G. G. Bain Katherine Stinson, “the flying schoolgirl,” Sheepshead Bay Speedway, Brooklyn 1918

Talk about a Pyrrhic victory.

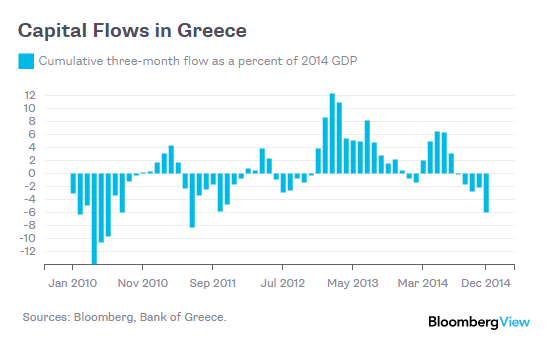

• Greek Parliament Approves Bailout Deal (Guardian)

After a tumultuous, often ill-tempered and at times surreal all-night debate, Greek MPs voted early on Friday to approve a new multibillion euro bailout deal aimed at keeping their debt-stricken country afloat. With his ruling leftist Syriza party apparently heading for a formal split over the €85bn package, prime minister Alexis Tsipras needed the support of the opposition to win parliament’s backing for the bill in a 9.45am vote which the government eventually won by a comfortable margin. But controversial former finance minister Yanis Varoufakis voted against the punishing terms of the deal, along with a large number of Syriza rebels angered by what they said was a sell-out of the party’s principles and a betrayal of its promises, leaving Tsipras severely weakened.

Tsipras told MPs before the vote that the rescue package was a “necessary choice” for the nation, saying it faced a battle to avert the threat of a bridge loan – which he called a return to a “crisis without end” – that Greece may be offered instead of a full-blown bailout. The draft bailout must now be approved by other eurozone member states at a meeting of finance ministers in Brussels on Friday afternoon, and ratified by national parliaments in a number of countries – including Germany, which remains sceptical – before a first tranche can be disbursed that will allowing Greece to make a crucial €3.2bn payment to the ECB due on 20 August. The Athens parliament did not start debating the 400-page text of the draft bailout plan until nearly 4am after parliamentary speaker Zoe Konstantopoulou, a Syriza hardliner, ignored Tsipras’s request to speed up proceedings and instead raised a lengthy series of procedural questions and objections.

[..] On the left, former energy minister Panayiotis Lafazanis, who leads a rebel bloc of around a quarter of Syriza’s 149 MPs, pledged to “smash the eurozone dictatorship”, while in her concluding pre-vote remarks, Konstantopoulou announced: “I am not going to support the prime minister any more.” Earlier, the government spokeswoman, Olga Gerovasili, conceded divisions within the leftist party, which swept to victory in January’s elections on a staunch anti-austerity platform, were now so deep that a formal split was probably inevitable. Tsipras could call fresh elections as early as next month.

Time for Dijsselbloem to screw up one last time.

• Greek Bailout On A Tightrope – Again (CNBC)

Greece’s third bailout is back in the hands of euro zone finance ministers, who are meeting Friday to discuss whether to go ahead with the deal – or delay it. The baton has been passed on to Brussels after the Greek government, which had debated the reforms that need to be introduced to secure the much needed funds through the night, secured enough votes to pass the bailout bill. However, further uncertainty was heaped on the bailout process with reports from Reuters that left-wing prime minister Alexis Tsipras seeking a vote of confidence from the parliament after August 20. The Eurogroup of finance ministers will be meeting in Brussels to debate the latest developments.

“It’s obvious we have to sign (a bailout deal) and we have to implement this agreement,” Kostas Chrysogonos, a Syriza member of the European parliament (MEP) told CNBC Friday following the Greek vote, saying that he hoped a deal would be completed at the Eurogroup meeting later today. A confidence vote was the last thing Greece needed right now, he added, so soon after Tsipras was elected in January. “I’m hopeful that many of the dissenters will resign their parliamentary seats…and the confidence vote will be enough to gain the confidence of the parliament for this government. It’s obvious that the last thing that we need right now is a general election, a country that stands at the edge of default cannot afford the luxury of having a second general election within eight months.”

Although the country and its international lenders and those overseeing the program have agreed technical details, a political agreement in the euro zone by member state governments is now necessary before any aid is release. But that is easier said than done with tensions running high both in Greece and Germany, Greece’s largest euro zone lender, over the bailout. This raises the possibility that the bailout deal could be delayed and Greece issued a bridging loan to tide it over. In Greece, members of parliament debated the third bailout package through the night after a long delay to the proceedings due to procedural objections saw the plenary session only get underway at 2am local time (midnight London time).

The vote on the bailout deal finally started at 7.30 London time with the government securing enough votes – 222 votes to 64 – to get the bailout approved. Tensions were running high in the Greek parliament, with high profile members of the ruling Syriza party, including former finance minister Yanis Varoufakis and parliamentary speaker Zoe Konstantopoulou, opposing the deal which involves more austerity, spending cuts and reforms. After the bailout was voted through the Greek parliament, Reuters, quoting a government official, said that Tsipras will seek a confidence vote in the Greek parliament after the August 20 deadline for payment to the ECB. A government spokesman told CNBC that he could not confirm the Reuters report but was expecting a statement shortly.

Wait till Monday.

• China Halts Yuan Devaluation With Slight Official Rise Against US Dollar (AFP)

China’s central bank has raised the value of the yuan against the US dollar by 0.05%, ending three days of falls in a surprise series of devaluations. The daily reference rate was set at 6.3975 yuan to $1.0, from 6.4010 the previous day, the China Foreign Exchange Trade System said. That was also slightly stronger than Thursday’s close of 6.3982 yuan. The higher fixing for the yuan came after the People’s Bank of China (PBoC) sought to reassure financial markets by pledging to seek a stable currency after a shock devaluation of nearly 2% on Tuesday.

The cut, and two subsequent reductions, rattled global financial markets – raising questions over the health of the world’s second-largest economy and sparking fears of a possible currency war. Beijing said the move was the result of switching to a more market-oriented method of calculating the daily reference rate which sets the value of the yuan, also known as the renminbi (RMB). Previously authorities based the rate on a poll of market-makers, but will now also take into account the previous day’s close, foreign exchange supply and demand and the rates of major currencies. The yuan is still only allowed to fluctuate up or down 2% on either side of the reference rate.

“Currently there is no basis for the renminbi exchange rate to continue to depreciate,” PBoC assistant governor Zhang Xiaohui said on Thursday. “The central bank has the ability to keep the renminbi basically stable at a reasonable and balanced level,” she said. Speaking earlier this week another PBoC official said the central bank could directly intervene in the market, after reports it bought yuan on Wednesday to prop up the unit. “The central bank, if necessary, is fully capable of stabilising the exchange rate through direct intervention in the foreign exchange market,” PBoC economist Ma Jun said.

“..the deputy governor of its central bank was forced to hold a press conference at which he insisted this was all part of a grand plan.”

• The Economic Wizards Of Beijing Have Feet Of Clay After All (Guardian)

The economic wizards of Beijing have feet of clay after all. That’s the growing sense after China’s currency fell for a third day and the deputy governor of its central bank was forced to hold a press conference at which he insisted this was all part of a grand plan. Zhang Xiaohui didn’t quite say “devaluation, what devaluation?” just as Jim Callaghan never quite said “crisis, what crisis?” during the Winter of Discontent. Both men were intent on showing that their governments were fully in control even though they were not. For UK politicians in the 1970s this was a familiar sensation; for China’s mandarins it is an entirely new experience. Over the past 30 years, the technocrats in Beijing have attained an almost mythical status.

Decade after decade of rapid growth has transformed China into the world’s second biggest economy, slashing poverty at the same time. There was much admiration – and not a little envy – in the west for the way in which communist party officials quickly lifted China out of recession following the financial crisis of 2008. The fact that policymaking was so opaque added to the mystique. But those golden days are now over. Beijing wanted to rebalance the Chinese economy, to make growth less focused on exports and more reliant on consumer spending. It wanted slower but more sustainable growth that gradually took the heat out of overvalued property and share prices.

This is proving difficult. Official figures understate the speed at which the economy is slowing. As fears of a hard landing have increased, policymakers have started to panic. Beijing botched attempts at shoring up the stock market, a move that was unnecessary given that the fall of 30% had been preceded by a rise of 150%. Now the attempts to reduce the value of the yuan are being conducted in an equally ham-fisted fashion. It won’t really wash that the events of this week are a carefully thought-out liberalisation plan that will persuade the IMF to include the yuan in its reserve assets known as special drawing rights.

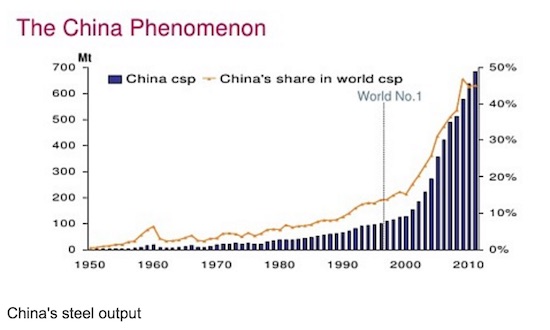

“China’s share of global steel output has rocketed from 10pc to 50pc over the last decade.” American and European steel industries can say goodbye.

• China Denies Currency War As Global Steel Industry Cries Foul (AEP)

Chinese steelmakers are preparing to flood the global market with cut-price exports as they take advantage of this week’s shock devaluation of the yuan, setting off furious protests from struggling competitors in Europe and the US. It is the first warning sign of a deflationary wave of cheap products from China after the central bank, the People’s Bank of China, abandoned its exchange rate regime, letting the currency fall in the steepest three-day drop since the country emerged as an economic powerhouse. The yuan has fallen 3.3pc against the dollar. Steel mills in the Chinese industrial hub of Hebei have already begun to trim prices of rebar mesh-wires used for building by between roughly $5 and $10 to $295, citing the devaluation as a fresh chance to offload excess stocks of steel.

Europe’s steel lobby Eurofer warned that there would be “very real competitiveness impacts” for European steel firms, already battling for their lives with wafer-thin margins. America’s United Steelworkers accused China of predatory practices.”It is time for China to live by the rules or face the consequences,” said the union’s international president, Leo Gerard. The US steel group Nucor called the devaluation the “latest attempt to support Chinese industry at the expense of producers in the rest of the world who have to earn their cost of capital to survive.” Indian tyre-makers have issued their own warnings, fearing a fresh rush of cheap imports from China. They are already grappling with a 100pc surge in shipments over the last year as the recession in China’s car industry displaces excess supply.

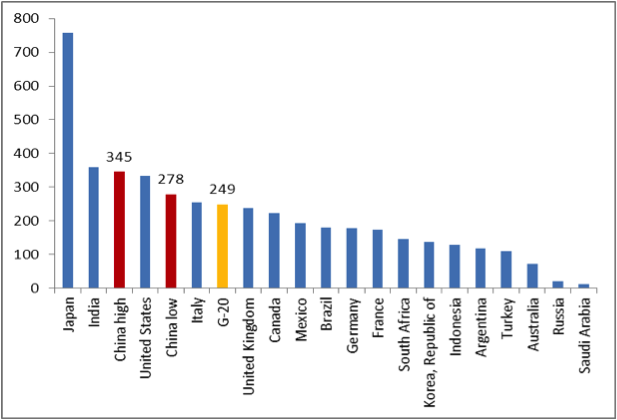

The anger is a foretaste of what China may face if this week’s devaluation is the start of a concerted effort to gain market share in a depressed global economy. Yet it is far from clear whether Beijing really has such an intention. The People’s Bank of China insisted on Thursday that the drop in the yuan was a one-off effect as the country shifts to a more market-friendly exchange regime, essentially a managed float. It described the sudden drop as “irrational” and said reports of a plot to drive down the yuan by 10pc were “nonsense”. China’s share of global steel output has rocketed from 10pc to 50pc over the last decade. It has installed capacity of 1.1bn tonnes a year that it cannot possibly absorb as the Chinese economy shifts away from heavy industry.

It now has 340m tonnes of excess capacity, which has driven down global steel prices by 40pc since early 2014. “This overcapacity alone is more than double the EU’s steel demand, and China is now exporting record quantities to Europe as a result,” said Eurofer.

“..another way of looking at QE is as an undeclared currency war – which is exactly how China sees it.”

• China and the Danger Of An Open Currency War (Paul Mason)

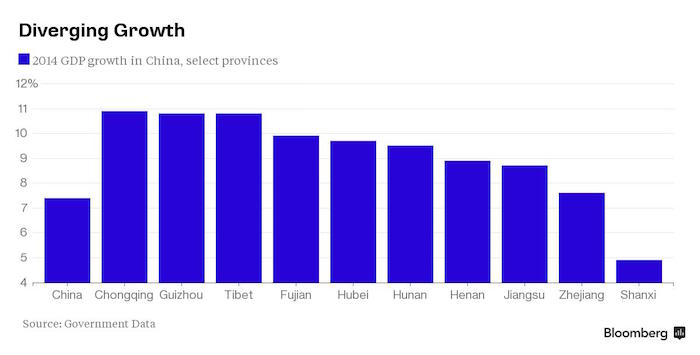

China has stunned the world by devaluing its currency twice in two days. Or rather it has stunned that naive part of the world that believed China’s economy was okay, that its Communist Party was en route to being some kind of team player in the global economy, and that the words “currency war” were just scaremongering. Here’s what’s happened, and why it matters. China’s economy, which grew at 9% and above per year in the period of rapid industrialisation in the 2000s, has slowed to 7%. Because the entire control system of the conomy is based on one bureaucrat lying to/competing with another, nobody really knows whether the Chinese growth figures are correct – but there’s been a clear slowdown.

That, in turn, caused a stock market slump last month – after more than a year of ordinary Chinese people pouring money into shares. So the government tried to contain by ordering state owned stockbrokers to buy RMB 120bn worth of shares, setting a stock market “target level” reminiscent of the old Soviet grain targets. Now, with growth continuing to falter, the Chinese government has devalued its own currency again in a bid to boost exports. At the same time – as a concession to its trade rivals – it has promised to “take more notice of the markets” when setting interest rates in future. Since it re-entered the global economy, China has pegged its currency, the renminbi, against the dollar – refusing to let it trade freely and to find a market rate.

Under pressure from America and Japan, which say China’s currency is too cheap and gives it an unfair trade advantage, China allowed the RMB gradually to rise against other currencies. This was seen as a first step towards the RMB becoming convertible, and ultimately emerging as a rival global currency to the dollar. Now that policy has been reversed. The context is, first, the tit-for-tat stimulus measures that the world’s major economies have been taking. Europe has launched a massive programme of quantitative easing; Britain’s QE programme remains in place and Japan is reliant on more and more dollops of printed money to buy state debt and keep the economy going. When states or currency unions print money on this scale the side effect is to weaken the value of their currency and boost exports. So another way of looking at QE is as an undeclared currency war – which is exactly how China sees it.

Abenomics can still get uglier than it already was.

• China’s Devaluation Becomes Japan’s Problem (Pesek)

Among the clearest casualties of China’s devaluation is the Bank of Japan. The chances were never high that Governor Haruhiko Kuroda was going to be able to unwind his institution’s aggressive monetary experiment anytime soon. But the odds are now lower than even skeptics would have previously believed. The real question, though, is what China’s move means more broadly for Abenomics. A sharply devalued yen, after all, is the core of Prime Minister Shinzo Abe’s gambit to end Japan’s 25-year funk. Abenomics is said to have three parts, but monetary easing has really been the only one. Fiscal-expansion was neutered by last year’s sales-tax hike, while structural reform has arrived only in a brief flurry, not the avalanche needed to enliven aging Japan and get companies to raise wages.

China’s devaluation tosses two immediate problems Japan’s way. The first is reduced exports. As Beijing guides its currency even lower, as surely it will, the yen will rise on a trade-weighted basis. And Bloomberg’s Japan economist Yuki Masujima points out that trade with China now contributes 13% more to Japanese GDP than the U.S., traditionally Tokyo’s main customer. “Given China’s rise to prominence, the yen-yuan exchange rate now has far greater influence on Japan than the yen-dollar rate,” Masujima says. The other problem is psychological. Japanese households have long lamented their rising reliance on China, a developing nation run by a government they widely view as hostile.

But the BOJ was glad to evoke China’s 7% growth – and the millions of Chinese tourists filling shopping malls across the Japanese archipelago – to convince Japanese consumers and executives that their own economy was in good shape. Now, the perception of China as a growth engine is fizzling, exacerbating the exchange-rate effect. “To the extent that the depreciation reflects weakness in China, then that weakness – rather than the depreciation per se – is a problem for Japan,” says Richard Katz, who publishes the New York-based Oriental Economist Report. It’s also a problem for Abe, whose approval ratings are now in the low 30s thanks to his unpopular efforts to “reinterpret” the pacifist constitution to deploy troops overseas. The prospect that Abe will enrage Japan’s neighbors by watering down past World War II apologies at ceremonies this weekend marking the 70th anniversary of the end of the wary is further damping support at home.

The worsening economy, which voters hoped Abe would have sorted out by now, doesn’t help. Inflation-adjusted wages dropped 2.9% in June, a sign Monday’s second-quarter gross domestic product report for the may be truly ugly. It’s an open question whether such an unpopular leader can push painful, but necessary, structural changes through parliament. “Already,” Katz says, “Abe has backpedaled on many issues to avoid further drops.” After 961 days, all Abenomics has really achieved is a sharply weaker yen, modest steps to tighten corporate governance and marketing slogans asking companies to hire more women.

Think leverage, shadow banking, and fill in the blanks.

• Why The Yuan May Deck Singapore Property Stocks (CNBC)

Singapore’s property shares, already on the back foot from expectations of rising interest rates, have taken a beating since China devalued its currency on Tuesday and more pain may be on the cards. “Given that the majority of property stocks with China exposure do not hedge the currency exposures of their incomes and balance sheets, a weaker renminbi suggests that both asset values and earnings/dividends would be negatively affected,” analysts at JPMorgan said in a note Wednesday. “Book values and dividend per unit (DPU) would be affected.” Singapore real-estate investment trusts (S-REITs) are also likely to take a hit as the moves Tuesday and Wednesday by the People’s Bank of China to push down the Chinese currency also caused the Singapore dollar to weaken.

“The weakening Singapore dollar would result in upward pressure on interest rates,” it said, estimating that every 100 basis point rise in interest rates pushes S-REITs’ DPU down by 2.7% because of increased costs. Singapore property shares with China exposure based on earnings and assets under management include CapitaLand Retail Trust China, Global Logistic Properties, CapitaLand and City Developments, JPMorgan noted. Those shares are down 1.2-5.5% so far this week, after a bit of a recovery Thursday. Singapore may not be alone in feeling property pain from China. In Hong Kong, Wharf, Cheung Kong Property and Hang Lung all have significant China exposure, noted Patrick Wong at BNP Paribas.

The spiralling debt is a direct consequence of the conditions those same creditors force upon Greece.

• Greece Creditors Raise ‘Serious Concerns’ About Spiralling Debt (Guardian)

Greece’s European creditors have underlined the temporary nature of the country’s surprise return to growth by warning that they have “serious concerns” about the spiralling debts of the eurozone’s weakest member. The economic news came as Greece’s parliament met in emergency session on Thursday to ratify a new bailout deal, although it was unclear whether the multibillion-euro agreement had the vital backing of Germany. The three European institutions negotiating a third bailout package with the government in Athens said that the Greek economy had plunged into a deep recession from which it would not emerge until 2017. According to an analysis completed by the EC, the ECB and the eurozone bailout fund, Greece’s debts will peak at 201% of GDP in 2016.

The study says that Greece’s debt burden can be made more bearable by waiving payments until the economy has recovered and then giving Athens longer to pay. However, it opposes the idea of a so-called “haircut” – or reducing the size of the debt. It is a course of action the International Monetary Fund, which joined the three European institutions in negotiating the latest bailout, thinks may be necessary for Greece’s debts to become sustainable.

“The high debt to GDP and the gross financing needs resulting from this analysis point to serious concerns regarding the sustainability of Greece’s public debt,” said the analysis, adding that far-reaching reforms were needed to address the worries. It forecasts that the Greek economy will contract by 2.3% this year and a further 1.3% in 2016 before returning to 2.7% growth in 2017. Greece’s debt to GDP ratio will peak next year but will still be 175% in 2020 and 160% in 2022. The IMF views a debt to GDP ratio above 120% as unsustainable.

Greece doesn’t want a bridge loan.

• Greece To Get €6 Billion In Bridge Loans If No Agreement At Eurogroup (Reuters)

Greece could get €6.04 billion in bridge financing if euro zone finance ministers cannot agree on the planned third bailout for Athens when they meet on Friday, according to German newspaper Bild, citing a European Commission proposal for the meeting. That proposal says the bridge loans should run for a maximum of three months, Bild said in an advance copy of an article due to be published on Friday. Eurozone finance ministers are due to meet in Brussels on Friday to discuss a third financial rescue that Greece has negotiated with its creditors.

Greek Finance Minister Euclid Tsakalotos expressed his opposition on Thursday to Greece taking another temporary loan to meet its immediate debt repayments, calling on lawmakers to approve a new, three-year bailout deal. “I think whatever everyone’s stance on the euro and on whether this is a good or bad accord, there must be no one who is working towards a bridge loan,” he told a parliamentary committee. Athens must make a €3.2 billion debt payment to the ECB on Aug. 20.

Cobden Partners was proposed to Varoufakis right after the January election as an advisor. Syriza opted for Lazard instead.

• Greece Crisis Proves The Need For A Currency Plan B (John Butler, Cobden)

The recent Greek capitulation under pressure from other euro member countries, led by Germany, demonstrates that euro members have de facto ceded sovereignty over fiscal policy to the EU. While this arrangement may be acceptable to some countries, perhaps even Greece, it will be resisted by others. However, as the Greek failure also demonstrates, any eurozone country wishing to restore fiscal sovereignty, or restructure some of their debt, or implement any policy or set of policies that runs afoul of the preferences of certain Eurogroup finance ministers will have near-zero negotiating leverage if they fail to plan, credibly and in advance, for the introduction of a viable alternative currency.

Without this critical card to play, the country in question will be held hostage by the now politicised ECB. Its domestic banking system and financial markets will be shut down, the economy will grind to a halt and the government will face either a humiliating retreat or full capitulation. Former Greek finance minister Yanis Varoufakis has now revealed much of the detail of the recent negotiations, capitulation and attempts to vilify him personally for acting insubordinately or even in a treasonous manner at the 11th hour. However, it is entirely understandable that, once Varoufakis became aware of the degree to which his country’s banks and national finances had been taken hostage by the ECB and EU institutions, he sought some flexibility in order to strengthen Greece’s negotiating position.

Alas, this was much too little, and way too late. In retrospect, it is now obvious that Varoufakis and his colleagues should have set about developing a credible alternative currency plan prior to entering into any negotiations around either debt reduction or fiscal reforms. Had they done so, when the ECB suspended further increases in the ELA, forcing the banks and financial markets to close, Greece would have been able to roll out a temporary plan which, in the event that subsequent negotiations were indeed to fail, could easily have become permanent. Moreover, the very existence of such a plan would have greatly strengthened Greece’s hand to the point where negotiations may well have succeeded.

Summary: Foreign corporations will take over everything.

• Greeks Taste Breadth Of Bailout In Loaf And Lotion Rules (Guardian)

Vouldis, 33, whose bakery was founded 22 years ago by his parents in the southern Athens suburb of Kallithea, and is one of 15,000 local bakeries in Greece, said: “If a supermarket can call itself a bakery and present frozen loaves as fresh, that’s cheating customers . And if we sell by the kilo – which we’ve been supposed to be doing since Easter, actually, but no one does – customers will end up spending more on their bread. Bakers will have far more opportunity to play around with their prices. “Neighbourhood bakeries are the heart of a community; it’s wrong to make things harder for them than they already are. And it’s unacceptable to have international institutions saying, you’re stupid, you don’t know how to run your business, here’s how you must do it.”

Stefanidi meanwhile was concerned at the bailout powers’ insistence that anyone should be allowed to own a pharmacy: at present, Greek law limits their ownership to pharmacists. The way the OECD and the international creditors saw it, far too many laws protected Greece’s 11,000 pharmacies – a quantity, per head of the population, about double that for France or Spain, and more than 15 times Denmark’s total. Many of the rules were scrapped last year despite a European court upholding Greece’s view that it was perfectly entitled to legislate on the matter since its supreme court had ruled that pharmacies were not pure commercial enterprises but also fulfilled a vital social function.

The rule that no district can have more than one pharmacy per 1,000 people will stay. But the regulation stipulating that over-the-counter medicines may only be sold at licensed pharmacies is soon to be scrapped; and the ownership restriction could be gone next week if the bailout package is approved. “It’s crazy,” said Konstantinos Lourantos, president of the Panhellenic Pharmaceutical Association, in his pharmacy in the Athens suburb of Nea Smyrni. “Anyone will be able to open a pharmacy now. Anyone. In all Europe, only in Slovenia and Hungary is this allowed. Even in Germany, a licensed pharmacist must own at least 51% of a pharmacy.”

There will be no real debt relief, not if Germany has its way. It’ll just be toying with margins, unacceptable for the IMF.

• European Union Backs IMF View Over Greece – Then Ignores It (Guardian)

The good news for the IMF, which has been saying for ages that Greece’s debts are unsustainable, is that European lenders now seem to agree. There are “serious concerns” about the sustainability of the country’s debts, the three European institutions negotiating the latest bailout said on Thursday. They think Greece’s debts will peak at 201% of GDP in 2016, which is roughly what the IMF said a month ago when it projected a high “close to 200% of GDP in the next two years”. So what should be done? Unfortunately, that is where unanimity seems to break down.

The IMF’s view of the options in July was blunt. First, there could be “deep upfront haircuts” – in other words, a portion of Greece’s debts to eurozone lenders would be written off, which, reading between the lines, seemed to be the IMF’s first preference. Second, there was the politically-impossible policy of eurozone partners making explicit transfers to Greece every year. Or, third, Greece could be given longer to repay, an approach likely to be more palatable to European leaders. But this option came with a heavy qualification from the IMF: “If Europe prefers to again provide debt relief through maturity extension, there would have to be a very dramatic extension with grace periods of, say, 30 years on the entire stock of European debt, including new assistance.”

Is Europe ready to be “very dramatic,” as the IMF defined it? Almost certainly not – at least not in Germany. Thursday’s European report spoke about extending repayment schedules but it seems highly unlikely that 30 years would be acceptable in Berlin. If that’s correct, the IMF’s willingness to cough up its €15bn-€20bn contribution to the latest €85bn rescue package must be in serious doubt. The fund’s guidelines say loans can only be advanced when there is a clear path back to debt sustainability, usually defined as borrowings being less than 120% of GDP. On Thursday’s European analysis, Greece would still be at 160% even in 2022.

Subprime is all America has left.

• Total U.S. Auto Lending Surpasses $1 Trillion for First Time (WSJ)

With the recession now six years behind in the nation’s rearview mirror, lending for automobiles has sharply accelerated: Around $119 billion in auto loans were originated in the second quarter of this year, a 10-year high, according to figures from the Federal Reserve Bank of New York released Thursday. Auto lending has climbed steadily during the past four years, helping sales of U.S. autos and light trucks completely recover their losses from the recession. In May, consumers purchased vehicles at an annual pace of 17.6 million, the highest since June 2005. Americans have now racked up more than $1 trillion in both auto-loan debt and student-loan debt, which surpassed $1 trillion for the first time in 2013.

The overall indebtedness of U.S. borrowers remains lower than before the recession, owing to declines in home-loan and credit-card balances. But with low gas prices, a growing number of jobs, and an aging automotive fleet, many people have found it an opportune time to get a new vehicle. “A lot of the gain we’ve seen is from light trucks, SUVs, cross-overs, minivans and pickup trucks,” said David Berson, chief economist at Nationwide Insurance in Columbus, Ohio. “Because gasoline prices have come down, it makes it less expensive to run the vehicles that use more fuel” and frees up consumers’ budgets to put toward more cars or higher car loan payments. Auto lending and credit-card lending used to trade spaces as the second- and third-largest categories of U.S. household debt, after mortgages.

Both were surpassed by student loans in 2010. Since 2011, auto loans have rapidly outgrown credit cards. Today, household credit-card balances stand at $703 billion, about the same as four years ago. Auto lending and mortgages offered a study in contrast over the past five years. Both types of debt fell in the recession; from 2008 to 2010 the total stock of auto loans declined by more than $100 billion. Mortgage balances dropped by more than $800 billion. “There was some tightening in auto-loan standards after the financial crisis, but by many measures it’s returned basically to where it was pre-recession,” said Wilbert van der Klauw, a New York Fed economist. “That’s quite a contrast to mortgage underwriting, which remains significantly tighter than before the recession.”

Spot the zombie.

• Surge in Global Commercial Real-Estate Prices Stirs Bubble Worries (WSJ)

Investors are pushing commercial real-estate prices to record levels in cities around the world, fueling concerns that the global property market is overheating. The valuations of office buildings sold in London, Hong Kong, Osaka and Chicago hit record highs in the second quarter of this year, on a price per square foot basis, and reached post-2009 highs in New York, Los Angeles, Berlin and Sydney, according to industry tracker Real Capital Analytics. Deal activity is soaring as well. The value of U.S. commercial real-estate transactions in the first half of 2015 jumped 36% from a year earlier to $225.1 billion, ahead of the pace set in 2006, according to Real Capital. In Europe, transaction values shot up 37% to €135 billion ($148 billion), the strongest start to a year since 2007.

Low interest rates and a flood of cash being pumped into economies by central banks have made commercial real estate look attractive compared with bonds and other assets. Big U.S. investors have bulked up their real-estate holdings, just as buyers from Asia and the Middle East have become more regular fixtures in the market. The surging demand for commercial property has drawn comparisons to the delirious boom of the mid-2000s, which ended in busts that sunk developers from Florida to Ireland. The recovery, which started in 2010, has gained considerable strength in the past year, with growth accelerating at a potentially worrisome rate, analysts said. “We’re calling it a late-cycle market now,” said Jacques Gordon at LaSalle Investment.

While it isn’t time to panic, Mr. Gordon said, “if too much capital comes into any asset class, generally not-so-good things tend to follow.” Regulators are watching the market closely. In its semiannual report to Congress last month, the Federal Reserve pointed out that “valuation pressures in commercial real estate are rising as commercial property prices continue to increase rapidly.” Historically low interest rates have buoyed the appeal of commercial real estate, especially in major cities where economies are growing strongly. A 10-year Treasury note is yielding about 2.2%. By contrast, New York commercial real estate has an average capitalization rate—a measure of yield—of 5.7%, according to Real Capital.

By keeping interest rates low, central banks around the world have nudged income-minded investors into a broad range of riskier assets, from high-yield or “junk” bonds to dividend-paying stocks and real estate. Lately money has been pouring into commercial property from all directions. U.S. pension funds, which got clobbered in the aftermath of the crash, now have 7.7% of their assets invested in property, up from 6.3% in 2011, according to alternative-assets tracker Preqin. Foreign investors also have been stepping on the gas. China’s Anbang Insurance in February paid $1.95 billion for New York’s Waldorf-Astoria, a record price for a U.S. hotel. Another Chinese insurer, Sunshine Insurance in May purchased New York’s glitzy Baccarat Hotel for more than $230 million, or a record $2 million per room.

Big Mining is in for a Big Surprise.

• Glencore: World Of Big Mining Agog At Huge Fall (Guardian)

How do you make a £2bn fortune from commodities? Answer: start with a £6bn fortune. Ivan Glasenberg, chief executive of Glencore, won’t be laughing. Those numbers are the value of his shareholding in the mining and commodity-trading company at flotation in 2011 and now. Yes, Glencore’s share price really has fallen by two-thirds, from 530p to 180p, since it came to market with a fanfare. Among London’s big miners, only Anglo-American has done worse. This week alone the fall has been 10% as the China-inspired rout has run through commodity markets and mining stocks. Glencore is being whacked harder than the likes of BHP Billiton and Rio Tinto for a simple reason – relative to earnings, it has a lot more debt.

Analysts predict borrowings will stand at about $48bn when the company reports half-year numbers next week, which is a hell of a sum even for a business making top-line (before interest and tax) earnings of $10bn-$12bn. Bold borrowings aren’t quite what they seem, it should be said, because Glencore’s marketing division holds a stockpile of commodities as inventories that can be turned into cash. Viewed that way, net debt might be nearer $30.5bn at year-end, estimates JP Morgan Cazenove.

But here’s the rub: Glencore might have to go ahead and turn some of that stock into cash if its wants to save its BBB credit rating. “At spot commodity prices, we calculate net debt needs to fall $16bn by year-end 2016 to safeguard Glencore’s BBB credit rating,” says JP Morgan. Preservation of BBB is a financial priority, Glencore said in March, for the sound reason that a healthy rating is vital to keep funding costs low in the trading-cum-marketing division. It’s a financial challenge caused by the plunge in prices that is undermining profits on the other side of Glencore – the mining operation concentrated on the old Xstrata assets, which are skewed towards copper and coal.

All ‘markets’ are about to have one of those.

• The Junk Bond Market ‘Is Having A Coronary’: David Rosenberg (CNBC)

The biggest trouble sign for stocks may be bonds. High-yield bonds, specifically, often are seen as an effective proxy for movements in the equity market. If that’s the case, trends in junk are pointing to a rocky road ahead. Average yields for low-rated companies have jumped to 7.3% and spreads between such debt and comparable duration Treasurys have widened dramatically, according to David Rosenberg at Gluskin Sheff. History suggests that fallout in stocks is not far behind. “If you think the equity market is heading for a spot of trouble here, the high-yield bond market is having a coronary,” Rosenberg said in his daily market analysis Thursday.

Rosenberg points out that the average yield is the highest since mid-December and has risen 120 basis points—1.2 percentage points—just since June. Spreads are at 580 basis points, a level hit only twice in the last three years. His caution on junk reflects sentiment heard from a number of other market analysts who believe the troubles in the high-yield market, which has led fixed income performance with 7% annualized returns over the past 10 years, are a bad sign. Since the most recent lows in June, spreads have widened a full percentage point. “In other words, this move in high-yield spreads is on par with what we have seen when we have previously had a 9% correction in equities or what would be about the same as the S&P 500 now correcting to 1,910,” he said.

“I am going to withdraw from the movement because I’m very old and I have a large family.”

• ‘I Will Leave Politics And Return To Comedy’: Beppe Grillo (Local.it)

Beppe Grillo, the leader of Italy’s anti-establishment Five Star Movement (M5S), said he plans to leave politics and return to his old job as a comedian. In a TV interview with La7 on Tuesday afternoon, Grillo said: “I am going to withdraw from the movement because I’m very old and I have a large family.” Grillo has distanced himself from the party recently, with some of its members seen as rising political stars. Luigi Di Maio, who at 29 is the youngest deputy president of the lower house in Italian history, is quickly becoming the new face of the Five Star Movement. While Grillo said that he’s “here for now” and that “the movement is my life”, he hinted that the party perhaps no longer needed to use his personality as a springboard for media coverage.

“Once people understand that I am not the undisputed leader of M5S, that I am not in charge and that they are not voting for Grillo but for an idea that I have been part of – then I can return to my job, which is making people laugh and showing them things they don’t know,” he said. The Five Star Movement’s leader has not yet given any clear indications as to when he will be stepping down. His spokesperson told The Local that the leader has not resigned. The comedian is working on a new show that he hopes to launch at the end of this year, after delaying it because of political commitments. A return to TV might also be on the cards. Reports last week suggested he could return to Italy’s national broadcaster Rai, but Grillo was uncertain. “I don’t know, I’m open to anything,” he said.

Drill baby drill 2.0.

• World without Water: The Dangerous Misuse of Our Most Valuable Resource (Spiegel)

California’s rivers and lakes are running dry, but its deep aquifers are also rapidly disappearing. The majority of the 40 million Californians are already drawing on this last reserve of water, and they are doing so with such intensity and without restriction that sometimes the ground sinks beneath their feet. The underground reservoir collapses. This in turn destabilizes bridges and damages irrigation canals and roads. This groundwater is thousands of years old, and it is not replenishing itself. Those who hope to win the race for the last water reserves are forced to drill deeper and deeper into the ground. The Earth may be a blue planet when seen from space, but only 2.5% of its water is fresh. That water is wasted, polluted and poisoned and its distribution is appallingly unfair.

The world’s population has almost tripled since 1950, but water consumption has increased six-fold. To make matters worse, mankind is changing the Earth’s climate with greenhouse gas emissions, which only exacerbates the injustices. When we talk about water becoming scarce, we are first and foremost referring to people who are suffering from thirst. Close to a billion people are forced to drink contaminated water, while another 2.3 billion suffer from a shortage of water. How will we manage to feed more and more people with less and less water? But people in developing countries are no longer the only ones affected by the problem. Droughts facilitate the massive wildfires in California, and they adversely affect farms in Spain.

Water has become the business of global corporations and it is being wasted on a gigantic scale to turn a profit and operate farms in areas where they don’t belong. “Water is the primary principle of all things,” the philosopher Thales of Miletus wrote in the 6th century BC. More than two-and-a-half thousand years later, on July 28, 2010, the United Nations felt it was necessary to define access to water as a human right. It was an act of desperation. The UN has not fallen so clearly short of any of its other millennium goals than the goal of cutting the number of people without this access in half by 2015. The question is whether water is public property and a human right. Or is it ultimately a commodity, a consumer good and a financial investment?

They should send it to an English port.

• Greece Sends Cruise Ship To Ease Kos Migrant Crisis (Guardian)

The Greek government has chartered a cruise ship to help deal with the refugee crisis on Kos, a day after more than 2,000 mainly Syrian refugees were locked inside a stadium on the island for more than a day with limited access to water. The vessel, which can fit up to 2,500 people, will function as a floating registration centre. Officials hope its presence will speed up the processing of about 7,000 refugees who are stranded on Kos after making the short boat journey from Turkey, and to whom the authorities have been previously unable to provide paperwork or housing. The move follows a disastrous attempt to register refugees inside an old stadium on Tuesday and Wednesday, which led to up to 2,500 mainly Syrian migrants trapped in the stadium grounds.

For more than 12 hours, much of it in temperatures of about 35C, migrants were without access to water or toilets. This led some to faint at a rate of one every 15 minutes, according to Médecins Sans Frontières, an aid agency providing medical support outside the stadium. By dawn on Thursday, the last migrants were finally released in calm circumstances witnessed by the Guardian, but some were literally bruised by the experience after clashes broke out on Wednesday between confused refugees and panicking police officers. Youssef, a 29-year-old Syrian banker, criticised the undignified nature of the process after being released early on Thursday morning. “I have a bachelor’s degree in accounting and an MBA,” he said. “It’s a shame to treat us like this.”

Registered migrants like Youssef are still stuck on Kos, with up to 5,000 others yet to be processed. The situation has led the Greek government to send a cruise liner, the Eleftherios Venizelos, to mitigate the fallout – as hundreds more refugees arrive every day. Kos’s mayor, Giorgos Kyritsis, who made the decision to use the stadium, denied that the ship would simply be yet another place of limbo for refugees. Kyritis said: “It’s not going to be used as a camp. As soon as it is filled with migrants, the ship with depart and another ship will come.”

Médecins Sans Frontières is forced to do what Europe should be doing.

• Mediterranean: Saving Lives at the World’s Most Dangerous Border (Spiegel)

The Mediterranean has become a crisis region, one where more than 2,000 people have died this year already – more than have lost their lives in attacks in Afghanistan. But of course that figure is misleading. It reflects only the number of recorded deaths. Who knows how many people have drowned without a trace? Nevertheless, no aid agencies are active in the region. They all wait on shore for the survivors to arrive. The business of saving lives is left to those who are the least prepared: navies and merchant vessels. Meanwhile, more and more refugees are embarking on the perilous journey across the Mediterranean – 188,000 so far this year. It’s hard to believe that a crisis area of this magnitude is empty of aid workers – unthinkable, Doctors Without Borders, or Médecins Sans Frontières, thought.

It is the biggest, best organized medical relief organization in the world. An army of survival. They are professionals for natural catastrophes and civil wars, and they are engaged in the fight against HIV, Ebola and measles. With a budget of €1.066 billion in 2014, MSF’s 2,769 international employees and 31,000 local helpers undertook some 8.3 million treatments. They calculate the need for help based on mortality rates – a cold, precise measurement. An emergency situation is considered acute when there is one death per day for every 10,000 people. Last year, at least 3,500 refugees died in the Mediterranean while 219,000 made it to Europe. That’s a mortality rate of around 10 per day, or one in 63. MSF, until now a land-based operation, has decided to set sail.

Never has the organization’s name been more fitting than right now, as it carries out its mission in a vast sea that has developed into the world’s deadliest border. Three boats have been in action since early summer. The Dignity 1, the Bourbon Argos and MY Phoenix, the smallest of the fleet. Together they have room for 1,400 refugees. It is the only real private rescue mission in the Mediterranean, and it is almost entirely funded by donations. Operating costs have already topped €10 million this year. Of that, Phoenix, jointly funded by MOAS, has cost €1.6 million thus far this year. MSF has rescued more than 10,000 people so far. By mid-2015, the mortality rate in the Mediterranean was one in 76. A small victory, but a victory nonetheless.

An estimated 15 to 20 boats carrying around 3,000 people set sail from Libya’s beaches every day. After a few hours, they call a contact person in Italy or they get in touch with the Maritime Rescue Coordination Centre (MRCC) in Rome directly. That’s if a navy vessel or a cargo ship doesn’t stumble across them first. Whoever is close by is obligated to come to the rescue. But what if no one is nearby to save them?