Edward Hopper Cat boat 1922

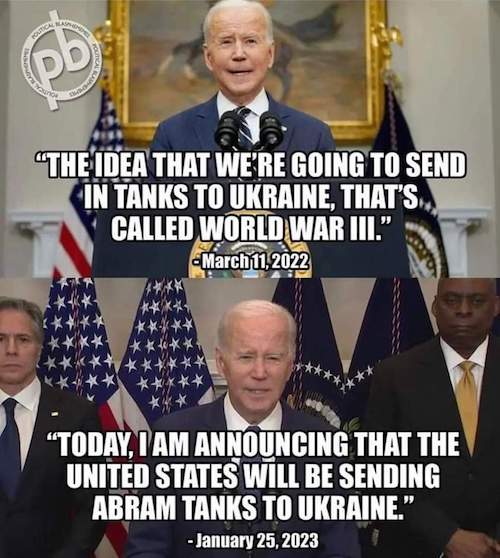

Douglas Macgregor – We are co Belligerents

“At first, the Germans sent soldiers’ helmets [to Ukraine], saying that they did not want to supply lethal weapons there. Now it’s come to tanks, and there are already talks about planes.” “Step by step, the Germans are drifting towards war,”

– Viktor Orban

Gonzalo Lira 2023.01.28 The West Has Lost Already

Madness

Ethical Sceptic

We begin Wk 2 2023 update with Excess Non-Covid Natural Cause Mortality.

It continues its 8/9-sigma excess each week, or 18.9% to the excess over a professionally-done baseline.

540,400 Excess Deaths, which are NOT Covid, NOT Fentanyl, Not Accidents, Not Lockdown/nocebo, etc. pic.twitter.com/vwTiA6G3d2

— Ethical Skeptic ☀ (@EthicalSkeptic) January 25, 2023

• Gonzalo: The last numbers I was confident of came from Col. Douglas Macgregor: He reported 157,000 KIA as of a few days ago.

• According to unofficial data circulating online, AFU Chief Valery Zaluzhny reported to the Pentagon and NATO on the number of losses of Ukrainian servicemen. According to the Ukrainian command, the AFU has lost a total of 232,000 killed since the start of the special operation.

• According to the private company Stratfor Forecasting, Ukraine’s losses exceed 305,000 killed.

“This grinding away can continue until Ukraine collapses because it is easier for the Russians to let the enemy come to them than go after them.”

• What’s Next? (Helmholtz Smith)

I don’t know what the Russians are going to do in Ukraine and neither does anyone else outside of their high command. But there sure have been a lot of wrong predictions. Leaving aside the Western propaganda mill (of which more below), serious observers seem to get the timing wrong. We know the correlation of forces favors Russia but we expect things to happen more quickly. We agree that Moscow was expecting something shorter, less bloody and quicker at the beginning and was probably surprised by the resistance of the Kiev regime and NATO’s unhinged support. Therefore there was a re-examination and the call-up of further forces. Thus far we are in agreement – it’s the timing of the next step that we seem to get wrong.

I’ve been thinking about why this is so and I have come to the following conclusions. By now everybody who is paying attention knows that the Ukraine battlefield is part of a world war in which those who control the US empire are trying to hold onto their dominance. For those outside the NATO propaganda bubble there is general agreement that

1/ Russia is winning both in the Ukraine battlefield and the wider theater.

2/ Time is on Russia’s side.First the Ukraine battlefield. The first aim in war is to destroy the enemy’s power and that Russia is doing, especially in the Bakhmut slaughterhouse. Kiev is determined to stand and fight here and the Russians are quite happy to let them do so – “artillery conquers and infantry occupies” – and that is what we see here. Slowly slowly the Russian forces advance over mountains of Ukrainian bodies. In the last week or so Russian forces have begun to advance on other fronts too. This grinding away can continue until Ukraine collapses because it is easier for the Russians to let the enemy come to them than go after them. Meanwhile Russian missiles destroy the infrastructure Kiev needs to continue the war. Time and developments favor Russia and there is no incentive to make “big arrow” movements.

Ukraine went steeply downhill due to corruption.

“..the country had “nuclear plants, an aviation industry, no debt and the most fertile land in the world.”

• Ex-Polish FM Names Two Major Ukrainian Problems (RT)

Ukraine was never able to achieve economic prosperity despite having a head start due to widespread graft among officials and delusions of being a significant global player, former Polish Foreign Minister Radoslaw Sikorski has suggested. In an interview with the magazine Krytyka Polityczna on Friday, Sikorski, who has represented Poland in the EU Parliament since 2019, stated that Ukrainian elites “were simply wasting their time.” In his view, they were “hiding their corruption and delusions of grandeur behind a story” that they were playing some big game with the US, Russia, Europe, and China.

The MEP recalled that after the collapse of the USSR in 1991, Ukraine had a huge edge over many other ex-Soviet republics and members of the former Eastern bloc. In particular, he said the country had “nuclear plants, an aviation industry, no debt and the most fertile land in the world.” However, even before Russia launched its military operation in Ukraine last year, the country “had a GDP four times smaller than Poland,” the former minister pointed out, adding that Ukrainians “are now paying dearly for this maneuvering” by the elites. Earlier this week, Sikorski suggested that Warsaw had considered partitioning Ukraine in the first weeks of the conflict. The allegation, however, was vehemently denied by Polish Prime Minister Mateusz Morawiecki, who accused Sikorski of acting “like a Russian propagandist.”

Once the second-largest economy in the Soviet Union, Ukraine was Europe’s poorest country by per-capita GDP as of 2020. Even before Russia’s military operation in February 2022, a major economic problem facing Ukraine stemmed from a popular revolt and hostilities in industry-heavy Donbass, which were sparked by a Western-backed coup in Kiev in 2014. Another major reason Ukraine had become something of an economic backwater, however, is rampant corruption. According to Transparency International’s Corruption Perception index, Ukraine ranked 122 out of 180 countries globally as of 2021. The same year, Freedom House, a US government-financed non-profit organization, described graft in Ukraine as “endemic,” noting that the government’s efforts to combat it “have met resistance and experienced setbacks.”

“For those two diplomats Minsk was not a sham, it was an attempt in good faith to bring peace to Ukraine..”

• Neutrality and Peaceful Multi-Ethnicity (Rosel)

Switzerland has been neutral since the year 1815. The great powers at that time guarantied the territorial integrity of Switzerland in the borders of 1815 provided that Switzerland would remian neutral in future conflicts. But even before 1815 the independence of the confederation from the great powers Austria and France was intertwined with its neutrality. Neutrality has been an issue in Switzerland since the latest Ukraine conflict began. A few months back the Foreign Minister Ignazio Cassis was considered to be negligent in the matter of neutrality and as a result a referendum is now being prepared by the Swiss People’s Party which will confirm, clarify and strengthen Switzerland’s neutrality. Switzerland is not unique. Austria is also neutral, meaning that it is not a member of NATO, and in this way it avoided being partitioned after World War II as Germany was.

Switzerland is also a multi-ethnic country. Despite its population of only 8 million, there are four cultural groups and four official languages. There is an unofficial custom which parliament always observes when electing a new government: the three main regions must always be represented in the government. All ministers are bilingual. There are no ethnic tensions. If you want to talk about values, think about neutrality and peaceful multi-ethnicity! Switzerland’s last war was in 1848 and it was a very short civil war. It is also said that the neutrality of Switzerland allows it to be an honest broker. Thus many international agencies and summits are hosted in Geneva. Switzerland is a go-between the estranged nations United States and Iran.

The change in government in Kiev in 2014 can be considered to be a coup d’état since the elected government was replaced by a government according to the wishes of the United States, as was evidenced by the leak of an infamous telephone conversation between the US ambassador and the US diplomat (who is now known for her undiplomatic language) Victoria Nuland. The Maidan coup d’état resulted in severe ethnic tensions in a politically fragile country, which at that time had only been a nation state for a total of 28 years including the years from 1917 to 1922. There was for example a massacre in Odessa in which 46 anti-Maidan demonstrators were killed.

When the conflict in Ukraine broke out in 2014 after the troubles on the Maidan square and the violent change of government, Switzerland held the presidency of the Organisation for Security and Cooperation in Europe OSCE. Therefore the Swiss diplomat Heidi Tagliavini (called “the facilitator” and praised by Bloomberg) was allowed to work on a ceasefire agreement which resulted in the Minsk I and the Minsk II Protocols, both signed for the OSCE by Tagliavini. She was supported by Swiss President Didier Burkhalter who at that time was President of the OSCE. He cautioned all parties not to pour oil on the fire. For those two diplomats Minsk was not a sham, it was an attempt in good faith to bring peace to Ukraine. Burkhalter retired prematurely from politics two years later.

“If you are comfortable in your approach to training, then you are not taking enough risk.”

• Air Force General Predicts War With China In 2025 (NBC)

A four-star Air Force general sent a memo on Friday to the officers he commands that predicts the U.S. will be at war with China in two years and tells them to get ready to prep by firing “a clip” at a target, and “aim for the head.” In the memo sent Friday and obtained by NBC News, Gen. Mike Minihan, head of Air Mobility Command, said, “I hope I am wrong. My gut tells me will fight in 2025.” Air Mobility Command has nearly 50,000 service members and nearly 500 planes and is responsible for transport and refueling. Minihan said in the memo that because both Taiwan and the U.S. will have presidential elections in 2024, the U.S. will be “distracted,” and Chinese President Xi Jinping will have an opportunity to move on Taiwan.

He lays out his goals for preparing, including building “a fortified, ready, integrated, and agile Joint Force Maneuver Team ready to fight and win inside the first island chain.” The signed memo is addressed to all air wing commanders in Air Mobility Command and other Air Force operational commanders, and orders them to report all major efforts to prepare for the China fight to Minihan by Feb. 28. During the month of February, he directs all AMC personnel to “fire a clip into a 7-meter target with the full understanding that unrepentant lethality matters most. Aim for the head.” He also orders all personnel to update their records and emergency contacts. In March he directs all AMC personnel to “consider their personal affairs and whether a visit should be scheduled with their servicing base legal office to ensure they are legally ready and prepared.”

Minihan urges them to accept some risk in training. “Run deliberately, not recklessly,” he writes, but later adds, “If you are comfortable in your approach to training, then you are not taking enough risk.” He also provides a window into one capability the U.S. is considering for possible conflict with China — commercial drone swarms. He directs the KC-135 units to prepare for “delivering 100 off-the-shelf size and type UAVs from a single aircraft.”

Looks like he’s actually saying that NATO is not ready:

“The fact that your enemy has better weapons is not the problem of the enemy. That is your problem..”

• NATO Ready For Direct Confrontation With Russia – Official (TASS)

Chair of the NATO Military Committee Rob Bauer said that the US-led bloc is ready for a direct confrontation with Russia in an interview with Portugal’s RTP TV channel. Replying to a question on the matter, he asserted: “We are ready.” That said, he added that NATO is going to respond only if Russia crosses the red line by invading one of NATO member states. The military official stressed that NATO should be better prepared because currently Russia has the military initiative. “The fact that your enemy has better weapons is not the problem of the enemy. That is your problem,” he said. The interview also raised the issue of introducing “a war-time economy but in peace time,” however, Bauer admitted that this process would be difficult.

Chair of the NATO Military Committee Rob Bauer – A doofus

https://twitter.com/i/status/1619357056032710657

“Then everything will definitely be turned to dust..”

• If WWIII Breaks Out, It Won’t Start On Tanks Or Fighter Jets – Medvedev (TASS)

Russian Security Council Deputy Chairman Dmitry Medvedev has lambasted Western attempts to justify arms deliveries to Kiev as an alleged effort to prevent a world war. “Firstly, defending Ukraine, which nobody needs in Europe, will not save the senile Old World from retribution if anything occurs. Secondly, once the Third World War breaks out, unfortunately it will not be on tanks or even on fighter jets. Then everything will definitely be turned to dust,” Medvedev wrote on his Telegram channel on Saturday. In this post, Medvedev commented, in particular, on Italian Defense Minister Guido Crosetto’s remarks that the Third World War would erupt if Russian tanks reached Kiev and “the borders of Europe”, and that the weapons sent to Ukraine were meant to stop the escalation. Medvedev equated his remarks to the calls from the United Kingdom to provide Kiev with all the weapons NATO has.

“What actions will you take to ensure that our military equipment is not falling into the hands of criminal networks, terrorists, or being sold for profit?”

• White House Confronted Over Tanks To Ukraine (RT)

Several Republican lawmakers have raised red flags about the decision by the administration of US President Joe Biden to send M1 Abrams tanks to Ukraine. They claim that the move comes at a time when the US is struggling with domestic problems, while the delivery itself is bound to face numerous challenges. In a letter released on Friday, representatives Troy Nehls, Paul Gosar, Eli Crane, and Lauren Boebert demanded answers from Biden and Secretary of Defense Lloyd Austin about the unprecedented step of sending Ukraine 31 M1 Abrams tanks to help it in its fight against Russia. The lawmakers said they were not elected by the American people “to continually spend their hard-earned money into a conflict halfway around the world” without the ability to properly track the use of military assistance to Ukraine.

They further argued that it is “shameful that the American taxpayer is continuing to subsidize the ongoing Ukraine conflict” while the White House is “turning a blind eye” to the issue of domestic security, particularly the record-high number of illegal crossings at the southern border. The delivery of heavy armor is certain to face logistical challenges, they said, noting that Abrams tanks could be delivered only in several months, while Ukrainian service members will have to undergo lengthy training to learn how to operate the machinery. The letter also noted that Ukraine has a history of being a hotbed for illegal arms trafficking. “What actions will you take to ensure that our military equipment is not falling into the hands of criminal networks, terrorists, or being sold for profit?” the lawmakers asked Biden and Austin.

They also wondered how the Pentagon intended to track the weapons and how the administration would account for the destruction of hardware provided under US military assistance and reimburse American taxpayers. In November, congressional Republicans called for an audit of US government funds appropriated for aid to Ukraine. A month later, however, the initiative was narrowly defeated in the House of Representatives, with Democrats arguing that it would send the wrong signal to Kiev.

All sides, all the time.

• Britain ‘Modeling Cyber Strikes’ On Russian Infrastructure – Moscow (RT)

Britain has been modeling cyberattacks on Russia’s critical infrastructure, the country’s deputy foreign minister, Oleg Syromolotov, said on Saturday. He added that the simulated hacks included energy facilities and were conducted under NATO guidance. The deputy minister stated that attempts to hack Russian government entities by foreign actors have “increased by two to three times” over the course of last year. Syromolotov was reacting to a story published by The Times last month, in which Lt. Gen. Tom Copinger-Symes, the deputy commander of the UK’s strategic command, was quoted as saying the National Cyber Force was seeking to recruit people with Russian degrees.

“The British are systematically using their offensive capabilities to target Russia’s information [sector],” Syromolotov told the TASS news agency. He added that London regularly conducts exercises, including joint NATO drills, simulating attacks on “Russian critical infrastructure.” “They include the modeling of strikes on government entities in the Kaliningrad Region and Moscow’s energy system,” the diplomat said. The Kaliningrad Region is a Russian exclave on the Baltic Sea that borders Poland and Lithuania. Syromolotov said that last year Russia was hit by “unprecedented cyberattacks from abroad,” with the majority of intrusions coming from the US and other NATO members, as well as Ukraine. “We have become a target of coordinated aggression involving intelligence services, transnational IT corporations and hacktivists from the collective West and its puppets.”

According to Syromolotov, government services have been targeted the most. The Foreign Ministry has been repeatedly attacked, he said. “Overall, around 50,000 hacker attacks were repulsed last year.” On April 11, 2022, on the eve of Russia’s Cosmonautics Day celebrations, hackers targeted the website of the country’s space agency, Roscosmos, according to its press service. Also last year, intruders gained access to the database of one of the contractors of the Russian national postal service, leaking some internal documents. On Wednesday, cyber attackers briefly hijacked a TV signal in Russia’s Belgorod Region and Crimea and broadcast an excerpt from a speech by Ukrainian President Vladimir Zelensky. Crimean officials blamed Kiev’s intelligence services for the intrusion.

“Why do we train guys? It isn’t simply to defend themselves, it’s to kill the enemy.”

• Mozart Group Trains Ukrainians To ‘Kill Russians’ – Founder (RT)

Despite its professed humanitarian mission in Ukraine, the Mozart Group is a private military company training Ukrainian soldiers to kill Russians, its founder and CEO told RT’s Afshin Rattansi on Saturday’s episode of ‘Going Underground.’ Founded by US citizens Andrew Milburn and Andrew Bain last March, the Mozart Group has been described as the Western answer to the Wagner Group – the Russian private military company currently fighting the Kiev forces for control of the key Donbass city of Artyomovsk (known as Bakhmut in Ukraine). Speaking to Rattansi, Milburn was keen to dispel any comparison between Mozart and Wagner. He told the RT host that his group’s mission is “purely humanitarian,” and that Mozart’s members primarily work to supply and evacuate civilians living near the front lines.

However, the group’s other mission is the training of Ukrainian soldiers, which often takes place “very close to the front line,” Milburn, a former US Marine Corps commander, said. “Sadly in this war – in any war actually – the more of the adversary you take off the playing field, or kill, the less the danger is to your own guys,” he said. “Why do we train guys? It isn’t simply to defend themselves, it’s to kill the enemy.” “Everything we’re doing is exactly within the parameters of NATO policy,” he continued. “The West is providing Ukraine with lethal weapons that kill Russians. Why are they doing that? It’s to kill Russians.” “When we train soldiers that is their goal. It’s why we teach them how to operate their weapons.”

While Mozart survives on private donations, Milburn has previously called for “funding from Western governments,” asking Newsweek last month, “What the hell is stopping the US, or UK, or European Union governments from reaching out and saying ‘Let us help you?’” Milburn is currently embroiled in a legal dispute with Bain, who accused the retired commander of violating US arms trafficking regulations and seeking to expand Mozart’s training operations into Armenia. The suit also accused Milburn of embezzling money donated to the organization, orchestrating the burglary of humanitarian supplies in Ukraine, sexually harassing a female co-worker, and bribing Ukrainian military leaders. Milburn in turn accused Bain of seeking money from the Mozart Group, and claimed that Bain is “heavily invested in Russia,” which he denies.

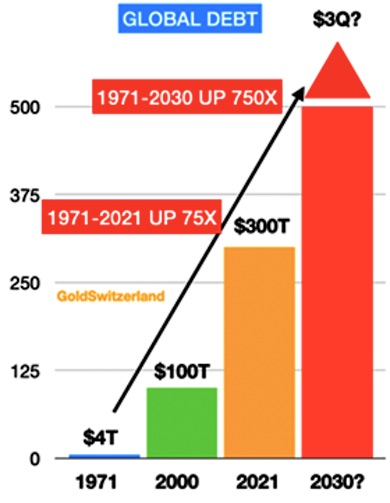

“Before the Western Ponzi scheme comes to an end, these three nations will virtually hold 100% of their own debt. At that point, the bonds will be worthless and interest rates will have reached infinity. Not a pretty prospect!”

• As West, Debt & Stocks Implode, East Gold & Oil Will Explode (Von Greyerz)

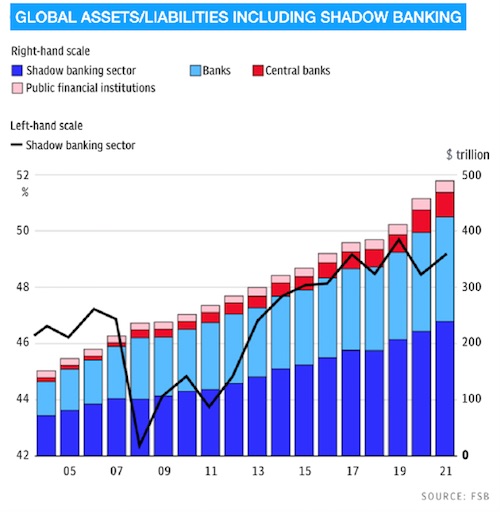

“The risk of over-tightening by the European Central Bank is nothing less than catastrophic” says Prof Kenneth Rogoff . At Davos he also said: “Italy is extremely vulnerable. But this could pop anywhere. Global debt has gone up massively since the pandemic: public debt, corporate debt, everything.” Rogoff believes that it is a miracle that the world averted a financial crisis in 2022, but the odds of a major accident are shortening as the delayed effects of past tightening feed through. As Rogoff said: “We were very fortunate that we didn’t have a global systemic event in 2022, and we can count our blessings for that, but rates are still going higher and the risk keeps rising.” But lurking in the murkiness is also the global financial assets/liabilities which is almost $500 trillion including the shadow banking system at 46% of the total. The shadow banking sector includes pension funds, hedge funds and other financial institutions which are largely unregulated.

Shadow banking is not subject to the normal mark-to-market rules. Thus no one knows what the real position or losses are. This means that central banks are in the dark when it comes to evaluation of the real risks of the system. Clearly, I am not the only one harping on about the catastrophic global debt/liability situation. And no one knows the extent of total global derivatives. But if they have grown in line with debt and also with the shadow banking system, they could easily be in excess of $3 quadrillion.

Cultures don’t die overnight, but the US has been in decline since at least the Vietnam war in the 1960s. Interestingly, the US has not had a real Budget surplus since the early 1930s with a handful of years of exception. But when you, like the US, live on borrowed time and borrowed money, it becomes increasingly difficult to keep up appearances. In 1971, the pressures on the US economy and currency became too great. Thus Nixon closed the Gold Window with the dollar having lost over 98% in real terms since then. This is of course a total catastrophe and a guarantee that the remaining 2% fall to ZERO will come in the near term future, whether it takes 5 or 10 years for the dollar to reach oblivion. Remember that the final 2% is 100% from today!

The US, EU and Japan have now reached the stage when no one wants their debt. So sovereign debt of these nations is no longer a question of “passing the parcel” but keeping the parcel. When every third party holder of these debts is a seller, who will buy? These three countries will end up holding their own debt. Japan already holds over 50% of its debt. Before the Western Ponzi scheme comes to an end, these three nations will virtually hold 100% of their own debt. At that point, the bonds will be worthless and interest rates will have reached infinity. Not a pretty prospect!

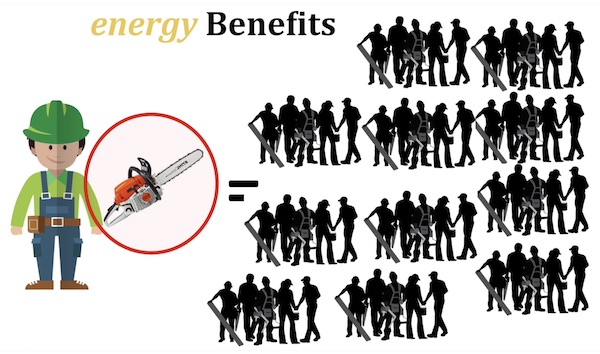

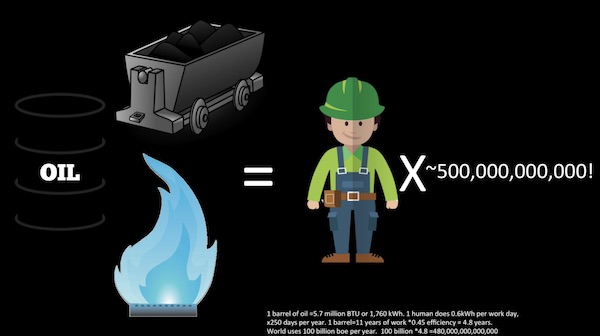

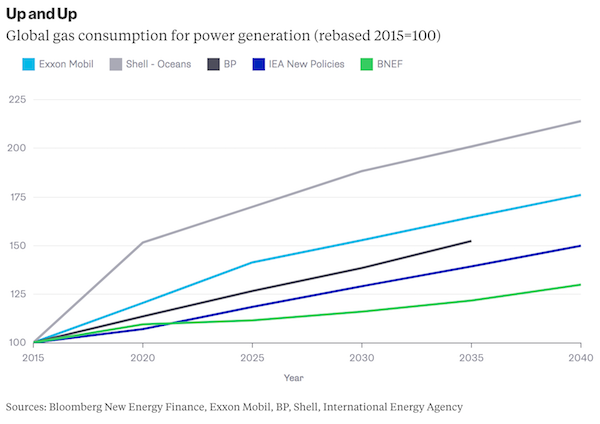

Why Just Stop Oil is a pretty dumb statement.

• Are You Really Against Fossil Fuels? Read This Before You Answer (RCE)

It is easy for anyone to say that they are against fossil fuels. Opposition to coal, oil and natural gas is fashionable and will prompt heads to nod and even hands to applaud in most places. But are people aware of the extent to which their lives are dependent on fossil fuels? Do they know that more than 90 percent of things used in their everyday lives are derived from fossil fuels? From your toothbrush to your car tire, a majority of the things you use today has been made possible because of fossil fuels. Shoes, refrigerators, washing machines, coffee makers, furniture, pens, eating utensils, eyeglasses, commodes, medical gear, camping equipment, and the list goes on and on.

Consider the computer or the phone from which you are reading this article. They are made of glass, metal, plastic, lithium and silicon – all of which require fossil fuels to mine, process or manufacture. While some are chemical derivatives of fossil fuels, all depend one way or another on their combustion for electricity generation, process heat or transportation. You wouldn’t have the iPhone, Android or MacBook without fossil fuels. Imagine the irony of typing out “end oil” from a phone that is made from fossil fuels! Or supporting climate activism by relaying video that was recorded with a camera made from fossil fuels! Of course, this sort of irony is displayed regularly and missed constantly. In short, the most fundamental necessities – and the most cherished conveniences – of daily life are products dependent on the use of fossil fuels.

“Twenty-four states have enacted bans or restrictions on private funding of local election offices. But the U.S. Alliance for Election Excellence has been working to ingratiate itself with local offices.“

• Zuckerberg-Funded “Non-Profit” Gears Up for 2024 Elections (GP)

The Zuckerberg-funded group the Center for Tech and Civic Life that gave out $420 million to election offices in 2020 is doing the same in 2024. Through the U.S. Alliance for Election Excellence, they are funneling $80 million in election grants to local election offices. A report from election integrity watchdogs Honest Elections Project, John Locke Foundation, and Florida’s Foundation for Government Accountability issued a warned that the Alliance “is focused on systematically reshaping election offices and pushing progressive voting policies.”

Epoch Times reported: Election integrity watchdogs, including Virginia-based Honest Elections Project (HEP), North Carolina’s John Locke Foundation, and Florida’s Foundation for Government Accountability, are again raising the alarm about CTCL—this time, a year before the election rather than months after—claiming its Alliance is a front for boosting Democratic turnout, especially in Democratic strongholds within swing states. “No matter what it claims to be, the U.S. Alliance for Election Excellence is nothing more than a dark money-fueled scheme to push liberal voting policies and influence election administration in key states,” HEP Executive Director Jason Snead told The Epoch Times.

“The work of the U.S. Alliance for Election Excellence is ‘Zuck Bucks 2.0,’” John Locke Foundation Civitas Center for Public Integrity Director Dr. Andy Jackson said, claiming in a statement that the Alliance is a vehicle “for the private funding of elections by left-wing donors.” Snead and Jackson collaborated in producing a Jan. 19 Zuck Bucks 2.0 report that claims CTCL’s Alliance “is focused on systematically reshaping election offices and pushing progressive voting policies,” adding, “How state and local governments respond will have ramifications for free and fair elections in 2024 and beyond.” An investigation from House Republicans found that less than 1% of the funds were spent on personal protective equipment. Twenty-four states have banned or restricted private funding for local election offices.

Fox News reported:” CTCL issued about $400 million in grants during the 2020 election to fund a variety of work and equipment. That included ballot drop boxes, voting equipment, additional manpower, protective gear for poll workers and public education campaigns on new voting methods, among other expenses.… House Republicans found in an investigation that less than 1% of the funds were spent on personal protective equipment. Instead, the U.S. Alliance for Election Excellence appears to be another effort by Zuckerberg and CTCL to influence local election operations, according to critics. “The work of the U.S. Alliance for Election Excellence is Zuck Bucks 2.0, which is why they avoided states that have instituted bans on the private funding of election administration,” Andy Jackson, director of the Civitas Center for Public Integrity, said in a statement. Twenty-four states have enacted bans or restrictions on private funding of local election offices. But the U.S. Alliance for Election Excellence has been working to ingratiate itself with local offices.“ The GOP needs to stop this!

“He invested $55 million in BioNTech back in 2019 and it’s now worth north of $550 million.

• Bill Gates Trashes Effectiveness of COVID Vaccines (CHD)

Bill Gates, long recognized as one of the world’s foremost proponents of vaccines, raised some eyebrows at a recent talk in Australia when he admitted there are “problems” with current COVID-19 vaccines. Speaking at Australia’s Lowy Institute as part of a talk entitled “Preparing for Global Challenges: In Conversation with Bill Gates,” the Microsoft founder made the following admission: “We also need to fix the three problems of [COVID-19] vaccines. The current vaccines are not infection-blocking. They’re not broad, so when new variants come up you lose protection, and they have very short duration, particularly in the people who matter, which are old people.” Such statements came as a surprise to some in light of Gates’ longstanding support of — and investments in — vaccine manufacturers and organizations promoting global vaccination.

However, they were the latest in a string of developments in recent weeks that have increasingly called the COVID-19 vaccines, in particular, into question. Several analysts and commentators were critical of Gates — but not due to disagreement with the statements he made in Australia. Instead, they argued that he had previously heavily invested in mRNA vaccines at the same time he encouraged a global COVID-19 vaccination campaign and supported mandatory vaccination. Speaking Jan. 25 on The Hill TV’s “Rising,” co-hosts Briahna Joy Gray and Robby Soave addressed Gates’ statements. Soave initially agreed at face value with Gates’ criticism of current mRNA vaccines, saying: “He really nails it on the issues that we’re having: the short duration of protection, not a significant discernable impact on the transmission of cases … not a massive benefit for a lot of otherwise healthy and younger people.”

However, Soave — who on Jan. 19 revealed “Facebook files” indicating the CDC significantly influenced content moderation and censorship on the platform pertaining to COVID-19 vaccines — then pointed out Gates’ prior investments that contributed to the development of mRNA vaccine technology. Soave said, “Bill Gates was a major proponent of mRNA technology … he was an investor in BioNTech, which developed the mRNA vaccine for Pfizer.” “We were just doing some digging,” continued Soave, “[and] we saw that he sold a lot of those shares at … how much profit was that?” “10x,” replied Gray. “He invested $55 million in BioNTech back in 2019 and it’s now worth north of $550 million. He sold some stock … at the end of last year, I believe it was, with the share price over $300, which represented a huge gain for him over when he invested.”

“No evidence to support the statement that the dashboard is a finger on the pulse of Russian information ops.” “Hardly evidence of a massive influence campaign.”

• Meet Hamilton 68, the New King of Media Fraud (Matt Taibbi)

If one goes by volume alone, this oft-cited neoliberal think-tank that spawned hundreds of fraudulent headlines and TV news segments may go down as the single greatest case of media fabulism in American history. Virtually every major news organization in America is implicated, including NBC, CBS, ABC, PBS, CNN, MSNBC, The New York Times and the Washington Post. Mother Jones alone did at least 14 stories pegged to the group’s “research.” Even fact-checking sites like Politifact and Snopes cited Hamilton 68 as a source. Hamilton 68 was and is a computerized “dashboard” designed to be used by reporters and academics to measure “Russian disinformation.” It was the brainchild of former FBI agent (and current MSNBC “disinformation expert”) Clint Watts, and backed by the German Marshall Fund and the Alliance for Securing Democracy, a bipartisan think-tank. The latter’s advisory panel includes former acting CIA chief Michael Morell, former Ambassador to Russia Michael McFaul, former Hillary for America chair John Podesta, and onetime Weekly Standard editor Bill Kristol.

The Twitter Files expose Hamilton 68 as a sham: The secret ingredient in Hamilton 68’s analytic method was a list of 644 accounts supposedly linked “to Russian influence activities online.” It was hidden from the public, but Twitter was in a unique position to recreate Hamilton’s sample by analyzing its Application Program Interface (API) requests, which is how they first “reverse-engineered” Hamilton’s list in late 2017. The company was concerned enough about the proliferation of news stories linked to Hamilton 68 that it also ordered a forensic analysis. Note the second page below lists many of the different types of shadow-banning techniques that existed at Twitter even in 2017, buttressing the “Twitter’s Secret Blacklist” thread by Bari Weiss last month. Here you see categories ranging from “Trends Blacklist” to “Search Blacklist” to “NSFW High Precision.” Twitter was checking to see how many of Hamilton’s accounts were spammy, phony, or bot-like. Note that out of 644 accounts, just 36 were registered in Russia, and many of those were associated with RT.

Examining further, Twitter execs were shocked. The accounts Hamilton 68 claimed were linked to “Russian influence activities online” were not only overwhelmingly English-language (86%), but mostly “legitimate people,” largely in the U.S., Canada, and Britain. Grasping right away that Twitter might be implicated in a moral outrage, they wrote that these account-holders “need to know they’ve been unilaterally labeled Russian stooges without evidence or recourse.” Other comments in internal company emails: “These accounts are neither strongly Russian nor strongly bots.” “No evidence to support the statement that the dashboard is a finger on the pulse of Russian information ops.” “Hardly evidence of a massive influence campaign.”

“I genuinely wanted to hear an innocent explanation if they had one. They still said nothing. Only after the story blew up online yesterday did they put out an explanation.”

• Responding to Hamilton 68 (Matt Taibbi)

Days before yesterday’s Twitter Files report about Hamilton 68, I wrote the public relations officers of both of the sites’ parent organizations, the Alliance for Securing Democracy (ASD) and the German Marshall Fund (GMF). I told them I was in possession of the Hamilton 68 list, which purported to track “Russian influence activities.” I said I had a slew of internal Twitter documents that among other things identified their project as “bullshit.” Toward the end I added: Given the sheer quantity of news stories sourced to Hamilton 68, this has to go down as one of the great media frauds of all time. Unless you have an explanation for how and why hundreds of non-Russians like Dennis Michael Lynch, Patrick Hennigsen, Joe Lauria, and [I inserted the name of a San Diego school board member] came to be on this list, there’s no other conclusion.

I hope you will treat this matter with respect and answer this query. My story is going to identify not just people like Clint Watts but members of the ASD advisory board as party to this. The story eventually published, “Move Over, Jayson Blair: Meet Hamilton 68, The New King of Media Fraud,” was based on email assessments of Twitter executives like Yoel Roth and Nick Pickles, the forensic analysis Roth had done in 2017 and which was excerpted yesterday, and interviews with people on the list. These elements — especially the interviews — made for a pretty ironclad case that the much-ballyhooed Hamilton 68 “dashboard” was a sham, that took real opinions of real people and falsely declared them part of a “network” of “Russian influence activities.”

On the remote chance Hamilton 68 had inside information legitimizing the linking of Dennis Michael Lynch, David Horowitz, and @TrumpDyke to “Russian influence activities,” I not only reached out to Hamilton’s creators, but when they were quiet, threw a tantrum on Twitter, tagging every member of the ASD advisory board in an effort to hear from them pre-publication. I genuinely wanted to hear an innocent explanation if they had one. They still said nothing. Only after the story blew up online yesterday did they put out an explanation.

Elon Mars

https://twitter.com/i/status/1619140353743015936

Musk landing

The day when Elon Musk made history. This video still gives me goosebumps! @elonmusk pic.twitter.com/tnENal6myD

— DogeDesigner (@cb_doge) January 28, 2023

This 1974 photograph shows the freshly excavated pit with 2,000-year-old terracotta warriors still showing the original color scheme before the rapid deterioration that made them as we know them today

Mandarin duck

This beautiful mandarin duck

This is a male, usually after breeding season these showy feathers will molt and he will have a more subtle appearance known as the eclipse plumagepic.twitter.com/Lwf0qh5gFM

— Science girl (@gunsnrosesgirl3) January 28, 2023

The sabertooth longhorn beetle is one of the largest beetles reaching a length of up to 17.7 cm. Its larval stage can last up to 10 years, while its adult phase is likely to last no more than a few months

Odd couple

https://twitter.com/i/status/1619316157235986432

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.

This question generated a number of comments in the last Blowout so I thought I would take a quick look at it. I find that the electrified portion of the Dutch railway network (Nederlandse Spoorwegen, or NS) runs on grid electricity that comes dominantly from fossil fuel generation (natural gas and coal). NS claims 100% wind power because it has a contract with various wind farms to produce enough energy to power its rail system, but this is just an accounting transaction. Only a small fraction of the power delivered to its trains actually comes from wind.

This question generated a number of comments in the last Blowout so I thought I would take a quick look at it. I find that the electrified portion of the Dutch railway network (Nederlandse Spoorwegen, or NS) runs on grid electricity that comes dominantly from fossil fuel generation (natural gas and coal). NS claims 100% wind power because it has a contract with various wind farms to produce enough energy to power its rail system, but this is just an accounting transaction. Only a small fraction of the power delivered to its trains actually comes from wind.