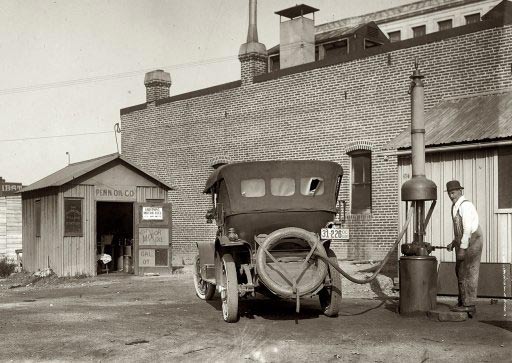

NPC Penn Oil Co., Massachusetts Avenue and North Capitol, Washington DC 1920

I can’t seem to get away from Ukraine and Iraq lately. Don’t know if I should apologize for that, but I certainly never had any intention of writing about politics. It’s just that it all seems to come together now, power games, waning energy resources and – the remnants of – hugely indebted societies. We’re taking our first baby steps on the downward ladder, so to speak, and we’re already having trouble keeping our balance. Where will this lead?

The US, UK and France are dropping supplies aimed at helping the Yazidi people on Mount Sinjar in western Iraq. Russia sends 280 trucks with supplies towards the Ukraine border, supplies aimed at helping the people in Luhansk (where people have had no power or water supply in at least 10 days) and Donetsk. The first set of supplies gets applauded, the second one is treated with allegations and suspicions (“fears of a full-scale Russian invasion disguised as humanitarian assistance”).

Russia says it may take a few days before the convoy reaches the border. There’s no full agreement with the Red Cross yet on the operation, something broadly explained as bad and terrifying, but if they wait until that agreement is in place, even more days go by without aid for the population. So why not do it this way?

A similar point is that the trucks have been painted white, also – but of course – ‘advertized’ as suspicious: “They’re really army trucks”! Excuse me, but where else would you find that many trucks on such short notice? And do you think it would be better for anyone involved if they were left in army colors?

As for Russia seeking to pull a Trojan horse, that would not seem very smart. They expect the trucks to be searched. And besides, if Russia would want to invade Ukraine, I think they would simply do it, or even simply already have done it. Who’s going to stop them? NATO? Ukraine is not a NATO country.

Isn’t it perhaps possible that everyone’s just running away with wave after wave of unfounded suspicions and allegations, while in reality Putin has no intention of invading Ukraine? That all he wants is to prevent a massacre? If “we” continue like this, we may force him to act. That would be very unfortunate, and it would all be on our shoulders, not Russia’s.

Russia was very uncomfortable with what happened in Kiev in February, when the elected president Yanukovych was toppled. Putin didn’t like the guy at all, but he was not going to topple him either. “We” did, though. And that was a direct threat to Russia’s only warm water ports, which is why he accepted Crimea’s request to join Russia, and its pipelines in Ukraine. The threat to those still exists. How or why should Russia not be uneasy about all this?

Victoria Nuland said the US had funded all sorts of ‘civil’ groups in Ukraine with $5 billion before February. The EU spent at least $600 million the same way. Of course he’s uneasy, even of he spent money himself as well.

I wrote yesterday on our Automatic Earth Facebook page:

Multiple parties are now talking about a humanitarian mission to Donetsk and Luhansk. Red Cross. At the same time, there’s constant talk about a fear that Russia will send troops to help the people there. (As if that would be terribly out of whack, to help people under siege who speak your language, from threats uttered by questionable forces. But that aside.)

Last week, NATO said 20,000 Russian troops were gathered at the border. Russia said a few days later that the exercise they had conducted had ended, and the troops were being withdrawn towards their homebase. Nobody in the west or Ukraine at the time denied that.

Then, just now, the Ukraine government says there are presently 45,000 Russian troops are at the border, with details about huge numbers of tanks, troops, artillery etc.

And in Holland someone from the military police told parliament this afternoon that the threat of a Russian invasion was the reason the recovery mission at the MH17 crash site was halted 5 days ago. That is, when that threat was, for all I know, a figment of somebody’s imagination. Another thing this guy said was that the threat of recovery workers being kidnapped had risen (that one was new to me).

Of course, no proof of anything was provided. But how real was either threat, ever? How real were NATO’s 20,000 numbers last week? Why are Ukraine’s numbers twice as high now? Is that because NATO can’t count? More importantly, where is the evidence? Are we now just squeezing anything that sounds somewhat credible out of this situation, because there simply is no more? And the folks at home still eat it up like candy anyway?

Why does anybody listen to, and take decisions based on, anything Ukraine says any longer? Is there even one thing the Kiev government has said since July 17 that’s not been found to be false? I can’t think of one single example.

Dutch military is right now telling a news program – not for the first time – about how respectful the rebels have treated everything on the crash site, the bodies, everything. But nobody hears it anymore. They’re all focused on the very first reports, 25 days ago, in the first hours/days, which said the rebels were monsters. Reports which all came from Kiev. It’s embarrassing and humiliating to see our western media, our politicians and our fellow citizens stoop to such levels.

But perhaps help is on its way, from sources that are likely even more unlikely than the cavalry. That is to say, the – right-wing – Daily Telegraph in Britain has started reporting on the dark sides of Ukraine’s government, and our attitude towards the country. Over the weekend, Christopher Booker wrote:

Fresh Evidence Of How The West Lured Ukraine Into Its Orbit

How odd it has been to read all those accounts of Europe sleepwalking into war in the summer of 1914, and how such madness must never happen again, against the background of the most misrepresented major story of 2014 – the gathering crisis between Russia and the West over Ukraine,

For months the West has been demonising President Putin, with figures such as the Prince of Wales and Hillary Clinton comparing him with Hitler, oblivious to the fact that what set this crisis in motion were those recklessly provocative moves to absorb Ukraine into the EU. There was never any way that this drive to suck the original cradle of Russian identity into the Brussels empire was not going to provoke Moscow to react – not least due to the prospect that its only warm-water ports, in Crimea, might soon be taken over by Nato.

And still scarcely reported here have been the billions of dollars and euros the West has been more or less secretively pouring into Ukraine to promote the cause: not just to prop up its bankrupt government and banking system, but to fund scores of bogus “pro-European” groups making up what the EU calls “civil society”.

… the European Commission told a journalist that, between 2004 and 2013, these groups had only been given €31 million [..] the true figure, shown on the commission’s own “Financial Transparency” website, was €496 million.

The 200 front organisations receiving this colossal sum have such names as “Center for European Co-operation” or the “Donetsk Regional Public Organisation with Hope for the Future”

One of my readers heard from a Ukrainian woman working in Britain that her husband back home earns €200 a month as an electrician, but is paid another €200 a month, from a German bank, to join demonstrations [..]

However dangerous this crisis becomes, it is the West which has brought it about; and our hysterical vilifying of Russia is more reminiscent of that fateful mood in the summer of 1914 than we should find it comfortable to contemplate.

Then yesterday, the same Telegraph published a very damning piece about the swastika brandishing units the Ukraine government uses against its fellow Ukrainians in the east:

The Neo-Nazi Brigade Fighting Pro-Russian Separatists

As Ukraine’s armed forces tighten the noose around pro-Russian separatists in the east of the country, the western-backed government in Kiev is throwing militia groups – some openly neo-Nazi – into the front of the battle. The Azov battalion has the most chilling reputation of all.

Kiev’s use of volunteer paramilitaries to stamp out the Russian-backed Donetsk and Luhansk “people’s republics”, proclaimed in eastern Ukraine in March, should send a shiver down Europe’s spine. Recently formed battalions such as Donbas, Dnipro and Azov, with several thousand men under their command, are officially under the control of the interior ministry but their financing is murky, their training inadequate and their ideology often alarming.

The Azov men use the neo-Nazi Wolfsangel (Wolf’s Hook) symbol on their banner and members of the battalion are openly white supremacists, or anti-Semites. [..] Two more militiamen died on Sunday fighting north of Donetsk. Petro Poroshenko, Ukraine’s president, called one of them a hero.

“The historic mission of our nation in this critical moment is to lead the White Races of the world in a final crusade for their survival,” [battalion’s commander Andriy Biletsky] wrote in a recent commentary. “A crusade against the Semite-led Untermenschen.”

Azov’s extremist profile and slick English–language pages on social media have even attracted foreign fighters. Mr Biletsky says he has men from Ireland, Italy, Greece and Scandinavia. At the base in Urzuf, Mikael Skillt, 37, a former sniper with the Swedish Army and National Guard, leads and trains a reconnaissance unit. Mr Skillt says he called himself a National Socialist as a young man and more recently he was active in the extreme right wing Party of the Swedes.

Ukraine’s government is unrepentant about using the neo-Nazis. “The most important thing is their spirit and their desire to make Ukraine free and independent,” said Anton Gerashchenko, an adviser to Arsen Avakov, the interior minister.

Mark Galeotti, an expert on Russian and Ukrainian security affairs at New York University: “The danger is that this is part of the building up of a toxic legacy for when the war ends,” he said.[..] “And what do you do when the war is over and you get veterans from Azov swaggering down your high street, and in your own lives?”

You sure you want those guys representing your side, paid by your tax dollars?

Today, Irish journalist and playwright Bryan MacDonald summarizes this development:

UK Media Approaching ‘Mea Culpa’ Moment On Russia

Russia has been suffering from vilification and falsity in much of the Western mainstream press since the US and EU ignited a needless civil war in Ukraine. I’ve already covered in a previous dispatch how the UK media managed to charge, try and sentence President Putin within hours of the appalling MH17 disaster – “Putin’s missile” as the internationally little-known court of ‘The Sun’ in London adjudicated. Never mind that there was no evidence. In fact, nearly a month on and there’s still not a shred of proof connecting the rebels to the tragedy – much less the Kremlin. [..]

When the media gets it wrong, they usually wait a few years (or even decades) before issuing the ‘mea culpa’, but it seems the UK media this week is beginning to realize that it backed the wrong horse in Ukraine and is in early apology mode. Let’s be very clear here – the three newspapers which form UK political opinion on external affairs are the The Daily Mail, The Daily Telegraph and The (Sunday and daily) Times. The Sun plays a huge role domestically, but not on extraneous matters as the red-top doesn’t prioritize foreign coverage.

This weekend, The Telegraph (which is effectively the ruling Tory party’s in-house journal) admitted that the EU paid protestors at the Maidan rallies. This clashes with a previously widely-held UK media viewpoint that Russia was paying protestors on the other side of Ukraine’s divide. I have to admit, I sputtered into my cornflakes when I first read it but I can clearly see where this new stance is headed. The ‘mea culpa’ is beginning to form a head of steam in double-quick time. [..]

Amid all this lunacy, there is also the re-emergence of aged ‘Cold Warriors’ who last had a day in the sun when the Soviet Union was coughing its dying breaths. After years of being ignored, they are back in (temporary) vogue and determined to make their voices heard, no matter how humungous a time-warp they are stuck in. Indeed, 86-year-old Zbigniew Brzezinski, last seen arming the mujahedeen in Afghanistan in the 1980’s, has re-appeared like a scarier version of The Simpson’s Mr Burns. His Afghan policy was so successful that it created Al Qaeda so what could possibly go wrong by following his advice on Russia?

Below them, there is a younger generation of ‘Russia experts’ who largely chose Russian or Slavic topics in their academic years, and have been lifelong non-entities as the region became a fringe topic in a West obsessed with problems in the Islamic world. As a consequence of an abrupt (probably fleeting) interest in Ukraine, they have been brought in from the ether and are determined to milk the moment they’ve spent their adult lives building up to. Previously niche authors, published on obscure websites, suddenly find themselves called on to write big-time magazine cover stories demonizing Putin to fit the new ‘bogeyman’ narrative and they are delirious with the acclaim.

Others who, until recently, could not command the attention of a few drunks at a Washington or London bar for their Russian rantings are overcome with joy at being invited on CNN/Sky News/NBC etc. to discuss their favorite topic. Basically, they are all partying like it is 1989. [..] However, last orders at their little shindig seems to be approaching as Western popular media edges towards its ‘mea culpa moment’ and editors realize that backing the wrong horse, no matter how generous the odds, has only ever made the punters poorer.

And I don’t even get around to the western escapades in the desert today, where in Baghdad Shi’ite private armies may be called upon to battle each other in the name of the constitution, or just power, and where “we” think we have some sort of right to once again interfere, due to past successes. Tell me: would you think this is how Rome built its empire, or how it lost it?

The other day, I said it might be good if you write to your Congressperson or MP and ask for the proof that their views and policies are based on. Our good friend Euan Mearns – of Oil Drum fame – in Aberdeen has taken up the challenge, and written to no-one less than a UK Secretary of State. This can be you blueprint, copy and paste, and send it off. I’m very curious to see what responses the mailman will deliver:

Dear Mr Hammond,

I am writing to you in your capacity as the UK Secretary of State for Foreign and Commonwealth Affairs.

A report by Raúl Ilargi Meijer, who runs the blog The Automatic Earth

, links to an article from the Malaysian New Straits Times that says:

“KUALA LUMPUR: INTELLIGENCE analysts in the United States had already concluded that Malaysia Airlines flight MH17 was shot down by an air-to-air missile, and that the Ukrainian government had had something to do with it. This corroborates an emerging theory postulated by local investigators that the Boeing 777-200 was crippled by an air-to-air missile and finished off with cannon fire from a fighter that had been shadowing it as it plummeted to earth. In a damning report dated Aug 3, headlined “Flight 17 Shoot-Down Scenario Shifts”, Associated Press reporter Robert Parry said “some US intelligence sources had concluded that the rebels and Russia were likely not at fault and that it appears Ukrainian government forces were to blame”.”

https://www.theautomaticearth.com/follow-the-money-all-the-way-to-the-next-war/#post-14511

https://www.nst.com.my/node/20925

I gather that the UK has joined EU partners and the USA in widening sanctions against Russia in the wake of this tragedy. I have to presume that the UK is in possession of EVIDENCE that unequivocally places blame for this incident on East Ukraine separatists with or without assistance from Russia and I hereby request that you make said evidence available for public scrutiny.

I look forward to your swift reply.

Yours sincerely,

Dr Euan Mearns, Aberdeen

• Fresh Evidence Of How The West Lured Ukraine Into Its Orbit (Telegraph)

How odd it has been to read all those accounts of Europe sleepwalking into war in the summer of 1914, and how such madness must never happen again, against the background of the most misrepresented major story of 2014 – the gathering crisis between Russia and the West over Ukraine, as we watch developments in that very nasty civil war, with 20,000 Russian troops massing on the border. For months the West has been demonising President Putin, with figures such as the Prince of Wales and Hillary Clinton comparing him with Hitler, oblivious to the fact that what set this crisis in motion were those recklessly provocative moves to absorb Ukraine into the EU. There was never any way that this drive to suck the original cradle of Russian identity into the Brussels empire was not going to provoke Moscow to react – not least due to the prospect that its only warm-water ports, in Crimea, might soon be taken over by Nato.

And still scarcely reported here have been the billions of dollars and euros the West has been more or less secretively pouring into Ukraine to promote the cause: not just to prop up its bankrupt government and banking system, but to fund scores of bogus “pro-European” groups making up what the EU calls “civil society”. When the European Commission told a journalist that, between 2004 and 2013, these groups had only been given €31 million, my co-author Richard North was soon reporting on his EU Referendum blog that the true figure, shown on the commission’s own “Financial Transparency” website, was €496 million. The 200 front organisations receiving this colossal sum have such names as “Center for European Co-operation” or the “Donetsk Regional Public Organisation with Hope for the Future” (the very first page shows how many are in eastern Ukraine or Crimea, with their largely Russian populations).

One of my readers heard from a Ukrainian woman working in Britain that her husband back home earns €200 a month as an electrician, but is paid another €200 a month, from a German bank, to join demonstrations such as the one last March when hundreds of thousands – many doubtless entirely sincere – turned out in Kiev to chant “Europe, Europe” at Baroness Ashton, the EU’s visiting “foreign minister”. However dangerous this crisis becomes, it is the West which has brought it about; and our hysterical vilifying of Russia is more reminiscent of that fateful mood in the summer of 1914 than we should find it comfortable to contemplate.

Read more …

• The Neo-Nazi Brigade Fighting Pro-Russian Separatists (Telegraph)

The fighters of the Azov battalion lined up in single file to say farewell to their fallen comrade. His pallid corpse lay under the sun in an open casket trimmed with blue velvet. Some of the men placed carnations by the body, others roses. Many struck their chests with a closed fist before touching their dead friend’s arm. One fighter had an SS tattoo on his neck. Sergiy Grek, 22, lost a leg and died from massive blood loss after a radio-controlled anti-tank mine exploded near to him. As Ukraine’s armed forces tighten the noose around pro-Russian separatists in the east of the country, the western-backed government in Kiev is throwing militia groups – some openly neo-Nazi – into the front of the battle. The Azov battalion has the most chilling reputation of all. Last week, it came to the fore as it mounted a bold attack on the rebel redoubt of Donetsk, striking deep into the suburbs of a city under siege. In Marinka, on the western outskirts, the battalion was sent forward ahead of tanks and armoured vehicles of the Ukrainian army’s 51st Mechanised Brigade.

A ferocious close-quarters fight ensued as they got caught in an ambush laid by well-trained separatists, who shot from 30 yards away. The Azov irregulars replied with a squall of fire, fending off the attack and seizing a rebel checkpoint. Mr Grek, also known as “Balagan”, died in the battle and 14 others were wounded. Speaking after the ceremony Andriy Biletsky, the battalion’s commander, told the Telegraph the operation had been a “100% success”. “The battalion is a family and every death is painful to us but these were minimal losses,” he said. “Most important of all, we established a bridgehead for the attack on Donetsk. And when that comes we will be leading the way.” The military achievement is hard to dispute. By securing Marinka the battalion “widened the front and tightened the circle”, around the rebels’ capital, as another fighter put it.

Read more …

• UK Media Approaching ‘Mea Culpa’ Moment On Russia (RT)

When the media gets it wrong, they usually wait a few years (or even decades) before issuing the ‘mea culpa’, but it seems the UK media this week is beginning to realize that it backed the wrong horse in Ukraine and is in early apology mode. Let’s be very clear here – the three newspapers which form UK political opinion on external affairs are the The Daily Mail, The Daily Telegraph and The (Sunday and daily) Times. The Sun plays a huge role domestically, but not on extraneous matters as the red-top doesn’t prioritize foreign coverage. This weekend, The Telegraph (which is effectively the ruling Tory party’s in-house journal) admitted that the EU paid protestors at the Maidan rallies. This clashes with a previously widely-held UK media viewpoint that Russia was paying protestors on the other side of Ukraine’s divide. I have to admit, I sputtered into my cornflakes when I first read it but I can clearly see where this new stance is headed. The ‘mea culpa’ is beginning to form a head of steam in double-quick time.

“Scarcely reported here have been the billions of dollars and euros the West has been more or less secretly pouring into Ukraine to promote the cause: not just to prop up its bankrupt government and banking system, but to fund scores of bogus “pro-European” groups making up what the EU calls “civil society”. “One of my readers heard from a Ukrainian woman working in Britain that her husband back home earns €200 a month as an electrician, but is paid another €200 a month, from a German bank, to join demonstrations such as the one last March when hundreds of thousands – many doubtless entirely sincere – turned out in Kiev to chant ‘Europe, Europe’ at Baroness Ashton, the EU’s visiting ‘foreign minister’,” wrote columnist Christopher Booker.

Booker went on to quote the author Richard North who has reported that the EU’s own ‘financial transparency’ website proves that €496 million has been given to these ‘pro-European’ groups, who have been presented by a generally pliant Western media as harmless NGO’s driven by people-power. Meanwhile, over at The Daily Mail, the respected Peter Hitchens has also been drawing from North’s research, writing about “how astonishing the amounts the EU have given to Ukraine are.” He continues: “Rebuilding schools and nurseries and providing school buses, all helpfully emblazoned with EU stars, paying for doctors and then rebuilding agricultural storage plants – it’s amazing that any one person could be found to vote against closer partnership with the EU after that.”

Read more …

“Tourism revenues from Russia increased 42% last year”…

• Russian Sanctions Dim Greek Hopes for Exit From Recession (Bloomberg)

Greece’s hopes of a 2014 exit from its deepest recession in a half-century may hit a stumbling block after Russia banned European Union food imports in retaliation for sanctions stemming from the insurgency in Ukraine. “The estimated total cost of Russian counter-sanctions for the Greek economy may look tolerable, but the impact could be quite damaging for industries such as tourism and agriculture amid the fragility of a slowly recovering economy,” said Thanos Dokos, director-general of the Hellenic Foundation for European and Foreign Policy, a Greek think-tank. “It also raises questions about energy security in the coming autumn and winter.” Russia is Greece’s biggest trading partner, mostly because of gas and oil exports, according to data compiled by Bloomberg. The value of total trade between the two nations reached €9.3 billion ($12.5 billion) in 2013, surpassing trade flows between Greece and fellow EU-member Germany.

The recent depreciation of the ruble amid the sanctions and the situation in Ukraine may mean that Greece will see 200,000 fewer Russian tourists this year than originally expected, said Xenophon Petropoulos, director of communications at the Association of Greek Tourism Enterprises, also known as SETE. That could deal a potential €300 million blow to Greece’s biggest industry, based on preliminary estimates. “Arrivals from Ukraine will drop by 50% and arrivals from Russia are expected to reach 1.1 million, instead of 1.3 million,” Petropoulos said. The ruble is the worst performer among 24 currencies of emerging countries tracked by Bloomberg in the last month, with a 5% decline against the dollar. Tourism contributes more than 16% to Greek gross domestic product, according to SETE data, and Russia has been the fastest growing source market for visitors to Greece. Tourism revenues from Russia increased 42% last year to €1.34 billion, according to Bank of Greece data.

Read more …

• Global Nausea (Jim Kunstler)

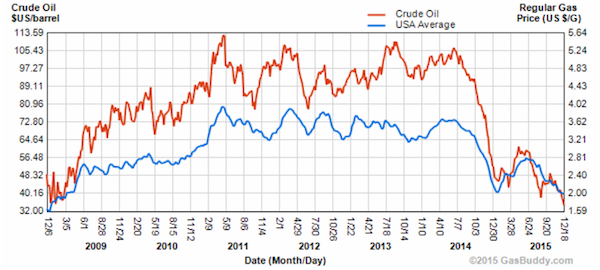

There is not a nation on earth that is preparing intelligently for the end of oil — and by that I mean 1) the end of cheap, affordable oil, and 2) the permanent destabilization of existing oil supply lines. Both of these conditions should be visible now in the evolving geopolitical dynamic, but nobody is paying attention, for instance, in the hubbub over Ukraine. That feckless, unfortunate, and tragic would-be nation, prompted by EU and US puppeteers, just replied to the latest trade sanction salvo from Russia by declaring it would block the delivery of Russian gas to Europe through pipelines on its territory. I hope everybody west of Dnepropetrovsk is getting ready to burn the furniture come November. But that just shows how completely irrational the situation has become… and I stray from my point.

Which is that in the worst case that ISIS succeeds in establishing a sprawling caliphate, they will never be able to govern it successfully, only preside over an awesome episode of bloodletting and social collapse. This is especially true in what is now called Saudi Arabia, with its sclerotic ruling elite clinging to power. If and when the ISIS maniacs come rolling in on a cavalcade of You-Tube beheading videos, what are the chances that the technicians running the oil infrastructure there will stick around on the job? And could ISIS run all that machinery themselves? I wouldn’t count on it. And I wouldn’t count on global oil supply lines continuing to function in the way the world requires them to. If you’re looking for the near-future spark of World War Three, start there.

By the way, the US is no less idiotic than Ukraine. We’ve sold ourselves the story that shale oil will insulate us from all the woes and conflicts breaking out elsewhere in the world over the dissolving oil economy paradigm. The shale oil story is false. By my reckoning we have about a year left of the drive-to-Walmart-economy before the public broadly gets what trouble we’re in. The amazing thing is that the public might get to that realization even before its political leadership does. That dynamic leads straight to the previously unthinkable (not for 150 years, anyway) breakup of the United States.

Read more …

• US Government Likely Hiding Truth in Malaysia Airlines Flight 17 Crash (Ron Paul)

The U.S. government has grown strangely quiet on the accusation that it was Russia or her allies that brought down the Malaysian airliner with a buck anti-aircraft missile. The little that we have heard from U.S. intelligence is that it has no evidence that Russia was involved. Yet the war propaganda was successful in convincing the American public that it was all Russia’s fault. It’s hard to believe that the U.S., with all of its spy satellites available for monitoring everything in Ukraine that precise proof of who did what and when is not available. When evidence contradicts our government’s accusations, the evidence is never revealed to the public—for national security reasons, of course. Some independent sources claim that the crash site revealed evidence that bullet holes may have come from a fighter jet. If true, it would implicate western Ukraine. Questions do remain regarding the serious international incident. Too bad we can’t count on our government to just tell us the truth and show us the evidence. I’m convinced that it knows a lot more than it’s telling us.

Read more …

As Germany goes, so goes Europe.

• The Economic Outlook For Germany In One Word: ‘Grim’ (BI)

The ZEW investor confidence survey index plunged to 44.3 in August from 61.8 a month ago. This was much worse than the 54.0 expected by economists. To make things worse, the expectations index crashed to 8.6 from 27.1. This was the lowest reading since December 2012. Economists were expecting 17.0. “In one line: Grim, as slump in investor sentiment deepens,” said Pantheon Economics’ Claus Vistesen. “Given the recent sharp drawdown in equities, a drop in sentiment was expected, but the decline was larger than anticipated, reinforcing downside risk to the economy.” Some of this deterioration is likely due to the escalating conflict with Russia, which recently imposed a ban on food imports from the European Union. “We expect the escalation of the Russian Ukrainian conflict as well as the persisting political turmoil in the Middle East to have a negative impact on the market environment,” said Henkel CEO Kasper Rorsted earlier Tuesday. Based in Dusseldorf, Henkel supplies the world with a variety of consumer goods ranging from laundry detergent to toothpaste.

The economic data out of Germany has been astonishingly bad this month, highlighted by sharp drops in industrial production and factory orders. “All Europe has been affected by these tensions as well as by the stalling of the German economy,” said Cumberland Adviors Bill Witherell on Friday. “The Italian economy, for example, appears to be slipping into recession. The French economy also has failed to establish sustainable growth. While the Spanish economy is seen as having been transformed by its structural reforms, industrial production in Spain fell by -0.8% month-to-month in June, following a -0.6% drop in May.” “The German ZEW survey suggests the euro-area economy will continue to slow through the first half of next year,” said Bloomberg economists David Powell and Niraj Shah. “That will provide ammunition for the proponents of quantitative easing at the European Central Bank.”

Read more …

• In the U.K., Work Doesn’t Pay (Bloomberg)

A conundrum confronts U.K. policy makers, both at the central bank and in government: Why aren’t wages keeping pace with inflation, never mind increasing, in what’s likely to be the fastest-growing economy among the Group of Seven industrialized nations? Consumer prices are rising at an annual pace of 1.9%, according to the most recent data. Figures scheduled for release this week, though, will show average weekly earnings dropping by 0.1%, according to the median forecast of economists surveyed by Bloomberg News. Only 38% of U.K. employers have conducted a pay review since the beginning of the year, a figure that drops to 26% for small- and medium-sized enterprises, according to a survey published today by the Chartered Institute of Personnel & Development, a London-based trade body for the human resources profession. Just 25% have made marginal improvements to starting salaries, with the majority leaving them unchanged, the report said:

This is despite a growing recognition among some employers that the cost of living or inflation is placing upward pressure on employers to award their pay increases. Among those workers who have enjoyed a basic pay rise, the median increase has fallen to 2% this year from 2.5% in 2013.

Read more …

Oh man …

• Margin Calls Hit Hedge Funds Speculating in Freddie/Fannie Bonds (Stockman)

Markets are more dangerous than ever before because six years of radical financial repression by the central banks have planted booby-traps everywhere. Ground zero consists of massive and reckless speculation in newly invented “structured finance” products which were designed to quench the market’s insatiable thirst for yield in the Fed’s whacky world of ZIRP. So below is news of margin calls on hedge funds that had piled into a 12 month old product called “risk sharing RMBS bonds”. It seems that Wall Street dealers had provided 80% leverage on these new fangled securities issued by the nation’s accomplished market wreckers – Fannie and Freddie. Various tranches of this new variant of synthetic CDOs—that is, the Wall Street created toxic waste that blew-up in 2007/2008 – offered yields of 200-700 basis points over LIBOR, but so great was the demand for an alternative to the Bernanke-Yellen ukase of zero return that prices of the first Freddie Mac issue were driven up by 30% over the past year.

Now imagine that. Speculators purchased newly invented and unseasoned securities from proven financial malefactors on 80% leverage and then saw their price rise by 30% in 12 months, meaning that the return on their own invested equity was a cool 150%. Stated differently, the scramble for yield got so frenzied that securities originally issued at a yield premium of 7.15% over LIBOR last summer had soared to the point that they yielded only 2.5% over LIBOR before the market broke a few weeks ago. A recent WSJ article captured the thought that irrational exuberance had indeed erupted in this newly invented “asset class”:

But, the rally was overextended by investors’ search for yield as Federal Reserve stimulus cut returns on safer assets, some investors said. Prices on Freddie Mac’s first issue of July 2013 had soared more than 30% through May, reducing yield premiums over the one-month London interbank offered rate to 2.5 percentage points from 7.15 percentage points. “Investors got too complacent,” Mr. Hentemann said. “They kept buying high-yielding assets to a point where prices and yields didn’t compensate you for the risk.”

Read more …

“When it comes to a bilateral relationship with a sovereign country and the violation of its immunities, it is necessary for the executive branch to intervene,” Capitanich said. “The executive has a monopoly on relations with other countries.”

• Argentina Calls On US Government To Intervene In Debt Case (Reuters)

Argentina on Monday called on Washington to intervene in a court case over the country’s defaulted debt after a U.S. district judge threatened the South American country with contempt for making what he called false statements. U.S. Judge Thomas Griesa, overseeing Argentina’s long-running battle with hedge funds over defaulted debt, said on Friday he would issue a contempt of court order unless the government stopped publicly claiming it had met its obligations and was not in default. Cabinet chief Jorge Capitanich countered on Monday that a contempt order would violate Argentina’s sovereign immunity and he called on the Obama administration to rein in Griesa. “When it comes to a bilateral relationship with a sovereign country and the violation of its immunities, it is necessary for the executive branch to intervene,” Capitanich said. “The executive has a monopoly on relations with other countries.”

“The United States is responsible for the actions of its branches of power, in this case the judicial branch, regardless of the independence of the functioning of those branches,” he said. In 2002 Argentina defaulted on about $100 billion in sovereign bonds. It restructured most of that debt in a deal that gave holders less than 30 cents on the dollar while a group of hedge funds went to court for full repayment. In 2012 Griesa ruled that Argentina could not repay holders of restructured debt without also paying hedge funds their court-award of $1.33 billion plus interest at the same time. Argentina says it met its obligation to the holders of restructured bonds when it deposited $539 million into the account of intermediary Bank of New York Mellon in June. Griesa called the deposit illegal and ordered the money frozen. As a result, Argentina effectively missed the coupon payment after a grace period ended on July 30, pushing it into default on its restructured debt. Griesa reiterated on Friday that “there has been no payment.”

Read more …

Lovely.

• Australian Banks Face Monumental Class Action Over Late Fees (AAP/Yahoo)

A monumental class action against major banks over credit card late fees will be filed in the NSW Supreme Court today. Compensation lawyers from firm Maurice Blackburn will lodge the action on behalf of hundreds of thousands of bank customers who have had credit card late fees imposed on them. What could be the largest class action in Australian history, the action will initially be filed against ANZ, Westpac and Citibank while American Express and Commonwealth will be next in line. According to report by Fairfax, every single customer who has been hit with excessive late fees from those specific institutions will be automatically included in the action. This ‘open class’ action makes it different from other previous bank class actions, which required participants to register.

Instead, the inclusive nature of the action makes it hard to estimate the scope of the potential claim, but it is thought to be worth hundreds of millions of dollars. Maurice Blackburn principal Andrew Watson says the scope for the payout is so large because it includes every customer from ANZ, Westpac and Citibank who has ever paid a late fee. “We’re talking about an enormous action,” Watson said. “If people are a bit like myself and not as careful about paying off their credit card, then they will be in the action and stand to benefit.” Watson also says more actions are on the horizon. “In the near future we’ll be filing further claims against other banks and they’ll be on the same basis,” he said. CEO of the Consumer Action Law Centre Gerard Brody told the ABC that while banks charge varying fees for late payments in Australia, some were charging up to $20 or more.

Read more …

A global phenomenon.

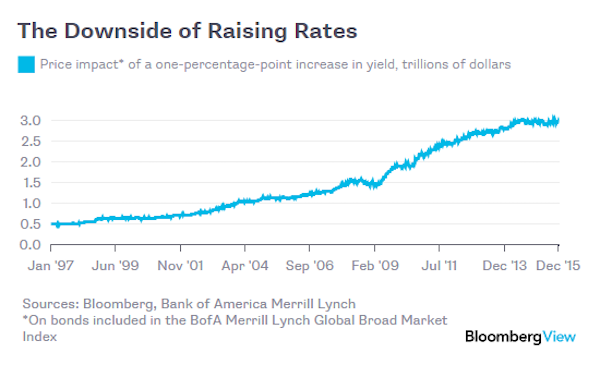

• Britain’s Consumer Credit Market Is A Giant Ticking Time Bomb (Telegraph)

It is increasingly clear that Britain’s army of borrowers are being lulled into a false sense of security. The cost of borrowing is actually falling, not rising, a remarkable and little-understood state of affairs which is storing up immense problems for the future. The consumer credit market is a ticking time bomb; it beggars belief that so many folk and companies who should know better are so relaxed about it. At some point, central banks, led by the Bank of England and the Federal Reserve, will start tightening monetary policy in earnest, and this is bound to eventually have a knock-on effect on the cost of consumer borrowing. When this does happen, the shock to borrowers, practical as well as psychological, will be immense. But for the time being, they are laughing all the way to the bank and pocketing the gains created by the authorities’ obsession with subsidising credit.

The figures are remarkable and help explain why the number of first-time buyers shot up by 19pc year on year in June, reaching the highest level since 2007 and keeping the housing market boom on track. The recent regulatory changes to the mortgage market, which now involve borrowers having to disclose far more information about their expenditure patterns, only temporarily delayed the flow of credit. Perhaps most surprisingly of all, the reduction in the number of financial institutions, and the fact that they must hold hugely more capital to protect themselves in case of losses, has still gone hand in hand with lower rates. Of course, the cost of borrowing would be even lower in the absence of these regulatory shifts but the scale of the changes are striking nonetheless.

The average mortgage rate paid by first-time buyers is down by 0.3 percentage points over the past year, an analysis by Citigroup reveals. The interest rate on the average two-year fixed mortgage with a 25pc deposit fell by 0.07pc month on month in July and the average rate on two-year fixed with a 10pc deposit fell 0.04pc. Both categories are down by more than one percentage point compared with two years ago. It is not just secured loans that are getting cheaper. The average cost of borrowing £10,000 was just 5.12pc in July, down from 5.23pc in June and 6.10pc a year ago. It is now at the lowest level since data began in 1995. As Michael Saunders, Citi’s chief economist, points out, the interest rate on a £10,000 unsecured loan is down 5.7 percentage points since late-2009 – in other words, it has more than halved since the height of the credit crunch. No wonder UK domestic car sales are booming.

Read more …

Smirk.

• Over 150 Chinese ‘Economic Fugitives’ At Large In US (Reuters)

More than 150 economic fugitives, many of whom are corrupt officials or suspected of graft in China, are at large in the United States, Chinese state media said on Monday, citing a senior official from the public security ministry. The United States “has become the top destination for Chinese fugitives fleeing the law,” the China Daily newspaper said, citing Liao Jinrong, director general of the ministry’s International Cooperation Bureau. Chinese President Xi Jinping has made fighting pervasive graft a central theme and has warned, like others before him, that corruption threatens the Communist Party’s survival.

Beijing has long grappled with the issue of so-called “naked officials” – government workers whose husbands, wives or children are all overseas – who use foreign family connections to illegally shift assets out of China or to avoid investigation. Some estimates put the number of Chinese officials and family members moving assets offshore at more than 1 million in the past five years. But bringing these fugitives back to China isn’t easy. There is no extradition treaty between China and the United States, and foreign governments have expressed reluctance to hand over Chinese suspects as they could face the death penalty in China. “We face practical difficulties in getting fugitives who fled to the United States back to face trial due to the lack of an extradition treaty and the complex and lengthy procedures,” the China Daily cited Liao as saying.

Read more …

Empire!

• US Reassures China As 2,500 Marines Head To Australia (AFP)

The United States stressed Tuesday it welcomes the rise of China and wants to work constructively with Beijing as it signed a deal to deploy 2,500 Marines to Australia as part of its “rebalance” to Asia. China bristled when the agreement to deploy Marines to the northern city of Darwin was first announced by President Barack Obama in 2011. But after signing the deal at the Australia-United States Ministerial Consultations (AUSMIN) in Sydney, US Secretary of State John Kerry said Washington was not interested in conflict with the Asian powerhouse. “We welcome the rise of China as a global partner, hopefully as a powerful economy, as a full participating constructive member of the international community,” he said.

“We are not seeking conflict and confrontation. And our hope is that China will likewise take advantage of the opportunities that are in front of it and be that cooperative partner.” Australia’s Foreign Minister Julie Bishop earlier defended the deal to bring US Marines and Air Force personnel to the Northern Territory, denying it was aimed at China which is embroiled in maritime disputes with neighbours. “That’s not what it is directed to do at all. It’s about working closely with the United States to ensure that we can work on regional peace and security,” she told a radio programme. “The United States is rebalancing to the Asia-Pacific so it’s ways we can work together to support economic development as well as security and peace.”

Read more …

Do it already!

• Interest Rate Rise More Likely As Property Market Takes Off Again (Guardian)

The latest mortgage lending data has added to the Bank of England’s dilemma over interest rates after a sharp rise in borrowing showed the property market had regained its previous momentum. The number of mortgages increased in June by 4% on the previous month, suggesting that tighter borrowing criteria imposed by the financial regulator this year had only cooled the market for a few months. The Council of Mortgage Lenders said a survey of the biggest lenders showed that 60,500 house purchase loans, worth £10bn, were taken out during the month, an increase of 5% by number and 6% by value on May’s figures. Compared with June 2013, the figures were 15% and 23% higher respectively. More than half of those loans were taken out by home movers, although the number of first-time buyers showed a bigger month-on-month increase, making up slightly less than half of the total at 28,600.

Chris Williamson, chief economist at Markit, said a continuing stream of positive data on the housing market would add to the pressure on the Bank to increase rates. “A few more months of data showing the property market is booming and double-digit price growth will add to the pressure on the Bank,” he said. Affordability tests, which force lenders to check applicants’ outgoings as well as their income and to stress-test their borrowing to ensure they can afford repayments if interest rates increase, appeared to damp the market after they were imposed in April. The central bank is under pressure to increase rates in response to the booming economy and the sharp increase in the number of people in work. Rising house prices have also triggered calls for an increase from the current historic low base rate of 0.5% to deter buyers and take the heat out of the market.

Read more …

Who do you think will pay for the decommissioning? The French?

• French Energy Company EDF Shuts Down Four UK Nuclear Reactors (FT)

EDF Energy said on Monday that it had shut down four of its UK nuclear reactors for eight weeks, or roughly a quarter of its total nuclear generating capacity, after discovering a fault in a boiler unit during a routine inspection. The UK subsidiary of French state-owned utility EDF owns and operates eight nuclear power stations in the country with a combined electricity generation capacity of roughly 8.8m kilowatts – just over 10 per cent of the UK total. The shutdowns highlight how reliant the UK has become on a fleet of nuclear plants that is nearing the end of its service life. All but one of EDF’s plants are scheduled to close by the end of 2023, and the company has been seeking life extensions for many of them. It is also planning to build a new multibillion pound power station at Hinkley Point C in Somerset, and last year signed an investment contract for the plant with the government guaranteeing it a price for the electricity generated of £92.50 per megawatt hour – roughly twice the current price.

The reactors that are to be shut down are at Heysham in Lancashire and Hartlepool. EDF said that during a planned outage at one of its two Heysham 1 reactors, an “unexpected result” was found during a routine inspection of a boiler unit. The reactor was returned to service early this year on a reduced load, with the affected part of the boiler isolated pending further tests. More detailed inspections during an outage that started in June confirmed a defect and the reactor remains shut down. But EDF Energy said it had taken the “conservative decision” to shut down three other reactors that are of similar design to the affected plant – a second at Heysham and two at Hartlepool. The closures will allow the company “to carry out further inspections in order to satisfy itself and the regulator that the reactors can be safely returned to service”, it said.

Read more …

HA!

• California Drought Can’t Stop Production Of Bottled Water (CNBC)

California’s severe drought—now in its third year—has led to major hardships in the state. The list includes dwindling water sources, declining revenues for water districts from conservation; and mandatory fines up to $500 for hosing down driveways or for overwatering lawns. Not to mention the loss of agriculture crops and related jobs. But what the drought hasn’t done is stop the use of California’s water supply for making bottled water products. “Water is essential and if people weren’t drinking our bottled water, they’d be drinking tap water or soda or beer,” said Jane Lazgin, director of corporate communications at Nestle. Nestle owns and operates Arrowhead Mountain Spring Water, which has been bottling water from a spring in Millard Canyon, California, some 80 miles east of Los Angeles.

It also makes water under its Pure Life brand from the same source, which is located on the Morongo Indian Reservation. Nestle pays the tribe for the water. Because the reservation is considered a sovereign nation, it’s not under any obligation to comply with state laws concerning the drought. However, at least one state water supplier said Nestle is getting an unfair break. “The restrictions we have here should be felt statewide regardless of the water source,” said said Kurt Born, general manager of Clear Creek CSD, located in the northern California town of Anderson.

Read more …

Tick tick tick.

• California Drought Transforms Global Food Market (Bloomberg)

For more than 70 years, Fred Starrh’s family was among the most prominent cotton growers in California’s San Joaquin Valley. Then shifting global markets and rising water prices told him that wouldn’t work anymore. So he replaced most of the cotton plants on his farm near Shafter, 120 miles northwest of Los Angeles, and planted almonds, which make more money per acre and are increasingly popular with consumers in Asia. “You can’t pay $1,000 an acre-foot to grow cotton,” said Starrh, 85, crouching to inspect a drip irrigator gently gurgling under an almond tree. Such crop switching is one sign of a sweeping transformation going on in California – the nation’s biggest agricultural state by value – driven by a three-year drought that climate scientists say is a glimpse of a drier future. The result will affect everything from the price of milk in China to the source of cherries eaten by Americans. It has already inflamed competition for water between farmers and homeowners.

Growers have adapted to the record-low rainfall by installing high-technology irrigation systems, watering with treated municipal wastewater and even recycling waste from the processing of pomegranates to feed dairy cows. Some are taking land out of production altogether, bulldozing withered orange trees and leaving hundreds of thousands of acres unplanted. “There will be some definite changes, probably structural changes, to the entire industry” as drought persists, said American Farm Bureau Federation President Bob Stallman. “Farmers have made changes. They’ve shifted. This is what farmers do.”

In the long term, California will probably move away from commodity crops produced in bulk elsewhere to high-value products that make more money for the water used, said Richard Howitt, a farm economist at the University of California at Davis. The state still has advantages in almonds, pistachios and wine grapes, and its location means it will always be well-situated to export what can be profitably grown. That may mean less farmland in production as growers abandon corn and cotton because of the high cost of water. Corn acreage in California has dropped 34% from last year, and wheat is down 53%, according to the USDA.

Read more …

I think it’s man.

• Great Barrier Reef’s Greatest Threat Is Climate Change (AAP)

Climate change is the most serious threat to the Great Barrier Reef, according to a major new report. Warmer ocean currents are also likely to remain a threat to the Queensland coral ecosystem for many years, the Great Barrier Reef Outlook Report 2014 said. “It is already affecting the reef and is likely to have far-reaching consequences in the decades to come,” the 300-page report said. Climate change remains the reef’s biggest threat, despite improvements since the last report five years ago. While the northern third of the reef enjoys good water quality, other areas are in jeopardy. “Key habitats, species and ecosystems in the central and southern inshore areas continued to deteriorate,” the report said. Poor water quality from land-based run-off, coastal development and fishing remain concerns.

But the report noted progress in the rising numbers of humpback whales, estuarine crocodiles and loggerhead turtles. The Great Barrier Reef Marine Park Authority has prepared the report with contributions from Australian and Queensland government agencies and scientists. “More needs to be done at reef-wide, regional and local scales,” it said. The report came ahead of the United Nations’ world heritage committee decision, due in 2015, on whether to give the reef “in danger” status. At its annual meeting in June, Unesco decided it would give Australia until 1 Feburary next year to prove it was looking after the reef.

Read more …

Go home and watch the telly!

• British Pubs Closing At Rate Of 31 A Week (Guardian)

The rate at which British pubs are closing down has accelerated to 31 a week and 3% of pubs in the suburbs have shut in the past six months, the real ale group Camra has warned. Campaigners are calling for an urgent change in the law to make it harder for pubs to be demolished or converted to supermarkets and convenience stores. At the start of its annual Great British Beer Festival, real ale group The peak closure period was between January and June 2009 when 52 pubs ceased trading every week, and there are now 54,490 pubs left in the country. Camra has launched a campaign calling for a planning application to be required before a pub is demolished or converted to another use. Pubs can currently be converted to a range of uses without planning permission.

Camra says that in most cases communities have been powerless to save their locals. Tom Stainer, head of communications at Camra, said: “Popular and profitable pubs are being left vulnerable by gaps in English planning legislation as pubs are increasingly being targeted by those wishing to take advantage of the absence of proper planning control. “It is utterly perverse that developers are able to demolish or convert a pub into a convenience store or many other uses without any requirement to apply for planning permission. It is wrong that communities are left powerless when a popular local pub is threatened with demolition or conversion into a Tesco store.” Camra is urging more than 55,000 festivalgoers to lobby their MPs to support a change to the law. It is hoping for a repeat of its successful campaign to scrap the beer duty escalator, which automatically increased taxes by 2% above inflation.

Read more …

”Greenspan’s intellectual hero, Ayn Rand, also turned her back on her own philosophy, living off of Social Security and other government aid before she died of cancer in 1982.”

• Celebrating Greenspan’s Legacy of Failure (Barry Ritholtz)

On this day in 1987, Alan Greenspan became chairman of the Federal Reserve Board. This anniversary allows us to take a quick look at what followed over the next two decades. As it turned out, it was one of the most interesting and, to be blunt, weirdest tenures ever for a Fed chairman. This was largely because of the strange ways Greenspan’s infatuation with the philosophy of Ayn Rand manifested themselves. He was a free marketer who loved to intervene in the markets, a chief bank regulator who seemingly failed to understand even the most basic premise of bank regulations. The stock market was having a scorching year in 1987, up 44% during the first seven months of the year. Stocks peaked within weeks of Greenspan being sworn in. He was still settling into the job when Black Monday came along and U.S. markets plummeted 23% on Oct. 19. Welcome to Wall Street, Mr. Chairman. The contradictions between Greenspan’s philosophy and his actions led to many key events over his career. The ones that stand out the most in my mind are as follows:

- The 1987 Crash: The day after Black Monday, the Federal Reserve issued the following statement: “The Federal Reserve System, consistent with its responsibilities as the nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the financial and economic system.”

- FOMC chastises its chairman for cutting rates between meetings: During the 1990–1991 recession, markets were dealing with a variety of macroeconomic factors: the S&L crisis, a real estate slump, the first Persian Gulf War, and a spike in energy prices had all taken their toll. Greenspan decided on his own to cut rates half a point, days prior to the February Open Market Committee meeting.

- The Greenspan Put: In July 1995, the Fed cut the funds rate 25 basis points. What made this so odd was that it followed a string of seven rate increases over the previous 12 months. There was another 25 basis point rate cut in December, and yet another in January of the following year. There was no real justification for these cuts.

- Slashing Rates in 2001-02: Amid the 2001 recession, and immediately following the Sept. 11 attacks, the FOMC brought rates down to new lows. Rates were under two% for three years, and at one% for a full year. This was simply unprecedented, and the impact was severe. Everything priced in dollars ramped higher.

- The Flaw: Greenspan ultimately conceded there was a “flaw” in his market ideology. Easy Al, as traders had taken to calling him, recognized that allowing radical deregulation of credit markets was a mistake, as was opposing rules on derivatives and ignoring the subprime and non-bank lenders at the heart of the financial crisis.

It’s worth noting that, Greenspan’s intellectual hero, Ayn Rand, also turned her back on her own philosophy, living off of Social Security and other government aid before she died of cancer in 1982.

Read more …