Harris&Ewing “Slaves reunion DC. Ages: 100, 104, 103; Rev. Simon P. Drew, born free.” 1921

Rising health care costs prop up US GDP. We all know that’s not a good thing.

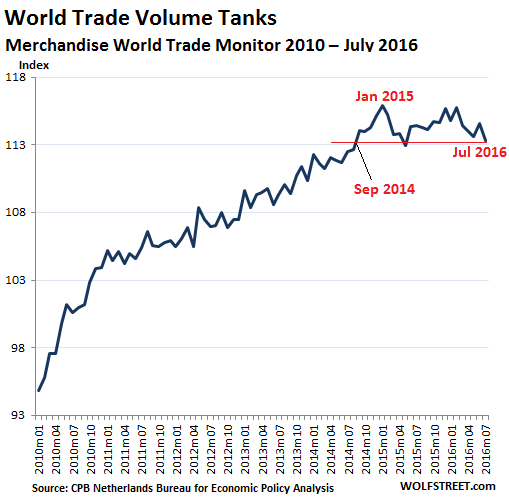

• World Trade Grinds Lower, Hits 2014 Levels (WS)

World trade in merchandise is a reflection of the global goods-producing economy. And it just can’t catch a break. The CPB Netherlands Bureau for Economic Policy Analysis, a division of the Ministry of Economic Affairs, just released the preliminary data of its Merchandise World Trade Monitor for July. The index fell 1.1% from June to 113.4, the lowest since May 2015 – a level it had first reached on the way up it in September 2014. The chart shows that merchandise world trade isn’t falling off a cliff, as it had done during the financial crisis, when global supply chains suddenly froze up. But it’s on a slow volatile grind lower. And compared to the fanciful growth after the Financial Crisis, it looks outright dismal:

This time – after the big adjustment in values months ago – we have another statistical note. In this data release, the CPB shifted the base year of the series from 2005 to 2010, so the values of the entire index shifted down. Hopefully, the change made the series more representative of reality – because getting a good grip on reality these days is really hard, when entire data systems are carefully designed to conceal more than they reveal (such as the official inflation data). The decline in trade was sharper in the emerging economies than the advanced economies. That makes sense: The US, on whose demand the health of the entire world economy seems to depend, experienced falling imports in July, according to the data.

Data point after data point document that the goods-based economy in the US is in trouble – manufacturing, wholesale, retail… nothing is firing on all or even most cylinders. But the service-based economy is not doing all that badly. Its biggest sector – and the biggest sector overall in the US – healthcare, is doing quite well, actually. Among the health-care companies in the S&P 500, revenues rose 5.2% in the second quarter, year over year, when revenues for all S&P 500 companies fell 3.1%. Revenues rose not because people are getting more health care; they rose because health care has been getting more expensive at a breath-taking pace for many years as the industry has been consolidating into oligopolies and as outrageous prices increases on pharmaceutical products regularly grace the headlines.

“They were trying to mix all kinds of powders and chemicals to produce essentially gold. And they all failed..”

• ‘When I Think Of Central Banks, I Think Of Alchemists’: Marc Faber (CNBC)

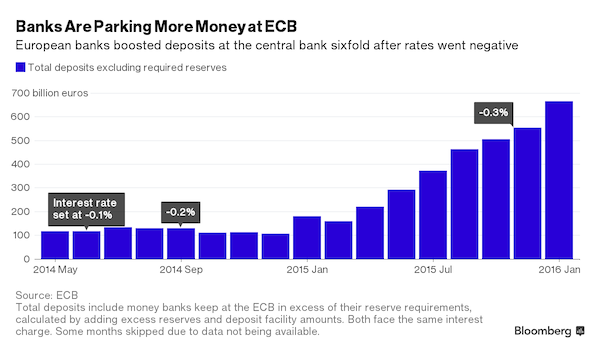

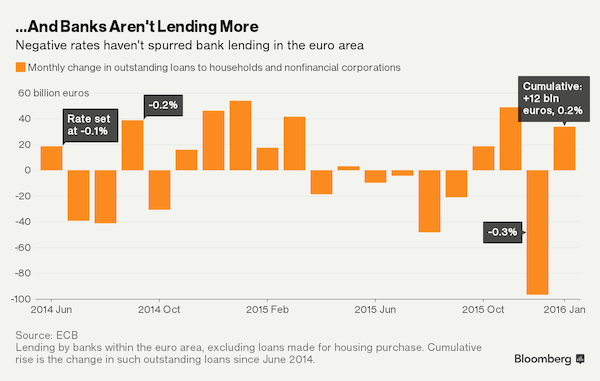

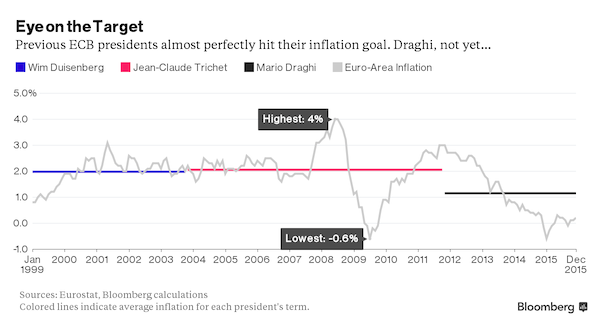

Central bankers trying to spur growth are like alchemists trying to make gold and they’re just as likely to fail, said Marc Faber, the publisher of the Gloom, Boom & Doom report. “When I think of central banks, I think of alchemists,” Faber, also known as Dr. Doom for his pessimistic views, told CNBC’s “Squawk Box” on Thursday. “They were trying to mix all kinds of powders and chemicals to produce essentially gold. And they all failed,” he said, although he noted that some alchemists did produce other useful chemicals during their ill-fated search for the precious metal. “But the central banks are just mixing water, in other words, paper money, and the results cannot be a favourable outcome in the long run.”

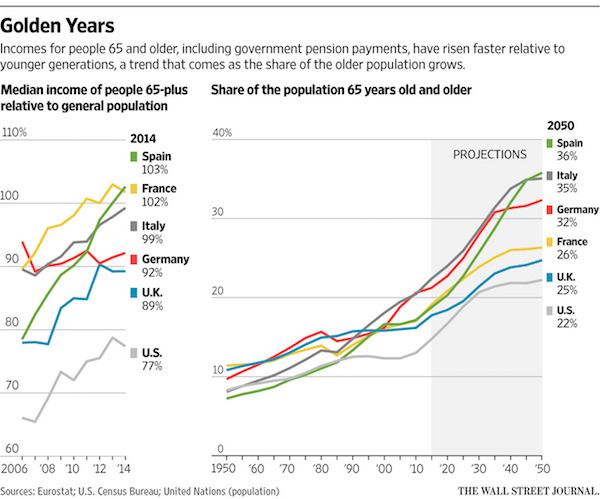

Faber noted that from the 1970s to the mid-1980s, people believed inflation was “forever,” but now the same central banks that were fighting inflation were now fighting deflation. This fight was a mistake, he said, claiming that across Asia, price rises were exceeding income gains. “It’s possible that suddenly inflationary pressures will be there, that central banks should then act but they cannot because the system is so overleveraged,” he said. At the same time, Faber noted that the low and negative interest rates globally were hurting pension funds. “Pension funds, even in these beautiful years of returns, 2009 to today, they have become less funded, they have become more underfunded,” he said. “With interest rates at zero and this low, their portion that’s in bonds is never going to meet the expected returns of 7.5%. It’s physically not possible.”

Alchemists and arsonists.

• Central Bankers Are The Arsonists That Create The Fire: Bill Fleckenstein (ZH)

Having been invited on to CNBC to discuss his views of the market, famous short-seller Bill Fleckenstein explained rather eloquently that QE4 is coming and people will wake up to the fact that central bankers “are the arsonists that create the fire, not the firemen that put it out.” This non-mainstream view was treated with disdain by CNBC host Tim Seymour who slammed Fleckenstein for “missing out” on the “artificial market’s” (because even CNBC now admits that’s what it is) gains. The response was epic. “Don’t be such a jerk… I don’t ask to come on this show, you invited me… and don’t get in my face because I won’t join your party…”

A $2 trillion black hole.

• Bad Debts In Chinese Banking System 10 Times Higher Than Admitted: Fitch (AEP)

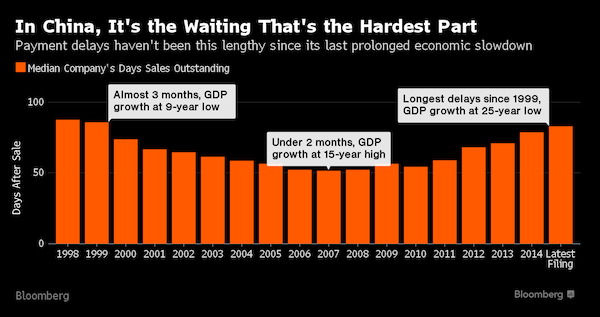

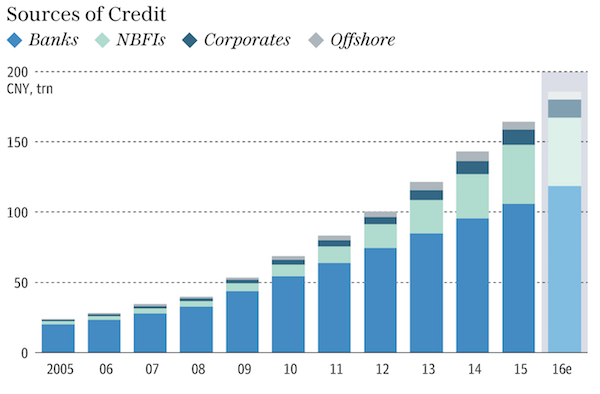

Bad debts in the Chinese banking system are ten times higher than officially admitted, and rescue costs could reach a third of GDP within two years if the authorities let the crisis fester, Fitch Ratings has warned. The agency said the rate of non-performing loans (NPLs) has reached between 15pc and 21pc and is rising fast as the country delays serious reform, relying instead on a fresh burst of credit to put off the day of reckoning. It would cost up to $2.1 trillion to clean up this toxic legacy even if the state acted today, and much of this would inevitably land in the lap of the government. “There are already signs of stress that point to NPLs being much higher than official estimates (1.8pc), most obviously the increased frequency with which the banks are writing off or offloading loans,” it said.

The banks have been shuffling losses off their balance sheets through wealth management vehicles or by classifying them as interbank credit, seemingly with the collusion of the regulators. Loans are past 90 days overdue are not always deemed bad debts. “The longer debt grows, the greater the risk of asset quality and liquidity shocks to the banking system,” said Fitch. Capital shortfalls are currently 11pc to 20pc of GDP, but this threatens to hit 33pc in a worst case scenario by the end of 2018. “Defaults in China could lead to mutual credit guarantees in the background pulling other firms into distress. A large increase in real defaults risks triggering a chain of bankruptcies that magnifies the potential for financial instability,” it said.

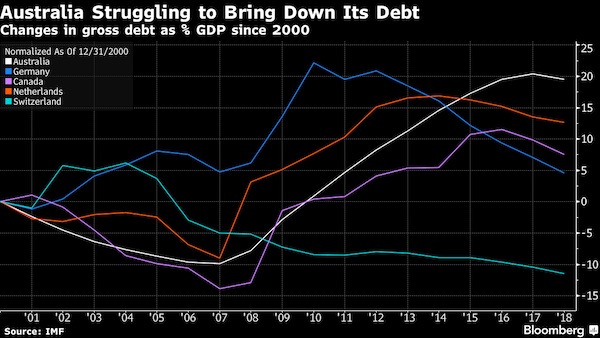

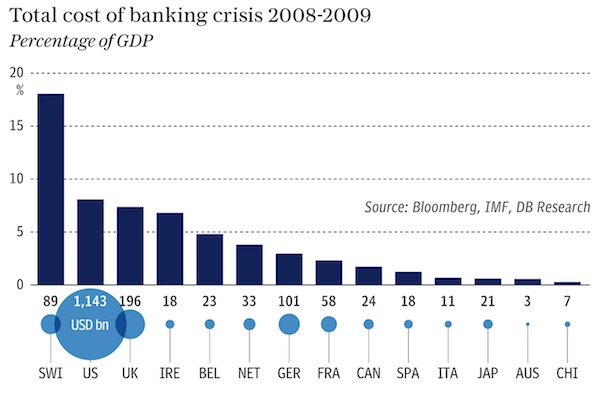

“Mid-tier banks have the weakest buffers, and are the most vulnerable to funding stress,” said the report, by Jonathan Cornish and Grace Wu. The damage eclipses losses during the global financial crisis in Britain and the US, where the direct costs of bank rescues were roughly 8pc of GDP. It would be closer to the trauma suffered by Ireland, Greece, and Cyprus when their banking systems collapsed, but on a vastly greater scale. The Chinese state has deep pockets but strains are mounting. Public debt has reached 55pc of GDP following the bail-out of local governments. This is now higher than among ‘A’ rated peers, mostly in the developing world. “Pressure on China’s sovereign rating could emerge if general government indebtedness were to rise significantly,” said the Fitch report.

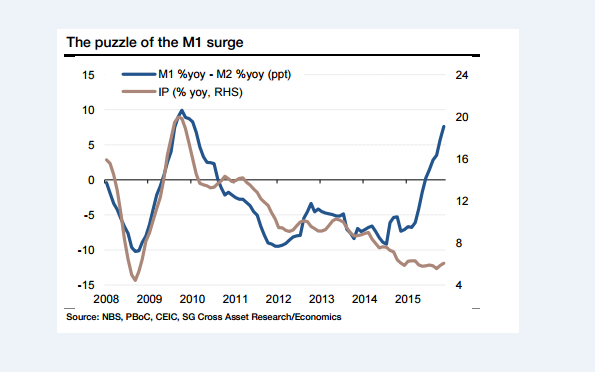

China let rip with a fresh burst of credit growth from the middle of last year after a series of policy errors triggered a recession – with ‘Chinese characteristics’ – in early 2015. It ditched any serious effort to reform the economy and opted for stimulus as usual, cutting interest rates and the reserve requirement ratio. Credit reached 243pc of GDP by the end on last year, double the level in 2008. Banking system assets have grown by $21 trillion over that time, 1.3 times greater than the entire US commercial banking nexus.

“Defaults mean loans and bonds won’t be paid back. The owners of the bonds and debt (mortgages, auto loans, etc.) will have to absorb massive losses.”

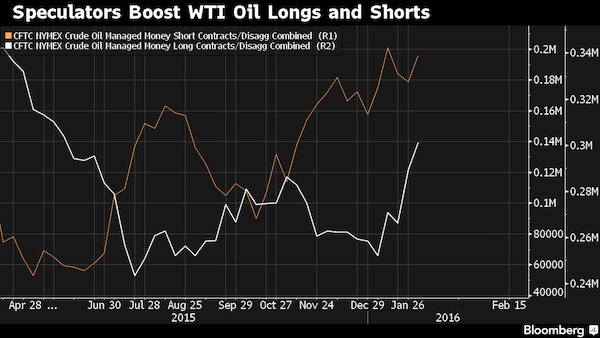

• The Coming Wave of Defaults Will Be Devastating (CH Smith)

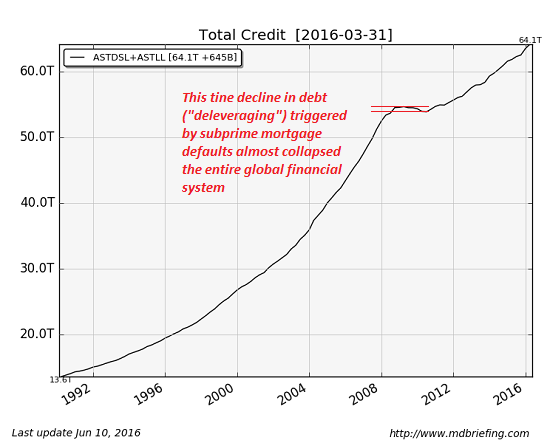

In an economy based on borrowing, i.e. credit a.k.a. debt, loan defaults and deleveraging (reducing leverage and debt loads) matter. Consider this chart of total credit in the U.S. Note that the relatively tiny decline in total credit in 2008 caused by subprime mortgage defaults (a.k.a. deleveraging) very nearly collapsed not just the U.S. financial system but the entire global financial system. Every credit boom is followed by a credit bust, as uncreditworthy borrowers and highly leveraged speculators inevitably default. Homeowners with 3% down payment mortgages default when one wage earner loses their job, companies that are sliding into bankruptcy default on their bonds, and so on. This is the normal healthy credit cycle.

Bad debt is like dead wood piling up in the forest. Eventually it starts choking off new growth, and Nature’s solution is a conflagration–a raging forest fire that turns all the dead wood into ash. The fire of defaults and deleveraging is the only way to open up new areas for future growth. Unfortunately, central banks have attempted to outlaw the healthy credit cycle. In effect, central banks have piled up dead wood (debt that will never be paid back) to the tops of the trees, and this is one fundamental reason why global growth is stagnant. The central banks put out the default/deleveraging forest fire in 2008 with a tsunami of cheap new credit. Central banks created trillions of dollars, euros, yen and yuan and flooded the major economies with this cheap credit.

They also lowered yields on savings to zero so banks could pocket profits rather than pay depositors interest. This enabled the banks to rebuild their cash and balance sheets – at the expense of everyone with cash, of course. Having unleashed tens of trillions of dollars in new credit since 2008, the central banks have simply increased the likelihood and scale of the coming default conflagration. Now the amount of deadwood that’s piled up is many times greater than it was in 2008. Very few observers explore what happens after defaults start cascading through the system. Defaults mean loans and bonds won’t be paid back. The owners of the bonds and debt (mortgages, auto loans, etc.) will have to absorb massive losses.

We’ve been alarmed about it for years.

• Time to ‘Be Alarmed’ about Emerging Market Debt: UN (DQ)

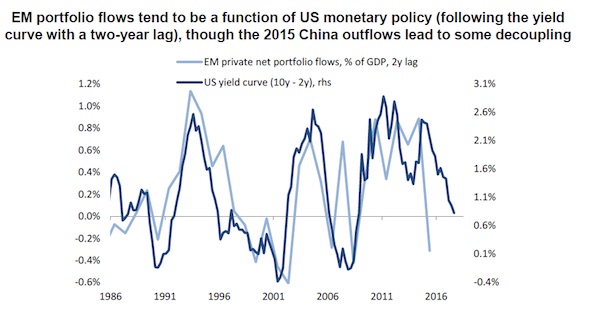

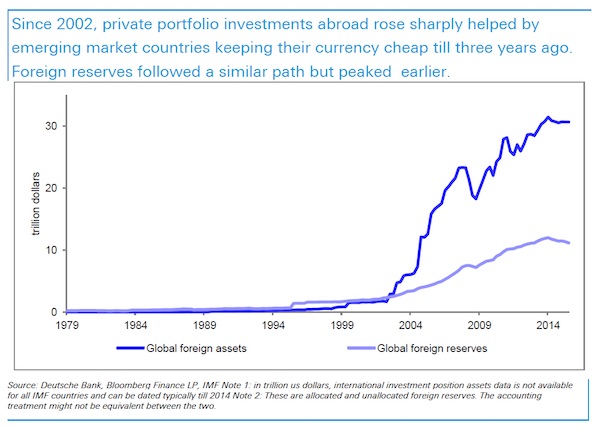

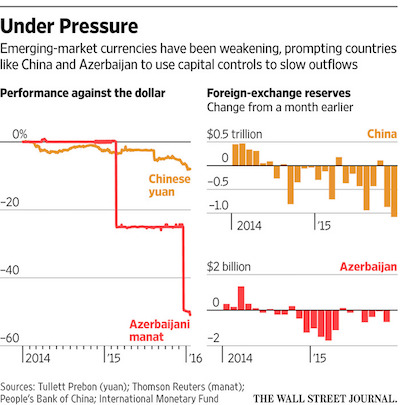

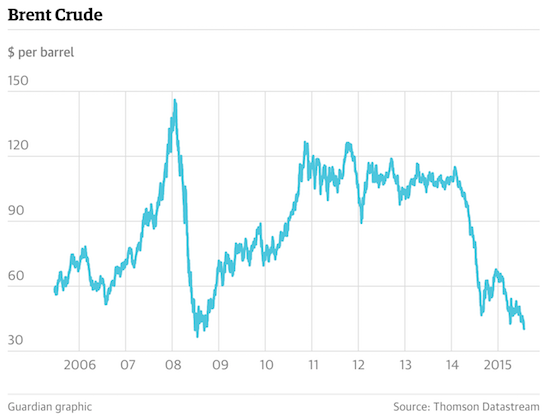

[..] It was the peak of the emerging market bubble, when the amount of debt that low-income developing economies could have sold to eager investors seemed almost limitless. The main reason for this unprecedented surge in appetite for EM debt was the huge monetary expansion unleashed in many of the world’s major economies, led by the Fed’s QE program. The result was the now-all-too-familiar reality of anemic (at best) yield opportunities in developed markets, prompting investors to seek out much riskier emerging market assets. The moment the Fed turned off the spigot, in mid-2014, the flow of funds began to reverse, according to the report, creating ripe conditions for a “prolonged commodity price shock, steep currency depreciations and worsening growth prospects,” which have “quickly driven up borrowing costs and debt-to-GDP ratios.”

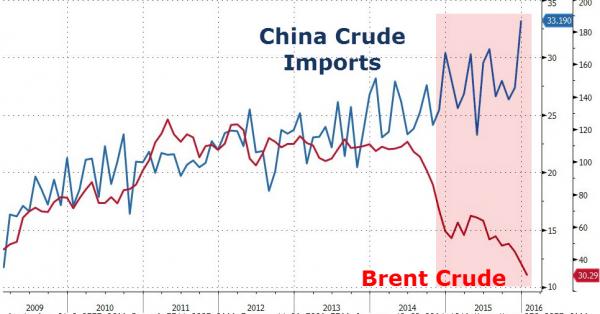

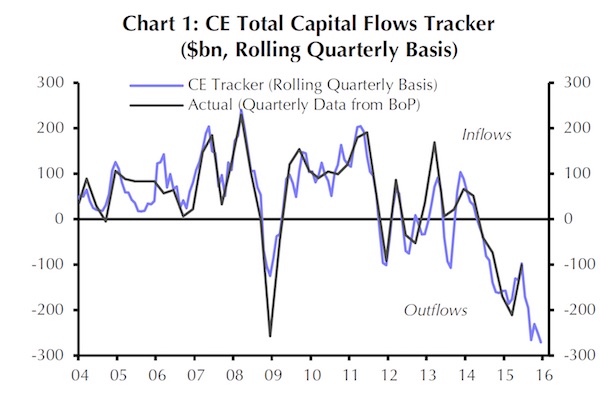

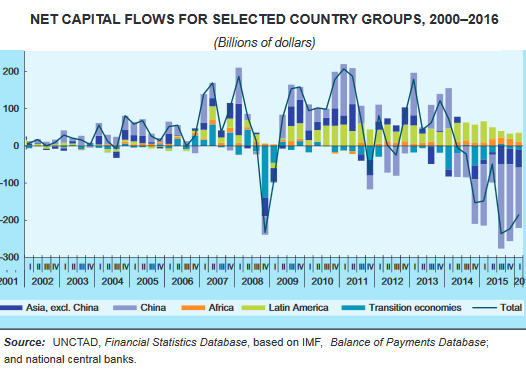

For the first time since the Latin American debt crisis in the second half of the 1980s, aggregate net capital flows entered negative territory. Aggregate outflows reached $656 billion in 2015 and $185 billion in the first quarter of 2016. The capital flight was particularly pronounced in China and other parts of Asia. Note how capital flight heated up in 2014 toward the end of the Fed’s “QE Infinity”.

More consequences of unbridled manipulation of financial markets.

• The Ted Spread Is Dead, Baby. The Ted Spread Is Dead (WSJ)

A measure of stress in financial markets, whose alarm bells heralded the 2008 financial crisis, just hit its highest level in over seven years. But don’t worry. It turns out the so-called Ted Spread might be dead, an unlikely casualty of the recent changes in U.S. money-market regulation. This spread charts the difference between the London interbank offered rate and the yield on three-month U.S. Treasury bills. Libor is a dollar-denominated global gauge of private-sector credit strength, particularly that of banks, and three-month bills measure an ultrasafe bet—the U.S. government’s creditworthiness. Ted stands for Treasury-Eurodollar rate, the Eurodollar being the greenback denominated lending reflected in the Libor rate.

If the difference, or spread, between what banks charge each other increases compared with yields on safe government debt, that reflects an elevated risk of defaults in the private sector that the banking sector lends to. For the past year and a half the spread has been creeping higher, rising from 0.2 of a percentage point at the turn of 2015, to 0.653 of a percentage point on Wednesday. That is the highest it has been since May 2009, in the aftermath of the global financial crisis, surpassing other moments of extreme stress, like the euro sovereign-debt crisis around 2011. But there is a problem with that. Looming U.S. regulation of money-market funds has driven Libor higher, meaning that it isn’t quite the indicator that it once was.

Blair and Cameron’s scorched earth.

• UK Councils ‘Building Up Dangerous Levels Of Debt And Risk’ (Ind.)

Cash-strapped local councils are building up dangerous levels of risk and debt as they turn to commercial ventures in a bid to raise funds, credit agencies and campaigners have warned. Moody’s, the credit agency, warned that a series of ambitious plans to boost revenue by setting up businesses could put council tax payers at risk should they run into difficulties. The warning, in a report into local government finance, comes amid mounting evidence that local authorities are increasingly turning to borrowing after a run of tough settlements with central Government. Roshana Arasaratnam, a senior credit officer at Moody’s, said in the wake of the report’s publication:

“Borrowing to invest in commercial projects exposes local authorities to additional credit risk, as the revenues that flow from these projects are inherently uncertain. “Those adopting this strategy also face increased project execution risk, and greater competition from the private sector.” Ms Arasaratnam said such borrowing contrasted sharply with local authorities’ traditional investments in schools, housing and transport which are underpinned by government grants and do not depend on generating revenues from commercial activities. The report highlights a series of business ventures set up by councils, some of which are now on negative credit watch. They include Warrington Borough Council, which in 2015 issued £150m of bonds to support an economic development plan aimed at increasing business rate revenues.

Paper wealth is not wealth.

• You’re Not as Rich as You Think (Satyajit Das)

The idea that the world is awash in savings – one factor driving the theory of secular stagnation – is, on the surface, a persuasive one. Too bad it may not be true. Yes, the postwar generation is wealthier than any before it. But the ultimate value of any investment depends upon being able to convert it into cash and thus generate purchasing power. In fact, the world’s accumulated wealth – around $250 trillion, according to Credit Suisse’s Global Wealth Report – is almost certainly incapable of realization at its paper value. The headline number thus vastly overstates the supposed savings glut. Most of these savings are held in two forms: real estate, primarily principal residences, and retirement portfolios that are invested in stocks and bonds.

Both are rising in value. A combination of population growth, higher incomes, increased access to credit, lower rates and, in some cases, limited housing stock have driven up home prices; those who got in early have done especially well. Meanwhile, increased earnings and dividends, driven by economic growth and inflation, have boosted equity values. So have loose monetary policies designed to counteract the Great Recession since 2009. Yet the appreciating value of one’s own home doesn’t automatically translate into purchasing power. A primary residence produces no income. Indeed, maintenance costs, utility bills and property taxes – which often rise along with home prices – mean that houses are cash-flow negative.

As soon as they understand the magnitude of the numbers, they’ll look the other way.

• Deutsche Bank Woes Sparks Concern Among German Lawmakers (BBG)

Deutsche Bank’s finances, weakened by low profitability and mounting legal costs, are raising concern among German politicians after the U.S. sought $14 billion to settle claims related to the sale of mortgage-backed securities. At a closed session of Social Democratic finance lawmakers this week, Deutsche Bank’s woes came up alongside a debate over Basel financial rules, according to two people familiar with the matter. Participants discussed the U.S. fine and the financial reserves at Deutsche Bank’s disposal if it had to cover the full amount, according to the people, who asked not to be identified because the meeting on Tuesday was private. While the participants – members of the junior party in Angela Merkel’s government – didn’t reach any conclusions on the likely outcome, the discussion signals that the risks have the attention of Germany’s political establishment.

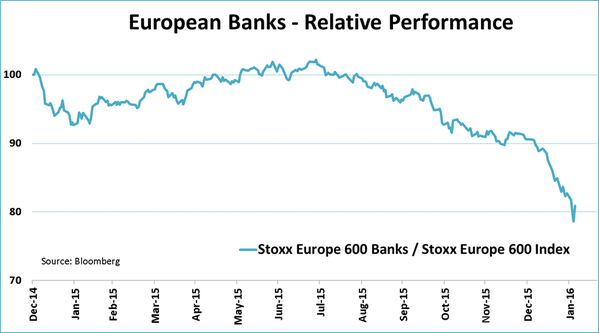

The German Finance Ministry last week called on the U.S. to ensure a “fair outcome” for Deutsche Bank, citing cases against other banks where the government settled for reduced fines. Pressure on Germany’s biggest lender has increased since German Finance Minister Wolfgang Schaeuble told Bloomberg Television on Feb. 9 that he has “no concerns about Deutsche Bank.” Germany’s biggest bank was already ranked among the worst-capitalized lenders in European stress tests before U.S. authorities demanded $14 billion during initial talks to settle a probe into how it handled mortgage securities during the 2008 financial crisis. The announcement led Deutsche Bank’s riskiest bonds to plunge.

Never ending story. Because it can’t end well.

• Regulators Expect Monte Dei Paschi To Ask Italy For Help (R.)

European regulators expect Italian bank Monte dei Paschi di Siena will have to turn to the government for support, three euro zone officials with knowledge of the matter said, although Rome would strongly resist such a move if bondholders suffered losses. Less than two months after the Tuscan lender announced an emergency plan to raise €5 billion of fresh capital, having come last in a health check of 51 European banks, there is growing concern among European regulators that the cash bid will fall short. While the bank is determined to see through the capital raising, if it were to disappoint, it would be left with a capital hole. Now euro zone authorities are considering whether state support would have to be tapped after what bankers have described as slack interest in the bank’s share offer.

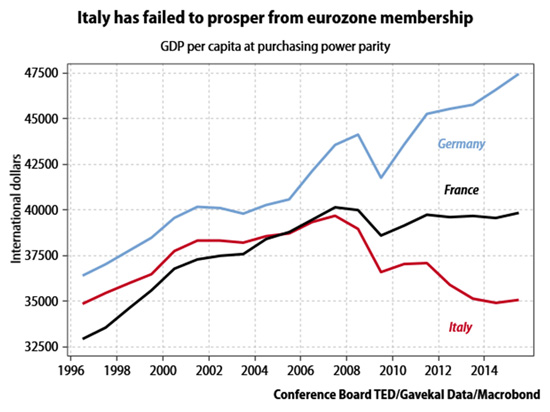

“There is clearly an execution risk to the capital raising,” said one official with knowledge of the rescue attempt, adding that the bank’s value, about one ninth the size of the planned €5 billion cash call, would be a turn-off for investors. That person said a “precautionary recapitalization by the Italian state” could be used to make up any shortfall once attempts to raise fresh cash from investors had concluded in the coming months. [..] Monte dei Paschi faces a considerable challenge in convincing investors to back its third recapitalisation in as many years. Further complicating the picture, a constitutional referendum, expected to be held by early December that could decide the future of Renzi, is likely to push the bank’s fund-raising into next year, the officials say. The bank’s fragile state poses a threat to confidence in other Italian lenders and even to heavily-indebted Italy, the euro zone’s third-largest economy.

There’s 24/7 propaganda and then there’s reality. It’s about air time more than anything else.

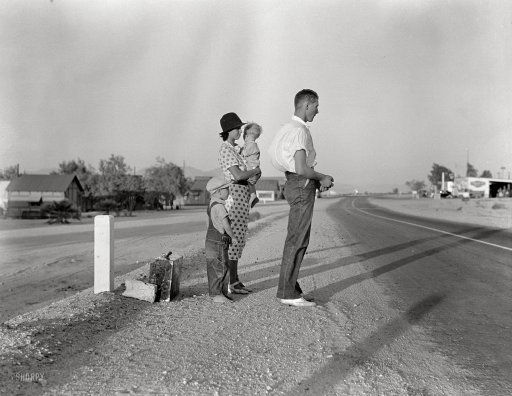

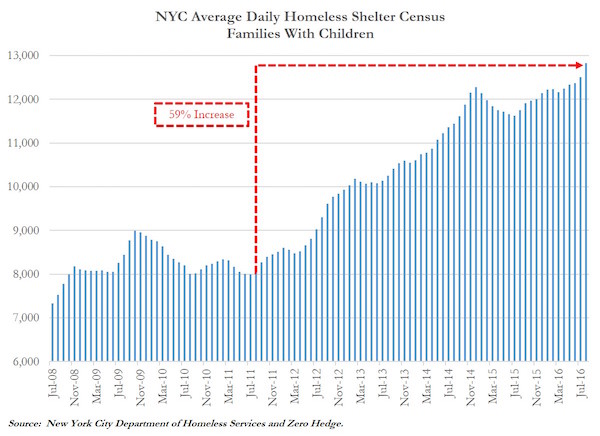

• How Does A 60% Increase In NYC Homelessness Constitute A Recovery? (ZH)

[..] ..courtesy of data from the New York City Department of Homeless Services, we have a couple of additional charts to add to the list like the one below that shows a ~60% increase in the number of NYC families living in homeless shelters over the past five years. Aside from an increse during the “great recession”, the number of New York City families living in homeless shelter remained fairly constant at around 8,000 from July 2008 through July 2011. That said, over the following 5 years beginning in August 2011 through today, NYC has experienced a nearly 60% increase in the number of families living in homeless shelters to nearly 13,000. Ironically, the increase in homelessness experienced during the “great recession” was just a blip on the radar compared to the past five years as residential rental rates in NYC have soared.

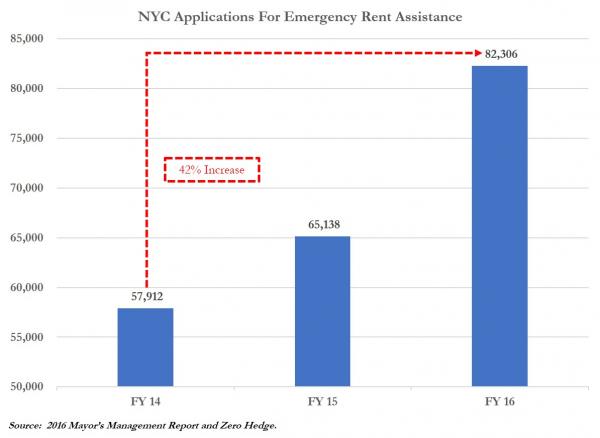

Alternatively, we offer up the following statistics from Mayor Bill De Blasio’s Fiscal 2016 “Mayor’s Management Report” highlighting a 42% increase in applications for “Emergency Rent Assistance” from New York City families at risk of losing their housing. If this is what a “recovery” looks like to Obama we would certainly like to better understand how he would define a recession.

“..journalism should not be used as a “weapon of destruction against persons and even entire peoples..“

• Pope Francis: Journalism Based On Gossip And Lies Is A Form Of Terrorism (G.)

Journalism based on gossip or rumours is a form of “terrorism” and media that stereotype entire populations or foment fear of migrants are acting destructively, Pope Francis has said . The pope, who made his comments in an address to leaders of Italy’s national journalists’ guild, said reporters had to go the extra mile to seek the truth, particularly in an age of round-the-clock news coverage. Spreading rumours is an example of “terrorism, of how you can kill a person with your tongue“, he said. “This is even more true for journalists because their voice can reach everyone and this is a very powerful weapon.“ In Italy, a number of newspapers are highly politicised and are regularly used to discredit those with differing political views, sometimes reporting unsubstantiated rumours about their private lives.

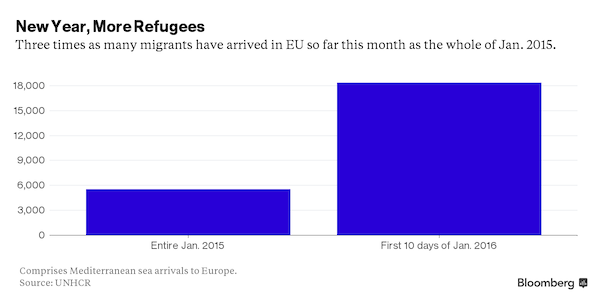

In 2009 several media outlets owned by the family of then-prime minister Silvio Berlusconi came under fire from the journalists’ guild over stories questioning the trustworthiness of a magistrate who had ruled against a company owned by the Berlusconi family. The stories were filled with insinuations about the way he dressed, including the colour of his socks, and the way he took walks in the park. The pope, who has often strongly defended the rights of refugees and migrants, said journalism should not be used as a “weapon of destruction against persons and even entire peoples“. “Neither should it foment fear before events like forced migration from war or from hunger,” he added.

A highly developed culture 10s of 1000s of years before anywhere else on the planet. Ignored as such by Europe and North American bias.

• Indigenous Australians The Oldest Living Culture; It’s In Our Dreamtime (G.)

Australia’s Aboriginal people have already been using the tag of “world’s oldest living culture” before given scientific confirmation in a recent study of the DNA of Australia’s Indigenous people. One likely response to the finding from the subjects of the research is a satisfied, “I told you so”. Scientific research often reaffirms what is in an oral history. This has been particularly so in Australia where cultural stories – often referred to as Dreamtime stories – that describe land movements and floods fit in with what later becomes known about seismic and glacial shifts from the geological record. For example, Associate Professor Nick Reid and Professor Patrick D. Nunn have analysed stories from Indigenous coastal communities and have seen a thread of discussions about the rise of tidal waters that occurred between 6,000 and 7,000 years ago.

And these are the newer stories. Other stories collected from around Cairns showed that stories recalled a time when the land covered the area that is now the Great Barrier Reef and stories from the Yorke Peninsula reference a time when there was no Spencer Gulf (it is now 50m below sea level). Reid and Nunn hypothesise that this could make these stories over 12,000 years old. So oral history and observation can reinforce what the science says. Or science can confirm what we’ve been saying all along. For many older Indigenous people, the cultural stories will seem the more trustworthy. There are historic reasons why Indigenous people remain suspicious of science practiced by Europeans, who have not yet countered the legacy of their obsessions with head measuring and blood quantum.

Aboriginal culture and traditions have been often viewed through a Eurocentric gaze that has failed to see the wisdom contained within its values and teachings. Cultural stories were often illustrated for children without looking for deeper meanings and codes. These stories didn’t just tell a tale of how the echidna got its spikes, they contained – like parables in the bible – a set of messages about the importance of sharing resources in a hunter-gatherer society and the consequences of selfishness.