Harris&Ewing WSS poster, Washington DC 1917

“..to understand the potentially devastating extent of the coming asset deflation cycle, it is important to reprise the extent of the just completed and historically unprecedented global capital investment boom.”

• Why The Casino Is In For A Rude Awakening, Part I (David Stockman)

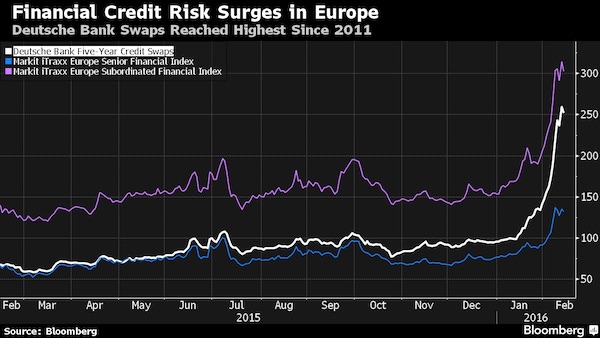

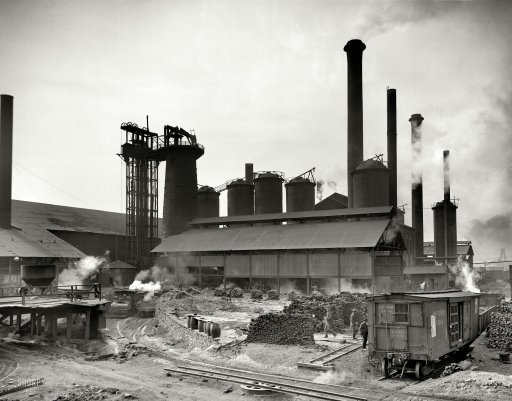

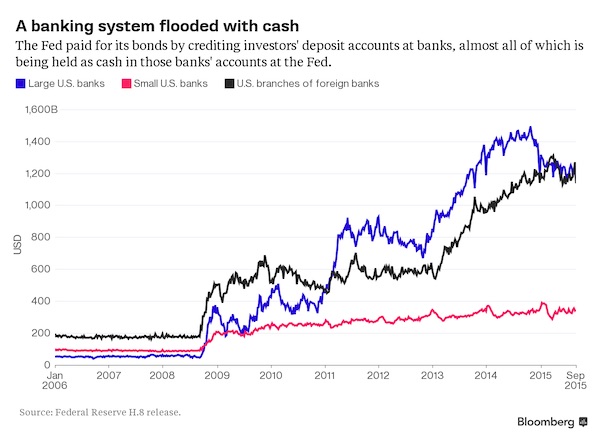

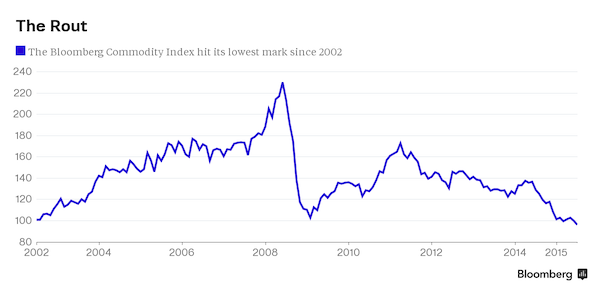

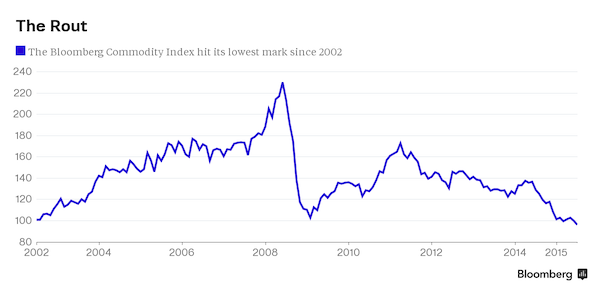

The reason that the Bloomberg index will now knife through the 100 index level tagged on both the right- and left-hand side of the chart is the law of supply and demand – along with its first cousin called variable cost pricing and a destructive interloper best described as zombie finance. The latter is what becomes of central bank driven bubble finance when the cycle turns, as it is now doing, from asset accumulation and inflation to asset liquidation and deflation. But to understand the potentially devastating extent of the coming asset deflation cycle, it is important to reprise the extent of the just completed and historically unprecedented global capital investment boom.

Thus, in the case of the global mining industries, CapEx by the top 40 miners amounted to $18 billion in 2001. During the original boom cycle it soared to $42 billion by 2008, and then after a temporary pause during the financial crisis, reaccelerated once again, reaching a peak of $130 billion in 2013. Owing to the collapse of commodity prices as shown above, new projects and greenfield investments have pretty much ground to a halt in iron ore, met coal, copper and the other principal industrial materials, but there is a catch. Namely, that big projects which were in the pipeline when commodity prices and profit margins began to roll-over in 2012, are being carried to completion owing to the sunk cost syndrome. This means that available, on-line capacity continues to soar.

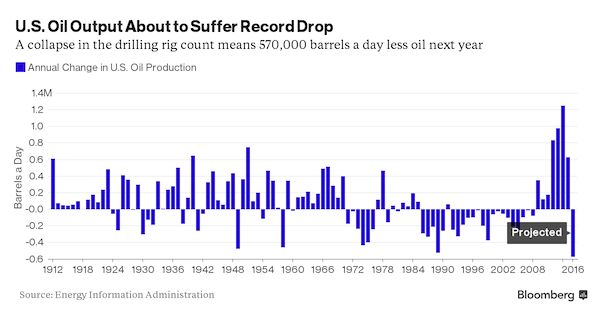

The poster child for that is the world’s largest iron ore port at Hedlund, Australia. The latter set another shipment record in June owing to still rising output in mines it services – a record notwithstanding the plunge of iron ore prices from a peak of $190 per ton in 2011 to $47 per ton a present. The ramp-up in E&P investment for oil and gas was similar. Global spending was $100 billion in the year 2000, but had risen to $400 billion by 2008 and peaked at $700 billion in 2014. In the case of hydrocarbon E&P investment, however,the law of variable cost pricing works with a vengeance because “lifting costs” even for shale and tar sands are modest compared to the front-end capital investment. Accordingly, the response of production to plunging prices has been initially limited and will be substantially prolonged.

Read more …

“All of that is creating an anti-inflationary environment that sucks the air out of the gold market.”

• Gold Is In Its Worst Slump Since 1996 (CNN)

So much for predictions that gold would spike to $2,000 an ounce. The yellow metal is in a deep slump. It’s down more than 40% from its 2011 peak and crashing back toward $1,000. The slide just keeps getting worse. Gold has declined for 10 straight days. That’s the longest losing streak for gold since September 1996. To put that into perspective, back then oil prices were fetching just $19 a barrel, New York Yankees rookie shortstop Derek Jeter was nearing his first World Series title and rap fans were mourning the death of Tupac Shakur. So why is gold getting creamed? It comes down to three key factors: a strong U.S. dollar, China slowing down its gold purchases and little worry about inflation anymore.

1. Strong dollar: A strong greenback hurts commodities that are measured in dollars because it makes them more expensive for overseas buyers. It’s a double negative for gold because the precious metal is supposed to be a hedge against inflation and the devaluing of currency. “Gold has taken it on the chin with the strength in the dollar. Over the past week or so, it was almost like a perfect storm,” said Bob Alderman, head of wealth management at Gold Bullion International, a provider of precious metals. The U.S. dollar lost ground against most currencies on Thursday, giving gold a short reprieve. Gold prices ticked up 0.2% to $1,093 an ounce. But over the coming months, the dollar is expected to keep climbing.

2. China, Iran & Greece: Gold plummeted by as much as $40 an ounce in mere minutes after China’s central bank gave a rare update on how much gold it’s hoarding. The numbers showed the world’s largest gold producer has been stockpiling gold reserves at a slower pace than previously thought, spooking gold investors. Gold has also been hurt by easing tensions in Europe and the Middle East. Iran’s landmark nuclear agreement with the West has lessened some fears about a conflict in that volatile region. Those fears had allowed gold, and more so oil, to trade at a premium. Likewise, Greece landed a last-minute deal with its creditors that allows the crisis-ravaged country to stay in the euro. Investors are no longer speculating about a Greek exit or the long-term implications for the currency union. “The new bailout softened the fear of contagion. That was not a good thing for gold,” said Alderman.

3. What inflation? Inflation worries also remain muted. When gold topped $1,900 in September 2011, some investors bought gold because they feared the Federal Reserve’s money printing would cause runaway inflation. But inflation continues to undershoot the Fed’s goals despite extremely low interest rates and years of massive bond purchases. “Over the last 5,000 years gold has been a store of value that will be there for a time when there is inflation. There is no inflation now,” said George Gero at RBC Capital Markets. In fact, the recent collapse in the commodities complex is only lowering inflation and inflation expectations. Everything from coffee, sugar, beans to crude oil is heading south. Industrial metals like copper and aluminum have renewed their tumble in recent days as soft global economic growth hurts demand and supply gluts deepen. All of that is creating an anti-inflationary environment that sucks the air out of the gold market.

Read more …

Does China have a choice?

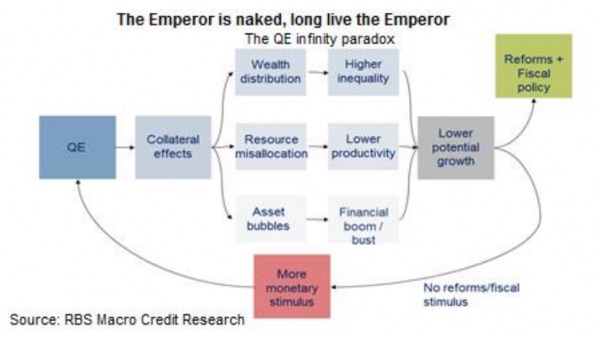

• Cheap Money Is Here to Stay (Pesek)

For decades, central banks lorded over markets. Traders quivered at the omnipotence of monetary authorities – their every move, utterance and wink a reason to scurry for safe havens or an opportunity to score huge profits. Now, though, markets are the ones doing the bullying. Take New Zealand and Australia. Yesterday, the Reserve Bank of New Zealand slashed borrowing costs for the second time in six weeks even as housing prices continue to skyrocket. A day earlier, its counterpart across the Tasman Sea (already wrestling with an even bigger property bubble of its own) said a third cut this year is “on the table.” Just one year ago, it seemed unthinkable that officials in Wellington and Sydney, more typically known for their hawkishness and stubborn independence, would join the global race toward zero.

But with commodity prices sliding, China slowing and governments reluctant to adopt bold reforms, jittery markets are demanding ever-bigger gestures from central banks. Even those presiding over stable growth feel the need to placate hedge funds, lest asset markets falter. When this dynamic overtakes countries such as New Zealand (growing 2.6%) and Australia (2.3%), it’s hard not to conclude that ultralow rates will be the global norm for a long, long time. Indeed, the major monetary powers that are easing – Europe, Japan, Australia and New Zealand – have all suggested rates may stay low almost indefinitely. Those angling to return to normalcy, meanwhile – the Fed and Bank of England – are pledging to move very slowly. Even nations with rising inflation problems, like India, are hinting at more stimulus.

“As interest rates continue to fall across most of the globe, central banks are also united in their main message: Once rates have come down, they’re likely to stay down,” says Simon Grose-Hodge of LGT Bank. “And when they finally do tighten, the ‘normal’ rate is going to be a lot lower than it used to be.” Could the People’s Bank of China be next? “With underlying GDP growth still looking weak, more monetary policy moves are likely,” says Adam Slater of Oxford Economics. “And China may even face the prospect of short-term rates dropping towards the zero lower bound.”

Read more …

But Henry expects a resurge. On what basis, though?

• A 50% Stock Market Plunge Would Not Be A Surprise (Blodget)

As regular readers know, for the past ~21 months I have been worrying out loud about US stock prices. Specifically, I have suggested that a decline of 30% to 50% would not be a surprise. I haven’t predicted a crash. But I have said clearly that I think stocks will deliver returns that are way below average for the next seven to 10 years. And I certainly won’t be surprised to see stocks crash. So don’t say no one warned you! So far, these concerns have just made me sound like Chicken Little. The S&P 500 is up strongly from where I first sounded the alarm. That’s actually good for me, because I own stocks. But my concerns haven’t changed. Earlier this year, for the first time, I even put (some) money where my mouth is!

In February, I changed the “dividend reinvestment” policy on my S&P 500 fund. (I’m an indexer — I think stock-picking is generally a lousy strategy for individuals.) Specifically, I stopped reinvesting dividends. I’m a long-term investor, so I don’t really care what stocks do next. This dividend change was a bet that, at some point in the future, I will be able to reinvest the cash from these dividends in stocks at lower prices than today. If stock prices never fall below today’s level, this will cost me money. It will also make me feel dumb for (sort of) trying to time the market. But at some point you’ve got to put some money behind what your analysis is telling you. What my analysis is telling me is:

1) stocks are extremely expensive and will eventually revert toward historical means, probably via a sharp correction of 30% to 50%

2) long-term stock returns from today’s level will be about 2% per year — nothing to write home about

So if I think there’s risk of a crash, why don’t I just sell everything? For the reasons outlined below. Again, I don’t care if the stocks I own tank, as long as they don’t tank permanently. A crash will just give me a chance to buy more at lower prices.

Read more …

Jim Fouras is a former speaker of the Queensland Parliament.

• Forced Austerity Will Take Greece Back 65 Years (Jim Fouras)

It’s hard to believe that in the last five years, Greece’s financial situation is comparable to those dark days when Germany invaded Greece. For example: a 25% decline in GDP; 25% unemployment (50% among youth); 40% of children living below the poverty line; soaring suicides rates; people cannot afford basic medicines and health care. Austerity measures are suffocating Greece and causing a brain drain that will damage it for generations. German leader Angela Merkel, in unison with the Troika, has forced austerity programs on the Greeks. For five years, Merkel has dominated the crisis management of the Greek economy through her insistence on fiscal rigour and cuts despite a huge economic slump and impoverishment of Greek society.

The IMF has argued internally for at least three years that the organisation was breaching its own rules by taking part in any bailout that held little prospect of achieving the debt sustainability that the IMF rescues prescribed. IMF boss Christine Lagarde ignored this advice. Nobel prize-winning economist Joseph Stigliz argues that “when the IMF arrives in a country, they are only interested in one thing. How do we make sure that banks and the financial institutions are paid … they are not interested in development or what helps a country get out of poverty”. The Troika has assumed their bailout programs would reduce Greece’s debt to well below 110% (of GDP) by 2022. The Guardian has published IMF documents showing that under the best-case scenario, which includes a growth projection of 4% per year for the next five years (a ridiculous assumption), the country’s debt level will drop to 124% Greece’s debt level is now 175% and the nation slid back into recession.

The Greek economy will continue to slide unless there is a significant reduction of its debt and policies that allow Greece to grow at a rate to service those debts. Two days before the recent referendum, the IMF conceded that the crisis-ridden country needs up to 60 billion euros of extra funds over the next three years and large-scale debt relief. Germany will not accept debt relief, consequently it is not the Troika’s agenda. Greece is being forced to sell assets worth €50 billion with the proceeds earmarked for a trust fund supervised by its creditors — foreign leaders demanding almost total surrender of its national fiscal sovereignty. It would be difficult to imagine any sensible seller taking part in such a fire sale. The Greek Parliament will now vote for their country to be poorer.

Read more …

“How Greeks will react remains unclear, with much depending on media coverage.”

• Greece Braces For Troika’s Return To Athens (Guardian)

Greece is bracing for the return to Athens of officials representing the reviled “troika” of creditors as the debt-stricken country prepares to start negotiations for a third bailout. Mission chiefs with the EU, ECB and IMF fly into the Greek capital on Friday for talks on a proposed €86bn (£60bn) bailout, the third emergency funding programme for Athens since 2010. The return of the triumvirate, a day after internationally mandated reforms were pushed through the parliament by MPs, marks a personal defeat for the prime minister, Alexis Tsipras, who had pledged never to allow the auditors to step foot in Greece again. How Greeks will react remains unclear, with much depending on media coverage.

“The press will almost certainly make a big deal out of this and the government will try to play it down,” said Aristides Hatzis, a leading political commentator. “But given what people have gone through recently it might seem rather trivial and that is to Tsipras’ advantage. Their presence will definitely reinforce the realisation that another bailout is here.” Much has changed for Tsipras, the young firebrand catapulted into office on promises to eradicate the biting austerity policies that over five years have created record levels of unemployment and poverty. In the six months since his election, the radical leftist has been brought face-to-face with the brute force of fiscal rectitude and a German-dominated Europe.

Addressing parliament ahead of the crucial vote, Tsipras, who succumbed to the demands of foreign lenders earlier this month – accepting an ultimatum to find €12bn of savings, by far the heaviest austerity package to date – conceded that his government had been defeated. But he insisted the alternative – bankruptcy and exit from the euro – would have been catastrophic. He told MPs: “We chose a difficult compromise to avert the most extreme plans by the most extreme circles in Europe.” [..] “We are turning our back on our common battles when in essence we say … austerity and giving into blackmail is a one-way street,” said Panagiotis Lafazanis, who heads the Left Platform, the far-left faction around which mutinous MPs rally around. “Greece does not have a future as a blackmailed eurozone colony under memorandum [bailout],” added the former minister who now advocates a return to the drachma.

Read more …

” The drama of the Euro will keep going as long as the Americans want it to, that is until the definitive approval of the TTIP by which the USA will place Europe in subjugation..”

• Italy’s Plan B For An Exit From The Euro (Beppe Grillo)

Tspiras couldn’t have done a worse job of defending the Greek people. Only profound economic short-sightedness together with an opaque political strategy could transform the enormous electoral consensus that brought him into government in January into the victory for his adversories, the creditor countries, only six months later, in spite of winning the referendum in the mean time. An a priori rejection of a Euroexit has been his death sentence. Like the PD, he was convinced that it’s possible to break the link between the Euro and Austerity. Tsipras has handed over his country into the hands of the Germans, to be used like a vassal. Thinking that it’s possible to oppose the Euro only from within and presenting oneself without an explicit Plan B for an exit, he has in fact ended up by depriving Greece of any negotiating power in relation to the Euro.

So it was clear from the beginning that Tsipras would have crashed even though Varoufakis did try to react a few times. Only Vendola, the PD and the media inspired by the Scalfari-style lies (among many) of the United States of Europe and of those who are nostalgic about the Ventotene Manifesto could have believed in a Euro without Austerity. And they are obliged to go on believing in this so as not to have to admit that there is an exit opportunity after seven years of economic disasters. The consequence of this political disaster is before everyone’s eyes:

– Explicit Nazi-ism on the part of those that have reduced the periphery of Europe to a protectorate by using the debt, with alarming echoes of historical parallels.

– Mutism or explicit support for Germany by the oher European countries perhaps because of opportunism (north) or because of subordination (periphery).

– Financial markets that are celebrating the end of democracy with new highs.

– Expropriation of the national wealth by mortgaging €50 billlion of Greek property that ended up in the fund created by Adolf Schauble so as to get to rake in the cash from the war debts.

It was all thought out, foreseen, and planned down to the last detail. The drama of the Euro will keep going as long as the Americans want it to, that is until the definitive approval of the TTIP by which the USA will place Europe in subjugation in a way that is not dissimilar to how Germany is subjugating the periphery. By now the Euro is an explicit battle between the creditors and the debtors. It’s not useful for our government to try to appear to be on the virtuous side of the winners – those supporting the Euro – and supporting reform. It’s not possible to reform the Euro from within but the fight must be fought on the outside and we must abandon this anti-democratic straitjacket. Our debt and lack of growth together with deflation, place us neatly in the category of those who are beaten by debt. Thus we’d do well to prepare ourselves with a government that is explicitly anti-Euro to defend ourselves from the final assault on the wealth of the Italian people who are ever more at risk, unless we reclaim our monetary sovereignty.

Read more …

“[This] is how not to lose the first battle we will face when the time comes to break away from the union and the ECB..”

• Beppe Grillo Wants Nationalisation Of Italian Banks, Exit From Euro (Guardian)

The populist leader of Italy’s second largest political party has called for the nationalisation of Italian banks and exit from the euro, and said the country should prepare to use its “enormous debt” as a weapon against Germany. Former comedian-turned-politician Beppe Grillo, who transformed Italian politics when he launched his anti-establishment Five Star Movement in 2009, has long been a bombastic critic of the euro. But his stance hardened significantly in a blogpost on Thursday in which he compared the Greek bailout negotiations to “explicit nazism”. Grillo constructed what he called a “Plan B” for Italy, which he said needed to heed the lessons of Greece so that it was ready “when the debtors come round”.

His plan called for Italy to adopt a clear anti-euro stance and to shake off its belief that – if forced to accept tough austerity – other “peripheral” countries would come to its aid. Grillo said Italy had to use its enormous €2tn (£1.4bn) debt as leverage against Germany, implying that the potential global damage of an Italian default would stop Germany from “interfering” with Italy’s “legitimate right” to convert its debt into another currency. He said Greece’s hand had been forced by the threat of bankruptcy to its banks, and that Italy therefore needed to nationalise its banks and shift to another currency. “[This] is how not to lose the first battle we will face when the time comes to break away from the union and the ECB,” Grillo wrote.

Setting aside Grillo’s colourful language and analogies, analyst Vincenzo Scarpetta of Open Europe said there was some merit to his arguments. “That blogpost does have some elements of truth,” Scarpetta said. “The lesson from Greece was that if you want to be in the eurozone you have to agree to rules of austerity.” The strength of anti-euro sentiment in Italy is easy to overlook since Matteo Renzi, the centre-left prime minister and head of the Democratic party, is a strong defender of Italy’s role in the eurozone. But Scarpetta pointed out that supporters of the Five Star Movement, coupled with supporters of the rightwing Northern League, which is also anti-euro, means that about 40% of Italians are at least sympathetic to anti-euro sentiments.

Read more …

No, really, M5S was the biggest single party in the latest elections. Renzi got in because of a ‘vote link’ between his party and another one.

• Grillo Calls For Italy To Throw Off Euro ‘Straitjacket’ (FT)

Beppe Grillo, the leader of Italy’s populist Five Star Movement, has launched a full-throated attack on the euro, saying Rome should abandon what he called an “anti-democratic straitjacket”. Mr Grillo, whose party is the second most popular in Italy, demanded the government formulate a “plan B” to exit the single currency and “take back our monetary sovereignty”. The comedian has become an increasingly trenchant critic of the euro at a time of rising euroscepticism across the Italian political landscape, spurred in part by the agonies of Greece and its prolonged bailout talks. But his attack on the single currency in an extensive blog post was nonetheless remarkable for its ferocity.

It suggests Mr Grillo sees a political opportunity in doubling down on his anti-euro message in the wake of Greece’s last-minute acceptance of exacting terms for a third bailout. It is also a sign of political contagion, or concerns that populist forces might gain traction from the Greek crisis. The Five Star Movement has been rising steadily in the polls since March. It is now garnering the support of nearly 25% of Italian voters and has narrowed the gap with the ruling centre-left Democratic party led by Matteo Renzi, the prime minister. Mr Grillo was particularly scathing about Alexis Tsipras, the Greek prime minister, whom he had professed to admire before the deal was reached. “It would be difficult to defend the interests of the Greek people worse than Tsipras did,” Mr Grillo wrote.

“His refusal to exit the euro was his death sentence. He was convinced that he could break the marriage between the euro and austerity, but ended up delivering his country into Germany’s hands, like a vassal.” To avoid that fate, Mr Grillo said Italy should use its heavy debt load — worth more than €2tn, or 130% of GDP — as a threat. “[The debt] is an advantage that allows us to be on the offensive in any future negotiation, it is not a bogeyman that should make us bite at any request from our creditors,” he said.

Read more …

“Its €2.3 trillion debt, more than 132% of GDP, is second only to Greece in the euro area. Italy has lost a quarter of its industrial output, and GDP has contracted by 9% since 2007.“

• Italy Leans While Greece Tumbles (Bloomberg)

Viewed from Berlin or London, the financial woes of Italy and Greece can look dangerously similar. Both sit on mountains of public debt and suffer from double-digit unemployment. So why hasn’t Italy had to shutter banks, submit to austerity measures in return for emergency loans, and contemplate an exit from the euro? For now Italy is chugging along, paying its debts and selling bonds. Its benchmark stock index is up 25% this year. It’s emerging from a record recession even as Greece enters a new slump after a brief rebound in 2014. Rome-based Eni, Europe’s No. 4 oil company, is pumping 1.7 million barrels per day globally and says output will keep rising. Finmeccanica sells helicopters to corporations and armed forces from the U.K. to China. Carnival cruise liners are made in Fincantieri’s Trieste shipyard.

Italian luxury goods, from Fendi to Ferrari, are at the top of consumer shopping lists. Among European manufacturers, Italy trails only Germany in production. The Greeks? They’ve got tourism and shipping and little else, says Marc Ostwald, a fixed income strategist at ADM Investor Service in London. Greek exports fell 7.5% in the first quarter, while Italy’s rose more than 3%. Tourism in Italy generated about €34 billion last year, almost triple what it did in Greece. With 60 million residents, Italy is more than five times as populous as Greece. History makes a difference, too. Rebuilding from World War II, Italy set off on the Dolce Vita boom years, popularizing the Vespa scooter and making a mark in international design.

Nutella, a nut-based chocolate spread introduced after the war, had annual sales of €8.4 billion last year, making the Ferrero family one of Italy’s richest. Greece, by contrast, went from government by junta in the 1960s and 1970s to a republic run by a political elite and a bloated government in the 1980s. Cutting its civil service and pension costs down to an appropriate size lies at the heart of the struggle between Greece and Europe on economic reform. Italy’s strength as an industrial exporter has provided stability, helping the country build up gold reserves of $90 billion—the world’s third-biggest stash after the U.S. and Germany and more than 20 times what Greece holds. Just a single Italian bank needed a public bailout after the 2008 crisis, even as dozens of lenders in northern Europe had to dip into state coffers to stay open.

[..] Italy may yet become another Greece. Aside from the recent uptick in growth, its numbers are grim. The global financial crisis of 2008-09, followed by the euro debt crisis, triggered the deepest and longest recessions in Italy’s postwar history. Its €2.3 trillion debt, more than 132% of GDP, is second only to Greece in the euro area. Italy has lost a quarter of its industrial output, and GDP has contracted by 9% since 2007. As a member of the euro zone, Italy can’t counter falling foreign demand by devaluing its currency, as it often did when the lira was in use. Unemployment is 12.5%, and 45% among youth—many of whom flee abroad. “Some of my best pupils, who speak English and other languages, have had to move to the U.K. or Germany to find jobs and a better future,” says Ivo Pezzuto at Università Cattolica in Milan

Read more …

“..we don’t believe in it and we should not be trying to implement a program whose logic we contest.”

• Interview: Yanis Varoufakis (ABCLateline)

EMMA ALBERICI: What was the point of the referendum then? The Greek people told you they didn’t want you to cave in to the demands from your eurozone partners and the IMF, but then that’s exactly what you’ve ended up doing.

YANIS VAROUFAKIS: That’s an excellent question, isn’t it? Let me remind you that on that night, the night of the referendum when I discovered that my prime minister and my government were going to move in the direction that you’ve mentioned, I resigned my post. That was the reason why I resigned, not because anybody else demanded it.

EMMA ALBERICI: So would it surprise you if you were forced back to the polls and indeed if you lost the next election?

YANIS VAROUFAKIS: Nothing would surprise me these days in Europe. We seem to be doing the wrong thing consistently. It’s a comedy of errors, from 2010 onwards. It’s my considered opinion that the responsible thing to do for our party will be to hand over the keys of government to those who believe in this program, in this fiscal consolidation reform program and the new loan, ’cause we don’t believe in it and we should not be trying to implement a program whose logic we contest.

EMMA ALBERICI: And it’s curious because at a time when Australia is debating a rise in the GST from 10 to 15%, the Greek people have seen their GST go up from 13 to 23% on public transport and processed foods. I mean, you didn’t get voted in to government – you actually got voted into government promising the opposite: no more austerity.

YANIS VAROUFAKIS: Precisely. It’s the reason why I resigned. To increase VAT in a broken economy like Greece to 23%, in an economy where the problem is not that the tax rates were too low, but the tax take was too low because of tax evasion. I spent five months in the Ministry of Finance trying to devise ways of having a new social contract between the state and the Greek people, the basis of which would be: we will reduce the rates for you, but you will pay it and you will not evade. And then you have the troika of lenders, the creditors, ruthlessly, effectively implementing the policies of a coup d’etat and putting our Prime Minister in a position where he had to choose between measures like the ones you mentioned, pushing VAT up to exorbitant heights, and therefore condemning our tax take to be reduced significantly or having our banks remain shut forever. This is a major assault both on rationality and on European democracy.

Read more …

“with the hope that my comrades will gain some time, and that we, all of us, united, will plan a new resistance to autocracy, misanthropy, and the (facilitated) acceleration and deepening of the crisis.”

• “Why I Voted ‘YES’ Tonight” (Yanis Varoufakis)

[..] .. in the document that I had sent to the institutions, I was merely accepting the responsibility of a “new Civil Code” and certainly not the one they would dictate. Nor would I have ever imagined that our government (under the supervision of the Troika) would accept to submit all those changes to the Parliament under the label “urgent”, thus negating all the adjustments and annulling the Parliament. Last Wednesday I had no other choice but to vote with a thunderous NO. Mine came to stand beside the NO that 61.5% of our compatriots answered to a capitulation under the infamous TINA (there is no alternative). I

have denied this for the past 35 years in all 4 continents where I have lived. Today, tonight, those two measures, which I had myself proposed on February, are introduced to the Greek Parliament in a manner that I had never imagined; a manner which adds no credit to the government of SYRIZA. My disagreement with the way we handled the negotiations after the referendum is essential. And yet, my main goal is to protect the unity of SYRIZA, to support A.Tsipras, and to stand behind E.Takalotos. I have already explained all that in my article with the title Why I voted NO published in EfSyn .

Accordingly, today I will vote YES, for two measures that I, myself, had proposed, albeit under radically different conditions and requirements. Unfortunately I am certain that my vote will not be of any help to the government towards our common goals. And that is because the Euro Summit “prior actions’ deal was designed to fail. I will, however offer my vote with the hope that my comrades will gain some time, and that we, all of us, united, will plan a new resistance to autocracy, misanthropy, and the (facilitated) acceleration and deepening of the crisis. (i) This morning, while participating at the Financial Committee of the parliament, I ascertained that no colleague of mine, not even the Minister of Justice, agreed with the new civil code. It was a sad spectacle.

Read more …

Daniel Munevar is a 30-year-old post-Keynesian economist from Bogotá, Colombia. From March to July 2015 he worked as a close aide to former Greek finance minister Yanis Varoufakis”

• Why I’ve Changed My Mind About Grexit (Daniel Munevar)

What do you make of the latest bailout agreed between Greece and its creditors? Well, first of all it’s still not clear that there will be an actual agreement – there are several parliaments that need to approve their country’s participation in an ESM bailout. And even if they somehow reach an agreement, there is simply no way it can work. The economics of the program are just insane. They haven’t announced the precise fiscal targets yet, but if we look at the Debt Sustainability Analyses (DSAs) published by the IMF and the Commission, they both state that the target should be a 3.5% primary surplus in the medium term.

But if you look at what has happened over the course of the past five years, Greece has managed to ‘improve’ its structural balance by 19 points of GDP. During that same time, GDP has collapsed by about 20% – that’s an almost one-to-one relation. So if you start from -1% – which is the general assumption for this year – to make it to 3.5 means you need an adjustment of over 4% of GDP, which means GDP will collapse by another 4 points between now and 2018. This brings us to another point, which is that the current agreement is just a taste of things to come. The final Memorandum of Understanding (MoU) is definitely going to contain much harsher austerity measure than the ones currently on the table, to offset the drop in GDP that we have witnessed in the past months as a result of the standoff with the creditors.

The problem is that these Memorandums are turning Greece into a debt colony: you’re basically creating a set of rules which, as the government misses its fiscal targets – knowing for a fact that it will –, will force the government to keep retrenching even more, which will cause GDP to collapse even further, which will mean even more austerity, etc. It’s a never-ending vicious circle. This underscores one of the core problems of this whole situation: i.e., that the institutions have always disentangled the fiscal targets from the debt sustainability analyses. The logic of having debt relief is that it allows you to basically have lower fiscal targets and distribute over time the impact of fiscal consolidation. But in Greece’s case, even if there is debt relief on the scale that they are suggesting – which is unlikely – Greece will still have to implement massive consolidation, on top of everything that has been already done.

Read more …

“.. in exchange for these loans, Merkel obtained much greater control over all eurozone governments’ budgets through a demand-sapping, democracy-constraining fiscal straitjacket..”

• The Eurozone’s German Problem (Philippe Legrain)

The eurozone has a German problem. Germany’s beggar-thy-neighbor policies and the broader crisis response that the country has led have proved disastrous. Seven years after the start of the crisis, the eurozone economy is faring worse than Europe did during the Great Depression of the 1930s. The German government’s efforts to crush Greece and force it to abandon the single currency have destabilized the monetary union. As long as German Chancellor Angela Merkel’s administration continues to abuse its dominant position as creditor-in-chief to advance its narrow interests, the eurozone cannot thrive – and may not survive. Germany’s immense current-account surplus – the excess savings generated by suppressing wages to subsidize exports – has been both a cause of the eurozone crisis and an obstacle to resolving it.

Before the crisis, it fueled German banks’ bad lending to southern Europe and Ireland. Now that Germany’s annual surplus – which has grown to €233 billion, approaching 8% of GDP – is no longer being recycled in southern Europe, the country’s depressed domestic demand is exporting deflation, deepening the eurozone’s debt woes. Germany’s external surplus clearly falls afoul of eurozone rules on dangerous imbalances. But, by leaning on the European Commission, Merkel’s government has obtained a free pass. This makes a mockery of its claim to champion the eurozone as a rules-based club. In fact, Germany breaks rules with impunity, changes them to suit its needs, or even invents them at will. Indeed, even as it pushes others to reform, Germany has ignored the Commission’s recommendations.

As a condition of the new eurozone loan program, Germany is forcing Greece to raise its pension age – while it lowers its own. It is insisting that Greek shops open on Sundays, even though German ones do not. Corporatism, it seems, is to be stamped out elsewhere, but protected at home. Beyond refusing to adjust its economy, Germany has pushed the costs of the crisis onto others. In order to rescue the country’s banks from their bad lending decisions, Merkel breached the Maastricht Treaty’s “no-bailout” rule, which bans member governments from financing their peers, and forced European taxpayers to lend to an insolvent Greece. Likewise, loans by eurozone governments to Ireland, Portugal, and Spain primarily bailed out insolvent local banks – and thus their German creditors.

To make matters worse, in exchange for these loans, Merkel obtained much greater control over all eurozone governments’ budgets through a demand-sapping, democracy-constraining fiscal straitjacket: tougher eurozone rules and a fiscal compact.

Germany’s clout has resulted in a eurozone banking union that is full of holes and applied asymmetrically. The country’s Sparkassen – savings banks with a collective balance sheet of some €1 trillion ($1.1 trillion) – are outside the European Central Bank’s supervisory control, while thinly capitalized mega-banks, such as Deutsche Bank, and the country’s rotten state-owned regional lenders have obtained an implausibly clean bill of health.

Read more …

Fischer (German Foreign Minister and Vice Chancellor from 1998-2005) is still a major voice in Germany. But he’s been awkwardly silent.

• The Return of the Ugly German (Joschka Fischer)

In terms of foreign policy, Germany rebuilt trust by embracing Western integration and Europeanization. The power at the center of Europe should never again become a threat to the continent or itself. Thus, the Western Allies’ aim after 1945 – unlike after World War I – was not to isolate Germany and weaken it economically, but to protect it militarily and firmly embed it politically in the West. Indeed, Germany’s reconciliation with its arch-enemy, France, remains the foundation of today’s European Union, helping to incorporate Germany into the common European market, with a view to the eventual political unification of Europe. But in today’s Germany, such ideas are considered hopelessly “Euro-romantic”; their time has passed.

Where Europe is concerned, from now on Germany will primarily pursue its national interests, just like everybody else. But such thinking is based on a false premise. The path that Germany will pursue in the twenty-first century – toward a “European Germany” or a “German Europe” – has been the fundamental, historical question at the heart of German foreign policy for two centuries. And it was answered during that long night in Brussels, with German Europe prevailing over European Germany. This was a fateful decision for both Germany and Europe. One wonders whether Chancellor Angela Merkel and Finance Minister Wolfgang Schäuble knew what they were doing. To dismiss the fierce criticism of Germany and its leading players that erupted after the diktat on Greece, as many Germans do, is to don rose-tinted glasses.

Certainly, there was nonsensical propaganda about a Fourth Reich and asinine references to the Führer. But, at its core, the criticism articulates an astute awareness of Germany’s break with its entire post-WWII European policy. For the first time, Germany didn’t want more Europe; it wanted less. Germany’s stance on the night of July 12-13 announced its desire to transform the eurozone from a European project into a kind of sphere of influence. Merkel was forced to choose between Schäuble and France (and Italy). The issue was fundamental: Her finance minister wanted to compel a eurozone member to leave “voluntarily” by exerting massive pressure.

Greece could either exit (in full knowledge of the disastrous consequences for the country and Europe) or accept a program that effectively makes it a European protectorate, without any hope of economic improvement. Greece is now subject to a cure – further austerity – that has not worked in the past and that was prescribed solely to address Germany’s domestic political needs. But the massive conflict with France and Italy, the eurozone’s second and third largest economies, is not over, because, for Schäuble, Grexit remains an option. By claiming that debt relief is “legally” possible only outside the eurozone, he wants to turn the issue into the lever for bringing about a “voluntary” Grexit.

Read more …

“Behind the curtain, the federalization of Europe is the ultimate goal, although politicians always denied that in front of the curtain.”

• Schäuble – The Man Behind the Throne (Martin Armstrong)

Many Europeans are starting to see a very hard-line German position championed by Schäuble, which they are characterizing behind the curtain as a more selfish edge by demanding painful measures from Athens and resisting any firm commitment to granting the Greek relief from crippling debt, despite the fact that it was such debt relief that enabled Germany to recover. Yet the position of Schäuble from the outset was his vision that the other nations must coordinate with the core, of which the other nations were not actually regarded. That perception of a selfish Germany has been fueled by Schäuble’s statement suggesting that Greece would get its best shot at a substantial cut in its debt ONLY if it was willing to give up membership in the European common currency. Schäuble is expected to take his tough stance once again with the next crash candidate. For many, that appears to be Italy, which is now considered the greatest risk within Euroland. Yet, his views are spelled out in his 1994 paper.

Schäuble seems to have foresaw the crisis back in 1994, distinguishing between core members and non-core members. Therefore, his thinking is quite different from that of France. Paris has jumped the gun after the Greece disaster and now want a core Europe push, but clearly with Italy as a full-fledged member into a new federalized Europe. Behind the curtain, the federalization of Europe is the ultimate goal, although politicians always denied that in front of the curtain. The curtain is starting to be drawn, but the equal federalization of Europe was never part of the German mindset. There seems to be a conflict emerging between Germany and France because France wiped out its economy with insane taxation. It too will fall in this next downward cycle.

Read more …

Schäuble has of course been at least as detrimental as Varoufakis to the conversation, but he’s still in place. Go figure.

• German FinMin Schäuble’s Tough Tone Heightens Uncertainty Over Bailout (WSJ)

Germany’s finance chief departed for his annual vacation on a posh North Sea island on Thursday, leaving the capital to mull a summer mystery that could decide Greece’s fate: What’s going on with Wolfgang Schäuble? Over the past two weeks, the 72-year-old Mr. Schäuble has puzzled even German officials who know the finance chief well with remarks questioning the wisdom of a new bailout for Greece. He has also hinted he might resign over differences with Chancellor Angela Merkel. The comments mark a shift to a more hawkish tone for Germany’s longest-serving national politician, whose career has been defined by loyalty to his political allies and to the idea of European integration.

They also underscore the fragility of last week’s agreement among eurozone leaders to work toward a new bailout deal for Greece, which governments will need to sign off on as early as next month. A person who works closely with Mr. Schäuble said the minister remained guided by a commitment to European interests—and that giving in to Greek demands, for instance, by forgiving debt would damage the EU’s credibility. The Finance Ministry is working to lay the groundwork for a new bailout, the person said, even though Mr. Schäuble’s preferred solution would have been for Greece to agree to a temporary “timeout” from the euro.

But Mr. Schäuble’s open skepticism over whether a new bailout would work has heightened uncertainty over what would happen once officials representing international creditors reached a preliminary deal with Athens, which is expected in the middle of next month. Over the weekend, Mr. Schäuble mused in response to a German magazine interviewer’s question about his differences on Greece with Ms. Merkel that he would resign if someone forced him to violate the responsibilities of his office. “I could go to the president and ask for my dismissal,” Mr. Schäuble told Der Spiegel, before adding that he wasn’t, in fact, considering resigning.

Read more …

“Greece was only a pipe through which French and German banks, for the most part, saved themselves.”

• Greece: Out of the Mouth of “Foreign Affairs” Comes the Truth (Bruno Adrie)

In an article by Mark Blyth titled “A Pain in the Athens: Why Greece Isn’t to Blame for the Crisis” and published on July 7th 2015 in Foreign Affairs, one discovers surprising statements, which are all the more surprising when one knows that this magazine is published by the Council on Foreign Relations that gathers the American élite, the New-Yorker banking élite being there for the most part. According to the author, “Greece has very little to do with the crisis that bears its name”. And, to make us understand this, he invites us to “follow the money—and those who bank it”. According to him, the origins of the crisis are not to be looked for in Greece but “in the architecture of European banking”.

Indeed, during the first decade of the euro, European banks, attracted by easy money, granted massive loans in what the author calls “the European periphery”, and, in 2010, in the middle of the financial crisis, banks had accumulated impaired periphery assets corresponding to €465 billion for French banks and €493 billion for German banks. “Only a small part of those impaired assets were Greek”, but the problem is that, in 2010, Greece published a revised budget equivalent to 15% of the GDP. Nothing to be afraid of actually since it only represented 0.3% of the Eurozone’s GDPs put together. But, because of their periphery assets and above all a leverage rate* twice as high—that is to say twice as risky—as the American banks’, European banks feared that a Greek default would make them collapse.

This is what really happened. The banks’ insatiable voracity led them, as always, to act carelessly, and, as they did not accept their failure, as always, they made sure that others would foot the bill. Nothing new under the golden sky of the Banking Industry, unless, this time, it went a bit further than usual. These banks set up the Troïka program in order to “stop the bond market bank run”. And no matter if it increased unemployment by 25% and destroyed the third of the country’s GDP. It doesn’t make much difference to the bankers. This is what the rescue plans have been used for. Apparently aimed at Greece, they were created by and for the major European banks. Today, given that the Greek can no longer pay French and German banks, even the European taxpayers are solicited.

Greece was only a pipe through which French and German banks, for the most part, saved themselves. On the total amount of €203 billion that represents the two rescue plans (2010-2013 and 2012-2014), 65% went right to the banks’ vaults. Some people even go so far as to say that 90% of the loans did not pass through Greece. This approach, expressed in the columns of Foreign Affairs, cannot be seen as heterodox. It is even confirmed by the ex-director of theBundesbank, Karl Otto Pöhl, who acknowledged that the rescue plan was meant to save the banks, and especially the French banks, from their rotten debts.

Read more …

The idea is to get the whole population on its kness.

• Greek Store Closures Spike As Recession, Austerity Return (AP)

Running a business in Koukaki is becoming a struggle. Shop-owners in the central Athens neighborhood, one of the capital city’s most financially diverse, are finding it a lot more difficult to get by. They could be cutting hair or selling extra-large shirts – it makes no difference. Their tales of hardship can be repeated up and down the country of nearly 11 million people. Empty storefronts are again a feature of Greeces towns and cities amid a crisis that put Greece’s future in the euro in doubt. The downturn worsened after the late-June decision by the Greek government to impose a series of strict controls on the free flow of money, with a paltry 60-euro a day limit on daily withdrawals from ATMs. Though banks reopened this week for the first time in more than three weeks, the ATM withdrawal limit is unchanged and cash is becoming scarce.

For an economy where cash payments are the norm, that’s a problem. In Koukaki, about 2 kilometers south of downtown Athens, 65-year-old mechanic Giorgos Prasinoudis is angry. His wife and 11-year-old daughter have already moved to Germany – the country that’s ironically blamed for many of the economic and social problems afflicting Greece. On Wednesday, he sat drinking coffee on the sidewalk outside his motorcycle repair shop, with posters of bikes and children’s drawings pinned to the wall. Hes closed the store after 32 years. A “For Sale” sign is taped to the window. “It’s over for Greece. We won’t recover for another 50 years,” he said. “The country borrowed so much money, those who benefited left the country, and ordinary people have been handed the bill …

I hope my daughter learns German and doesn’t come back. Not even for a holiday.” Prasinoudis is one of the countless victims of Greeces economic crisis. Locked out of international bond markets in the spring of 2010, the country has relied on foreign rescue money to pay its debts – on condition that tough austerity measures, such as cuts to spending and increases in taxes were imposed. The cost has been huge. A million jobs, mostly in the private sector, have been lost since then ? around a fifth of the country’s workforce. But after appearing to stabilize last year, the Greek economy has gone into reverse but unemployment remains high. At last count, unemployment was still over 25% and more than 50% for the under-25s.

Alongside the capital controls, the government imposed a new round of austerity, raising sales taxes and levies on businesses, while maintaining emergency taxes on households that have eaten up disposable incomes. Early Thursday, parliament approved a second round of measures demanded by rescue creditors for a new bailout. Retail associations fear a return to the peak levels of unemployment around 2012 when they were hit by a surge of business failures.

Read more …

“The argument that shipping companies will migrate to substantially higher cost locations to avoid tonnage taxes seems ludicrous.”

• A Few Thoughts On Greek Shipping And Taxes (Papaeconomou)

We have all witnessed a lot of Greek drama during the past few weeks as the impasse between the Greek government and its international creditors reached its climax. It now appears that after months of terse negotiations between the two parties, Greece has finally agreed to pass and implement austerity measures in exchange for financial aid. One of the innocent bystanders in all this has been the Greek shipping community. As part of the broad agreement between Athens and the Eurozone, the Greek government has undertaken to increase the tonnage tax, a flat tax that is assessed each year on all ships that are managed by shipping companies based in Greece.

As expected the shipping community has been up in arms crying foul over the proposed tax and threatening to leave to more tax-friendly locales like Monaco, Dubai, or Singapore. This has made me wonder: what would be the effect of increased tonnage tax on a shipping company’s running costs?

[..] Let’s assume for example that the Greek government unilaterally doubles the tonnage tax in accordance with the agreement provision. Star Bulk Carriers will have to pay an additional $129 per ownership day. Is this amount really the straw that will break the camel’s back and force a mass exodus of Greek shipping companies to greener pastures? I don’t think so. But let’s further assume that Greek shipping companies do decide to move to Monaco, Dubai, Singapore, or even London or New York. Have shipping executives done a cost of living comparison between say Monaco or New York City and Athens? The argument that shipping companies will migrate to substantially higher cost locations to avoid tonnage taxes seems ludicrous.

I believe the lobbying on behalf of Greek ship-owners is not about tonnage taxes, but about keeping their income tax-free status. Greek ship-owners are some of the hardest-nosed traders you can find. I don’t believe a tempest in a teapot will cloud their business acumen. I suspect that they will cut a deal with the taxman sooner or later, and if I may add, for the benefit of both sides.

Read more …

EU doesn’t want to help.

• Greek Financial Crisis Makes Its Migration Crisis Worse. EU Must Help. (WaPo)

Greece’s problems are many. Thanks to the financial crisis, citizens have endured long ATM lines and shortages in stores. Greece may be the last place in Europe equipped to handle its newest problem: record numbers of migrants, particularly Syrians, arriving daily by boat. Since the beginning of 2015, an astounding 79,338 migrants have arrived by sea, 60% of whom are Syrian. Slightly more migrants have transited to Greece than to Italy, a reversal from 2014, when Italy received 170,100 migrants and Greece only 34,442 total, according to estimates from the International Organization for Migration. These migrants pay traffickers exorbitant fees and risk their lives on dangerous journeys. Once arrived, they find the small communities on Greece’s many islands totally overwhelmed and unable to help. Most try to move northwards, to states like Hungary, via the Balkans.

Other migrants remain in hungry squalor throughout Greece. UNHCR recently reported more than 3,000 refugees in makeshift accommodations at a site on the northern Aegean island of Lesbos. Refugees kept in detention centers have limited access to electricity and water. Dozens sleep on makeshift pallets in the Kos police station courtyard. Greece’s financial crisis exacerbates xenophobia and discrimination against migrants. While many Greeks have rallied to help the migrants, the far-right portrays these migrants as taking precious resources and sullying Greek culture. Golden Dawn, a far-right party, said “We will do everything we can to protect the Greek homeland against immigrants.” Even before the 2015 surge, 84% of adults in Greece wanted decreased immigration — the highest proportion in the world — according to 2012 and 2014 Gallup interviews.

And Greece’s No. 1 industry, tourism, could suffer. Migrants crowd the sidewalks of island resort towns beside vacationers, but the contrast could hardly be starker between the wet and hungry arrivals from Iraq, Afghanistan and Syria, and the European tourists who dine on fine meals and rest in posh surroundings. Many migrants fleeing conflict-ridden states have walked almost 40 miles across Greece, sick, exhausted and sometimes pregnant, because they were not allowed to take public or private transportation due to a law that equated anyone assisting migrants with human smugglers. The law — overturned this month — kept both private citizens and public buses from driving migrants that landed in Greece without being rescued by coast guards.

Read more …

It needs to be abandoned.

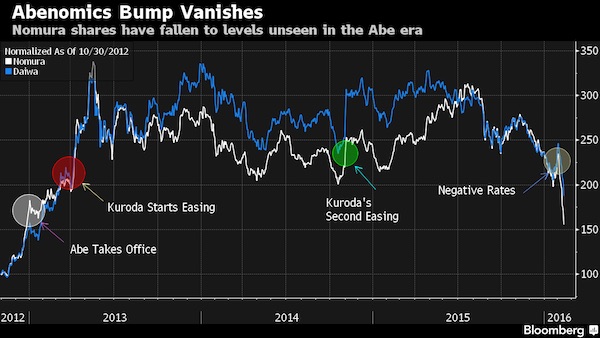

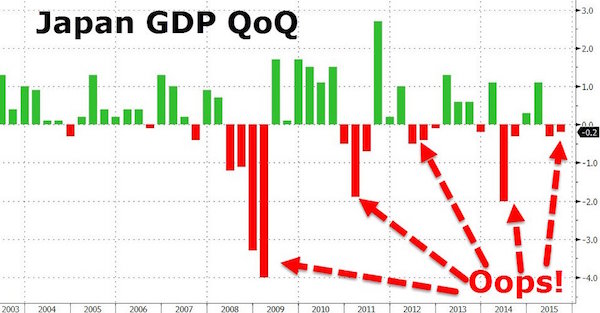

• Abenomics Needs To Be ‘Reloaded’, Warns IMF (CNBC)

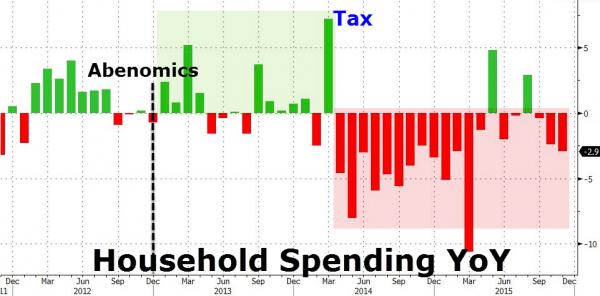

Japan needs to reduce its reliance on a weak yen to reflate its economy, the IMF warned, as it called on authorities to speed up “high impact” structural reforms and prepare for further monetary easing. “The Bank of Japan needs to stand ready to ease further, provide stronger guidance to markets through enhanced communication, and put greater emphasis on achieving the 2% inflation target in a stable manner,” the IMF said in its 2015 Article IV Consultation with Japan published late Wednesday. Under current policies, the central bank won’t meet its 2% inflation target in the medium-term, or over a five-year horizon, according to the international lender. After rising to 1.5% in mid-2014, core inflation – excluding fresh food and the effects of the consumption tax increase – has declined rapidly and has been close to zero since February 2015.

“Abenomics needs to be reloaded so that policy shortcomings do not become a drag on growth and inflation,” the IMF said. Abenomics refers to three-pronged economic revival plan launched by Prime Minister Shinzo Abe in late 2012, consisting of monetary easing, fiscal expansion and structural reforms. Deeper structural reforms must accompany further easing if the government is to achieve its inflation goal, the IMF stressed. “With the exception of corporate governance and some progress on female labor force participation, structural reforms have not yet been in areas that could provide the biggest bang for the buck,” it said.

Read more …

Much too late.

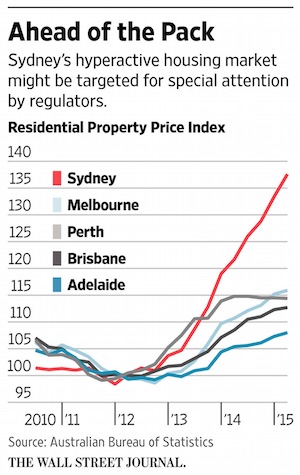

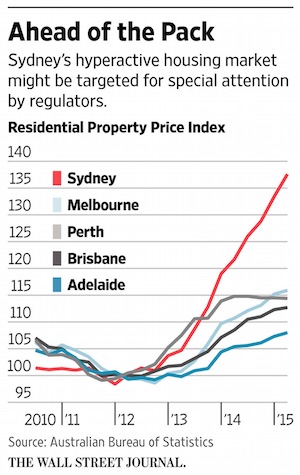

• Australia Weighs Steps to Rein In Sydney Property (WSJ)

Fast-rising house prices are prompting regulators in New Zealand and Australia to try, or consider, measures to prick nascent bubbles in single cities, an unusual move for any country. In Auckland, New Zealand’s biggest city, property prices have jumped 17% over the past year, compared with a nationwide average of 9.3%, and now are more than 50% higher than eight years ago. Sydney prices have risen about four times as fast as those in almost all other Australian state capitals in the past 12 months. It is rare for countries to focus tough new clamps on a single city or district. But a surge in homegrown speculators, and of buyers from countries such as China, has left too many people chasing too few properties in Sydney and Auckland.

Policy makers are increasingly concerned that a sudden crash could derail their economies. In Australia, Sydney-specific regulation is merely under discussion. But in New Zealand, measures to limit the impact of a price surge in Auckland are in place already: From October, real-estate investors in the city will be required to put down deposits of at least 30% on properties they want to purchase. No such rules will apply to property investment in other cities. Until now, Australian policy makers have sought to temper house-price growth by restricting lending to speculators and making it costlier to provide mortgages to residential buyers generally, anywhere in the country. In the past several weeks, however, the central bank has made clear it sees the issue as essentially a local one, describing soaring prices in the nation’s most populous city as “crazy.”

The narrowing focus on Sydney has triggered speculation that similar moves to New Zealand’s may be in the offing, steered by the banking regulator. “The boom is now quite singularly in Sydney,” said George Tharenou at UBS. “It’s difficult and very micro to target Sydney house prices, but it’s getting to the point where it needs to be considered.” Earlier this month, Citigroup said the risk of a crash had become so real that it was time to stop banks lending so freely to Sydney property investors specifically. “The horse has already bolted,” said Paul Brennan at Citi Research, Australia. “Additional prudential measures directed at the Sydney market may be unavoidable, even if it is late in the cycle.”

Read more …