DPC Gillender Building, corner of Nassau and Wall Streets, built 1897, wrecked 1910 1900

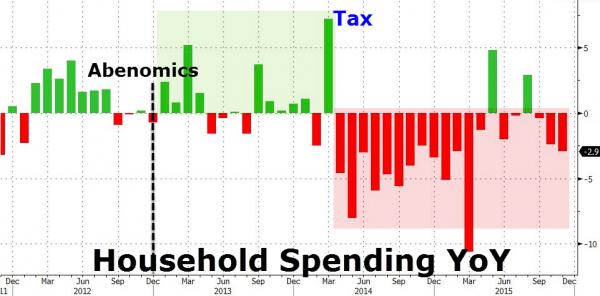

Oh, sure: “Manufacturers surveyed by the trade ministry expect to increase production by 0.9% in December and raise it by 6.0% in January. Zero Hedge take: ” • Household Spending plunges 2.9% YoY – worst since March (post-tax-hike) • Jobless Rate jumps to 3.3% (from 3.1%) • Industrial Production drops 1.0% MoM – worst in 3 months • Retail Trade tumbles 1.0% YoY – biggest drop since March (post-tax-hike) • Retail Sales plunges 2.5% MoM – Worst drop since Fukushima Tsunami (absent tax-hike)

• Japan Output, Retail Sales Slump, Dampen Recovery Prospects (Reuters)

Japan’s factory output fell for the first time in three months in November and retail sales slumped, suggesting that a clear recovery in the world’s third-largest economy will be delayed until early in 2016. While manufacturers expect to increase output in coming months, the weak data casts doubt on the Bank of Japan’s view that an expected pick-up in exports and consumption will help jump-start growth and accelerate inflation toward its 2% target. Industrial output fell 1.0% in November from the previous month, more than a median market forecast for a 0.6% decline, data by the trade ministry showed on Monday. Separate data showed that retail sales fell 1.0% in November from a year earlier, more than a median forecast for a 0.6% drop, as warm weather hurt sales of winter clothing.

“We’re finally seeing signs of pick-up in exports, but the economy has yet to make a clear turnaround,” said Takeshi Minami, chief economist at Norinchukin Research Institute. “There’s a risk consumption will remain sluggish and prevent economic growth from picking up,” he said. Japan’s economy narrowly dodged recession in July-September and analysts expect only modest growth in the current quarter, as consumption and exports lack steam. Some analysts warn the economy may suffer a contraction in October-December if household spending remains weak. Taro Saito, senior economist at NLI Research Institute, expects consumption in the current quarter to have risen less than a 0.4% quarter-on-quarter increase in July-September.

Wary of soft growth, the government plans nearly $800 billion in record spending in the budget for the fiscal year that will begin on April 1. The BOJ has signalled readiness to expand stimulus if risks threaten Japan’s recovery prospects. The central bank fine-tuned its stimulus programme on Dec. 18 to ensure it can keep up or even accelerate its money-printing. While sluggish emerging market demand dims the export outlook, analysts expect output to gradually increase early in 2016 as automakers ramp up production of new models. Manufacturers surveyed by the trade ministry expect to increase production by 0.9% in December and raise it by 6.0% in January.

Abe can still go nuttier. Just watch him. He has one policy only, has been pumping it for 3 years now, and it has failed miserably (as we always said it must). So that’s his career. Next: panic.

• Japan Business Lobby Head Won’t Commit To Higher Wages (Reuters)

The head of an influential Japanese business lobby won’t pass on the government’s requests to its members to raise salaries next year, a worrying sign that real wages may not increase fast enough to boost consumption in the country. Higher wages are crucial to policymakers’ efforts to break a decades-long cycle of weak growth and deflation. Prime Minister Shinzo Abe has won modest wage gains from the largest firms, but this has been slow to filter through the economy. Renewed concern about a slowdown in emerging markets and weak overseas demand could make more companies reluctant to raise wages. This could in turn scupper the government’s efforts to increase consumption and put the Bank of Japan’s 2% inflation target out of reach.

“The government is hoping for higher wages, but the Keizai Doyukai, as an organization that corporate executives personally belong to, is not going to tell its members what to do,” said Yoshimitsu Kobayashi, chairman of the Keizai Doyukai, which regularly participates in the government’s corporate policy panels and is one of Japan’s top three business lobbies. “Companies that don’t have money obviously won’t raise wages.” Since taking office in late 2012, Abe has repeatedly asked big business lobbies to encourage their members to raise wages at annual spring salary negotiations with unions. Abe will also raise the minimum wage by about 3% from next fiscal year to encourage salaries to rise more broadly throughout the economy.

Many companies have enjoyed record profits recently, so there is room for these companies to offer their workers higher pay, Kobayashi said. Japanese companies also have the funds needed to increase domestic investment in plants, research and develop their workers’ skills, he said. However, around 65% of people work at small and medium-sized enterprises, many of which are losing money and are therefore unlikely to raise salaries or spend extra money on training employees.

“Profits of state-owned enterprises among major industrial firms saw a 23% slump in the first 11 months this year..”

• China Industrial Profits Fall For Sixth Straight Month (Reuters)

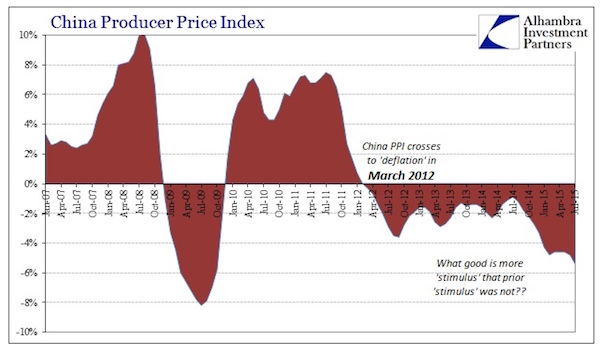

Profits earned by Chinese industrial companies in November fell 1.4% from a year earlier, marking a sixth consecutive month of decline, statistics bureau data showed on Sunday. Industrial profits – which cover large enterprises with annual revenue of more than 20 million yuan ($3.1 million) from their main operations – fell 1.9% in the first 11 months of the year compared with the same period a year earlier, the National Bureau of Statistics (NBS) said on its website. The November profits of industrial firms have seen some improvement from the previous month. In October, profits fell 4.6% from a year earlier. “The November industrial profit data matched earlier output data and they showed some signs of stabilizing, which are in line with recent data from other Asian countries,” said Zhou Hao at Commerzbank in Singapore, adding the figures were slightly better than market expectations.

The NBS said investment returns for industrial companies in November increased from a year earlier by 9.25 billion yuan ($1.43 billion). The jump in November profits from the auto manufacturing and electricity sectors, up 35% and 51% from a year earlier, respectively, helped narrow overall declines, the statistics bureau said. “Declines in industrial profits narrowed in November, but uncertainties still exist,” said He Ping, an official of the Industry Department at NBS. He added that inventory of finished goods grew at a faster pace last month. Profits of state-owned enterprises (SOEs) among major industrial firms saw a 23% slump in the first 11 months this year from the same period in 2014. Mining remained the laggard sector, with profits falling 56.5% in the same period. Aluminum producer China Hongqiao Group said in early December it would cut annual capacity by 250,000 tonnes immediately to curb supplies.

Eight Chinese nickel producers including state-owned Jinchuan Group, said they would cut production by 15,000 tonnes of metal in December and reduce output next year by at least 20% from this year, in a bid to lift prices from their worst slump in over a decade. China’s producer prices have been in negative territory for nearly four years due to weak domestic demand and overcapacity. The country’s top leader last week outlined main economic targets for next year after they held the annual Central Economic Work Conference, where it said the government will push forward “supply-side reform” to help generate new growth engines in the world’s second-largest economy while tackling factory overcapacity and property inventories.

Hotshots keep disappearing over there. Think they have a luxury resort they all gather in?

• Head Of China Telecom ‘Taken Away’ As Probe Launched (AFP)

The head of China Telecom, one of the nation’s big three telecoms firms, is under investigation for “severe disciplinary violations”, the government said Sunday, the latest high-profile target in a corruption crackdown. News of the probe into Chang Xiaobing, 58, was given in a statement on the website of the Central Commission for Discipline Inspection, the watchdog of the ruling Communist Party. The term is normally a euphemism for graft. Chang had been “taken away”, according to an article in the respected business magazine Caijing, which added that he disappeared just days before a meeting of the state-owned company planned for December 28. A memo saying the meeting would be postponed was issued on the evening of the 26th, the article said.

Chang’s phone was switched off and he had not responded to multiple calls, it added. In August, after 11 years as chairman and party secretary of China’s second largest telecoms provider China Unicom, Beijing announced Chang would head China Telecom. That decision, Caijing said, was made despite widespread rumours that the executive was under investigation. It sparked speculation about an imminent tie-up between the two industry leaders and the third major player, China Mobile. In April the state news agency Xinhua reported that China was considering merging scores of its biggest state-owned companies to create around 40 national champions from the existing 111.

Authorities have been pursuing a hard-hitting campaign against allegedly crooked officials since President Xi Jinping took office in 2013, a crusade that some experts have called a political purge. Several high-profile business leaders have been caught up in the web of graft investigations after authorities pledged they would turn their efforts to the state-owned enterprise system, a bulwark of graft that has resisted multiple attempts at reform. The campaign is seen as an attempt to force executives of state firms, who jealously guard their prerogatives, to toe the party line, reducing resistance to structural reforms intended to bolster the slowing economy. Beijing announced it had begun investigations into the country’s telecom industry earlier this year, while Chang was still at China Unicom.

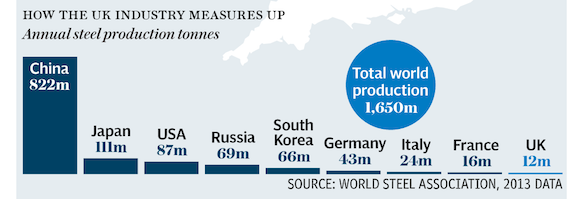

2016 looks like a black year for steel. And not only steel.

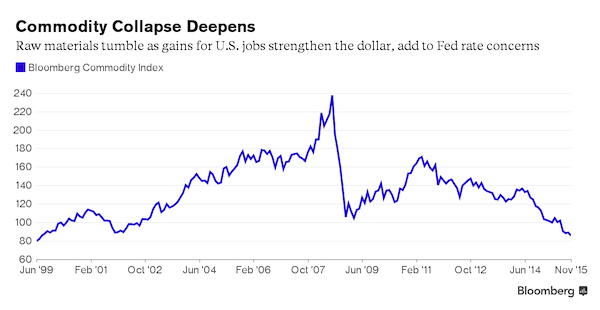

• World Steel Chief Calls Chinese Glut ‘Serious And Critical’ (USA Today)

The global steel industry is reeling amid a plunge in steel prices, a flood of low-priced imports from China and other countries, and a collapse in investment in pipes for oil drilling as a result of tumbling crude prices. USA TODAY economics reporter Paul Davidson spoke about these challenges with Wolfgang Eder, chairman of the World Steel Association and CEO of Austrian steel giant Voestalpine. The company has 46,000 employees worldwide and 2,500 workers and nearly two dozen factories in the USA.

Q: U.S. steelmakers are awaiting decisions on trade cases against China for illegally dumping steel below cost in this country. Is this a global problem? A: The current Chinese overcapacity problem affects all parts of the world. Chinese plants (are selling) not only to the U.S. but also to Europe. It’s an intensive discussion of what should be the reaction and an ongoing discussion to what extent Europe should follow the U.S. (in filing trade cases). The problem at the moment is enormous. I do hope we will find some balance again in the next months, but at the moment, the situation is a very serious and critical one.

Q: What’s the long-term solution? A: In the long run, a solution to the problem can only come from the reduction of capacities. According to OECD (countries in the Organization for Economic Cooperation and Development ), there are 600 to 700 million tons of overcapacity (worldwide), the largest part in China. That means permanent pressure on margins and prices.

Q: Is the plunge in steel prices affecting your company, Voestalpine? A: We are not (selling) any material via the spot market. We do have only high-quality steel, and this steel is only sold based on contracts. We are, of course, the (supplier) for the German auto producers — BMW, Mercedes, Audi, Porsche. So we are one of the largest suppliers for these car producers. They are only buying really high-tech, high-quality material where we can differentiate. Two-thirds (of production) is downstream — we make complete automotive components, exteriors of cars, we produce complete rail tracks.

Q: Still, you do make some raw steel, and the drop in prices has affected you, hasn’t it? A: We have started additional cost-cutting measures. We try to avoid layoffs because we do not want to lose highly qualified people. So for the time being, we have (cut staff) in only a very few locations — some in Germany, some in Brazil. And, of course, we try to extend our product range. We intend to sell more automotive parts.

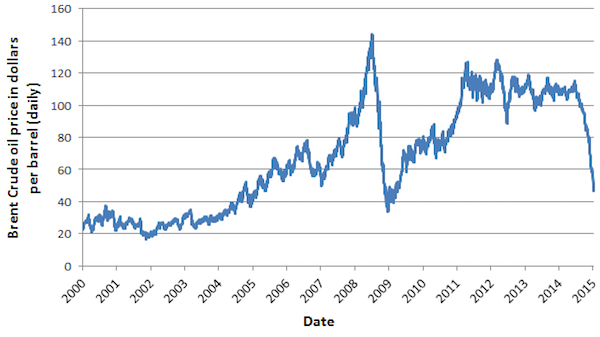

Q: Have you been affected by the downturn in oil and gas drilling? A: We have not yet been affected by the weakness in the oil and gas market, but we do expect, looking forward … the second half (of the fiscal year) will be a really more difficult period. Inventories are extremely high now, of oil and gas, but also inventories for all the production equipment are at very high levels. We cannot expect oil and gas levels will come down quickly over the winter as they have reached levels we have never seen before. So it’s unlikely we’ll see recovery of this segment before the summer of next year.

The same people eager to claim OPEC no longer functions are just as eager to say OPEC kills US shale.

• Shale’s Running Out of Survival Tricks as OPEC Ramps Up Pressure (BBG)

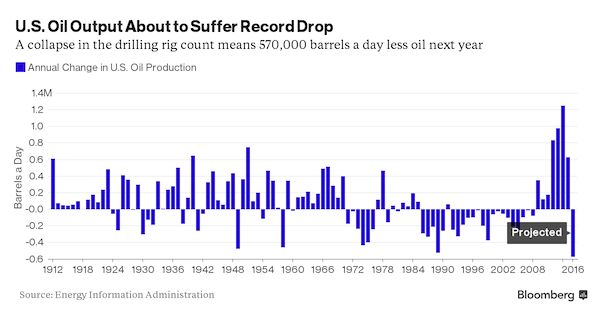

In 2015, the fracking outfits that dot America’s oil-rich plains threw everything they had at $50-a-barrel crude. To cope with the 50% price plunge, they laid off thousands of roughnecks, focused their rigs on the biggest gushers only and used cutting-edge technology to squeeze all the oil they could out of every well. Those efforts, to the surprise of many observers, largely succeeded. As of this month, U.S. oil output remained within 4% of a 43-year high. The problem? Oil’s no longer at $50. It now trades near $35. For an industry that already was pushing its cost-cutting efforts to the limits, the new declines are a devastating blow. These drillers are “not set up to survive oil in the $30s,” said R.T. Dukes at Wood Mackenzie in Houston.

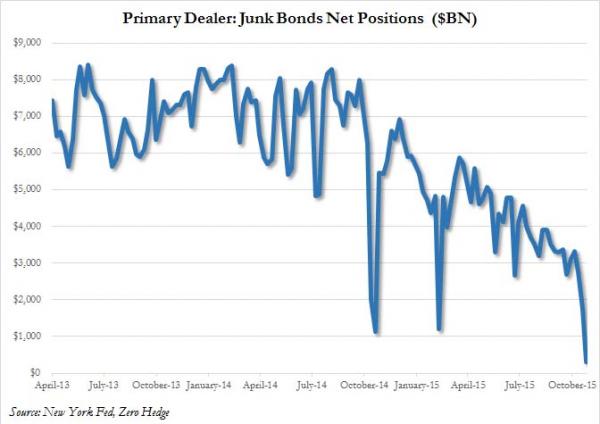

The Energy Information Administration now predicts that companies operating in U.S. shale formations will cut production by a record 570,000 barrels a day in 2016. That’s precisely the kind of capitulation that OPEC is seeking as it floods the world with oil, depressing prices and pressuring the world’s high-cost producers. It’s a high-risk strategy, one whose success will ultimately hinge on whether shale drillers drop out before the financial pain within OPEC nations themselves becomes too great. Drillers including Samson and Magnum Hunter have already filed for bankruptcy. About $99 billion in face value of high-yield energy bonds are trading at distressed prices, according to Bloomberg Intelligence analyst Spencer Cutter.

The BofA Merrill Lynch U.S. High Yield Energy Index has given up almost all of its outperformance since 2001, with the yield reaching its highest level relative to the broader market in at least 10 years. “You are going to see a pickup in bankruptcy filings, a pickup in distressed asset sales and a pickup in distressed debt exchanges,” said Jeff Jones at Blackhill Partners. “And $35 oil will clearly accelerate the distress.”

“They also question how the new landscape will affect traders such as BP and Trafigura, which signed long-term contracts to buy all the output from those facilities.”

• End Of Easy Money For Mini-Refiners Splitting US Shale? (Reuters)

Energy companies and oil trading firms that teamed up to build several mini-refineries that convert a swelling surplus of ultra-light U.S. crude into fuels for export seemed like a pretty safe investment bet for a while. The bet was built on several converging dynamics: an ever-rising supply of condensate; a U.S. refining system built to run heavier crudes; and a longstanding ban on crude exports that appeared unlikely to unwind amid partisan paralysis in Washington, D.C. Now, as U.S. oil output reverses its five-year rise and after lawmakers ended the 40-year-old export ban this month, oil executives and analysts question the wisdom of nearly $1 billion worth of so-called condensate splitters built over the past year, and the future of another $1.2 billion planned.

Traders are wondering what will happen with existing splitters run by companies such as Kinder Morgan. They also question how the new landscape will affect traders such as BP and Trafigura, which signed long-term contracts to buy all the output from those facilities. Other pending projects without guaranteed buyers could be abandoned, experts say. The once-restricted domestic crude not only faces increased competition. It also is hurt by the inversion of the global oil market, where once-abundant U.S. production is declining while global supplies are rising. This has eliminated the price discount that underpinned their model.

“It’s a much different competitive environment now that we don’t have distressed condensate,” said Sandy Fielden, an analyst with RBN Energy. While the same can be said of the nation’s larger, older fleet of full-scale refineries, splitters may be most exposed to the sudden changes, given their dependence on the most deeply discounted variety of oil. “Why would you distill it here if you can distill it elsewhere? The only reason you want to do it here is when it’s cheaper, but now it doesn’t make sense,” said Nick Rados, global business director of feedstocks for IHS Chemical.

Peanuts.

• China Fines Eight Shipping Lines $63 Million for Price Collusion (BBG)

China fined eight shipping lines 407 million yuan ($63 million) in total after finding them responsible for price collusion in the transportation of vehicles and heavy machinery. Japan’s Nippon Yusen, Mitsui OSK lines, Kawasaki Kisen Kaisha and Eastern Car Liner, Korea’s Eukor Car Carriers, Norway’s Wallenius Wilhelmsen, Chile’s Cia. Sud Americana de Vapores and its shipping line were the eight indicted after a year-long investigation, the National Development and Reform Commission said in a statement on its website Monday. The companies acknowledge wrongdoing, the top Chinese economic planning agency said. The probe follows similar investigations by the European Union in 2013 and Japan’s Fair Trade Commission.

Japanese regulators raided the offices of five shipping lines in 2013 over allegations they discussed raising rates together for transporting cars, and imposed fines on Nippon Yusen and Kawasaki Kisen in January 2014. AP Moeller-Maersk, CMA CGMand MSC Mediterranean Shipping were among companies in the European Union probe. Eukor will accept the Chinese decision and pay a fine of 284.7 million yuan, the company said in a statement on its website. The company also has implemented a competition law compliance program and corrective measures including antitrust compliance training, it said. Nippon Yusen has fully cooperated with the investigation by the Chinese agency and consequently received an immunity from the fine, the Japanese company said in a statement.

Re: Minsky.

• The Danger Of Safety (Tengdin)

The US Forest Service was created in 1905. Teddy Roosevelt signed the bill in response to a series of disastrous forest fires, like the Great Hinckley Fire of 1894. These fires threatened future commercial timber supplies, and the Federal Government had begun to establish national forest reserves. Why create them, people wondered, if they were just going to burn down? So the Forest Service established a systematic approach to fire control, building a network of roads, lookout towers, ranger stations, and communications. They also offered financial incentives for states to fight fires. With new technology, like airplanes, smokejumpers, and chemicals, they established their 10 am policy: every fire should be suppressed by 10 am the day following its initial report.

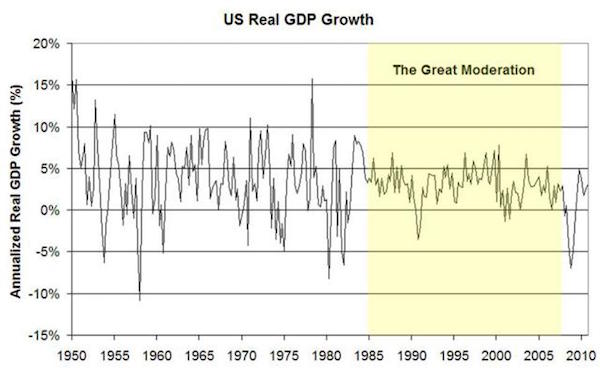

But a funny thing happened: by eliminating fire from the forest ecosystem, a lot of dead wood and other fuel accumulated over time. This insured that when fires did break out, they would become far more destructive. Moreover, scientists noted that fire was an essential part of many plant and tree life cycles. The Forest Service changed its approach from fire control to fire management-letting naturally occurring fires burn, unless they threatened developed areas. Is this part of what led to the Financial Crisis of 2007-2009? During the 25 years prior, economists had noted that more effective bank regulation and monetary policy had led to a “Great Moderation”-a significant dampening of the business cycle in the US and other developed nations.

It’s possible that reduced economic volatility led investors, homeowners, and banks to take on greater risks. In essence, the Fed’s policy of fire suppression allowed toxic assets to be created and distributed throughout the financial ecosystem. Highly regulated (and insured) banks were replaced by (uninsured) shadow banks. These assumed particular risks and contributed to a culture of increased systemic risk. When some of their assets began to unravel, it was impossible to contain the damage. We find a sort of risk-homeostasis in other areas. Anti-lock brakes encourage more aggressive driving; better skydiving gear allows hazardous high-speed maneuvers close to the ground. This is sometimes called the Peltzman effect: people behave as if they want a certain level of risk in their lives.

This appears to be the case with ecosystems and economies, too. Are safety measures useless, then? Absolutely not! The rate of accidental fatalities has fallen dramatically over time, and there are also fewer bank failures. But like the US Forest Service, we need to focus on risk management rather than risk reduction. Don’t assume government regulators will control your financial risks. Diversification, analysis, and-above all-not paying too much are still crucial, and always will be. The biggest risk, after all, is believing that we aren’t taking any risk. In a dynamic world, that’s guaranteed to fail.

Britain lost decades not acting on what was already obvious all those years ago.

• Britain Needs Dutch-Style Delta Plan To Stem Tide Of Floods (Guardian)

When more than 1,800 people died in the wake of the 1953 North Sea flood in the Netherlands, the national reaction was: never again. The resulting Delta programme to close off the south-western river delta from the sea was so bold that its name became synonymous with dealing with a crisis. If an issue needs a major response, you can be sure that a Dutch politician will call for a “Delta plan to tackle X”. It is time that the UK took some of that attitude and got a Delta plan to tackle flooding. Flooding has become an almost annual event in the UK. We are waiting for the next storm and flash flood to hit, with another group – or even the same group – of people evacuated, all followed by the promise of some money for a bit of flood defence work. As a nation, we can no longer afford to accept that.

Consider the personal misery for those affected, even in areas not traditionally flood-prone like Manchester and Leeds. Consider that the financial cost of these events will continue to rise – and not only for the government. Every home insurance policy now includes a £10.50 Flood Re levy to subsidise insurance for homes with a high risk of flooding. With the climate changing and becoming more volatile, we can expect heavier rain and more severe storms. Water management systems in the UK, and in particular in England, are unable to deal with what lies ahead. After almost every flood, journalists and policymakers go to the Netherlands to learn how they are adapting to climate change and what lessons there are for the UK. We see Dutch projects in the news, such as a neighbourhood with floating homes that forms part of a major national programme to create space for the rivers.

But those lessons never seem to be taken on board. Come the next flood, off they all go to Holland again. For the Dutch, water management goes to the core of their national identity. The country was forged in the battle against water. This common fight led to the pooling of resources and decision-making in regional water authorities – among the oldest democratic institutions in the world – which continue that work today. The national habit of consensus decision-making in tackling major issues became known internationally in the 90s as the “polder model”, echoing its water-based roots. No Dutch politician wants to be part of the generation that fails in the common endeavour against water, and no voter would accept someone caught sleeping on their watch.

The Netherlands has adapted to the changing nature of the threat. Today, the biggest danger is not the sea swallowing the land but the rain overwhelming it. The main focus no longer is building higher dykes and bigger dams, like they did after the 1953 flood. Instead, the Dutch have spent the past decade deepening and widening rivers, creating new side canals that provide extra capacity, and setting aside land as dedicated flood plains. This €2.3bn project is still ongoing. All this so that when the water does come, the swollen rivers can expand without flooding homes and causing misery. In Britain, we need to start to realise and accept that flooding is becoming an equally existential issue. There can be no northern powerhouse or sustainable prosperity anywhere if it risks being swept away by the rain.

Putin won.

• US Sees Bearable Costs, Key Goals Met For Russia In Syria So Far (Reuters)

Three months into his military intervention in Syria, Russian President Vladimir Putin has achieved his central goal of stabilizing the Assad government and, with the costs relatively low, could sustain military operations at this level for years, U.S. officials and military analysts say. That assessment comes despite public assertions by President Barack Obama and top aides that Putin has embarked on an ill-conceived mission in support of Syrian President Bashar al-Assad that it will struggle to afford and that will likely fail. “I think it’s indisputable that the Assad regime, with Russian military support, is probably in a safer position than it was,” said a senior administration official, who requested anonymity. Five other U.S. officials interviewed by Reuters concurred with the view that the Russian mission has been mostly successful so far and is facing relatively low costs.

The U.S. officials stressed that Putin could face serious problems the longer his involvement in the more than four-year-old civil war drags on. Yet since its campaign began on Sept. 30, Russia has suffered minimal casualties and, despite domestic fiscal woes, is handily covering the operation’s cost, which analysts estimate at $1-2 billion a year. The war is being funded from Russia’s regular annual defense budget of about $54 billion, a U.S. intelligence official said. The expense, analysts and officials said, is being kept in check by plummeting oil prices that, while hurting Russia’s overall economy, has helped its defense budget stretch further by reducing the costs of fueling aircraft and ships. It has also been able to tap a stockpile of conventional bombs dating to the Soviet era.

Putin has said his intervention is aimed at stabilizing the Assad government and helping it fight the Islamic State group, though Western officials and Syrian opposition groups say its air strikes mostly have targeted moderate rebels. Russia’s Syrian and Iranian partners have made few major territorial gains. Yet Putin’s intervention has halted the opposition’s momentum, allowing pro-Assad forces to take the offensive. Prior to Russia’s military action, U.S. and Western officials said, Assad’s government looked increasingly threatened.

Let’s all buy shares!

• US Foreign Arms Deals Increased Nearly $10 Billion in 2014 (NY Times)

Foreign arms sales by the United States jumped by almost $10 billion in 2014, about 35%, even as the global weapons market remained flat and competition among suppliers increased, a new congressional study has found. American weapons receipts rose to $36.2 billion in 2014 from $26.7 billion the year before, bolstered by multibillion-dollar agreements with Qatar, Saudi Arabia and South Korea. Those deals and others ensured that the United States remained the single largest provider of arms around the world last year, controlling just over 50% of the market. Russia followed the United States as the top weapons supplier, completing $10.2 billion in sales, compared with $10.3 billion in 2013.

Sweden was third, with roughly $5.5 billion in sales, followed by France with $4.4 billion and China with $2.2 billion. South Korea, a key American ally, was the world’s top weapons buyer in 2014, completing $7.8 billion in contracts. It has faced continued tensions with neighboring North Korea in recent years over the North’s nuclear weapons program and other provocations. The bulk of South Korea’s purchases, worth more than $7 billion, were made with the United States and included transport helicopters and related support, as well as advanced unmanned aerial surveillance vehicles. Iraq followed South Korea, with $7.3 billion in purchases intended to build up its military in the wake of the American troop withdrawal there.

Brazil, another developing nation building its military force, was third with $6.5 billion worth of purchase agreements, primarily for Swedish aircraft. The report to Congress found that total global arms sales rose slightly in 2014 to $71.8 billion, from $70.1 billion in 2013. Despite that increase, the report concluded that “the international arms market is not likely growing over all,” because of “the weakened state of the global economy.”

What better sign is there of our collective insanity?

• Britain’s New, Open Way to Sell Arms (BBG)

Champion cyclist Ryan Perry, a British army captain, was uncharacteristically tipsy the night of Nov. 25, but no one could blame him for enjoying the Champagne. Standing on the stage of a grand 15th century hall in London, the 28-year-old cradled a crystal plaque naming him the army’s sportsman of the year. Seated in front of him was one of the British military’s most influential officers, the chief of the general staff, or CGS. “Yesterday I was riding around Burnley in the wind and rain,” Perry told the crowd, referring to his seaside hometown. “Tonight I’m drinking Champagne with CGS.” Attending the banquet were executives from at least 20 contractors for the U.K.’s Ministry of Defence—including U.S.-based arms manufacturers Boeing, Lockheed Martin, and Raytheon.

They raised glasses with senior military officials, many of whom are directly involved in spending some of the $268 billion in defense procurement the U.K. has planned for the next decade. The contractors paid for the black-tie dinner in the historic Guildhall. The corporations are sponsoring the dinner through Team Army, a charity established in 2011 after an antibribery law went into effect in the U.K. The law was enacted following a string of high-profile corruption cases, including some in defense deals. Team Army’s role is to be in the middle of what were once unofficial big-dollar transactions between generals and defense companies. “It’s as clean as we can make the damn thing,” says Lamont Kirkland, a general who ran the army’s boxing, rugby, and winter sports programs before retiring to lead the charity.

Arms makers and other contractors pay Team Army as much as £70,000 ($104,000) for memberships. The members sponsor tables or buy tickets for Champagne receptions and other fêtes. Corporate suites at premier soccer games, rugby matches, and horse races are also used to raise money. Contractors are invited to spend time at the events with the top brass who buy their wares. The charity uses money from the contractors to fund military sports programs, Paralympics, and elite military athletes. Top-draw competitions, including the annual army-navy rugby match at London’s 82,000-seat Twickenham Stadium, are used for more fundraising. Although the official numbers won’t be public until 2016, Team Army raised a record amount this year, Kirkland says. Since 2011 the charity has amassed about $4.5 million for military sports.

China, US, France, what’s the difference?!

• China Passes Antiterrorism Law That Critics Fear May Overreach (NY Times)

China’s legislature approved an antiterrorism law on Sunday after months of international controversy, including criticism from human rights groups, business lobbies and President Obama. Critics had said that the draft version of the law used a recklessly broad definition of terrorism, gave the government new censorship powers and authorized state access to sensitive commercial data. The government argued that the requirements were needed to prevent terrorist attacks. Opponents countered that the new powers could be abused to monitor peaceful citizens and steal technological secrets. Whether the complaints persuaded the government to dilute the bill was not clear: State news media did not immediately publish the text of the new law.

But an official who works for the Standing Committee of the National People’s Congress indicated that at least some rules authorizing greater state access to encrypted data remained in the law. “Not only in China, but also in many places internationally, growing numbers of terrorists are using the Internet to promote and incite terrorism, and are using the Internet to organize, plan and carry out terrorist acts,” the official, Li Shouwei, told a news conference in Beijing. Mr. Li, a criminal law expert, said the antiterrorism law included a requirement that telecommunication and Internet service providers “shall provide technical interfaces, decryption and other technical support and assistance to public security and state security agencies when they are following the law to avert and investigate terrorist activities.”

The approval by the legislature, which is controlled by the Communist Party, came as Beijing has become increasingly jittery about antigovernment violence, especially in the ethnically divided region of Xinjiang in western China, where members of the Uighur minority have been at growing odds with the authorities. Chinese leaders have ordered security forces to be on alert against possible terrorist slaughter of the kind that devastated Paris in November. Over the weekend, the shopping neighborhood of Sanlitun in Beijing was under reinforced guard by People’s Armed Police troops after several foreign embassies, including that of the United States, warned that there were heightened security risks there around Christmas.

“..Chinese people over the age of 65 will jump 85% to 243 million by 2030..”

• China Approves New Two-Child Birth Policy (WSJ)

China’s lawmakers will allow all couples to have two children from the beginning of next year, implementing a new birth policy aimed at mitigating a potential demographic crisis. In a congressional meeting Sunday, Chinese lawmakers approved the new birth policy, which will take effect Jan. 1, 2016, Xinhua reported. Top Communist Party leaders had previously approved the new policy. The announcement sets a timeline for a policy that will replace the country’s controversial 35-year-old one-child policy. The National Health and Family Planning Commission, which implements China’s reproduction policy, said at the time it would move slowly to avoid population spikes. Demographers have warned China’s leaders for the past decade that falling birthrates in the nation may cause a future labor shortage that would endanger economic growth.

China has the world’s largest population at 1.37 billion, but its working-age population -those aged 15 to 64- is shrinking. The United Nations projects the number of Chinese people over the age of 65 will jump 85% to 243 million by 2030, up from 131 million this year. Many health experts say that while the new policy will likely enable up to 100 million couples to have additional children, they don’t expect a baby boom. Many Chinese couples say the cost of having children is prohibitive, and some will opt to have only one child. A previous relaxation of China’s one-child policy did not lead to a significant increase in baby numbers. Health officials previously said they are moving to simplify the birth application procedures for couples, who currently have to go through a complicated procedure that can often take months.

This is actually an article on some grand projects that do still get built. I like the other side of the coin better.

• Greek Construction Sector Shrinks By 63% Since 2011 (Kath.)

As construction continues to slump, the prevalent impression is that all building activity has come grinding to a halt. Yet this is only one side of the coin and mainly concerns private projects. According to data from the Hellenic Statistical Authority (ELSTAT), construction activity (measured by the number of permits issued) throughout the country dropped by 63.47% in the period from 2011 to 2014. Attica has been hit hardest by the economic crisis, with construction nosediving 73.10%, while the greatest losses have been seen in the residential property market. Up until the start of the crisis, 75% of investments in construction went toward residential property. In the third quarter of 2014, this had shrunk to 31%, with losses of €23.29 billion.

This is the “big picture” as a walk around any neighborhood in the Greek capital will attest. But there are also the shining exceptions, projects that were started well before the crisis or that defied the circumstances and forged ahead. The most important similarity between these projects is that they have progressed enough so they are no longer at risk of remaining on paper. And, irrespective of their scale, they are all important, if only on a symbolic level because they create a sense that something is happening, that there is movement in the works.

Where did they find them?

• Germany Hires 8,500 Teachers To Teach German To 196,000 Child Refugees (AFP)

Germany has recruited 8,500 people to teach child refugees German, as the country expects the number of new arrivals to soar past the million mark in 2015, Die Welt daily reported on Sunday. About 196,000 children fleeing war and poverty will enter the German school system this year, and 8,264 “special classes” have been created to help them catch up with their peers, Die Welt said, citing a survey carried out in 16 German federal states. Germany’s education authority says 325,000 school-aged children reached the EU country in 2015 during Europe’s worst migration crisis since the second world war.

Germany expects more than a million asylum seekers this year, which is five times more than in 2014. It has put a strain on its ability to provide services to all the newcomers. “Schools and education administrations have never been confronted with such a challenge,” Brunhild Kurth, who heads the education authority, told Die Welt. “We must accept that this exceptional situation will become the norm for a long time to come.” Heinz-Peter Meidinger, head of the DPhV teachers’ union, said Germany would need up to 20,000 additional teachers to cater for the new numbers. “By next summer, at the latest, we will feel that gap,” he said.

Better solve this fast.

• Refugee Crisis Creates ‘Stateless Generation’ Of Children In Limbo (Guardian)

Europe’s refugee crisis is threatening to compound a hidden problem of statelessness, with experts warning that growing numbers of children are part of an emerging “stateless generation”. Gender-biased nationality laws in Syria combined with ineffective legal safeguards in the EU states mean that many children born to Syrian refugees in Europe are at high risk of becoming stateless – a wretched condition of marginalisation that affects 10 million people worldwide. Under Syrian law, only men can pass citizenship on to their children. The UN estimates that 25% of Syrian refugee households are fatherless. “A lot of those who are resettled to Europe are women whose husband or partner was killed or lost and are being resettled with their kids or are pregnant at the time, so that is becoming a bigger problem,” said Zahra Albarazi of the Institute on Statelessness and Inclusion, based in the Netherlands.

Sanaa* is a 35-year-old single mother who gave birth to her daughter, Siba*, in Berlin last year. “I went to the Syrian embassy and explained my situation but they said they cannot give Siba a passport because the father should be Syrian, and the father and mother married,” Sanaa said. Germany, in common with the rest of Europe, does not automatically grant citizenship to children born there. This means Siba does not have citizenship of any country. Under international treaties including the UN convention on the rights of the child, governments are obliged to grant nationality to any child born on their soil who would otherwise be stateless. But few EU countries have adopted this principle into domestic law and those that have consistently fail to implement it.

The UNHCR refugee agency estimates that at least 680,000 people in Europe are without citizenship of any country, although experts say the true figure is likely to be far higher because stateless people are hard to count. The statelessness problem is particularly bad in south-east Asia: in Myanmar alone the UN estimates there are more than 810,000 stateless people. But the situation in Europe is about to get much worse as a result of the unprecedented migration. Up until now, groups such as the Roma and Russian-speaking people from the Baltics have been most affected, although the UN blames statelessness on a “bewildering array of causes”, with people from a wide range of backgrounds finding they are not legally entitled to citizenship of any country.

No research has been done into the scale of statelessness among the children of Syrian refugees in Europe, but it is thought that many are likely to be in the same position as Siba. Statelessness in Europe can pose huge problems. Experts say many parents are unaware that their children are stateless. Often the children realise they do not have legal citizenship only when they reach adulthood and find they cannot legally work, marry, own property, vote or even graduate from school. [..] The UN says more than 30,000 babies born to Syrian refugees in Lebanon are at risk of statelessness. And research by Refugees International (RI) this year found that many of the 60,000 children born to Syrian refugees in Turkey since 2011 could be in the same position.