Paul Gauguin The wave 1888

Stormy Daniels boosts Da Donald’s stats. What’s not to like?

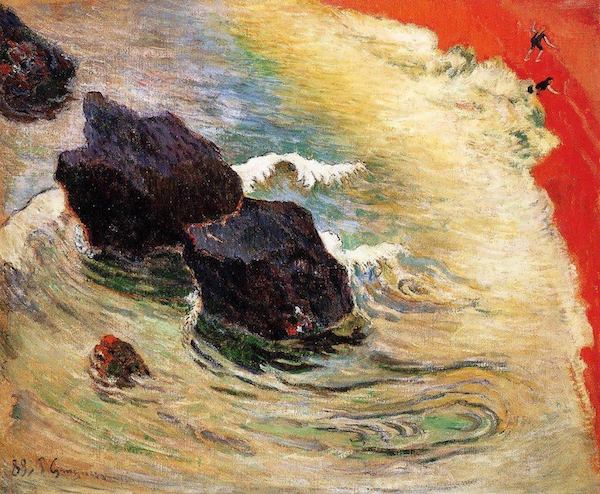

• Trump Approval At 11-Month High – Will The Dollar Follow? (ZH)

The last few days have seen a rapid rush to the ‘safe-haven’ dollar, stalling a seemingly non-stop drop in the world’s reserve currency.

Which raises the question, is the correlation between President Trump’s approval rating and ‘king dollar’ about to reignite?

President Trump’s approval rating has been rising since the start of the year, and the results from the most recent presidential job approval survey by CNN shows that Donald Trump is now at an 11-month high. Although he still has majority disapproval, 42% of respondents are currently giving him a thumbs up – the highest rate recorded by CNN since March 2017 where the president was on 44%. So how, during a time of seemingly endless scandals trying to burst their way into the public sphere, is Trump seemingly on the up? [..] Despite being criticized from some corners for his protectionist approach, Trump following through on his America First campaign promises is seemingly helping to win some voters back around. In many ways, the road ahead is looking far from smooth for the president, but having come through scandal and controversy relatively unscathed in the past, who knows where this current wave will lead.

Just on rumors Trump doesn’t like them. Wait till he starts tweeting on the topic.

• Amazon Loses $53 Billion in Market Value, Becoming FAANG’s Biggest Loser (BBG)

Move over, Facebook. U.S. investors have a new punching bag among the FAANGs: Amazon.com, Inc. Facebook Inc. gave up the top loser spot to Amazon.com, which lost $53 billion in market value on Wednesday after Axios reported that President Donald Trump is “obsessed” with regulating the e-commerce behemoth. The social media giant had previously underperformed the tech megacap group amid concern over the company’s handling of its users’ personal information. The FAANG stocks, once assumed to be a monolith of performance, have suffered degrees of decoupling recently, including the outperformance by Netflix Inc. earlier in the year.

Amazon.com fell as much as 7.4% Wednesday before paring some losses to close 4.4% lower after a Stifel Nicolaus & Co. analyst said the weakness created a buying opportunity. Facebook diverged from the group in early trading, rallying 0.5% after announcing it’s redesigning a menu of privacy settings in response to public outrage over the user data practices. Netflix was the second-biggest loser in the FAANG group of stocks, sliding 5% on the heels of the #DeleteNetflix campaign. “Netflix and Amazon haven’t really experienced the intense selling that Facebook did,” said Michael Antonelli, an institutional equity sales trader and managing director at Robert W. Baird & Co. “The ‘flu’ that Facebook got is now spreading to the others.”

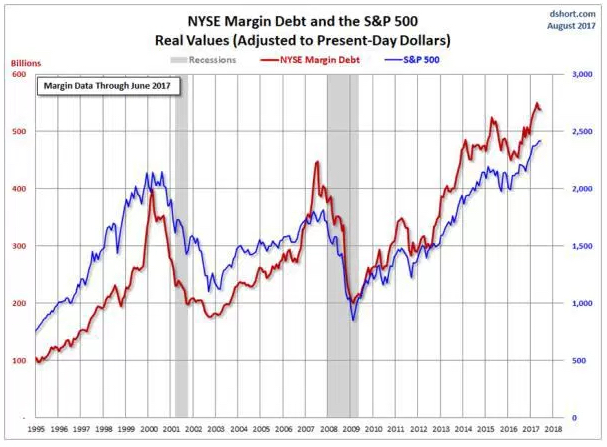

There’s only one real mistake here: the Fed itself.

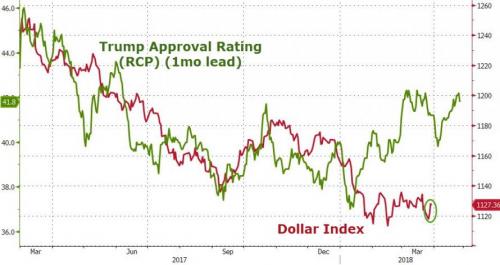

• Fed Mistakes Could Spark ‘Unusually Fast’ Bear Market (MW)

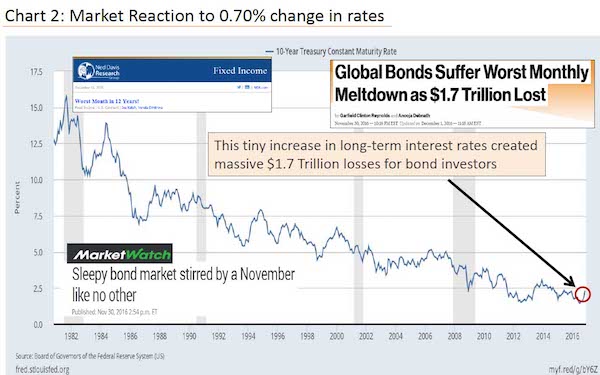

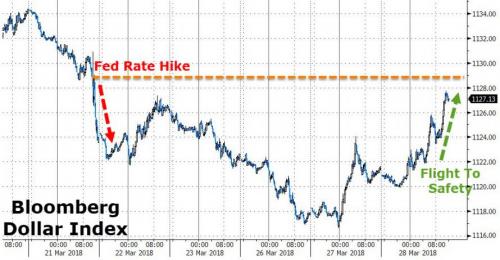

Uncertainty over trade policy may be the primary driver of the U.S. stock market at the moment, but the real policy risk facing equities could be coming from the Federal Reserve, with the potential downside a lot more pronounced than investors are currently anticipating. Last week, Fed Chairman Jerome Powell said the economic outlook had strengthened, but he painted a mixed picture about what policy might look like going forward. The U.S. central bank raised interest rates but indicated it would only do a total of three rate hikes in 2018, which some saw as a dovish signal given that a number of investors had expected four this year. However, the Fed pushed up its expected rate path in 2019 and 2020.

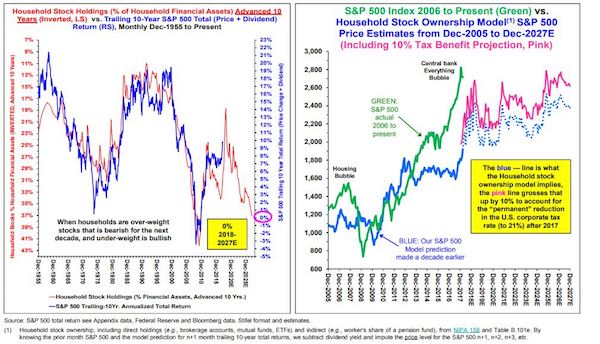

Barry Bannister, head of institutional equity strategy at Stifel, said it was a concern that the Fed’s view for 2019 and 2020 had grown more hawkish, which raised the risk of the central bank making a policy mistake. “What matters for investors is that any decline is likely to be unusually rapid and occur as a result of P/E compression, resulting from policy risks not weak GDP,” he wrote in a research report. “Investors need a bit more acrophobia, as our best model points to a bear market and lost decade for stocks.” Bannister argued the new Fed, under Powell, “wishes to fade the ‘Fed put,’” or the idea that the central bank would step in to prop up falling equity prices. “The cost may be a 16% P/E drop,” he wrote, referring to price-to-earnings, a popular measure of equity valuation.

The Fed is expected to regularly raise rates over the coming years, and some investors think it may hasten its pace of increases to rates in the event that inflation returns to the market in a more pronounced fashion. “Maybe it is not that the Fed has actually made an error, perhaps it is fear the Fed may make an error,” Stifel wrote (emphasis in original). “The late-2010s echo the late-1990s as ‘bookends’ for global imbalances. Unlike the yield curve inversion in [the first half of the 2000s] in anticipation of 2% inflation that led to an S&P 500 peak, investors may simply worry that the same outcome is possible in this cycle, causing equities to decline.”

And now I can’t get that song out of my head anymore.

• Tesla Bonds Are in Free Fall (BBG)

Elon Musk’s creditors are suddenly having a serious bout of buyer’s remorse. In August, they lined up for the chance to finance Tesla’s ambitious rollout of its Model 3 sedan. Wooed by Musk’s personal appeals, bond investors pretty much ignored the carmaker’s prolific cash burn and repeated failures to meet production targets and lent it $1.8 billion at record-low interest rates. But now, after a spate of fresh setbacks in the past week, including a fatal Tesla crash and a credit-rating downgrade, bondholders are asking hard questions about whether Musk can deliver on his bold promise to bring electric cars to the masses before the company runs out of cash. On Wednesday, Tesla’s notes plunged to a low of 86 cents on the dollar, the clearest sign yet creditors aren’t totally sure the company will be money good.

“It’s getting worse and worse every single day” for Tesla, said Bill Zox at Diamond Hill Investment Group. “That’s the nature of being in this negative feedback loop. Everyone is worried.” The consequences are significant. Tesla’s woes have played out most visibly in the stock market, with its shares suffering a two-day, 15% drop that’s the biggest since 2016. But surging borrowing costs, which are now near 8%, could hamper the carmaker’s ability to finance itself at a critical time. The company, which has never shown an annual profit in the 15 years since it was founded, will need to raise over $2 billion to cover not only its cash burn this year, but also about $1.2 billion of debt that comes due by 2019, Moody’s Investors Service analyst Bruce Clark said in a report Tuesday.

One of a million pieces denouncing Bolton. Can’t we send Stormy Daniels to his hotel room?

• The New Warlord in the White House (Jacobin)

There is no daylight between the ethos of a thug with a lead pipe shaking down a pedestrian for money and John Bolton, except that one has a J.D. from Yale. Bolton is particularly dangerous because he combines devotion to the ruthless exercise of power for American interests with a glassy-eyed faith in the durability of that same power. Anyone even remotely in touch with reality will have viewed the past two decades as a profound lesson in the limits of American military might — a fact that, ironically, helped Trump come to power. Not Bolton. Despite the ever worsening failure of the war he so desperately wished for, he has been heedlessly slavering for ever more destruction, still entranced by schoolboy myths about American power that the Right long ago turned into a near-evangelical worldview.

Unless Trump grows tired of Bolton’s mustache in record time, the Korean peninsula or the Middle East is very likely headed for war. Yet despite what Bolton thinks — and despite the Democrats’ abdication of this responsibility under Obama — a president cannot declare war without congressional authorization. The question is whether Congress will finally reassert this role under Trump or simply line up behind him. The good news is that Democrats are poised to make significant gains in this year’s midterms, including possibly retaking the House. The bad news is that if they do, they will do so with one of the most conservative and militaristic batch of new Democrats in modern memory.

Whatever happens, Bolton’s dismaying rise to power couldn’t have happened without the Reagan and Bush presidencies that liberals and centrists are now so eager to rehabilitate. Nor could it have happened without the many news outlets that have provided him a platform and legitimized him as a serious foreign policy thinker, instead of the deluded fanatic that he is. Perhaps this will spur some soul-searching, but let’s take things one day at a time.

Yeah. No. This does it for me. They’re making it up one chapter at a time.

• Skripals Poisoned From Front Door Of Salisbury Home, Police Say (G.)

Detectives investigating the attempted murders of Russian double agent Sergei Skripal and his daughter Yulia Skripal have said they believe the pair were poisoned with a nerve agent at the front door of his Salisbury home. Specialists investigating the poisoning of the the Skripals have found the highest concentration of the nerve agent on the front door at the address, police said. Counter-terrorism detectives will continue to focus their inquiries on the home address for the coming weeks, and possibly months, after the father and daughter were found unconscious on a park bench in Salisbury earlier this month.

Local police have retaken control of The Maltings shopping centre, where the Skripals were first discovered, and London Road cemetery from counter-terrorism detectives, where officers focused their investigation into the nerve agent attack in previous weeks. More than 130 people could have been exposed to the chemical weapon in the aftermath of the poisoning in Salisbury, which the UK government believes was committed by the Russian state. In response to the poisoning, more than 150 Russian officials have been expelled from more than 25 countries, and the UK government is considering further measures to punish Russia, including a ban on the City of London from selling Russian sovereign debt.

Public health experts are still working to establish whether the nerve agent attack presents a long term risks to Salisbury’s residents, which will receive a £1m support package from central government to help recover. Deputy assistant commissioner Dean Haydon, the senior national coordinator for counterterrorism policing, said: “At this point in our investigation, we believe the Skripals first came into contact with the nerve agent from their front door. “We are therefore focusing much of our efforts in and around their address. Those living in the Skripals’ neighbourhood can expect to see officers carrying out searches as part of this but I want to reassure them that the risk remains low and our searches are precautionary.”

Translation: City tells May what to do.

• May Considers Banning City Of London From Selling Russian Debt (G.)

Theresa May has agreed to look into imposing a ban on the City of London from helping Russia to sell its sovereign debt, which prop ups the Russian economy. Last month, City clearing houses, working alongside a major sanctioned Russian bank, helped issue $4bn (£2.83bn) of eurobonds to finance Russian sovereign debt, of which nearly half was sold in London markets. Nearly half the debt was bought by London-based investors, predominantly institutional investors. A loophole in EU and UK legislation has allowed sanctioned Russian banks, primarily VTB bank, to act as the main organisers – known as book runners – for the issuance of Russian debt.

A public call for the loophole to be closed has been made three times in the past week by the foreign affairs select committee chairman, Tom Tugendhat. On each occasion ministers seemed to be unaware of the issue, but the foreign secretary, Boris Johnson, last week described the idea as interesting. Speaking to the liaison committee of MPs on Tuesday, the prime minister said she would report back on the policy options. The foreign affairs select committee is setting up an inquiry into how the UK financially props up Vladimir Putin’s allies, and the measures the UK has taken to clamp down on corrupt Russian money in London.

Tugendhat has been briefed by a British research fellow at the Harvard Society of Fellows, Emile Simpson, who has argued Russia’s greatest weakness is its dependence on western investors. He contends a policy blindness leads the west to sanction individuals, and sometimes sectors, but not to look at sanctioning the Russian state as a whole. He said: “At present, Russia can borrow in EU and US capital markets despite western sanctions and then can support the sanctioned Kremlin-linked banks and energy companies that can no longer do so”. Tugendhat has proposed that Russian bond sales are no longer made available to key western clearing houses such as Euroclear and Clearstream, making them effectively untradeable on the secondary market and so deterring the majority of EU and US investors from buying them.

Know why? Skripal.

• Ecuador Cuts Off Julian Assange’s Internet Access At London Embassy (G.)

Ecuador has cut Julian Assange’s communications with the outside world from its London embassy, where the founder of the whistleblowing WikiLeaks website has been living for nearly six years. The Ecuadorian government said in statement that it had acted because Assange had breached “a written commitment made to the government at the end of 2017 not to issue messages that might interfere with other states”. It said Assange’s recent behaviour on social media “put at risk the good relations [Ecuador] maintains with the United Kingdom, with the other states of the European Union, and with other nations”. The move came after Assange tweeted on Monday challenging Britain’s accusation that Russia was responsible for the nerve agent poisoning of a Russian former double agent and his daughter in the English city of Salisbury earlier this month.

The WikiLeaks founder also questioned the decision by the UK and more than 20 other countries to retaliate against the poisoning by expelling Russian diplomats deemed spies. Assange has lived in the embassy since June 2012 to avoid extradition to Sweden over allegations of sex crimes he denies. Sweden has dropped the case but Assange remains subject to arrest in the UK for jumping bail and fears he will be extradited to the US for questioning about WikiLeaks’ activities if he leaves the embassy building.

[..] Assange’s comments on the nerve agent attack on double agent Sergei Skripal and his daughter Yulia prompted the British foreign office minister Alan Duncan to call him a “miserable little worm” during a Commons debate on Tuesday. Duncan said he should leave the embassy and surrender to British justice. Assange replied: “Britain should come clean on whether it intends to extradite me to the United States for publishing the truth and cease its ongoing violation of the UN rulings in this matter. “If it does this disgraceful impasse can be resolved tomorrow. I have already fully served any theoretical (I haven’t been charged) ‘bail violation’ whilst in prison and under house arrest. So why is there a warrant for my arrest?”

The former Greek finance minister, Yanis Varoufakis, and the music producer Brian Eno said in a statement they had heard “with great concern” about Assange’s lost internet access. “Only extraordinary pressure from the US and the Spanish governments can explain why Ecuador’s authorities should have taken such appalling steps in isolating Julian,” they pair said, adding Assange had only recently been granted citizenship. “Clearly, Ecuador’s government has been subjected to bullying over its decision to grant Julian asylum, support and ultimately, diplomatic status.”

In the end, it’s simple.

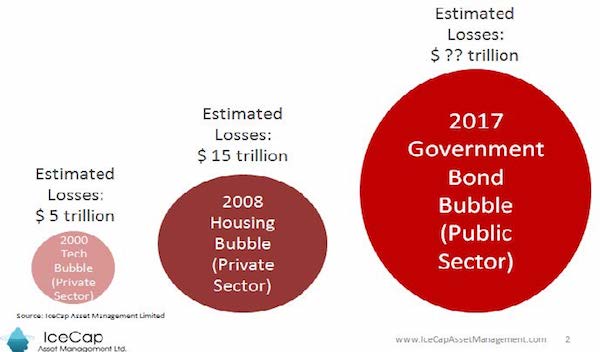

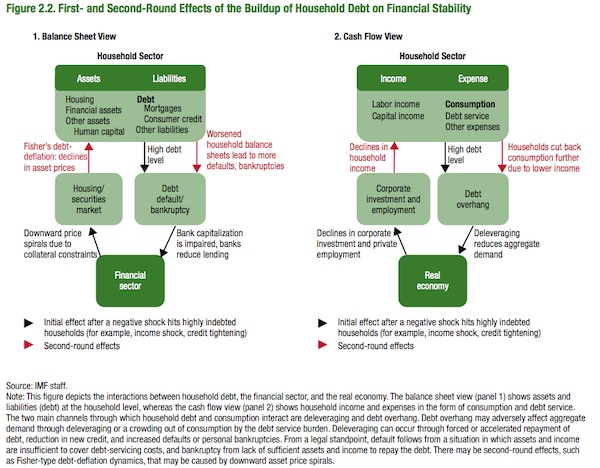

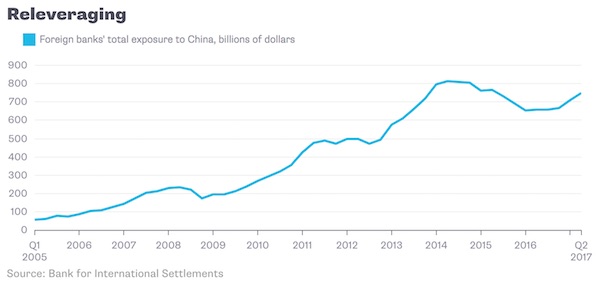

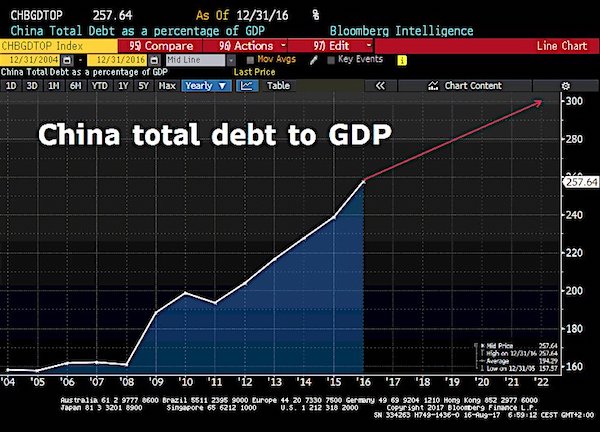

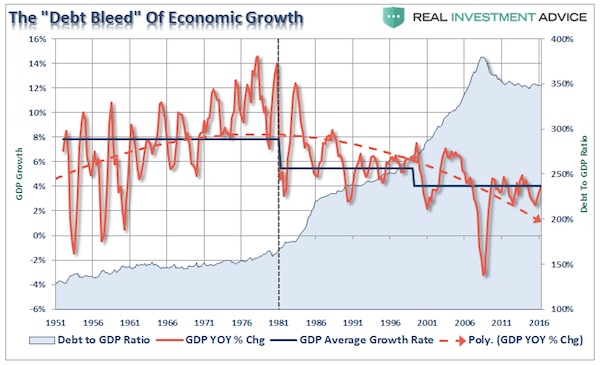

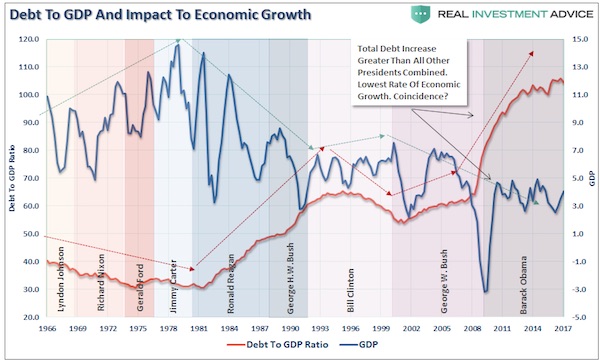

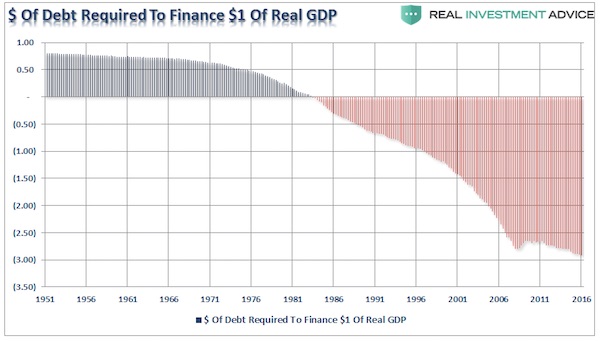

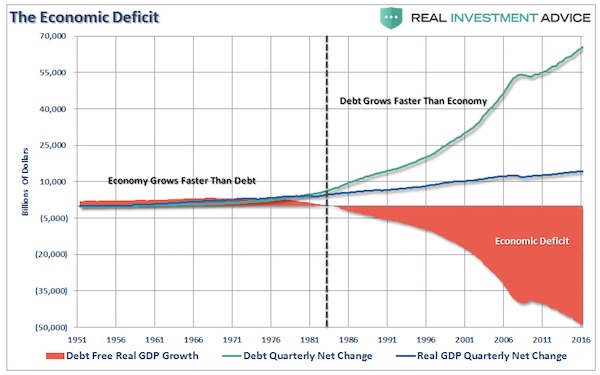

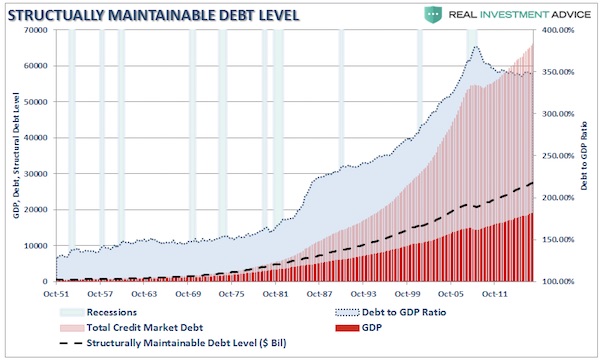

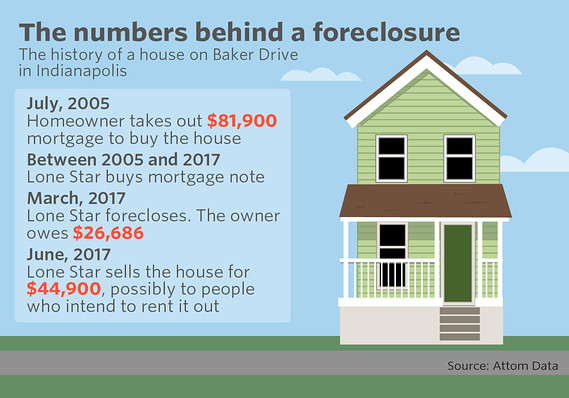

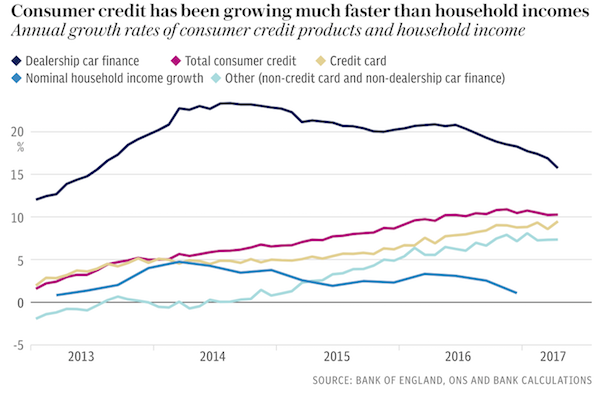

• The Debt We Don’t Talk About (Vague)

How do you know a major financial crisis is coming? Look for a spike in privately held debt, by households and corporations. That’s the argument of Richard Vague, author of The Next Economic Disaster: Why It’s Coming and How to Avoid It. Having worked for more than 30 years in consumer banking, Vague describes how he saw the build-up of private debt in the mortgage and credit card industries first hand–even though it’s an issue that neoclassical economists like Milton Friedman barely acknowledge. To avoid another crisis, Vague says firms and governments need to take debt forgiveness–the biblical “jubilee”–seriously. As he says, after the financial crisis “We helped the banks, we didn’t help the households.”

We wish Yanis godspeed.

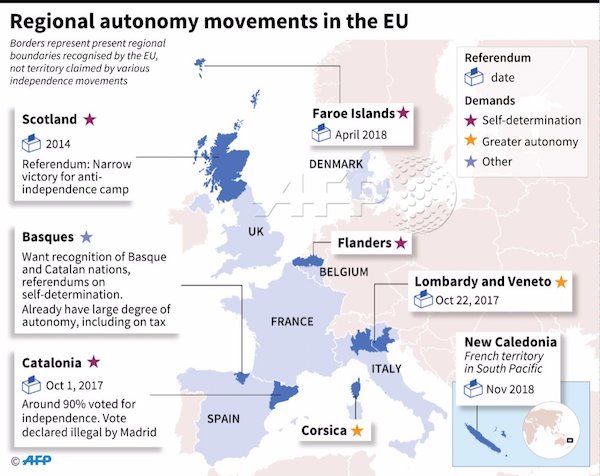

• The European Realistic Disobedience Front (WSJ)

Yanis Varoufakis is back to rescue Greece and rock the European establishment again. Or so he hopes. On Monday night the flamboyant former finance minister, who enraged European authorities at the height of Greece’s debt crisis in 2015, launched his new Greek political party at a theater here. That year, his country bowed to strict austerity demands. Now his solution to Greece’s sky-high debt is the same as his unsuccessful push before: to show creditors who’s boss. If elected, he told the gathering of around 300 people, he will run looser budgets. Greek banks will be revived with public money. He will swap Greece’s bonds for new ones whose payments depend on economic growth.

These and other policies to end Greece’s “debt colony status” will be implemented on day one, he said. And this time, unlike in 2015, he vowed there will be no negotiation with Europe, no surrender. His party is called the European Realistic Disobedience Front. His refrain is that Europe’s establishment is unrealistic, not him. “When they start sending orders, they will receive strong disobedience,” he said. “They will have to bear the cost of defenestrating us from the euro, or accept our policies,” he said to warm applause.

Here comes Merkel’s biggest nightmare. She deserves it. The refugees do not.

• Concern On Greek Islands As Hundreds Of Refugees Reach Lesbos (K.)

Authorities on the Aegean islands were on standby on Wednesday after nearly 300 migrants reached Lesvos on eight boats following several days without new arrivals from neighboring Turkey. Apart from the 295 people who landed on Lesvos, another 50 migrants arrived on Kos. Sources at the Citizens’ Protection Ministry expressed concern about the spike in arrivals, noting that no boats reached the islands on Monday, when Turkish President Recep Tayyip Erdogan was meeting with European Union leaders in Varna, Bulgaria, for talks that touched on an EU-Turkey migration pact signed in March 2016. The diplomatic stance struck by Erdogan in Varna was in sharp contrast to a string of threats and hostile language against Greece last week. Ministry sources said the next few days would indicate whether the increase in arrivals represents a new trend or not.

I’ve said it many times before: this risks getting terribly out of hand. He doesn’t mention Turkey by name of course.

• Greek President Vows Country Will Defend Itself Against Turkey (K.)

President Prokopis Pavlopoulos on Wednesday sought to send another firm message to Ankara amid increasingly hostile rhetoric from across the Aegean as a Greek military readiness exercise got under way in the southern Aegean. “Greece will strongly support its borders and those of Europe,” Pavlopoulos said during a visit to the Salamina naval base, repeating that “there are no gray zones” in the Aegean. Defending “international legitimacy… is not simply our right, it is also our duty to the international community,” he said. The president, who was accompanied by Defense Minister Panos Kammenos, once again called on Turkey to respect international laws and treaties, noting that the only issue of dispute between the two countries relates to the delineation of the continental shelf.

Pavlopoulos said he observed the “readiness of the country’s navy to defend our national sovereignty and borders, and consequently the borders of the European Union.” Kammenos had ordered the one-day exercise, code-named Pyrpolitis (Fire-raiser), to be carried out in the Aegean, northwest of Rhodes, following a long meeting with military officials on Tuesday night, during which the recent activity of Turkish armed forces in the region was discussed. The exercise involved a Hellenic Navy frigate, assault and transport helicopters and a Zubr military hovercraft carrying members of the special forces, and also saw the participation of Hellenic Air Force planes.

The aim of the exercise was to test the readiness of Greek armed forces in a crisis scenario, such as the need to recapture an islet. It was completed successfully at the end of the day without any signs of Turkish transgressions of Greek air space or territorial waters. However, Turkey’s National Security Council issued a stern message on Wednesday, toward Greece as well as the European Union and US, declaring that it will not give up its claims in the Aegean, the Eastern Mediterranean and northern Syria, where Turkish troops have occupied Afrin.

Well, that was fast… Did make a screenshot last night though.

Surprised? Neh… Some people are just so lost they will never be found.

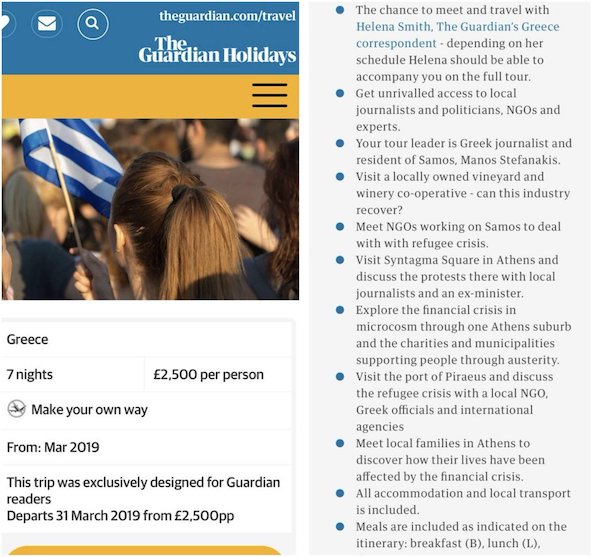

• Guardian Pulls Greek Crisis Porn Holiday Package (KTG)

The Guardian has taken down its Greece crisis-porn holiday package “Greece and the Euro” after a shitstorm on social media. Not only Greeks but also foreigners, among them many from UK, slammed the daily for offering a vacation tour to the debt-ridden country under the perspective meet the suffering Greeks at £2,500 for 7 days. The tour package was taken down sometime late on Wednesday evening. In a statement to Greek media correspondent in London, Thanassis Gavos, the Guardian said: “The Guardian has been working with Political Tours to provide informative trips to Greece and other countries for people who wish to develop their understanding of the political and social landscapes in these places. On reflection we have now paused this project in order to reconsider our approach. All Political Tours/Guardian packages to Greece, Bosnia, Ukraine have been removed from site.”

In other words what the daily says is we will find other ways, less obviously insulting to exploit the suffering of people in areas of economic crisis and wars in the future. In the company of journalists, including the daily’s correspondent in Athens, the happy but crisis conscious traveler will swill wine and then go visit Greek families who will unfold their daily drama in front of people they have never seen before and who have paid to listen to them. It is unknown whether the Greek crisis victims will get a small commission for being live witnesses of an 8-year-old economic crisis. NGOs on the island of Samos and the port of Piraeus will explain every facet of the Refugee Crisis and drama.