Marc Riboud Sur les Quais de Paris 1953

The Dutch elections on Wednesday have provided a whole bunch of Orwellian narratives. PM Mark Rutte’s right wing VVD party, actually the ‘business’ -or should we say ‘rent-seekers’ in 2017- party, who lost some 20% of the seats they had obtained in the previous parliamentary election in November 2012, down from 41 to 33 seats, is declared the big winner. While Geert Wilders’ very right wing party, PVV, won 25% more seats -it went from 16 to 20- and is the big loser.

Moreover, Rutte’s coalition partner, labor PvdA, gave up 29 out of 38 seats to end up with just 9. That’s a loss of over 75%. Together, the coalition partners went from 79 seats in the 2012 election to 42 in 2017. That’s an almost 50% less. Not that it could prevent Rutte from proudly declaring: “We want to stick to the course we have – safe and stable and prosperous..” Makes you wonder who the ‘we’ are that he’s talking about.

That course he wants to stick to had a finance minister named Dijsselbloem, and his party just lost by over 75%. So he won’t be back. But perhaps the EU can pull another ‘Tusk’, and leave him in place in Brussels as chairman of the Eurogroup no matter what voters in his own country think of him. Still, declaring your intention to ‘stick to the course’ when your coalition has just been sawed in half, it’s quite something.

The only reasons Rutte’s VVD ended up being the biggest party all have to do with Wilders. The anxiety over the election all had to do with polls. Wilders is a one man party and a a one trick pony. If he would leave, his party would dissolve. And his sole ‘message’ is that Islam is bad and should vanish from first Holland and then Europe. He doesn’t really have any other political program points. Ok, there’s Brussels. Doesn’t like that either.

Perhaps that’s why he largely shunned the pre-election debates. Problem with that is, these things attract a lot of TV viewers, crucial free air-time. All in all, since he’s his own worst enemy in many respects, it’s not that much of a surprise that Wilders’ support collapsed, and that’s just if we were to take Dutch pollsters more serious than their counterparts in the US and UK.

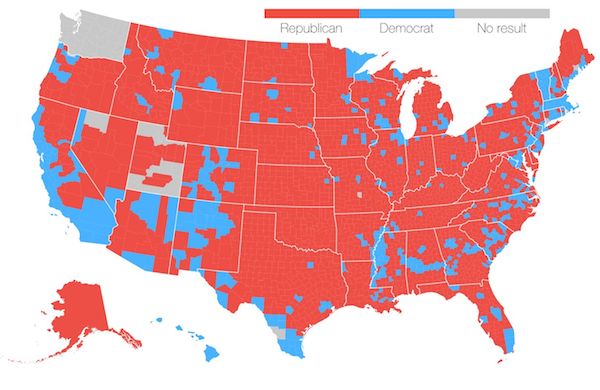

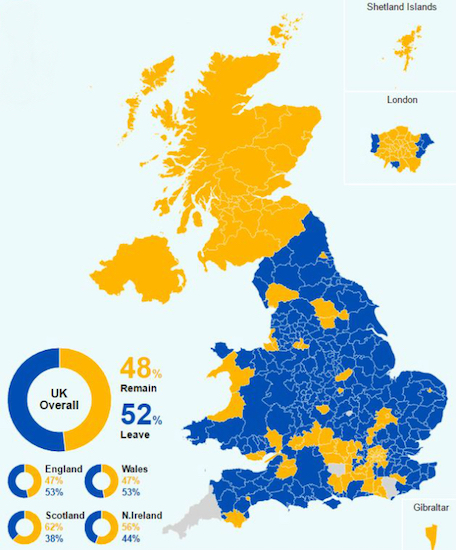

Talking of which, according to Rutte, those are the countries where ‘the wrong kind of populism’ has won and delivered Trump and Brexit. And of course there are lots of people who agree with that. What either they, or Rutte himself, would label ‘the right kind of populism’ is unclear. Maybe Rutte himself is the right kind of populist?

The row with Turkey over the weekend must have helped Rutte quite a bit. Not only were his actions in the row met with approval by a large majority of the Dutch population, including just about all other party leaders, the Dutch also got to think about what WIlders would do in such a situation. And there can be no doubt that Rutte is seen as much more of a statesman than Wilders.

Not that the row is over. After Turkey announced yesterday it would return 40 Dutch cows (?!) , today Turkish Foreign Minister Cavusoglu said Europe’s politicians are “taking Europe toward an abyss”, and: “Soon religious wars will break out in Europe. That’s the way it’s going.” There can be no doubt that a shouting war like this with Wilders as one of the participants would take on a whole different shape, and a different choice of words.

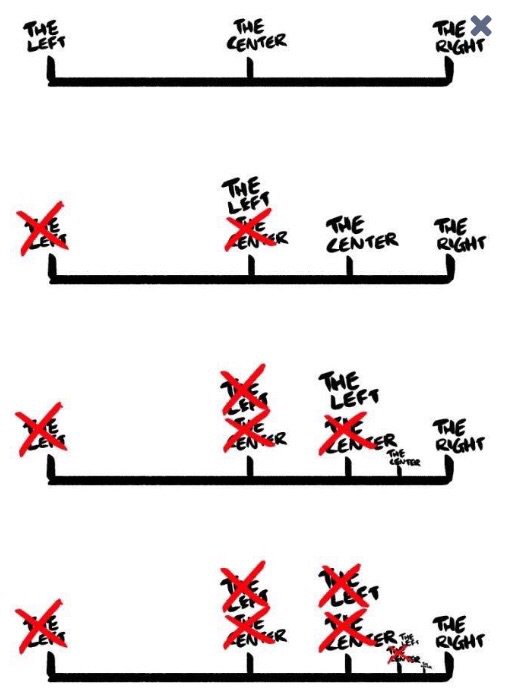

What Rutte’s going to do next is form a new coalition, this time not with the left but with the center-right, and no-one will be able to tell the difference. If Dutch, and European, and global, politics have one main problem, it’s that. Left is right and right is left and winners are losers. If a guy like Dijsselbloem can squeeze Greek society dry in his capacity as Eurogroup head, while he runs as a leftist candidate in his own country, and loses hugely, anything goes.

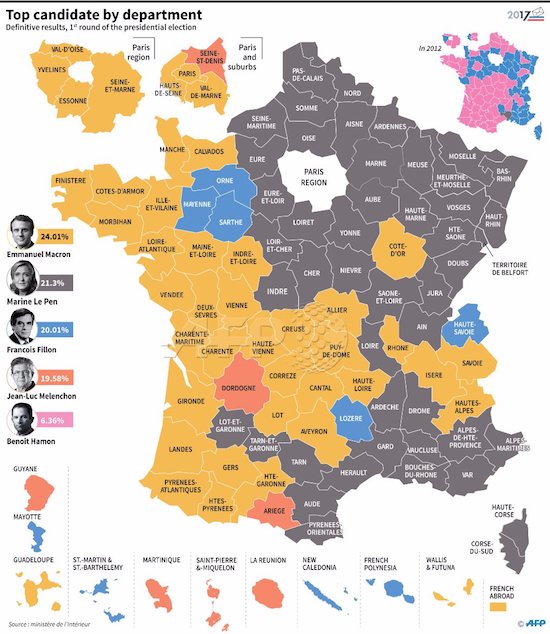

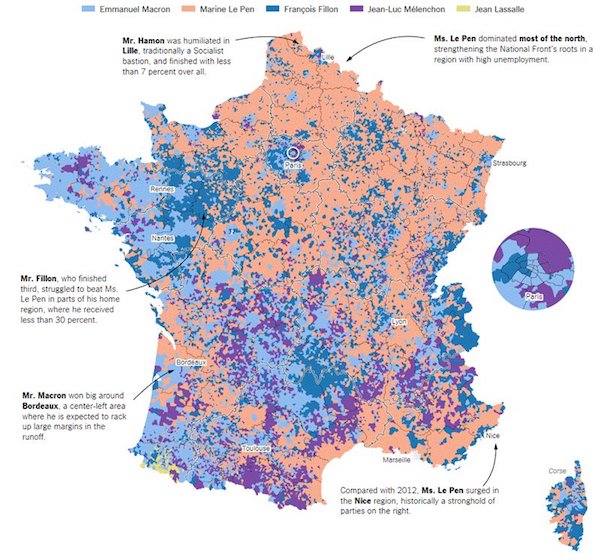

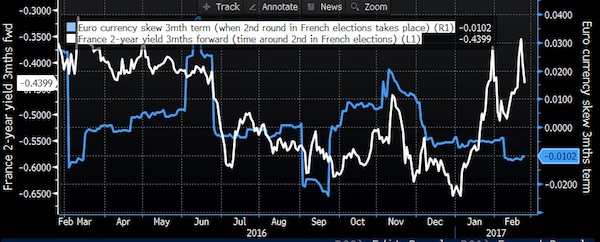

All those who think they can see in the Dutch experience, a sign that Marine Le Pen’s chances in France’s presidential elections in April and May have dropped a lot, would appear to be delusional. Judging from reactions in the financial markets, many seem to be. But Le Pen is much less of a fringe figure than Wilders is, and she certainly wouldn’t shun a debate. It’s true that her Front National is a one-woman operation, bit she has a much clearer political program than Wilders does.

And she doesn’t have an opponent like Rutte, who’s become a formidable presence domestically, as anyone would be who can be PM for many years and not be put out by the curb. The man who should be Le Pen’s main adversary is not; Hollande is out by that curb and doesn’t even dare run again. His Socialist party has become a joke. The next strongest opponent should be François Fillon, but he’s all but gone now he’s been placed under formal investigation.

That leaves only Emmanual Macron, an independent without a party and without a program. In France, you can be elected president in such a situation, but your hand are tied in all sorts of ways, because you need parliament to vote for things.

..the nuances of the French political system put Macron in a spot of bother. The president derives their power from the support of a majority in the lower house of parliament, the National Assembly. Macron was a minister for the Socialist Party government but quit in 2016 to form his own political movement. Now he doesn’t even have a party, let alone a majority. Although the constitution of the French Fifth Republic, created by Charles De Gaulle in 1958, extended presidential powers, it did not enable the president to run the country.

There are only a few presidential powers that do not need the prime minister’s authorisation. The president can appoint a prime minister, dissolve the National Assembly, authorise a referendum and become a “temporary dictator” in exceptional circumstances imperilling the nation. They can also appoint three judges to the Constitutional Council and refer any law to this body. While all important tasks, this does not, by any stretch of the imagination, amount to running a country. The president can’t suggest laws, pass them through parliament and then implement them without the prime minister.

The role of a president is best defined as a “referee”. Presidential powers give the ability to oversee operations and act when the smooth running of institutions is impeded. So a president is able to step in if a grave situation arises or to unlock a standoff between the prime minister and parliament, such as by announcing a referendum on a disputed issue or by dismissing the National Assembly.

So, why does everyone see the president as the key figure? In a nutshell, it’s because the constitution has never been truly applied. There lies the devilish beauty of French politics. A country known since the 1789 revolution for its inability to foster strong majorities in parliament has succeeded, from 1962, in providing solid majorities.

Perhaps those who believe that what happened in Holland is also likely to happen in France are swayed by the notion that both are part of the EU. But they are very different countries and cultures, and different political systems. And Le Pen is no Wilders. She doesn’t say crazy things anymore, she’s cleansed the public image of her party by getting rid of her father, and she keeps any remaining extremists out of view.

There is still plenty suspicion in France about her, and about her party, but there are also a lot of people who agree with a lot of what she says. The perhaps most noteworthy statement she’s made recently is that she would step down if she loses the referendum about membership of the EU she intends to launch if elected president. That should keep Brussels on their toes. Marine means what she says. And a lot of French people may get to like her for that. In a political landscape in which the competition keeps shooting itself in the foot.

Another thing about Le Pen is that her political program contains quite a few bits and bolts that could be labeled leftist; a 35-hour work week, retirement at 60, lower energy prices. It’s just that she wants to reserve these things for the French. Foreigners, especially, Muslims, are not invited. And she is very much opposed to neo-liberalism and globalization:

They’ve made an ideology out of it. An economic globalism which rejects all limits, all regulation of globalization, and which consequently weakens the immune defences of the nation state, dispossessing it of its constituent elements: borders, national currency, the authority of its laws and management of the economy, thus enabling another globalism to be born and to grow: Islamist fundamentalism..

Le Pen’s popularity does not come from an overwhelming innate racism in France -though such a thing certainly exists-. It comes instead from the formidable failure that the country’s immigration policy has been for many decades. At the outskirts of major cities ghetto’s have been allowed to form in which those that come from former French colonies, especially in Africa, feel trapped with no way out. The French tend to feel superior to all other people, and the political system has let the situation slip completely out of hand.

Now France, and Europe is general, will have to deal with this mess. So far, the main European reaction is to turn Greece into a prison camp for a new wave of refugees and migrants. That can of course only make things worse. And it doesn’t solve any of the existing problems. Which makes the rise of Marine Le Pen inevitable.

And Wilders too; he’s the no. 2 party in Holland, because his party won 33% more seats than in 2012 to go from 15 to 20. That 33% gain, versus Rutte’s 20% loss, makes Wilders a loser in the eyes of many ‘relieved’ observers.

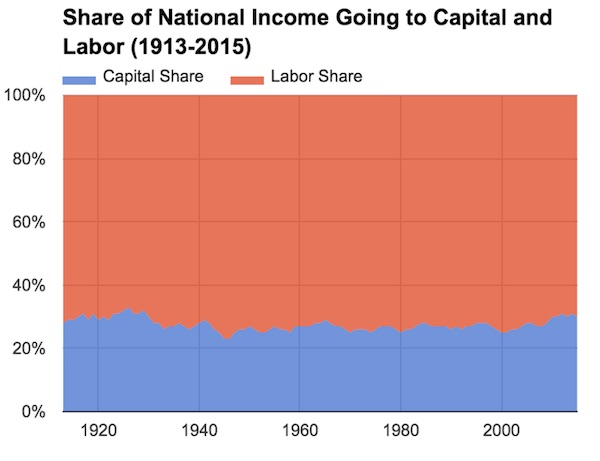

Winners are losers, and as is evident in Le Pen’s social policies for the French, in European coalition governments that contain Labor and right wing parties, and in the course of the Democratic party in the US, left is definitely the same as right.

Orwell always wins. Next problem: the actual left are not represented by anyone anymore.

MarcRiboud Sur les Quais de Paris 1953

The Dutch elections on Wednesday have provided a whole bunch of Orwellian narratives. PM Mark Rutte’s right wing VVD party, actually the ‘business’ -or should we say ‘rent-seekers’ in 2017- party, who lost some 20% of the seats they had obtained in the previous parliamentary election in November 2012, down from 41 to 33 seats, is declared the big winner. While Geert Wilders’ very right wing party, PVV, won 25% more seats -it went from 16 to 20- and is the big loser.

Moreover, Rutte’s coalition partner, labor PvdA, gave up 29 out of 38 seats to end up with just 9. That’s a loss of over 75%. Together, the coalition partners went from 79 seats in the 2012 election to 42 in 2017. That’s an almost 50% less. Not that it could prevent Rutte from proudly declaring: “We want to stick to the course we have – safe and stable and prosperous..” Makes you wonder who the ‘we’ are that he’s talking about.

That course he wants to stick to had a finance minister named Dijsselbloem, and his party just lost by over 75%. So he won’t be back. But perhaps the EU can pull another ‘Tusk’, and leave him in place in Brussels as chairman of the Eurogroup no matter what voters in his own country think of him. Still, declaring your intention to ‘stick to the course’ when your coalition has just been sawed in half, it’s quite something.

The only reasons Rutte’s VVD ended up being the biggest party all have to do with Wilders. The anxiety over the election all had to do with polls. Wilders is a one man party and a a one trick pony. If he would leave, his party would dissolve. And his sole ‘message’ is that Islam is bad and should vanish from first Holland and then Europe. He doesn’t really have any other political program points. Ok, there’s Brussels. Doesn’t like that either.

Perhaps that’s why he largely shunned the pre-election debates. Problem with that is, these things attract a lot of TV viewers, crucial free air-time. All in all, since he’s his own worst enemy in many respects, it’s not that much of a surprise that Wilders’ support collapsed, and that’s just if we were to take Dutch pollsters more serious than their counterparts in the US and UK.

Talking of which, according to Rutte, those are the countries where ‘the wrong kind of populism’ has won and delivered Trump and Brexit. And of course there are lots of people who agree with that. What either they, or Rutte himself, would label ‘the right kind of populism’ is unclear. Maybe Rutte himself is the right kind of populist?

The row with Turkey over the weekend must have helped Rutte quite a bit. Not only were his actions in the row met with approval by a large majority of the Dutch population, including just about all other party leaders, the Dutch also got to think about what WIlders would do in such a situation. And there can be no doubt that Rutte is seen as much more of a statesman than Wilders.

Not that the row is over. After Turkey announced yesterday it would return 40 Dutch cows (?!) , today Turkish Foreign Minister Cavusoglu said Europe’s politicians are “taking Europe toward an abyss”, and: “Soon religious wars will break out in Europe. That’s the way it’s going.” There can be no doubt that a shouting war like this with Wilders as one of the participants would take on a whole different shape, and a different choice of words.

What Rutte’s going to do next is form a new coalition, this time not with the left but with the center-right, and no-one will be able to tell the difference. If Dutch, and European, and global, politics have one main problem, it’s that. Left is right and right is left and winners are losers. If a guy like Dijsselbloem can squeeze Greek society dry in his capacity as Eurogroup head, while he runs as a leftist candidate in his own country, and loses hugely, anything goes.

All those who think they can see in the Dutch experience, a sign that Marine Le Pen’s chances in France’s presidential elections in April and May have dropped a lot, would appear to be delusional. Judging from reactions in the financial markets, many seem to be. But Le Pen is much less of a fringe figure than Wilders is, and she certainly wouldn’t shun a debate. It’s true that her Front National is a one-woman operation, bit she has a much clearer political program than Wilders does.

And she doesn’t have an opponent like Rutte, who’s become a formidable presence domestically, as anyone would be who can be PM for many years and not be put out by the curb. The man who should be Le Pen’s main adversary is not; Hollande is out by that curb and doesn’t even dare run again. His Socialist party has become a joke. The next strongest opponent should be François Fillon, but he’s all but gone now he’s been placed under formal investigation.

That leaves only Emmanual Macron, an independent without a party and without a program. In France, you can be elected president in such a situation, but your hand are tied in all sorts of ways, because you need parliament to vote for things.

..the nuances of the French political system put Macron in a spot of bother. The president derives their power from the support of a majority in the lower house of parliament, the National Assembly. Macron was a minister for the Socialist Party government but quit in 2016 to form his own political movement. Now he doesn’t even have a party, let alone a majority. Although the constitution of the French Fifth Republic, created by Charles De Gaulle in 1958, extended presidential powers, it did not enable the president to run the country.

There are only a few presidential powers that do not need the prime minister’s authorisation. The president can appoint a prime minister, dissolve the National Assembly, authorise a referendum and become a “temporary dictator” in exceptional circumstances imperilling the nation. They can also appoint three judges to the Constitutional Council and refer any law to this body. While all important tasks, this does not, by any stretch of the imagination, amount to running a country. The president can’t suggest laws, pass them through parliament and then implement them without the prime minister.

The role of a president is best defined as a “referee”. Presidential powers give the ability to oversee operations and act when the smooth running of institutions is impeded. So a president is able to step in if a grave situation arises or to unlock a standoff between the prime minister and parliament, such as by announcing a referendum on a disputed issue or by dismissing the National Assembly.

So, why does everyone see the president as the key figure? In a nutshell, it’s because the constitution has never been truly applied. There lies the devilish beauty of French politics. A country known since the 1789 revolution for its inability to foster strong majorities in parliament has succeeded, from 1962, in providing solid majorities.

Perhaps those who believe that what happened in Holland is also likely to happen in France are swayed by the notion that both are part of the EU. But they are very different countries and cultures, and different political systems. And Le Pen is no Wilders. She doesn’t say crazy things anymore, she’s cleansed the public image of her party by getting rid of her father, and she keeps any remaining extremists out of view.

There is still plenty suspicion in France about her, and about her party, but there are also a lot of people who agree with a lot of what she says. The perhaps most noteworthy statement she’s made recently is that she would step down if she loses the referendum about membership of the EU she intends to launch if elected president. That should keep Brussels on their toes. Marine means what she says. And a lot of French people may get to like her for that. In a political landscape in which the competition keeps shooting itself in the foot.

Another thing about Le Pen is that her political program contains quite a few bits and bolts that could be labeled leftist; a 35-hour work week, retirement at 60, lower energy prices. It’s just that she wants to reserve these things for the French. Foreigners, especially, Muslims, are not invited. And she is very much opposed to neo-liberalism and globalization:

They’ve made an ideology out of it. An economic globalism which rejects all limits, all regulation of globalization, and which consequently weakens the immune defences of the nation state, dispossessing it of its constituent elements: borders, national currency, the authority of its laws and management of the economy, thus enabling another globalism to be born and to grow: Islamist fundamentalism..

Le Pen’s popularity does not come from an overwhelming innate racism in France -though such a thing certainly exists-. It comes instead from the formidable failure that the country’s immigration policy has been for many decades. At the outskirts of major cities ghetto’s have been allowed to form in which those that come from former French colonies, especially in Africa, feel trapped with no way out. The French tend to feel superior to all other people, and the political system has let the situation slip completely out of hand.

Now France, and Europe is general, will have to deal with this mess. So far, the main European reaction is to turn Greece into a prison camp for a new wave of refugees and migrants. That can of course only make things worse. And it doesn’t solve any of the existing problems. Which makes the rise of Marine Le Pen inevitable.

And Wilders too; he’s the no. 2 party in Holland, because his party won 33% more seats than in 2012 to go from 15 to 20. That 33% gain, versus Rutte’s 20% loss, makes Wilders a loser in the eyes of many ‘relieved’ observers.

Winners are losers, and as is evident in Le Pen’s social policies for the French, in European coalition governments that contain Labor and right wing parties, and in the course of the Democratic party in the US, left is definitely the same as right.

Orwell always wins. Next problem: the actual left are not represented by anyone anymore.