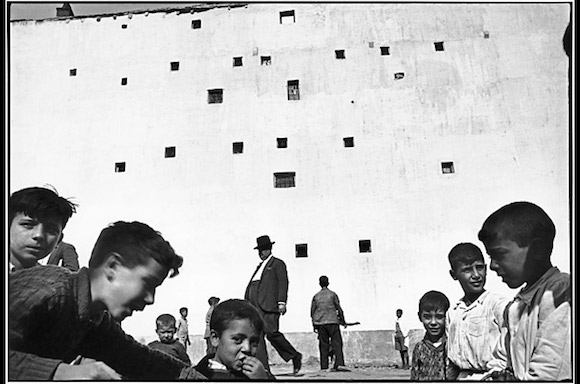

Tamara de Lempicka The refugees 1937

Note: I feel kind of sorry this has become such a long essay. But I still left out so much. You know by now I care a lot about Greece, and it’s high time for another look, and another update, and another chance for people to understand what is happening to the country, and why. To understand that hardly any of it is because the Greeks had so much debt and all of that narrative.

The truth is, Greece was set up to be a patsy for the failure of Europe’s financial system, and is now being groomed simultaneously as a tourist attraction to benefit foreign investors who buy Greek assets for pennies on the dollar, and as an internment camp for refugees and migrants that Europe’s ‘leaders’ view as a threat to their political careers more than anything else.

I would almost say: here we go again, but in reality we never stopped going. It’s just that Greece’s 15 minutes of fame may be long gone, but its ordeal is far from over. If you read through this, you will understand why that is. The EU is deliberately, and without any economic justification, destroying one of its own member states, destroying its entire economy.

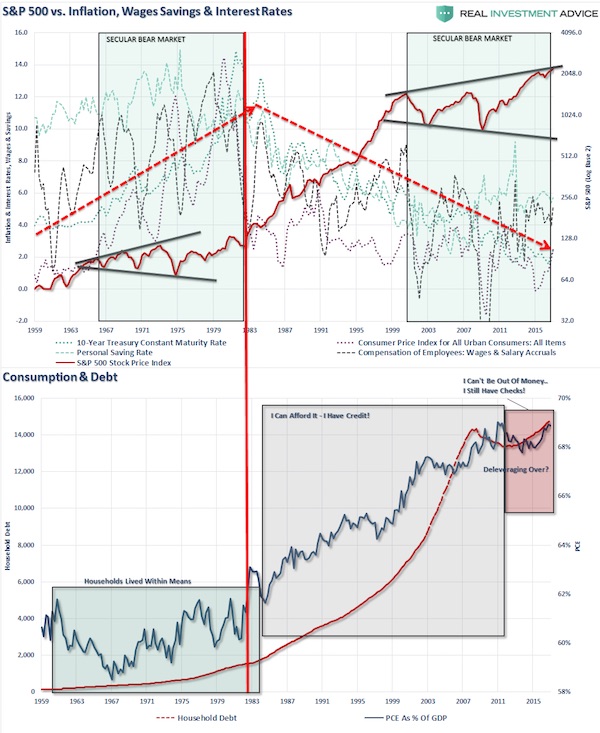

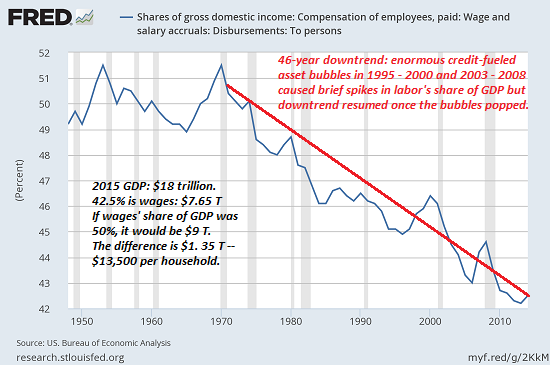

A short article in Greek paper Kathimerini last week detailed the latest new cuts in pensions the Troika has imposed on Greece, and it’s now getting beyond absurd. For an economy to function, you need people spending money. That is what keeps jobs alive, jobs which pay people the money they need to spend on their basic necessities. If you don’t do at least that, there’ll be ever fewer jobs, and/or ever less money to spend. It’s a vicious cycle.

We may assume the Troika is well aware of this, and that would mean they are intentionally killing off the Greek economy. Something I’ve said a thousand times before. Still, both the Greek Tsipras government and exterior voices continue to claim the economy is recovering. Even if that is mathematically impossible. There undoubtedly are sectors of the economy being boosted, but they are only the ones the Troika members are interested in.

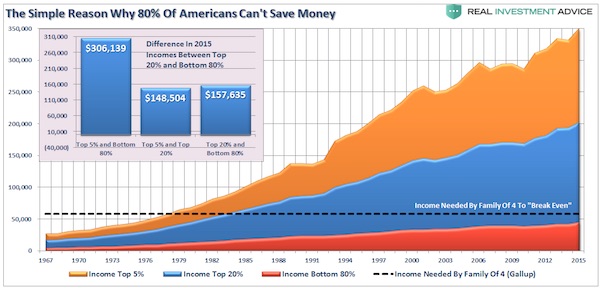

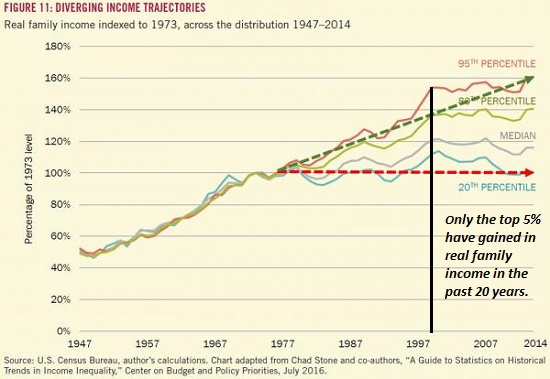

The economy’s foundation, the ‘normal’ people, who work jobs if they’re lucky, are not recovering or being boosted. Quite the contrary. Half of young people are unemployed and receive no money at all. Most of those who do have jobs receive less than €500 for a full month of work. Mind you, this is while the cost of living is as high as it is in Germany or Holland, where people would protest vehemently if even their unemployment benefits were cut that low. Unemployment benefits hardly exist at all in Greece.

This situation, as also mentioned often before, means that entire families must live off the pension a grandmother or grandfather gets. As of next year, such a pension will be cut to net €480. Of which most will go to rent. And the cuts are not finished. There are plenty neighborhoods in Athens where there are more boarded-up shops then there are open ones. It is fiscal waterboarding, it is strangulation of an entire society, and there is no valid economic reason for it, nor is there a justification.

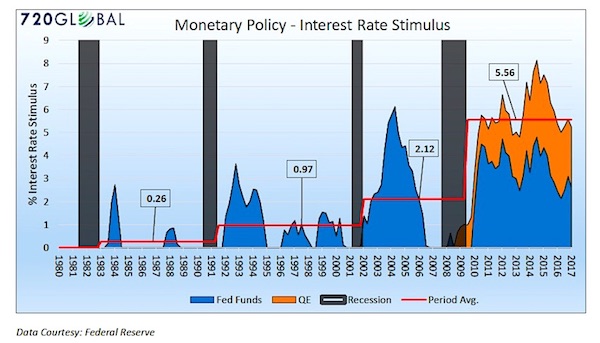

If Greece had access to international debt markets, if would perhaps pay a higher interest rate, but investors would buy its bonds. The Troika denies Greece that access. Likewise, if the ECB had not excluded the country from its QE bond-buying programs, the country would be nowhere near its present disastrous predicament. The ECB’s decision not to buy Greek bonds can only be a political one, it’s not economic. There is something else going on.

Here’s that latest pension news:

Greek Pension Cuts To Hit 70% Since The Start Of The Bailouts

The next batch of pension cuts, voted through in the last couple of years and set to come into force within the next two years, will take total losses for pensioners since the start of the bailout period in 2010 up to 70%. A recent European Commission report on the course of Greece’s bailout program revealed that the reforms passed since 2015 will slash up to 7% of the country’s GDP up to 2030. The United Pensioners network has made its own calculations and estimates that the impending cuts will exacerbate pensioners’ already difficult position, with 1.5 million of them threatened with poverty. The network argues that when the cuts expected in 2018 and 2019 are added to those implemented since 2010, the reduction in pensions will reach 70%.

Network chief Nikos Hatzopoulos notes that “owing to the additional measures up until 2019, the flexibility in employment and the reduction of state funding from 18 billion to 12 billion euros, by 2021, one in every two pensioners will get a net pension of 550 euros [per month]. If one also takes into account the reduction of the tax-free threshold, the net amount will come to 480 euros.” Pensioners who retired before 2016 stand to lose up to 18% of their main and auxiliary pensions, while the new pensions to be issued based on the law introduced in May 2016 by then minister Giorgos Katrougalos will be up to 30% lower.

More than 140,000 retirees on low pensions will see their EKAS supplement decrease in 2018, as another 238 million euros per year is to be slashed from the budget for benefits for low income pensioners. The number of recipients will drop from 210,000 to 70,000 in just one year. There will also be a reduction in new auxiliary pensions (with applications dating from January 2015), a 6% cut to the retirement lump sum, and a freeze on existing pensions for another four years, as retirees will not get the nominal raise they would normally receive based on the growth rate and inflation.

As half of the pensioners see their pensions cut to €480 a month, they’re not the worst off in the country. There are about a million unemployed who get nothing at all, and 580,000 who do have ‘jobs’ but ‘earn’ just €407 a month. And that’s if they’re lucky enough to get a contract. Many don’t, and work for even less. Yeah, that’s how you keep unemployment numbers down; Americans should know all about it.

Unemployment Decreases, Yet 580,000 Workers Earn Just €407 Per Month

Greece’s jobless rate fell to 20.2% in July-to-September from 21.1% in the second quarter, data from the country’s statistics service ELSTAT have showed. About 75.6% of Greece’s 970,000 jobless are long-term unemployed, meaning they have been out of work for at least 12 months, the figures showed on Thursday. Greece’s highest unemployment rate was recorded in the first quarter of 2014, when joblessness hit 27.8%.

Athens has already published monthly unemployment figures through June, which differ from quarterly data because they are based on different samples and are seasonally adjusted. Quarterly figures are not seasonally adjusted. At the same time, part-time employment has been constantly increasing. According to latest data, 580,000 workers earn just 407 euros per month. An amount that is for sure not enough to help people come through the month. And this data refers to declared work contracts. In undeclared work market people earn even 200 or 300 euros.

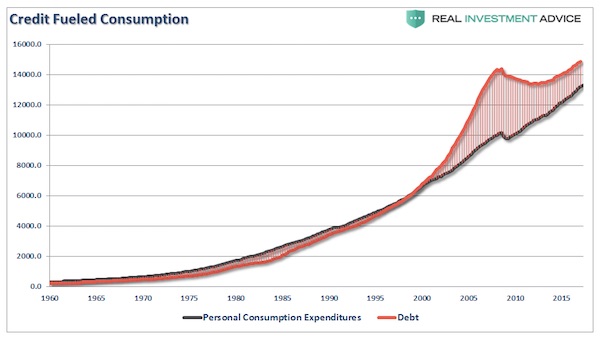

While all these Greeks don’t make enough to feed themselves and their families, the Troika-induced tax rises keep on coming like a runaway train with broken brakes. Every single day, more people are added to the list of those who simply can’t afford to pay their taxes, under the guise of going after ‘strategic defaulters’. There is no way out if this other than large scale debt forgiveness, debt restructuring, debt write-offs. Consumer spending is what keeps economies alive, but in Greece that is what’s shrinking day after day.

Greeks Crushed By Tax Burden

Tax authorities have confiscated the salaries, pensions and assets of more that 180,000 taxpayers since the start of the year, but expired debts to the state have continued to rise, reaching almost €100 billion, as the taxpaying capacity of the Greeks is all but exhausted. In the month of October, authorities made almost 1,000 confiscations a day from people with debts to the state of more than €500. In the first 10 months of the year, the state confiscated some €4 billion, and the plans of the Independent Authority for Public Revenue provide for forced measures to be imposed on 1.7 million state debtors next year.

IAPR statistics show that in October alone, the unpaid tax obligations of households and enterprises came to €1.2 billion. Unpaid taxes from January to October amounted to €10.44 billion, which brings the total including unpaid debts from previous years to almost €100 billion, or about 55% of the country’s GDP. The inability of citizens and businesses to meet their obligations is also confirmed by the course of public revenues, which this year have declined by more than €2.5 billion. The same situation is expected to continue into next year, as the new tax burdens and increased social security contributions look set to send debts to the state soaring. Notably, since 2014, there has been a consolidated trend of a €1 billion increase each month in expired debts to the state.

There are now 4.17 million taxpayers who owe the state money. This means that one in every two taxpayers is in arrears to the state, with 1,724,708 taxpayers facing the risk of forced collection measures. Of the €99.8 billion of total debt, just €10-15 billion is still considered to be collectible, as the lion’s share concerns debts from previous years, in many cases of bankrupt enterprises and deceased individuals.

Lately, a narrative is being force-fed into, and by, western media about Greece becoming some sort of paradise for investors. But why would anyone want to invest into an economy that clearly is no longer functioning, not even viable? Well, in such an economy, all kinds of things can be bought on the cheap. And because Greece is very beautiful, and has beautiful weather, why not buy it all and turn it into a tourist colony owned by foreigners and the odd rich Greek?

One tiny thing: they would prefer a different, even more business-friendly government. As if Tsipras hasn’t crawled up the Troika’s where-the-sun-never-shines parts enough. That’s the context into which to place for instance Kyle Bass’s comments:

Kyle Bass: Investors to Pour Billions into Greece after Political Change

Hedge fund manager Kyle Bass believes that Greece will come out of the crisis and investors will pour billions into its economy once the government changes, according to a CNBC report. The founder and chief investment officer of Hayman Capital Management; which manages an estimated $815 million in assets, is closely following the course of the Greek economy and political situation, and has invested in Greek bank stocks.

Bass says that foreign investors are waiting on the sidelines for a political shift to take place in 2018. “My best guess is a snap election for prime minister will be called between April and September of next year and Prime Minister Alexis Tsipras will lose power. When that happens, there will be a massive move into the Greek stock market. Big money will flow in as investors feel more confident with a more moderate administration,” Bass said.

“It’s going to take Kyriakos Mitsotakis; president of New Democracy, the Greek conservative party, to be voted in as prime minister to reform the culture and rekindle investor confidence,” the investor said. “I have no doubt 15 billion euros in bank deposits will come back to Greek banks if he’s elected. The stock and bond markets will also jump following the election.” Bass says that global investors are waiting for the political change in order to invest in real estate, energy and tourism.

So far, the hedge fund manager noted, Greece has proceeded with privatizations of its main port; regional airports; its railway system; the largest insurance company, and there are more important ones to be completed within the next two years. “There is so much potential in Greece,” Bass said, noting that investors are waiting for the right moment to enter, the CNBC report concludes.

Kyle Bass and all his ilk are lining up for the goodies for pennies on the dollar. If only the desolate pensioners and unemployed young are desperate enough to believe that, and vote for, a right-wing government is good, simultaneously, for both their interests and that of international vultures and hedge funds.

Funds Take Positions Ahead Of Government Change In Greece

Brevan Howard Asset Management, one of Europe’s biggest hedge funds, revealed to Bloomberg on Tuesday that it has set up two investment funds whose exclusive targets are assets in Greece such as real estate, enterprises and securities, and is aiming to collect 500 million euros from private investors. Co-founder of Brevan Howard and head of one of the two funds Trifon Natsis said that some 250 million euros has already been collected. The company was co-founded by four others, including Alan Howard, in 2002. “After eight years of crisis and recession that’s hit Greece, we’re at a point where the tail risks have disappeared and the country is stabilizing at a low base,” he said.

“We anticipate a material uplift in the Greek economy and asset prices.” “The likely political transition over the next 12 to 18 months will add momentum and reinforce that process,” Natsis said. Brevan Howard seems to be in agreement with Hayman Capital, whose head Kyle Bass said a few weeks ago that the brewing change in government in Greece within the next 18 months will benefit the market: “You’re starting to see green shoots, you’re starting to see the banks do the right things finally in Greece, and you’re about to have new leadership,” he stated recently.

My personal assessment after spending much of my time over the past 2.5 years in Athens is that they will be disappointed. Not only does a country, to make it attractive for foreigners, need a functioning economy, which Greece no longer has even at a “low base”, but the anger that has been building up here, which was held in check by Syriza and its ultimately empty promises, is bound to explode when some right winger manages to seize power.

Athens is the most peaceful city you can imagine, the only violence is between ‘anarchists’ and police, and it mostly takes place at set dates and places. Violence among people is virtually non-existent, despite all the deception, the betrayal, the poverty and the youthful testosterone energy that has nowhere to go. But that’s not going to last, I’m afraid.

And that will also be because many Greeks understand the contents of the following, devastating, interview by Michael Nevradakis for Mint Press News with Nicholas Logothetis, former member of the board of the Greek Statistical Authority (ELSTAT). Greece has been set up. And many people here know it. They have put their hopes in the democratic process, in voting into power a different government from the same old clique they have seen for many decades.

The likely winner of the next elections is New Democracy, led by Kyriakos Mitsotakis, the man the hedge-funders want in. Mitsotakis, a banker, is very much part of the old Greek elite, his father was a prime minister. If he gets elected things are not very likely to remain peaceful. Says my gut.

Update: while I was writing this article, the following came out. Eurogroup head Dijsselbloem admitting the first Greek referendum had nothing to do with helping Greece, the reason always provided for why it happened. Instead, it was always, as we’ve said so many times, meant to save German and French banks. And now that he’s leaving the job, Dijsselbloem, who obviously feels untouchable, just lays it out there. After having played a large role in destroying the country, the society, the economy. It’s almost hard to believe. But only almost. Because the Troika doesn’t answer to anyone. Then again, Greece has an independent judicial system.

The Aim Of The First Memorandum Was To Rescue Investors Outside Greece, Dijsselbloem Admits

The main aim of the first Greek memorandum, especially, was to rescue investors outside Greece, outgoing Eurogroup chief Jeroen Dijsselbloem admitted in the Europarliament on Thursday. “There were mistakes in the first programmes, we improvised. The way we dealt with the banks was expensive and ineffective. It is true that our aim was to rescue investors outside Greece and for this reason I support the rules for bail-ins, so that investors aren’t rescued with tax-payers’ money,” said Dijsselbloem in reply to independent Greek MEP Notis Marias.

Dijsselbloem noted that it had been a huge crisis because the fiscal sector had faced the risk of a total collapse that would have left many countries with a high debt. However, he pointed out that banks had only needed €4.5 billion in the third programme because the private sector had a huge participation. Referring to the non-performing loans, he said that a private solution that did not once again place the burden on tax-payers was near. He also pointed to measures being taken in Greece for the protection of the socially weaker groups, to make sure that they were not the victims of the auctions.

Referring to the early payment of the IMF loans with the remaining money of the programme, the Eurogroup chief said that this made sense financially, given that the IMF’s loans were more expensive than those of the Europeans. However, from a political point of view, the Eurogroup prefers that the IMF remain fully involved in the Greek programme, with its own responsibilities, he added. In any case, he noted that the final decisions on debt relief will be made later, when the programme is concluded and the sustainability of the Greek debt has been examined.

As an introduction, a piece of that interview with former Greek Statistical Authority bioard member Nicholas Logothetis (see the rest below). Greece being set up is not just some fantasy idea.

In my opinion, joining these medieval memorandums, which have brought about this economic crisis that Greece is still experiencing, was beyond any doubt pre-planned and predetermined. This arises not only from Strauss-Kahn’s own admission that the IMF had been preparing every detail of this with Papandreou, it also arises for other reasons that subsequently became known – that Greece was chosen by the designers of the European Union to become the guinea pig for the implementation of harsh austerity and other forms of economic punishment, set up for all as an example to be avoided, in the context of a new EU economic policy for handling the member countries with fiscal problems.

Indeed, the policy of the memorandums gave the opportunity not only to the IMF to put a foot in Europe – until then its activities always were, with devastating consequences, limited to developing countries in Africa and Latin America – but also gave the opportunity to the French and German banks to get rid of their so-called toxic bonds, that were loaded onto the Greek people by turning a private debt into a state debt.

In order to achieve all of this, of course, they had to plant the appropriate person in ELSTAT at a time when certain statistical adjustments were required, in order to support their treacherous plan. Where did this lead eventually? To the bankruptcy of the Greek state.

This is some story. It’s being denied in what just about amounts to a full blast PR campaign by many of those involved on the Troika side. Their narrative is: how dare the Greeks attack, and drag into court, their own unblemished ex-IMF statistician (who’s not even a statistician)? Whereas the actual question should be: how dare the Troika et al attack the Greek judicial system?

They’re getting away with it so far, but there are still court cases pending. And as Nicholas Logothetis says, he is confident that the Greek court system is the only party that has the power and the independence to set this straight.

I wanted to take bits and pieces out of this, shorten it etc., but it’s just too good. Sorry, Michael, sorry MintPress! It reads like a crime novel. And you can never again say you didn’t know. We can only hope that the Greek court system will hold Europe to task.

But while they can probably call on Papandreou to stand trial, what about Strauss-Kahn or Lagarde? Or Schäuble and Dijsselbloem? What if they can even prove Greece was set up, who’s going to pay the damage done to the Greek population, society, and the Greek economy, over a decade?

It’ll take many decades for the country to recover from what has been perpetrated upon it. And this could only happen because western media have been too lazy and compliant to question what has been going on. 90%+ of what you’ve been reading about Greece has been fake news. Note: I always put everything I quote in italics, but this is an exception to that rule:

Here we go:

The Trials of Andreas Georgiou and the Fraud That Drove Greece into Austerity

The mainstream narrative regarding the cause of the severe economic crisis Greece has experienced is that the Greek people and Greek state were irresponsible with their finances, lived “beyond their means” at the expense of EU taxpayers, and provided overly generous social benefits and pensions to an underproductive, uncompetitive, and lazy populace.

These characterizations have then been used to justify the successive memorandum agreements, or “bailouts,” and the austerity measures that have been imposed in Greece since 2010, as the country’s “just deserts” — the “bitter medicine” that must be prescribed to correct Greece’s previous ills.

A different view exists, however — one that is based on allegations that Greece was driven into the memorandum and austerity regime not by economic incompetence and cultural deficiencies, but by a fraud that was perpetrated against the Greek people and the country of Greece.

In this interview, which aired in November on Dialogos Radio, Nicholas Logothetis, a former member of the board of the Greek Statistical Authority (ELSTAT), describes allegations that have been made against Andreas Georgiou, ELSTAT’s former president, and against EU statistical authority Eurostat, regarding how Greece’s deficit and debt figures were illegitimately inflated in 2010, providing the rationale to drag Greece under a regime of austerity and extreme economic oversight.

Logothetis details how debt swaps and other questionable financial dealings were added to Greece’s debt and deficit, as well as the consequences of these actions, the criminal and civil convictions against Georgiou, and the court cases that are still pending.

MPN: Let’s begin with a discussion about Andreas Georgiou, the embattled former president of ELSTAT, who oversaw the augmentation of the Greek deficit and debt. Describe for us Georgiou’s background prior to taking on the role of president of ELSTAT. Was Georgiou even a statistician?

NL: No, he wasn’t. The operation of the Hellenic Statistical Authority (ELSTAT), as a continuation of the initial National Statistical Authority, as we called it, officially began in late June of 2010. This was the time that the members of ELSTAT’s management board were selected and approved by the conference of parliamentary presidents, with the required supermajority of four-fifths.

Georgiou has been working at the International Monetary Fund since the late 1980s. For a few years before he came to Greece, he was deputy head of a division of the IMF’s statistics department, the financial institutions division. However, the Greek Ministry of Finance announced the appointment of ELSTAT’s board of directors through a press release to all Greek newspapers. In that press release, it presented Georgiou as deputy head of the entire IMF statistics department, a very big department in the IMF and a very important one, hiding his actual organizational position in the IMF, a position of an economic nature rather than a statistical nature, in a subordinate division of the statistics department.

Obviously, the objective of the Greek Minister of Finance was to present Georgiou as an experienced statistician with a significant management position at the IMF, who supposedly left America and came here to “save” Greece by putting in order all of its statistics. In fact, this gentleman was not only unable to run an important institution such as ELSTAT, with over 1,000 employees, but he wasn’t even a statistician, with no academic publications and no knowledge of statistics.

Moreover, for at least six months after assuming the ELSTAT presidency, Georgiou still held his organizational position at the IMF, something that was explicitly forbidden by ELSTAT’s founding law.

MPN: What were the actions undertaken by Georgiou as president of ELSTAT? In other words, how were the Greek deficit and debt figures manipulated and in what other ways were Greece’s official economic figures altered?

NL: First of all, Georgiou’s first moves were to remove from the other members of the board any ability and initiative to propose discussion topics or to be involved in the calculation of the deficit or the debt. They were forbidden even to communicate with the remaining staff of ELSTAT! This behavior of Georgiou was not only due to his inability to act as a manager but also due to the fact that he understood from the very beginning, even from the second meeting of the board in September 2010, our refusal to adopt the deficit and debt calculation procedures he wanted to follow. He knew that eventually, the majority of the board members would not approve his deficit figures to be officially published before the end of October 2010.

Andreas Georgiou, stands outside the headquarters of the Statistics agency, in Athens, Greece. (AP/Petros Giannakouris)

Shortly after the last meeting of the board in early October 2010, the final silencing of the whole board followed and we were never convened again, thus leaving the way free for Georgiou, always under the auspices of senior Eurostat executives, on the one hand, to change the founding law—as he always wanted, to turn ELSTAT into one-person authority—and on the other hand, to inflate the 2009 figures. Exactly how he did this became clear later, but we had suspected soon enough what he was going to do.

My first disagreement with him was when I realized he would add to the deficit figures and to the national debt of Greece the Simitis swaps — that is, the swaps that former Greek prime minister Costas Simitis had made use of in 2001 in order for Greece to get accepted to the Eurozone. Allow me to briefly explain what these swaps are, as they indicate clearly an activity typical of the statistical mishandlings that had always been used and are still taking place in our country, every time the government’s leaders want to achieve something with communication or financial benefits for themselves or for third parties. Swaps are a type of a bond, a banking derivative or simply a stock exchange bet, a currency exchange bet. Many countries do it, even now they are doing it, converting their existing debt into currencies of other countries, say in Swiss francs or Japanese yen, betting that the value of that currency will rise and at the maturity of this debt, the owner will gain from the difference in the value of currencies.

In a way, what happened in 2001 is that much of Greece’s debt was converted into yen, but at the value that the yen had in 1995, which was higher than that of 2001! Remember, the swaps were made in 2001, but the price of the yen in 1995 was the one used for this swap. We can put a big question mark here because I don’t know how legitimate this was, to consider as valid the exchange value of the yen of six years ago. But anyway, this was what happened.

From this action, Greece was theoretically gaining an amount of 2.8 billion euros, which theoretically reduced our debt by this amount, and also reduced the annual deficit below 3%, thus meeting the requirement of the Maastricht Treaty for Greece’s entry into the Eurozone. But let us not forget, however, that this was a bet. It’s not unlike, say, a bond that matures and is redeemable after 30 years: at the time of the swap, there was no applicable European regulation allowing the “bond” to be cashed in prior to maturity, and therefore the swaps were of indeterminate value.

However, Walter Radermacher — at the time the general director of Eurostat, the EU’s statistical authority — decided only for Greece and only for that time and while the value of the yen had collapsed, that this swap value had to be included in our total debt, thus raising our national debt by 21 billion euros because of the losses of the yen. So we found ourselves with an additional fiscal debt of 21 billion euros.

Radermacher’s additional act was to instruct Georgiou to divide this amount by four and to include what came out of it in the deficits for the years 2009, 2008, 2007, and 2006. So eventually, for 2009 and all the three previous years, we found ourselves with an additional deficit of about 5.5 billion euros. But I’m pointing out again that swaps should not be used in any way before their maturity, in order to manipulate negatively or positively the fiscal debt, let alone the yearly deficit.

Another illegal augmentation of our deficit made by Georgiou included the addition of 3.6 billion euros in hospital costs that were not even approved by the Court of Auditors. The Court of Auditors is one of the three institutions of Greek justice, along with the Supreme Court and the Council of State. With regards to this cost, as it turned out later, no one committed to it and no one was paying for it. And finally, the major swelling of the budget deficit was accomplished by the overnight inclusion of the deficits of 17 public utilities, violating many Eurostat criteria and rules. That alone added 18.2 billion euros, equivalent to 20 billion dollars, to the fiscal debt of Greece.

As a result of all the above, Greece ended up with a huge deficit for the year 2009 — 36 billion euros, or equivalently, 15.4% of GDP. This legitimated the first memorandum, paved the way for the second and worst memorandum, and justified the imposition of these cumbersome austerity measures, such as the pension cuts, social insurance and healthcare, and the tax increases — huge tax increases — measures that we are still suffering today.

MPN: Dominique Strauss-Kahn himself, the former president of the International Monetary Fund, has gone on the record as saying that he met with George Papandreou to discuss an IMF “bailout” of Greece in April 2009. This was several months before Papandreou was elected as prime minister and at a time when Papandreou was saying, while campaigning, that plenty of money existed to fund the social programs he was promising to Greek voters. Do you believe that the economic “crisis” in Greece was pre-ordained or pre-planned?

Greek Prime Minister George Papandreou, right, shakes hand with the head of the International Monetary Fund, Dominique Strauss-Kahn, during a joint news conference in Athens, Dec. 7, 2010. (AP/Thanassis Stavrakis)

NL: Yes, I do. In my opinion, joining these medieval memorandums, which have brought about this economic crisis that Greece is still experiencing, was beyond any doubt pre-planned and predetermined. This arises not only from Strauss-Kahn’s own admission that the IMF had been preparing every detail of this with Papandreou, it also arises for other reasons that subsequently became known — that Greece was chosen by the designers of the European Union to become the guinea pig for the implementation of harsh austerity and other forms of economic punishment, set up for all as an example to be avoided, in the context of a new EU economic policy for handling the member countries with fiscal problems.

Indeed, the policy of the memorandums gave the opportunity not only to the IMF to put a foot in Europe — until then its activities always were, with devastating consequences, limited to developing countries in Africa and Latin America — but also gave the opportunity to the French and German banks to get rid of their so-called toxic bonds, that were loaded onto the Greek people by turning a private debt into a state debt.

In order to achieve all of this, of course, they had to plant the appropriate person in ELSTAT at a time when certain statistical adjustments were required, in order to support their treacherous plan. Where did this lead eventually? To the bankruptcy of the Greek state.

MPN: Andreas Georgiou is no longer in Greece, despite the fact that various legal cases and judicial decisions are outstanding against him. Where does Georgiou find himself today and what is he presently involved with?

NL: He’s away, because he knows what he’s faced with, with trials and legal cases. Georgiou is currently in his comfortable villa in Maryland. He left Greece in the summer of 2015, one month before the end of his five-year term as ELSTAT chairman. Coincidentally, this was shortly after the call from the House of Parliament to testify before the examination committee that had been formed at that time to investigate the reasons for our accession to the first memorandum. He never came to the examination room, pretending to be in the hospital with “pneumonia.” Who on earth has ever heard of a pneumonia case in the middle of the Greek summer?

Anyway, immediately after his “discharge” from the hospital, he left for America. I repeat, one month before the end of his term and without requesting a renewal of the chairmanship position for another five years. He could have done that, but he didn’t, apparently having realized that he could not have avoided the imminent court hearing on the prosecutions for breach of duty and for the felony of inflating the deficit figures — which in the legal language is expressed as “felony of false certification at the expense of the state” together with the “aggravating order for public abusers,” a very impressive legal phrase. This is a legal category that leads to life imprisonment.

I presume that he’s engaged at this time in preparing his defense, through statements via his lawyers in Greece, while he remains absent, missing from every trial that has taken place regarding him.

MPN: A few months ago Georgiou was found guilty by the Greek justice system. What were the charges for which Georgiou was convicted and sentenced?

NL: There are two convictions Georgiou had this year. In March, in a criminal court, he was convicted for libel and for written defamation, and he was given one-year imprisonment with a three-year suspension. He appealed through his lawyers, but the Penal Court of Appeals condemned Georgiou again, giving him the same sentence.

Georgiou’s crime was that, in an official ELSTAT news release, he accused former ELSTAT board member Dr. Nicholas Stroblos of being a statistical swindler, obviously trying to divert guilt from himself for statistical fraud. I’m pointing out here that Dr. Stroblos is the former director of the national accounts department of ELSTAT, whom Georgiou illegally replaced with one of his now co-defendants. Consequently, Stroblos sued him in both criminal and civil courts and, apart from the one-year imprisonment imposed by the criminal court, the civil court fined Georgiou 10,000 euros for damages resulting from libel.

Georgiou’s most recent conviction is concerned with one of the three accusations included in the prosecution for breach of duty. The first accusation was related to the fact that he was in parallel for several months, from July to November 2010, as head of the statistical authority in Greece but also as an employee of the IMF, a duplication of employment explicitly prohibited by ELSTAT’s founding law 3832 of 2010. That law required him to work exclusively and with full employment in the ELSTAT board. Georgiou deluded the Greek parliament about his ongoing post with the IMF — and note that the IMF is one of the lenders of Greece — while at the same time he had accepted the post as president of ELSTAT’s board. He would not have been selected as ELSTAT president, not even as a simple member of the board, had the parliament known about his double post.

The second accusation concerned the fact that Georgiou did not convene the ELSTAT board for a whole year, violating the law that required meetings at least once a month.

The third accusation, and the most important of all three, concerned the fact that the decision to endorse the revised figures for 2009’s deficit was taken only by Georgiou, without the agreement of the other members of the board — which had been selected, I remind you, and approved exactly for this purpose by the conference of the parliamentary presidents with a majority of four-fifths. For this accusation, he was convicted in the context of breach of duty, and this had to do with the publication of deficit figures without our approval, as required by law. Georgiou appealed this conviction to the Supreme Court, and we are waiting to see what the Supreme Court will decide.

Georgiou was acquitted on the charge that he did not timely convene the ELSTAT board, although this is intimately interconnected with the non-convening of the board for the approval of the data, for which he was convicted. So we ended up with a paradoxical situation here. He was also acquitted of the charge that while he was a member of the IMF — that is to say, a servant of the lender — he was also chairman of ELSTAT — that is, a servant of the borrower — something that is inconceivable worldwide and yet happened in today’s occupied and economically enslaved Greece.

Naturally, the people who were present in the courtroom were annoyed and protested these acquittals, but when they heard the announcement of his conviction on the third charge they were relieved, of course, and for this charge he was sentenced to two years’ imprisonment with a three year suspension — without being granted, of course, any mitigation.

I, together with fellow whistleblower and former ELSTAT board member Zoe Georganta, filed an objection against the court judgment for the two accusations for which he was acquitted, and we expect a Supreme Court decision as to whether or not Georgiou will go to a new trial for these new accusations. At the moment, the two acquittals cannot be considered irrevocable. But it is true that the most important accusation, for which Georgiou desperately wanted to be acquitted, was the one for which he got convicted.

Indeed, the fact that Georgiou published the inflated elements of the deficit without approval by the ELSTAT board not only proves his guilt of the second accusation, of not convening the board as he should have, but it also implies a deception, because he knew that his swollen deficit figures would never be accepted by a majority of the board members. He further recognized that such a disagreement would sooner or later become public and reveal the irregularities he used with the help of Eurostat itself. Such a revelation would result in the failure of the plan to legitimize the first memorandum and thence to impose onerous austerity measures on Greece. That was not acceptable by the initiators of this plan, who I believe had to use Georgiou and instructed him to silence the rest of the ELSTAT board.

MPN: Following the guilty verdicts against Georgiou this past spring, a barrage of positive coverage and PR in favor of Georgiou appeared in the Greek and international media — including Bloomberg, the Washington Post and Politico. We also heard numerous statements of support from major political figures in Greece, the European Union, and elsewhere. These statements criticized the supposed lack of independence of the Greek justice system in the verdicts against Georgiou. How would you describe or characterize Georgiou’s network of support within and outside of Greece, and these arguments made in his favor?

NL: Yes, indeed, various statements have been heard and continue to be heard in support of Georgiou, trying to sanctify him, to elevate him as a serious personality and as an honest scientist. All this in order to justify everything he did illegally as ELSTAT president. All that has been said rests on myths that have been circulated by the domestic and foreign supporters of Georgiou, who are desperate that the case not be brought to the court of justice — the major case of the inflation of the deficit figures.

But this also proves their own guilt in the matter. If they really believe that Georgiou is innocent and that we are the slanderers and the liars, why don’t they let Greek justice do its job and prove his presumed innocence in a court hearing? I would even expect Georgiou himself to be the first to grab this opportunity to be redeemed. This furious effort of all his supporters to prevent the case from being brought to trial reveals their panic as well as their guilt, because they know very well that in the forthcoming court hearing all the evidence will be revealed proving that Greece has suffered the greatest national betrayal since the time of the Thermopylae treason, 2500 years ago, when Efialtes betrayed the Greek army which was fighting the Persian invasion.

The participation of all those major political figures in Greece and the European Union in the betrayal perpetrated by Georgiou will also be revealed. Indeed, the core of this support network includes first and foremost Eurostat, whose senior staff advised Georgiou on how to inflate the 2009 deficit and also how to change ELSTAT’s founding laws in order to neutralize the rest of the board.

Imagine therefore what impact Georgiou’s conviction would have on Eurostat’s image! Eurostat’s political chief is the European Commission, Brussels — that is, one-third of the troika — with all that implies, of course, for many high-ranking political figures in the European Union and beyond. So one can clearly understand why high-level managers from Eurostat and major political figures from the EU itself are continuing to build a wall of protection and support for Georgiou — in the hope that the government and the Supreme Court of Greece will believe all these myths they are promoting.

Greece’s Statistics agency employees walk past the logo of the agency in Piraeus, near Athens. (AP/Petros Giannakouris)

The first myth is that in recent years Georgiou was acquitted many times but the persecution against him continues. That’s what they say. The supporters of Georgiou claim again and again that Georgiou was acquitted, but it’s not true. The acquittal may occur only after the irrevocable final judgment in a court trial, or after an exonerating court order is accepted by the Supreme Court. As appeals against all rulings in Georgiou’s case have been filed with the Supreme Court, he has not been acquitted irrevocably for any charges brought against him.

On the contrary, he has had an irrevocable conviction for defamation, as I said before, and a conviction for one of the three accusations for breach of duty — regarding which the Supreme Court decision is awaited, whether or not it will become irrevocable. But the other two accusations for breach of duty for which he has been acquitted, as I have already said, for these we have filed a complaint and they cannot, therefore, be considered irrevocable or a final acquittal. So it’s in keeping with due process that the prosecutions against him still continue.

The second myth goes as follows: Georgiou took over the presidency of ELSTAT after the first memorandum. He cannot, therefore, be regarded responsible for the memorandum and the economic crisis that followed. Well indeed, when Georgiou took action in ELSTAT, we were already under the first memorandum. If you remember, our entry into the first memorandum was announced by George Papandreou in his speech made on the Greek island of Kasterllorizo in April 2010, and the reason for this was allegedly the high level of the 2009 deficit, which was put by Papandreou at 13.6% of GDP. That’s equivalent to about 30 billion euros.

However, it was not the actual deficit, but the prediction by Papandreou of what it would be after all relevant calculations took place. Papandreou did not have the right to take such an important decision, one that would affect Greek society so much, based only on a prediction that had not even been approved by the Court of Auditors. We would be the ones, as ELSTAT’s management board, to supervise the calculations of the actual deficit, to approve it and publish it in October 2010, six months later.

Actually, if we had been given the opportunity to do that and found these deficit figures to be less than 10%, we would have been able to denounce the first memorandum and cancel it! And of course, the rest of the memorandums that followed. But obviously, this would not be something that the designers of the first memorandum wished to happen, and so the appropriate person must be found who, with specific statistical adjustments, could make the deficit of 2009 “confirm” the “validity” of Papandreou’s deficit “forecast” in April 2010, and fully justify our entry into the first memorandum. This is what they wanted.

Furthermore, in order to avoid any controversies with the rest of the board that could endanger their plan, it was decided to neutralize not only the dissidents on the board but the whole of ELSTAT’s board. As a result of all these unlawful actions, the first memorandum was legitimized — and the door opened for the second and worst memorandum and obviously the rest of the memorandums that have followed, and for the austerity measures that have been imposed since then. Therefore, it’s perhaps wrong to say that the first memorandums was due to Georgiou. It’s more appropriate to say that all memorandums and their related medieval austerity measures that we still have on our backs are actually due to Georgiou!

The third myth: since Eurostat has approved Georgiou’s practices and figures, they must be right, they must be correct. But would it have been possible for Eurostat not to approve these statistics, provided by Georgiou, and the methods of administration that he was using? It was Eurostat’s director himself, Walter Radermacher, who gave orders to Georgiou as to what data to add to the deficit. Correspondence has been revealed, from Radermacher to Georgiou, that shows how to add this amount of debt that was incurred by the Simitis swaps, how to add it into four years’ deficits until 2009 — prior to the expiry date, as we previously explained, and although no European regulation existed at the time that would allow this.

Also, it was the permanent representative of Eurostat at ELSTAT, Hallgrimur Snorrason, who — with the assistance of Eurostat’s legal adviser, Per Samuelson — advised Georgiou on how to change ELSTAT’s founding law in order to transform ELSTAT into one-man authority. It’s hardly surprising therefore that Eurostat approved the practices and the deficit figures of Georgiou. Of course, that does not mean that they were correct.

The final myth that I want to mention is that his proponents are saying Georgiou applied all proper European regulations. On the contrary, most European regulations and Eurostat’s own criteria for the deficit and debt calculations were violated by Georgiou and his advisers from Eurostat, in order to justify the unjustifiable integration of deficits of many public utilities into the 2009 deficit — a decision that would require a thorough study of several months for each public utility. You can’t just decide to include the deficit of a utility in the public debt; you need a thorough study, for several months, six months. So what kind of European regulations did Georgiou actually apply, I wonder? No one knows.

MPN: What is plainly evident is that there is a very extensive and very powerful network of support for the likes of Andreas Georgiou, a network that includes powerful media voices, major politicians and political figures, major centers of power and influence and decision-making. How can such a powerful and seemingly unified network of political and media forces even be countered by the Greek people?

NL: Indeed, Georgiou’s support network, composed of high-ranking political figures — domestic and foreign — is powerful. But no matter how much influence this network can have on political affairs in Greece, I think that it is not in a position to influence the Greek justice system, which I consider impartial. The fact that the case has reached up to the level of the Supreme Court, which so far has justified many of our objections and appeals against Georgiou, gives us hope that ultimately the systemic power network that exists supporting Georgiou can be successfully dealt with.

At the end of the day, our justice system, perhaps the only irreproachable institution in our country, seems to have borne the burden of this matter. I believe that the truth will soon be revealed, no matter how many powerful political and media forces try to force an acquittal of Georgiou.

MPN: What are the judicial cases still outstanding regarding the ELSTAT case and Andreas Georgiou? What are the charges which Georgiou is still facing? And what is your expectation regarding the outcome of these cases?

NL: Most importantly, the cases of the false inflation of data and of the breach of duty by Georgiou, involve crimes of public document forgery and violation of ELSTAT’s founding law. As I have already said, Georgiou was convicted of one of the more important accusations related to the breach of duty — that of the publication of the 2009 deficit figures without the approval of the ELSTAT board. He has been acquitted on the other two charges — the duplication of his appointment in the IMF and ELSTAT and the non-convening of the board — but we have appealed these two verdicts, and we hope that the Supreme Court will decide to repeat the trial for these two related charges.

If this affair is remanded back to the trial courts, we certainly expect Georgiou to be convicted, because the evidence we have against him is rock solid and undeniable. This is what Georgiou’s supporters know. That’s why they push as hard as they can to prevent the case from reaching the high court of justice.

MPN: In what way do you believe the verdicts that will be reached by the Greek justice system concerning the ELSTAT and Georgiou cases impact the future of Greece, particularly with regard to the austerity policies and memorandums that are being imposed and the non-serviceable public debt of Greece?

NL: I agree with you that Greek debt is non-serviceable. Even if we get away from the memorandums, we don’t get away from the related loan agreements, and we will continue to be under supervision by the EU until we pay 75% of our debt, something impossible for the next 60 years!

If, however, as we hope, there is an irrevocable conviction of Georgiou for the act of inflating the deficit figures, this will prove that all these medieval memorandums were imposed on the basis of false figures — which gives Greece the right to claim compensation from the European Union for the damage we suffered in the last seven years of the financial crisis.

Article 340 of the Treaty on the Functioning of the European Union gives us the right to claim this compensation, and we have even estimated the financial loss since Georgiou set foot in Greece, a cost that may well exceed 210 billion euros. A compensation of this magnitude would certainly overturn the disgraceful economic situation we are experiencing today. However, I emphasize again that a necessary condition is an irrevocable conviction of Georgiou regarding the felony of inflating the deficit figures.

And what about these instigators who used Georgiou to carry out their treacherous plans? Even Grigoris Peponis — the impeccable investigator who proposed the criminal prosecution of Georgiou in the first place — has suggested that the possible existence of certain instigators within the Greek and European political systems, who directed Georgiou on what to do, has to be taken into consideration. These are the ones who do not want the case to reach an open court hearing — the ones who are so desperate for the acquittal of Georgiou as early as possible, in order to cover their own involvement in the above crime, because they’re well aware that we have evidence of their unlawful intervention in inflating the deficit and also in transforming ELSTAT from an independent authority into one-man authority.

If the Supreme Court sends Georgiou to trial in the high court of justice, all his supporters know that this will mean a likely conviction for him. The support network will then collapse, and they will find themselves accused for their betrayal of their homeland and crimes against its citizens. Our country will then pass from an underprivileged position of a beggar, to the strong position of a challenger, on the basis of specific articles of the Treaty on the Functioning of the European Union itself.

Protesters hold a banner during a rally in Athens, Thursday, Dec. 8, 2016. (AP/Yorgos Karahalis)

As far as we are concerned, we do not really care about the strict or non-strict punishment of Georgiou, who is now a pensioner of the IMF. What interests us is to prove his guilt and thereby to remove the injustice that has been committed against Greece through the false inflation of the public debt and deficit of 2009, and also prove the criminal involvement of the European Commission and Eurostat. This will only be done when the case is referred to an open court hearing, in which Eurostat and Georgiou will have to be present, in order to testify under oath whether or not they have falsely inflated the statistical figures of Greece, and the reasons for doing so.

I do not know when and if this will happen, and how many battles we have to give from now on in order to achieve this. Some tell us that there’s no point in continuing to fight, as it seems that with such a front of support for Georgiou by strong decision-making centers, the battle has already been won against us. We reply by saying that if we stop fighting, there will simply be no other battle — something we don’t want, because let’s not forget what Bertolt Brecht said once: “He who fights, can lose. He who doesn’t fight, has already lost.”

MPN: Looking at the situation in Greece today and the economic claims that are being made by the Greek government — that the country has returned to economic growth, that Greece has turned a corner — do you believe that the Greek statistical figures today are credible, or are they perhaps still being manipulated?

NL: Unfortunately, the statistical figures have already been exploited by any government in power so far in Greece. We have seen this happen with the alchemies of swaps in order to get into the Eurozone. By the way, I wish that we had never gotten into the Eurozone in the first place! Our economy was not in a position to handle such a strong and competitive currency. We saw another exploitation of the statistical figures, of the deficit, this time. They became the reason for an economic crisis of the past seven years.

I cannot say what is happening these days with the statistical figures, as I am not in ELSTAT. But we will find out sooner or later what is happening. The truth always comes out for any case of mishandling of statistical figures. We’ve seen this happen. But unfortunately, as long as there is no reliable team to correctly manage the handling of the statistical data in the Greek Statistical Authority, I’m afraid we should again expect irregularities and alchemies of the data.