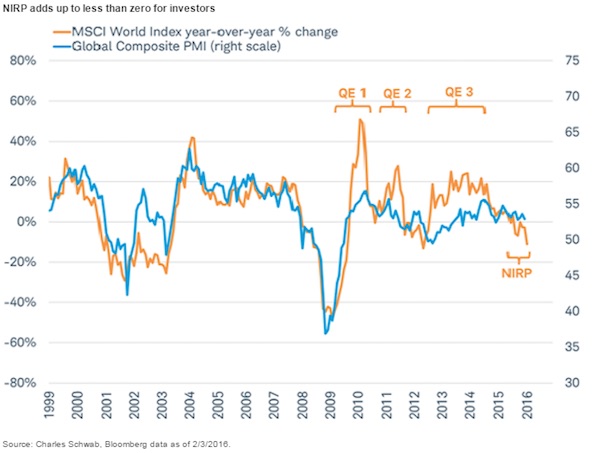

Central banks have implemented negative rates in an effort to halt the hoarding of cash in a bid to fuel spending and push up inflation. But skeptics fear the strategy could backfire. “The increasing number of central banks adopting [negative interest rate policies] is weighing on the profit outlook for financial companies that now must pay to hold some of their reserves at the central bank and hurting the performance of the global financial sector.,” wrote Jeffrey Kleintop, global chief investment strategist at Charles Schwab, in a blog post. A main worry is that banks might have to push up lending rates to cover the cost of holding some reserves at the central bank. As a result, it’s the financial sector, not falling oil, that has been the leading driver of the fall in global stocks in 2016, Kleintop said (see chart).

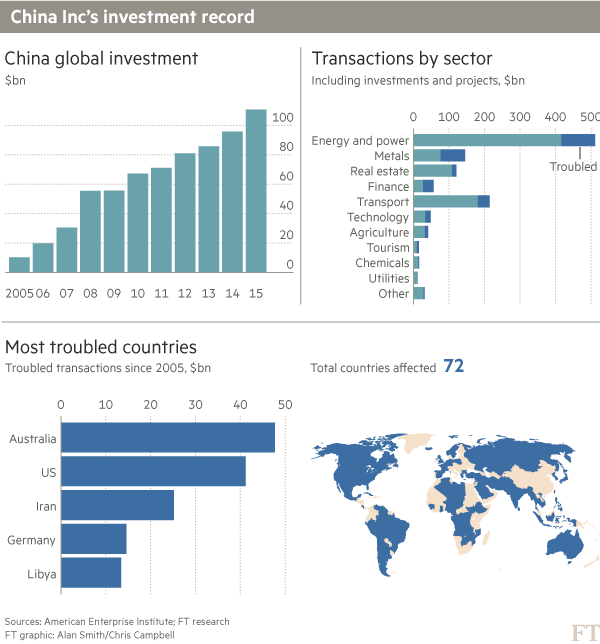

Now combine this with Kyle Bass’ assertion that FX reserves are already depleted. What exactly are they buying foreign companies with then?

• China Buys The World With State-Backed Debt (FT)

The warnings are clear for ChemChina. The company behind China Inc’s biggest outward investment bid will be hoping to avoid the unhappy experiences suffered by some of the country’s earlier trailblazers. The state-owned oil company Cnooc , for example, ran into problems after it paid a record $15bn in 2013 for Nexen, one of Canada’s largest oil firms. Cnooc began with good intentions, paying a 60% premium to Nexen’s share price, only to suffer from the prolonged slump in global oil prices. A huge pipeline spill and a retreat from promises to safeguard Canadian jobs — it fired senior Nexen executives and laid off hundreds of staff — have further dented goodwill around the deal. Investments by other Chinese stalwarts have also hit turbulence, falling at regulatory hurdles or unravelling for commercial reasons.

“Chinese investment overseas is a double-edged sword,” says Derek Scissors, of the American Enterprise Institute. The outward embrace of China Inc raises a series of challenges for target companies and countries, he adds. Common problems arise from a mismatch of regulatory systems, a clash of corporate cultures and commercial miscalculations. China is not alone in having deals that hit problems — it happens to US and European companies also. But increasingly the issue for Chinese deals is debt. Analysts say that a surge in the indebtedness of corporate China since 2009 has meant that many of its largest companies are looking for acquisitions abroad while dragging behind them mountains of unpaid loans and bonds. ChemChina, which is offering $44bn for Syngenta, the Swiss agrichemical giant, is a case in point.

Its total debt is 9.5 times its annual earnings before interest, tax, depreciation and amortisation (ebitda), putting it into the “highly-leveraged” category as defined by Standard & Poor’s, the rating agency. This, say analysts, highlights the nature of ChemChina’s planned acquisition before even a cent has been paid. The proposed deal is not between two commercial businesses but between the Chinese state and a Swiss company. “Bids like that by ChemChina are backed by the state,” Mr Scissors says. “There is no chance a company as heavily leveraged as this would be able to secure this level of financing on a commercial basis. “If your financials are out of whack with every commercial company on the planet then you can call yourself commercial but you are not,” he adds. The issue with debt is by no means confined to ChemChina.

The median debt multiple of the 54 Chinese companies that publish financial figures and did deals overseas last year was 5.4, according to data from S&P Global Market Intelligence. Many would be regarded as “highly leveraged”. Some companies are almost off the chart. Zoomlion, a lossmaking and partially state-owned Chinese machinery company that is bidding for US rival Terex, has a debt multiple of 83; by comparison Terex’s is 3.6. China Cosco, a state-owned shipping company, is seven times more indebted than Piraeus Port Authority in Greece, which it bought for €368.5m last month . The state-owned Cofco Corporation, which recently reached an agreement with Noble Group, the commodities trader, under which its subsidiary Cofco International would acquire a stake in Noble Agri for $750m, has debts equivalent to 52 times its ebitda.

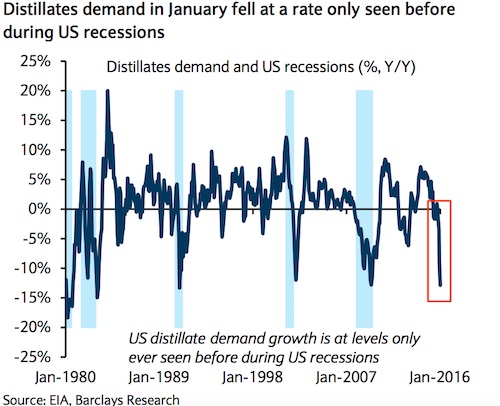

Wiping out the entire region’s oil processing industry.

• China Turns a Glut of Oil Into a Flood of Diesel (BBG)

Fuel producers from India to South Korea are finding that rising refined products from China are cutting the profit margins they’ve enjoyed from cheap oil to the lowest in more than a year. Worse may be coming. China’s total net exports of oil products – a measure that strips out imports – will rise 31% this year to 25 million metric tons, China National Petroleum Corp., the country’s biggest energy company, said in its annual research report last month. That comes after diesel exports jumped almost 75% last year.

“If China dumps more fuel into the market, international prices will crash,” said B.K. Namdeo, director of refineries at India’s state-run Hindustan Petroleum. “It will be similar to what happened to crude prices due to the oversupply. If international prices of oil products come down, then it will hurt margins of all refiners.” A common measure of refining profitability in Asia – the margin from turning Middle East benchmark Dubai grade into fuels including diesel and gasoline in the regional trading hub of Singapore – slid this week to the lowest level since October 2014, adding to mounting evidence that China’s exports are weighing on Asian processors.

Let’s blame Russia.

• 11.5% Of Syrian Population Killed Or Injured (Guardian)

Syria’s national wealth, infrastructure and institutions have been “almost obliterated” by the “catastrophic impact” of nearly five years of conflict, a new report has found. Fatalities caused by war, directly and indirectly, amount to 470,000, according to the Syrian Centre for Policy Research (SCPR) – a far higher total than the figure of 250,000 used by the United Nations until it stopped collecting statistics 18 months ago. In all, 11.5% of the country’s population have been killed or injured since the crisis erupted in March 2011, the report estimates. The number of wounded is put at 1.9 million. Life expectancy has dropped from 70 in 2010 to 55.4 in 2015. Overall economic losses are estimated at $255bn (£175bn).

The stark account of the war’s toll came as warnings multiplied about Aleppo, Syria’s largest city, which is in danger of being cut off by a government advance aided by Russian airstrikes and Iranian militiamen. The Syrian opposition is demanding urgent action to relieve the suffering of tens of thousands of civilians. The International Red Cross said on Wednesday that 50,000 people had fled the upsurge in fighting in the north, requiring urgent deliveries of food and water. Talks in Munich on Thursday between the US secretary of state, John Kerry, and his Russian counterpart, Sergei Lavrov, will be closely watched for any sign of an end to the deadly impasse. UN-brokered peace talks in Geneva are scheduled to resume in two weeks but are unlikely to do so without a significant shift of policy.

Of the 470,000 war dead counted by the SCPR, about 400,000 were directly due to violence, while the remaining 70,000 fell victim to lack of adequate health services, medicine, especially for chronic diseases, lack of food, clean water, sanitation and proper housing, especially for those displaced within conflict zones. “We use very rigorous research methods and we are sure of this figure,” Rabie Nasser, the report’s author, told the Guardian. “Indirect deaths will be greater in the future, though most NGOs [non-governmental organisations] and the UN ignore them. “We think that the UN documentation and informal estimation underestimated the casualties due to lack of access to information during the crisis,” he said. In statistical terms, Syria’s mortality rate increased from 4.4 per thousand in 2010 to 10.9 per thousand in 2015.

“Beyond commands, we’re human. We’ll lose heart, we’ll cry, we’ll feel sad if something doesn’t go well. There isn’t a person who won’t be moved by this..”

• Greeks At Frontline Of Refugee Crisis Angry At Europe’s Criticism (Reuters)

Some EU members have suggested Greece should be suspended from Schengen if it does not improve. But the criticism and threats have been met with anger in Greece. Prime Minister Alexis Tsipras on Wednesday said the EU was “confused and bewildered” by the migrant crisis and said the bloc should take responsibility like Greece has done, despite being crash-strapped. Most Greeks, including the coast guard, the army, the police were “setting an example of humanity to the world,” Tsipras said. For those at the frontline, foreign criticism is even more painful. “We’re giving 150%,” said Lieutenant Commander Antonis Sofiadelis, head of coast guard operations on Lesvos. Once a dinghy enters Greek territorial waters, the coast guard is obliged to rescue it and transport its passengers to the port.

”The sea is not like land. You’re dealing with a boat with 60 people in constant danger. It could sink, they could go overboard,” he said. More than a million people, many fleeing war-ravaged countries and poverty in the Middle East and Africa, reached Europe in the past year, most of them arriving in Greece. For the crews plying a 250-km-long coastline between Lesvvos and Turkey, the numbers attempting the crossing are simply too big to handle. It is but a fraction of a coastline thousands of kilometers long between Greece and Turkish shores. ”The flow is unreal,” Sofiadelis said. Lesvos has long been a stopover for refugees. Locals recall when people fleeing the Iraqi-Kurdish civil war in the mid-1990s swam across from Turkey. Yet those numbers do not compare to what has become Europe’s biggest migration crisis since WWII and which has continued unabated despite the winter making the Aegean Sea even more treacherous.

After days of gale force winds and freezing temperatures, more than 2,400 people arrived on Greece’s outlying islands on Monday, nearly double the daily average for February, according to United Nations data. Sofiadelis, the Lesvos commander, said controls should be stepped up on the Turkish side, while Europe should provide assistance with more boats, more staff and better monitoring systems such as radars and night-vision cameras. Greek boats, assisted by EU border control agency Frontex, already scan the waters night and day. By late morning on Monday, Captain Frangoulis and his crew – including a seafaring dog picked up at a port years ago – have been at sea for more than 24 hours. Each time his crew spot a boat that could be carrying migrants “our stomach is tied up in knots,” Frangoulis said.

”There’s this fear that everything must go well, everyone boards safely, no child falls in the sea, no one’s injured.” Though fewer than 10 nautical miles separate Lesvos from Turkish shores, hundreds of people have drowned trying to make it across. Patrol boats, as well as local fishermen, have often fished out corpses from the many shipwrecks of the past months, the bodies blackened and bruised from days at sea. After every rescue operation, a sense of relief fills the crews. Once the Agios Efstratios docked at the Lesvos harbour on Monday, Frangoulis’ beaming crew helped passengers disembark, holding up crying babies in their arms. ”There’s no room for sentimentalism. We execute commands,” Frangoulis said of the rescue operations. “Beyond commands, we’re human. We’ll lose heart, we’ll cry, we’ll feel sad if something doesn’t go well. There isn’t a person who won’t be moved by this,” he said.

Real people.

• The Grandmothers Of Lesvos (Kath.)

Even as the high winds whip up the sea they still come. I spot two black dots far away on the horizon: rubber dinghies that have set off from the Turkish coast, overladen with men, women and children. If she could, 85-year-old Maritsa Mavrapidi would walk down the road from her front gate to the beach of Skala Sykamias and wait – as she has done so many times in the past – for the boats to land. After all, she knows exactly what it means to be refugee. “Our mothers came here as refugees from Turkey, just across the way, and they were just girls at the time. They came without clothes, with nothing,” she says. “That’s why we feel sorry for the migrants.” Maritsa prefers not to go out on cold days. Her cousins would also have liked to be at the beach to help the newcomers but they also avoid bad weather.

Efstratia Mavrapidi is 89 and Militsa (Emilia) Kamvisi 83. The latter was recently nominated for a Nobel Peace Prize along with a Lesvos fisherman as representatives of the islanders who have taken the refugees into their hearts and their homes. “Dear Lord, we never expected this: people coming through the storm,” says Maritsa. “As soon as they step off the boat they say prayers and kiss the ground; it’s unbelievable. They’re to be pitied. And there are so many babies, tiny little things. It breaks your heart to see the babies in such a sorry state, trembling with cold.” I sit with the three women in Militsa’s home. The village’s olive grove starts at the back of the house and from the front there’s a view to the sea. “I’ve moved downstairs because I have volunteers who help the refugees staying upstairs,” she says.

[..] They share roots and a hard life. Their mothers arrived on Lesvos on fishing boats from Asia Minor in 1922. They are reminded every time they see refugees landing on the island’s shores of the scenes of exodus their mothers had described. “My mother had three babies when she came from Turkey,” remembers Efstratia. “She had no clothes for the youngest and had to tear her underskirt to wrap it in.” Back in Turkey Militsas’s father had been engaged to a different woman. “He packed up his sewing machine and a trunk of clothes as they prepared to leave, but his fiancee and her mother were killed. He came to Lesvos alone and later met my mother.” They know from the stories they were told that the islanders were not particularly welcoming to the new arrivals from Asia Minor.

“The locals were scared that the refugees would settle here,” says Maritsa. “Eventually they did. They bought land and got married.” One of the places where many of the refugees put down roots was Skala Sykamias. Here, in this spot that was the birthplace of celebrated novelist Stratis Myrivilis, the refugees experienced poverty and suffering. “They led very sad lives and had many children, like the migrants that coming today,” says Militsa. “They made their homes in olive storage sheds. Four families could live in one room, separated by hanging carpets,” adds Efstratia.